A history of delivering shareholder value and positioned for growth February 2026 Exhibit 99.1

Forward-Looking Statements 2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of BankUnited, Inc. (“BankUnited,” “BKU” or the “Company”) with respect to, among other things, future events and financial performance, dividend payments and stock repurchases. The Company generally identifies forward-looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” "forecasts" or the negative version of those words or other comparable words. Any forward-looking statements contained in this presentation are based on the historical performance of the Company and its subsidiaries or on the Company’s current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company that the future plans, estimates or expectations contemplated by the Company will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions, including (without limitation) those relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy and liquidity, including as impacted by external circumstances outside the Company's direct control, such as but not limited to adverse events or conditions impacting the financial services industry. If one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from those indicated in these statements. These factors should not be construed as exhaustive. The Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements. Information on these factors can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are available at the SEC’s website (www.sec.gov).

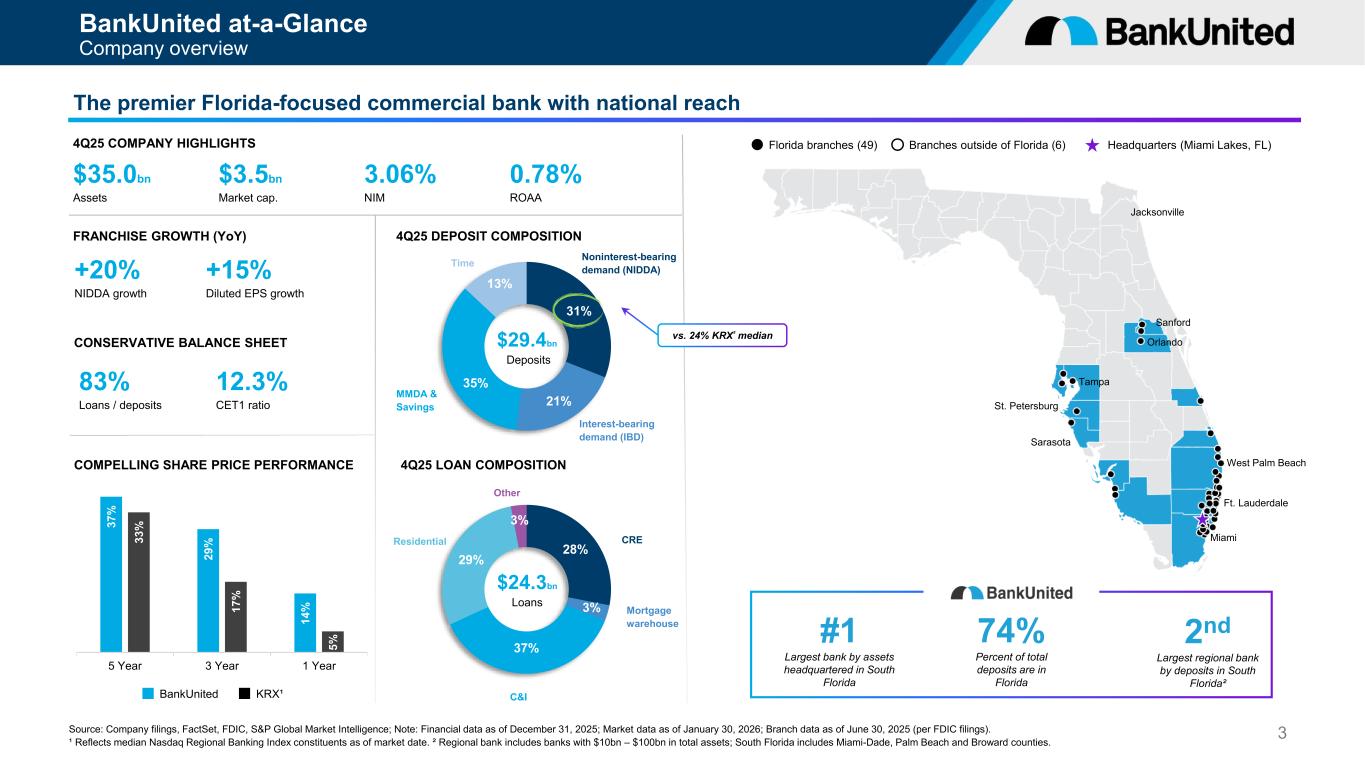

28% 3% 37% 29% 3%3 7 % 2 9 % 1 4 % 3 3 % 1 7 % 5 % 5 Year 3 Year 1 Year Jacksonville Sanford Orlando Tampa St. Petersburg Sarasota West Palm Beach Ft. Lauderdale Miami 3 BankUnited at-a-Glance Company overview The premier Florida-focused commercial bank with national reach 4Q25 COMPANY HIGHLIGHTS $35.0bn Assets +15% Diluted EPS growth 83% Loans / deposits 3.06% NIM 0.78% ROAA 12.3% CET1 ratio +20% NIDDA growth FRANCHISE GROWTH (YoY) CONSERVATIVE BALANCE SHEET 4Q25 DEPOSIT COMPOSITION Source: Company filings, FactSet, FDIC, S&P Global Market Intelligence; Note: Financial data as of December 31, 2025; Market data as of January 30, 2026; Branch data as of June 30, 2025 (per FDIC filings). ¹ Reflects median Nasdaq Regional Banking Index constituents as of market date. ² Regional bank includes banks with $10bn – $100bn in total assets; South Florida includes Miami-Dade, Palm Beach and Broward counties. $3.5bn Market cap. Florida branches (49) Branches outside of Florida (6) Headquarters (Miami Lakes, FL) 31% 21% 35% 13% 4Q25 LOAN COMPOSITIONCOMPELLING SHARE PRICE PERFORMANCE $29.4bn Deposits $24.3bn Loans Time Interest-bearing demand (IBD) MMDA & Savings Noninterest-bearing demand (NIDDA) Residential Other C&I CRE vs. 24% KRX² median BankUnited KRX¹ 2nd Largest regional bank by deposits in South Florida² #1 Largest bank by assets headquartered in South Florida 74% Percent of total deposits are in Florida Mortgage warehouse

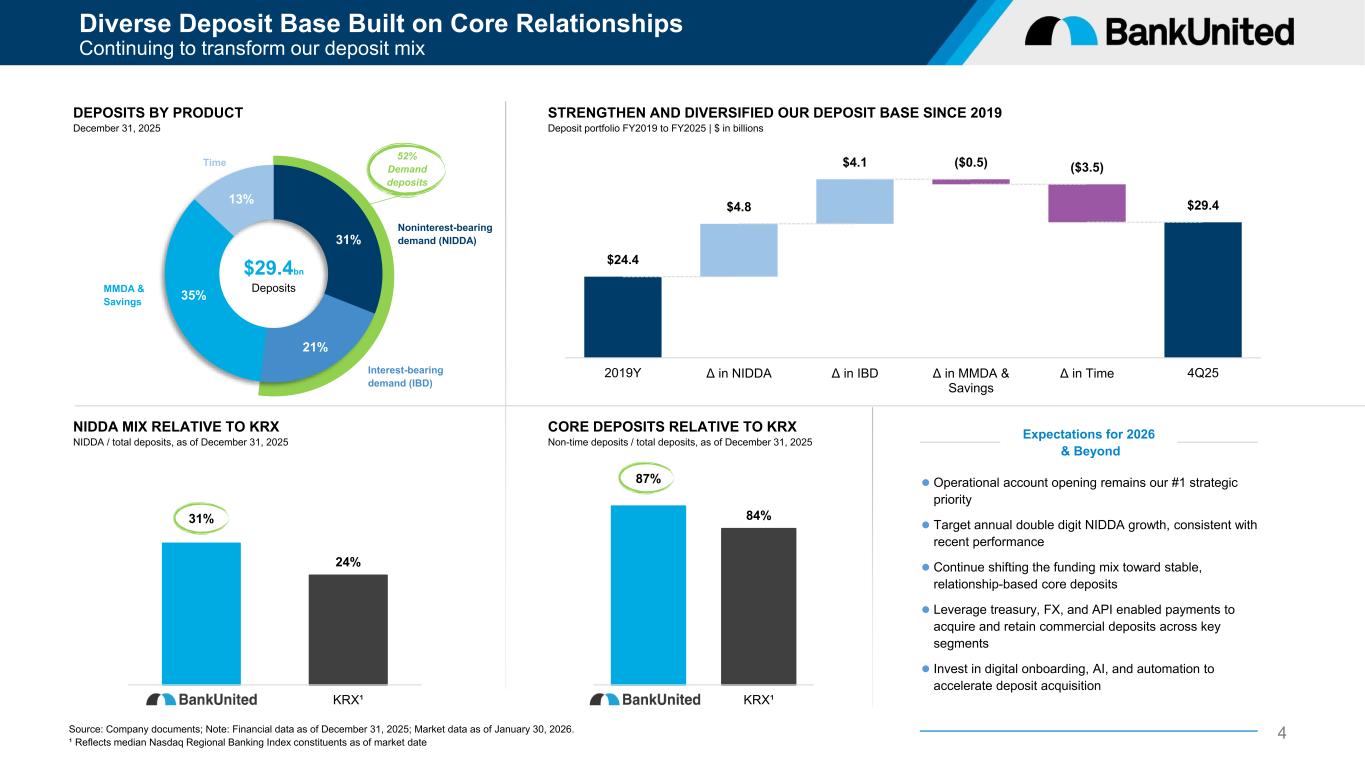

31% 21% 35% 13% Diverse Deposit Base Built on Core Relationships Continuing to transform our deposit mix Source: Company documents; Note: Financial data as of December 31, 2025; Market data as of January 30, 2026. ¹ Reflects median Nasdaq Regional Banking Index constituents as of market date DEPOSITS BY PRODUCT December 31, 2025 $29.4bn Deposits Time MMDA & Savings STRENGTHEN AND DIVERSIFIED OUR DEPOSIT BASE SINCE 2019 Deposit portfolio FY2019 to FY2025 | $ in billions Expectations for 2026 & Beyond ⚫ Operational account opening remains our #1 strategic priority ⚫ Target annual double digit NIDDA growth, consistent with recent performance ⚫ Continue shifting the funding mix toward stable, relationship-based core deposits ⚫ Leverage treasury, FX, and API enabled payments to acquire and retain commercial deposits across key segments ⚫ Invest in digital onboarding, AI, and automation to accelerate deposit acquisition CORE DEPOSITS RELATIVE TO KRX Non-time deposits / total deposits, as of December 31, 2025 87% 84% KRX¹ 52% Demand deposits 4 NIDDA MIX RELATIVE TO KRX NIDDA / total deposits, as of December 31, 2025 National 9% 31% 24% KRX¹ Interest-bearing demand (IBD) Noninterest-bearing demand (NIDDA) $24.4 $4.8 $4.1 ($0.5) ($3.5) $29.4 2019Y Δ in NIDDA Δ in IBD Δ in MMDA & Savings Δ in Time 4Q25

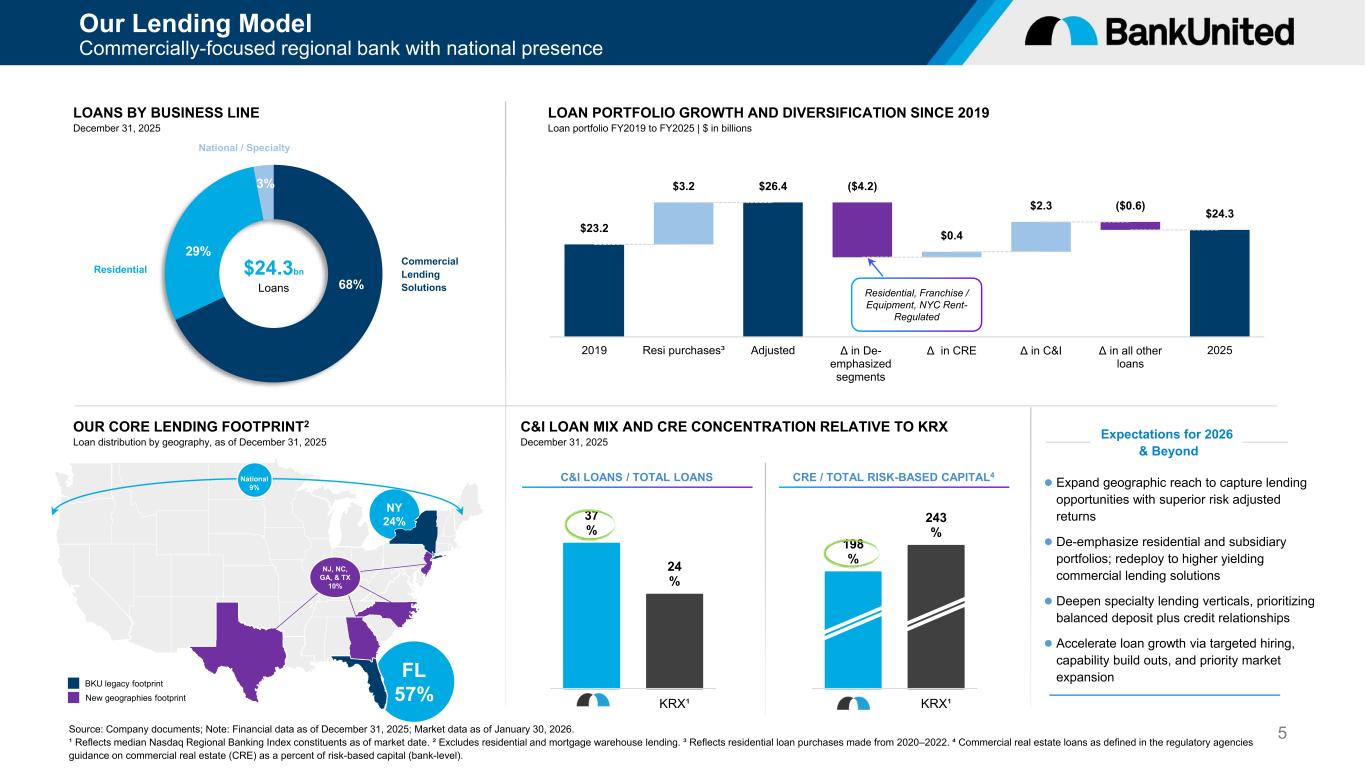

68% 29% 3% 5 Our Lending Model Commercially-focused regional bank with national presence LOANS BY BUSINESS LINE December 31, 2025 $24.3bn Loans Residential National / Specialty Commercial Lending Solutions LOAN PORTFOLIO GROWTH AND DIVERSIFICATION SINCE 2019 Loan portfolio FY2019 to FY2025 | $ in billions C&I LOAN MIX AND CRE CONCENTRATION RELATIVE TO KRX December 31, 2025 Expectations for 2026 & Beyond ⚫ Expand geographic reach to capture lending opportunities with superior risk adjusted returns ⚫ De-emphasize residential and subsidiary portfolios; redeploy to higher yielding commercial lending solutions ⚫ Deepen specialty lending verticals, prioritizing balanced deposit plus credit relationships ⚫ Accelerate loan growth via targeted hiring, capability build outs, and priority market expansion 37 % 24 % KRX¹ Source: Company documents; Note: Financial data as of December 31, 2025; Market data as of January 30, 2026. ¹ Reflects median Nasdaq Regional Banking Index constituents as of market date. ² Excludes residential and mortgage warehouse lending. ³ Reflects residential loan purchases made from 2020–2022. ⁴ Commercial real estate loans as defined in the regulatory agencies guidance on commercial real estate (CRE) as a percent of risk-based capital (bank-level). Residential, Franchise / Equipment, NYC Rent- Regulated 198 % 243 % KRX¹ BKU reviewing (rent- stabilized MF loan figure) NY 24% FL 57% OUR CORE LENDING FOOTPRINT2 Loan distribution by geography, as of December 31, 2025 BKU legacy footprint NJ, NC, GA, & TX 10% New geographies footprint National 9% C&I LOANS / TOTAL LOANS CRE / TOTAL RISK-BASED CAPITAL4 $23.2 $3.2 $26.4 ($4.2) $0.4 $2.3 ($0.6) $24.3 2019 Resi purchases³ Adjusted Δ in De- emphasized segments Δ in CRE Δ in C&I Δ in all other loans 2025 Residential, Franchise / Equipm nt, NYC Rent- Regulated

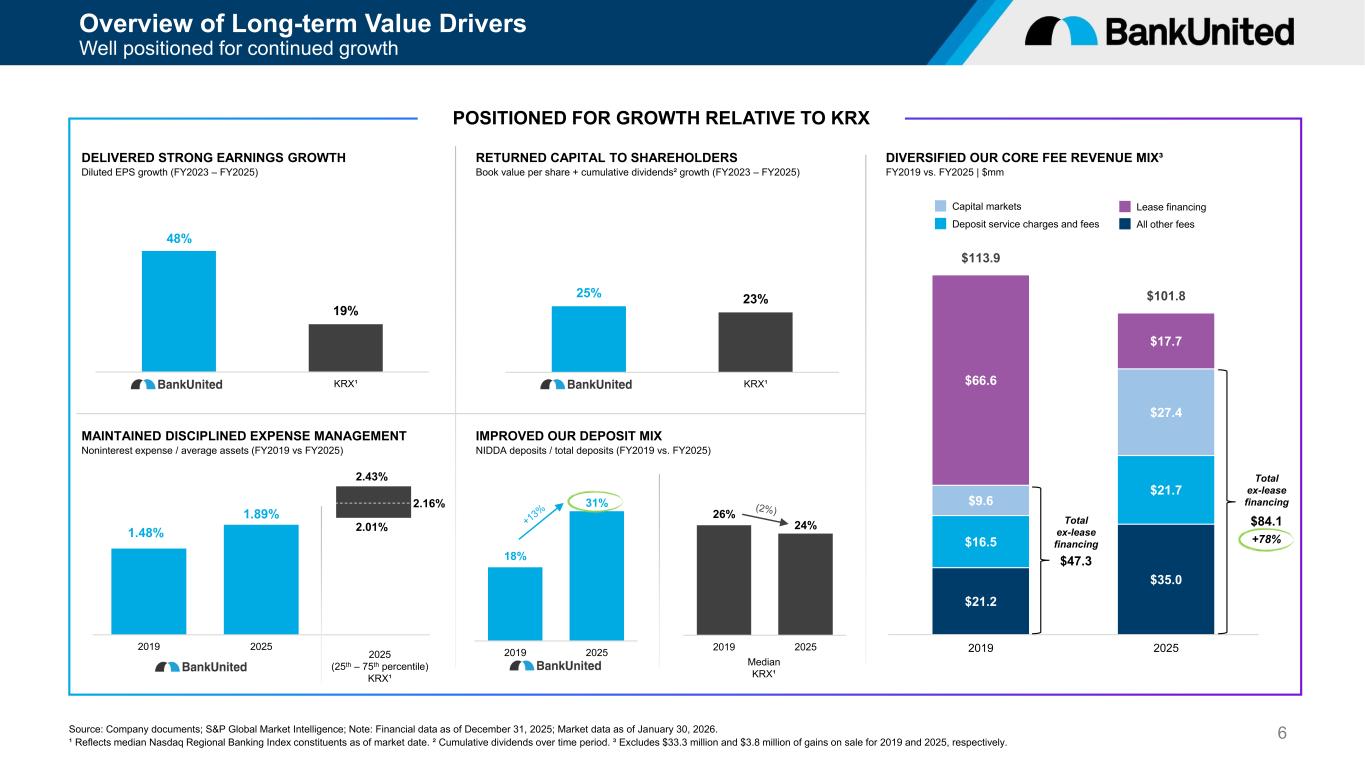

48% 19% BKU KRX¹ 25% 23% BKU KRX¹ 26% 24% 2019 2025 $21.2 $35.0 $16.5 $21.7 $9.6 $27.4 $66.6 $17.7 $113.9 $101.8 2019 2025 6Source: Company documents; S&P Global Market Intelligence; Note: Financial data as of December 31, 2025; Market data as of January 30, 2026. ¹ Reflects median Nasdaq Regional Banking Index constituents as of market date. ² Cumulative dividends over time period. ³ Excludes $33.3 million and $3.8 million of gains on sale for 2019 and 2025, respectively. RETURNED CAPITAL TO SHAREHOLDERS Book value per share + cumulative dividends² growth (FY2023 – FY2025) DELIVERED STRONG EARNINGS GROWTH Diluted EPS growth (FY2023 – FY2025) IMPROVED OUR DEPOSIT MIX NIDDA deposits / total deposits (FY2019 vs. FY2025) DIVERSIFIED OUR CORE FEE REVENUE MIX³ FY2019 vs. FY2025 | $mm 18% 31% 2019 2025 MAINTAINED DISCIPLINED EXPENSE MANAGEMENT Noninterest expense / average assets (FY2019 vs FY2025) Median KRX¹ Capital markets Lease financing All other feesDeposit service charges and fees $47.3 Total ex-lease financing $84.1 +78% Total ex-lease financing Overview of Long-term Value Drivers Well positioned for continued growth 1.48% 1.89% 2019 2025 2.01% 2.43% 2.16% 2025 (25th – 75th percentile) KRX¹ POSITIONED FOR GROWTH RELATIVE TO KRX

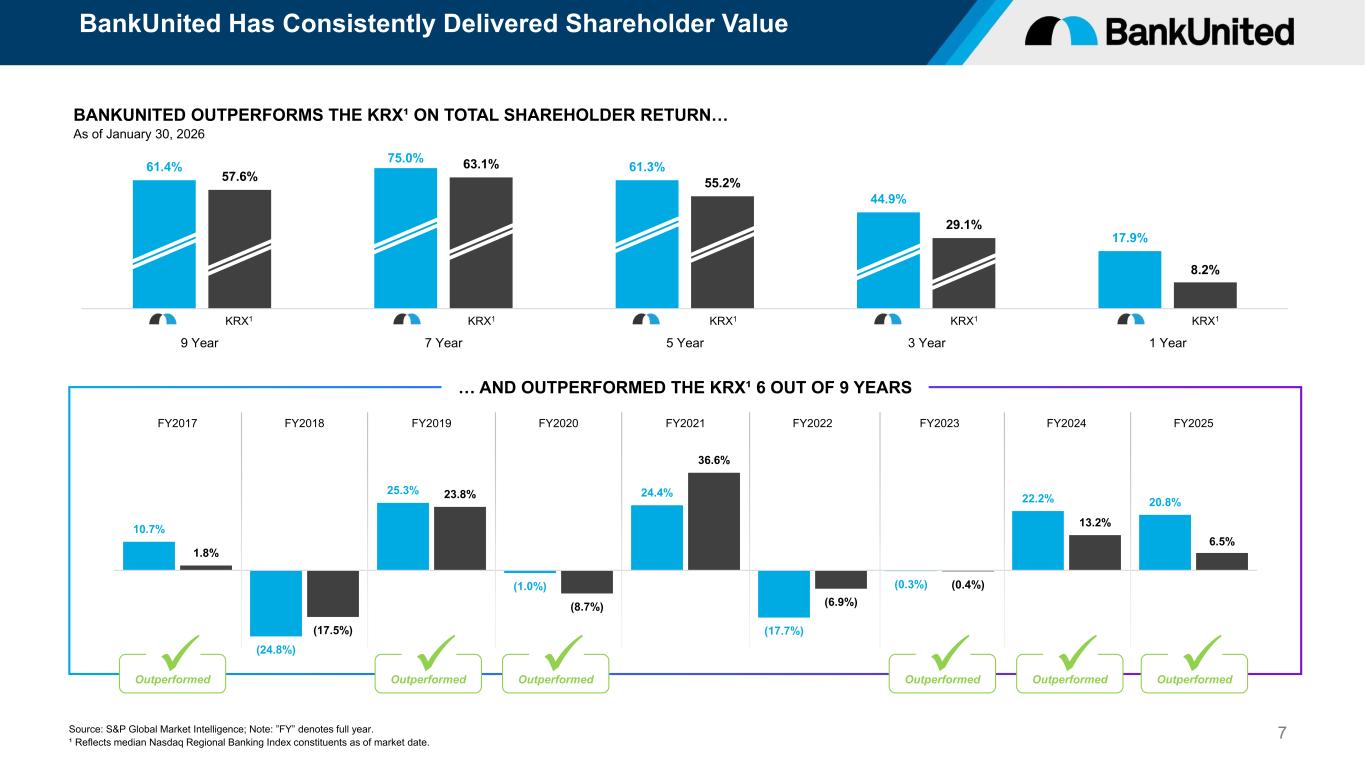

10.7% (24.8%) 25.3% (1.0%) 24.4% (17.7%) (0.3%) 22.2% 20.8% 1.8% (17.5%) 23.8% (8.7%) 36.6% (6.9%) (0.4%) 13.2% 6.5% FY2017 FY2018 FY2019 FY2020 FY2021 FY2022 FY2023 FY2024 FY2025 61.4% 75.0% 61.3% 44.9% 17.9% 57.6% 63.1% 55.2% 29.1% 8.2% 9 Year 7 Year 5 Year 3 Year 1 Year 7 BankUnited Has Consistently Delivered Shareholder Value Source: S&P Global Market Intelligence; Note: ”FY” denotes full year. ¹ Reflects median Nasdaq Regional Banking Index constituents as of market date. … AND OUTPERFORMED THE KRX¹ 6 OUT OF 9 YEARS KRX1 BANKUNITED OUTPERFORMS THE KRX¹ ON TOTAL SHAREHOLDER RETURN… As of January 30, 2026 Outperformed✓ Outperformed✓ Outperformed✓ Outperformed✓ Outperformed✓Outperformed✓ 9 Year 7 Year 5 Year 3 Year 1 Year KRX1 KRX1 KRX1 KRX1

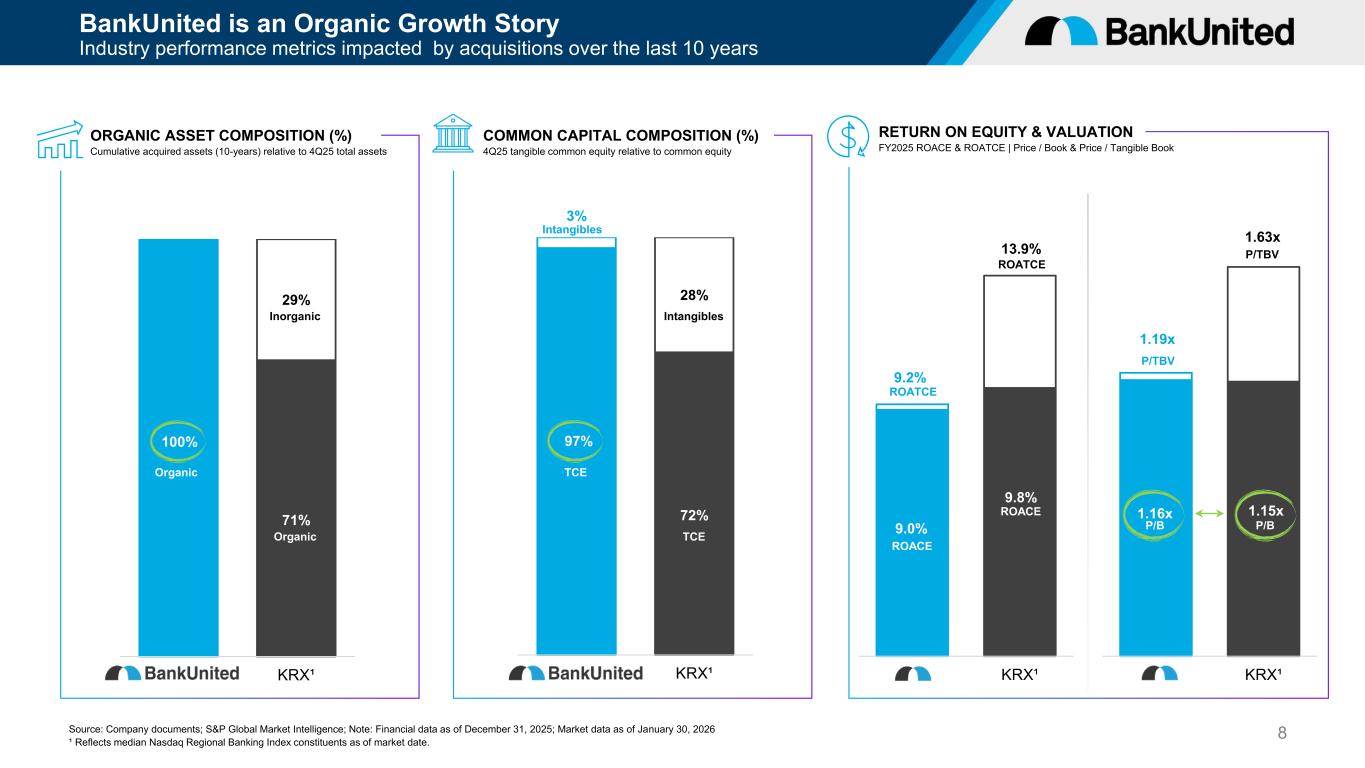

9.0% 9.8% 9.2% 13.9% KRX¹ 8 BankUnited is an Organic Growth Story Industry performance metrics impacted by acquisitions over the last 10 years ORGANIC ASSET COMPOSITION (%) Cumulative acquired assets (10-years) relative to 4Q25 total assets COMMON CAPITAL COMPOSITION (%) 4Q25 tangible common equity relative to common equity RETURN ON EQUITY & VALUATION FY2025 ROACE & ROATCE | Price / Book & Price / Tangible Book 97% 72% 3% 28% KRX¹ 100% 71% 29% KRX¹ Organic Organic TCE TCE Intangibles Intangibles Inorganic Source: Company documents; S&P Global Market Intelligence; Note: Financial data as of December 31, 2025; Market data as of January 30, 2026 ¹ Reflects median Nasdaq Regional Banking Index constituents as of market date. ROATCE ROATCE ROACE ROACE 1.16x 1.15x 1.19x 1.63x KRX¹ P/TBV P/TBV RO AE P/B P/B

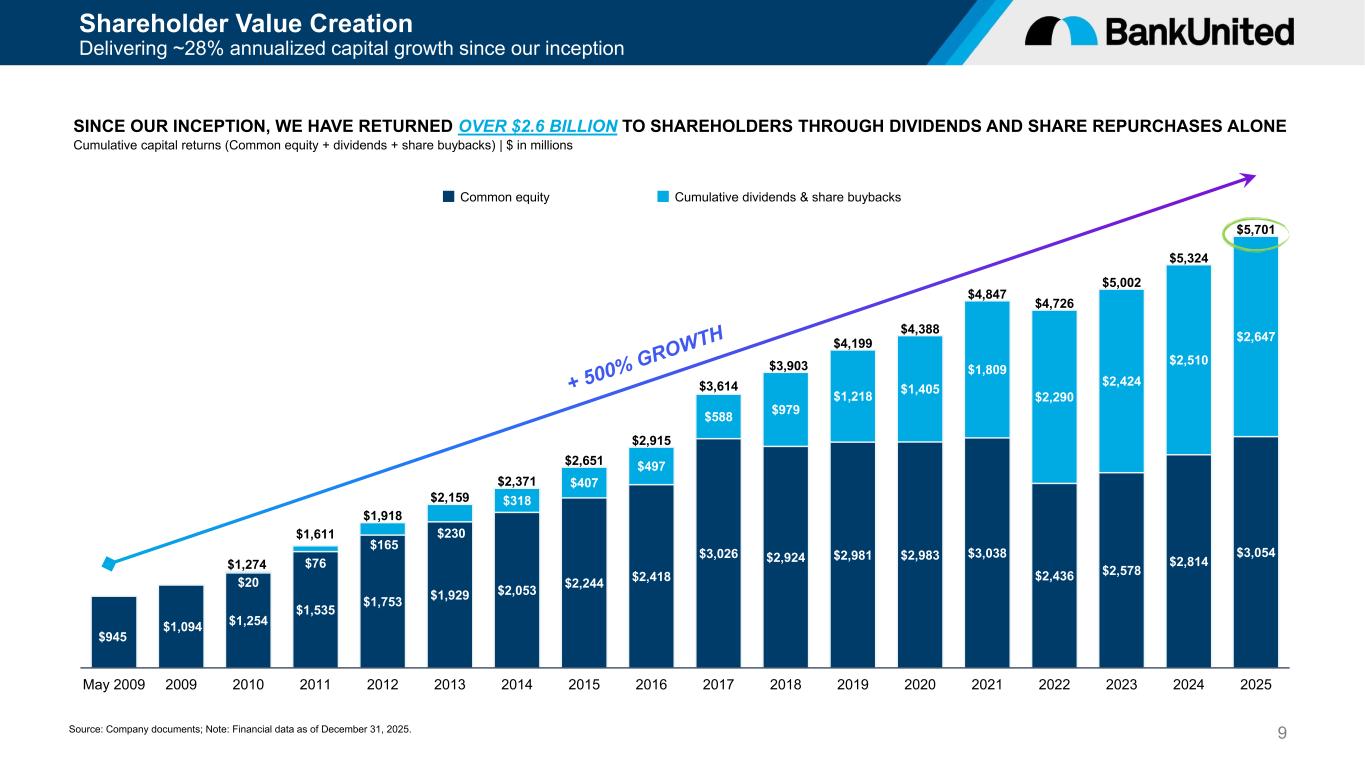

$1,274 $1,611 $1,918 $2,159 $2,371 $2,651 $2,915 $3,614 $3,903 $4,199 $4,388 $4,847 $4,726 $5,002 $5,324 $5,701 $945 $1,094 $1,254 $1,535 $1,753 $1,929 $2,053 $2,244 $2,418 $3,026 $2,924 $2,981 $2,983 $3,038 $2,436 $2,578 $2,814 $3,054 $20 $76 $165 $230 $318 $407 $497 $588 $979 $1,218 $1,405 $1,809 $2,290 $2,424 $2,510 $2,647 May 2009 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 9 Shareholder Value Creation Delivering ~28% annualized capital growth since our inception SINCE OUR INCEPTION, WE HAVE RETURNED OVER $2.6 BILLION TO SHAREHOLDERS THROUGH DIVIDENDS AND SHARE REPURCHASES ALONE Cumulative capital returns (Common equity + dividends + share buybacks) | $ in millions Common equity Cumulative dividends & share buybacks Source: Company documents; Note: Financial data as of December 31, 2025.