Exhibit 99.1

Dear [Advisor],

Given the recent headlines around software and AI investing, we wanted to provide a timely update on Oaktree Strategic Credit Fund (“OSC” or the “Fund”) sector exposure and underwriting criteria.

We believe our software portfolio is well positioned today against the rising threat of AI, and we have limited exposure to annual recurring revenue (ARR) loans and payment-in-kind (PIK) features. ARR and PIK loans are more sensitive to changes in enterprise growth expectations and cash flow durability, especially in periods of technological disruption.

As of December 31, 2025:

| • | Software represented approximately 18% of investments at fair value across 32 issuers in the Fund |

| • | 92% of our software positions are first lien term loans |

| • | 1 ARR loan, representing <1% of fair value |

| • | PIK as a percentage of our total software investment income was only 0.3% |

| • | Largest software position represented 1.2% of fair value and the average software position represented 0.6% of fair value |

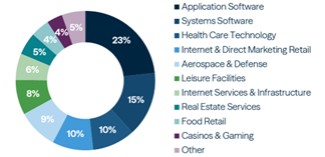

| Software Performance in OSC1 | Software End Market Exposure2 | |

|

Note: The above chart represents a breakdown of the Fund’s ~18% of software investments at fair value. | |

Our foundational approach to software investing has not changed in light of AI, and we continue to be selective in the sector. At its core, our framework focuses on software providers that are deeply embedded in customers’ daily workflows and business processes, require meaningful buy-in from multiple stakeholders and have high costs associated with switching providers.

AI has raised the quality bar for software investments, and we have added incremental criteria to our underwriting for both new investments and existing portfolio companies in turn. Today, we prioritize software businesses with multiple control points, data gravity, business context, high mission criticality and a coherent and credible AI roadmap.

We continue to believe our disciplined underwriting, deal selectivity and active portfolio management will remain critical drivers of long-term performance.

Thank you for your continued support,

[XX]