Exhibit 99.3

Humana Inc. Fourth Quarter 2025 Prepared Management Remarks 2/11/2026

Please view these remarks in conjunction with our 4Q 2025 earnings release that can be found on our website at www.humana.com under the Investors section, or via the following link: https://humana.gcs-web.com/financial-information/quarterly-results.

We also invite you to listen to our live question and answer webcast with our President and Chief Executive Officer, Jim Rechtin, Chief Financial Officer, Celeste Mellet, President of Insurance, George Renaudin, and President of Enterprise Growth, David Dintenfass, which will begin today at 8:00 a.m. Eastern Time and will be available at via the following link: https://humana.gcs-web.com/events-and-presentations/upcoming-events. For those unable to listen to the live event, the archive will be available in the Historical Webcasts and Presentations section of the Investor Relations page via the following link: https://humana.gcs-web.com/events-and-presentations.

Cautionary Statement

Certain of the matters discussed in these prepared remarks are forward-looking and are subject to a number of risks, uncertainties and assumptions. Actual results could differ materially.

Investors are advised to read the detailed risk factors discussed in our latest Form 10-K, our other filings with the Securities and Exchange Commission, and our 4Q 2025 earnings release as they relate to forward-looking statements along with other risks discussed in our SEC filings. We undertake no obligation to publicly address or update any forward-looking statements in future filings or communications regarding our business or results.

Today’s release, our historical financial news releases and our filings with the SEC are all also available on our Investor Relations site.

These remarks include financial measures that are not in accordance with generally accepted accounting principles, or GAAP.

Management's explanation for the use of these non-GAAP measures and reconciliations of GAAP to non-GAAP financial measures are included in today’s release which can be found via the following link: https://humana.gcs-web.com/financial-information/quarterly-results.

Finally, any references to earnings per share or EPS made within these remarks refer to diluted earnings per common share.

Exhibit 99.3

Humana Inc. Fourth Quarter 2025 Prepared Management Remarks 2/11/2026

Executive Summary

•Committed to delivering a stable and compelling Medicare Advantage (MA) margin and unlocking the earnings potential of the business by 2028 as laid out at our 2025 Investor Day

•Our MA benefit strategy will contemplate the funding environment each year

•Efforts to strengthen our Stars program are progressing as anticipated as we focus on achieving Top Quartile Stars results in Bonus Year (BY) 2028

•Delivered on our commitments in 2025, reporting Full Year (FY) Adjusted EPS of $17.14, in line with expectations and above our initial guidance of ‘approximately $16.25’

•Remain confident in our customer-led strategy and 2026 membership outlook for individual MA

•Expect new members to be enterprise accretive in 2026, on average

•More importantly, expect the membership to drive significant lifetime value, further fueling our ability to unlock the earnings potential of the business by 2028

•Our financial guidance philosophy is to be appropriately conservative. For 2026, the level of conservatism in our initial guidance is higher than typical to account for the dynamic environment

•Confident in our ability to fund the 2026 MA membership growth and are comfortable with our capital levels

Additional Key Takeaways

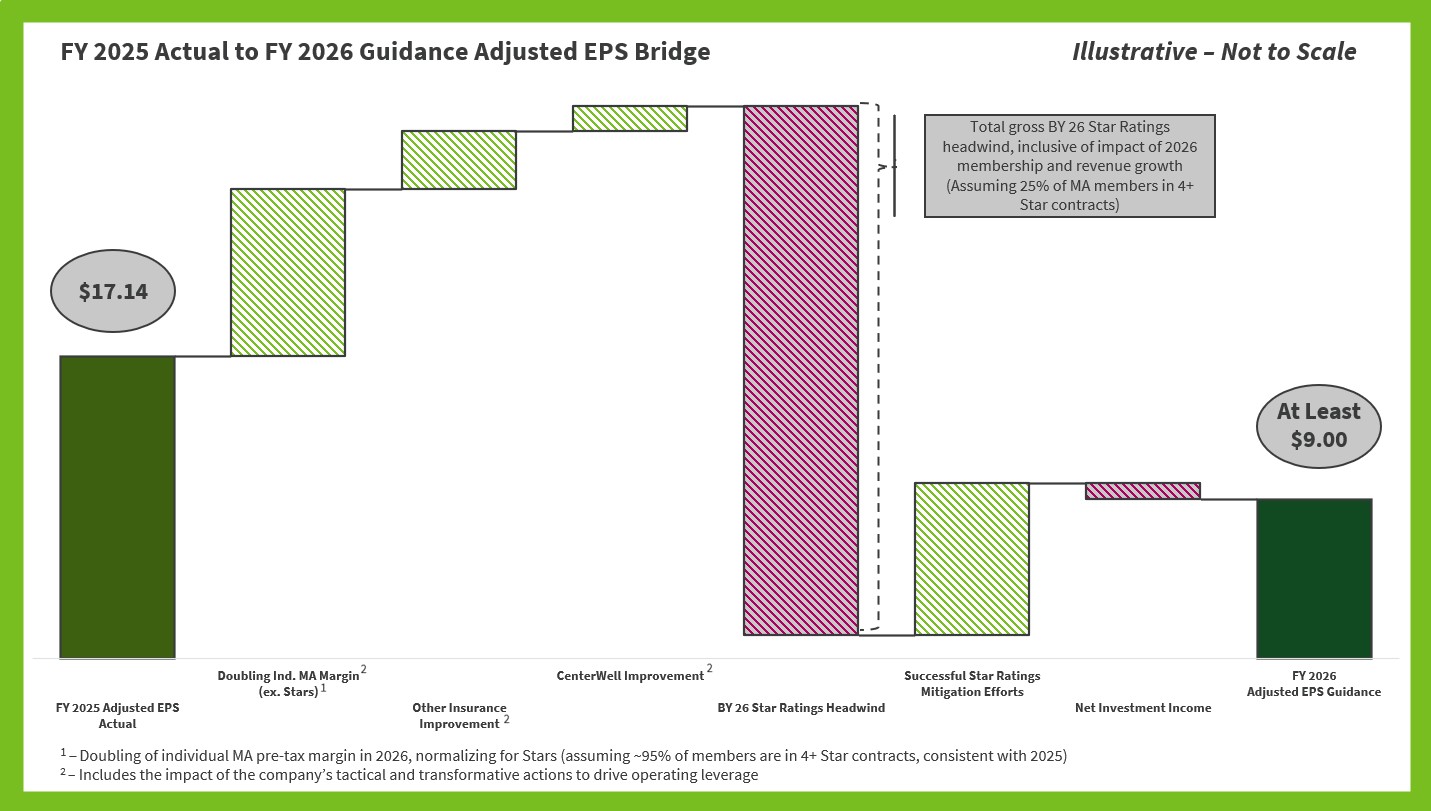

•Provided FY 2026 Adjusted EPS outlook of ‘at least $9’, with the anticipated year over year decline driven by the previously communicated BY 2026 Star Ratings headwind, net of mitigation (Appendix A)

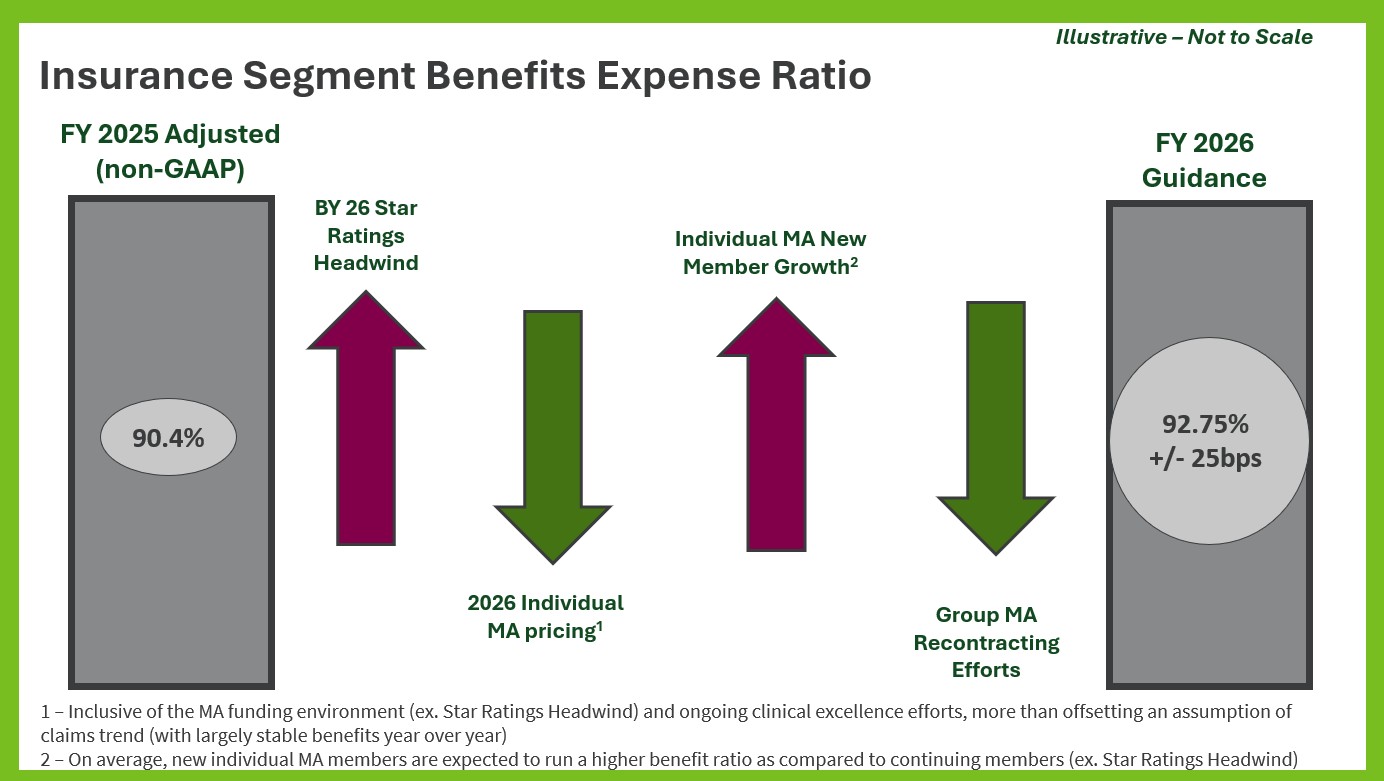

oExpect the FY 2026 Insurance segment benefit ratio to be 92.75%, plus or minus 25 basis points (Appendix B)

•Anticipate FY 2026 Individual MA membership growth of ‘approximately 25%’

oRetention rate improved by over 500 basis points year over year during the Annual Election Period (AEP)

oAnticipate approximately 45% of MA members in 4+ Star contracts in 2026

oConfident we have the operational capacity to deliver an exceptional experience and high-quality care that improves member retention, inclusive of our new Stars onboarding initiatives

•Group MA recontracting efforts expected to drive significant margin improvement in 2026 (normalizing for Stars), consistent with the outlook shared at our 2025 Investor Day

•Anticipate continued Medicaid and CenterWell momentum in 2026, which are expected to drive increased earnings contribution over the mid and longer term as they mature through their respective J curves

oExpanded Medicaid footprint, which now spans 13 states, including Georgia and Texas which are anticipated to launch in 2027; we continue to anticipate margin improvement from J curve maturation in 2026

oStrong growth expected in CenterWell Primary Care adding 60 to 70 clinics and 120,000 to 140,000 patients, while remaining on track to fully offset the impact of v28 and expand margin in 2026

oWe also expect CenterWell Pharmacy to benefit from increased volumes driven by membership growth and continued agnostic client base expansion

Exhibit 99.3

Humana Inc. Fourth Quarter 2025 Prepared Management Remarks 2/11/2026

Detailed Discussion:

2025 Results

•Achieved FY 2025 Adjusted EPS of $17.14, in line with expectations and exceeding initial guidance of ‘approximately $16.25’ while also electing to fund higher than initially planned investments to accelerate our transformation and position us well for the future

oResults underpinned by solid performance across the Insurance and CenterWell segments

oFY 2025 Insurance segment benefit ratio of 90.4%, slightly better than guidance of ‘the top end of the range of 90.1% to 90.5%’

Includes a benefit set aside for a potential Doc Fix for 2025, which was then invested in areas such as network management and increased administrative costs to support items such as technology and other areas that position us well for the future

2026 Outlook

Individual MA

Membership

•Expect FY membership growth of approximately 25% driven by new sales and improved retention from our customer-led benefit strategy and changes to our customer service approach

•Membership growth of approximately 1 million, or 20%, in the AEP (effective 1/1/2026)

oInclusive of approximately 140,000 additional D-SNP members, representing 18% D-SNP growth

oAEP growth represents a higher than historical percentage of expected FY growth due to the previously discussed adjustments made to our post-AEP marketing and distribution strategies, which we continue to manage dynamically

•Retention improved over 500 basis points year over year during the AEP, exceeding expectations and surpassing the ‘350 to 450 basis point improvement by 2028’ goal communicated at our 2025 Investor Day

•Most new sales during the AEP were on contracts with 4+ Stars. As a result, we now anticipate approximately 45% of MA members in 4+ Star contracts in 2026

•Over 70% of new sales during AEP were switchers from competitor MA plans

oHowever, our share capture of members impacted by competitor plan exits was approximately 12%, which is below our market share

•Nearly 30% of new sales during the AEP were bounce back members, which are individuals who have been a Humana member in the past

oBounce back members have historically been more engaged with the health plan as compared to individuals that have not previously been a Humana member

oFurther, we have greater insight into expected health status and utilization patterns due to our previous experience with these members

•Greater than 75% of our AEP sales came from higher lifetime value channels due to ongoing distribution mix rebalancing

•Project 20% lower per sale member acquisition costs in 2026 compared to 2025

•Confident we have the operational capacity to deliver an exceptional experience and high-quality care that improves member retention, inclusive of our new Stars onboarding initiatives

Exhibit 99.3

Humana Inc. Fourth Quarter 2025 Prepared Management Remarks 2/11/2026

•Membership growth expected to further fuel our ability to unlock the earnings potential of the business by 2028 as laid out at our 2025 Investor Day

Revenue, Cost Trends & Margin

•Individual MA premium yield expected to be in the low to mid-single digits for the FY, driven by the 2026 MA funding changes and the increased Part D direct subsidy, partially offset by the BY 2026 Star Ratings headwind

•Continue to anticipate the blend of core medical and pharmacy cost trends to be in the high single digits for 2026, with core medical cost trends on the higher end of mid-single digits and core pharmacy trends in the low double-digit range

•Continue to anticipate doubling individual MA margin in 2026 (normalizing for Stars – therefore assuming ~95% of members are in 4+ Star plans, consistent with 2025)

oAll in, after accounting for the BY 2026 Star Ratings headwind, our initial 2026 guidance assumes Individual MA margins are slightly below breakeven

Group MA

•Expect FY membership growth of approximately 150,000 driven by strong retention and the addition of new public and private sector clients including a large airline, the Teacher Retirement System (TRS) of Kentucky and the Alabama Public Education Employees' Health Insurance Plan (PEEHIP)

•Consistent with expectations communicated at our 2025 Investor Day, we anticipate significant improvement in Group MA margins in 2026 (normalizing for Stars) driven by re-contracting to appropriately reflect the reimbursement levels and cost trends

Stand-Alone Part D (PDP)

•Anticipate FY membership growth of approximately 1 million, largely concentrated in our Basic and Value PDP plans

•We are participating in the PDP Premium Stabilization Demonstration in 2026 which limits the maximum amount of member premium increase, while increasing the direct subsidy paid to plan sponsors

•Finally, we are enhancing patient health outcomes and enterprise value from our PDP plans by driving mail order pharmacy usage and conversions to MA

Medicaid

•Expect FY membership growth in the range of 25,000 to 100,000

oIncludes the January 1, 2026 initial phase-in of the Michigan Highly Integrated Dual Eligible (HIDE) Special Need Plan (SNP), the statewide Illinois Fully Integrated Dual Eligible (FIDE) SNP program launch, as well as the carve in of dual eligibles into the South Carolina Medicaid program

oNew program launches expected to be partially offset by the impact of national Medicaid enrollment headwinds

•Anticipate margin improvement from J curve maturation in 2026, with approximately 40% of expected revenue in the 6 states that we have operated less than 3 years

Exhibit 99.3

Humana Inc. Fourth Quarter 2025 Prepared Management Remarks 2/11/2026

•Continue to navigate procurement challenges related to our recent awards in Texas and Georgia. We remain bullish on these awards and our ability to win new business and successfully deliver value for our members and state partners

oAnticipate a decision on our Illinois Temporary Assistance for Needy Families (TANF) Request for Proposal (RFP) submission in the first quarter of 2026

CenterWell

Primary Care

•We anticipate adding up to 60 to 70 centers with net patient growth of 120,000 to 140,000, reflecting approximately 26% patient growth at the midpoint

oAccelerated pace of growth driven by continued high-value, opportunistic M&A as well as strong same-store organic growth, expansion of our IPA business, and continued, albeit measured, de novo expansion

•Continue to anticipate we will mitigate the ultimate impact of the v28 risk model changes in 2026 through a multi-pronged plan including numerous operational efficiencies such as centralizing and streamlining administrative functions, standardizing the clinic operating model, and improving clinician productivity to increase capacity

•Consistent with expectations shared at our 2025 Investor Day, anticipate improved margin year over year with the impact of the final year of the v28 phase in and the addition of centers at various stages of maturation (including the previously discussed headwind related to The Villages Health acquisition) expected to be offset by:

oAdvancement of our ongoing v28 mitigation activities, including clinical model investments and

oFurther maturation of our existing centers progressing through the J curve

Home

•CenterWell Home Health anticipates a mid-single digit percentage increase in same store admissions for FY 2026

•Within OneHome, we expect expansion of our value-based home health models in 2026, including:

oBroader coverage of Skilled Nursing Facility (SNF) services across 15 states, representing approximately 2 million lives

•In addition, we continue to execute on our comprehensive initiative to drive productivity and efficiency within our home operating model to offset reimbursement and other pressures

oInitiatives focused in areas such as improving caregiver productivity, minimizing the use of contract labor, and outsourcing certain aspects of revenue cycle management

Pharmacy

•CenterWell Pharmacy expects increased volumes in 2026 associated with Humana’s membership growth and continued industry leading mail order penetration

•Further, we expect continued expansion of our agnostic client base with a significant year over year increase in Specialty, Direct to Consumer (DtC), and Direct to Employer (DtE) volumes anticipated

Exhibit 99.3

Humana Inc. Fourth Quarter 2025 Prepared Management Remarks 2/11/2026

•All in, we anticipate solid improvement in Pharmacy earnings contribution in 2026 with robust revenue growth across Specialty, DtC, DtE and Home delivery

•Within Humana Pharmacy Solutions, our Pharmacy Benefit Manager (PBM) business, we remain focused on providing affordable access to medications for Humana health plan members

oAs a reminder, our PBM fees are not linked to drug prices. Further, our PBM activity is intercompany and is reported and eliminated within our Insurance segment

Operating Efficiencies

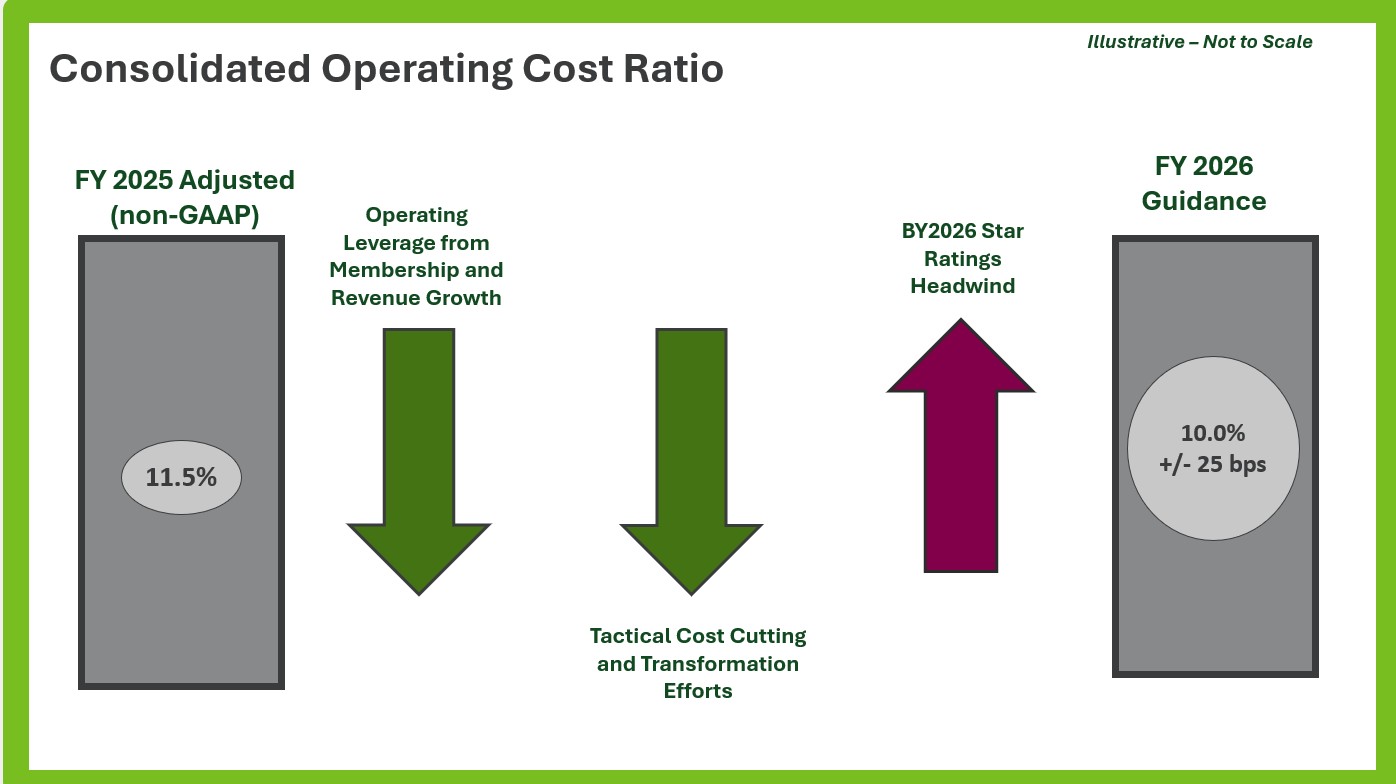

•Anticipate the consolidated operating cost ratio to be 10%, plus or minus 25 basis points

oThe expected decrease from the FY 2025 Adjusted operating cost ratio of 11.5% is driven by operating leverage from membership and revenue growth, along with tactical cost cutting and transformation efforts, which are progressing as anticipated. These items were partially offset by the impact of the BY 2026 Star Ratings decline (Appendix C)

Net Investment Income

•As previously shared, FY 2026 net investment income is expected to be down approximately $150 million year over year primarily driven by lower average interest rates on our investment portfolio and other capital optimization activity

oYear over year comparison excludes the impact of the non-cash impairment charge in 4Q25 related to a discrete joint-venture investment which was adjusted for non-GAAP purposes in 2025

Capital Deployment & Balance Sheet

•Will continue our prudent capital deployment approach in 2026, taking a balanced approach to evaluating capital investments and returns

oAs a result, our 2026 outlook contemplates minimal share repurchase activity to offset dilution from stock-based compensation

oWe will continue to evaluate select small to mid-sized strategic M&A activity, primarily within CenterWell

•Continue to execute on our efforts to increase the efficiency of our balance sheet and fortify our foundation, including working capital improvements, non-core asset sales, liability and capital management

oOur capital optimization progress significantly reduces the funding required for expected membership growth in 2026

oInitiatives include optimizing legal entity structures, refining reinsurance and risk transfer arrangements, enhancing investment portfolio efficiency, and managing the timing and structure of capital deployment

oImprovements in capital efficiency will offset over $3 billion of growth in our capital requirements from the end of 2024 through 2026, representing the overwhelming majority of the capital needed to fund 2026 membership growth, while maintaining strong regulatory capital and liquidity positions

oWe continue to evaluate additional opportunities in a disciplined manner with a focus on regulatory requirements, ratings agency considerations, and market conditions

Exhibit 99.3

Humana Inc. Fourth Quarter 2025 Prepared Management Remarks 2/11/2026

•As of December 31, 2025, we have no amount drawn on the 5-year revolver and no outstanding commercial paper

oDebt to capitalization as of December 31, 2025 is 41.1%, up from 40.3% as of September 30, 2025 driven by the impact of the 4Q25 net loss, partially offset by the repayment of senior notes in 4Q25

oWe continue to target a debt to capitalization ratio of approximately 40% over the long term

•Intend to maintain our dividend flat year over year on a per share basis throughout 2026

•In summary, after contemplating capital required to fund 2026 membership growth and select small to mid-size strategic M&A opportunities, we remain comfortable with our capital levels, which are in line with regulatory and rating agency expectations. Further, we remain committed to prudent debt to capital management and are focused on maintaining our credit ratings.

Earnings Seasonality

•At this time, we expect first quarter earnings to be approximately 110% to 115% of expected FY 2026 Adjusted earnings and anticipate that the first quarter Insurance segment benefit ratio to be just under 90%. Finally, we expect the consolidated benefit ratio will be generally in line with the Insurance segment benefit ratio.

Conclusion:

•Pleased with our solid performance in 2025 and remain confident in our customer-led strategy and 2026 membership outlook for MA

•Remain focused on levers within our control, driving clinical excellence and improved operating efficiency, which we expect to drive better health outcomes and experiences for our members, patients, provider partners and associates, while delivering compelling long-term value for our shareholders

•Committed to delivering a stable and compelling MA margin and unlocking the earnings potential of the business by 2028 as laid out at our 2025 Investor Day

oOur MA benefit strategy will contemplate the funding environment each year

Jim Rechtin, President and Chief Executive Officer

Celeste Mellet, Chief Financial Officer

Exhibit 99.3

Humana Inc. Fourth Quarter 2025 Prepared Management Remarks 2/11/2026

Appendix A

Exhibit 99.3

Humana Inc. Fourth Quarter 2025 Prepared Management Remarks 2/11/2026

Appendix B

Exhibit 99.3

Humana Inc. Fourth Quarter 2025 Prepared Management Remarks 2/11/2026

Appendix C