Exhibit 99.1

|

|

FOR EXISTING BLACKSTONE PRIVATE CREDIT FUND SHAREHOLDERS ONLY FEBRUARY 2026 |

BCRED: Software in Spotlight

|

|

|

Michael Zawadzki and Rodney Zemmel discuss Blackstone’s approach to private credit in software and assessing Artificial Intelligence (AI) risks and opportunities. |

||

|

Michael Zawadzki Global Chief Investment Officer, BXCI |

Rodney Zemmel Global Head of Blackstone Operating Team |

Q. What is your view on how the emergence of AI will impact software businesses?

Investors can’t simply paint software with a broad brush – AI impact varies widely by business. We see more resilient companies anchored in proprietary data, complex and mission-critical workflows, and high judgement use-cases. These include areas such as cybersecurity, vertical software, and enterprise resource planning. By contrast, businesses are more vulnerable to AI disruption when relying on commoditized data, rules-based or basic creative work, or legacy technology. Ultimately, outcomes will be driven by fundamentals and execution, not AI headlines. Management teams, sponsorship, and active engagement are critical.

|

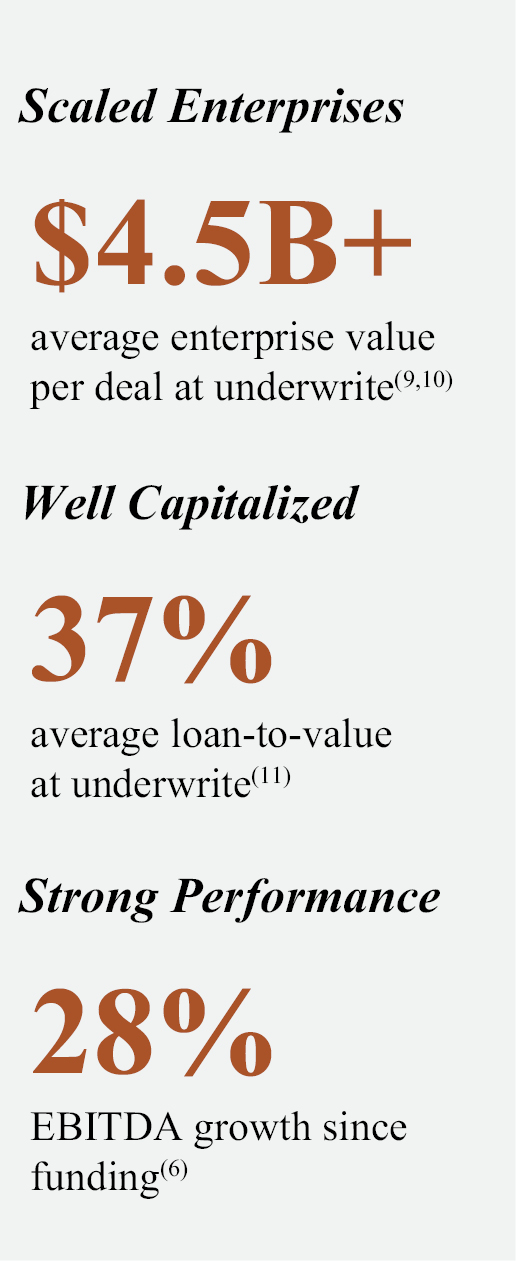

Q. What is BCRED’s current exposure in software? BCRED’s software exposure, at approximately 26% of the portfolio,(1) is intentional and grounded in long-term credit fundamentals. Technology, which includes software, has historically been the lowest default rate sector over the past ~20 years,(2) supported by high growth, recurring revenues, and strong free cash flow. BCRED’s software portfolio is invested across more than a dozen sub-verticals and heavily weighted toward areas that we believe benefit from AI adoption or face low disruption risk based on our current analysis.(3,4) Our software investments are characterized by large, established companies, low LTVs with ~$3B of average equity cushion per deal at underwrite,(5) and continue to demonstrate strong performance with 28% EBITDA growth(6) since our investment and ~2x interest coverage ratio.(7) While a small subset of companies will face AI-related headwinds, we believe this select portion of the portfolio is appropriately reflected in our marks(8) and BCRED’s NAV, and BX has the operational and value creation capabilities to support these companies as needed. |

|

|

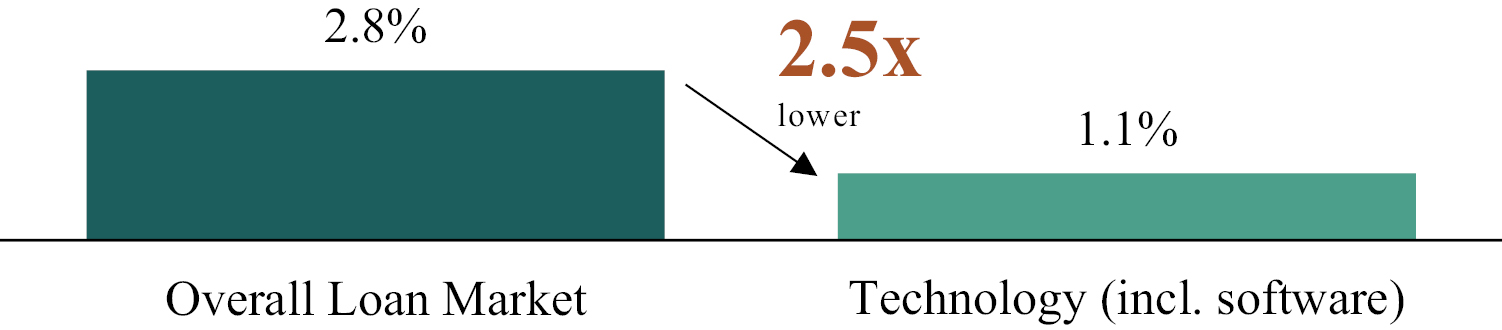

Long-Term Average Loan Default Rates(2)

|

|

As of December 31, 2025 unless noted otherwise, and the above reflects Blackstone Credit & Insurance’s views and beliefs as of this date only, which is subject to change. Past performance does not predict future returns. There can be no assurance that any Blackstone fund or investment will achieve its objectives or avoid substantial losses. There can be no assurances that any of the trends described herein will continue or will not reverse. See “Important Disclosure Information” including “Opinions” and “Use of Leverage”. |

|||

|

BCRED: Software in Spotlight |

Blackstone |

| |

1 |

|

FOR EXISTING BLACKSTONE PRIVATE CREDIT FUND SHAREHOLDERS ONLY |

Q. How is BCRED’s software portfolio positioned in today’s AI macro environment?

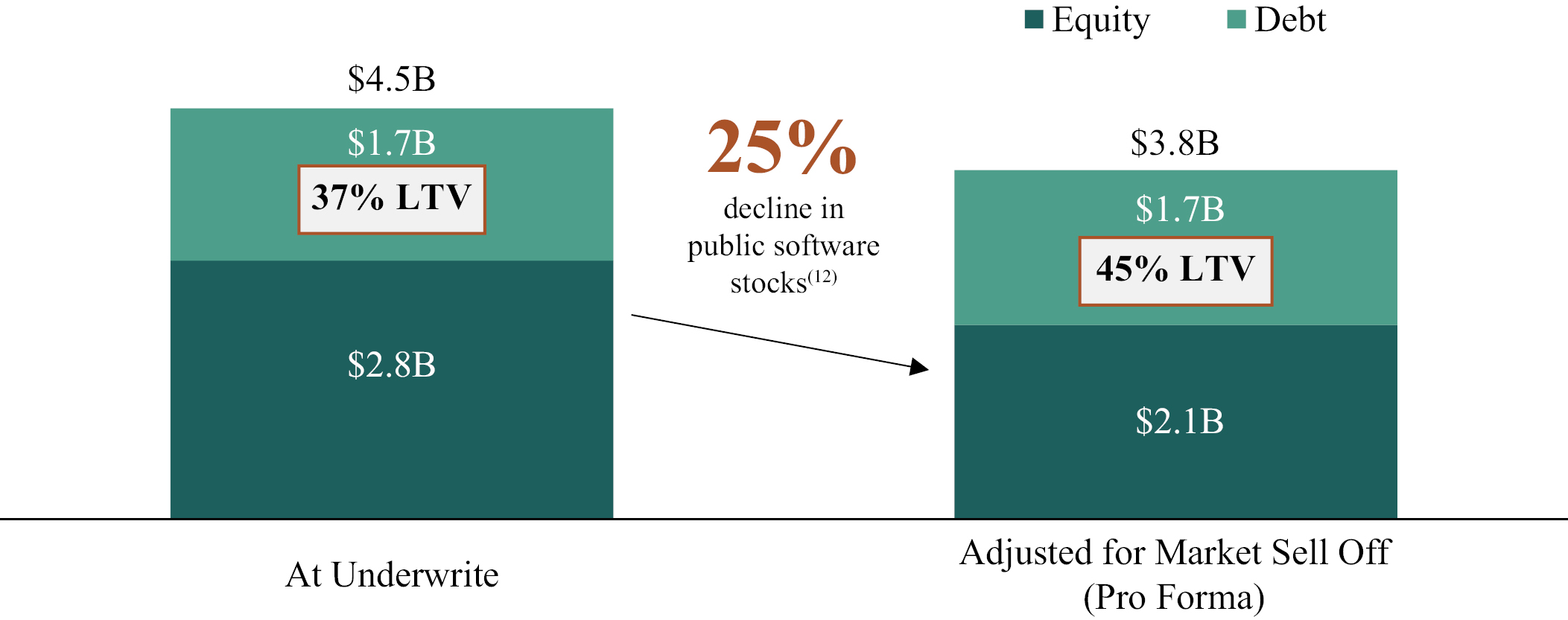

BCRED’s senior secured positioning provides us meaningful downside protection. We sit at the top of the capital structure, with an average LTV of 37% at underwrite,(11) meaning more than 60% of a company’s value would need to be impaired before our capital is affected. Even accounting for the nearly 25% decline in public software stocks,(12) our LTV would remain below 50%, reinforcing BCRED’s core value proposition: strong risk mitigation combined with attractive current income and excess spread.

Illustrative Enterprise Value Impact(13)

|

Note: The above chart is presented for illustrative purposes only and should not be viewed as a projection or guarantee of actual or future values. |

Q. What are the key factors when underwriting and managing AI-related risk?

AI has been a key theme for Blackstone Credit & Insurance’s (BXCI’s) Investment Committee. BXCI approaches it from two angles: How do we invest in AI opportunities? And how do we protect our portfolio from AI disruption?

Across BXCI, AI is a ‘page one’ topic when we review deals, assessed through our proprietary AI scorecard. BXCI focuses on companies with attributes that have real moats around them – critical infrastructure that is difficult to replace, proprietary data that no one else can replicate, or executing complex workflows that lead to critical outcomes. BXCI leverages Blackstone’s scale and intellectual capital to evaluate each subsector and deal through this specific lens.

Blackstone Advantages Include:

• Hundreds of technologists within Blackstone who use and evaluate procurement of software products daily, providing true product-level insight

• Our scaled data science team that works actively with portfolio companies and sponsors to help them adapt to change

• Active partnership with Blackstone Operating Team (BXOT) to support portfolio companies and leverage insights from our PE team

The goal is simple: leverage these resources to help businesses thrive - whether by capitalizing on AI opportunities or protecting against disruption.

|

As of December 31, 2025 unless noted otherwise, and the above reflects Blackstone Credit & Insurance’s views and beliefs as of this date only, which is subject to change. Past performance does not predict future returns. There can be no assurance that any Blackstone fund or investment will achieve its objectives or avoid substantial losses. There can be no assurances that any of the trends described herein will continue or will not reverse. See “Important Disclosure Information” including “Opinions” and “Use of Leverage”. |

||||||

|

BCRED: Software in Spotlight |

Blackstone |

| |

2 |

|||

|

FOR EXISTING BLACKSTONE PRIVATE CREDIT FUND SHAREHOLDERS ONLY |

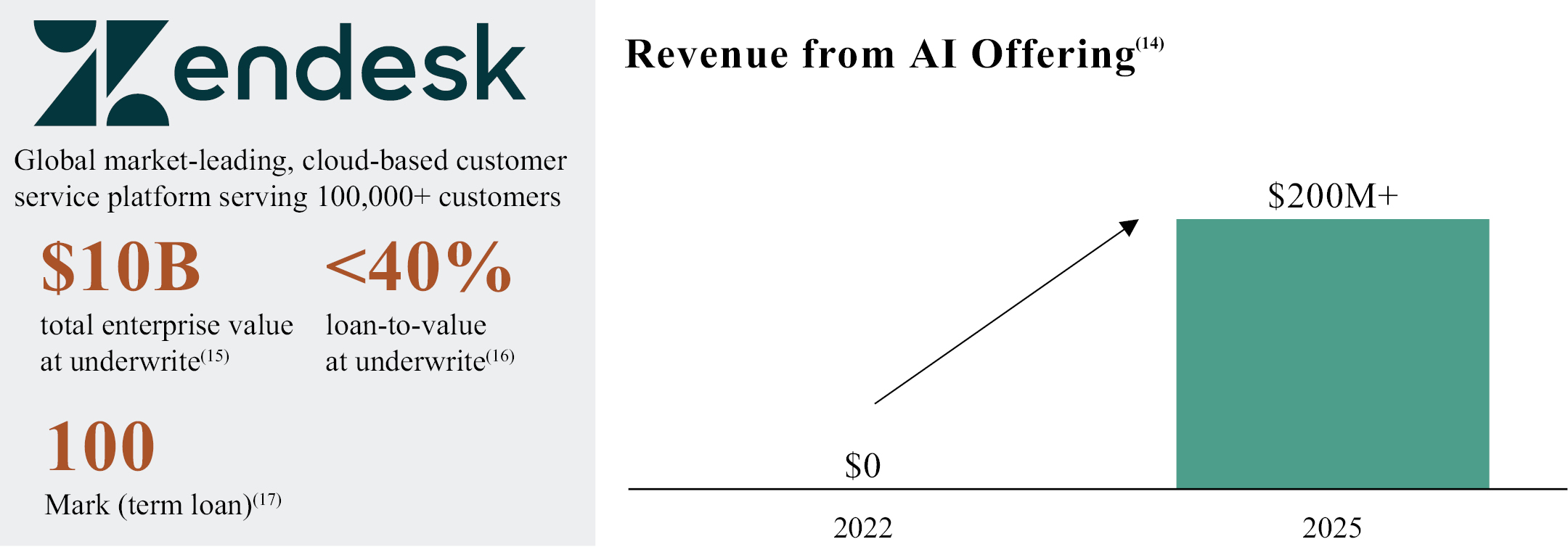

Sponsorship & Management: Incumbency Can Turn Companies into AI Winners

AI exposure does not inherently imply negative outcomes. With the right sponsor and management, companies can turn headwinds into advantages, as illustrated by Zendesk, one of BCRED’s top five software positions as of December 2025, which has leveraged its scale and incumbency to invest strategically in AI and grow in-house AI annual recurring revenue from $0 to over $200M since its acquisition in 2022.(14)

|

|

Q. Where are you finding opportunities in the current AI-driven environment and why does manager and platform matter more than ever?

Ultimately, this environment reinforces that who you invest with matters. Periods of disruption and rapid technological innovation reward private credit managers with scale, experience, and a proven ability to focus on fundamentals through the noise. The AI cycle is opening new, attractive areas for private credit, particularly in data centers, AI infrastructure, and “picks-and-shovels” that benefit from long-term secular tailwinds. BCRED benefits from the depth and insights across Blackstone’s platform to identify attractive opportunities, complete rigorous due diligence, and create value for our companies.

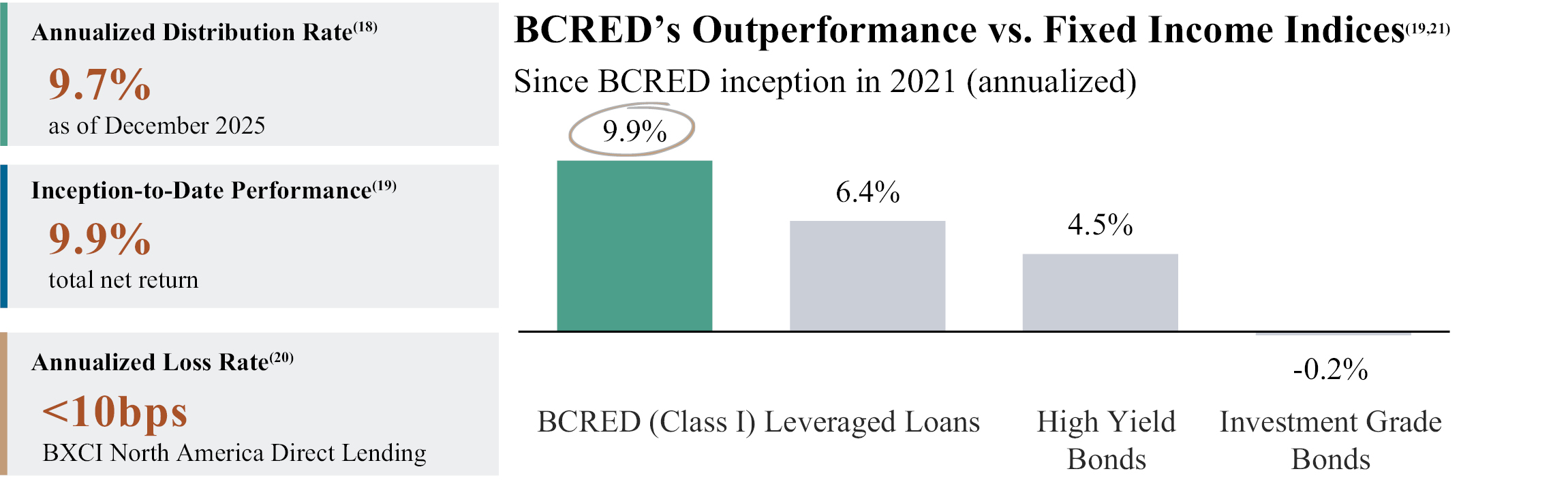

That advantage has translated into results: Five years of delivering strong risk-adjusted returns to investors. BCRED has continued to deliver on its core promise – high current income, consistent performance across market cycles, disciplined underwriting, and a defensively constructed portfolio.

|

As of December 31, 2025 unless noted otherwise and the above reflects Blackstone Credit & Insurance’s views and beliefs as of this date only, which is subject to change. Past performance does not predict future returns. There can be no assurance that any Blackstone fund or investment will achieve its objectives or avoid substantial losses. There can be no assurances that any of the trends described herein will continue or will not reverse. See “Important Disclosure Information” including “Case Studies“ “Logos” and “Use of Leverage”. |

||||||

|

BCRED: Software in Spotlight |

Blackstone |

| |

3 |

|||

End Notes

Note: Based on Blackstone Credit & Insurance views as of December 31, 2025. Data is as of December 31, 2025, unless otherwise indicated. Returns for periods greater than one year are annualized. Past performance does not predict future returns. There can be no assurance that any fund or alternative asset class will achieve results comparable to those of any of Blackstone’s funds or be able to implement its strategy or achieve its investment objectives, including due to an inability to access sufficient investment opportunities, avoid substantial losses, or that any expected returns will be met.

1. Reflects the fair market value of investments within the BCRED’s Software portfolio (as classified under the GICS Industry level) as a percentage of the total fair market value of all investments.

2. Source: Fitch Ratings as of January 2026. Data from 2007 – 2025 (LTM average). Based on the total universe and Technology sector (of which approximately 60% is software) loan sector default rates. See “Important Disclosure Information” including “Trends.”

3. AI risk categories reflect current views of Blackstone Credit & Insurance, based on a qualitative application of BXCI’s AI risk scorecard, in conjunction with an assessment of the AI risk profiles of companies within each vertical. The scorecard evaluates potential risks to end markets, business models, and company moats. AI risk categories of investments within BCRED’s Software portfolio (as classified under the GICS Industry level) as a percentage of the total fair market value of all investments, are as follows: 17% (Low AI Impact/ Tailwinds), 4% (Drive AI Impact), <5% (AI Head-winds).

4. Diversification does not ensure a profit or protect against losses.

5. Based on the subordinated capital at close for each applicable investment. Includes all debt investments within BCRED’s software portfolio (as classified under the GICS Industry level) for which fair value is determined by the Board in conjunction with a third-party valuation firm and excludes both asset-based investments and quoted investments. Average subordinated capital is weighted based on the fair value of total applicable investments as of December 31, 2025.

6. Includes all applicable debt investments in BCRED’s software portfolio (as classified under the GICS Industry level) for which fair value is determined by the Board in conjunction with a third-party valuation firm and excludes both asset-based investments and quoted investments. Amounts derived from the most recently available portfolio company financial statements have not been independently verified by BCRED, may reflect a normalized or adjusted amount, and are generally about 90 days in arrears. Accordingly, BCRED makes no representation or warranty in respect of this information. Aggregate growth since close represents portfolio company growth since BCRED’s initial investment close and is not adjusted for repricings or refinancings. EBITDA growth since funding for debt investments within BCRED’s Software sector (as classified under the GICS Industry level), split by BXCI AI risk category is as follows: 32% (Low AI Impact/ Tailwinds), 26% (Drive AI Impact), and 6% (AI Head-winds).

7. Interest coverage ratio (“ICR”) is estimated as the ratio of average LTM EBITDA, to cash interest paid over the last 12 months for each applicable portfolio company. Includes all debt investments within BCRED’s Software portfolio (as classified under the GICS Industry level) (excluding ARR loans) for which fair value is determined by the Board in conjunction with a third party valuation firm and excludes both asset-based investments and quoted investments. Amounts derived from the most recently available portfolio company financial statements, have not been independently verified by BCRED, may reflect a normalized or adjusted amount, and are generally about 90 days in arrears. Accordingly, BCRED makes no representation or warranty in respect of this information. EBITDA is a non-GAAP financial measure. For a particular portfolio company, LTM EBITDA is generally defined as net income before net interest expense, income tax expense, depreciation and amortization over the preceding 12-month period. Currency fluctuations may have an adverse effect on the value, price or income and costs of our portfolio companies and investments which may increase or decrease as a result of changes in exchange rates. Average mark based on debt investments within BCRED’s Software portfolio (as classified under the GICS Industry level) for all applicable categorizations. EBITDA growth since funding includes all applicable debt investments in BCRED’s software portfolio (as classified under the GICS Industry level) for which fair value is determined by the Board in conjunction with a third-party valuation firm and excludes both asset-based investments and quoted investments. Amounts derived from the most recently available portfolio company financial statements have not been independently verified by BCRED, may reflect a normalized or adjusted amount, and are generally about 90 days in arrears. Accordingly, BCRED makes no representation or warranty in respect

of this information. Aggregate growth since close represents portfolio company growth since BCRED’s initial investment and is not adjusted for repricings or refinancings. ICR based on debt investments within BCRED’s Software sector (as classified under the GICS Industry level) split by BXCI AI risk categories is as follows: 2.2x (Low AI Impact/ Tailwinds), 2.3x (Drive AI Impact), and 1.2x (AI Head-winds).

8. As of December 31, 2025. Average mark based on debt investments within BCRED’s Software sector (as classified under the GICS Industry level) split by BXCI AI risk categories is as follows: 99% (Low AI Impact/ Tailwinds), 99% (Drive AI Impact), 88% (AI Head-winds).

9. Based on the enterprise value at close for each applicable investment. Includes all debt investments within BCRED’s software portfolio (as classified under the GICS Industry level) for which fair value is determined by the Board in conjunction with a third-party valuation firm and excludes both asset-based investments and quoted investments. Average enterprise value is weighted based on the fair value of total applicable investments as of December 31, 2025. The number is presented for illustrative purposes and does not reflect actual realized proceeds to BCRED or to the equity sponsor or the company, and there can be no assurance that realized proceeds received by Blackstone or any investor in a Blackstone fund will be increased as a result. Currency fluctuations may have an adverse effect on the value, price or income and costs of our portfolio companies and investments which may increase or decrease as a result of changes in exchange rates.

10. As of December 31, 2025. Average last-twelve-month (“LTM”) LTM EBITDA was $350M and includes all debt investments within BCRED’s software portfolio (as classified under the GICS Industry level) for which fair value is determined by BCRED’s Board in conjunction with a third-party valuation firm and excludes both asset-based investments and quoted investments. EBITDA is a non-GAAP financial measure. For a particular portfolio company, LTM EBITDA is generally defined as net income before net interest expense, income tax expense, depreciation and amortization over the preceding 12-month period. Amounts are weighted on fair market value of each respective investment. Amounts were derived from the most recently available portfolio company financial statements (which are generally one quarter in arrears), have not been independently verified by BCRED, and may reflect a normalized or adjusted amount. Accordingly, BCRED makes no representation or warranty in respect of this information.

11. Average loan-to-value represents the net ratio of loan-to-value for each portfolio company in BCRED’s software portfolio (as classified under the GICS Industry level) weighted based on the fair value of total applicable investments as of December 31, 2025. Includes all debt investments within BCRED’s software portfolio for which fair value is determined by the Board in conjunction with a third-party valuation firm and excludes both asset-based investments and quoted investments. Loan-to-value is calculated as the total net debt through each respective loan divided by the estimated enterprise value of the portfolio company at time of underwrite. Amounts have not been independently verified by BCRED and may reflect a normalized or adjusted amount. Accordingly, BCRED makes no representation or warranty in respect of this information.

12. Based on the S&P 500 Software (Industry) Index price performance for the 6-month period ending February 10, 2026.

13. Based on Blackstone Credit & Insurance views as of December 31, 2025. Past performance does not predict future returns, and there can be no assurance that Blackstone Credit & Insurance will achieve comparable results or that Blackstone Credit & Insurance will be able to implement its investment strategy or achieve its investment objectives. Portfolio diversification does not guarantee profit or protect against loss. For more information, please see additional disclosures at the end of this presentation. See “Important Disclosure Information” including “Trends” and “Use of Leverage”.

14. Bloomberg article published on February 3, 2026, “Private Equity’s Giant Software Bet Has Been Upended by AI.” See “Important Disclosure Information” including “Case Studies” “Logos” and “Third Party Information.“

15. Based on enterprise value at close of the investment. Please refer to Footnote 9 for more information on enterprise value.

16. Loan-to-value is calculated as the total net debt through each respective loan divided by the estimated enterprise value of the portfolio company at time of underwrite. Amounts have not been independently verified by BCRED and may reflect a normalized or adjusted amount. Accordingly, BCRED makes no representation or warranty in respect of this information.

17. As of September 30, 2025.

|

BCRED: Software in Spotlight |

Blackstone |

| |

4 |

End Notes (Cont’d)

18. Annualized Distribution Rate reflects January 2026’s distribution annualized and divided by last reported NAV from December 2025. Distributions are not guaranteed. Past performance does not predict future returns. Distributions have been and may in the future be funded through sources other than net investment income. See BCRED’s prospectus. Please visit the Shareholders page on BCRED’s website for notices regarding distributions subject to Section 19(a) of the Investment Company Act of 1940. We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital, or offering proceeds, and although we generally expect to fund distributions from cash flow from operations, we have not established limits on the amounts we may pay from such sources. As of December 31, 2025, 100% of inception to date distributions were funded from net investment income or realized short-term capital gains, rather than a return of capital. A return of capital (1) is a return of the original amount invested, (2) does not constitute earnings or profits and (3) will have the effect of reducing the basis such that when a shareholder sells its shares the sale may be subject to taxes even if the shares are sold for less than the original purchase price. Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by Blackstone Credit BDC Advisors LLC (the “Sub-Adviser”) or its affiliates, that may be subject to reimbursement to the Sub-Adviser or its affiliates. The repayment of any amounts owed to our affiliates will reduce future distributions to which you would otherwise be entitled.

19. Inception date for Class I and Class S shares: January 7, 2021. Inception date for Class D shares: May 1, 2021. Total Net Return is calculated as the change in net asset value (“NAV”) per share during the period, plus distributions per share (assuming dividends and distributions are reinvested) divided by the beginning NAV per share. Returns greater than one year are annualized. Inception-to-date (“ITD”) total return for Class S (no/with upfront placement fee): 9.0%/8.2%. ITD total return for Class D (no/with upfront placement fee): 9.2%/8.9%. All returns shown are derived from unaudited financial information and are net of all BCRED expenses, including general and administrative expenses, transaction related expenses, management fees, incentive fees, and share class specific fees, but exclude the impact of early repurchase deductions on the repurchase of shares that have been outstanding for less than one year. Past performance does not predict future returns. Class S and Class D listed as (With Upfront Placement Fee or Brokerage Commissions) reflect the returns after the maximum upfront placement fees. Class S and Class D listed as (No Upfront Placement Fee or Brokerage Commissions) exclude upfront placement fees. Class I does not have upfront placement fees. The returns have been prepared using unaudited data and valuations of the underlying investments in BCRED’s portfolio, which are estimates of fair value and form the basis for BCRED’s NAV. Valuations based upon unaudited reports from the underlying investments may be subject to later adjustments, may not correspond to realized value and may not accurately reflect the price at which assets could be liquidated.

20. Represents BXCI’s average annualized loss rate for its North America Direct Lending strategy from 2006 through December 31, 2025. The annualized loss rate represents annualized net losses for substantially realized investments. Whether an investment is substantially realized is determined in the manager’s discretion. Investments are included in the loss rate if (1) a payment was missed, (2) bankruptcy was declared, (3) there was a restructuring, or (4) it was realized with a total multiple on invested capital less than 1.0x. Net losses include all profits and losses associated with these investments, including interest payments received. Net losses are represented in the year the investment is substantially realized and excludes all losses associated with unrealized investments. The annualized net loss rate is the net losses divided by the average annual remaining invested capital within the platform. Investments sourced by BXCI for the Sub Advised Investments did, in certain cases, experience defaults and losses after BXCI was no longer sub-adviser, and such defaults and losses are not included in the rates provided. Prior to December 31, 2022, the methodology used by the North America Direct Lending track record for calculating the platform’s average annual loss rate was based on net loss of principal resulting only from payment defaults in the year of default which would exclude interest payments. Past performance does not predict future returns, and there can be no assurance that BXCI will achieve comparable results or that any entity or account managed by or advised by BXCI will be able to implement its investment strategy or achieve its investment objectives.

21. Please see “Index Definitions” and “Index Comparison” at the end of this presentation for more information. Source: Morningstar, Blackstone Credit & Insurance (“BXCI”) as of December 31, 2025. “Leveraged Loans” is represented by Morningstar LSTA U.S. Leveraged Loan Index. “High Yield Bonds” is represented by the Bloomberg U.S. Corporate High Yield Index. “Investment Grade Bonds” is represented by the Bloomberg U.S. Aggregate Bond Index. There can be no assurances that any of the trends described throughout this material will continue or will not reverse.

|

BCRED: Software in Spotlight |

Blackstone |

| |

5 |

Past Performance and Forward-Looking Statements

Past performance does not predict future returns. The opinions expressed herein reflect the current opinions of Blackstone as of the date appearing in this material only. There can be no assurance that views and opinions expressed in this document will come to pass. The above is not intended to be indicative of future results to be achieved by the proposed fund; actual results may differ materially from the information generated through the use of illustrative components of return. While Blackstone believes that these assumptions are reasonable under the circumstances, there is no assurance that the results will be obtained, and unpredictable general economic conditions and other factors may cause actual results to vary materially. Any variations could be adverse to the actual results.

Certain information contained in this communication constitutes “forward-looking statements”. These forward-looking statements can be identified by the use of forward-looking terminology, such as “outlook,” “indicator,” “believes,” “expects,” “potential,“ “continues,” “may,” “can,“ “could,” “will,” “should,” “seeks,” “approximately,” “predicts,“ “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction,“ “identified” or the negative versions of these words or

other comparable words thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, statements regarding future performance, statements regarding economic and market trends and statements regarding identified but not yet closed investments. Such forward- looking statements are inherently subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. BCRED believes these factors also include but are not limited to those described under the section entitled “Risk Factors” in its prospectus, and any such updated factors included in its periodic filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document (or BCRED’s prospectus and other filings). Except as otherwise required by federal securities laws, BCRED undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

Important Disclosure Information and Risk Factors

Summary of Risk Factors

Blackstone Private Credit Fund (“BCRED” or the “Fund”) is a non- exchange traded business development company (“BDC”) that expects to invest at least 80% of its total assets (net assets plus borrowings for investment purposes) in private credit investments (loans, bonds and other credit instruments that are issued in private offerings or issued by private companies). This investment involves a high degree of risk. You should purchase these securities only if you can afford the complete loss of your investment. You should read the prospectus carefully for a description of the risks associated with an investment in BCRED.

These risks include, but are not limited to, the following:

▪ There is no assurance that we will achieve our investment objectives.

▪ This is a “blind pool” offering and thus you will not have the opportunity to evaluate our investments before we make them.

▪ You should not expect to be able to sell your shares regardless of how we perform.

▪ You should consider that you may not have access to the money you invest for an extended period of time.

▪ We do not intend to list our shares on any securities exchange, and we do not expect a secondary market in our shares to develop prior to any listing.

▪ Because you may be unable to sell your shares, you will be unable to reduce your exposure in any market downturn.

▪ We have implemented a share repurchase program, but only a limited number of shares will be eligible for repurchase and repurchases will be subject to available liquidity and other significant restrictions.

▪ An investment in our common shares is not suitable for you if you need access to the money you invest. See “Suitability Standards” and “Share Repurchase Program” in the prospectus.

▪ You will bear substantial fees and expenses in connection with your investment. See “Fees and Expenses” in the prospectus.

▪ We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital or offering proceeds, and although we generally expect to fund distributions from cash flow from operations, we have not established limits on the amounts we may pay from such sources.

▪ Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by Blackstone Private Credit Strategies LLC (the “Adviser”) and Blackstone Credit BDC Advisors LLC (the “Sub Adviser” and, together with the Adviser, the “Advisers”) or their affiliates, that may be subject to reimbursement to the Advisers or their affiliates. The repayment of any amounts owed to our affiliates will reduce future distributions to which you would otherwise be entitled.

▪ We use and continue to expect to use leverage, which will magnify the potential for loss on amounts invested in us.

▪ We intend to invest in securities that are rated below investment grade by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value.

▪ We do not own the Blackstone name, but we are permitted to use it as part of our corporate name pursuant to the investment advisory agreement between BCRED and an affiliate of Blackstone Inc. (“Blackstone”). Use of the name by other parties or the termination of the use of the Blackstone name under the investment advisory agreement may harm our business.

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved of these securities or determined if the prospectus is truthful or complete. Any representation to the contrary is unlawful.

This sales material must be read in conjunction with the BCRED prospectus in order to fully understand all the implications and risks of an investment in BCRED. This sales material is neither an offer to sell nor a solicitation of an offer to buy securities. An offering is made only by the prospectus, which must be made available to you prior to making a purchase of shares and is available at www.BCRED.com. An investor should consider the investment objectives, risks, and charges and expenses of BCRED carefully before investing. Prior to making an investment, investors should read the prospectus, including the “Risk Factors” section therein, which contains a discussion of the risks and uncertainties that we believe are material to our business, operating results, prospects and financial condition.

Numerical data is approximate and as of December 31, 2025 unless otherwise noted. The words “we”, “us”, and “our” refer to BCRED, unless the context requires otherwise.

|

BCRED: Software in Spotlight |

Blackstone |

| |

6 |

Additional Important Disclosures

This document (together with any attachments, appendices, and related materials, the “Materials”) is provided on a confidential basis for informational due diligence purposes only and is not, and may not be relied on in any manner as legal, tax, investment, accounting or other advice or as an offer to sell, or a solicitation of an offer to buy, any security or instrument in or to participate in any trading strategy with Blackstone or its affiliates in the credit-focused business of Blackstone Inc. (together with its affiliates, “Blackstone”), or any fund or separately managed account currently or to be sponsored, managed, advised or sub-advised or pursued by Blackstone (each, a “Fund”), nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract or investment decision. If such offer is made, it will only be made by means of an offering memorandum (collectively with additional offering documents, the “Offering Documents”), which would contain material information (including certain risks of investing in such Fund) not contained in the Materials and which would supersede and qualify in its entirety the information set forth in the Materials. Any decision to invest in a Fund should be made after reviewing the Offering Documents of such Fund, conducting such investigations as the investor deems necessary and consulting the investor’s own legal, accounting and tax advisers to make an independent determination of the suitability and consequences of an investment in such Fund. In the event that the descriptions or terms described herein are inconsistent with or contrary to the descriptions in or terms of the Offering Documents, the Offering Documents shall control. of Blackstone, its funds, nor any of their affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein should be relied upon as a promise or representation as to past or future performance of a Fund or any other entity, transaction, or investment. No securities commission or similar regulatory authority in Canada has reviewed or in any way passed upon the merits of the investments described herein and any representation to the contrary is an offense. All information is as of December 31, 2025 (the “Reporting Date”), unless otherwise indicated and may change materially in the future. Capitalized terms used herein but not otherwise defined have the meanings set forth in the Offering Documents.

The Materials contain highly confidential information regarding Blackstone and a Fund’s investments, strategy and organization. Your acceptance of the Materials constitutes your agreement that the Materials are designated as “trade secret” and “highly confidential” by Blackstone and are neither publicly available nor do they constitute a public record and that you shall (i) keep confidential all the information contained in the Materials, as well as any information derived by you from the information contained in the Materials (collectively, “Confidential Information”) and not disclose any such Confidential Information to any other person (including in response to any Freedom of Information Act, public records statute, or similar request), (ii) not use any of the Confidential Information for any purpose other than to evaluate or monitor investments in a Fund, (iii) not use the Confidential Information for purposes of trading securities, including, without limitation, securities of Blackstone or its portfolio companies, (iv) except to download the Materials from BXAccess, not copy the Materials without the prior consent of Blackstone, and (v) promptly return any or all of the Materials and copies hereof to Blackstone upon Blackstone’s request, in each case subject to the confidentiality provisions more fully set forth in a Fund’s Offering Documents and any other written agreement(s) between the recipient and Blackstone, a current or potential portfolio company, or a third-party service provider engaged by Blackstone in connection with evaluation of a potential investment opportunity.

Blackstone Proprietary Data. Certain information and data provided herein is based on Blackstone proprietary knowledge and data. Portfolio companies may provide proprietary market data to Blackstone, including about local market supply and demand conditions, current market rents and operating expenses, capital expenditures, and valuations for multiple assets. Such proprietary market data is used by Blackstone to evaluate market trends as well as to underwrite potential and existing investments. While Blackstone currently believes that such information is reliable for purposes used herein, it is subject to change, and reflects Blackstone’s opinion as to whether the amount, nature and quality of the data is sufficient for the applicable conclusion, and no representations are made as to the accuracy or completeness thereof.

Case. Studies. The selected investment examples, case studies and/or transaction summaries presented or referred to herein may not be representative of all transactions of a given type or of investments generally and are intended to be illustrative of the types of investments that have been made or may be made by the Fund in employing the Fund’s investment strategies. It should not be assumed that the Fund will make equally successful or comparable investments in the future. Moreover, the actual investments to be made by the Fund will be made under different market conditions from those investments presented or referenced and may differ substantially from the investments presented herein as a result of various factors. Prospective investors

should also note that the selected investment examples, case studies and/or transaction summaries presented or referred to herein have involved Blackstone professionals who will be involved with the management and operations of the Fund as well as other Blackstone personnel who will not be involved in the management and operations of such Fund. Certain investment examples described herein may be owned by investment vehicles managed by Blackstone and by certain other third-party equity partners, and in connection therewith Blackstone may own less than a majority of the equity securities of such investment. Further investment details are available upon request.

Conflicts of Interest. There may be occasions when a Fund’s general partner and/or the investment advisor, and their affiliates will encounter potential conflicts of interest in connection with such Fund’s activities including, without limitation, the allocation of investment opportunities, relationships with Blackstone’s and its affiliates’ investment banking and advisory clients, and the diverse interests of such Fund’s limited partner group. There can be no assurance that Blackstone will identify, mitigate, or resolve all conflicts of interest in a manner that is favorable to the fund.

ERISA Fiduciary Disclosure. The foregoing information has not been provided in a fiduciary capacity under ERISA, and it is not intended to be, and should not be considered as, impartial investment advice.

Diversification; Potential Lack Thereof. Diversification is not a guarantee of either a return or protection against loss in declining markets. The number of investments which a Fund makes may be limited, which would cause the Fund’s investments to be more susceptible to fluctuations in value resulting from adverse economic or business conditions with respect thereto. There is no assurance that any of the Fund’s investments will perform well or even return capital; if certain investments perform unfavorably, for the Fund to achieve above-average returns, one or a few of its investments must perform very well. There is no assurance that this will be the case. In addition, certain geographic regions and/or industries in which the Fund is heavily invested may be more adversely affected from economic pressures when compared to other geographic regions and/or industries.

Forward-Looking Statements. Certain information contained in the Materials constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue” or other similar words, or the negatives thereof. These may include financial predictions estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, and statements regarding future performance. Such forward-looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. Blackstone believes these factors include but are not limited to those described under the section entitled “Risk Factors” in its Annual Report on Form 10-K for the most recent fiscal year ended December 31 of that year, and any such updated factors included in its periodic filings with the Securities and Exchange Commission, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in the Materials and in the filings. Blackstone undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

Logos. The logos presented herein were not selected based on performance of the applicable company or sponsor to which they pertain. In Blackstone’s opinion, the logos selected were generally the most applicable examples of the given thesis, theme or trend discussed on the relevant slide(s). All rights to the trademarks and/or logos presented herein belong to their respective owners and Blackstone’s use hereof does not imply an affiliation with, or endorsement by the owners of these logos.

Opinions. Opinions expressed reflect the current opinions of Blackstone as of the date appearing in the Materials only and are based on Blackstone’s opinions of the current market environment, which is subject to change. Certain information contained in the Materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

Recent Market Events Risk. Local, regional, or global events such as war (e.g., Russia/Ukraine), acts of terrorism, public health issues like pandemics (e.g., COVID-19), recessions, or other economic, political and global macro factors and events could lead to a substantial economic downturn or recession in the U.S. and global economies and have a significant impact on the Fund and its investments. The recovery from such downturns is uncertain and may last for an extended period of time or result in significant volatility, and many of the risks discussed herein associated with an investment in the Fund may be increased.

|

BCRED: Software in Spotlight |

Blackstone |

| |

7 |

Additional Important Disclosures (Cont’d)

Third-Party Information. Certain information contained in the Materials has been obtained from sources outside Blackstone, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Blackstone, its funds, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information. In particular, you should note that, since many investments of the Funds may be unquoted, net asset value figures in relation to Funds may be based wholly or partly on estimates of the values of such funds’ investments provided by the originating banks of those underlying investments or other market counterparties, which estimates may themselves have been subject to no verification or auditing process or may relate to a valuation at a date before the relevant net asset valuation for such fund, or which have otherwise been estimated by Blackstone.

Trends. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results.

Use of Leverage. BCRED intends to borrow money. If returns on such investment exceed the costs of borrowing, investor returns will be enhanced. However, if returns do not exceed the costs of borrowing, BCRED performance will be depressed. This includes the potential for BCRED to suffer greater losses than it otherwise would have. The effect of leverage is that any losses will be magnified. The use of leverage involves a high degree of financial risk and will increase BCRED’s exposure to adverse economic factors such as rising interest rates, downturns in the economy or deteriorations in the condition of the Investments. This leverage may also subject BCRED and its Investments to restrictive financial and operating covenants, which may limit flexibility in responding to changing business and economic conditions. For example, leveraged entities may be subject to restrictions on making interest payments and other distributions.

Index Definitions

The Cliffwater Direct Lending Index (CDLI) seeks to measure the unlevered, gross of fee performance of US middle market corporate loans, as represented by the asset-weighted performance of the underlying assets of Business Development Companies (BDCs), including both exchange-traded and unlisted BDCs, subject to certain eligibility requirements.

Morningstar LSTA Leveraged Loan Index is a market value-weighted index designed to measure the performance of the US leveraged loan market based upon market weightings, spreads and interest payments.

Morningstar LSTA Leveraged Loan 100 Index is designed to measure the performance of the 100 largest facilities in the US leveraged loan market.

Bloomberg U.S. Corporate High Yield Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below.

Bloomberg U.S. Aggregate Bonds Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis.

The S&P 500 Index measures the performance of the large-cap segment of the U.S. market. Considered to be a proxy of the U.S. equity market, the index is composed of 500 constituent companies.

The S&P 500 Software (Industry) Index is a market-capitalization- weighted sub-index of the S&P 500, focusing exclusively on companies within the software industry. It tracks major U.S. companies involved in software development, including application, systems, and database software, serving as a performance benchmark for this specific sector.

Index Comparison. The volatility and risk profile of the indices presented in this document is likely to be materially different from that of BCRED. In addition, the indices employ different investment guidelines and criteria than BCRED and do not employ leverage; as a result, the holdings in BCRED and the liquidity of such holdings may differ significantly from the securities that comprise the indices. The indices are not subject to fees or expenses and it may not be possible to invest in the indices. A summary of the investment guidelines for the indices presented is available upon request.

Additional Information on Certain Indexes. Investment Grade Bonds is represented by the Bloomberg U.S. Aggregate Bond Index. Leveraged Loans is represented by the Morningstar LSTA U.S. Leveraged Loan Index. High Yield is represented by the Bloomberg U.S. Corporate High Yield Index. It is not possible to invest in any of the above indices. We believe that these indices are appropriate and accepted indexes representing common public fixed income asset classes.

An investment in BCRED has material differences from an investment in investment grade bonds, leveraged loans, and high yield bonds, including, among other things, those related to costs and expenses, liquidity, volatility, risk profile and tax treatment. Unlike BCRED shareholders, holders of bonds do not hold an ownership interest in the issuer. Investment grade bonds and high yield bonds are typically issued in $1,000 or $5,000 denominations and when purchased as a new issue, are not subject to fees or expenses. Leveraged loan denominations are negotiated by the issuer and arranger and typically are subject to fees and expenses. The purchase price of BCRED shares is generally the prior month’s NAV per share for the applicable class, plus upfront selling commissions and dealer manager fees for Class S and D shares. Such shares classes are also subject to shareholder servicing fees.

While the liquidity of assets in public markets depends on its credit rating and market conditions, there exists a secondary market for such bonds. There is no public trading market for shares of BCRED and an investor’s ability to dispose of shares will likely be limited to repurchase by us, subject to the limitations described in BCRED’s prospectus.

The volatility and risk profile of public markets are also likely to be materially different from that of BCRED because, among other things, BCRED’s shares are not fixed-rate debt instruments, and such bonds represent debt issued by corporations across a variety of issuers with varying pricing, terms and conditions. BCRED’s share price may be subject to less volatility because its per share NAV is based on the value of assets it owns and is not subject to market pricing forces in the same way as are the prices of bonds in public markets but is not immune to fluctuations.

The bonds in the Bloomberg U.S. Aggregate Bond Index and Bloomberg U.S. Corporate High Yield Index bear a contractual interest rate for periods of over one year, whereas BCRED’s yield is generated primarily by income from its underlying assets and these obligations are not rated. Furthermore, issuers of investment grade bonds and high yield bonds are contractually obligated to pay periodic interest and repay a fixed principal amount at maturity, whereas we cannot guarantee that we will make any distributions and investing in BCRED involves a high degree of risk, as described in BCRED’s prospectus.

In addition, the Bloomberg U.S. Aggregate Bond Index, Bloomberg U.S. Corporate High Yield Index, Morningstar LSTA US Leveraged Loan Index employ different investment guidelines and criteria than BCRED; as a result, the assets in BCRED may differ significantly from the holdings of the securities that comprise these indexes.

Such bonds generally provide investors with current income, and BCRED’s primary objective is to provide current income with some appreciation. While BCRED invests primarily in privately originated and privately negotiated U.S. first lien senior secured floating rate loans, an investment in BCRED is not a direct investment in the underlying portfolio companies and BCRED’s investments are typically below investment grade.

|

BCRED: Software in Spotlight |

Blackstone |

| |

8 |