| NABORS INDUSTRIES LTD February 2026 4Q 2025 Earnings Presentation |

| N A B O R S . C O M We often discuss expectations regarding our future markets, demand for our products and services, and our performance in our annual, quarterly, and current reports, press releases, and other written and oral statements. Such statements, including statements in this document that relate to matters that are not historical facts, are “forward-looking statements” within the meaning of the safe harbor provisions of Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of 1934. These “forward-looking statements” are based on our analysis of currently available competitive, financial and economic data and our operating plans. They are inherently uncertain, and investors should recognize that events and actual results could turn out to be significantly different from our expectations. Factors to consider when evaluating these forward-looking statements include, but are not limited to: • geopolitical events, pandemics and other macro-events and their respective and collective impact on our operations as well as oil and gas markets and prices; • fluctuations and volatility in worldwide prices of and demand for oil and natural gas; • fluctuations in levels of oil and natural gas exploration and development activities; • fluctuations in the demand for our services; • competitive and technological changes and other developments in the oil and gas and oilfield services industries; • our ability to renew customer contracts in order to maintain competitiveness; • the existence of operating risks inherent in the oil and gas and oilfield services industries; • the possibility of the loss of one or a number of our large customers; • the amount and nature of our future capital expenditures and how we expect to fund our capital expenditures; • the occurrence of cybersecurity incidents, attacks and other breaches to our information technology systems; • the impact of long-term indebtedness and other financial commitments on our financial and operating flexibility; • our access to and the cost of capital, including the impact of a further downgrade in our credit rating, covenant restrictions, availability under our revolving credit facility, and future issuances of debt or equity securities and the global interest rate environment; • our dependence on our operating subsidiaries and investments to meet our financial obligations; Forward-Looking Statements NABORS INDUSTRIES 2 • our ability to retain skilled employees; • our ability to realize the expected benefits of strategic transactions we may undertake; • changes in tax laws and the possibility of changes in other laws and regulation; • global views on and the regulatory environment related to energy transition and our ability to implement our energy transition initiatives; • potential long-lived asset impairments • the possibility of changes to U.S. trade policies and regulations including the imposition of trade embargoes, sanctions or tariffs, by either the U.S. or any other country in which we operate or have supply lines; • general economic conditions, including the capital and credit markets; • Our ability to utilize NOLs. Our businesses depend, to a large degree, on the level of spending by oil and gas companies for exploration, development and production activities. Therefore, sustained lower oil or natural gas prices that have a material impact on exploration, development or production activities could also materially affect our financial position, results of operations and cash flows. The above description of risks and uncertainties is by no means all-inclusive but is designed to highlight what we believe are important factors to consider. For a discussion of these factors and other risks and uncertainties, please refer to our filings with the Securities and Exchange Commission ("SEC"), including those contained in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, which are available at the SEC's website at www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. Non-GAAP Financial Measures This presentation refers to certain “non-GAAP” financial measures, such as adjusted EBITDA, net debt, adjusted gross margin and adjusted free cash flow. The components of these non-GAAP measures are computed by using amounts that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Other companies in our industry may compute these metrics differently. These measures have limitations and should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. |

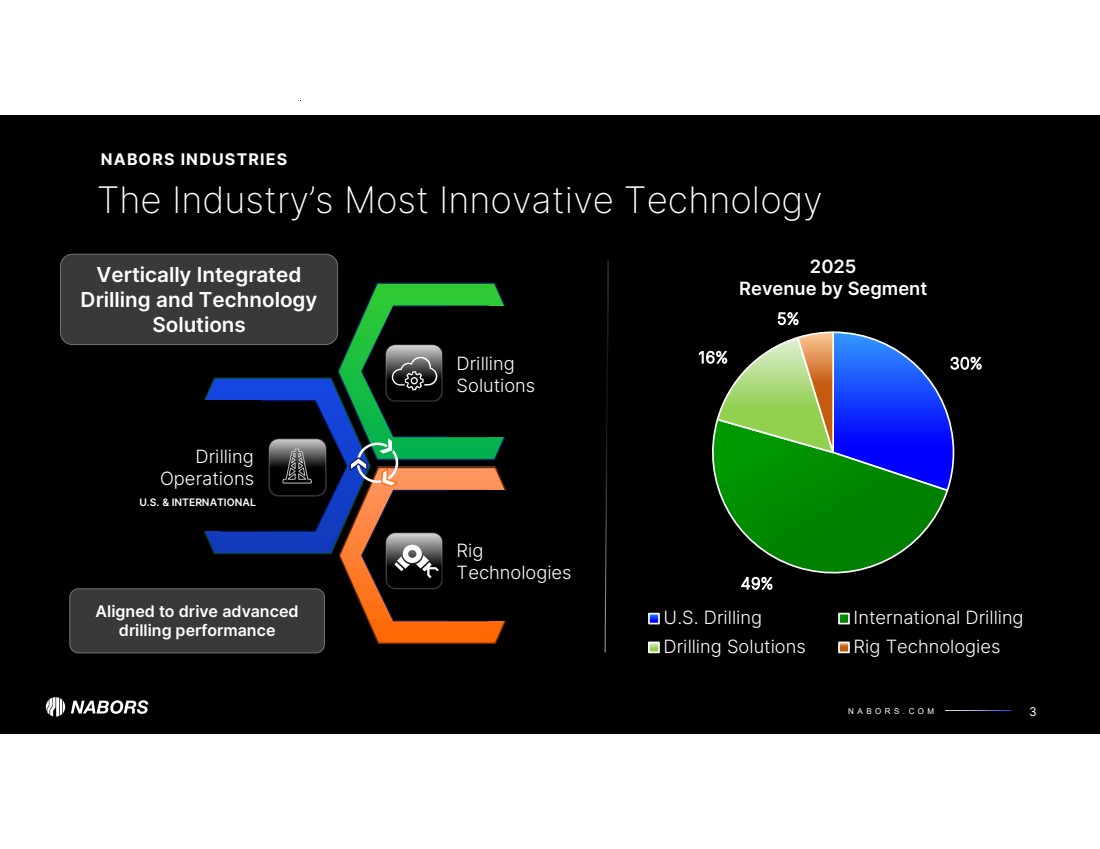

| N A B O R S . C O M 30% 49% 16% 5% 2025 Revenue by Segment U.S. Drilling International Drilling Drilling Solutions Rig Technologies 3 The Industry’s Most Innovative Technology NABORS INDUSTRIES Vertically Integrated Drilling and Technology Solutions Drilling Operations Rig Technologies Drilling Solutions Aligned to drive advanced drilling performance U.S. & INTERNATIONAL |

| Vertical Integration Drives Significant Value Rig Technologies Drilling rig equipment & technology designed to enable automation Drilling Solutions (NDS) Utilizing the rig as a platform to deliver differentiated services U.S. Drilling A leading provider of high-specification rigs NABORS INDUSTRIES N A B O R S . C O M 4 International Drilling Deploying best fit-for-purpose rigs in key markets |

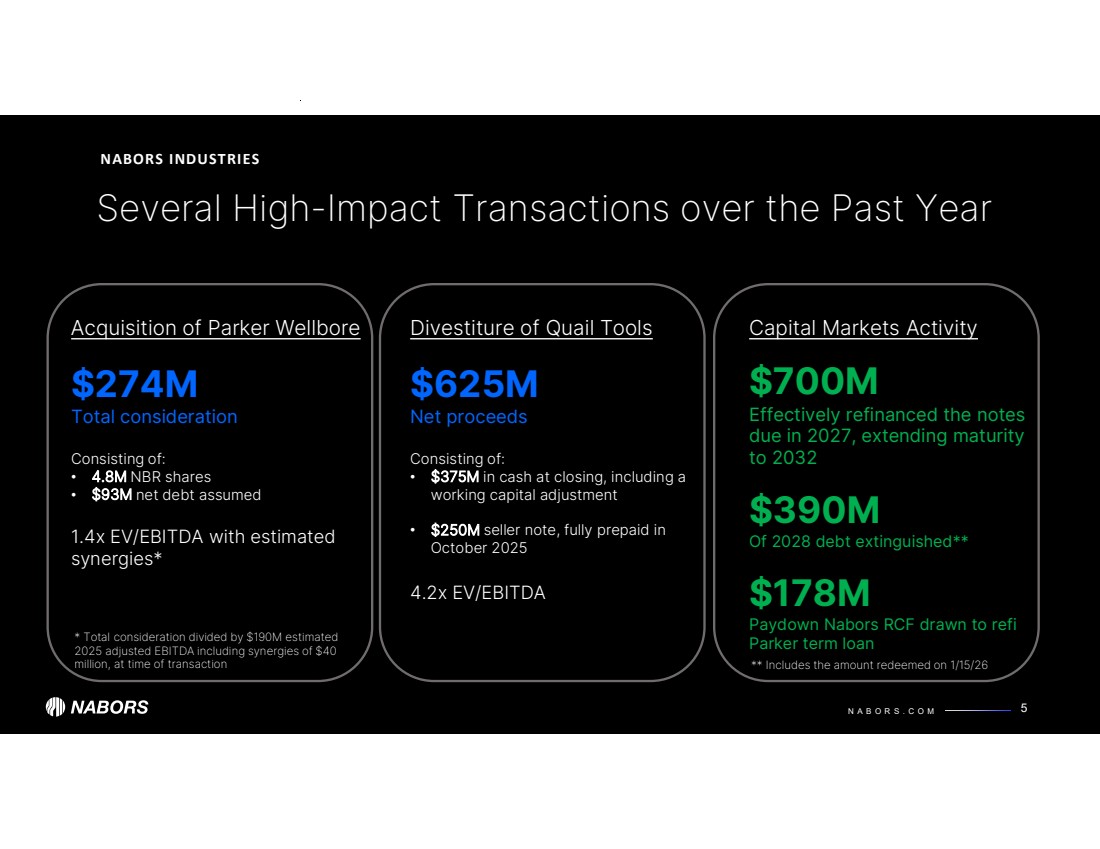

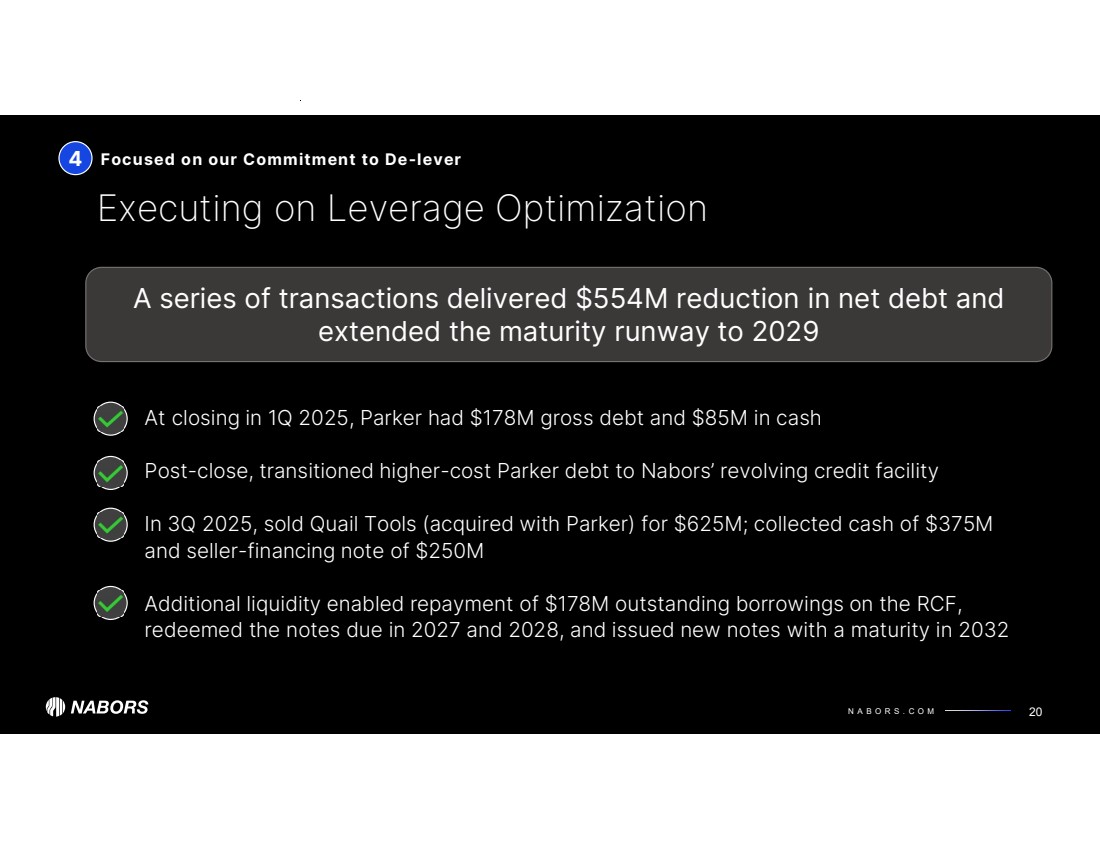

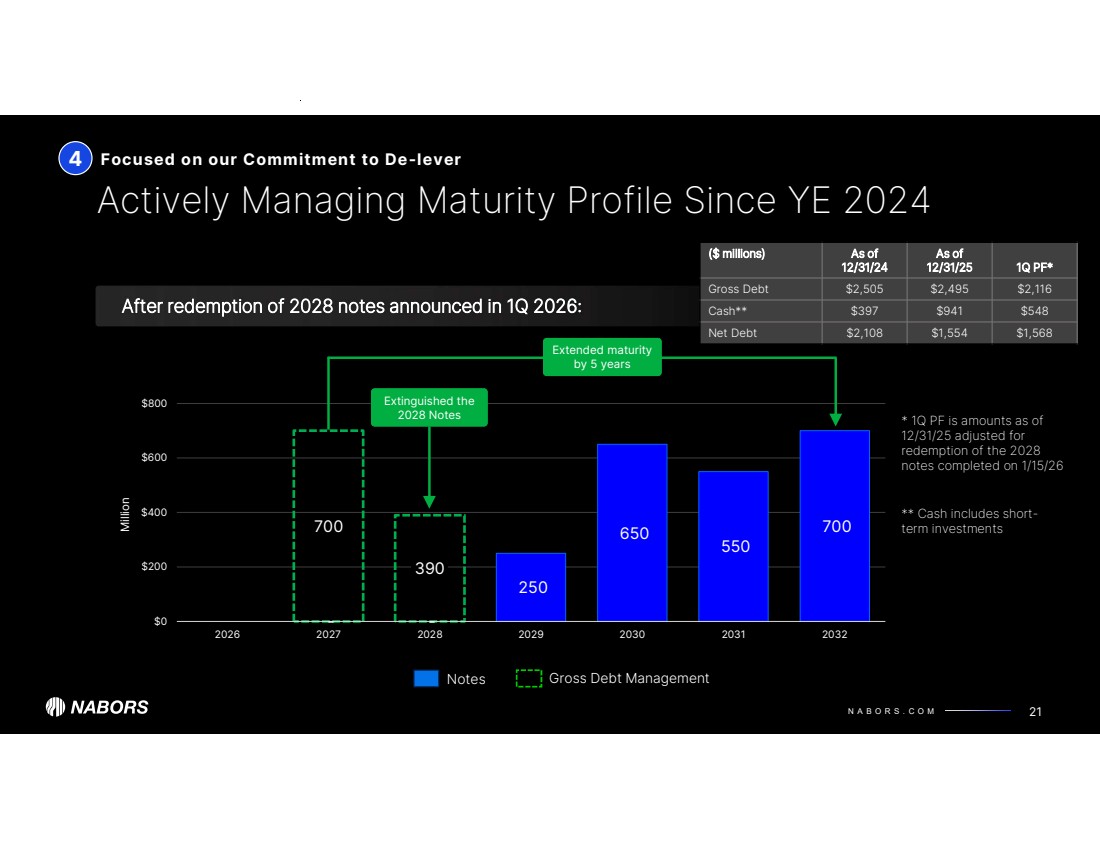

| N A B O R S . C O M Several High-Impact Transactions over the Past Year NABORS INDUSTRIES 5 Acquisition of Parker Wellbore $274M Total consideration Consisting of: • 4.8M NBR shares • $93M net debt assumed 1.4x EV/EBITDA with estimated synergies* Divestiture of Quail Tools $625M Net proceeds Consisting of: • $375M in cash at closing, including a working capital adjustment • $250M seller note, fully prepaid in October 2025 4.2x EV/EBITDA Capital Markets Activity $700M Effectively refinanced the notes due in 2027, extending maturity to 2032 $390M Of 2028 debt extinguished** $178M Paydown Nabors RCF drawn to refi Parker term loan ** Includes the amount redeemed on 1/15/26 * Total consideration divided by $190M estimated 2025 adjusted EBITDA including synergies of $40 million, at time of transaction |

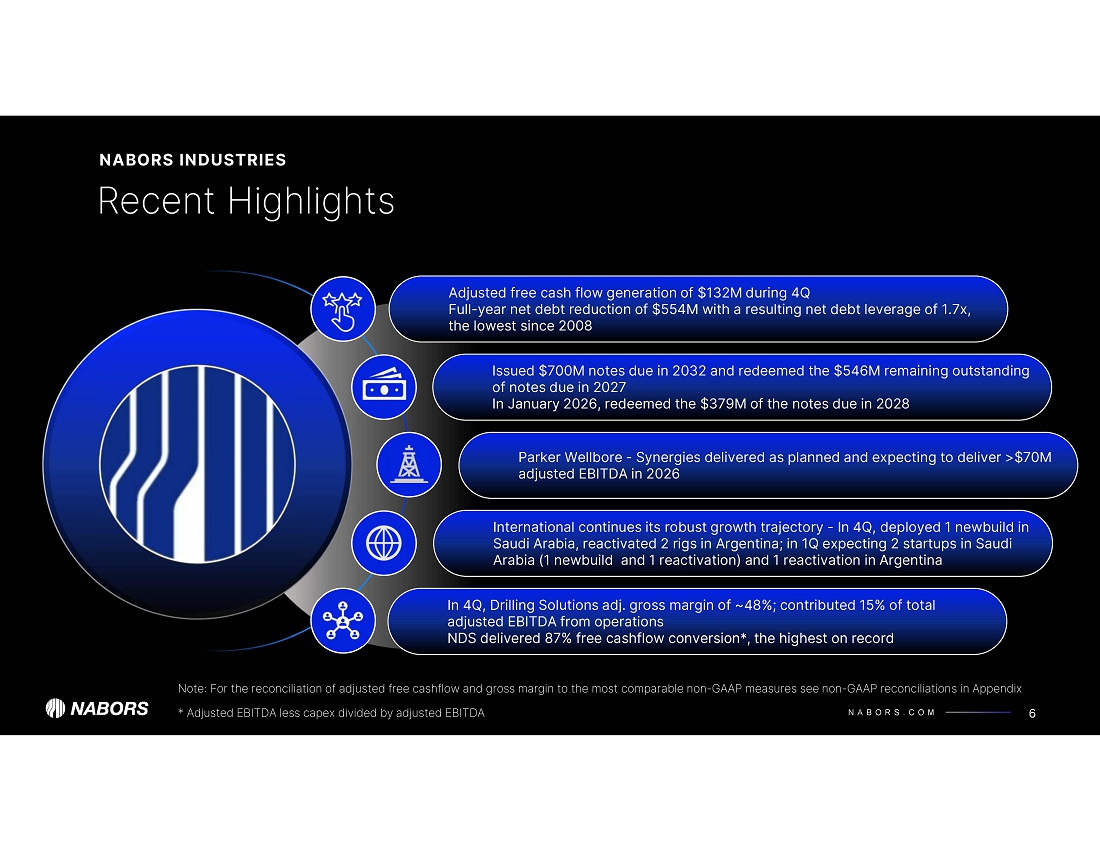

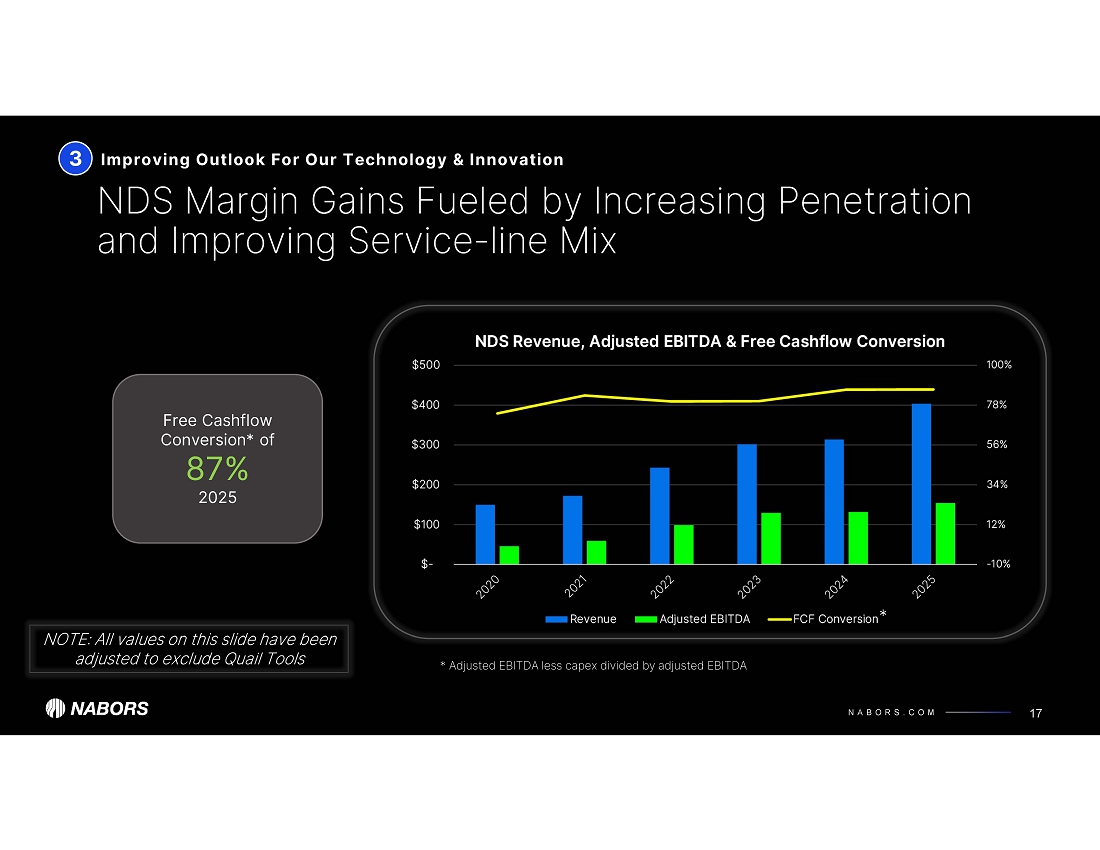

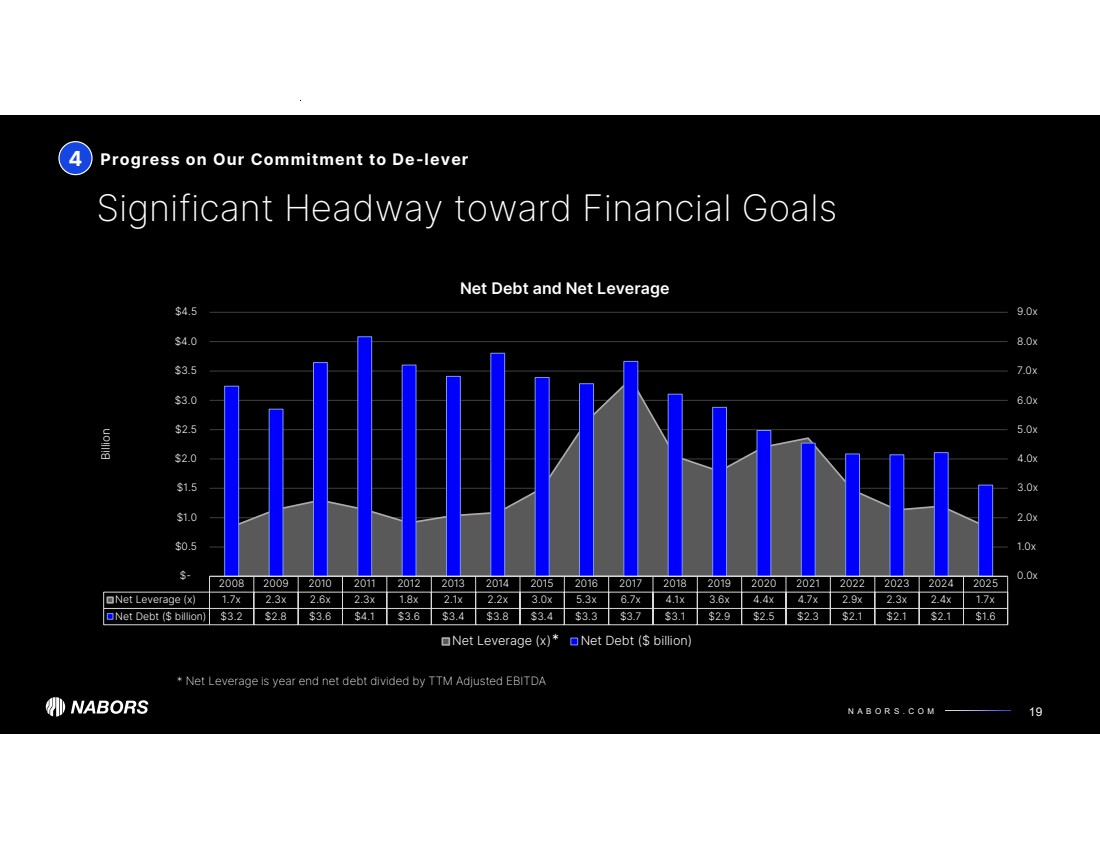

| N A B O R S . C O M Recent Highlights NABORS INDUSTRIES 6 International continues its robust growth trajectory - In 4Q, deployed 1 newbuild in Saudi Arabia, reactivated 2 rigs in Argentina; in 1Q expecting 2 startups in Saudi Arabia (1 newbuild and 1 reactivation) and 1 reactivation in Argentina Adjusted free cash flow generation of $132M during 4Q Full-year net debt reduction of $554M with a resulting net debt leverage of 1.7x, the lowest since 2008 Parker Wellbore - Synergies delivered as planned and expecting to deliver >$70M Nabors adjusted EBITDA in 2026 In 4Q, Drilling Solutions adj. gross margin of ~48%; contributed 15% of total adjusted EBITDA from operations NDS delivered 87% free cashflow conversion*, the highest on record Note: For the reconciliation of adjusted free cashflow and gross margin to the most comparable non-GAAP measures see non-GAAP reconciliations in Appendix Issued $700M notes due in 2032 and redeemed the $546M remaining outstanding of notes due in 2027 In January 2026, redeemed the $379M of the notes due in 2028 * Adjusted EBITDA $154M less capex of $21M divided by adjusted EBITDA $154M |

| N A B O R S . C O M Performance excellence in the Lower 48 7 Expanding & enhancing our International business Key Value Drivers 1 Advancing technology & innovation with demonstrated results Focused on our commitment to de-lever 2 3 Leading in Sustainability and the Energy Transition 4 5 |

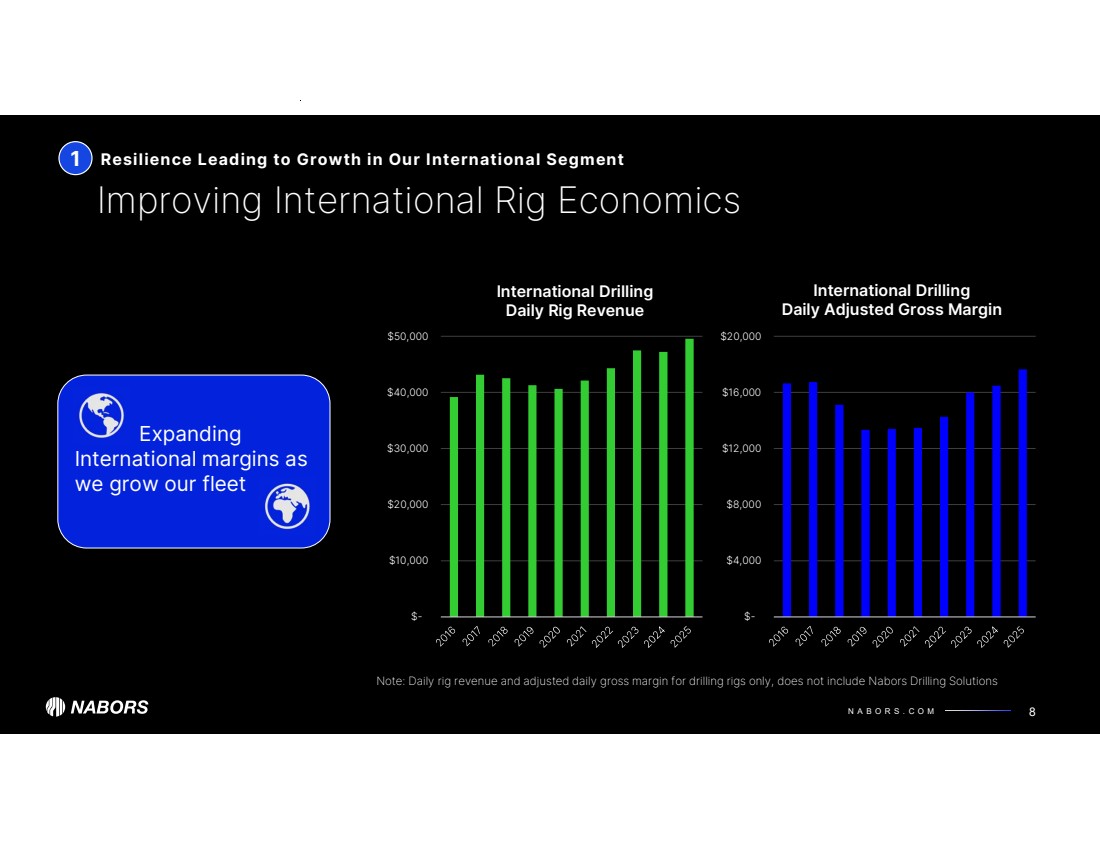

| N A B O R S . C O M $- $4,000 $8,000 $12,000 $16,000 $20,000 International Drilling Daily Adjusted Gross Margin $- $10,000 $20,000 $30,000 $40,000 $50,000 International Drilling Daily Rig Revenue 1 Expanding International margins as we grow our fleet Improving International Rig Economics Resilience Leading to Growth in Our International Segment 8 Note: Daily rig revenue and adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions |

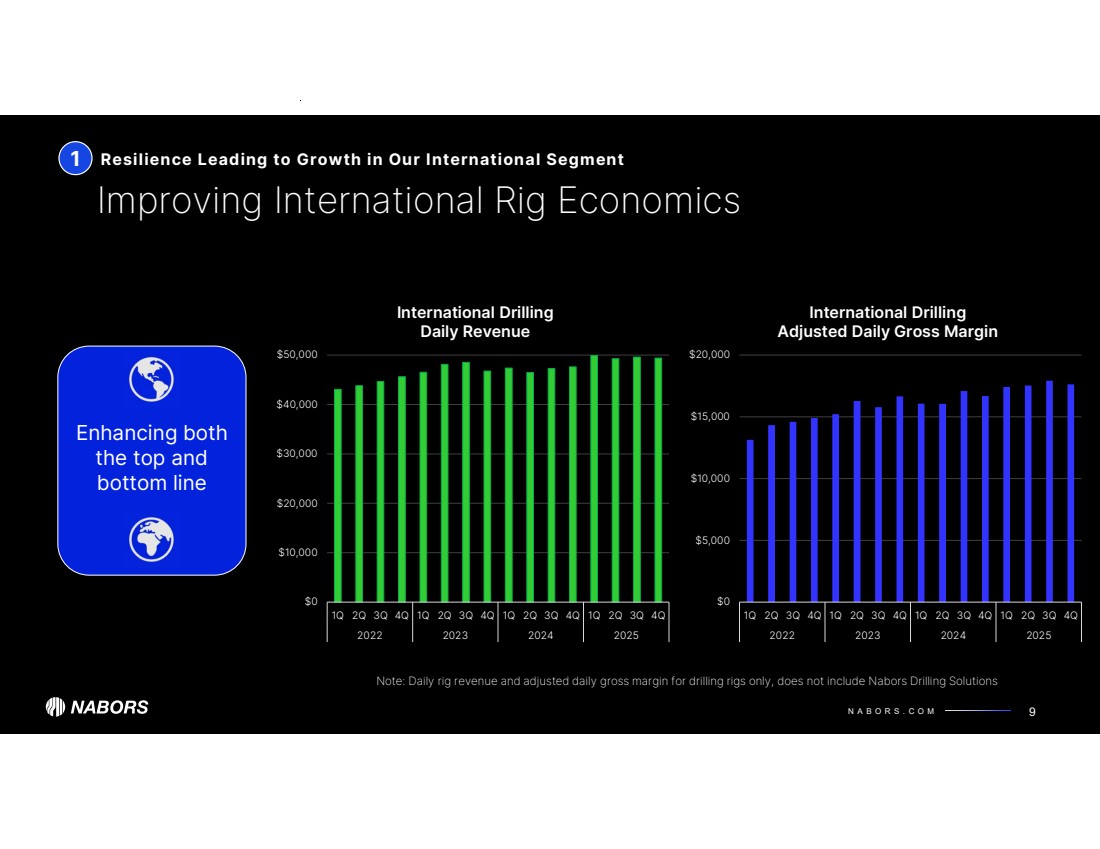

| N A B O R S . C O M $0 $5,000 $10,000 $15,000 $20,000 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 2022 2023 2024 2025 International Drilling Adjusted Daily Gross Margin $0 $10,000 $20,000 $30,000 $40,000 $50,000 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 2022 2023 2024 2025 International Drilling Daily Revenue 1 Enhancing both the top and bottom line Improving International Rig Economics Resilience Leading to Growth in Our International Segment 9 Note: Daily rig revenue and adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions |

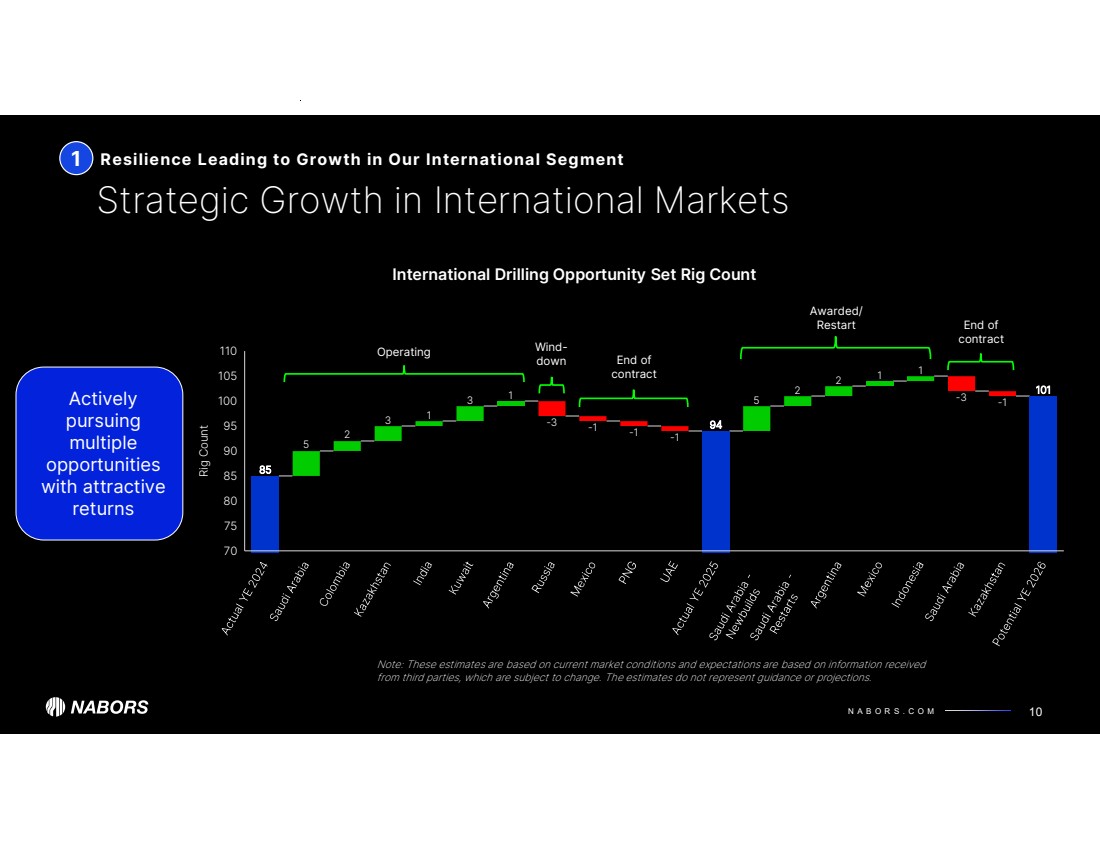

| N A B O R S . C O M 5 2 3 1 3 1 -3 -1 -1 -1 5 2 2 1 1 -3 -1 85 94 101 Rig Count 70 75 80 85 90 95 100 105 110 1 Strategic Growth in International Markets 10 Actively pursuing multiple opportunities with attractive returns Note: These estimates are based on current market conditions and expectations are based on information received from third parties, which are subject to change. The estimates do not represent guidance or projections. Resilience Leading to Growth in Our International Segment Awarded/ Restart International Drilling Opportunity Set Rig Count Operating End of contract Wind-down End of contract |

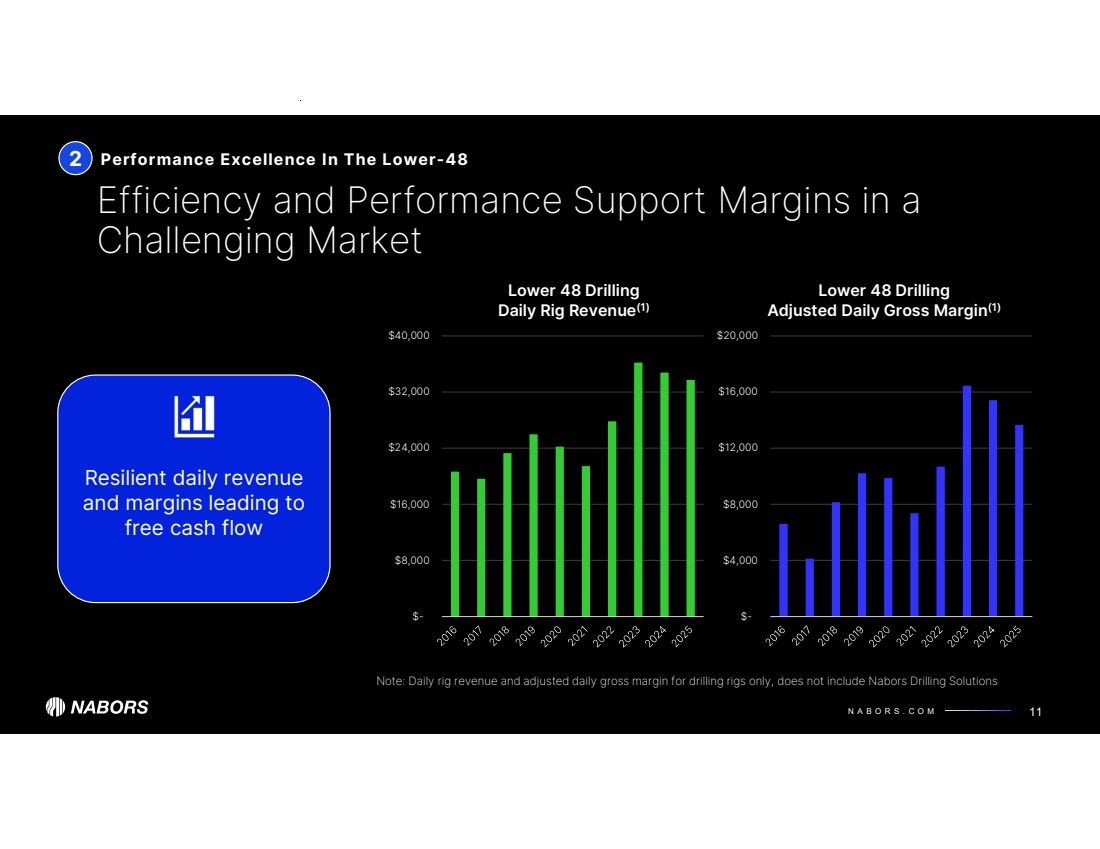

| N A B O R S . C O M $- $4,000 $8,000 $12,000 $16,000 $20,000 Lower 48 Drilling Adjusted Daily Gross Margin(1) 2 Efficiency and Performance Support Margins in a Challenging Market Performance Excellence In The Lower-48 11 Resilient daily revenue and margins leading to free cash flow Note: Daily rig revenue and adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions $- $8,000 $16,000 $24,000 $32,000 $40,000 Lower 48 Drilling Daily Rig Revenue(1) |

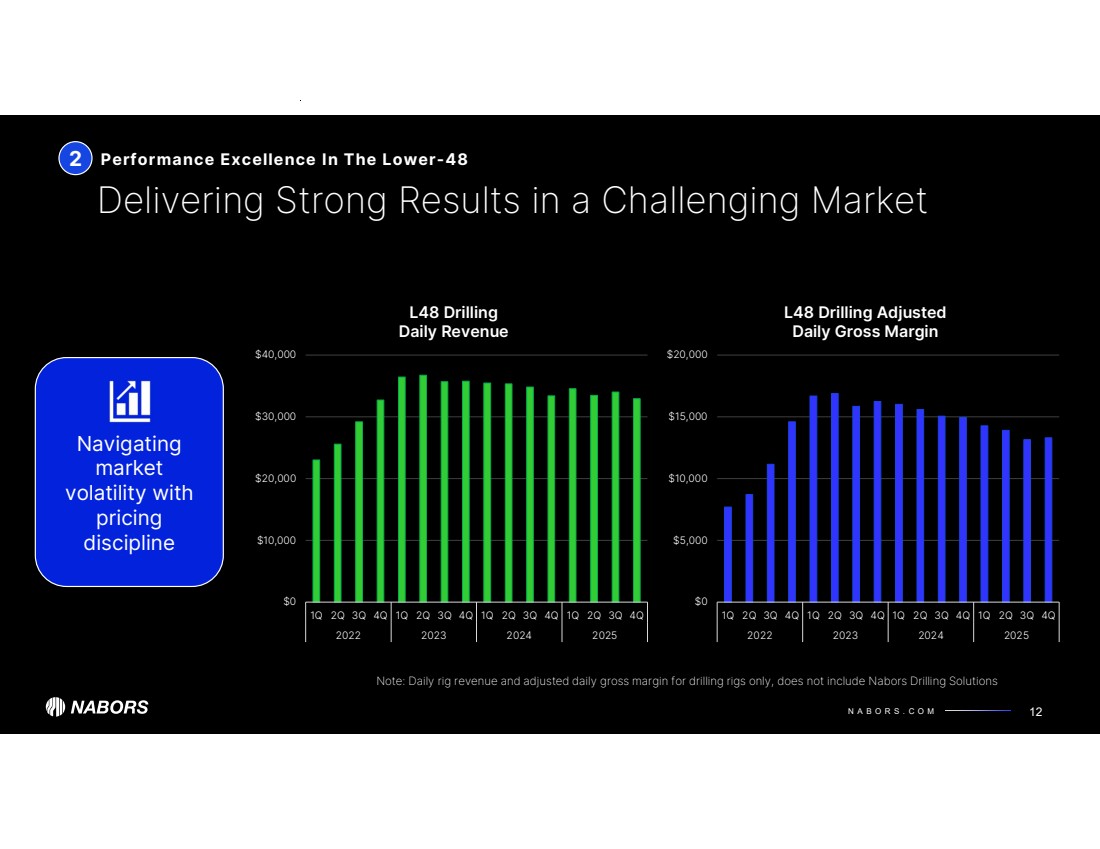

| N A B O R S . C O M $0 $10,000 $20,000 $30,000 $40,000 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 2022 2023 2024 2025 L48 Drilling Daily Revenue $0 $5,000 $10,000 $15,000 $20,000 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 2022 2023 2024 2025 L48 Drilling Adjusted Daily Gross Margin 2 Delivering Strong Results in a Challenging Market Performance Excellence In The Lower-48 12 Navigating market volatility with pricing discipline Note: Daily rig revenue and adjusted daily gross margin for drilling rigs only, does not include Nabors Drilling Solutions |

| N A B O R S . C O M 13 Nabors Drilling Solutions Leveraging ‘Rig as a Platform’ Managed Pressure Drilling Performance Software Wellbore Placement Automated Casing Running Data Integration / 3 Improving Outlook For Our Technology & Innovation Drill Pipe and BOP Rentals |

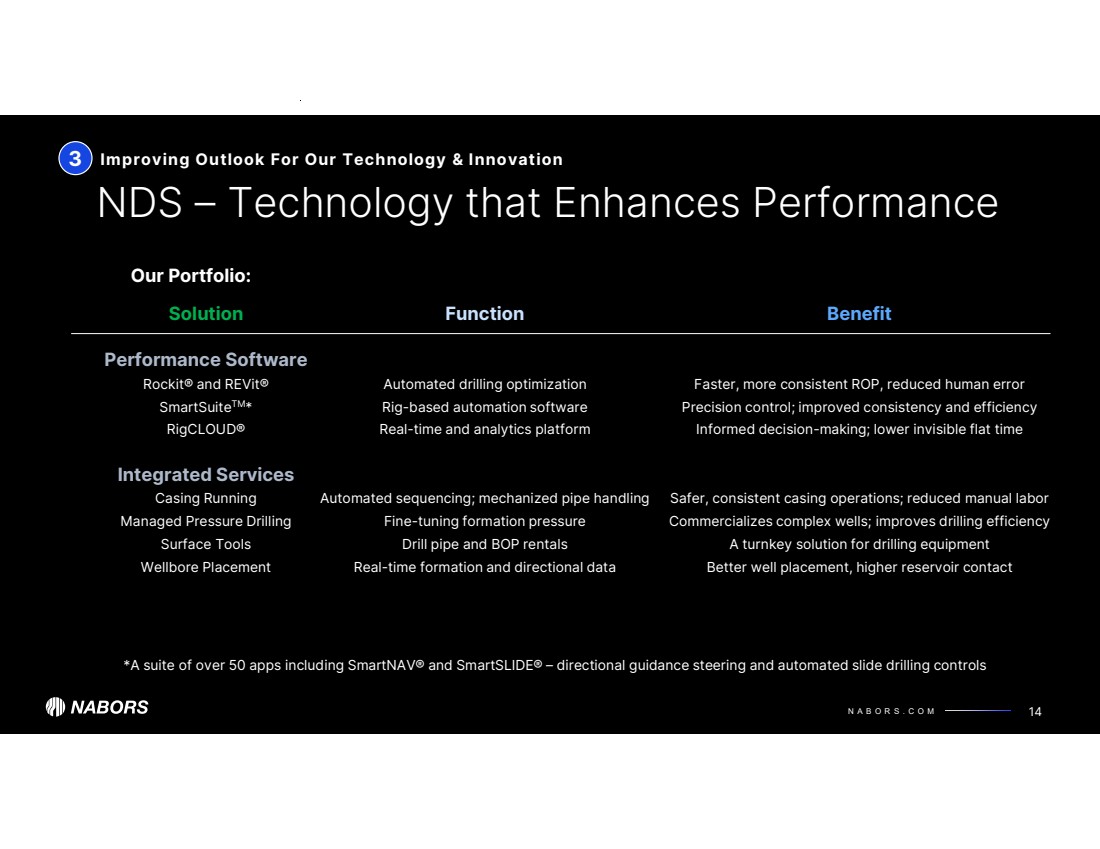

| N A B O R S . C O M 14 NDS – Technology that Enhances Performance Our Portfolio: Solution Performance Software Rockit® and REVit® SmartSuiteTM* RigCLOUD® Integrated Services Casing Running Managed Pressure Drilling Surface Tools Wellbore Placement Function Performance Software Automated drilling optimization Rig-based automation software Real-time and analytics platform Integrated Services Automated sequencing; mechanized pipe handling Fine-tuning formation pressure Drill pipe and BOP rentals Real-time formation and directional data Benefit Performance Software Faster, more consistent ROP, reduced human error Precision control; improved consistency and efficiency Informed decision-making; lower invisible flat time Integrated Services Safer, consistent casing operations; reduced manual labor Commercializes complex wells; improves drilling efficiency A turnkey solution for drilling equipment Better well placement, higher reservoir contact *A suite of over 50 apps including SmartNAV® and SmartSLIDE® – directional guidance steering and automated slide drilling controls 3 Improving Outlook For Our Technology & Innovation |

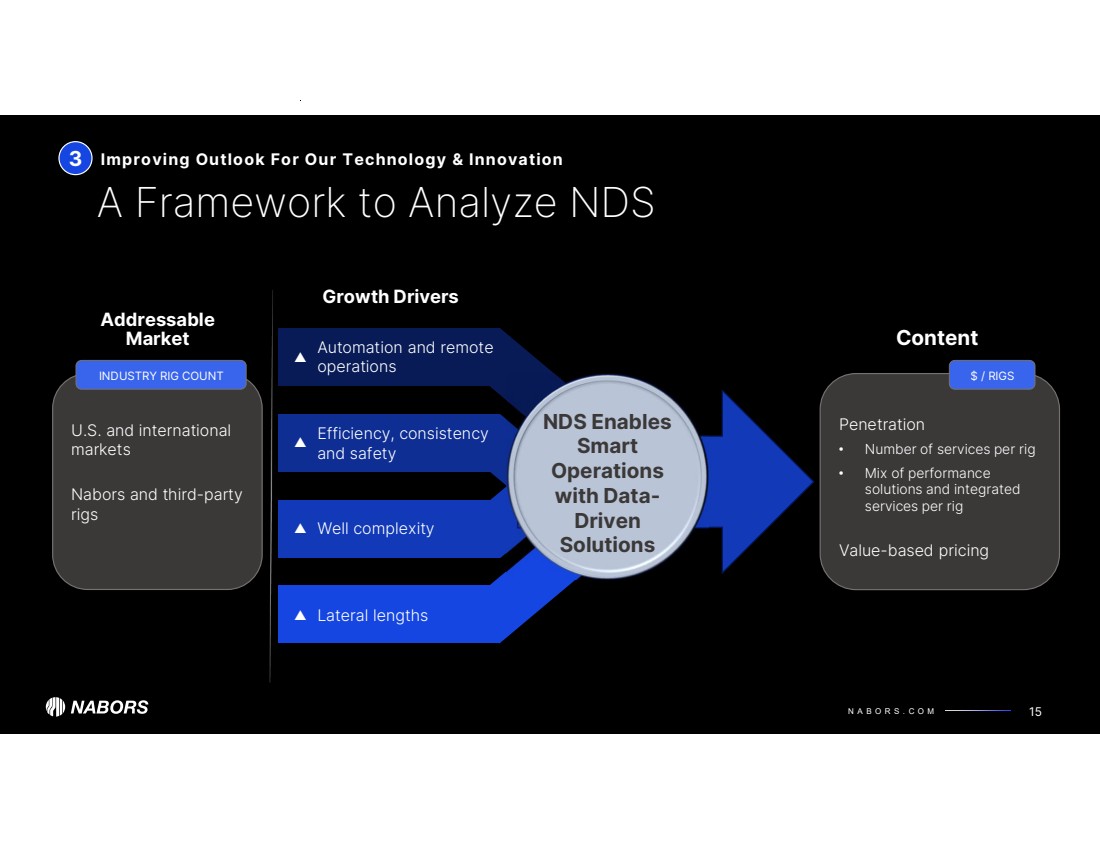

| N A B O R S . C O M 15 A Framework to Analyze NDS NDS Enables Smart Operations with Data-Driven Solutions 3 Improving Outlook For Our Technology & Innovation Efficiency, consistency and safety Automation and remote operations Well complexity Lateral lengths Addressable Market Growth Drivers Content Penetration • Number of services per rig • Mix of performance solutions and integrated services per rig Value-based pricing $ / RIGS U.S. and international markets Nabors and third-party rigs INDUSTRY RIG COUNT ▲ ▲ ▲ ▲ |

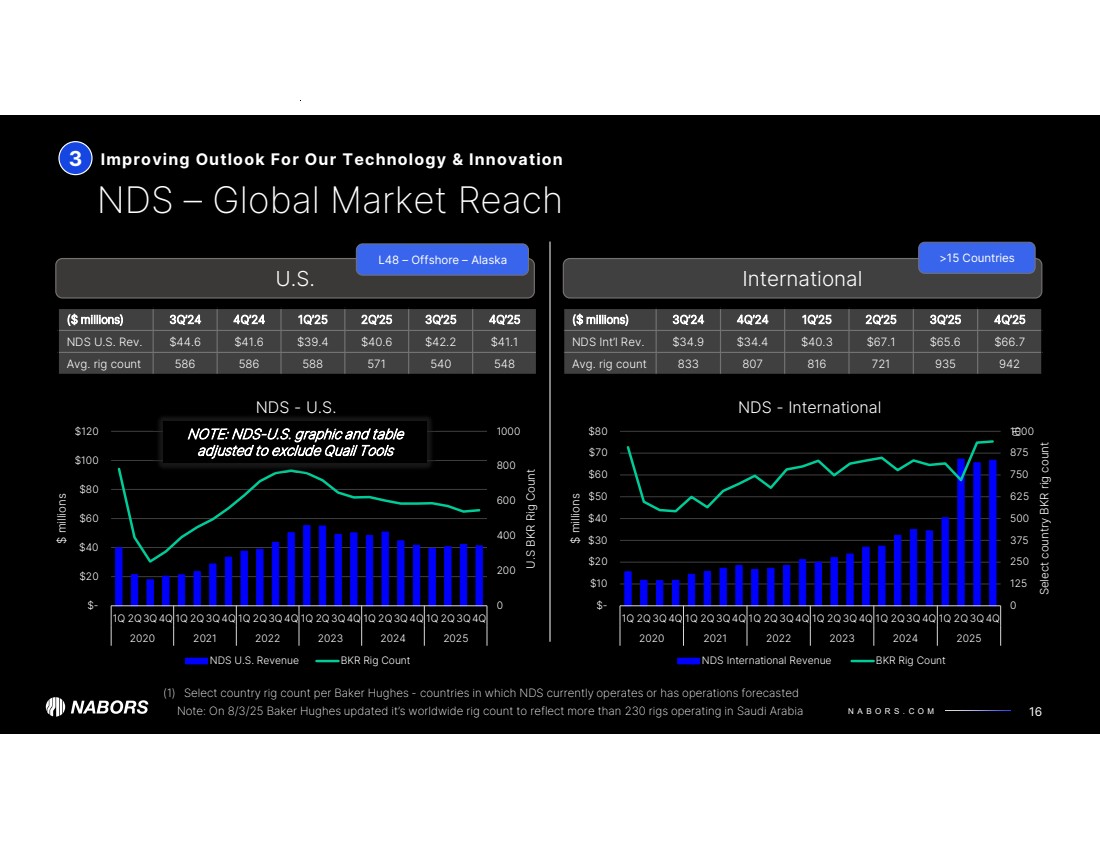

| N A B O R S . C O M 0 200 400 600 800 1000 $- $20 $40 $60 $80 $100 $120 1Q 2Q3Q4Q 1Q 2Q3Q4Q 1Q 2Q3Q4Q 1Q 2Q3Q4Q 1Q 2Q3Q4Q 1Q 2Q 3Q4Q 2020 2021 2022 2023 2024 2025 U.S BKR Rig Count $ millions NDS - U.S. NDS U.S. Revenue BKR Rig Count 0 125 250 375 500 625 750 875 1000 $- $10 $20 $30 $40 $50 $60 $70 $80 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 2020 2021 2022 2023 2024 2025 Select country BKR rig count $ millions NDS - International NDS International Revenue BKR Rig Count U.S. 16 NDS – Global Market Reach International L48 – Offshore – Alaska (1) Select country rig count per Baker Hughes - countries in which NDS currently operates or has operations forecasted (1) >15 Countries ($ millions) 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 4Q’25 NDS U.S. Rev. $44.6 $41.6 $39.4 $40.6 $42.2 $41.1 Avg. rig count 586 586 588 571 540 548 ($ millions) 3Q’24 4Q’24 1Q’25 2Q’25 3Q’25 4Q’25 NDS Int’l Rev. $34.9 $34.4 $40.3 $67.1 $65.6 $66.7 Avg. rig count 833 807 816 721 935 942 3 Improving Outlook For Our Technology & Innovation NOTE: NDS-U.S. graphic and table adjusted to exclude Quail Tools Note: On 8/3/25 Baker Hughes updated it’s worldwide rig count to reflect more than 230 rigs operating in Saudi Arabia |

| N A B O R S . C O M -10% 12% 34% 56% 78% 100% $- $100 $200 $300 $400 $500 NDS Revenue, Adjusted EBITDA & Free Cashflow Conversion Revenue Adjusted EBITDA FCF Conversion NDS Margin Gains Fueled by Increasing Penetration and Improving Service-line Mix Improving Outlook For Our Technology & Innovation 17 3 Free Cashflow Conversion* of 87% 2025 NOTE: All values on this slide have been adjusted to exclude Quail Tools * Adjusted EBITDA $154M less capex of $21M divided by adjusted EBITDA $154M * |

| N A B O R S . C O M 18 3 Improving Outlook For Our Technology & Innovation — Eric Kolstad, EVP of Wells of Caturus Energy The integration of this leading-edge technology represents the highest standard of power and performance in the industry and, just as importantly, demonstrates our continued commitment to safe and sustainable operations while improving drilling cycle time. PACE-X Ultra : The Next-Generation, High-Spec Rig PACE PACE-X Ultra ®-X Mast Rating 800,000 lbs. 1,000,000 lbs. Racking Capacity 25,000 ft 35,000 ft of 5-7/8” drill pipe C500 High-Torque or Sigma 65,000+ ft/lbs. 500 Ton AC 51,400 ft/lbs. Canrig Top Drive 6 x CAT 3512C with Smart EMS and DGB2 Engines/Generators 4 x CAT 3512C 3 x 2,000 HP 10,000 PSI Mud Pressure 3 x 1,600 HP 7,500 PSI Mud Pressure Mud Pumps |

| N A B O R S . C O M 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Net Leverage (x) 1.7x 2.3x 2.6x 2.3x 1.8x 2.1x 2.2x 3.0x 5.3x 6.7x 4.1x 3.6x 4.4x 4.7x 2.9x 2.3x 2.4x 1.7x Net Debt ($ billion) $3.2 $2.8 $3.6 $4.1 $3.6 $3.4 $3.8 $3.4 $3.3 $3.7 $3.1 $2.9 $2.5 $2.3 $2.1 $2.1 $2.1 $1.6 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 7.0x 8.0x 9.0x $- $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 Billion Net Debt and Net Leverage Net Leverage (x) Net Debt ($ billion) Significant Headway toward Financial Goals Progress on Our Commitment to De-lever 19 4 * Net Leverage is year end net debt divided by TTM Adjusted EBITDA * |

| N A B O R S . C O M At closing in 1Q 2025, Parker had $178M gross debt and $85M in cash Post-close, transitioned higher-cost Parker debt to Nabors’ revolving credit facility In 3Q 2025, sold Quail Tools (acquired with Parker) for $625M; collected cash of $375M and seller-financing note of $250M Additional liquidity enabled repayment of $178M outstanding borrowings on the RCF, redeemed the notes due in 2027 and 2028, and issued new notes with a maturity in 2032 Executing on Leverage Optimization Focused on our Commitment to De-lever 20 4 A series of transactions delivered $554M reduction in net debt and extended the maturity runway to 2029 |

| N A B O R S . C O M - - 250 650 550 700 700 390 $0 $200 $400 $600 $800 2026 2027 2028 2029 2030 2031 2032 Million 21 Actively Managing Maturity Profile Since YE 2024 Notes Gross Debt Management After redemption of 2028 notes announced in 1Q 2026: 4 Focused on our Commitment to De-lever Extinguished the 2028 Notes 1Q PF* As of 12/31/25 As of 12/31/24 ($ millions) Gross Debt $2,505 $2,495 $2,116 Cash** $397 $941 $548 Net Debt $2,108 $1,554 $1,568 * 1Q PF is amounts as of 12/31/25 adjusted for redemption of the 2028 notes completed on 1/15/26 Extended maturity by 5 years ** Cash includes short-term investments |

| N A B O R S . C O M Our Energy Transition and Sustainability Strategy Leading in Sustainability and the Energy Transition 22 Improve Nabors’ environmental footprint Collaborate with peers to reduce carbon output in our industry Partner in adjacent markets that leverage our talent and technologies Invest in companies developing green technologies 5 |

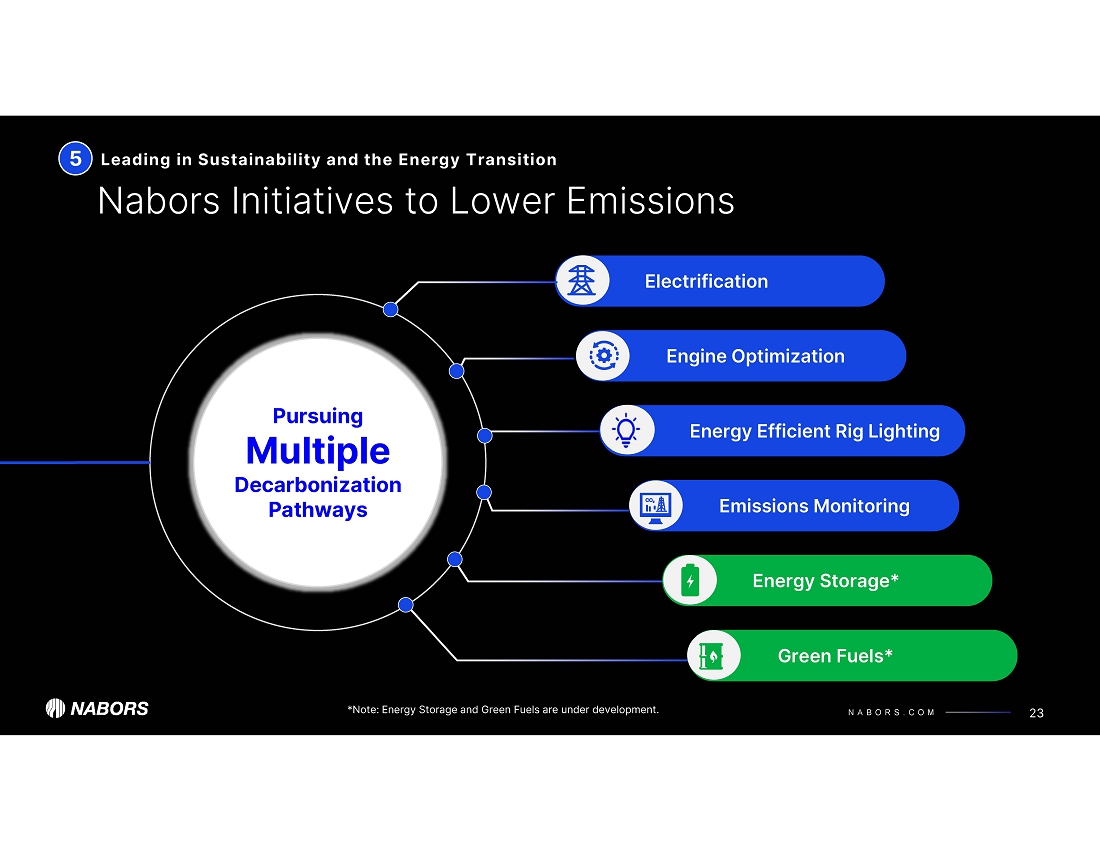

| N A B O R S . C O M Electrification Pursuing Multiple Decarbonization Pathways Green Fuels* Energy Storage* Leading in Sustainability and the Energy Transition Nabors Initiatives to Lower Emissions 23 Emissions Monitoring Engine Optimization 5 Energy Efficient Rig Lighting *Note: Energy Storage and Green Fuels are under development. |

| Appendix 24 |

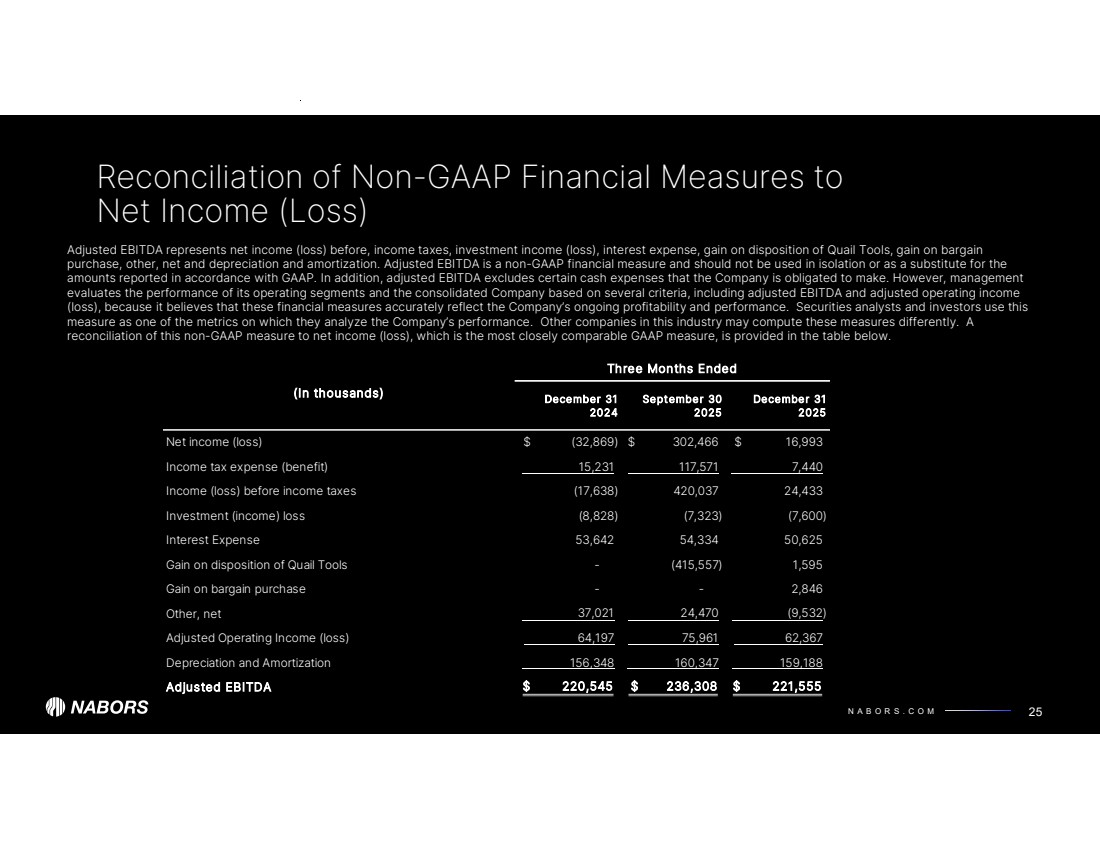

| N A B O R S . C O M Reconciliation of Non-GAAP Financial Measures to Net Income (Loss) 25 Adjusted EBITDA represents net income (loss) before, income taxes, investment income (loss), interest expense, gain on disposition of Quail Tools, gain on bargain purchase, other, net and depreciation and amortization. Adjusted EBITDA is a non-GAAP financial measure and should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. In addition, adjusted EBITDA excludes certain cash expenses that the Company is obligated to make. However, management evaluates the performance of its operating segments and the consolidated Company based on several criteria, including adjusted EBITDA and adjusted operating income (loss), because it believes that these financial measures accurately reflect the Company’s ongoing profitability and performance. Securities analysts and investors use this measure as one of the metrics on which they analyze the Company’s performance. Other companies in this industry may compute these measures differently. A reconciliation of this non-GAAP measure to net income (loss), which is the most closely comparable GAAP measure, is provided in the table below. (In thousands) December 31 September 30 December 31 2024 2025 2025 Net income (loss) (32,869) $ 302,466 $ 16,993 $ Income tax expense (benefit) 15,231 117,571 7,440 Income (loss) before income taxes (17,638) 420,037 24,433 Investment (income) loss (8,828) (7,323) (7,600) Interest Expense 53,642 54,334 50,625 Gain on disposition of Quail Tools - (415,557) 1,595 Gain on bargain purchase - - 2,846 Other, net 37,021 24,470 (9,532) Adjusted Operating Income (loss) 64,197 75,961 62,367 Depreciation and Amortization 156,348 160,347 159,188 Adjusted EBITDA $ 220,545 236,308 $ 221,555 $ Three Months Ended |

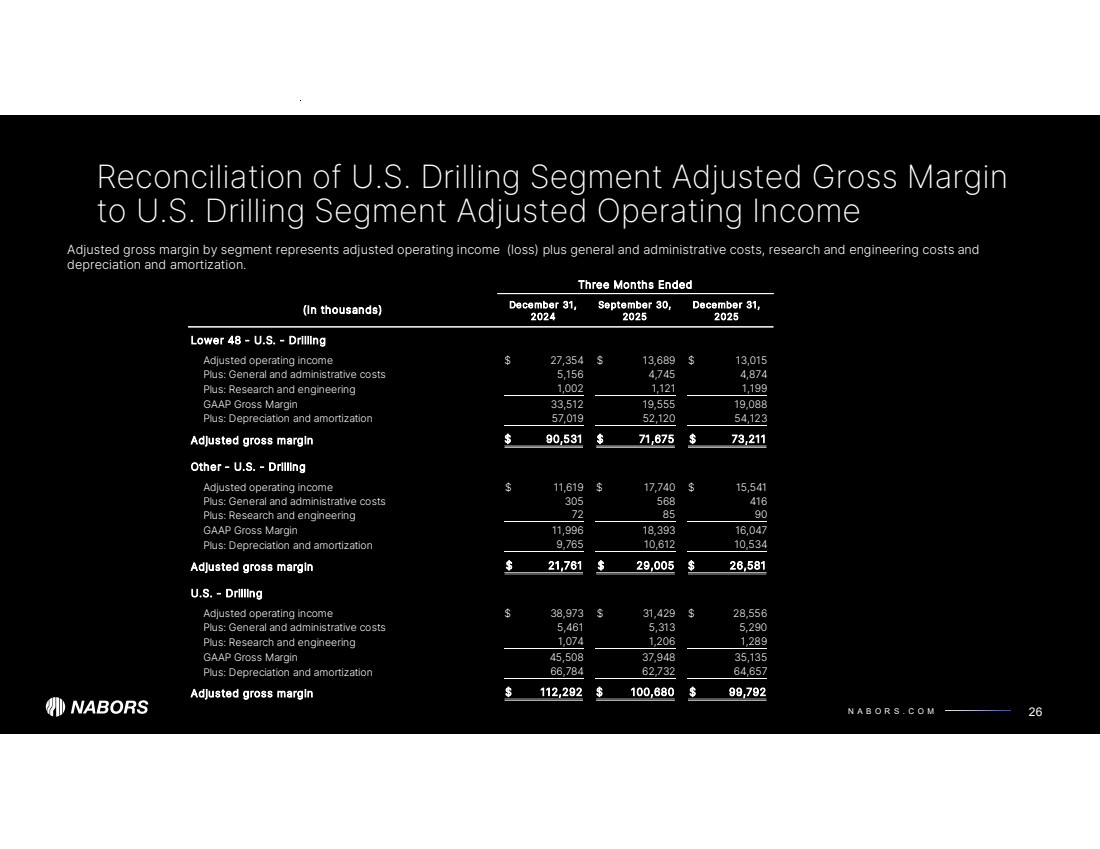

| N A B O R S . C O M Reconciliation of U.S. Drilling Segment Adjusted Gross Margin to U.S. Drilling Segment Adjusted Operating Income 26 Adjusted gross margin by segment represents adjusted operating income (loss) plus general and administrative costs, research and engineering costs and depreciation and amortization. December 31, September 30, December 31, 2024 2025 2025 Lower 48 - U.S. - Drilling Adjusted operating income 27,354 $ 13,689 $ 13,015 $ Plus: General and administrative costs 5,156 4,745 4,874 Plus: Research and engineering 1,002 1,121 1,199 GAAP Gross Margin 33,512 19,555 19,088 Plus: Depreciation and amortization 57,019 52,120 54,123 Adjusted gross margin $ 90,531 71,675 $ 73,211 $ Other - U.S. - Drilling Adjusted operating income 11,619 $ 17,740 $ 15,541 $ Plus: General and administrative costs 305 568 416 Plus: Research and engineering 85 72 90 GAAP Gross Margin 11,996 18,393 16,047 Plus: Depreciation and amortization 9,765 10,612 10,534 Adjusted gross margin $ 29,005 21,761 $ 26,581 $ U.S. - Drilling Adjusted operating income 38,973 $ 31,429 $ 28,556 $ Plus: General and administrative costs 5,461 5,313 5,290 Plus: Research and engineering 1,206 1,074 1,289 GAAP Gross Margin 45,508 37,948 35,135 Plus: Depreciation and amortization 62,732 66,784 64,657 Adjusted gross margin $ 100,680 112,292 $ 99,792 $ (In thousands) Three Months Ended |

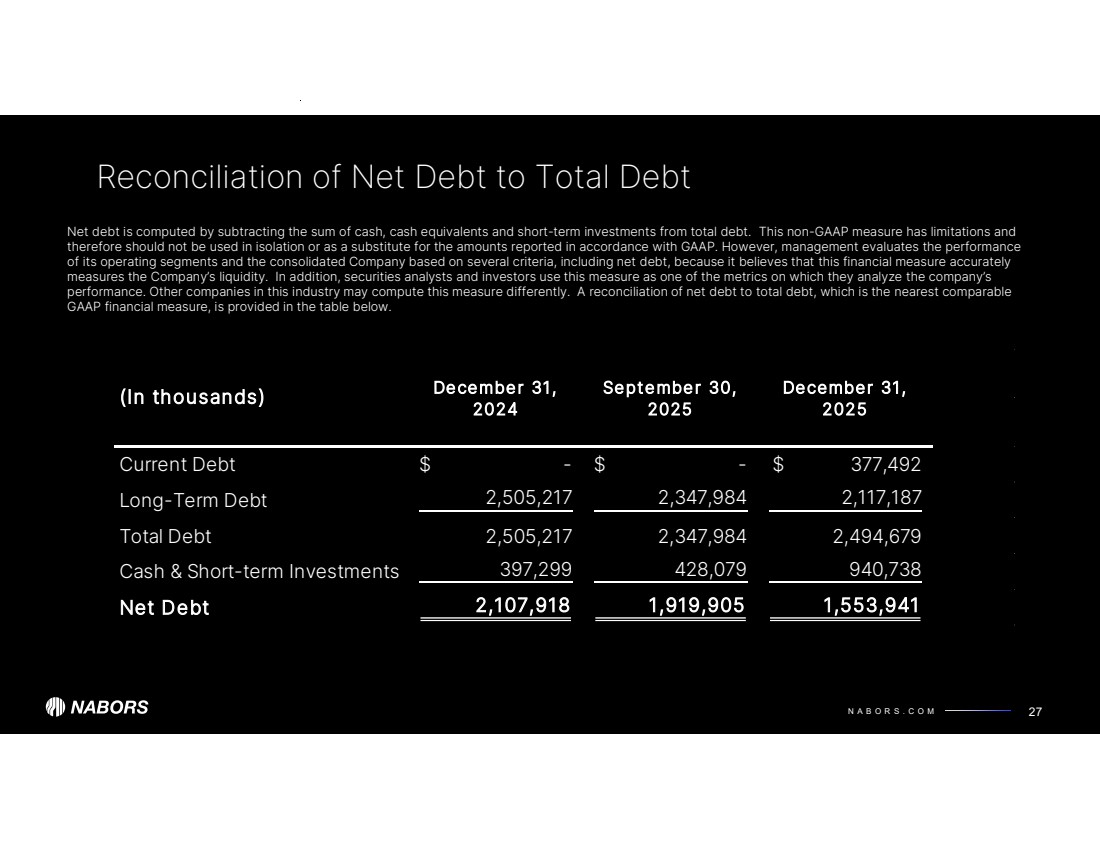

| N A B O R S . C O M Reconciliation of Net Debt to Total Debt 27 Net debt is computed by subtracting the sum of cash, cash equivalents and short-term investments from total debt. This non-GAAP measure has limitations and therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. However, management evaluates the performance of its operating segments and the consolidated Company based on several criteria, including net debt, because it believes that this financial measure accurately measures the Company’s liquidity. In addition, securities analysts and investors use this measure as one of the metrics on which they analyze the company’s performance. Other companies in this industry may compute this measure differently. A reconciliation of net debt to total debt, which is the nearest comparable GAAP financial measure, is provided in the table below. December 31, September 30, December 31, 2024 2025 2025 Current Debt - $ - $ 377,492 $ Long-Term Debt 2,505,217 2,347,984 2,117,187 Total Debt 2,505,217 2,347,984 2,494,679 Cash & Short-term Investments 397,299 428,079 940,738 Net Debt 2,107,918 1,919,905 1,553,941 (In thousands) |

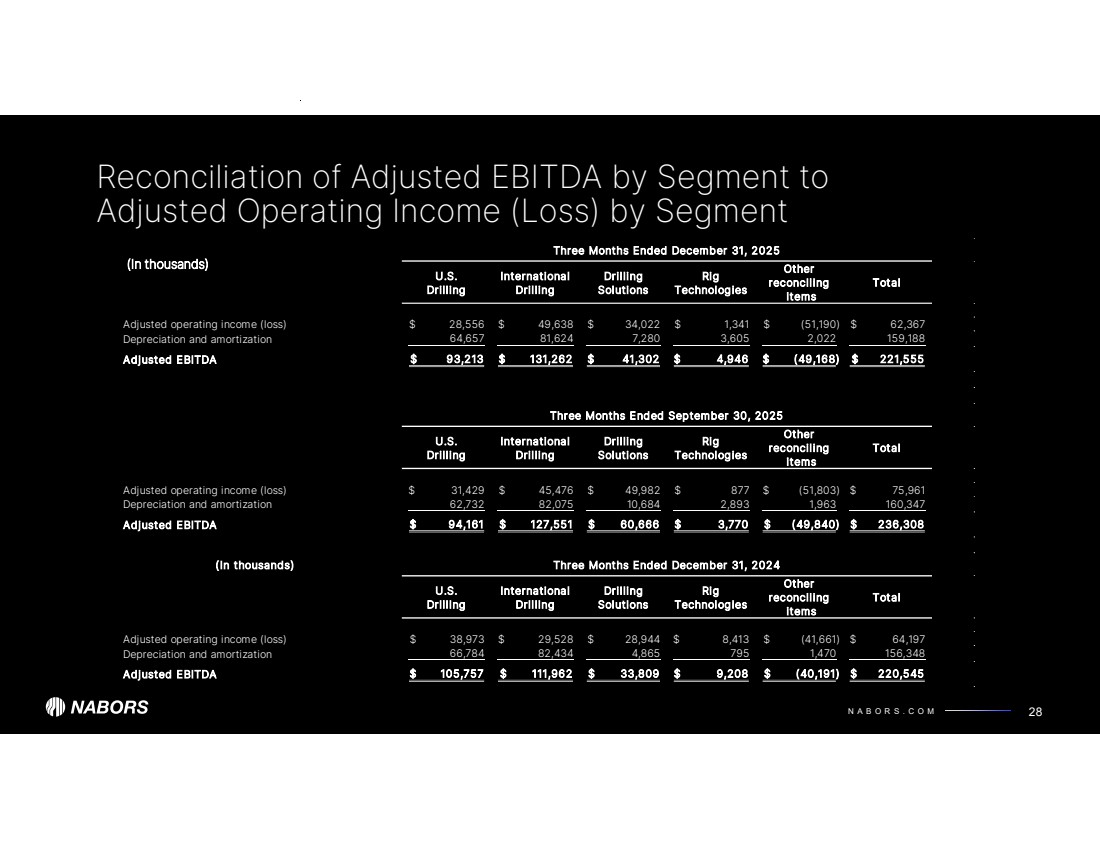

| N A B O R S . C O M Three Months Ended December 31, 2025 U.S. Drilling International Drilling Drilling Solutions Rig Technologies Other reconciling items Total Adjusted operating income (loss) 28,556 $ 49,638 $ 34,022 $ 1,341 $ (51,190) $ 62,367 $ Depreciation and amortization 81,624 64,657 7,280 3,605 2,022 159,188 Adjusted EBITDA $ 131,262 93,213 $ 41,302 $ 4,946 $ (49,168) $ 221,555 $ Three Months Ended September 30, 2025 U.S. Drilling International Drilling Drilling Solutions Rig Technologies Other reconciling items Total Adjusted operating income (loss) 31,429 $ 45,476 $ 49,982 $ 877 $ (51,803) $ 75,961 $ Depreciation and amortization 82,075 62,732 10,684 2,893 1,963 160,347 Adjusted EBITDA $ 94,161 127,551 $ 60,666 $ 3,770 $ (49,840) $ 236,308 $ (In thousands) Three Months Ended December 31, 2024 U.S. Drilling International Drilling Drilling Solutions Rig Technologies Other reconciling items Total Adjusted operating income (loss) 38,973 $ 29,528 $ 28,944 $ 8,413 $ (41,661) $ 64,197 $ Depreciation and amortization 82,434 66,784 4,865 795 1,470 156,348 Adjusted EBITDA $ 105,757 111,962 $ 33,809 $ 9,208 $ (40,191) $ 220,545 $ Reconciliation of Adjusted EBITDA by Segment to Adjusted Operating Income (Loss) by Segment 28 (In thousands) |

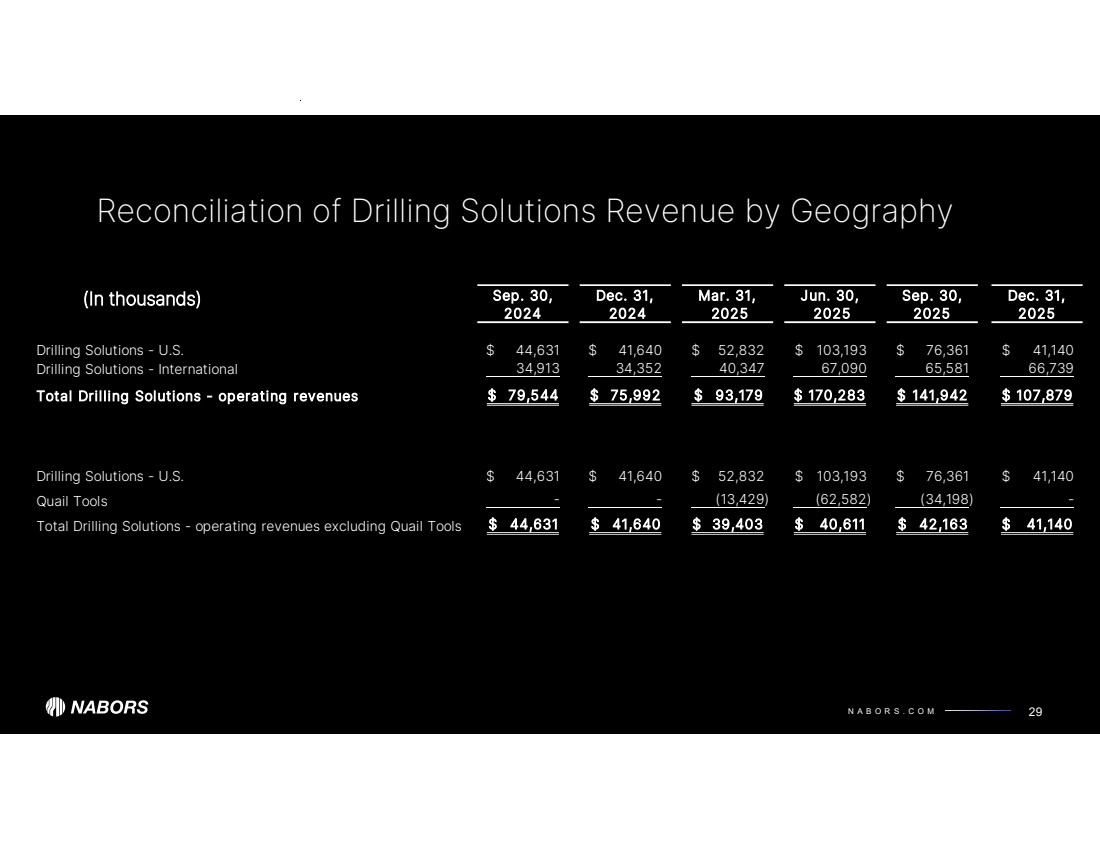

| N A B O R S . C O M Sep. 30, 2024 Dec. 31, 2024 Mar. 31, 2025 Jun. 30, 2025 Sep. 30, 2025 Dec. 31, 2025 Drilling Solutions - U.S. 44,631 $ 41,640 $ 52,832 $ 103,193 $ 76,361 $ 41,140 $ Drilling Solutions - International 34,913 34,352 40,347 67,090 65,581 66,739 Total Drilling Solutions - operating revenues $ 75,992 79,544 $ 93,179 $ 170,283 $ 141,942 $ 107,879 $ Drilling Solutions - U.S. 44,631 $ 41,640 $ 52,832 $ 103,193 $ 76,361 $ 41,140 $ Quail Tools - - (13,429) (62,582) (34,198) - Total Drilling Solutions - operating revenues excluding Quail Tools $ 41,640 44,631 $ 39,403 $ 40,611 $ 42,163 $ 41,140 $ Reconciliation of Drilling Solutions Revenue by Geography 29 (In thousands) |

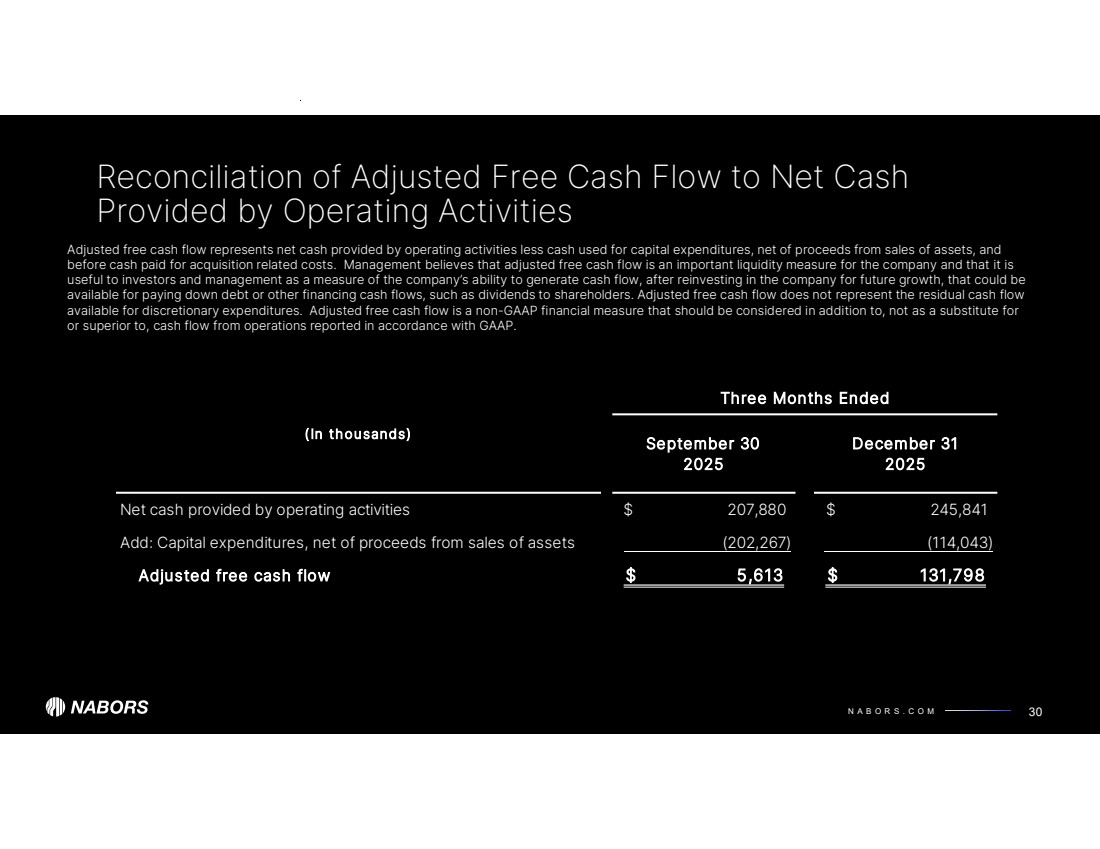

| N A B O R S . C O M Reconciliation of Adjusted Free Cash Flow to Net Cash Provided by Operating Activities 30 Adjusted free cash flow represents net cash provided by operating activities less cash used for capital expenditures, net of proceeds from sales of assets, and before cash paid for acquisition related costs. Management believes that adjusted free cash flow is an important liquidity measure for the company and that it is useful to investors and management as a measure of the company’s ability to generate cash flow, after reinvesting in the company for future growth, that could be available for paying down debt or other financing cash flows, such as dividends to shareholders. Adjusted free cash flow does not represent the residual cash flow available for discretionary expenditures. Adjusted free cash flow is a non-GAAP financial measure that should be considered in addition to, not as a substitute for or superior to, cash flow from operations reported in accordance with GAAP. Three Months Ended (In thousands) September 30 December 31 2025 2025 Net cash provided by operating activities 207,880 $ 245,841 $ Add: Capital expenditures, net of proceeds from sales of assets (202,267) (114,043) Adjusted free cash flow $ 131,798 5,613 $ |

| NABORS INDUSTRIES LTD. NABORS.COM NABORS CORPORATE SERVICES 515 W. Greens Road Suite 1200 Houston, TX 77067-4525 @ n a b o r s g l o b a l Contact Us: William C. Conroy, CFA VP - Corporate Development and Investor Relations William.Conroy@nabors.com Kara K. Peak Director - Corporate Development and Investor Relations Kara.Peak@nabors.com |