Exhibit 99.2

Kornit Digital. All Rights Reserved. Kornit Digital. All Rights Reserved. Kornit Digital (NASDAQ: KRNT) Fourth Quarter and Full - Year 2025 Earnings Conference Call Supporting Slides February 11, 2026 Kornit Digital. All Rights Reserved.

Kornit Digital. All Rights Reserved. On Today’s Call Ronen Samuel CEO Assaf Zipori CFO Andy Backman Chief Capital Markets Officer

Kornit Digital. All Rights Reserved. Safe Harbor This presentation contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other U . S . securities laws . Forward - looking statements are characterized by the use of forward - looking terminology such as “will,” “expects,” “anticipates,” “believes,” “intends,” “planned,” or other similar words . These forward - looking statements include, but are not limited to, statements relating to the Company’s objectives, plans and strategies, including with respect to the Company’s goals for 2026 and beyond, innovation roadmap, pipeline of opportunities and expected revenue growth, and all additional statements that address developments that the Company expects or anticipates will or may occur in the future . Forward - looking statements are not guarantees of future performance and are subject to risks and uncertainties . The Company has based these forward - looking statements on assumptions and assessments made by its management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate . Important factors that could cause actual results, developments and business decisions to differ materially from those anticipated in these forward - looking statements include, among other things : the Company’s degree of success in developing, introducing and selling new or improved products and product enhancements including specifically the Company’s Poly Pro and Presto products, and the Company’s Apollo direct - to - garment platform ; the extent of the Company’s ability to increase sales of its systems, ink and consumables ; the extent of the Company’s ability to continue to grow customer adoption of the AIC model ; the development of the market for digital textile printing ; the Company’s securities class action litigation expenses ; and those additional factors referred to under “Risk Factors” in Item 3 . D of the Company’s Annual Report on Form 20 - F for the year ended December 31 , 2024 , filed with the SEC on March 28 , 2025 . Any forward - looking statements in this presentation are made as of the date hereof, and will not be updated by the Company, whether as a result of new information, future events or otherwise, except as required by law . In addition to U . S . GAAP financials, this presentation includes certain non - GAAP financial measures . These non - GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U . S . GAAP . Please see the reconciliation table that appears among the financial tables in our earnings release being issued today, which earnings release is attached as Exhibit 99 . 1 to our report of foreign private issuer on Form 6 - K being furnished to the SEC today, which reconciliation table is incorporated by reference in this presentation . Please also see Slide 21 of this presentation . This presentation contains statistical data that we obtained from industry publications and reports generated by third parties . Although we believe that the publications and reports are reliable, we have not independently verified this statistical data . Kornit, Kornit Digital, the K logo, and NeoPigment are trademarks of Kornit Digital Ltd . All other trademarks are the property of their respective owners and are used for reference purposes only . Such use should not be construed as an endorsement of our products or services .

Kornit Digital. All Rights Reserved. Business Highlights

Kornit Digital. All Rights Reserved. Full - Year 2025 Recap Achieved 2025 goals including: x A return to revenue growth x Transitioning business toward a more recurring ARR model x Delivering positive Adjusted EBITDA and generating positive cash flow from operations x Capturing share of bulk apparel production x Driving impressions growth across our installed base

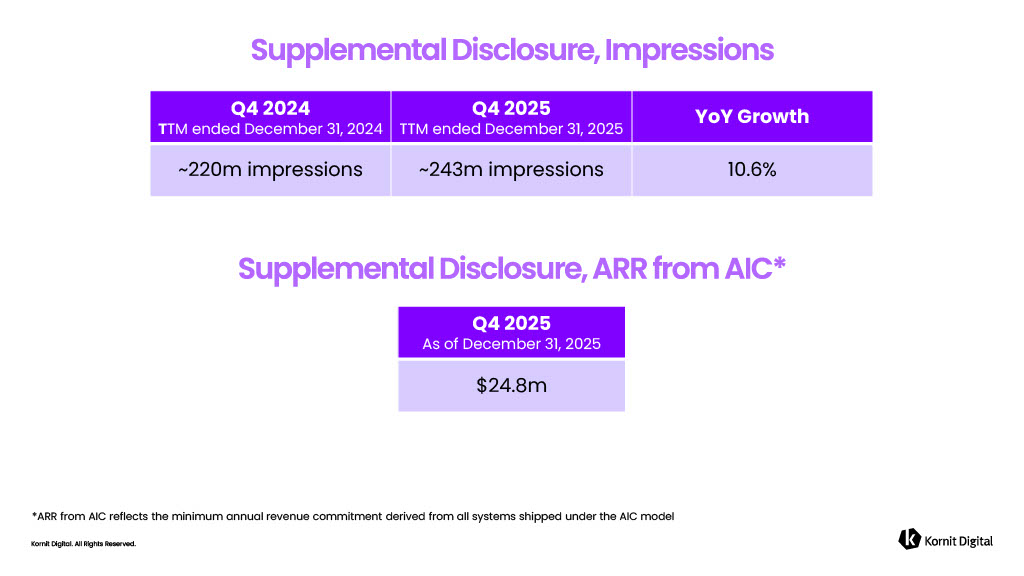

Kornit Digital. All Rights Reserved. Results reflect disciplined execution and meaningful progress in building a more recurring, predictable business model Fourth Quarter 2025 Recap Q4'25 Revenues of $58.9m Q4'25 Adjusted EBITDA of $5.5m Annualized Recurring Revenue (ARR) from AIC reached ~ $25m at the end of 2025 Successful peak season with strong double - digit impression growth in Q4 YoY and 11% growth for the full year 2025

Kornit Digital. All Rights Reserved. • Seeing a shift of impressions into longer runs and incremental bulk apparel production moving to digital • Over 40 % of system deals in 2025 came from net new customers, many of them traditional screen printers adopting digital for the first time • Since the first Apollo installation, adoption continues to accelerate as customers expand their fleets and increase utilization Progress Updates

Kornit Digital. All Rights Reserved. Apollo & Atlas • Over 40% of existing Apollo customers added a second system or more in 2025 • Atlas MAX family continues to gain traction among small and mid - size screen printers Progress Updates Bulk Apparel • Impressions are shifting into longer runs, with incremental bulk apparel production moving to digital • Over 40% of systems deals in 2025 were from net new customers, many traditional screen printers adopting digital production for the first time Customized Design • Seeing encouraging momentum in our customized design segment • Growth momentum returning across several of our key accounts

Kornit Digital. All Rights Reserved. • Continue to see growth in impressions and pipeline development in the sports footwear market • Global strategic customer recently placed an order to continue upgrading its fleet to the Atlas MAX platform, reinforcing long - term confidence in our technology and partnership Progress Updates

Kornit Digital. All Rights Reserved. Looking Ahead in 2026 • Priorities remain clear : • Continue driving incremental impressions from screen market • Expanding AIC program • Delivering on our innovation roadmap to support growth beyond 2026 • Entering 2026 with a growing pipeline of opportunities and much better visibility for the year • Today, more than 83 % of our revenues are recurring or highly predictable • Expecting low single - digit revenue growth in 2026 , reflecting our deliberate decision to accelerate transition to AIC model, alongside stronger profitability expansion and continued positive cash from operations

Kornit Digital. All Rights Reserved. KONNECTIONS '26 DEFINING THE FUTURE OF DIGITAL PRINT. TOGETHER Showcasing breakthrough innovations aimed at expanding addressable markets, accelerating digital adoption, and enabling future growth HOLLYWOOD, FL | THE DIPLOMAT BEACH RESORT APRIL 12 – 14 , 2026

Kornit Digital. All Rights Reserved. Financial Highlights

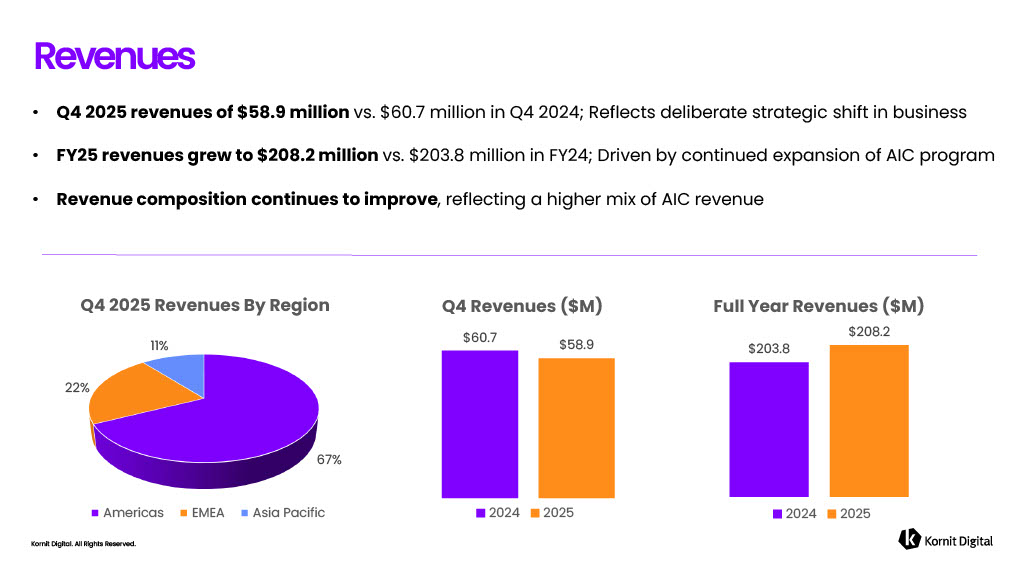

Kornit Digital. All Rights Reserved. • Q4 2025 revenues of $58.9 million vs. $60.7 million in Q4 2024; R eflects deliberate strategic shift in business • FY25 revenues grew to $208.2 million vs. $203.8 million in FY24; D riven by continued expansion of AIC program • Revenue composition continues to improve , reflecting a higher mix of AIC revenue Revenues $203.8 $208.2 Full Year Revenues ($M) 2024 2025 67% 22% 11% Q4 2025 Revenues By Region Americas EMEA Asia Pacific $ 60.7 $58.9 Q4 Revenues ($M) 2024 2025

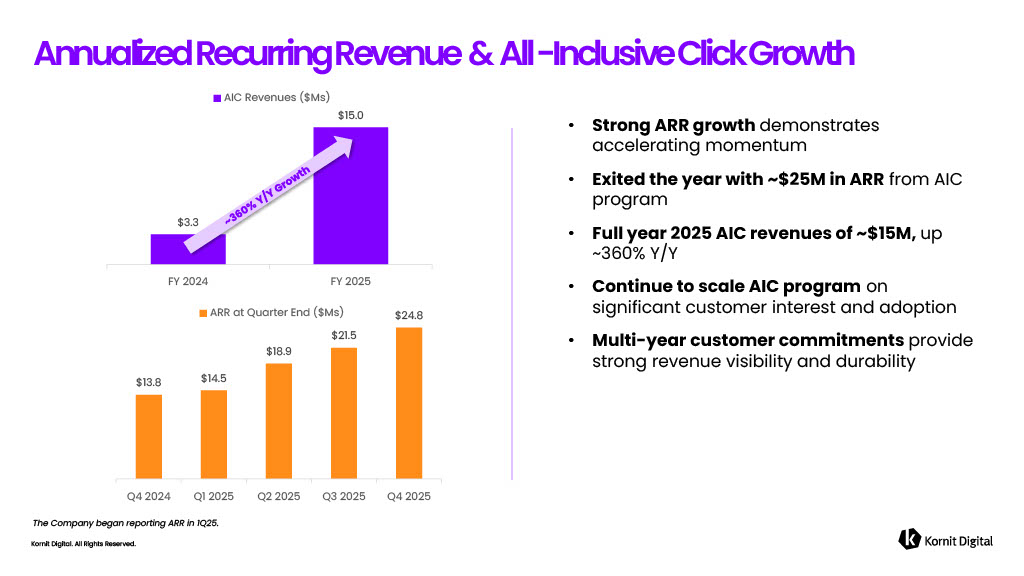

Kornit Digital. All Rights Reserved. • Strong ARR growth demonstrates accelerating momentum • Exited the year with ~$25M in ARR from AIC program • Full year 2025 AIC revenues of ~$15M, up ~360% Y/Y • Continue to scale AIC program on significant customer interest and adoption • Multi - year customer commitments provide strong revenue visibility and durability Annualized Recurring Revenue & All - Inclusive Click Growth The Company began reporting ARR in 1 Q 25 . $13.8 $14.5 $18.9 $21.5 $24.8 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 ARR at Quarter End ($Ms) $3.3 $15.0 FY 2024 FY 2025 AIC Revenues ($Ms)

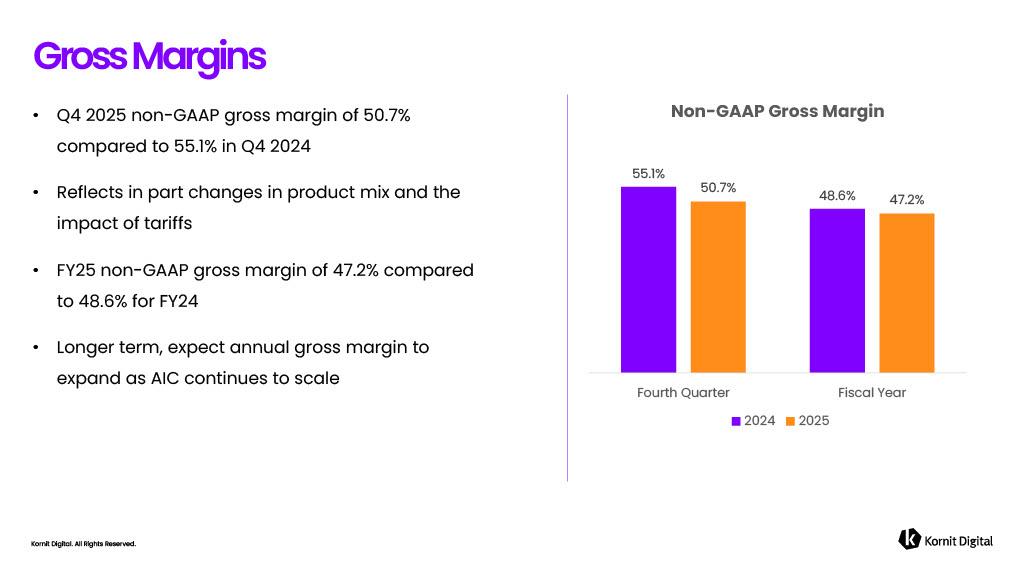

Kornit Digital. All Rights Reserved. • Q4 2025 non - GAAP gross margin of 50.7% compared to 55.1% in Q4 2024 • Reflects in part changes in product mix and the impact of tariffs • FY25 non - GAAP gross margin of 47.2% compared to 48.6% for FY24 • Longer term, expect annual gross margin to expand as AIC continues to scale Gross Margins 55.1% 48.6% 50.7% 47.2 % Fourth Quarter Fiscal Year Non - GAAP Gross Margin 2024 2025

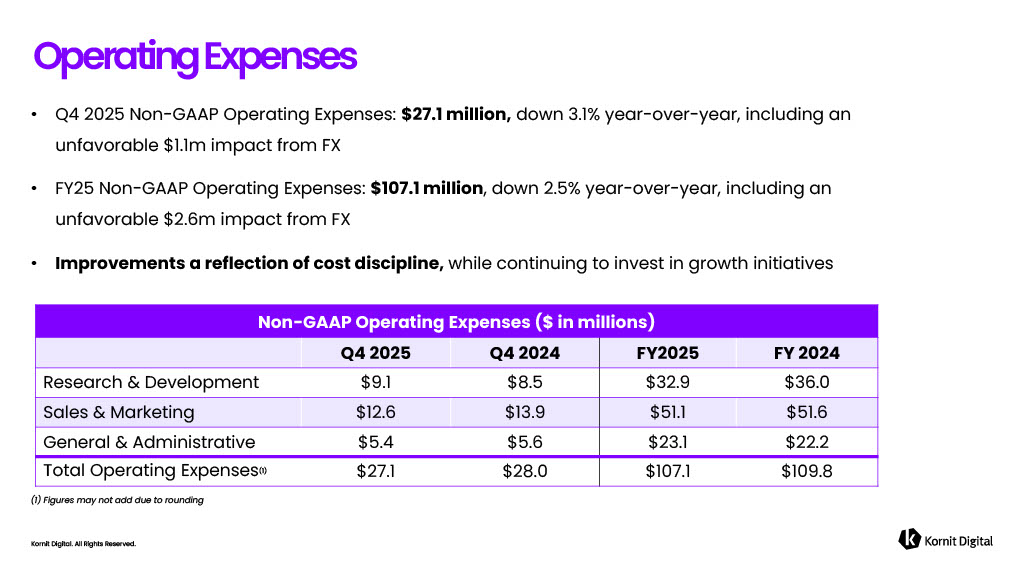

Kornit Digital. All Rights Reserved. • Q4 2025 Non - GAAP Operating Expenses: $27.1 million, down 3.1% year - over - year, including an unfavorable $1.1m impact from FX • FY25 Non - GAAP Operating Expenses: $107.1 million , down 2.5% year - over - year, including an unfavorable $2.6m impact from FX • Improvements a reflection of cost discipline, while continuing to invest in growth initiatives Operating Expenses (1) Figures may not add due to rounding Non - GAAP Operating Expenses ($ in millions) FY 2024 FY2025 Q4 2024 Q4 2025 $36.0 $32.9 $8.5 $9.1 Research & Development $51.6 $51.1 $13.9 $12.6 Sales & Marketing $22.2 $23.1 $5.6 $5.4 General & Administrative $109.8 $107.1 $28.0 $27.1 Total Operating Expenses (1)

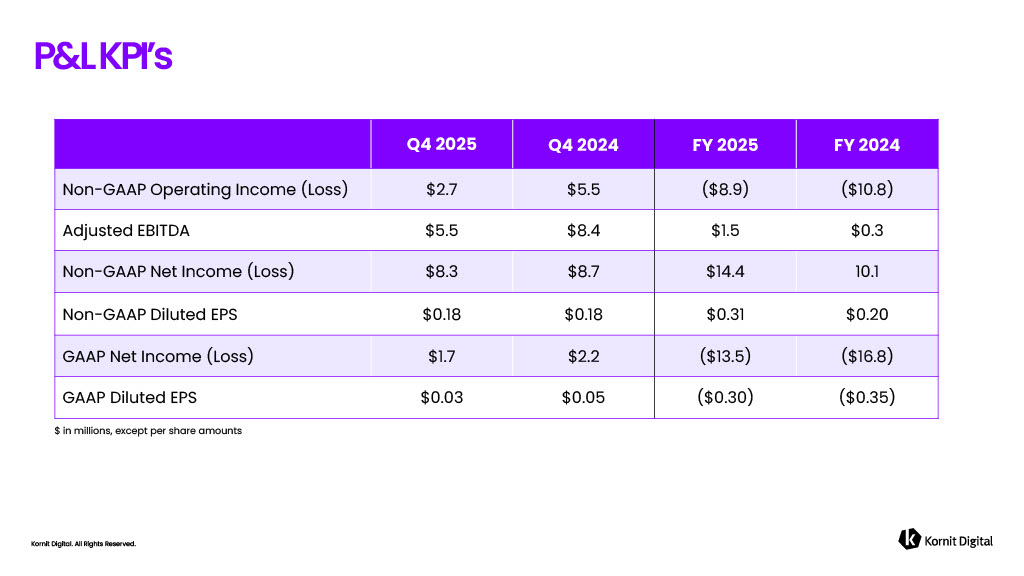

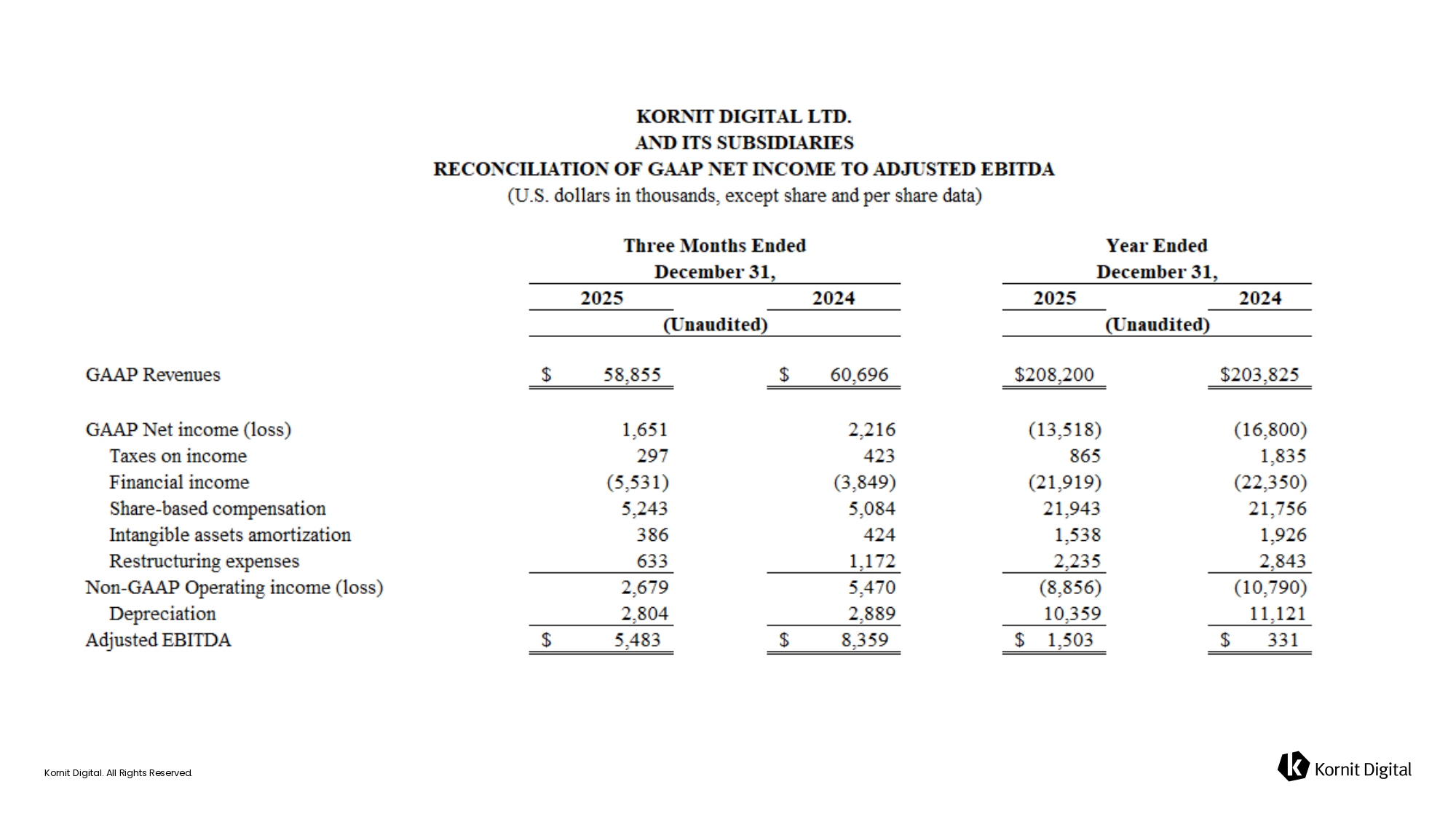

Kornit Digital. All Rights Reserved. P&L KPI’s $ in millions, except per share amounts FY 2024 FY 2025 Q4 2024 Q4 2025 ($10.8) ($8.9) $5.5 $2.7 Non - GAAP Operating Income (Loss) $0.3 $1.5 $8.4 $5.5 Adjusted EBITDA 10.1 $14.4 $8.7 $8.3 Non - GAAP Net Income (Loss) $0.20 $0.31 $0.18 $0.18 Non - GAAP Diluted EPS ($16.8) ($13.5) $2.2 $1.7 GAAP Net Income (Loss) ($0.35) ($0.30) $0.05 $0.03 GAAP Diluted EPS

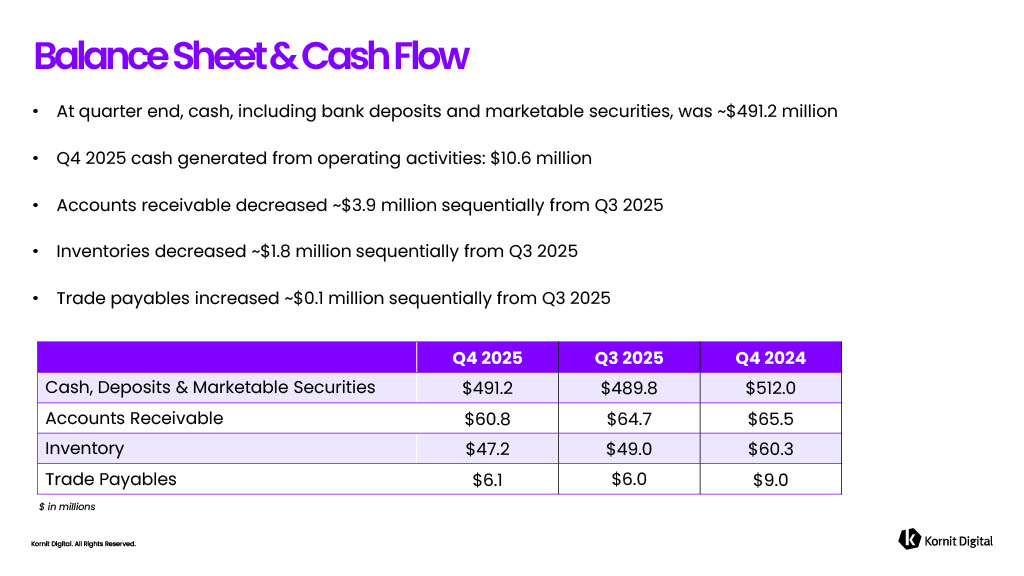

Kornit Digital. All Rights Reserved. • At quarter end, cash, including bank deposits and marketable securities, was ~$491.2 million • Q4 2025 cash generated from operating activities: $10.6 million • Accounts receivable decreased ~$3.9 million sequentially from Q3 2025 • Inventories decreased ~$1.8 million sequentially from Q3 2025 • Trade payables increased ~$0.1 million sequentially from Q3 2025 Balance Sheet & Cash Flow $ in millions Q4 2024 Q3 2025 Q4 2025 $512.0 $489.8 $491.2 Cash, Deposits & Marketable Securities $65.5 $64.7 $60.8 Accounts Receivable $60.3 $49.0 $47.2 Inventory $9 .0 $6.0 $6.1 Trade Payables

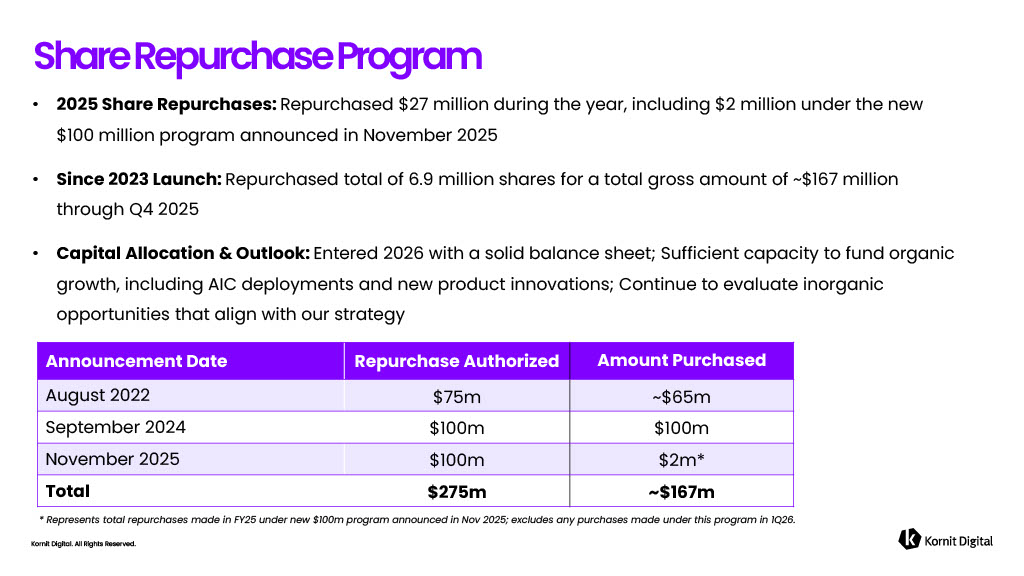

Kornit Digital. All Rights Reserved. • 2025 Share Repurchases: Repurchased $27 million during the year, including $2 million under the new $100 million program announced in November 2025 • Since 2023 Launch: Repurchased total of 6.9 million shares for a total gross amount of ~$167 million through Q4 2025 • Capital Allocation & Outlook: Entered 2026 with a solid balance sheet; Sufficient capacity to fund organic growth, including AIC deployments and new product innovations; Continue to evaluate inorganic opportunities that align with our strategy Share Repurchase Program * Represents total repurchases made in FY25 under new $100m program announced in Nov 2025; excludes any purchases made under thi s program in 1Q26. Amount Purchased Repurchase Authorized Announcement Date ~$65m $75m August 2022 $100m $100m September 2024 $2m* $100m November 2025 ~$167m $275m Total

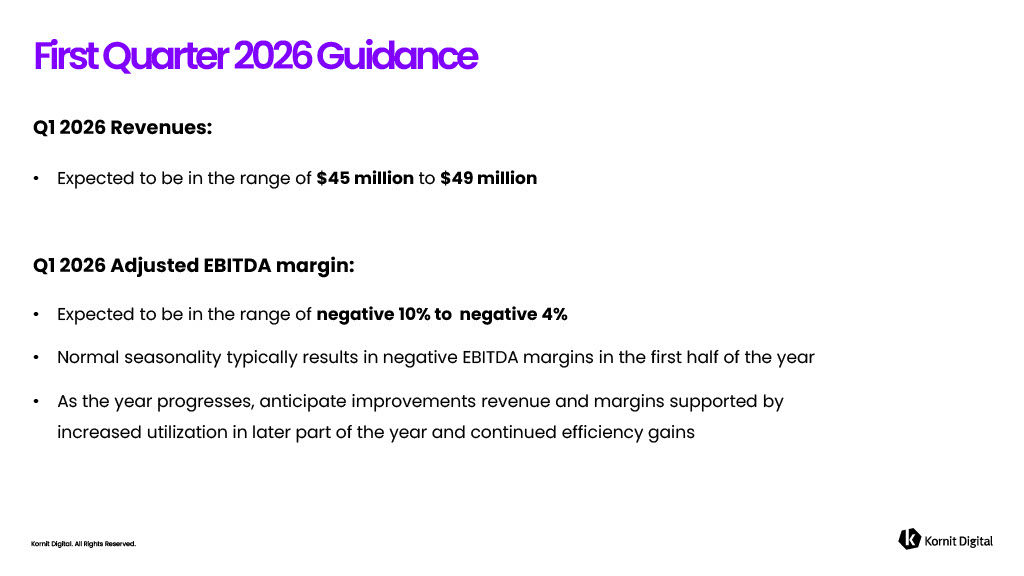

Kornit Digital. All Rights Reserved. Q1 2026 Revenues: • Expected to be in the range of $45 million to $49 million Q1 2026 Adjusted EBITDA margin: • Expected to be in the range of negative 10% to negative 4% • Normal seasonality typically results in negative EBITDA margins in the first half of the year • As the year progresses, anticipate improvements revenue and margins supported by increased utilization in later part of the year and continued efficiency gains First Quarter 2026 Guidance

Kornit Digital. All Rights Reserved.

Kornit Digital. All Rights Reserved. YoY Growth Q4 2025 TTM ended December 31, 2025 Q4 2024 T TM ended December 31, 2024 10.6% ~243m impressions ~220m impressions Q4 2025 As of December 31, 2025 $24.8m *ARR from AIC reflects the minimum annual revenue commitment derived from all systems shipped under the AIC model

Kornit Digital. All Rights Reserved. Thank You!