Pay vs Performance Disclosure

|

12 Months Ended |

|

Nov. 30, 2025

USD ($)

|

Nov. 30, 2024

USD ($)

|

Nov. 30, 2023

USD ($)

|

Nov. 30, 2022

USD ($)

|

Nov. 30, 2021

USD ($)

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

Pay Versus Performance For all fiscal years from 2021–2025, the Principal Executive Officer (“CEO”) was Richard B. Handler and “other NEOs” included Brian P. Friedman, Joseph S. Steinberg and Michael J. Sharp. In fiscal 2021–2023, other NEOs included Theresa S. Gendron, and in fiscal 2022–2025, other NEOs included Matthew S. Larson. The Summary Compensation Table totals reported for our CEO for fiscal 2021–2025 and those amounts for the other NEOs reflected in the table on page 58 were subject to the following adjustments per Item 402(v)(2)(iii) of Regulation S-K to calculate “compensation actually paid”: | | | | | | | | | | | | | | | | | | | Summary

Compensation Table

total compensation | | | $28,447,020 | | | $12,148,360 | | | $22,622,248 | | | $8,231,106 | | | $26,136,030 | | | $6,970,239 | | | $56,897,424 | | | $13,636,275 | | | $28,872,946 | | | $9,788,301 | | | Deduction for change

in pension value

in Summary

Compensation Table | | | (8,768) | | | — | | | (34,996) | | | — | | | — | | | — | | | — | | | — | | | (15,287) | | | — | | | Increase - “Service cost” and “Prior service cost” for pension benefits | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | Deduction for amount reported under the “Stock Awards” and “Option Awards” columns of

the Summary Compensation Table | | | (17,206,243) | | | (6,703,541) | | | (9,356,074) | | | (2,227,616) | | | (16,306,281) | | | (2,785,146) | | | (45,435,003) | | | (9,087,001) | | | (15,666,463) | | | (3,916,616) | | | Increase - year-end fair value of equity awards granted during year

that remain unvested

at year end | | | 13,175,587 | | | 5,986,823 | | | 19,804,002 | | | 4,715,188 | | | 14,727,354 | | | 2,454,561 | | | 47,972,375 | | | 9,594,477 | | | — | | | — | | | Increase - vest-date fair value of equity awards granted during year that vested during year | | | — | | | — | | | — | | | — | | | 2,022,899 | | | 404,580 | | | — | | | — | | | 15,666,463 | | | 3,916,616 | | | Increase/deduct - Change in fair value of all equity awards unvested at prior year end and at year end (year-end fair value minus prior-year-end

fair value) | | | (30,819,973) | | | (7,266,693) | | | 84,426,796 | | | 20,019,503 | | | 3,750,055 | | | 918,577 | | | 10,536,256 | | | 2,107,251 | | | 37,842,380 | | | 9,463,138 | | | Increase/deduct - Change in fair value of all equity awards unvested at prior year end that vested during year (vest date fair value minus prior-year-end

fair value) | | | 1,438,854 | | | 359,713 | | | — | | | — | | | 3,563,008 | | | 712,594 | | | (1,242,547) | | | (248,509) | | | — | | | 10,502 | | | Deduct - Fair value of equity awards unvested at prior year end but forfeited during year (deduct fair value at prior year end) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | Increase - dividends paid on restricted stock and dividend equivalents accrued on unvested equity awards during

the year (not otherwise counted in Summary Compensation Table

or year-end or

vest-date fair value

of equity awards) | | | 132,820 | | | 87,689 | | | 212,756 | | | 103,671 | | | 155,202 | | | 60,607 | | | — | | | — | | | — | | | — | | | | | | Total adjustments | | | $(33,287,724) | | | $(7,536,009) | | | $95,052,485 | | | $22,610,746 | | | $7,912,237 | | | $1,765,773 | | | $11,831,081 | | | $2,366,219 | | | $37,827,093 | | | $9,473,640 | | | Total - “Compensation Actually Paid” | | | $(4,840,704) | | | $4,612,351 | | | $117,674,733 | | | $30,841,852 | | | $34,048,267 | | | $8,736,012 | | | $68,728,505 | | | $16,002,494 | | | $66,700,039 | | | $19,261,941 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The fair value of equity awards is determined in a manner consistent with that disclosed in our consolidated financial statements included in our 2025 Annual Report on Form 10-K, and in footnotes (1) and (2) to the Summary Compensation Table on page 58. Awards of RSUs are valued based on the closing market price of our Common Shares at each measurement date, subject to the following: (i) Performance-based RSUs based on TSR performance (with performance periods covering fiscal 2021 and 2022) were valued using a Monte Carlo valuation model at each measurement date; (ii) performance-based RSUs based on ROTE or return on tangible deployable equity (ROTDE) performance were valued based on the probable outcome of the performance goal at each measurement date; and (iii) awards subject to mandatory holding periods following vesting were valued at each measurement date with a discount based on the illiquidity of the shares that, when vested, would be subject to the holding period. Stock options were valued using the Black-Scholes valuation methodology. As required by Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation deemed to be “compensation actually paid” or CAP (as that term is used in Item 402(v)) and certain key metrics relating to our financial performance. For further information regarding how our executive compensation program is structured and how we align executive compensation with Jefferies’ performance, please see the “Compensation Discussion and Analysis” section above. | | | | | | | | | | | | | | | | | | | | | | | | | 2025 | | | 28,447,020 | | | (4,840,704) | | | 12,148,360 | | | 4,612,351 | | | $307.63 | | | $209.79 | | | $630,791 | | | 10.1% | | | 2024 | | | 22,622,248 | | | 117,674,733 | | | 8,231,106 | | | 30,841,852 | | | 411.62 | | | 198.80 | | | 669,273 | | | 10.9% | | | 2023 | | | 26,136,030 | | | 34,048,267 | | | 6,970,239 | | | 8,736,012 | | | 179.85 | | | 136.62 | | | 263,072 | | | 3.9% | | | 2022 | | | 56,897,424 | | | 68,728,505 | | | 13,636,275 | | | 16,002,494 | | | 177.82 | | | 135.48 | | | 777,168 | | | 10.3% | | | 2021 | | | 28,872,946 | | | 66,700,039 | | | 9,788,301 | | | 19,261,941 | | | 169.76 | | | 138.89 | | | 1,677,403 | | | 24.5% | |

(1)

| ROTE is a non-GAAP measure. For reconciliation to GAAP amounts, see Annex A of this Proxy Statement. |

|

|

|

|

|

| Company Selected Measure Name |

ROTE

|

|

|

|

|

| Named Executive Officers, Footnote |

For all fiscal years from 2021–2025, the Principal Executive Officer (“CEO”) was Richard B. Handler and “other NEOs” included Brian P. Friedman, Joseph S. Steinberg and Michael J. Sharp. In fiscal 2021–2023, other NEOs included Theresa S. Gendron, and in fiscal 2022–2025, other NEOs included Matthew S. Larson.

|

|

|

|

|

| Peer Group Issuers, Footnote |

Significantly, despite a negative TSR for Jefferies in fiscal 2025, our TSR was positive in each of the preceding four fiscal years and robustly so for the full five-year period. By comparison, the total return of the S&P 500 Financials Index–an index of financial services companies–over the same five-year period was substantially below that of Jefferies.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 28,447,020

|

$ 22,622,248

|

$ 26,136,030

|

$ 56,897,424

|

$ 28,872,946

|

| PEO Actually Paid Compensation Amount |

$ (4,840,704)

|

117,674,733

|

34,048,267

|

68,728,505

|

66,700,039

|

| Adjustment To PEO Compensation, Footnote |

The Summary Compensation Table totals reported for our CEO for fiscal 2021–2025 and those amounts for the other NEOs reflected in the table on page 58 were subject to the following adjustments per Item 402(v)(2)(iii) of Regulation S-K to calculate “compensation actually paid”: | | | | | | | | | | | | | | | | | | | Summary

Compensation Table

total compensation | | | $28,447,020 | | | $12,148,360 | | | $22,622,248 | | | $8,231,106 | | | $26,136,030 | | | $6,970,239 | | | $56,897,424 | | | $13,636,275 | | | $28,872,946 | | | $9,788,301 | | | Deduction for change

in pension value

in Summary

Compensation Table | | | (8,768) | | | — | | | (34,996) | | | — | | | — | | | — | | | — | | | — | | | (15,287) | | | — | | | Increase - “Service cost” and “Prior service cost” for pension benefits | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | Deduction for amount reported under the “Stock Awards” and “Option Awards” columns of

the Summary Compensation Table | | | (17,206,243) | | | (6,703,541) | | | (9,356,074) | | | (2,227,616) | | | (16,306,281) | | | (2,785,146) | | | (45,435,003) | | | (9,087,001) | | | (15,666,463) | | | (3,916,616) | | | Increase - year-end fair value of equity awards granted during year

that remain unvested

at year end | | | 13,175,587 | | | 5,986,823 | | | 19,804,002 | | | 4,715,188 | | | 14,727,354 | | | 2,454,561 | | | 47,972,375 | | | 9,594,477 | | | — | | | — | | | Increase - vest-date fair value of equity awards granted during year that vested during year | | | — | | | — | | | — | | | — | | | 2,022,899 | | | 404,580 | | | — | | | — | | | 15,666,463 | | | 3,916,616 | | | Increase/deduct - Change in fair value of all equity awards unvested at prior year end and at year end (year-end fair value minus prior-year-end

fair value) | | | (30,819,973) | | | (7,266,693) | | | 84,426,796 | | | 20,019,503 | | | 3,750,055 | | | 918,577 | | | 10,536,256 | | | 2,107,251 | | | 37,842,380 | | | 9,463,138 | | | Increase/deduct - Change in fair value of all equity awards unvested at prior year end that vested during year (vest date fair value minus prior-year-end

fair value) | | | 1,438,854 | | | 359,713 | | | — | | | — | | | 3,563,008 | | | 712,594 | | | (1,242,547) | | | (248,509) | | | — | | | 10,502 | | | Deduct - Fair value of equity awards unvested at prior year end but forfeited during year (deduct fair value at prior year end) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | Increase - dividends paid on restricted stock and dividend equivalents accrued on unvested equity awards during

the year (not otherwise counted in Summary Compensation Table

or year-end or

vest-date fair value

of equity awards) | | | 132,820 | | | 87,689 | | | 212,756 | | | 103,671 | | | 155,202 | | | 60,607 | | | — | | | — | | | — | | | — | | | | | | Total adjustments | | | $(33,287,724) | | | $(7,536,009) | | | $95,052,485 | | | $22,610,746 | | | $7,912,237 | | | $1,765,773 | | | $11,831,081 | | | $2,366,219 | | | $37,827,093 | | | $9,473,640 | | | Total - “Compensation Actually Paid” | | | $(4,840,704) | | | $4,612,351 | | | $117,674,733 | | | $30,841,852 | | | $34,048,267 | | | $8,736,012 | | | $68,728,505 | | | $16,002,494 | | | $66,700,039 | | | $19,261,941 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The fair value of equity awards is determined in a manner consistent with that disclosed in our consolidated financial statements included in our 2025 Annual Report on Form 10-K, and in footnotes (1) and (2) to the Summary Compensation Table on page 58. Awards of RSUs are valued based on the closing market price of our Common Shares at each measurement date, subject to the following: (i) Performance-based RSUs based on TSR performance (with performance periods covering fiscal 2021 and 2022) were valued using a Monte Carlo valuation model at each measurement date; (ii) performance-based RSUs based on ROTE or return on tangible deployable equity (ROTDE) performance were valued based on the probable outcome of the performance goal at each measurement date; and (iii) awards subject to mandatory holding periods following vesting were valued at each measurement date with a discount based on the illiquidity of the shares that, when vested, would be subject to the holding period. Stock options were valued using the Black-Scholes valuation methodology. |

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 12,148,360

|

8,231,106

|

6,970,239

|

13,636,275

|

9,788,301

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 4,612,351

|

30,841,852

|

8,736,012

|

16,002,494

|

19,261,941

|

| Adjustment to Non-PEO NEO Compensation Footnote |

The Summary Compensation Table totals reported for our CEO for fiscal 2021–2025 and those amounts for the other NEOs reflected in the table on page 58 were subject to the following adjustments per Item 402(v)(2)(iii) of Regulation S-K to calculate “compensation actually paid”: | | | | | | | | | | | | | | | | | | | Summary

Compensation Table

total compensation | | | $28,447,020 | | | $12,148,360 | | | $22,622,248 | | | $8,231,106 | | | $26,136,030 | | | $6,970,239 | | | $56,897,424 | | | $13,636,275 | | | $28,872,946 | | | $9,788,301 | | | Deduction for change

in pension value

in Summary

Compensation Table | | | (8,768) | | | — | | | (34,996) | | | — | | | — | | | — | | | — | | | — | | | (15,287) | | | — | | | Increase - “Service cost” and “Prior service cost” for pension benefits | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | Deduction for amount reported under the “Stock Awards” and “Option Awards” columns of

the Summary Compensation Table | | | (17,206,243) | | | (6,703,541) | | | (9,356,074) | | | (2,227,616) | | | (16,306,281) | | | (2,785,146) | | | (45,435,003) | | | (9,087,001) | | | (15,666,463) | | | (3,916,616) | | | Increase - year-end fair value of equity awards granted during year

that remain unvested

at year end | | | 13,175,587 | | | 5,986,823 | | | 19,804,002 | | | 4,715,188 | | | 14,727,354 | | | 2,454,561 | | | 47,972,375 | | | 9,594,477 | | | — | | | — | | | Increase - vest-date fair value of equity awards granted during year that vested during year | | | — | | | — | | | — | | | — | | | 2,022,899 | | | 404,580 | | | — | | | — | | | 15,666,463 | | | 3,916,616 | | | Increase/deduct - Change in fair value of all equity awards unvested at prior year end and at year end (year-end fair value minus prior-year-end

fair value) | | | (30,819,973) | | | (7,266,693) | | | 84,426,796 | | | 20,019,503 | | | 3,750,055 | | | 918,577 | | | 10,536,256 | | | 2,107,251 | | | 37,842,380 | | | 9,463,138 | | | Increase/deduct - Change in fair value of all equity awards unvested at prior year end that vested during year (vest date fair value minus prior-year-end

fair value) | | | 1,438,854 | | | 359,713 | | | — | | | — | | | 3,563,008 | | | 712,594 | | | (1,242,547) | | | (248,509) | | | — | | | 10,502 | | | Deduct - Fair value of equity awards unvested at prior year end but forfeited during year (deduct fair value at prior year end) | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | Increase - dividends paid on restricted stock and dividend equivalents accrued on unvested equity awards during

the year (not otherwise counted in Summary Compensation Table

or year-end or

vest-date fair value

of equity awards) | | | 132,820 | | | 87,689 | | | 212,756 | | | 103,671 | | | 155,202 | | | 60,607 | | | — | | | — | | | — | | | — | | | | | | Total adjustments | | | $(33,287,724) | | | $(7,536,009) | | | $95,052,485 | | | $22,610,746 | | | $7,912,237 | | | $1,765,773 | | | $11,831,081 | | | $2,366,219 | | | $37,827,093 | | | $9,473,640 | | | Total - “Compensation Actually Paid” | | | $(4,840,704) | | | $4,612,351 | | | $117,674,733 | | | $30,841,852 | | | $34,048,267 | | | $8,736,012 | | | $68,728,505 | | | $16,002,494 | | | $66,700,039 | | | $19,261,941 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

The fair value of equity awards is determined in a manner consistent with that disclosed in our consolidated financial statements included in our 2025 Annual Report on Form 10-K, and in footnotes (1) and (2) to the Summary Compensation Table on page 58. Awards of RSUs are valued based on the closing market price of our Common Shares at each measurement date, subject to the following: (i) Performance-based RSUs based on TSR performance (with performance periods covering fiscal 2021 and 2022) were valued using a Monte Carlo valuation model at each measurement date; (ii) performance-based RSUs based on ROTE or return on tangible deployable equity (ROTDE) performance were valued based on the probable outcome of the performance goal at each measurement date; and (iii) awards subject to mandatory holding periods following vesting were valued at each measurement date with a discount based on the illiquidity of the shares that, when vested, would be subject to the holding period. Stock options were valued using the Black-Scholes valuation methodology. |

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

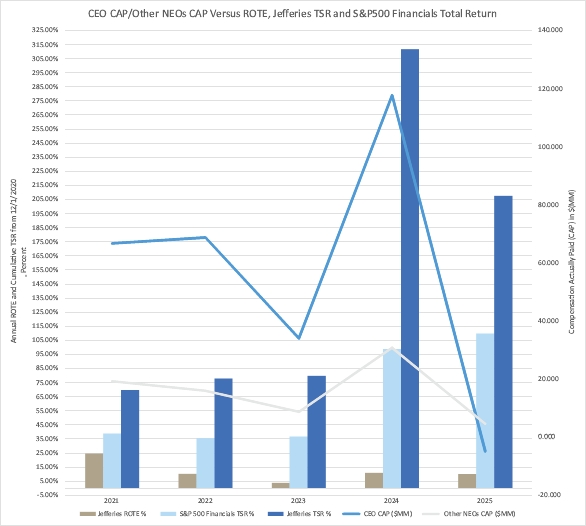

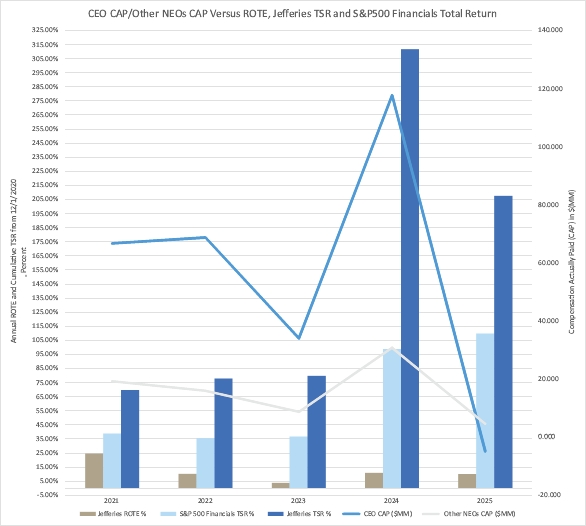

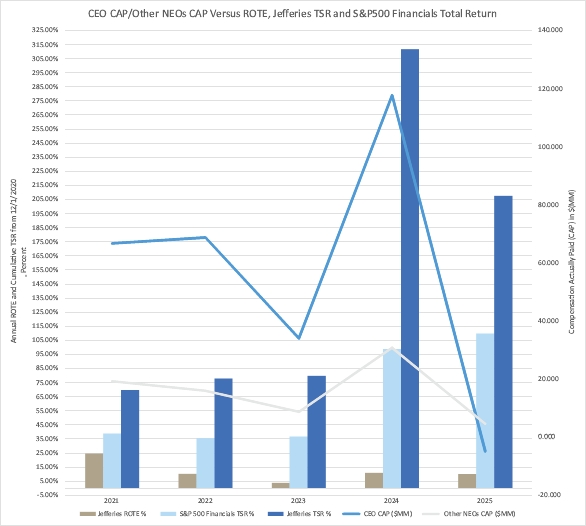

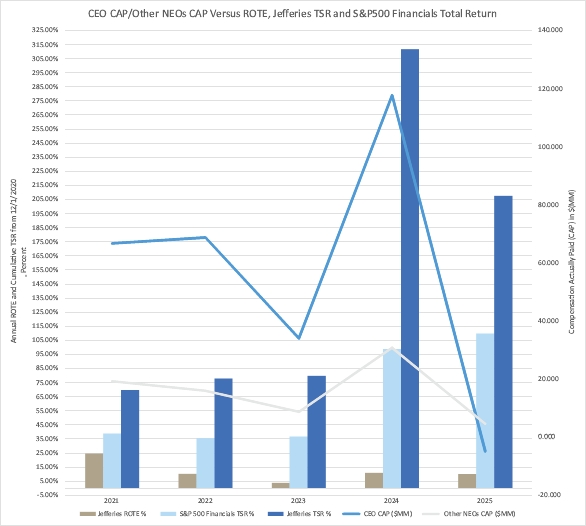

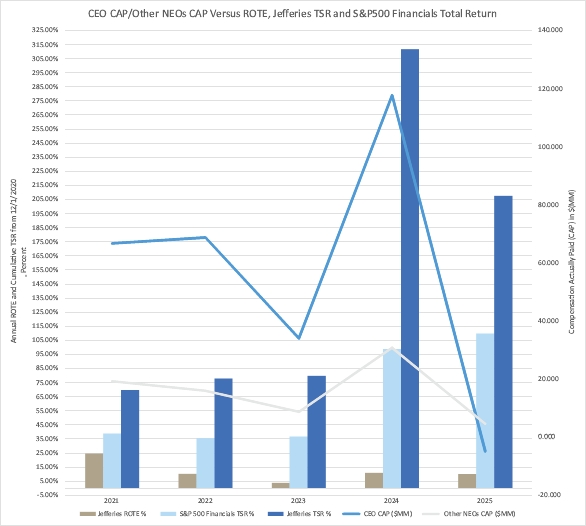

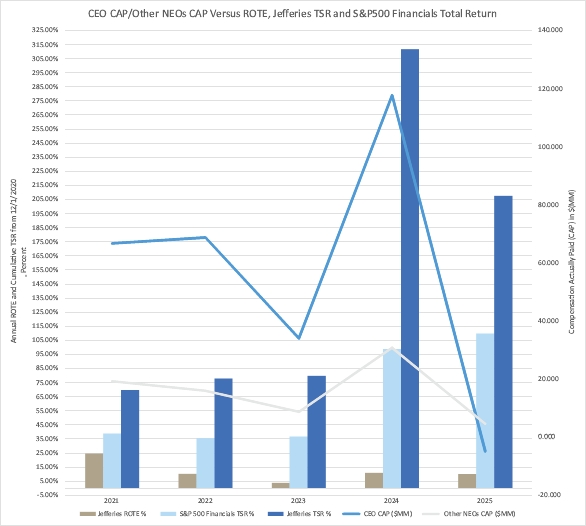

The following chart, covering the past five fiscal years, demonstrates the correlation between: (a) the compensation actually paid to our CEO and our other NEOs and (b) ROTE7, TSR and the total return of the S&P 500 Financials Index (total returns are measured over five years from November 30, 2020).

|

|

|

|

|

| Compensation Actually Paid vs. Net Income |

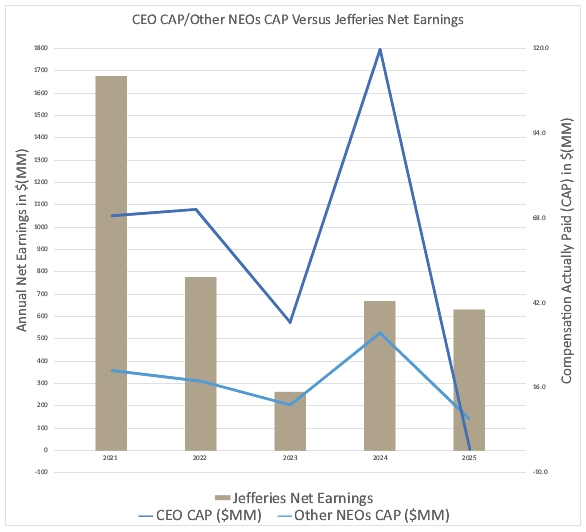

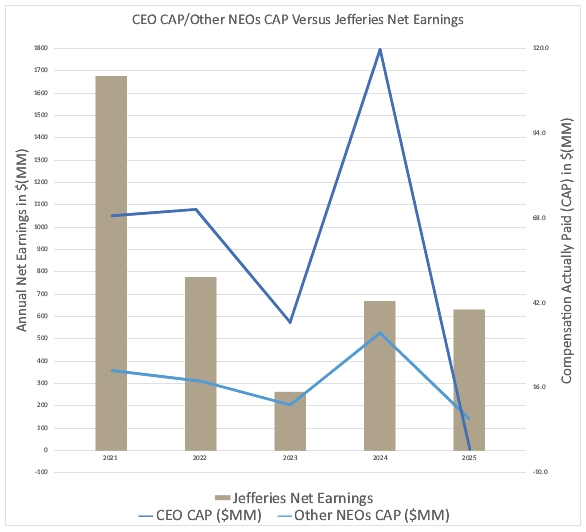

The following chart, covering the past five fiscal years, demonstrates the correlation between the compensation actually paid to our CEO and our other NEOs and our net earnings.

|

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

The following chart, covering the past five fiscal years, demonstrates the correlation between: (a) the compensation actually paid to our CEO and our other NEOs and (b) ROTE7, TSR and the total return of the S&P 500 Financials Index (total returns are measured over five years from November 30, 2020).  7

| ROTE is a non-GAAP measure. For reconciliation to GAAP amounts, see Annex A of this Proxy Statement. |

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

The following chart, covering the past five fiscal years, demonstrates the correlation between: (a) the compensation actually paid to our CEO and our other NEOs and (b) ROTE7, TSR and the total return of the S&P 500 Financials Index (total returns are measured over five years from November 30, 2020).

|

|

|

|

|

| Tabular List, Table |

Financial Performance Measures We have identified ROTE as the company-selected measure for the pay-versus-performance disclosure, as it represents the most important financial performance measure for our CEO and President to earn annual incentive awards and PSUs and in the determination of annual equity award grants to the CEO and President. TSR is the metric most affecting changes in value of unvested equity awards, which greatly impact the compensation actually paid calculation for the CEO and President. This is because, under the SEC’s disclosure rules, the change in value of unvested equity awards from the end of one fiscal year to the end of the next fiscal year or to any vesting date within that next fiscal year, whether positive or negative, plus the year-end value of unvested equity awards granted in the fiscal year, are included in the calculation of compensation actually paid. It is important to understand that executives cannot realize disposable income from equity awards until they are vested, so in that sense the changes in equity value factored into the SEC’s “compensation actually paid” prior to vesting of the equity awards constitute only potential and not actual disposable income. Tabular List of Performance Measures The three measures listed below represent an unranked list of the most important measures we currently use, which generally had the effect of aligning compensation actually paid to the NEOs for 2025 with Jefferies’ performance. | | | | ROTE7 | | | TSR | | | Net Earnings / Net Income | |

As discussed in the Compensation Discussion and Analysis, a number of other financial and non-financial metrics are considered by the Compensation Committee in its decisions on the compensation of the CEO and the President. These metrics also are factors considered by the Compensation Committee in determining the annual bonuses paid to the Executive Vice Presidents who are included as other NEOs. Historically, those other NEOs have been compensated primarily through discretionary cash bonuses and not by equity award grants, so ROTE, TSR and Net Earnings have had only indirect rather than formulaic impacts on their “compensation actually paid” as defined in the SEC rules. In fiscal 2025, each of the Executive Vice Presidents who are other NEOs received a grant of RSUs, so changes in TSR had a small effect on this calculation in fiscal 2025 and likely will have a greater effect in future fiscal years.

|

|

|

|

|

| Total Shareholder Return Amount |

$ 307.63

|

411.62

|

179.85

|

177.82

|

169.76

|

| Peer Group Total Shareholder Return Amount |

$ 209.79

|

$ 198.8

|

$ 136.62

|

$ 135.48

|

$ 138.89

|

| Company Selected Measure Amount |

0.101

|

0.109

|

0.039

|

0.103

|

0.245

|

| PEO Name |

Richard B. Handler

|

Richard B. Handler

|

Richard B. Handler

|

Richard B. Handler

|

Richard B. Handler

|

| Additional 402(v) Disclosure |

The above charts show that, over the past five fiscal years, compensation actually paid to the CEO and other NEOs was generally aligned with TSR (more so on a year-over-year basis) and with ROTE and Net Earnings as well. Under the SEC's “compensation actually paid” metric, as applied to Jefferies, the most significant factor has been TSR, which incorporates both year-over-year changes in value of equity awards and the compounding effect of crediting dividend equivalents on RSUs, which are converted into additional share units. Our fiscal 2025 results illustrate this, in that stock price decreased by 27%, fueling a one-year TSR of -25%, which was the principal factor in the CEO's calculated “compensation actually paid” of negative $4.8 million and that of the other NEOs a positive amount but down 85% from the year earlier level. Similarly, highly positive TSR in fiscal 2024 resulted in a very high calculation of CAP for the CEO in that year. Jefferies' TSR results affect the “compensation actually paid” for other NEOs, but to a lesser extent, because the President’s compensation (part of the average for the other NEOs) is structured in the same way as the CEO’s compensation. Jefferies' ROTE and Net Earnings also are aligned with compensation, but the sustained increases in TSR from 2021 to 2024 and the one-year reversal of that trend in 2025 have overshadowed those factors in the SEC's compensation actually paid calculations. In years with comparatively stronger Net Earnings and three-year ROTE above our target of 10%, PSUs have been earned at above-target levels. This was the case for PSUs granted to the CEO and President with a performance period of fiscal 2021–2023. However, the three-year ROTE in the fiscal 2022–2024 performance period and fiscal 2023–2025 period fell short of the target so that the PSUs tied to those performance periods were earned at a level below target. In fiscal 2023, when year-over-year TSR growth was positive but not dramatic, compensation actually paid declined in alignment with the lower levels of ROTE and Net Earnings in that year. The SEC’s prescribed measure of compensation–CAP–was not used by our Compensation Committee in determining the structure and amount of executive compensation and, to our knowledge, prior to the SEC’s adoption of the rule requiring disclosure of “compensation actually paid,” had not been widely known or regarded as a useful measure of executive compensation.

|

|

|

|

|

| Net Income Loss and Preferred Stock Dividends Income Statement Impact |

$ 630,791,000

|

$ 669,273,000

|

$ 263,072,000

|

$ 777,168,000

|

$ 1,677,403,000

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

ROTE

|

|

|

|

|

| Non-GAAP Measure Description |

(1)

| ROTE is a non-GAAP measure. For reconciliation to GAAP amounts, see Annex A of this Proxy Statement. |

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

TSR

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Net Earnings / Net Income

|

|

|

|

|

| PEO |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (33,287,724)

|

95,052,485

|

7,912,237

|

11,831,081

|

37,827,093

|

| PEO | Aggregate Change in Present Value of Accumulated Benefit for All Pension Plans Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(8,768)

|

(34,996)

|

0

|

0

|

(15,287)

|

| PEO | Aggregate Pension Adjustments Service Cost |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(17,206,243)

|

(9,356,074)

|

(16,306,281)

|

(45,435,003)

|

(15,666,463)

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

13,175,587

|

19,804,002

|

14,727,354

|

47,972,375

|

0

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(30,819,973)

|

84,426,796

|

3,750,055

|

10,536,256

|

37,842,380

|

| PEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

2,022,899

|

0

|

15,666,463

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,438,854

|

0

|

3,563,008

|

(1,242,547)

|

0

|

| PEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| PEO | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

132,820

|

212,756

|

155,202

|

0

|

0

|

| Non-PEO NEO |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(7,536,009)

|

22,610,746

|

1,765,773

|

2,366,219

|

9,473,640

|

| Non-PEO NEO | Aggregate Change in Present Value of Accumulated Benefit for All Pension Plans Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Aggregate Pension Adjustments Service Cost |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(6,703,541)

|

(2,227,616)

|

(2,785,146)

|

(9,087,001)

|

(3,916,616)

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

5,986,823

|

4,715,188

|

2,454,561

|

9,594,477

|

0

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(7,266,693)

|

20,019,503

|

918,577

|

2,107,251

|

9,463,138

|

| Non-PEO NEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

404,580

|

0

|

3,916,616

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

359,713

|

0

|

712,594

|

(248,509)

|

10,502

|

| Non-PEO NEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 87,689

|

$ 103,671

|

$ 60,607

|

$ 0

|

$ 0

|