Exhibit 99.1

NASDAQ: EMAT February 2026 US Champion: Critical Materials Supply Chain Evolution Metals & Technologies Corp.

2 Disclaimers This presentation has been prepared by Evolution Metals & Technologies Corp . (“EM&T”) . This presentation has been provided for informational purposes only to assist interested parties in conducting their own evaluation of EM&T, its business, operations, prospects and industry . This presentation does not purport to contain all information that may be required or desired by an interested party in evaluating EM&T or its subsidiaries (“Operating Companies”), and it should not be relied upon as a complete description of EM&T’s business, financial condition, results of operations or prospects, past, present or future . Portions of this presentation have been prepared based on information obtained from EM&T, its subsidiaries and other sources believed to be reliable ; however, EM&T has not independently verified all such information, and no representation or warranty, express or implied, is made as to the accuracy, completeness or reliability of the information contained herein . None of EM&T or any of its affiliates, control persons, officers, directors, employees, representatives or agents shall have any liability whatsoever (in negligence or otherwise) for any loss arising from any use of this presentation or its contents or otherwise arising in connection with this presentation . Only those representations and warranties that are expressly included in any legally binding definitive agreements entered into by EM&T shall have legal effect . The information contained in this presentation is subject to change without notice, and EM&T undertakes no obligation to update or revise this presentation or any information contained herein, except as required by applicable law or regulation . Certain market, industry and other data included in this presentation are based on estimates, assumptions, projections and publicly available information and involve a high degree of uncertainty . No assurance can be given as to the accuracy or completeness of such data . Cautionary Statement Regarding Forward - Looking Statements . This presentation contains certain statements that may constitute “forward - looking statements” within the meaning of the federal securities laws . Forward - looking statements include, but are not limited to, statements regarding EM&T’s future financial condition, results of operations, business strategy, growth plans, market opportunities, industry positioning, competitive advantages, integration of acquired operations, capital requirements and expectations regarding future performance . Forward - looking statements are based on current expectations, estimates and assumptions and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those expressed or implied . Words such as “anticipate,” “believe,” “expect,” “intend,” “plan,” “estimate,” “project,” “forecast,” “target,” “may,” “will,” “should,” “could,” “would” and similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain such identifying words . These statements speak only as of the date of this presentation . Risks and uncertainties that may affect EM&T’s actual results include, but are not limited to : EM&T’s ability to successfully integrate the Operating Companies ; EM&T’s ability to execute its business plan and growth strategy ; EM&T’s ability to secure sufficient capital to fund planned operations and expansion ; operational and manufacturing risks ; supply chain constraints ; customer concentration ; competition from companies with greater resources ; regulatory and compliance risks ; geopolitical risks ; fluctuations in commodity prices ; intellectual property protection ; litigation and regulatory proceedings ; and other risks described in EM&T’s filings with the U . S . Securities and Exchange Commission (“SEC”), including the definitive proxy statement/prospectus filed by EM&T with the SEC on August 11 , 2025 , and subsequent periodic reports filed by EM&T . Except as required by law, EM&T undertakes no obligation to publicly update or revise any forward - looking statements to reflect subsequent events or circumstances . Market and Industry Data . Certain market, industry and other data included in this presentation have been obtained from third - party sources and publications . Although such information is believed to be reliable, EM&T has not independently verified such data, and no representation or warranty is made as to its accuracy or completeness . Trademarks . This presentation may contain trademarks, service marks, trade names, copyrights and logos of other companies, which are the property of their respective owners . The use of such intellectual property does not imply any affiliation with or endorsement by such owners . No Offer or Solicitation . This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall it constitute a solicitation of any vote or approval, in any jurisdiction in which such offer, solicitation or sale would be unlawful . Any offer of securities will be made only pursuant to definitive offering documents and in compliance with applicable securities laws .

3 China’s Dominance in Midstream Processing 1 Why Now? 2 Solution to Disrupt China 3 Deeply Experienced Leadership 4 Feedstock Strategy: End of Life Materials 5 Proven Technologies 6 US Industrial Campus & Operations in the Republic of Korea 7 How Can EM&T Compete with China? 8 Compelling Sustainability Investment 9 Planned CapEx 10 US Champion in Critical Materials Supply Chain, No Reliance on China Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor

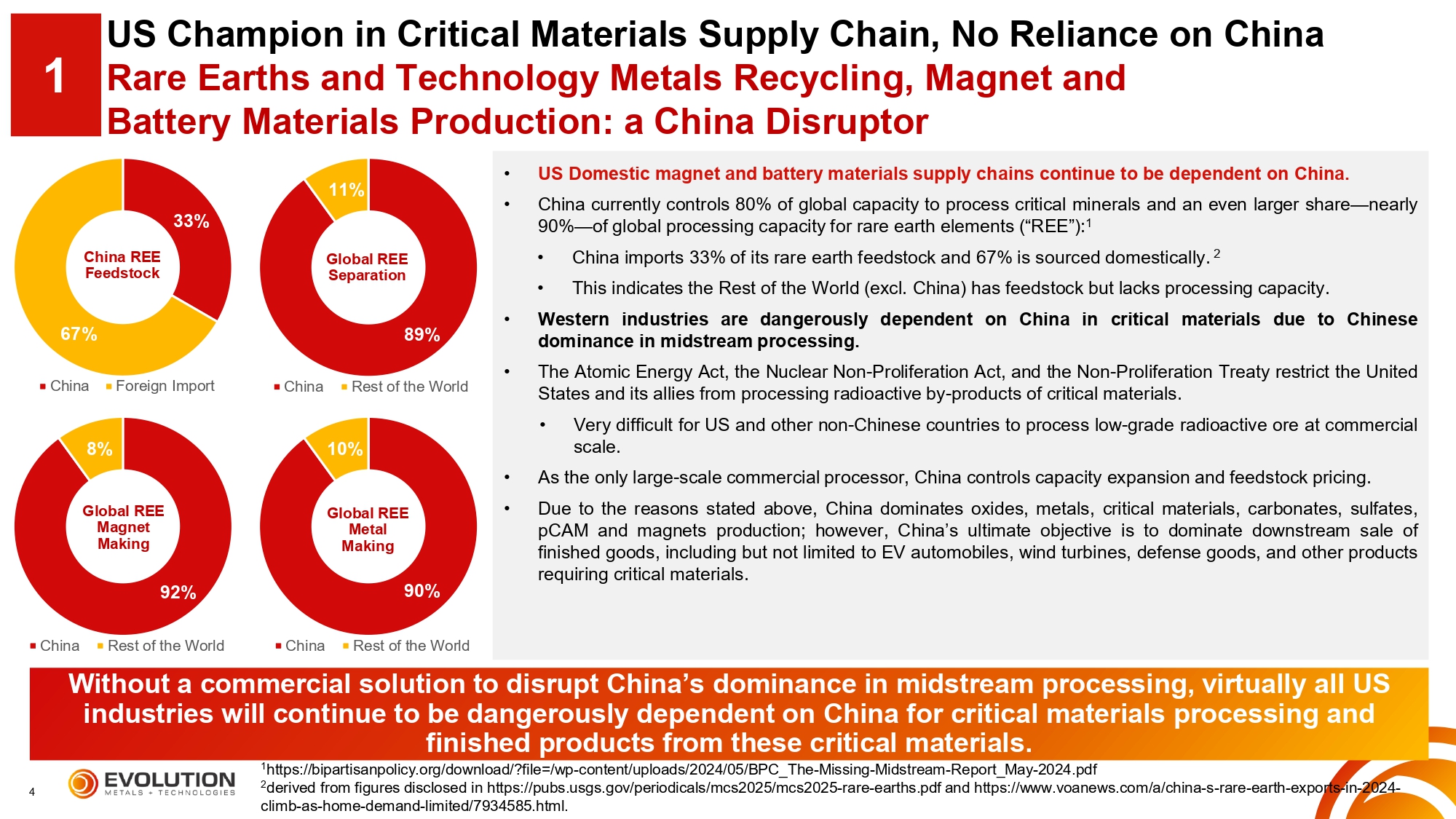

4 1 https://bipartisanpolicy.org/download/?file=/wp - content/uploads/2024/05/BPC_The - Missing - Midstream - Report_May - 2024.pdf 2 derived from figures disclosed in https://pubs.usgs.gov/periodicals/mcs2025/mcs2025 - rare - earths.pdf and https://www.voanews.com/a/china - s - rare - earth - exports - in - 2024 - climb - as - home - demand - limited/7934585.html. US Champion in Critical Materials Supply Chain, No Reliance on China Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 1 China Foreign Import 33% 67% China REE Feedstock China Rest of the World 89% 11% Global REE Separation 90% 10% Global REE Metal Making China Rest of the World China Rest of the World Without a commercial solution to disrupt China’s dominance in midstream processing, virtually all US industries will continue to be dangerously dependent on China for critical materials processing and finished products from these critical materials. 92% 8% Global REE Magnet Making • US Domestic magnet and battery materials supply chains continue to be dependent on China. • China currently controls 80% of global capacity to process critical minerals and an even larger share — nearly 90% — of global processing capacity for rare earth elements (“REE”): 1 • China imports 33% of its rare earth feedstock and 67% is sourced domestically. 2 • This indicates the Rest of the World (excl. China) has feedstock but lacks processing capacity. • Western industries are dangerously dependent on China in critical materials due to Chinese dominance in midstream processing. • The Atomic Energy Act, the Nuclear Non - Proliferation Act, and the Non - Proliferation Treaty restrict the United States and its allies from processing radioactive by - products of critical materials. • Very difficult for US and other non - Chinese countries to process low - grade radioactive ore at commercial scale. • As the only large - scale commercial processor, China controls capacity expansion and feedstock pricing . • Due to the reasons stated above, China dominates oxides, metals, critical materials, carbonates, sulfates, pCAM and magnets production ; however, China’s ultimate objective is to dominate downstream sale of finished goods, including but not limited to EV automobiles, wind turbines, defense goods, and other products requiring critical materials .

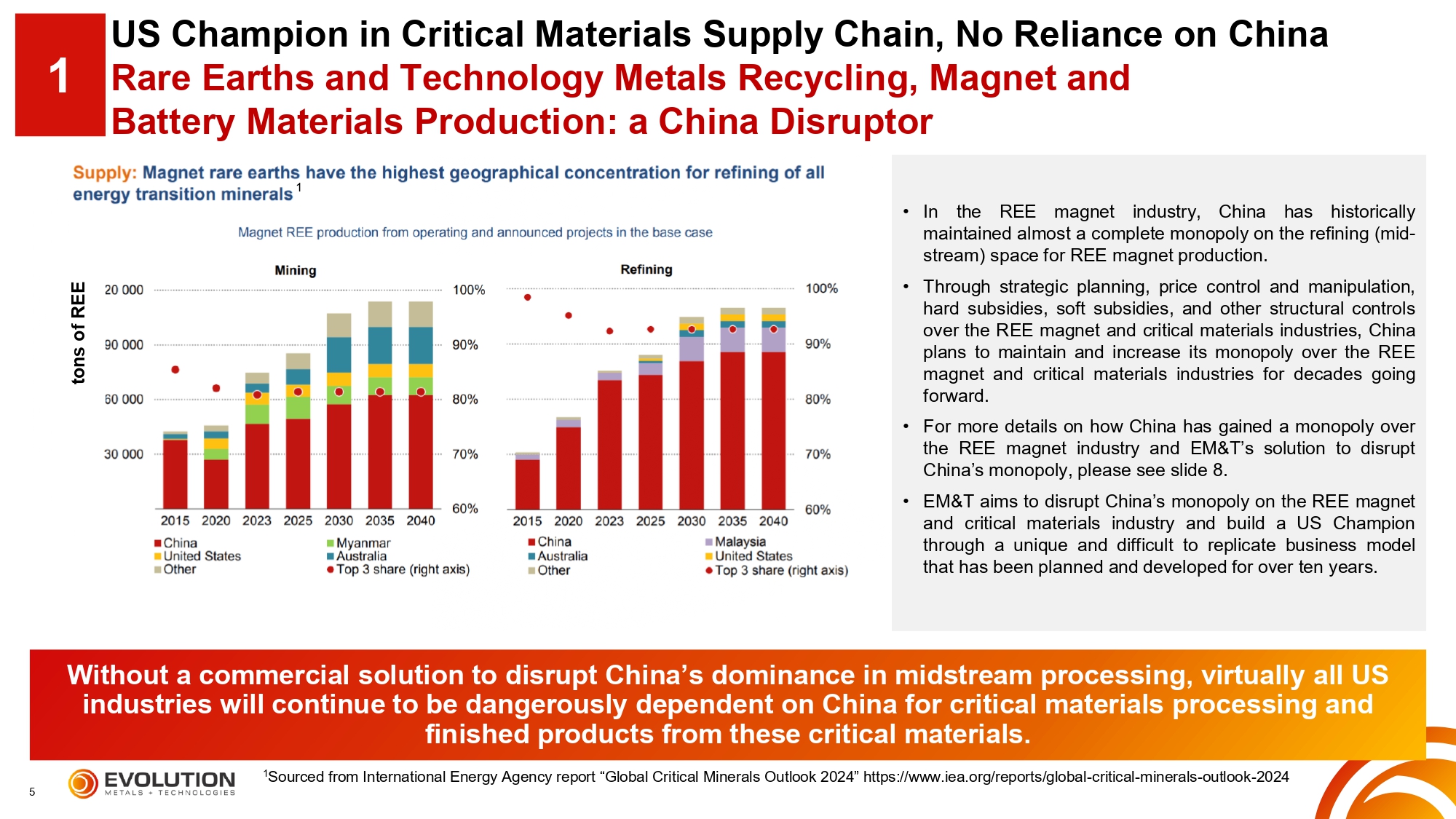

5 Without a commercial solution to disrupt China’s dominance in midstream processing, virtually all US industries will continue to be dangerously dependent on China for critical materials processing and finished products from these critical materials. US Champion in Critical Materials Supply Chain, No Reliance on China Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 1 • In the REE magnet industry, China has historically maintained almost a complete monopoly on the refining (mid - stream) space for REE magnet production . • Through strategic planning, price control and manipulation, hard subsidies, soft subsidies, and other structural controls over the REE magnet and critical materials industries, China plans to maintain and increase its monopoly over the REE magnet and critical materials industries for decades going forward . • For more details on how China has gained a monopoly over the REE magnet industry and EM&T’s solution to disrupt China’s monopoly, please see slide 8 . • EM&T aims to disrupt China’s monopoly on the REE magnet and critical materials industry and build a US Champion through a unique and difficult to replicate business model that has been planned and developed for over ten years . 1 Sourced from International Energy Agency report “Global Critical Minerals Outlook 2024” https://www.iea.org/reports/global - critical - minerals - outlook - 2024 1 tons of REE

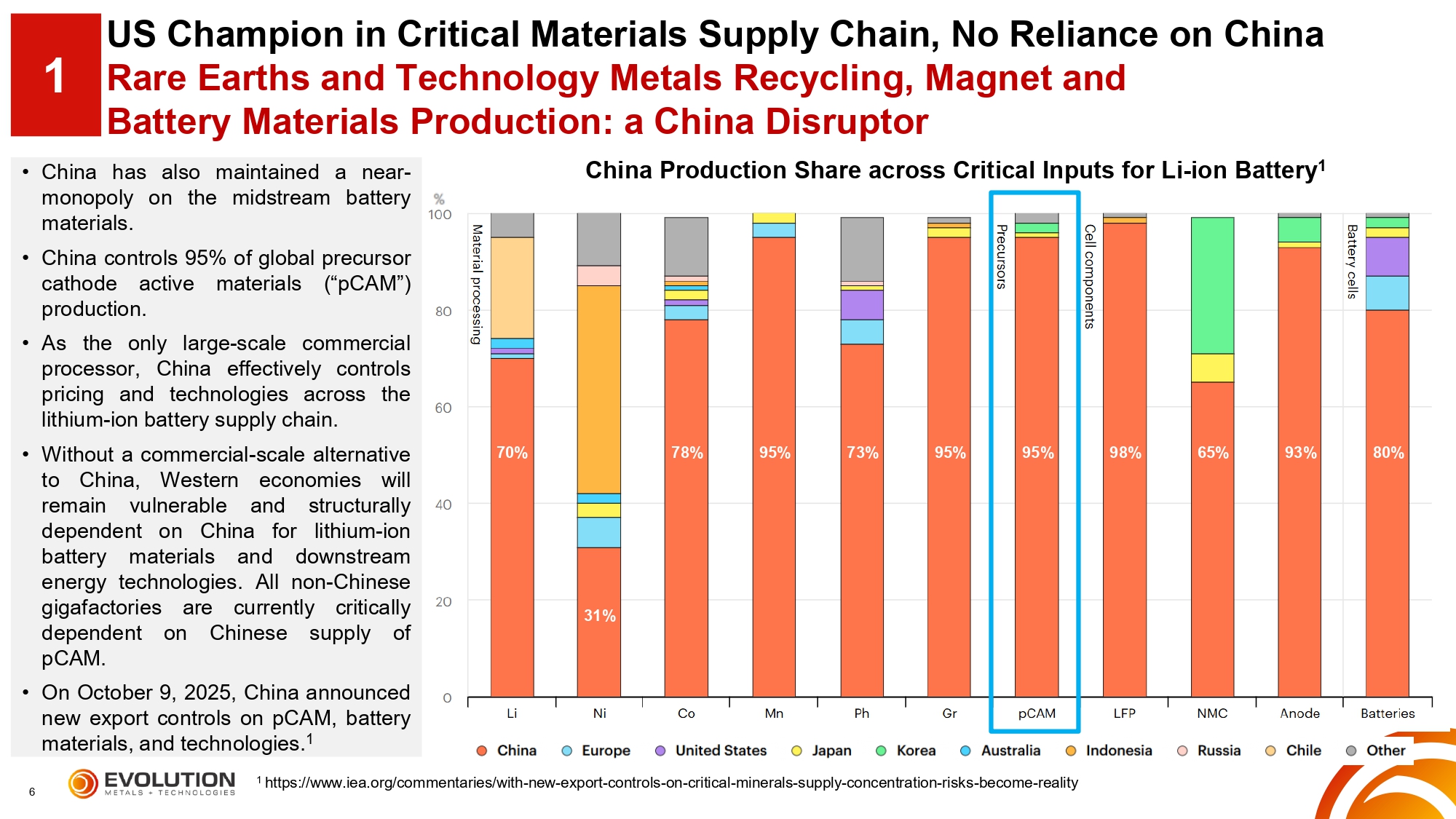

6 1 https://www.iea.org/commentaries/with - new - export - controls - on - critical - minerals - supply - concentration - risks - become - reality 70% 95% 80% 93% 31% 78% 95% 73% 95% 98% 65% • China has also maintained a near - monopoly on the midstream battery materials . • China controls 95 % of global precursor cathode active materials (“pCAM”) production . • As the only large - scale commercial processor, China effectively controls pricing and technologies across the lithium - ion battery supply chain . • Without a commercial - scale alternative to China, Western economies will remain vulnerable and structurally dependent on China for lithium - ion battery materials and downstream energy technologies . All non - Chinese are currently critically on Chinese supply of gigafactories dependent pCAM. • On October 9 , 2025 , China announced new export controls on pCAM, battery materials, and technologies . 1 US Champion in Critical Materials Supply Chain, No Reliance on China Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 1 China Production Share across Critical Inputs for Li - ion Battery 1

7 • Escalating global geopolitical tensions, heightened by the COVID pandemic, have amplified the risks of China - dependent value chains. • Geopolitical tensions between the US/Rest of World and China continue to escalate: • Oct 2022: U.S. imposes semiconductor export controls on China. • Dec 2023: China bans export of rare - earth - processing IP. • Dec 2024: China bans exports of gallium and germanium to the U.S. • Apr 2025: China adds medium & heavy rare earths (Dy, Tb) to export control list. • Oct 2025: China restricts export of magnets containing >0.1% Dy or Tb. • Jan 2026: China imposes dual - use rare earth export ban on Japan amid Taiwan tensions. Further escalation between China and the Rest of the World (RoW) anticipated • “China has a ‘near monopoly’ on the mining of many raw materials that are critical for the production of semiconductors, Li - ion batteries, and other technologies, highlighting the importance of key minerals in the escalating U.S. - China trade war” 1 • Semi - conductor chip making Fabs and Battery giga - factories are dangerously dependent upon critical materials processing from China. 1 • Reliable sources 2 indicate China is consolidating its four major rare earth companies into Northern and Southern Rare Earth companies, enhancing its ability to: • Control global supply, off - take and pricing of critical materials. • Eliminate competitors by maintaining its monopoly on midstream processing. • Additionally, rare earths are typically found in deposits with low grades of 2 - 3% which also contain low grade levels of radioactive elements like thorium and uranium. • US and allied countries processing constrained by radioactive byproduct regulations. • Consequently, China, along with a small presence in Malaysia and Vietnam, is the only region with existing commercial scale capability of processing rare earth ore with radioactive elements. 1 https://www.fortune.com/2024/06/10/china - near - monopoly - many - critical - minerals - jpmorgan - says - next - battleground - usa/ 2 https://rawmaterials.net/further - consolidation - in - chinas - rare - earth - industry/ 2 https://www.lightnowblog.com/2024/01/china - consolidates - rare - earth - industry - restricts - processing - technology - exports/ 2 https://www.mining.com/web/china - bans - export - of - rare - earth - processing - tech - over - national - security/ 3 https://www.reuters.com/world/us/trump - says - anyone - investing - 1 - billion - us - will - receive - expedited - permits - 2024 - 12 - 10/ US Champion in Critical Materials Supply Chain, No Reliance on China Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 2

8 U.S. policy now simultaneously increases feedstock supply and economically incentivizes domestic midstream and downstream processing, directly aligning with EM&T’s strategy. US Champion in Critical Materials Supply Chain, No Reliance on China Rare Earths and Technology Metals Recycling, Magnet and 2 Battery Materials Production: a China Disruptor The U.S. government has made critical materials supply - chain security a national priority. Supply chain realities have propelled global government support for diversification of critical and strategic minerals production into Western Industries. Unleashing America’s Offshore Critical Minerals Resources Apr 24, 2025 Immediate Measures to Increase American Mineral Production Mar 20, 2025 Bipartisan REMSA Act Feb 25, 2025 Unleashing American Energy Jan 20, 2025 • Declares offshore and seabed critical minerals a strategic national asset . • Accelerates exploration of polymetallic nodules and seabed mineral deposits . • Mobilizes federal agencies to map, inventory, and de - risk offshore resources . • Explicitly links offshore extraction to U . S . - based processing and manufacturing, not raw exports . • Expands l ong - term feedstock availability for domestic midstream capacity . • Mandates fast - tracked permitting for mining, processing, and refining projects . • Prioritizes projects tied to national security and critical supply chains . • Encourages public - private partnerships and large - scale private capital deployment . • Explicitly includes processing and refining , not just mining . • Focuses on securing rare earth magnet supply chains for defense, EVs, and advanced manufacturing . • Introduces production tax credits : • $ 30 /kg for U . S . - made rare earth magnets produced from recycled materials • $ 20 /kg for U . S . - made rare earth magnets (non - recycled feedstock) • Incentivizes domestic magnet manufacturing and recycling - based supply chains . • Signals bipartisan Congressional commitment to onshoring magnet production . • Establishes energy, resource, and supply - chain independence as core national objectives . • Directs agencies to remove regulatory bottlenecks for domestic resource development . • Sets the policy foundation for scaling critical minerals, materials, and manufacturing capacity .

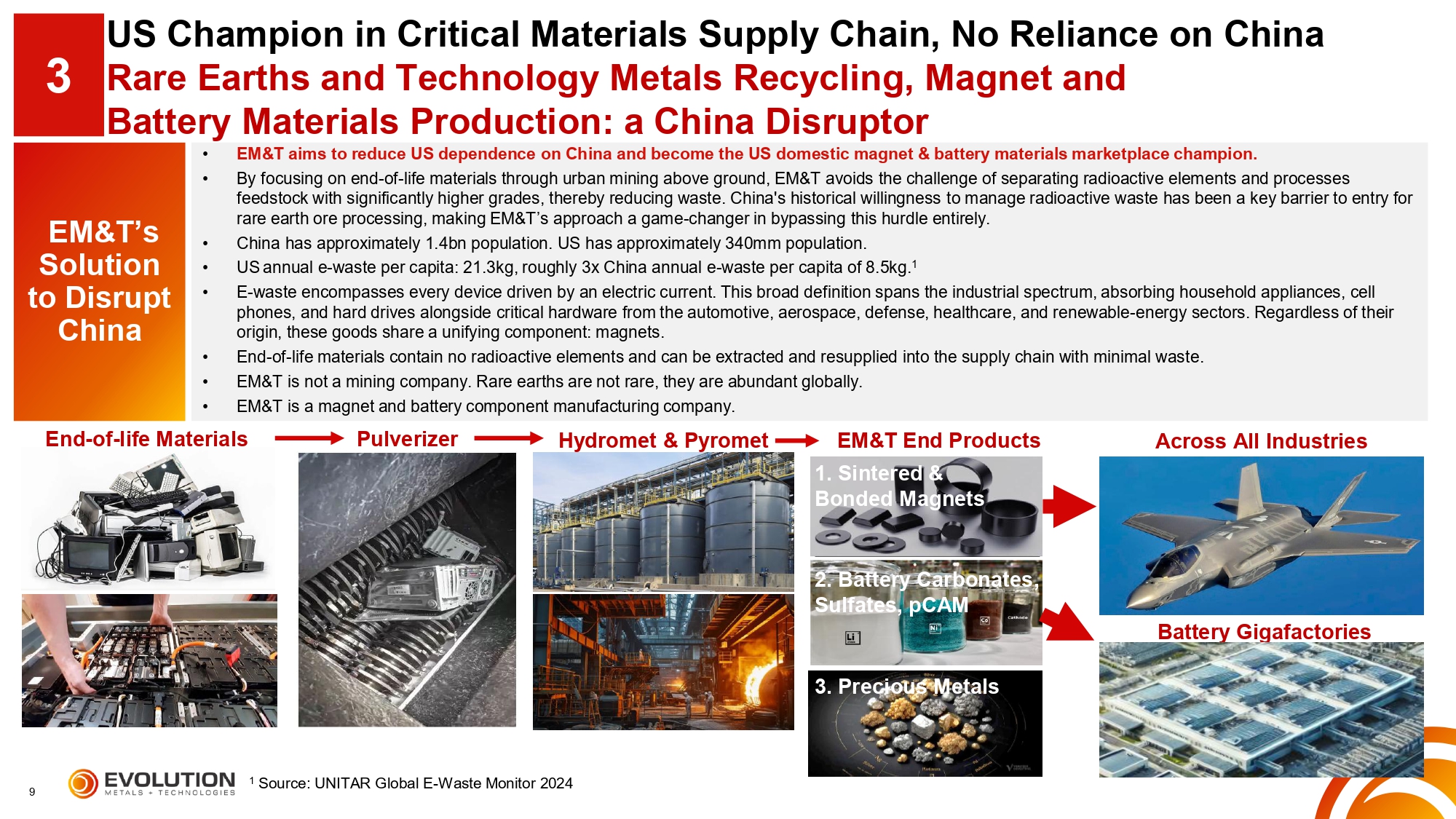

9 • EM&T aims to reduce US dependence on China and become the US domestic magnet & battery materials marketplace champion. • By focusing on end - of - life materials through urban mining above ground, EM&T avoids the challenge of separating radioactive elements and processes feedstock with significantly higher grades, thereby reducing waste. China's historical willingness to manage radioactive waste has been a key barrier to entry for rare earth ore processing, making EM&T’s approach a game - changer in bypassing this hurdle entirely. • China has approximately 1.4bn population. US has approximately 340mm population. • US annual e - waste per capita: 21.3kg, roughly 3x China annual e - waste per capita of 8.5kg. 1 • E - waste encompasses every device driven by an electric current. This broad definition spans the industrial spectrum, absorbing household appliances, cell phones, and hard drives alongside critical hardware from the automotive, aerospace, defense, healthcare, and renewable - energy sectors. Regardless of their origin, these goods share a unifying component: magnets. • End - of - life materials contain no radioactive elements and can be extracted and resupplied into the supply chain with minimal waste. • EM&T is not a mining company. Rare earths are not rare, they are abundant globally. • EM&T is a magnet and battery component manufacturing company. EM&T’s Solution to Disrupt China 1 Source: UNITAR Global E - Waste Monitor 2024 US Champion in Critical Materials Supply Chain, No Reliance on China Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 3 End - of - life Materials Pulverizer Hydromet & Pyromet 2. Battery Carbonates, Sulfates, pCAM Battery Gigafactories 3. Precious Metals EM&T End Products 1. Sintered & Bonded Magnets Across All Industries

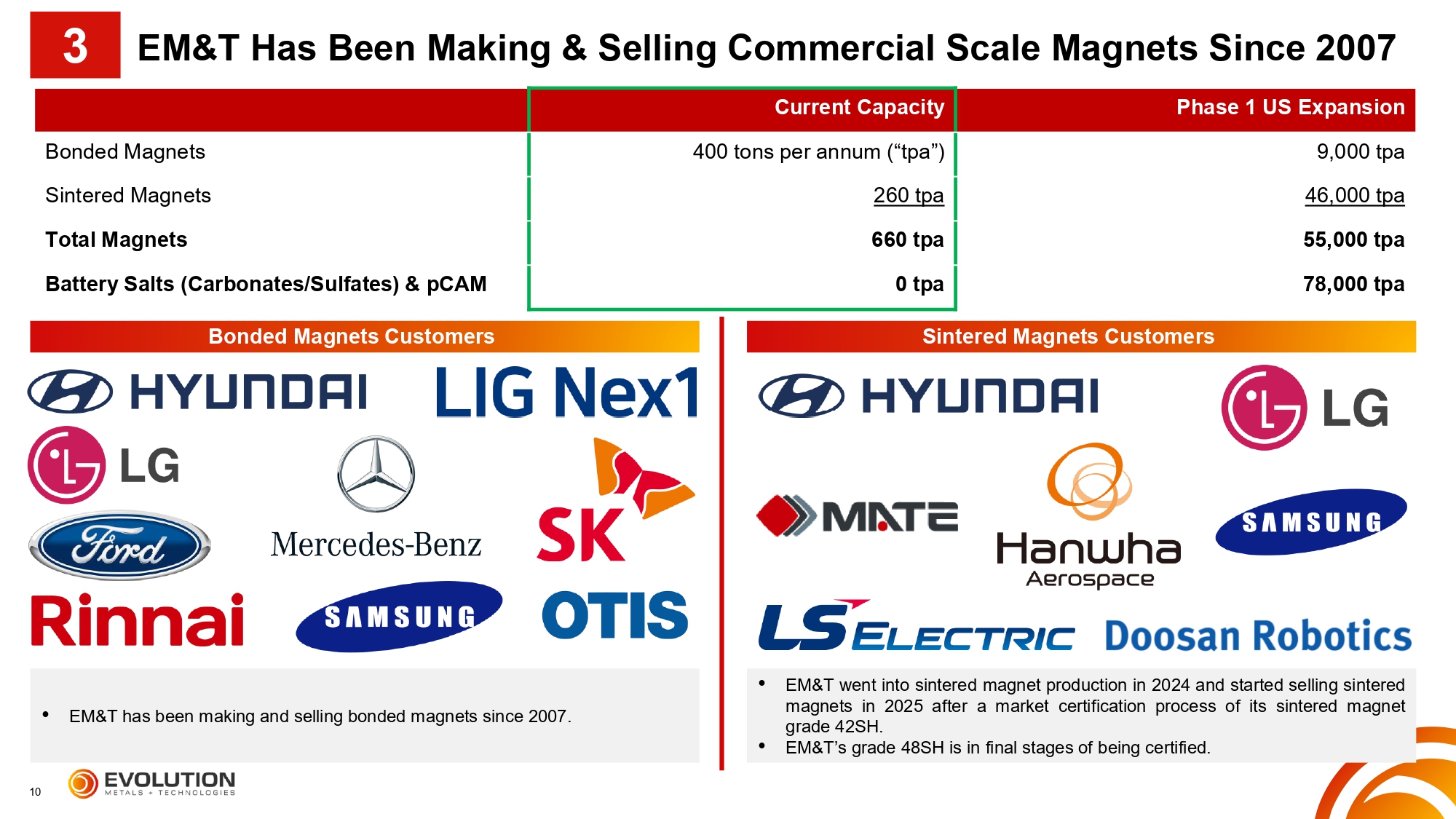

10 EM&T Has Been Making & Selling Commercial Scale Magnets Since 2007 3 Phase 1 US Expansion Current Capacity 9,000 tpa 400 tons per annum (“tpa”) Bonded Magnets 46,000 tpa 260 tpa Sintered Magnets 55,000 tpa 660 tpa Total Magnets 78,000 tpa 0 tpa Battery Salts (Carbonates/Sulfates) & pCAM Bonded Magnets Customers Sintered Magnets Customers • EM&T has been making and selling bonded magnets since 2007. • EM&T went into sintered magnet production in 2024 and started selling sintered magnets in 2025 after a market certification process of its sintered magnet grade 42 SH . • EM&T’s grade 48 SH is in final stages of being certified .

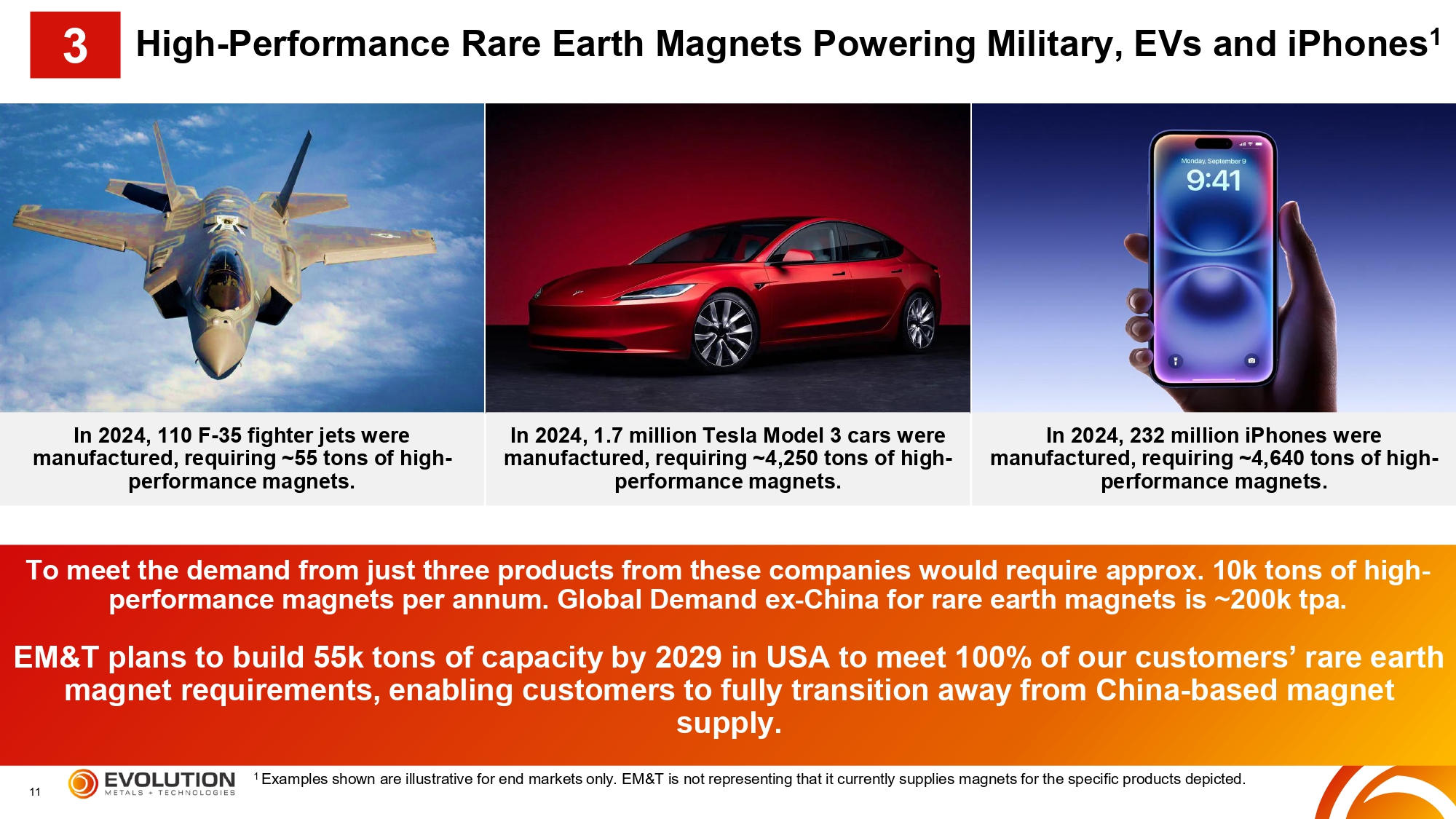

11 High - Performance Rare Earth Magnets Powering Military, EVs and iPhones 1 In 2024, 110 F - 35 fighter jets were manufactured, requiring ~55 tons of high - performance magnets. In 2024, 1.7 million Tesla Model 3 cars were manufactured, requiring ~4,250 tons of high - performance magnets. In 2024, 232 million iPhones were manufactured, requiring ~4,640 tons of high - performance magnets. To meet the demand from just three products from these companies would require approx. 10k tons of high - performance magnets per annum. Global Demand ex - China for rare earth magnets is ~200k tpa. EM&T plans to build 55k tons of capacity by 2029 in USA to meet 100% of our customers’ rare earth magnet requirements, enabling customers to fully transition away from China - based magnet supply. 3 1 Examples shown are illustrative for end markets only. EM&T is not representing that it currently supplies magnets for the specific products depicted.

12 Battery Grade Carbonates, Sulfates and pCAM Powering Gigafactories Hyundai Gigafactory in Georgia started operation in early 2025, with 500,000 EVs manufacturing capacity requiring ~45,000 tons of pCAM. GM’s JV Ultium Battery Cells plant in Tennessee and Ohio with 90 GWh/year capacity requiring ~120,000 tons of pCAM. Ford’s JV BlueOval City plant in Tennessee with 45GWh/year capacity requiring ~60,000 tons of pCAM. To meet the demand from just three gigafactories from these companies would require approx. 225,000 tons of pCAM per annum. EM&T plans to build 78,000 tons of pCAM capacity in the USA to supply to gigafactories. 3

13 Executive Leadership • Over 35 years of industrial base experience including C - Suite roles in mining, processing and manufacturing for base, precious and rare earth metals . • Including his team of 42 engineers and PhDs, they have executed successful operations across the full lifecycle of critical materials : mine to finished OEM products including recycling . • Leadership roles in rare earth magnet and related companies including Australia Strategic Materials Ltd (ASX : ASM), ASM Korea, KSM Technologies, KSM Metals Co . , Ltd . , and Alkane Resources . • Advisor to Kay Tech in Hong Kong, Samwha Group Steel Division, HydroTech Korea, and Kyungdong Group Global. Frank (Suk Jin) Moon CEO Christopher Clower CFO / COO • 15 - year banking Lynch . investment career at Merrill • Raised over $ 5 bn for client base as Managing Director and Head of Investment Banking for Merrill Lynch Southeast Asia . • Co - founded, built and sold a natural resources company in Indonesia to deliver 30 x return in two years . • Former Intelligence Officer in the US Air Force . Dean Evans CMO • Over 25 years of experience in the automotive and technology industries. • Has overseen national advertising campaigns for OEMs and deeply skilled in marketing and analytics building infrastructure processes. • Recognized as a Forbes Top 20 Global CMO and a Fortune 300 Top CMO . • Has held senior leadership roles at America, Hyundai Genesis Motor Motor America, Subaru of America, and Cars.com. Andrew F. Knaggs, Esq. President • Presidentially Appointed US Deputy Assistant Secretary of Defense in President Trump’s First Administration. • Former CEO of Pacem Solutions International, a US consultancy, risk management, and munitions manufacturing company . • Former Head of Research & Engineering at JIEDDO (a DoD agency) leading a $ 1 B R&D portfolio and a $ 300 M budget . • Founded Knaggs Law PLLC, a boutique DC law firm, advising on business law, M&A, and corporate governance . • Decorated U . S . Army Special Forces officer (“Green Beret”) with multiple combat tours • Member of the District of Columbia Bar . attorney domestic business in significant and international and commercial disputes representing publicly traded and privately held businesses in arbitrations, federal, state, and appellate courts. • Recognized by Chambers USA for his “mastery of complex issues” and being "attuned to the client's goals and the best path to achieve them . " • Named among Lawdragon's 500 Leading Litigators in America and recognized by Best Lawyers in America, among others . Senior Fellow of the Litigation Counsel of America and Fellow of the American Bar Foundation . John Arrastia Jr., Esq. CLO / Secretary • Experienced as first chair trial 4

14 Board of Directors • Former US Ambassador to Dominican Republic ( 2018 - 2021 ) in President Trump’s first Administration . • Awarded Order of Duarte from the Dominican Republic for her work as Ambassador . • 40 years experience across business, government, and non - profit sectors as an entrepreneur, consultant, estate broker, diplomat, business insurance and real and advisor. Currently President of Richard S. Bernstein and Associates, Inc. of Rbern business Also currently Manager Ventures, LLC, a consulting firm. • Presidential Served in two Administrations, with prior experience at the U . S . Department of Commerce and on President Carter’s transition team . Amb. Robin Bernstein (ret.) Independent Director • Former US Secretary of Defense in President Trump’s First Administration. • As Secretary of Defense, oversaw $720bn budget, two million service members, and 700,000 civilian employees. • Currently acting as Chief Strategy Officer for DYZNE and U.S. national security apparatus As a former Green Beret, in the 2001 and 2003 Iraq participated Afghanistan invasions . • After retiring from the US Technologies, specializing in • autonomous flight and drones. • Served 34 years in the Army Military in 2014, continued • advising on Special Operations and Intelligence. The Hon. Chris Miller Independent Director • • Founder, visionary, and largest shareholder of EM&T . • Built EM&T after witnessing first hand the world dependency being created by China for critical materials processing and downstream manufacturing . • Foresaw, more than a decade ago, the need to produce and manufacture magnets, with zero dependency on China, in the US . • One of the world’s foremost experts on the economics, metallurgical and environmental complexities, and the geo - political national security dynamics of the entire rare earth magnet and critical materials global supply • chain. • Began his career at Deutsche Bank, based • in London and New York, and has operated across four continents. Later became a derivatives trading specialist, leading global teams focused on regulatory reform initiatives and value creation arising from government policy changes . David Wilcox Executive Chairman of the Board • 50 years experience in real estate development, operations, and finance, including managing complex commercial and industrial properties . • Chief Operating Officer at UCR Group, LLC, a leading residential multi - family development and management firm. Held key financial roles in public and private companies, including Corporate Treasurer of a multinational real estate firm • Responsibilities have included bank relations, investments, secured and unsecured credit lines, construction financing, payroll, audits, and legal coordination. Extensive experience managing hotels under prominent brands such as Marriott, Hyatt, Hilton, and Wyndham . Tom Stoddard Independent Director • Founded, built and sold his insurance consulting firm, Alexander Benefits Consulting, to NFP/Aon in 2024 . executive Insurance • Over 30 years of experience in the industry . • In 1993 created the Healthcare Benefits Consulting Trust which is today the largest industry trust in the U . S . , providing benefit programs corporations and to large major universities, and includes over 1 , 000 hospitals and more than • one million employees . • Has served on boards and held officer roles with organizations including the Girl Scouts of America, the Association, St. Alzheimer’s Joseph Hospital, where he assisted in funding and building a new hospital in Denver, and Sisters of Charity of Leavenworth . Saul Locker Independent Director 4

15 • EM&T is contracting for proprietary access to attractive and abundant feedstocks, focusing on end - of - life materials to: • Recycle lithium - ion batteries to produce battery grade materials for OEM gigafactories. • Recycle e - waste including US Government (“USG”) e - waste to produce oxides, metals, alloy powder and flakes, and sintered and bonded magnets for industries including, but not limited to, renewable energy, automotive, aerospace, defense, healthcare, high tech, electronics and others. • Global Leader in Lithium - ion Battery Recycling: base metals historically have had a very high recycling rate: 50% of the world’s aluminum supply comes from recycling; copper is 100% recyclable, and nearly all copper ever mined is still in circulation due to near 100% recycling rate. 1 EM&T intends to bring that recycling operational expertise to the lithium - ion battery space, which has high growth outlook as the world transitions to sustainable energy storage solutions needed to expand the renewable energy industry. • USG e - Scrap Recycling Solution: historic sole solution to recycle USG e - waste is to incinerate, which is unreliable, environmentally harmful, with small capacity. Not all the incinerators are secured facilities, which means that classified e - waste cannot be stored on site for those unsecured facilities. Yet these facilities generate a dust byproduct that cannot be sold to US and Western countries because they do not have the midstream capacity to process the dust. The incinerators are limited to selling to a single buyer: China, because the US and Western Countries have no midstream capacity to process the dust. • EM&T is on track to offer the USG a highly reliable recycling solution with large commercial capacity, utilizing pulverization instead of incineration . This process enables the recovery of precious metals from components like printed circuit boards, produces NdPr oxides for magnet manufacturing, and is significantly more environmentally friendly . • EM&T plans to build a secured facility, allowing on - site storage of classified materials, enabling acceptance of all USG shipments, even unscheduled, without disrupting plant operations. The ability to handle all classified shipments promptly, even unscheduled ones, is critical for maintaining a strong, trusted relationship with the USG, positioning EM&T as a reliable partner, and maximizing the capacity utilization of the plant. • Having a secured facility maximizes capacity utilization and maximizes EBITDA, as EBITDA is highly sensitive to capacity utilization due to high fixed costs and overheads being constant. • USG, including all branches of the US military, multiple intelligence agencies and investigative agencies, and all of their suppliers turn over electronics every 3 - 5 years. Millions of pounds of USG e - waste are being stored expensively due to no recycling solution in the past. 2 1 https://www.visualcapitalist.com/sp/visualizing - all - the - known - copper - in - the - world 2 https://www.matrix - ndi.com/resources/maximizing - efficiency - the - three - to - five - year - it - infrastructure - refresh - cycle/ US Champion in Critical Materials Supply Chain, No Reliance on China Rare Earths and Technology Metals Recycling, Magnet and Battery Materials Production: a China Disruptor 5 EM&T’s Business Model Re - Introduces Battery Materials and USG E - Scrap, including Magnet Materials and Precious Metals, Back into the US Domestic Market.

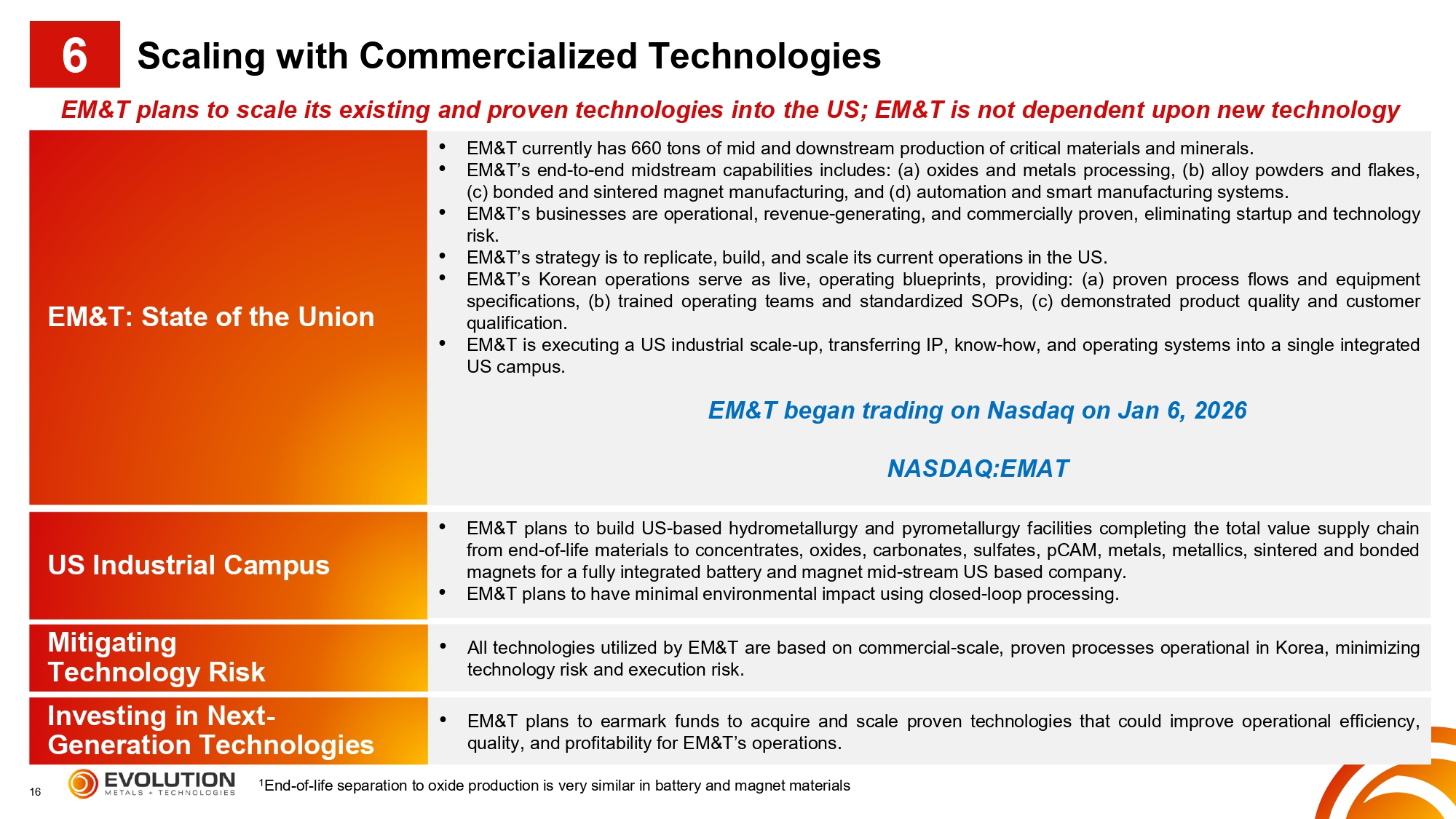

16 • EM&T currently has 660 tons of mid and downstream production of critical materials and minerals . • EM&T’s end - to - end midstream capabilities includes : (a) oxides and metals processing, (b) alloy powders and flakes, (c) bonded and sintered magnet manufacturing, and (d) automation and smart manufacturing systems . • EM&T’s businesses are operational, revenue - generating, and commercially proven, eliminating startup and technology risk . • EM&T’s strategy is to replicate, build, and scale its current operations in the US . • EM&T’s Korean operations serve as live, operating blueprints, providing : (a) proven process flows and equipment specifications, (b) trained operating teams and standardized SOPs, (c) demonstrated product quality and customer qualification . • EM&T is executing a US industrial scale - up, transferring IP, know - how, and operating systems into a single integrated US campus . EM&T began trading on Nasdaq on Jan 6, 2026 NASDAQ:EMAT EM&T: State of the Union • EM&T plans to build US - based hydrometallurgy and pyrometallurgy facilities completing the total value supply chain from end - of - life materials to concentrates, oxides, carbonates, sulfates, pCAM, metals, metallics, sintered and bonded magnets for a fully integrated battery and magnet mid - stream US based company . • EM&T plans to have minimal environmental impact using closed - loop processing . US Industrial Campus • All technologies utilized by EM&T are based on commercial - scale, proven processes operational in Korea, minimizing technology risk and execution risk. Mitigating Technology Risk • EM&T plans to earmark funds to acquire and scale proven technologies that could improve operational efficiency, quality, and profitability for EM&T’s operations. Investing in Next - Generation Technologies EM&T plans to scale its existing and proven technologies into the US; EM&T is not dependent upon new technology Scaling with Commercialized Technologies 6 1 End - of - life separation to oxide production is very similar in battery and magnet materials

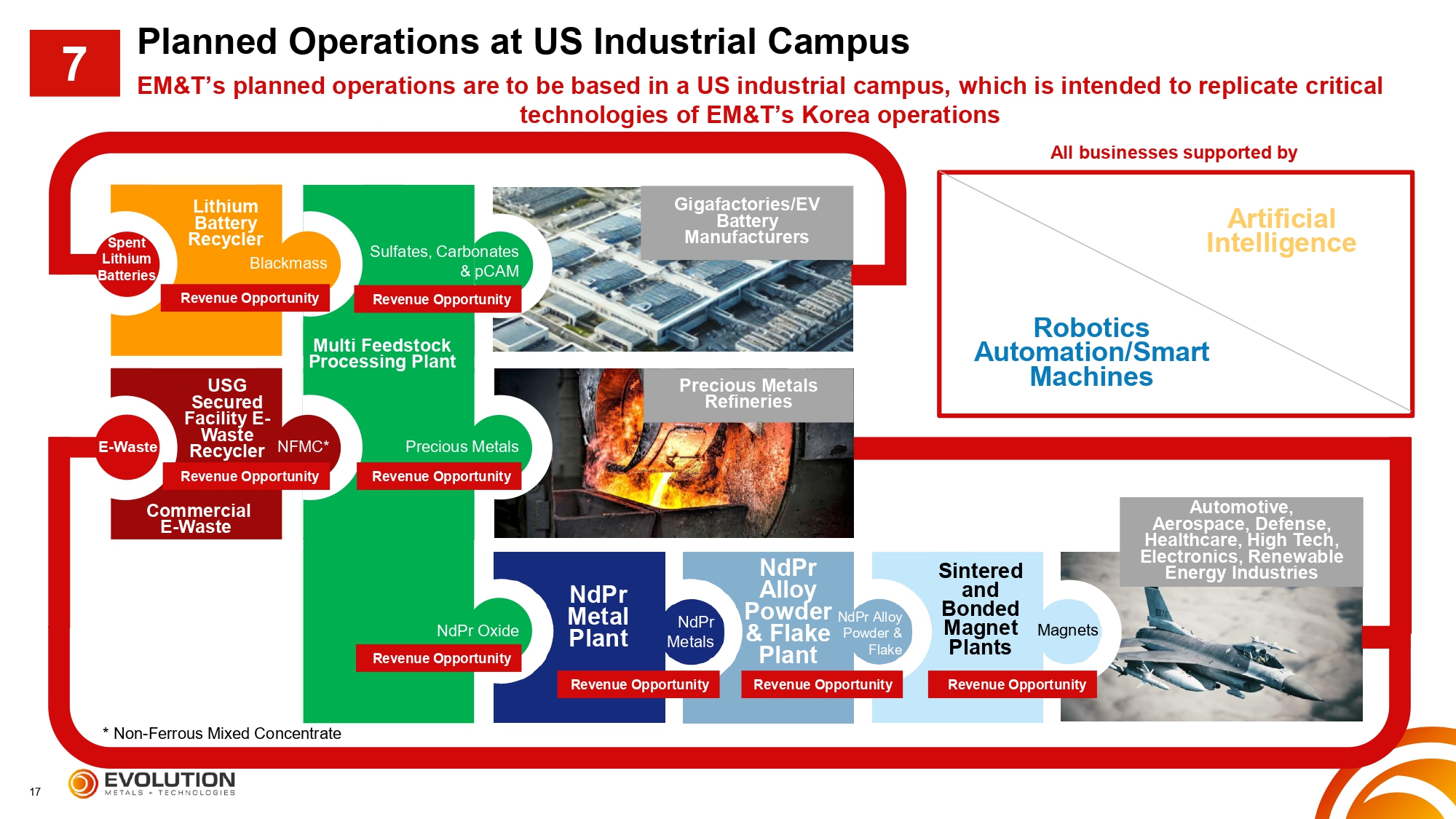

17 Precious Metals Refineries Gigafactories/EV Battery Manufacturers Lithium Battery Recycler USG Secured Facility E - Waste Recycler Sulfates, Carbonates & pCAM Multi Feedstock Processing Plant Blackmass NFMC* Precious Metals NdPr Oxide NdPr Metal Plant NdPr Metals NdPr Alloy & Flake Plant Powder NdPr Alloy Powder & Flake Sintered and Bonded Magnet Plants Magnets Automotive, Aerospace, Defense, Healthcare, High Tech, Electronics, Renewable Energy Industries Spent Lithium Batteries E - Waste Artificial Intelligence Robotics Automation/Smart Machines Revenue Opportunity Revenue Opportunity Revenue Opportunity Revenue Opportunity Revenue Opportunity Revenue Opportunity Revenue Opportunity Revenue Opportunity * Non - Ferrous Mixed Concentrate EM&T’s planned operations are to be based in a US industrial campus, which is intended to replicate critical technologies of EM&T’s Korea operations All businesses supported by Planned Operations at US Industrial Campus 7 Commercial E - Waste

18 Using Proprietary and Licensed Technologies, EM&T Plans to Build A Modular, Large - Commercial - Scale Hydrometallurgical Facility in the US. Hydrometallurgy: “The Missing Piece” in USA that is Critical to China’s 7 • Hydrometallurgy is necessary for producing Western industrial products. • China has approximately 95% of hydrometallurgy capacity globally. • There are no planned large commercial scale hydrometallurgical plants outside China due to: • feedstock supply constraints; processing new materials requires handling radioactive waste and often involves foreign - origin feedstock, both of which are heavily restricted by environmental, nuclear, and import regulations outside China, limiting the availability of scalable feedstock; • large capital expenditure project greater than $1bn; • cost and availability of energy; • environmental permits. Large - Commercial - Scale Hydrometallurgical Plant • EM&T is planning to build a hydrometallurgical plant in the US using feedstock from end - of - life materials from the USG and commercial market. • Frank Moon (EM&T’s CEO) and his personnel of 42 deeply experienced engineers including 11 PhDs, have built and operated commercial scale hydrometallurgical plants for POSCO and Hyundai. • Frank Moon and his personnel previously operated the Vietnam Rare Earth JSC (“VTRE”) plant in Vietnam. 1 https://www.foxnews.com/politics/chinas - rare - earth - tech - obsession - ensnares - us - resident - ccp - looks - maintain - stranglehold

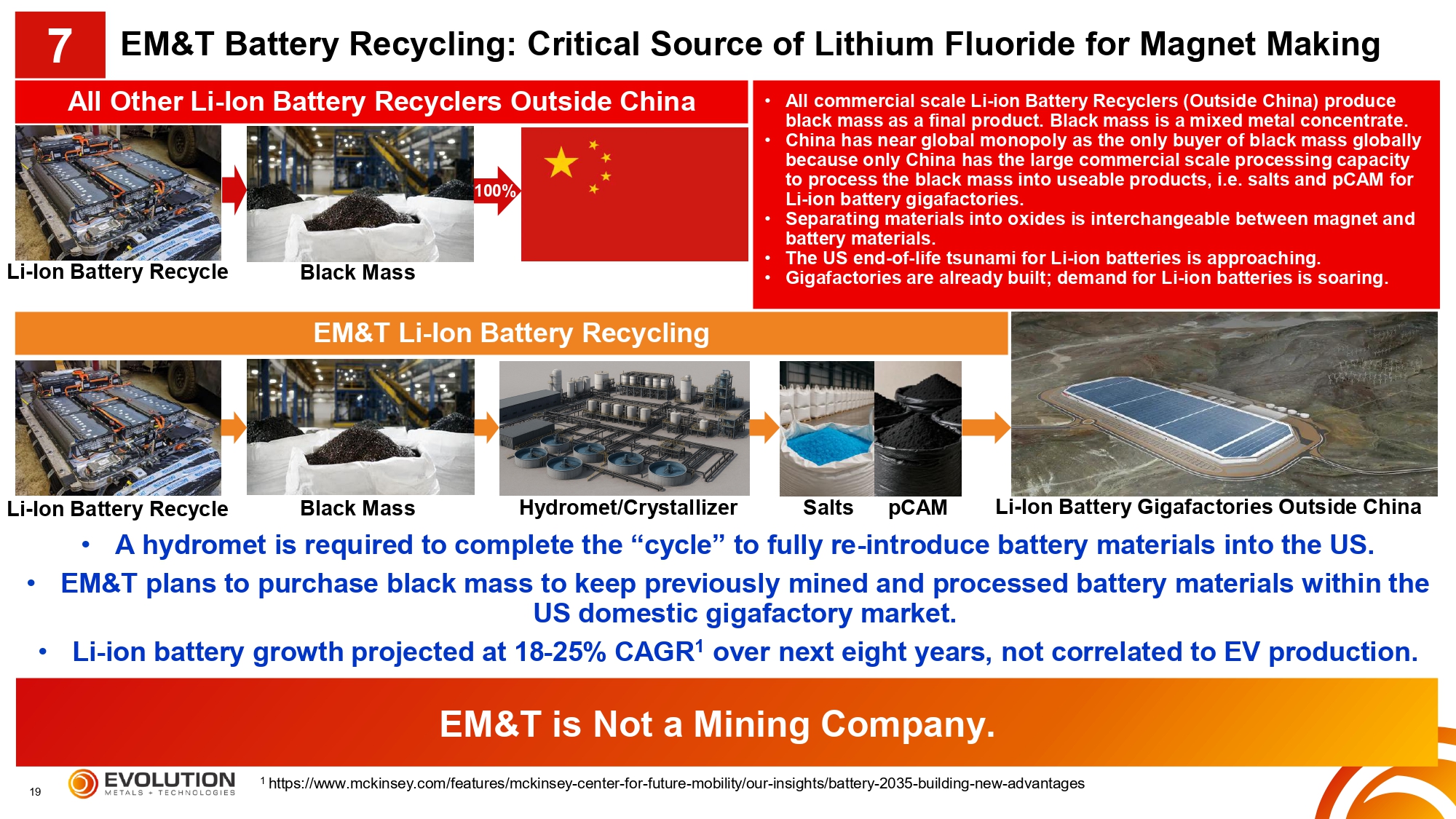

19 EM&T Battery Recycling: Critical Source of Lithium Fluoride for Magnet Making All Other Li - Ion Battery Recyclers Outside China • All commercial scale Li - ion Battery Recyclers (Outside China) produce black mass as a final product. Black mass is a mixed metal concentrate. • China has near global monopoly as the only buyer of black mass globally because only China has the large commercial scale processing capacity to process the black mass into useable products, i . e . salts and pCAM for Li - ion battery gigafactories . • Separating materials into oxides is interchangeable between magnet and battery materials . • The US end - of - life tsunami for Li - ion batteries is approaching . • Gigafactories are already built ; demand for Li - ion batteries is soaring . 100% Li - Ion Battery Recycle Black Mass Li - Ion Battery Gigafactories Outside China Li - Ion Battery Recycle Black Mass Hydromet/Crystallizer Salts pCAM • A hydromet is required to complete the “cycle” to fully re - introduce battery materials into the US. • EM&T plans to purchase black mass to keep previously mined and processed battery materials within the US domestic gigafactory market. • Li - ion battery growth projected at 18 - 25% CAGR 1 over next eight years, not correlated to EV production. • Lithium fluoride is necessary for magnet production. EM&T is Not a Mining Company. EM&T Li - Ion Battery Recycling 7 1 https://www.mckinsey.com/features/mckinsey - center - for - future - mobility/our - insights/battery - 2035 - building - new - advantages

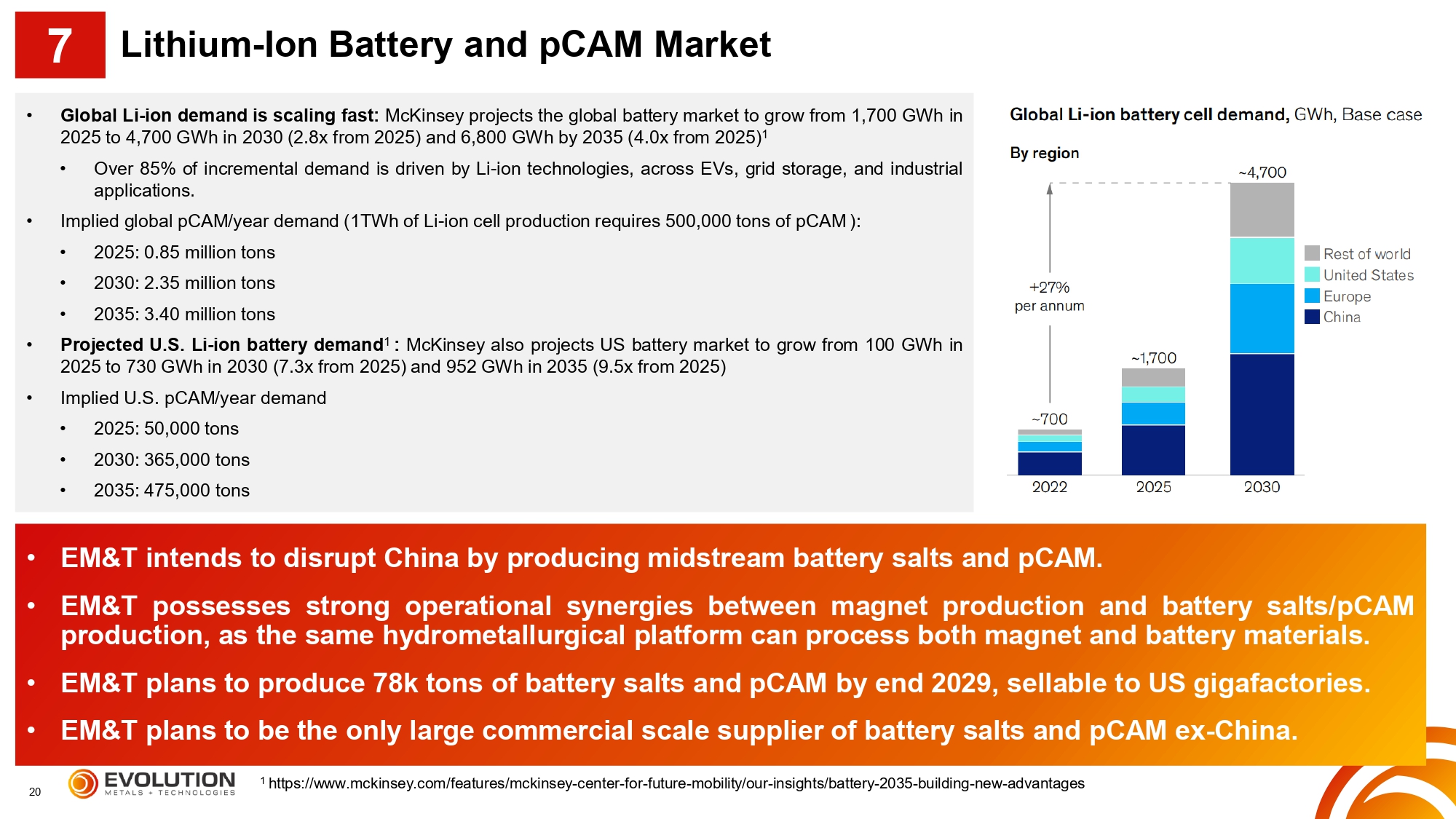

20 Lithium - Ion Battery and pCAM Market 7 1 https://www.mckinsey.com/features/mckinsey - center - for - future - mobility/our - insights/battery - 2035 - building - new - advantages • Global Li - ion demand is scaling fast: McKinsey projects the global battery market to grow from 1,700 GWh in 2025 to 4,700 GWh in 2030 (2.8x from 2025) and 6,800 GWh by 2035 (4.0x from 2025) 1 • Over 85% of incremental demand is driven by Li - ion technologies, across EVs, grid storage, and industrial applications. • Implied global pCAM/year demand (1TWh of Li - ion cell production requires 500,000 tons of pCAM ): • 2025: 0.85 million tons • 2030: 2.35 million tons • 2035: 3.40 million tons • Projected U.S. Li - ion battery demand 1 : McKinsey also projects US battery market to grow from 100 GWh in 2025 to 730 GWh in 2030 (7.3x from 2025) and 952 GWh in 2035 (9.5x from 2025) • Implied U.S. pCAM/year demand • 2025: 50,000 tons • 2030: 365,000 tons • 2035: 475,000 tons • EM&T intends to disrupt China by producing midstream battery salts and pCAM. • EM&T possesses strong operational synergies between magnet production and battery salts/pCAM production, as the same hydrometallurgical platform can process both magnet and battery materials. • EM&T plans to produce 78k tons of battery salts and pCAM by end 2029, sellable to US gigafactories. • EM&T plans to be the only large commercial scale supplier of battery salts and pCAM ex - China.

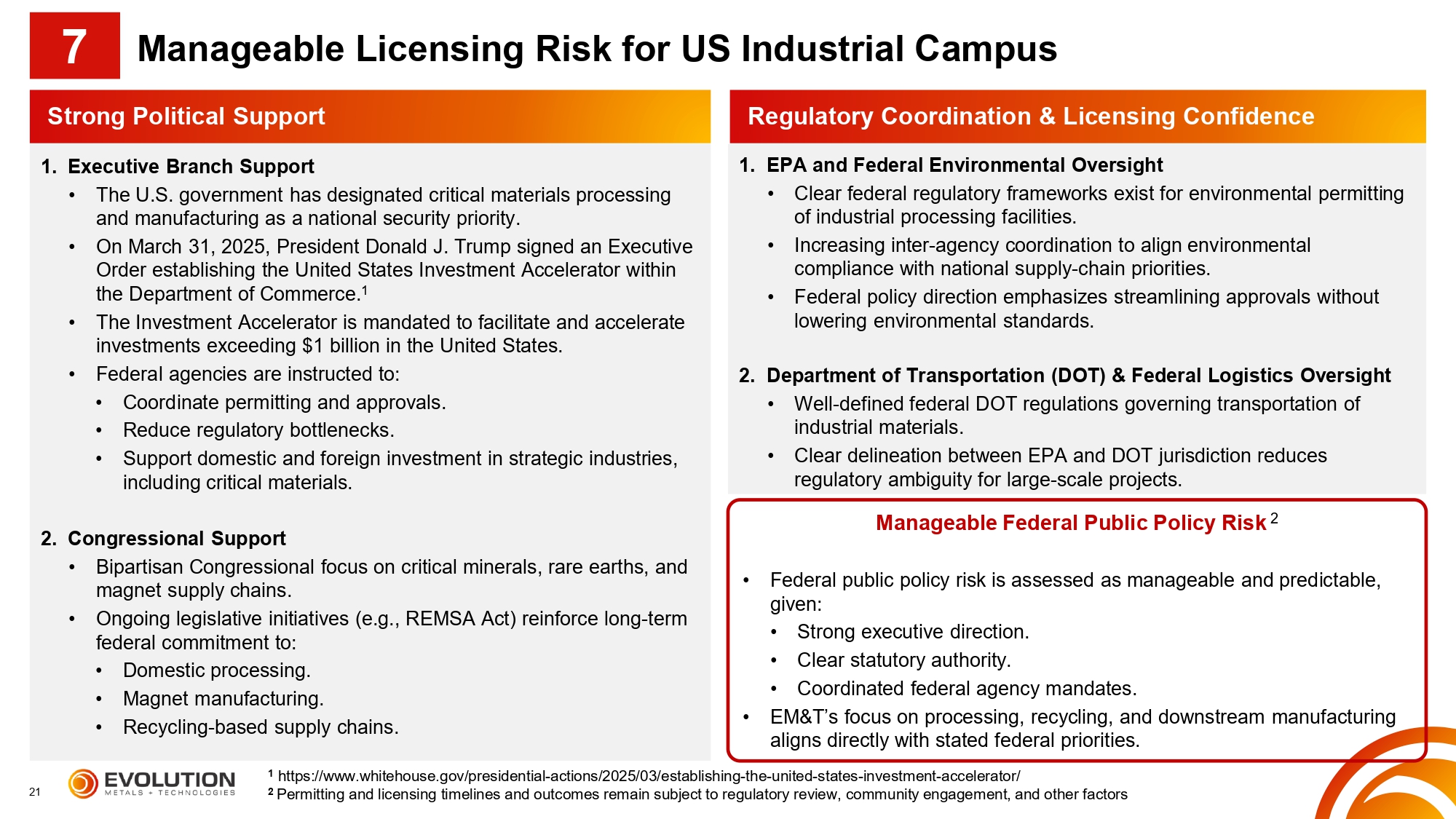

21 1. Executive Branch Support • The U.S. government has designated critical materials processing and manufacturing as a national security priority. • On March 31, 2025, President Donald J. Trump signed an Executive Order establishing the United States Investment Accelerator within the Department of Commerce. 1 • The Investment Accelerator is mandated to facilitate and accelerate investments exceeding $1 billion in the United States. • Federal agencies are instructed to: • Coordinate permitting and approvals. • Reduce regulatory bottlenecks. • Support domestic and foreign investment in strategic industries, including critical materials. 2. Congressional Support • Bipartisan Congressional focus on critical minerals, rare earths, and magnet supply chains. • Ongoing legislative initiatives (e.g., REMSA Act) reinforce long - term federal commitment to: • Domestic processing. • Magnet manufacturing. • Recycling - based supply chains. 1. EPA and Federal Environmental Oversight • Clear federal regulatory frameworks exist for environmental permitting of industrial processing facilities. • Increasing inter - agency coordination to align environmental compliance with national supply - chain priorities. • Federal policy direction emphasizes streamlining approvals without lowering environmental standards. 1. Department of Transportation (DOT) & Federal Logistics Oversight • Well - defined federal DOT regulations governing transportation of industrial materials. • Clear delineation between EPA and DOT jurisdiction reduces regulatory ambiguity for large - scale projects. Strong Political Support Regulatory Coordination & Licensing Confidence 1 https://www.whitehouse.gov/presidential - actions/2025/03/establishing - the - united - states - investment - accelerator/ 2 Permitting and licensing timelines and outcomes remain subject to regulatory review, community engagement, and other factors Manageable Licensing Risk for US Industrial Campus 7 Manageable Federal Public Policy Risk 2 • Federal public policy risk is assessed as manageable and predictable, given: • Strong executive direction. • Clear statutory authority. • Coordinated federal agency mandates. • EM&T’s focus on processing, recycling, and downstream manufacturing aligns directly with stated federal priorities.

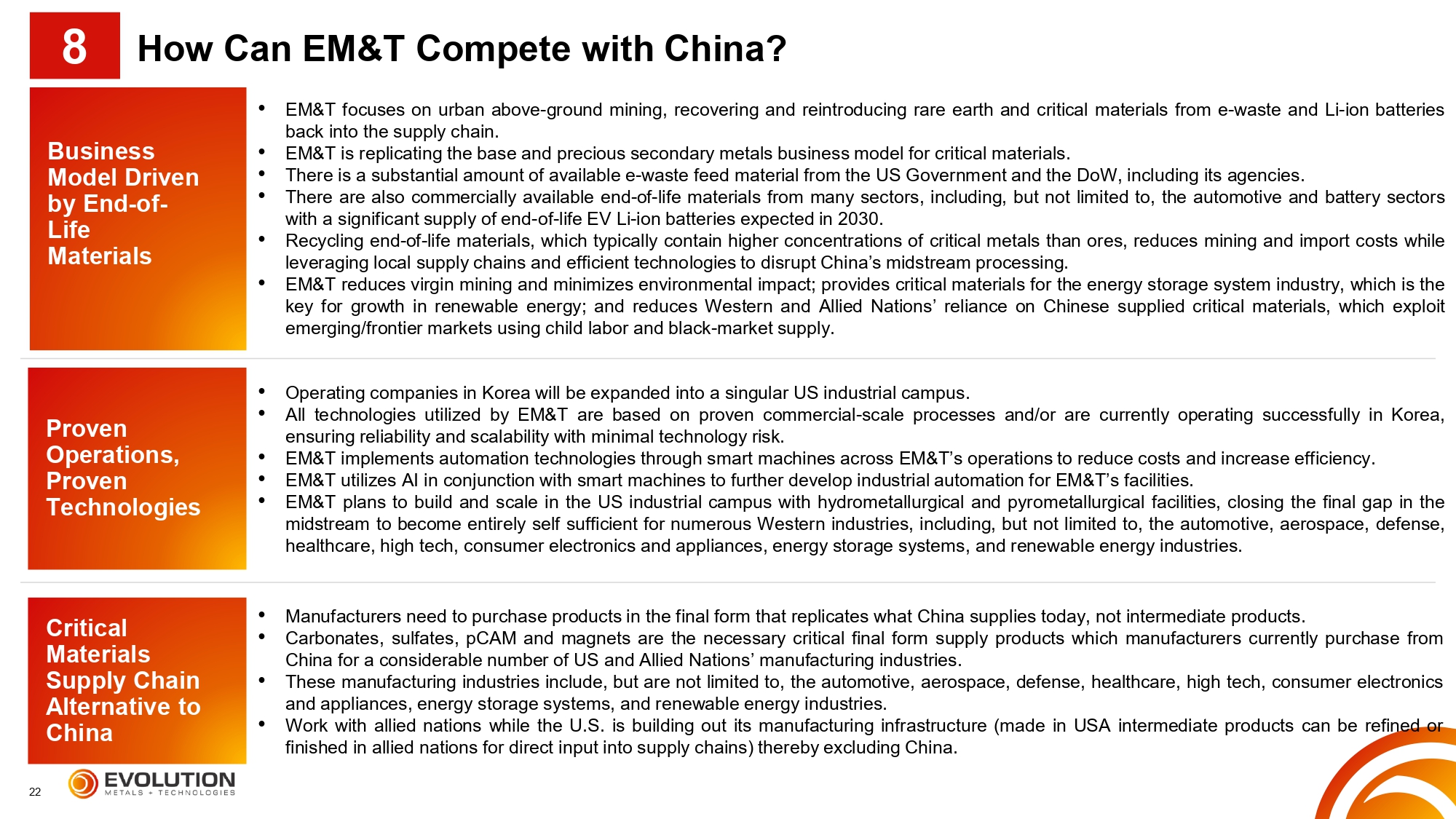

22 • Manufacturers need to purchase products in the final form that replicates what China supplies today, not intermediate products. • Carbonates, sulfates, pCAM and magnets are the necessary critical final form supply products which manufacturers currently purchase from China for a considerable number of US and Allied Nations’ manufacturing industries. • These manufacturing industries include, but are not limited to, the automotive, aerospace, defense, healthcare, high tech, consumer electronics and appliances, energy storage systems, and renewable energy industries. • Work with allied nations while the U.S. is building out its manufacturing infrastructure (made in USA intermediate products can be refined or finished in allied nations for direct input into supply chains) thereby excluding China. • Operating companies in Korea will be expanded into a singular US industrial campus. • All technologies utilized by EM&T are based on proven commercial - scale processes and/or are currently operating successfully in Korea, ensuring reliability and scalability with minimal technology risk. • EM&T implements automation technologies through smart machines across EM&T’s operations to reduce costs and increase efficiency. • EM&T utilizes AI in conjunction with smart machines to further develop industrial automation for EM&T’s facilities. • EM&T plans to build and scale in the US industrial campus with hydrometallurgical and pyrometallurgical facilities, closing the final gap in the midstream to become entirely self sufficient for numerous Western industries, including, but not limited to, the automotive, aerospace, defense, healthcare, high tech, consumer electronics and appliances, energy storage systems, and renewable energy industries . • EM&T focuses on urban above - ground mining, recovering and reintroducing rare earth and critical materials from e - waste and Li - ion batteries back into the supply chain. • EM&T is replicating the base and precious secondary metals business model for critical materials. • There is a substantial amount of available e - waste feed material from the US Government and the DoW, including its agencies. • There are also commercially available end - of - life materials from many sectors, including, but not limited to, the automotive and battery sectors with a significant supply of end - of - life EV Li - ion batteries expected in 2030. • Recycling end - of - life materials, which typically contain higher concentrations of critical metals than ores, reduces mining and import costs while leveraging local supply chains and efficient technologies to disrupt China’s midstream processing . • EM&T reduces virgin mining and minimizes environmental impact ; provides critical materials for the energy storage system industry, which is the key for growth in renewable energy ; and reduces Western and Allied Nations’ reliance on Chinese supplied critical materials, which exploit emerging/frontier markets using child labor and black - market supply . How Can EM&T Compete with China? 8 Business Model Driven by End - of - Life Materials Proven Operations, Proven Technologies Critical Materials Supply Chain Alternative to China

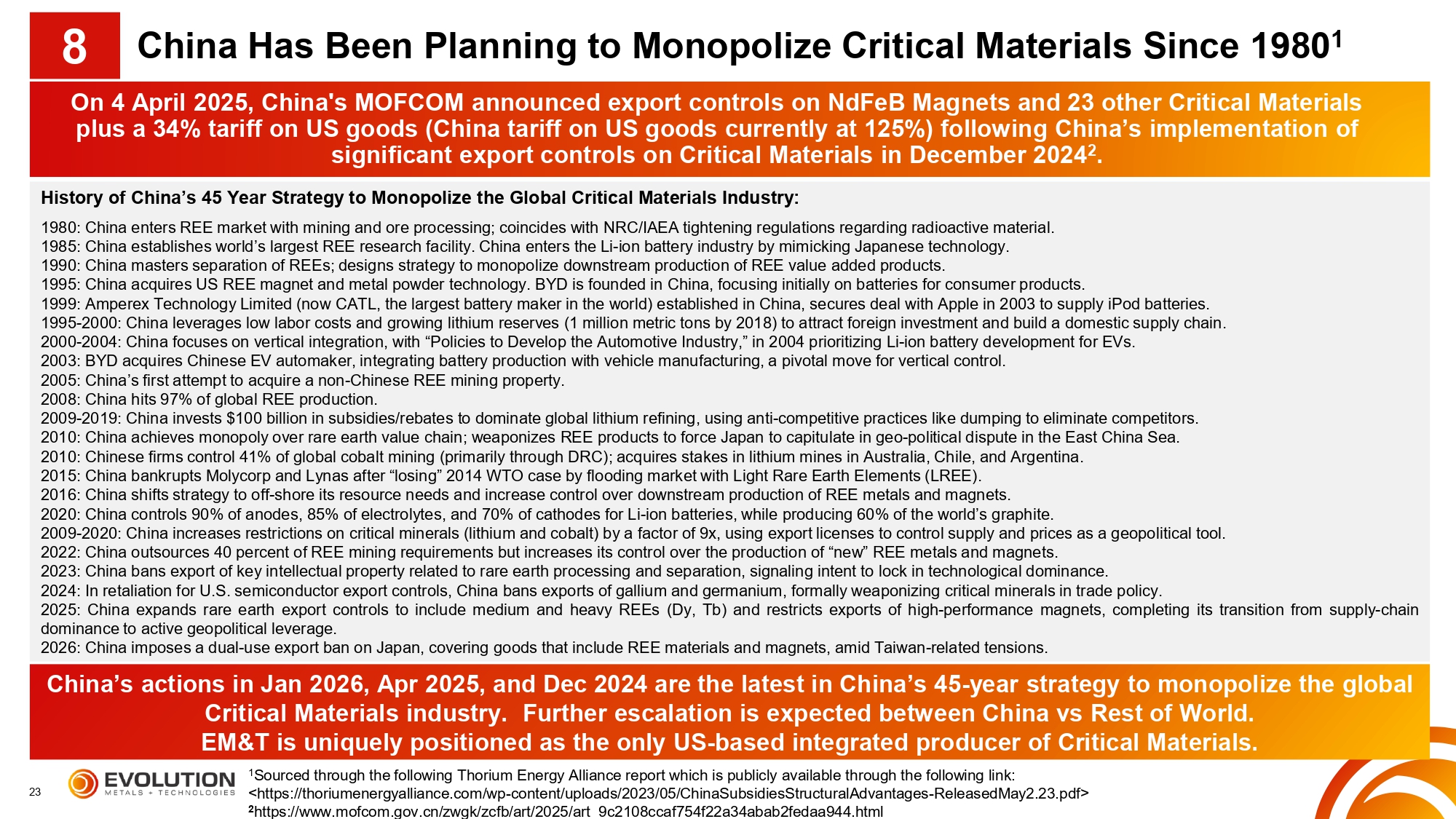

23 On 4 April 2025, China's MOFCOM announced export controls on NdFeB Magnets and 23 other Critical Materials plus a 34% tariff on US goods (China tariff on US goods currently at 125%) following China’s implementation of significant export controls on Critical Materials in December 2024 2 . China Has Been Planning to Monopolize Critical Materials Since 1980 1 8 History of China’s 45 Year Strategy to Monopolize the Global Critical Materials Industry: 1980: China enters REE market with mining and ore processing; coincides with NRC/IAEA tightening regulations regarding radioactive material. 1985: China establishes world’s largest REE research facility. China enters the Li - ion battery industry by mimicking Japanese technology. 1990: China masters separation of REEs; designs strategy to monopolize downstream production of REE value added products. 1995: China acquires US REE magnet and metal powder technology. BYD is founded in China, focusing initially on batteries for consumer products. 1999: Amperex Technology Limited (now CATL, the largest battery maker in the world) established in China, secures deal with Apple in 2003 to supply iPod batteries. 1995 - 2000: China leverages low labor costs and growing lithium reserves (1 million metric tons by 2018) to attract foreign investment and build a domestic supply chain. 2000 - 2004: China focuses on vertical integration, with “Policies to Develop the Automotive Industry,” in 2004 prioritizing Li - ion battery development for EVs. 2003: BYD acquires Chinese EV automaker, integrating battery production with vehicle manufacturing, a pivotal move for vertical control. 2005: China’s first attempt to acquire a non - Chinese REE mining property. 2008: China hits 97% of global REE production. 2009 - 2019: China invests $100 billion in subsidies/rebates to dominate global lithium refining, using anti - competitive practices like dumping to eliminate competitors. 2010: China achieves monopoly over rare earth value chain; weaponizes REE products to force Japan to capitulate in geo - political dispute in the East China Sea. 2010: Chinese firms control 41% of global cobalt mining (primarily through DRC); acquires stakes in lithium mines in Australia, Chile, and Argentina. 2015: China bankrupts Molycorp and Lynas after “losing” 2014 WTO case by flooding market with Light Rare Earth Elements (LREE). 2016: China shifts strategy to off - shore its resource needs and increase control over downstream production of REE metals and magnets. 2020: China controls 90% of anodes, 85% of electrolytes, and 70% of cathodes for Li - ion batteries, while producing 60% of the world’s graphite. 2009 - 2020: China increases restrictions on critical minerals (lithium and cobalt) by a factor of 9x, using export licenses to control supply and prices as a geopolitical tool. 2022: China outsources 40 percent of REE mining requirements but increases its control over the production of “new” REE metals and magnets. 2023: China bans export of key intellectual property related to rare earth processing and separation, signaling intent to lock in technological dominance. 2024: In retaliation for U.S. semiconductor export controls, China bans exports of gallium and germanium, formally weaponizing critical minerals in trade policy. 2025: China expands rare earth export controls to include medium and heavy REEs (Dy, Tb) and restricts exports of high - performance magnets, completing its transition from supply - chain dominance to active geopolitical leverage. 2026: China imposes a dual - use export ban on Japan, covering goods that include REE materials and magnets, amid Taiwan - related tensions. China’s actions in Jan 2026, Apr 2025, and Dec 2024 are the latest in China’s 45 - year strategy to monopolize the global Critical Materials industry. Further escalation is expected between China vs Rest of World. EM&T is uniquely positioned as the only US - based integrated producer of Critical Materials. 1 Sourced through the following Thorium Energy Alliance report which is publicly available through the following link: < https://thoriumenergyalliance.com/wp - content/uploads/2023/05/ChinaSubsidiesStructuralAdvantages - ReleasedMay2.23.pdf > 2 https://www.mofcom.gov.cn/zwgk/zcfb/art/2025/art_9c2108ccaf754f22a34abab2fedaa944.html

24 A Compelling Sustainable Investment for a Greener and Cleaner Future 9 Circular Economy & End - of - Life Materials Recycling Potential Carbon Credits & Emission Reductions Enabling the Energy Transition Through Critical Metals Recovery Job Creation & Economic Sustainability • Closed - loop solution: recycling end - of - life batteries and e - waste, including magnets. • Reduces virgin mining, minimizes environmental impact. • Proven, scalable, and profitable operations. • Lower CO ₂ footprint vs. primary metal extraction. • Potential revenue from carbon credit programs. • Designed to reduce environmental impact. • Extracts critical metals for EVs, wind, and energy storage. • Sustainable alternative to carbon - intensive mining. • Strengthens US supply chains. • Recovered materials power the next energy revolution. • Creates high - skill US jobs. • US industrial complex drive local employment and economic advancement. • Strengthens domestic supply chain resilience. Alignment with UN Sustainable Development Goals (SDGs) EM&T is one of the only proven critical material supply chain companies utilizing closed - loop solutions to recover critical materials necessary for the next energy revolution. This is achieved through recycling end - of - life materials while generating minimal residual waste, most of which is further recovered or repurposed.

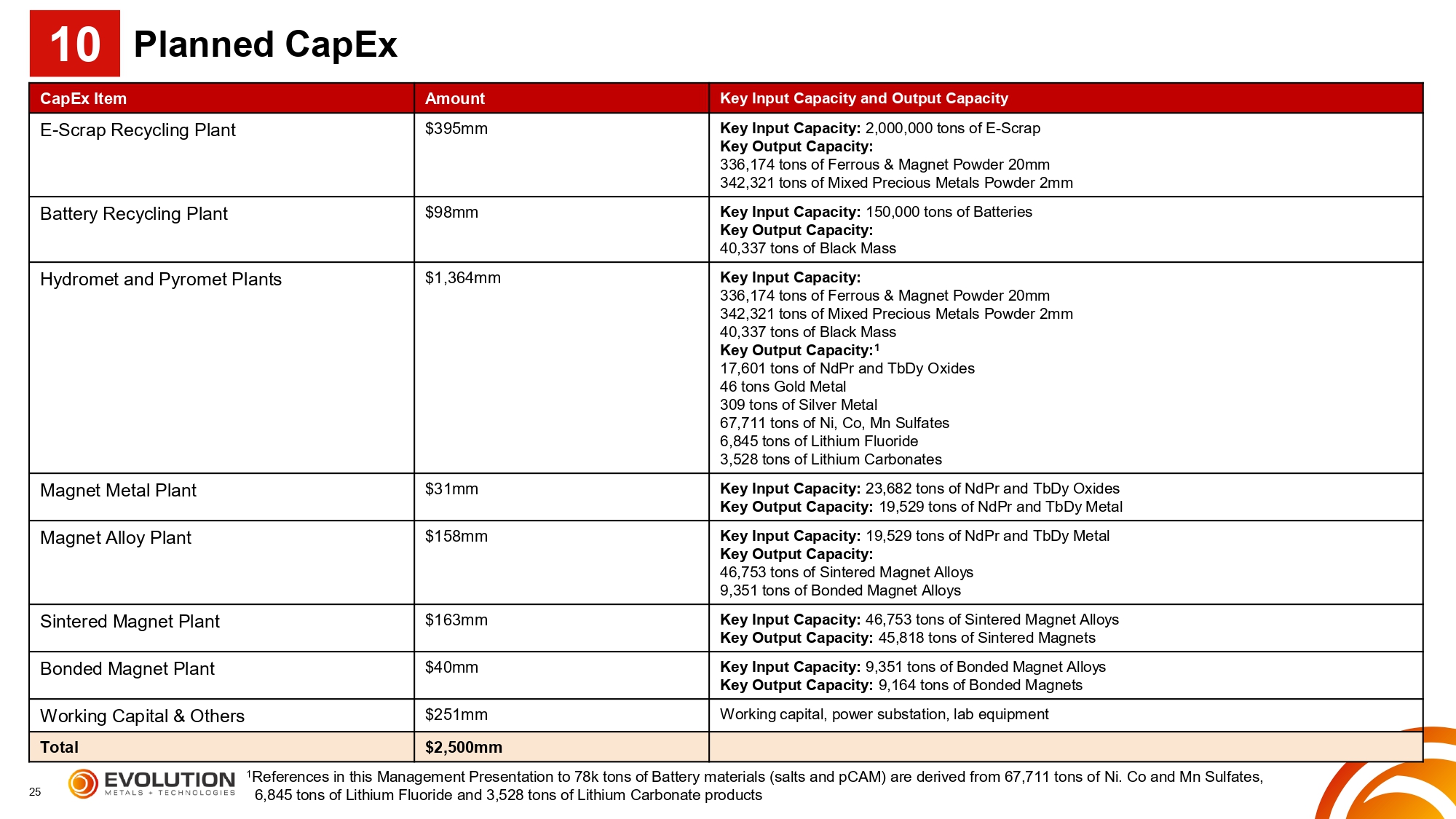

25 Planned CapEx Key Input Capacity and Output Capacity Amount CapEx Item Key Input Capacity: 2,000,000 tons of E - Scrap Key Output Capacity: 336,174 tons of Ferrous & Magnet Powder 20mm 342,321 tons of Mixed Precious Metals Powder 2mm $395mm E - Scrap Recycling Plant Key Input Capacity: 150,000 tons of Batteries Key Output Capacity: 40,337 tons of Black Mass $98mm Battery Recycling Plant Key Input Capacity: 336,174 tons of Ferrous & Magnet Powder 20mm 342,321 tons of Mixed Precious Metals Powder 2mm 40,337 tons of Black Mass Key Output Capacity: 1 17,601 tons of NdPr and TbDy Oxides 46 tons Gold Metal 309 tons of Silver Metal 67,711 tons of Ni, Co, Mn Sulfates 6,845 tons of Lithium Fluoride 3,528 tons of Lithium Carbonates $1,364mm Hydromet and Pyromet Plants Key Input Capacity: 23,682 tons of NdPr and TbDy Oxides Key Output Capacity: 19,529 tons of NdPr and TbDy Metal $31mm Magnet Metal Plant Key Input Capacity: 19,529 tons of NdPr and TbDy Metal Key Output Capacity: 46,753 tons of Sintered Magnet Alloys 9,351 tons of Bonded Magnet Alloys $158mm Magnet Alloy Plant Key Input Capacity: 46,753 tons of Sintered Magnet Alloys Key Output Capacity: 45,818 tons of Sintered Magnets $163mm Sintered Magnet Plant Key Input Capacity: 9,351 tons of Bonded Magnet Alloys Key Output Capacity: 9,164 tons of Bonded Magnets $40mm Bonded Magnet Plant Working capital, power substation, lab equipment $251mm Working Capital & Others $2,500mm Total 10 1 References in this Management Presentation to 78k tons of Battery materials (salts and pCAM) are derived from 67,711 tons of Ni. Co and Mn Sulfates, 6,845 tons of Lithium Fluoride and 3,528 tons of Lithium Carbonate products