Phillip D. Green, Chairman and Chief Executive Officer | Dan Geddes, Chief Financial Officer Cullen/Frost Bankers, Inc. December 31, 2025

2 Cautionary Statement Certain statements contained in this presentation that are not statements of historical fact constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”), notwithstanding that such statements are not specifically identified as such. In addition, certain statements may be contained in our future filings with the SEC, in press releases, and in oral and written statements made by us or with our approval that are not statements of historical fact and constitute forward-looking statements within the meaning of the Act. Examples of forward-looking statements include, but are not limited to: (i) projections of revenues, expenses, income or loss, earnings or loss per share, the payment or nonpayment of dividends, capital structure and other financial items; (ii) statements of plans, objectives and expectations of Cullen/Frost or its management or Board of Directors, including those relating to products, services or operations; (iii) statements of future economic performance; and (iv) statements of assumptions underlying such statements. Words such as “believes”, “anticipates”, “expects”, “intends”, “targeted”, “continue”, “remain”, “will”, “should”, “may” and other similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. Forward-looking statements involve risks and uncertainties that may cause actual results to differ materially from those in such statements. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to: In addition, financial markets, international relations, and global supply chains have been significantly impacted by recent U.S. trade policies and practices. Due to the rapidly evolving and changing state of U.S. trade policies, the amount and duration of any tariffs and their ultimate impact on us, our customers, financial markets, and the overall U.S. and global economies is currently uncertain. Nonetheless, prolonged uncertainty, elevated tariff levels or their wide-spread use in U.S. trade policy could weaken economic conditions and adversely impact the ability of borrowers to repay outstanding loans or the value of collateral securing these loans or adversely affect financial markets or the values of securities. To the extent that these risks may have a negative impact on the financial condition of borrowers or financial markets, it could also have a material adverse effect on our business, financial condition and results of operations. Forward-looking statements speak only as of the date on which such statements are made. We do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, or to reflect the occurrence of unanticipated events. • Our ability to increase market share and control expenses. • Our ability to attract and retain qualified employees. • Changes in our organization, compensation, and benefit plans. • The soundness of other financial institutions. • Volatility and disruption in national and international financial and commodity markets. • Changes in the competitive environment in our markets and among banking organizations and other financial service providers. • Government intervention in the U.S. financial system. • Political or economic instability. • Acts of God or of war or terrorism. • The potential impact of climate change. • The impact of pandemics, epidemics, or any other health-related crisis. • The costs and effects of legal and regulatory developments, the resolution of legal proceedings or regulatory or other governmental inquiries, the results of regulatory examinations or reviews and the ability to obtain required regulatory approvals. • The effect of changes in laws and regulations (including laws and regulations concerning taxes, banking, securities, and insurance) and their application with which we and our subsidiaries must comply. • The effect of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board, the Financial Accounting Standards Board and other accounting standard setters. • Our success at managing the risks involved in the foregoing items. • The effects of and changes in trade and monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve Board and the implementation of tariffs and other protectionist trade policies. • Inflation, interest rate, securities market, and monetary fluctuations. • Local, regional, national, and international economic conditions and the impact they may have on us and our customers and our assessment of that impact. • Changes in the financial performance and/or condition of our borrowers. • Changes in the mix of loan geographies, sectors and types or the level of non-performing assets and charge-offs. • Changes in estimates of future credit loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements. • Changes in our liquidity position. • Impairment of our goodwill or other intangible assets. • The timely development and acceptance of new products and services and perceived overall value of these products and services by users. • Changes in consumer spending, borrowing, and saving habits. • Greater than expected costs or difficulties related to the integration of new products and lines of business. • Technological changes. • The cost and effects of cyber incidents or other failures, interruptions, or security breaches of our systems or those of our customers or third-party providers. • Acquisitions and integration of acquired businesses. • Changes in the reliability of our vendors, internal control systems or information systems.

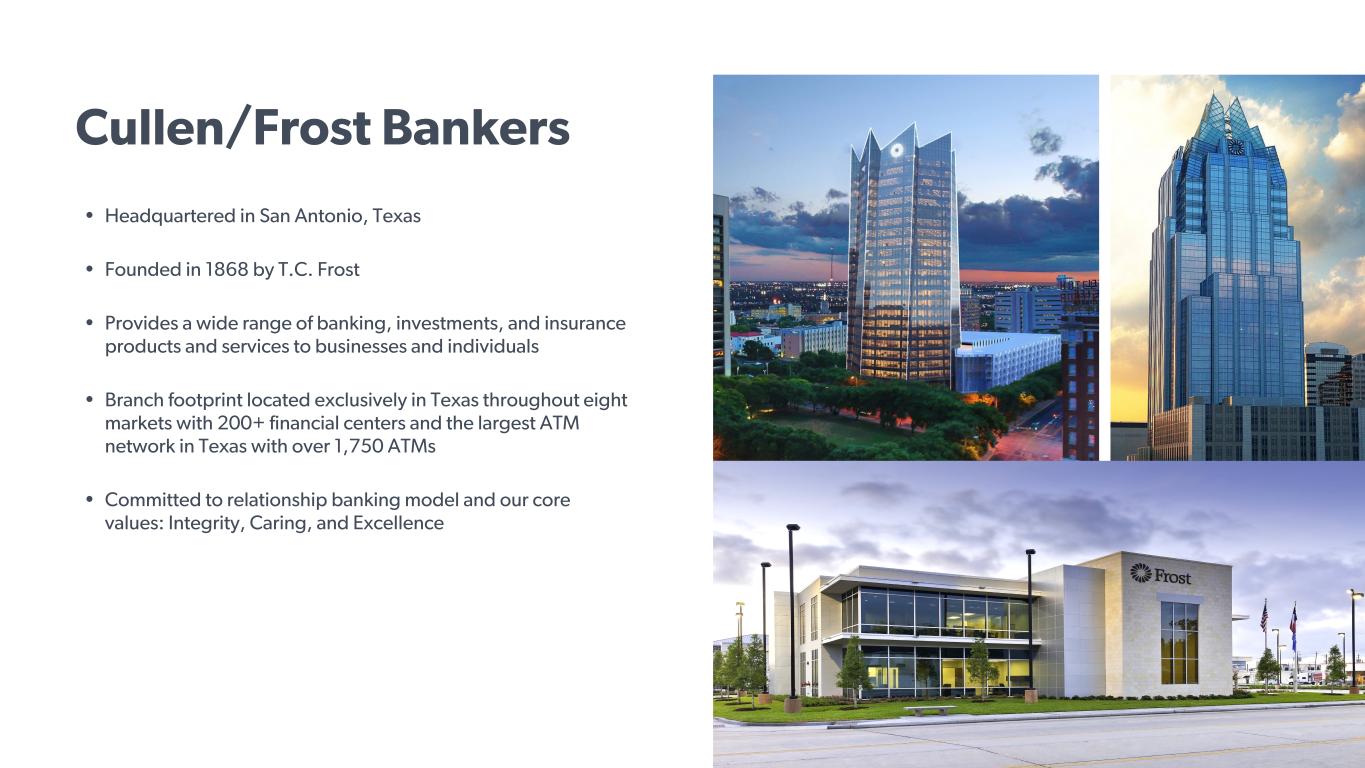

Cullen/Frost Bankers • Headquartered in San Antonio, Texas • Founded in 1868 by T.C. Frost • Provides a wide range of banking, investments, and insurance products and services to businesses and individuals • Branch footprint located exclusively in Texas throughout eight markets with 200+ financial centers and the largest ATM network in Texas with over 1,750 ATMs • Committed to relationship banking model and our core values: Integrity, Caring, and Excellence

4 Award Winning Value Proposition J.D. Power Company Highlights Listing NYSE:CFR Market Capitalization ($ billions) 8.1 Total Assets 53.0 Trust Assets 51.0 Total Loans 21.9 Total Deposits 42.9 Moody's L-T Rating / Outlook A3/Stable S&P L-T Rating / Outlook A-/Stable • Highest ranked retail bank in Texas in the J.D. Power 2025 U.S. Retail Banking Satisfaction Survey • #1 Ranking since inception and for 17 consecutive years Source: S&P Global Market Intelligence Note: Market and financial data as of December 31, 2025 • In 2025, Frost received 15 awards for excellence in small business banking and 12 awards for excellence in middle-market banking, including: • Best Bank – Customer Service • Best Bank – Ease of Doing Business • Best Bank – Overall Satisfaction Cullen/Frost Bankers

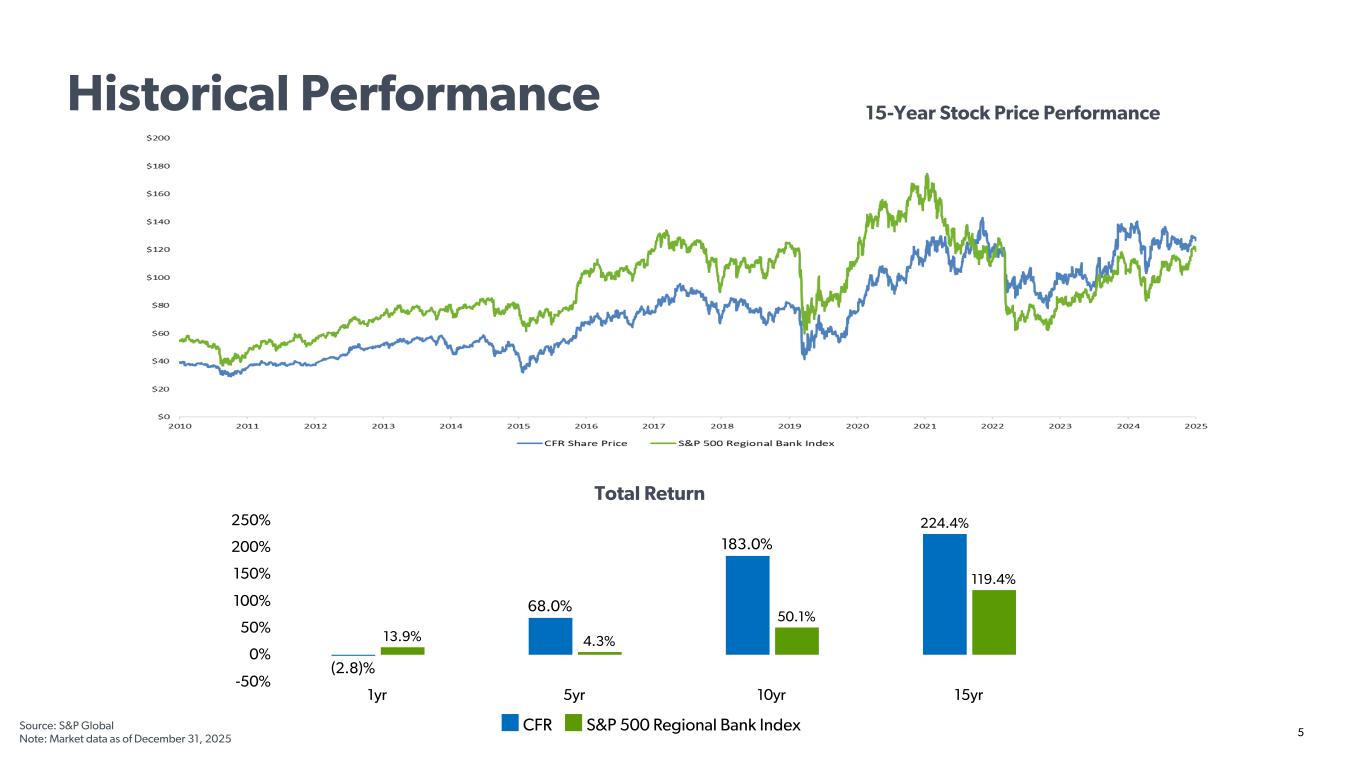

5 15-Year Stock Price Performance Total Return (2.8)% 68.0% 183.0% 224.4% 13.9% 4.3% 50.1% 119.4% CFR S&P 500 Regional Bank Index 1yr 5yr 10yr 15yr -50% 0% 50% 100% 150% 200% 250% Historical Performance Source: S&P Global Note: Market data as of December 31, 2025

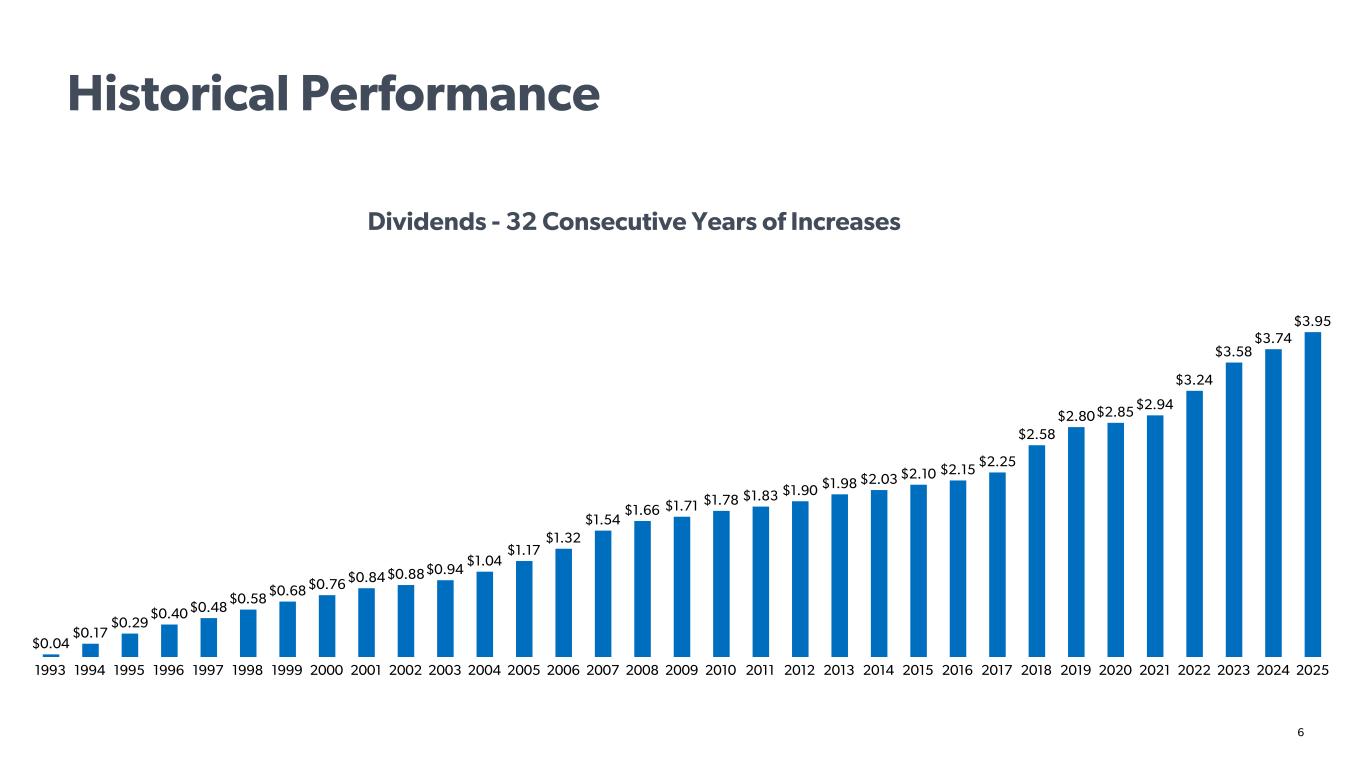

6 Dividends - 32 Consecutive Years of Increases $0.04 $0.17 $0.29 $0.40 $0.48 $0.58 $0.68 $0.76 $0.84 $0.88$0.94 $1.04 $1.17 $1.32 $1.54 $1.66 $1.71 $1.78 $1.83 $1.90 $1.98 $2.03 $2.10 $2.15 $2.25 $2.58 $2.80$2.85 $2.94 $3.24 $3.58 $3.74 $3.95 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Historical Performance

7 We will grow and prosper, building long-term relationships based on top-quality service, high ethical standards and safe, sound assets. INTEGRITY Steadfast adherence to an ethical code. CARING Feeling and exhibiting concern for others. EXCELLENCE Commitment to being outstanding. Our Mission

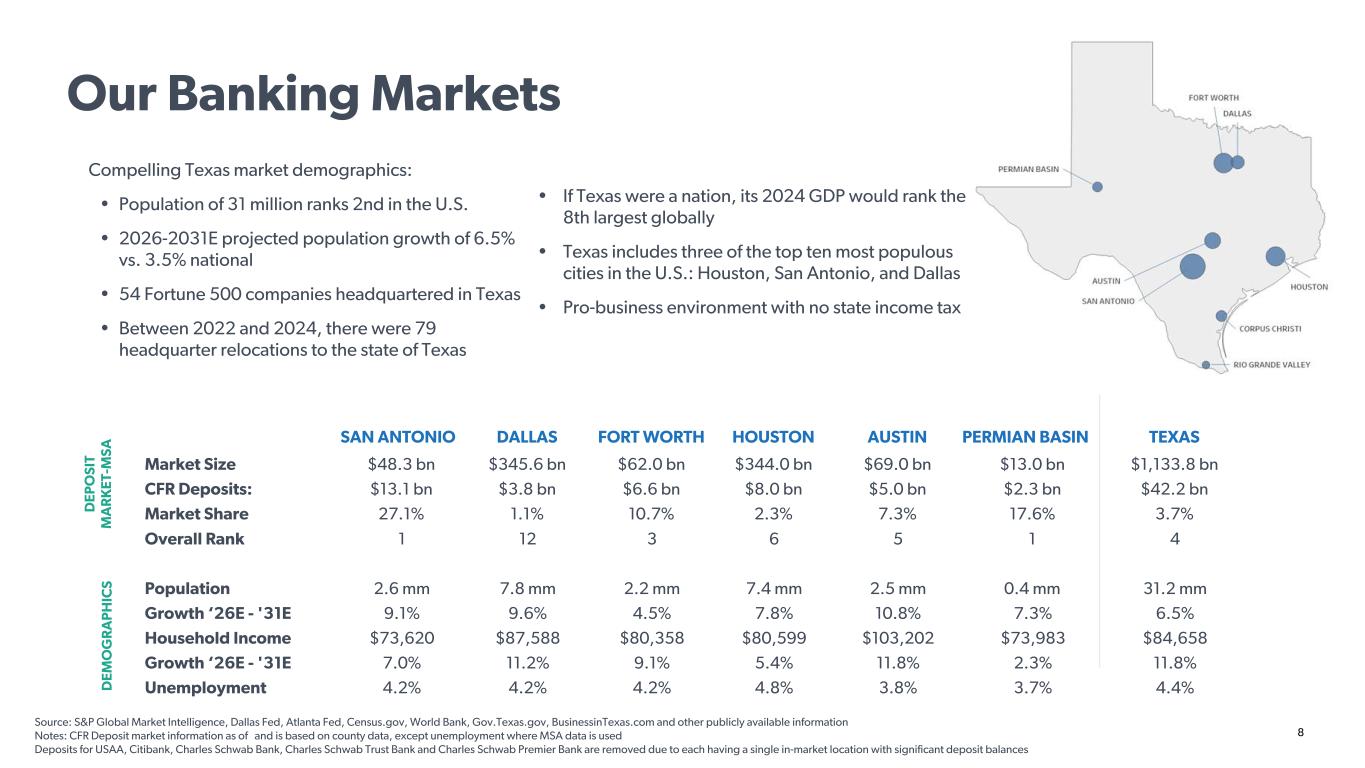

8 Compelling Texas market demographics: • Population of 31 million ranks 2nd in the U.S. • 2026-2031E projected population growth of 6.5% vs. 3.5% national • 54 Fortune 500 companies headquartered in Texas • Between 2022 and 2024, there were 79 headquarter relocations to the state of Texas D EP O SI T M A R K ET -M SA D EM O G R A P H IC S • If Texas were a nation, its 2024 GDP would rank the 8th largest globally • Texas includes three of the top ten most populous cities in the U.S.: Houston, San Antonio, and Dallas • Pro-business environment with no state income tax Our Banking Markets Source: S&P Global Market Intelligence, Dallas Fed, Atlanta Fed, Census.gov, World Bank, Gov.Texas.gov, BusinessinTexas.com and other publicly available information Notes: CFR Deposit market information as of and is based on county data, except unemployment where MSA data is used Deposits for USAA, Citibank, Charles Schwab Bank, Charles Schwab Trust Bank and Charles Schwab Premier Bank are removed due to each having a single in-market location with significant deposit balances SAN ANTONIO DALLAS FORT WORTH HOUSTON AUSTIN PERMIAN BASIN TEXAS Market Size $48.3 bn $345.6 bn $62.0 bn $344.0 bn $69.0 bn $13.0 bn $1,133.8 bn CFR Deposits: $13.1 bn $3.8 bn $6.6 bn $8.0 bn $5.0 bn $2.3 bn $42.2 bn Market Share 27.1% 1.1% 10.7% 2.3% 7.3% 17.6% 3.7% Overall Rank 1 12 3 6 5 1 4 Population 2.6 mm 7.8 mm 2.2 mm 7.4 mm 2.5 mm 0.4 mm 31.2 mm Growth ‘26E - '31E 9.1% 9.6% 4.5% 7.8% 10.8% 7.3% 6.5% Household Income $73,620 $87,588 $80,358 $80,599 $103,202 $73,983 $84,658 Growth ‘26E - '31E 7.0% 11.2% 9.1% 5.4% 11.8% 2.3% 11.8% Unemployment 4.2% 4.2% 4.2% 4.8% 3.8% 3.7% 4.4%

9 Technology Highlights • In Q4-2025, 53% of consumer deposit account openings came from our online channel • Highest-rated consumer banking mobile app of all U.S. banks • Delivered new features to enable a more personalized, secure, and goal- oriented digital banking experience • 24/7 customer phone and chat support with real humans • Consumer digital-channel money-movement increased 8% from Q4-2024 to Q4-2025

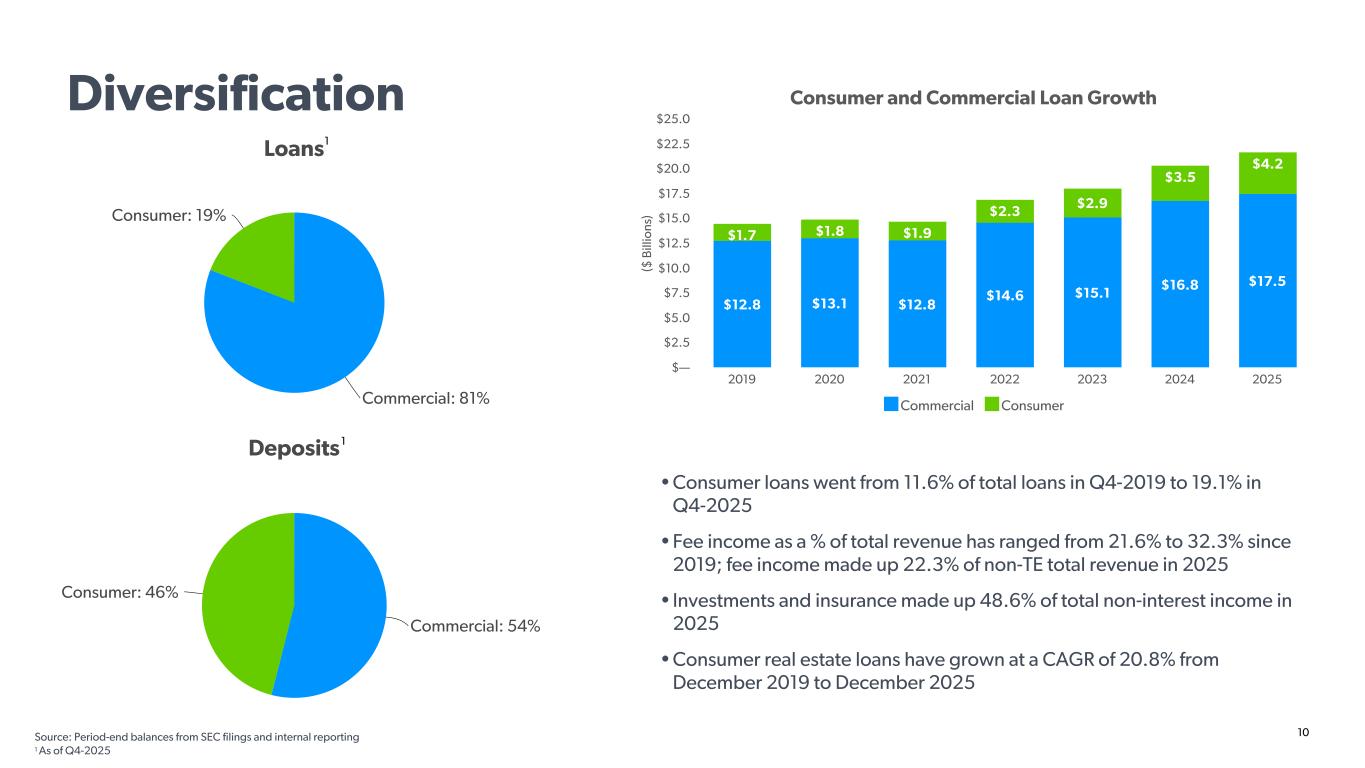

10 Loans Commercial: 81% Consumer: 19% Deposits Commercial: 54% Consumer: 46% ($ B ill io ns ) Consumer and Commercial Loan Growth $12.8 $13.1 $12.8 $14.6 $15.1 $16.8 $17.5 $1.7 $1.8 $1.9 $2.3 $2.9 $3.5 $4.2 Commercial Consumer 2019 2020 2021 2022 2023 2024 2025 $— $2.5 $5.0 $7.5 $10.0 $12.5 $15.0 $17.5 $20.0 $22.5 $25.0 • Consumer loans went from 11.6% of total loans in Q4-2019 to 19.1% in Q4-2025 • Fee income as a % of total revenue has ranged from 21.6% to 32.3% since 2019; fee income made up 22.3% of non-TE total revenue in 2025 • Investments and insurance made up 48.6% of total non-interest income in 2025 • Consumer real estate loans have grown at a CAGR of 20.8% from December 2019 to December 2025 Source: Period-end balances from SEC filings and internal reporting 1 As of Q4-2025 1 1 Diversification

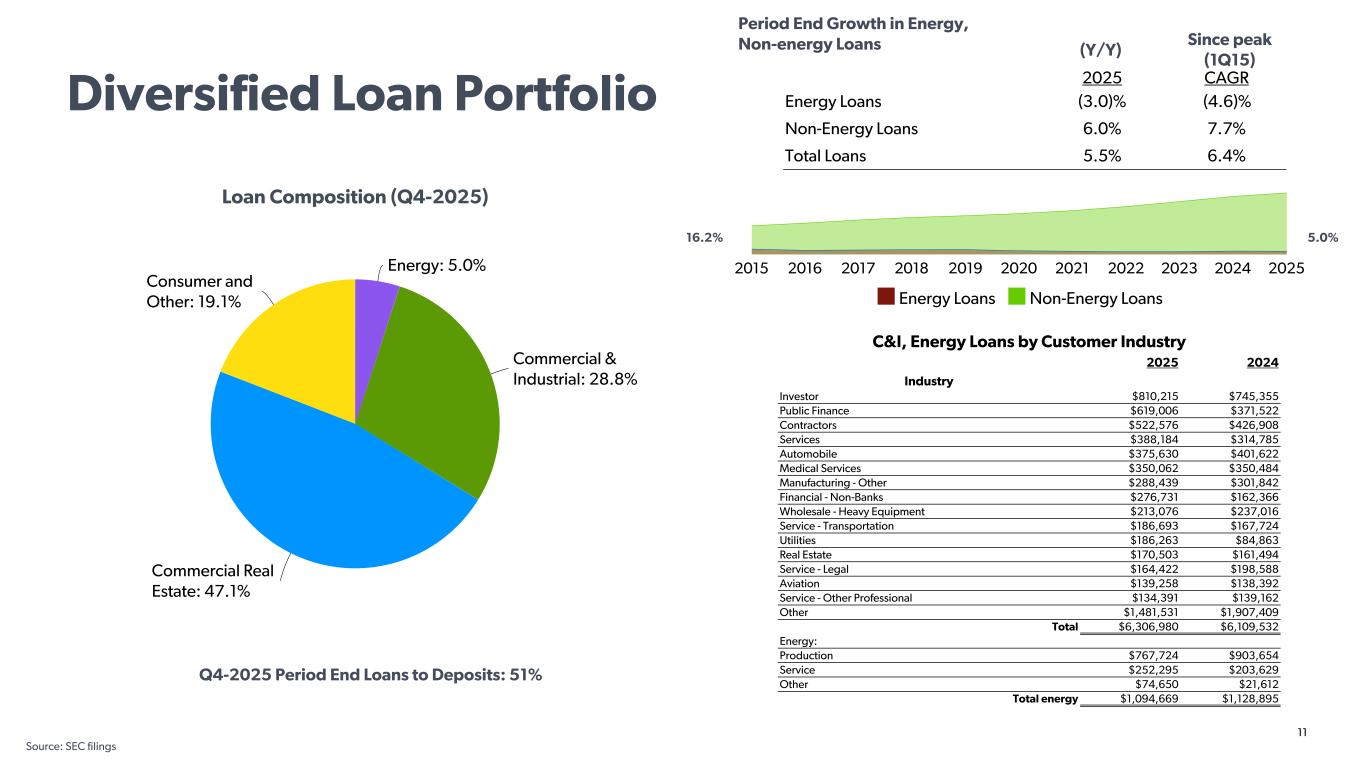

11 Period End Growth in Energy, Non-energy Loans Loan Composition (Q4-2025) Q4-2025 Period End Loans to Deposits: 51% Since peak (1Q15) (Y/Y) 2025 CAGR Energy Loans (3.0)% (4.6)% Non-Energy Loans 6.0% 7.7% Total Loans 5.5% 6.4% 5.0% Energy Loans Non-Energy Loans 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025Energy: 5.0% Commercial & Industrial: 28.8% Commercial Real Estate: 47.1% Consumer and Other: 19.1% C&I, Energy Loans by Customer Industry 2025 2024 Industry Investor $810,215 $745,355 Public Finance $619,006 $371,522 Contractors $522,576 $426,908 Services $388,184 $314,785 Automobile $375,630 $401,622 Medical Services $350,062 $350,484 Manufacturing - Other $288,439 $301,842 Financial - Non-Banks $276,731 $162,366 Wholesale - Heavy Equipment $213,076 $237,016 Service - Transportation $186,693 $167,724 Utilities $186,263 $84,863 Real Estate $170,503 $161,494 Service - Legal $164,422 $198,588 Aviation $139,258 $138,392 Service - Other Professional $134,391 $139,162 Other $1,481,531 $1,907,409 Total $6,306,980 $6,109,532 Energy: Production $767,724 $903,654 Service $252,295 $203,629 Other $74,650 $21,612 Total energy $1,094,669 $1,128,895 16.2% Diversified Loan Portfolio Source: SEC filings

12 • Frost introduced a consumer first lien mortgage/home loan product in 2023 • Frost consumer first lien mortgage loan balances totaled $595 million at December 31, 2025 • Total consumer real estate loans were $3.7 billion or 17% of total loans outstanding at December 31, 2025 • Total consumer loans are made up of consumer real estate and consumer/other, which is mainly personal lines of credit $ (M ill io ns ) H4 Products Mortgage Other 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 $— $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 Source: SEC filings Consumer Loan Growth

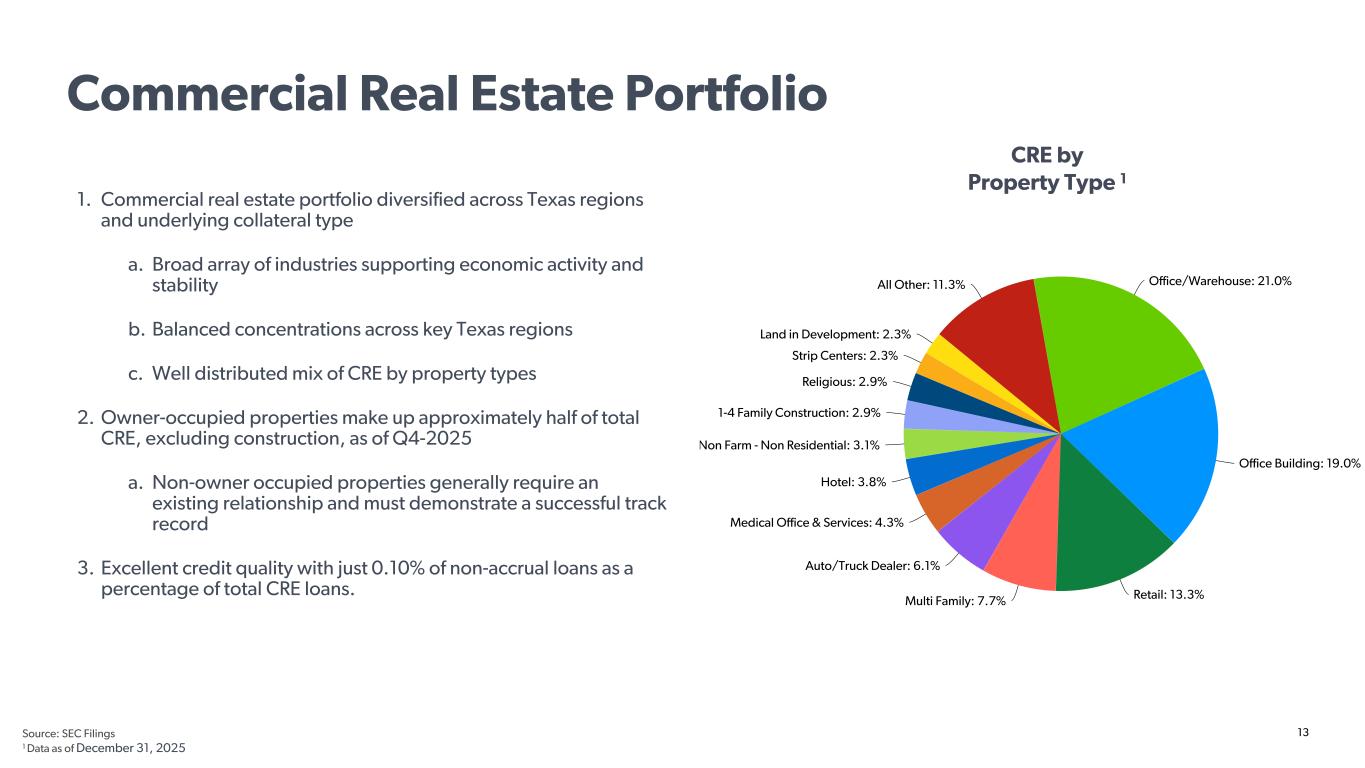

13 1. Commercial real estate portfolio diversified across Texas regions and underlying collateral type a. Broad array of industries supporting economic activity and stability b. Balanced concentrations across key Texas regions c. Well distributed mix of CRE by property types 2. Owner-occupied properties make up approximately half of total CRE, excluding construction, as of Q4-2025 a. Non-owner occupied properties generally require an existing relationship and must demonstrate a successful track record 3. Excellent credit quality with just 0.10% of non-accrual loans as a percentage of total CRE loans. CRE by Property Type 1 Office/Warehouse: 21.0% Office Building: 19.0% Retail: 13.3%Multi Family: 7.7% Auto/Truck Dealer: 6.1% Medical Office & Services: 4.3% Hotel: 3.8% Non Farm - Non Residential: 3.1% 1-4 Family Construction: 2.9% Religious: 2.9% Strip Centers: 2.3% Land in Development: 2.3% All Other: 11.3% Source: SEC Filings 1 Data as of December 31, 2025 Commercial Real Estate Portfolio

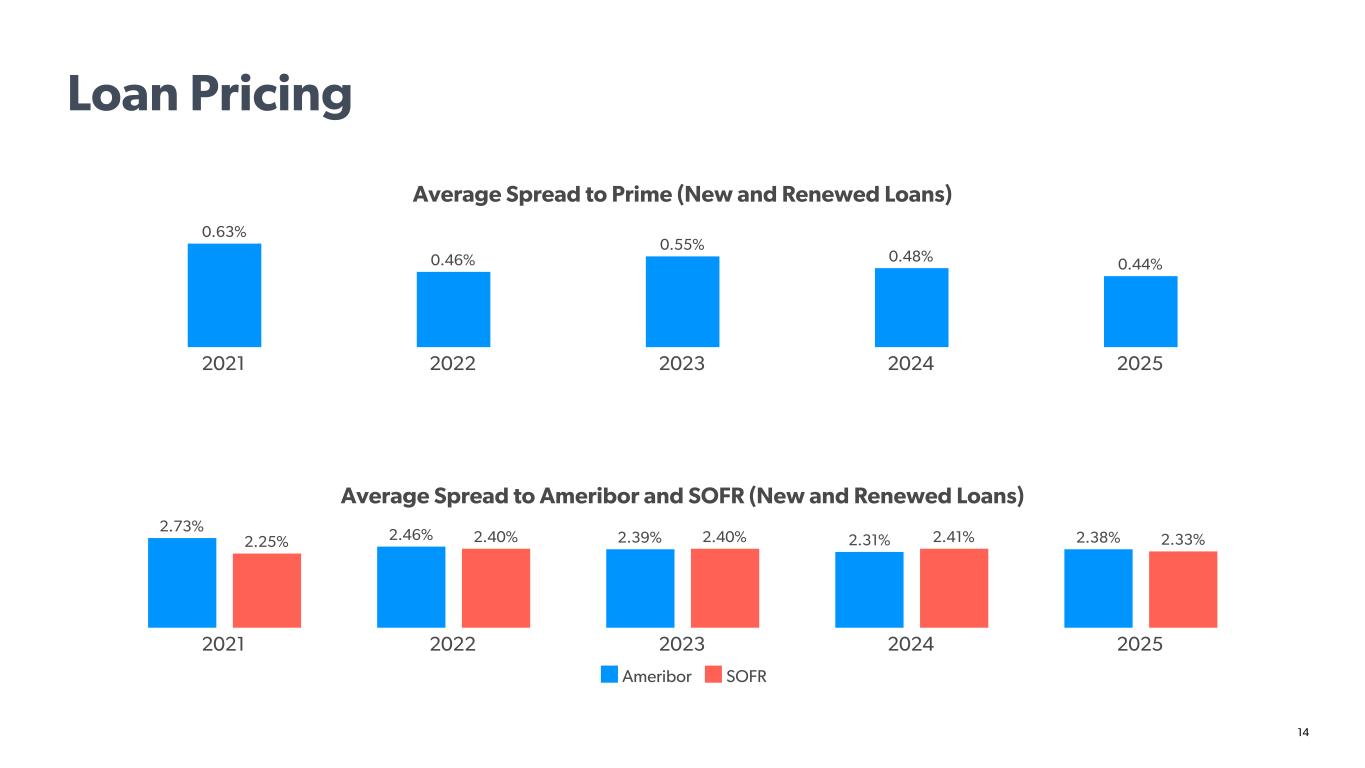

14 Average Spread to Ameribor and SOFR (New and Renewed Loans) Average Spread to Prime (New and Renewed Loans) 2.73% 2.46% 2.39% 2.31% 2.38%2.25% 2.40% 2.40% 2.41% 2.33% Ameribor SOFR 2021 2022 2023 2024 2025 0.63% 0.46% 0.55% 0.48% 0.44% 2021 2022 2023 2024 2025 Loan Pricing

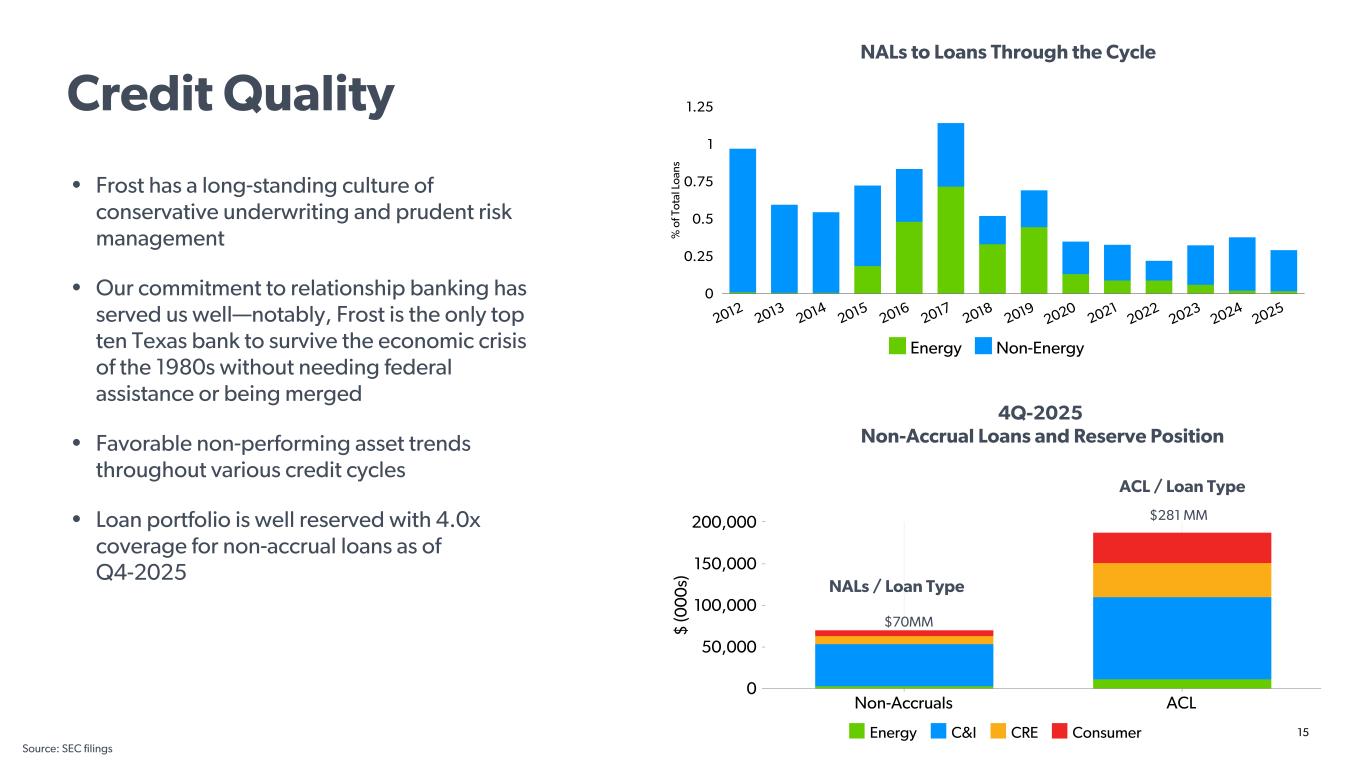

15 $ (0 00 s) Energy C&I CRE Consumer Non-Accruals ACL 0 50,000 100,000 150,000 200,000 • Frost has a long-standing culture of conservative underwriting and prudent risk management • Our commitment to relationship banking has served us well—notably, Frost is the only top ten Texas bank to survive the economic crisis of the 1980s without needing federal assistance or being merged • Favorable non-performing asset trends throughout various credit cycles • Loan portfolio is well reserved with 4.0x coverage for non-accrual loans as of Q4-2025 NALs to Loans Through the Cycle 4Q-2025 Non-Accrual Loans and Reserve Position ACL / Loan Type NALs / Loan Type $70MM $281 MM % o f T ot al L oa ns Energy Non-Energy 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 0 0.25 0.5 0.75 1 1.25 Source: SEC filings Credit Quality

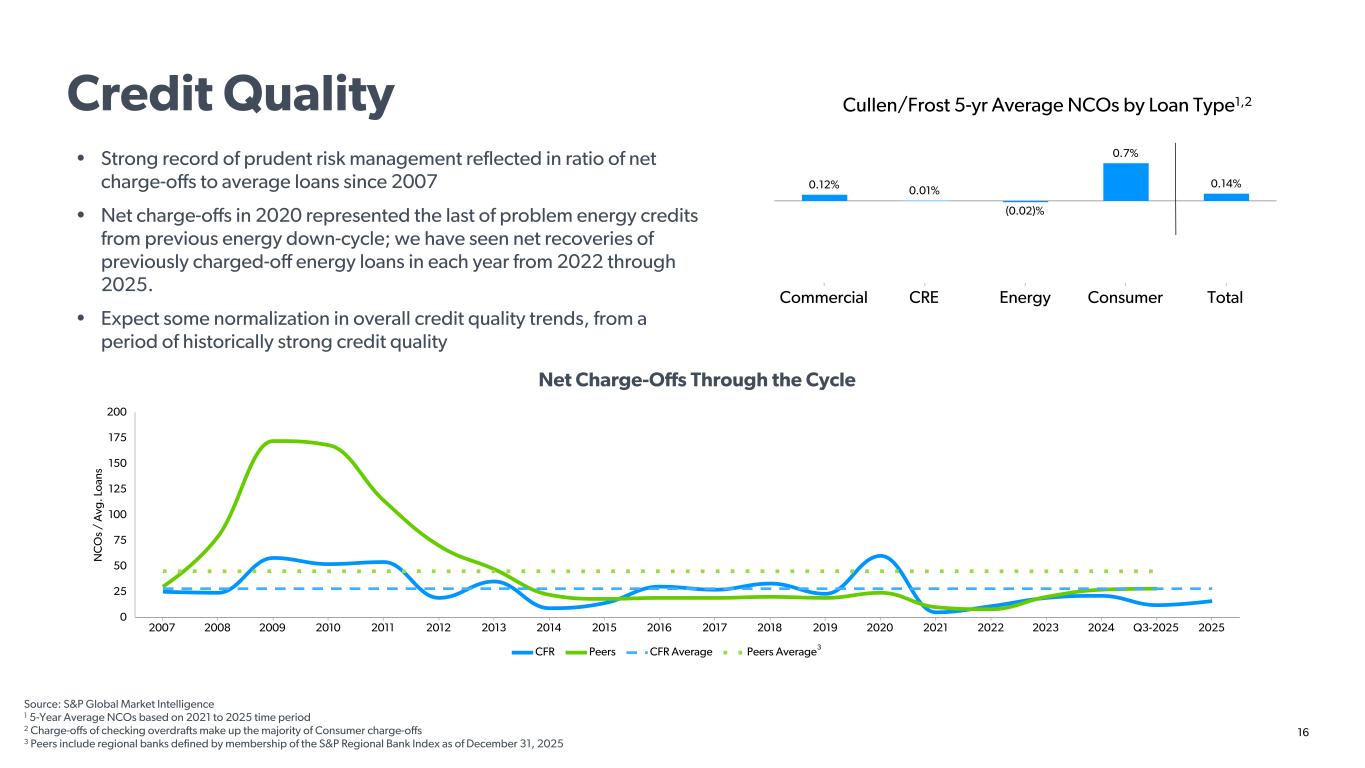

16 • Strong record of prudent risk management reflected in ratio of net charge-offs to average loans since 2007 • Net charge-offs in 2020 represented the last of problem energy credits from previous energy down-cycle; we have seen net recoveries of previously charged-off energy loans in each year from 2022 through 2025. • Expect some normalization in overall credit quality trends, from a period of historically strong credit quality Net Charge-Offs Through the Cycle N C O s / A vg . L oa ns CFR Peers CFR Average Peers Average 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 Q3-2025 2025 0 25 50 75 100 125 150 175 200 0.12% 0.01% (0.02)% 0.7% 0.14% Commercial CRE Energy Consumer Total Cullen/Frost 5-yr Average NCOs by Loan Type1,2 3 Source: S&P Global Market Intelligence 1 5-Year Average NCOs based on 2021 to 2025 time period 2 Charge-offs of checking overdrafts make up the majority of Consumer charge-offs 3 Peers include regional banks defined by membership of the S&P Regional Bank Index as of December 31, 2025 Credit Quality

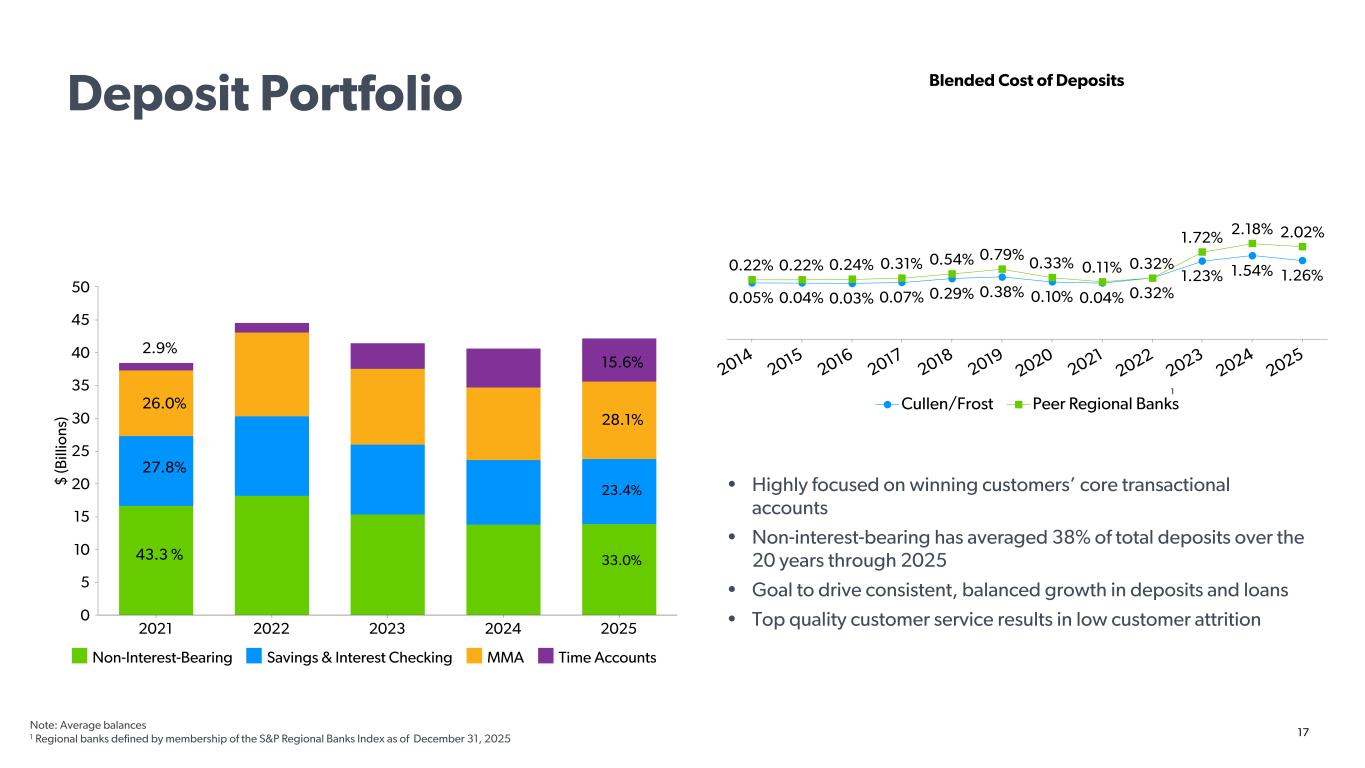

17 • Highly focused on winning customers’ core transactional accounts • Non-interest-bearing has averaged 38% of total deposits over the 20 years through 2025 • Goal to drive consistent, balanced growth in deposits and loans • Top quality customer service results in low customer attrition $ (B ill io ns ) Non-Interest-Bearing Savings & Interest Checking MMA Time Accounts 2021 2022 2023 2024 2025 0 5 10 15 20 25 30 35 40 45 50 33.0% 23.4% 28.1% Blended Cost of Deposits 0.05% 0.04% 0.03% 0.07% 0.29% 0.38% 0.10% 0.04% 0.32% 1.23% 1.54% 1.26% 0.22% 0.22% 0.24% 0.31% 0.54% 0.79% 0.33% 0.11% 0.32% 1.72% 2.18% 2.02% Cullen/Frost Peer Regional Banks 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 202515.6% 43.3 % 27.8% 26.0% 2.9% 1 Deposit Portfolio Note: Average balances 1 Regional banks defined by membership of the S&P Regional Banks Index as of December 31, 2025

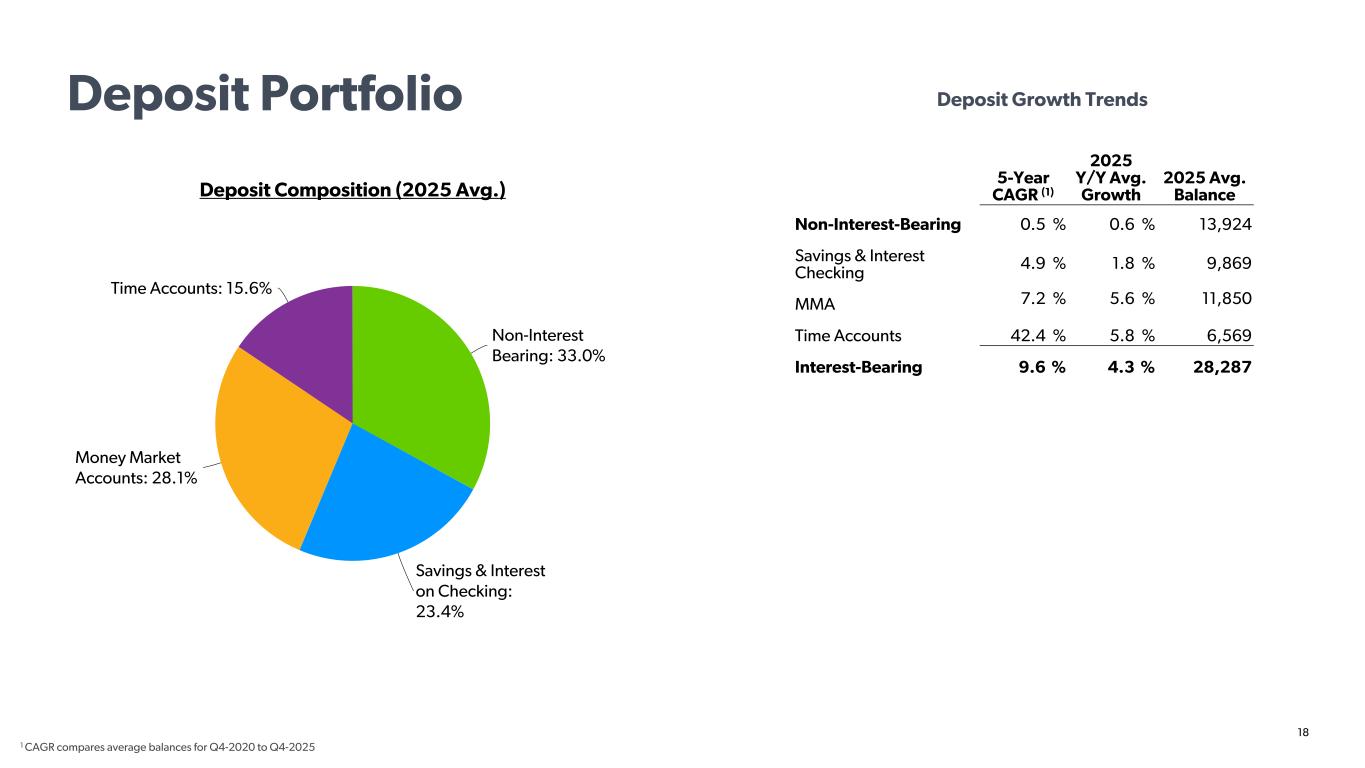

18 Deposit Composition (2025 Avg.) Deposit Growth Trends Non-Interest Bearing: 33.0% Savings & Interest on Checking: 23.4% Money Market Accounts: 28.1% Time Accounts: 15.6% 5-Year CAGR (1) 2025 Y/Y Avg. Growth 2025 Avg. Balance Non-Interest-Bearing 0.5 % 0.6 % 13,924 Savings & Interest Checking 4.9 % 1.8 % 9,869 MMA 7.2 % 5.6 % 11,850 Time Accounts 42.4 % 5.8 % 6,569 Interest-Bearing 9.6 % 4.3 % 28,287 1 CAGR compares average balances for Q4-2020 to Q4-2025 Deposit Portfolio

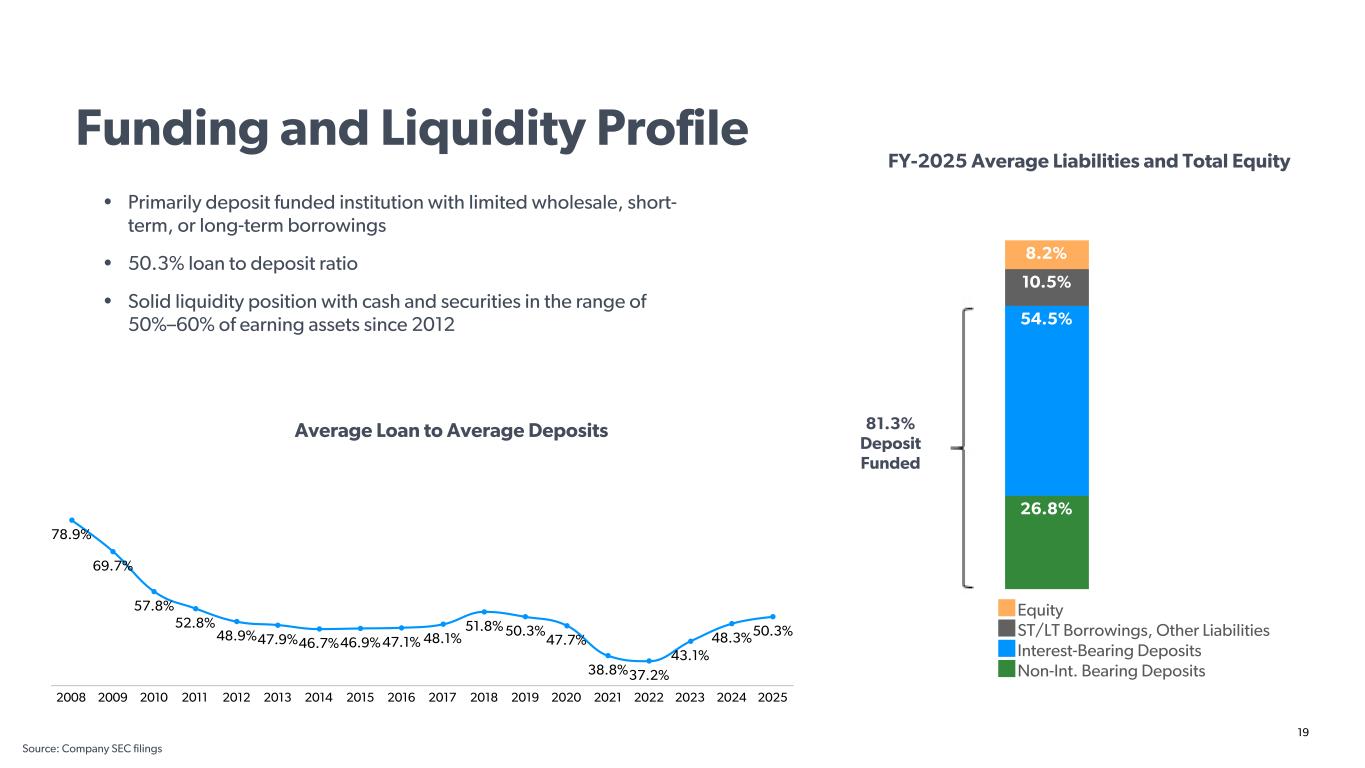

19 Funding and Liquidity Profile • Primarily deposit funded institution with limited wholesale, short- term, or long-term borrowings • 50.3% loan to deposit ratio • Solid liquidity position with cash and securities in the range of 50%–60% of earning assets since 2012 FY-2025 Average Liabilities and Total Equity Average Loan to Average Deposits 81.3% Deposit Funded • 1 Ratio of cash and cash equivalents and securities to total earning assets for 2018 was 55% 78.9% 69.7% 57.8% 52.8% 48.9%47.9%46.7%46.9% 47.1% 48.1% 51.8% 50.3% 47.7% 38.8%37.2% 43.1% 48.3%50.3% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 26.8% 54.5% 10.5% 8.2% Equity ST/LT Borrowings, Other Liabilities Interest-Bearing Deposits Non-Int. Bearing Deposits Source: Company SEC filings

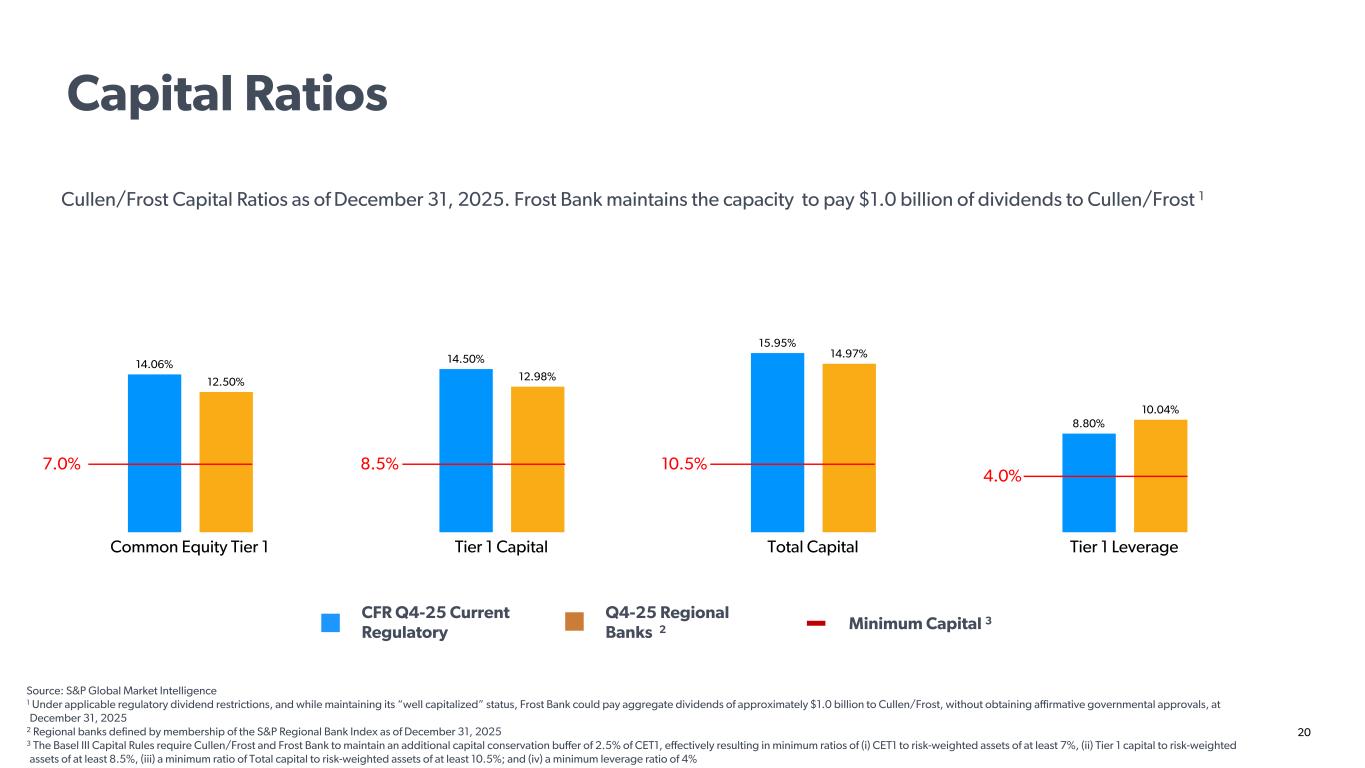

20 14.06% 14.50% 15.95% 8.80% 12.50% 12.98% 14.97% 10.04% Common Equity Tier 1 Tier 1 Capital Total Capital Tier 1 Leverage Cullen/Frost Capital Ratios as of December 31, 2025. Frost Bank maintains the capacity to pay $1.0 billion of dividends to Cullen/Frost 1 CFR Q4-25 Current Regulatory Q4-25 Regional Banks 2 Minimum Capital 3 4.0% 10.5%8.5%7.0% Source: S&P Global Market Intelligence 1 Under applicable regulatory dividend restrictions, and while maintaining its “well capitalized” status, Frost Bank could pay aggregate dividends of approximately $1.0 billion to Cullen/Frost, without obtaining affirmative governmental approvals, at December 31, 2025 2 Regional banks defined by membership of the S&P Regional Bank Index as of December 31, 2025 3 The Basel III Capital Rules require Cullen/Frost and Frost Bank to maintain an additional capital conservation buffer of 2.5% of CET1, effectively resulting in minimum ratios of (i) CET1 to risk-weighted assets of at least 7%, (ii) Tier 1 capital to risk-weighted assets of at least 8.5%, (iii) a minimum ratio of Total capital to risk-weighted assets of at least 10.5%; and (iv) a minimum leverage ratio of 4% Capital Ratios

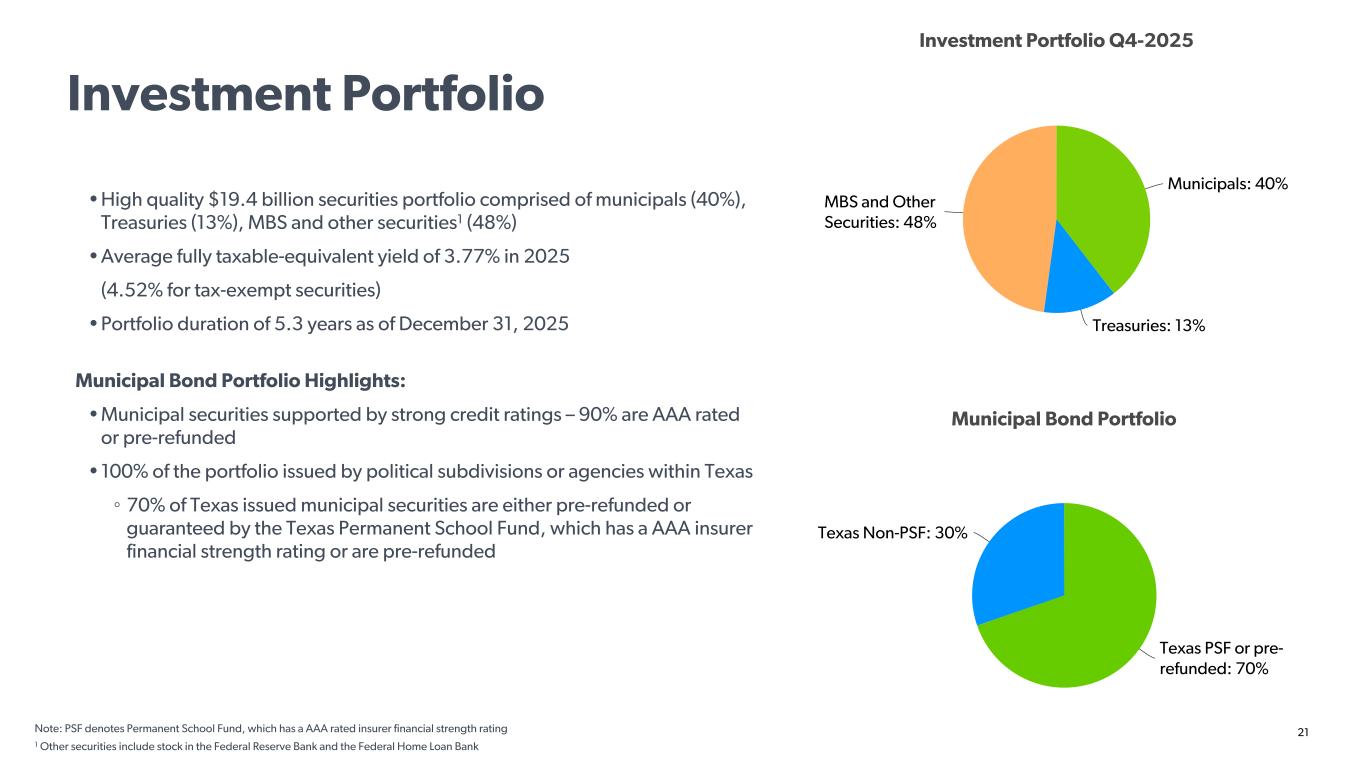

21 • High quality $19.4 billion securities portfolio comprised of municipals (40%), Treasuries (13%), MBS and other securities1 (48%) • Average fully taxable-equivalent yield of 3.77% in 2025 (4.52% for tax-exempt securities) • Portfolio duration of 5.3 years as of December 31, 2025 Municipal Bond Portfolio Highlights: • Municipal securities supported by strong credit ratings – 90% are AAA rated or pre-refunded • 100% of the portfolio issued by political subdivisions or agencies within Texas ◦ 70% of Texas issued municipal securities are either pre-refunded or guaranteed by the Texas Permanent School Fund, which has a AAA insurer financial strength rating or are pre-refunded Investment Portfolio Q4-2025 Municipals: 40% Treasuries: 13% MBS and Other Securities: 48% Municipal Bond Portfolio Texas PSF or pre- refunded: 70% Texas Non-PSF: 30% Investment Portfolio Note: PSF denotes Permanent School Fund, which has a AAA rated insurer financial strength rating 1 Other securities include stock in the Federal Reserve Bank and the Federal Home Loan Bank

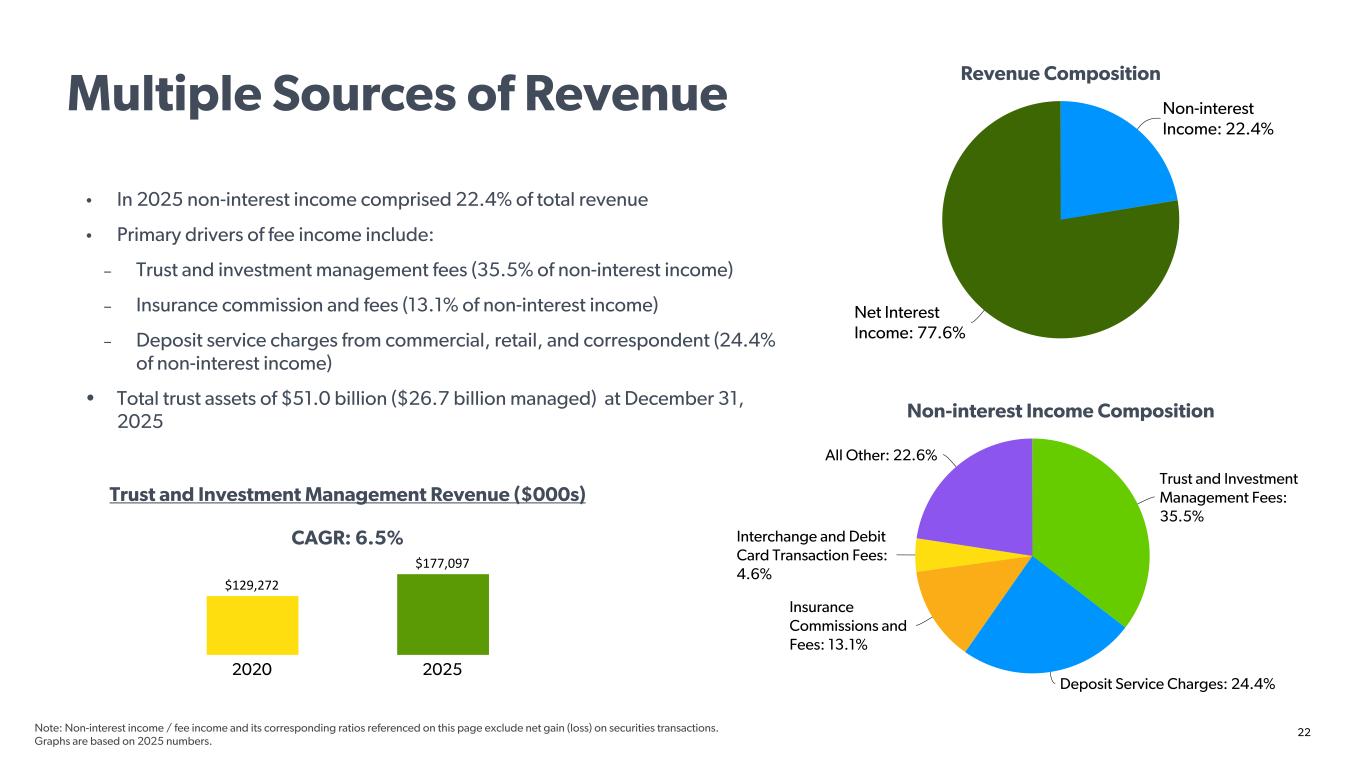

22 • In 2025 non-interest income comprised 22.4% of total revenue • Primary drivers of fee income include: – Trust and investment management fees (35.5% of non-interest income) – Insurance commission and fees (13.1% of non-interest income) – Deposit service charges from commercial, retail, and correspondent (24.4% of non-interest income) • Total trust assets of $51.0 billion ($26.7 billion managed) at December 31, 2025 Trust and Investment Management Revenue ($000s) Non-interest Income Composition Revenue Composition Non-interest Income: 22.4% Net Interest Income: 77.6% Trust and Investment Management Fees: 35.5% Deposit Service Charges: 24.4% Insurance Commissions and Fees: 13.1% Interchange and Debit Card Transaction Fees: 4.6% All Other: 22.6% $129,272 $177,097 2020 2025 CAGR: 6.5% Note: Non-interest income / fee income and its corresponding ratios referenced on this page exclude net gain (loss) on securities transactions. Graphs are based on 2025 numbers. Multiple Sources of Revenue

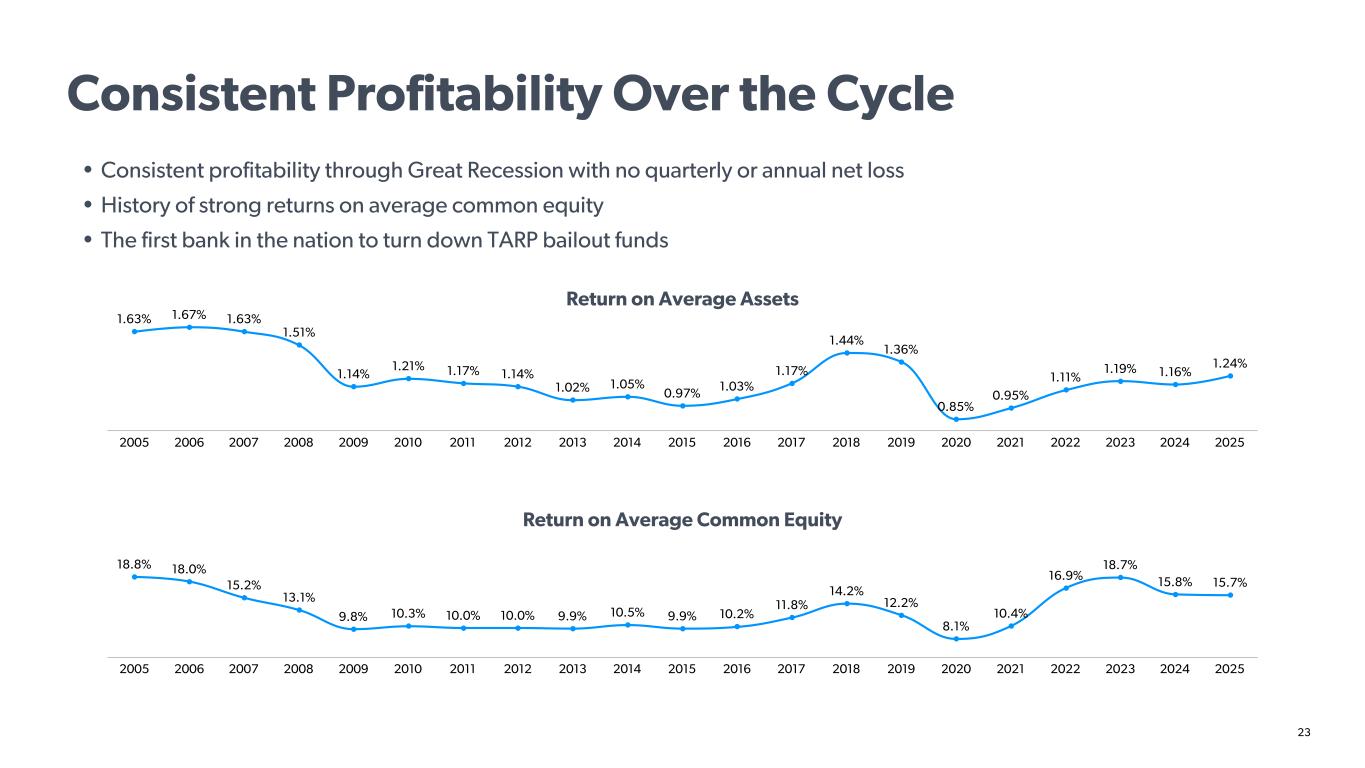

23 Return on Average Assets Return on Average Common Equity 1.63% 1.67% 1.63% 1.51% 1.14% 1.21% 1.17% 1.14% 1.02% 1.05% 0.97% 1.03% 1.17% 1.44% 1.36% 0.85% 0.95% 1.11% 1.19% 1.16% 1.24% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 18.8% 18.0% 15.2% 13.1% 9.8% 10.3% 10.0% 10.0% 9.9% 10.5% 9.9% 10.2% 11.8% 14.2% 12.2% 8.1% 10.4% 16.9% 18.7% 15.8% 15.7% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Consistent Profitability Over the Cycle • Consistent profitability through Great Recession with no quarterly or annual net loss • History of strong returns on average common equity • The first bank in the nation to turn down TARP bailout funds

24 Our strategy is focused on combining organic branch expansion, top-quality digital banking tools and an empathetic customer experience to deliver market-leading organic growth in customer relationships, deposits, loans and, ultimately, profitability. We aim to be #1 among all banks at planning, executing, and continually improving an organic growth strategy. RELATIONSHIPS DEPOSITS LOANS $— $23 $266 $466 $809 $1,275 $1,768 $2,367 2018 2019 2020 2021 2022 2023 2024 2025 0 2 8 16 26 43 60 78 2018 2019 2020 2021 2022 2023 2024 2025 $— $27 $282 $691 $1,166 $1,883 $2,462 $3,041 2018 2019 2020 2021 2022 2023 2024 2025 Note: Relationships shown in thousands $ in millions Our Expansion Strategy

25 Organic Strategy Pro Con We control selection of new locations and staff X Long-lasting organic growth in relationships, deposits, and loans after branch opening X Projects our brand into selected new markets X Earnings dilution during initial investment X Takes time to mature and turn profitable X M&A Strategy Pro Con Immediately accretive X Access to new regional markets X Cultural risk of integration X Financial risks (numerous) X Must be done repeatedly to sustain growth X Organic Expansion vs. M&A: Pros and Cons

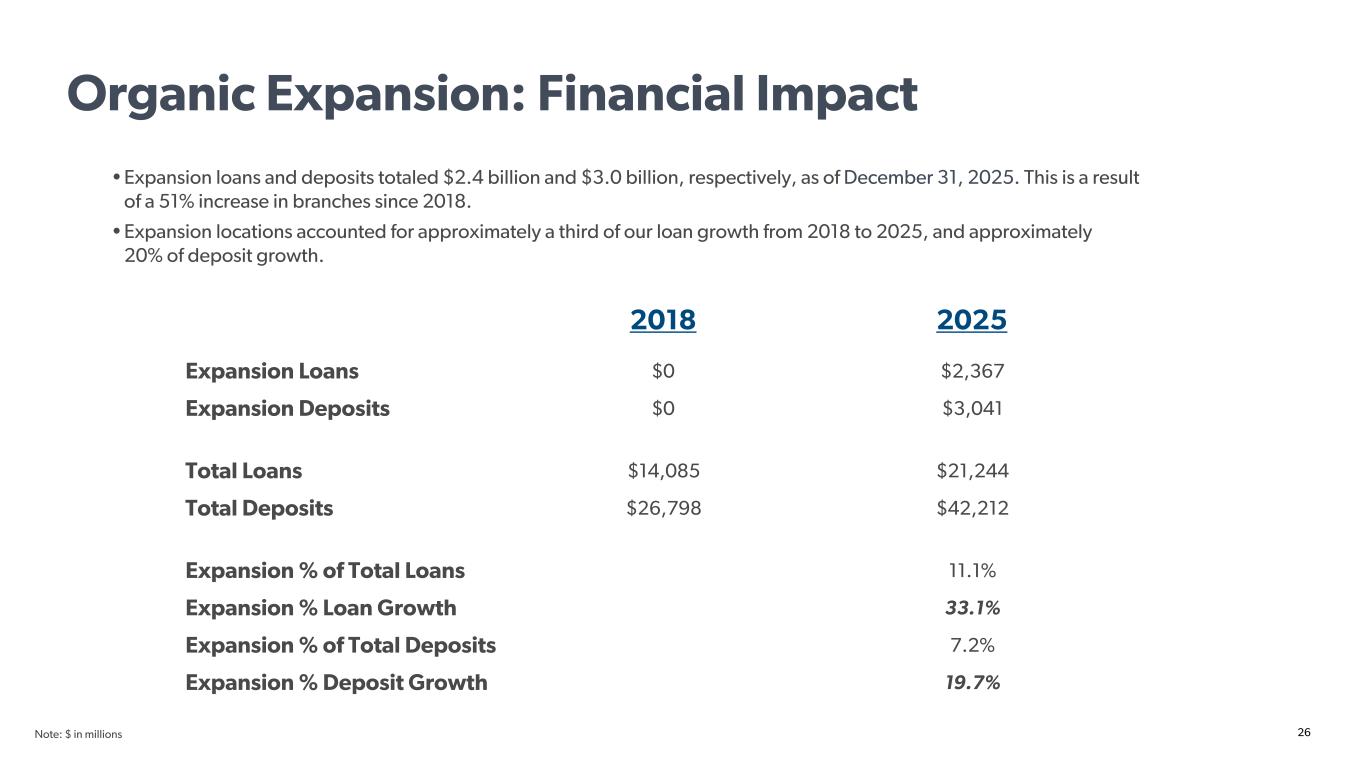

26 2018 2025 Expansion Loans $0 $2,367 Expansion Deposits $0 $3,041 Total Loans $14,085 $21,244 Total Deposits $26,798 $42,212 Expansion % of Total Loans 11.1% Expansion % Loan Growth 33.1% Expansion % of Total Deposits 7.2% Expansion % Deposit Growth 19.7% Note: $ in millions • Expansion loans and deposits totaled $2.4 billion and $3.0 billion, respectively, as of December 31, 2025. This is a result of a 51% increase in branches since 2018. • Expansion locations accounted for approximately a third of our loan growth from 2018 to 2025, and approximately 20% of deposit growth. Organic Expansion: Financial Impact

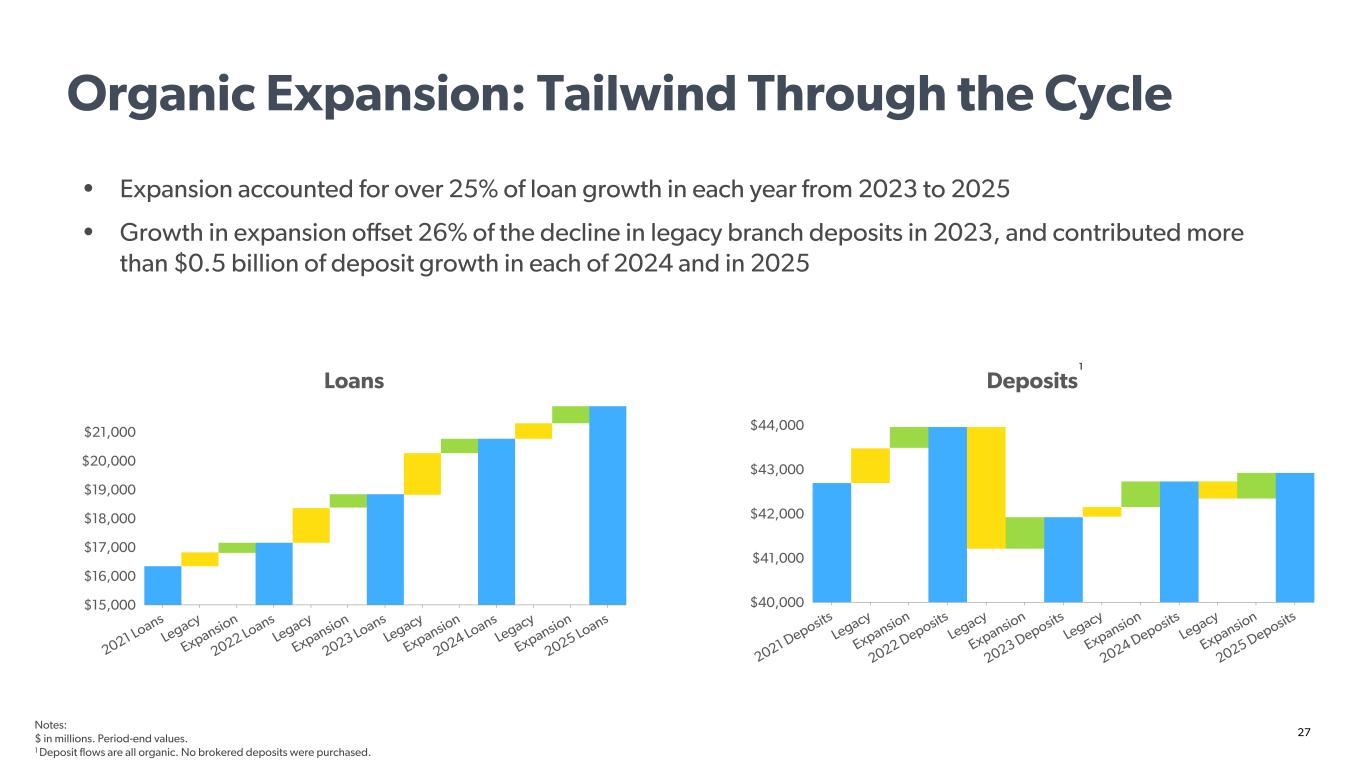

27 Notes: $ in millions. Period-end values. 1 Deposit flows are all organic. No brokered deposits were purchased. • Expansion accounted for over 25% of loan growth in each year from 2023 to 2025 • Growth in expansion offset 26% of the decline in legacy branch deposits in 2023, and contributed more than $0.5 billion of deposit growth in each of 2024 and in 2025 Loans 2021 Loans Legacy Expansion 2022 Loans Legacy Expansion 2023 Loans Legacy Expansion 2024 Loans Legacy Expansion 2025 Loans $15,000 $16,000 $17,000 $18,000 $19,000 $20,000 $21,000 Deposits 2021 Deposits Legacy Expansion 2022 Deposits Legacy Expansion 2023 Deposits Legacy Expansion 2024 Deposits Legacy Expansion 2025 Deposits $40,000 $41,000 $42,000 $43,000 $44,000 Organic Expansion: Tailwind Through the Cycle 1

28 Expansion EPS Contribution 2019 2020 2021 2022 2023 2024 2025 2026 2027 Notes: future values are approximations based on current internal estimates Includes locations opened as part of our announced Houston, Dallas and Austin expansions Organic Expansion: Earnings Growth Trajectory

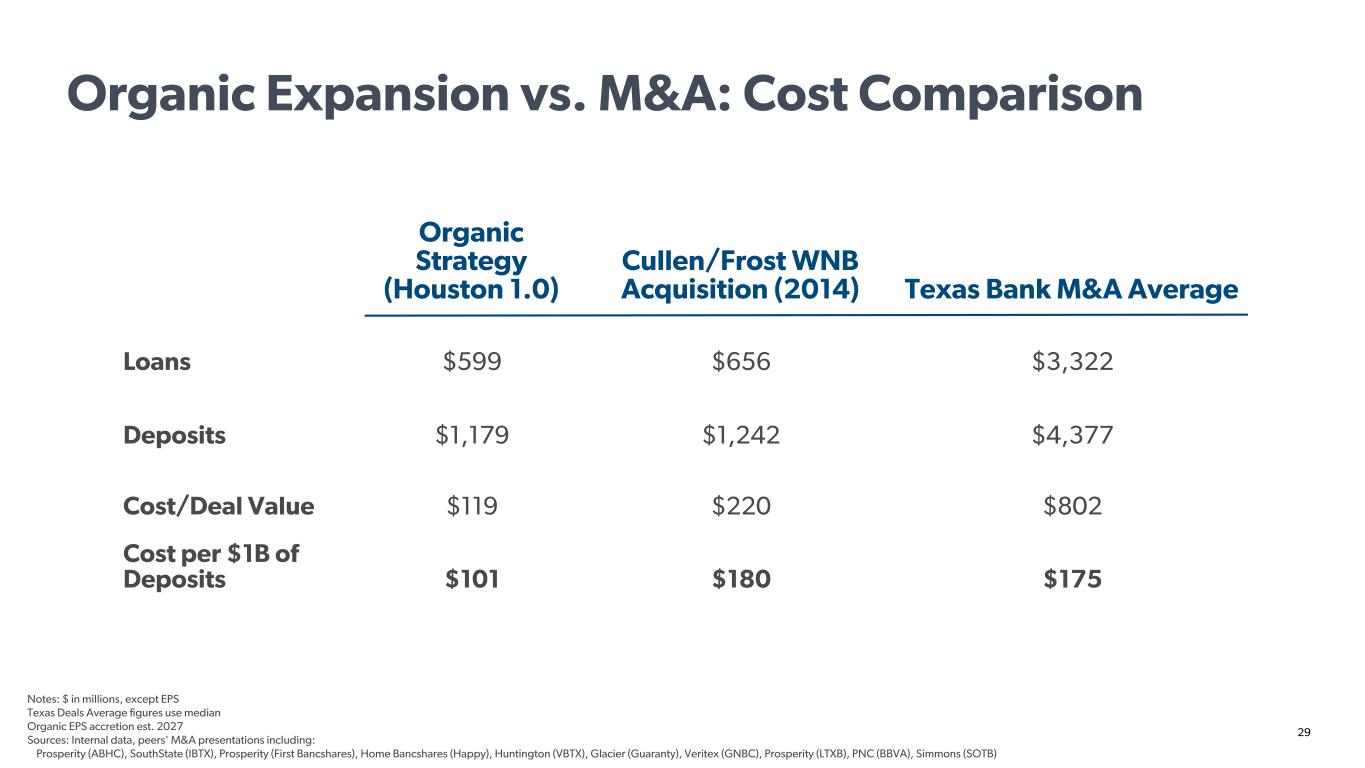

29 Organic Strategy (Houston 1.0) Cullen/Frost WNB Acquisition (2014) Texas Bank M&A Average Loans $599 $656 $3,322 Deposits $1,179 $1,242 $4,377 Cost/Deal Value $119 $220 $802 Cost per $1B of Deposits $101 $180 $175 Notes: $ in millions, except EPS Texas Deals Average figures use median Organic EPS accretion est. 2027 Sources: Internal data, peers' M&A presentations including: Prosperity (ABHC), SouthState (IBTX), Prosperity (First Bancshares), Home Bancshares (Happy), Huntington (VBTX), Glacier (Guaranty), Veritex (GNBC), Prosperity (LTXB), PNC (BBVA), Simmons (SOTB) Organic Expansion vs. M&A: Cost Comparison

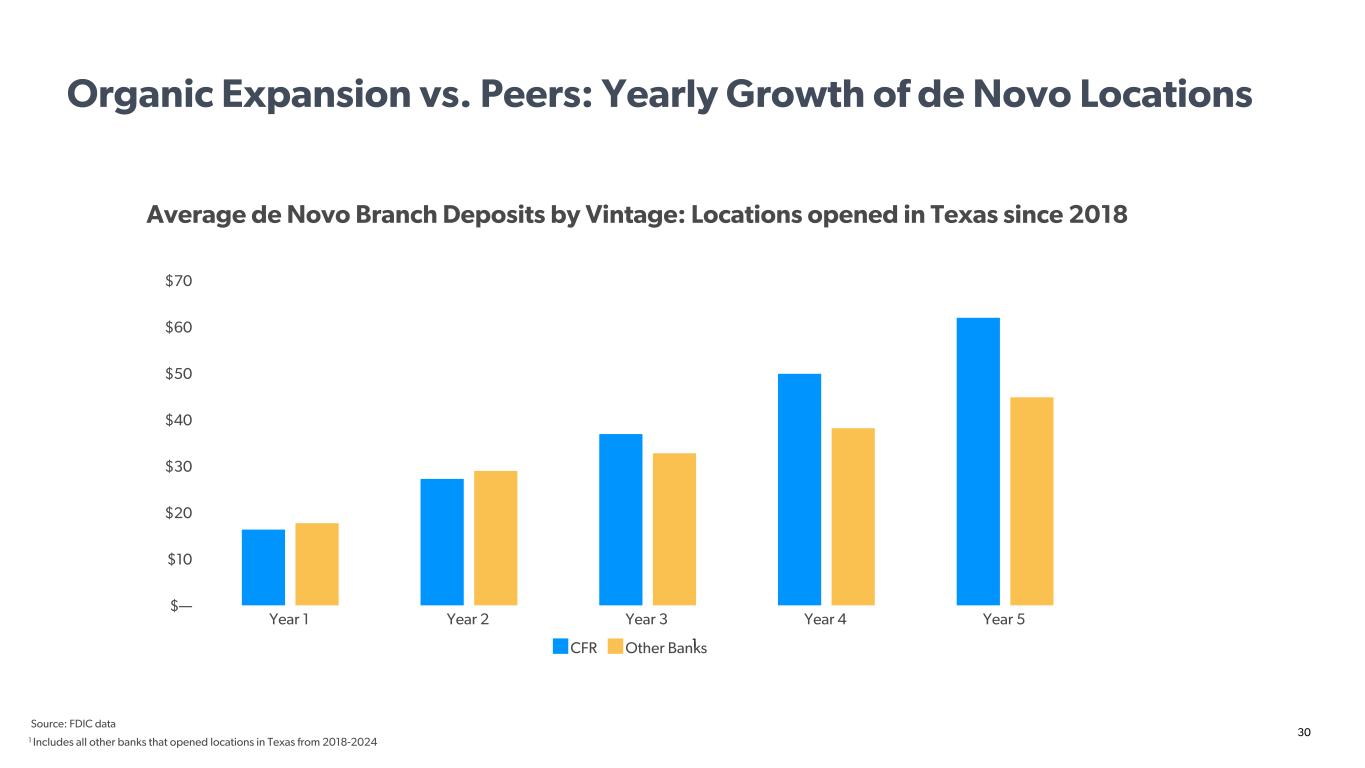

30 1 Includes all other banks that opened locations in Texas from 2018-2024 Average de Novo Branch Deposits by Vintage: Locations opened in Texas since 2018 CFR Other Banks Year 1 Year 2 Year 3 Year 4 Year 5 $— $10 $20 $30 $40 $50 $60 $70 Organic Expansion vs. Peers: Yearly Growth of de Novo Locations Source: FDIC data 1

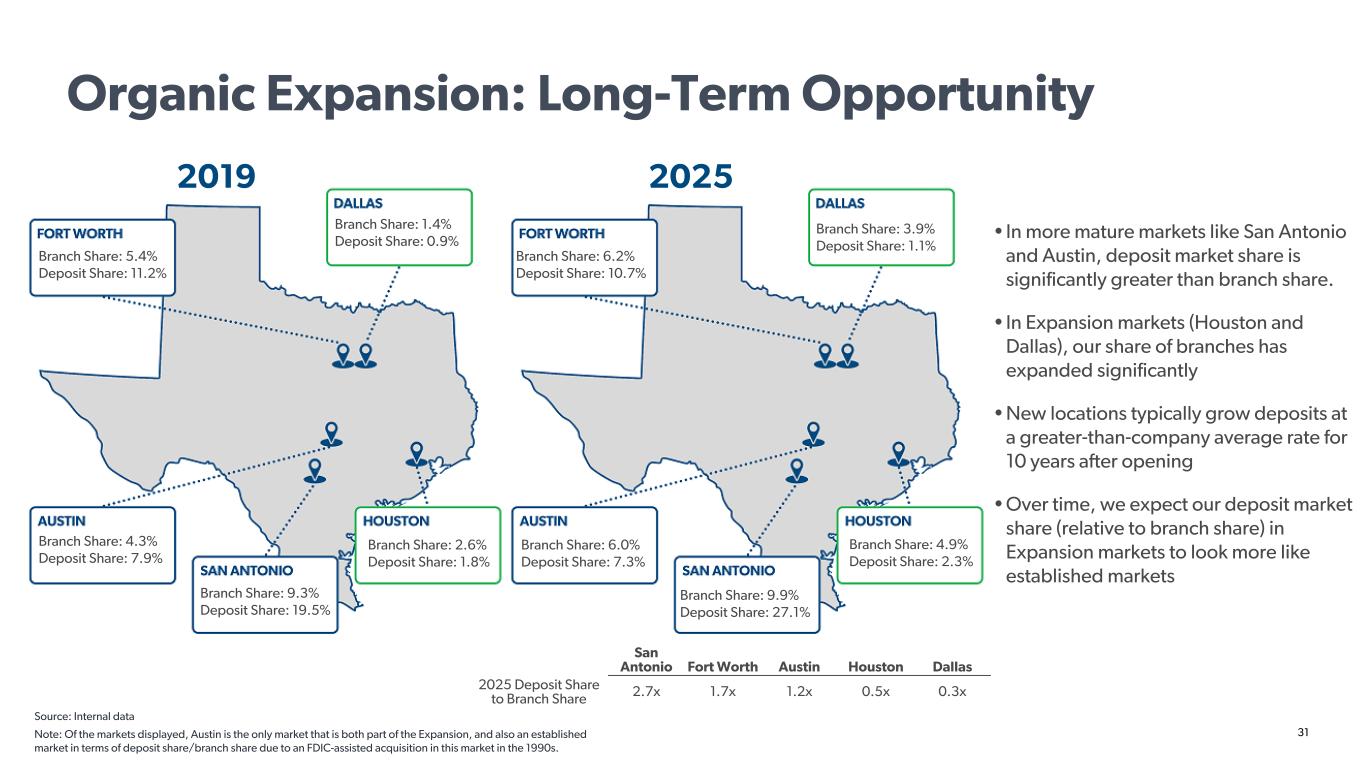

31 Source: Internal data Note: Of the markets displayed, Austin is the only market that is both part of the Expansion, and also an established market in terms of deposit share/branch share due to an FDIC-assisted acquisition in this market in the 1990s. Organic Expansion: Long-Term Opportunity San Antonio Fort Worth Austin Houston Dallas 2025 Deposit Share to Branch Share 2.7x 1.7x 1.2x 0.5x 0.3x 2019 2025 Branch Share: 6.0% Deposit Share: 7.3% Branch Share: 9.9% Deposit Share: 27.1% Branch Share: 1.4% Deposit Share: 0.9% Branch Share: 2.6% Deposit Share: 1.8% Branch Share: 9.3% Deposit Share: 19.5% Branch Share: 4.3% Deposit Share: 7.9% • In more mature markets like San Antonio and Austin, deposit market share is significantly greater than branch share. • In Expansion markets (Houston and Dallas), our share of branches has expanded significantly • New locations typically grow deposits at a greater-than-company average rate for 10 years after opening • Over time, we expect our deposit market share (relative to branch share) in Expansion markets to look more like established markets Branch Share: 5.4% Deposit Share: 11.2% Branch Share: 6.2% Deposit Share: 10.7% Branch Share: 3.9% Deposit Share: 1.1% Branch Share: 4.9% Deposit Share: 2.3%

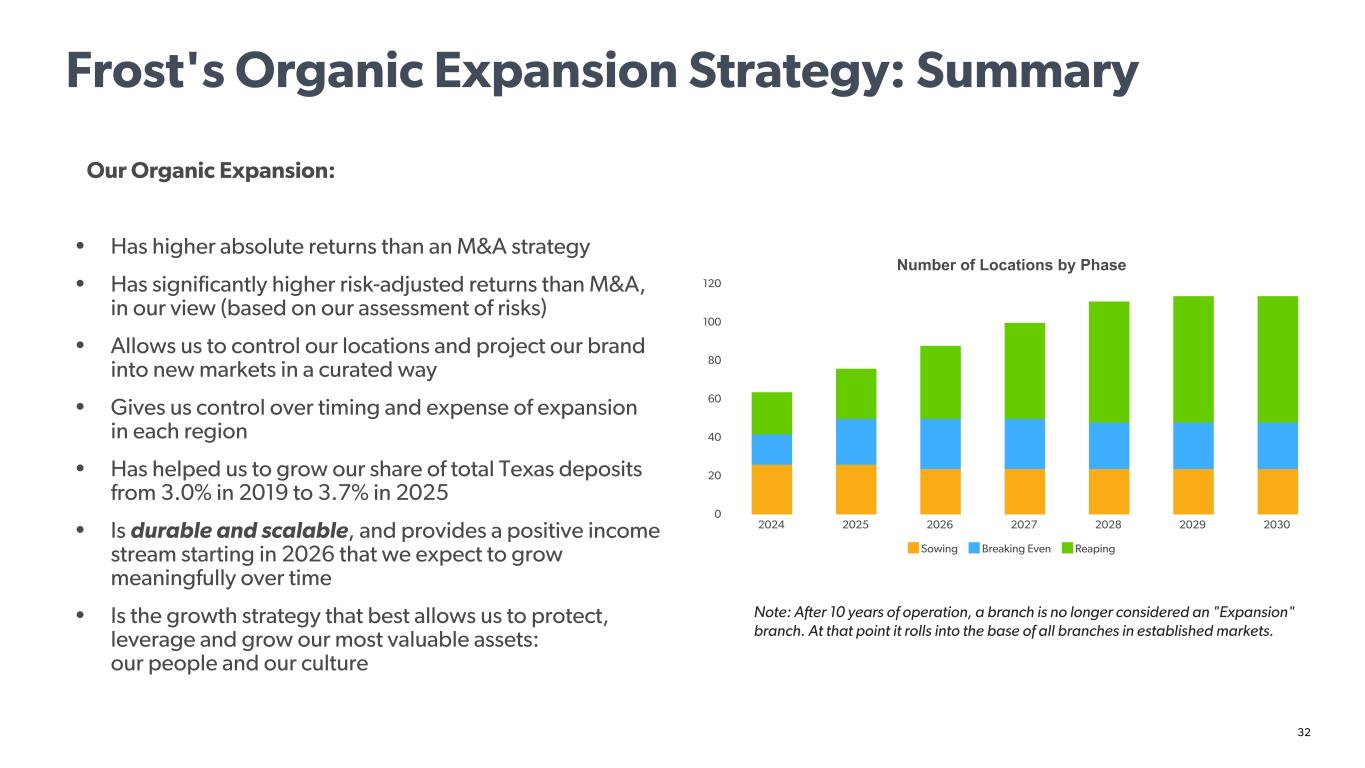

32 Our Organic Expansion: • Has higher absolute returns than an M&A strategy • Has significantly higher risk-adjusted returns than M&A, in our view (based on our assessment of risks) • Allows us to control our locations and project our brand into new markets in a curated way • Gives us control over timing and expense of expansion in each region • Has helped us to grow our share of total Texas deposits from 3.0% in 2019 to 3.7% in 2025 • Is durable and scalable, and provides a positive income stream starting in 2026 that we expect to grow meaningfully over time • Is the growth strategy that best allows us to protect, leverage and grow our most valuable assets: our people and our culture Number of Locations by Phase Sowing Breaking Even Reaping 2024 2025 2026 2027 2028 2029 2030 0 20 40 60 80 100 120 Frost's Organic Expansion Strategy: Summary Note: After 10 years of operation, a branch is no longer considered an "Expansion" branch. At that point it rolls into the base of all branches in established markets.