CNA Financial Corporation Supplemental Financial Information December 31, 2025 This report is for informational purposes only and includes consolidated financial statements and financial exhibits that are unaudited. This report should be read in conjunction with documents filed with the U.S. Securities and Exchange Commission, including the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q.

Table of Contents Consolidated Results Statements of Operations 1 Components of Income (Loss), Per Share Data and Return on Equity 2 Selected Balance Sheet Data and Statements of Cash Flows Data 3 Results of Operations Property & Casualty 4 Specialty 5 Commercial 6 International 7 Life & Group 8 Corporate & Other 9 Investment Information Investment Summary - Consolidated 10 Investment Summary - Property & Casualty and Corporate & Other 11 Investment Summary - Life & Group 12 Investments - Fixed Maturity Securities by Credit Rating 13 Components of Net Investment Income 14 Net Investment Gains (Losses) 15 Other Claim & Claim Adjustment Expense Reserve Rollforward 16 Life & Group Policyholder Reserves 17 Definitions and Presentation 18 Page

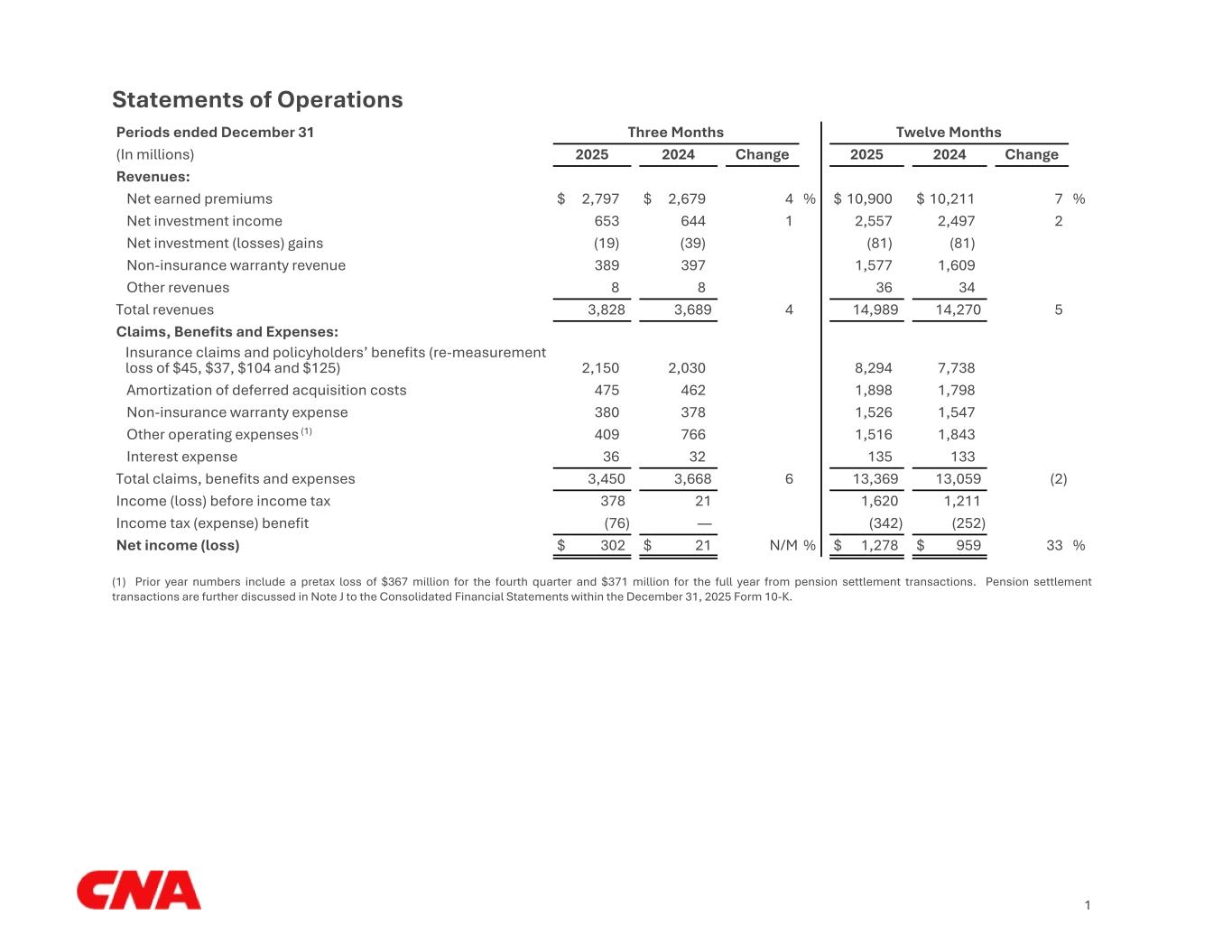

Statements of Operations Periods ended December 31 Three Months Twelve Months (In millions) 2025 2024 Change 2025 2024 Change Revenues: Net earned premiums $ 2,797 $ 2,679 4 % $ 10,900 $ 10,211 7 % Net investment income 653 644 1 2,557 2,497 2 Net investment (losses) gains (19) (39) (81) (81) Non-insurance warranty revenue 389 397 1,577 1,609 Other revenues 8 8 36 34 Total revenues 3,828 3,689 4 14,989 14,270 5 Claims, Benefits and Expenses: Insurance claims and policyholders’ benefits (re-measurement loss of $45, $37, $104 and $125) 2,150 2,030 8,294 7,738 Amortization of deferred acquisition costs 475 462 1,898 1,798 Non-insurance warranty expense 380 378 1,526 1,547 Other operating expenses (1) 409 766 1,516 1,843 Interest expense 36 32 135 133 Total claims, benefits and expenses 3,450 3,668 6 13,369 13,059 (2) Income (loss) before income tax 378 21 1,620 1,211 Income tax (expense) benefit (76) — (342) (252) Net income (loss) $ 302 $ 21 N/M % $ 1,278 $ 959 33 % (1) Prior year numbers include a pretax loss of $367 million for the fourth quarter and $371 million for the full year from pension settlement transactions. Pension settlement transactions are further discussed in Note J to the Consolidated Financial Statements within the December 31, 2025 Form 10-K. 1

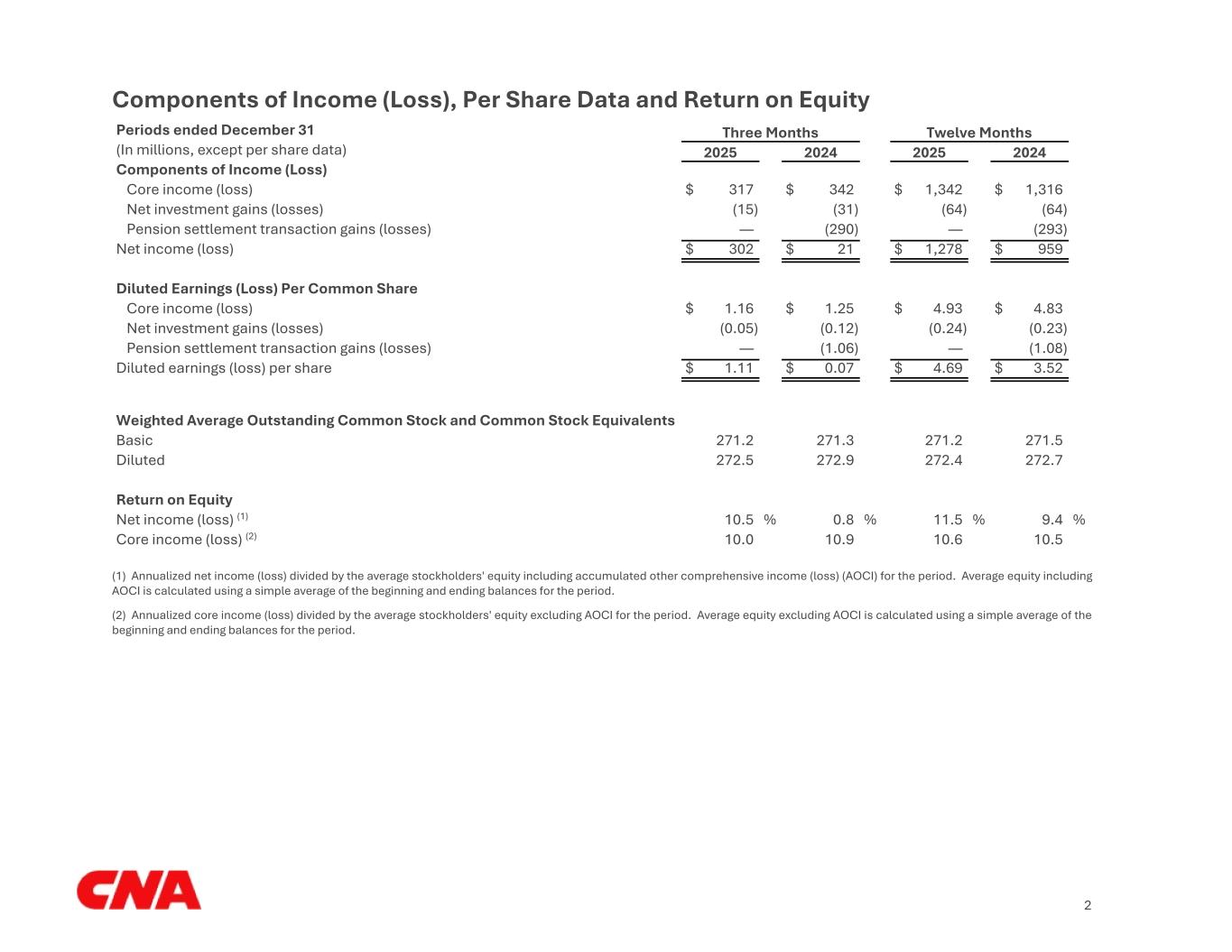

Components of Income (Loss), Per Share Data and Return on Equity Periods ended December 31 Three Months Twelve Months (In millions, except per share data) 2025 2024 2025 2024 Components of Income (Loss) Core income (loss) $ 317 $ 342 $ 1,342 $ 1,316 Net investment gains (losses) (15) (31) (64) (64) Pension settlement transaction gains (losses) — (290) — (293) Net income (loss) $ 302 $ 21 $ 1,278 $ 959 Diluted Earnings (Loss) Per Common Share Core income (loss) $ 1.16 $ 1.25 $ 4.93 $ 4.83 Net investment gains (losses) (0.05) (0.12) (0.24) (0.23) Pension settlement transaction gains (losses) — (1.06) — (1.08) Diluted earnings (loss) per share $ 1.11 $ 0.07 $ 4.69 $ 3.52 Weighted Average Outstanding Common Stock and Common Stock Equivalents Basic 271.2 271.3 271.2 271.5 Diluted 272.5 272.9 272.4 272.7 Return on Equity Net income (loss) (1) 10.5 % 0.8 % 11.5 % 9.4 % Core income (loss) (2) 10.0 10.9 10.6 10.5 (1) Annualized net income (loss) divided by the average stockholders' equity including accumulated other comprehensive income (loss) (AOCI) for the period. Average equity including AOCI is calculated using a simple average of the beginning and ending balances for the period. (2) Annualized core income (loss) divided by the average stockholders' equity excluding AOCI for the period. Average equity excluding AOCI is calculated using a simple average of the beginning and ending balances for the period. 2

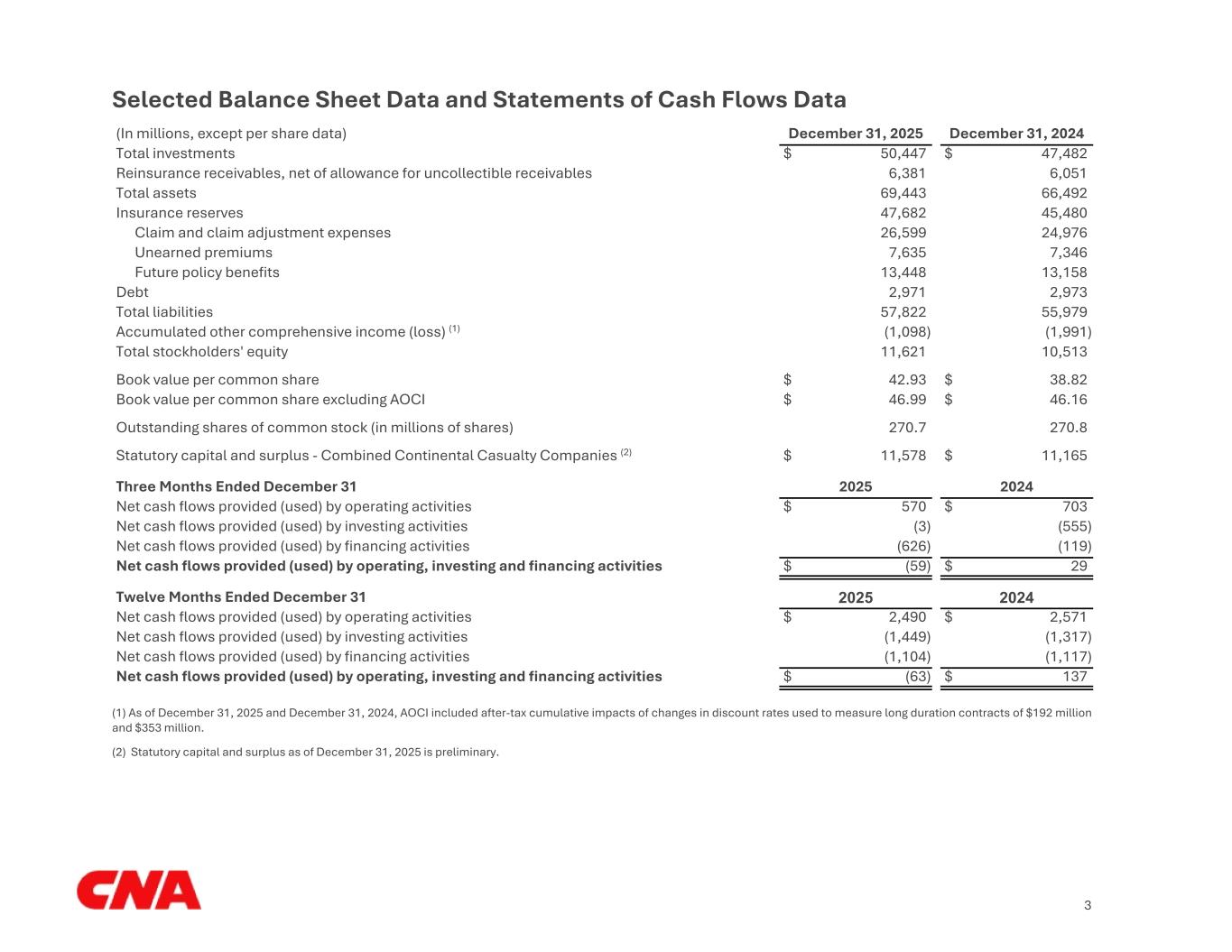

Selected Balance Sheet Data and Statements of Cash Flows Data (In millions, except per share data) December 31, 2025 December 31, 2024 Total investments $ 50,447 $ 47,482 Reinsurance receivables, net of allowance for uncollectible receivables 6,381 6,051 Total assets 69,443 66,492 Insurance reserves 47,682 45,480 Claim and claim adjustment expenses 26,599 24,976 Unearned premiums 7,635 7,346 Future policy benefits 13,448 13,158 Debt 2,971 2,973 Total liabilities 57,822 55,979 Accumulated other comprehensive income (loss) (1) (1,098) (1,991) Total stockholders' equity 11,621 10,513 Book value per common share $ 42.93 $ 38.82 Book value per common share excluding AOCI $ 46.99 $ 46.16 Outstanding shares of common stock (in millions of shares) 270.7 270.8 Statutory capital and surplus - Combined Continental Casualty Companies (2) $ 11,578 $ 11,165 Three Months Ended December 31 2025 2024 Net cash flows provided (used) by operating activities $ 570 $ 703 Net cash flows provided (used) by investing activities (3) (555) Net cash flows provided (used) by financing activities (626) (119) Net cash flows provided (used) by operating, investing and financing activities $ (59) $ 29 Twelve Months Ended December 31 2025 2024 Net cash flows provided (used) by operating activities $ 2,490 $ 2,571 Net cash flows provided (used) by investing activities (1,449) (1,317) Net cash flows provided (used) by financing activities (1,104) (1,117) Net cash flows provided (used) by operating, investing and financing activities $ (63) $ 137 (1) As of December 31, 2025 and December 31, 2024, AOCI included after-tax cumulative impacts of changes in discount rates used to measure long duration contracts of $192 million and $353 million. (2) Statutory capital and surplus as of December 31, 2025 is preliminary. 3

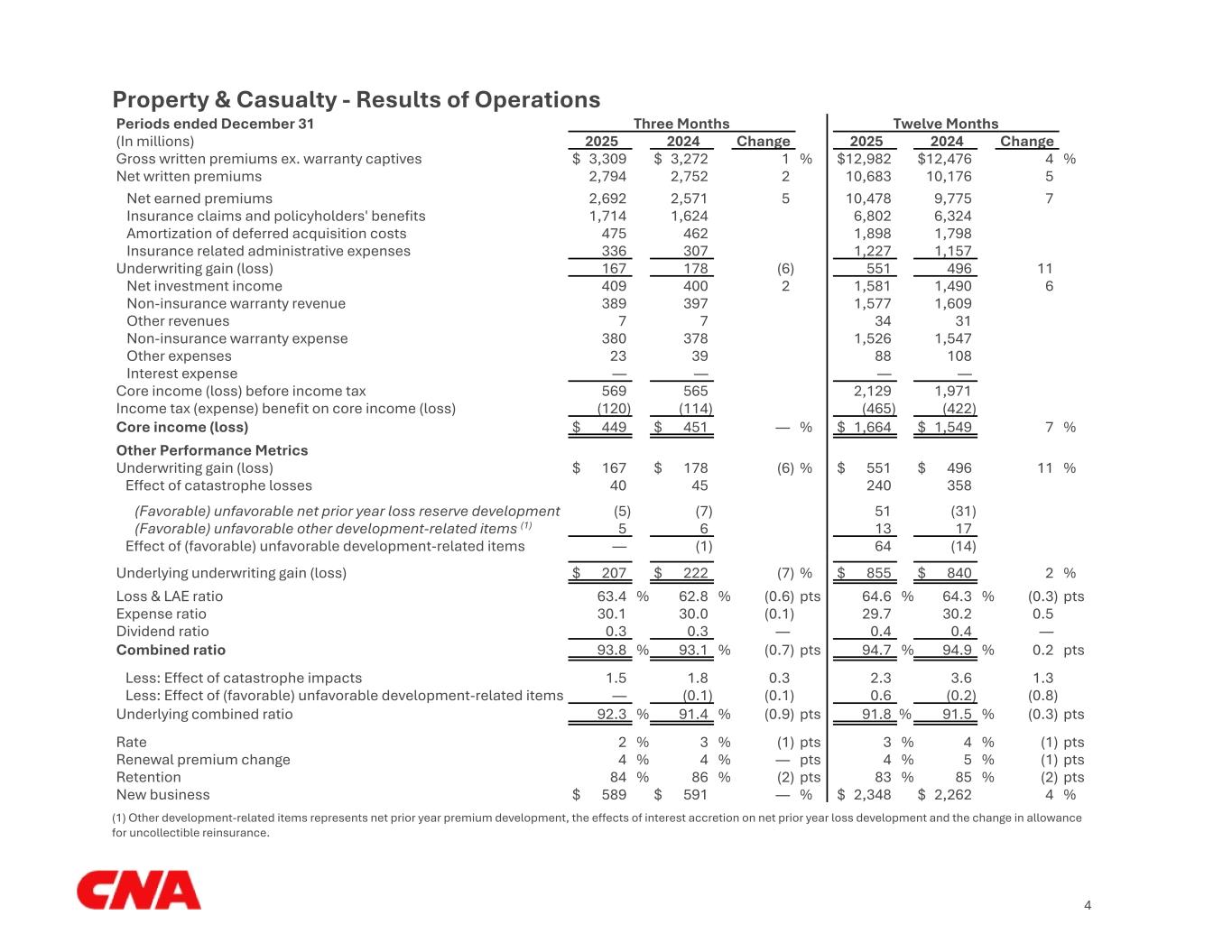

Property & Casualty - Results of Operations Periods ended December 31 Three Months Twelve Months (In millions) 2025 2024 Change 2025 2024 Change Gross written premiums ex. warranty captives $ 3,309 $ 3,272 1 % $ 12,982 $ 12,476 4 % Net written premiums 2,794 2,752 2 10,683 10,176 5 Net earned premiums 2,692 2,571 5 10,478 9,775 7 Insurance claims and policyholders' benefits 1,714 1,624 6,802 6,324 Amortization of deferred acquisition costs 475 462 1,898 1,798 Insurance related administrative expenses 336 307 1,227 1,157 Underwriting gain (loss) 167 178 (6) 551 496 11 Net investment income 409 400 2 1,581 1,490 6 Non-insurance warranty revenue 389 397 1,577 1,609 Other revenues 7 7 34 31 Non-insurance warranty expense 380 378 1,526 1,547 Other expenses 23 39 88 108 Interest expense — — — — Core income (loss) before income tax 569 565 2,129 1,971 Income tax (expense) benefit on core income (loss) (120) (114) (465) (422) Core income (loss) $ 449 $ 451 — % $ 1,664 $ 1,549 7 % Other Performance Metrics Underwriting gain (loss) $ 167 $ 178 (6) % $ 551 $ 496 11 % Effect of catastrophe losses 40 45 240 358 (Favorable) unfavorable net prior year loss reserve development (5) (7) 51 (31) (Favorable) unfavorable other development-related items (1) 5 6 13 17 Effect of (favorable) unfavorable development-related items — (1) 64 (14) Underlying underwriting gain (loss) $ 207 $ 222 (7) % $ 855 $ 840 2 % Loss & LAE ratio 63.4 % 62.8 % (0.6) pts 64.6 % 64.3 % (0.3) pts Expense ratio 30.1 30.0 (0.1) 29.7 30.2 0.5 Dividend ratio 0.3 0.3 — 0.4 0.4 — Combined ratio 93.8 % 93.1 % (0.7) pts 94.7 % 94.9 % 0.2 pts Less: Effect of catastrophe impacts 1.5 1.8 0.3 2.3 3.6 1.3 Less: Effect of (favorable) unfavorable development-related items — (0.1) (0.1) 0.6 (0.2) (0.8) Underlying combined ratio 92.3 % 91.4 % (0.9) pts 91.8 % 91.5 % (0.3) pts Rate 2 % 3 % (1) pts 3 % 4 % (1) pts Renewal premium change 4 % 4 % — pts 4 % 5 % (1) pts Retention 84 % 86 % (2) pts 83 % 85 % (2) pts New business $ 589 $ 591 — % $ 2,348 $ 2,262 4 % (1) Other development-related items represents net prior year premium development, the effects of interest accretion on net prior year loss development and the change in allowance for uncollectible reinsurance. 4

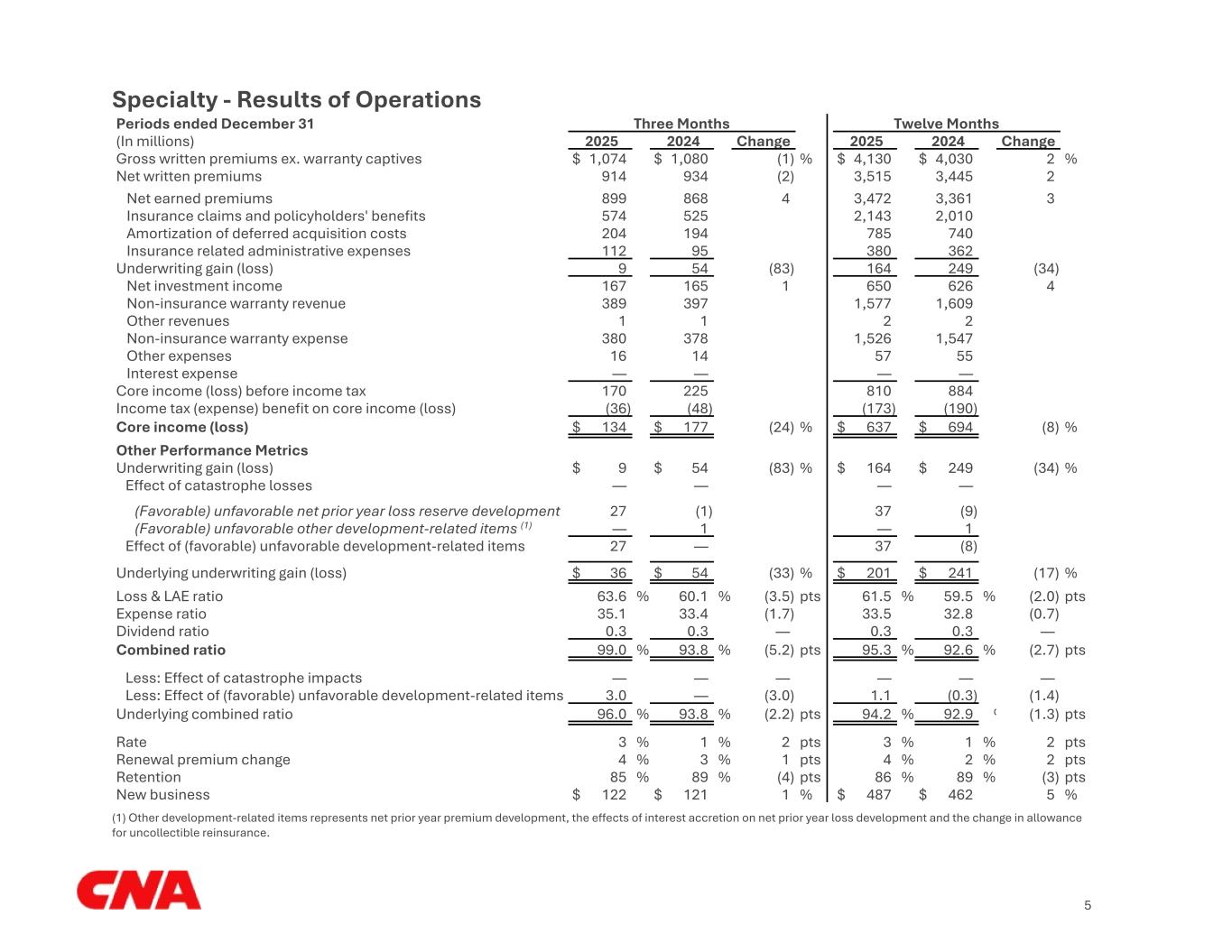

Specialty - Results of Operations Periods ended December 31 Three Months Twelve Months (In millions) 2025 2024 Change 2025 2024 Change Gross written premiums ex. warranty captives $ 1,074 $ 1,080 (1) % $ 4,130 $ 4,030 2 % Net written premiums 914 934 (2) 3,515 3,445 2 Net earned premiums 899 868 4 3,472 3,361 3 Insurance claims and policyholders' benefits 574 525 2,143 2,010 Amortization of deferred acquisition costs 204 194 785 740 Insurance related administrative expenses 112 95 380 362 Underwriting gain (loss) 9 54 (83) 164 249 (34) Net investment income 167 165 1 650 626 4 Non-insurance warranty revenue 389 397 1,577 1,609 Other revenues 1 1 2 2 Non-insurance warranty expense 380 378 1,526 1,547 Other expenses 16 14 57 55 Interest expense — — — — Core income (loss) before income tax 170 225 810 884 Income tax (expense) benefit on core income (loss) (36) (48) (173) (190) Core income (loss) $ 134 $ 177 (24) % $ 637 $ 694 (8) % Other Performance Metrics Underwriting gain (loss) $ 9 $ 54 (83) % $ 164 $ 249 (34) % Effect of catastrophe losses — — — — (Favorable) unfavorable net prior year loss reserve development 27 (1) 37 (9) (Favorable) unfavorable other development-related items (1) — 1 — 1 Effect of (favorable) unfavorable development-related items 27 — 37 (8) Underlying underwriting gain (loss) $ 36 $ 54 (33) % $ 201 $ 241 (17) % Loss & LAE ratio 63.6 % 60.1 % (3.5) pts 61.5 % 59.5 % (2.0) pts Expense ratio 35.1 33.4 (1.7) 33.5 32.8 (0.7) Dividend ratio 0.3 0.3 — 0.3 0.3 — Combined ratio 99.0 % 93.8 % (5.2) pts 95.3 % 92.6 % (2.7) pts Less: Effect of catastrophe impacts — — — — — — Less: Effect of (favorable) unfavorable development-related items 3.0 — (3.0) 1.1 (0.3) (1.4) Underlying combined ratio 96.0 % 93.8 % (2.2) pts 94.2 % 92.9 % (1.3) pts Rate 3 % 1 % 2 pts 3 % 1 % 2 pts Renewal premium change 4 % 3 % 1 pts 4 % 2 % 2 pts Retention 85 % 89 % (4) pts 86 % 89 % (3) pts New business $ 122 $ 121 1 % $ 487 $ 462 5 % (1) Other development-related items represents net prior year premium development, the effects of interest accretion on net prior year loss development and the change in allowance for uncollectible reinsurance. 5

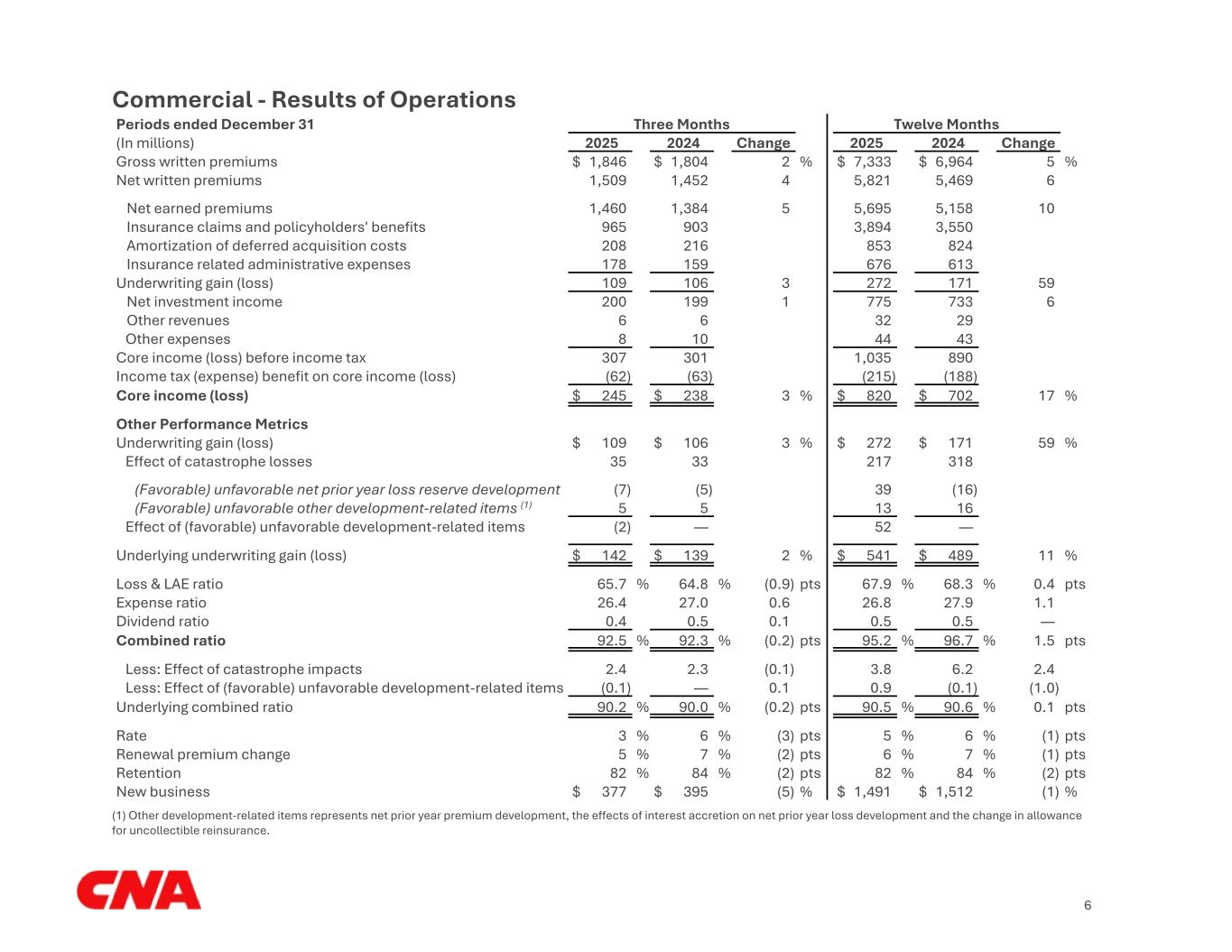

Commercial - Results of Operations Periods ended December 31 Three Months Twelve Months (In millions) 2025 2024 Change 2025 2024 Change Gross written premiums $ 1,846 $ 1,804 2 % $ 7,333 $ 6,964 5 % Net written premiums 1,509 1,452 4 5,821 5,469 6 Net earned premiums 1,460 1,384 5 5,695 5,158 10 Insurance claims and policyholders' benefits 965 903 3,894 3,550 Amortization of deferred acquisition costs 208 216 853 824 Insurance related administrative expenses 178 159 676 613 Underwriting gain (loss) 109 106 3 272 171 59 Net investment income 200 199 1 775 733 6 Other revenues 6 6 32 29 Other expenses 8 10 44 43 Core income (loss) before income tax 307 301 1,035 890 Income tax (expense) benefit on core income (loss) (62) (63) (215) (188) Core income (loss) $ 245 $ 238 3 % $ 820 $ 702 17 % Other Performance Metrics Underwriting gain (loss) $ 109 $ 106 3 % $ 272 $ 171 59 % Effect of catastrophe losses 35 33 217 318 (Favorable) unfavorable net prior year loss reserve development (7) (5) 39 (16) (Favorable) unfavorable other development-related items (1) 5 5 13 16 Effect of (favorable) unfavorable development-related items (2) — 52 — Underlying underwriting gain (loss) $ 142 $ 139 2 % $ 541 $ 489 11 % Loss & LAE ratio 65.7 % 64.8 % (0.9) pts 67.9 % 68.3 % 0.4 pts Expense ratio 26.4 27.0 0.6 26.8 27.9 1.1 Dividend ratio 0.4 0.5 0.1 0.5 0.5 — Combined ratio 92.5 % 92.3 % (0.2) pts 95.2 % 96.7 % 1.5 pts Less: Effect of catastrophe impacts 2.4 2.3 (0.1) 3.8 6.2 2.4 Less: Effect of (favorable) unfavorable development-related items (0.1) — 0.1 0.9 (0.1) (1.0) Underlying combined ratio 90.2 % 90.0 % (0.2) pts 90.5 % 90.6 % 0.1 pts Rate 3 % 6 % (3) pts 5 % 6 % (1) pts Renewal premium change 5 % 7 % (2) pts 6 % 7 % (1) pts Retention 82 % 84 % (2) pts 82 % 84 % (2) pts New business $ 377 $ 395 (5) % $ 1,491 $ 1,512 (1) % (1) Other development-related items represents net prior year premium development, the effects of interest accretion on net prior year loss development and the change in allowance for uncollectible reinsurance. 6

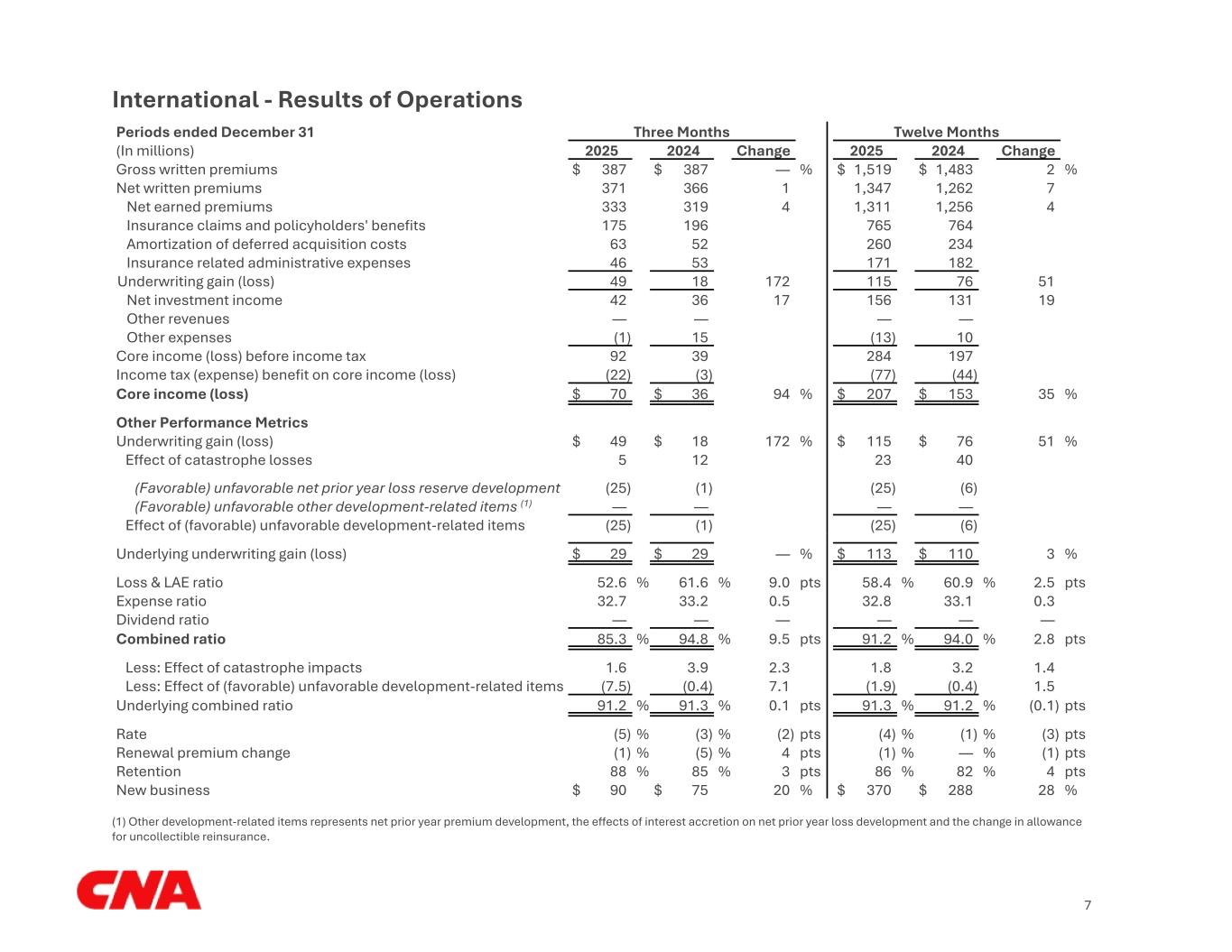

International - Results of Operations Periods ended December 31 Three Months Twelve Months (In millions) 2025 2024 Change 2025 2024 Change Gross written premiums $ 387 $ 387 — % $ 1,519 $ 1,483 2 % Net written premiums 371 366 1 1,347 1,262 7 Net earned premiums 333 319 4 1,311 1,256 4 Insurance claims and policyholders' benefits 175 196 765 764 Amortization of deferred acquisition costs 63 52 260 234 Insurance related administrative expenses 46 53 171 182 Underwriting gain (loss) 49 18 172 115 76 51 Net investment income 42 36 17 156 131 19 Other revenues — — — — Other expenses (1) 15 (13) 10 Core income (loss) before income tax 92 39 284 197 Income tax (expense) benefit on core income (loss) (22) (3) (77) (44) Core income (loss) $ 70 $ 36 94 % $ 207 $ 153 35 % Other Performance Metrics Underwriting gain (loss) $ 49 $ 18 172 % $ 115 $ 76 51 % Effect of catastrophe losses 5 12 23 40 (Favorable) unfavorable net prior year loss reserve development (25) (1) (25) (6) (Favorable) unfavorable other development-related items (1) — — — — Effect of (favorable) unfavorable development-related items (25) (1) (25) (6) Underlying underwriting gain (loss) $ 29 $ 29 — % $ 113 $ 110 3 % Loss & LAE ratio 52.6 % 61.6 % 9.0 pts 58.4 % 60.9 % 2.5 pts Expense ratio 32.7 33.2 0.5 32.8 33.1 0.3 Dividend ratio — — — — — — Combined ratio 85.3 % 94.8 % 9.5 pts 91.2 % 94.0 % 2.8 pts Less: Effect of catastrophe impacts 1.6 3.9 2.3 1.8 3.2 1.4 Less: Effect of (favorable) unfavorable development-related items (7.5) (0.4) 7.1 (1.9) (0.4) 1.5 Underlying combined ratio 91.2 % 91.3 % 0.1 pts 91.3 % 91.2 % (0.1) pts Rate (5) % (3) % (2) pts (4) % (1) % (3) pts Renewal premium change (1) % (5) % 4 pts (1) % — % (1) pts Retention 88 % 85 % 3 pts 86 % 82 % 4 pts New business $ 90 $ 75 20 % $ 370 $ 288 28 % (1) Other development-related items represents net prior year premium development, the effects of interest accretion on net prior year loss development and the change in allowance for uncollectible reinsurance. 7

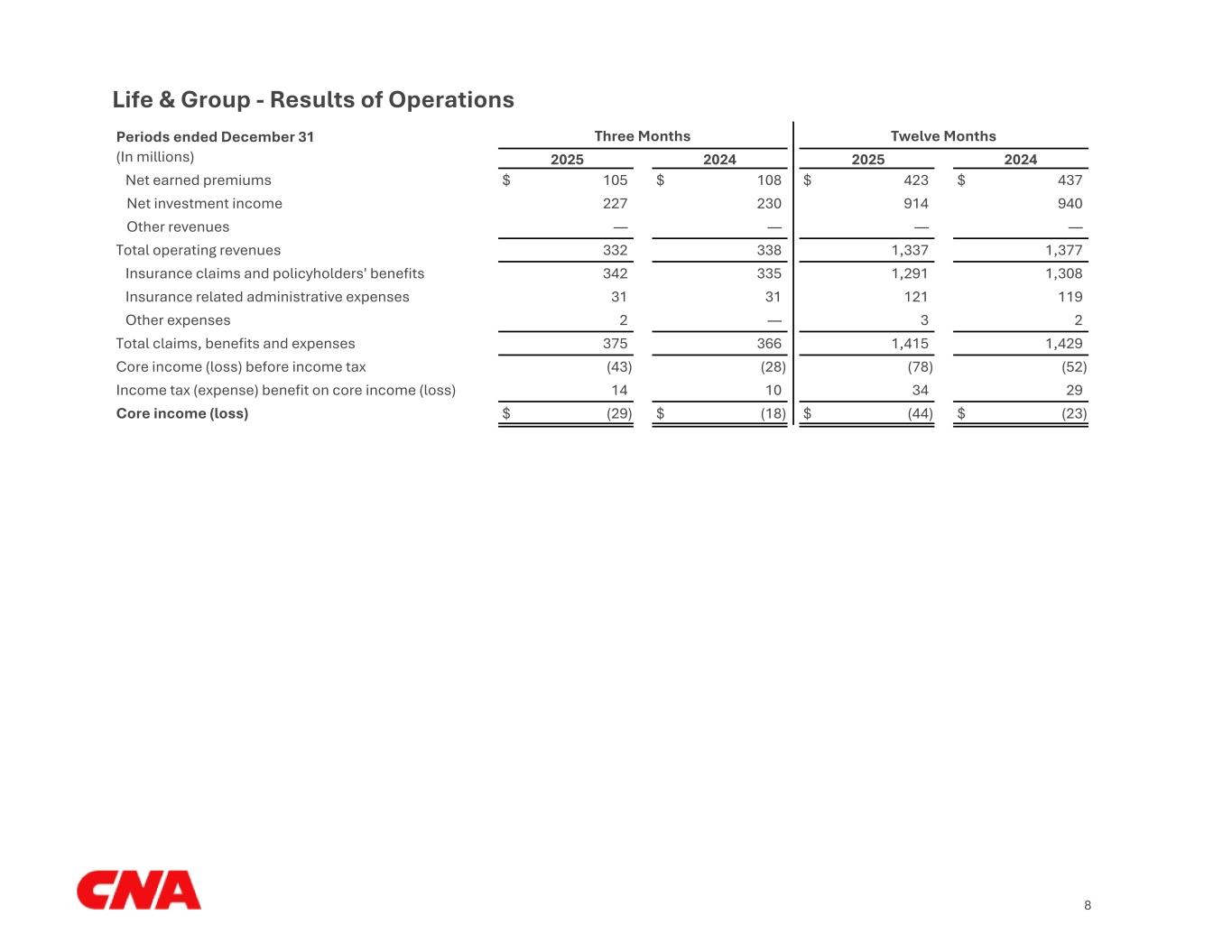

Life & Group - Results of Operations Periods ended December 31 Three Months Twelve Months (In millions) 2025 2024 2025 2024 Net earned premiums $ 105 $ 108 $ 423 $ 437 Net investment income 227 230 914 940 Other revenues — — — — Total operating revenues 332 338 1,337 1,377 Insurance claims and policyholders' benefits 342 335 1,291 1,308 Insurance related administrative expenses 31 31 121 119 Other expenses 2 — 3 2 Total claims, benefits and expenses 375 366 1,415 1,429 Core income (loss) before income tax (43) (28) (78) (52) Income tax (expense) benefit on core income (loss) 14 10 34 29 Core income (loss) $ (29) $ (18) $ (44) $ (23) 8

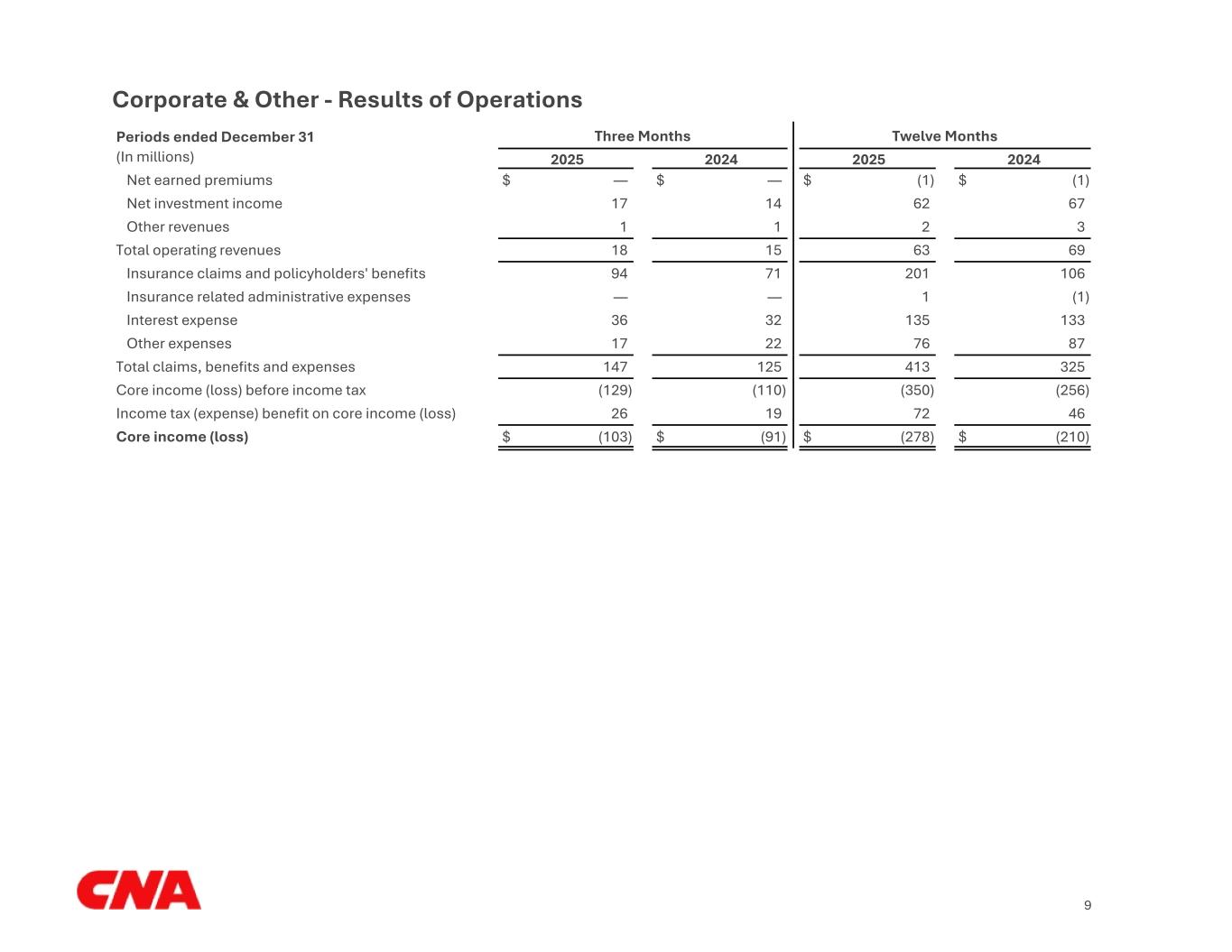

Corporate & Other - Results of Operations Periods ended December 31 Three Months Twelve Months (In millions) 2025 2024 2025 2024 Net earned premiums $ — $ — $ (1) $ (1) Net investment income 17 14 62 67 Other revenues 1 1 2 3 Total operating revenues 18 15 63 69 Insurance claims and policyholders' benefits 94 71 201 106 Insurance related administrative expenses — — 1 (1) Interest expense 36 32 135 133 Other expenses 17 22 76 87 Total claims, benefits and expenses 147 125 413 325 Core income (loss) before income tax (129) (110) (350) (256) Income tax (expense) benefit on core income (loss) 26 19 72 46 Core income (loss) $ (103) $ (91) $ (278) $ (210) 9

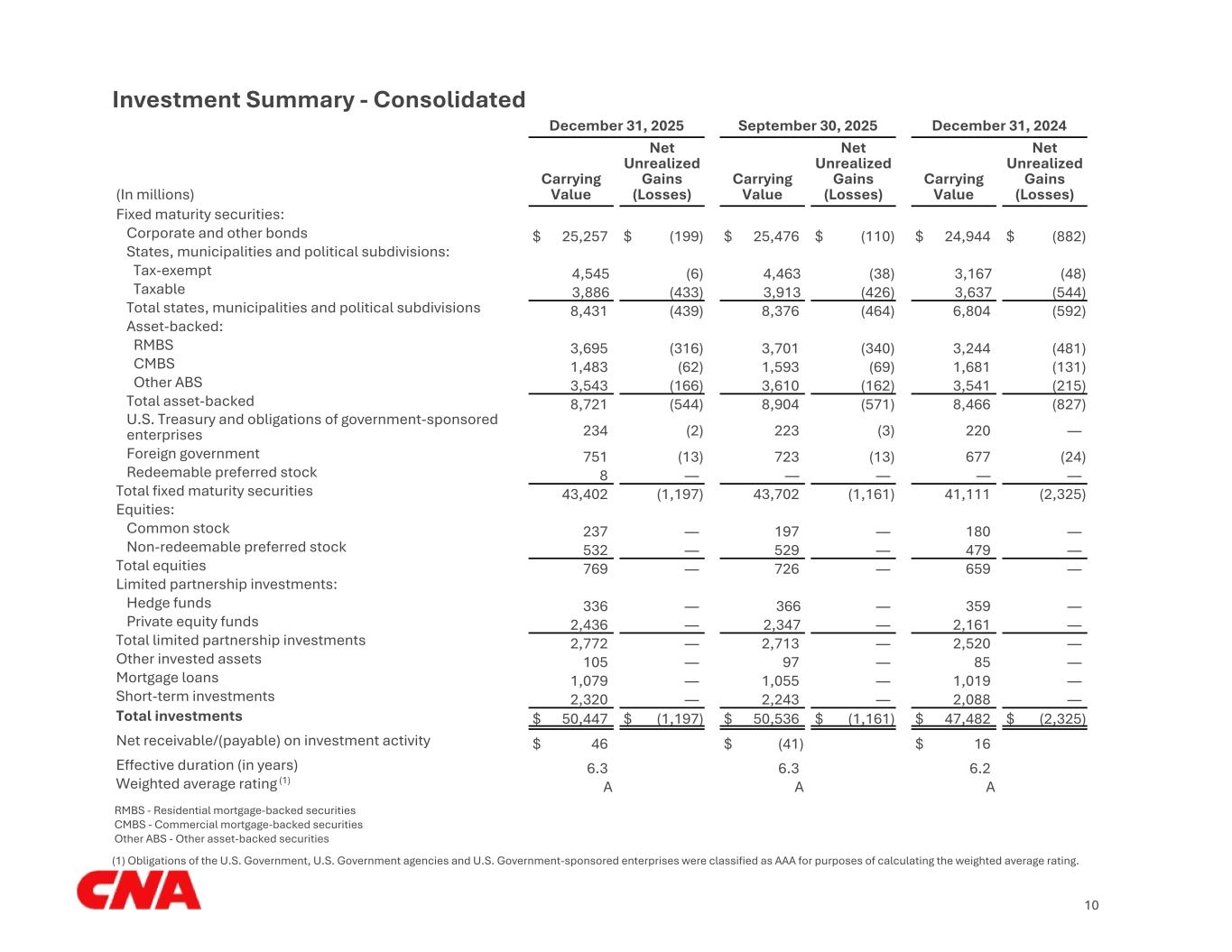

Investment Summary - Consolidated December 31, 2025 September 30, 2025 December 31, 2024 (In millions) Carrying Value Net Unrealized Gains (Losses) Carrying Value Net Unrealized Gains (Losses) Carrying Value Net Unrealized Gains (Losses) Fixed maturity securities: Corporate and other bonds $ 25,257 $ (199) $ 25,476 $ (110) $ 24,944 $ (882) States, municipalities and political subdivisions: Tax-exempt 4,545 (6) 4,463 (38) 3,167 (48) Taxable 3,886 (433) 3,913 (426) 3,637 (544) Total states, municipalities and political subdivisions 8,431 (439) 8,376 (464) 6,804 (592) Asset-backed: RMBS 3,695 (316) 3,701 (340) 3,244 (481) CMBS 1,483 (62) 1,593 (69) 1,681 (131) Other ABS 3,543 (166) 3,610 (162) 3,541 (215) Total asset-backed 8,721 (544) 8,904 (571) 8,466 (827) U.S. Treasury and obligations of government-sponsored enterprises 234 (2) 223 (3) 220 — Foreign government 751 (13) 723 (13) 677 (24) Redeemable preferred stock 8 — — — — — Total fixed maturity securities 43,402 (1,197) 43,702 (1,161) 41,111 (2,325) Equities: Common stock 237 — 197 — 180 — Non-redeemable preferred stock 532 — 529 — 479 — Total equities 769 — 726 — 659 — Limited partnership investments: Hedge funds 336 — 366 — 359 — Private equity funds 2,436 — 2,347 — 2,161 — Total limited partnership investments 2,772 — 2,713 — 2,520 — Other invested assets 105 — 97 — 85 — Mortgage loans 1,079 — 1,055 — 1,019 — Short-term investments 2,320 — 2,243 — 2,088 — Total investments $ 50,447 $ (1,197) $ 50,536 $ (1,161) $ 47,482 $ (2,325) Net receivable/(payable) on investment activity $ 46 $ (41) $ 16 Effective duration (in years) 6.3 6.3 6.2 Weighted average rating (1) A A A RMBS - Residential mortgage-backed securities CMBS - Commercial mortgage-backed securities Other ABS - Other asset-backed securities (1) Obligations of the U.S. Government, U.S. Government agencies and U.S. Government-sponsored enterprises were classified as AAA for purposes of calculating the weighted average rating. 10

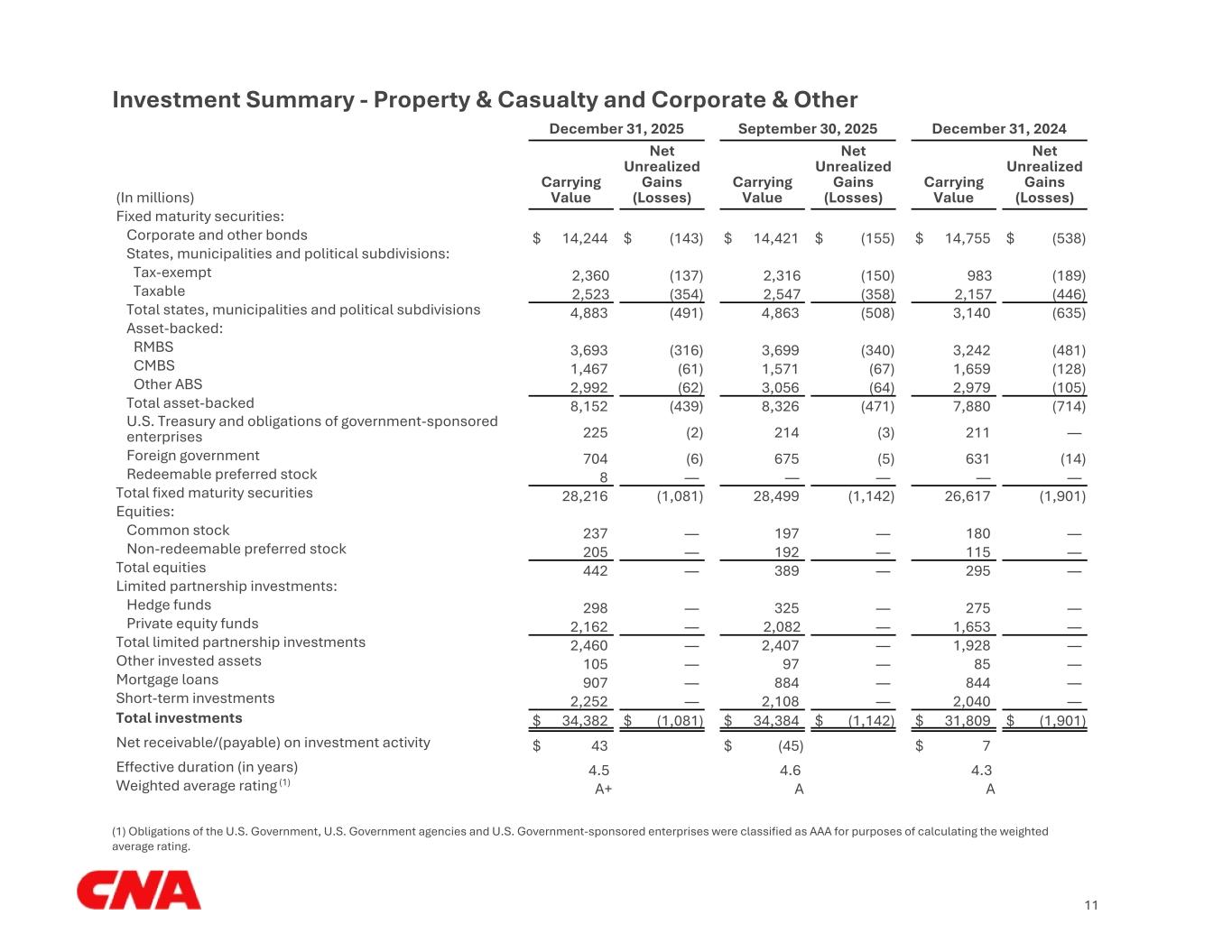

Investment Summary - Property & Casualty and Corporate & Other December 31, 2025 September 30, 2025 December 31, 2024 (In millions) Carrying Value Net Unrealized Gains (Losses) Carrying Value Net Unrealized Gains (Losses) Carrying Value Net Unrealized Gains (Losses) Fixed maturity securities: Corporate and other bonds $ 14,244 $ (143) $ 14,421 $ (155) $ 14,755 $ (538) States, municipalities and political subdivisions: Tax-exempt 2,360 (137) 2,316 (150) 983 (189) Taxable 2,523 (354) 2,547 (358) 2,157 (446) Total states, municipalities and political subdivisions 4,883 (491) 4,863 (508) 3,140 (635) Asset-backed: RMBS 3,693 (316) 3,699 (340) 3,242 (481) CMBS 1,467 (61) 1,571 (67) 1,659 (128) Other ABS 2,992 (62) 3,056 (64) 2,979 (105) Total asset-backed 8,152 (439) 8,326 (471) 7,880 (714) U.S. Treasury and obligations of government-sponsored enterprises 225 (2) 214 (3) 211 — Foreign government 704 (6) 675 (5) 631 (14) Redeemable preferred stock 8 — — — — — Total fixed maturity securities 28,216 (1,081) 28,499 (1,142) 26,617 (1,901) Equities: Common stock 237 — 197 — 180 — Non-redeemable preferred stock 205 — 192 — 115 — Total equities 442 — 389 — 295 — Limited partnership investments: Hedge funds 298 — 325 — 275 — Private equity funds 2,162 — 2,082 — 1,653 — Total limited partnership investments 2,460 — 2,407 — 1,928 — Other invested assets 105 — 97 — 85 — Mortgage loans 907 — 884 — 844 — Short-term investments 2,252 — 2,108 — 2,040 — Total investments $ 34,382 $ (1,081) $ 34,384 $ (1,142) $ 31,809 $ (1,901) Net receivable/(payable) on investment activity $ 43 $ (45) $ 7 Effective duration (in years) 4.5 4.6 4.3 Weighted average rating (1) A+ A A (1) Obligations of the U.S. Government, U.S. Government agencies and U.S. Government-sponsored enterprises were classified as AAA for purposes of calculating the weighted average rating. 11

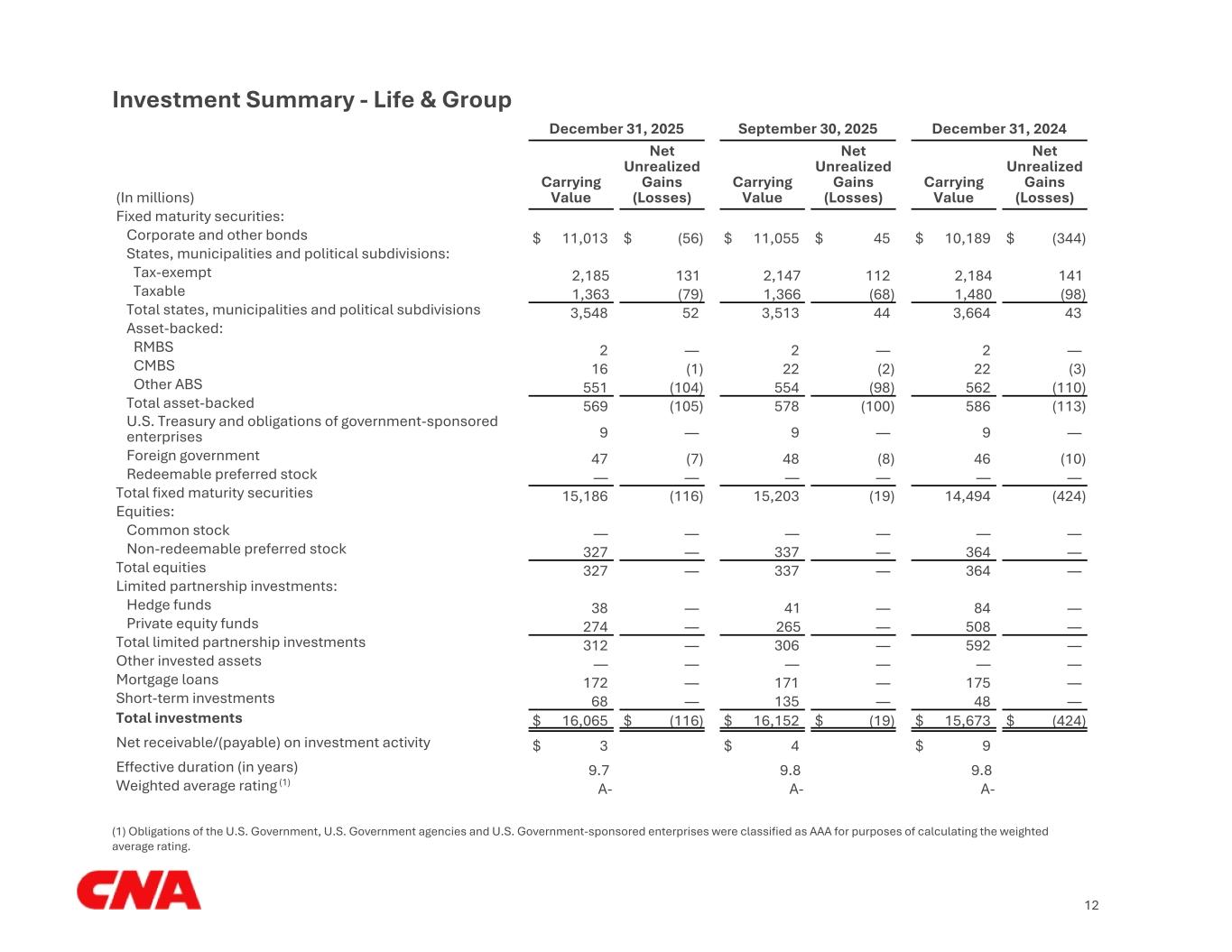

Investment Summary - Life & Group December 31, 2025 September 30, 2025 December 31, 2024 (In millions) Carrying Value Net Unrealized Gains (Losses) Carrying Value Net Unrealized Gains (Losses) Carrying Value Net Unrealized Gains (Losses) Fixed maturity securities: Corporate and other bonds $ 11,013 $ (56) $ 11,055 $ 45 $ 10,189 $ (344) States, municipalities and political subdivisions: Tax-exempt 2,185 131 2,147 112 2,184 141 Taxable 1,363 (79) 1,366 (68) 1,480 (98) Total states, municipalities and political subdivisions 3,548 52 3,513 44 3,664 43 Asset-backed: RMBS 2 — 2 — 2 — CMBS 16 (1) 22 (2) 22 (3) Other ABS 551 (104) 554 (98) 562 (110) Total asset-backed 569 (105) 578 (100) 586 (113) U.S. Treasury and obligations of government-sponsored enterprises 9 — 9 — 9 — Foreign government 47 (7) 48 (8) 46 (10) Redeemable preferred stock — — — — — — Total fixed maturity securities 15,186 (116) 15,203 (19) 14,494 (424) Equities: Common stock — — — — — — Non-redeemable preferred stock 327 — 337 — 364 — Total equities 327 — 337 — 364 — Limited partnership investments: Hedge funds 38 — 41 — 84 — Private equity funds 274 — 265 — 508 — Total limited partnership investments 312 — 306 — 592 — Other invested assets — — — — — — Mortgage loans 172 — 171 — 175 — Short-term investments 68 — 135 — 48 — Total investments $ 16,065 $ (116) $ 16,152 $ (19) $ 15,673 $ (424) Net receivable/(payable) on investment activity $ 3 $ 4 $ 9 Effective duration (in years) 9.7 9.8 9.8 Weighted average rating (1) A- A- A- (1) Obligations of the U.S. Government, U.S. Government agencies and U.S. Government-sponsored enterprises were classified as AAA for purposes of calculating the weighted average rating. 12

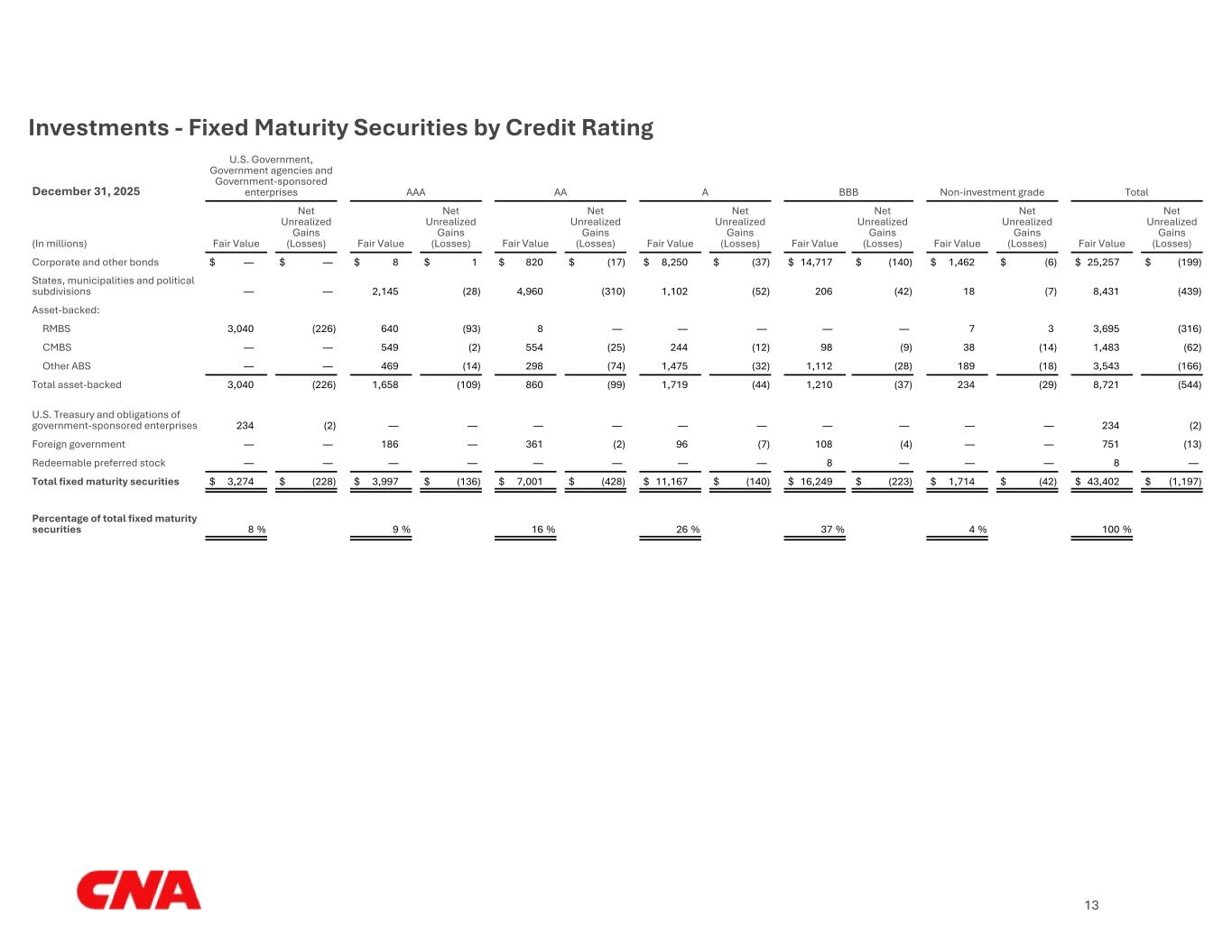

Investments - Fixed Maturity Securities by Credit Rating December 31, 2025 U.S. Government, Government agencies and Government-sponsored enterprises AAA AA A BBB Non-investment grade Total (In millions) Fair Value Net Unrealized Gains (Losses) Fair Value Net Unrealized Gains (Losses) Fair Value Net Unrealized Gains (Losses) Fair Value Net Unrealized Gains (Losses) Fair Value Net Unrealized Gains (Losses) Fair Value Net Unrealized Gains (Losses) Fair Value Net Unrealized Gains (Losses) Corporate and other bonds $ — $ — $ 8 $ 1 $ 820 $ (17) $ 8,250 $ (37) $ 14,717 $ (140) $ 1,462 $ (6) $ 25,257 $ (199) States, municipalities and political subdivisions — — 2,145 (28) 4,960 (310) 1,102 (52) 206 (42) 18 (7) 8,431 (439) Asset-backed: RMBS 3,040 (226) 640 (93) 8 — — — — — 7 3 3,695 (316) CMBS — — 549 (2) 554 (25) 244 (12) 98 (9) 38 (14) 1,483 (62) Other ABS — — 469 (14) 298 (74) 1,475 (32) 1,112 (28) 189 (18) 3,543 (166) Total asset-backed 3,040 (226) 1,658 (109) 860 (99) 1,719 (44) 1,210 (37) 234 (29) 8,721 (544) U.S. Treasury and obligations of government-sponsored enterprises 234 (2) — — — — — — — — — — 234 (2) Foreign government — — 186 — 361 (2) 96 (7) 108 (4) — — 751 (13) Redeemable preferred stock — — — — — — — — 8 — — — 8 — Total fixed maturity securities $ 3,274 $ (228) $ 3,997 $ (136) $ 7,001 $ (428) $ 11,167 $ (140) $ 16,249 $ (223) $ 1,714 $ (42) $ 43,402 $ (1,197) Percentage of total fixed maturity securities 8 % 9 % 16 % 26 % 37 % 4 % 100 % 13

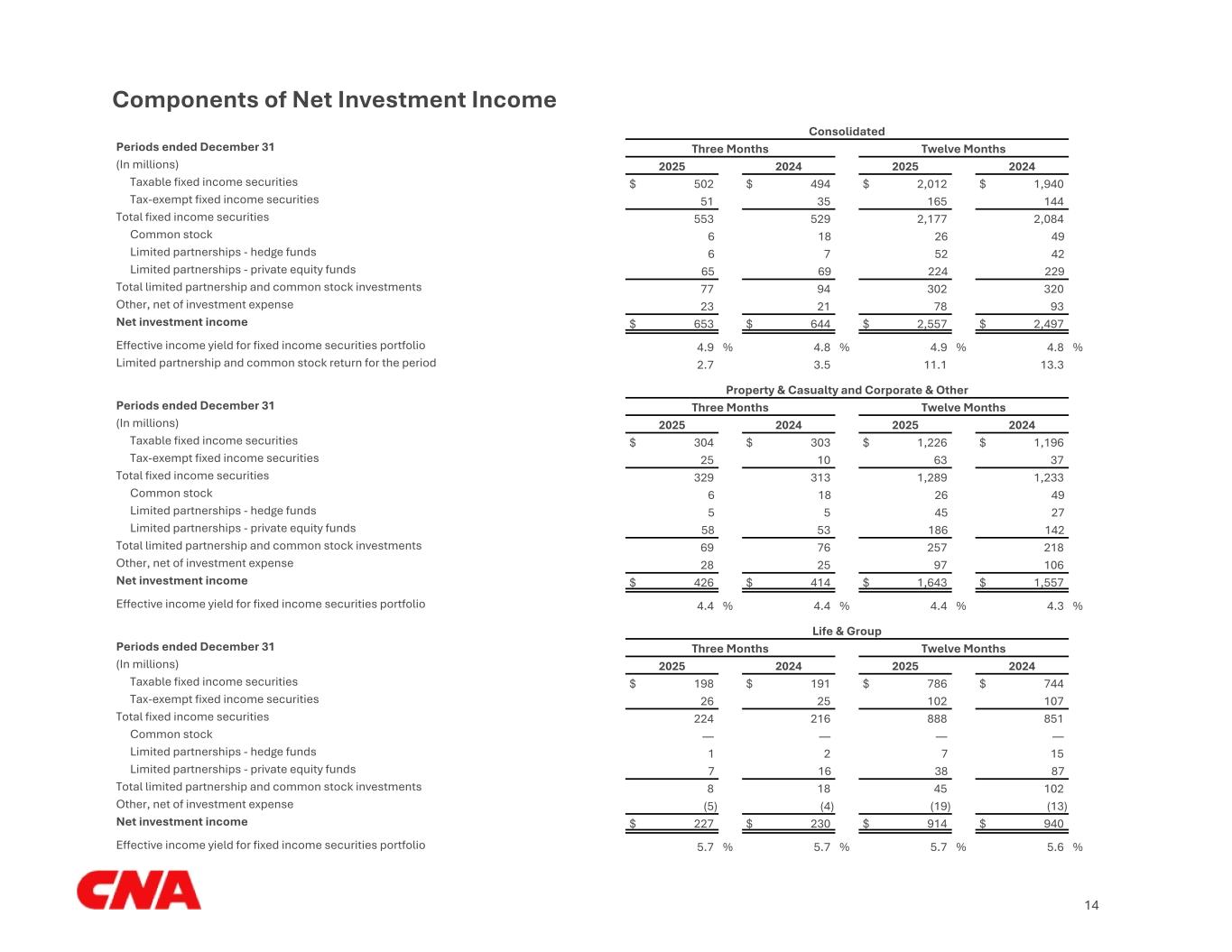

Components of Net Investment Income Consolidated Periods ended December 31 Three Months Twelve Months (In millions) 2025 2024 2025 2024 Taxable fixed income securities $ 502 $ 494 $ 2,012 $ 1,940 Tax-exempt fixed income securities 51 35 165 144 Total fixed income securities 553 529 2,177 2,084 Common stock 6 18 26 49 Limited partnerships - hedge funds 6 7 52 42 Limited partnerships - private equity funds 65 69 224 229 Total limited partnership and common stock investments 77 94 302 320 Other, net of investment expense 23 21 78 93 Net investment income $ 653 $ 644 $ 2,557 $ 2,497 Effective income yield for fixed income securities portfolio 4.9 % 4.8 % 4.9 % 4.8 % Limited partnership and common stock return for the period 2.7 3.5 11.1 13.3 Property & Casualty and Corporate & Other Periods ended December 31 Three Months Twelve Months (In millions) 2025 2024 2025 2024 Taxable fixed income securities $ 304 $ 303 $ 1,226 $ 1,196 Tax-exempt fixed income securities 25 10 63 37 Total fixed income securities 329 313 1,289 1,233 Common stock 6 18 26 49 Limited partnerships - hedge funds 5 5 45 27 Limited partnerships - private equity funds 58 53 186 142 Total limited partnership and common stock investments 69 76 257 218 Other, net of investment expense 28 25 97 106 Net investment income $ 426 $ 414 $ 1,643 $ 1,557 Effective income yield for fixed income securities portfolio 4.4 % 4.4 % 4.4 % 4.3 % Life & Group Periods ended December 31 Three Months Twelve Months (In millions) 2025 2024 2025 2024 Taxable fixed income securities $ 198 $ 191 $ 786 $ 744 Tax-exempt fixed income securities 26 25 102 107 Total fixed income securities 224 216 888 851 Common stock — — — — Limited partnerships - hedge funds 1 2 7 15 Limited partnerships - private equity funds 7 16 38 87 Total limited partnership and common stock investments 8 18 45 102 Other, net of investment expense (5) (4) (19) (13) Net investment income $ 227 $ 230 $ 914 $ 940 Effective income yield for fixed income securities portfolio 5.7 % 5.7 % 5.7 % 5.6 % 14

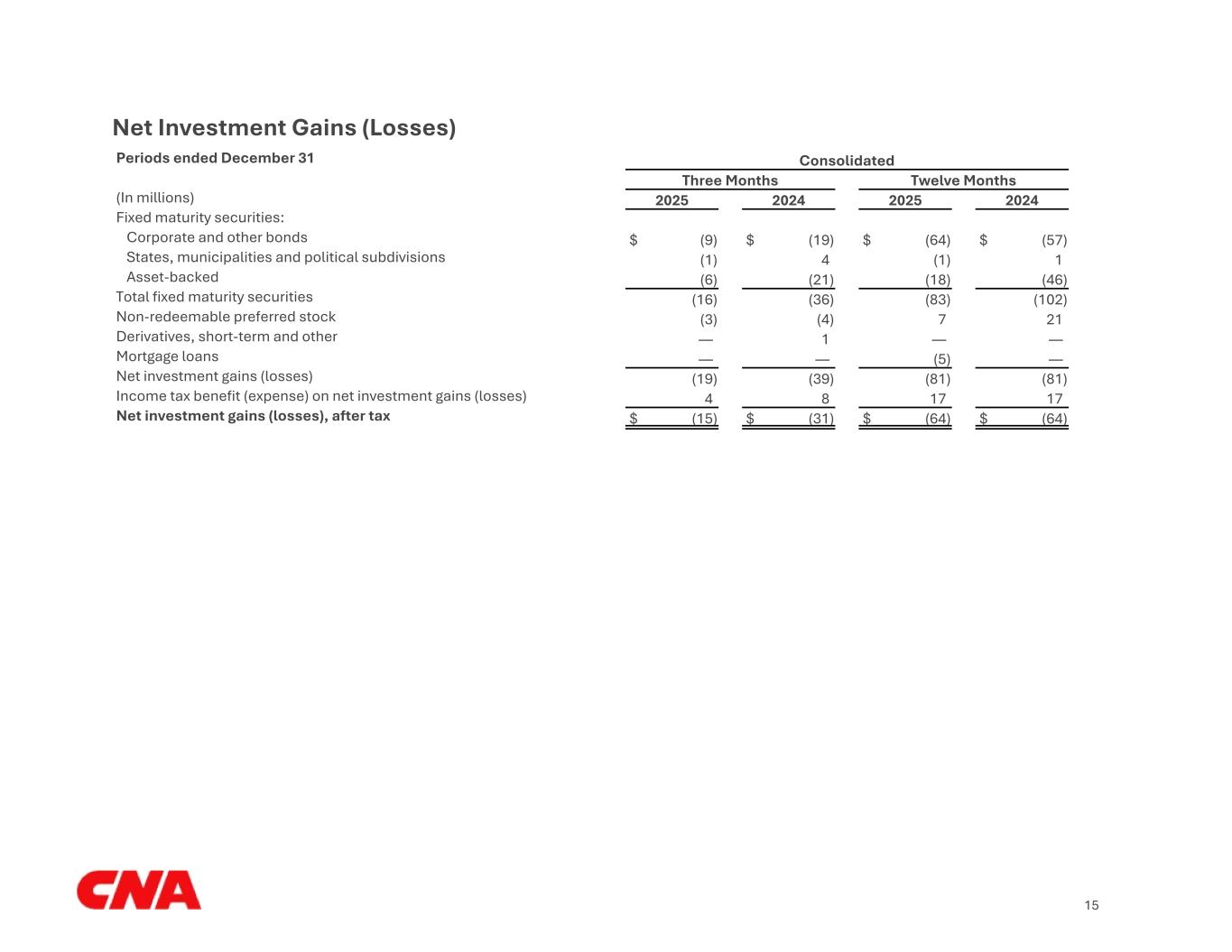

Net Investment Gains (Losses) Periods ended December 31 Consolidated Three Months Twelve Months (In millions) 2025 2024 2025 2024 Fixed maturity securities: Corporate and other bonds $ (9) $ (19) $ (64) $ (57) States, municipalities and political subdivisions (1) 4 (1) 1 Asset-backed (6) (21) (18) (46) Total fixed maturity securities (16) (36) (83) (102) Non-redeemable preferred stock (3) (4) 7 21 Derivatives, short-term and other — 1 — — Mortgage loans — — (5) — Net investment gains (losses) (19) (39) (81) (81) Income tax benefit (expense) on net investment gains (losses) 4 8 17 17 Net investment gains (losses), after tax $ (15) $ (31) $ (64) $ (64) 15

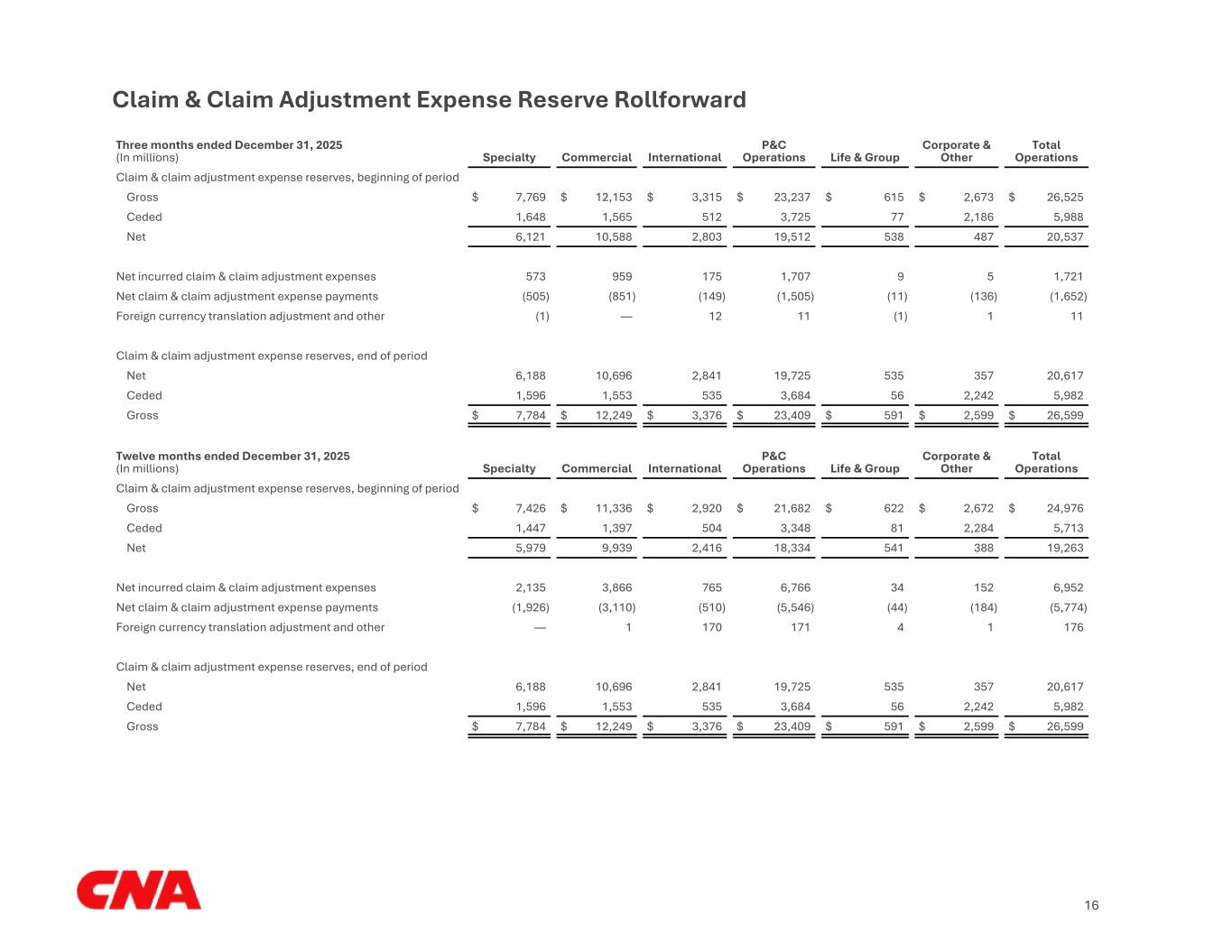

Claim & Claim Adjustment Expense Reserve Rollforward Three months ended December 31, 2025 (In millions) Specialty Commercial International P&C Operations Life & Group Corporate & Other Total Operations Claim & claim adjustment expense reserves, beginning of period Gross $ 7,769 $ 12,153 $ 3,315 $ 23,237 $ 615 $ 2,673 $ 26,525 Ceded 1,648 1,565 512 3,725 77 2,186 5,988 Net 6,121 10,588 2,803 19,512 538 487 20,537 Net incurred claim & claim adjustment expenses 573 959 175 1,707 9 5 1,721 Net claim & claim adjustment expense payments (505) (851) (149) (1,505) (11) (136) (1,652) Foreign currency translation adjustment and other (1) — 12 11 (1) 1 11 Claim & claim adjustment expense reserves, end of period Net 6,188 10,696 2,841 19,725 535 357 20,617 Ceded 1,596 1,553 535 3,684 56 2,242 5,982 Gross $ 7,784 $ 12,249 $ 3,376 $ 23,409 $ 591 $ 2,599 $ 26,599 Twelve months ended December 31, 2025 (In millions) Specialty Commercial International P&C Operations Life & Group Corporate & Other Total Operations Claim & claim adjustment expense reserves, beginning of period Gross $ 7,426 $ 11,336 $ 2,920 $ 21,682 $ 622 $ 2,672 $ 24,976 Ceded 1,447 1,397 504 3,348 81 2,284 5,713 Net 5,979 9,939 2,416 18,334 541 388 19,263 Net incurred claim & claim adjustment expenses 2,135 3,866 765 6,766 34 152 6,952 Net claim & claim adjustment expense payments (1,926) (3,110) (510) (5,546) (44) (184) (5,774) Foreign currency translation adjustment and other — 1 170 171 4 1 176 Claim & claim adjustment expense reserves, end of period Net 6,188 10,696 2,841 19,725 535 357 20,617 Ceded 1,596 1,553 535 3,684 56 2,242 5,982 Gross $ 7,784 $ 12,249 $ 3,376 $ 23,409 $ 591 $ 2,599 $ 26,599 16

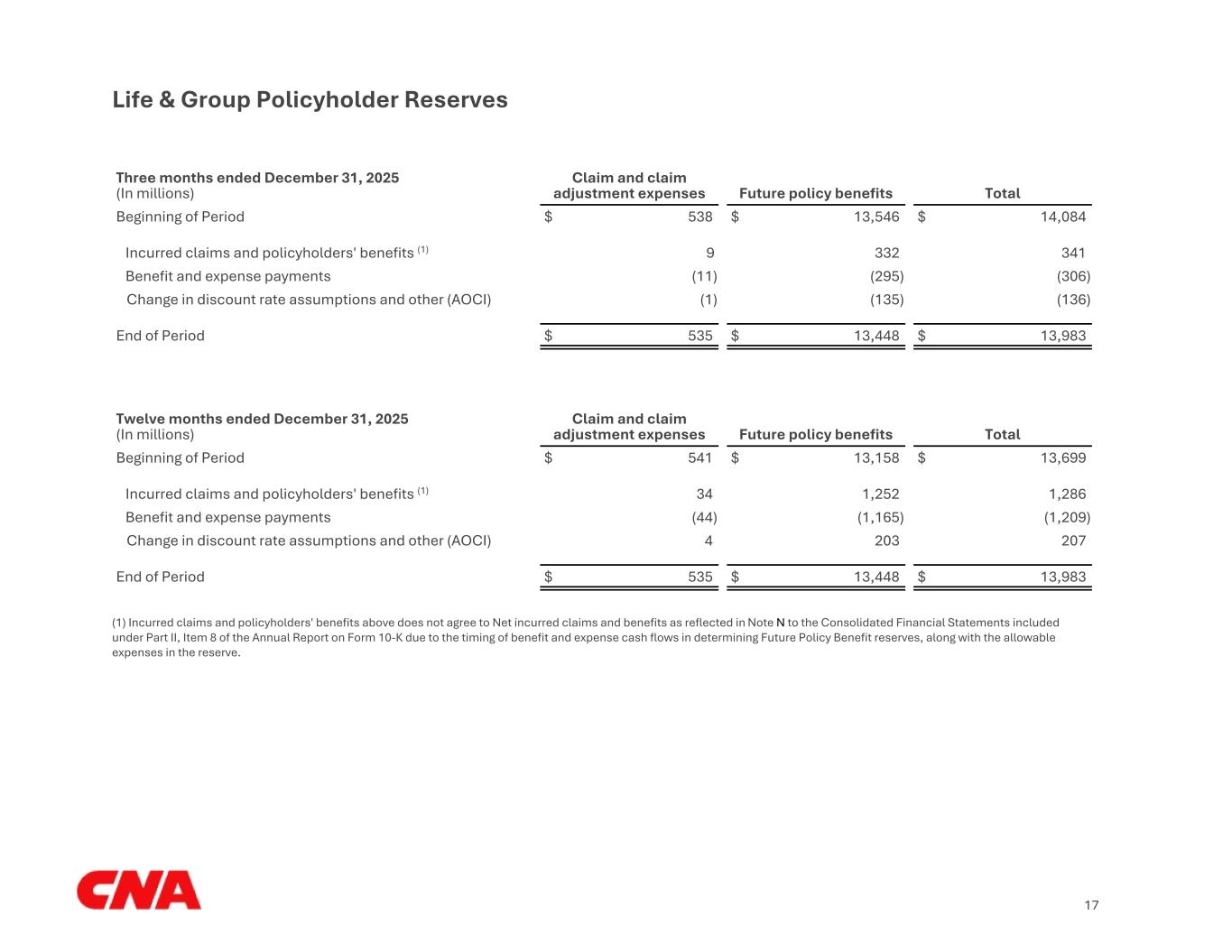

Life & Group Policyholder Reserves Three months ended December 31, 2025 (In millions) Claim and claim adjustment expenses Future policy benefits Total Beginning of Period $ 538 $ 13,546 $ 14,084 Incurred claims and policyholders' benefits (1) 9 332 341 Benefit and expense payments (11) (295) (306) Change in discount rate assumptions and other (AOCI) (1) (135) (136) End of Period $ 535 $ 13,448 $ 13,983 Twelve months ended December 31, 2025 (In millions) Claim and claim adjustment expenses Future policy benefits Total Beginning of Period $ 541 $ 13,158 $ 13,699 Incurred claims and policyholders' benefits (1) 34 1,252 1,286 Benefit and expense payments (44) (1,165) (1,209) Change in discount rate assumptions and other (AOCI) 4 203 207 End of Period $ 535 $ 13,448 $ 13,983 (1) Incurred claims and policyholders' benefits above does not agree to Net incurred claims and benefits as reflected in Note N to the Consolidated Financial Statements included under Part II, Item 8 of the Annual Report on Form 10-K due to the timing of benefit and expense cash flows in determining Future Policy Benefit reserves, along with the allowable expenses in the reserve. 17

Definitions and Presentation • Collectively, CNA Financial Corporation (CNAF) and its subsidiaries are referred to as CNA or the Company. • P&C Operations includes Specialty, Commercial and International. • Life & Group segment includes the individual and group run-off long-term care businesses as well as structured settlement obligations not funded by annuities related to certain property and casualty claimants. • Corporate & Other segment primarily includes certain corporate expenses, including interest on corporate debt, and the results of certain property and casualty business in run-off, including asbestos and environmental pollution (A&EP), a legacy portfolio of excess workers' compensation (EWC) policies and certain legacy mass tort reserves. • Management uses the core income (loss) financial measure to monitor the Company’s operations for the Specialty, Commercial and International segments. Core income (loss) is calculated by excluding from net income (loss) the after-tax effects of net investment gains or losses and gains or losses resulting from pension settlement transactions. Net investment gains or losses are excluded from the calculation of core income (loss) because they are generally driven by economic factors that are not necessarily reflective of our primary operations. The calculation of core income (loss) excludes gains or losses resulting from pension settlement transactions as they result from decisions regarding our defined benefit pension plans which are unrelated to our primary operations. Management monitors core income (loss) for each business segment to assess segment performance. Presentation of consolidated core income (loss) is deemed to be a non-GAAP financial measure and management believes some investors may find this measure useful to evaluate the Company's primary operations. Please refer to Note N to the Consolidated Financial Statements within the December 31, 2025 Form 10-K for further discussion regarding how the Company manages its business. • In evaluating the results of the Specialty, Commercial and International segments, management uses the loss ratio, the underlying loss ratio, the expense ratio, the dividend ratio, the combined ratio and the underlying combined ratio. These ratios are calculated using financial results prepared in accordance with accounting principles generally accepted in the United States of America. The loss ratio is the percentage of net incurred claim and claim adjustment expenses to net earned premiums. The underlying loss ratio excludes the impact of catastrophe losses and development-related items from the loss ratio. Development-related items represents net prior year loss reserve and premium development, and includes the effects of interest accretion and change in allowance for uncollectible reinsurance. The expense ratio is the percentage of insurance underwriting and acquisition expenses, including the amortization of deferred acquisition costs, to net earned premiums. The dividend ratio is the ratio of policyholders' dividends incurred to net earned premiums. The combined ratio is the sum of the loss ratio, the expense ratio and the dividend ratio. The underlying combined ratio is the sum of the underlying loss ratio, the expense ratio and the dividend ratio. The underlying loss ratio and the underlying combined ratio are deemed to be non-GAAP financial measures, and management believes some investors may find these ratios useful to evaluate our underwriting performance since they remove the impact of catastrophe losses, which are unpredictable as to timing and amount, and development-related items as they are not indicative of our current year underwriting performance. In addition, management also utilizes renewal premium change, rate, retention and new business in evaluating operating trends. Renewal premium change represents the estimated change in average premium on policies that renew, including rate and exposure changes. Rate represents the average change in price on policies that renew excluding exposure change. Exposure represents the measure of risk used in the pricing of the insurance product. The change in exposure represents the change in premium dollars on policies that renew as a result of the change in risk of the policy. Retention represents the percentage of premium dollars renewed, excluding rate and exposure changes, in comparison to the expiring premium dollars from policies available to renew. New business represents premiums from policies written with new customers and additional policies written with existing customers. • Management uses underwriting gain (loss) and underlying underwriting gain (loss), calculated using GAAP financial results, to monitor our insurance operations. Underwriting gain (loss) is deemed to be a non-GAAP financial measure and is calculated pretax as net earned premiums less total insurance expenses, which includes insurance claims and policyholders' benefits, amortization of deferred acquisition costs and other insurance related expenses. Net income (loss) is the most directly comparable GAAP measure. Management believes some investors may find this measure useful to evaluate the profitability, before tax, derived from our underwriting activities, which are managed separately from our investing activities. Underlying underwriting gain (loss) is also 18

deemed to be a non-GAAP financial measure, and represents pretax underwriting gain (loss) excluding catastrophe losses and development-related items. Management believes some investors may find this measure useful to evaluate the profitability, before tax, derived from our underwriting activities, excluding the impact of catastrophe losses, which are unpredictable as to timing and amount, and development-related items as they are not indicative of our current year underwriting performance. • This financial supplement may also reference or contain financial measures utilized to monitor the Company's investment portfolio that are not in accordance with GAAP. The Company's investment portfolio is monitored by management through analysis of various factors including unrealized gains and losses on securities, portfolio duration and exposure to market and credit risk. • For reconciliations of non-GAAP measures to the most comparable GAAP measures and other information, please refer herein and/or to CNA's filings with the Securities and Exchange Commission, available at cna.com. • Gross written premiums ex. warranty captives represents gross written premiums excluding warranty business that is ceded to third-party captives, which primarily consists of insurance policies supporting service contracts for portable electronics and vehicles. • Statutory capital and surplus represents the excess of an insurance company's admitted assets over its liabilities, including loss reserves, as determined in accordance with statutory accounting practices. • Net investment income from fixed income securities, as presented, includes both fixed maturity securities and non-redeemable preferred stock. • Certain immaterial differences are due to rounding. • N/M = Not Meaningful 19