1 Q4 Letter to Shareholders DATE ISSUED February 9, 2026

2 Q4 Financial Highlights Gal Krubiner | Co-founder and CEO Our fourth quarter and full-year results demonstrate, again, the benefits of years of work to position our company for long-term durable growth with a focus on increasing profitability, benefitting from our prior investments across the entire enterprise. Looking ahead, we will continue to leverage our platform and our disciplined risk framework, to further bridge the gap between Main Street and Wall Street.” “ $2.7B Network volume of $2.7 billion compared to our outlook of $2.65 - $2.9 billion and grew 3% year-over-year and 34% ex-SFR, with a focus on prudent growth. $335M Total revenue & other income of $335 million compared to our outlook of $333 - $358 million and grew 20% year-over-year, driven by 16% growth in revenue from fees. $131M Revenue from fees less production costs (“FRLPC”) of $131 million increased 12% year-over- year, outpacing network revenue growth. FRLPC as a percentage of network volume (“FRLPC %”) improved 40bps year-over-year to 4.9%. $98M Adjusted EBITDA of $98 million compared to our outlook of $99 - $109 million and grew 53% year- over-year, well ahead of revenue and FRLPC growth, demonstrating continued strong operating leverage. Adjusted EBITDA margin rose more than 6 points to 29%. GAAP operating income was $80 million. $34M Record GAAP net income attributable to Pagaya shareholders of $34 million, a 10% margin, compared to our outlook of $25 - $35 million, up $272 million year-over-year driven by fee revenue growth and operating leverage. $79M Adjusted net income of $79 million excludes the impact of non-cash items such as share-based compensation expense and fair value adjustments.

3 Scaling our network with three new partners & multiple in the onboarding queue We have multiple additional partners getting onboarded at this time which will go live over the next few quarters, including regional banks. These new partners represent each of the three asset classes in which we operate. Our strong pipeline solidifies Pagaya’s unique value proposition as lenders look for ways to grow their businesses and meet their customers where they are. Unlocking funding capacity with new revolving structures and continued diversification In the fourth quarter we issued $2.9B in our ABS program across 7 transactions marketed to a network of more than 150 institutional investors. We announced our inaugural POS forward flow with Sound Point, bringing forward flow agreements to all core asset classes. We also closed our inaugural revolving PAID ABS securitization with 26 North for $350 million. Combined with the previous two revolving POS deals, we have up to ~$3 billion capacity from these three structures across Personal Loans and POS. Record GAAP net income & cash flow from operations Fourth quarter incremental net income margin of >100% of year-over-year FRLPC growth & a record 60% of cash flow from operations as a percent of FRLPC highlights continued cost discipline and inherent operating leverage. Strengthened balance sheet and liquidity profile During the fourth quarter we used our strong liquidity to make approximately $47 million in discretionary investments in the form of ABS bonds, driving lower cost of funding and higher interest income in the form of highly liquid securities that we can further monetize in the future. We also made an opportunistic investment into our high-yield debt securities, an attractive use of our capital. Growing top of funnel through wide adoption of new products and features while reducing potential tail credit risk In the fourth quarter, approximately half of originations came from outside of decline monetization, as we converted another core Personal Loan partner into a multi-product relationship within our Affiliate Marketing Engine. Additionally, we signed multiple partner agreements for our prescreen program in Direct Mail and Email channels, augmenting our top of funnel presence and moving above and beyond Decline Monetization. Importantly, we swiftly realigned our positioning to operate through increased uncertainty, a testament to our agile and focused culture of risk management. Q4 Business Highlights

4 Gal Krubiner Co-founder and CEO Dear Fellow Shareholders, I’m pleased to discuss our fourth quarter and full year 2025 results, highlighting our achievements and how we are positioned toward our longer term goals. To wrap up the year, in Q4 we achieved $34M GAAP net income and $80M operating cash flow. We achieved the goals we set at the beginning 2024: to become GAAP net income and cash flow positive, which we further accelerated in Q4. Record full year revenue of $1.3B, grew 26% year over year, outpacing volume growth, demonstrating our ability to monetize volumes and drive profitability with lower risk per unit of volume. Our adjusted EBITDA of $371M grew 76%, and we achieved a full year of GAAP net income of $81M, up $483M versus 2024, with EPS of $0.93. These results were a direct outcome of optimizing unit economics, growing and diversifying our business across verticals, as well as across both first and second-look loans, right sizing our balance sheet and operations, and increasing the monetization of our network. 2025 was another year of discipline. We expanded the foundations of our business and our approach toward risk management and underwriting. This drives consistency for our investors as we serve our lending partners’ needs, all while building an enterprise focused on sustainable, through-the-cycle profitable growth. As part of our disciplined approach this year, we took proactive action in late Q4 in the face of consumer uncertainty and persistent trends and cut certain tiers to eliminate tail-risk exposure. While our data does not indicate consumer deterioration, we have the luxury of pivoting our production. As such, credit performance on all products remains in line with expectations. While this cut creates a short-term hit to financial KPIs, it is a deliberate trade-off for long- term stability. It is important to take a step back and appreciate where we are as a business and how we can leverage our strengths to drive the best long term outcomes for our stakeholders. As a technology company built on operating leverage, we prioritize our core margins over growth in certain tiers. Being a B2B2C company with a strong data moat and increasingly diversified business, our partners expect us to manage for long-term durability, which is why we proactively filter out vulnerable segments as we scale. Think of it like a retailer that expands its total footprint while reducing same store exposure. We are adding more partners and products while being more selective about the risk we carry. Building a more resilient business, not just a bigger one, is core to our strategy. Our disciplined growth is coming both from onboarding new partners and deepening existing partnerships. Our product is becoming industry standard, which is reflected in our robust pipeline. In the latest quarter and the months that followed, we onboarded Achieve, GLS and a major buy-now- pay-later provider in North America. GLS, or Global Lending Services is a leading auto finance provider that offers financing solutions to almost 20,000 franchise and independent dealers nationwide. We

5 have a handful of additional lending partners in the onboarding queue, progressing toward 2026 launches across all asset classes. In the coming years, we expect more consumer lenders to join the Pagaya network, demonstrating the potential and value of our enterprise platform. For existing partners, we continue to drive innovation in our product, with high partner usage, satisfaction, and deeper engagement. For instance, LendingClub recently became a multi-product partner with the adoption of our marketing affiliate offering. We expect to end the first quarter of 2026 with several large Personal Loan partners onboarding our prescreen offering. As we drive that disciplined growth, our earnings power and cash flow generation will become stronger. At the same time, we are institutionalizing and diversifying our business through long term agreements with fee and flow commitments, further stabilizing our business and aligning priorities with our partners. In fact, we have now entered into a long term agreement with our largest partners across each asset class. While we work hard to expand application flow from new and existing partners, our decisions remain firmly grounded in portfolio performance and optimization, not in the pursuit of market share. We are comfortable accepting lower conversions when appropriate to remain prudent on risk and to limit potential adverse outcomes. As a mature organization, a driving force of our culture is to deliberately balance long-term growth and profitability against short-term gains. Our top of funnel expansion is designed for the future as we continue to build toward an enterprise platform with a focus on long term vs. short term gains On the funding side, we continue to leverage favorable market dynamics to solidify longer-term, more committed funding structures that provide greater capacity and reduce funding volatility risk. We made strides in the diversification of our funding business across all asset classes, ending the quarter with an Auto Forward flow, and recently announced the launch of our first POS forward flow. Building on this momentum even further, we enhanced funding stability by expanding into revolvers, marking an important evolution toward committed capital. Earlier in 2025, we completed two revolving POS structures and we closed the year with a $350 million revolving personal loan ABS with 26North, providing in total, almost $3B of revolving capacity across PL and POS. Together, these steps meaningfully increase committed capital, bolster the consistency of our funding base, and position the business to better navigate short-term market volatility while supporting long-term growth.

6 Pagaya Growth Trajectory: On the way to becoming a preferred tech partner for every major consumer lender B us in e ss P ro fit ab ili ty Time We are here 2026+ 2024 2025 2026+ Profitable Scaling • New Partner Growth • Expansion with existing partners - Products and New flow • New product rollout • Continued model improvements Became Profitable & Cash Flow Positive • Balance sheet optimization (Interest expense reduction) • Product diversification (Affiliate Marketing engine, Direct Marketing engine, Dual Look, others) • Funding diversification (Revolving ABSs & Forward Flows) Set the Stage for Profitability • Improved unit economics • Increased operational efficiency • Grew capital efficiency & Expanded access to capital EXHIBIT 1 As we enter 2026, our guidance and business plan are driven first and foremost by this disciplined growth philosophy that has been shaped over time. We’ve accomplished a tremendous amount in 2024 and 2025 that set us up for efficient and durable growth. We stabilized the business as we reached scale, we optimized both operating costs and balance sheet structure - and diversified our sources of revenue and funding. Going forward we have the best structure in our history for balanced, efficient profitable growth. For 2026, investors should anticipate more measured volume, thus revenue growth, as we prioritize credit risk over market share gains in the current environment. This clearly flows down to adjusted EBITDA and GAAP net income given our high degree of operating leverage. We believe our strategy reflects a business that is in control of its long term growth trajectory, intentionally deploying risk to maximize earnings power over time. As we approach our 10 year anniversary, we believe this strategy reflects a company that builds enduring platforms and maximizes value creation over time. The first decade was about proving our model and securing our place in the market. The next decade is about scaling that foundation with greater ambition, durability and impact. We are building a B2B2C platform that will be embedded in every lender in the U.S and become part of the financial infrastructure. With intelligent AI quant decisioning at its core, our platform will operate wherever our partners are, powering products that resonate with consumers and that are built to perform through cycles. 2024 2025

As we wrap up the year with our fourth consecutive quarter of GAAP net income profitability and look ahead, our disciplined growth strategy is clear: continue to build a sustainable and profitable business that is increasingly embedded in the US financial ecosystem. Pagaya’s growth continues to be driven by institutional grade scaling of existing partner relationships as well as new partner additions. We have been diversifying across products, including Direct Marketing Engine, Affiliate Optimizer Engine and Dual Look. The benefits of this diversification include the following: 1. Provides Pagaya with new volume beyond Decline Monetization 2. Increases both the value & stickiness of Pagaya with its lending partners 3. Unlocks further growth for Pagaya without expanding our own credit box In fact, our Affiliate Optimizer Engine-enabled volume on Credit Karma Lightbox increased from $2.0B in 2024 to $2.9B in 2025 - more than 45% growth. At the same time, we remain disciplined in our underwriting, with our core focus centered around gaining access to more high-quality flow from existing and new partners. We continue to leverage our unique ability to assess risk in real-time, based on the data from over 30 lenders across three asset Sanjiv Das Co-founder and President 7 Update on our Operating Business classes with agile decision-making. Our existing partners continue to adopt our products and are signing institutionalized long-term agreements. At the same time, our onboarding pipeline is the most robust in our company’s history, having recently onboarded 3 new partners. New Partners Our onboarding process is truly “industrial grade” now, minimizing partner resource requirements. We would note the following among our onboarding process enhancements: • Launched Pagaya API version 2: Onboarding for all products upfront (prebuilt API integration for the entire PGY product suite during onboarding) • All agreements with new partners are long term agreements with volume, fee and other commitments, along with other mutual protections • All of our new partners have committed to an 18-month joint roadmap to accelerate scaling across our product suite These, along with other ongoing enhancements, helped to efficiently drive 3 recent new partner launches (Achieve, GLS/Global Lending Services, and a major buy-now-pay-later provider in North America), while multiple additional partners, including banks, are currently being onboarded. These are expected to go live within the next few quarters. A. B. C.

Existing Partners The evidence of PGY product adoption across leading partners includes the following (see Exhibit 2): • Several of our largest existing partners adopted Direct Marketing Engine after a series of tests, and are scaling with us across Direct Mail and Email prescreen campaigns. These partners have signed agreements with Pagaya that will help to unlock accelerated disciplined growth for both parties. • We recently onboarded one of our leading partners onto Credit Karma as part of Affiliate Optimizer Engine adoption, which we estimate has the potential to double the volume this lender will book with Pagaya. We are currently in the process of onboarding our first partner onto Experian’s Activate platform, with several more in the onboarding queue. We are leveraging our strong relationships with leading affiliate marketplaces to help integrate our partners, unlocking additional volume and revenue growth for our partners and Pagaya. • 50% of our FRLPC and 44% of our booked volume is driven by new (non-decline-monetization) Pagaya products - up from 46% and 39% a year ago. • We recently signed several long term agreements with leading partners to establish commitments around application flow size, quality and controls to maximize mutual benefit through the cycle. EXHIBIT 2 We Are Continuing to Expand Our Product Suite Across the Funnel Lending Partner Funnel, Illustrative PGY Products (Not Exhaustive) Current State in 2026 # Partners Adopted Accomplishments in 2025 Marketing App, Decisioning and Pricing Offer Presentation Affiliate Optimizer Engine Driving applications through marketplaces such as Credit Karma & Experian Activate Direct Marketing Engine Pre-screening our lending partners existing customers and giving them PGY enabled offers by Email & Mail (incremental to partners’ own campaigns) Decline Monetization Dual Look Generating offers concurrently with partners, offer with highest probability of conversion is presented to consumer • Aggregated knowledge, data and insights to launch a product in close partnership with leading affiliates • Onboarded leading existing partner on Credit Karma • Onboarding leading partners on to Experian Activate • Expanding onboarding queue • Concluded positive proof-of-concepts with leading partners • Signed multiple term sheets, locking mutually beneficial terms. • Continuing to scale with partners already engaged • In active negotiations with additional partners for 2026 onboarding • Expanded and improved Dual Look value proposition • Increased adoption across PL and Auto partners • In advanced negotiations with several leading partners to onboard Dual Look Products Launched in ‘25 5 5 3 8 Value for PGY lending Partners 1. PGY-enabled loans always funded by Pagaya, across all products 2. Customer growth: New customers, existing customer retention 3. Financial benefit: Incremental volume and revenue for partners

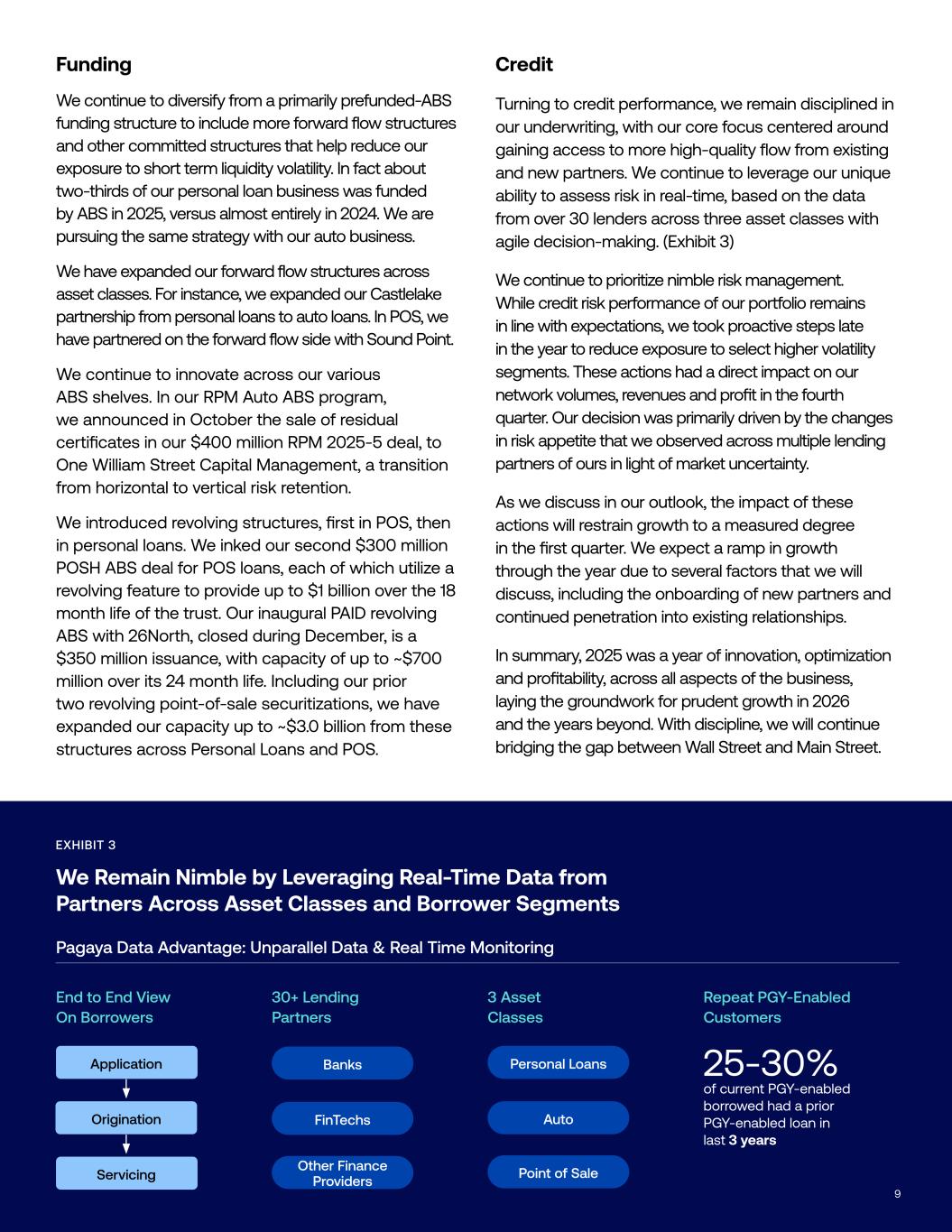

9 Funding We continue to diversify from a primarily prefunded-ABS funding structure to include more forward flow structures and other committed structures that help reduce our exposure to short term liquidity volatility. In fact about two-thirds of our personal loan business was funded by ABS in 2025, versus almost entirely in 2024. We are pursuing the same strategy with our auto business. We have expanded our forward flow structures across asset classes. For instance, we expanded our Castlelake partnership from personal loans to auto loans. In POS, we have partnered on the forward flow side with Sound Point. We continue to innovate across our various ABS shelves. In our RPM Auto ABS program, we announced in October the sale of residual certificates in our $400 million RPM 2025-5 deal, to One William Street Capital Management, a transition from horizontal to vertical risk retention. We introduced revolving structures, first in POS, then in personal loans. We inked our second $300 million POSH ABS deal for POS loans, each of which utilize a revolving feature to provide up to $1 billion over the 18 month life of the trust. Our inaugural PAID revolving ABS with 26North, closed during December, is a $350 million issuance, with capacity of up to ~$700 million over its 24 month life. Including our prior two revolving point-of-sale securitizations, we have expanded our capacity up to ~$3.0 billion from these structures across Personal Loans and POS. Credit Turning to credit performance, we remain disciplined in our underwriting, with our core focus centered around gaining access to more high-quality flow from existing and new partners. We continue to leverage our unique ability to assess risk in real-time, based on the data from over 30 lenders across three asset classes with agile decision-making. (Exhibit 3) We continue to prioritize nimble risk management. While credit risk performance of our portfolio remains in line with expectations, we took proactive steps late in the year to reduce exposure to select higher volatility segments. These actions had a direct impact on our network volumes, revenues and profit in the fourth quarter. Our decision was primarily driven by the changes in risk appetite that we observed across multiple lending partners of ours in light of market uncertainty. As we discuss in our outlook, the impact of these actions will restrain growth to a measured degree in the first quarter. We expect a ramp in growth through the year due to several factors that we will discuss, including the onboarding of new partners and continued penetration into existing relationships. In summary, 2025 was a year of innovation, optimization and profitability, across all aspects of the business, laying the groundwork for prudent growth in 2026 and the years beyond. With discipline, we will continue bridging the gap between Wall Street and Main Street. EXHIBIT 3 We Remain Nimble by Leveraging Real-Time Data from Partners Across Asset Classes and Borrower Segments Pagaya Data Advantage: Unparallel Data & Real Time Monitoring End to End View On Borrowers 30+ Lending Partners 3 Asset Classes Repeat PGY-Enabled Customers Application Origination Servicing Personal Loans Auto Point of Sale 25-30% of current PGY-enabled borrowed had a prior PGY-enabled loan in last 3 years Banks FinTechs Other Finance Providers

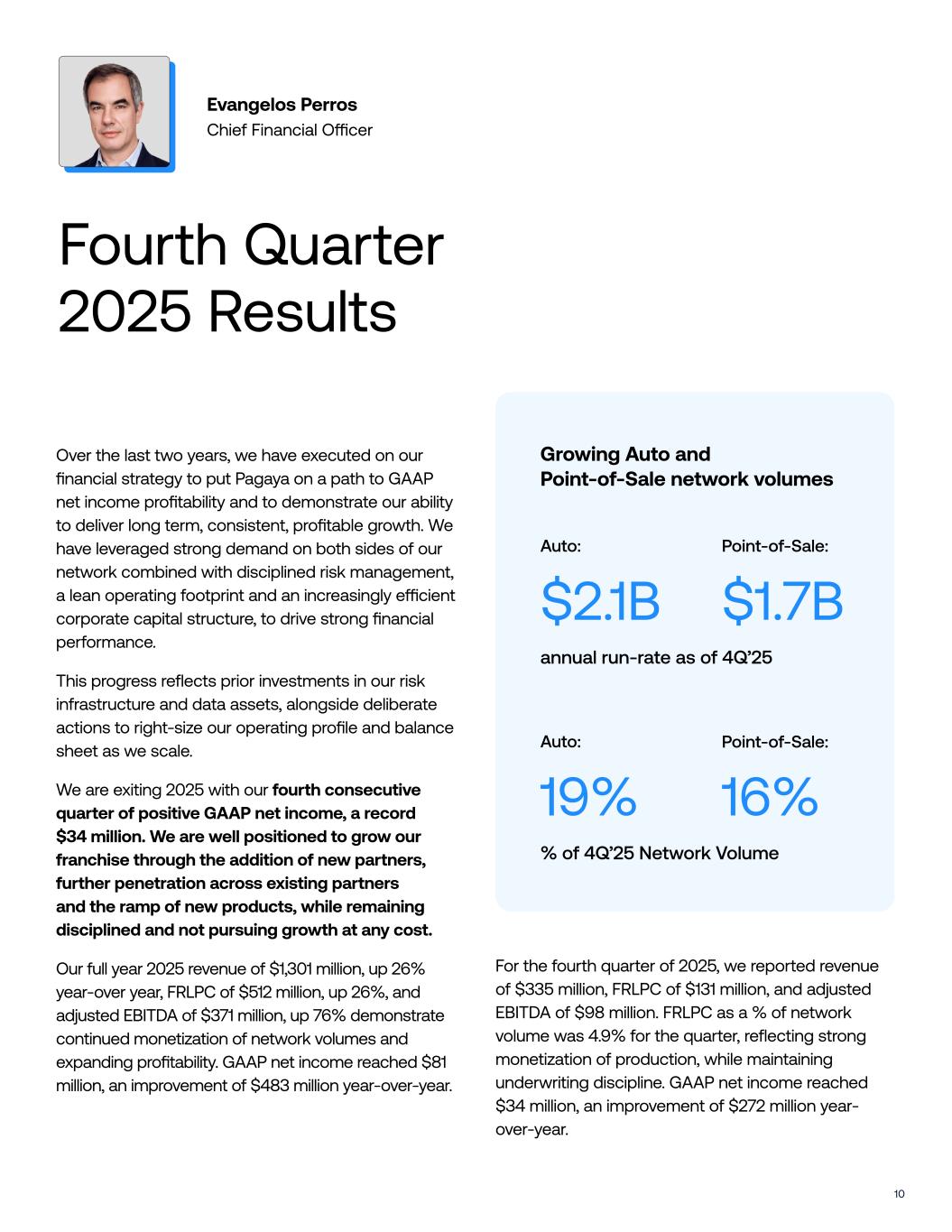

10 Evangelos Perros Chief Financial Officer Fourth Quarter 2025 Results Growing Auto and Point-of-Sale network volumes Point-of-Sale: annual run-rate as of 4Q’25 $2.1B $1.7B Auto: Over the last two years, we have executed on our financial strategy to put Pagaya on a path to GAAP net income profitability and to demonstrate our ability to deliver long term, consistent, profitable growth. We have leveraged strong demand on both sides of our network combined with disciplined risk management, a lean operating footprint and an increasingly efficient corporate capital structure, to drive strong financial performance. This progress reflects prior investments in our risk infrastructure and data assets, alongside deliberate actions to right-size our operating profile and balance sheet as we scale. We are exiting 2025 with our fourth consecutive quarter of positive GAAP net income, a record $34 million. We are well positioned to grow our franchise through the addition of new partners, further penetration across existing partners and the ramp of new products, while remaining disciplined and not pursuing growth at any cost. Our full year 2025 revenue of $1,301 million, up 26% year-over year, FRLPC of $512 million, up 26%, and adjusted EBITDA of $371 million, up 76% demonstrate continued monetization of network volumes and expanding profitability. GAAP net income reached $81 million, an improvement of $483 million year-over-year. For the fourth quarter of 2025, we reported revenue of $335 million, FRLPC of $131 million, and adjusted EBITDA of $98 million. FRLPC as a % of network volume was 4.9% for the quarter, reflecting strong monetization of production, while maintaining underwriting discipline. GAAP net income reached $34 million, an improvement of $272 million year- over-year. Point-of-Sale: % of 4Q’25 Network Volume 19% 16% Auto:

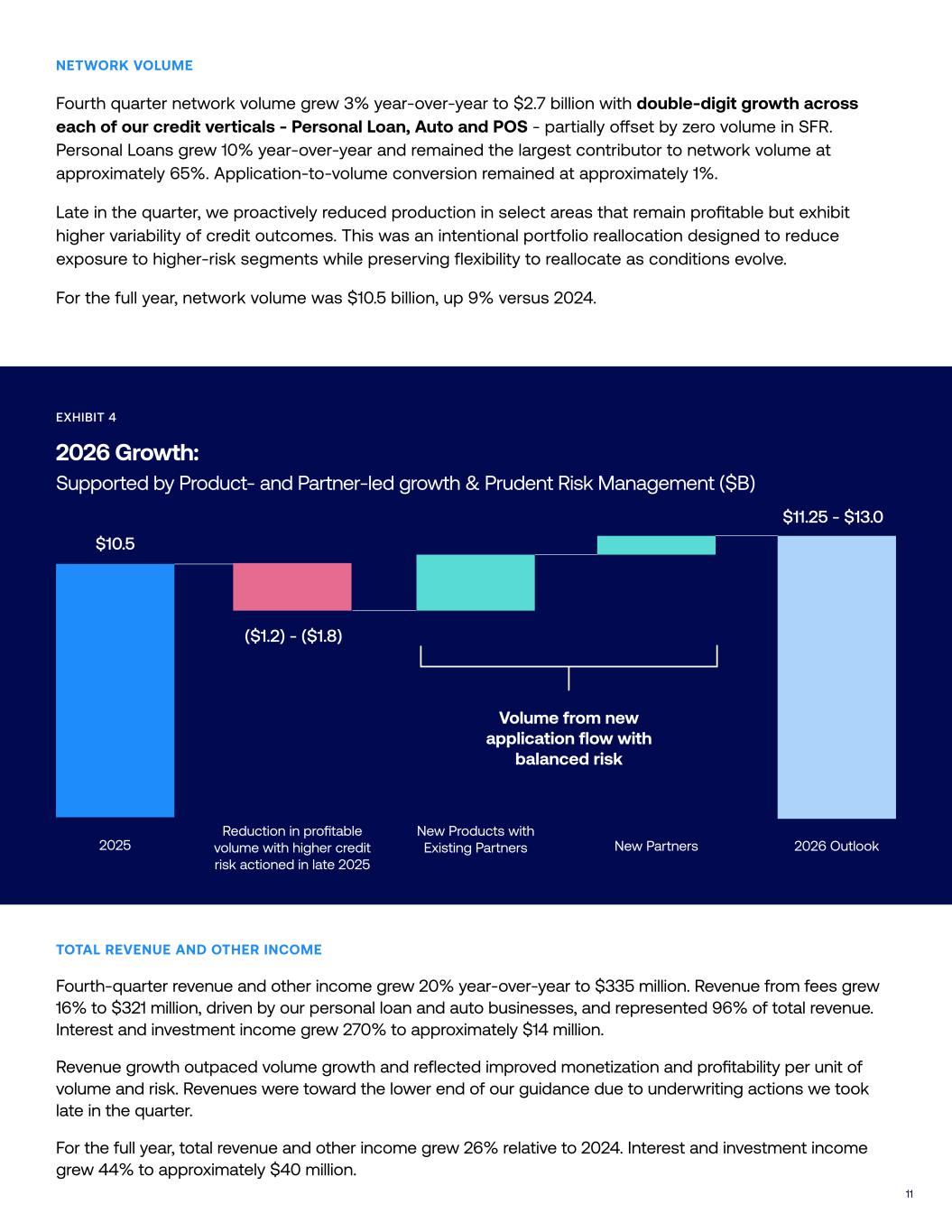

11 NETWORK VOLUME Fourth quarter network volume grew 3% year-over-year to $2.7 billion with double-digit growth across each of our credit verticals - Personal Loan, Auto and POS - partially offset by zero volume in SFR. Personal Loans grew 10% year-over-year and remained the largest contributor to network volume at approximately 65%. Application-to-volume conversion remained at approximately 1%. Late in the quarter, we proactively reduced production in select areas that remain profitable but exhibit higher variability of credit outcomes. This was an intentional portfolio reallocation designed to reduce exposure to higher-risk segments while preserving flexibility to reallocate as conditions evolve. For the full year, network volume was $10.5 billion, up 9% versus 2024. 2026 Growth: Supported by Product- and Partner-led growth & Prudent Risk Management ($B) $10.5 ($1.2) - ($1.8) $11.25 - $13.0 2025 Reduction in profitable volume with higher credit risk actioned in late 2025 New Products with Existing Partners New Partners 2026 Outlook Volume from new application flow with balanced risk TOTAL REVENUE AND OTHER INCOME Fourth-quarter revenue and other income grew 20% year-over-year to $335 million. Revenue from fees grew 16% to $321 million, driven by our personal loan and auto businesses, and represented 96% of total revenue. Interest and investment income grew 270% to approximately $14 million. Revenue growth outpaced volume growth and reflected improved monetization and profitability per unit of volume and risk. Revenues were toward the lower end of our guidance due to underwriting actions we took late in the quarter. For the full year, total revenue and other income grew 26% relative to 2024. Interest and investment income grew 44% to approximately $40 million. EXHIBIT 4

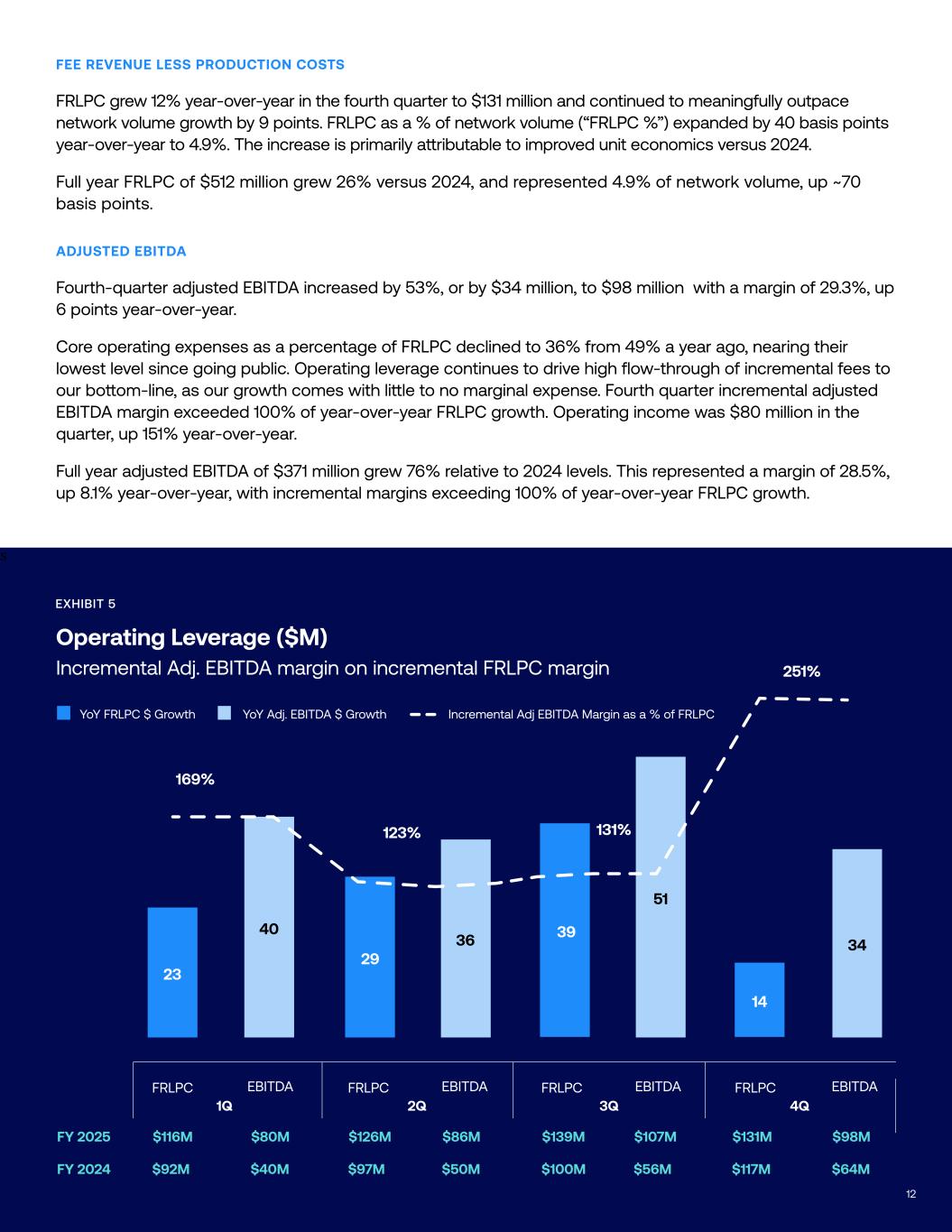

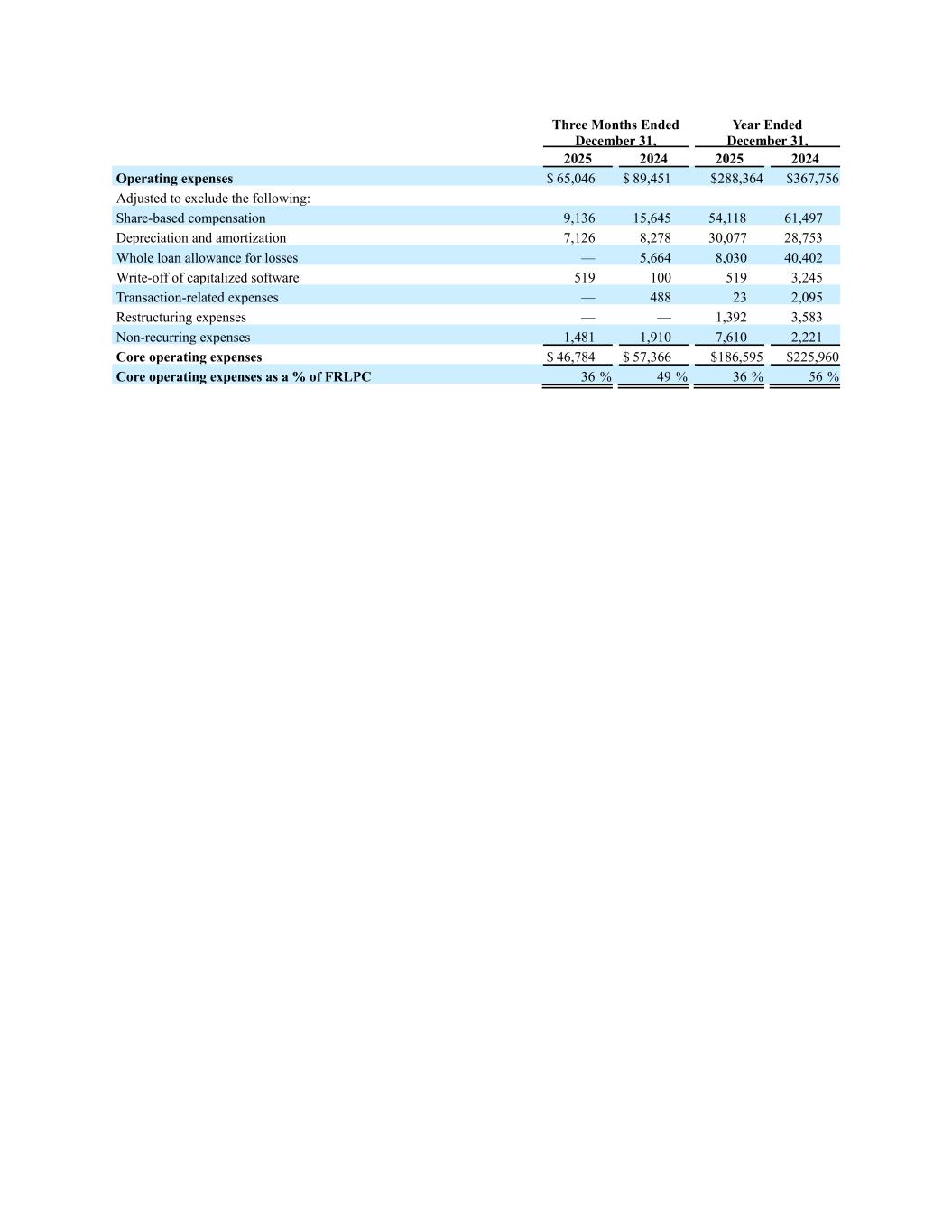

12 s FEE REVENUE LESS PRODUCTION COSTS FRLPC grew 12% year-over-year in the fourth quarter to $131 million and continued to meaningfully outpace network volume growth by 9 points. FRLPC as a % of network volume (“FRLPC %”) expanded by 40 basis points year-over-year to 4.9%. The increase is primarily attributable to improved unit economics versus 2024. Full year FRLPC of $512 million grew 26% versus 2024, and represented 4.9% of network volume, up ~70 basis points. ADJUSTED EBITDA Fourth-quarter adjusted EBITDA increased by 53%, or by $34 million, to $98 million with a margin of 29.3%, up 6 points year-over-year. Core operating expenses as a percentage of FRLPC declined to 36% from 49% a year ago, nearing their lowest level since going public. Operating leverage continues to drive high flow-through of incremental fees to our bottom-line, as our growth comes with little to no marginal expense. Fourth quarter incremental adjusted EBITDA margin exceeded 100% of year-over-year FRLPC growth. Operating income was $80 million in the quarter, up 151% year-over-year. Full year adjusted EBITDA of $371 million grew 76% relative to 2024 levels. This represented a margin of 28.5%, up 8.1% year-over-year, with incremental margins exceeding 100% of year-over-year FRLPC growth. Operating Leverage ($M) Incremental Adj. EBITDA margin on incremental FRLPC margin YoY FRLPC $ Growth Incremental Adj EBITDA Margin as a % of FRLPC FRLPC EBITDA 1Q FRLPC EBITDA 2Q FRLPC EBITDA 3Q FRLPC EBITDA 4Q EXHIBIT 5 YoY Adj. EBITDA $ Growth FY 2025 FY 2024 $116M $92M $80M $40M $126M $97M $86M $50M $139M $100M $107M $56M $131M $117M $98M $64M 169% 123% 131% 251% 23 29 39 14 40 36 51 34 12

NET INCOME We reported a record $34 million of GAAP net income in the fourth quarter. GAAP net income included the positive impact of $9 million from non- recurring tax-related benefits & debt extinguishment. This compared to a net loss of ($238) million in 4Q’24, driven primarily by 16% growth in fee revenue and lower levels of operating expenses, interest expense and impairments. This equated to a 10% margin, compared to 6% in the prior quarter and negative 85% in the year-ago quarter. Gains and losses on investments in loans and securities amounted to a loss of $44 million. Interest expense of $19 million declined by $3 million from the prior quarter, reflecting the full quarter benefit from refinancing through the issuance of our corporate notes in the previous quarter. Adjusted net income, which excludes share-based compensation and other non-cash items such as fair value adjustments, was $79 million. For the full year, GAAP net income was $81 million relative to a loss of $401 million in 2024. Gains and losses on investments in loans and securities amounted to a loss of $107 million in 2025. Adjusted net income was $275 million, compared to $67 million in 2024. CREDIT PERFORMANCE Credit performance remains in line with underwriting expectations across all verticals. Credit trends of 2025 vintages represent normalized production, particularly given the lower cost of capital of our investors. For personal loans, cumulative net losses (“CNLs”) for quarterly vintages from 2H2024 through 1H2025 are trending approximately 30% - 40% lower than peak levels in the fourth quarter of 2021 at month-on-book (“MOB”) 5 - 14. For auto loans, CNLs across the same vintages are trending approximately 50% - 70% below comparable 2022 periods at MOB 5 - 14. While Auto 60+ delinquencies are higher than 2024 (following that year’s pullback) and broadly in line with 2023 levels, recoveries and roll rates are better than both 2023 and 2024, indicating normalized level of expected losses. For POS as well, credit trends remain stable and in line with expectations. Late quarter production adjustments to reduce higher risk volume were informed by increased and persistent uncertainty rather than observed deterioration. Our platform is designed to reduce tail exposure during periods of uncertainty and reallocate as conditions improve. Auto CNLs vs comparable 2022 period Personal Loan CNLs vs 4Q’21 peak 3Q’24 4Q’24 1Q’25 2Q’25 3Q’24 4Q’24 1Q’25 2Q’25 (54%) (71%) (36%) (31%) (35%) (41%) MOB 14 11 8 5 MOB 14 11 8 5 (69%) (61%) EXHIBIT 6 13

14 Funding and Balance Sheet Efficiency Funding Performance continues to drive strong demand across all asset verticals, and we remain focused on diversifying our funding. During the fourth quarter, we issued $2.9 billion through our ABS program across 7 transactions, marketed to our network of more than 150 institutional funding partners. We announced our first Auto forward flow with Castlelake in the fourth quarter and our first POS forward flow with Sound Point in January. We also sold a certificate in one of our Auto ABS, our first such sale since 2021. As a step toward funding structures that provide longer-term capital, we announced our first revolving $350 million Personal Loans ABS transaction with 26North. Combined with the two existing POS deals, these structures provide up to approximately $3 billion of funding capacity. Balance sheet We have significantly improved the quality and mix of investments on our balance sheet over the past twelve months, providing enhanced liquidity and flexibility. As of December 31, 2025, our balance sheet consisted primarily of $288 million in cash and cash equivalents and $945 million of Investments in Loans and Securities, primarily related to regulatory risk retention and discretionary investment in assets from sponsored ABS transactions. In line with our stated objectives, we are leveraging our improving liquidity and capital structure to make opportunistic investments. For instance, approximately one-third of Investments in Loans and Securities represent discretionary investments in bonds from our sponsored ABS transactions, which lower cost of funding and increase interest income. These securities are highly liquid and provide potential future monetization opportunities above their cost as they season. During 2025, discretionary investments totaled approximately $171 million. In late December, we purchased approximately $7 million of our 8.875% senior unsecured notes at a discount of approximately 12.5% to par using excess cash from the balance sheet. The repurchase and retirement of this debt represent an attractive use of our capital. During the fourth quarter, the fair value of the overall investment portfolio and allowances, prior to new additions, was adjusted downward by $50 million compared to $33 million in the prior quarter. We also added $97 million of new investments in loans & securities, net of paydowns from prior investments. 2025 Capital Efficiency Total Investments in Loans & Securities as % of Network Volume 4.1% 1.7% 5.8% -3.0% 2.8% ABS Risk Retention & Other Discretionary Investments (ABS Bonds) Total Gross Investments in Loans & Securities Return of Capital from Prior Investments Total Investments in Loans & Securities, Net of Return of Capital EXHIBIT 7 Note: excludes SFR volume; sale of certificate presented net

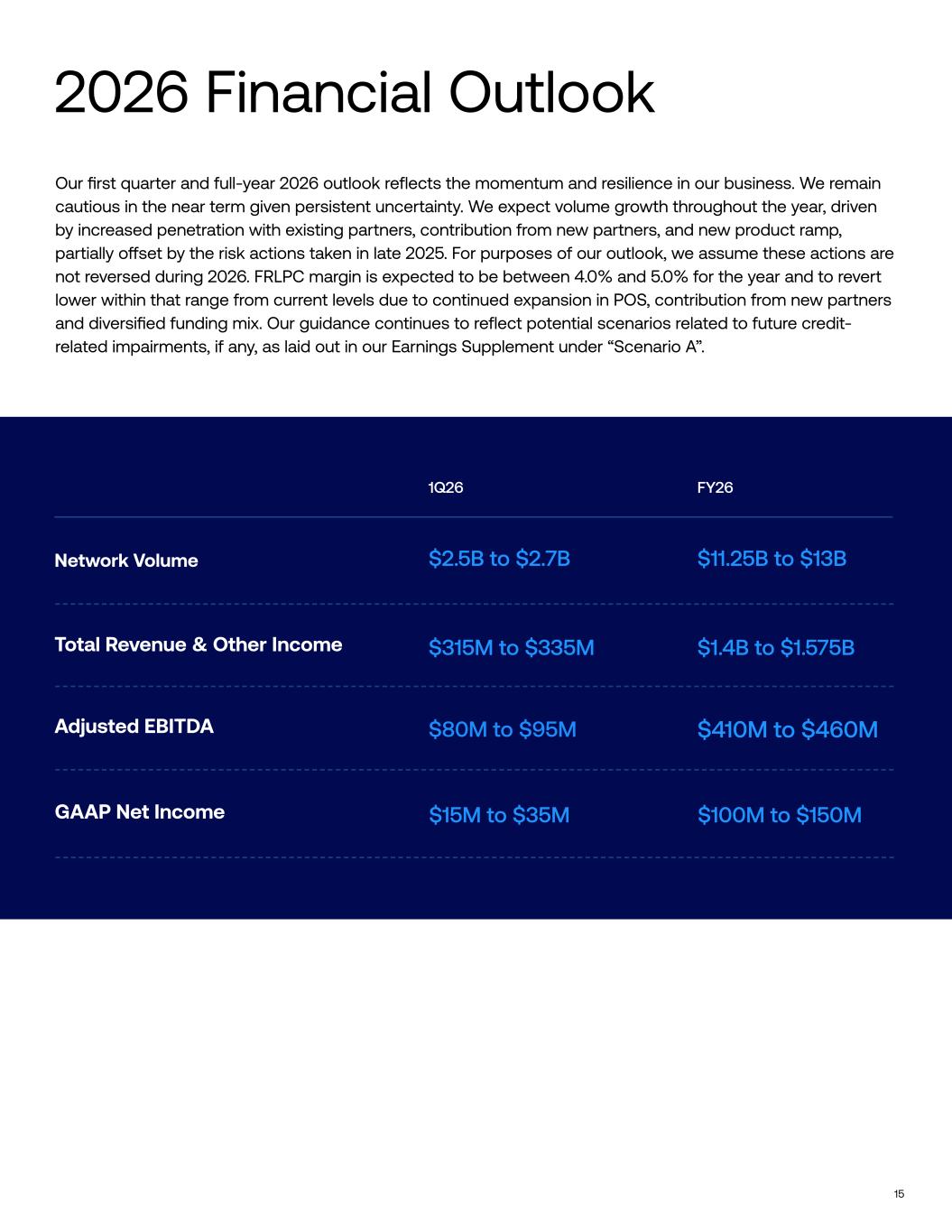

15 Our first quarter and full-year 2026 outlook reflects the momentum and resilience in our business. We remain cautious in the near term given persistent uncertainty. We expect volume growth throughout the year, driven by increased penetration with existing partners, contribution from new partners, and new product ramp, partially offset by the risk actions taken in late 2025. For purposes of our outlook, we assume these actions are not reversed during 2026. FRLPC margin is expected to be between 4.0% and 5.0% for the year and to revert lower within that range from current levels due to continued expansion in POS, contribution from new partners and diversified funding mix. Our guidance continues to reflect potential scenarios related to future credit- related impairments, if any, as laid out in our Earnings Supplement under “Scenario A”. 2026 Financial Outlook 1Q26 Network Volume $2.5B to $2.7B Total Revenue & Other Income $315M to $335M Adjusted EBITDA $80M to $95M GAAP Net Income $15M to $35M FY26 $11.25B to $13B $1.4B to $1.575B $410M to $460M $100M to $150M

16 Conference Call and Webcast Information The Company will hold a webcast and conference call today, February 9, 2026, at 8:30 a.m. Eastern Time. A live webcast of the call will be available via the Investor Relations section of the Company’s website at investor.pagaya.com. To listen to the live webcast, please go to the site at least five minutes prior to the scheduled start time in order to register, download and install any necessary audio software. Shortly before the call, the accompanying materials will be made available on the Company’s website. Shortly after the call, a replay of the webcast will be available for 90 days on the Company’s website. The conference call can also be accessed by dialing 1-877-808-1531 or 1-201-493-6782 and providing conference ID PAGAYA. The telephone replay can be accessed by dialing 1-844-512-2921 or 1-412-317-6671 and providing the conference ID# 13757954. The telephone replay will be available starting shortly after the call until Monday, February 23, 2026. A replay will also be available on the Investor Relations website following the call. About Pagaya Technologies Pagaya (NASDAQ: PGY) is a global technology company making life-changing financial products and services available to more people nationwide, as it reshapes the financial services ecosystem. By using machine learning, a vast data network and an AI-driven approach, Pagaya provides comprehensive consumer credit and residential real estate solutions for its partners, their customers, and investors. Its proprietary API and capital solutions integrate into its network of partners to deliver seamless user experiences and greater access to the mainstream economy. Pagaya has offices in New York and Tel Aviv. For more information, visit pagaya.com. INVESTORS & ANALYSTS Josh Fagen, CFA Head of Investor Relations & COO of Finance ir@pagaya.com MEDIA & PRESS Natasha Seth Head of Marketing and Brand press@pagaya.com

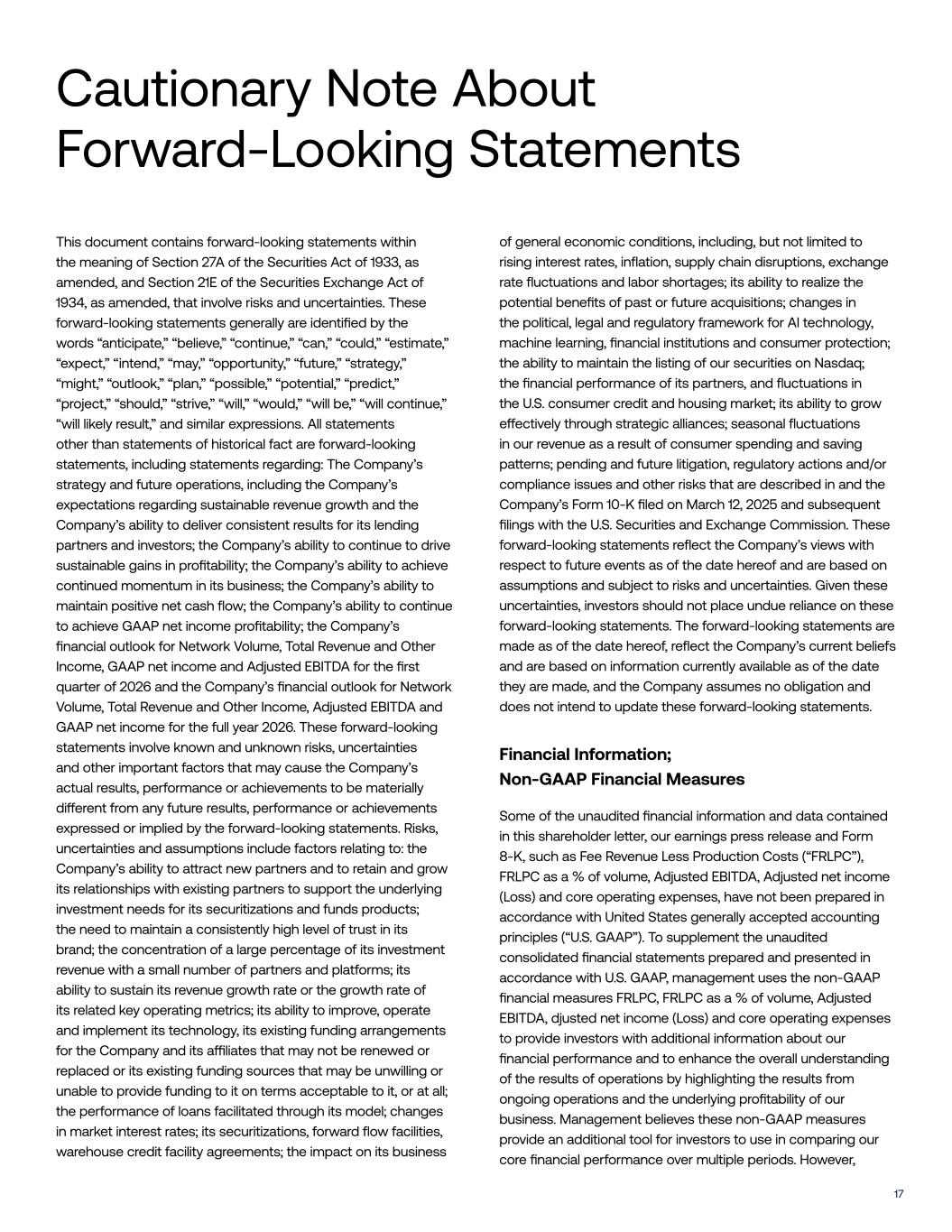

17 This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that involve risks and uncertainties. These forward-looking statements generally are identified by the words “anticipate,” “believe,” “continue,” “can,” “could,” “estimate,” “expect,” “intend,” “may,” “opportunity,” “future,” “strategy,” “might,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “strive,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. All statements other than statements of historical fact are forward-looking statements, including statements regarding: The Company’s strategy and future operations, including the Company’s expectations regarding sustainable revenue growth and the Company’s ability to deliver consistent results for its lending partners and investors; the Company’s ability to continue to drive sustainable gains in profitability; the Company’s ability to achieve continued momentum in its business; the Company’s ability to maintain positive net cash flow; the Company’s ability to continue to achieve GAAP net income profitability; the Company’s financial outlook for Network Volume, Total Revenue and Other Income, GAAP net income and Adjusted EBITDA for the first quarter of 2026 and the Company’s financial outlook for Network Volume, Total Revenue and Other Income, Adjusted EBITDA and GAAP net income for the full year 2026. These forward-looking statements involve known and unknown risks, uncertainties and other important factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Risks, uncertainties and assumptions include factors relating to: the Company’s ability to attract new partners and to retain and grow its relationships with existing partners to support the underlying investment needs for its securitizations and funds products; the need to maintain a consistently high level of trust in its brand; the concentration of a large percentage of its investment revenue with a small number of partners and platforms; its ability to sustain its revenue growth rate or the growth rate of its related key operating metrics; its ability to improve, operate and implement its technology, its existing funding arrangements for the Company and its affiliates that may not be renewed or replaced or its existing funding sources that may be unwilling or unable to provide funding to it on terms acceptable to it, or at all; the performance of loans facilitated through its model; changes in market interest rates; its securitizations, forward flow facilities, warehouse credit facility agreements; the impact on its business of general economic conditions, including, but not limited to rising interest rates, inflation, supply chain disruptions, exchange rate fluctuations and labor shortages; its ability to realize the potential benefits of past or future acquisitions; changes in the political, legal and regulatory framework for AI technology, machine learning, financial institutions and consumer protection; the ability to maintain the listing of our securities on Nasdaq; the financial performance of its partners, and fluctuations in the U.S. consumer credit and housing market; its ability to grow effectively through strategic alliances; seasonal fluctuations in our revenue as a result of consumer spending and saving patterns; pending and future litigation, regulatory actions and/or compliance issues and other risks that are described in and the Company’s Form 10-K filed on March 12, 2025 and subsequent filings with the U.S. Securities and Exchange Commission. These forward-looking statements reflect the Company’s views with respect to future events as of the date hereof and are based on assumptions and subject to risks and uncertainties. Given these uncertainties, investors should not place undue reliance on these forward-looking statements. The forward-looking statements are made as of the date hereof, reflect the Company’s current beliefs and are based on information currently available as of the date they are made, and the Company assumes no obligation and does not intend to update these forward-looking statements. Financial Information; Non-GAAP Financial Measures Some of the unaudited financial information and data contained in this shareholder letter, our earnings press release and Form 8-K, such as Fee Revenue Less Production Costs (“FRLPC”), FRLPC as a % of volume, Adjusted EBITDA, Adjusted net income (Loss) and core operating expenses, have not been prepared in accordance with United States generally accepted accounting principles (“U.S. GAAP”). To supplement the unaudited consolidated financial statements prepared and presented in accordance with U.S. GAAP, management uses the non-GAAP financial measures FRLPC, FRLPC as a % of volume, Adjusted EBITDA, djusted net income (Loss) and core operating expenses to provide investors with additional information about our financial performance and to enhance the overall understanding of the results of operations by highlighting the results from ongoing operations and the underlying profitability of our business. Management believes these non-GAAP measures provide an additional tool for investors to use in comparing our core financial performance over multiple periods. However, Cautionary Note About Forward-Looking Statements

18 non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by U.S. GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, non-GAAP financial measures may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. As a result, non- GAAP financial measures should be viewed as supplementing, and not as an alternative or substitute for, our unaudited consolidated financial statements prepared and presented in accordance with U.S. GAAP. To address these limitations, management provides a reconciliation of Adjusted net income (Loss), Adjusted EBITDA to net income (loss) attributable to Pagaya’s shareholders, a reconciliation of FRLPC to Operating Income and a reconciliation of core operating expenses to Operating expenses, and a calculation of FRLPC as a % of volume. Management encourages investors and others to review our financial information in its entirety, not to rely on any single financial measure and to view Adjusted net income (Loss) and Adjusted EBITDA in conjunction with its respective related GAAP financial measures. Non-GAAP financial measures include the following items: Fee Revenue Less Production Costs (“FRLPC”) is defined as revenue from fees less production costs. FRLPC as a % of volume is defined as FRLPC divided by Network Volume. Adjusted Net Income (Loss) is defined as net income (loss) attributable to Pagaya Technologies Ltd.’s shareholders excluding share-based compensation expense, change in fair value of warrant liability, change in fair value of contingent liability, impairment, including credit-related charges, restructuring expenses, transaction-related expenses, and non-recurring expenses associated with mergers and acquisitions and other one-time expenses. Adjusted EBITDA is defined as net income (loss) attributable to Pagaya Technologies Ltd.’s shareholders excluding share-based compensation expense, change in fair value of warrant liability, change in fair value of contingent liability, impairment, including credit-related charges, restructuring expenses, transaction-related expenses, non-recurring expenses associated with mergers and acquisitions and other one-time expenses, interest expense, depreciation expense, and income tax expense (benefit). Core operating expenses is defined as operating expenses less share-based compensation, depreciation and amortization, whole loan allowance for losses, write-off of capitalized software, transaction-related expenses, restructuring expenses and non- recurring expenses associated with mergers and acquisitions and other one-time expenses. The foregoing items are excluded from our Adjusted net income (Loss), Adjusted EBITDA and core operating expenses measures because they are noncash in nature, or because the amount and timing of these items is unpredictable, is not driven by core results of operations and renders comparisons with prior periods and competitors less meaningful. We believe FRLPC, FRLPC as a % of volume, Adjusted net income (Loss), Adjusted EBITDA and core operating expenses provide useful information to investors and others in understanding and evaluating our results of operations, as well as providing a useful measure for period-to-period comparisons of our business performance. Moreover, we have included FRLPC, FRLPC as a % of volume, Adjusted net income (Loss), Adjusted EBITDA and core operating expenses because these are key measurements used by our management internally to make operating decisions, including those related to operating expenses, evaluate performance, and perform strategic planning and annual budgeting. However, this non-GAAP financial information is presented for supplemental informational purposes only, should not be considered a substitute for or superior to financial information presented in accordance with U.S. GAAP and may be different from similarly titled non-GAAP financial measures used by other companies. The tables below provide reconciliations of this non-GAAP financial information to its most directly comparable U.S. GAAP metric. In addition, Pagaya provides an outlook for the first quarter and full year 2026 on a non-GAAP basis. The Company cannot reconcile its expected Adjusted EBITDA to expected Net Income Attributable to Pagaya under “2026 Financial Outlook” without unreasonable effort because certain items that impact net income (loss) and other reconciling items are out of the Company’s control and/or cannot be reasonably predicted at this time, which unavailable information could have a significant impact on the Company’s U.S. GAAP financial results.

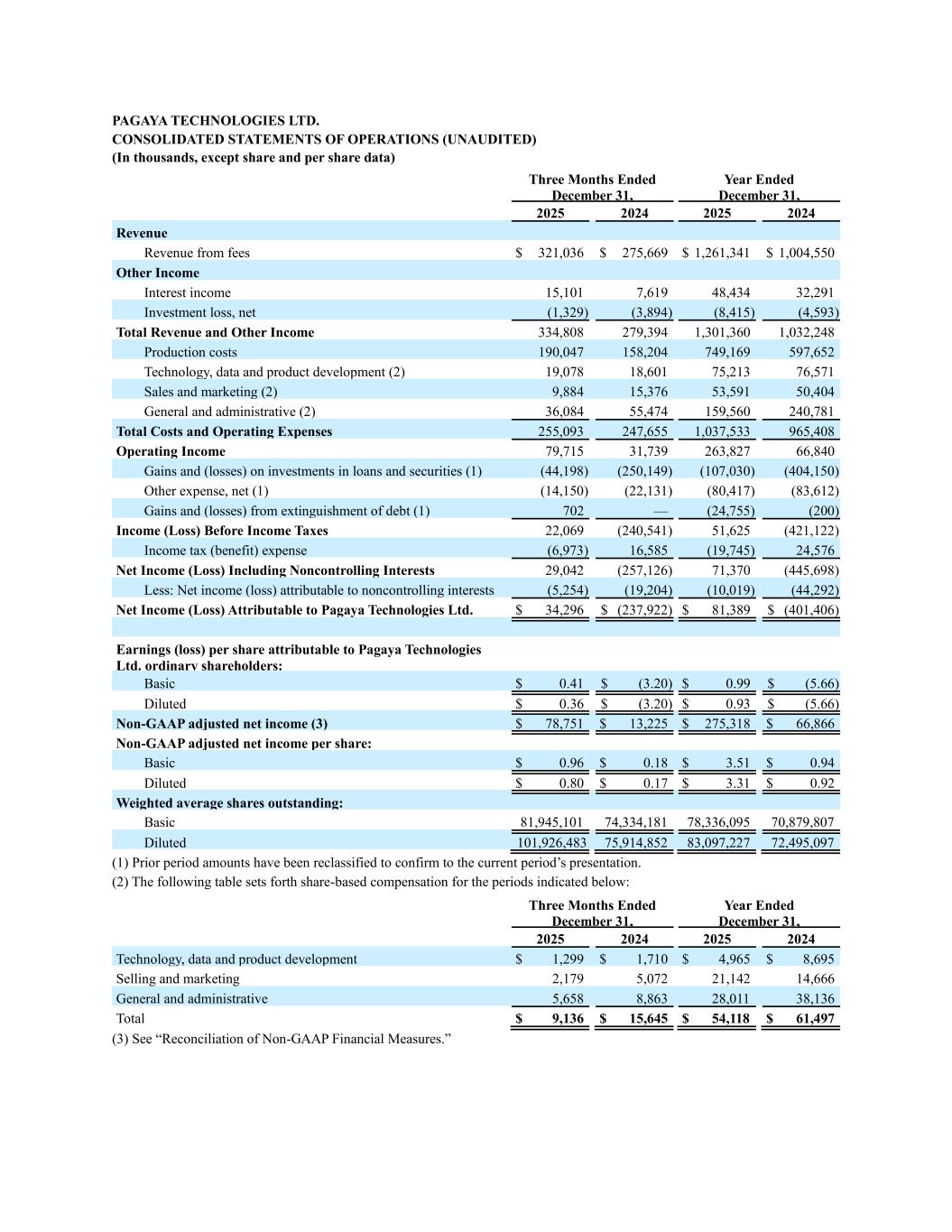

PAGAYA TECHNOLOGIES LTD. CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) (In thousands, except share and per share data) Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Revenue Revenue from fees $ 321,036 $ 275,669 $ 1,261,341 $ 1,004,550 Other Income Interest income 15,101 7,619 48,434 32,291 Investment loss, net (1,329) (3,894) (8,415) (4,593) Total Revenue and Other Income 334,808 279,394 1,301,360 1,032,248 Production costs 190,047 158,204 749,169 597,652 Technology, data and product development (2) 19,078 18,601 75,213 76,571 Sales and marketing (2) 9,884 15,376 53,591 50,404 General and administrative (2) 36,084 55,474 159,560 240,781 Total Costs and Operating Expenses 255,093 247,655 1,037,533 965,408 Operating Income 79,715 31,739 263,827 66,840 Gains and (losses) on investments in loans and securities (1) (44,198) (250,149) (107,030) (404,150) Other expense, net (1) (14,150) (22,131) (80,417) (83,612) Gains and (losses) from extinguishment of debt (1) 702 — (24,755) (200) Income (Loss) Before Income Taxes 22,069 (240,541) 51,625 (421,122) Income tax (benefit) expense (6,973) 16,585 (19,745) 24,576 Net Income (Loss) Including Noncontrolling Interests 29,042 (257,126) 71,370 (445,698) Less: Net income (loss) attributable to noncontrolling interests (5,254) (19,204) (10,019) (44,292) Net Income (Loss) Attributable to Pagaya Technologies Ltd. $ 34,296 $ (237,922) $ 81,389 $ (401,406) Earnings (loss) per share attributable to Pagaya Technologies Ltd. ordinary shareholders: Basic $ 0.41 $ (3.20) $ 0.99 $ (5.66) Diluted $ 0.36 $ (3.20) $ 0.93 $ (5.66) Non-GAAP adjusted net income (3) $ 78,751 $ 13,225 $ 275,318 $ 66,866 Non-GAAP adjusted net income per share: Basic $ 0.96 $ 0.18 $ 3.51 $ 0.94 Diluted $ 0.80 $ 0.17 $ 3.31 $ 0.92 Weighted average shares outstanding: Basic 81,945,101 74,334,181 78,336,095 70,879,807 Diluted 101,926,483 75,914,852 83,097,227 72,495,097 (1) Prior period amounts have been reclassified to confirm to the current period’s presentation. (2) The following table sets forth share-based compensation for the periods indicated below: Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Technology, data and product development $ 1,299 $ 1,710 $ 4,965 $ 8,695 Selling and marketing 2,179 5,072 21,142 14,666 General and administrative 5,658 8,863 28,011 38,136 Total $ 9,136 $ 15,645 $ 54,118 $ 61,497 (3) See “Reconciliation of Non-GAAP Financial Measures.”

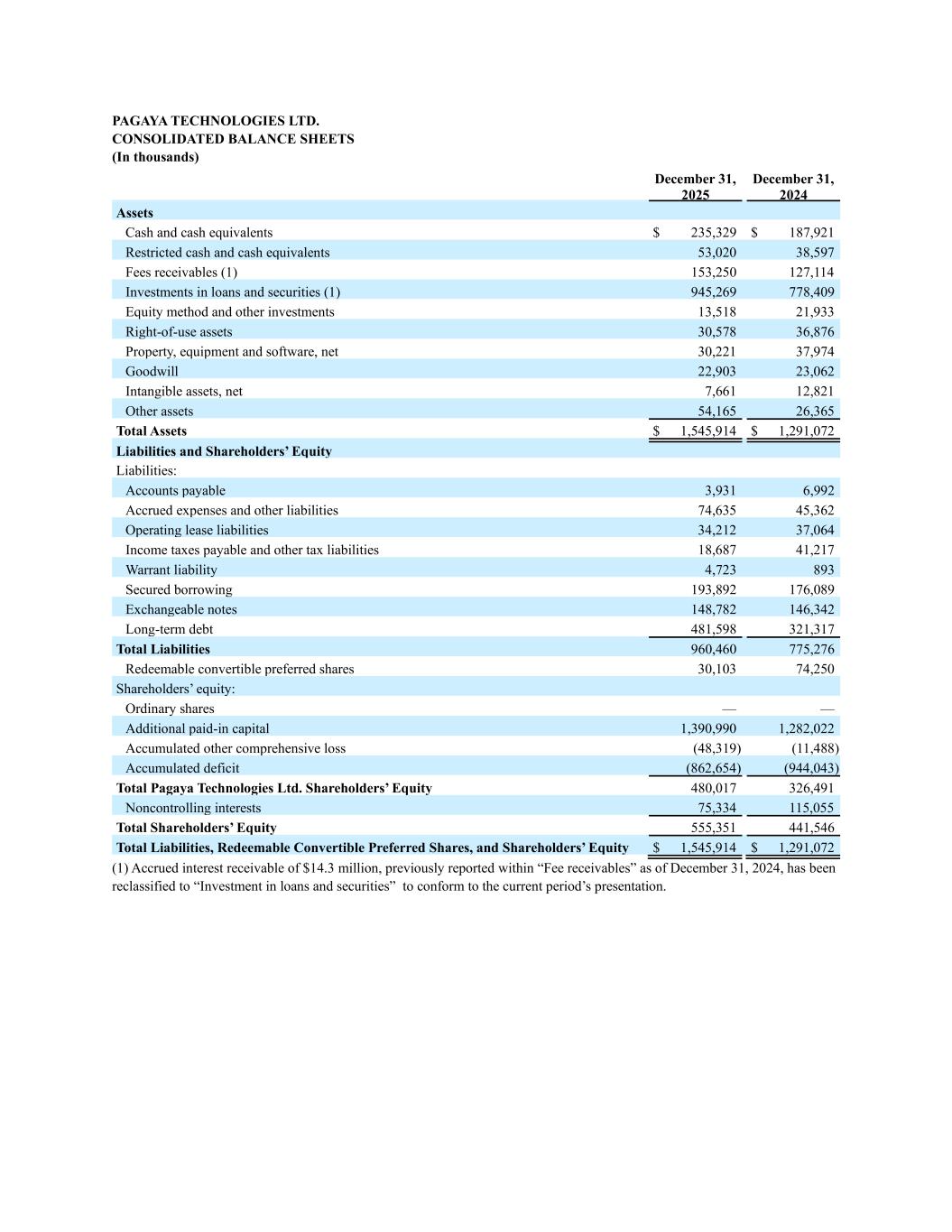

PAGAYA TECHNOLOGIES LTD. CONSOLIDATED BALANCE SHEETS (In thousands) December 31, 2025 December 31, 2024 Assets Cash and cash equivalents $ 235,329 $ 187,921 Restricted cash and cash equivalents 53,020 38,597 Fees receivables (1) 153,250 127,114 Investments in loans and securities (1) 945,269 778,409 Equity method and other investments 13,518 21,933 Right-of-use assets 30,578 36,876 Property, equipment and software, net 30,221 37,974 Goodwill 22,903 23,062 Intangible assets, net 7,661 12,821 Other assets 54,165 26,365 Total Assets $ 1,545,914 $ 1,291,072 Liabilities and Shareholders’ Equity Liabilities: Accounts payable 3,931 6,992 Accrued expenses and other liabilities 74,635 45,362 Operating lease liabilities 34,212 37,064 Income taxes payable and other tax liabilities 18,687 41,217 Warrant liability 4,723 893 Secured borrowing 193,892 176,089 Exchangeable notes 148,782 146,342 Long-term debt 481,598 321,317 Total Liabilities 960,460 775,276 Redeemable convertible preferred shares 30,103 74,250 Shareholders’ equity: Ordinary shares — — Additional paid-in capital 1,390,990 1,282,022 Accumulated other comprehensive loss (48,319) (11,488) Accumulated deficit (862,654) (944,043) Total Pagaya Technologies Ltd. Shareholders’ Equity 480,017 326,491 Noncontrolling interests 75,334 115,055 Total Shareholders’ Equity 555,351 441,546 Total Liabilities, Redeemable Convertible Preferred Shares, and Shareholders’ Equity $ 1,545,914 $ 1,291,072 (1) Accrued interest receivable of $14.3 million, previously reported within “Fee receivables” as of December 31, 2024, has been reclassified to “Investment in loans and securities” to conform to the current period’s presentation.

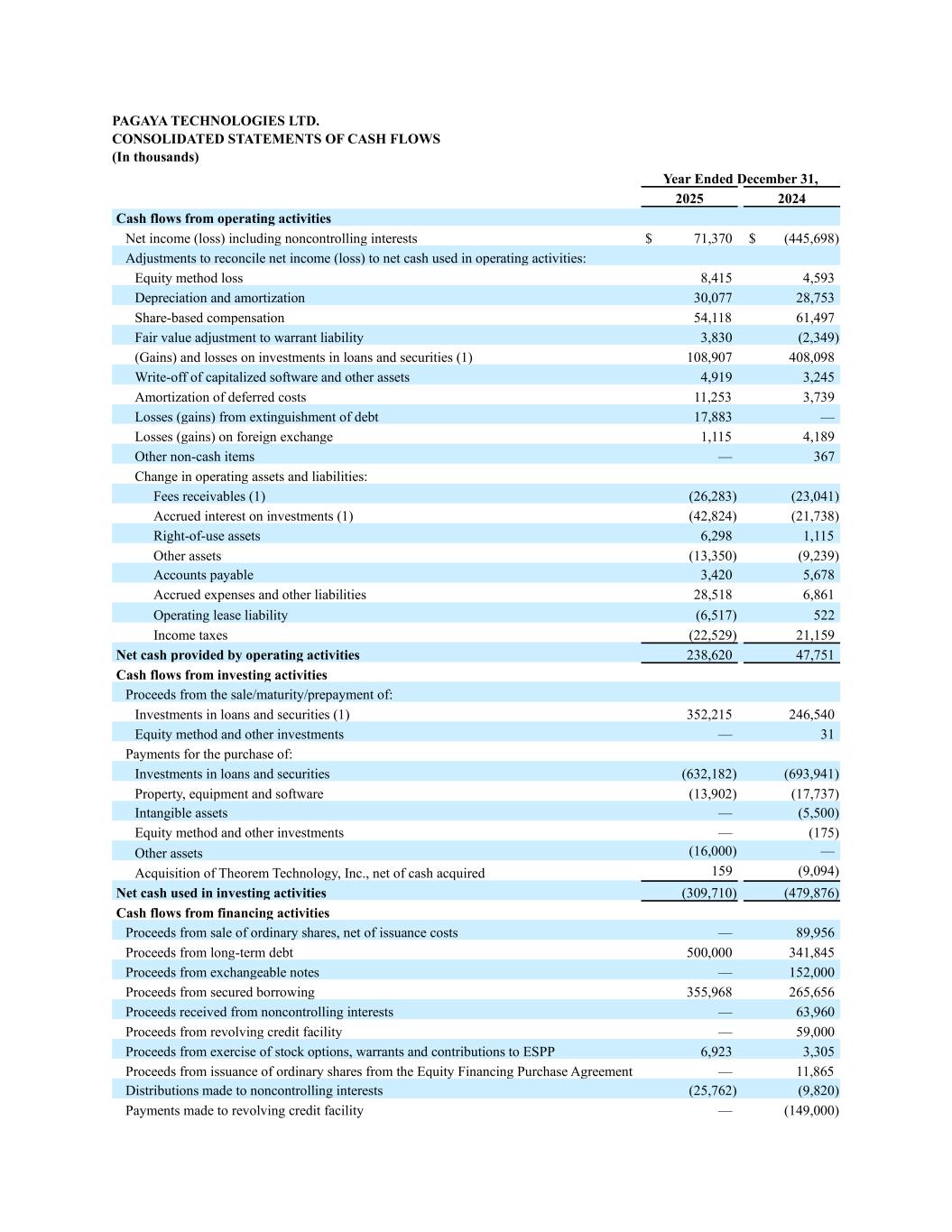

PAGAYA TECHNOLOGIES LTD. CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) Year Ended December 31, 2025 2024 Cash flows from operating activities Net income (loss) including noncontrolling interests $ 71,370 $ (445,698) Adjustments to reconcile net income (loss) to net cash used in operating activities: Equity method loss 8,415 4,593 Depreciation and amortization 30,077 28,753 Share-based compensation 54,118 61,497 Fair value adjustment to warrant liability 3,830 (2,349) (Gains) and losses on investments in loans and securities (1) 108,907 408,098 Write-off of capitalized software and other assets 4,919 3,245 Amortization of deferred costs 11,253 3,739 Losses (gains) from extinguishment of debt 17,883 — Losses (gains) on foreign exchange 1,115 4,189 Other non-cash items — 367 Change in operating assets and liabilities: Fees receivables (1) (26,283) (23,041) Accrued interest on investments (1) (42,824) (21,738) Right-of-use assets 6,298 1,115 Other assets (13,350) (9,239) Accounts payable 3,420 5,678 Accrued expenses and other liabilities 28,518 6,861 Operating lease liability (6,517) 522 Income taxes (22,529) 21,159 Net cash provided by operating activities 238,620 47,751 Cash flows from investing activities Proceeds from the sale/maturity/prepayment of: Investments in loans and securities (1) 352,215 246,540 Equity method and other investments — 31 Payments for the purchase of: Investments in loans and securities (632,182) (693,941) Property, equipment and software (13,902) (17,737) Intangible assets — (5,500) Equity method and other investments — (175) Other assets (16,000) — Acquisition of Theorem Technology, Inc., net of cash acquired 159 (9,094) Net cash used in investing activities (309,710) (479,876) Cash flows from financing activities Proceeds from sale of ordinary shares, net of issuance costs — 89,956 Proceeds from long-term debt 500,000 341,845 Proceeds from exchangeable notes — 152,000 Proceeds from secured borrowing 355,968 265,656 Proceeds received from noncontrolling interests — 63,960 Proceeds from revolving credit facility — 59,000 Proceeds from exercise of stock options, warrants and contributions to ESPP 6,923 3,305 Proceeds from issuance of ordinary shares from the Equity Financing Purchase Agreement — 11,865 Distributions made to noncontrolling interests (25,762) (9,820) Payments made to revolving credit facility — (149,000)

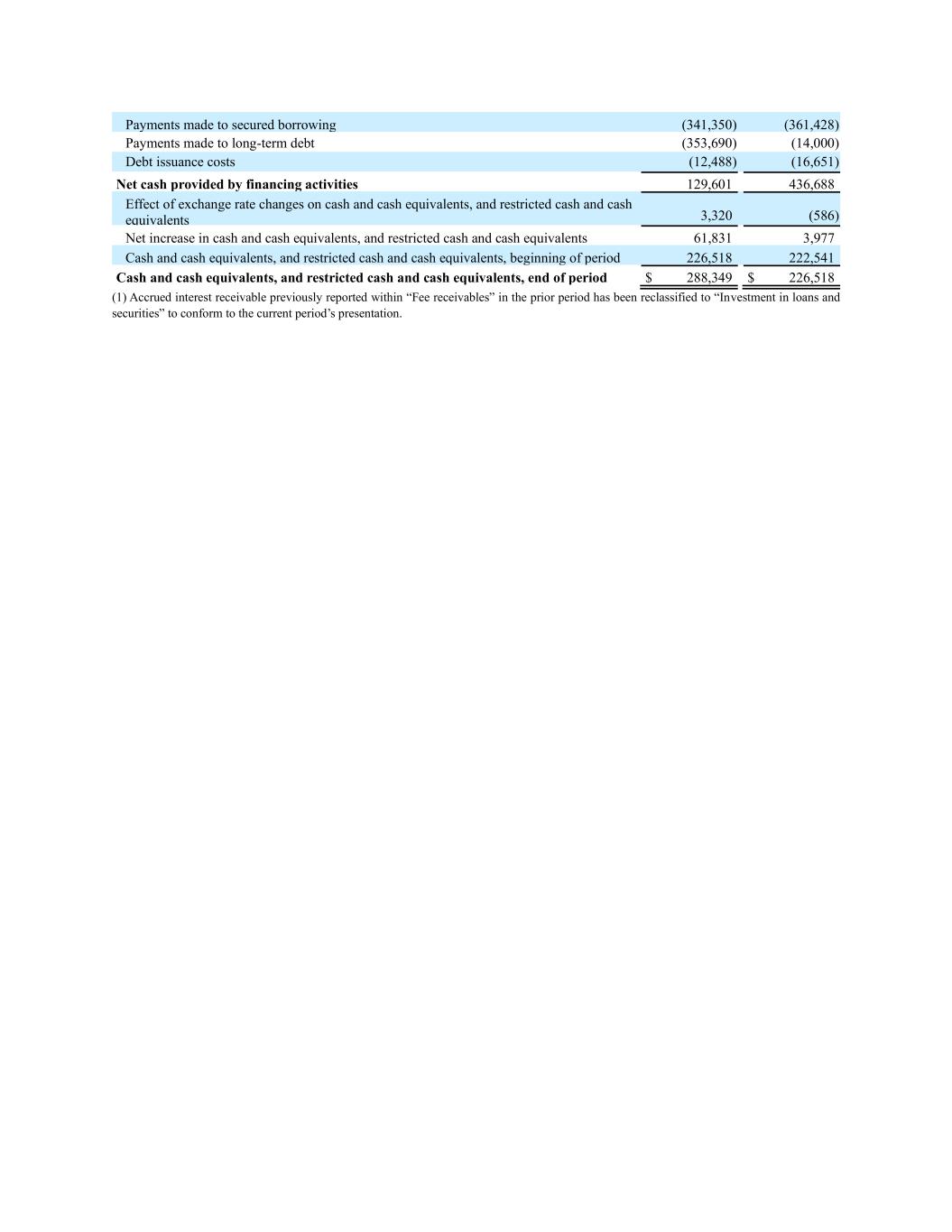

Payments made to secured borrowing (341,350) (361,428) Payments made to long-term debt (353,690) (14,000) Debt issuance costs (12,488) (16,651) Net cash provided by financing activities 129,601 436,688 Effect of exchange rate changes on cash and cash equivalents, and restricted cash and cash equivalents 3,320 (586) Net increase in cash and cash equivalents, and restricted cash and cash equivalents 61,831 3,977 Cash and cash equivalents, and restricted cash and cash equivalents, beginning of period 226,518 222,541 Cash and cash equivalents, and restricted cash and cash equivalents, end of period $ 288,349 $ 226,518 (1) Accrued interest receivable previously reported within “Fee receivables” in the prior period has been reclassified to “Investment in loans and securities” to conform to the current period’s presentation.

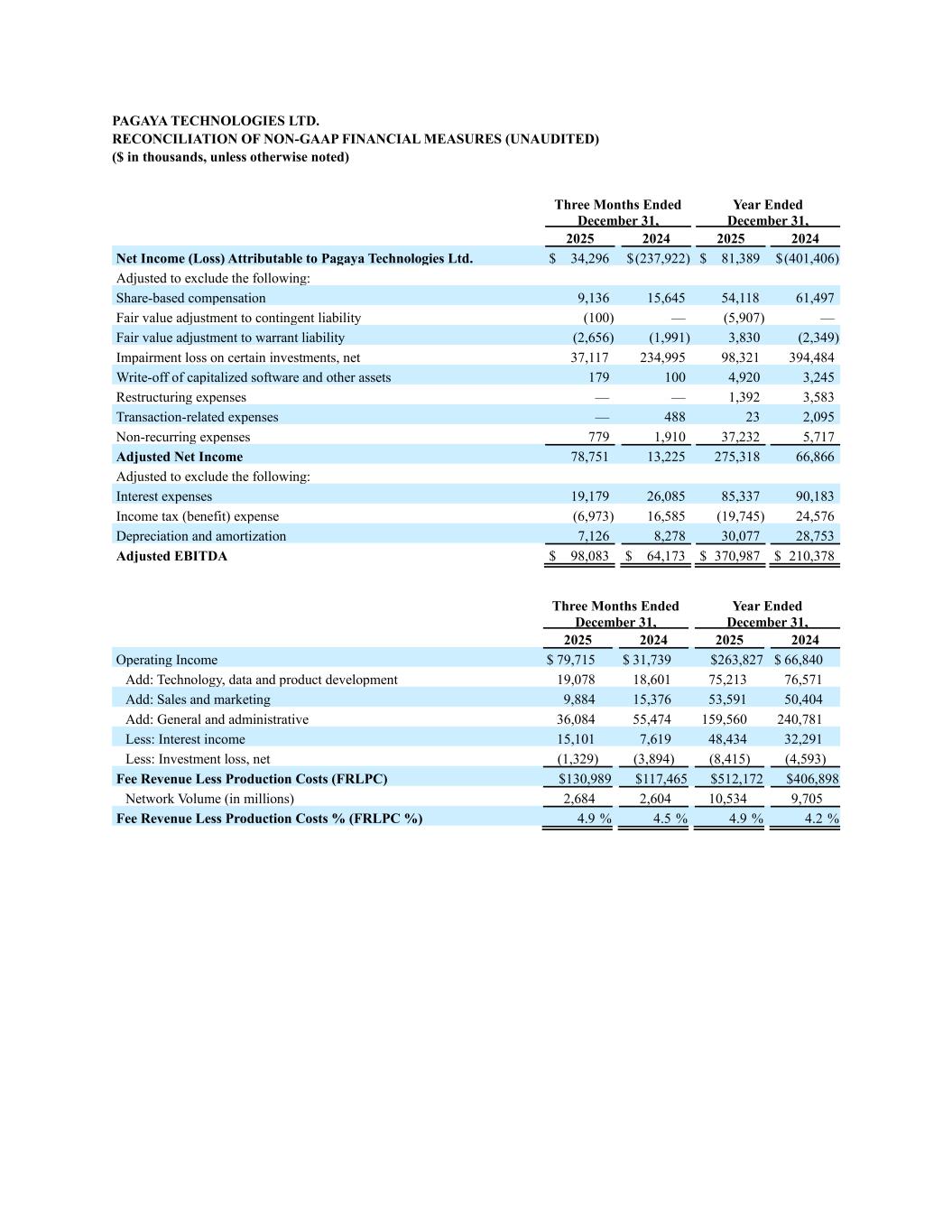

PAGAYA TECHNOLOGIES LTD. RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (UNAUDITED) ($ in thousands, unless otherwise noted) Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Net Income (Loss) Attributable to Pagaya Technologies Ltd. $ 34,296 $ (237,922) $ 81,389 $ (401,406) Adjusted to exclude the following: Share-based compensation 9,136 15,645 54,118 61,497 Fair value adjustment to contingent liability (100) — (5,907) — Fair value adjustment to warrant liability (2,656) (1,991) 3,830 (2,349) Impairment loss on certain investments, net 37,117 234,995 98,321 394,484 Write-off of capitalized software and other assets 179 100 4,920 3,245 Restructuring expenses — — 1,392 3,583 Transaction-related expenses — 488 23 2,095 Non-recurring expenses 779 1,910 37,232 5,717 Adjusted Net Income 78,751 13,225 275,318 66,866 Adjusted to exclude the following: Interest expenses 19,179 26,085 85,337 90,183 Income tax (benefit) expense (6,973) 16,585 (19,745) 24,576 Depreciation and amortization 7,126 8,278 30,077 28,753 Adjusted EBITDA $ 98,083 $ 64,173 $ 370,987 $ 210,378 Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Operating Income $ 79,715 $ 31,739 $263,827 $ 66,840 Add: Technology, data and product development 19,078 18,601 75,213 76,571 Add: Sales and marketing 9,884 15,376 53,591 50,404 Add: General and administrative 36,084 55,474 159,560 240,781 Less: Interest income 15,101 7,619 48,434 32,291 Less: Investment loss, net (1,329) (3,894) (8,415) (4,593) Fee Revenue Less Production Costs (FRLPC) $130,989 $117,465 $512,172 $406,898 Network Volume (in millions) 2,684 2,604 10,534 9,705 Fee Revenue Less Production Costs % (FRLPC %) 4.9 % 4.5 % 4.9 % 4.2 %

Three Months Ended December 31, Year Ended December 31, 2025 2024 2025 2024 Operating expenses $ 65,046 $ 89,451 $288,364 $367,756 Adjusted to exclude the following: Share-based compensation 9,136 15,645 54,118 61,497 Depreciation and amortization 7,126 8,278 30,077 28,753 Whole loan allowance for losses — 5,664 8,030 40,402 Write-off of capitalized software 519 100 519 3,245 Transaction-related expenses — 488 23 2,095 Restructuring expenses — — 1,392 3,583 Non-recurring expenses 1,481 1,910 7,610 2,221 Core operating expenses $ 46,784 $ 57,366 $186,595 $225,960 Core operating expenses as a % of FRLPC 36 % 49 % 36 % 56 %