| 1 November 4, 2025 KBW Investor Conference |

| 2 Forward Looking Statements Statements in this press release that are not historical facts are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to b e covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. We may also make forward-looking statements in other documents we file with the Securities and Exchange Commission (the “SEC”), in our annual reports to our stockholders, in press releases and other written materials, and in oral statements made by our officers, directors or employees. You can identify forward-looking statements by the use of the words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “assume,” “outlook,” “will,” “should,” and other expressions that predict or indicate future events and trends and which do not relate to historical matters. Althou gh the Company believes that these forward-looking statements are based on reasonable estimates and assumptions, they are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and other factors. You should not place undue reliance on our forward-looking statements. You should exercise caution in interpreting and relying on forward-looking statements because they are subject to significant risks, uncertainties and other factors which are, in some cases, beyond the Company’s control. The Company’s actual results could differ materially from those projected in the forward-looking statements as a result of, among other factors, changes in general business and economic conditions on a national basis and in the local markets in which the Company operates, includin g changes which adversely affect borrowers’ ability to service and repay loans; changes in customer behavior due to political, business and economic conditions, including inflation and concerns about liquidity; turbulence in the capital and debt markets; reductions in net interest income resulting from interest rate volatility as well as changes in the balances and mix of loans and deposits; changes in interest rates and real estate values; changes in loan collectability and increases in defaults and charge-off rates; decreases in the value of securities and other assets, adequacy of credit loss reserves, or deposit levels necessitating increased borrowing to fund loans and investments; failure to consummate or a delay in consummating the acquisition of Provident, including as a result of any failure to obtain the necessary regulatory approvals, to obtain Provident shareholder approval or to satisfy any of the other conditions to the proposed transaction on a timely basis or at all; risks related to the Company’s pending acquisition of Provident and acquisitions generally, including disruption to current plans and operations; difficulties in customer and employee retention; fees, expenses and charges related to these transactions being significantly higher than anticipated; unforeseen integration issues or impairment of other intangibles; and the Company’s inability to achieve expected revenues, cost savings, synergies, and other benefits at levels or within the timeframes originally anticipated; changing government regulation; competitive pressures from other financial institutions; changes in legislation or regulation and accounting principles, policies and guidelines; cybersecurity incidents, fraud, natural disasters, and future pandemics; the risk that the Company may not be successful in the implementation of its business strategy; the risk that intangibles recorded in the Company’s financial statements will become impaired; changes in assumptions used in making such forward-looking statements; and the other risks and uncertainties detailed in the Company’s Form 10-K and updated by our Quarterly Report on Form 10-Q and other filings submitted to the SEC. These statements speak only as of the date of this release and the Company does not undertake any obligation to update or revise any of these forward-looking statements to reflect events or circumstances occurring after the date of this communication or to reflect the occurrence of unanticipated events. 2 |

| 3 NB Bancorp, Inc. Overview |

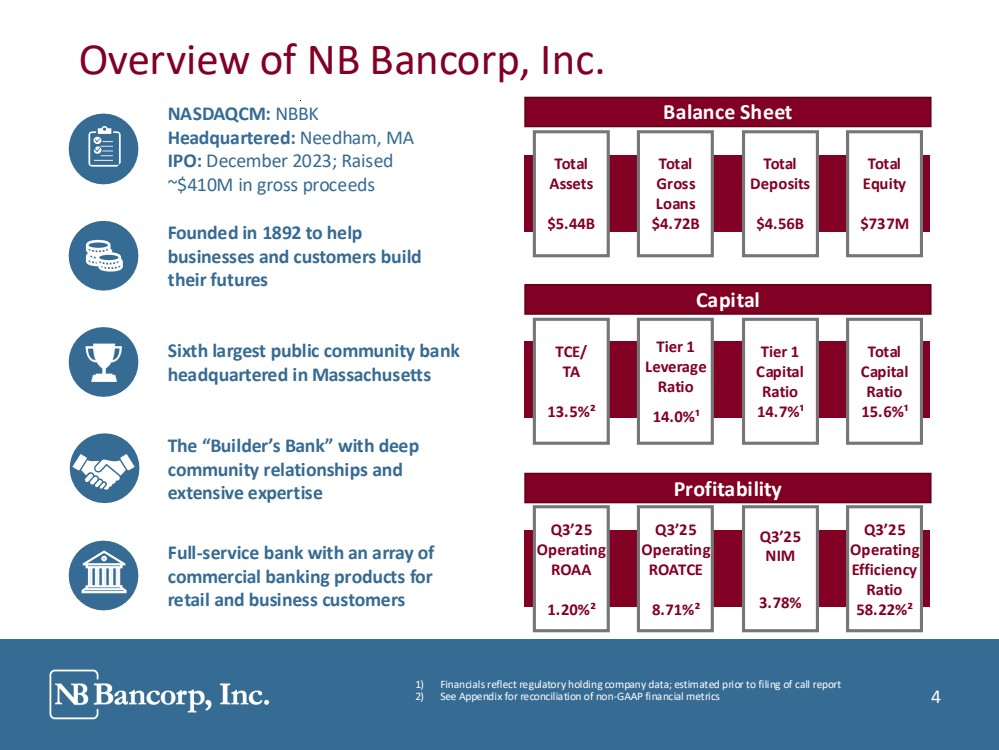

| 4 Overview of NB Bancorp, Inc. NASDAQCM: NBBK Headquartered: Needham, MA IPO: December 2023; Raised ~$410M in gross proceeds Sixth largest public community bank headquartered in Massachusetts The “Builder’s Bank” with deep community relationships and extensive expertise Full-service bank with an array of commercial banking products for retail and business customers Founded in 1892 to help businesses and customers build their futures Total Assets $5.44B Total Gross Loans $4.72B Total Deposits $4.56B Total Equity $737M TCE/ TA 13.5%² Tier 1 Leverage Ratio 14.0%¹ Tier 1 Capital Ratio 14.7%¹ Total Capital Ratio 15.6%¹ Q3’25 Operating ROAA 1.20%² Q3’25 Operating ROATCE 8.71%² Q3’25 NIM 3.78% Q3’25 Operating Efficiency Ratio 58.22%² Balance Sheet Profitability Capital 1) Financials reflect regulatory holding company data; estimated prior to filing of call report 2) See Appendix for reconciliation of non-GAAP financial metrics 4 |

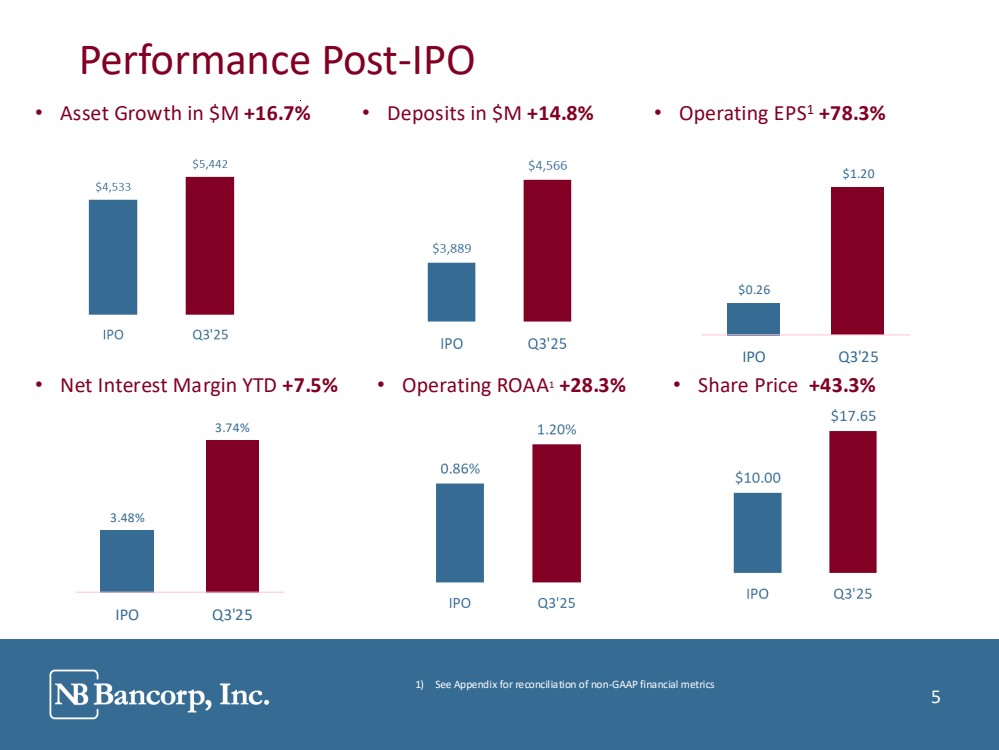

| 5 Performance Post-IPO 5 1) See Appendix for reconciliation of non-GAAP financial metrics • Asset Growth in $M +16.7% • Deposits in $M +14.8% • Operating EPS1 +78.3% • Net Interest Margin YTD +7.5% • Operating ROAA1 +28.3% • Share Price +43.3% $0.26 $1.20 IPO Q3'25 3.48% 3.74% IPO Q3'25 |

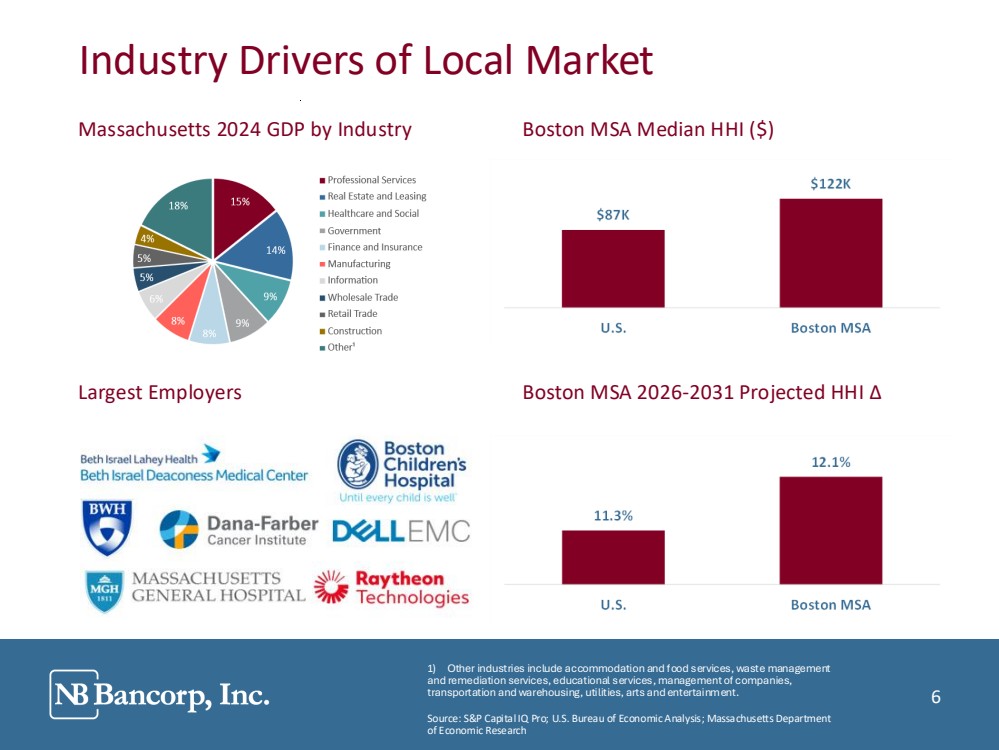

| 6 Largest Employers Boston MSA 2026-2031 Projected HHI Δ Massachusetts 2024 GDP by Industry Boston MSA Median HHI ($) Industry Drivers of Local Market 1) Other industries include accommodation and food services, waste management and remediation services, educational services, management of companies, transportation and warehousing, utilities, arts and entertainment. Source: S&P Capital IQ Pro; U.S. Bureau of Economic Analysis; Massachusetts Department of Economic Research 6 |

| 7 Experienced Institutional Leadership Joseph Campanelli Chairman, President & CEO William Darcey President & CEO – Provider Insurance Group Paul J. Ayoub Chair – Nutter McClennen & Fish LLP Susan Elliott Retired EVP – Federal Home Loan Bank of Boston Angela Jackson CEO – Future Forward Strategies Christopher Lynch President – Marshall Resources Joseph R. Nolan, Jr. Chairman, President & CEO – Eversource Francis Orfanello Lead Independent Director Operating Partner – One Rock Capital Partners Hope Pascucci President & Principal – Rose Grove Capital Management Raza Shaikh Managing Director – Launchpad Venture Group Mark Whalen Retired CEO – Needham Bank Joseph Campanelli Chairman, President & CEO Christine Roberts EVP & Chief Operating Officer James White EVP & Chief Administrative Officer Paul Evangelista EVP & Director of Consumer Payments Kevin Henkin EVP & Chief Credit Officer Stephanie Maiona EVP & Director of Commercial Real Estate Lending James Daley EVP & Director of Commercial and Industrial Lending Executive Management Board of Directors JP Lapointe EVP & Chief Financial Officer 7 Peter Bakkala EVP & Chief Risk Officer Kenneth Montgomery Retired FVP, COO – Federal Reserve Bank of Boston |

| 8 Investment Highlights Experienced management team and talent base to grow market share, invest for the future and serve the community Focused on driving franchise value via relationship-based banking and active community involvement History of consistent earnings through various market cycles Excellent credit profile reflective of a diligent and conservative risk management culture Prudent stewards of capital – committed to responsible lending, driving organic growth and investing in the future Strong and stable deposit base with 100+ year history of banking in the communities served Attractive markets of operation to continue generating core loans and deposits 8 |

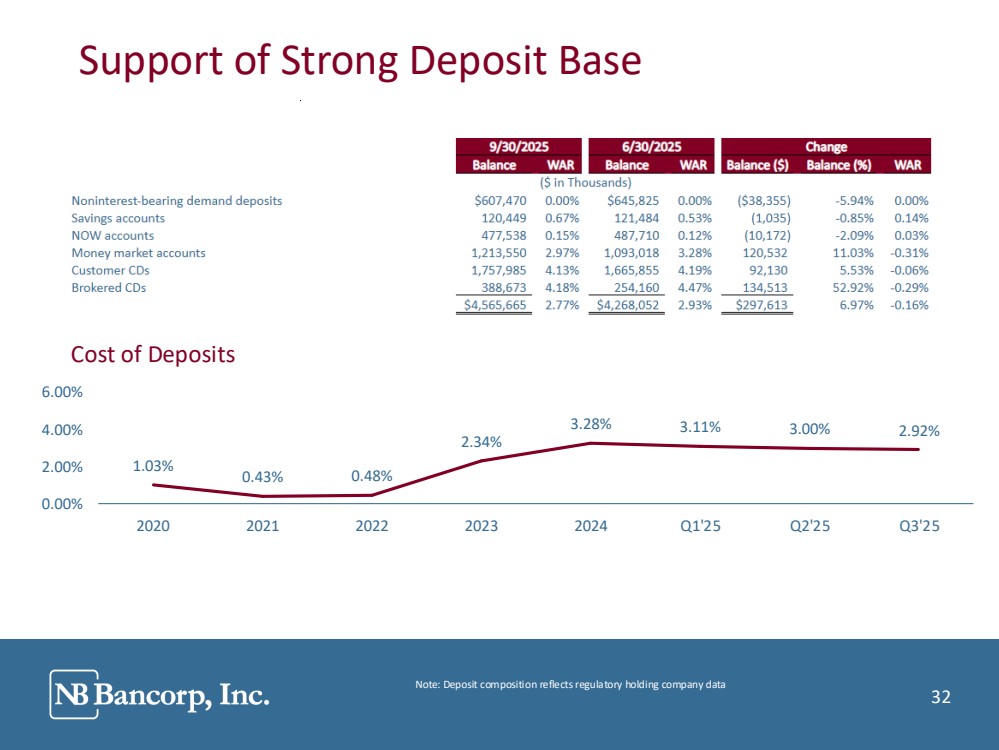

| 9 Financial Highlights for the Third Quarter 2025 • GAAP Net income of $15.4 million, or $0.43 per diluted share for the quarter. • Operating Net Income1 (Non-GAAP) of $16.0 million, or $0.45 per diluted share for the quarter. • Gross loans increased $175.0 million, or 3.9%, to $4.72 billion, from $4.54 billion in the prior quarter. • The net interest margin compressed 4 basis points to 3.78%, primarily the result of loans re-pricing and default interest earned during the prior quarter. • Asset quality remains strong: • Annualized Q3 net charge-offs of 0.05% of average total loans and non-performing loans of $11.4 million, or 0.24% of total loans. • Provision for credit losses was $1.4 million, down from $3.2 million in the prior quarter, and contributing to an increase in the ACL of $451 thousand, primarily from updated consumer loan prepayment speeds and the increased loan portfolio, partially offset by loans migrating from Construction to permanent loans. • Resulting in a decreased coverage ratio of 0.91% of total loans, compared to 0.94% in the prior quarter; mainly due to construction loans converting to permanent multi-family loans during the current quarter. • Total core deposits increased $163.1 million or 4.1% from the prior quarter, to $4.18 billion, primarily driven by increases in money market accounts and customer CDs of $120.5 million and $92.1 million, respectively, partially offset by a decrease of $38.4 million in checking accounts. • The loans to deposit ratio decreased 3 percentage points to 103% from the prior quarter while loans grew $175.0 million. 1) See Appendix for reconciliation of non-GAAP financial metrics 9 |

| 10 Financial Highlights for the Third Quarter 2025 (Continued) • Borrowings and brokered deposits totaled 7.9% of total assets, which is 60 bps higher than the prior quarter, resulting primarily from utilizing more brokered deposits to replace maturing FHLB advances and fund loan growth as FHLB advances decreased $86.1 million, or 67.5%, while brokered deposits increased $134.5 million, or 52.9%, during the current quarter. • Strong capital position with 13.5% shareholders equity to total assets and tangible shareholders' equity to tangible assets¹. • Book value and tangible book value per share were $18.51 and $18.48¹, respectively. • One-time pre-tax transactions recorded during the third quarter included: • Acquisition costs of $994 thousand related to the pending BankProv acquisition that is expected to close in Q4 2025; and • State voluntary disclosure agreement income tax expenses of $561 thousand related to new state income taxes; partially offset by • Defined benefit pension termination refund of previous expenses of $739 thousand. • During the quarter, we executed two $150 million notional value balance sheet hedges against our adjustable-rate loans to protect us in down rate environments. The hedges were both 3 year received-fixed swaps, one which forward starts in a year and one which was effective immediately. 1) See Appendix for reconciliation of non-GAAP financial metrics 10 |

| 11 Financial Overview |

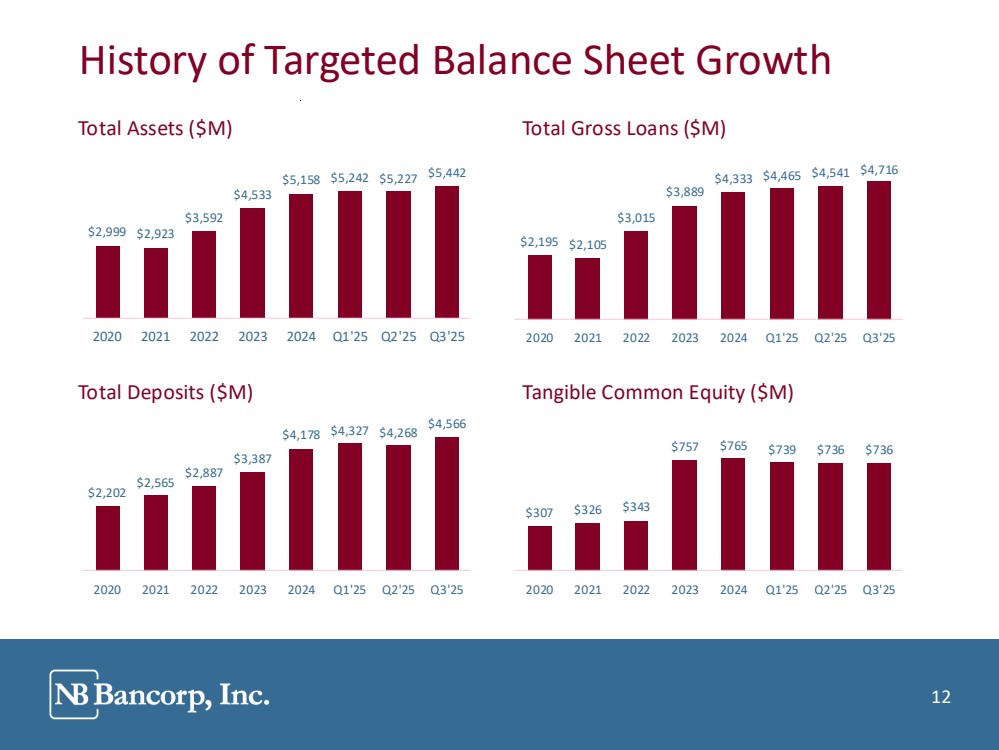

| 12 Total Deposits ($M) Tangible Common Equity ($M) Total Assets ($M) Total Gross Loans ($M) History of Targeted Balance Sheet Growth 12 $2,999 $2,923 $3,592 $4,533 $5,158 $5,242 $5,227 $5,442 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 $2,195 $2,105 $3,015 $3,889 $4,333 $4,465 $4,541 $4,716 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 $2,202 $2,565 $2,887 $3,387 $4,178 $4,327 $4,268 $4,566 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 $307 $326 $343 $757 $765 $739 $736 $736 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 |

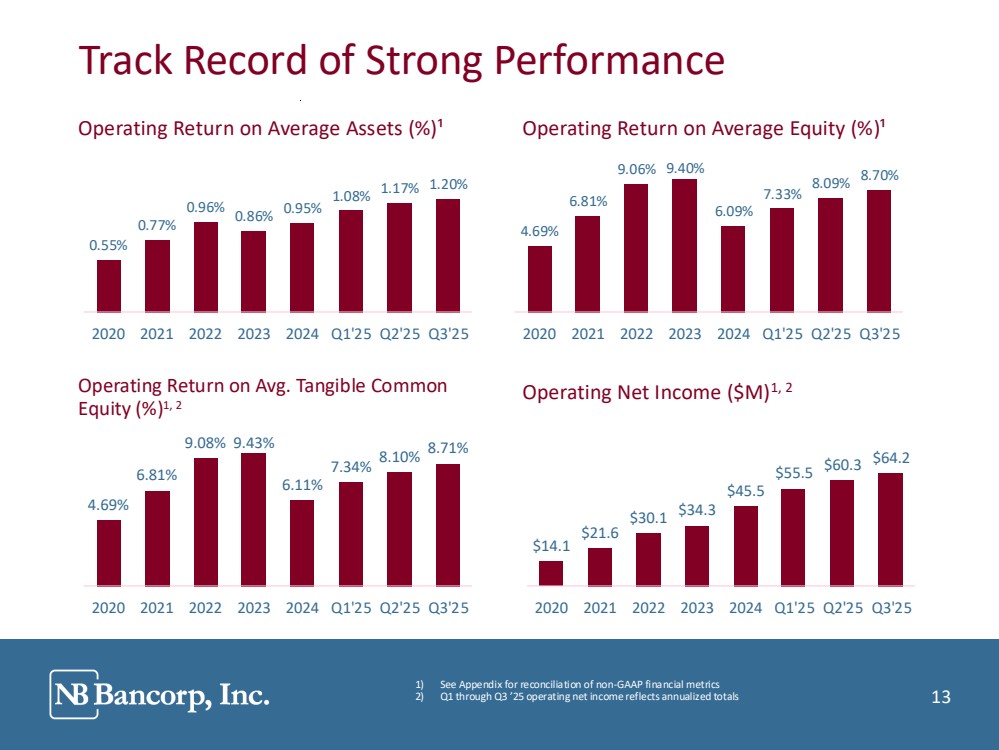

| 13 Operating Return on Avg. Tangible Common Equity (%)1, 2 Operating Net Income ($M)1, 2 Operating Return on Average Assets (%)¹ Operating Return on Average Equity (%)¹ Track Record of Strong Performance 1) See Appendix for reconciliation of non-GAAP financial metrics 2) Q1 through Q3 ’25 operating net income reflects annualized totals 13 0.55% 0.77% 0.96% 0.86% 0.95% 1.08% 1.17% 1.20% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 4.69% 6.81% 9.06% 9.40% 6.09% 7.33% 8.09% 8.70% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 4.69% 6.81% 9.08% 9.43% 6.11% 7.34% 8.10% 8.71% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 $14.1 $21.6 $30.1 $34.3 $45.5 $55.5 $60.3 $64.2 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 |

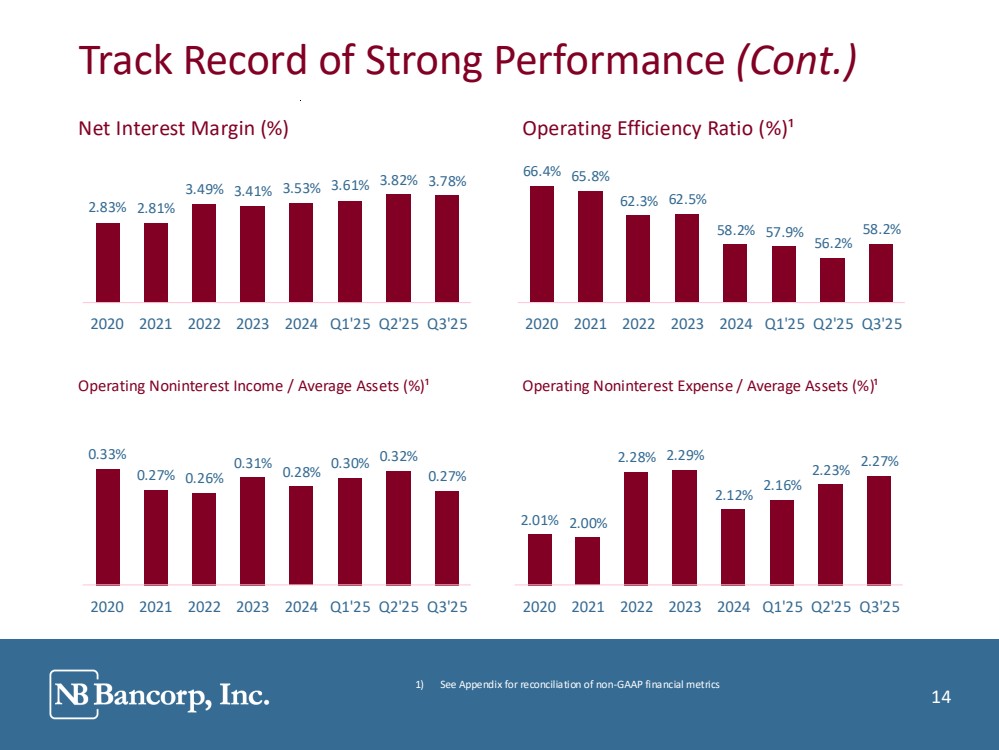

| 14 Operating Noninterest Income / Average Assets (%)¹ Operating Noninterest Expense / Average Assets (%)¹ Net Interest Margin (%) Operating Efficiency Ratio (%)¹ Track Record of Strong Performance (Cont.) 1) See Appendix for reconciliation of non-GAAP financial metrics 14 2.83% 2.81% 3.49% 3.41% 3.53% 3.61% 3.82% 3.78% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 66.4% 65.8% 62.3% 62.5% 58.2% 57.9% 56.2% 58.2% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 0.33% 0.27% 0.26% 0.31% 0.28% 0.30% 0.32% 0.27% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 2.01% 2.00% 2.28% 2.29% 2.12% 2.16% 2.23% 2.27% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 |

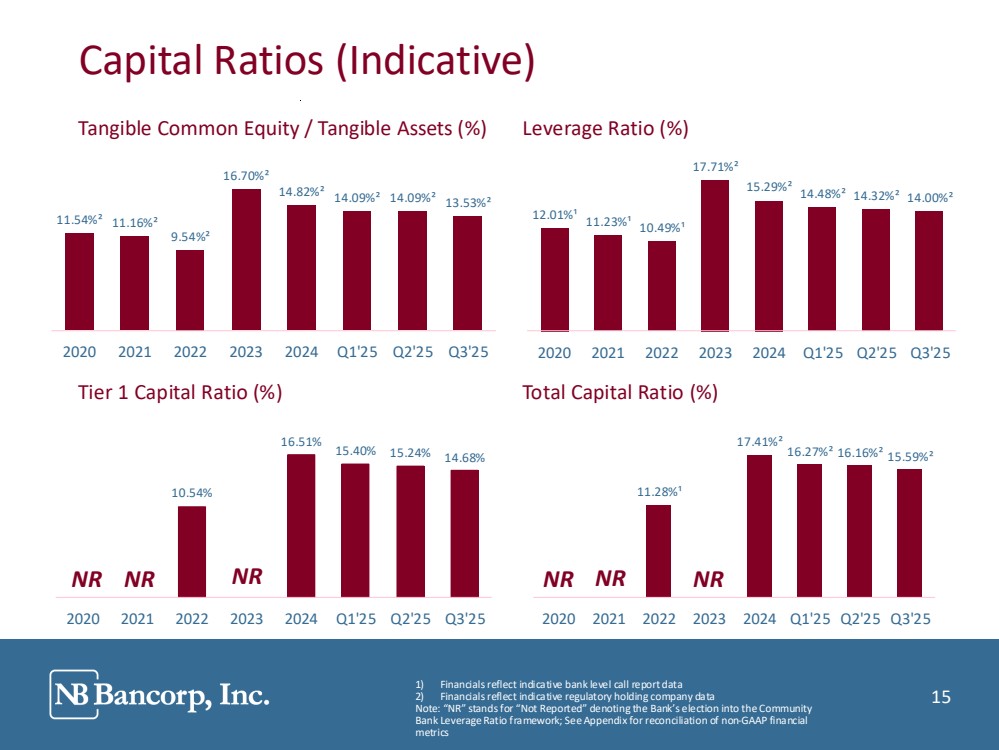

| 15 11.28%¹ 17.41%² 16.27%² 16.16%² 15.59%² 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 10.54% 16.51% 15.40% 15.24% 14.68% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 Tier 1 Capital Ratio (%) Total Capital Ratio (%) Tangible Common Equity / Tangible Assets (%) Leverage Ratio (%) Capital Ratios (Indicative) 1) Financials reflect indicative bank level call report data 2) Financials reflect indicative regulatory holding company data Note: “NR” stands for “Not Reported” denoting the Bank’s election into the Community Bank Leverage Ratio framework; See Appendix for reconciliation of non-GAAP financial metrics NR NR NR NR NR NR 15 11.54%² 11.16%² 9.54%² 16.70%² 14.82%² 14.09%² 14.09%² 13.53%² 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 12.01%¹ 11.23%¹ 10.49%¹ 17.71%² 15.29%² 14.48%² 14.32%² 14.00%² 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 |

| 16 Loan Portfolio & Asset Quality |

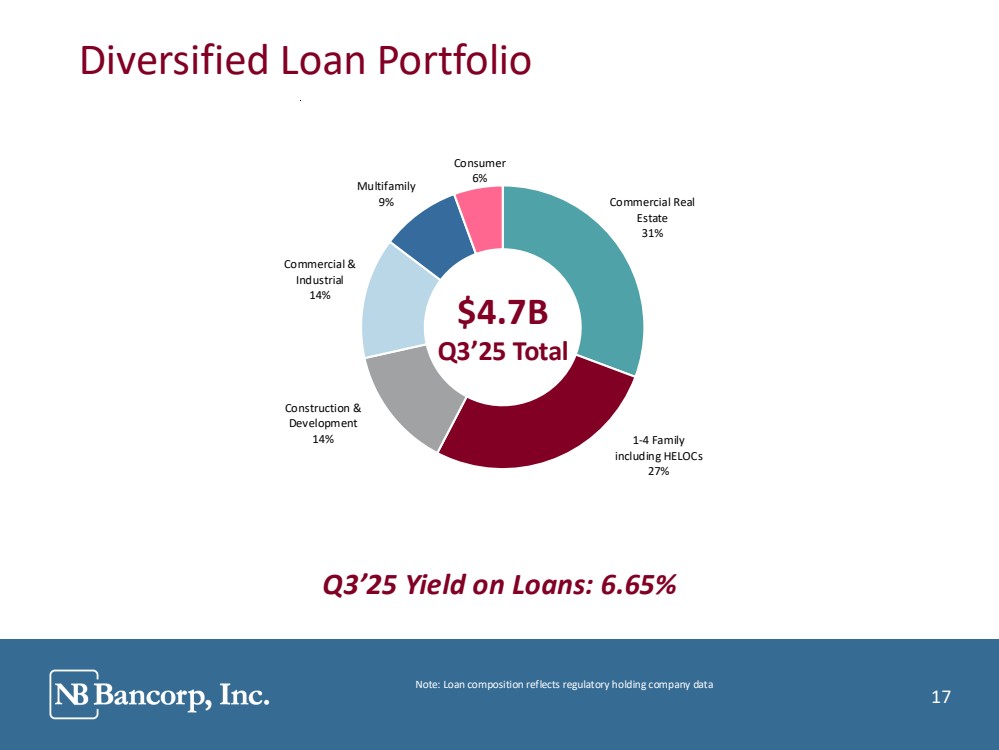

| 17 Note: Loan composition reflects regulatory holding company data Diversified Loan Portfolio Q3’25 Yield on Loans: 6.65% $4.7B Q3’25 Total 17 Commercial Real Estate 31% 1-4 Family including HELOCs 27% Construction & Development 14% Commercial & Industrial 14% Multifamily 9% Consumer 6% |

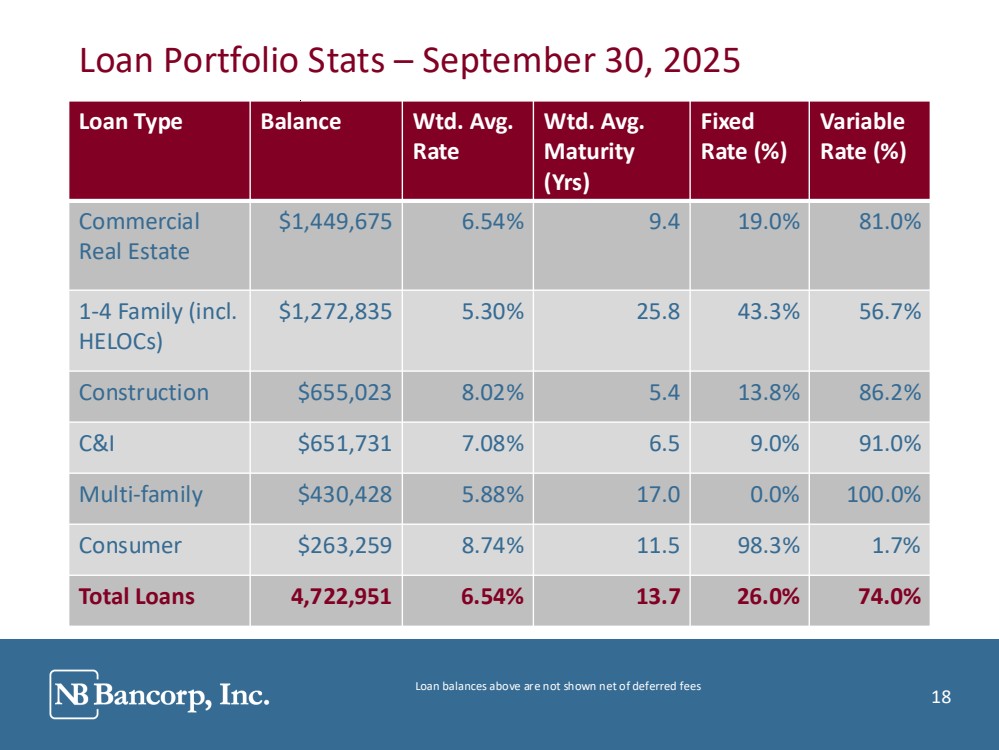

| 18 Loan balances above are not shown net of deferred fees Loan Portfolio Stats – September 30, 2025 Loan Type Balance Wtd. Avg. Rate Wtd. Avg. Maturity (Yrs) Fixed Rate (%) Variable Rate (%) Commercial Real Estate $1,449,675 6.54% 9.4 19.0% 81.0% 1-4 Family (incl. HELOCs) $1,272,835 5.30% 25.8 43.3% 56.7% Construction $655,023 8.02% 5.4 13.8% 86.2% C&I $651,731 7.08% 6.5 9.0% 91.0% Multi-family $430,428 5.88% 17.0 0.0% 100.0% Consumer $263,259 8.74% 11.5 98.3% 1.7% Total Loans 4,722,951 6.54% 13.7 26.0% 74.0% 18 |

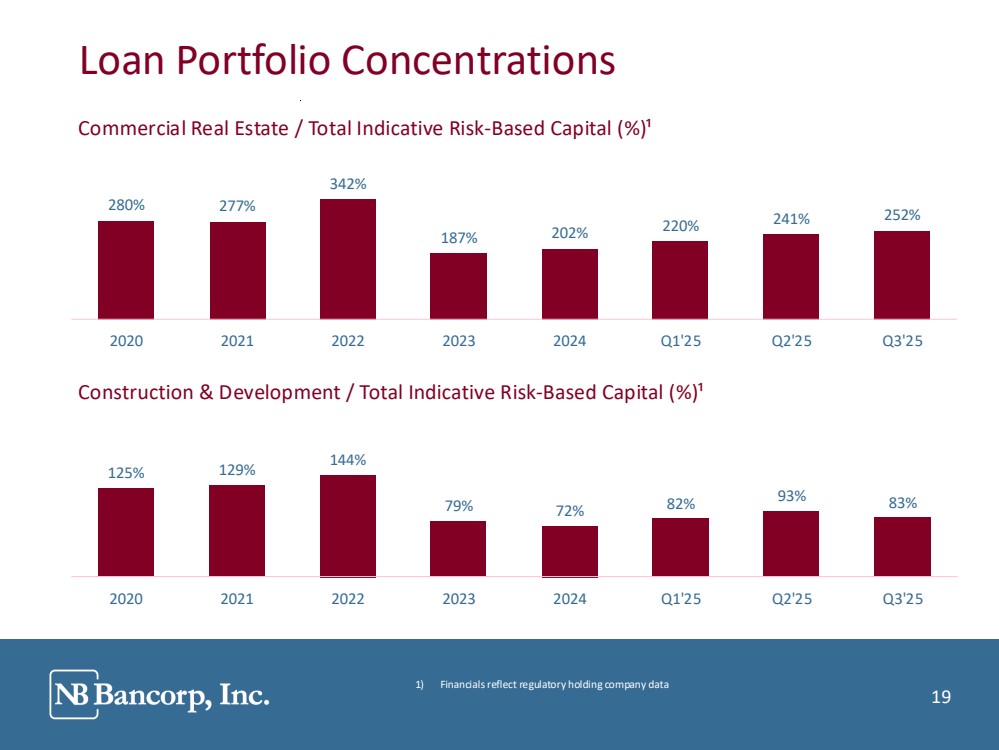

| 19 Construction & Development / Total Indicative Risk-Based Capital (%)¹ Commercial Real Estate / Total Indicative Risk-Based Capital (%)¹ Loan Portfolio Concentrations 1) Financials reflect regulatory holding company data 19 280% 277% 342% 187% 202% 220% 241% 252% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 125% 129% 144% 79% 72% 82% 93% 83% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 |

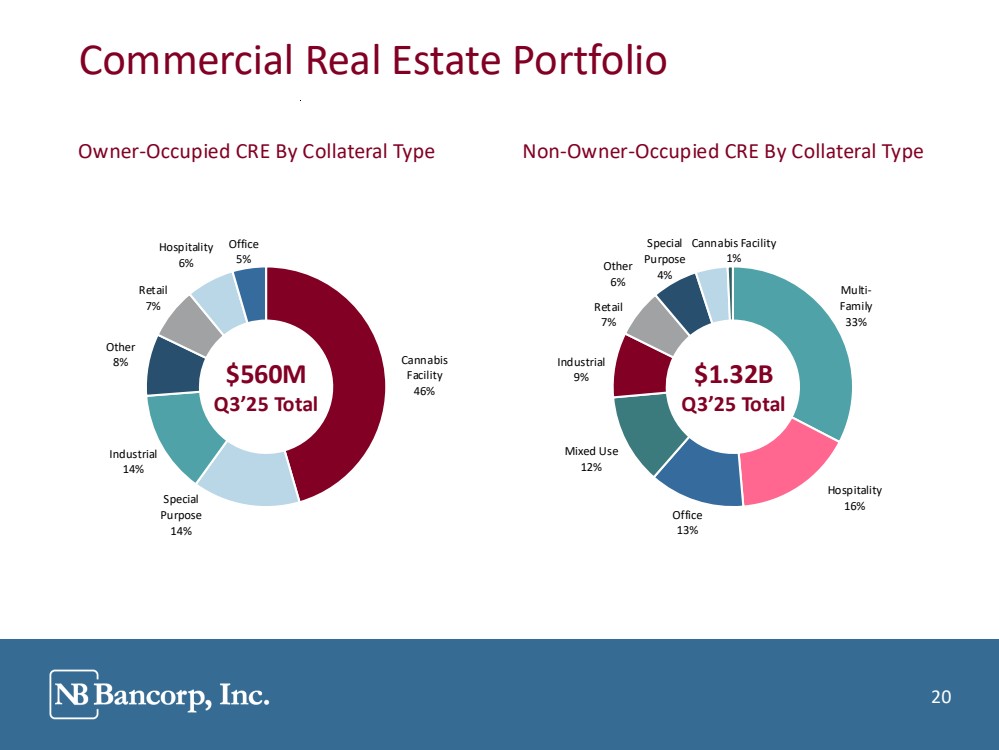

| 20 Owner-Occupied CRE By Collateral Type Non-Owner-Occupied CRE By Collateral Type Commercial Real Estate Portfolio $560M Q3’25 Total $1.32B Q3’25 Total 20 Cannabis Facility 46% Special Purpose 14% Industrial 14% Other 8% Retail 7% Hospitality 6% Office 5% Multi-Family 33% Hospitality 16% Office 13% Mixed Use 12% Industrial 9% Retail 7% Other 6% Special Purpose 4% Cannabis Facility 1% |

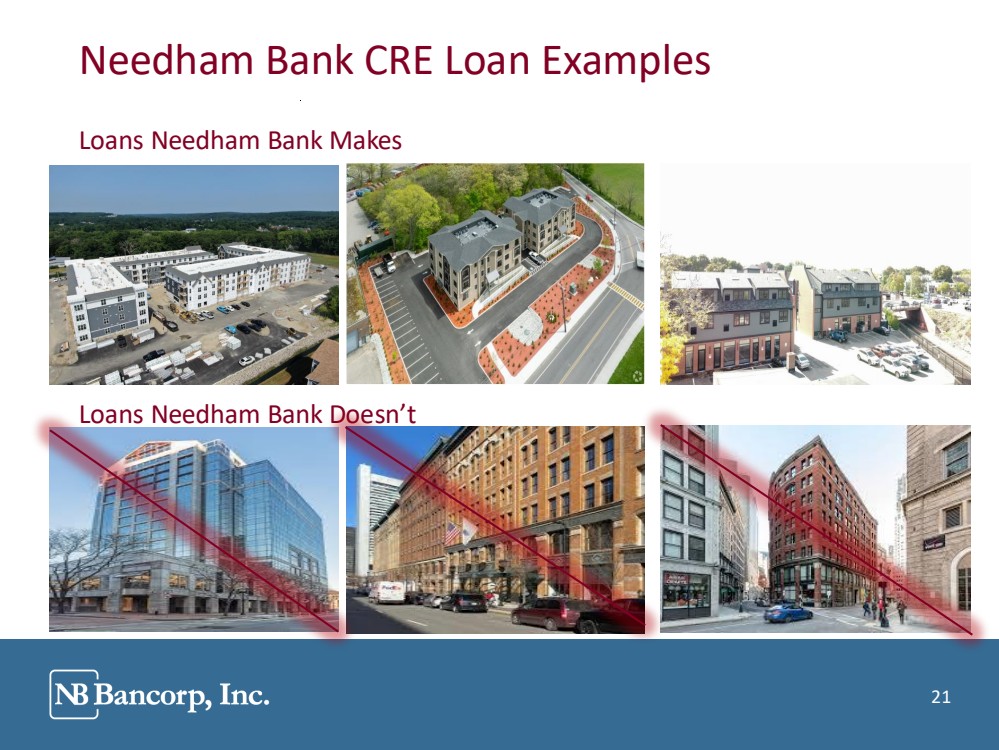

| 21 Loans Needham Bank Makes Loans Needham Bank Doesn’t Make Needham Bank CRE Loan Examples 21 |

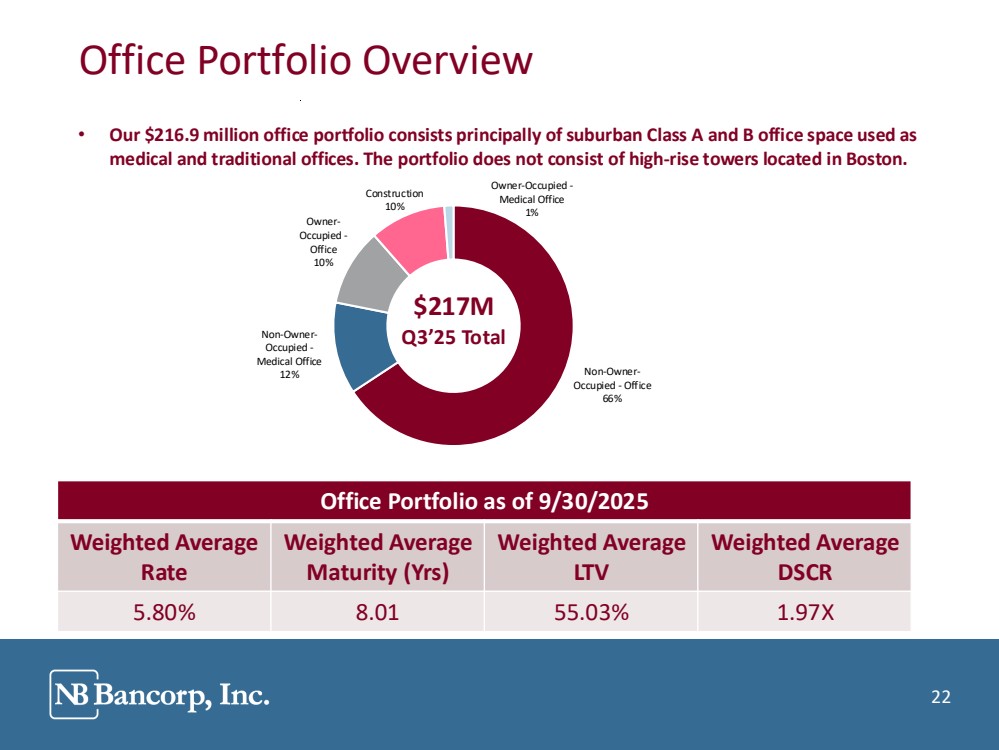

| 22 Office Portfolio Overview • Our $216.9 million office portfolio consists principally of suburban Class A and B office space used as medical and traditional offices. The portfolio does not consist of high-rise towers located in Boston. $217M Q3’25 Total 22 Office Portfolio as of 9/30/2025 Weighted Average Rate Weighted Average Maturity (Yrs) Weighted Average LTV Weighted Average DSCR 5.80% 8.01 55.03% 1.97X Non-Owner-Occupied - Office 66% Non-Owner-Occupied - Medical Office 12% Owner-Occupied - Office 10% Construction 10% Owner-Occupied - Medical Office 1% |

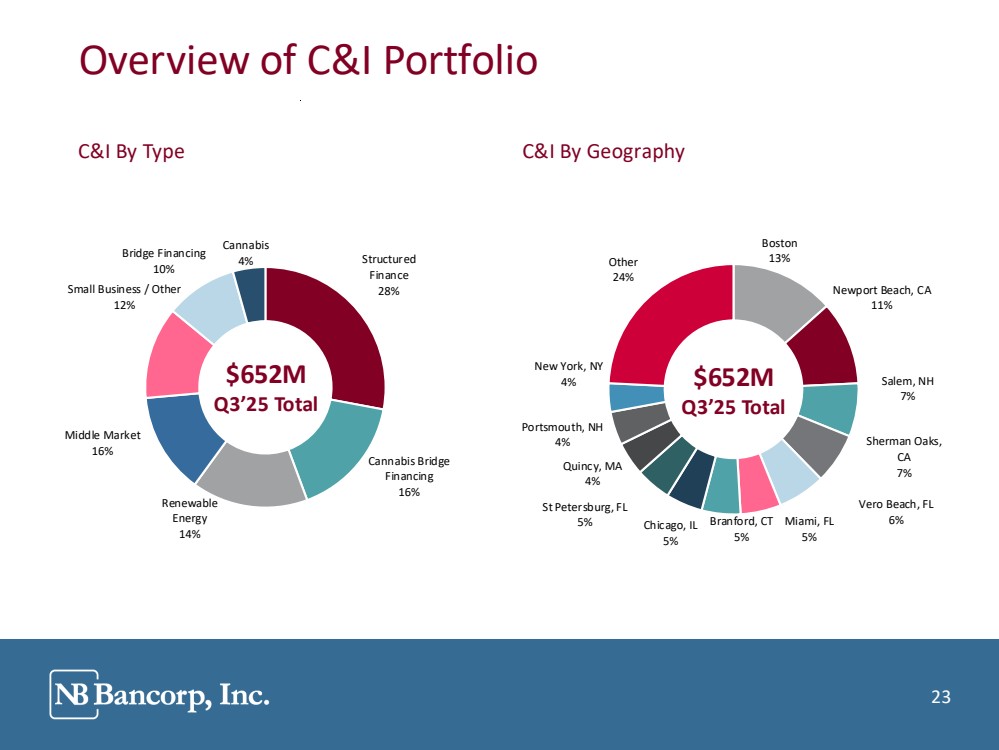

| 23 C&I By Type C&I By Geography Overview of C&I Portfolio $652M Q3’25 Total $652M Q3’25 Total 23 Structured Finance 28% Cannabis Bridge Financing 16% Middle Market 16% Renewable Energy 14% Small Business / Other 12% Bridge Financing 10% Cannabis 4% Boston 13% Newport Beach, CA 11% Salem, NH 7% Sherman Oaks, CA 7% Vero Beach, FL Miami, FL 6% 5% Branford, CT 5% Chicago, IL 5% St Petersburg, FL 5% Quincy, MA 4% Portsmouth, NH 4% New York, NY 4% Other 24% |

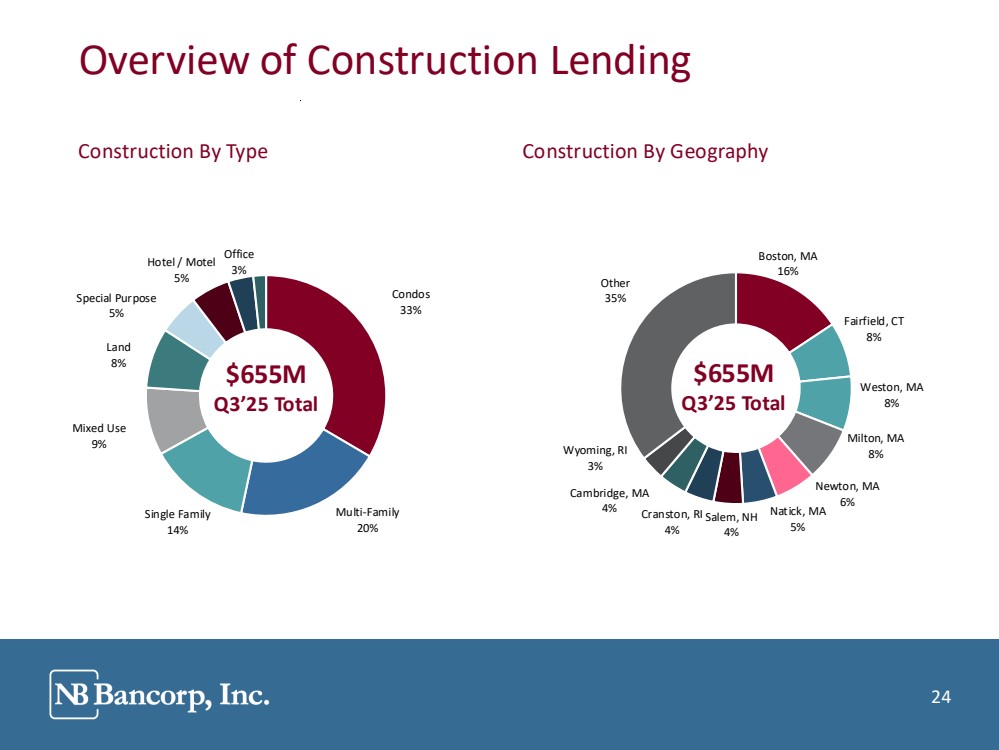

| 24 Construction By Type Construction By Geography Overview of Construction Lending $655M Q3’25 Total $655M Q3’25 Total 24 Condos 33% Multi-Family 20% Single Family 14% Mixed Use 9% Land 8% Special Purpose 5% Hotel / Motel 5% Office 3% Boston, MA 16% Fairfield, CT 8% Weston, MA 8% Milton, MA 8% Newton, MA 6% Natick, MA 5% Salem, NH 4% Cranston, RI 4% Cambridge, MA 4% Wyoming, RI 3% Other 35% |

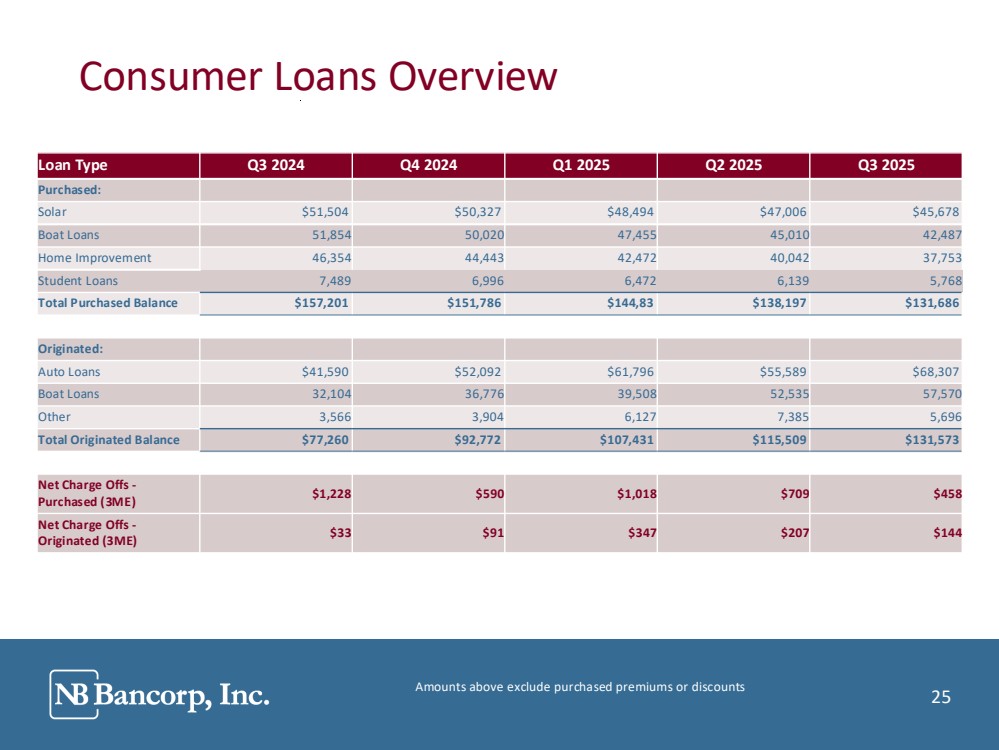

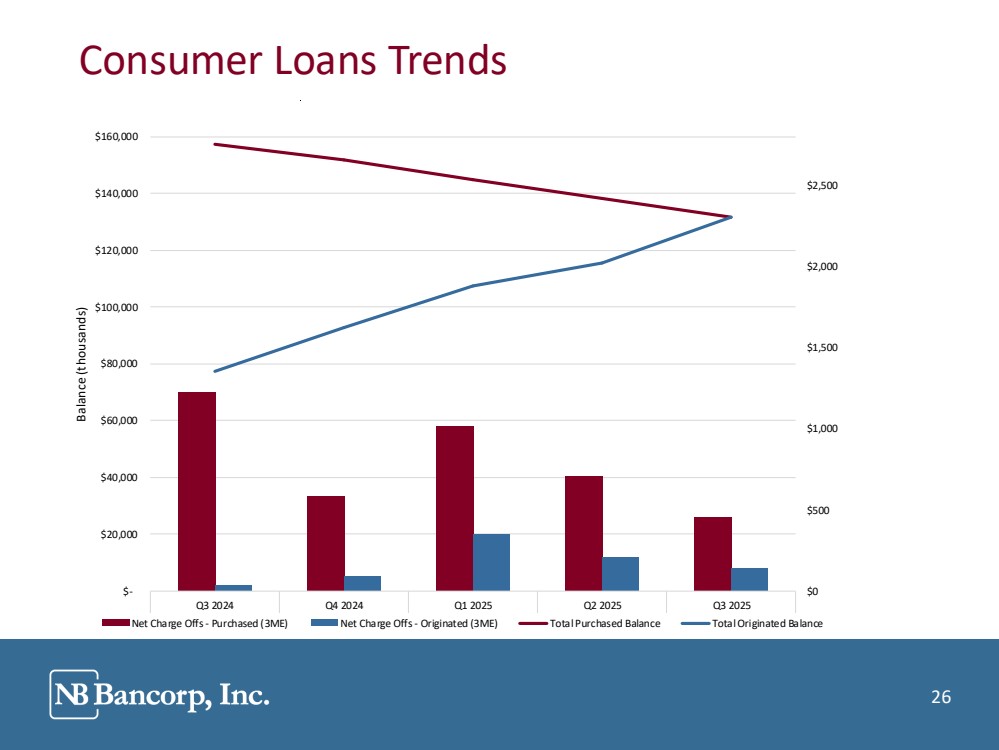

| 25 Consumer Loans Overview Amounts above exclude purchased premiums or discounts 25 Loan Type Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Purchased: Solar $51,504 $50,327 $48,494 $47,006 $45,678 Boat Loans 51,854 50,020 47,455 45,010 42,487 Home Improvement 46,354 44,443 42,472 40,042 37,753 Student Loans 7,489 6,996 6,472 6,139 5,768 Total Purchased Balance $157,201 $151,786 $144,83 $138,197 $131,686 Originated: Auto Loans $41,590 $52,092 $61,796 $55,589 $68,307 Boat Loans 32,104 36,776 39,508 52,535 57,570 Other 3,566 3,904 6,127 7,385 5,696 Total Originated Balance $77,260 $92,772 $107,431 $115,509 $131,573 Net Charge Offs - Purchased (3ME) $1,228 $590 $1,018 $709 $458 Net Charge Offs - Originated (3ME) $33 $91 $347 $207 $144 |

| 26 Consumer Loans Trends 26 $0 $500 $1,000 $1,500 $2,000 $2,500 $- $20,000 $40,000 $60,000 $80,000 $100,000 $120,000 $140,000 $160,000 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Balance (thousands) Net Charge Offs - Purchased (3ME) Net Charge Offs - Originated (3ME) Total Purchased Balance Total Originated Balance |

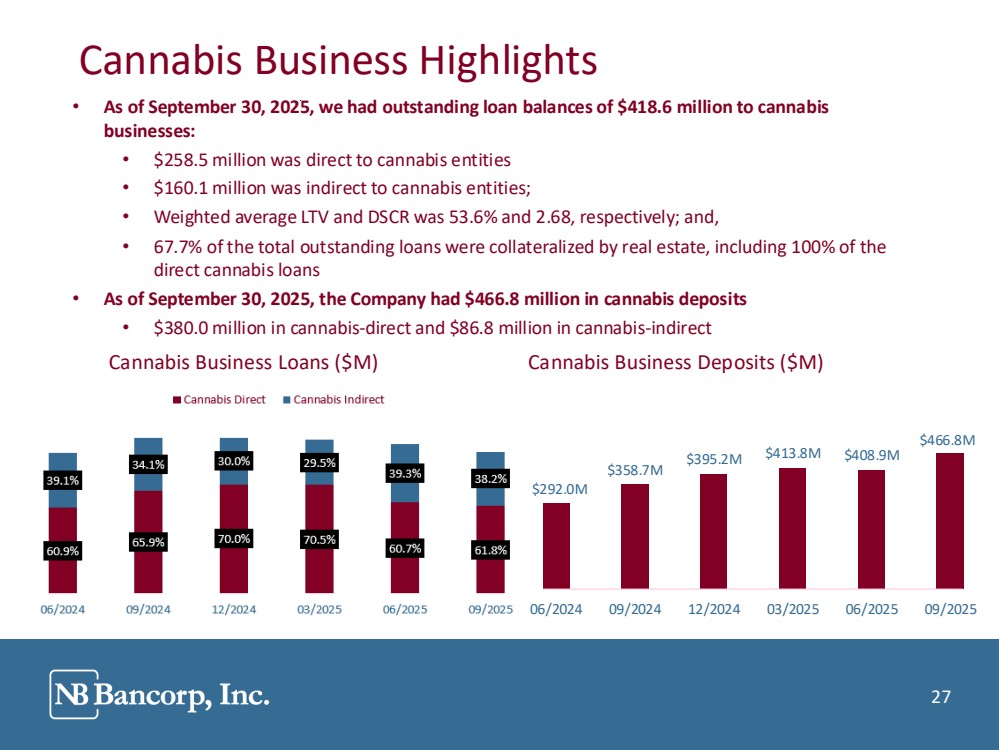

| 27 Cannabis Business Highlights • As of September 30, 2025, we had outstanding loan balances of $418.6 million to cannabis businesses: • $258.5 million was direct to cannabis entities • $160.1 million was indirect to cannabis entities; • Weighted average LTV and DSCR was 53.6% and 2.68, respectively; and, • 67.7% of the total outstanding loans were collateralized by real estate, including 100% of the direct cannabis loans • As of September 30, 2025, the Company had $466.8 million in cannabis deposits • $380.0 million in cannabis-direct and $86.8 million in cannabis-indirect Cannabis Business Loans ($M) Cannabis Business Deposits ($M) 27 $292.0M $358.7M $395.2M $413.8M $408.9M $466.8M 06/2024 09/2024 12/2024 03/2025 06/2025 09/2025 |

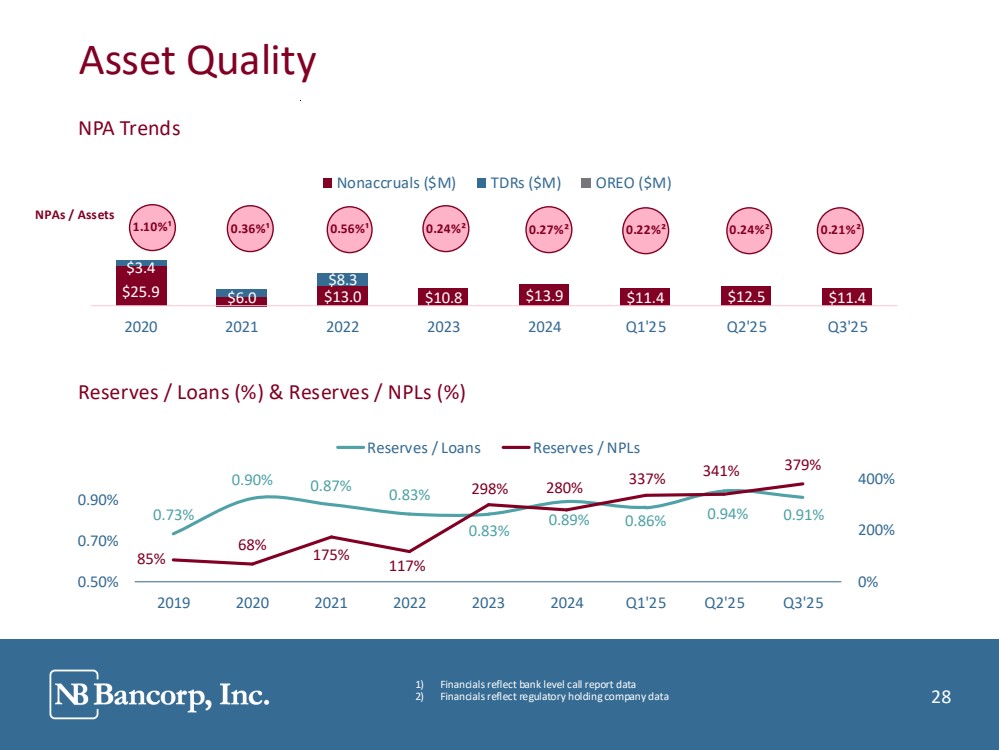

| 28 $25.9 $6.0 $13.0 $10.8 $13.9 $11.4 $12.5 $11.4 $3.4 $4.5 $8.3 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 Nonaccruals ($M) TDRs ($M) OREO ($M) Reserves / Loans (%) & Reserves / NPLs (%) NPA Trends Asset Quality 1) Financials reflect bank level call report data 2) Financials reflect regulatory holding company data 1.10%¹ 0.36%¹ 0.56%¹ 0.24%² NPAs / Assets 28 0.27%² 0.22%² 0.24%² 0.21%² 0.73% 0.90% 0.87% 0.83% 0.83% 0.89% 0.86% 0.94% 0.91% 85% 68% 175% 117% 298% 280% 337% 341% 379% 0% 200% 400% 0.50% 0.70% 0.90% 2019 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 Reserves / Loans Reserves / NPLs |

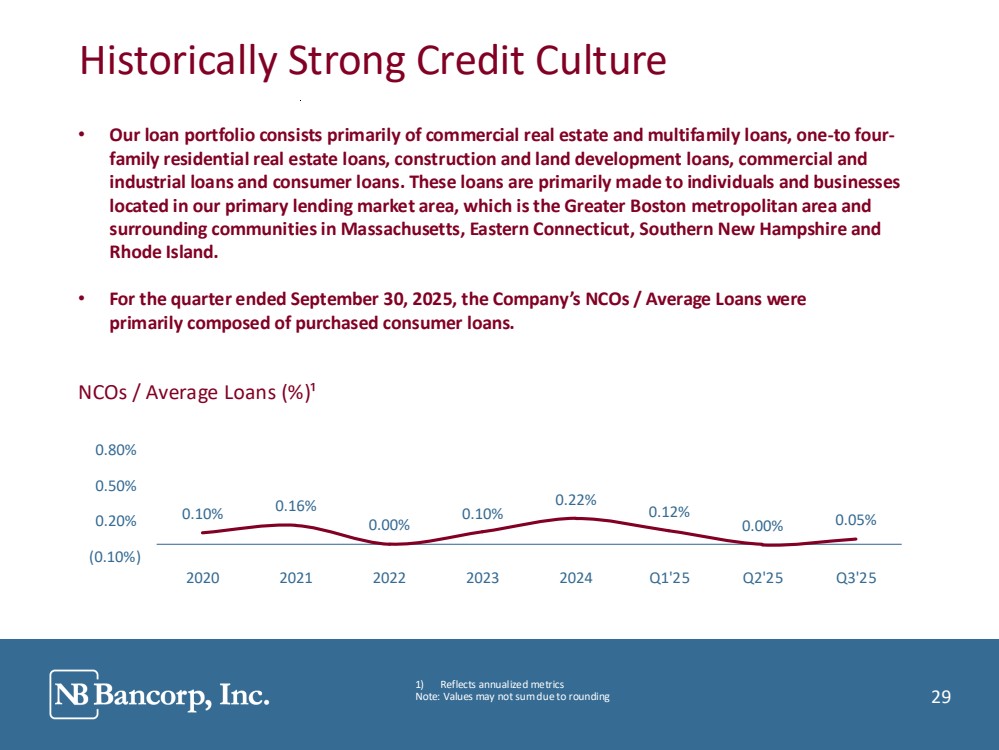

| 29 1) Reflects annualized metrics Note: Values may not sum due to rounding Historically Strong Credit Culture NCOs / Average Loans (%)¹ • Our loan portfolio consists primarily of commercial real estate and multifamily loans, one-to four-family residential real estate loans, construction and land development loans, commercial and industrial loans and consumer loans. These loans are primarily made to individuals and businesses located in our primary lending market area, which is the Greater Boston metropolitan area and surrounding communities in Massachusetts, Eastern Connecticut, Southern New Hampshire and Rhode Island. • For the quarter ended September 30, 2025, the Company’s NCOs / Average Loans were primarily composed of purchased consumer loans. 29 0.10% 0.16% 0.00% 0.10% 0.22% 0.12% 0.00% 0.05% (0.10%) 0.20% 0.50% 0.80% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 |

| 30 Funding & Liquidity Management |

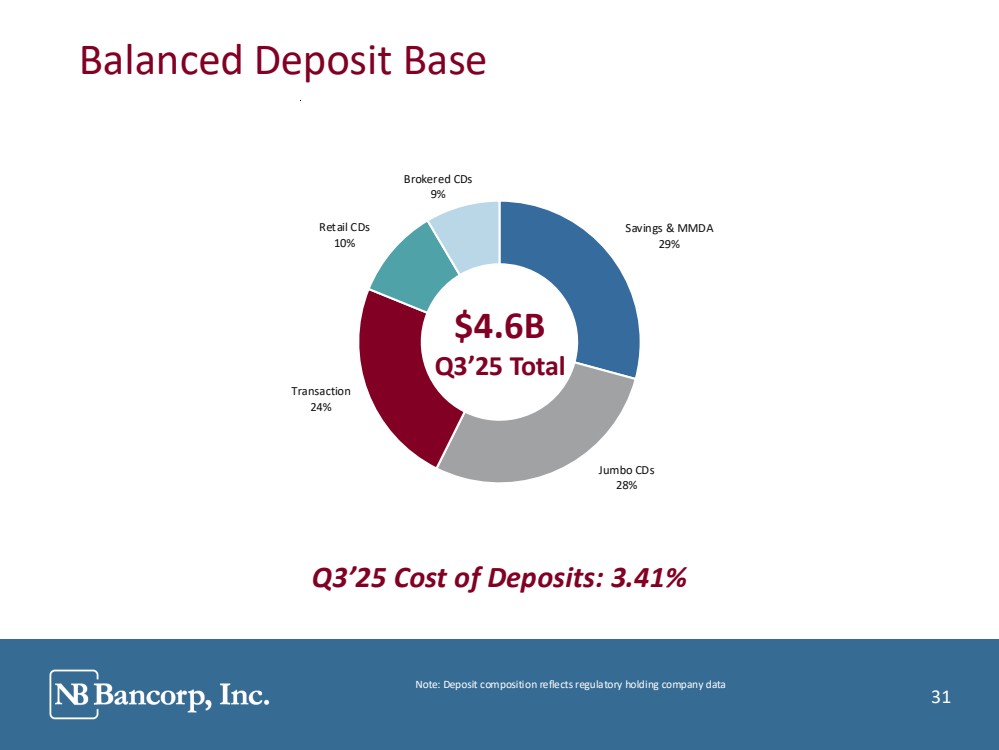

| 31 Note: Deposit composition reflects regulatory holding company data Balanced Deposit Base Q3’25 Cost of Deposits: 3.41% $4.6B Q3’25 Total 31 Savings & MMDA 29% Jumbo CDs 28% Transaction 24% Retail CDs 10% Brokered CDs 9% |

| 32 Note: Deposit composition reflects regulatory holding company data Support of Strong Deposit Base Cost of Deposits 32 1.03% 0.43% 0.48% 2.34% 3.28% 3.11% 3.00% 2.92% 0.00% 2.00% 4.00% 6.00% 2020 2021 2022 2023 2024 Q1'25 Q2'25 Q3'25 |

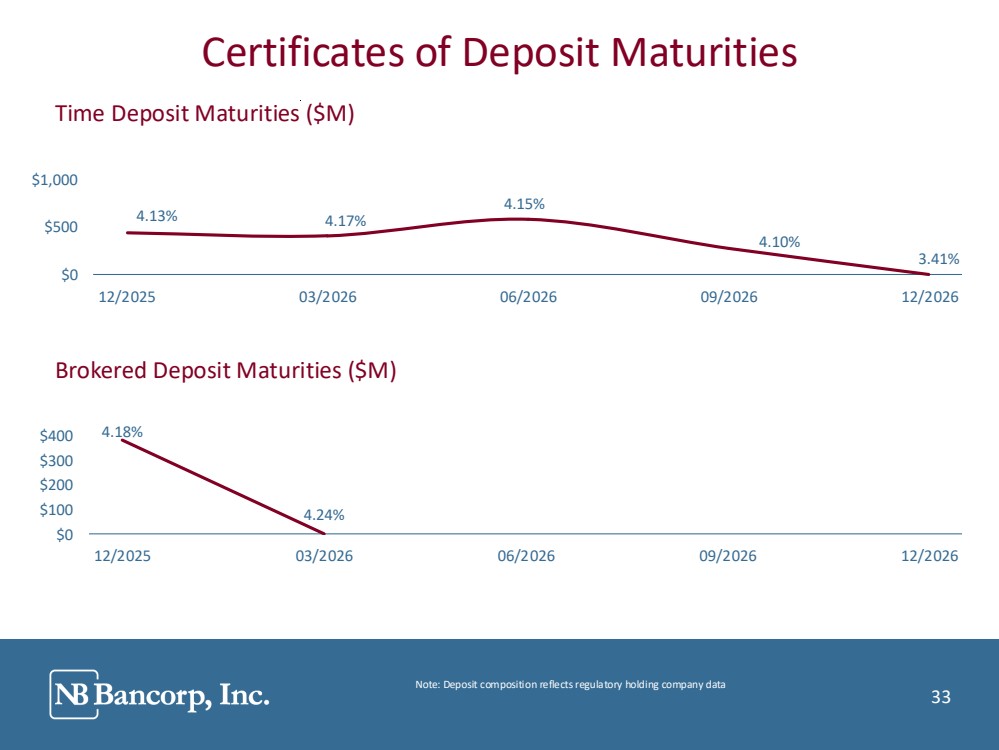

| 33 Note: Deposit composition reflects regulatory holding company data Certificates of Deposit Maturities 33 Time Deposit Maturities ($M) Brokered Deposit Maturities ($M) 4.13% 4.17% 4.15% 4.10% 3.41% $0 $500 $1,000 12/2025 03/2026 06/2026 09/2026 12/2026 4.18% 4.24% $0 $100 $200 $300 $400 12/2025 03/2026 06/2026 09/2026 12/2026 |

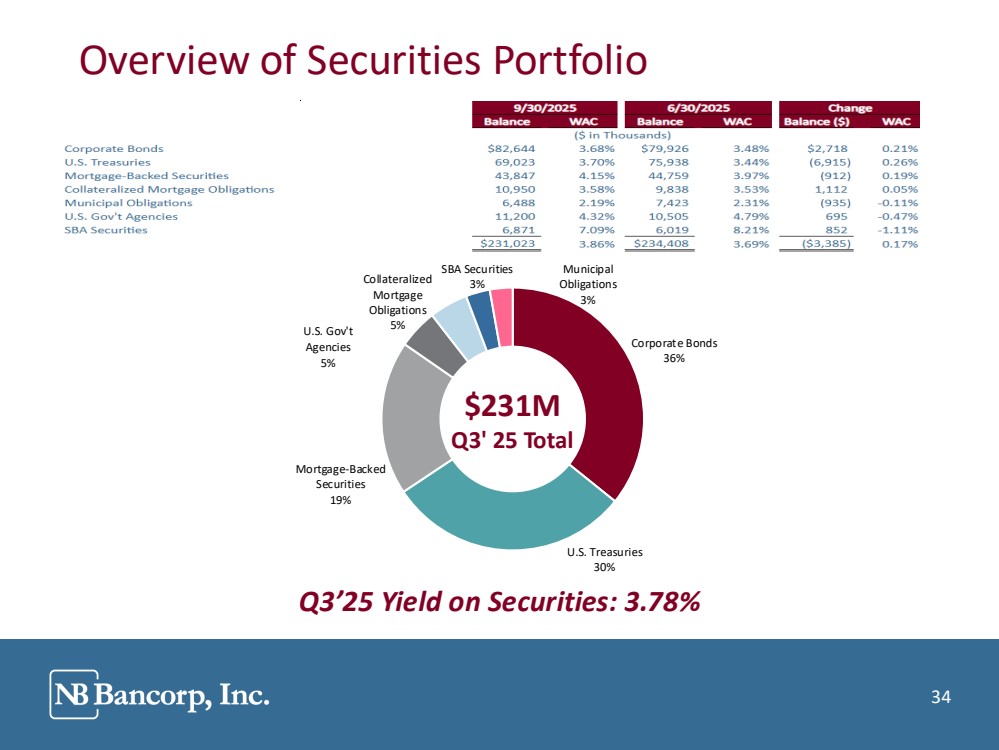

| 34 Overview of Securities Portfolio $231M Q3' 25 Total Q3’25 Yield on Securities: 3.78% 34 Corporate Bonds 36% U.S. Treasuries 30% Mortgage-Backed Securities 19% U.S. Gov't Agencies 5% Collateralized Mortgage Obligations 5% SBA Securities 3% Municipal Obligations 3% |

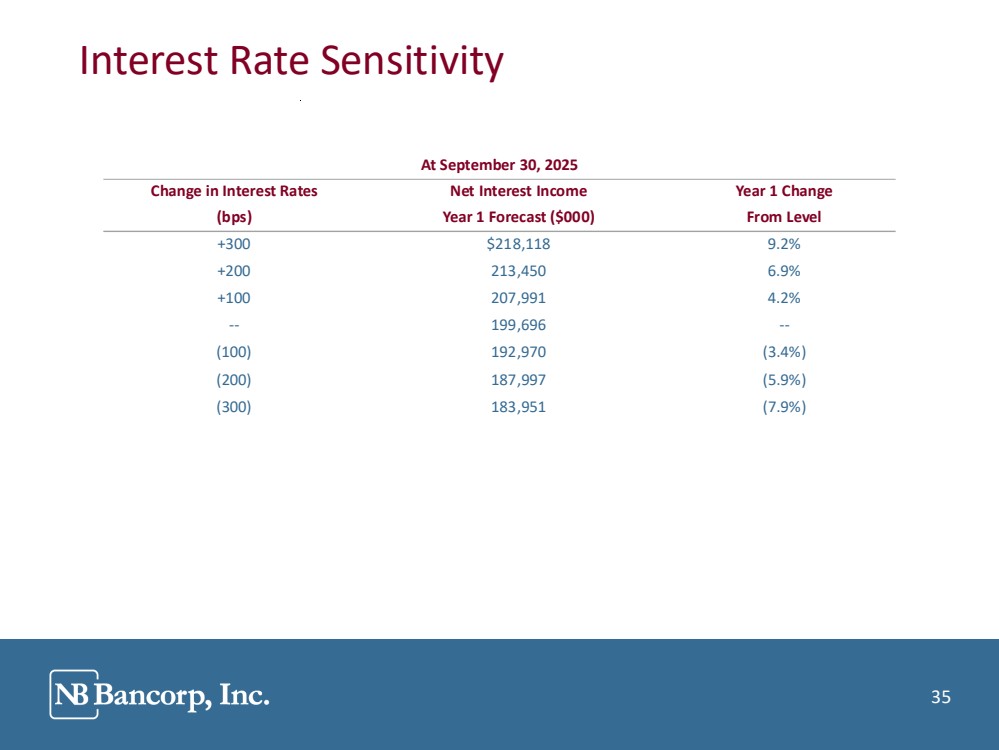

| 35 Interest Rate Sensitivity 35 At September 30, 2025 Change in Interest Rates Net Interest Income Year 1 Change (bps) Year 1 Forecast ($000) From Level +300 $218,118 9.2% +200 213,450 6.9% +100 207,991 4.2% -- 199,696 -- (100) 192,970 (3.4%) (200) 187,997 (5.9%) (300) 183,951 (7.9%) |

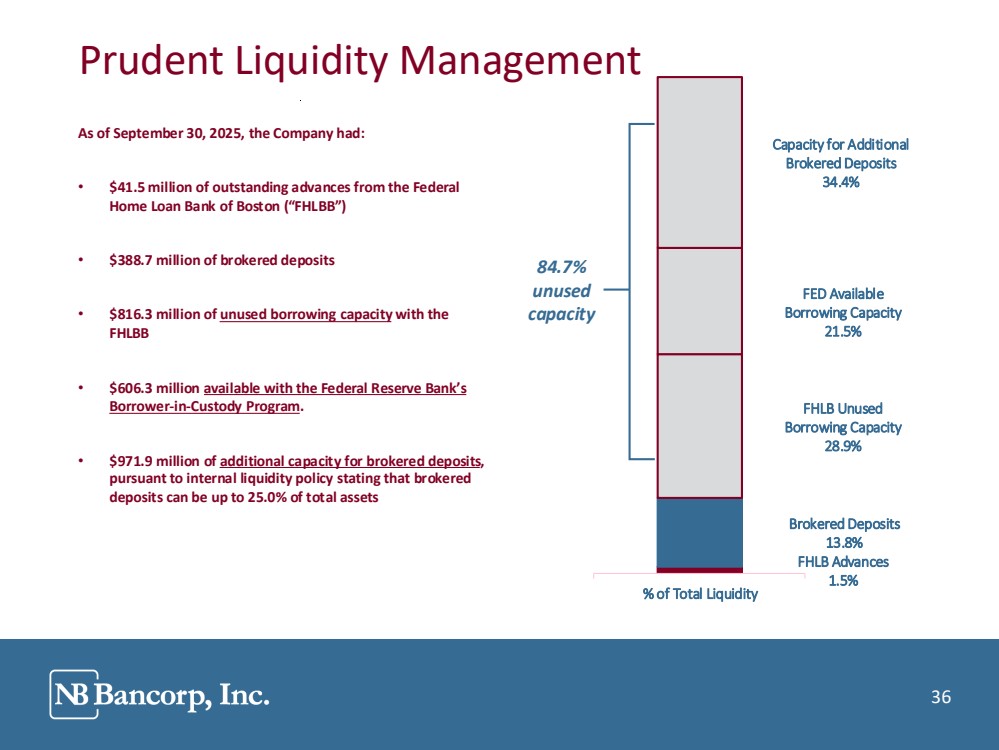

| 36 FHLB Advances 1.5% Brokered Deposits 13.8% FHLB Unused Borrowing Capacity 28.9% FED Available Borrowing Capacity 21.5% Capacity for Additional Brokered Deposits 34.4% % of Total Liquidity Prudent Liquidity Management As of September 30, 2025, the Company had: • $41.5 million of outstanding advances from the Federal Home Loan Bank of Boston (“FHLBB”) • $388.7 million of brokered deposits • $816.3 million of unused borrowing capacity with the FHLBB • $606.3 million available with the Federal Reserve Bank’s Borrower-in-Custody Program. • $971.9 million of additional capacity for brokered deposits, pursuant to internal liquidity policy stating that brokered deposits can be up to 25.0% of total assets 84.7% unused capacity 36 |

| 37 Pending BankProv Acquisition |

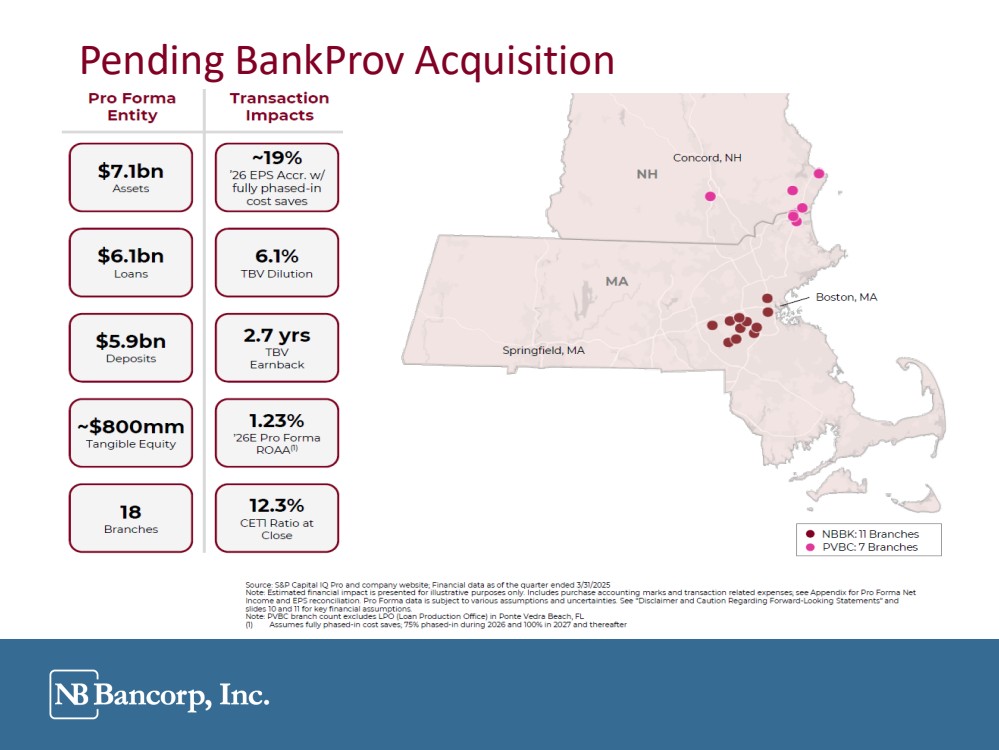

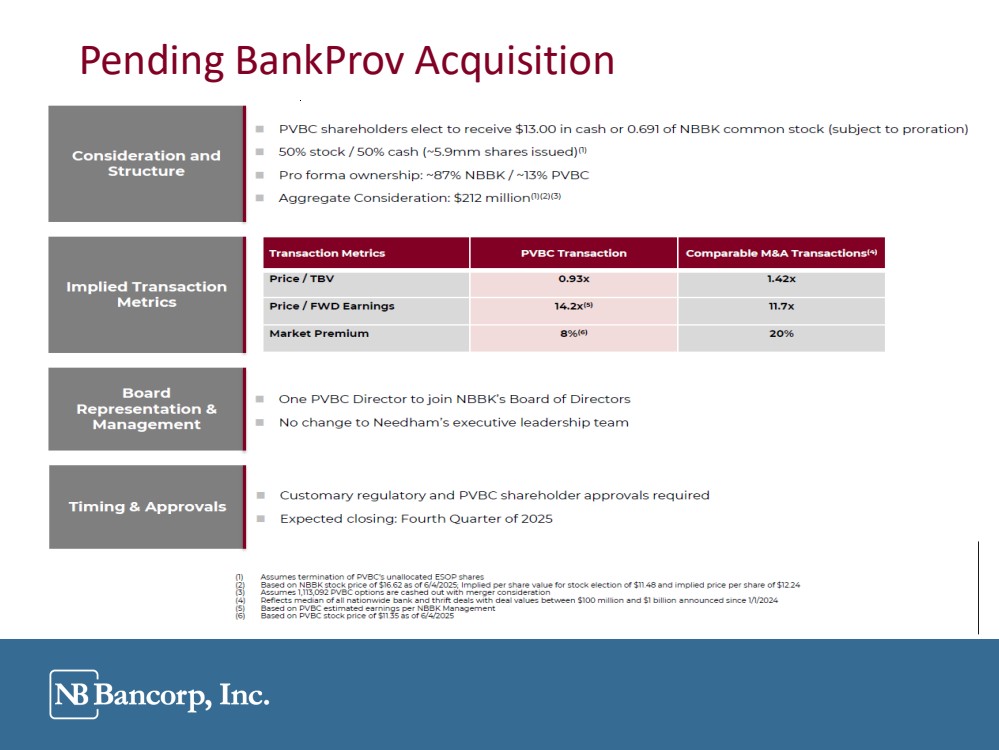

| 38 Pending BankProv Acquisition |

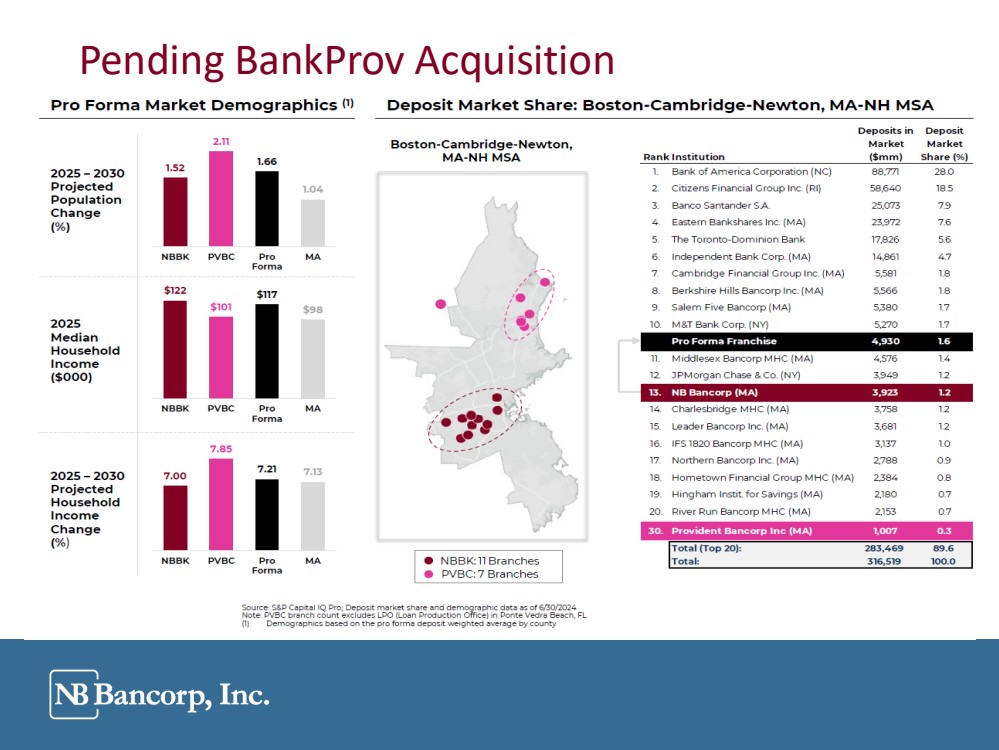

| 39 Pending BankProv Acquisition |

| 40 Appendix |

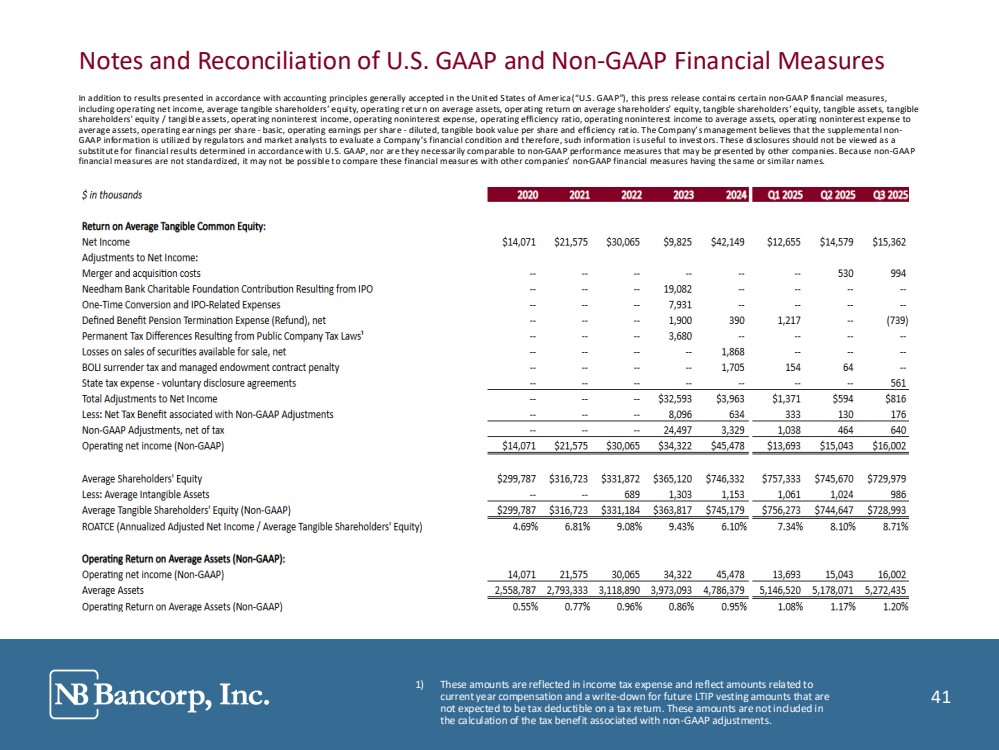

| 41 Notes and Reconciliation of U.S. GAAP and Non-GAAP Financial Measures In addition to results presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), this press release contains certain non-GAAP financial measures, including operating net income, average tangible shareholders’ equity, operating return on average assets, operating return on average shareholders’ equity, tangible shareholders’ equity, tangible assets, tangible shareholders' equity / tangible assets, operating noninterest income, operating noninterest expense, operating efficiency ratio, operating noninterest income to average assets, operating noninterest expense to average assets, operating earnings per share - basic, operating earnings per share - diluted, tangible book value per share and efficiency ratio. The Company’s management believes that the supplemental non-GAAP information is utilized by regulators and market analysts to evaluate a Company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results determined in accordance with U.S. GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names. 1) These amounts are reflected in income tax expense and reflect amounts related to current year compensation and a write-down for future LTIP vesting amounts that are not expected to be tax deductible on a tax return. These amounts are not included in the calculation of the tax benefit associated with non-GAAP adjustments. 41 |

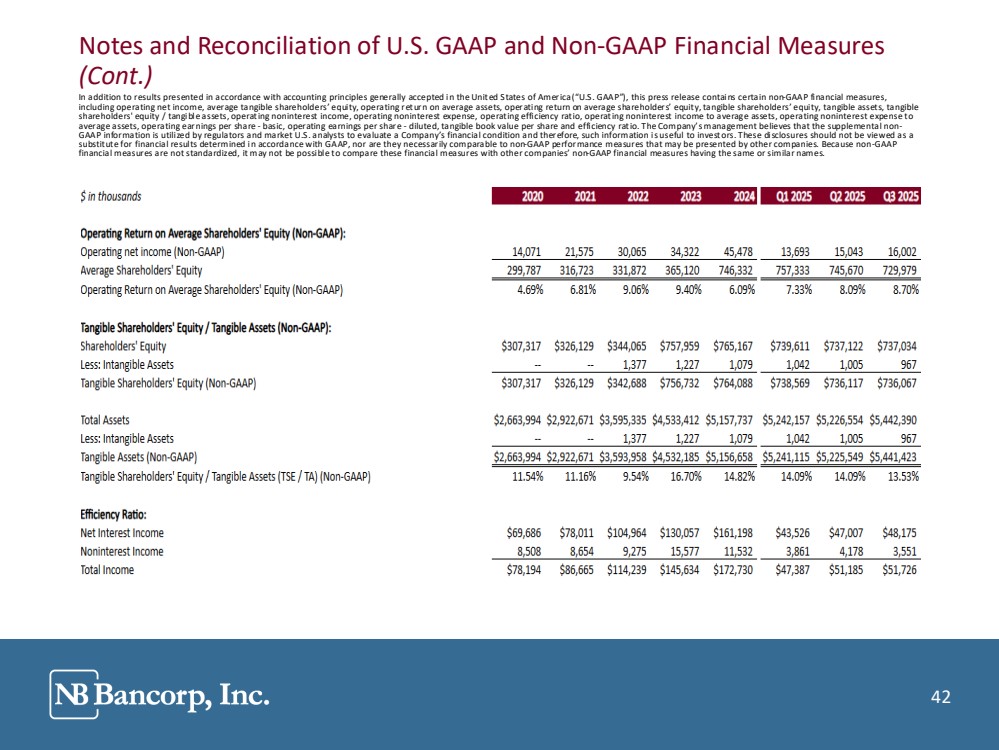

| 42 Notes and Reconciliation of U.S. GAAP and Non-GAAP Financial Measures (Cont.) In addition to results presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), this press release contains certain non-GAAP financial measures, including operating net income, average tangible shareholders’ equity, operating return on average assets, operating return on average shareholders’ equity, tangible shareholders’ equity, tangible assets, tangible shareholders' equity / tangible assets, operating noninterest income, operating noninterest expense, operating efficiency ratio, operating noninterest income to average assets, operating noninterest expense to average assets, operating earnings per share - basic, operating earnings per share - diluted, tangible book value per share and efficiency ratio. The Company’s management believes that the supplemental non-GAAP information is utilized by regulators and market U.S. analysts to evaluate a Company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names. 42 |

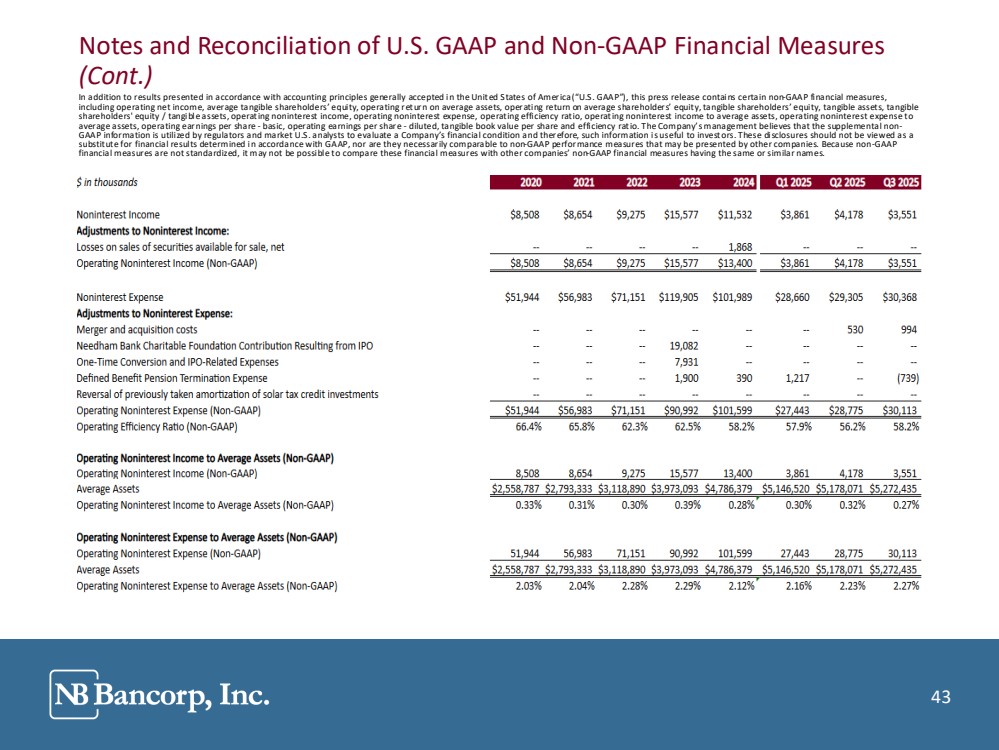

| 43 Notes and Reconciliation of U.S. GAAP and Non-GAAP Financial Measures (Cont.) In addition to results presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), this press release contains certain non-GAAP financial measures, including operating net income, average tangible shareholders’ equity, operating return on average assets, operating return on average shareholders’ equity, tangible shareholders’ equity, tangible assets, tangible shareholders' equity / tangible assets, operating noninterest income, operating noninterest expense, operating efficiency ratio, operating noninterest income to average assets, operating noninterest expense to average assets, operating earnings per share - basic, operating earnings per share - diluted, tangible book value per share and efficiency ratio. The Company’s management believes that the supplemental non-GAAP information is utilized by regulators and market U.S. analysts to evaluate a Company’s financial condition and therefore, such information is useful to investors. These disclosures should not be viewed as a substitute for financial results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names. 43 |

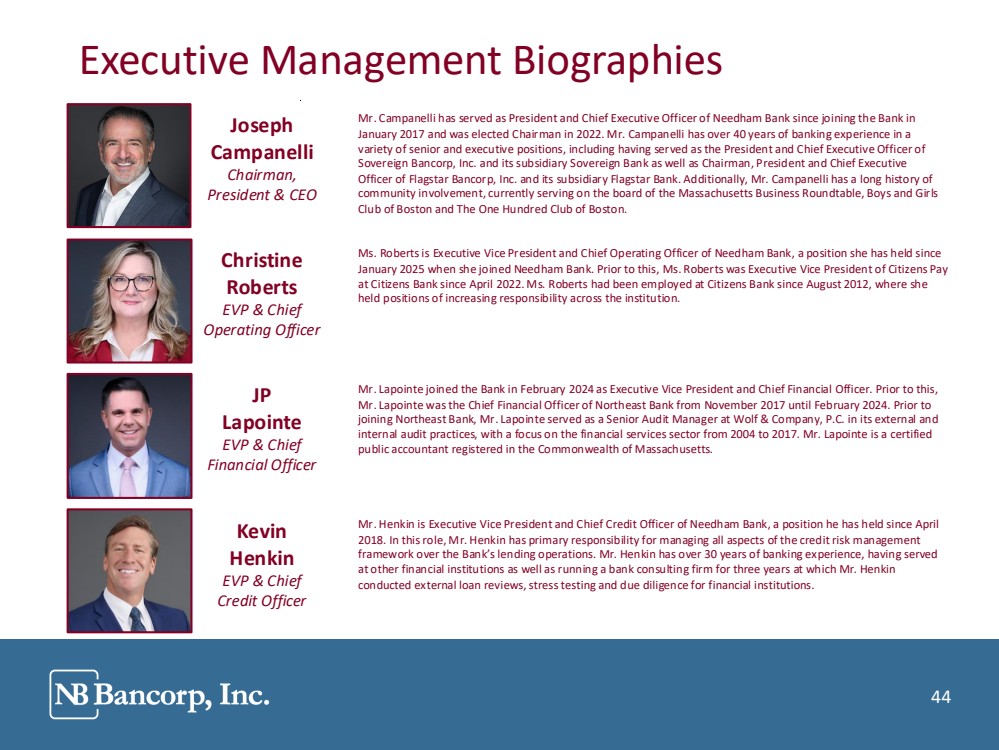

| 44 Executive Management Biographies Joseph Campanelli Chairman, President & CEO Christine Roberts EVP & Chief Operating Officer JP Lapointe EVP & Chief Financial Officer Mr. Campanelli has served as President and Chief Executive Officer of Needham Bank since joining the Bank in January 2017 and was elected Chairman in 2022. Mr. Campanelli has over 40 years of banking experience in a variety of senior and executive positions, including having served as the President and Chief Executive Officer of Sovereign Bancorp, Inc. and its subsidiary Sovereign Bank as well as Chairman, President and Chief Executive Officer of Flagstar Bancorp, Inc. and its subsidiary Flagstar Bank. Additionally, Mr. Campanelli has a long history of community involvement, currently serving on the board of the Massachusetts Business Roundtable, Boys and Girls Club of Boston and The One Hundred Club of Boston. Ms. Roberts is Executive Vice President and Chief Operating Officer of Needham Bank, a position she has held since January 2025 when she joined Needham Bank. Prior to this, Ms. Roberts was Executive Vice President of Citizens Pay at Citizens Bank since April 2022. Ms. Roberts had been employed at Citizens Bank since August 2012, where she held positions of increasing responsibility across the institution. Mr. Lapointe joined the Bank in February 2024 as Executive Vice President and Chief Financial Officer. Prior to this, Mr. Lapointe was the Chief Financial Officer of Northeast Bank from November 2017 until February 2024. Prior to joining Northeast Bank, Mr. Lapointe served as a Senior Audit Manager at Wolf & Company, P.C. in its external and internal audit practices, with a focus on the financial services sector from 2004 to 2017. Mr. Lapointe is a certified public accountant registered in the Commonwealth of Massachusetts. Kevin Henkin EVP & Chief Credit Officer Mr. Henkin is Executive Vice President and Chief Credit Officer of Needham Bank, a position he has held since April 2018. In this role, Mr. Henkin has primary responsibility for managing all aspects of the credit risk management framework over the Bank’s lending operations. Mr. Henkin has over 30 years of banking experience, having served at other financial institutions as well as running a bank consulting firm for three years at which Mr. Henkin conducted external loan reviews, stress testing and due diligence for financial institutions. 44 |

| 45 Thank You |