Shareholder Report

|

12 Months Ended |

|

Aug. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

PGIM ETF Trust

|

| Entity Central Index Key |

0001727074

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Aug. 31, 2025

|

| PGIM Jennison Better Future ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Jennison Better Future ETF

|

| Class Name |

PGIM Jennison Better Future ETF

|

| Trading Symbol |

PJBF

|

| Security Exchange Name |

CboeBZX

|

| Annual or Semi-Annual Statement [Text Block] |

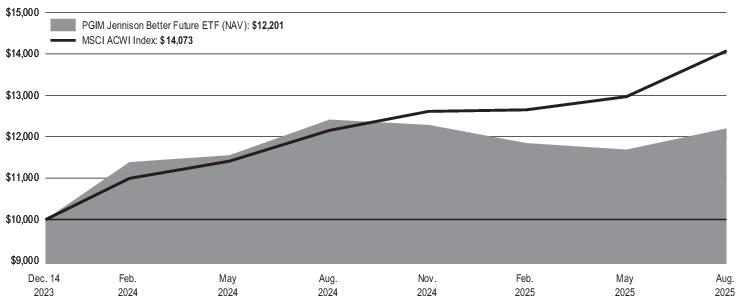

This annual shareholder report contains important information about the PGIM Jennison Better Future ETF (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Jennison Better Future ETF |

|

|

|

| Expenses Paid, Amount |

$ 52

|

| Expense Ratio, Percent |

0.52%

|

| Factors Affecting Performance [Text Block] |

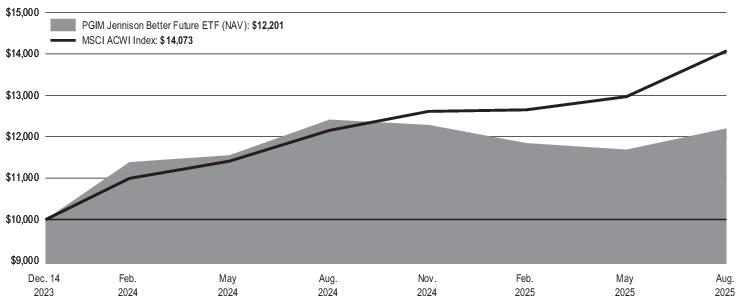

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ Global equities, as represented by the Fund’s benchmark, the MSCI ACWI Index (the “Index”), advanced during the reporting period, with all regions posting solid returns, albeit not without notable volatility. The period was marked by a US Federal Reserve interest rate cut; heightened uncertainties about US tariff and trade policies; the surprise launch of China’s Deep Seek artificial intelligence model, which fueled volatility in the technology sector; increased defense and infrastructure spending in Europe, especially Germany; and new policy initiatives in China to address challenges stemming from weaknesses in the real estate and equity markets. ■ The Fund’s underweight exposure to consumer staples and lack of exposure to energy, materials, and real estate added the most value relative to the Index. ■ Holdings in the consumer discretionary sector, especially in the automobiles and luxury goods industries, were the most significant detractors from results relative to the Index. Software names drove underperformance in the information technology sector, while pharmaceuticals hurt results in the health care sector. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

|

|

|

|

| Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Dec. 14, 2023

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 10,355,145

|

| Holdings Count | Holding |

33

|

| Advisory Fees Paid, Amount |

$ 88,190

|

| Investment Company, Portfolio Turnover |

138.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS THE FUND’S HOLDINGS AS OF 8/31/2025?

|

|

|

|

Semiconductors & Semiconductor Equipment |

|

|

|

|

|

Affiliated Mutual Fund - Short-Term Investment |

|

|

|

Textiles, Apparel & Luxury Goods |

|

Technology Hardware, Storage & Peripherals |

|

|

|

Health Care Equipment & Supplies |

|

|

|

|

|

Interactive Media & Services |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other assets in excess of liabilities |

|

|

|

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

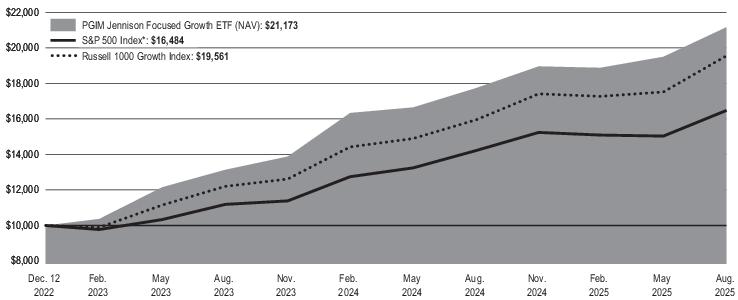

| PGIM Jennison Focused Growth ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Jennison Focused Growth ETF

|

| Class Name |

PGIM Jennison Focused Growth ETF

|

| Trading Symbol |

PJFG

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

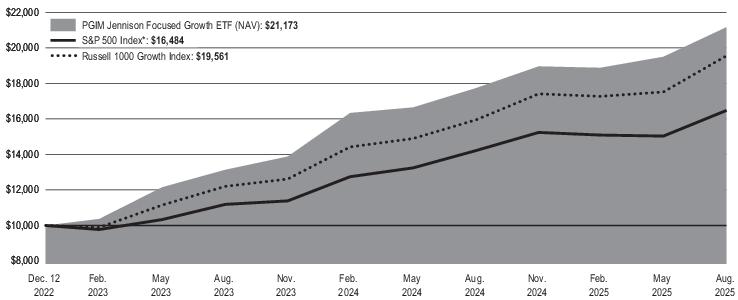

This annual shareholder report contains important information about the PGIM Jennison Focused Growth ETF (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Jennison Focused Growth ETF |

|

|

|

| Expenses Paid, Amount |

$ 81

|

| Expense Ratio, Percent |

0.74%

|

| Factors Affecting Performance [Text Block] |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ US equities posted solid gains for the reporting period, though returns were marked by bouts of elevated volatility. Key influences included a US Federal Reserve interest rate cut, the US presidential election, and uncertainty regarding the US administration’s tariff and trade policies. ■ Strong stock selection within the information technology sector, particularly in semiconductor & equipment companies, was the strongest driver of performance relative to the Fund’s benchmark, the Russell 1000 Growth Index (the “Index”). Additional contributions came from the interactive media industry within the communication services sector and the aerospace & defense industry within the industrials sector, both of which also added meaningful value. ■ Conversely, the largest detractors from relative performance were positions in the health care sector, driven primarily by pharmaceuticals, and in the consumer discretionary sector, led by broadline retail. An underweight allocation to the information technology sector, coupled with an overweight in the health care sector, also weighed on results relative to the Index. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

|

|

|

|

|

Russell 1000 Growth Index |

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Dec. 12, 2022

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 121,748,546

|

| Holdings Count | Holding |

35

|

| Advisory Fees Paid, Amount |

$ 848,016

|

| Investment Company, Portfolio Turnover |

37.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

|

|

Semiconductors & Semiconductor Equipment |

|

|

|

Interactive Media & Services |

|

|

|

|

|

Technology Hardware, Storage & Peripherals |

|

|

|

|

|

Consumer Staples Distribution & Retail |

|

|

|

|

|

|

|

Health Care Equipment & Supplies |

|

|

|

|

|

|

|

|

|

|

|

|

|

Affiliated Mutual Fund - Short-Term Investment |

|

|

|

Liabilities in excess of other assets |

|

|

|

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

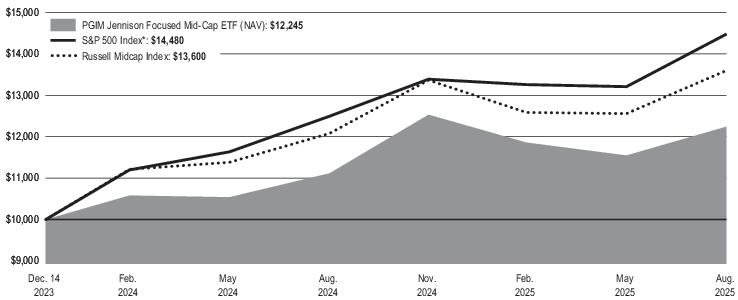

| PGIM JENNISON FOCUSED MID-CAP ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Jennison Focused Mid-Cap ETF

|

| Class Name |

PGIM Jennison Focused Mid-Cap ETF

|

| Trading Symbol |

PJFM

|

| Security Exchange Name |

CboeBZX

|

| Annual or Semi-Annual Statement [Text Block] |

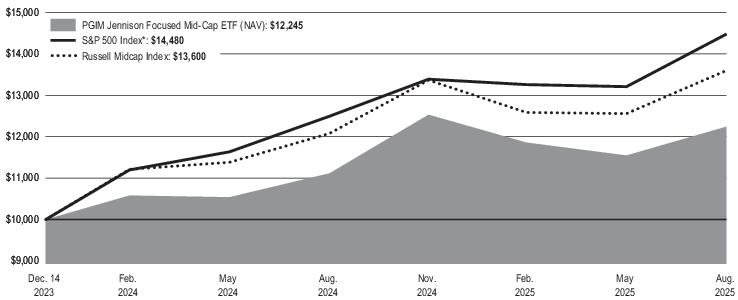

This annual shareholder report contains important information about the PGIM Jennison Focused Mid-Cap ETF (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Jennison Focused Mid-Cap ETF |

|

|

|

| Expenses Paid, Amount |

$ 43

|

| Expense Ratio, Percent |

0.41%

|

| Factors Affecting Performance [Text Block] |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ Over the reporting period, equities generally advanced but experienced significant volatility. The period was marked by a US Federal Reserve interest rate cut, a US presidential election, the surprise launch of China’s Deep Seek artificial intelligence model, and heightened uncertainties about the US administration’s tariff and trade policies, among other developments. Mid-cap stocks, as represented by the Fund’s benchmark, the Russell Midcap Index (the “Index”), generated solid gains but lagged the broad market, as represented by the S&P 500 Index. ■ Security selection within the materials sector (primarily metals & mining) and consumer staples sector (driven by distribution) added the most to the Fund’s performance relative to the Index. Underweight exposure to health care also bolstered results relative to the Index. ■ Stock selection within the information technology sector (led by software), industrials sector (driven by aerospace & defense), consumer discretionary sector (especially hotels, restaurants & leisure), and communication services sector (primarily interactive media & services) were the primary sources of underperformance relative to the Index. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

|

|

|

|

|

|

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Dec. 14, 2023

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 15,180,177

|

| Holdings Count | Holding |

43

|

| Advisory Fees Paid, Amount |

$ 54,701

|

| Investment Company, Portfolio Turnover |

102.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods |

|

|

|

Trading Companies & Distributors |

|

|

|

Hotels, Restaurants & Leisure |

|

Interactive Media & Services |

|

|

|

|

|

Semiconductors & Semiconductor Equipment |

|

|

|

|

|

Consumer Staples Distribution & Retail |

|

|

|

Health Care Providers & Services |

|

|

|

|

|

|

|

|

|

Oil, Gas & Consumable Fuels |

|

|

|

|

|

Health Care Equipment & Supplies |

|

|

|

Real Estate Management & Development |

|

Affiliated Mutual Fund - Short-Term Investment |

|

|

|

Liabilities in excess of other assets |

|

|

|

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

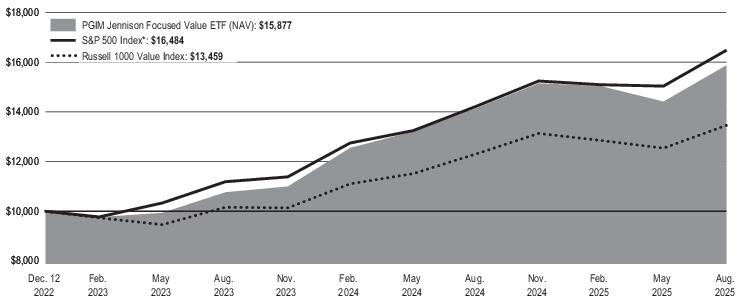

| PGIM JENNISON FOCUSED VALUE ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Jennison Focused Value ETF

|

| Class Name |

PGIM Jennison Focused Value ETF

|

| Trading Symbol |

PJFV

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

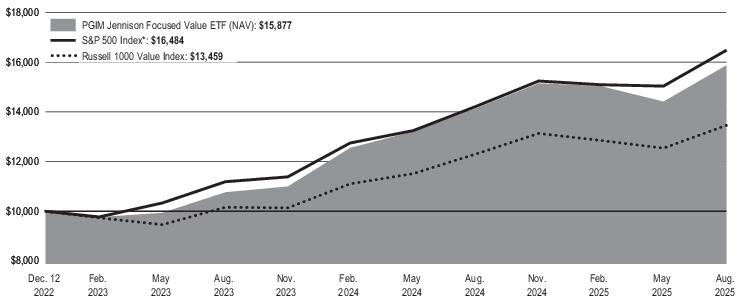

This annual shareholder report contains important information about the PGIM Jennison Focused Value ETF (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Jennison Focused Value ETF |

|

|

|

| Expenses Paid, Amount |

$ 72

|

| Expense Ratio, Percent |

0.68%

|

| Factors Affecting Performance [Text Block] |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ Over the reporting period, equities generally advanced but experienced significant volatility. The period was marked by a US Federal Reserve interest rate cut, a US presidential election, the surprise launch of China’s Deep Seek artificial intelligence model, and heightened uncertainties about the US administration’s tariff and trade policies, among other developments. Generally speaking, growth outperformed value during the period. ■ Positions within consumer staples sector (led by distribution), information technology sector (driven by software and semiconductors), and industrials sector (boosted by aerospace & defense) added the most to the Fund’s performance relative to its benchmark, the Russell 1000 Value Index (the “Index”). ■ Conversely, positions within financials sector (especially banks) detracted the most from results relative to the Index. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

|

|

|

|

|

|

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Dec. 12, 2022

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 20,110,566

|

| Holdings Count | Holding |

36

|

| Advisory Fees Paid, Amount |

$ 114,947

|

| Investment Company, Portfolio Turnover |

56.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

|

|

|

|

Oil, Gas & Consumable Fuels |

|

|

|

|

|

Semiconductors & Semiconductor Equipment |

|

|

|

|

|

|

|

|

|

Consumer Staples Distribution & Retail |

|

|

|

Interactive Media & Services |

|

|

|

|

|

|

|

|

|

Affiliated Mutual Fund - Short-Term Investment |

|

|

|

|

|

|

|

Health Care Equipment & Supplies |

|

Technology Hardware, Storage & Peripherals |

|

|

|

Other assets in excess of liabilities |

|

|

|

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

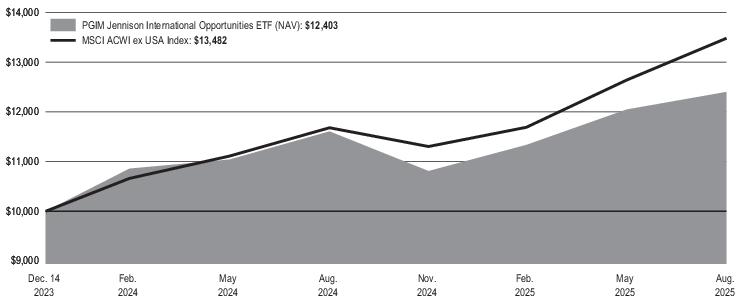

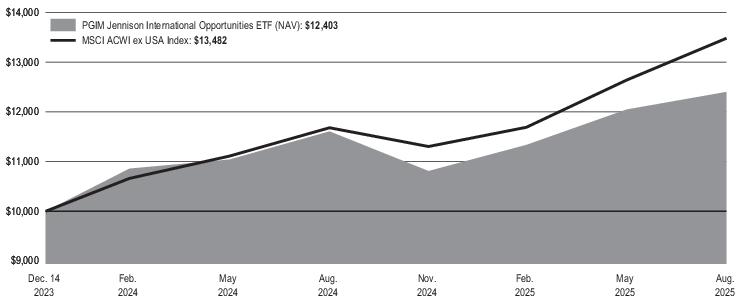

| PGIM JENNISON INTERNATIONAL OPPORTUNITIES ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Jennison International Opportunities ETF

|

| Class Name |

PGIM Jennison International Opportunities ETF

|

| Trading Symbol |

PJIO

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PGIM Jennison International Opportunities ETF (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment )

|

|

Costs paid as a percentage |

PGIM Jennison International Opportunities ETF |

|

|

|

| Expenses Paid, Amount |

$ 83

|

| Expense Ratio, Percent |

0.80%

|

| Factors Affecting Performance [Text Block] |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ International equities, as represented by the Fund’s benchmark, the MSCI ACWI ex USA Index (the “Index”), advanced during the reporting period, with all regions posting positive results, while modestly lagging US equities, as represented by the S&P 500 Index. Macro themes influencing international markets included heightened uncertainties about new US tariff and trade policies; the surprise launch of China’s Deep Seek artificial intelligence model, which fueled volatility in the technology sector; increased defense and infrastructure spending in Europe, especially Germany; and new policy initiatives in China to address challenges stemming from weaknesses in the real estate and equity markets. ■ The Fund’s security selection within the industrials sector, especially aerospace & defense, added the most value relative to the Index. Entertainment holdings drove outperformance in the communication services sector. Lack of exposure to the energy and materials sectors also bolstered performance relative to the Index. ■ Conversely, consumer discretionary sector positions were the most significant detractors from returns relative to the Index, as retail and automobile holdings underperformed. Banks drove underperformance in the financials sector, while software weighed on results in the information technology sector. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

|

|

|

|

| Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Index are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Dec. 14, 2023

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data. |

| Net Assets |

$ 27,227,772

|

| Holdings Count | Holding |

34

|

| Advisory Fees Paid, Amount |

$ 117,883

|

| Investment Company, Portfolio Turnover |

89.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

|

|

|

|

|

|

|

|

|

|

Textiles, Apparel & Luxury Goods |

|

Semiconductors & Semiconductor Equipment |

|

Hotels, Restaurants & Leisure |

|

|

|

|

|

|

|

Affiliated Mutual Fund - Short-Term Investment |

|

|

|

Technology Hardware, Storage & Peripherals |

|

|

|

|

|

|

|

|

|

|

|

|

|

Health Care Equipment & Supplies |

|

Life Sciences Tools & Services |

|

Electronic Equipment, Instruments & Components |

|

|

|

Other assets in excess of liabilities |

|

|

|

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-209

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

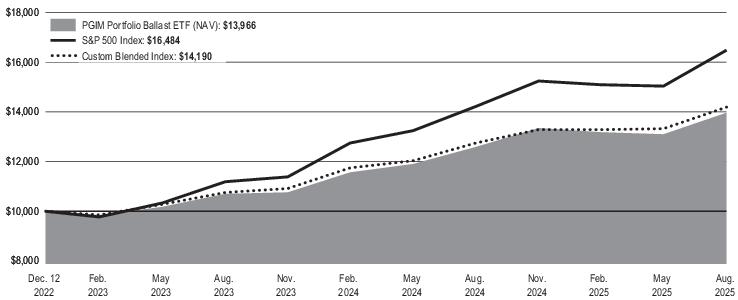

| PGIM PORTFOLIO BALLAST ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Portfolio Ballast ETF

|

| Class Name |

PGIM Portfolio Ballast ETF

|

| Trading Symbol |

PBL

|

| Security Exchange Name |

CboeBZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PGIM Portfolio Ballast ETF (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Portfolio Ballast ETF |

|

|

|

| Expenses Paid, Amount |

$ 45

|

| Expense Ratio, Percent |

0.43%

|

| Factors Affecting Performance [Text Block] |

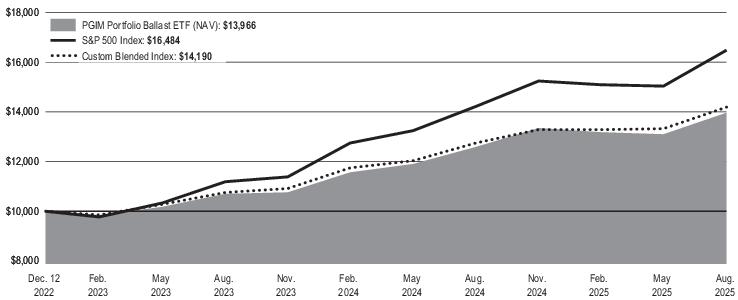

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ US equities performed strongly during the reporting period, with the S&P 500 Index up over 18%. US bonds also gained, with the Bloomberg Intermediate Government Index up over 4%. Implied volatility peaked at 52.3 on April 8, 2025, but finished the reporting period nearly unchanged, with the CBOE Volatility Index closing out the period at 15.4 versus 15.6 at the beginning of the period. ■ The Fund benefited from equity market appreciation as average equity exposure during the period was 65%, slightly higher than the baseline 60%. ■ Fixed income exposure also added value during the period, as bonds appreciated. ■ As expected, option time decay, which is the reduction in the value of an option as the time to the expiration date approaches, was a drag on performance. Overall, the Fund performed as expected during the period, providing 60% participation in the S&P 500 Index. ■ The Fund invests primarily in FLEX long-term call options on the SPDR ® S&P 500 ETF (SPY) and other exchange-traded funds (“ETFs”) designed to track the S&P 500 to implement equity exposure and provide market participation. Additionally, the Fund invests in US Treasuries and cash for managing targeted duration to help reduce equity downside, and at times uses S&P 500 index futures and US Treasury futures to manage exposures to those asset classes. These exposures had a positive impact on the Fund’s performance during the period. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

|

|

|

|

|

|

|

| Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Dec. 12, 2022

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 68,988,242

|

| Holdings Count | Holding |

13

|

| Advisory Fees Paid, Amount |

$ 231,213

|

| Investment Company, Portfolio Turnover |

20.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

|

|

U.S. Treasury Obligations |

|

|

|

Affiliated Mutual Fund - Short-Term Investment |

|

Unaffiliated Exchange-Traded Funds - Domestic Equity |

|

|

|

Liabilities in excess of other assets |

|

|

|

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

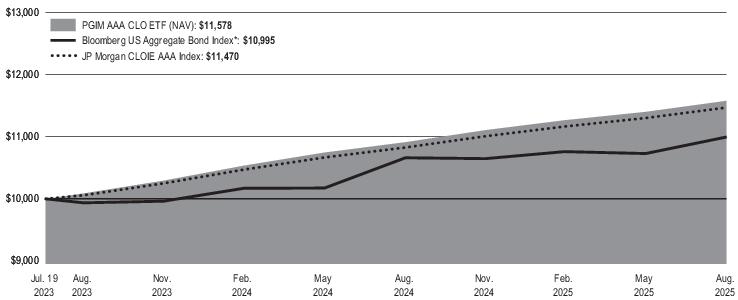

| PGIM AAA CLO ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM AAA CLO ETF

|

| Class Name |

PGIM AAA CLO ETF

|

| Trading Symbol |

PAAA

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PGIM AAA CLO ETF (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

|

|

|

|

| Expenses Paid, Amount |

$ 20

|

| Expense Ratio, Percent |

0.19%

|

| Factors Affecting Performance [Text Block] |

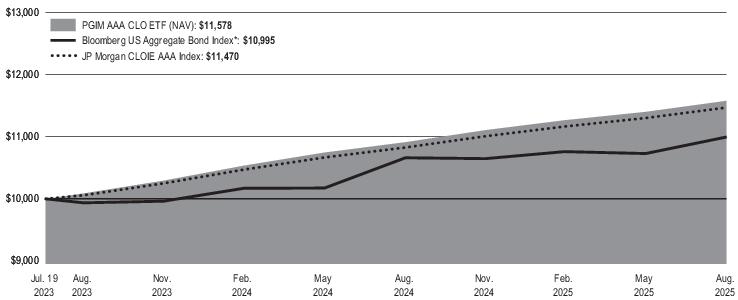

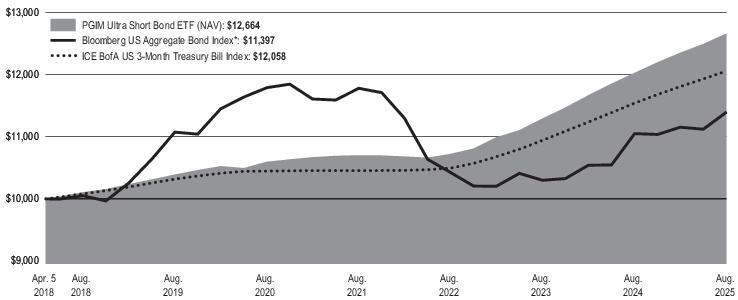

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ Collateralized loan obligation (CLO) AAA spreads rallied approximately 11 basis points (bps) over the 12-month period ending August 31, 2025. The spread-tightening environment was driven by robust demand for the asset class despite elevated supply throughout the period. The Fund outperformed its benchmark, the JP Morgan CLOIE AAA Index (the “Index”), by 35 bps over the period. ■ The following strategies contributed most to the Fund’s performance during the period: The portfolio was positioned longer in spread duration relative to the Index, and as such, benefited from additional price appreciation, as longer spread-duration assets outperformed the shorter end of the term curve. The portfolio’s rating composition largely matched the Index throughout the period. ■ The following strategies detracted from the Fund’s performance during the period: The Fund received approximately $3.7 billion in net flows over the period, causing some marginal cash drag. However, the team was largely able to stay invested, with an average CLO balance of approximately 98.5%. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

|

|

Bloomberg US Aggregate Bond Index* |

|

|

JP Morgan CLOIE AAA Index |

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Jul. 19, 2023

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 4,233,291,809

|

| Holdings Count | Holding |

327

|

| Advisory Fees Paid, Amount |

$ 4,555,310

|

| Investment Company, Portfolio Turnover |

68.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

Credit Quality expressed as a percentage of total investments as of 8/31/2025 (%) |

|

|

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

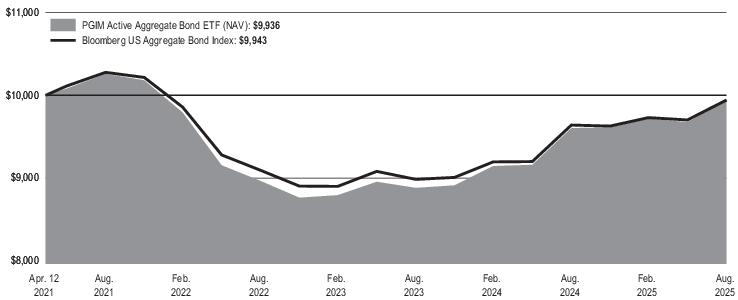

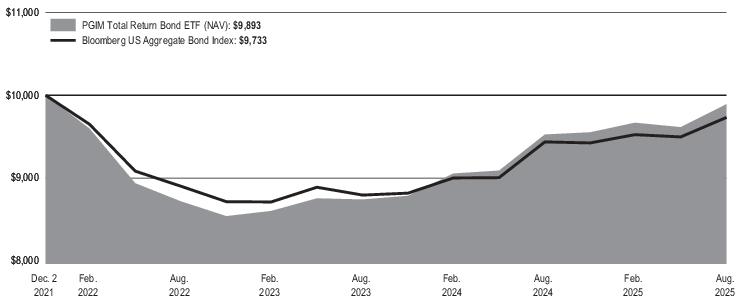

| PGIM ACTIVE AGGREGATE BOND ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Active Aggregate Bond ETF

|

| Class Name |

PGIM Active Aggregate Bond ETF

|

| Trading Symbol |

PAB

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PGIM Active Aggregate Bond ETF (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US. |

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Active Aggregate Bond ETF |

|

|

|

| Expenses Paid, Amount |

$ 16

|

| Expense Ratio, Percent |

0.16%

|

| Factors Affecting Performance [Text Block] |

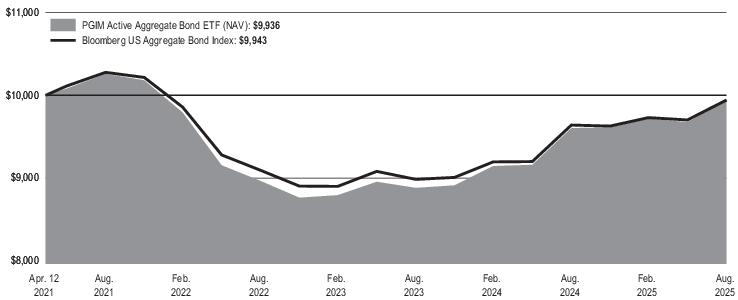

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ During the reporting period, credit spreads across a broad spectrum of fixed income asset classes generally tightened, recovering from the reciprocal tariffs introduced on April 2, 2025. The US Federal Reserve's easing cycle, which began with three rate cuts in the second half of 2024, was paused in the first half of 2025 amid increased uncertainty over the impact of US policy changes on the domestic labor market and inflation. Indeed, Core PCE, a key inflation metric that tracks price changes (excluding volatile food and energy prices), came in higher than expected for the reporting period. In addition, revisions to the nonfarm payroll report at the end of the period revealed a weaker labor market than previously indicated, causing investors to reprice their expectations for a September rate cut and a steepening of the US Treasury yield curve. ■ The following strategies contributed most to the Fund’s performance relative to the Bloomberg US Aggregate Bond Index (the “Index”) during the period: positioning in AAA non-agency commercial mortgage-backed securities (CMBS) and AAA collateralized loan obligations (CLO); overweights to the US investment-grade corporate, emerging-market investment grade, and asset-backed securities (ABS) sectors, along with an underweight to the mortgage-backed securities (MBS) sector; yield curve positioning; security selection in US Treasuries, and ABS; and credit positioning in REITs. ■ The Fund’s duration positioning detracted most from the Fund’s performance relative to the Index during the period. ■ The Fund uses derivatives to facilitate the implementation of the overall investment approach. During the reporting period, the Fund used swaps and futures to help manage duration positioning and yield curve exposure. In aggregate, these positions detracted from performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

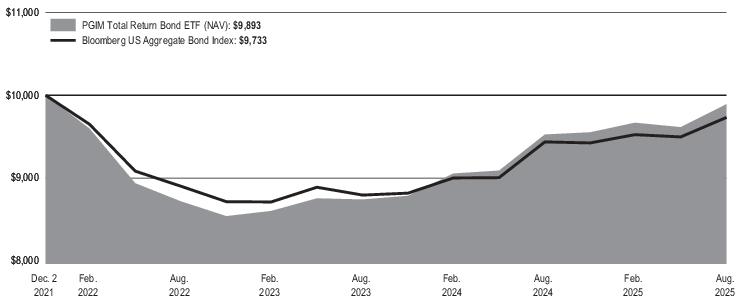

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

|

|

Bloomberg US Aggregate Bond Index |

|

| Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns . Since Inception returns for the Index are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Apr. 12, 2021

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 84,110,813

|

| Holdings Count | Holding |

470

|

| Advisory Fees Paid, Amount |

$ 100,469

|

| Investment Company, Portfolio Turnover |

134.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

Credit Quality expressed as a percentage of total investments as of 8/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

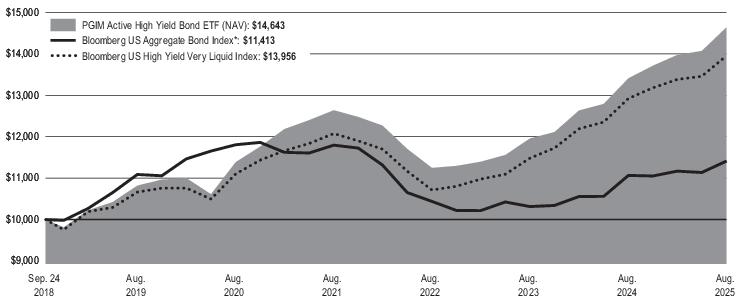

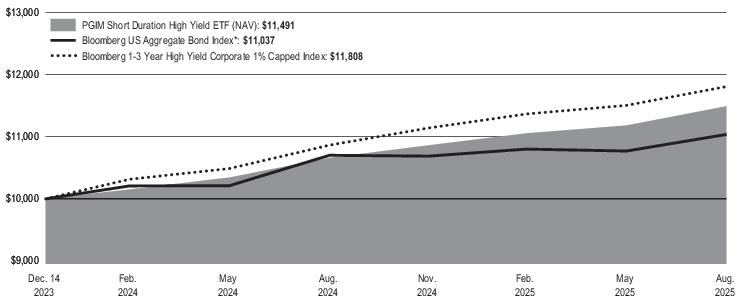

| PGIM ACTIVE HIGH YIELD BOND ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Active High Yield Bond ETF

|

| Class Name |

PGIM Active High Yield Bond ETF

|

| Trading Symbol |

PHYL

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PGIM Active High Yield Bond ETF (the “Fund”) for the period of September 1, 2024 to August 31, 2025 .

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Active High Yield Bond ETF |

|

|

|

| Expenses Paid, Amount |

$ 39

|

| Expense Ratio, Percent |

0.37%

|

| Factors Affecting Performance [Text Block] |

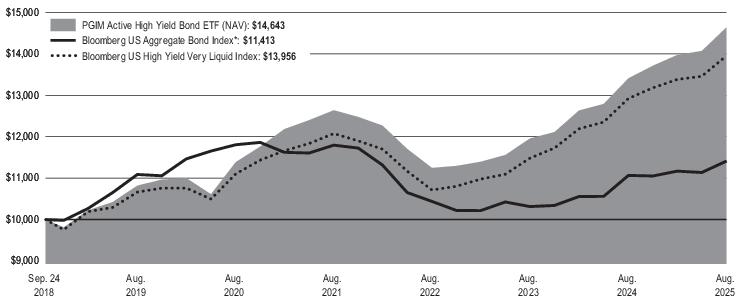

WHAT AFFECTED THE FUND’S PERF ORMANCE DURING THE REPORTING PERIOD? ■ US high yield bonds posted gains over the reporting period, as overall solid corporate earnings and resilient market technicals held firm against a challenging environment marked by the 2024 US election cycle, geopolitical tensions on multiple fronts, a broad-based increase in US tariffs, and elevated inflation. In addition, despite macro uncertainty and tight financial conditions, the high yield market continued to grow in 2025. ■ The following strategies contributed the most to the Fund’s performance relative to the Bloomberg US High Yield Very Liquid Index (the “Index”) during the period: security selection in cable & satellite, health care & pharmaceuticals, and retailers & restaurants industries; industry underweights to midstream energy and cable & satellite, along with an industry overweight to telecom; an underweight to the US high yield corporate sector and overweights to the AAA collateralized loan obligation and emerging-market high yield sectors. ■ The following strategies detracted the most from the Fund’s performance relative to the Index during the period: security selection in consumer non-cyclicals, chemicals, and building materials & home construction industries; industry underweights to media & entertainment and consumer non-cyclicals, and an industry overweight to health care & pharmaceuticals. ■ The Fund uses derivatives to facilitate the implementation of the overall investment approach. During the reporting period, the Fund used swaps, forwards, and futures to help manage duration positioning and yield curve exposure. In aggregate, these positions contributed to performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

|

|

|

|

Bloomberg US Aggregate Bond Index* |

|

|

|

Bloomberg US High Yield Very Liquid Index |

|

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Sep. 24, 2018

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 422,217,137

|

| Holdings Count | Holding |

746

|

| Advisory Fees Paid, Amount |

$ 913,409

|

| Investment Company, Portfolio Turnover |

56.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

Credit Quality expressed as a percentage of total investments as of 8/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

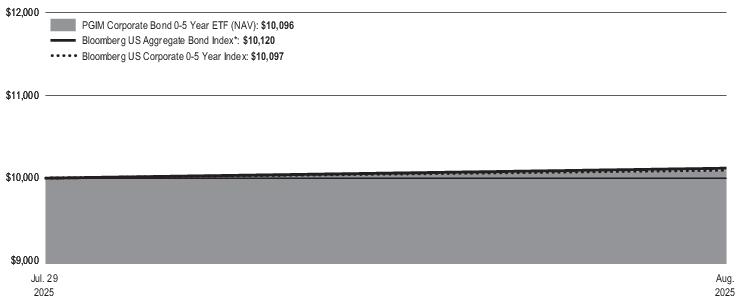

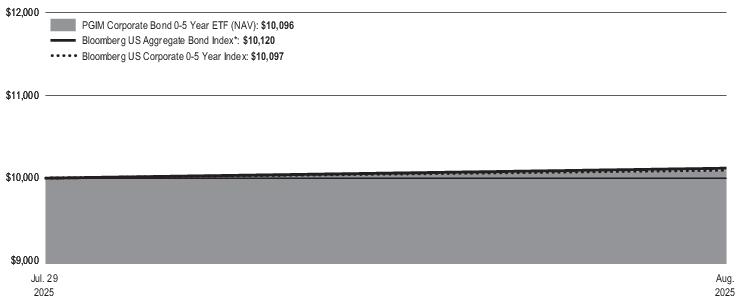

| PGIM CORPORATE BOND 0-5 YEAR ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Corporate Bond 0-5 Year ETF

|

| Class Name |

PGIM Corporate Bond 0-5 Year ETF

|

| Trading Symbol |

PCS

|

| Security Exchange Name |

CboeBZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PGIM Corporate Bond 0-5 Year ETF (the “Fund”) for the period of July 29, 2025 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Corporate Bond 0-5 Year ETF |

|

| This report covers a period less than full fiscal year. Expenses for a full fiscal year would be higher than the figures shown. |

| Expenses Paid, Amount |

$ 2

|

| Expense Ratio, Percent |

0.20%

|

| Factors Affecting Performance [Text Block] |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ In August, the US economy showed signs of strain as job growth slowed and unemployment rate rose to 4.2%. Inflation pressures persisted, partly driven by reciprocal tariffs effective August 1st and newly implemented duties, while consumer spending remained strong. Fed Chair Jerome Powell indicated the FOMC’s openness to a possible rate cut at the September meeting, citing sufficiently restrictive monetary policy and a shift in the balance of risks toward employment as key factors supporting a cut. This fueled gains across most equity indexes. On an excess return basis, the long end of the IG curve performed in line with the short end of the curve. ■ Positioning in investment grade corporates; and security selection in automotive, gaming/lodging/leisure, and cable & satellite contributed the most to the Fund's performance relative to the Bloomberg US Corporate 0-5 Year Index (the “Index”) during the period. ■ Security selection in chemicals; an overweight in midstream energy and an underweight in banking detracted from the Fund's performance relative to the Index during the period. ■ The Fund uses derivatives to facilitate the implementation of the overall investment approach. During the reporting period, the Fund used financial futures to help manage duration positioning and yield curve exposure. These positions detracted slightly from performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Total Returns as of 8/31/2025 |

|

|

|

|

Bloomberg US Aggregate Bond Index* |

|

Bloomberg US Corporate 0-5 Year Index |

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Jul. 29, 2025

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 142,591,903

|

| Holdings Count | Holding |

209

|

| Advisory Fees Paid, Amount |

$ 23,819

|

| Investment Company, Portfolio Turnover |

14.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

Credit Quality expressed as a percentage of total investments as of 8/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

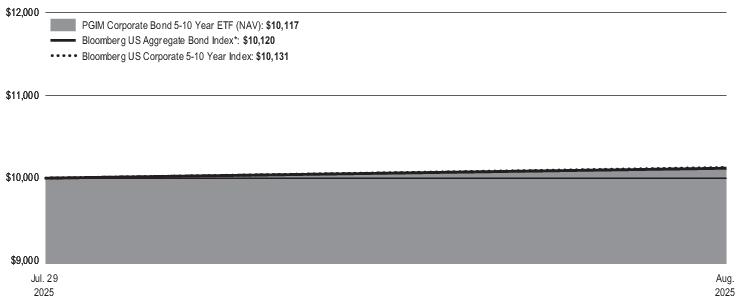

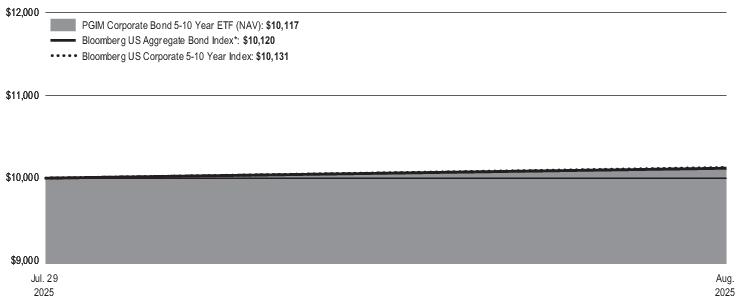

| PGIM CORPORATE BOND 5-10 YEAR ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Corporate Bond 5-10 Year ETF

|

| Class Name |

PGIM Corporate Bond 5-10 Year ETF

|

| Trading Symbol |

PCI

|

| Security Exchange Name |

CboeBZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PGIM Corporate Bond 5-10 Year ETF (the “Fund”) for the period of July 29, 2025 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Corporate Bond 5-10 Year ETF |

|

| This report covers a period less than full fiscal year. Expenses for a full fiscal year would be higher than the figures shown. |

| Expenses Paid, Amount |

$ 2

|

| Expense Ratio, Percent |

0.25%

|

| Factors Affecting Performance [Text Block] |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ In August, the US economy showed signs of strain as job growth slowed and unemployment rate rose to 4.2%. Inflation pressures persisted, partly driven by reciprocal tariffs effective August 1st and newly implemented duties, while consumer spending remained strong. Fed Chair Jerome Powell indicated the FOMC’s openness to a possible rate cut at the September meeting, citing sufficiently restrictive monetary policy and a shift in the balance of risks toward employment as key factors supporting a cut. This fueled gains across most equity indexes. On an excess return basis, the long end of the IG curve performed in line with the short end of the curve. ■ Underweights in technology, retailers & restaurants, and capital goods contributed to the Fund's performance relative to the Bloomberg US Corporate 5-10 Year Index (the “Index”) during the period. ■ Positioning in investment grade corporates; security selection in upstream energy; and overweights in midstream energy and REITS detracted the most from the Fund's performance relative to the Index during the period. ■ The Fund uses derivatives to facilitate the implementation of the overall investment approach. During the reporting period, the Fund used financial futures to help manage duration positioning and yield curve exposure. These positions contributed to performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Total Returns as of 8/31/2025 |

|

|

|

|

Bloomberg US Aggregate Bond Index* |

|

Bloomberg US Corporate 5-10 Year Index |

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Jul. 29, 2025

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 146,675,925

|

| Holdings Count | Holding |

196

|

| Advisory Fees Paid, Amount |

$ 30,616

|

| Investment Company, Portfolio Turnover |

10.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

Credit Quality expressed as a percentage of total investments as of 8/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

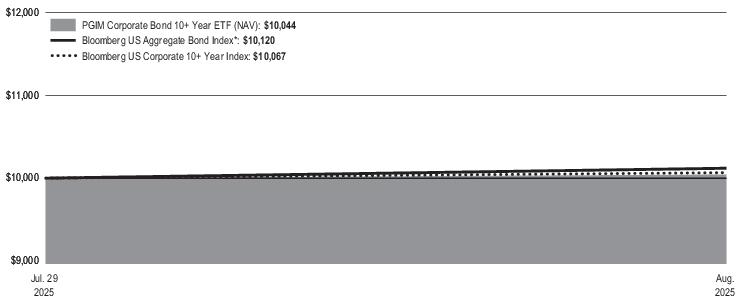

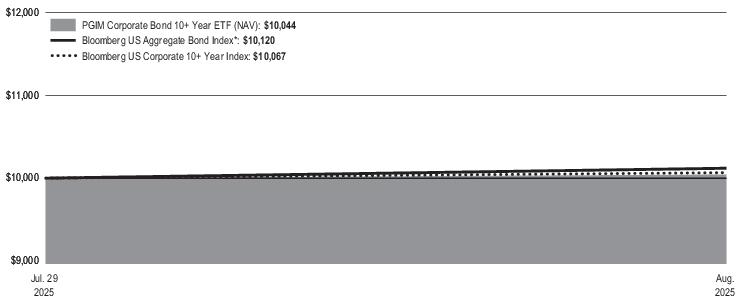

| PGIM CORPORATE BOND 10+ YEAR ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Corporate Bond 10+ Year ETF

|

| Class Name |

PGIM Corporate Bond 10+ Year ETF

|

| Trading Symbol |

PCL

|

| Security Exchange Name |

CboeBZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PGIM Corporate Bond 10+ Year ETF (the “Fund”) for the period of July 29, 2025 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Corporate Bond 10+ Year ETF |

|

| This report covers a period less than full fiscal year. Expenses for a full fiscal year would be higher than the figures shown. |

| Expenses Paid, Amount |

$ 2

|

| Expense Ratio, Percent |

0.25%

|

| Factors Affecting Performance [Text Block] |

WHAT AFF EC TED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ In August, the US economy showed signs of strain as job growth slowed and unemployment rate rose to 4.2%. Inflation pressures persisted, partly driven by reciprocal tariffs effective August 1st and newly implemented duties, while consumer spending remained strong. Fed Chair Jerome Powell indicated the FOMC’s openness to a possible rate cut at the September meeting, citing sufficiently restrictive monetary policy and a shift in the balance of risks toward employment as key factors supporting a cut. This fueled gains across most equity indexes. On an excess return basis, the long end of the IG curve performed in line with the short end of the curve. ■ The following strategies contributed most to the Fund’s performance relative to the Bloomberg US Corporate 10+ Year Index (the “Index”) during the period: positioning in investment grade corporates; and security selection in electric utilities, retailers & restaurants, and property & casualty. ■ The following strategies detracted performance relative to the Index during the period: security selection in banking and revenue health care municipals; and an overweight in midstream energy. ■ The Fund uses derivatives to facilitate the implementation of the overall investment approach. During the reporting period, the Fund used financial futures to help manage duration positioning and yield curve exposure. These positions detracted from performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Total Returns as of 8/31/2025 |

|

|

|

|

Bloomberg US Aggregate Bond Index* |

|

Bloomberg US Corporate 10+ Year Index |

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

Jul. 29, 2025

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 75,317,927

|

| Holdings Count | Holding |

139

|

| Advisory Fees Paid, Amount |

$ 16,369

|

| Investment Company, Portfolio Turnover |

17.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

Credit Quality expressed as a percentage of total investments as of 8/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| Updated Prospectus Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

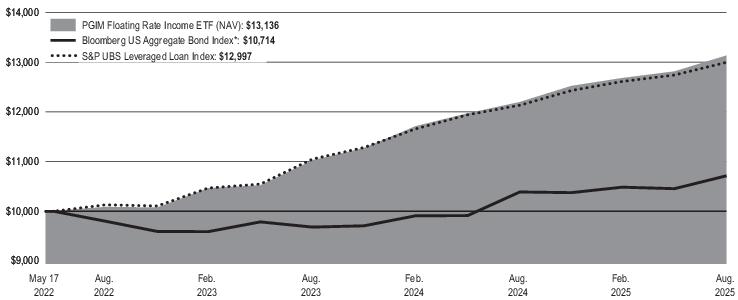

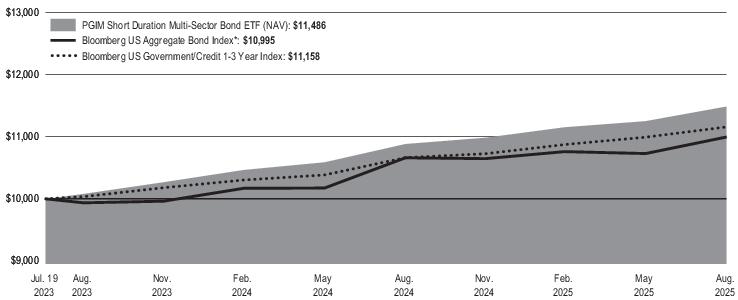

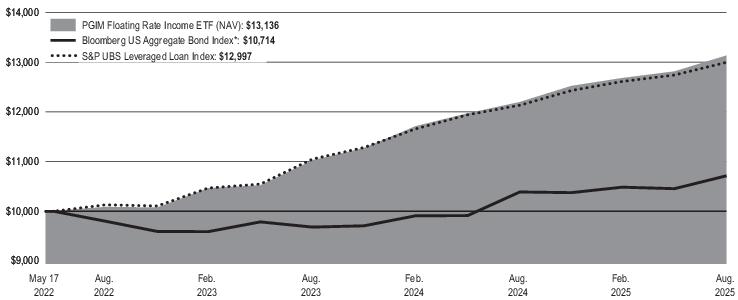

| PGIM FLOATING RATE INCOME ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Floating Rate Income ETF

|

| Class Name |

PGIM Floating Rate Income ETF

|

| Trading Symbol |

PFRL

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PGIM Floating Rate Income ETF (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

| |

|

Costs paid as a percentage |

PGIM Floating Rate Income ETF |

|

|

|

| Expenses Paid, Amount |

$ 84

|

| Expense Ratio, Percent |

0.81%

|

| Factors Affecting Performance [Text Block] |

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ US leveraged loans posted gains over the reporting period, as generally solid corporate earnings and supportive technicals held firm overall against a challenging environment marked by the 2024 US election cycle, geopolitical and US-driven trade tensions on multiple fronts, and elevated inflation. Thus far in 2025, loan mutual funds reported inflows of approximately $6.3 billion, while collateralized loan obligation (CLO) formation remained robust at over $138 billion. ■ The following contributed the most to the Fund’s performance during the period: security selection in the health care & pharmaceuticals, banking, and electric & water industries; overweights relative to the S&P UBS Leveraged Loan Index (the “Index”) in the CLO AA sector; and an underweight relative to the Index in the technology industry. The market risk of the portfolio was higher than the Index over the period, which also contributed. ■ The following detracted the most from the Fund’s performance during the period: security selection in the consumer noncyclicals, chemicals, and technology industries, and an overweight relative to the Index in the US high yield corporate sector. ■ The Fund held interest rate futures and swaps to help manage the portfolio’s duration and yield curve exposure and to reduce its sensitivity to changes in the levels of interest rates. Overall, this strategy had a positive impact on performance during the period. The Fund also participated in credit default swaps to increase or reduce credit risk. This strategy had a negative impact on performance.

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

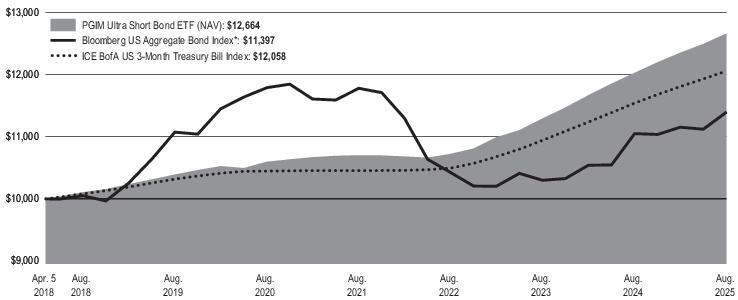

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

| |

|

|

| |

|

|

Bloomberg US Aggregate Bond Index* |

|

|

S&P UBS Leveraged Loan Index |

|

| *The Fund compares its performance against this broad-based index in response to regulatory requirements. Since Inception returns are provided for the Fund since it has less than 10 fiscal years of returns. Since Inception returns for the Indexes are measured from the closest month-end to the Fund’s inception date. |

| Performance Inception Date |

May 17, 2022

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Material Change Date |

Sep. 01, 2024

|

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/etfs/prospectuses-fact-sheets or call (888) 247-8090 or (973) 802-2093 from outside the US for more recent performance data.

|

| Net Assets |

$ 79,321,838

|

| Holdings Count | Holding |

364

|

| Advisory Fees Paid, Amount |

$ 615,408

|

| Investment Company, Portfolio Turnover |

112.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

| |

|

| |

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

Credit Quality expressed as a percentage of total investments as of 8/31/2025 (%) |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| Material Fund Change [Text Block] |

WERE THERE ANY SIGNIFICANT CHANGES TO THE FUND THIS YEAR? The following is a summary of certain changes to the Fund since September 1, 2024: For the year ended August 31, 2025, the total annual Fund operating expenses after waivers and/or expense reimbursement increased from 0.70% in the year ended August 31, 2024 to 0.81% due to interest expense on reverse repurchase agreements. For more complete information, you should review the Fund’s next prospectus, which we expect to be available by October 30, 2025 at pgim.com/investments/etfs/prospectuses-fact-sheets or by request at (800) 225-1852.

|

| Material Fund Change Expenses [Text Block] |

For the year ended August 31, 2025, the total annual Fund operating expenses after waivers and/or expense reimbursement increased from 0.70% in the year ended August 31, 2024 to 0.81% due to interest expense on reverse repurchase agreements.

|

| Summary of Change Legend [Text Block] |

The following is a summary of certain changes to the Fund since September 1, 2024: For the year ended August 31, 2025, the total annual Fund operating expenses after waivers and/or expense reimbursement increased from 0.70% in the year ended August 31, 2024 to 0.81% due to interest expense on reverse repurchase agreements.

|

| Updated Prospectus Phone Number |

(800) 225-1852

|

| Updated Prospectus Web Address |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

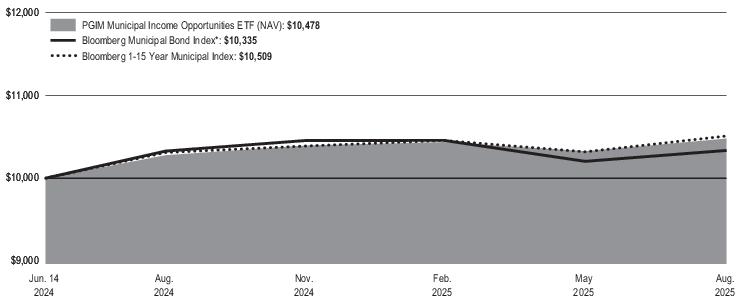

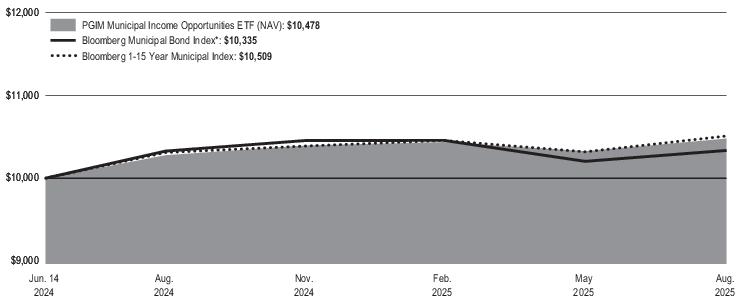

| PGIM MUNICIPAL INCOME OPPORTUNITIES ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Municipal Income Opportunities ETF

|

| Class Name |

PGIM Municipal Income Opportunities ETF

|

| Trading Symbol |

PMIO

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PGIM Municipal Income Opportunities ETF (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/etfs/prospectuses-fact-sheets . You can also request this information by contacting us at (888) 247-8090 or (973) 802-2093 from outside the US.

|

| Additional Information Phone Number |

(888) 247-8090 or (973) 802-2093

|

| Additional Information Website |

pgim.com/investments/etfs/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Municipal Income Opportunities ETF |

|

|

|

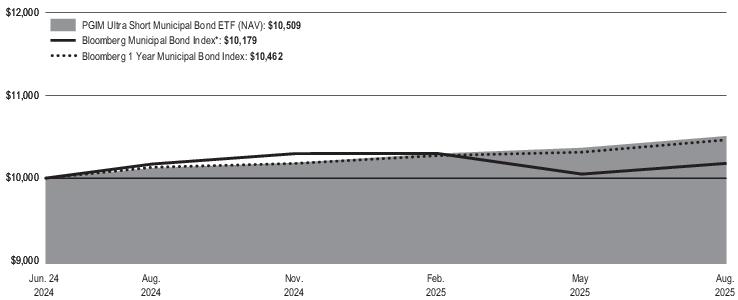

| Expenses Paid, Amount |

$ 21

|

| Expense Ratio, Percent |

0.21%

|

| Factors Affecting Performance [Text Block] |