| + c BUILDING A GLOBAL HEALTH & WELLNESS LEADER Exhibit 99.2 |

| + c Important Information for Investors and Stockholders 2 This communication does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction. It does not constitute a prospectus or prospectus equivalent document. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. This communication may be deemed to be solicitation material in respect of the proposed transaction between Kimberly-Clark Corporation (“K-C”) and Kenvue Inc. (“Kenvue”). In connection therewith, K-C and Kenvue intend to file relevant materials with the Securities and Exchange Commission (the “SEC”), including, among other filings, a K-C registration statement on Form S-4 in connection with the proposed issuance of shares of K-C’s common stock pursuant to the proposed transaction that will include a joint proxy statement of K-C and Kenvue that also constitutes a prospectus of K-C, and a definitive joint proxy statement/prospectus, which, after the registration statement is declared effective by the SEC, will be mailed to stockholders of K-C and Kenvue seeking their approval of their respective transaction-related proposals. INVESTORS AND STOCKHOLDERS OF K-C AND KENVUE ARE URGED TO READ CAREFULLY THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS AND OTHER DOCUMENTS IN THEIR ENTIRETY THAT WILL BE FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION, THE PARTIES TO THE PROPOSED TRANSACTION AND ANY SOLICITATION. This communication is not a substitute for the registration statement, the joint proxy statement/prospectus or any other document that K-C or Kenvue may file with the SEC and send to its stockholders in connection with the proposed transaction. Investors and stockholders will be able to obtain free copies of the registration statement and the joint proxy statement/prospectus (when available) and other documents filed with the SEC by K-C or Kenvue through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by K-C will be available free of charge on K-C’s website at kimberly-clark.com under the tab “Investors” and under the heading “Financial” and subheading “SEC Filings.” Copies of the documents filed with the SEC by Kenvue will be available free of charge on Kenvue’s website at kenvue.com under the tab “Investors” and under the heading “Financials & reports” and subheading “SEC filings.” Certain Information Regarding Participants K-C, Kenvue, and their respective directors and executive officers and certain other members of management and employees may be considered participants in the solicitation of proxies from the stockholders of K-C and Kenvue in connection with the proposed transaction. Information about the directors and executive officers of K-C is set forth in its Annual Report on Form 10-K for the year ended December 31, 2024, which was filed with the SEC on February 13, 2025, its proxy statement for its 2025 annual meeting, which was filed with the SEC on March 10, 2025, and its Current Report on Form 8-K, which was filed with the SEC on May 6, 2025. Information about the directors and executive officers of Kenvue is set forth in its Annual Report on Form 10-K for the year ended December 29, 2024, which was filed with the SEC on February 24, 2025, its proxy statement for its 2025 annual meeting, which was filed with the SEC on April 9, 2025, and its Current Reports on Form 8-K, which were filed with the SEC on May 8, 2025, June 24, 2025, July 14, 2025 and November 3, 2025. To the extent holdings of K-C’s or Kenvue’s securities by its directors or executive officers have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC, including the Initial Statements of Beneficial Ownership on Form 3, Statements of Change in Ownership on Form 4 or Annual Statements of Beneficial Ownership on Form 5 filed with the SEC on: 5/2/2025, 5/2/2025, 5/2/2025, 5/2/2025, 5/2/2025, 5/2/2025, 5/2/2025, 5/2/2025, 5/2/2025, 5/2/2025, 5/27/2025, 5/27/2025, 5/27/2025, 5/27/2025, 5/27/2025, 5/27/2025, 5/27/2025, 5/27/2025, 6/2/2025, 6/4/2025, 8/1/2025, 8/1/2025, 8/4/2025, 9/10/2025, 9/24/2025, 10/1/2025, 10/1/2025, 10/1/2025, 10/1/2025, 10/3/2025 and 10/7/2025. Additional information about the directors and executive officers of K-C and Kenvue and other information regarding the potential participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, which may, in some cases, be different than those of K-C’s stockholders or Kenvue’s stockholders generally, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction. You may obtain these documents (when they become available) free of charge through the website maintained by the SEC at http://www.sec.gov and from K-C’s or Kenvue’s website as described above. |

| + c Cautionary Statement Regarding Forward-Looking Statements 3 Certain matters contained in this communication, including projections as to the anticipated benefits of the proposed transaction, the impact of the proposed transaction on K-C’s and Kenvue’s business and future financial and operating results and prospects, the amount and timing of synergies from the proposed transaction, the terms and scope of the expected financing in connection with the proposed transaction, the expected amount of indebtedness of the combined company following the closing of the proposed transaction, expectations regarding cash flow generation and the post-closing capital structure, growth initiatives, innovations, marketing and other spending, net sales and other contingencies in connection with the proposed transaction, and the closing date for the proposed transaction, constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act and are based upon the current expectations and beliefs of the management of K-C and Kenvue concerning future events impacting K-C and Kenvue and are qualified by the inherent risks and uncertainties surrounding future expectations generally. There can be no assurance that these future events will occur as anticipated or that our results will be as estimated. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties, many of which are beyond K-C’s and Kenvue’s control. Forward-looking statements speak only as of the date they were made, and we undertake no obligation to publicly update them. Some of these forward-looking statements can be identified by words like “anticipate,” “approximately,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “outlook,” “plan,” “potential,” “possible,” “predict,” “project,” “target,” “seek,” “should,” “will,” or “would,” the negative of these words, other terms of similar meaning or the use of future dates. The assumptions used as a basis for the forward-looking statements include many estimates that depend on many factors outside of K-C’s or Kenvue’s control, including, but not limited to, risks and uncertainties around the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, including circumstances requiring a party to pay the other party a termination fee pursuant to the merger agreement, the risk that the conditions to the completion of the proposed transaction (including stockholder and regulatory approvals) are not satisfied in a timely manner or at all, the possibility that competing offers or transaction proposals may be made, the risks arising from the integration of the K-C and Kenvue businesses, the uncertainty of rating agency actions, the risk that the anticipated benefits and synergies of the proposed transaction may not be realized when expected or at all and that the proposed transaction may not be completed in a timely manner or at all, the risk of unexpected costs or expenses resulting from the proposed transaction, the risk of litigation related to the proposed transaction, including resulting expense or delay, the risks related to disruption to ongoing business operations and diversion of management’s time as a result of the proposed transaction, the risk that the proposed transaction may have an adverse effect on the ability of K-C and Kenvue to retain key personnel, customers and suppliers, the risk that the credit ratings of the combined company declines following the proposed transaction, the risk that the announcement or the consummation of the proposed transaction has a negative effect on the market price of the capital stock of K-C and Kenvue or on K-C’s and Kenvue’s operating results, the risk of product liability litigation or government or regulatory action, including related to product liability claims, the risk of product efficacy or safety concerns resulting in product recalls or regulatory action, risks relating to inflation and other economic factors, such as interest rate and currency exchange rate fluctuations, government trade or similar regulatory actions (including current and potential trade and tariff actions and other constraints on trade affecting the countries where K-C or Kenvue operate and the resulting negative impacts on our supply chain, commodity costs, and consumer spending), natural disasters, acts of war, terrorism, catastrophes, pandemics, epidemics, or other disease outbreaks, the prices and availability of K-C’s or Kenvue’s raw materials, manufacturing difficulties or delays or supply chain disruptions, disruptions in the capital and credit markets, counterparty defaults (including customers, suppliers and financial institutions with which K-C or Kenvue do business), impairment of goodwill and intangible assets and projections of operating results and other factors that may affect impairment testing, changes in customer preferences, severe weather conditions, regional instabilities and hostilities, potential competitive pressures on selling prices for K-C and Kenvue products, energy costs, general economic and political conditions globally and in the markets in which K-C and Kenvue do business (including the related responses of consumers, customers and suppliers on sanctions issued by the U.S., the European Union, Russia or other countries), the ability to maintain key customer relationships, competition, including technological advances, new products, and intellectual property attained by competitors, challenges inherent in new product research and development, uncertainty of commercial success for new and existing products and digital capabilities, challenges to intellectual property protections including counterfeiting, the ability of K-C and Kenvue to successfully execute business development strategy and other strategic plans, changes to applicable laws and regulations and other requirements imposed by stakeholders, as well as changes in behavior and spending patterns of consumers, could affect the realization of these estimates. Additional information and factors concerning these risks, uncertainties and assumptions can be found in K-C’s and Kenvue’s respective filings with the SEC, including the risk factors discussed in K-C’s and Kenvue’s most recent Annual Reports on Form 10- K, as updated by their Quarterly Reports on Form 10-Q and future filings with the SEC. Forward-looking statements included herein are made only as of the date hereof and neither K-C nor Kenvue undertakes any obligation to update any forward-looking statements, or any other information in this communication, as a result of new information, future developments or otherwise, or to correct any inaccuracies or omissions in them which become apparent. All forward-looking statements in this communication are qualified in their entirety by this cautionary statement. Important Note about Combined and Non-GAAP Financial Information The projected financial information for the combined businesses of K-C and Kenvue is based on management’s estimates, assumptions and projections and has not been prepared in conformance with the applicable requirements of Regulation S-X relating to pro forma financial information, and the required pro forma adjustments have not been applied and are not reflected therein. This information is provided for illustrative purposes only and should not be considered in isolation from, or as a substitute for, the historical financial statements of K-C or Kenvue. Various factors could cause actual future results to differ materially from those currently estimated by management, including, but not limited to, the risks described above and in each of K-C’s and Kenvue’s respective filings with the SEC. This communication also includes certain financial measures not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), such as adjusted EBITDA and estimates of cost and revenue synergies. Non-GAAP financial measures have limitations as an analytical tool and are not meant to be considered in isolation from, or as a substitute for, the comparable GAAP measures. There are limitations to non-GAAP financial measures because they are not prepared in accordance with GAAP and may not be comparable to similarly titled measures of other companies due to potential differences in methods of calculation and items being excluded. K-C and Kenvue caution you not to place undue reliance on these non-GAAP financial measures. |

| + c Today’s Presenters 4 Mike Hsu Kimberly-Clark Chairman & Chief Executive Officer Nelson Urdaneta Kimberly-Clark Chief Financial Officer Sherilyn McCoy Kimberly-Clark Lead Independent Director Kirk Perry Kenvue Chief Executive Officer |

| + c 5 Kimberly-Clark acquiring Kenvue, the largest pure-play consumer health company by revenue Powerful next step that builds on success of Kimberly-Clark’s Powering Care transformation Tremendous complementarity across categories, geographies and commercial capabilities led by a world-class team Exceptional portfolio of iconic brands engaging consumers across all stages of life Significant value creation with a strong balance sheet and financial flexibility Bringing Together Two Iconic American Companies to Create a Global Health & Wellness Leader 5 |

| + c Opportunity to scale globally with winning capabilities built for speed Exceptional complementarity across categories and critical markets Future-ready organization built to win with the "best of both" Uniquely positioned to drive significant efficiencies through de-duplication Opportunity to Create a Preeminent Consumer Health & Wellness Company 6 ALIGNED PURPOSE & VALUES A passion for people Driven by innovation and collaboration Caring for the planet Working efficiently to drive growth Combination of Kimberly-Clark and Kenvue will drive tremendous growth, innovation and go-to-market strength, powered by a commercial engine to fuel sustained global leadership + |

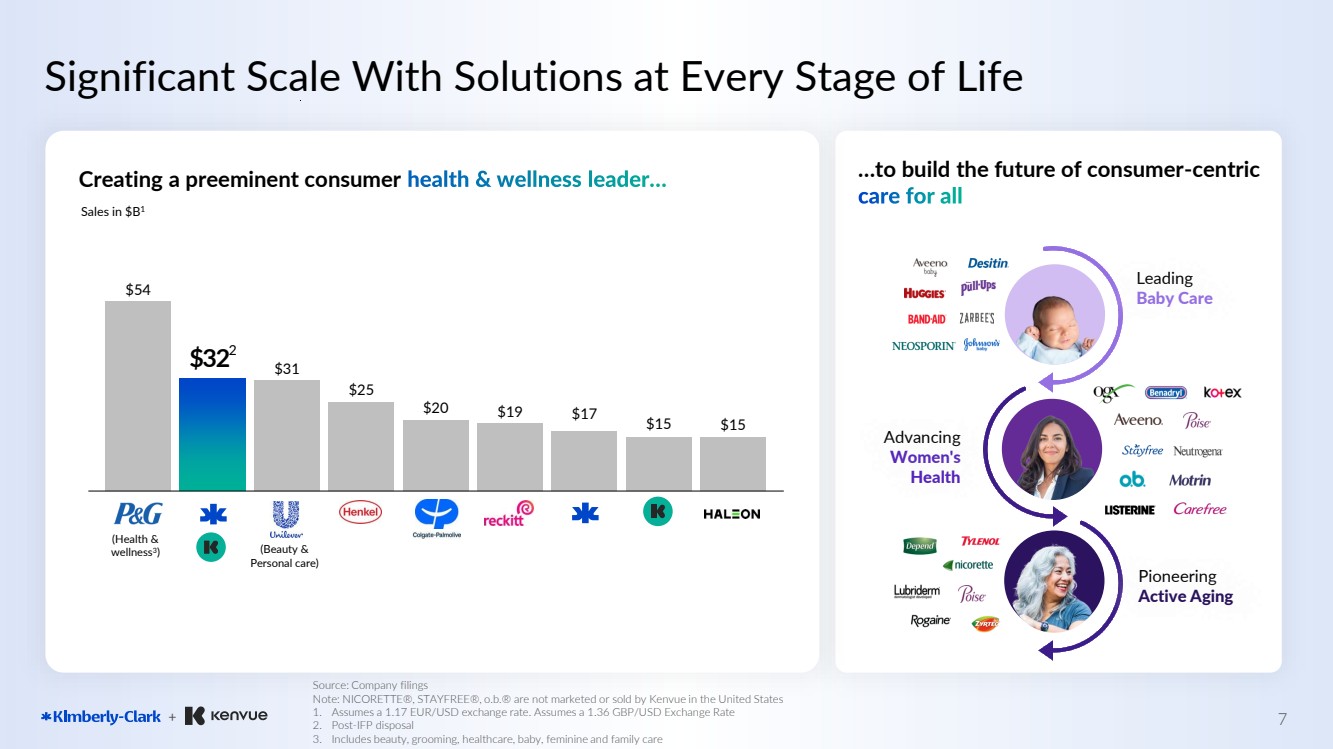

| + c $54 $322 $31 $25 $20 $19 $17 $15 $15 Creating a preeminent consumer health & wellness leader… (Beauty & Personal care) (Health & wellness3 ) …to build the future of consumer-centric care for all Significant Scale With Solutions at Every Stage of Life 7 Source: Company filings Note: NICORETTE®, STAYFREE®, o.b.® are not marketed or sold by Kenvue in the United States 1. Assumes a 1.17 EUR/USD exchange rate. Assumes a 1.36 GBP/USD Exchange Rate 2. Post-IFP disposal 3. Includes beauty, grooming, healthcare, baby, feminine and family care Sales in $B1 Advancing Women's Health Pioneering Active Aging Leading Baby Care |

| + c Delivering Value to Kenvue Shareholders 8 Immediate and compelling value through cash consideration Meaningful upside through ~46% ownership of global health and wellness leader Transaction follows rigorous Board review of all strategic alternatives |

| + c Kimberly-Clark is the Ideal Partner for Kenvue 9 Highly complementary portfolios of iconic brands and geographies Shared commitment to delivering advanced innovation with superior science Strong, established capabilities at Kimberly-Clark to strengthen category leadership and accelerate growth Purpose-driven cultures with expanded career opportunities + |

| + c Direct experience with the power and value of Kenvue’s brands Kimberly-Clark Board conducted a thorough review of this opportunity Successful Kimberly-Clark transformation and team provide platform to deliver on significant value creation potential Right Opportunity, Right Time + 10 “Together, these companies will serve billions of consumers and create a global leader positioned for the next 150 years.” Sherilyn McCoy Kimberly-Clark Lead Independent Director |

| + c Kimberly-Clark is a Global Leader in Personal Care and Hygiene Solutions 11 Source: Company filings Source for market sizes: Euromonitor 1. Post-IFP disposal 2. Key country x category combinations per Euromonitor 1 in 4 people globally served daily In >80% of key markets2 Leading Positions K-C core categories K-C invented 5 of 8 Share growth in key markets since 2019 +5 pts Category growth in Adult and Feminine care 5%+ $1B+ Global brands 6 $17B Net sales in 20241 c BABY AND CHILD CARE $70B FEMININE CARE $40B ADULT CARE $10B FAMILY CARE $100B 11 |

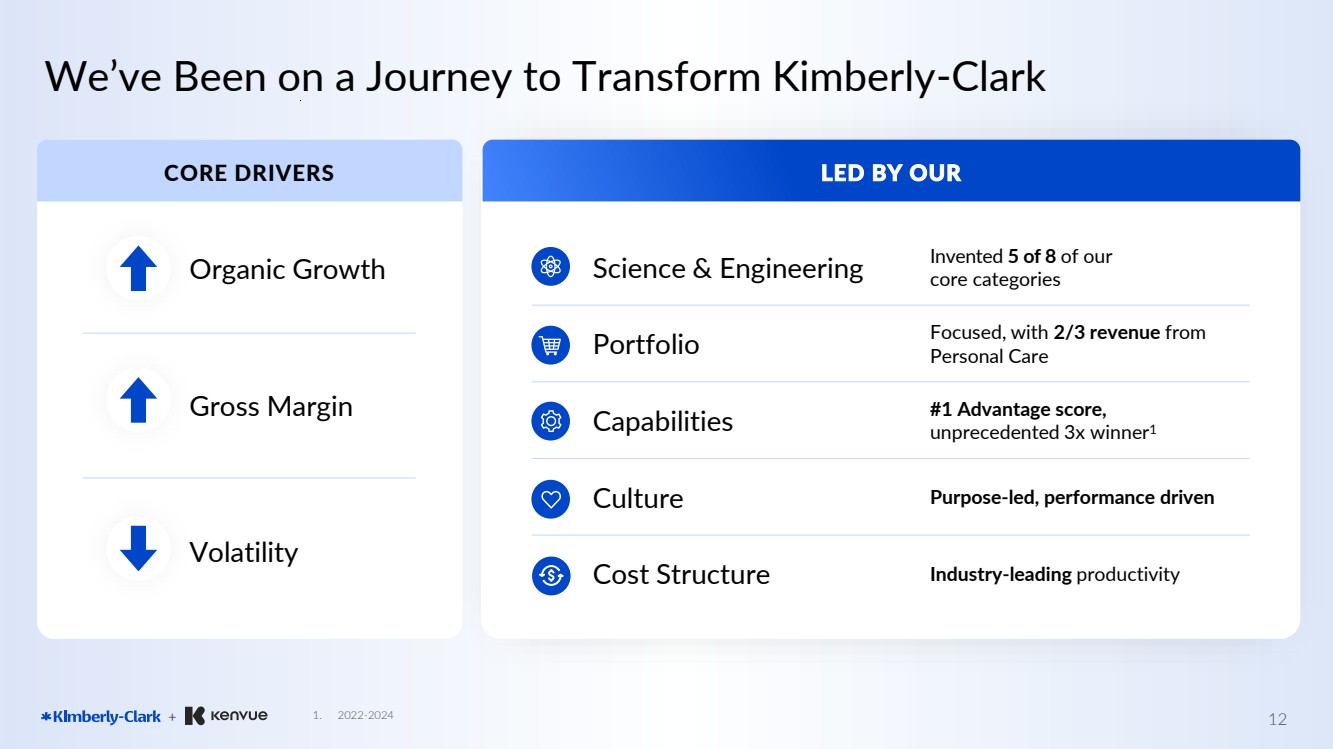

| + c Science & Engineering Invented 5 of 8 of our core categories Portfolio Focused, with 2/3 revenue from Personal Care Capabilities #1 Advantage score, unprecedented 3x winner1 Culture Purpose-led, performance driven Cost Structure Industry-leading productivity CORE DRIVERS We’ve Been on a Journey to Transform Kimberly-Clark 12 Organic Growth Gross Margin Volatility LED BY OUR 1. 2022-2024 |

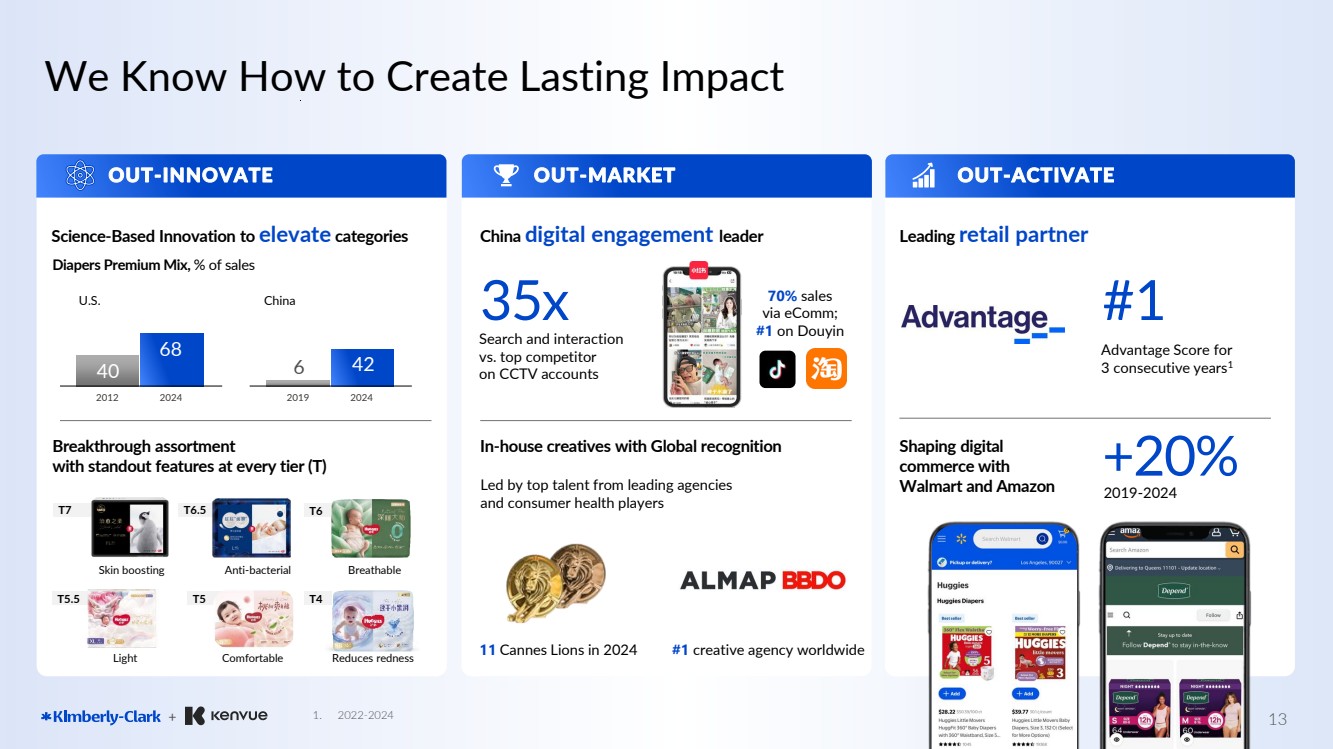

| + c c OUT-ACTIVATE C( c We Know How to Create Lasting Impact 13 Science-Based Innovation to elevate categories Breakthrough assortment with standout features at every tier (T) Diapers Premium Mix, % of sales 11 Cannes Lions in 2024 China digital engagement leader Leading retail partner U.S. China 2012 35x Search and interaction vs. top competitor on CCTV accounts T7 T6.5 T6 T5.5 T5 T4 Skin boosting Anti-bacterial Breathable Light Comfortable Reduces redness 70% sales via eComm; #1 on Douyin Led by top talent from leading agencies and consumer health players #1 creative agency worldwide Shaping digital commerce with Walmart and Amazon In-house creatives with Global recognition #1 Advantage Score for 3 consecutive years1 +20% 2019-2024 2024 2019 2024 40 68 6 42 OUT-INNOVATE OUT-MARKET 1. 2022-2024 |

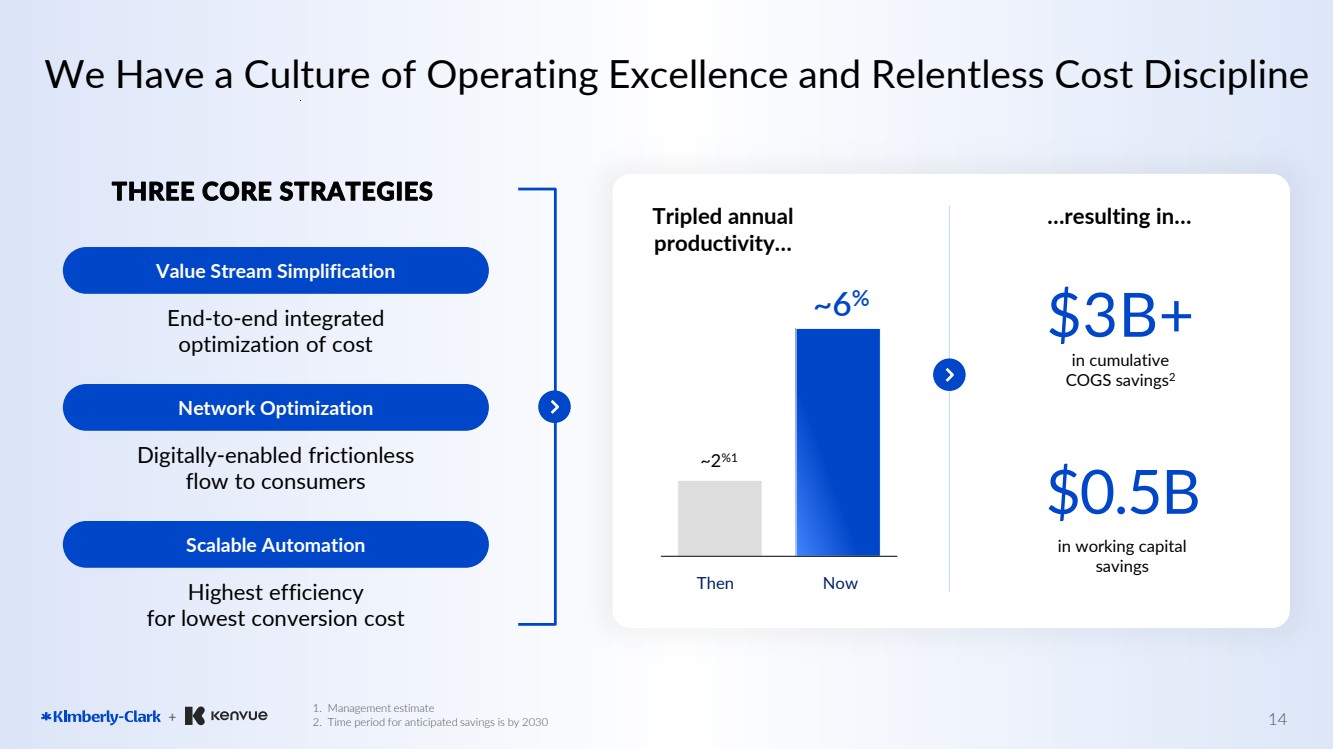

| + c 14 1. Management estimate 2. Time period for anticipated savings is by 2030 …resulting in… $3B+ in cumulative COGS savings2 $0.5B in working capital savings Tripled annual productivity… Then Now ~2%1 ~6% THREE CORE STRATEGIES End-to-end integrated optimization of cost Value Stream Simplification Digitally-enabled frictionless flow to consumers Network Optimization Highest efficiency for lowest conversion cost Scalable Automation We Have a Culture of Operating Excellence and Relentless Cost Discipline |

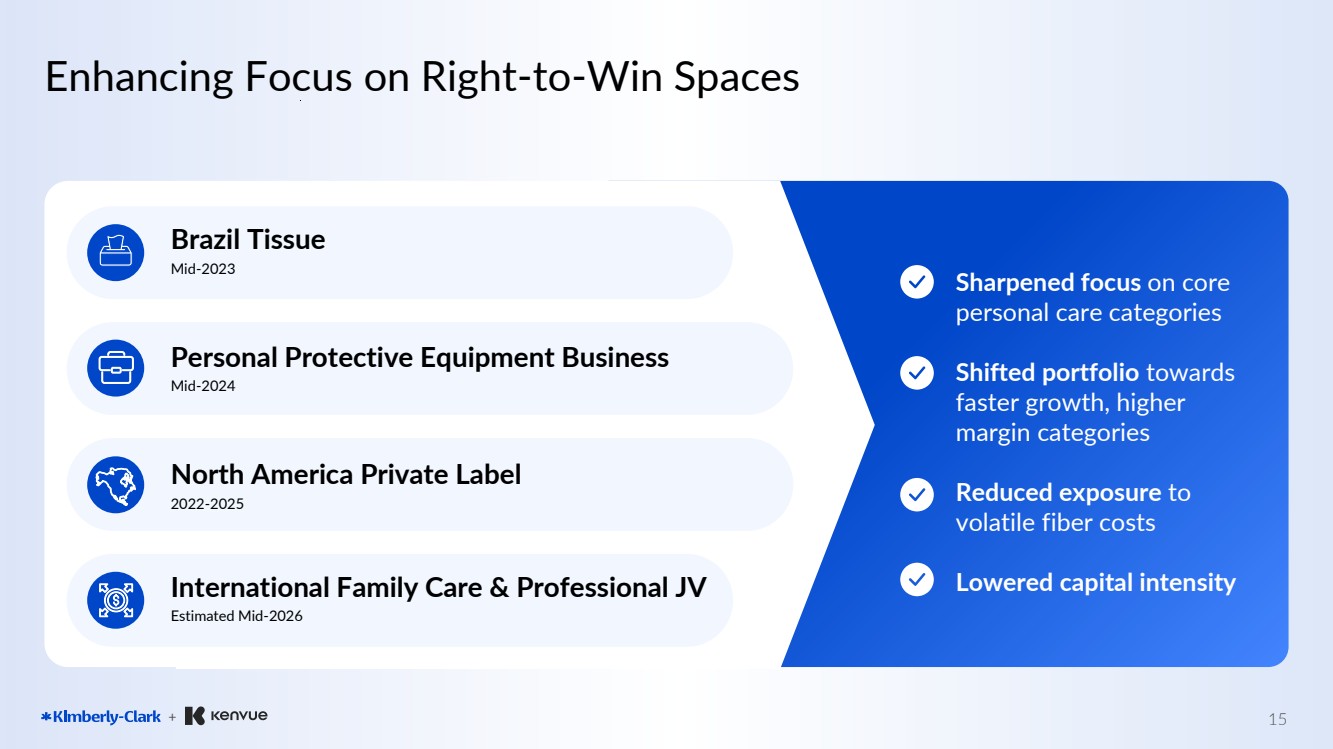

| + c Enhancing Focus on Right-to-Win Spaces 15 Brazil Tissue Mid-2023 Personal Protective Equipment Business Mid-2024 North America Private Label 2022-2025 International Family Care & Professional JV Estimated Mid-2026 Sharpened focus on core personal care categories Shifted portfolio towards faster growth, higher margin categories Reduced exposure to volatile fiber costs Lowered capital intensity |

| + c 16 A PREEMINENT CONSUMER HEALTH AND WELLNESS LEADER |

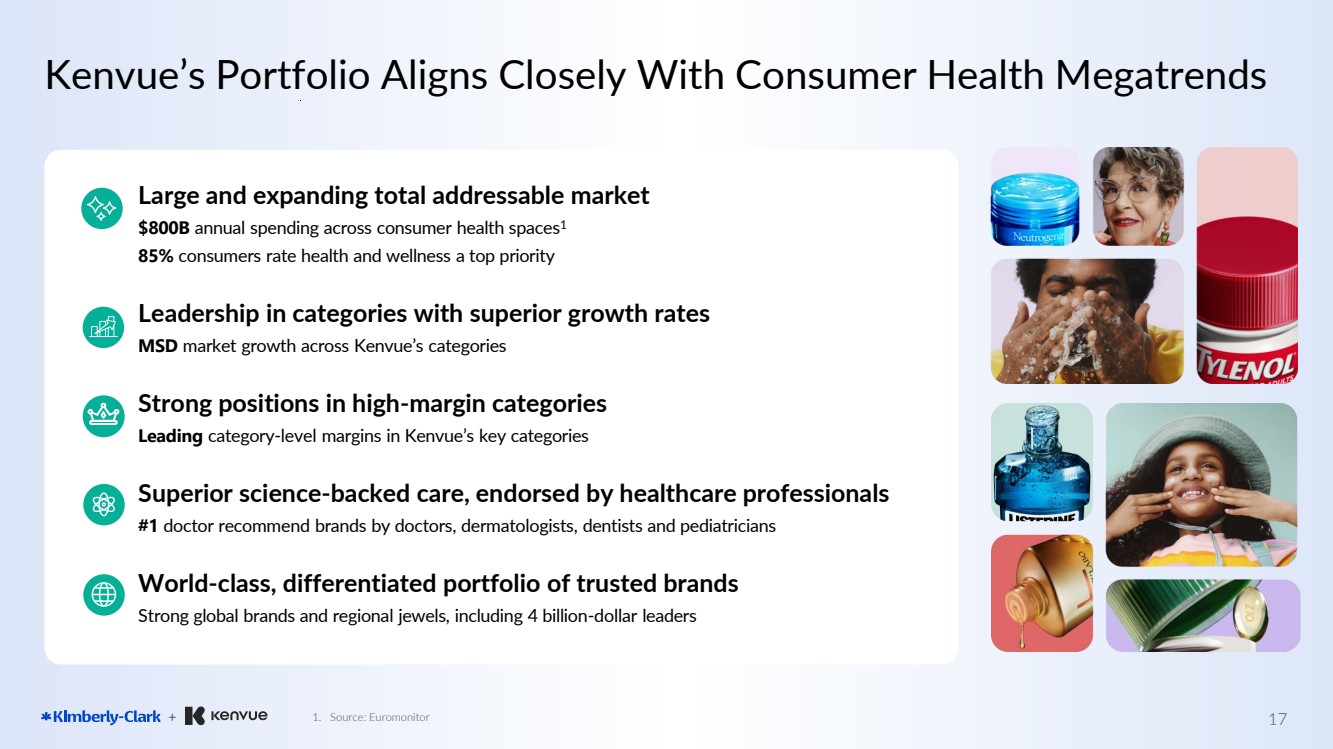

| + c c Kenvue’s Portfolio Aligns Closely With Consumer Health Megatrends 17 Large and expanding total addressable market $800B annual spending across consumer health spaces1 85% consumers rate health and wellness a top priority Leadership in categories with superior growth rates MSD market growth across Kenvue’s categories Strong positions in high-margin categories Leading category-level margins in Kenvue’s key categories Superior science-backed care, endorsed by healthcare professionals #1 doctor recommend brands by doctors, dermatologists, dentists and pediatricians World-class, differentiated portfolio of trusted brands Strong global brands and regional jewels, including 4 billion-dollar leaders 1. Source: Euromonitor |

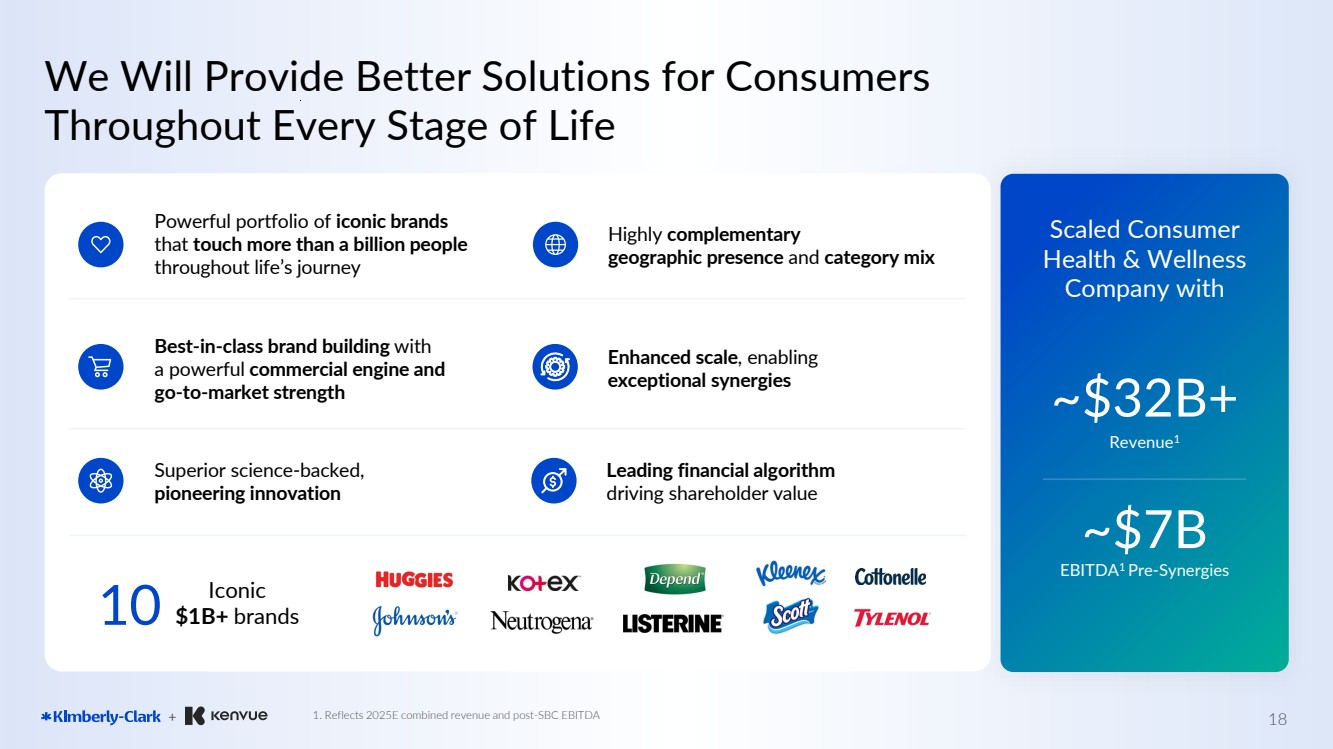

| + c We Will Provide Better Solutions for Consumers Throughout Every Stage of Life 18 1. Reflects 2025E combined revenue and post-SBC EBITDA Powerful portfolio of iconic brands that touch more than a billion people throughout life’s journey Best-in-class brand building with a powerful commercial engine and go-to-market strength Superior science-backed, pioneering innovation Highly complementary geographic presence and category mix Enhanced scale, enabling exceptional synergies Leading financial algorithm driving shareholder value 10 Iconic $1B+ brands Scaled Consumer Health & Wellness Company with ~$7B EBITDA1 Pre-Synergies ~$32B+ Revenue1 |

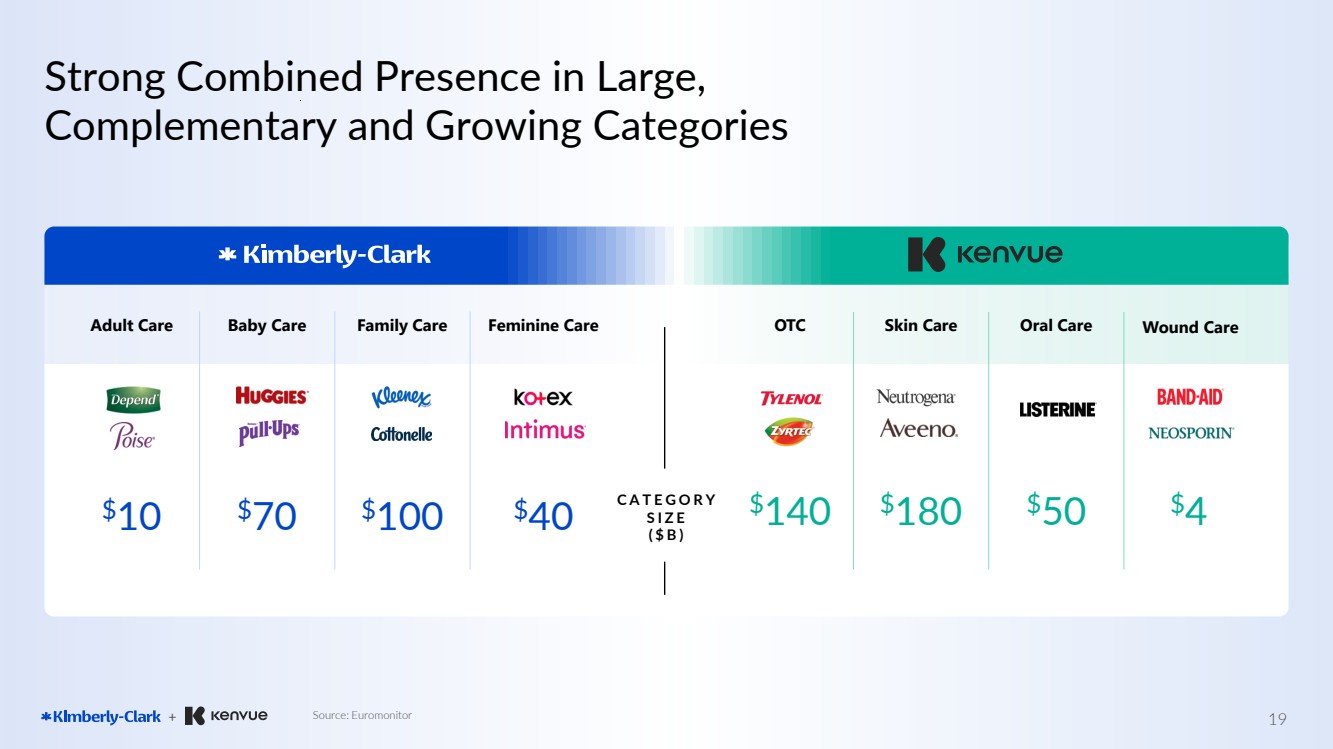

| + c Strong Combined Presence in Large, Complementary and Growing Categories 19 Source: Euromonitor Adult Care Baby Care Family Care Feminine Care $10 $70 $100 $40 OTC Skin Care Oral Care $140 $180 $50 $4 Wound Care C A T E G O R Y S I Z E ( $ B ) |

| + c $1.4 $1.7 $1.8 $3.2 $3.2 $4.5 Leading Commercial Execution Across Global Markets 20 Note: Reflects branded sales only; excludes private label, industrial/professional wipers, and other corporate sales c N.A. Wellness leader with $16B In combined Health & Wellness scale Adult care Oral care, hair care & other Skin health Baby care OTC Tissue & towel Long-horizon strategic partnership with customers Category-defining growth Industry-leading science and innovation Differentiated digital model Best-in-class marketing Consistent cost discipline FUELED BY OUR COMBINED CAPABILITIES China playbook and speed for the world Unique and Appealing Consumer Promise To drive trade-up Superior Innovation Delivered faster and cheaper than market Advantaged Digital Engagement For impact & efficiency at scale Winning Through Premiumization Fully integrated with business model |

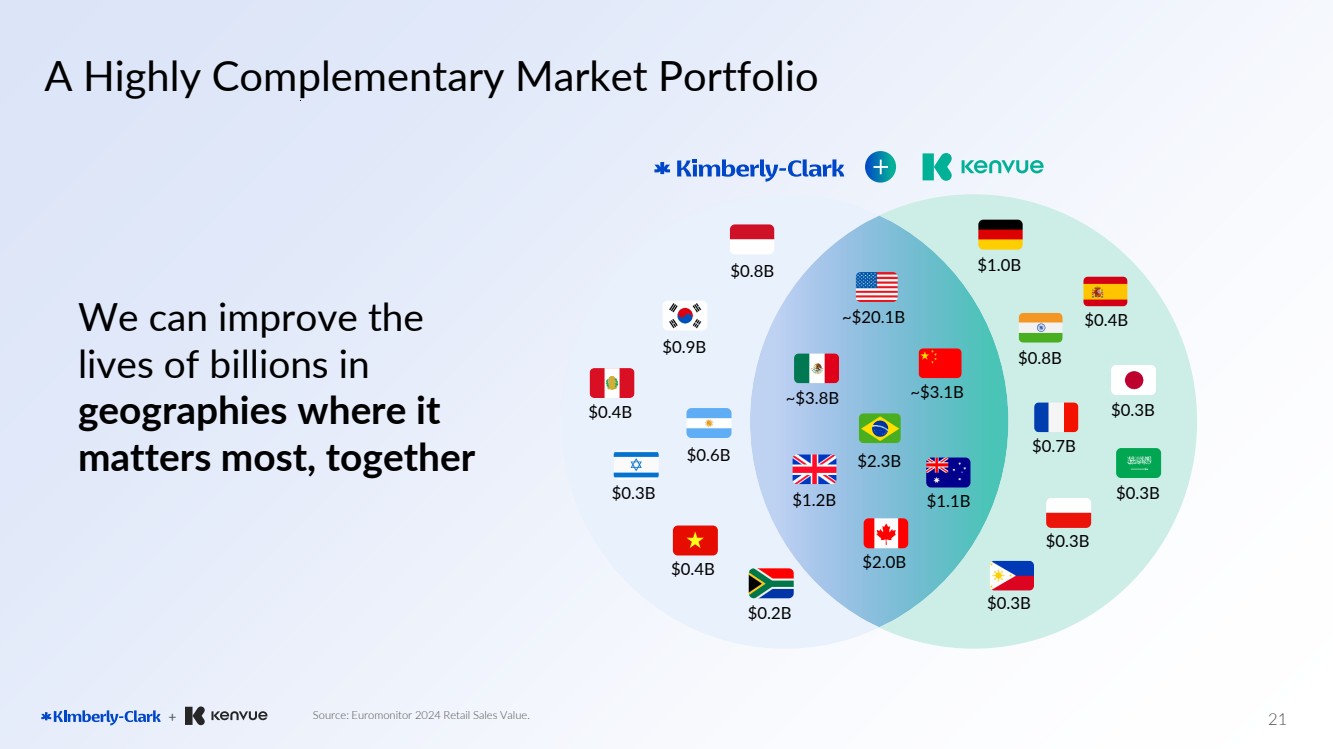

| + A Highly Complementary Market Portfolio 21 Source: Euromonitor 2024 Retail Sales Value. $0.8B $0.9B $0.4B $1.2B $1.1B $2.0B $0.6B $0.2B ~$20.1B $2.3B $0.4B $0.3B ~$3.1B ~$3.8B $1.0B $0.4B $0.7B $0.3B $0.3B $0.8B $0.3B $0.3B We can improve the lives of billions in geographies where it matters most, together |

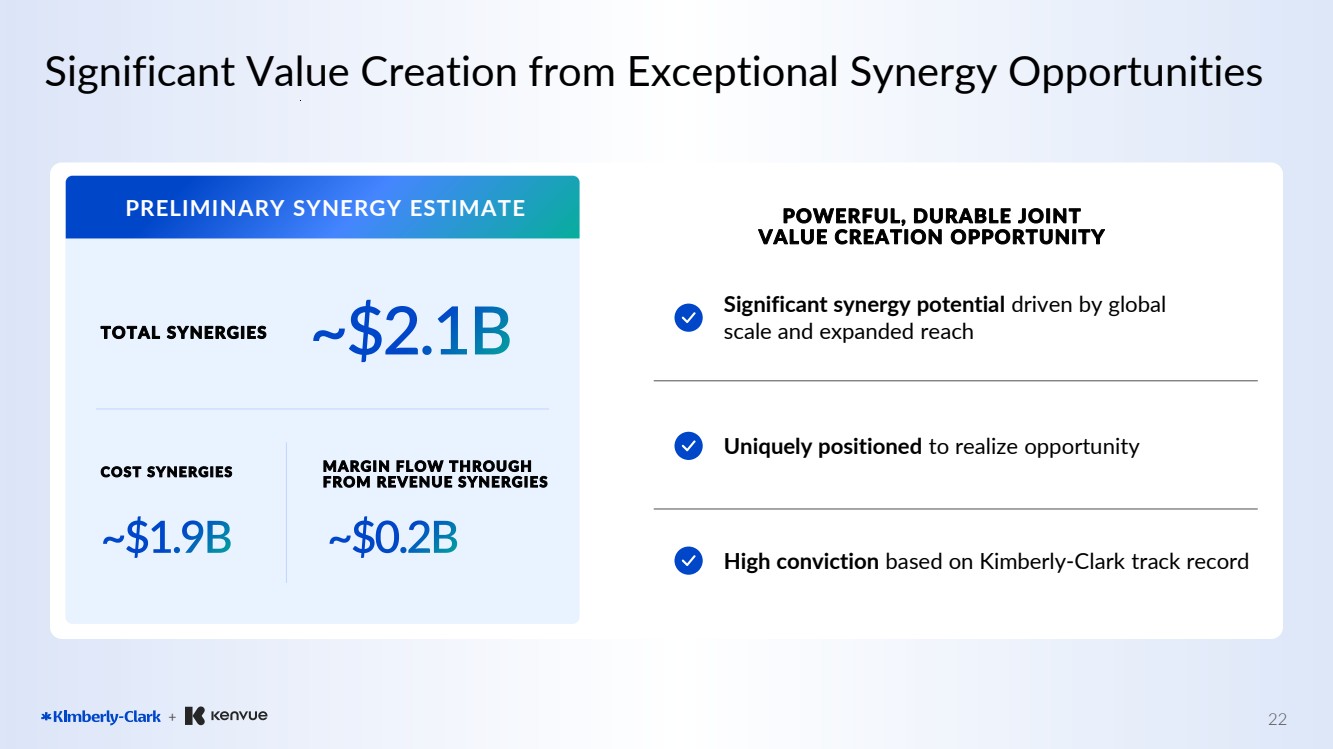

| + c c Significant Value Creation from Exceptional Synergy Opportunities 22 Significant synergy potential driven by global scale and expanded reach Uniquely positioned to realize opportunity High conviction based on Kimberly-Clark track record POWERFUL, DURABLE JOINT VALUE CREATION OPPORTUNITY TOTAL SYNERGIES ~$2.1B PRELIMINARY SYNERGY ESTIMATE COST SYNERGIES ~$1.9B MARGIN FLOW THROUGH FROM REVENUE SYNERGIES ~$0.2B |

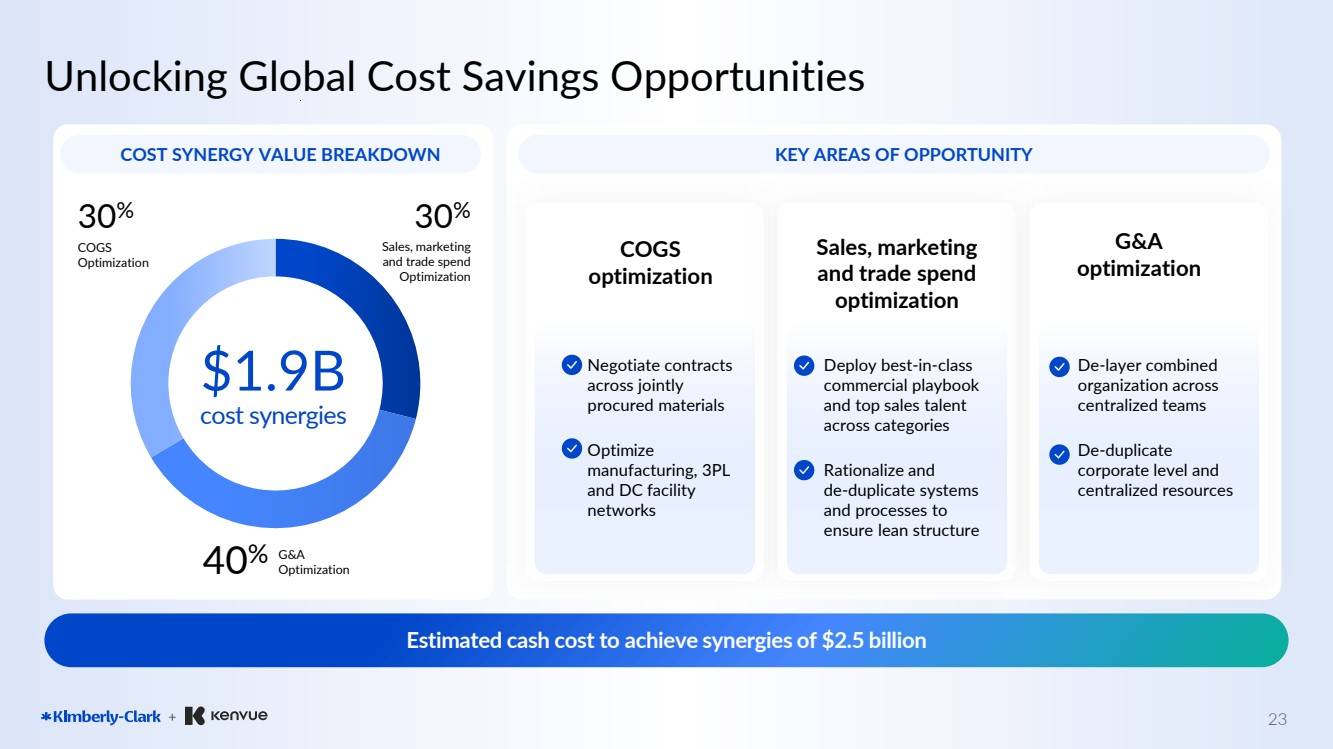

| + c Unlocking Global Cost Savings Opportunities 23 Estimated cash cost to achieve synergies of $2.5 billion COST SYNERGY VALUE BREAKDOWN KEY AREAS OF OPPORTUNITY Deploy best-in-class commercial playbook and top sales talent across categories Rationalize and de-duplicate systems and processes to ensure lean structure Sales, marketing and trade spend optimization De-layer combined organization across centralized teams De-duplicate corporate level and centralized resources Negotiate contracts across jointly procured materials Optimize manufacturing, 3PL and DC facility networks G&A optimization COGS optimization 30% COGS Optimization Sales, marketing and trade spend Optimization G&A Optimization 30% 40 % $1.9B cost synergies |

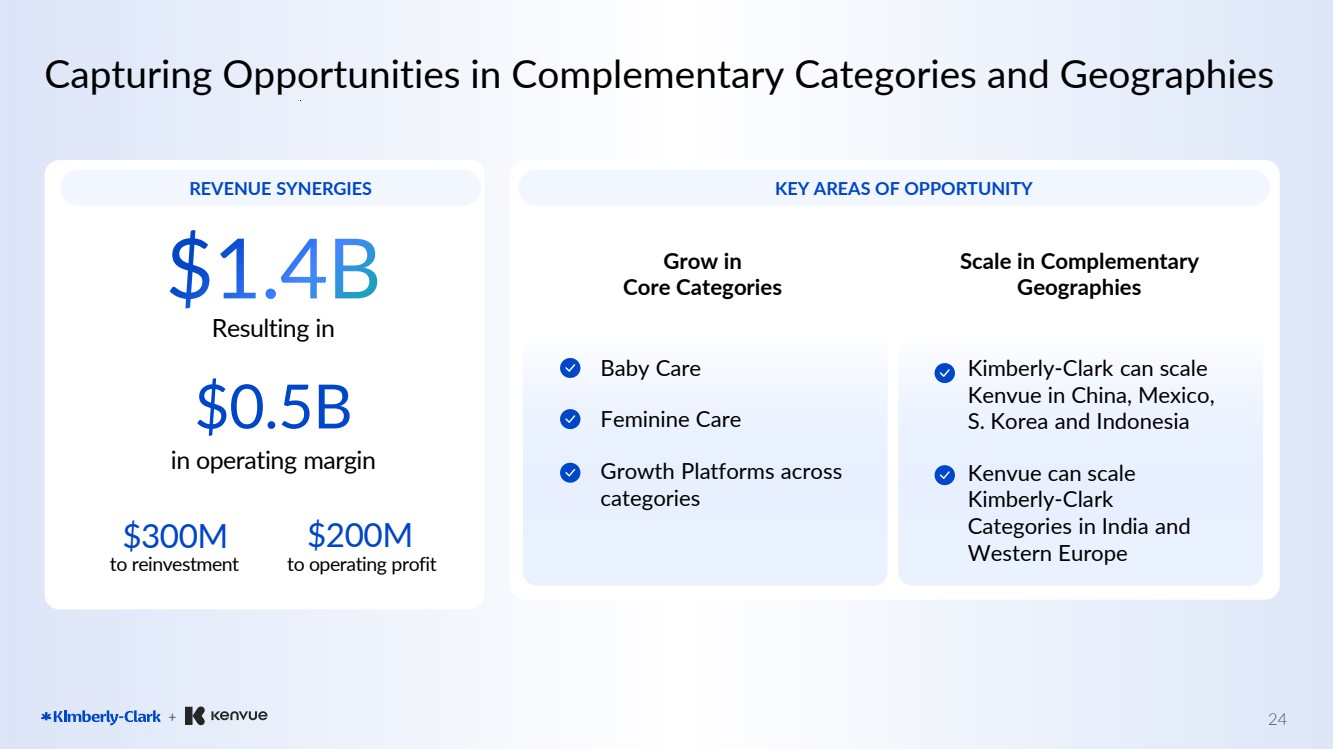

| + c Capturing Opportunities in Complementary Categories and Geographies 24 REVENUE SYNERGIES KEY AREAS OF OPPORTUNITY Baby Care Feminine Care Growth Platforms across categories Grow in Core Categories Kimberly-Clark can scale Kenvue in China, Mexico, S. Korea and Indonesia Kenvue can scale Kimberly-Clark Categories in India and Western Europe Scale in Complementary $1.4B Geographies Resulting in in operating margin $0.5B to reinvestment $300M to operating profit $200M |

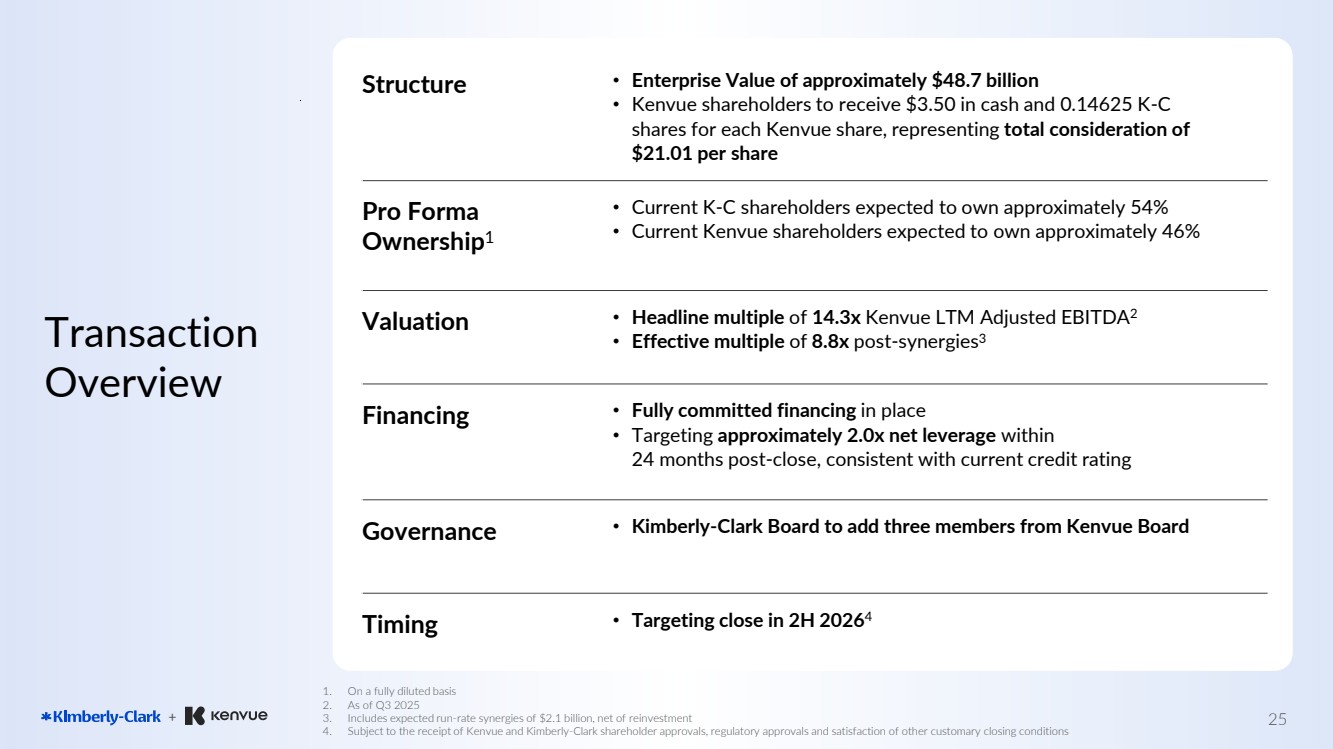

| + c Transaction Overview 25 1. On a fully diluted basis 2. As of Q3 2025 3. Includes expected run-rate synergies of $2.1 billion, net of reinvestment 4. Subject to the receipt of Kenvue and Kimberly-Clark shareholder approvals, regulatory approvals and satisfaction of other customary closing conditions Structure • Enterprise Value of approximately $48.7 billion • Kenvue shareholders to receive $3.50 in cash and 0.14625 K-C shares for each Kenvue share, representing total consideration of $21.01 per share Pro Forma Ownership1 • Current K-C shareholders expected to own approximately 54% • Current Kenvue shareholders expected to own approximately 46% Valuation • Headline multiple of 14.3x Kenvue LTM Adjusted EBITDA2 • Effective multiple of 8.8x post-synergies3 Financing • Fully committed financing in place • Targeting approximately 2.0x net leverage within 24 months post-close, consistent with current credit rating Governance • Kimberly-Clark Board to add three members from Kenvue Board Timing • Targeting close in 2H 20264 |

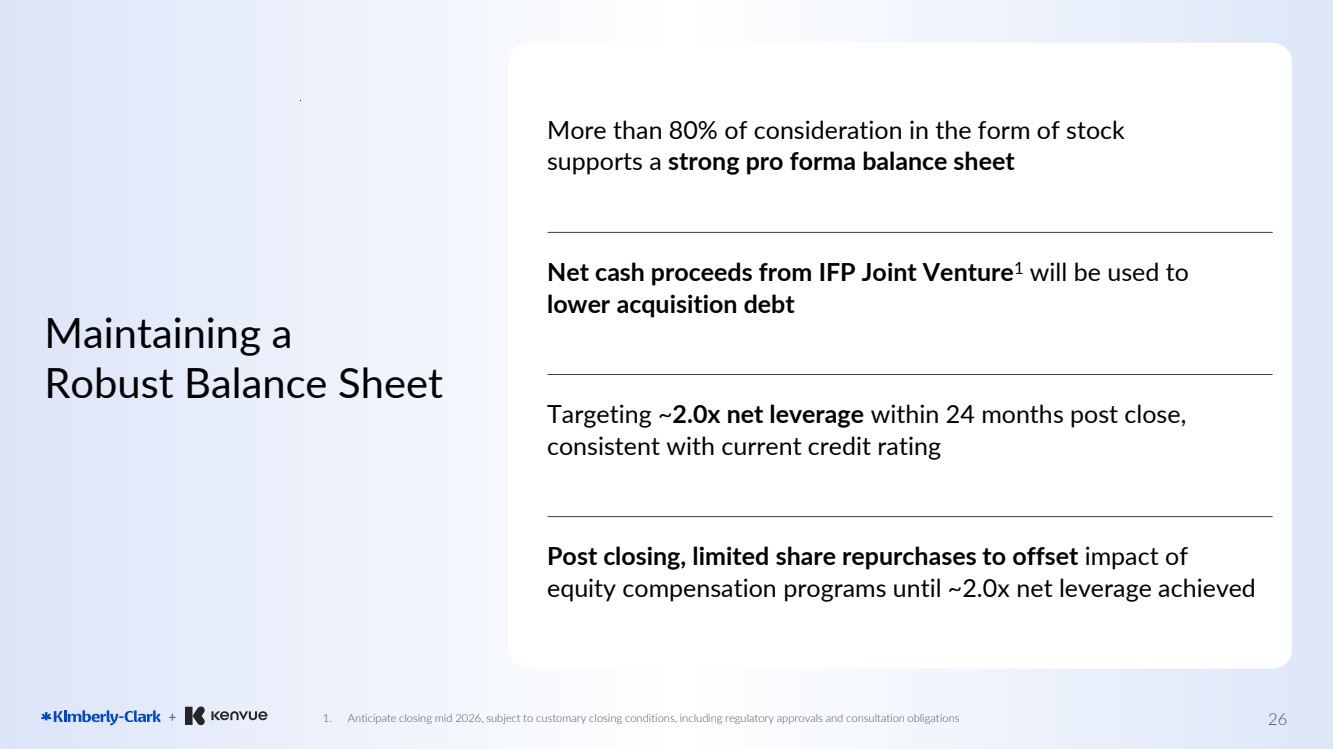

| + c 26 More than 80% of consideration in the form of stock supports a strong pro forma balance sheet Net cash proceeds from IFP Joint Venture1 will be used to lower acquisition debt Targeting ~2.0x net leverage within 24 months post close, consistent with current credit rating Post closing, limited share repurchases to offset impact of equity compensation programs until ~2.0x net leverage achieved Maintaining a Robust Balance Sheet 1. Anticipate closing mid 2026, subject to customary closing conditions, including regulatory approvals and consultation obligations |

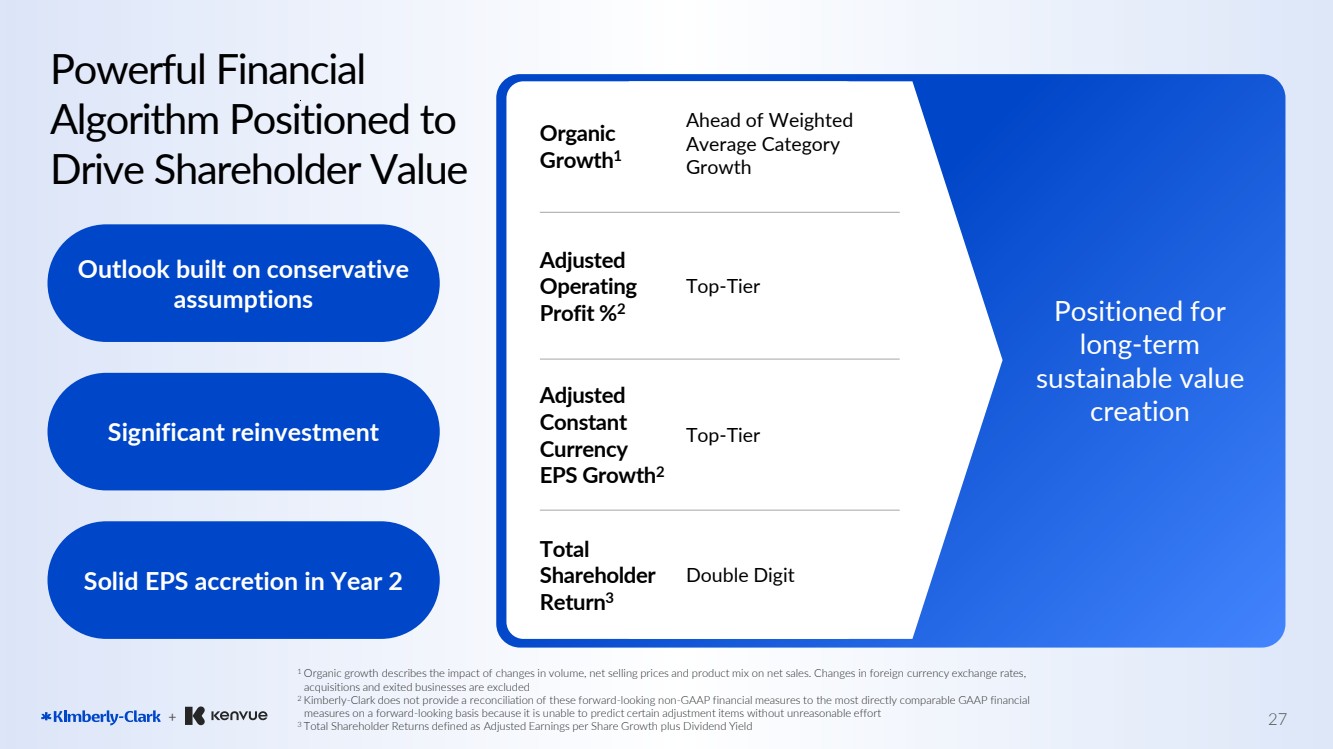

| + c 27 Positioned for long-term sustainable value creation Organic Growth1 Ahead of Weighted Average Category Growth Adjusted Operating Profit %2 Top-Tier Adjusted Constant Currency EPS Growth2 Top-Tier Total Shareholder Return3 Double Digit Powerful Financial Algorithm Positioned to Drive Shareholder Value Outlook built on conservative assumptions Significant reinvestment Solid EPS accretion in Year 2 1 Organic growth describes the impact of changes in volume, net selling prices and product mix on net sales. Changes in foreign currency exchange rates, acquisitions and exited businesses are excluded 2 Kimberly-Clark does not provide a reconciliation of these forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures on a forward-looking basis because it is unable to predict certain adjustment items without unreasonable effort 3 Total Shareholder Returns defined as Adjusted Earnings per Share Growth plus Dividend Yield |

| + c 28 Kimberly-Clark acquiring Kenvue, the largest pure-play consumer health company by revenue Powerful next step that builds on success of Kimberly-Clark’s Powering Care transformation Tremendous complementarity across categories, geographies and commercial capabilities led by a world-class team Exceptional portfolio of iconic brands engaging consumers across all stages of life Significant value creation with a strong balance sheet and financial flexibility Bringing Together Two Iconic American Companies to Create a Global Health & Wellness Leader 28 |