Shareholder Report

|

12 Months Ended |

|

Aug. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Prudential Investment Portfolios 4

|

| Entity Central Index Key |

0000807394

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Aug. 31, 2025

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| PGIM MUNI HIGH INCOME FUND - CLASS A [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Muni High Income Fund

|

| Class Name |

Class A

|

| Trading Symbol |

PRHAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class A shares of PGIM Muni High Income Fund (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Muni High Income Fund—Class A |

|

|

|

| Expenses Paid, Amount |

$ 80

|

| Expense Ratio, Percent |

0.81%

|

| Factors Affecting Performance [Text Block] |

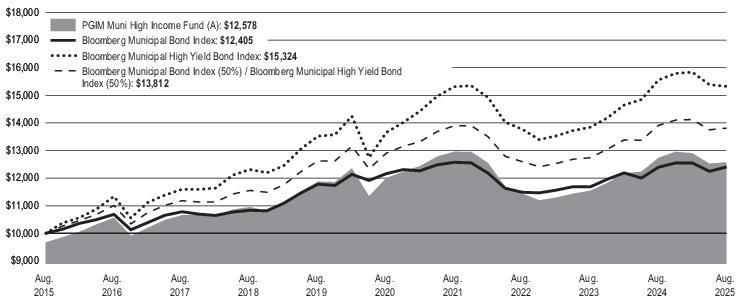

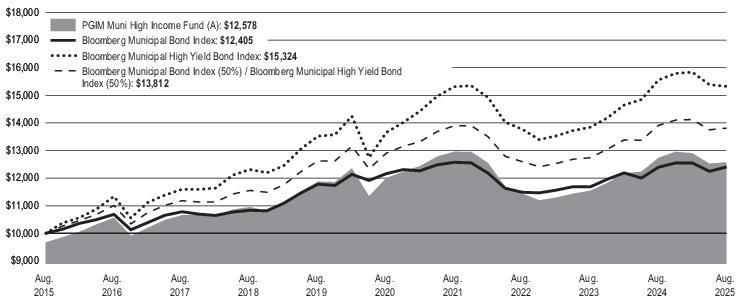

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ During the reporting period, the US Federal Reserve's easing cycle was paused amid increased uncertainty over the impact of US policies and actions (e.g., taxes and higher education). Issuance in the municipal bond market, as of August 2025, exceeded last year's record by approximately 15–20%, driven by issuers in the health care, university, and transportation sectors. Investor demand was skewed toward short-dated municipal bonds, resulting in a steeper municipal bond yield curve and relative values that exceeded their long-term averages. ■ The following contributed most to the Fund’s performance relative to the Bloomberg Municipal Bond Index (the “Index”) during the period: an overweight position in housing bonds (particularly Freddie Mac multifamily deals) and prepay gas bonds as spreads tightened; an underweight to a commuter train project in Florida, which underperformed as its spreads wid ened. ■ The following detracted most from the Fund’s performance relative to the Index during the reporting period: yield curve positioning (flattener); and security selection in charter schools that underperformed. ■ The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used futures to help manage duration positioning and yield curve exposure. The Fund’s positions in futures contributed modestly to performance during the reporting period. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

Class A with sales charges |

|

|

|

Class A without sales charges |

|

|

|

Bloomberg Municipal Bond Index |

|

|

|

Bloomberg Municipal High Yield Bond Index |

|

|

|

Bloomberg Municipal Bond Index (50%) / Bloomberg Municipal High |

|

|

|

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 861,233,995

|

| Holdings Count | Holding |

401

|

| Advisory Fees Paid, Amount |

$ 3,616,661

|

| Investment Company, Portfolio Turnover |

56.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

Credit Quality expressed as a percentage of total investments as of 8/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| PGIM MUNI HIGH INCOME FUND - CLASS C [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Muni High Income Fund

|

| Class Name |

Class C

|

| Trading Symbol |

PHICX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class C shares of PGIM Muni High Income Fund (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Muni High Income Fund—Class C |

|

|

|

| Expenses Paid, Amount |

$ 162

|

| Expense Ratio, Percent |

1.64%

|

| Factors Affecting Performance [Text Block] |

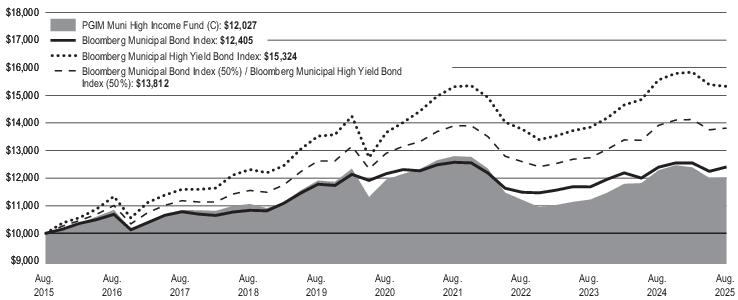

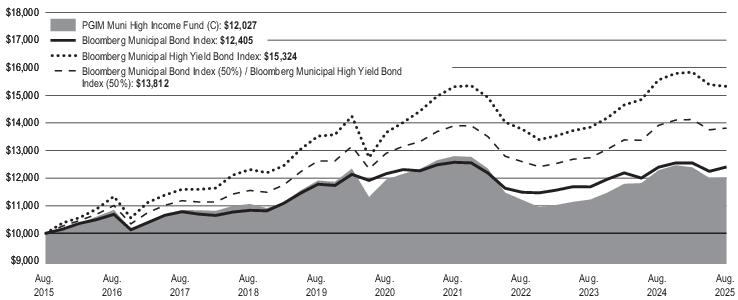

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIO D ? ■ During the reporting period, the US Federal Reserve's easing cycle was paused amid increased uncertainty over the impact of US policies and actions (e.g., taxes and higher education). Issuance in the municipal bond market, as of August 2025, exceeded last year's record by approximately 15–20%, driven by issuers in the health care, university, and transportation sectors. Investor demand was skewed toward short-dated municipal bonds, resulting in a steeper municipal bond yield curve and relative values that exceeded their long-term averages. ■ The following contributed most to the Fund’s performance relative to the Bloomberg Municipal Bond Index (the “Index”) during the period: an overweight position in housing bonds (particularly Freddie Mac multifamily deals) and prepay gas bonds as spreads tightened; an underweight to a commuter train project in Florida, which underperformed as its spreads widened. ■ The following detracted most from the Fund’s performance relative to the Index during the reporting period: yield curve positioning (flattener); and security selection in charter schools that underperformed. ■ The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used futures to help manage duration positioning and yield curve exposure. The Fund’s positions in futures contributed modestly to performance during the reporting period. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

Class C with sales charges |

|

|

|

Class C without sales charges |

|

|

|

Bloomberg Municipal Bond Index |

|

|

|

Bloomberg Municipal High Yield Bond Index |

|

|

|

Bloomberg Municipal Bond Index (50%) / Bloomberg Municipal High |

|

|

|

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 861,233,995

|

| Holdings Count | Holding |

401

|

| Advisory Fees Paid, Amount |

$ 3,616,661

|

| Investment Company, Portfolio Turnover |

56.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

Credit Quality expressed as a percentage of total investments as of 8/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| PGIM MUNI HIGH INCOME FUND - CLASS Z [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Muni High Income Fund

|

| Class Name |

Class Z

|

| Trading Symbol |

PHIZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class Z shares of PGIM Muni High Income Fund (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Muni High Income Fund—Class Z |

|

|

|

| Expenses Paid, Amount |

$ 58

|

| Expense Ratio, Percent |

0.58%

|

| Factors Affecting Performance [Text Block] |

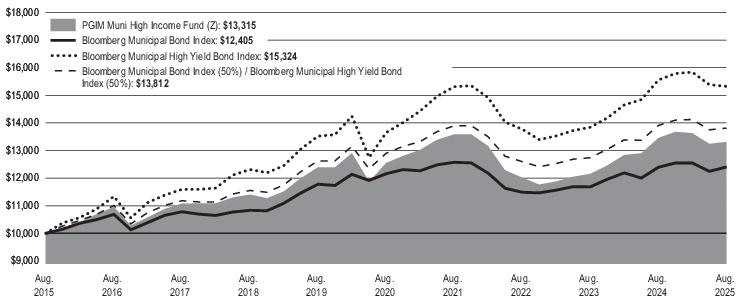

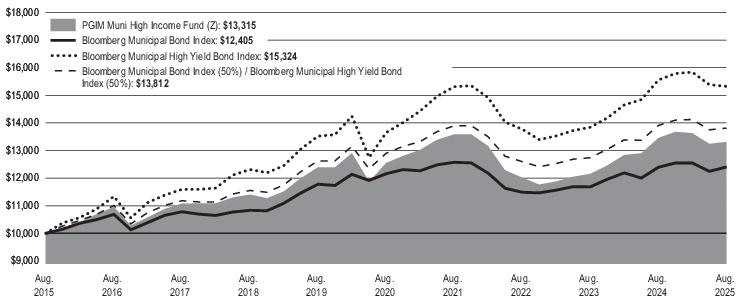

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ During the reporting period, the US Federal Reserve's easing cycle was paused amid increased uncertainty over the impact of US policies and actions (e.g., taxes and higher education). Issuance in the municipal bond market, as of August 2025, exceeded last year's record by approximately 15–20%, driven by issuers in the health care, university, and transportation sectors. Investor demand was skewed toward short-dated municipal bonds, resulting in a steeper municipal bond yield curve and relative values that exceeded their long-term averages. ■ The following contributed most to the Fund’s performance relative to the Bloomberg Municipal Bond Index (the “Index”) during the period: an overweight position in housing bonds (particularly Freddie Mac multifamily deals) and prepay gas bonds as spreads tightened; an underweight to a commuter train project in Florida, which underperformed as its spreads widened. ■ The following detracted most from the Fund’s performance relative to the Index during the reporting period: yield curve positioning (flattener); and security selection in charter schools that underperformed. ■ The Fund uses derivatives when they facilitate implementation of the overall investment approach. During the reporting period, the Fund used futures to help manage duration positioning and yield curve exposure. The Fund’s positio ns in f utures contributed modestly to performance during the reporting period. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

|

|

|

|

Bloomberg Municipal Bond Index |

|

|

|

Bloomberg Municipal High Yield Bond Index |

|

|

|

Bloomberg Municipal Bond Index (50%) / Bloomberg Municipal High |

|

|

|

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 861,233,995

|

| Holdings Count | Holding |

401

|

| Advisory Fees Paid, Amount |

$ 3,616,661

|

| Investment Company, Portfolio Turnover |

56.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

Credit Quality expressed as a percentage of total investments as of 8/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|

| PGIM MUNI HIGH INCOME FUND - CLASS R6 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PGIM Muni High Income Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

PHIQX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Class R6 shares of PGIM Muni High Income Fund (the “Fund”) for the period of September 1, 2024 to August 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at pgim.com/investments/mutual-funds/prospectuses-fact-sheets . You can also request this information by contacting us at (800) 225-1852 or (973) 367-3529 from outside the US.

|

| Additional Information Phone Number |

(800) 225-1852 or (973) 367-3529

|

| Additional Information Website |

pgim.com/investments/mutual-funds/prospectuses-fact-sheets

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

|

|

Costs paid as a percentage |

PGIM Muni High Income Fund—Class R6 |

|

|

|

| Expenses Paid, Amount |

$ 49

|

| Expense Ratio, Percent |

0.49%

|

| Factors Affecting Performance [Text Block] |

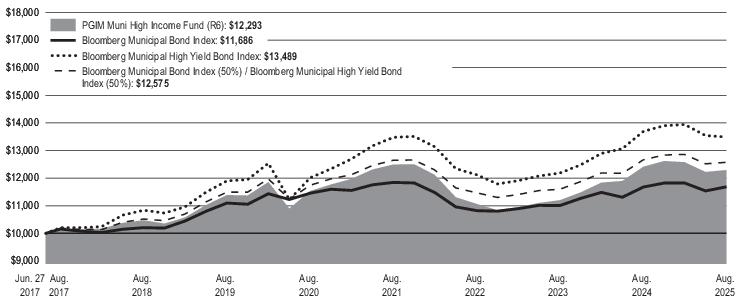

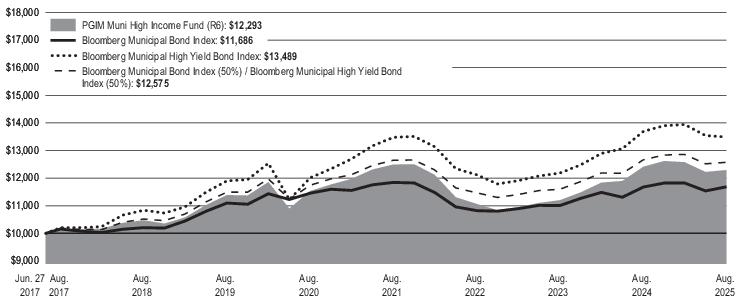

WHAT AFFECTED THE FUND’S PERFORMANCE DURING THE REPORTING PERIOD? ■ During the reporting period, the US Federal Reserve's easing cycle was paused amid increased uncertainty over the impact of US policies and actions (e.g., taxes and higher education). Issuance in the municipal bond market, as of August 2025, exceeded last year's record by approximately 15–20%, driven by issuers in the health care, university, and transportation sectors. Investor demand was skewed toward short-dated municipal bonds, resulting in a steeper municipal bond yield curve and relative values that exceeded their long-term averages. ■ The following contributed most to the Fund’s performance relative to the Bloomberg Municipal Bond Index (the “Index”) during the period: an overweight position in housing bonds (particularly Freddie Mac multifamily deals) and prepay gas bonds as spreads tightened; an underweight to a commuter train project in Florida, which underperformed as its spreads widened. ■ The following detracted most from the Fund’s performance relative to the Index during the reporting period: yield curve positioning (flattener); and security selection in charter schools that underperformed. ■ The Fund uses derivatives when they facilitate implementation of the overall investment approach. Durin g the repo rting period, the Fund used futures to help manage duration positioning and yield curve exposure. The Fund’s positions in futures contributed modestly to performance during the reporting period. |

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns as of 8/31/2025 |

|

|

|

|

|

|

|

|

Bloomberg Municipal Bond Index |

|

|

|

Bloomberg Municipal High Yield Bond Index |

|

|

|

Bloomberg Municipal Bond Index (50%) / Bloomberg Municipal High Yield Bond Index (50%) |

|

|

|

|

| Performance Inception Date |

Jun. 27, 2017

|

| No Deduction of Taxes [Text Block] |

The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Updated Performance Information Location [Text Block] |

Visit pgim.com/investments/mutual-funds/prospectuses-fact-sheets or call (800) 225-1852 or (973) 367-3529 from outside the US for more recent performance data.

|

| Net Assets |

$ 861,233,995

|

| Holdings Count | Holding |

401

|

| Advisory Fees Paid, Amount |

$ 3,616,661

|

| Investment Company, Portfolio Turnover |

56.00%

|

| Additional Fund Statistics [Text Block] |

WHAT ARE SOME KEY FUND STATISTICS AS OF 8/31/2025?

|

|

|

|

Total advisory fees paid for the year |

|

Portfolio turnover rate for the year |

|

|

| Holdings [Text Block] |

WHAT ARE SOME CHARACTERISTICS OF THE FUND’S HOLDINGS AS OF 8/31/2025?

Credit Quality expressed as a percentage of total investments as of 8/31/2025 (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Credit Quality Explanation [Text Block] |

Credit ratings reflect the highest rating assigned by a nationally recognized statistical rating organization (NRSRO) such as Moody’s Investors Service, Inc. (Moody’s), S&P Global Ratings (S&P), or Fitch Ratings, Inc. (Fitch). Credit ratings reflect the common nomenclature used by both S&P and Fitch. Where applicable, ratings are converted to the comparable S&P/Fitch rating tier nomenclature. The Not Rated category consists of securities that have not been rated by an NRSRO. Credit ratings are subject to change. Values may not sum to 100.0% due to rounding.

|