Exhibit 99.2

$9.7bn AI Cloud Contract with Microsoft NASDAQ: IREN November 3, 2025

DISCLAIMER Forward-Looking Statements This investor update includes

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), that involve substantial risks

and uncertainties. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plan and strategies and trends we expect to affect our business. These

statements often include words such as “anticipate,” “expect,” “suggest,” “plan,” “believe,” “intend,” “estimate,” “target,” “project,” “should,” “potential,” “could,” “would,” “may,” “will,” “forecast,” and other similar expressions

Forward-looking statements may also be made, verbally or in writing, by members of our Board or management team. Such statements are subject to the same limitations, uncertainties, assumptions and disclaimers set out in this investor

update. We base these forward-looking statements or projections on our current expectations, plans and assumptions that we have made in light of our experience in the industry, as well as our perceptions of historical trends, current

conditions, expected future developments and other factors we believe are appropriate under the circumstances and at such time. The forward-looking statements are subject to and involve risks, uncertainties and assumptions and you should

not place undue reliance on these forward-looking statements. Although we believe that these forward-looking statements are based on reasonable assumptions at the time they are made, you should be aware that many factors could affect our

actual financial results or results of operations, and could cause actual results to differ materially from those expressed in the forward-looking statements. Factors that may materially affect such forward-looking statements include, but

are not limited to: Bitcoin price and foreign currency exchange rate fluctuations; our ability to obtain additional capital on commercially reasonable terms and in a timely manner to meet our capital needs and facilitate our expansion

plans; the terms of any future financing or any refinancing, restructuring or modification to the terms of any future financing, which could require us to comply with onerous covenants or restrictions, and our ability to service our debt

obligations, any of which could restrict our business operations and adversely impact our financial condition, cash flows and results of operations; our ability to successfully execute on our growth strategies and operating plans, including

our ability to continue to develop our existing data center sites, design and deploy direct-to-chip liquid cooling systems, and diversify and expand into the market for high-performance computing (“HPC”) solutions (including the market for

AI Cloud Services and potential colocation services such as powered shell, build-to-suit and turnkey data centers (collectively “HPC and AI services”)); our limited experience with respect to new markets we have entered or may seek to

enter, including the market for HPC and AI services); our ability to remain competitive in dynamic and rapidly evolving industries; expectations with respect to the ongoing profitability, viability, operability, security, popularity and

public perceptions of the Bitcoin network; expectations with respect to the useful life and obsolescence of hardware (including hardware for Bitcoin mining and any current or future HPC and AI services we offer); delays, increases in costs

or reductions in the supply of equipment used in our operations including as a result of tariffs and duties, and certain equipment being in high demand due to global supply chain constraints; expectations with respect to the profitability,

viability, operability, security, popularity and public perceptions of any current and future HPC and AI services we offer; our ability to secure and retain customers on commercially reasonable terms or at all, particularly as it relates to

our strategy to expand into markets for HPC and AI services; our ability to establish and maintain a customer base for our HPC and AI services business and customer concentration; our ability to manage counterparty risk (including credit

risk) associated with any current or future customers, including customers of our HPC and AI services and other counterparties; the risk that any current or future customers, including customers of our HPC and AI services or other

counterparties, may terminate, default on or underperform their contractual obligations; changing political and geopolitical conditions, including changing international trade policies and the implementation of wide-ranging, reciprocal and

retaliatory tariffs, surtaxes and other similar import or export duties, or trade restrictions; Bitcoin global hashrate fluctuations; our ability to secure renewable energy, renewable energy certificates, power capacity, facilities and

sites on commercially reasonable terms or at all; delays associated with, or failure to obtain or complete, permitting approvals, grid connections and other development activities customary for greenfield or brownfield infrastructure

projects; our reliance on power and utilities providers, third party mining pools, exchanges, banks, insurance providers and our ability to maintain relationships with such parties; expectations regarding availability and pricing of

electricity; our participation and ability to successfully participate in demand response products and services and other load management programs run, operated or offered by electricity network operators, regulators or electricity market

operators; the availability, reliability and/or cost of electricity supply, hardware and electrical and data center infrastructure, including with respect to any electricity outages and any laws and regulations that may restrict the

electricity supply available to us; any variance between the actual operating performance of our miner hardware achieved compared to the nameplate performance including hashrate; electricity market risks relating to changes in regulations

and requirements of market operators and regulatory bodies, including with respect to grid stability, interconnection and curtailment obligations; our ability to curtail our electricity consumption and/or monetize electricity depending on

market conditions, including changes in Bitcoin mining economics and prevailing electricity prices; actions undertaken by electricity network and market operators, regulators, governments or communities in the regions in which we operate;

the availability, suitability, reliability and cost of internet connections at our facilities; our ability to secure additional hardware, including hardware for Bitcoin mining and any current or future HPC and AI services we offer, on

commercially reasonable terms or at all, and any delays or reductions in the supply of such hardware or increases in the cost of procuring such hardware; our ability to operate in an evolving regulatory environment; our ability to

successfully operate and maintain our property and infrastructure; reliability and performance of our infrastructure compared to expectations; malicious attacks on our property, infrastructure or IT systems; our ability to maintain in good

standing the operating and other permits and licenses required for our operations and business; our ability to obtain, maintain, protect and enforce our intellectual property rights and confidential information; any intellectual property

infringement and product liability claims; whether the secular trends we expect to drive growth in our business materialize to the degree we expect them to, or at all; any pending or future acquisitions, dispositions, joint ventures or

other strategic transactions; the occurrence of any environmental, health and safety incidents at our sites, and any material costs relating to environmental, health and safety requirements or liabilities; damage to our property and

infrastructure and the risk that any insurance we maintain may not fully cover all potential exposures; ongoing proceedings relating to the default under certain equipment financing facilities, ongoing securities litigation, and any future

litigation, claims and/or regulatory investigations, and the costs, expenses, use of resources, diversion of management time and efforts, liability and damages that may result therefrom; our failure to comply with any laws including the

anti-corruption laws of the United States and various international jurisdictions; any failure of our compliance and risk management methods; any laws, regulations and ethical standards that may relate to our business, including those that

relate to Bitcoin and the Bitcoin mining industry and those that relate to any other services we offer, including laws and regulations related to data privacy, cybersecurity and the storage, use or processing of information and consumer

laws; our ability to attract, motivate and retain senior management and qualified employees; increased risks to our global operations including, but not limited to, political instability, acts of terrorism, theft and vandalism, cyberattacks

and other cybersecurity incidents and unexpected regulatory and economic sanctions changes, among other things; climate change, severe weather conditions and natural and man-made disasters that may materially adversely affect our business,

financial condition and results of operations; public health crises, including an outbreak of an infectious disease and any governmental or industry measures taken in response; damage to our brand and reputation; evolving stakeholder

expectations and requirements relating to environmental, social or governance issues or reporting, including actual or perceived failure to comply with such expectations and requirements; the market price of our Ordinary share may be highly

volatile; that we do not currently pay any cash dividends on our Ordinary shares, and may not in the foreseeable future and, accordingly, your ability to achieve a return on your investment in our Ordinary shares will depend on

appreciation, if any, in the price of our Ordinary shares; and other important factors discussed under the caption “Risk Factors” in IREN’s annual report on Form 10-K filed with the SEC on August 28, 2024 as such factors may be updated from

time to time in its other filings with the SEC, accessible on the SEC's website at www.sec.gov and the Investor Relations section of IREN's website at https:// investors.iren.com. These and other important factors could cause actual

results to differ materially by the forward-looking statements made in this investor update. Any forward-looking statement that IREN makes in this investor update speaks only as of the date of such statement. Except as required by law, IREN

disclaims any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements, whether as a result of new information, future events or otherwise. Special Note Regarding non-GAAP

Measures This investor update refers to certain measures that are not recognized under GAAP and do not have a standardized meaning prescribed by GAAP. IREN uses non-GAAP measures including "Estimated Project EBITDA margin" (as defined

below) as additional information to complement GAAP measures by providing further understanding of the Company’s operations from management’s perspective. "Estimated Project EBITDA margin" represents expected earnings before interest,

taxes, depreciation, and amortization at the project level, divided by estimated project revenue. It reflects estimated operating profitability after power, repairs and maintenance, and other direct operating costs, but before corporate

overhead, financing costs, and non-cash items. No reconciliation of the Estimated Project EBITDA Margin is included in this presentation because Estimated Project EBITDA Margin is forward looking, we are unable to quantify certain amounts

that would be required to be included in the comparable GAAP financial measure without unreasonable efforts, and we believe such reconciliation would imply a degree of precision that could be confusing or misleading to investors. 2

AI CLOUD CONTRACT SIGNED WITH MICROSOFT 3 20% Prepayment 5YR

Term 200MW Data Centers (IT Load) $9.7bn Contract Value

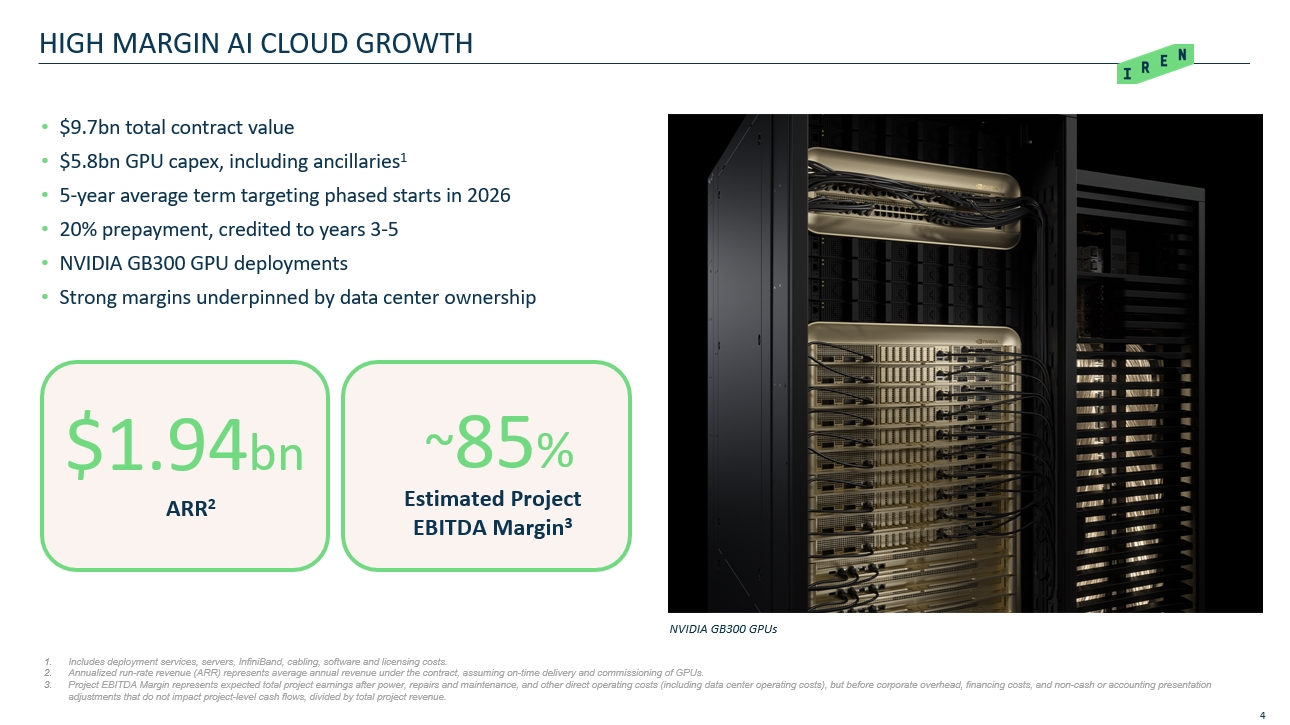

HIGH MARGIN AI CLOUD GROWTH 4 Includes deployment services, servers,

InfiniBand, cabling, software and licensing costs. Annualized run-rate revenue (ARR) represents average annual revenue under the contract, assuming on-time delivery and commissioning of GPUs. Project EBITDA Margin represents expected

total project earnings after power, repairs and maintenance, and other direct operating costs (including data center operating costs), but before corporate overhead, financing costs, and non-cash or accounting presentation adjustments that

do not impact project-level cash flows, divided by total project revenue. 85% Estimated Project EBITDA Margin3 $1.94bn $9.7bn total contract value $5.8bn estimated GPU capex, including ancillaries1 5-year average term targeting

phased starts in 2026 20% prepayment, credited to years 3-5 NVIDIA GB300 GPU deployments Strong margins underpinned by data center ownership NVIDIA GB300 GPUs ARR2

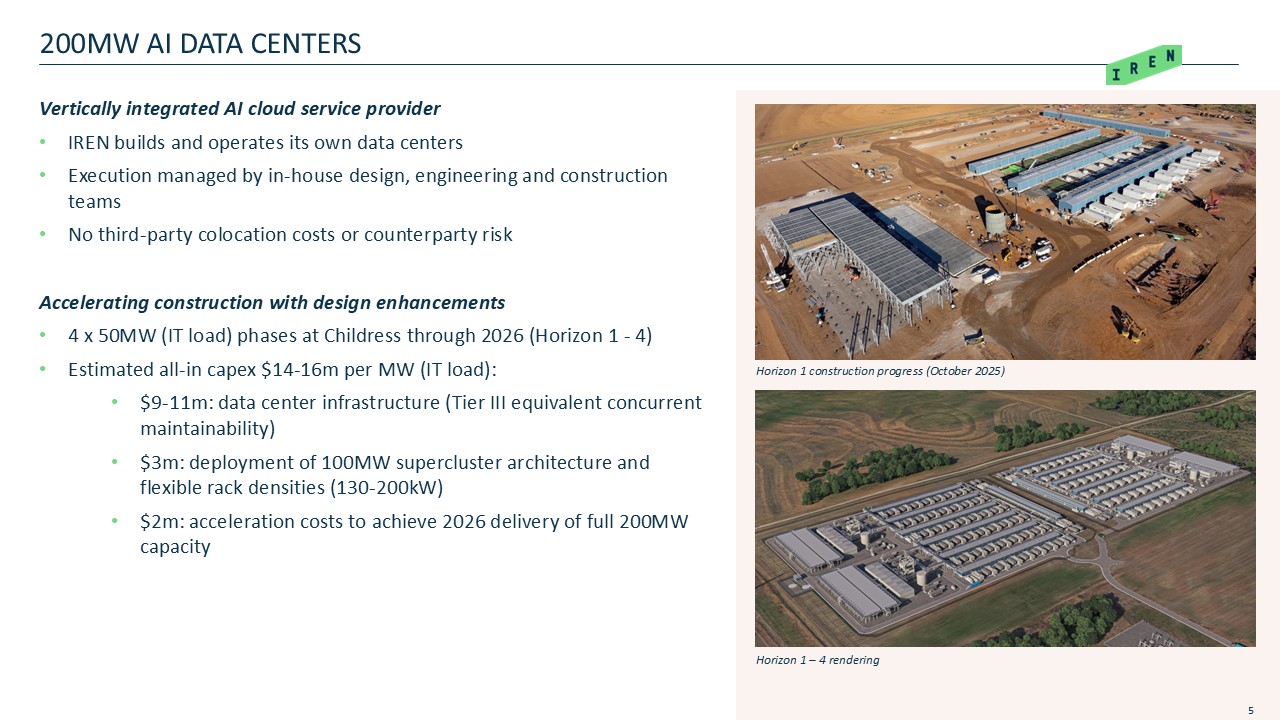

200MW AI DATA CENTERS Vertically integrated AI cloud service provider IREN

builds and operates its own data centers Execution managed by in-house design, engineering and construction teams No third-party colocation costs or counterparty risk Accelerating construction with design enhancements 4 x 50MW (IT

load) phases at Childress through 2026 (Horizon 1 - 4) Estimated all-in capex $14-16m per MW (IT load): $9-11m: data center infrastructure (Tier III equivalent concurrent maintainability) $3m: deployment of 100MW supercluster

architecture and flexible rack densities (130-200kW) $2m: acceleration costs to achieve 2026 delivery of full 200MW capacity 5 Horizon 1 – 4 rendering Updated Photos on Thursday Horizon 1 construction progress (October 2025)

IMMEDIATE EXPANSION POTENTIAL Advancing design workstreams for potential

conversion of entire 750MW Childress campus to liquid-cooled AI deployments 450MW additional capacity available Rendering of Project Horizon concept – liquid cooling transformation of Childress (750MW) 6 750MW Available

Power Childress Texas Horizon 5 - 10 (450MW) Horizon 1 - 4 (300MW)

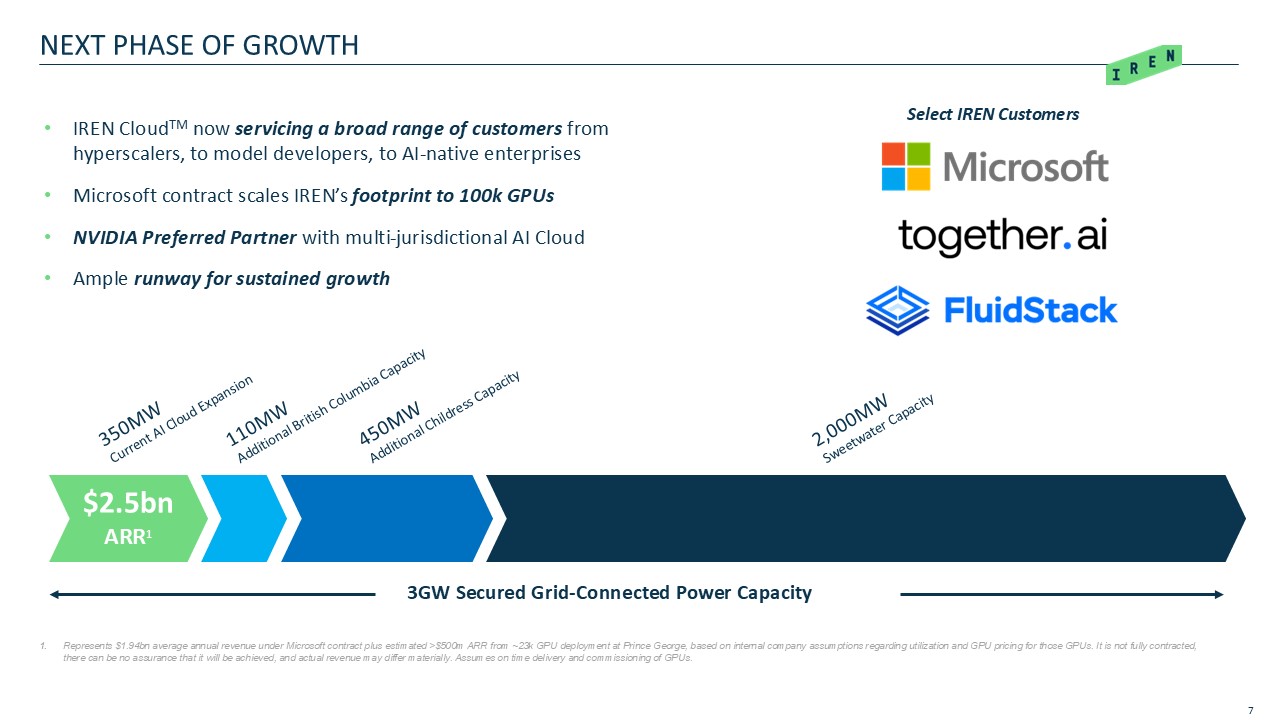

NEXT PHASE OF GROWTH 7 Represents $1.94bn average annual revenue under

Microsoft contract plus estimated >$500m ARR from ~23k GPU deployment at Prince George, based on internal company assumptions regarding utilization and GPU pricing for those GPUs. It is not fully contracted, there can be no assurance

that it will be achieved, and actual revenue may differ materially. Assumes on time delivery and commissioning of GPUs. 350MW Current AI Cloud Expansion 110MW Additional British Columbia Capacity 450MW Additional Childress

Capacity 2,000MW Sweetwater Capacity $2.5bn ARR1 3GW Secured Grid-Connected Power Capacity IREN CloudTM now servicing a broad range of customers from hyperscalers, to model developers, to AI-native enterprises Microsoft contract

scales IREN’s footprint to 100k GPUs NVIDIA Preferred Partner with multi-jurisdictional AI Cloud Ample runway for sustained growth Select IREN Customers

8