|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Franklin Templeton SMACS: Series E1

|

$0

|

0.00%

|

|

Top contributors to performance:

|

|

|

↑

|

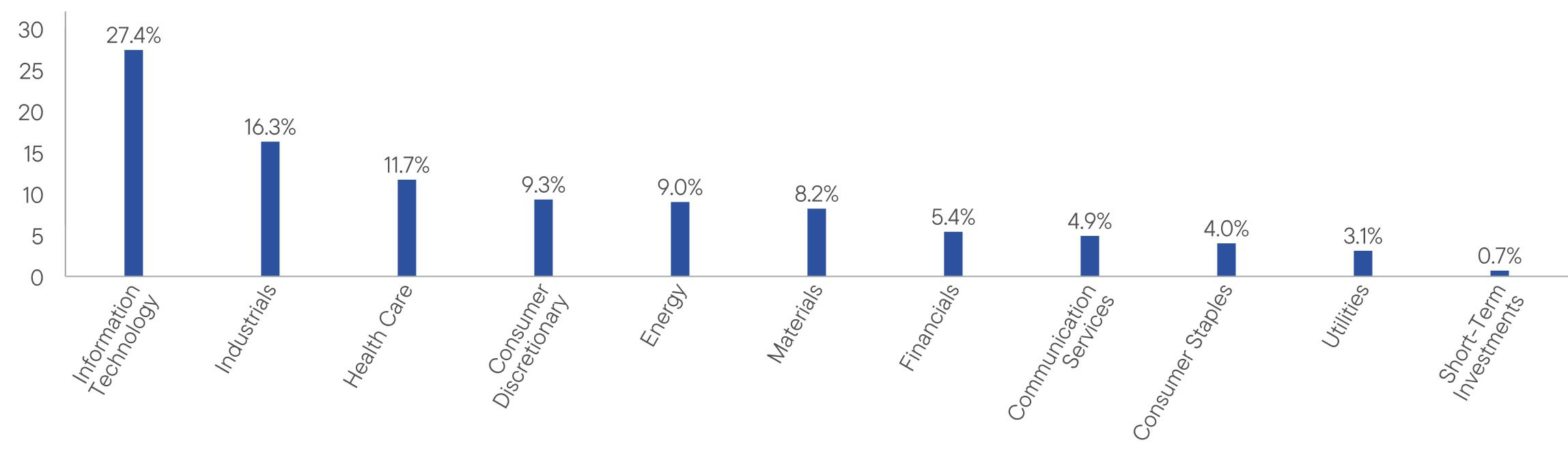

Information technology (IT), industrials, and materials sectors led absolute returns during the period.

|

|

↑

|

Boeing and Broadcom added value within industrials and IT, respectively, while Philip Morris International contributed within consumer staples.

|

|

↑

|

Selection within the industrials and IT sectors assisted relative returns, as did an underweight allocation to consumer staples.

|

|

Top detractors from performance:

|

|

|

↓

|

The energy sector detracted from absolute returns.

|

|

↓

|

In terms of individual issuers, PepsiCo and Target hindered performance within consumer staples. UnitedHealth Group also detracted within health care.

|

|

↓

|

Relative returns were weakened by selection and underweight positioning within the financials and health care sectors, as well as selection within energy.

|

|

|

1 Year

|

5 Year

|

Since Inception

(6/3/2019) |

|

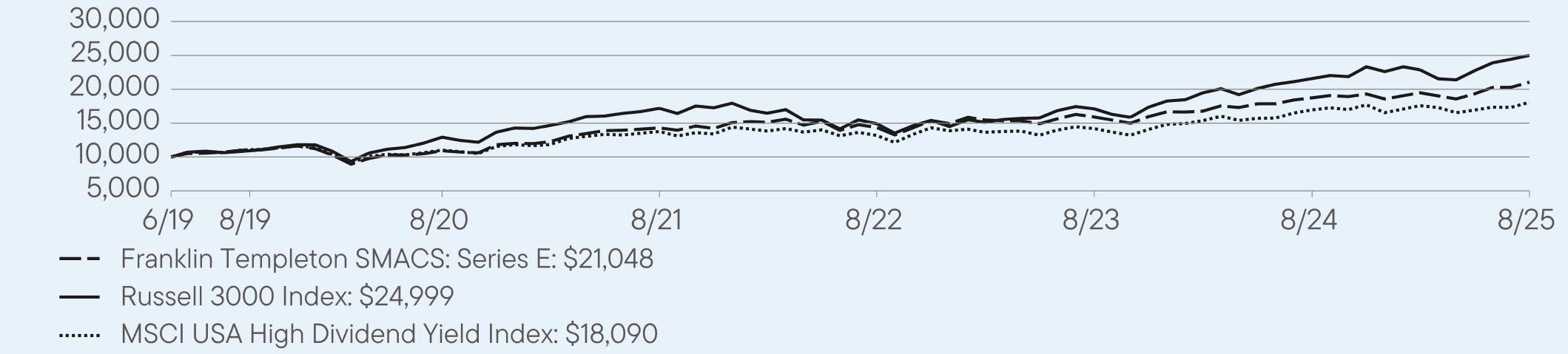

Franklin Templeton SMACS: Series E

|

12.34

|

14.02

|

12.66

|

|

Russell 3000 Index

|

15.84

|

14.11

|

16.06

|

|

MSCI USA High Dividend Yield Index

|

6.68

|

10.44

|

9.77

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$413,849,433

|

|

Total Number of Portfolio Holdings

|

110

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

103.34%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Franklin Templeton SMACS: Series I1

|

$0

|

0.00%

|

|

Top contributors to performance:

|

|

|

↑

|

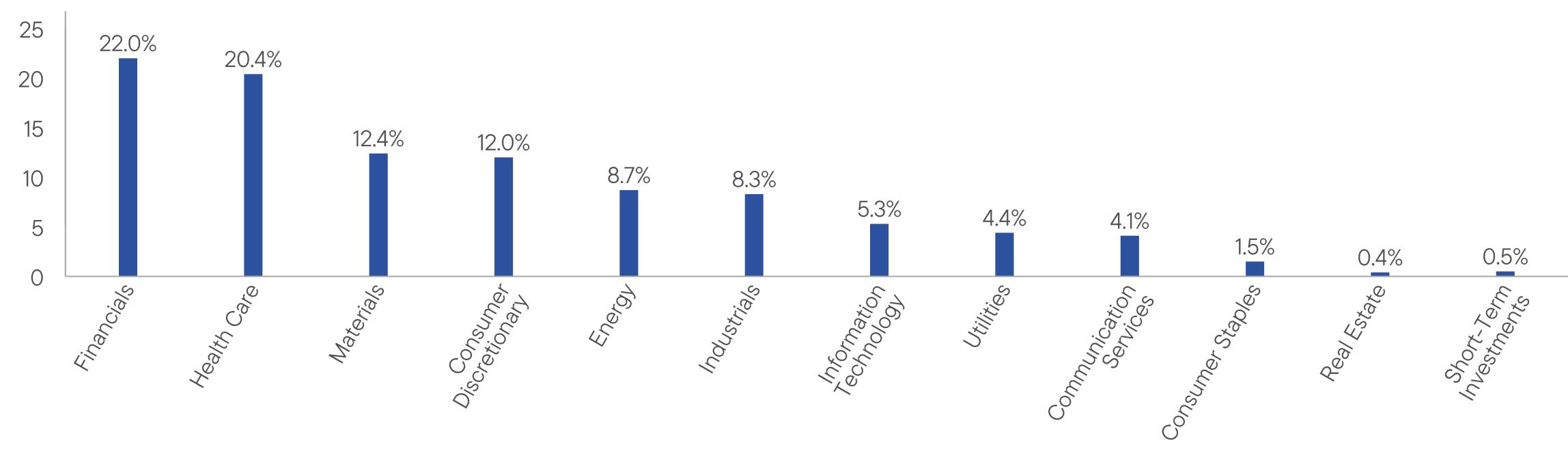

Returns were driven by health care, in addition to securitized products and the consumer discretionary sector.

|

|

↑

|

The Federal Home Loan Mortgage Corporation (Freddie Mac) led returns within securitized products, while Community Health Systems contributed within health care. CommScope Holding also added value within information technology (IT).

|

|

↑

|

Relative performance benefited from selection and underweight allocations to the IT, consumer discretionary, and energy sectors.

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. Treasuries (USTs) detracted from returns.

|

|

↓

|

In addition to USTs, Ardagh Holdings and Pfizer hindered results within the materials and health care sectors, respectively.

|

|

↓

|

Selection and underweight positioning within the communication services sector weakened relative returns, as did overweight allocations to USTs and securitized products.

|

|

|

1 Year

|

5 Year

|

Since Inception

(6/3/2019) |

|

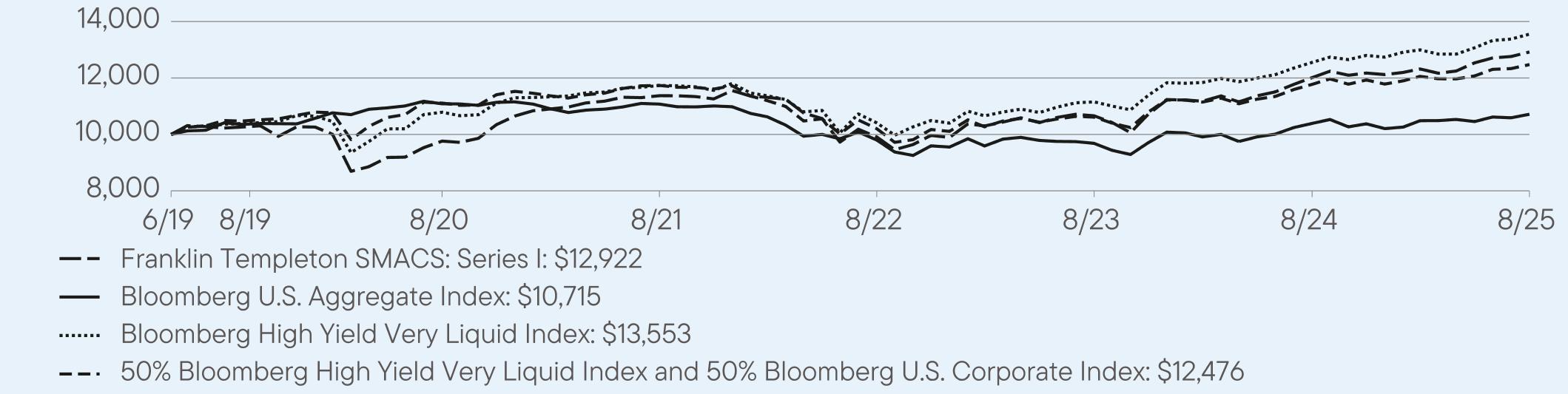

Franklin Templeton SMACS: Series I

|

7.57

|

5.77

|

4.19

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

1.06

|

|

Bloomberg High Yield Very Liquid Index

|

7.98

|

4.67

|

5.01

|

|

50% Bloomberg High Yield Very Liquid Index and 50% Bloomberg U.S. Corporate Index

|

5.95

|

2.34

|

3.59

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$615,016,164

|

|

Total Number of Portfolio Holdings

|

167

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

52.45%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

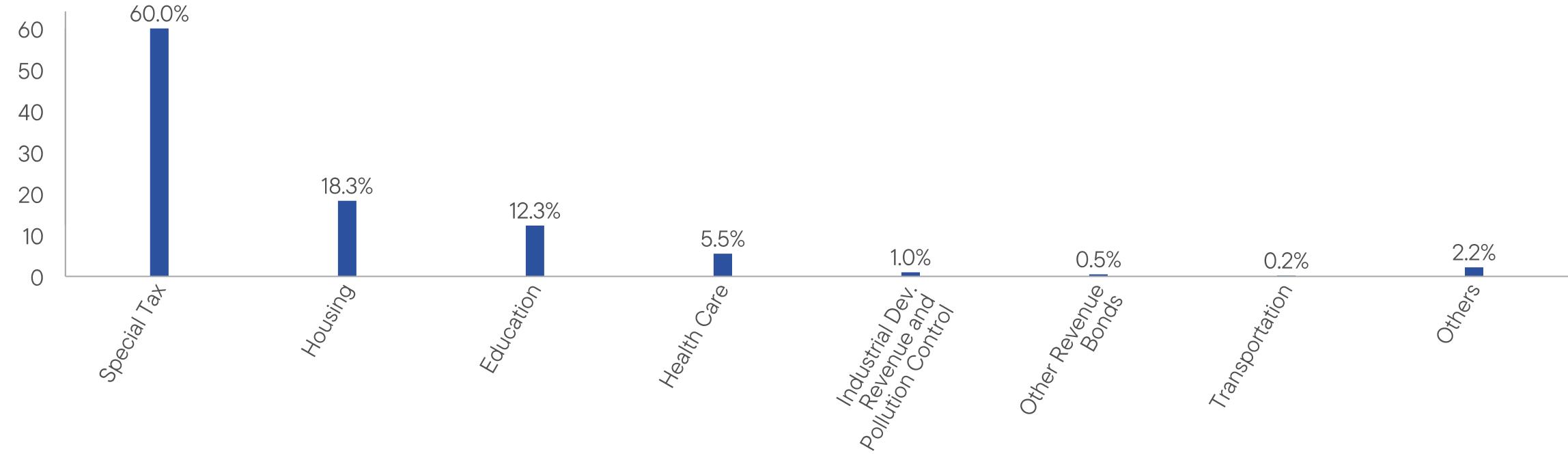

Franklin Templeton SMACS: Series CH1

|

$0

|

0.00%

|

|

Top contributors to performance:

|

|

|

↑

|

Security selection in BBB rated bonds

|

|

↑

|

Overweight allocation to 6% coupon bonds

|

|

↑

|

Security selection in AA rated bonds

|

|

Top detractors from performance:

|

|

|

↓

|

Overweight allocation to bonds five or more years to maturity

|

|

↓

|

Overweight allocation to bonds rated below investment-grade

|

|

↓

|

Security selection in BBB rated bonds

|

|

|

1 Year

|

5 Year

|

Since Inception

(6/3/2019) |

|

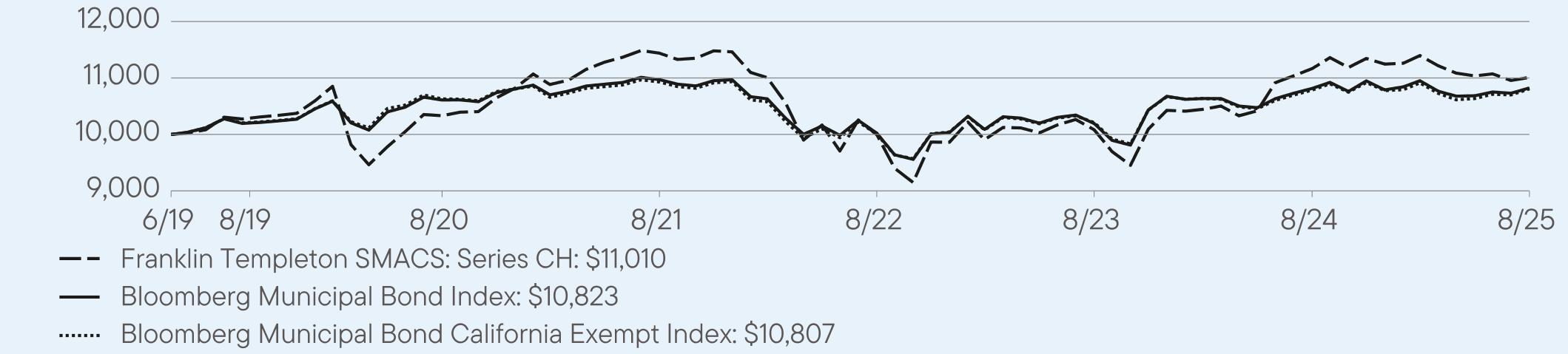

Franklin Templeton SMACS: Series CH

|

-1.39

|

1.29

|

1.56

|

|

Bloomberg Municipal Bond Index

|

0.08

|

0.40

|

1.26

|

|

Bloomberg Municipal Bond California Exempt Index

|

0.19

|

0.33

|

1.24

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$27,406,851

|

|

Total Number of Portfolio Holdings

|

64

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

28.21%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

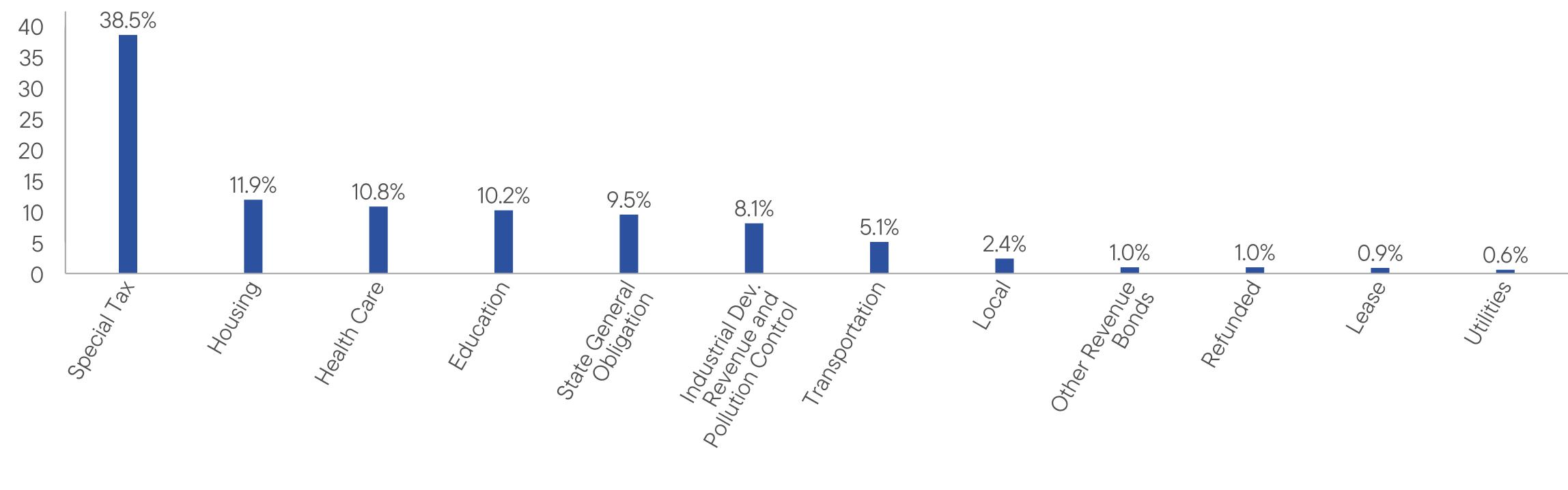

Franklin Templeton SMACS: Series H1

|

$0

|

0.00%

|

|

Top contributors to performance:

|

|

|

↑

|

Overweight exposure to bonds rated AAA

|

|

↑

|

Overweight exposure to bonds rated below investment-grade

|

|

↑

|

Security selection in bonds rated below investment-grade

|

|

Top detractors from performance:

|

|

|

↓

|

Overweight exposure to municipal bonds with 10 or more years to maturity

|

|

↓

|

Security selection in AAA rated bonds

|

|

↓

|

Underweight exposure to AA rated bonds

|

|

|

1 Year

|

5 Year

|

Since Inception

(6/3/2019) |

|

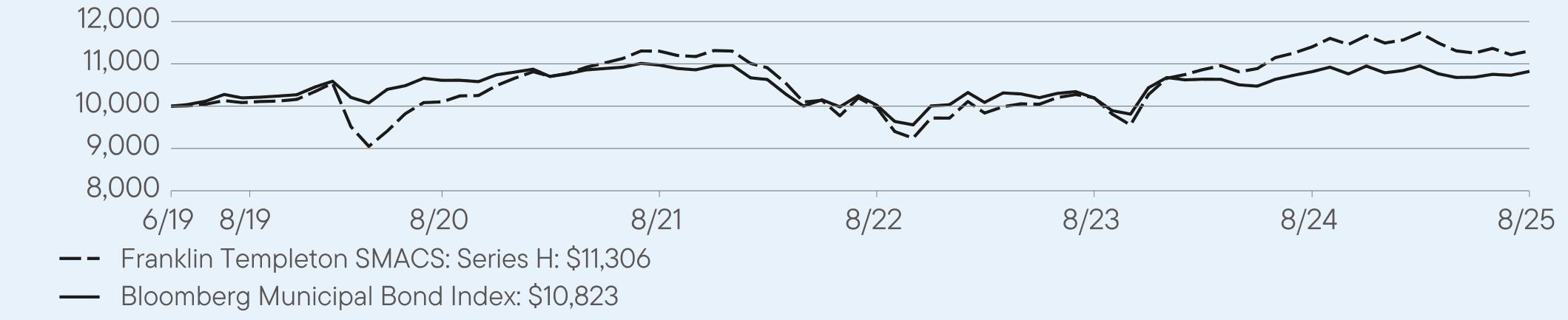

Franklin Templeton SMACS: Series H

|

-0.84

|

2.28

|

1.99

|

|

Bloomberg Municipal Bond Index

|

0.08

|

0.40

|

1.26

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$26,831,070

|

|

Total Number of Portfolio Holdings

|

175

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

7.25%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|

||

| [11] |

|

||

| [12] |

|