Shareholder Report

|

12 Months Ended |

|

Aug. 31, 2025

USD ($)

$ / shares

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Legg Mason Partners Institutional Trust

|

|

| Entity Central Index Key |

0000889512

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Aug. 31, 2025

|

|

| Class L |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Western Asset Institutional Government Reserves

|

|

| Class Name |

Class L

|

|

| Trading Symbol |

LWPXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Western Asset Institutional Government Reserves for the period September 1, 2024, to August 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 1-800-625-4554, or 1-203-703-6002.

|

|

| Additional Information Phone Number |

1-800-625-4554, or 1-203-703-6002

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

|

|

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class L1

|

$18

|

0.18%

|

|

[1],[2] |

| Expenses Paid, Amount |

$ 18

|

[1] |

| Expense Ratio, Percent |

0.18%

|

[1] |

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE? As of August 31, 2025, the seven-day current yield for Class L shares of the Western Asset Institutional Government Reserves was 4.20% and the seven-day effective yield was 4.28%. The seven-day current yield represents net interest income generated by the Fund’s investments for the past seven days and assumes income is generated each week over a 365-day period. The seven-day effective yield assumes reinvestment of the coupon (interest payments) and will typically be slightly higher than the current yield because of the compounding effect on investment returns. The Fund was positively impacted by its focus on the short-term supply/demand dynamics of the U.S. Treasury bill and government agency market. The anticipation of increasing deficits led to higher yield levels and offered more attractive opportunities to extend the average maturity of the Fund. The Fund also maintained a sizeable percentage in agency floating rate securities, which contributed additional yield without additional maturity risk.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

|

|

| Updated Performance Information Location [Text Block] |

For current month-end performance, please call Franklin Templeton at 1-800-625-4554, or 1-203-703-6002 or visit

https://www.franklintempleton.com/investments/options/money-market-funds.

|

|

| Net Assets |

$ 14,157,264,126

|

|

| Holdings Count | $ / shares |

124

|

|

| Advisory Fees Paid, Amount |

$ 19,177,955

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (as of August 31, 2025)

|

|

|

Total Net Assets

|

$14,157,264,126

|

|

Total Number of Portfolio Holdings (reflects holdings of Government Portfolio)

|

124

|

|

Total Management Fee Paid

|

$19,177,955

|

|

|

| Holdings [Text Block] |

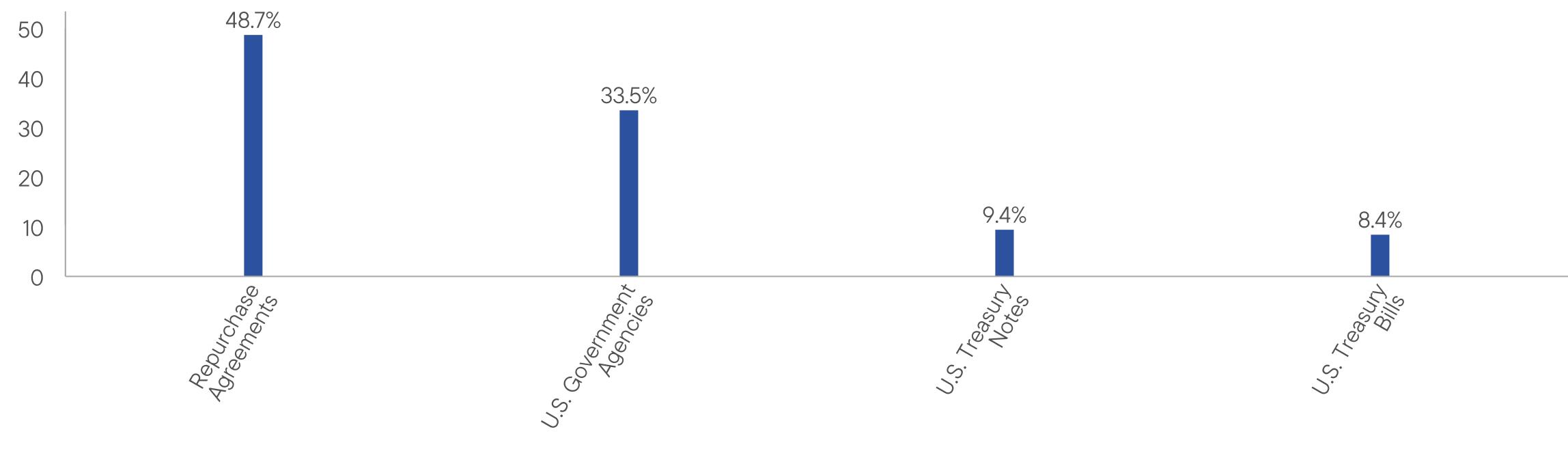

WHAT DID THE FUND INVEST IN? (as of August 31, 2025) Portfolio Composition* (% of Total Investments)

|

[3] |

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Institutional Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Western Asset Institutional Government Reserves

|

|

| Class Name |

Institutional Shares

|

|

| Trading Symbol |

INGXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Western Asset Institutional Government Reserves for the period September 1, 2024, to August 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 1-800-625-4554, or 1-203-703-6002.

|

|

| Additional Information Phone Number |

1-800-625-4554, or 1-203-703-6002

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

|

|

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Institutional Shares1

|

$16

|

0.16%

|

|

[4],[5] |

| Expenses Paid, Amount |

$ 16

|

[4] |

| Expense Ratio, Percent |

0.16%

|

[4] |

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE? As of August 31, 2025, the seven-day current yield for Institutional Shares of the Western Asset Institutional Government Reserves was 4.22% and the seven-day effective yield was 4.31%. The seven-day current yield represents net interest income generated by the Fund’s investments for the past seven days and assumes income is generated each week over a 365-day period. The seven-day effective yield assumes reinvestment of the coupon (interest payments) and will typically be slightly higher than the current yield because of the compounding effect on investment returns. The Fund was positively impacted by its focus on the short-term supply/demand dynamics of the U.S. Treasury bill and government agency market. The anticipation of increasing deficits led to higher yield levels and offered more attractive opportunities to extend the average maturity of the Fund. The Fund also maintained a sizeable percentage in agency floating rate securities, which contributed additional yield without additional maturity risk.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

|

|

| Updated Performance Information Location [Text Block] |

For current month-end performance, please call Franklin Templeton at 1-800-625-4554, or 1-203-703-6002 or visit

https://www.franklintempleton.com/investments/options/money-market-funds.

|

|

| Net Assets |

$ 14,157,264,126

|

|

| Holdings Count | $ / shares |

124

|

|

| Advisory Fees Paid, Amount |

$ 19,177,955

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (as of August 31, 2025)

|

|

|

Total Net Assets

|

$14,157,264,126

|

|

Total Number of Portfolio Holdings (reflects holdings of Government Portfolio)

|

124

|

|

Total Management Fee Paid

|

$19,177,955

|

|

|

| Holdings [Text Block] |

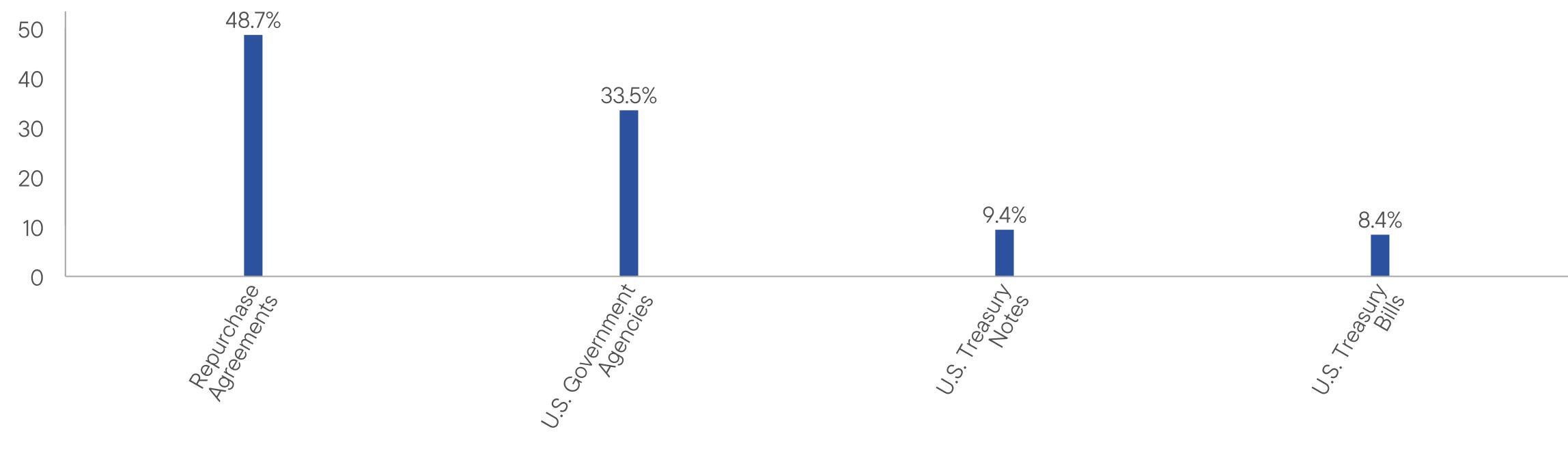

WHAT DID THE FUND INVEST IN? (as of August 31, 2025) Portfolio Composition* (% of Total Investments)

|

[6] |

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Investor Shares |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Western Asset Institutional Government Reserves

|

|

| Class Name |

Investor Shares

|

|

| Trading Symbol |

LGRXX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Western Asset Institutional Government Reserves for the period September 1, 2024, to August 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at 1-800-625-4554, or 1-203-703-6002.

|

|

| Additional Information Phone Number |

1-800-625-4554, or 1-203-703-6002

|

|

| Additional Information Website |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (based on a hypothetical $10,000 investment)

|

|

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Investor Shares1

|

$21

|

0.21%

|

|

[7],[8] |

| Expenses Paid, Amount |

$ 21

|

[7] |

| Expense Ratio, Percent |

0.21%

|

[7] |

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE? As of August 31, 2025, the seven-day current yield for Investor Shares of the Western Asset Institutional Government Reserves was 4.17% and the seven-day effective yield was 4.25%. The seven-day current yield represents net interest income generated by the Fund’s investments for the past seven days and assumes income is generated each week over a 365-day period. The seven-day effective yield assumes reinvestment of the coupon (interest payments) and will typically be slightly higher than the current yield because of the compounding effect on investment returns. The Fund was positively impacted by its focus on the short-term supply/demand dynamics of the U.S. Treasury bill and government agency market. The anticipation of increasing deficits led to higher yield levels and offered more attractive opportunities to extend the average maturity of the Fund. The Fund also maintained a sizeable percentage in agency floating rate securities, which contributed additional yield without additional maturity risk.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future.

|

|

| Updated Performance Information Location [Text Block] |

For current month-end performance, please call Franklin Templeton at 1-800-625-4554, or 1-203-703-6002 or visit

https://www.franklintempleton.com/investments/options/money-market-funds.

|

|

| Net Assets |

$ 14,157,264,126

|

|

| Holdings Count | $ / shares |

124

|

|

| Advisory Fees Paid, Amount |

$ 19,177,955

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (as of August 31, 2025)

|

|

|

Total Net Assets

|

$14,157,264,126

|

|

Total Number of Portfolio Holdings (reflects holdings of Government Portfolio)

|

124

|

|

Total Management Fee Paid

|

$19,177,955

|

|

|

| Holdings [Text Block] |

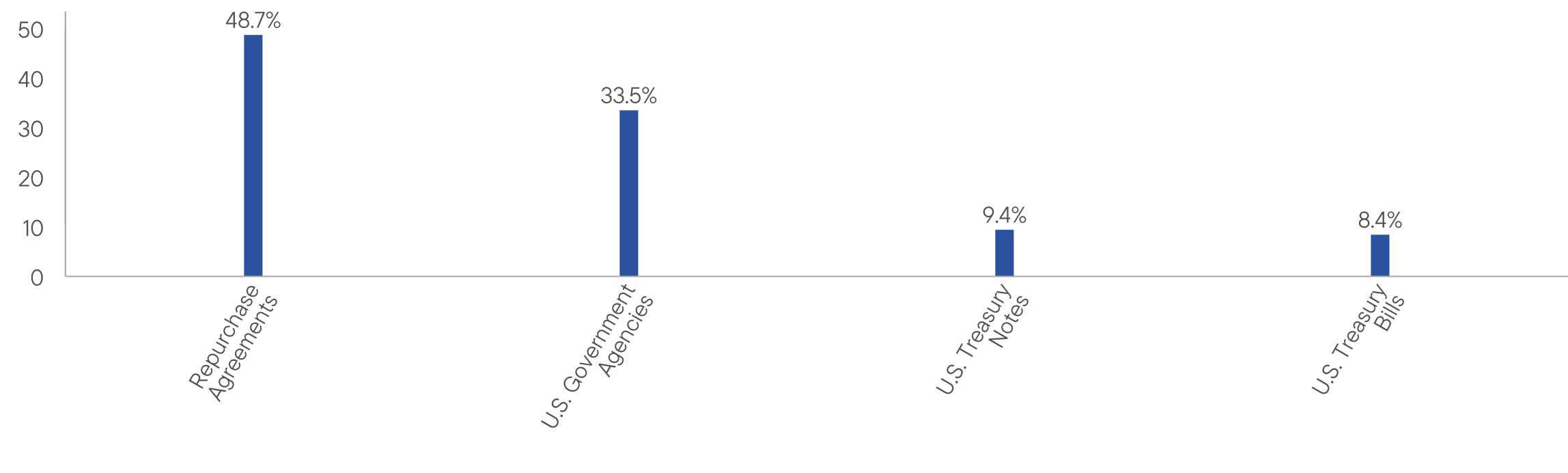

WHAT DID THE FUND INVEST IN? (as of August 31, 2025) Portfolio Composition* (% of Total Investments)

|

[9] |

| Updated Prospectus Web Address |

https://www.franklintempleton.com/regulatory-fund-documents

|

|

|

|