|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

A |

$115

|

1.10%

|

|

Top

contributors to performance: | |

|

↑

|

Standard

Chartered, an emerging market-focused bank, delivered a strong year overall, with shares supported by robust earnings growth

and capital returns. The bank benefited from higher income in wealth and markets divisions, disciplined cost control, and multiple

share buybacks through mid-2025, which bolstered investor confidence. |

|

↑

|

Alibaba

Group, China’s leading e-commerce and cloud provider, saw shares recover strongly over the year as artificial intelligence

(AI)-driven growth and cloud momentum boosted sentiment. Active buybacks and supportive policy measures added tailwinds,

though volatility persisted amid regulatory uncertainty and competitive pressures. |

|

↑

|

Dassault

Aviation, the French aerospace and defense group behind Rafale jets and Falcon business aircraft, saw strong share gains

over the year. Performance was supported by solid results, a healthy order backlog and a new buyback program, though supply

chain issues and political uncertainty added some volatility. |

|

Top

detractors from performance: | |

|

↓

|

Ørsted

A/S, a Danish multinational energy company was the leading stock detractor. Much of its negative contribution related to developments

late in the period which included an announcement of a rights issue to shore up its balance sheet along with a U.S. ‘stop

work’ order on a major offshore wind project. |

|

↓

|

Persimmon,

one of the UK’s largest housebuilders, saw its shares decline as higher mortgage rates and affordability challenges weighed

on demand. Despite some improvement in its order book, persistent cost pressures and regulatory burdens kept margins under

strain, leaving investor sentiment cautious. |

|

↓

|

Stellantis,

the multinational carmaker, saw its shares fall over the period as profits slumped and restructuring risks grew. Losses were

driven by weaker sales, higher costs and large charges from program cancellations, while tariffs and a negative product mix added

pressure. Investor confidence was further hit by suspended guidance and a credit outlook downgrade |

|

|

1

Year |

5

Year |

10

Year |

|

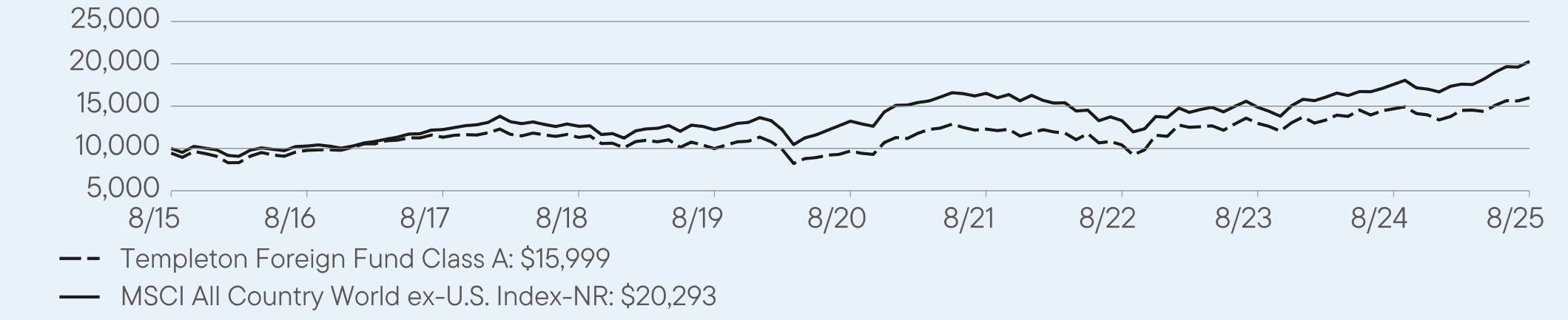

Class

A |

8.91

|

10.51

|

5.41

|

|

Class

A (with sales charge) |

2.93

|

9.28

|

4.82

|

|

MSCI

All Country World ex-U.S. Index-NR |

15.42

|

8.94

|

7.33

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total

Net Assets |

$2,582,933,485

|

|

Total

Number of Portfolio Holdings |

46

|

|

Total

Management Fee Paid |

$16,809,875

|

|

Portfolio

Turnover Rate |

44.39%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

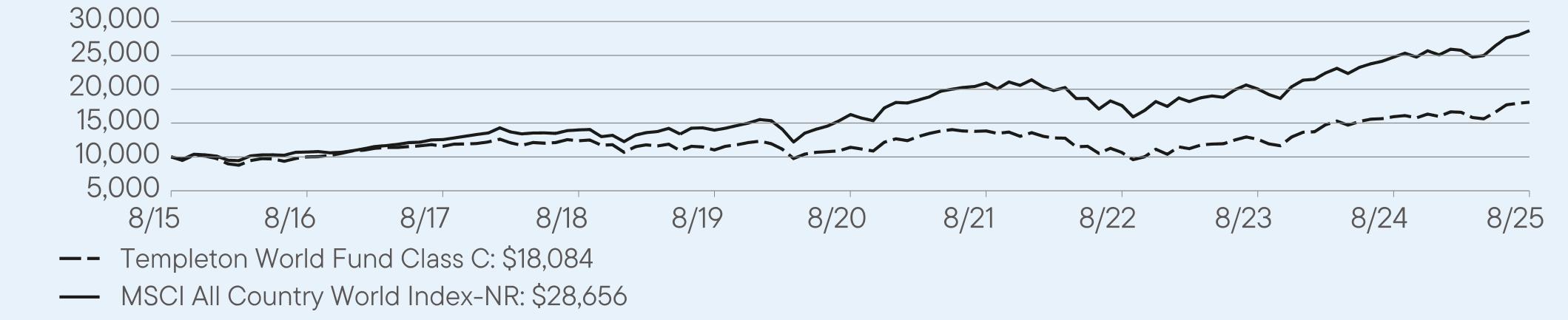

Class

C |

$193

|

1.85%

|

|

Top

contributors to performance: | |

|

↑

|

Standard

Chartered, an emerging market-focused bank, delivered a strong year overall, with shares supported by robust earnings growth

and capital returns. The bank benefited from higher income in wealth and markets divisions, disciplined cost control, and multiple

share buybacks through mid-2025, which bolstered investor confidence. |

|

↑

|

Alibaba

Group, China’s leading e-commerce and cloud provider, saw shares recover strongly over the year as artificial intelligence

(AI)-driven growth and cloud momentum boosted sentiment. Active buybacks and supportive policy measures added tailwinds,

though volatility persisted amid regulatory uncertainty and competitive pressures. |

|

↑

|

Dassault

Aviation, the French aerospace and defense group behind Rafale jets and Falcon business aircraft, saw strong share gains

over the year. Performance was supported by solid results, a healthy order backlog and a new buyback program, though supply

chain issues and political uncertainty added some volatility. |

|

Top

detractors from performance: | |

|

↓

|

Ørsted

A/S, a Danish multinational energy company was the leading stock detractor. Much of its negative contribution related to developments

late in the period which included an announcement of a rights issue to shore up its balance sheet along with a U.S. ‘stop

work’ order on a major offshore wind project. |

|

↓

|

Persimmon,

one of the UK’s largest housebuilders, saw its shares decline as higher mortgage rates and affordability challenges weighed

on demand. Despite some improvement in its order book, persistent cost pressures and regulatory burdens kept margins under

strain, leaving investor sentiment cautious. |

|

↓

|

Stellantis,

the multinational carmaker, saw its shares fall over the period as profits slumped and restructuring risks grew. Losses were

driven by weaker sales, higher costs and large charges from program cancellations, while tariffs and a negative product mix added

pressure. Investor confidence was further hit by suspended guidance and a credit outlook downgrade |

|

|

1

Year |

5

Year |

10

Year |

|

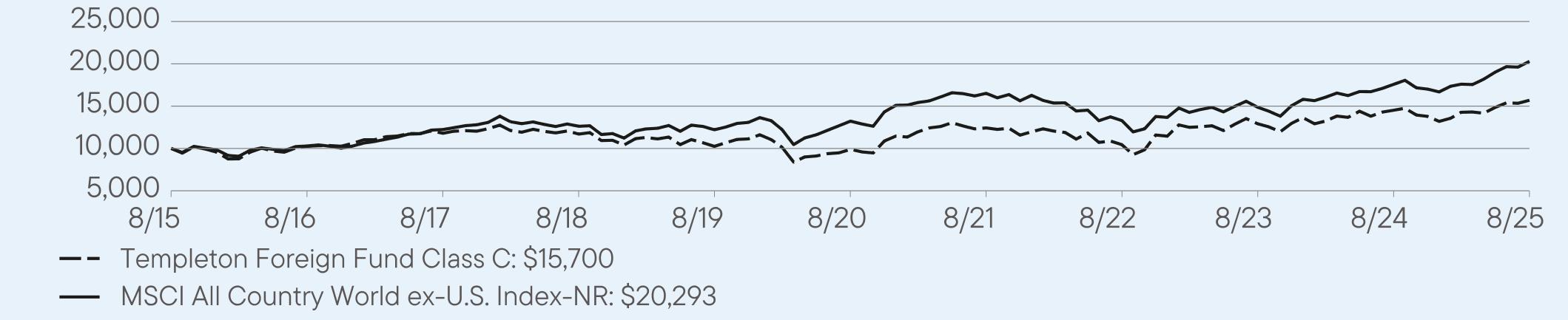

Class

C |

8.13

|

9.66

|

4.61

|

|

Class

C (with sales charge) |

7.13

|

9.66

|

4.61

|

|

MSCI

All Country World ex-U.S. Index-NR |

15.42

|

8.94

|

7.33

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

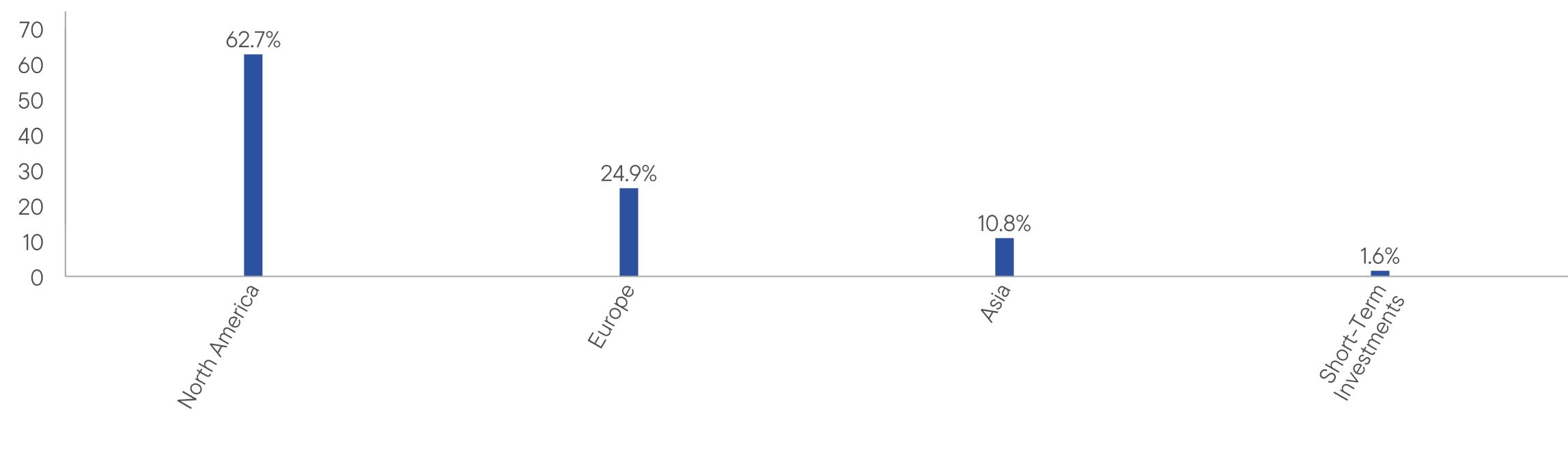

Total

Net Assets |

$2,582,933,485

|

|

Total

Number of Portfolio Holdings |

46

|

|

Total

Management Fee Paid |

$16,809,875

|

|

Portfolio

Turnover Rate |

44.39%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

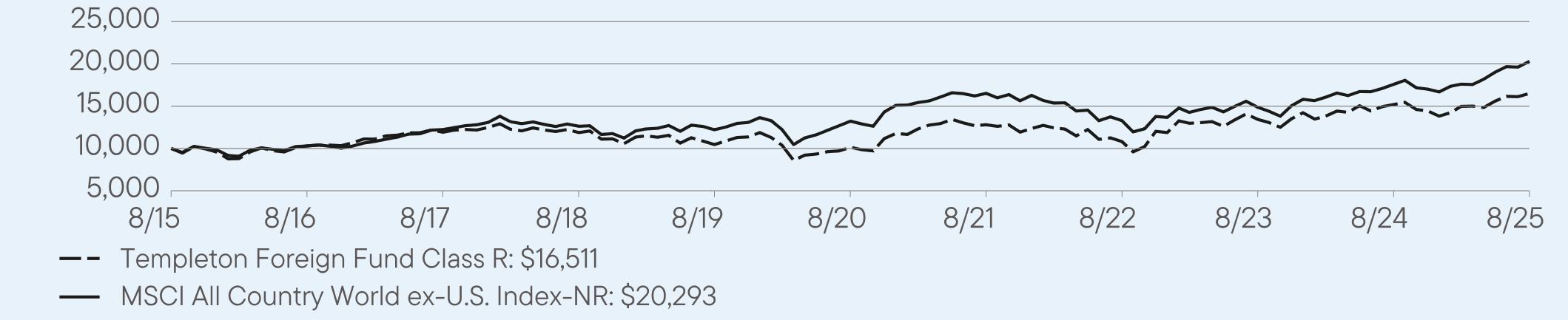

Class

R |

$141

|

1.35%

|

|

Top

contributors to performance: | |

|

↑

|

Standard

Chartered, an emerging market-focused bank, delivered a strong year overall, with shares supported by robust earnings growth

and capital returns. The bank benefited from higher income in wealth and markets divisions, disciplined cost control, and multiple

share buybacks through mid-2025, which bolstered investor confidence. |

|

↑

|

Alibaba

Group, China’s leading e-commerce and cloud provider, saw shares recover strongly over the year as artificial intelligence

(AI)-driven growth and cloud momentum boosted sentiment. Active buybacks and supportive policy measures added tailwinds,

though volatility persisted amid regulatory uncertainty and competitive pressures. |

|

↑

|

Dassault

Aviation, the French aerospace and defense group behind Rafale jets and Falcon business aircraft, saw strong share gains

over the year. Performance was supported by solid results, a healthy order backlog and a new buyback program, though supply

chain issues and political uncertainty added some volatility. |

|

Top

detractors from performance: | |

|

↓

|

Ørsted

A/S, a Danish multinational energy company was the leading stock detractor. Much of its negative contribution related to developments

late in the period which included an announcement of a rights issue to shore up its balance sheet along with a U.S. ‘stop

work’ order on a major offshore wind project. |

|

↓

|

Persimmon,

one of the UK’s largest housebuilders, saw its shares decline as higher mortgage rates and affordability challenges weighed

on demand. Despite some improvement in its order book, persistent cost pressures and regulatory burdens kept margins under

strain, leaving investor sentiment cautious. |

|

↓

|

Stellantis,

the multinational carmaker, saw its shares fall over the period as profits slumped and restructuring risks grew. Losses were

driven by weaker sales, higher costs and large charges from program cancellations, while tariffs and a negative product mix added

pressure. Investor confidence was further hit by suspended guidance and a credit outlook downgrade |

|

|

1

Year |

5

Year |

10

Year |

|

Class

R |

8.63

|

10.24

|

5.14

|

|

MSCI

All Country World ex-U.S. Index-NR |

15.42

|

8.94

|

7.33

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

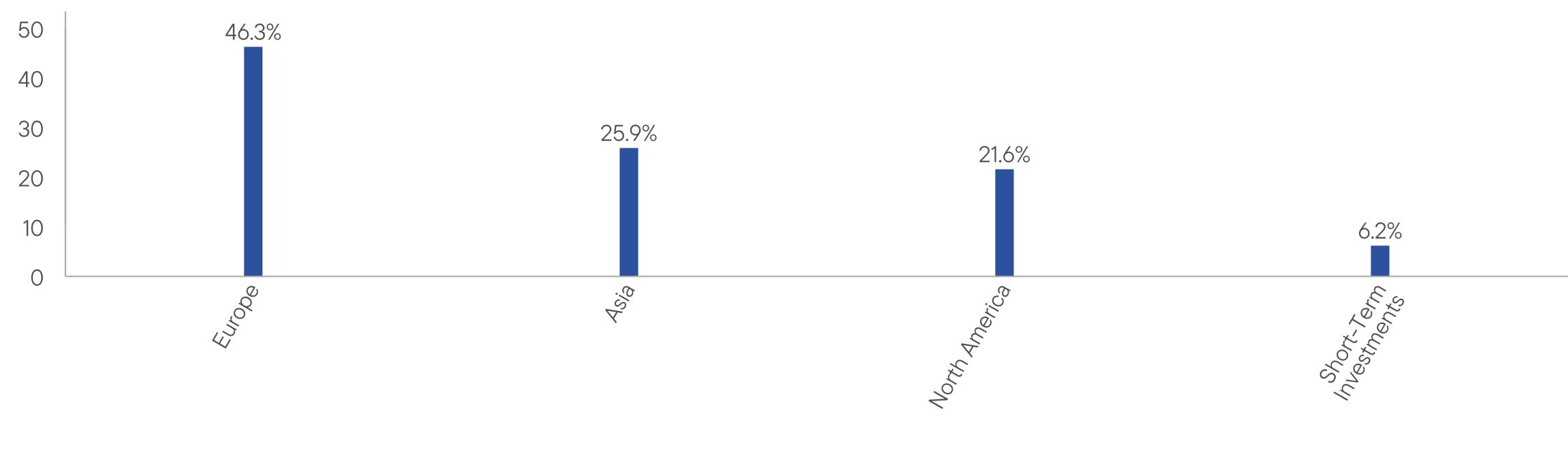

Total

Net Assets |

$2,582,933,485

|

|

Total

Number of Portfolio Holdings |

46

|

|

Total

Management Fee Paid |

$16,809,875

|

|

Portfolio

Turnover Rate |

44.39%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

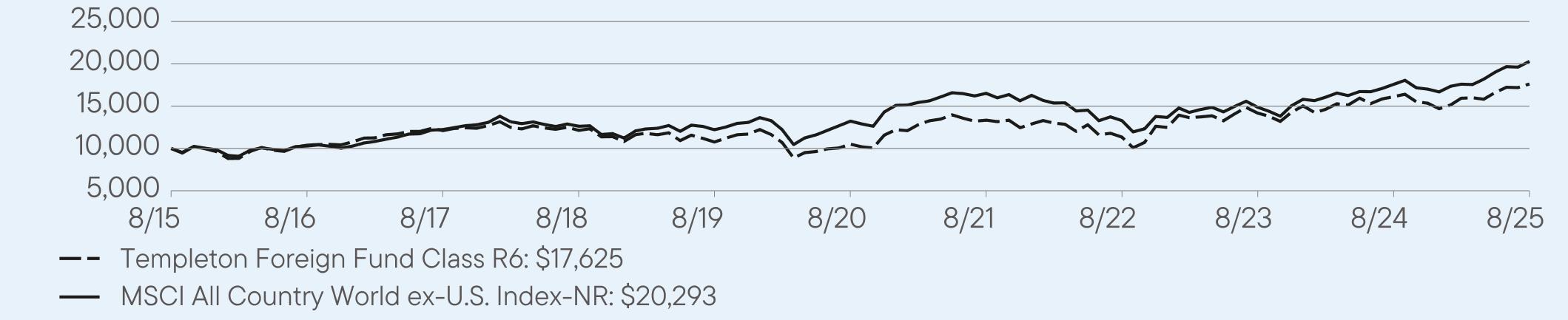

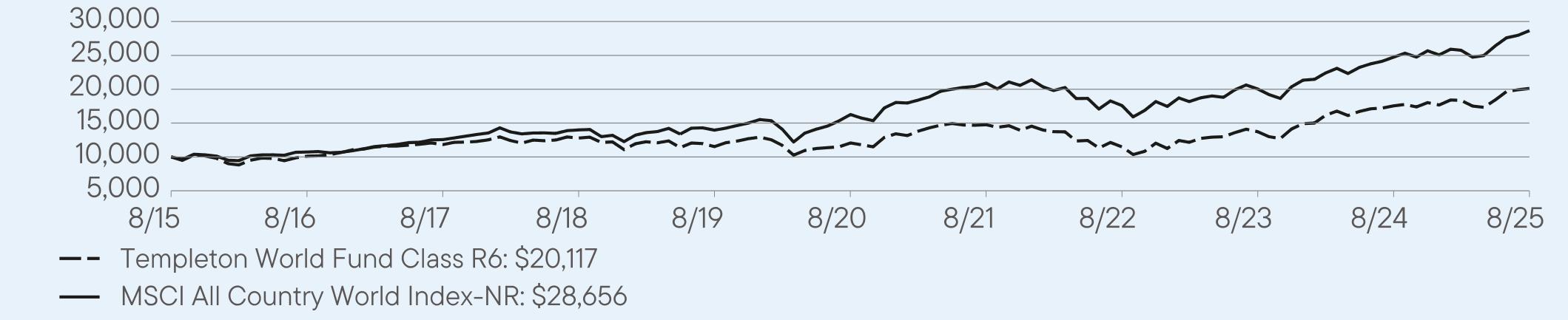

Class

R6 |

$77

|

0.74%

|

|

Top

contributors to performance: | |

|

↑

|

Standard

Chartered, an emerging market-focused bank, delivered a strong year overall, with shares supported by robust earnings growth

and capital returns. The bank benefited from higher income in wealth and markets divisions, disciplined cost control, and multiple

share buybacks through mid-2025, which bolstered investor confidence. |

|

↑

|

Alibaba

Group, China’s leading e-commerce and cloud provider, saw shares recover strongly over the year as artificial intelligence

(AI)-driven growth and cloud momentum boosted sentiment. Active buybacks and supportive policy measures added tailwinds,

though volatility persisted amid regulatory uncertainty and competitive pressures. |

|

↑

|

Dassault

Aviation, the French aerospace and defense group behind Rafale jets and Falcon business aircraft, saw strong share gains

over the year. Performance was supported by solid results, a healthy order backlog and a new buyback program, though supply

chain issues and political uncertainty added some volatility. |

|

Top

detractors from performance: | |

|

↓

|

Ørsted

A/S, a Danish multinational energy company was the leading stock detractor. Much of its negative contribution related to developments

late in the period which included an announcement of a rights issue to shore up its balance sheet along with a U.S. ‘stop

work’ order on a major offshore wind project. |

|

↓

|

Persimmon,

one of the UK’s largest housebuilders, saw its shares decline as higher mortgage rates and affordability challenges weighed

on demand. Despite some improvement in its order book, persistent cost pressures and regulatory burdens kept margins under

strain, leaving investor sentiment cautious. |

|

↓

|

Stellantis,

the multinational carmaker, saw its shares fall over the period as profits slumped and restructuring risks grew. Losses were

driven by weaker sales, higher costs and large charges from program cancellations, while tariffs and a negative product mix added

pressure. Investor confidence was further hit by suspended guidance and a credit outlook downgrade |

|

|

1

Year |

5

Year |

10

Year |

|

Class

R6 |

9.31

|

10.90

|

5.83

|

|

MSCI

All Country World ex-U.S. Index-NR |

15.42

|

8.94

|

7.33

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

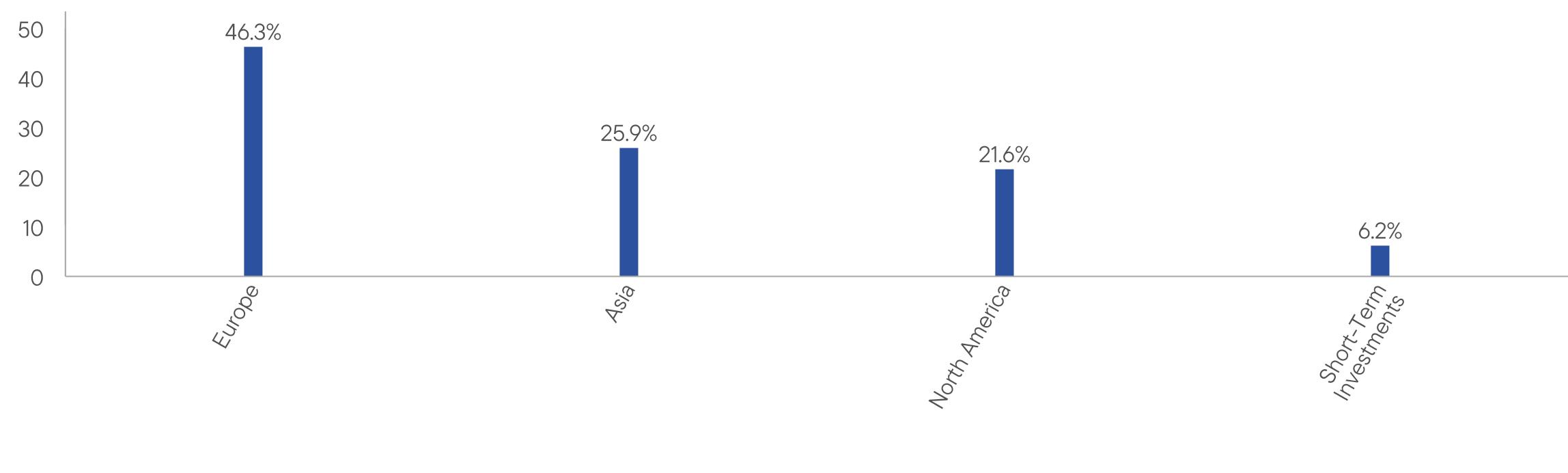

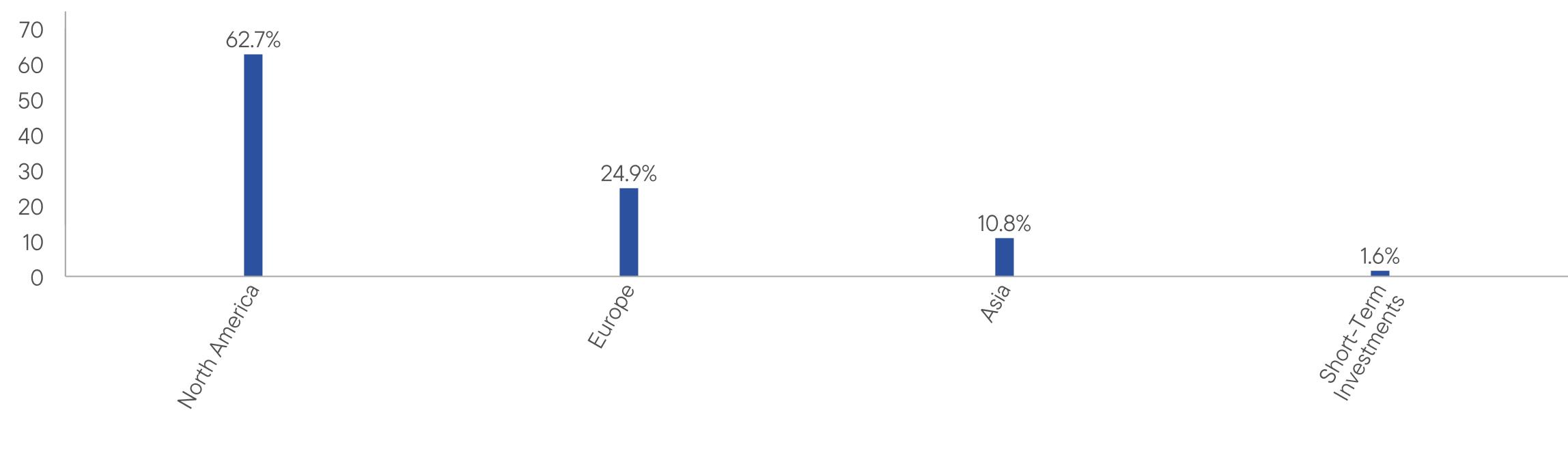

Total

Net Assets |

$2,582,933,485

|

|

Total

Number of Portfolio Holdings |

46

|

|

Total

Management Fee Paid |

$16,809,875

|

|

Portfolio

Turnover Rate |

44.39%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Advisor

Class |

$89

|

0.85%

|

|

Top

contributors to performance: | |

|

↑

|

Standard

Chartered, an emerging market-focused bank, delivered a strong year overall, with shares supported by robust earnings growth

and capital returns. The bank benefited from higher income in wealth and markets divisions, disciplined cost control, and multiple

share buybacks through mid-2025, which bolstered investor confidence. |

|

↑

|

Alibaba

Group, China’s leading e-commerce and cloud provider, saw shares recover strongly over the year as artificial intelligence

(AI)-driven growth and cloud momentum boosted sentiment. Active buybacks and supportive policy measures added tailwinds,

though volatility persisted amid regulatory uncertainty and competitive pressures. |

|

↑

|

Dassault

Aviation, the French aerospace and defense group behind Rafale jets and Falcon business aircraft, saw strong share gains

over the year. Performance was supported by solid results, a healthy order backlog and a new buyback program, though supply

chain issues and political uncertainty added some volatility. |

|

Top

detractors from performance: | |

|

↓

|

Ørsted

A/S, a Danish multinational energy company was the leading stock detractor. Much of its negative contribution related to developments

late in the period which included an announcement of a rights issue to shore up its balance sheet along with a U.S. ‘stop

work’ order on a major offshore wind project. |

|

↓

|

Persimmon,

one of the UK’s largest housebuilders, saw its shares decline as higher mortgage rates and affordability challenges weighed

on demand. Despite some improvement in its order book, persistent cost pressures and regulatory burdens kept margins under

strain, leaving investor sentiment cautious. |

|

↓

|

Stellantis,

the multinational carmaker, saw its shares fall over the period as profits slumped and restructuring risks grew. Losses were

driven by weaker sales, higher costs and large charges from program cancellations, while tariffs and a negative product mix added

pressure. Investor confidence was further hit by suspended guidance and a credit outlook downgrade |

|

|

1

Year |

5

Year |

10

Year |

|

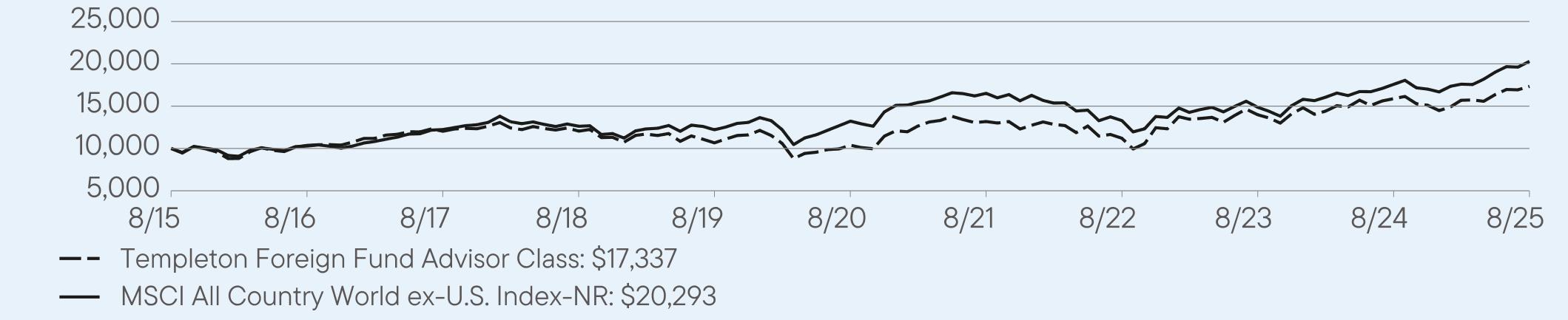

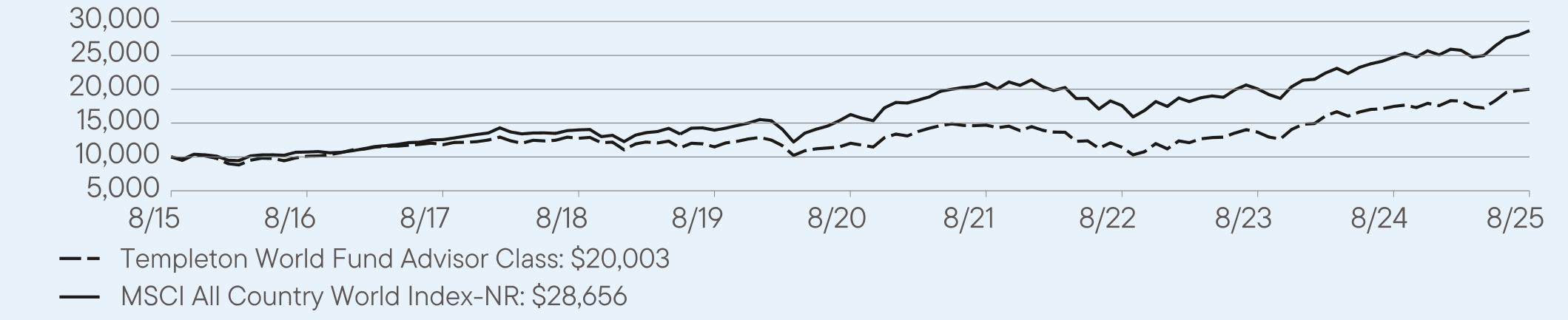

Advisor

Class |

9.14

|

10.78

|

5.66

|

|

MSCI

All Country World ex-U.S. Index-NR |

15.42

|

8.94

|

7.33

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total

Net Assets |

$2,582,933,485

|

|

Total

Number of Portfolio Holdings |

46

|

|

Total

Management Fee Paid |

$16,809,875

|

|

Portfolio

Turnover Rate |

44.39%

|

at https://www.franklintempleton.com/regulatory-fund-documents or upon request at (800) DIAL BEN/342-5236 or

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment |

|

Class

A |

$112

|

1.05%

|

|

Top

contributors to performance: | |

|

↑

|

Rolls-Royce

Holdings saw shares surge over the year as its turnaround project continued to deliver profits and cash flow stepped up,

distributions were reinstated alongside a buyback, and guidance was raised after a strong first half. Sentiment was further supported

by civil-aerospace recovery, steady defense and progress on small modular reactors. |

|

↑

|

A

newly established position in Safran SA added value over the period as the company delivered strong results and maintained a positive

outlook. Growth in its core businesses and steady demand for services supported confidence, while a favorable environment

for aerospace and defense provided an additional boost. |

|

↑

|

GE

Vernova, a U.S.-based electrification and power-equipment provider (wind turbines, gas turbines and grid solutions), benefited

from U.S. generation and grid build-out and rising data-center power demand, but the position was closed during the period

on valuation after a strong run. |

|

Top

detractors from performance: | |

|

↓

|

UnitedHealth

detracted as it shares sold off in the second quarter of 2025 after a first quarter earnings miss, higher-than-expected

Medicare Advantage medical costs, a surprise CEO change, and news of a federal investigation; the Fund exited

the position during the period as these developments undermined the original thesis. |

|

↓

|

Also

from the health care sector, Ireland-based ICON plc underperformed, with its share price declining after it reported weaker-than-expected

first quarter 2025 results and lowered full-year guidance, and after it cited delays and cancellations in clinical

trial activity—particularly among biotech clients—highlighting ongoing softness in the contract research market.

|

|

↓

|

From

the energy sector, BP detracted due to timing rather than thesis. The Fund initiated the position mid-period and held it through

a softer phase for the shares; then exited ahead of the late-August recovery, so the holding window captured the drawdown

but not the subsequent rebound. |

|

|

1

Year |

5

Year |

10

Year |

|

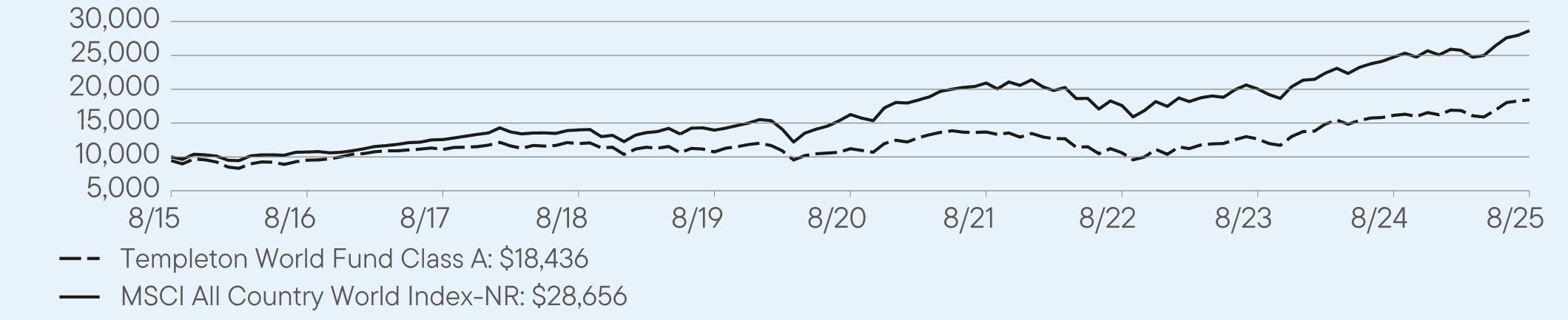

Class

A |

14.23

|

10.44

|

6.91

|

|

Class

A (with sales charge) |

7.92

|

9.20

|

6.31

|

|

MSCI

All Country World Index-NR |

15.79

|

12.00

|

11.10

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total

Net Assets |

$2,797,739,781

|

|

Total

Number of Portfolio Holdings |

46

|

|

Total

Management Fee Paid |

$18,583,845

|

|

Portfolio

Turnover Rate |

100.16%

|

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment |

|

Class

C |

$192

|

1.80%

|

|

Top

contributors to performance: | |

|

↑

|

Rolls-Royce

Holdings saw shares surge over the year as its turnaround project continued to deliver profits and cash flow stepped up,

distributions were reinstated alongside a buyback, and guidance was raised after a strong first half. Sentiment was further supported

by civil-aerospace recovery, steady defense and progress on small modular reactors. |

|

↑

|

A

newly established position in Safran SA added value over the period as the company delivered strong results and maintained a positive

outlook. Growth in its core businesses and steady demand for services supported confidence, while a favorable environment

for aerospace and defense provided an additional boost. |

|

↑

|

GE

Vernova, a U.S.-based electrification and power-equipment provider (wind turbines, gas turbines and grid solutions), benefited

from U.S. generation and grid build-out and rising data-center power demand, but the position was closed during the period

on valuation after a strong run. |

|

Top

detractors from performance: | |

|

↓

|

UnitedHealth

detracted as it shares sold off in the second quarter of 2025 after a first quarter earnings miss, higher-than-expected

Medicare Advantage medical costs, a surprise CEO change, and news of a federal investigation; the Fund exited

the position during the period as these developments undermined the original thesis. |

|

↓

|

Also

from the health care sector, Ireland-based ICON plc underperformed, with its share price declining after it reported weaker-than-expected

first quarter 2025 results and lowered full-year guidance, and after it cited delays and cancellations in clinical

trial activity—particularly among biotech clients—highlighting ongoing softness in the contract research market.

|

|

↓

|

From

the energy sector, BP detracted due to timing rather than thesis. The Fund initiated the position mid-period and held it through

a softer phase for the shares; then exited ahead of the late-August recovery, so the holding window captured the drawdown

but not the subsequent rebound. |

|

|

1

Year |

5

Year |

10

Year |

|

Class

C |

13.39

|

9.62

|

6.10

|

|

Class

C (with sales charge) |

12.39

|

9.62

|

6.10

|

|

MSCI

All Country World Index-NR |

15.79

|

12.00

|

11.10

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total

Net Assets |

$2,797,739,781

|

|

Total

Number of Portfolio Holdings |

46

|

|

Total

Management Fee Paid |

$18,583,845

|

|

Portfolio

Turnover Rate |

100.16%

|

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment*

|

|

Class

R6 |

$82

|

0.76%

|

|

Top

contributors to performance: | |

|

↑

|

Rolls-Royce

Holdings saw shares surge over the year as its turnaround project continued to deliver profits and cash flow stepped up,

distributions were reinstated alongside a buyback, and guidance was raised after a strong first half. Sentiment was further supported

by civil-aerospace recovery, steady defense and progress on small modular reactors. |

|

↑

|

A

newly established position in Safran SA added value over the period as the company delivered strong results and maintained a positive

outlook. Growth in its core businesses and steady demand for services supported confidence, while a favorable environment

for aerospace and defense provided an additional boost. |

|

↑

|

GE

Vernova, a U.S.-based electrification and power-equipment provider (wind turbines, gas turbines and grid solutions), benefited

from U.S. generation and grid build-out and rising data-center power demand, but the position was closed during the period

on valuation after a strong run. |

|

Top

detractors from performance: | |

|

↓

|

UnitedHealth

detracted as it shares sold off in the second quarter of 2025 after a first quarter earnings miss, higher-than-expected

Medicare Advantage medical costs, a surprise CEO change, and news of a federal investigation; the Fund exited

the position during the period as these developments undermined the original thesis. |

|

↓

|

Also

from the health care sector, Ireland-based ICON plc underperformed, with its share price declining after it reported weaker-than-expected

first quarter 2025 results and lowered full-year guidance, and after it cited delays and cancellations in clinical

trial activity—particularly among biotech clients—highlighting ongoing softness in the contract research market.

|

|

↓

|

From

the energy sector, BP detracted due to timing rather than thesis. The Fund initiated the position mid-period and held it through

a softer phase for the shares; then exited ahead of the late-August recovery, so the holding window captured the drawdown

but not the subsequent rebound. |

|

|

1

Year |

5

Year |

10

Year |

|

Class

R6 |

14.61

|

10.77

|

7.24

|

|

MSCI

All Country World Index-NR |

15.79

|

12.00

|

11.10

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total

Net Assets |

$2,797,739,781

|

|

Total

Number of Portfolio Holdings |

46

|

|

Total

Management Fee Paid |

$18,583,845

|

|

Portfolio

Turnover Rate |

100.16%

|

prospectus.us.franklintempleton@fisglobal.com.

|

Class

Name |

Costs

of a $10,000 investment

|

Costs

paid as a percentage of a $10,000

investment |

|

Advisor

Class |

$86

|

0.80%

|

|

Top

contributors to performance: | |

|

↑

|

Rolls-Royce

Holdings saw shares surge over the year as its turnaround project continued to deliver profits and cash flow stepped up,

distributions were reinstated alongside a buyback, and guidance was raised after a strong first half. Sentiment was further supported

by civil-aerospace recovery, steady defense and progress on small modular reactors. |

|

↑

|

A

newly established position in Safran SA added value over the period as the company delivered strong results and maintained a positive

outlook. Growth in its core businesses and steady demand for services supported confidence, while a favorable environment

for aerospace and defense provided an additional boost. |

|

↑

|

GE

Vernova, a U.S.-based electrification and power-equipment provider (wind turbines, gas turbines and grid solutions), benefited

from U.S. generation and grid build-out and rising data-center power demand, but the position was closed during the period

on valuation after a strong run. |

|

Top

detractors from performance: | |

|

↓

|

UnitedHealth

detracted as it shares sold off in the second quarter of 2025 after a first quarter earnings miss, higher-than-expected

Medicare Advantage medical costs, a surprise CEO change, and news of a federal investigation; the Fund exited

the position during the period as these developments undermined the original thesis. |

|

↓

|

Also

from the health care sector, Ireland-based ICON plc underperformed, with its share price declining after it reported weaker-than-expected

first quarter 2025 results and lowered full-year guidance, and after it cited delays and cancellations in clinical

trial activity—particularly among biotech clients—highlighting ongoing softness in the contract research market.

|

|

↓

|

From

the energy sector, BP detracted due to timing rather than thesis. The Fund initiated the position mid-period and held it through

a softer phase for the shares; then exited ahead of the late-August recovery, so the holding window captured the drawdown

but not the subsequent rebound. |

|

|

1

Year |

5

Year |

10

Year |

|

Advisor

Class |

14.55

|

10.72

|

7.18

|

|

MSCI

All Country World Index-NR |

15.79

|

12.00

|

11.10

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total

Net Assets |

$2,797,739,781

|

|

Total

Number of Portfolio Holdings |

46

|

|

Total

Management Fee Paid |

$18,583,845

|

|

Portfolio

Turnover Rate |

100.16%

|

prospectus.us.franklintempleton@fisglobal.com.

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|

||

| [11] |

|

||

| [12] |

|

||

| [13] |

|

||

| [14] |

|

||

| [15] |

|