|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A1,2

|

$43

|

0.42%

|

|

Top contributors to performance:

|

|

|

↑

|

Global Fixed Income strategy

|

|

↑

|

High Yield Fixed Income strategy

|

|

↑

|

International High Dividend Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

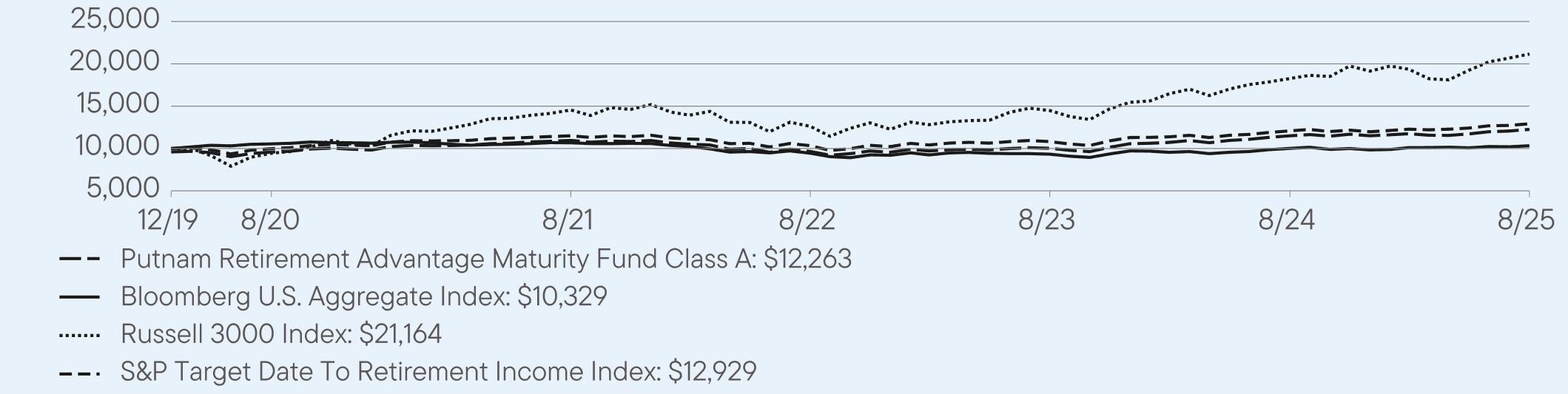

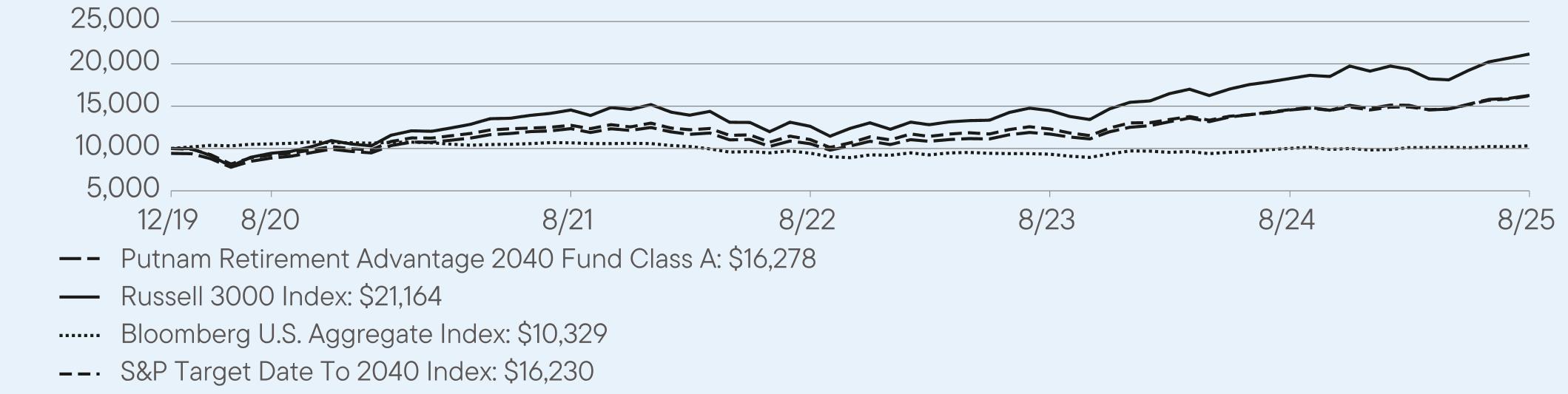

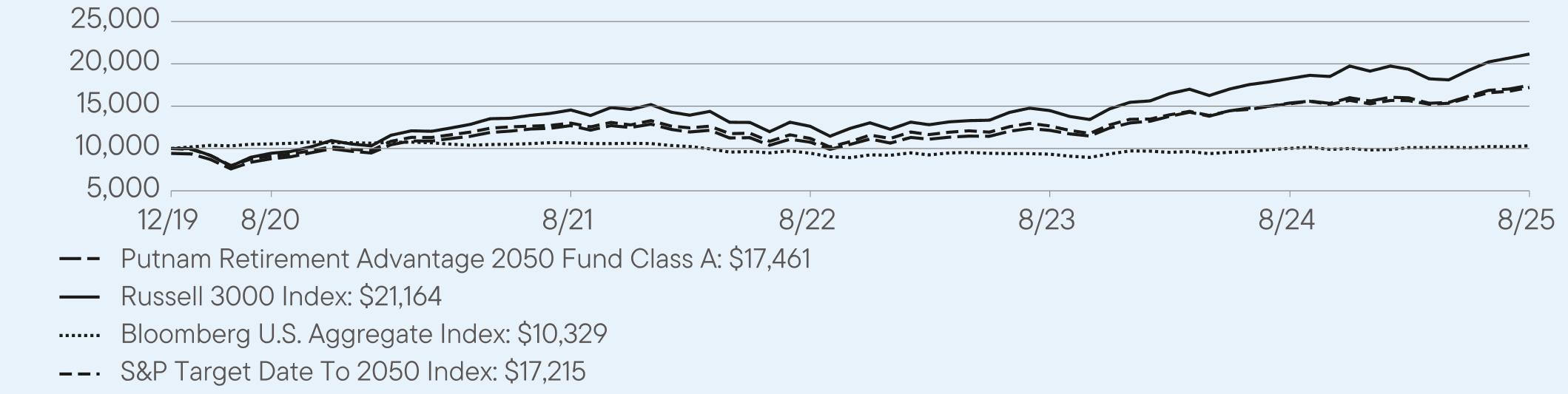

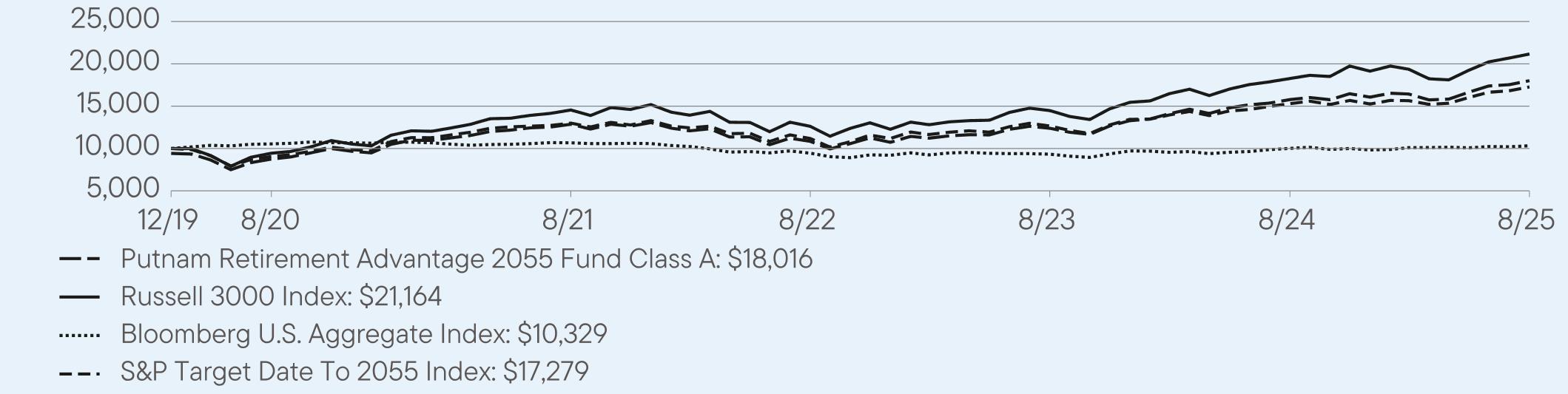

Class A

|

6.62

|

4.06

|

4.41

|

|

Class A (with sales charge)

|

2.35

|

3.21

|

3.67

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

S&P Target Date To Retirement Income Index

|

7.00

|

4.25

|

4.64

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

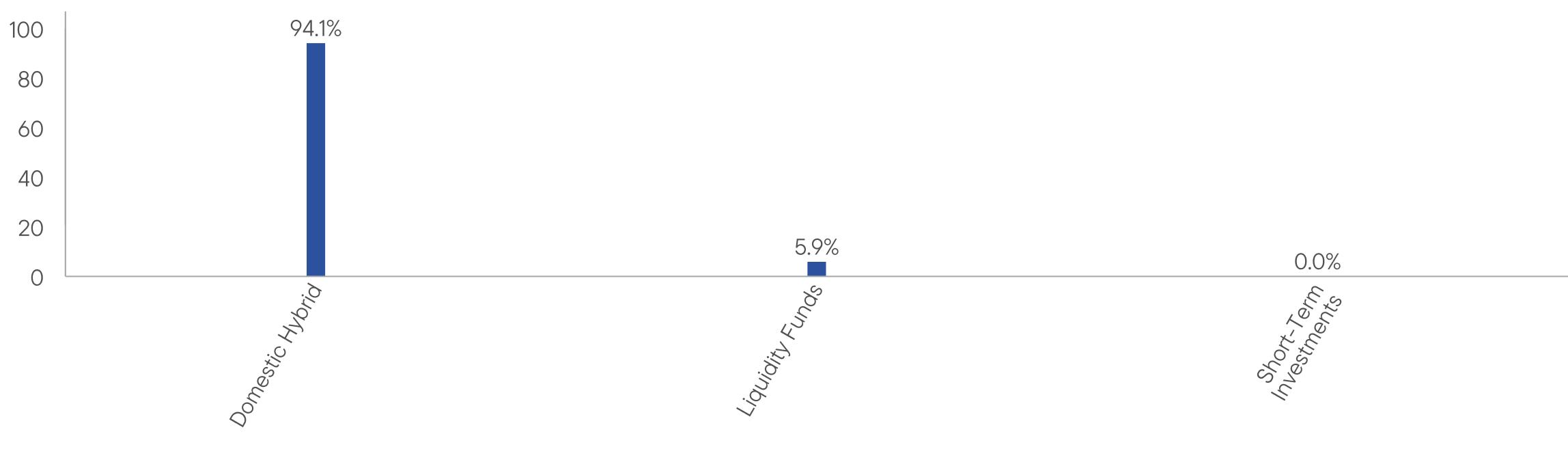

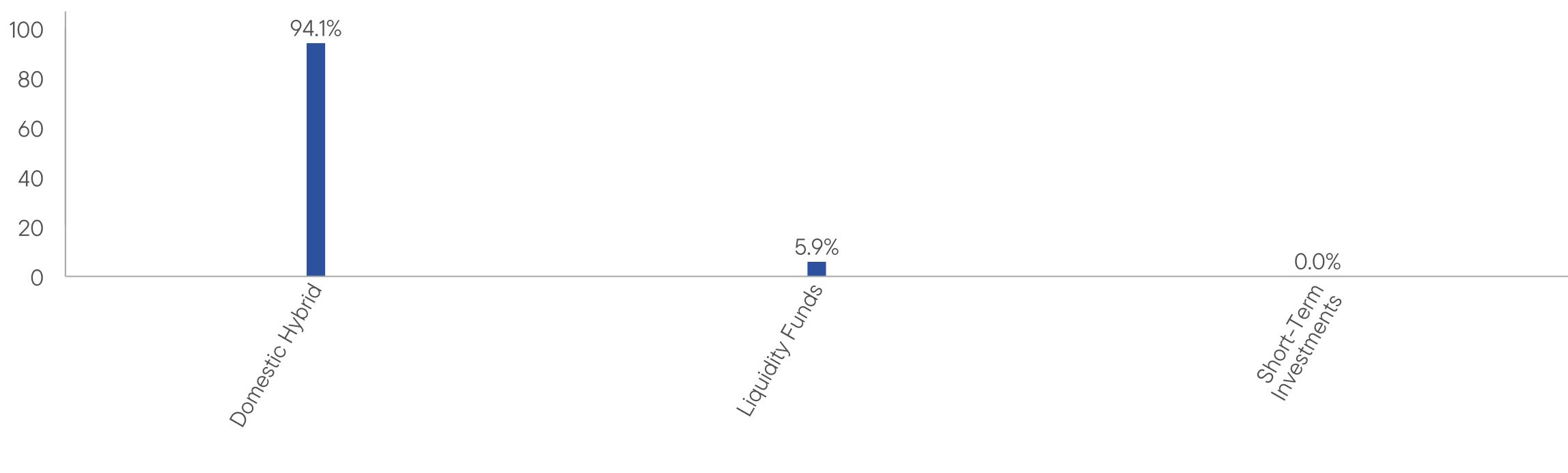

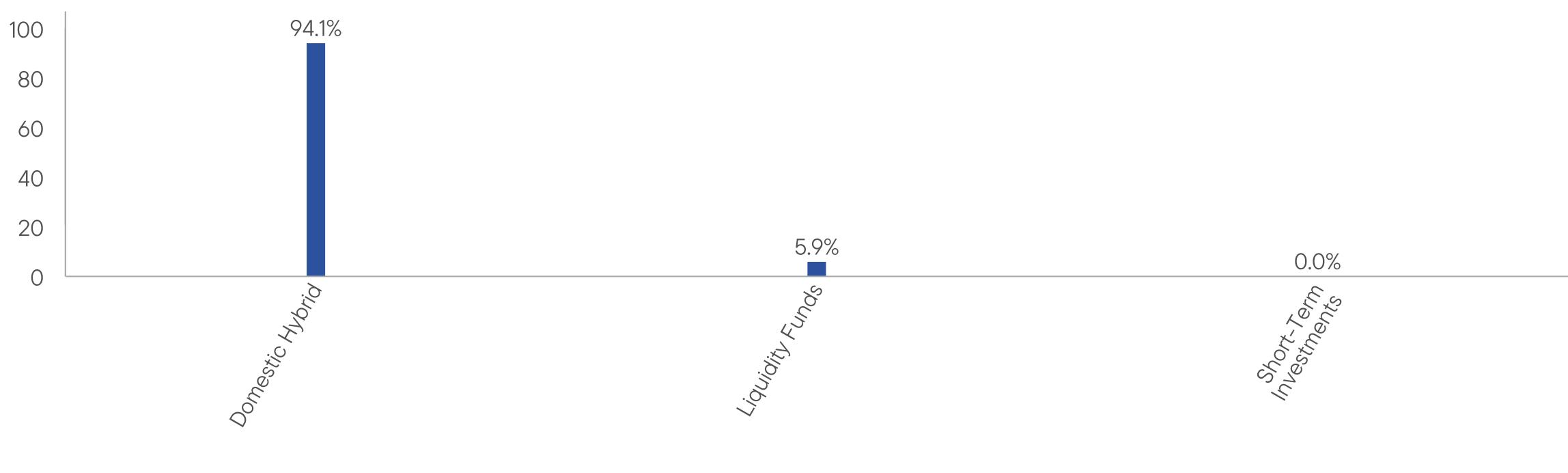

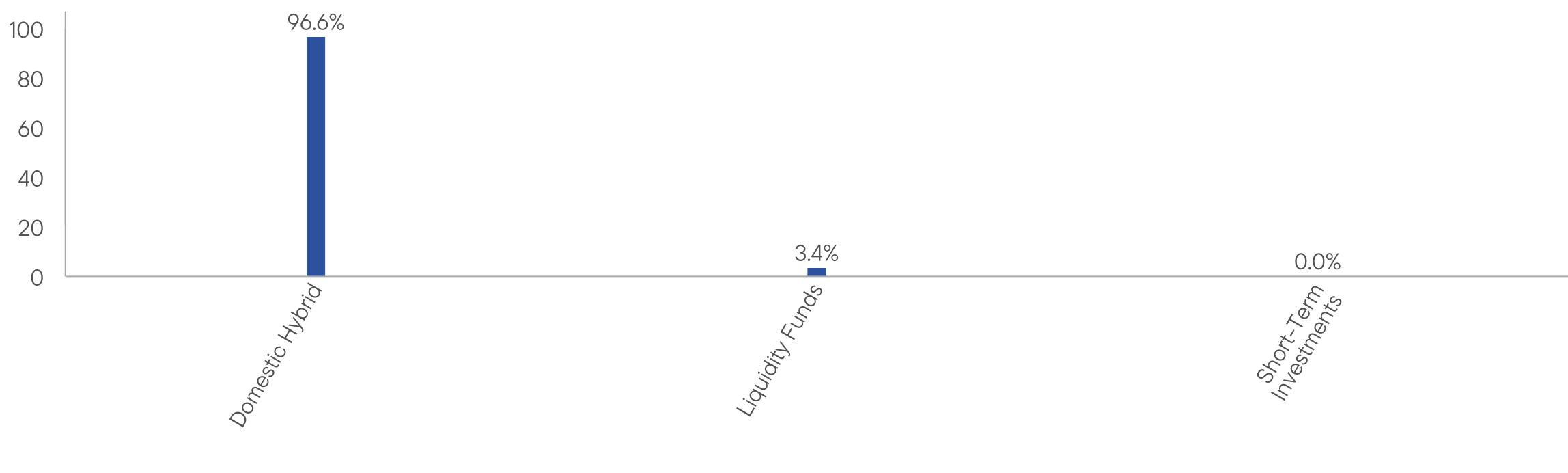

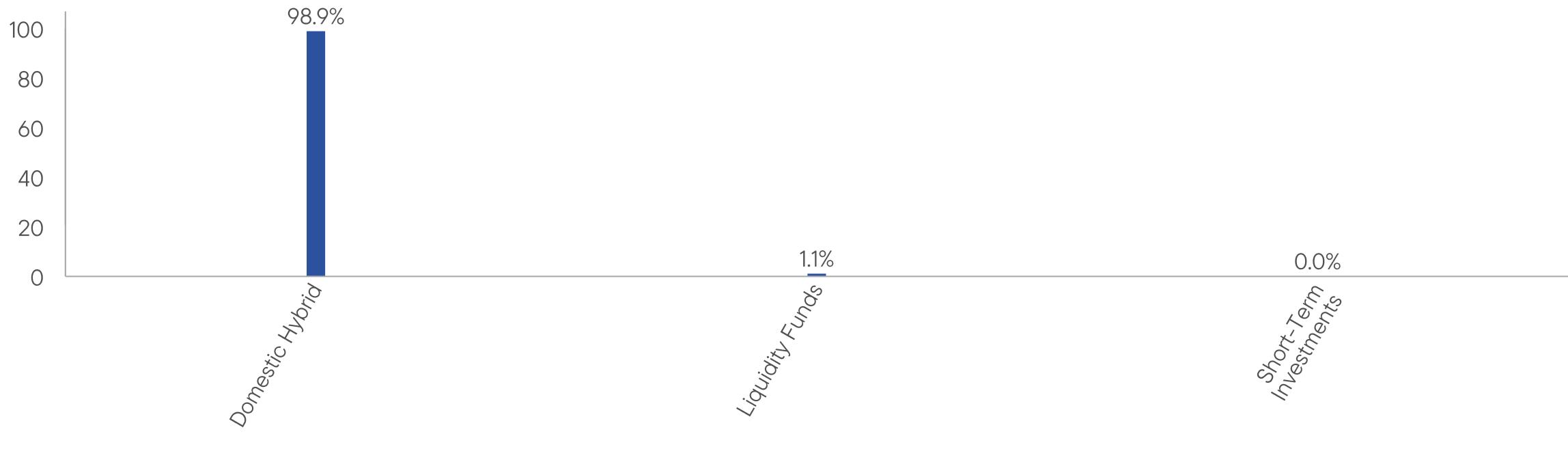

Total Net Assets

|

$41,010,267

|

|

Total Number of Portfolio Holdings

|

2

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

58%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C1,2

|

$121

|

1.18%

|

|

Top contributors to performance:

|

|

|

↑

|

Global Fixed Income strategy

|

|

↑

|

High Yield Fixed Income strategy

|

|

↑

|

International High Dividend Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

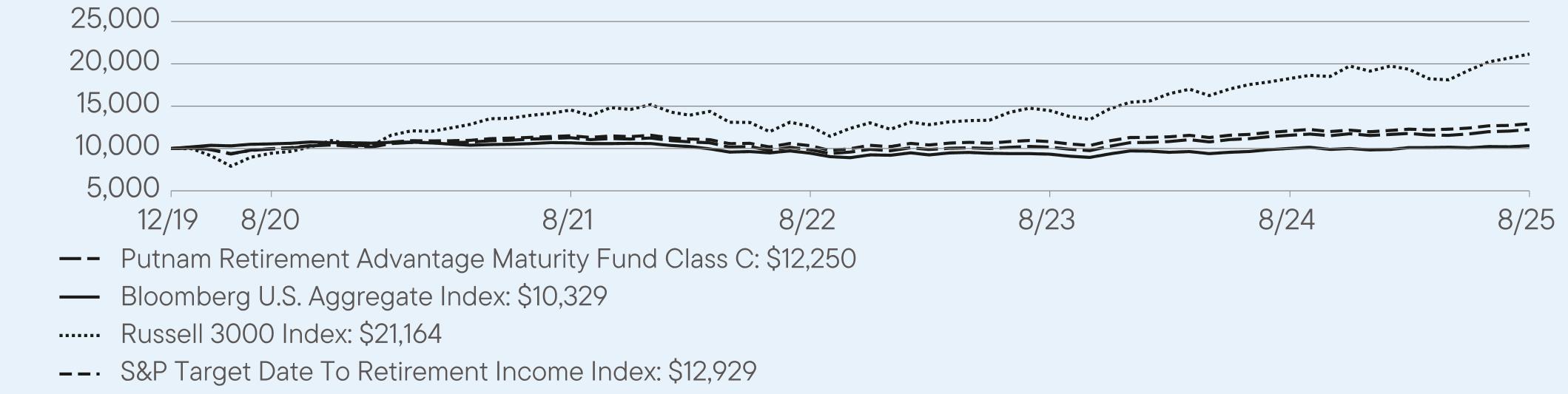

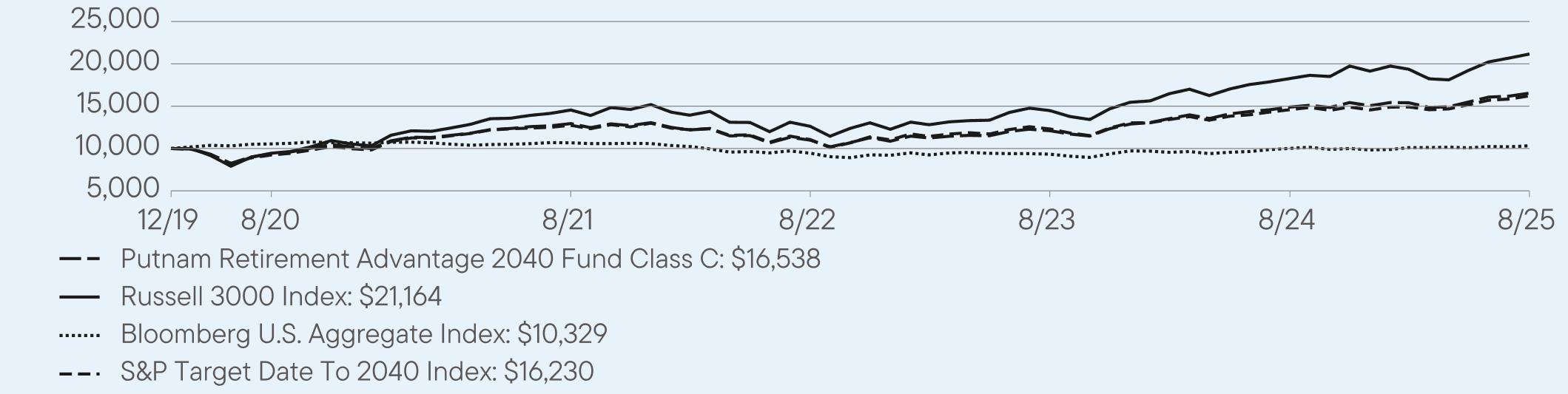

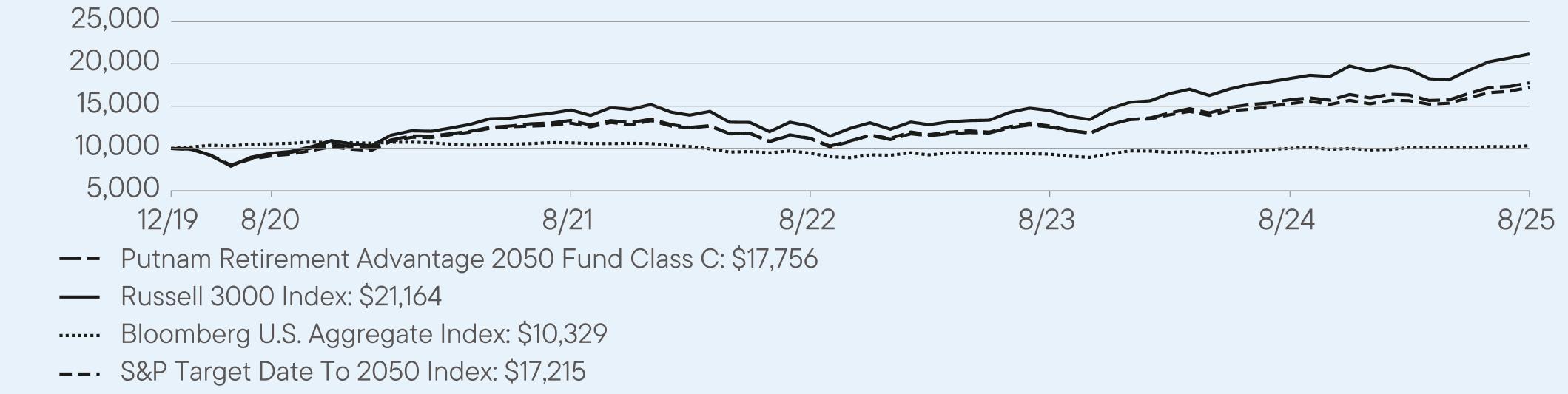

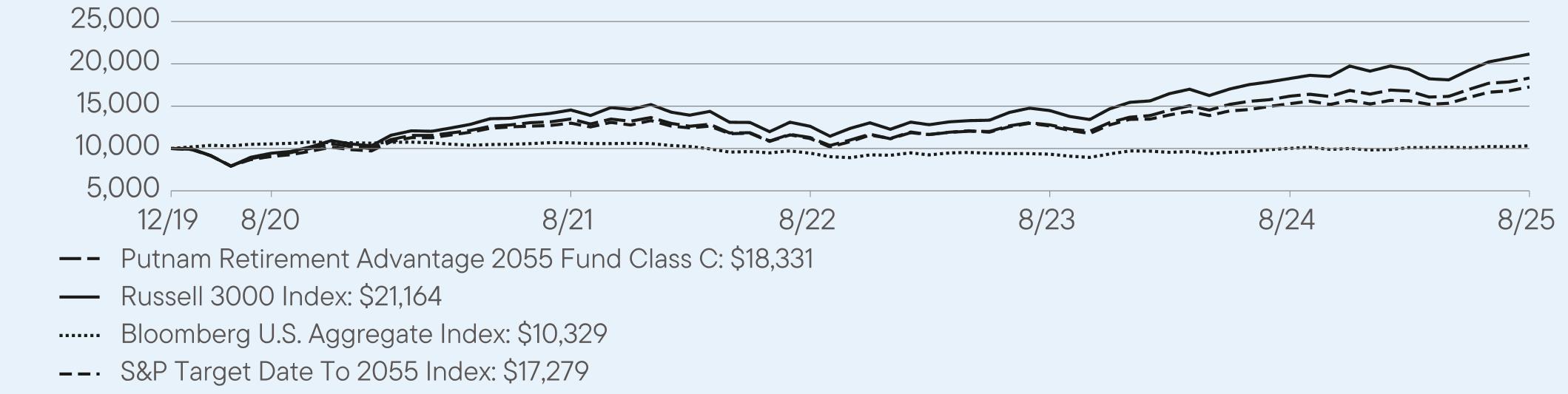

Class C

|

5.88

|

3.30

|

3.65

|

|

Class C (with sales charge)

|

4.88

|

3.30

|

3.65

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

S&P Target Date To Retirement Income Index

|

7.00

|

4.25

|

4.64

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

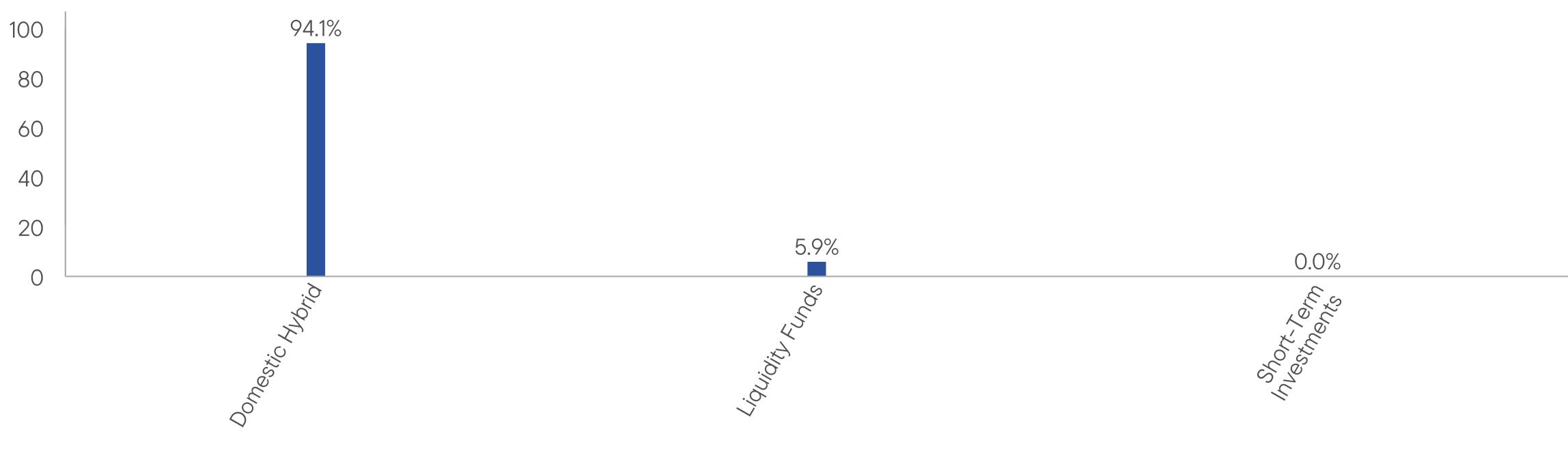

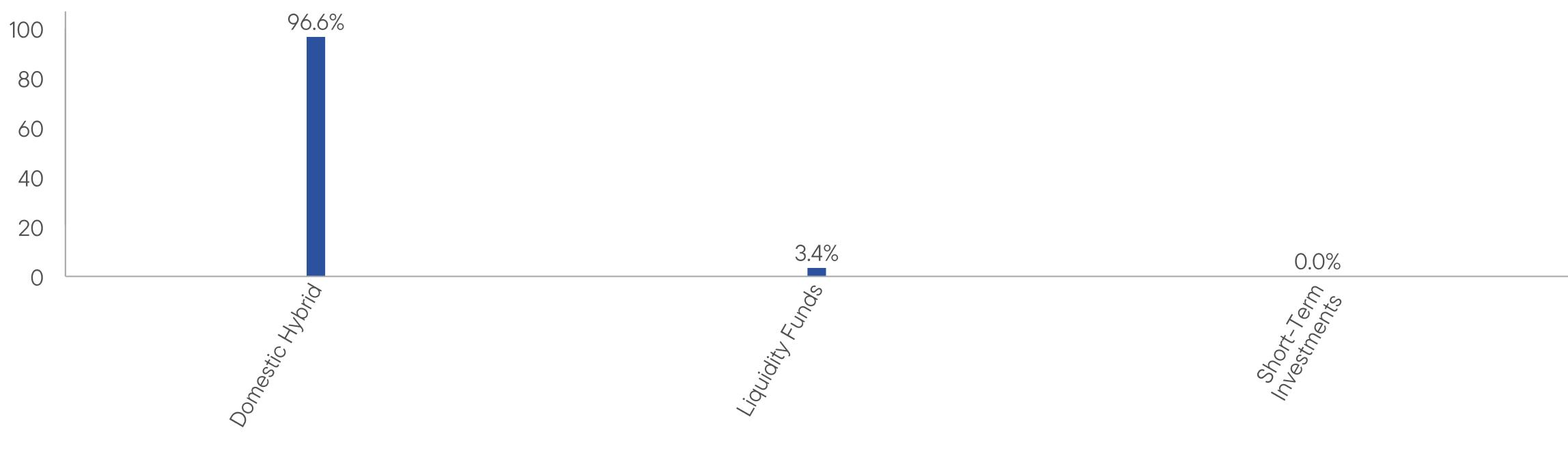

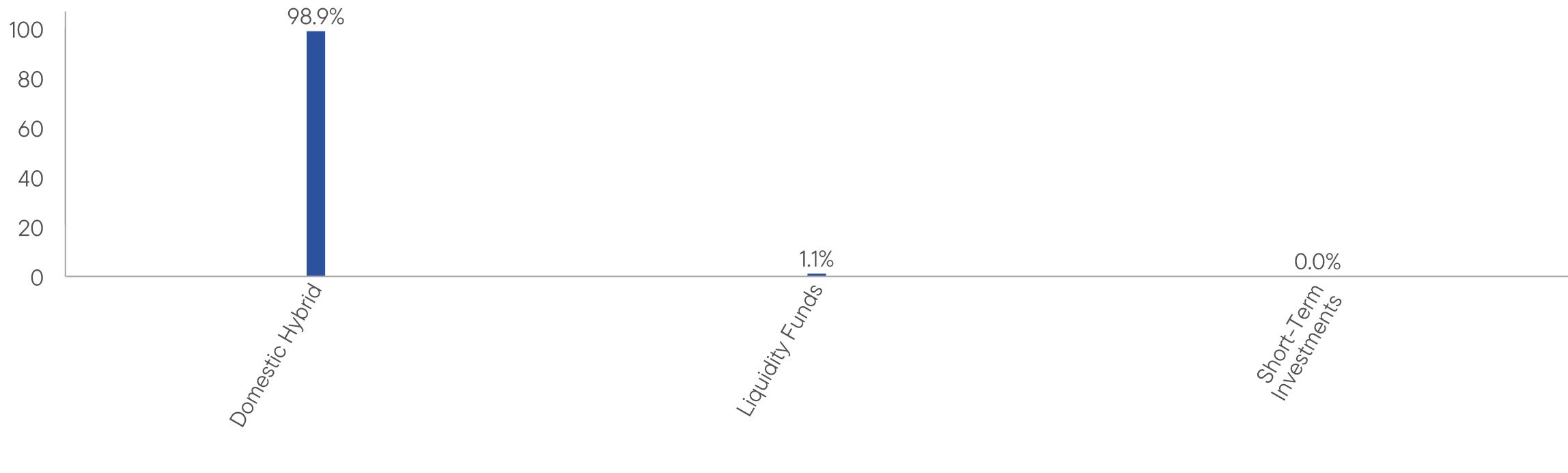

Total Net Assets

|

$41,010,267

|

|

Total Number of Portfolio Holdings

|

2

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

58%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

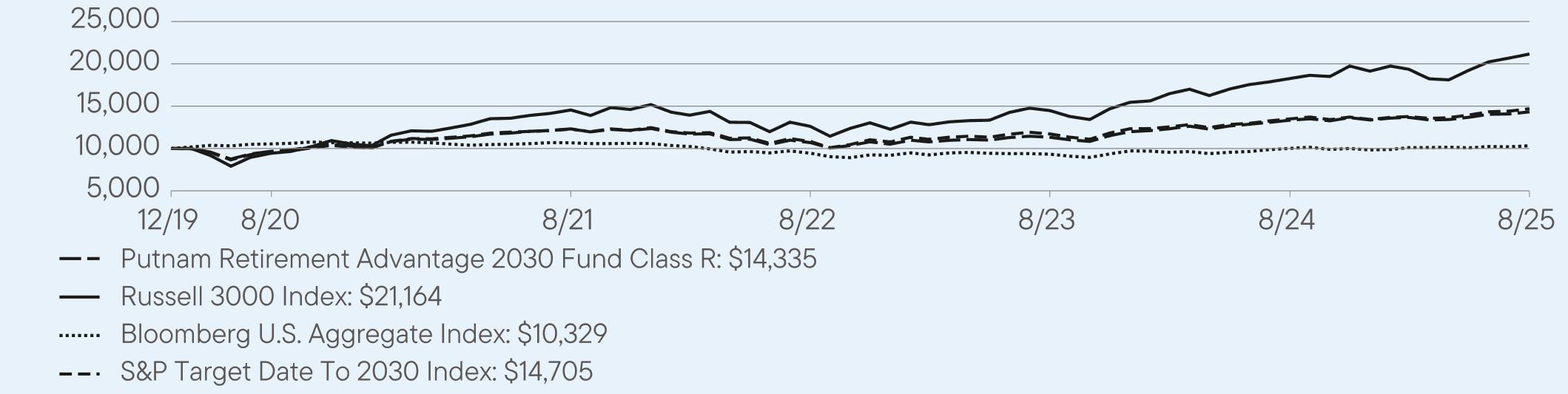

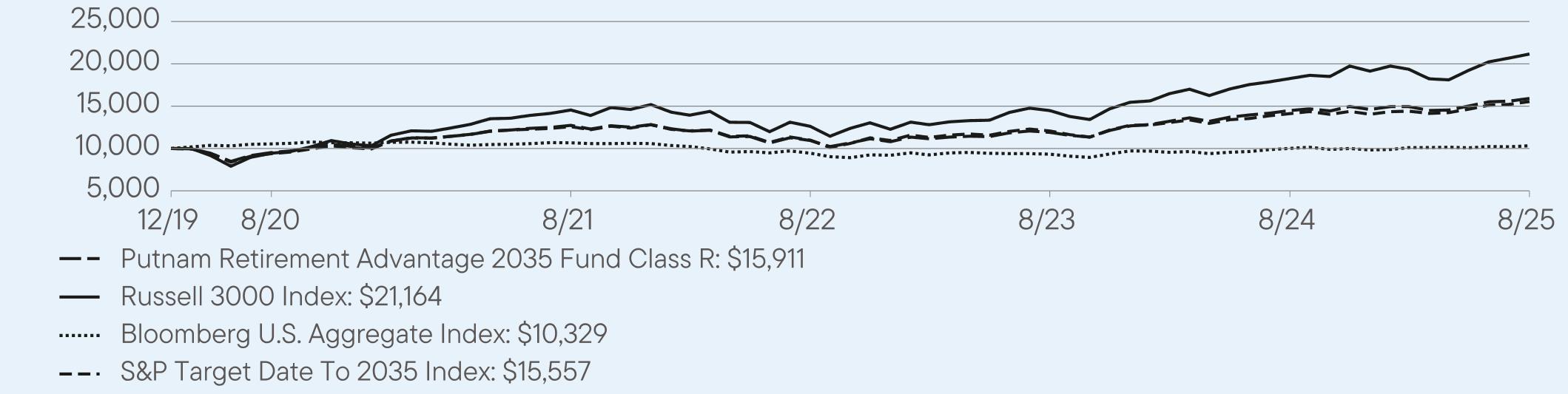

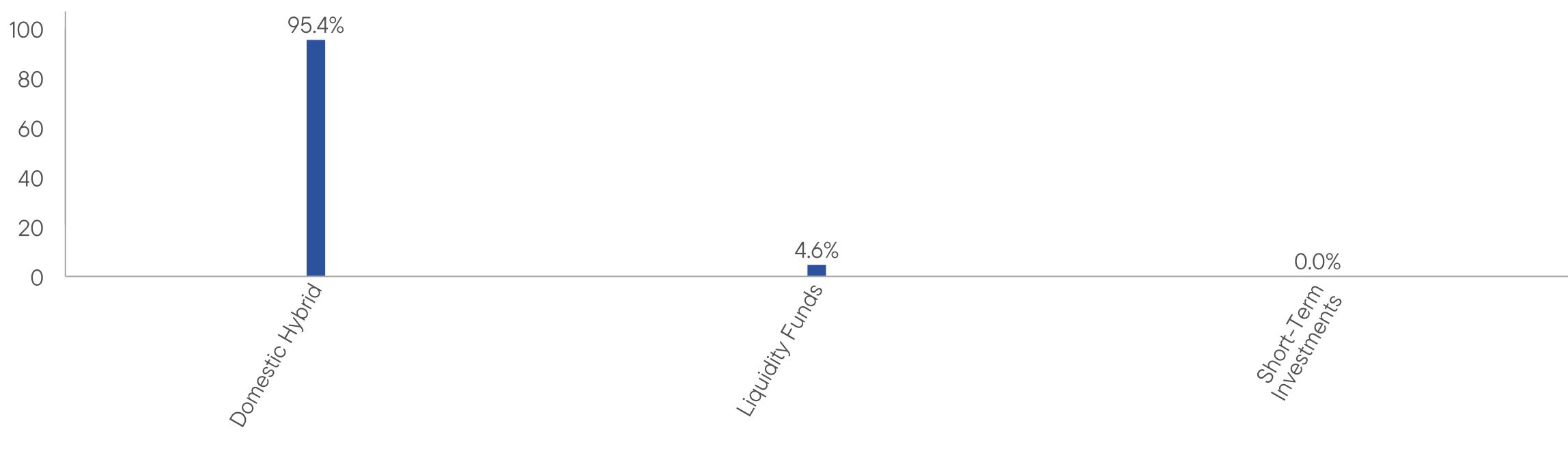

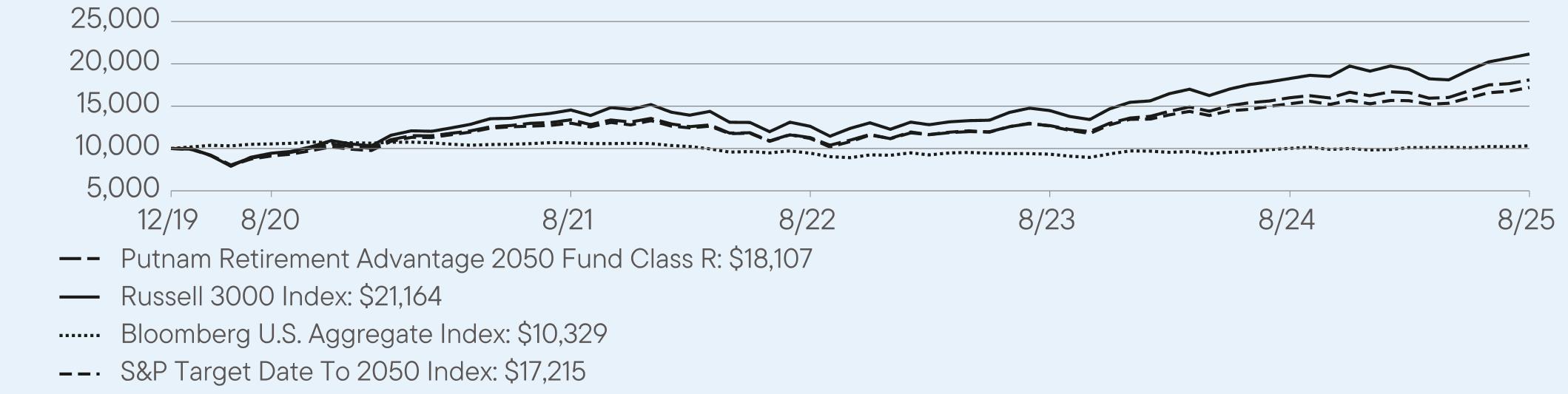

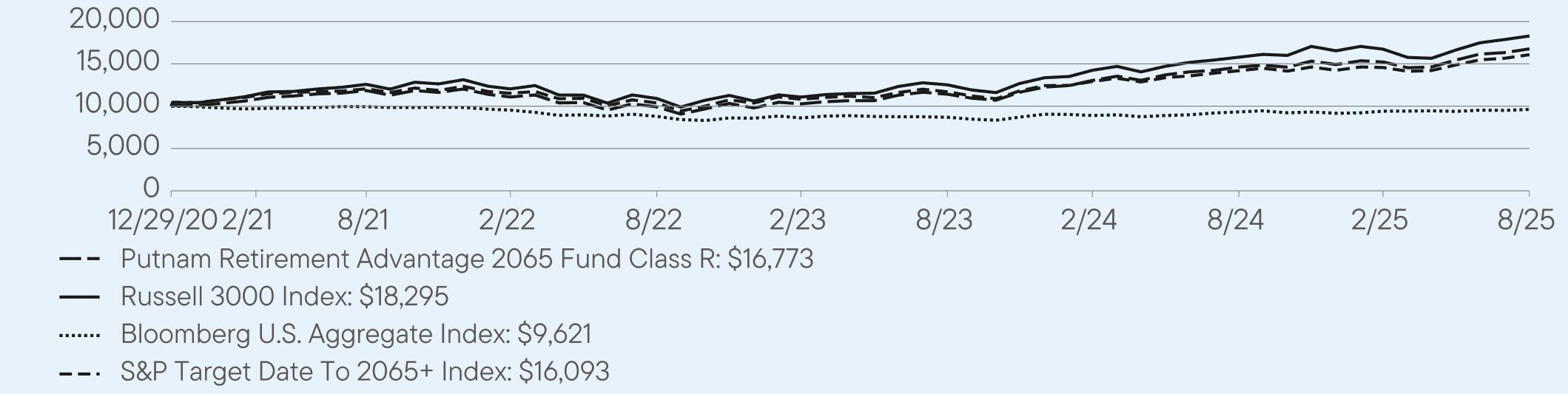

Class R1,2

|

$85

|

0.82%

|

|

Top contributors to performance:

|

|

|

↑

|

Global Fixed Income strategy

|

|

↑

|

High Yield Fixed Income strategy

|

|

↑

|

International High Dividend Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

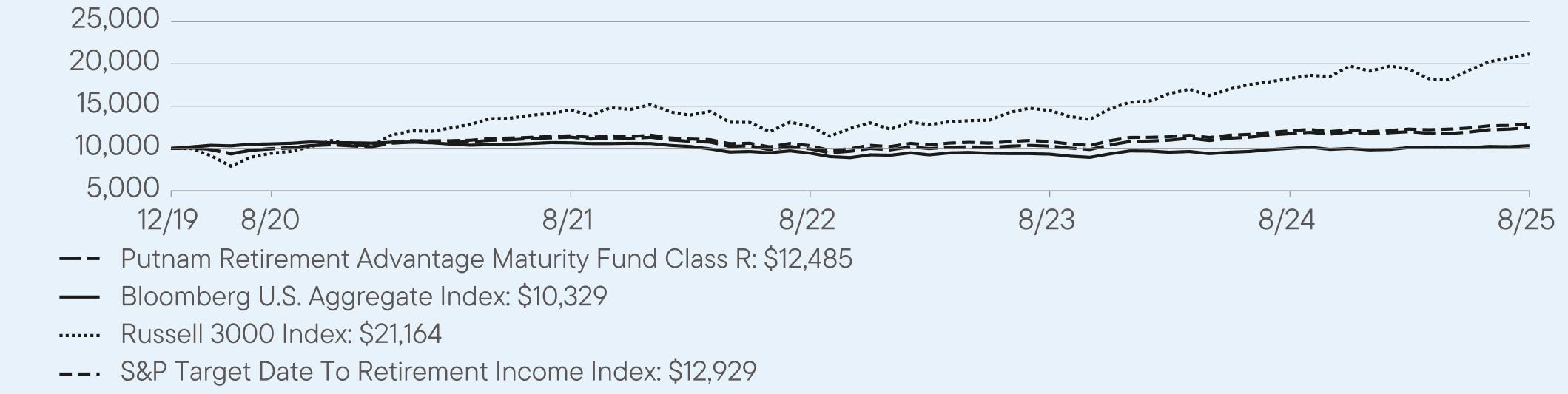

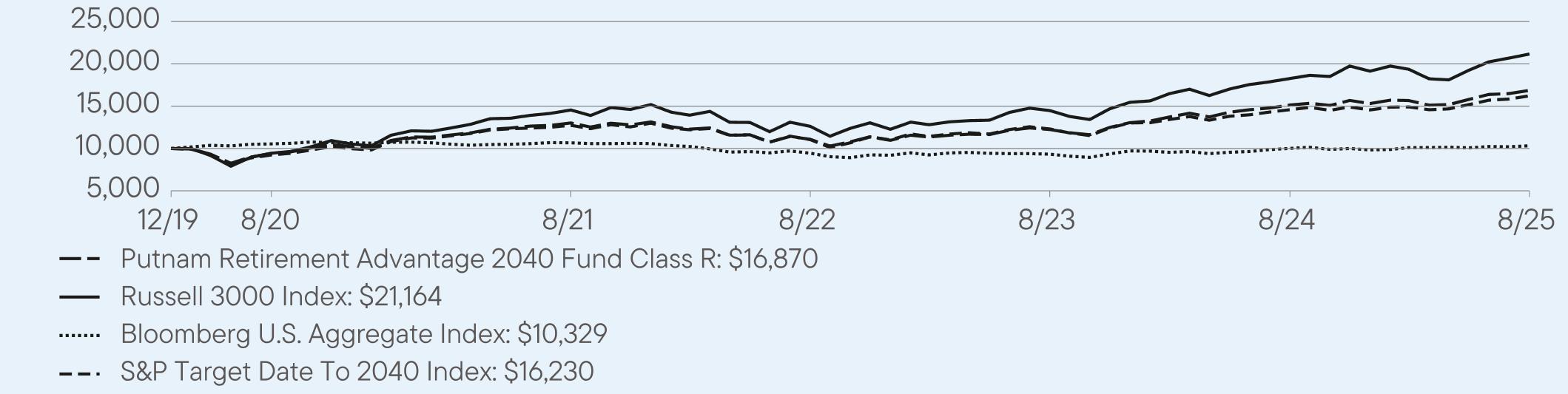

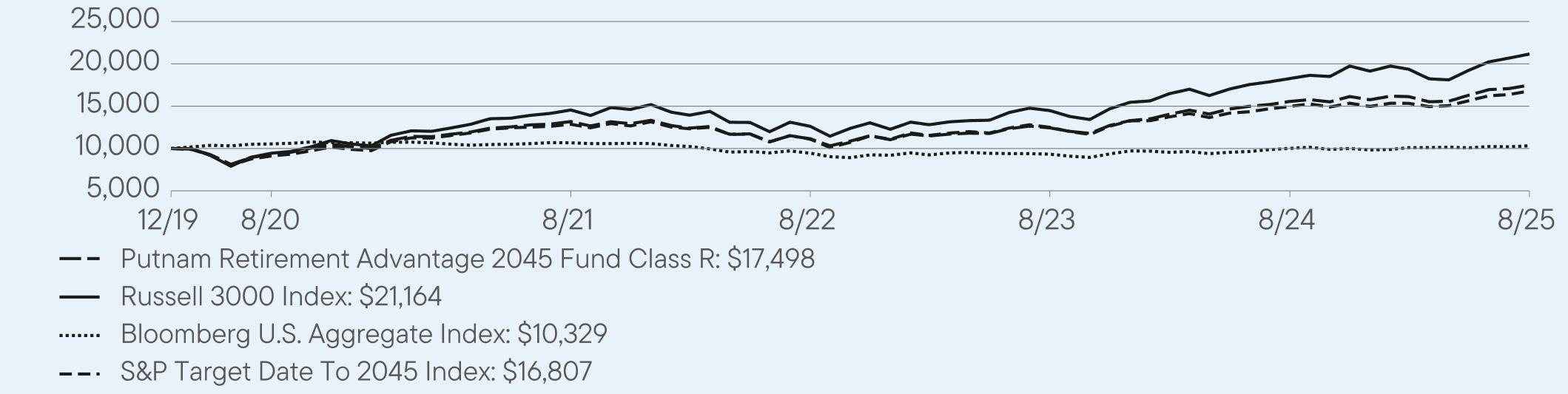

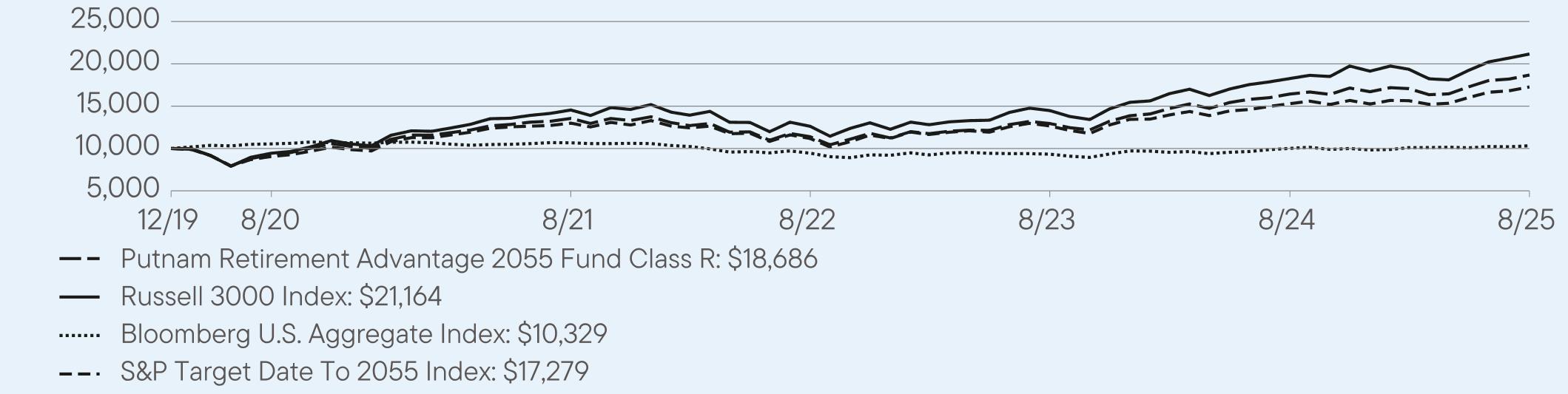

Class R

|

6.22

|

3.65

|

3.99

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

S&P Target Date To Retirement Income Index

|

7.00

|

4.25

|

4.64

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

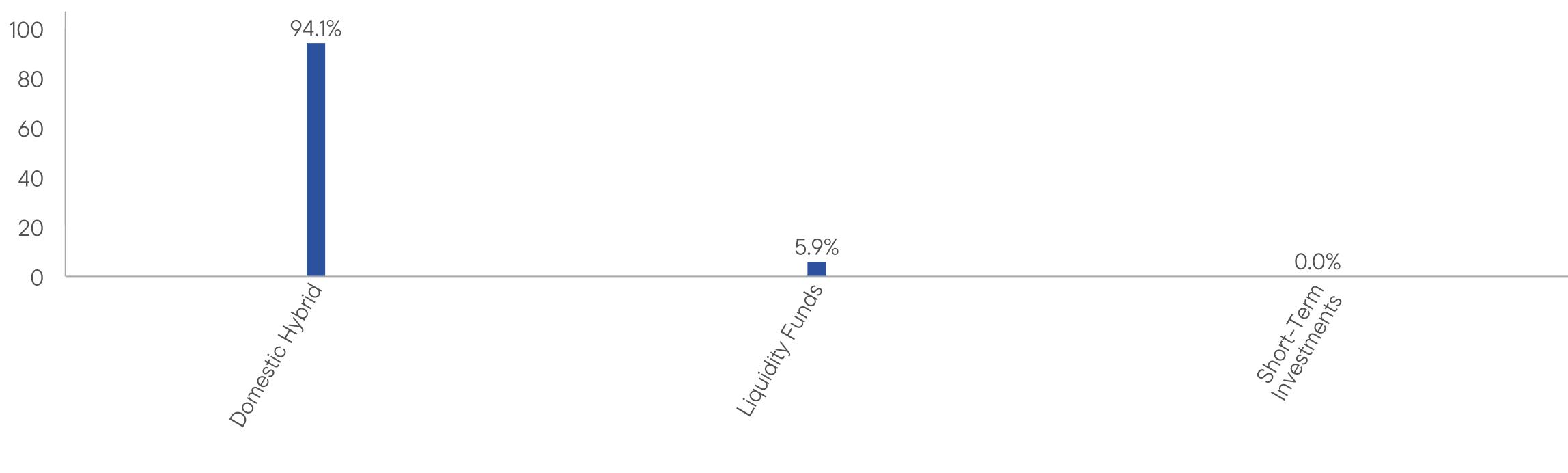

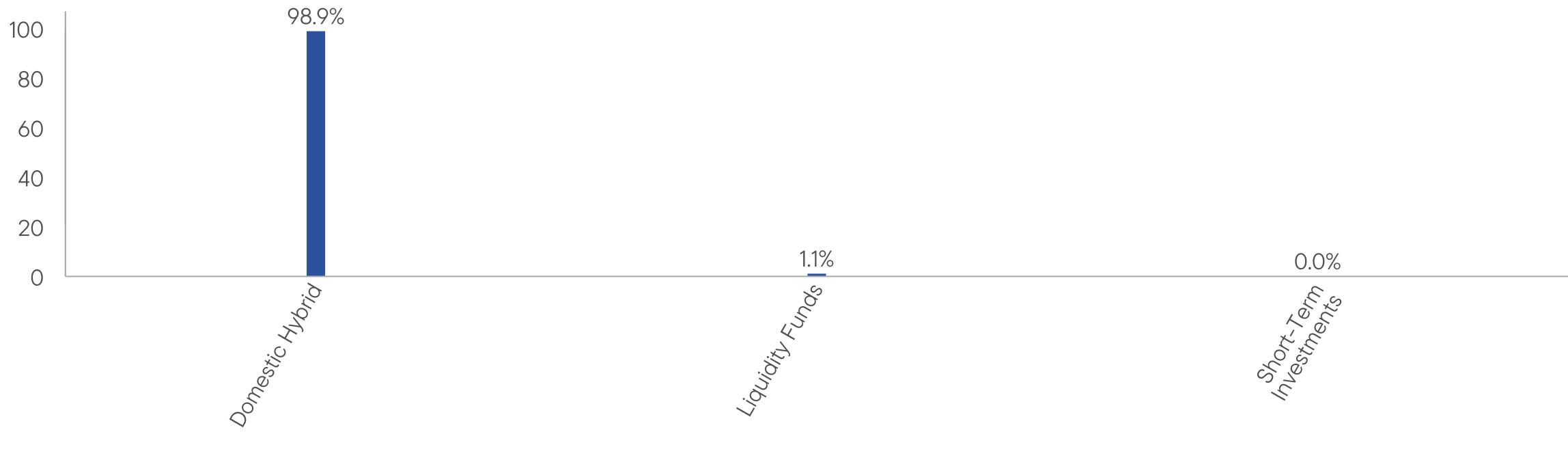

Total Net Assets

|

$41,010,267

|

|

Total Number of Portfolio Holdings

|

2

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

58%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

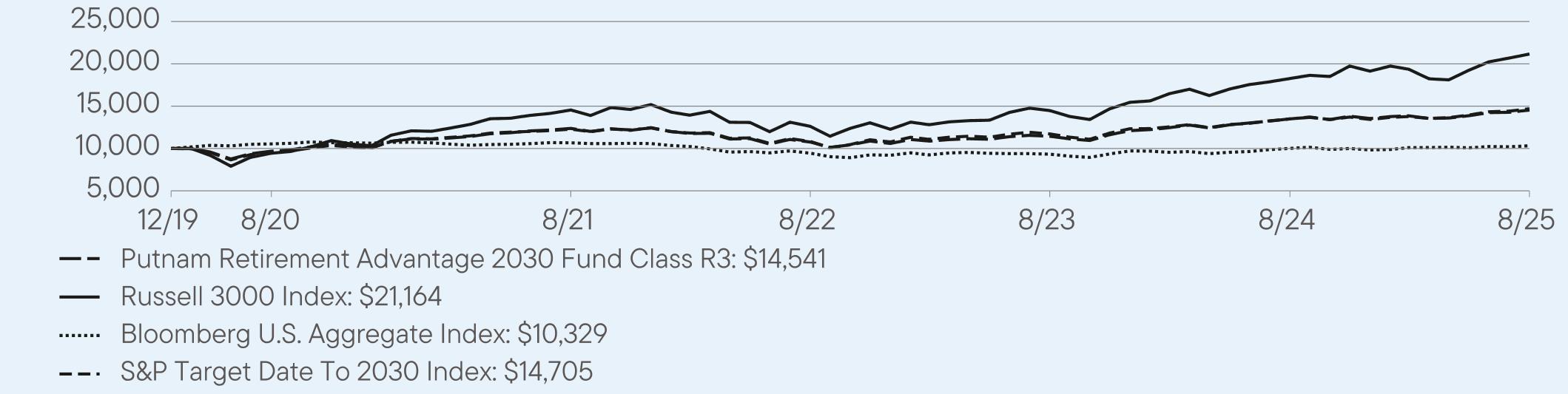

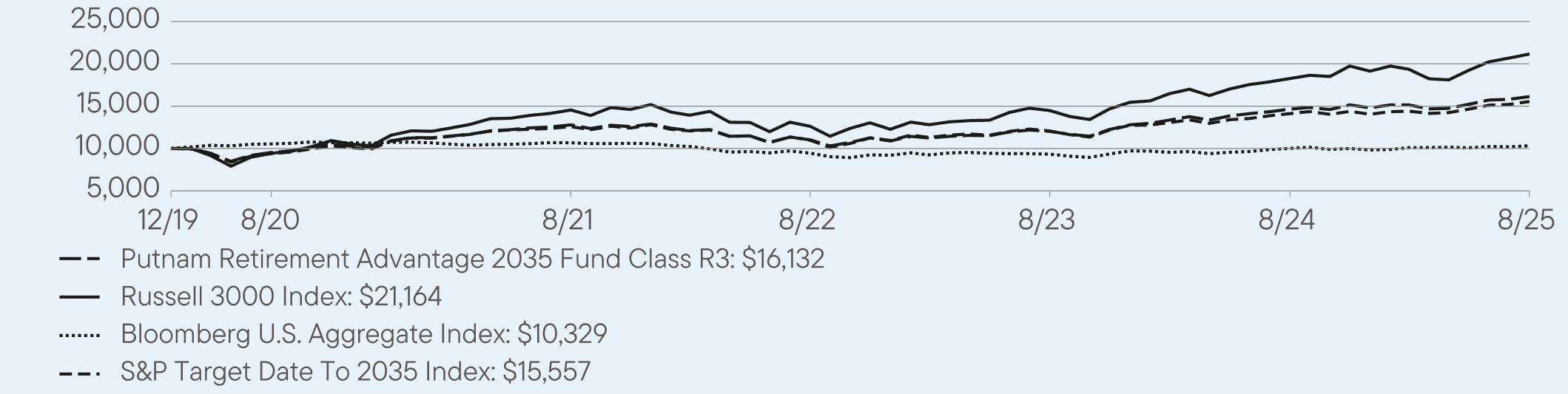

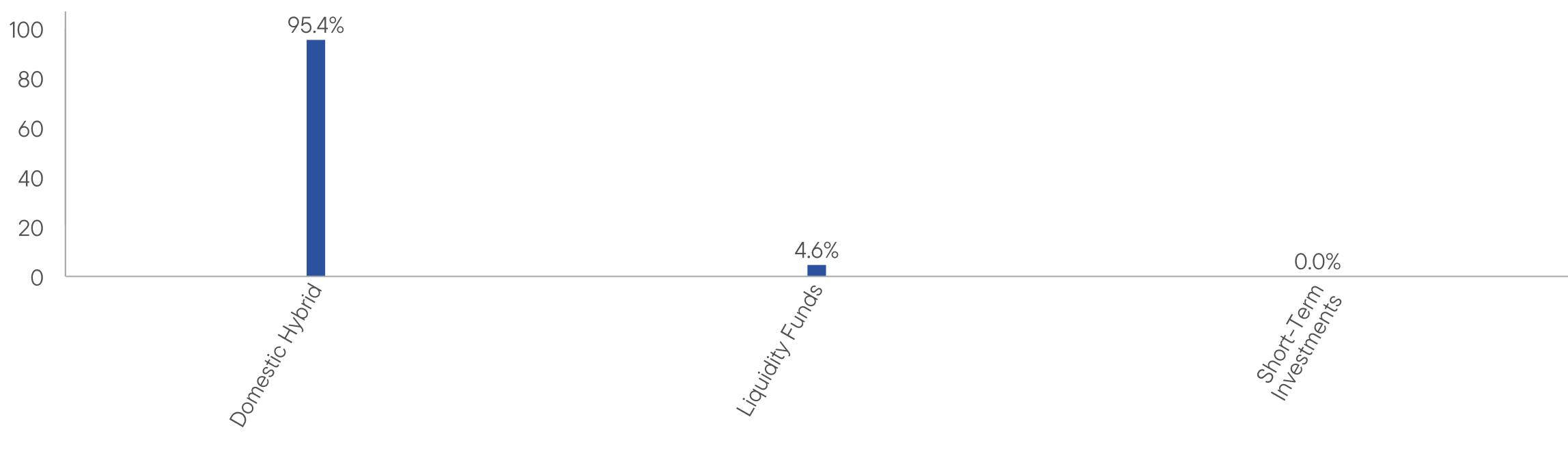

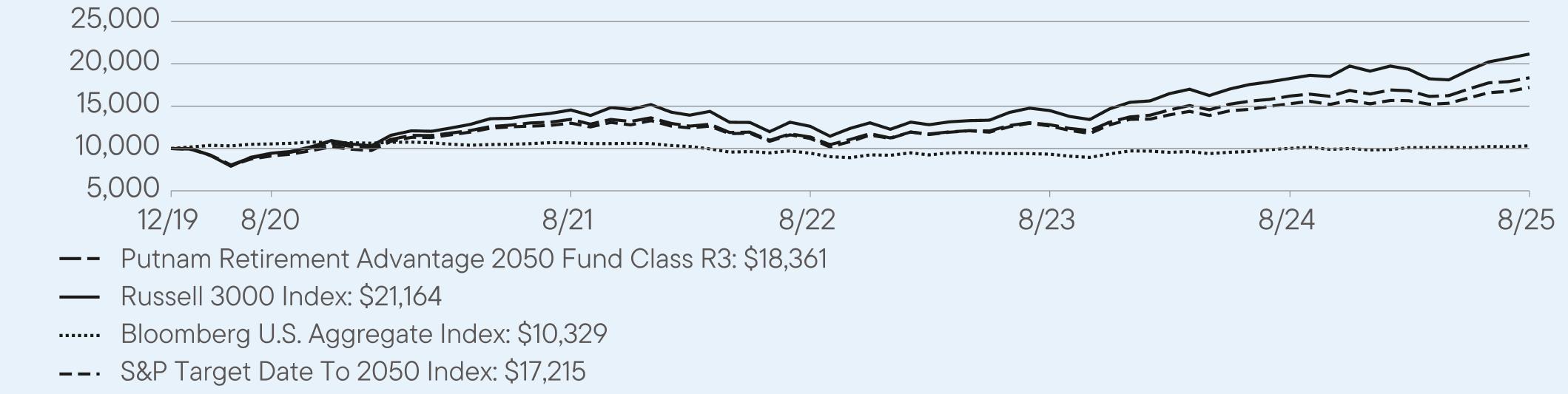

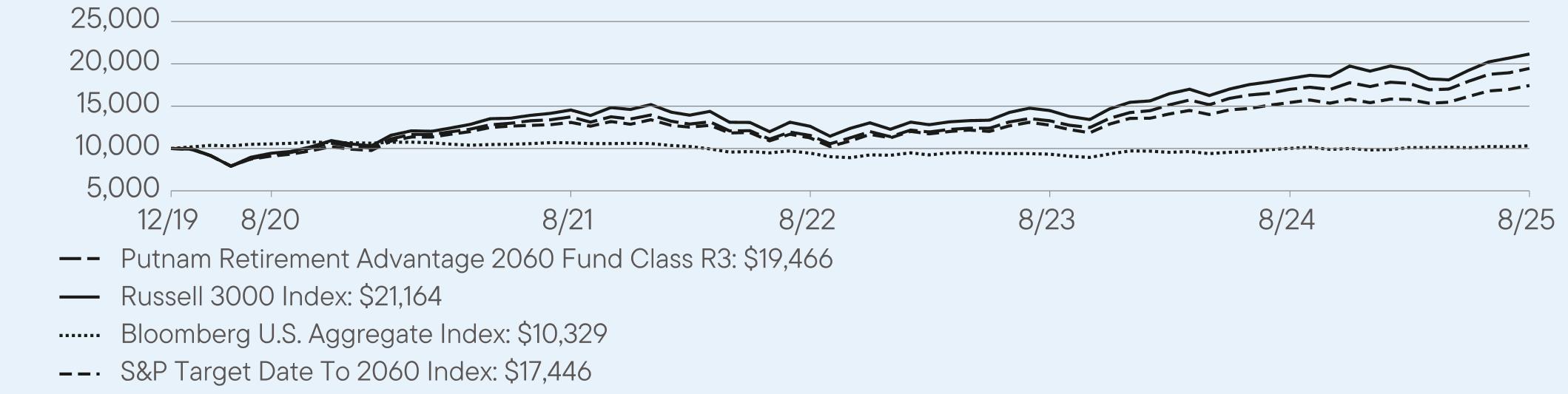

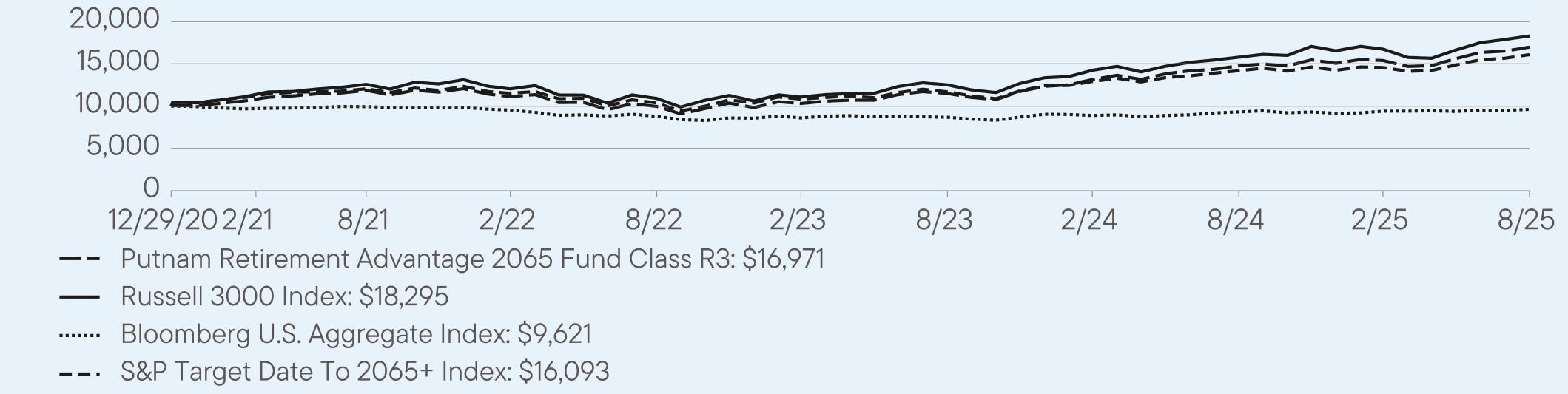

Class R31,2

|

$59

|

0.57%

|

|

Top contributors to performance:

|

|

|

↑

|

Global Fixed Income strategy

|

|

↑

|

High Yield Fixed Income strategy

|

|

↑

|

International High Dividend Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

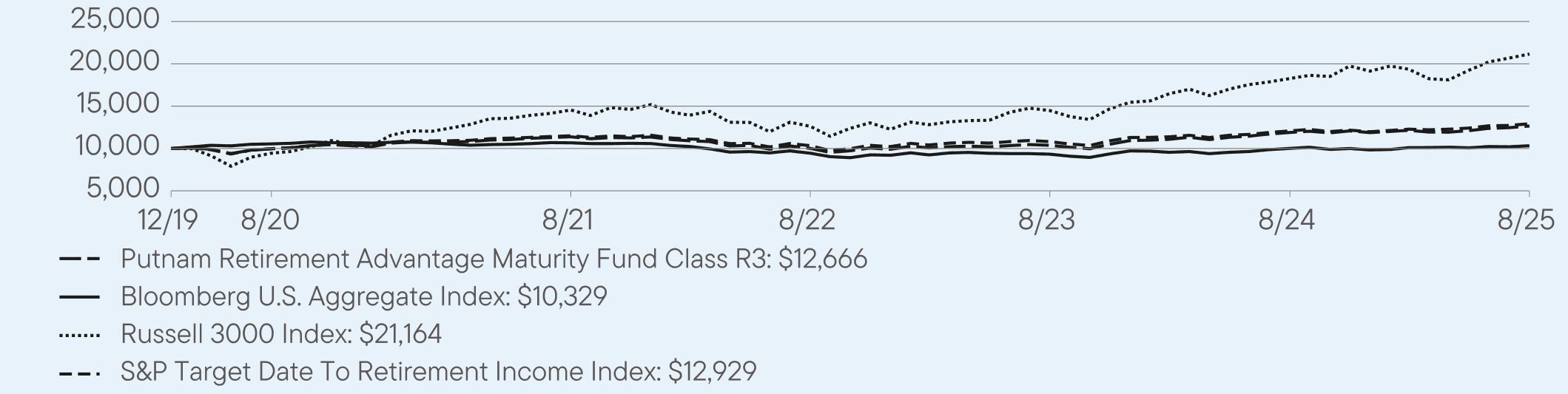

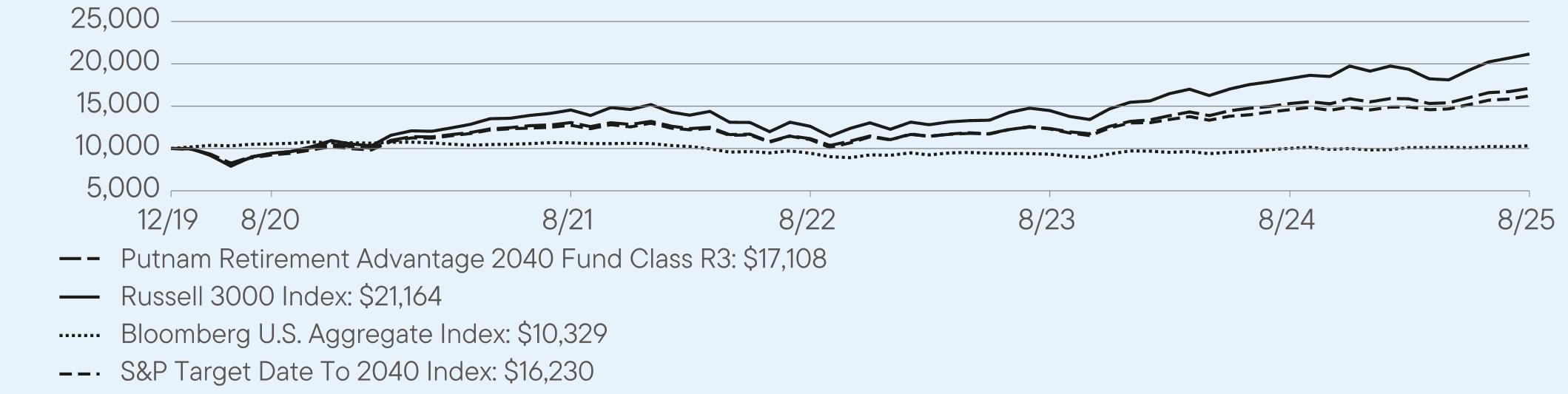

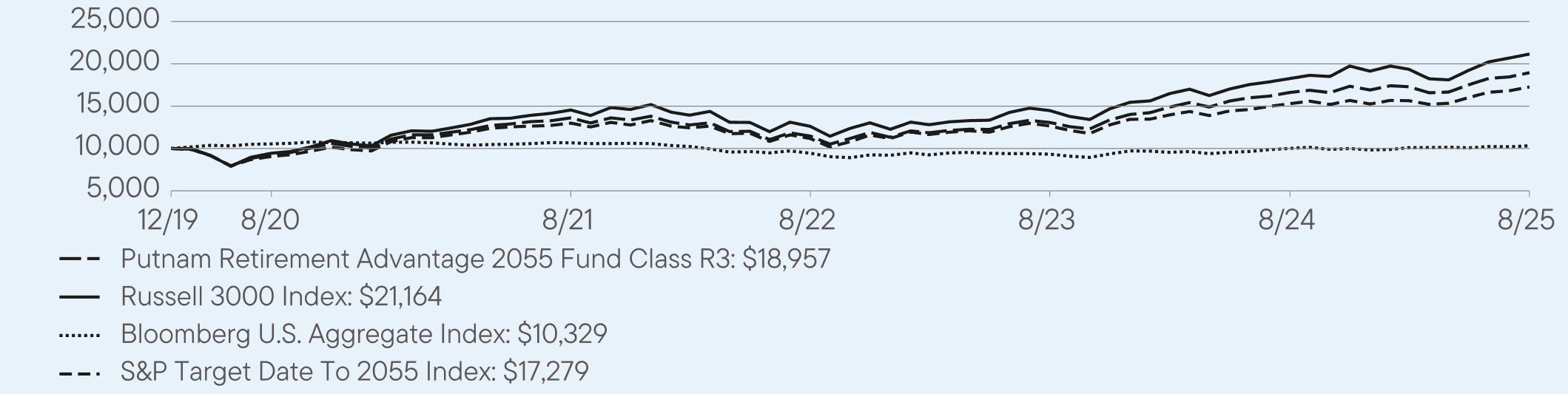

Class R3

|

6.47

|

3.90

|

4.26

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

S&P Target Date To Retirement Income Index

|

7.00

|

4.25

|

4.64

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

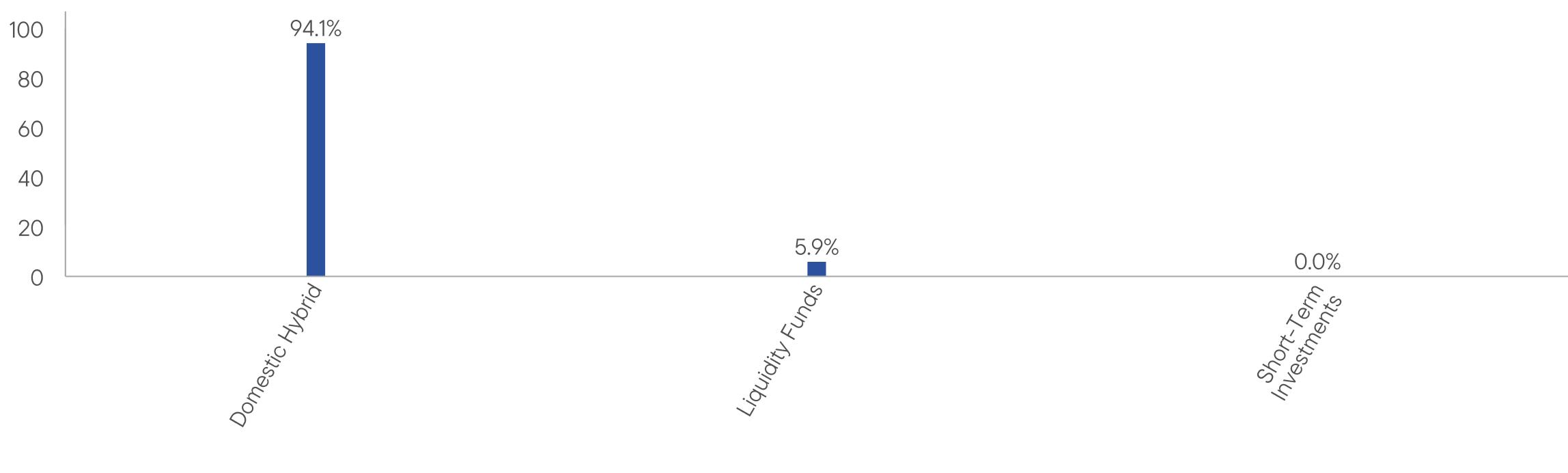

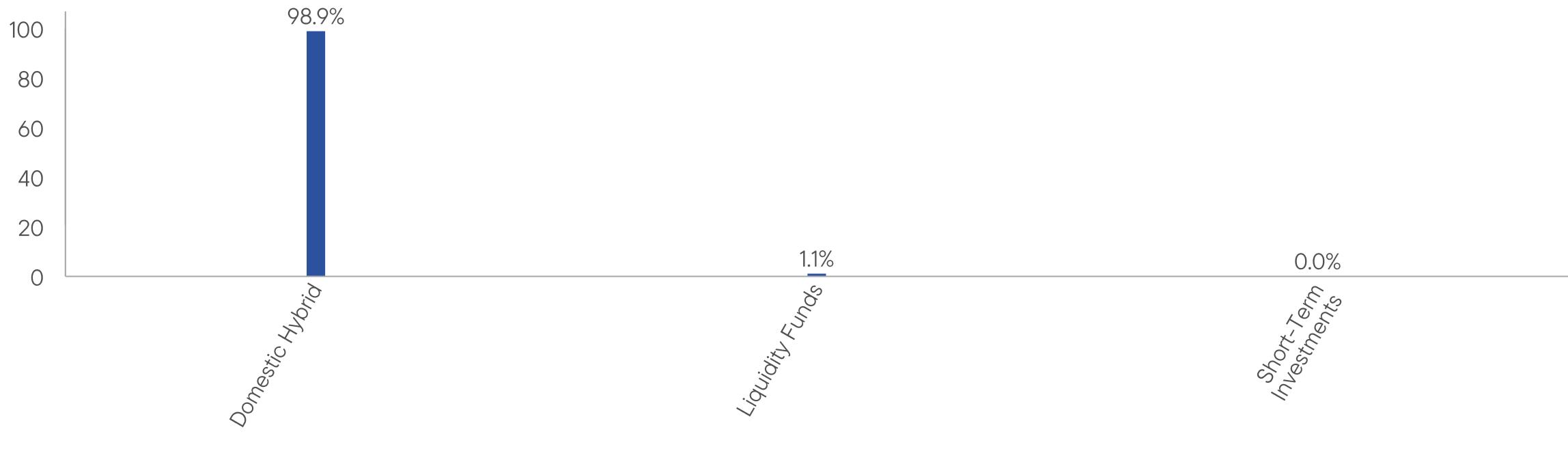

Total Net Assets

|

$41,010,267

|

|

Total Number of Portfolio Holdings

|

2

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

58%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

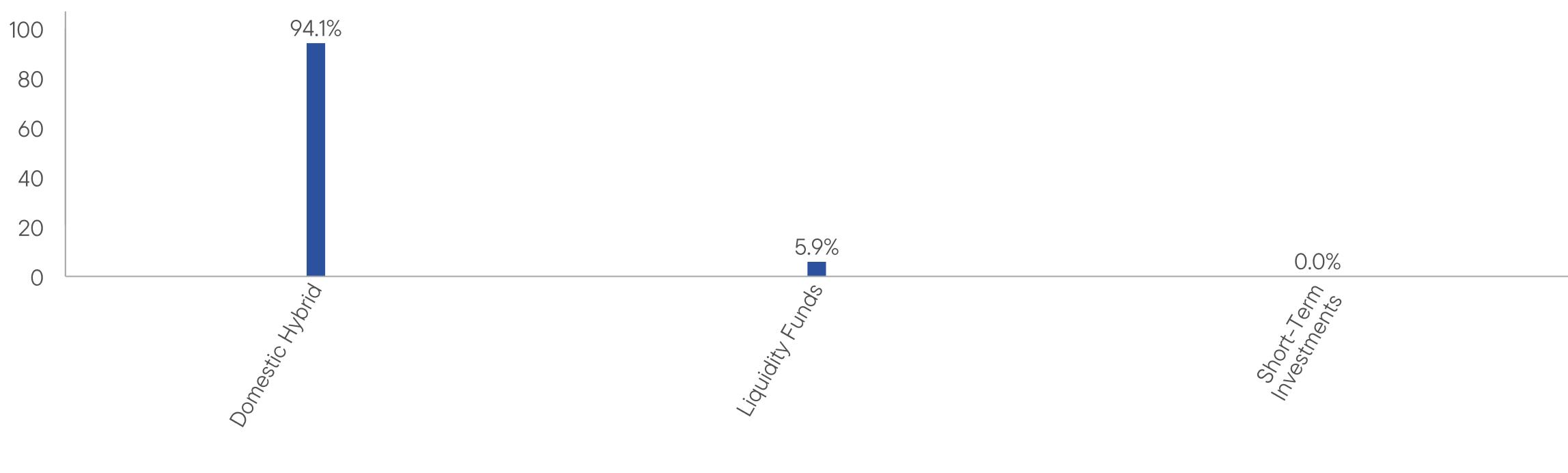

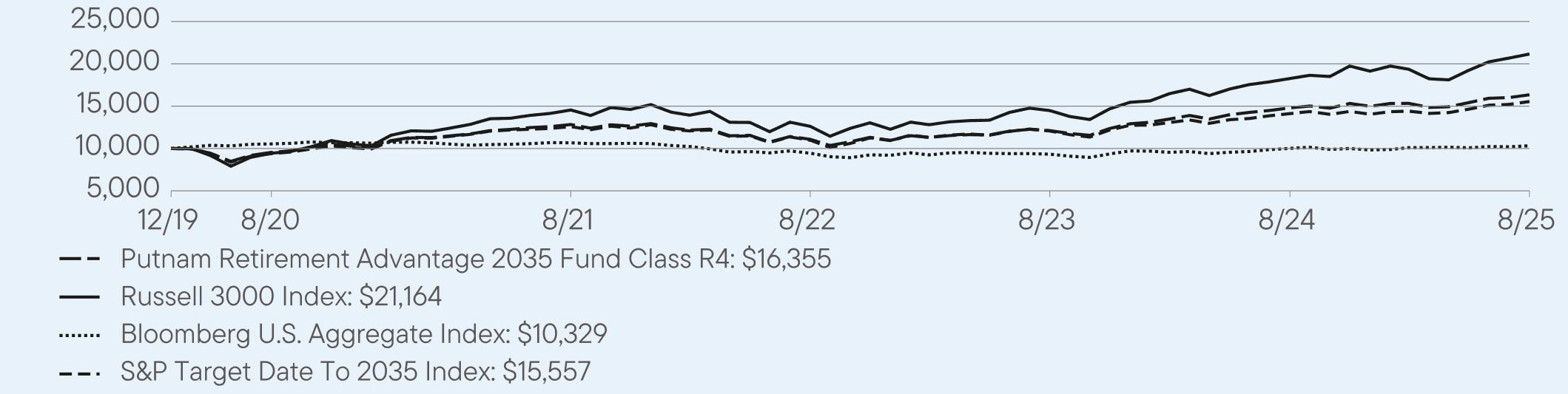

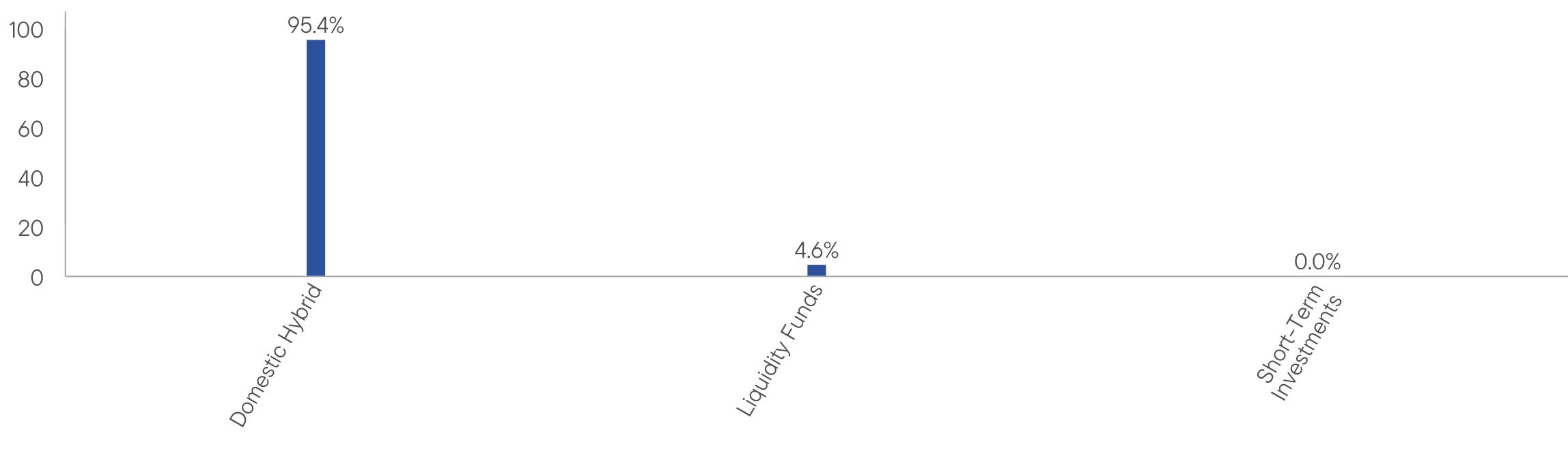

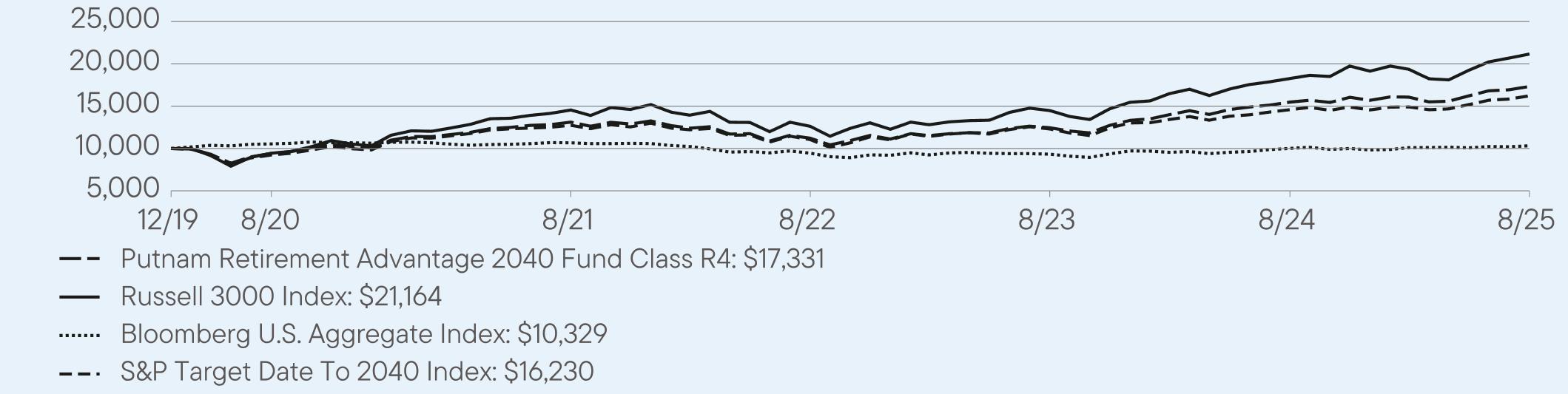

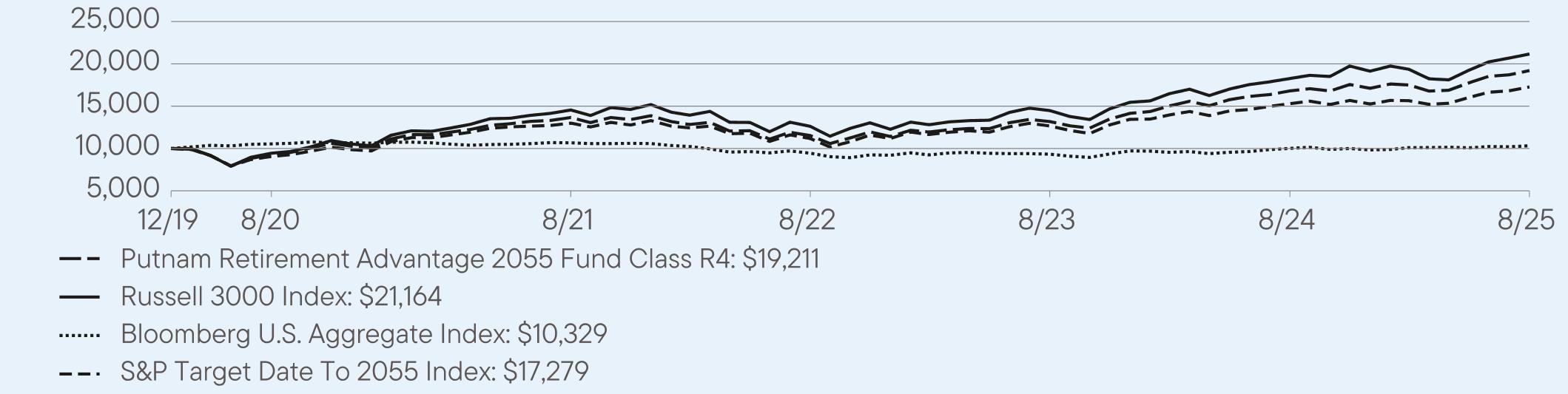

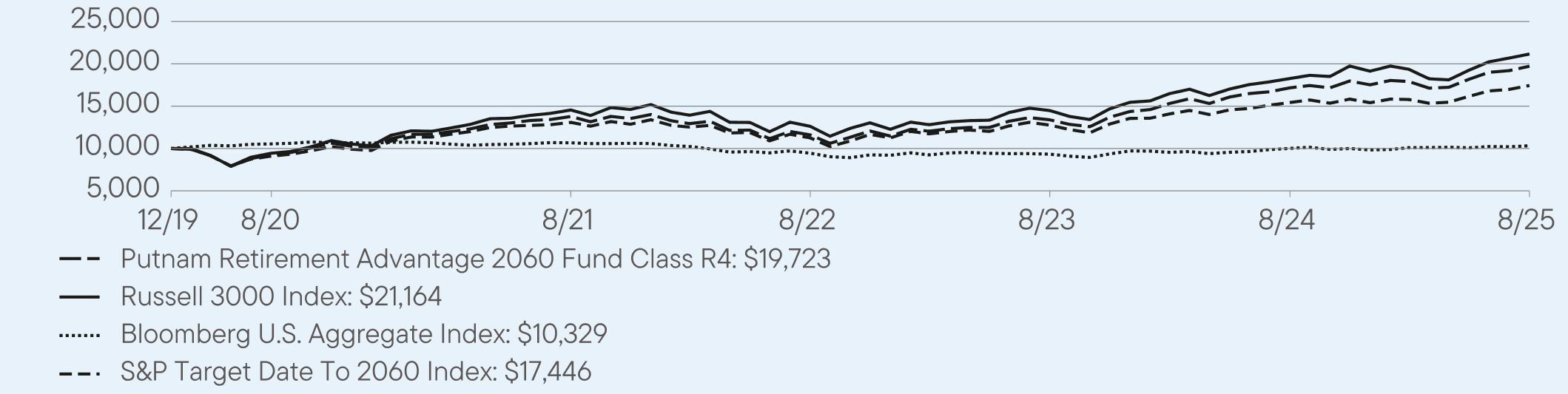

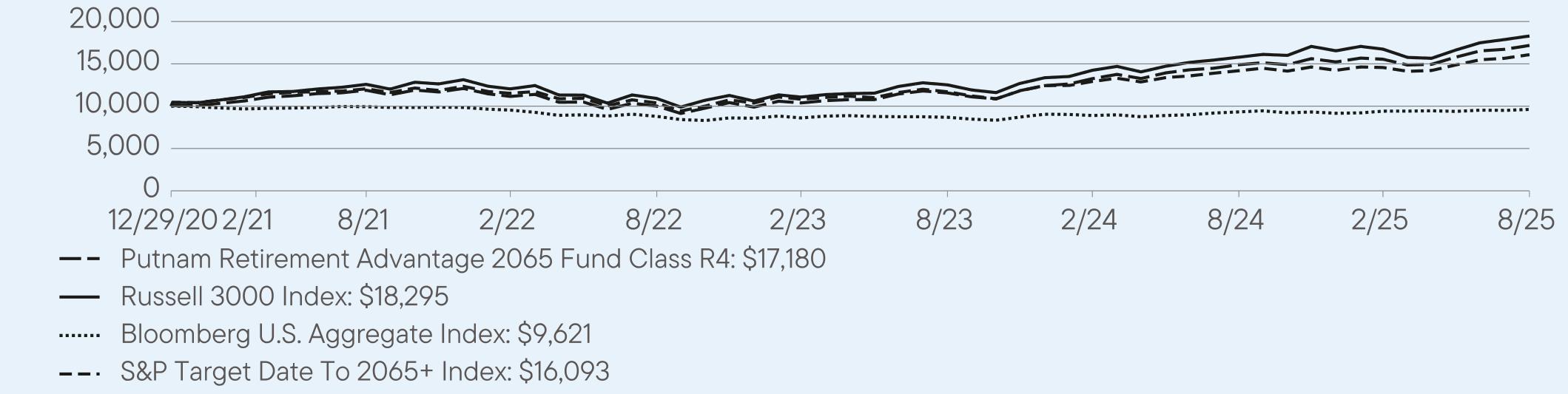

Class R41,2

|

$33

|

0.32%

|

|

Top contributors to performance:

|

|

|

↑

|

Global Fixed Income strategy

|

|

↑

|

High Yield Fixed Income strategy

|

|

↑

|

International High Dividend Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

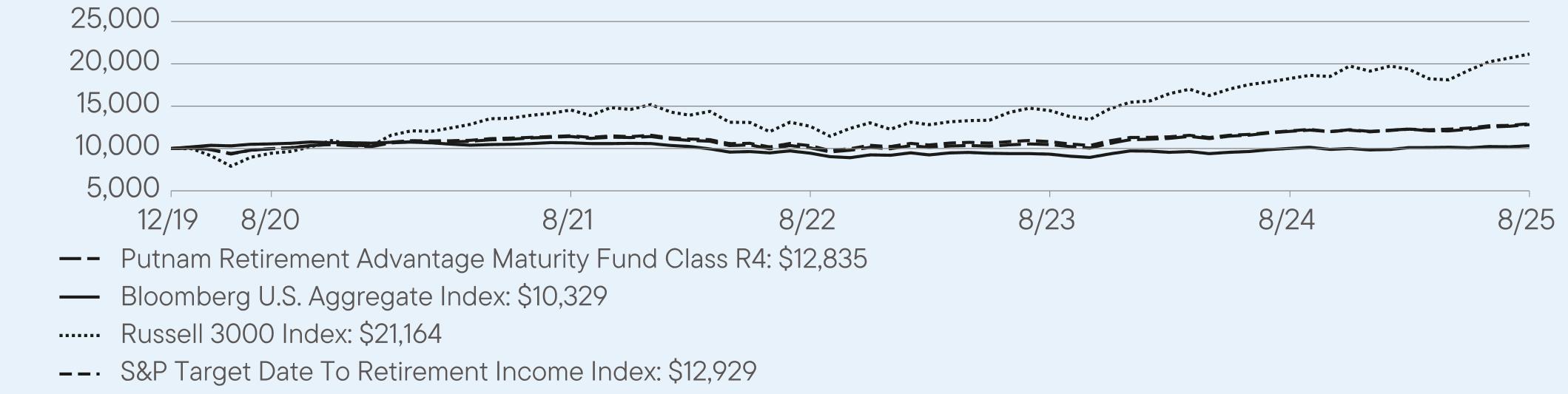

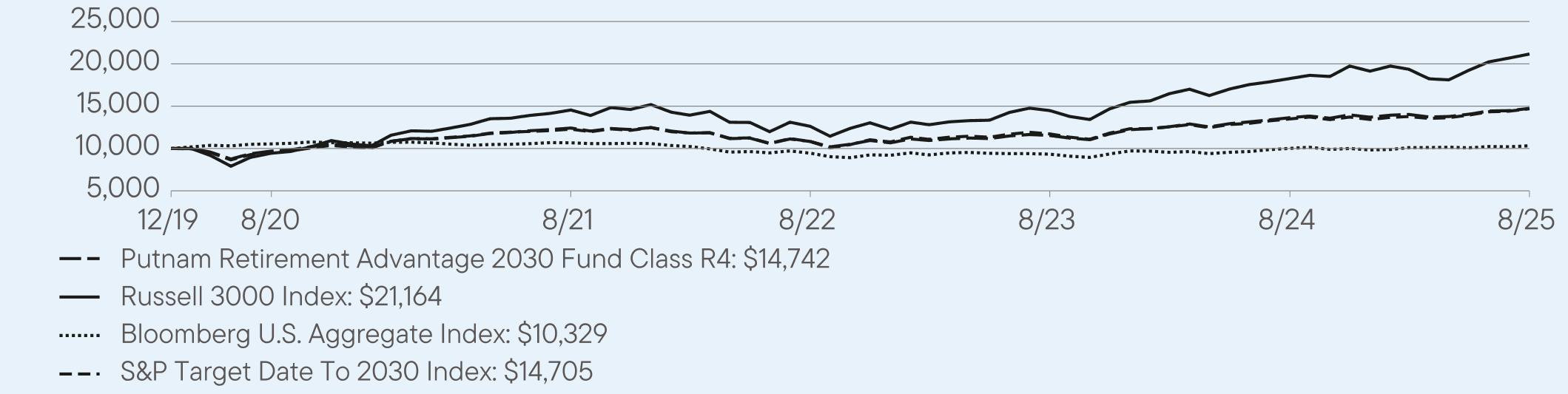

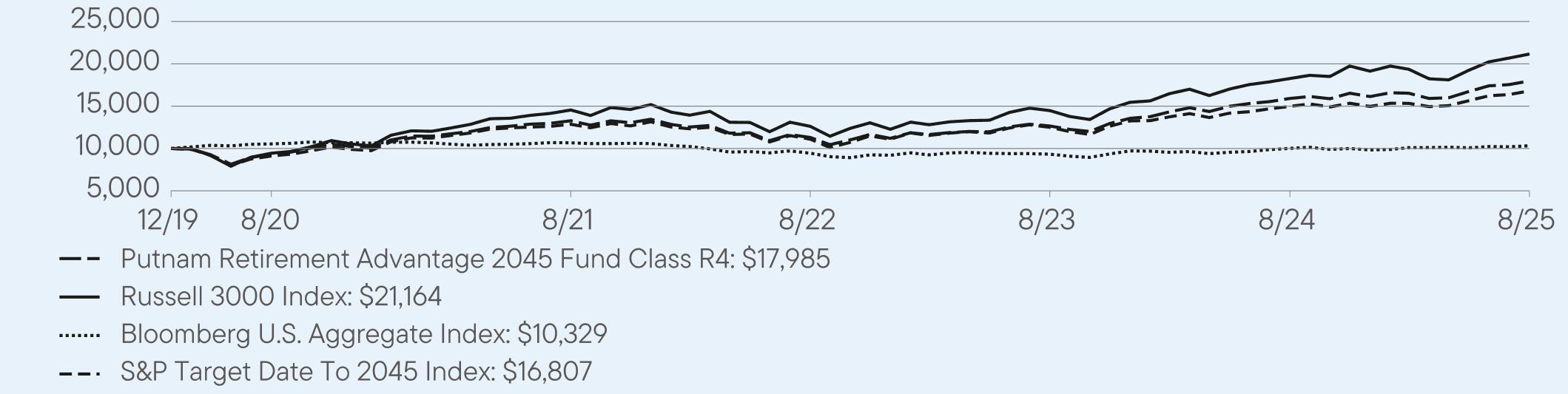

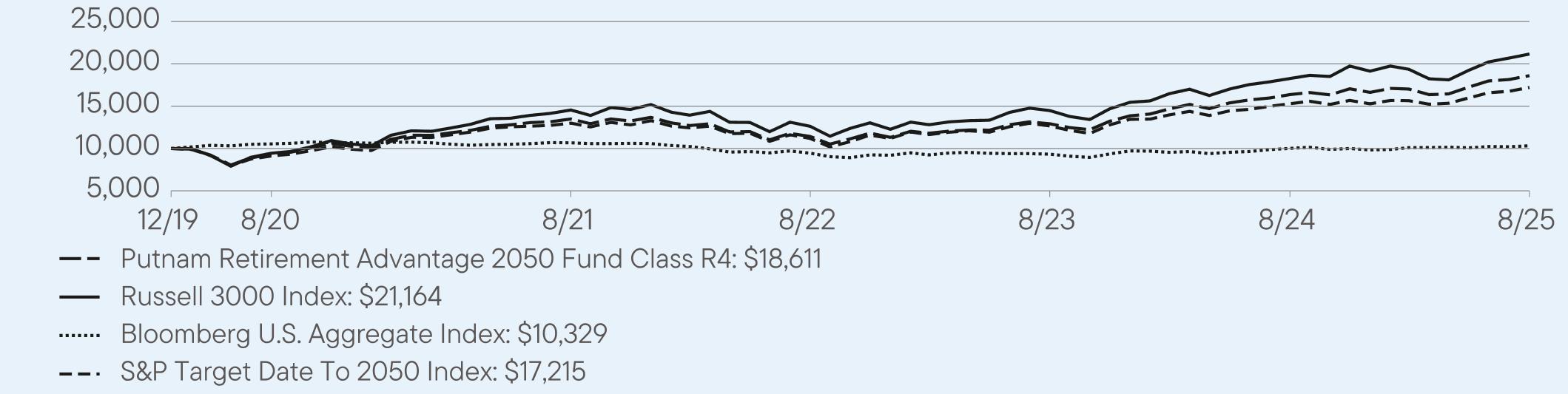

Class R4

|

6.70

|

4.16

|

4.50

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

S&P Target Date To Retirement Income Index

|

7.00

|

4.25

|

4.64

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

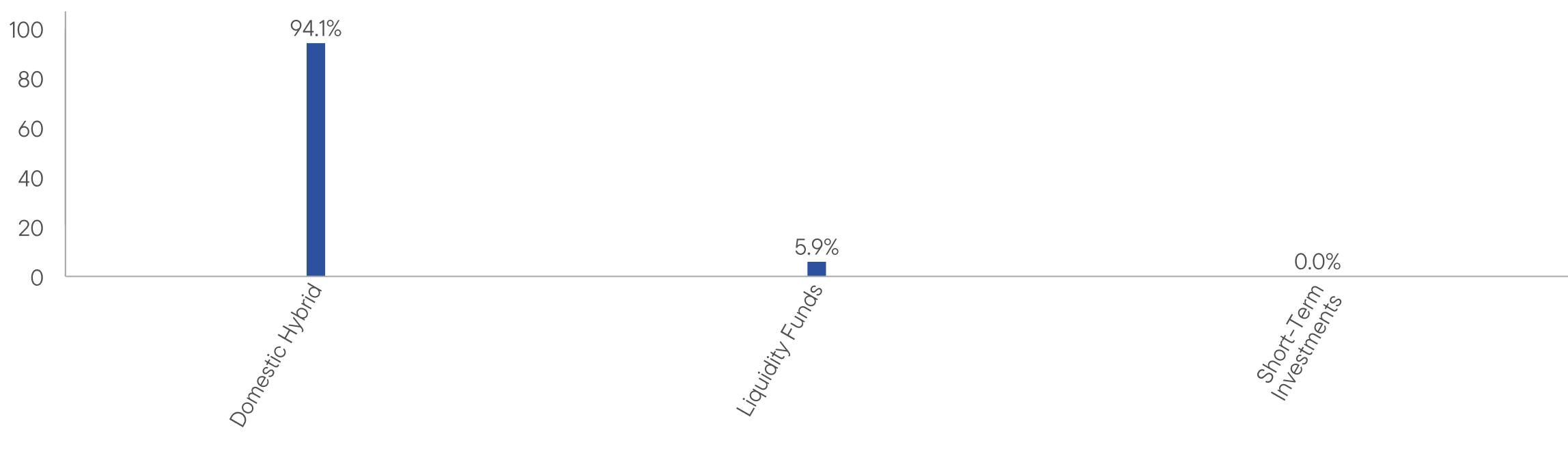

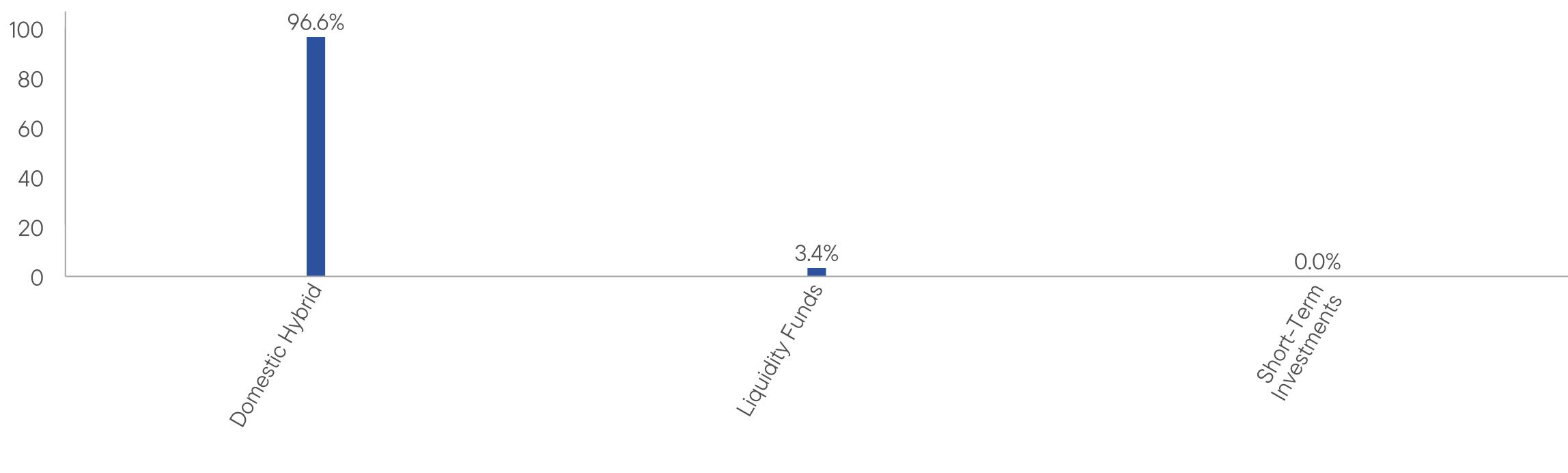

Total Net Assets

|

$41,010,267

|

|

Total Number of Portfolio Holdings

|

2

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

58%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

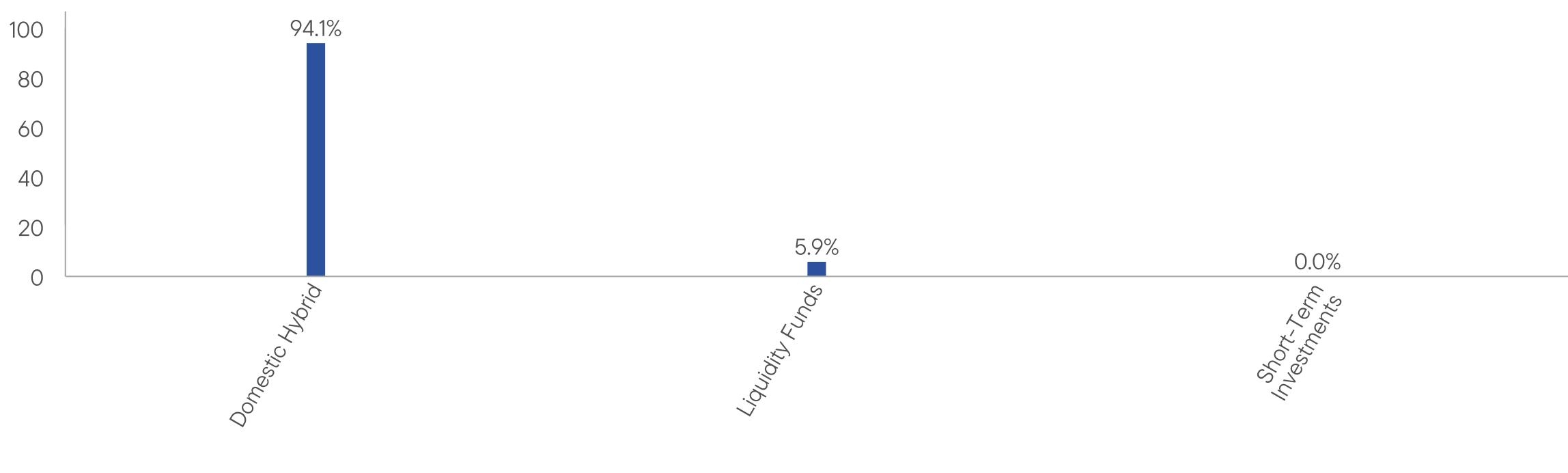

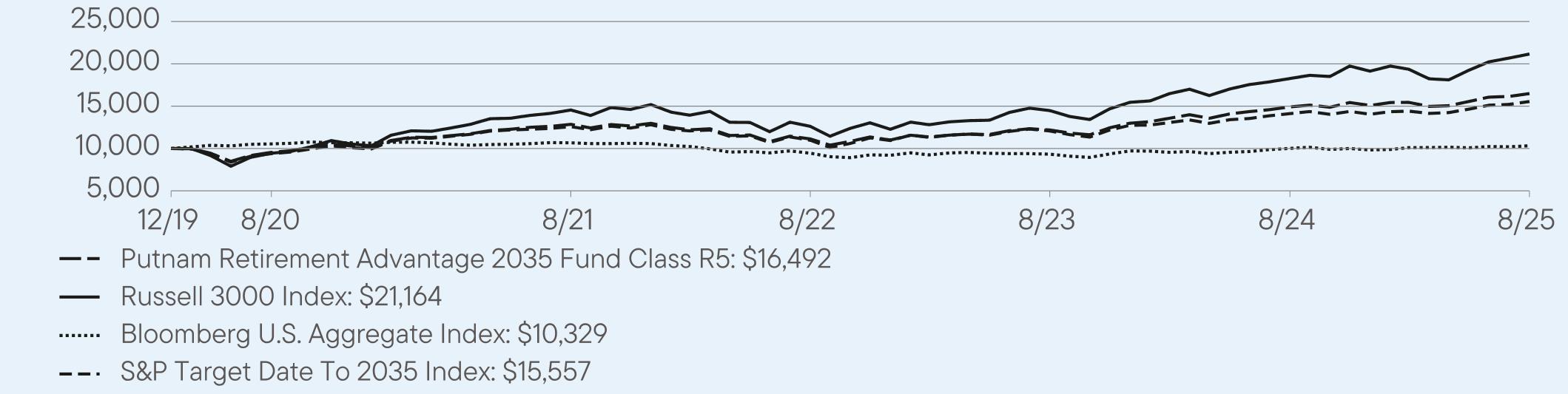

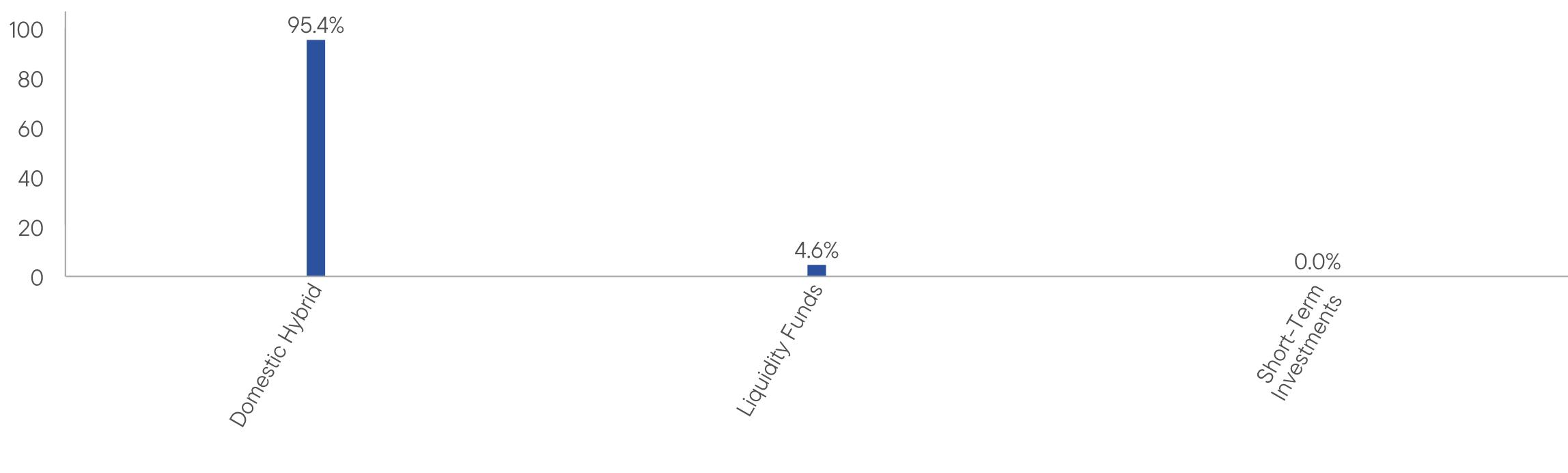

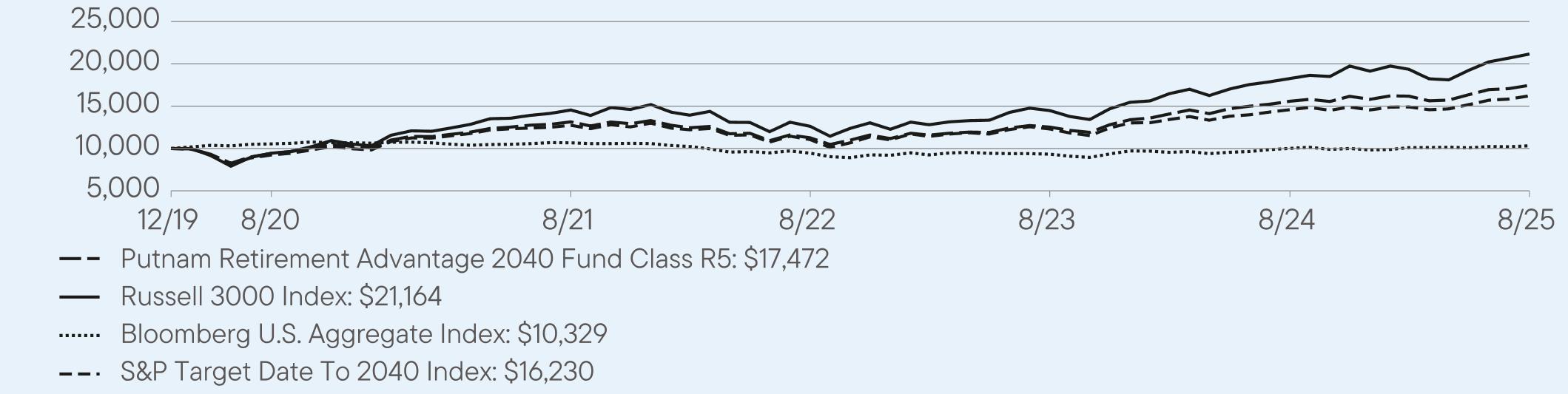

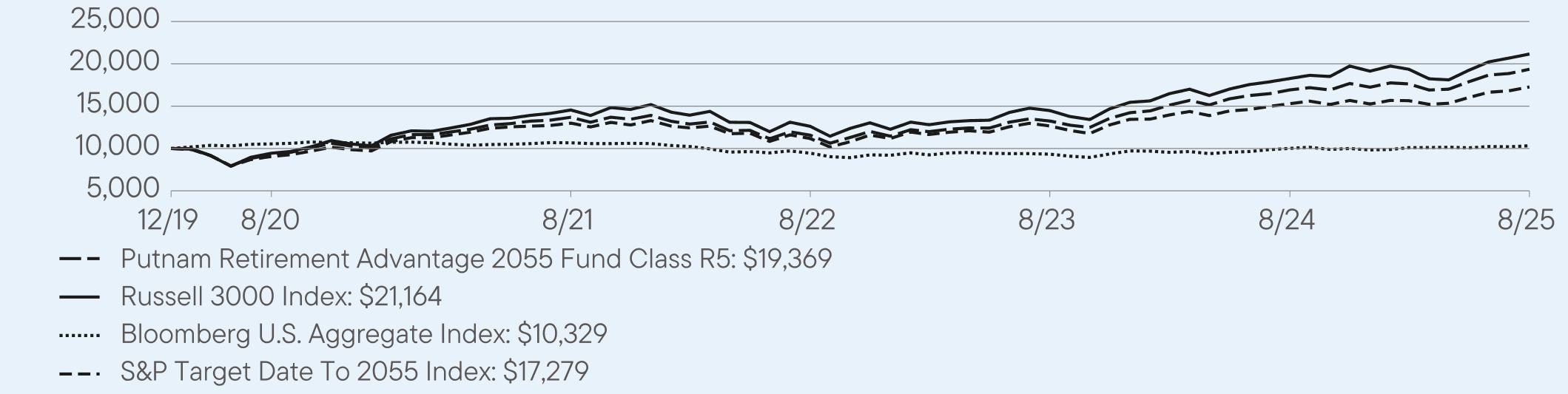

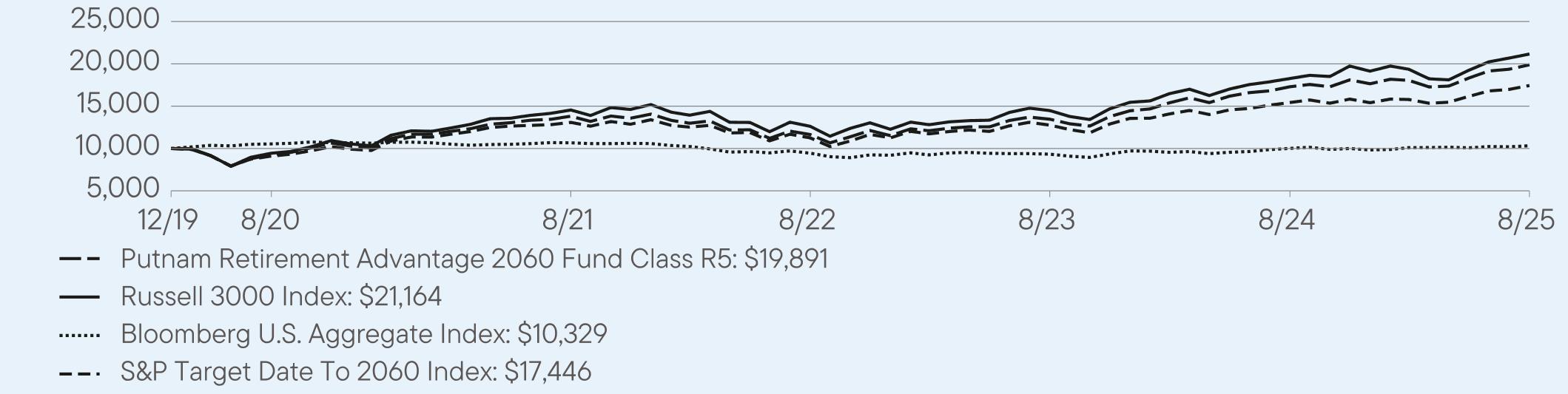

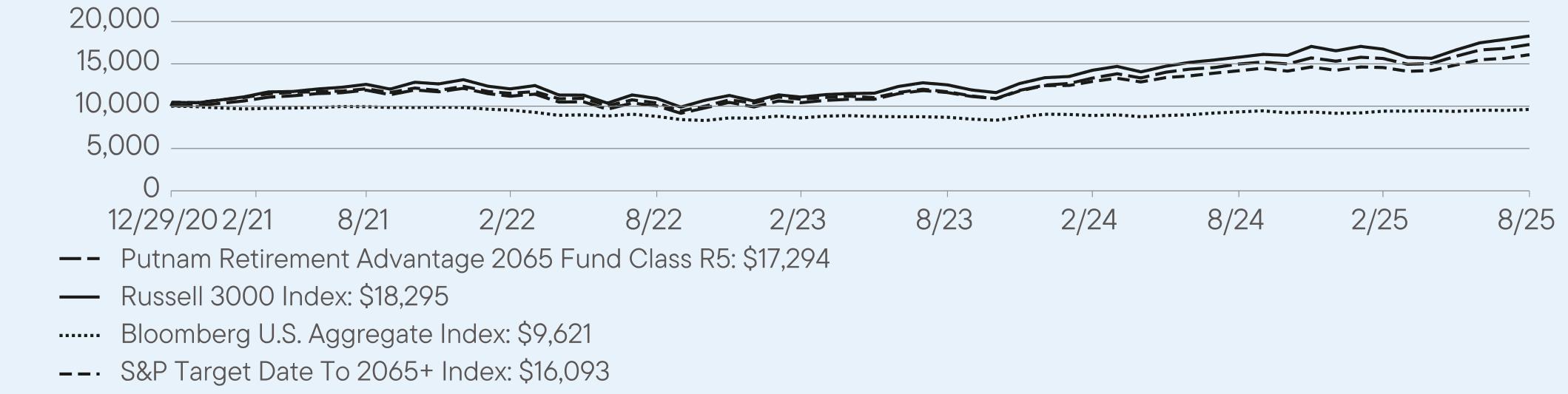

Class R51,2

|

$18

|

0.17%

|

|

Top contributors to performance:

|

|

|

↑

|

Global Fixed Income strategy

|

|

↑

|

High Yield Fixed Income strategy

|

|

↑

|

International High Dividend Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

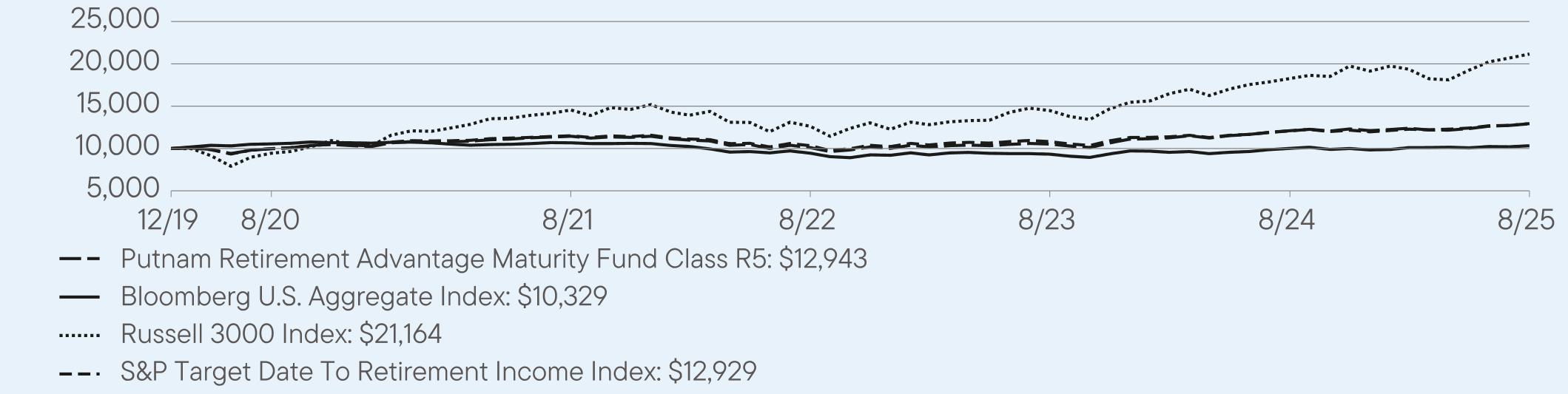

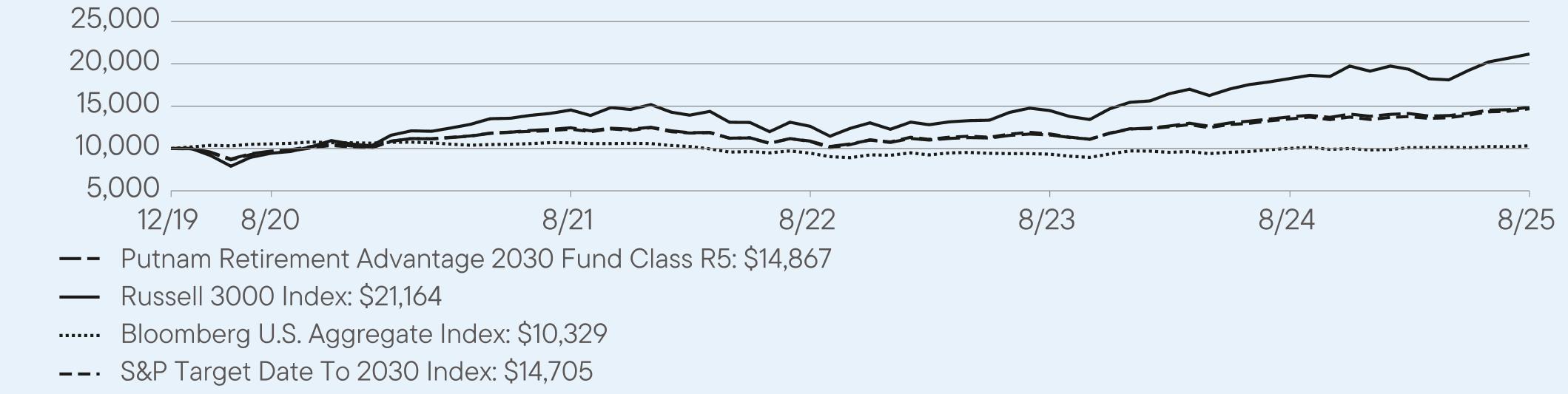

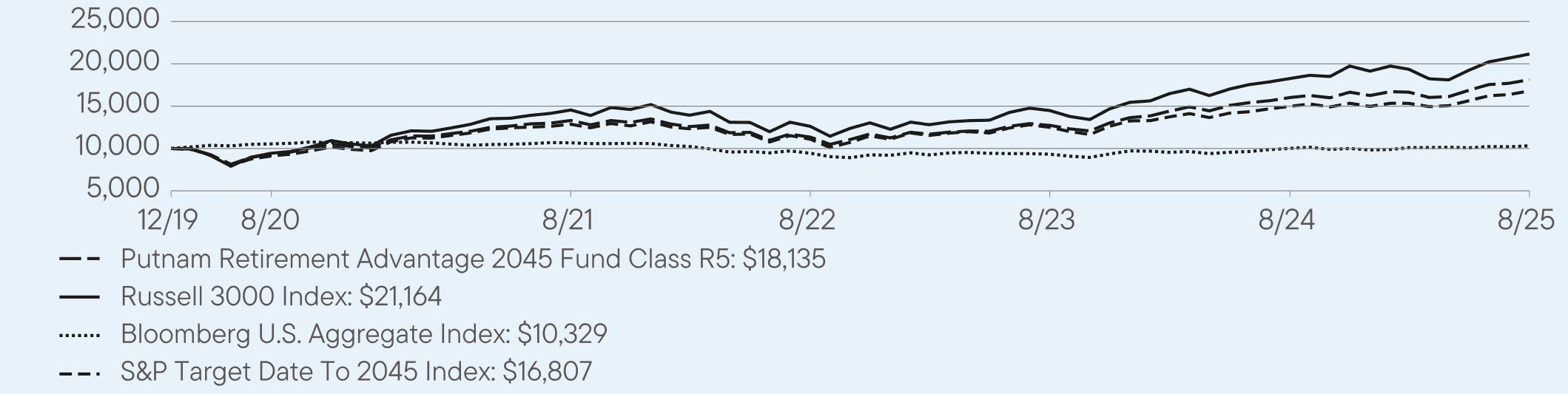

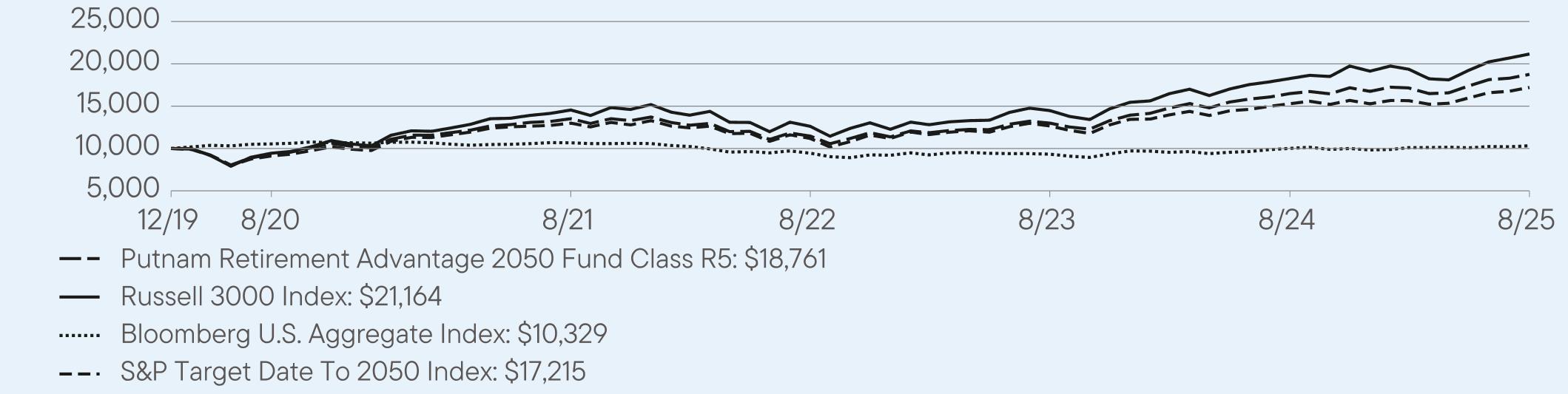

Class R5

|

6.91

|

4.31

|

4.66

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

S&P Target Date To Retirement Income Index

|

7.00

|

4.25

|

4.64

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

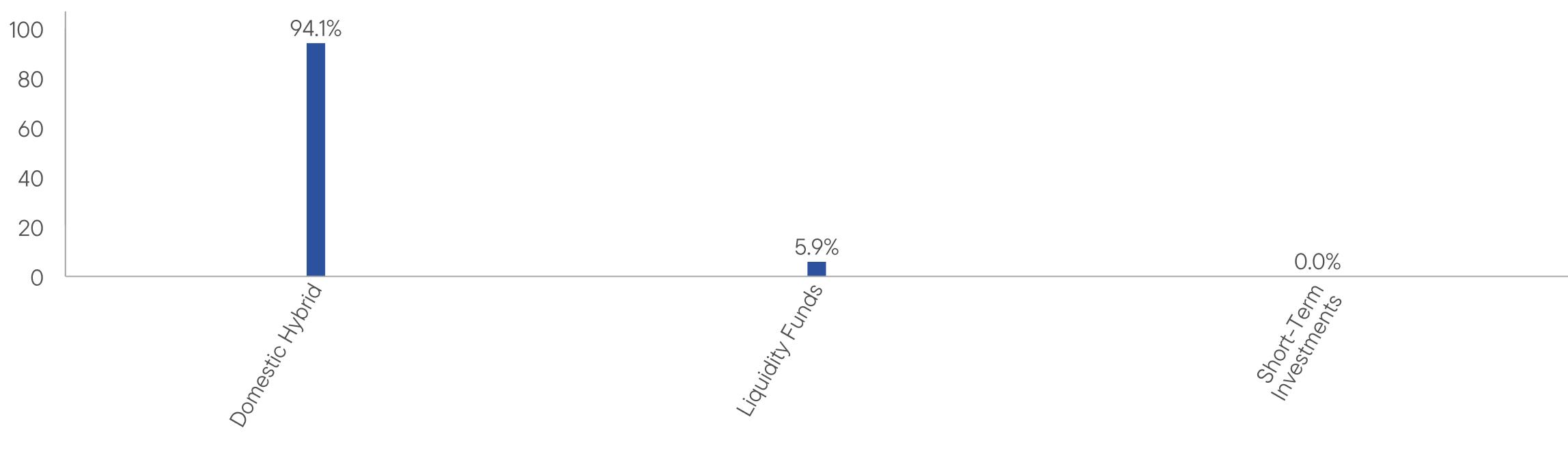

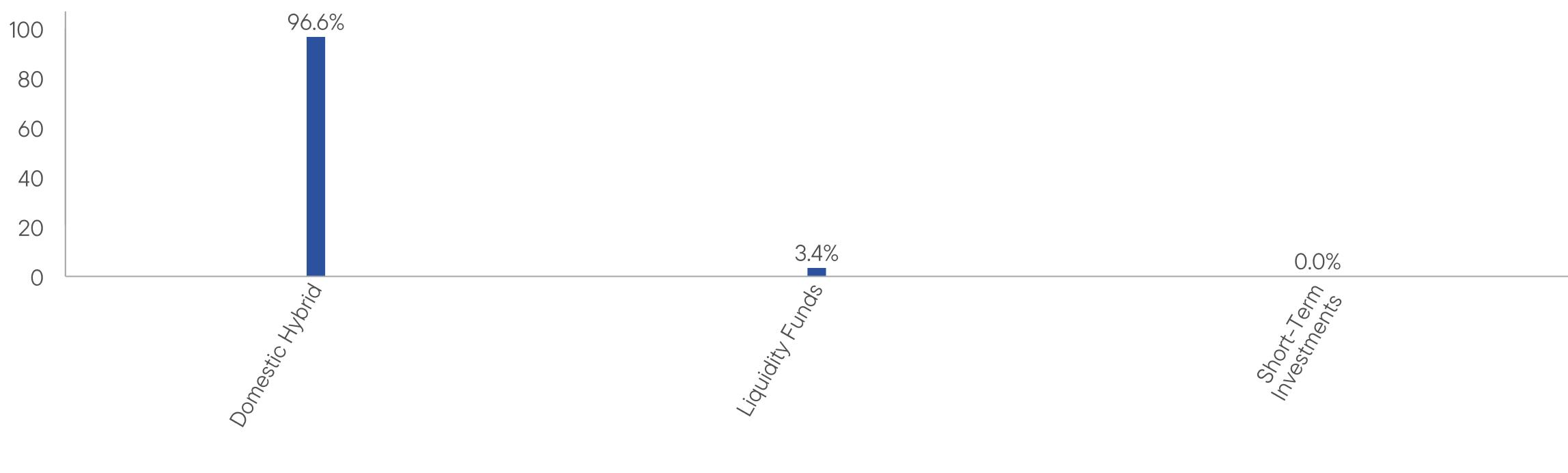

Total Net Assets

|

$41,010,267

|

|

Total Number of Portfolio Holdings

|

2

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

58%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

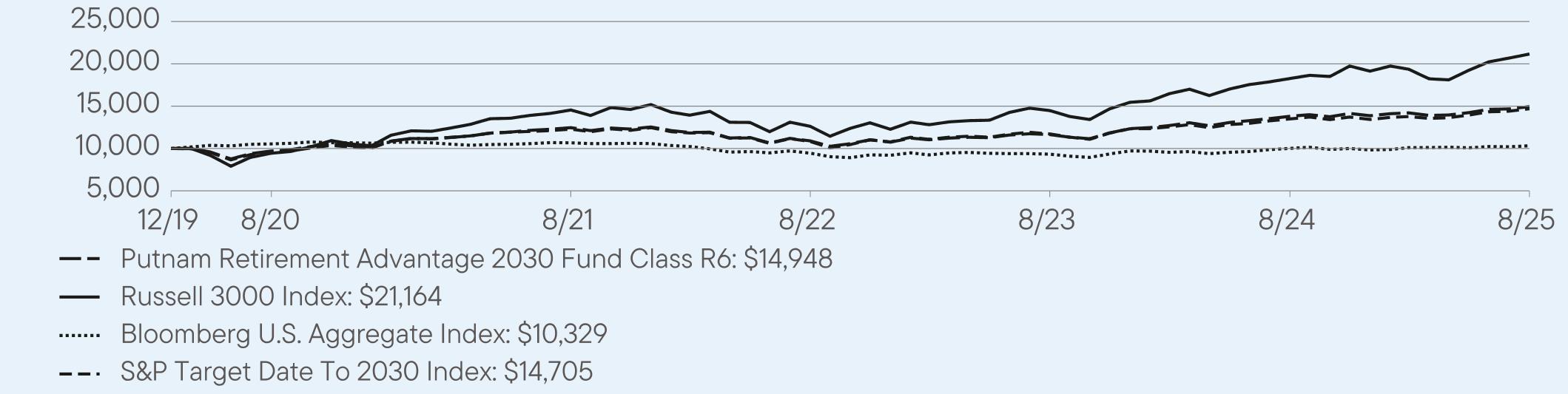

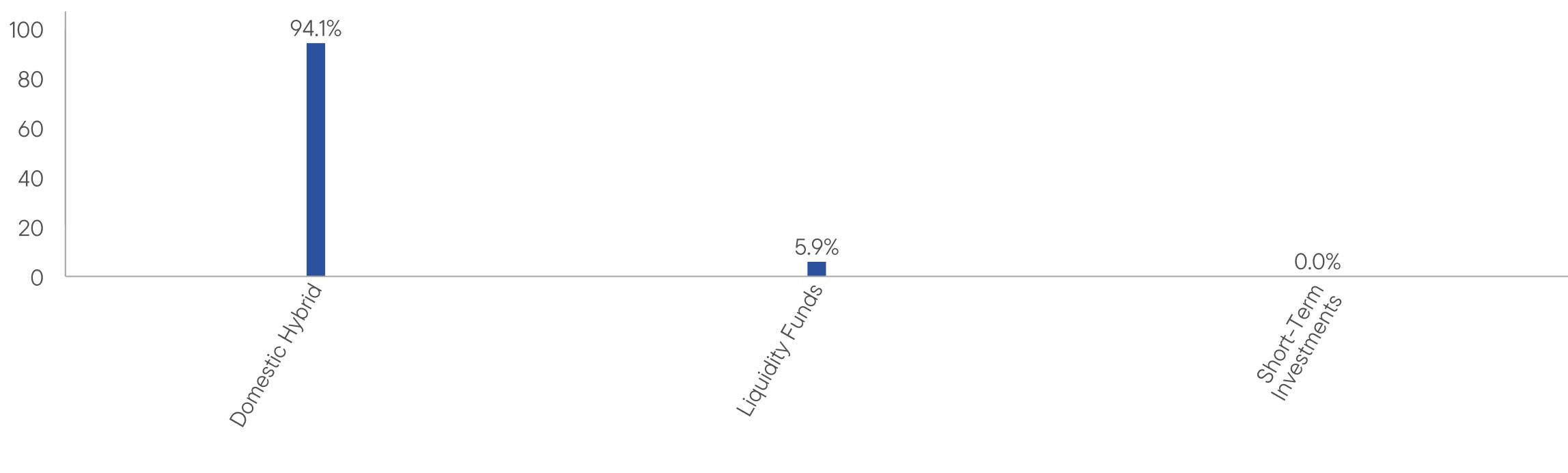

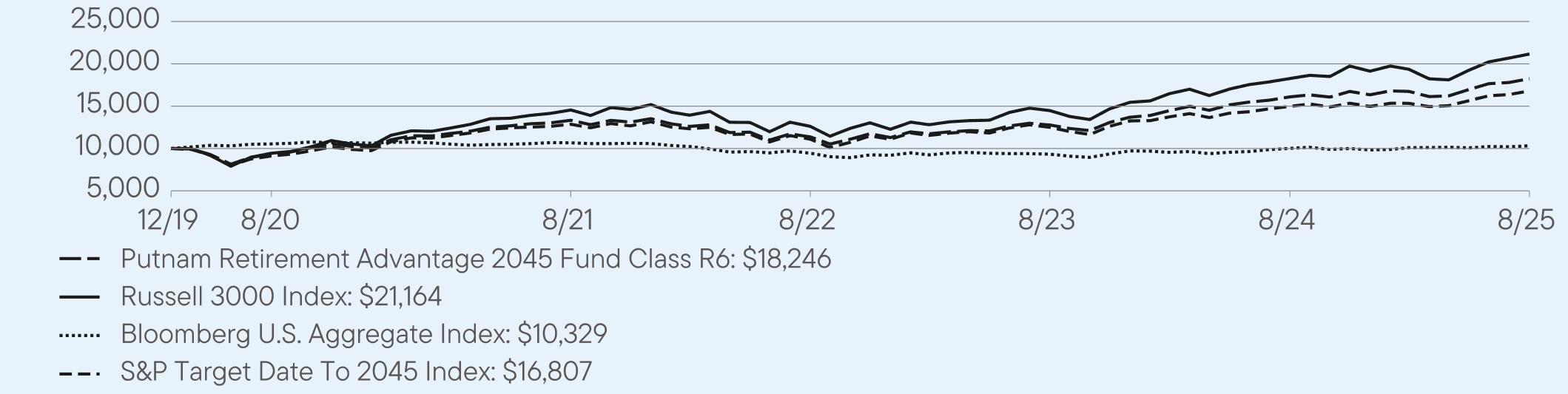

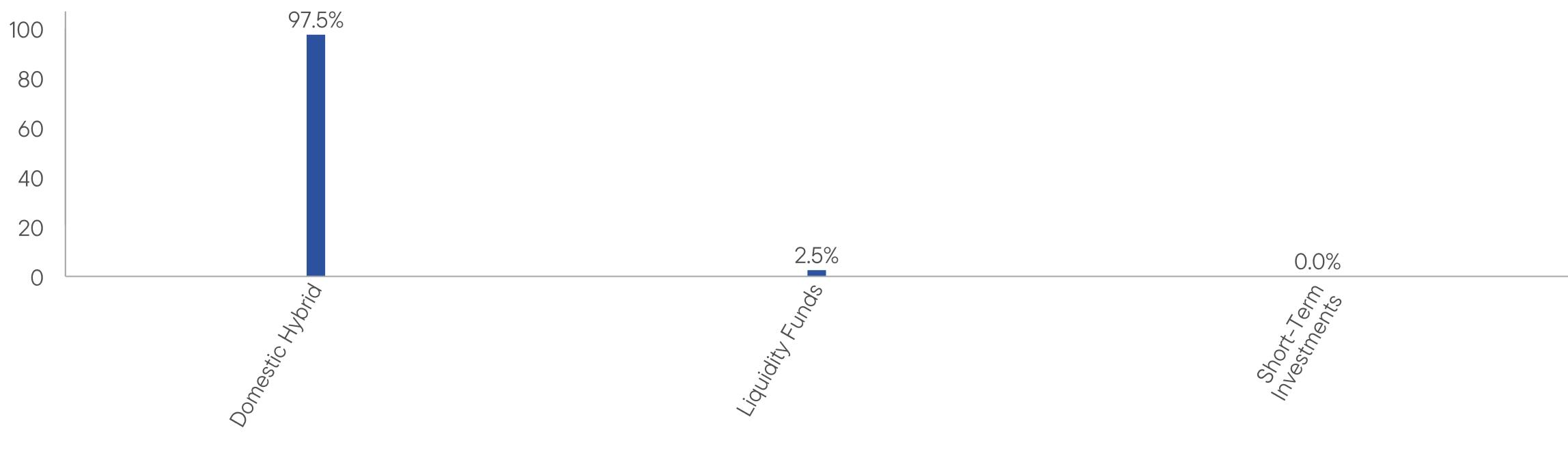

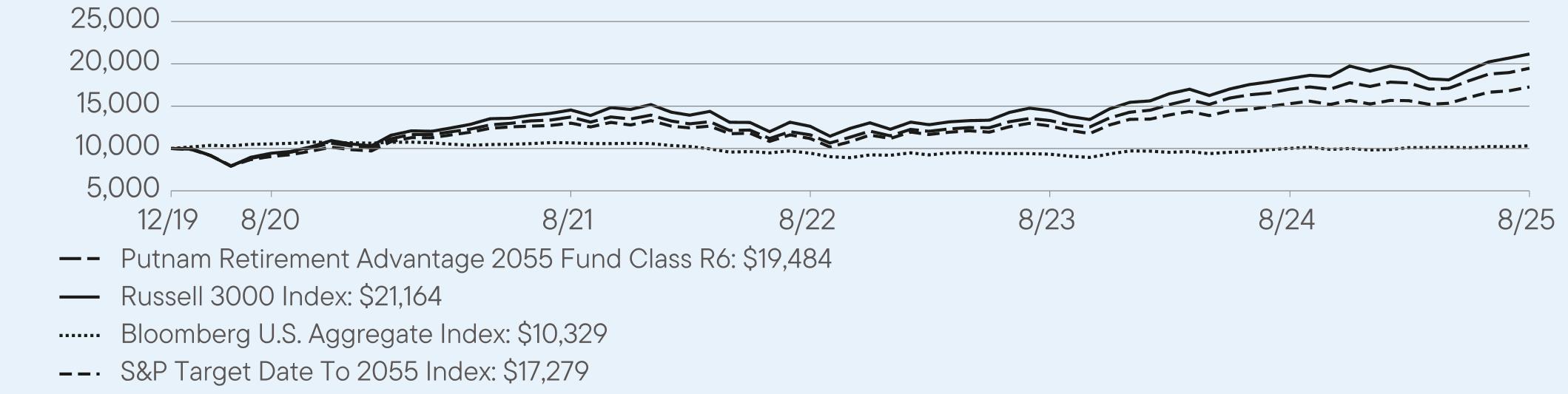

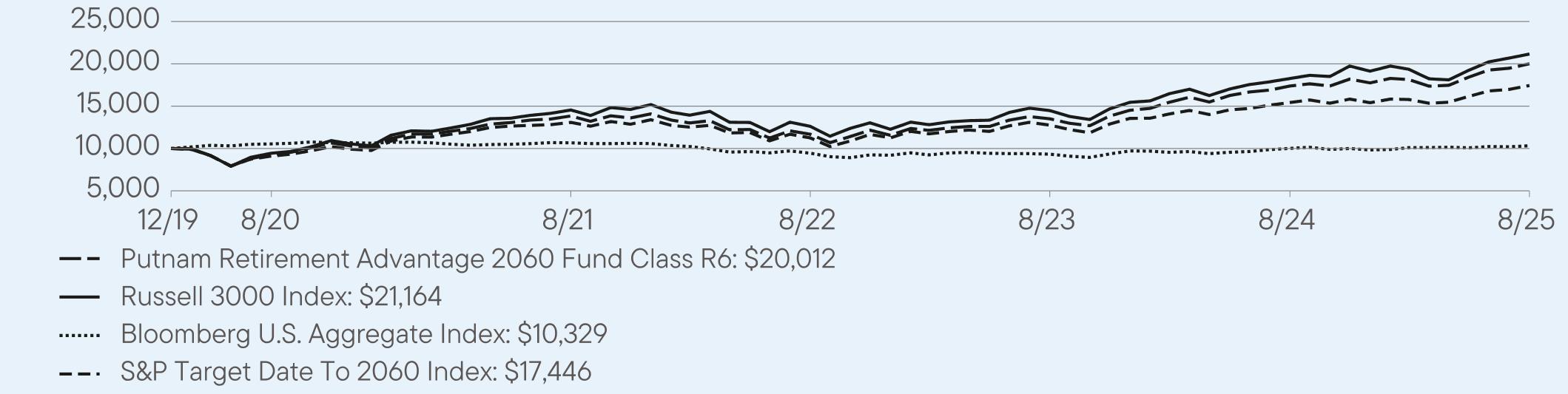

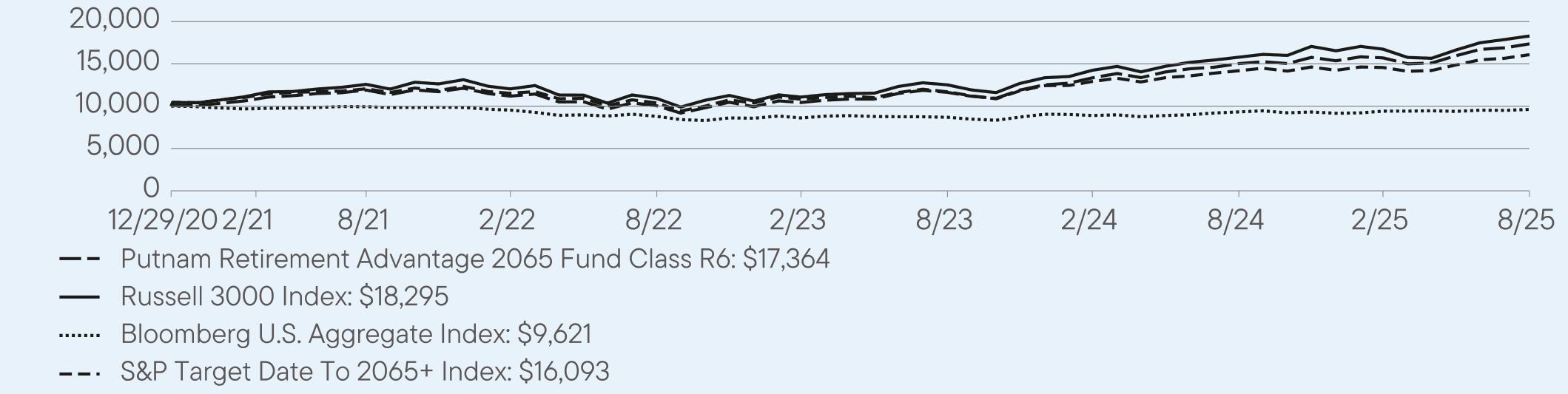

Class R61,2

|

$7

|

0.07%

|

|

Top contributors to performance:

|

|

|

↑

|

Global Fixed Income strategy

|

|

↑

|

High Yield Fixed Income strategy

|

|

↑

|

International High Dividend Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

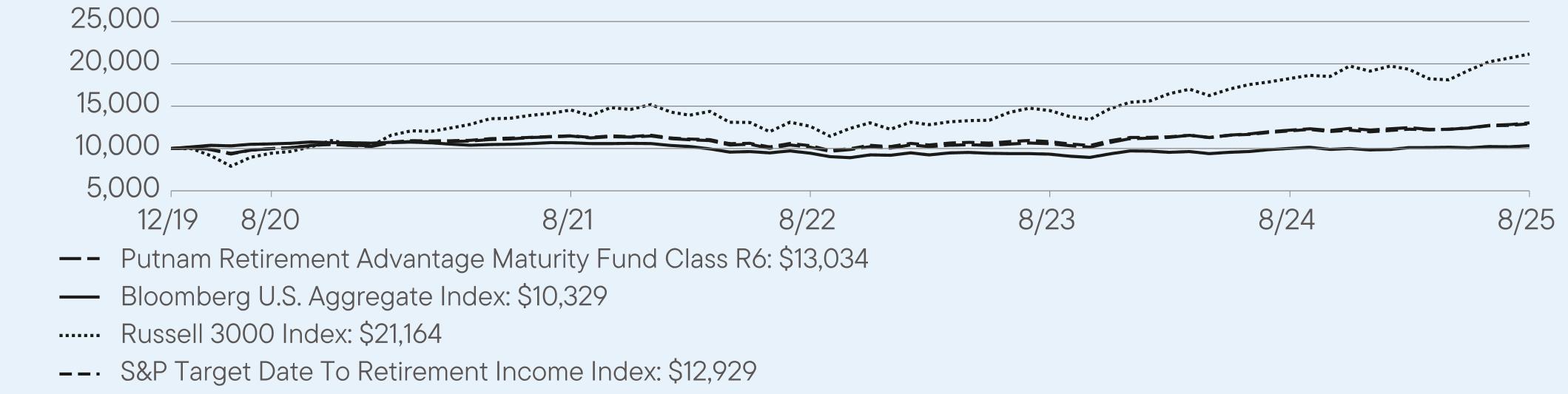

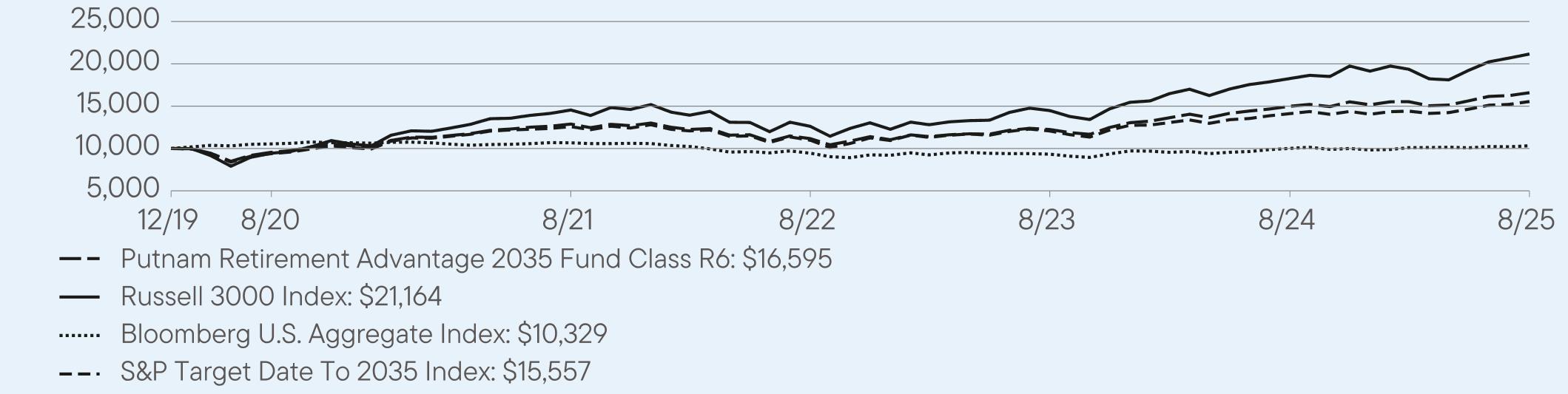

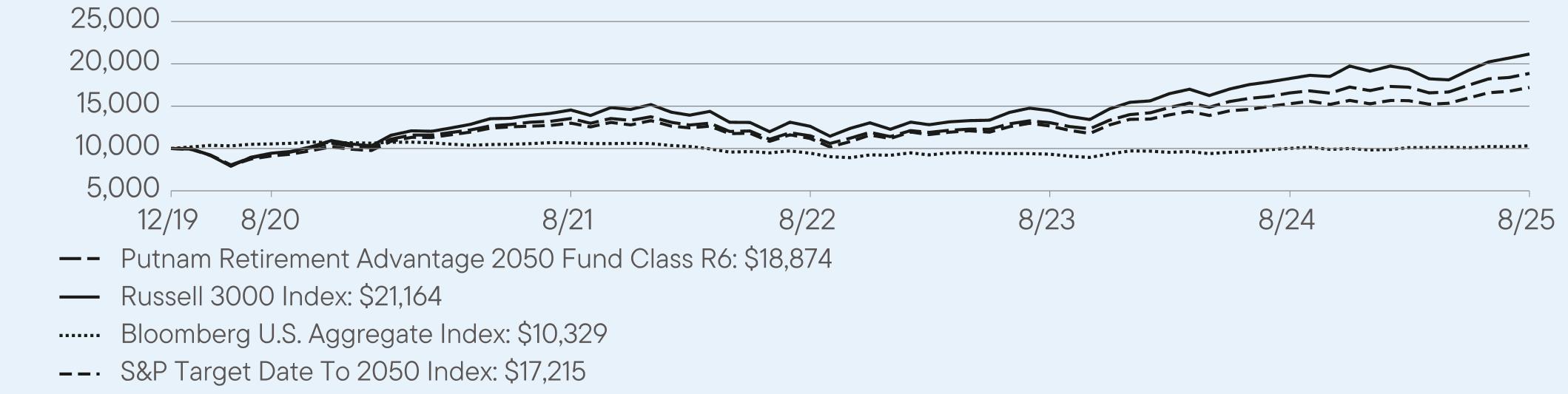

Class R6

|

7.10

|

4.44

|

4.79

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

S&P Target Date To Retirement Income Index

|

7.00

|

4.25

|

4.64

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

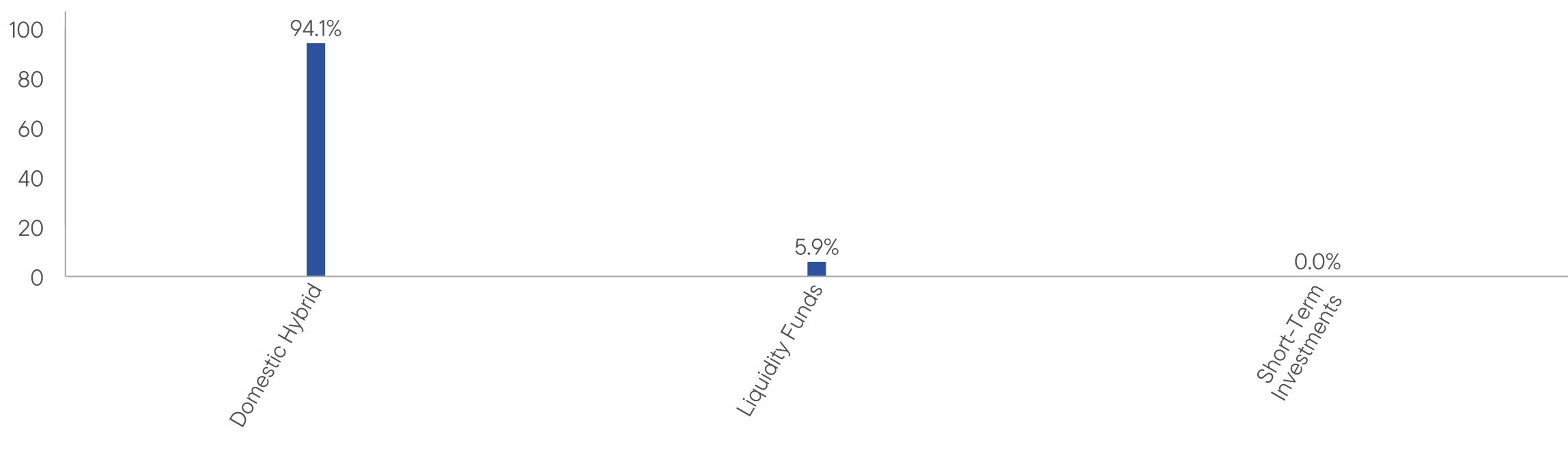

Total Net Assets

|

$41,010,267

|

|

Total Number of Portfolio Holdings

|

2

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

58%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

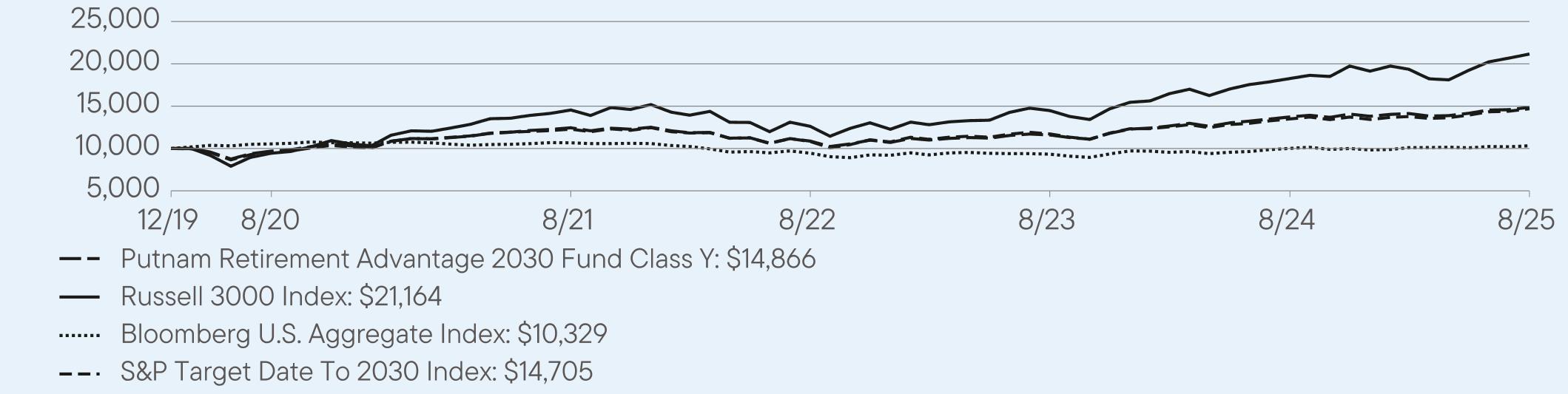

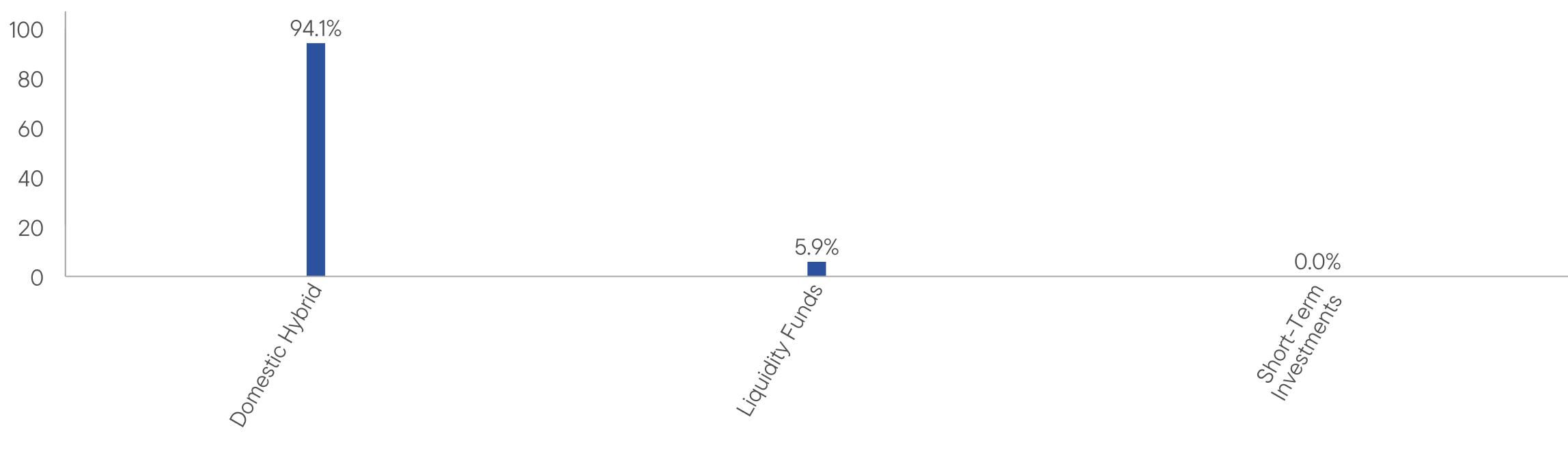

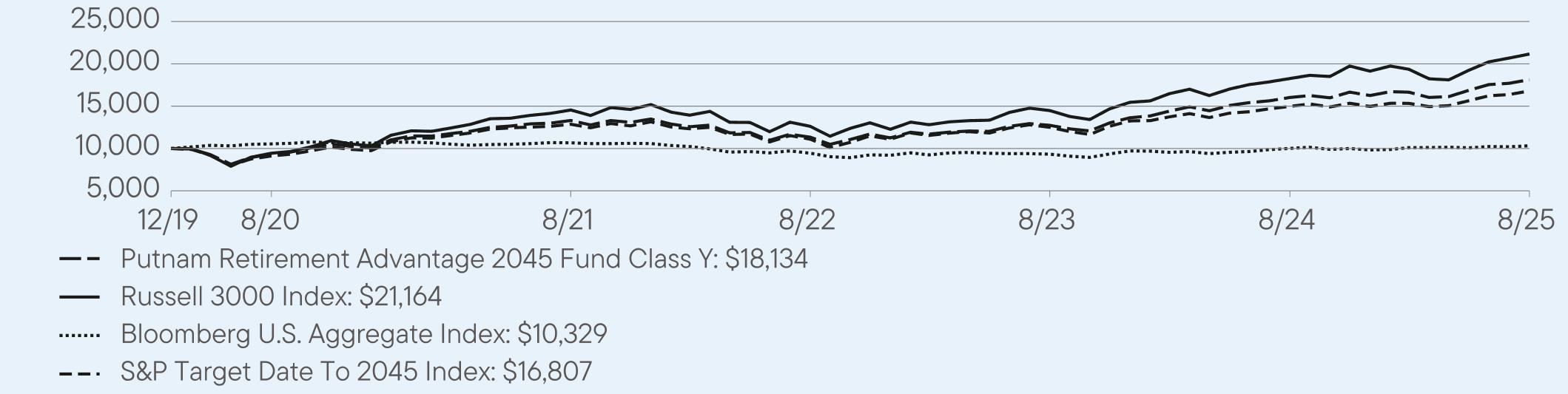

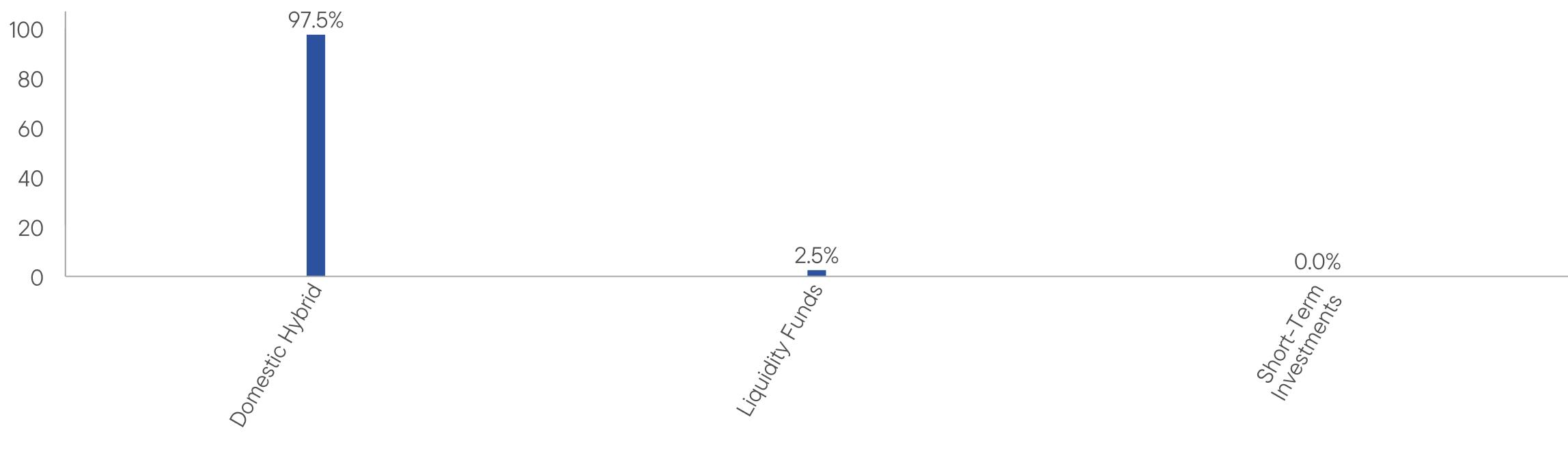

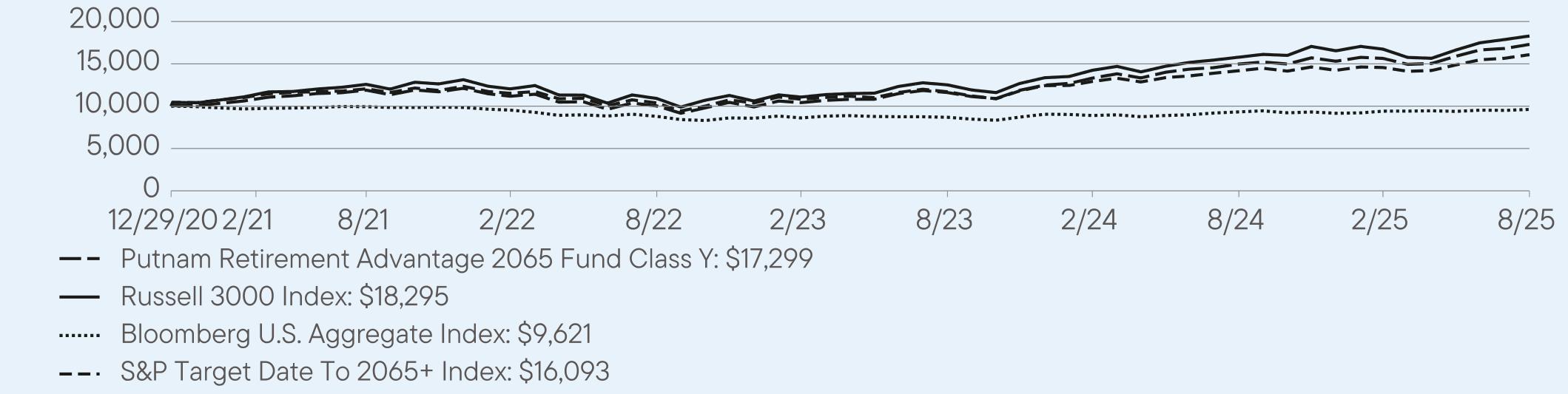

Class Y1,2

|

$18

|

0.17%

|

|

Top contributors to performance:

|

|

|

↑

|

Global Fixed Income strategy

|

|

↑

|

High Yield Fixed Income strategy

|

|

↑

|

International High Dividend Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

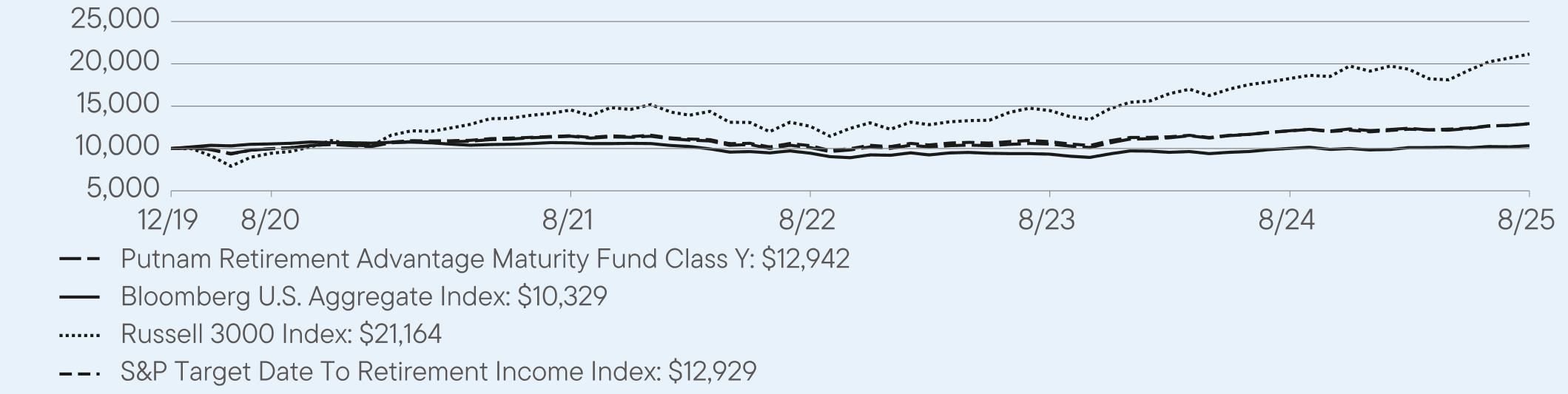

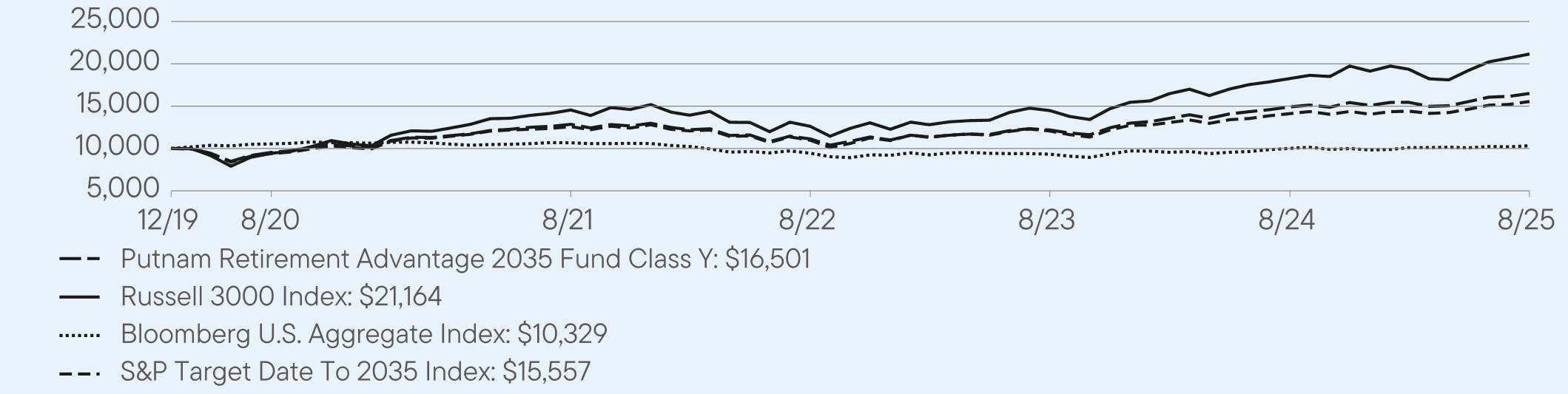

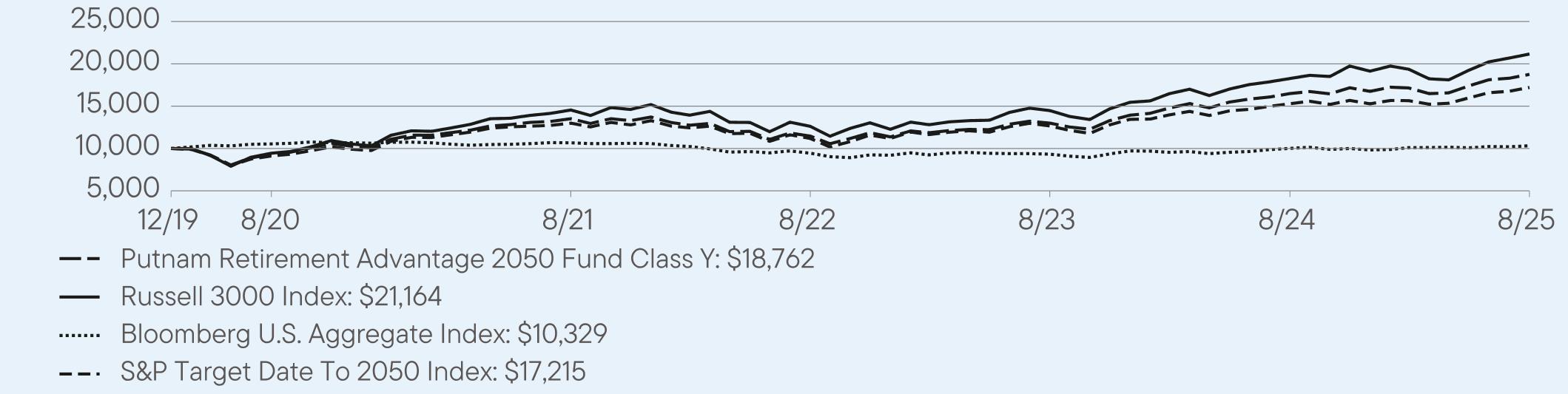

Class Y

|

6.90

|

4.31

|

4.66

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

S&P Target Date To Retirement Income Index

|

7.00

|

4.25

|

4.64

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

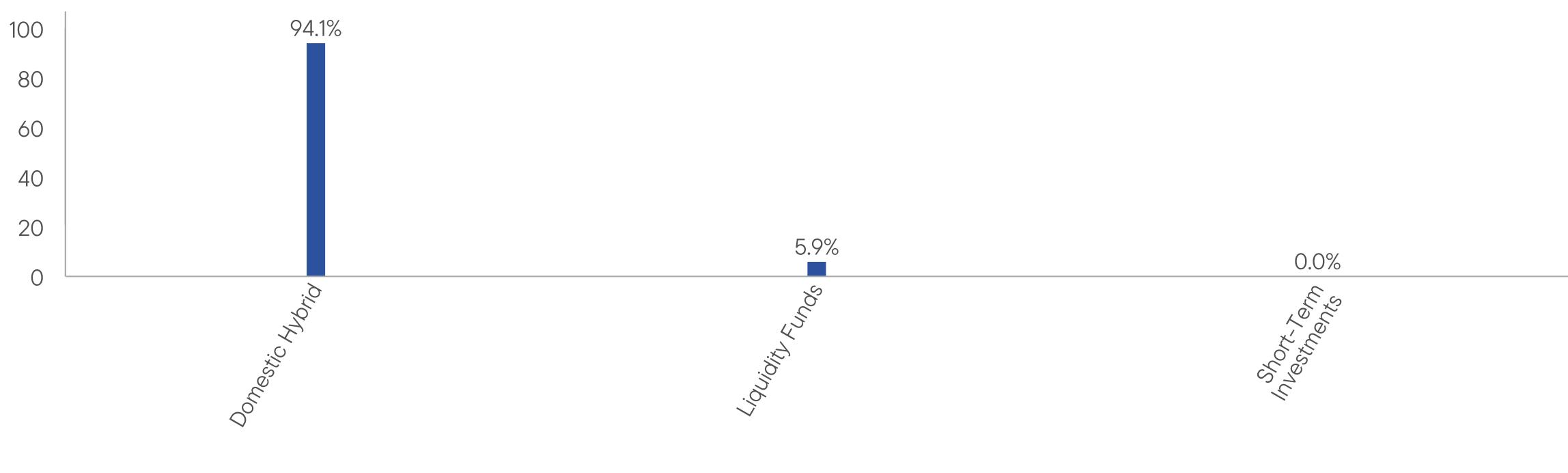

Total Net Assets

|

$41,010,267

|

|

Total Number of Portfolio Holdings

|

2

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

58%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A1

|

$28

|

0.27%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class A

|

7.84

|

6.84

|

6.98

|

|

Class A (with sales charge)

|

1.64

|

5.58

|

5.87

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

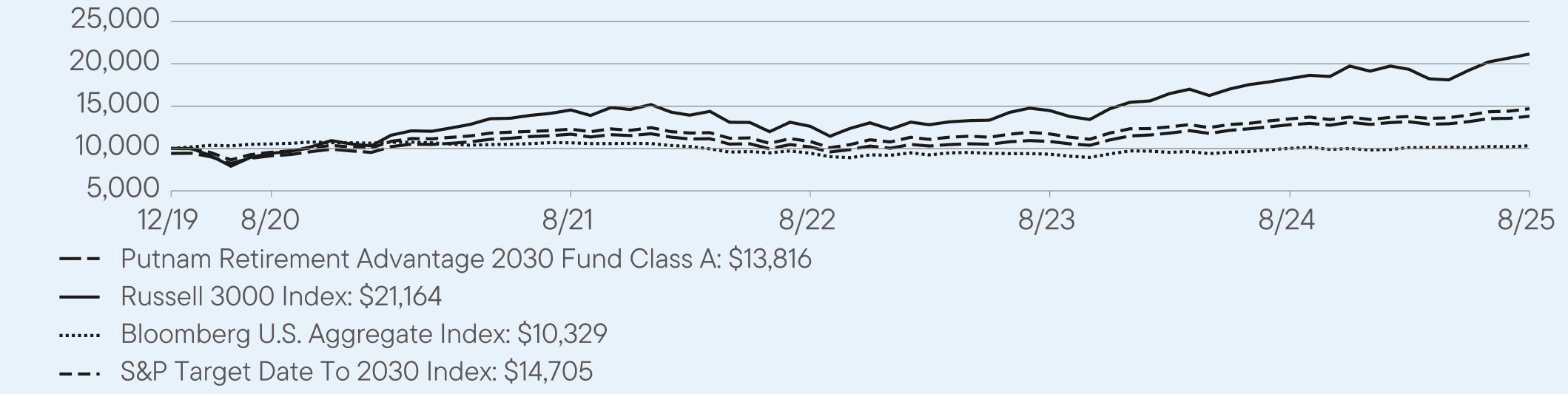

S&P Target Date To 2030 Index

|

8.90

|

7.23

|

7.04

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

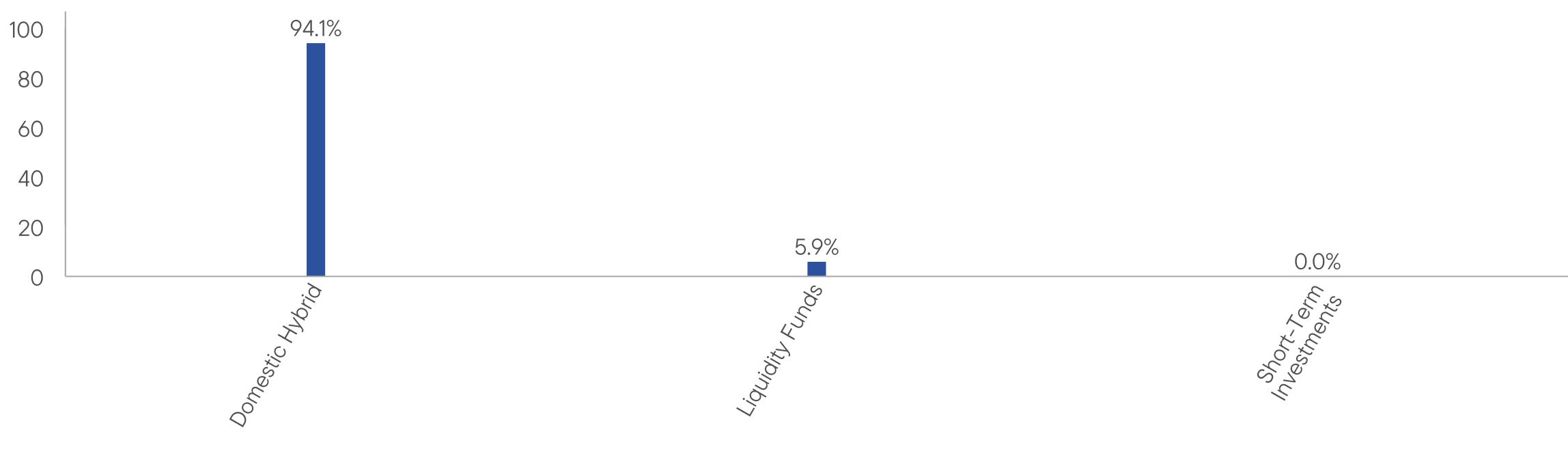

Total Net Assets

|

$38,846,788

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

56%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C1

|

$107

|

1.03%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

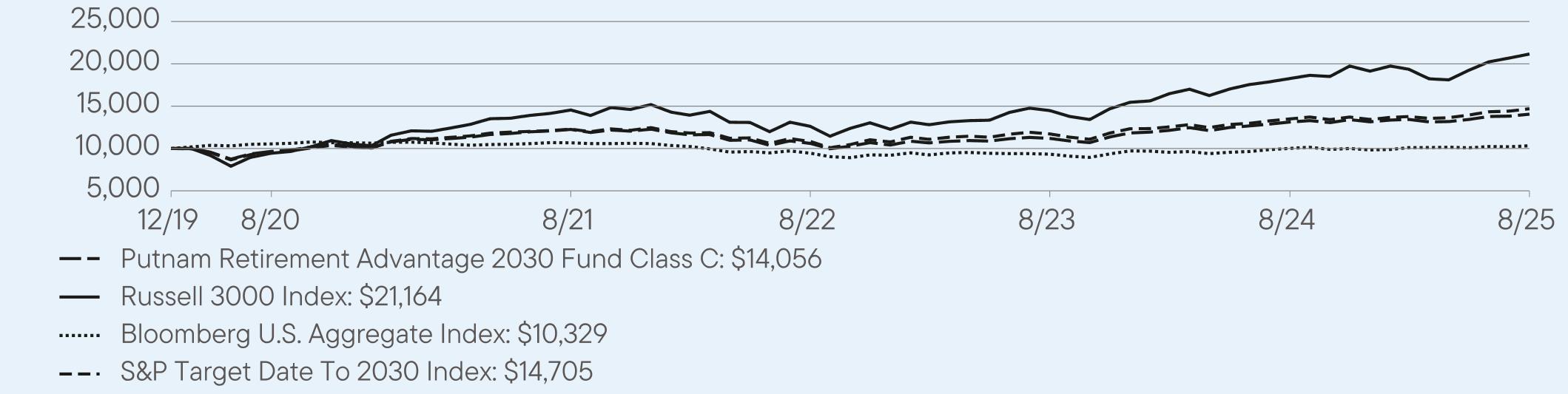

Class C

|

7.01

|

6.05

|

6.19

|

|

Class C (with sales charge)

|

6.01

|

6.05

|

6.19

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2030 Index

|

8.90

|

7.23

|

7.04

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

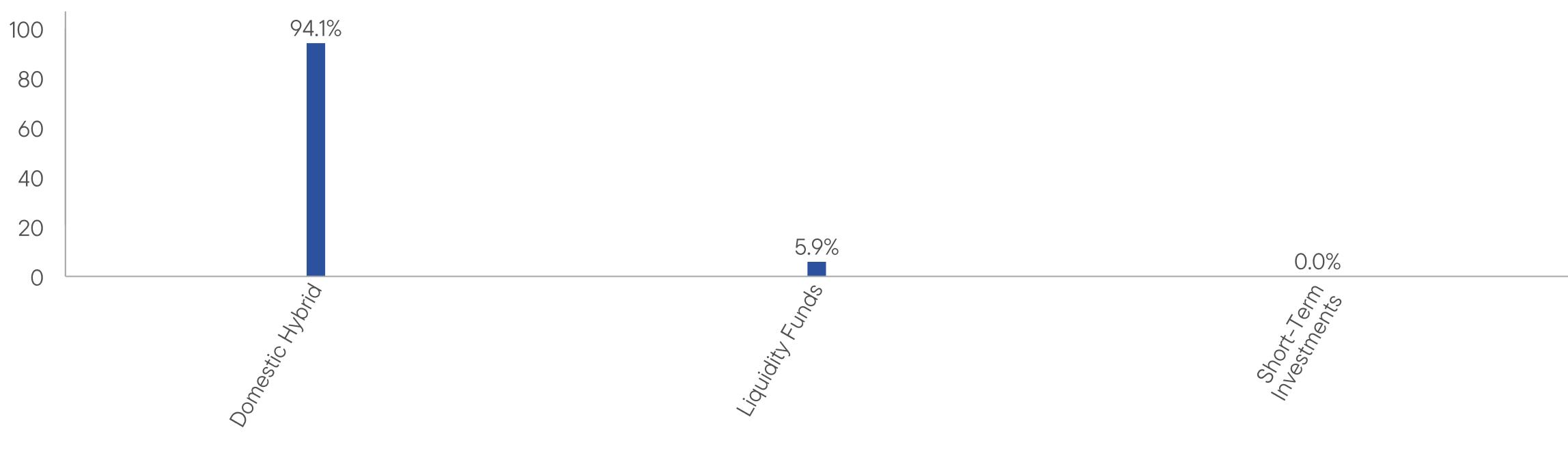

Total Net Assets

|

$38,846,788

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

56%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R1

|

$69

|

0.67%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R

|

7.42

|

6.43

|

6.56

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2030 Index

|

8.90

|

7.23

|

7.04

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,846,788

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

56%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R31

|

$44

|

0.42%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R3

|

7.67

|

6.69

|

6.83

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2030 Index

|

8.90

|

7.23

|

7.04

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,846,788

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

56%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R41

|

$18

|

0.17%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R4

|

8.05

|

6.96

|

7.09

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2030 Index

|

8.90

|

7.23

|

7.04

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,846,788

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

56%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R51

|

$2

|

0.02%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R5

|

8.17

|

7.12

|

7.25

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2030 Index

|

8.90

|

7.23

|

7.04

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,846,788

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

56%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R61

|

$(8)

|

-0.08%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R6

|

8.28

|

7.22

|

7.35

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2030 Index

|

8.90

|

7.23

|

7.04

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,846,788

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

56%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class Y1

|

$2

|

0.02%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

↓

|

U.S. High Dividend Equity strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class Y

|

8.23

|

7.12

|

7.25

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2030 Index

|

8.90

|

7.23

|

7.04

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,846,788

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

56%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

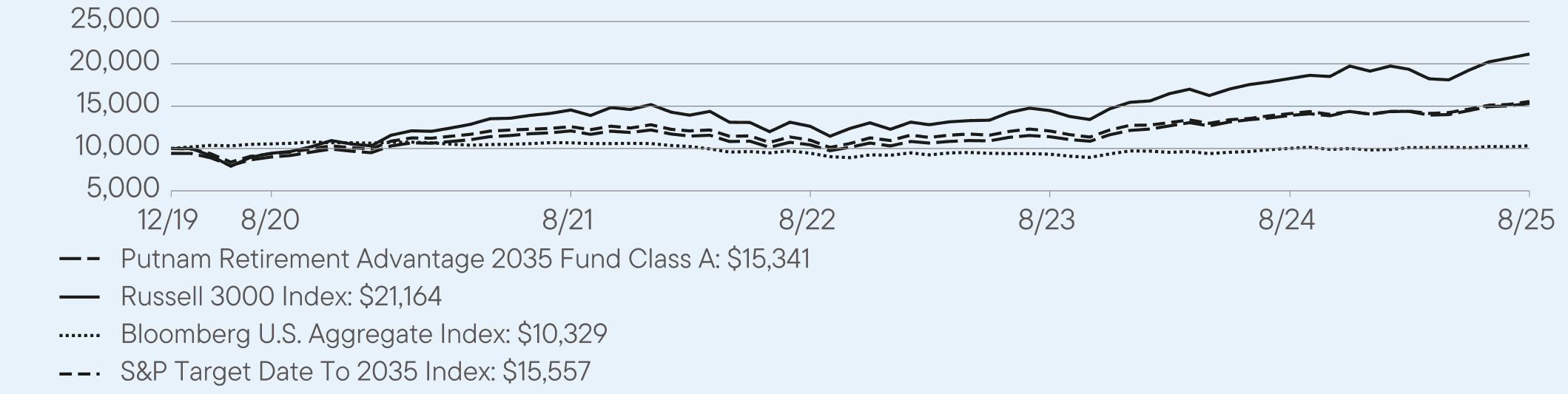

Class A1

|

$27

|

0.26%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class A

|

10.30

|

9.08

|

8.98

|

|

Class A (with sales charge)

|

3.95

|

7.80

|

7.84

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2035 Index

|

10.13

|

8.54

|

8.11

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

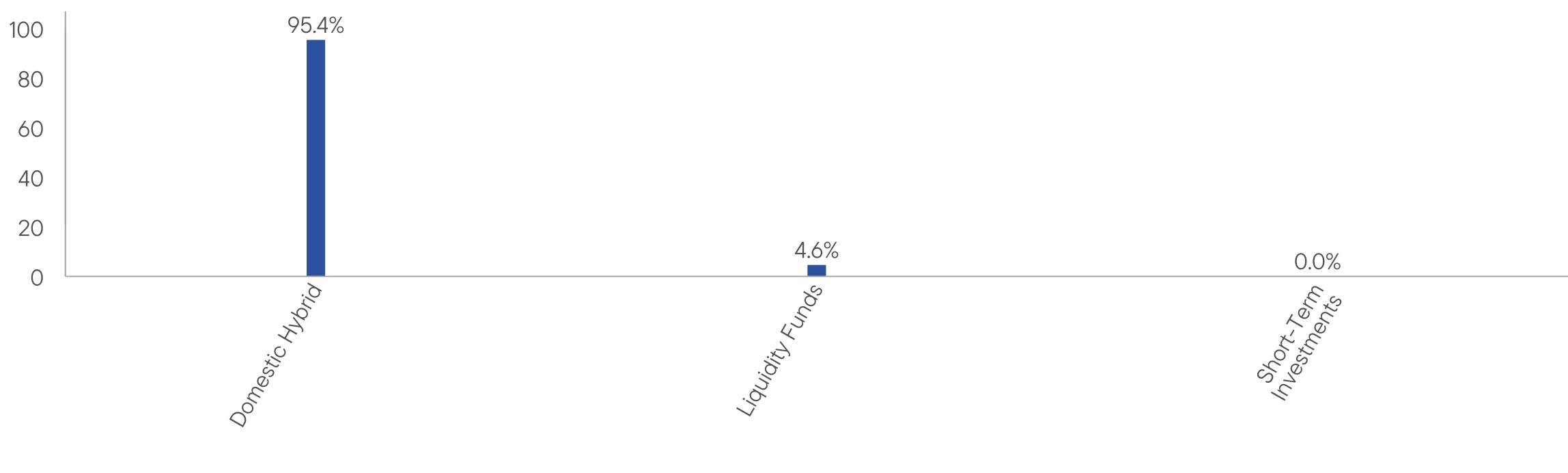

Total Net Assets

|

$45,446,662

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

32%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

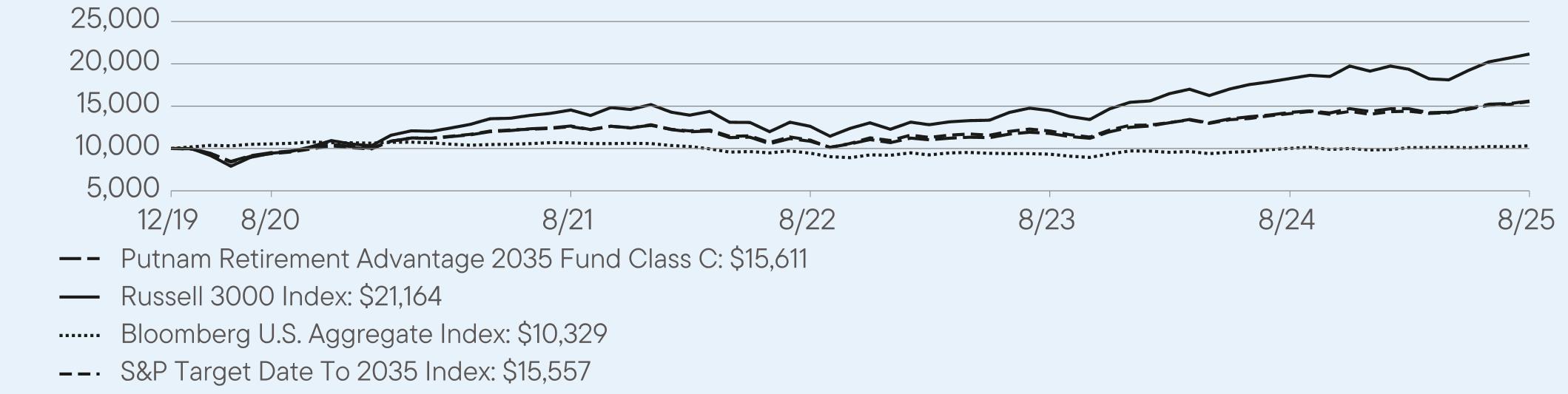

Class C1

|

$107

|

1.02%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class C

|

9.43

|

8.28

|

8.18

|

|

Class C (with sales charge)

|

8.43

|

8.28

|

8.18

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2035 Index

|

10.13

|

8.54

|

8.11

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

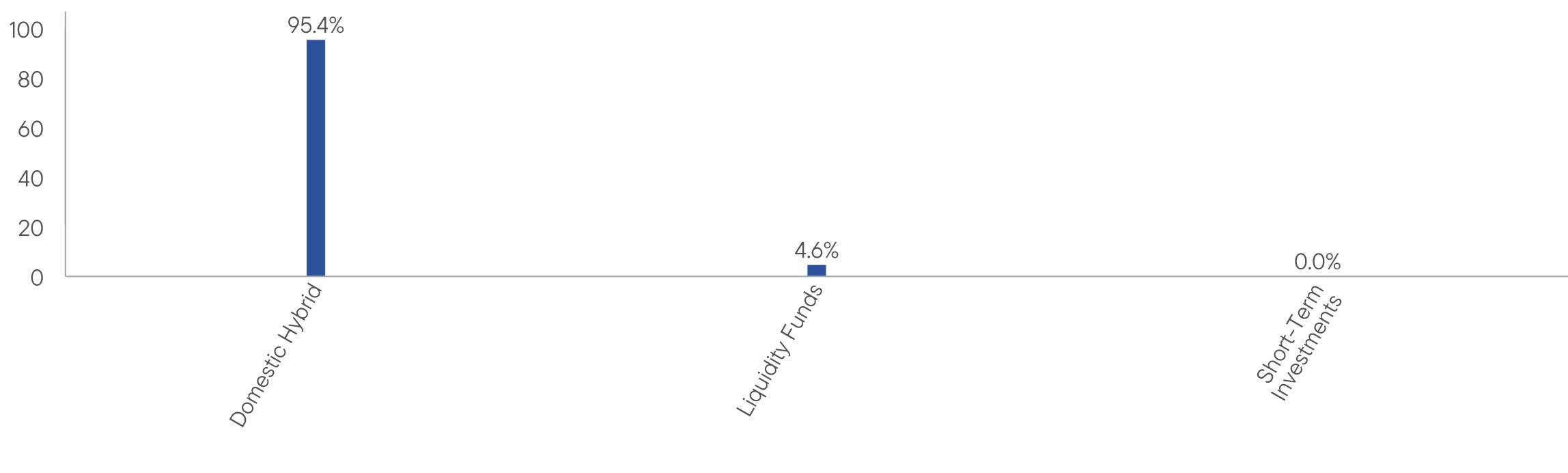

Total Net Assets

|

$45,446,662

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

32%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R1

|

$70

|

0.67%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R

|

9.80

|

8.65

|

8.54

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2035 Index

|

10.13

|

8.54

|

8.11

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$45,446,662

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

32%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R31

|

$43

|

0.41%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R3

|

10.04

|

8.91

|

8.81

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2035 Index

|

10.13

|

8.54

|

8.11

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$45,446,662

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

32%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R41

|

$17

|

0.16%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R4

|

10.43

|

9.19

|

9.07

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2035 Index

|

10.13

|

8.54

|

8.11

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$45,446,662

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

32%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R51

|

$2

|

0.02%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R5

|

10.54

|

9.35

|

9.23

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2035 Index

|

10.13

|

8.54

|

8.11

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$45,446,662

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

32%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R61

|

$(9)

|

-0.09%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R6

|

10.65

|

9.46

|

9.35

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2035 Index

|

10.13

|

8.54

|

8.11

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$45,446,662

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

32%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class Y1

|

$1

|

0.01%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class Y

|

10.58

|

9.36

|

9.24

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2035 Index

|

10.13

|

8.54

|

8.11

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$45,446,662

|

|

Total Number of Portfolio Holdings

|

4

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

32%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A1

|

$23

|

0.22%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class A

|

11.89

|

10.39

|

10.11

|

|

Class A (with sales charge)

|

5.45

|

9.09

|

8.96

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

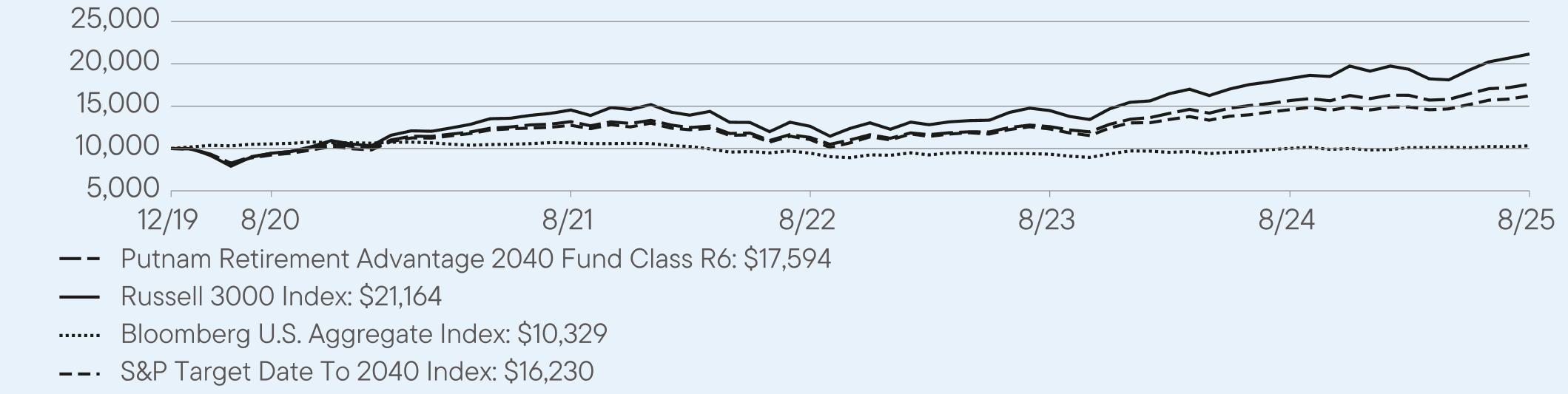

S&P Target Date To 2040 Index

|

11.25

|

9.67

|

8.92

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,655,513

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

39%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C1

|

$102

|

0.97%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class C

|

10.96

|

9.56

|

9.28

|

|

Class C (with sales charge)

|

9.96

|

9.56

|

9.28

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2040 Index

|

11.25

|

9.67

|

8.92

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,655,513

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

39%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R1

|

$66

|

0.62%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R

|

11.45

|

9.95

|

9.67

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2040 Index

|

11.25

|

9.67

|

8.92

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,655,513

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

39%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R31

|

$39

|

0.37%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R3

|

11.70

|

10.22

|

9.94

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2040 Index

|

11.25

|

9.67

|

8.92

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,655,513

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

39%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R41

|

$13

|

0.12%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R4

|

11.93

|

10.48

|

10.19

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2040 Index

|

11.25

|

9.67

|

8.92

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,655,513

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

39%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R51

|

$(3)

|

-0.03%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R5

|

12.10

|

10.64

|

10.35

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2040 Index

|

11.25

|

9.67

|

8.92

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,655,513

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

39%

|

funddocuments@putnam.com.

|

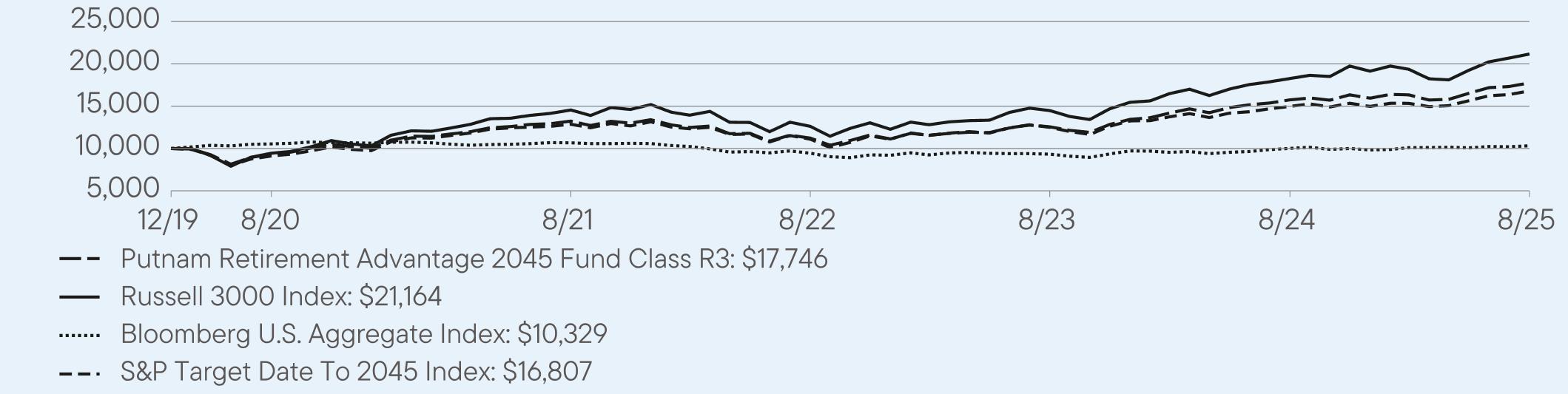

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R61

|

$(14)

|

-0.13%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R6

|

12.32

|

10.77

|

10.48

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2040 Index

|

11.25

|

9.67

|

8.92

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,655,513

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

39%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class Y1

|

$(3)

|

-0.03%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

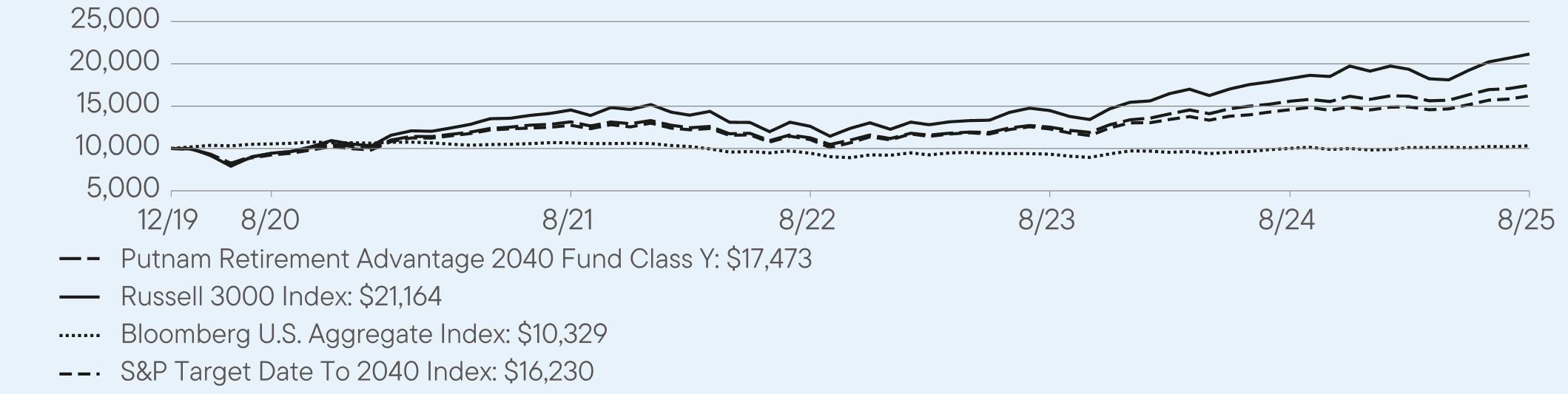

Class Y

|

12.08

|

10.64

|

10.35

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2040 Index

|

11.25

|

9.67

|

8.92

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$38,655,513

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

39%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

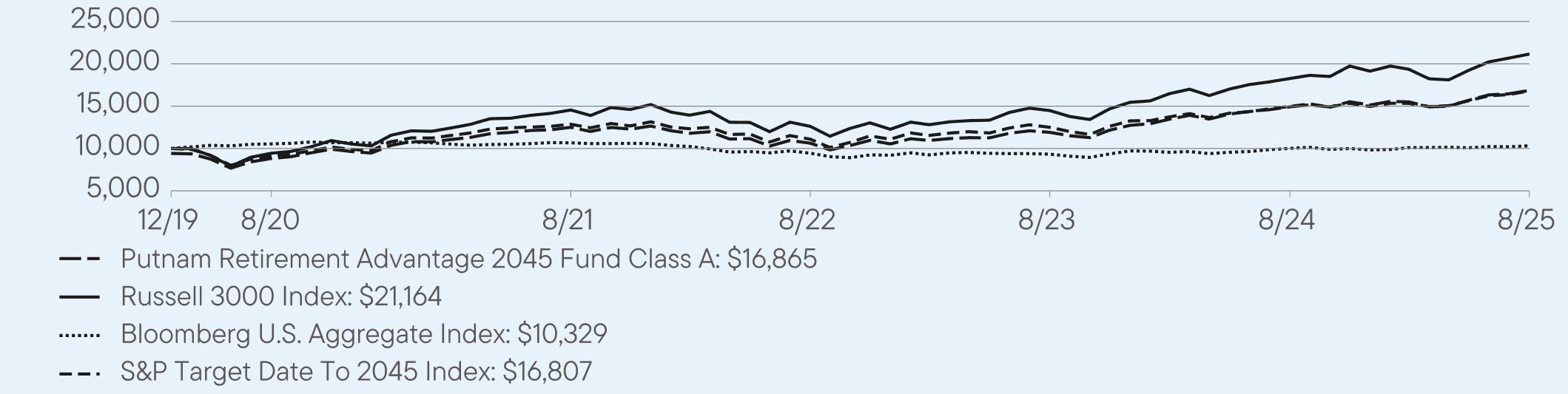

Class A1

|

$20

|

0.19%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class A

|

12.95

|

11.19

|

10.81

|

|

Class A (with sales charge)

|

6.45

|

9.88

|

9.66

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2045 Index

|

12.16

|

10.55

|

9.60

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

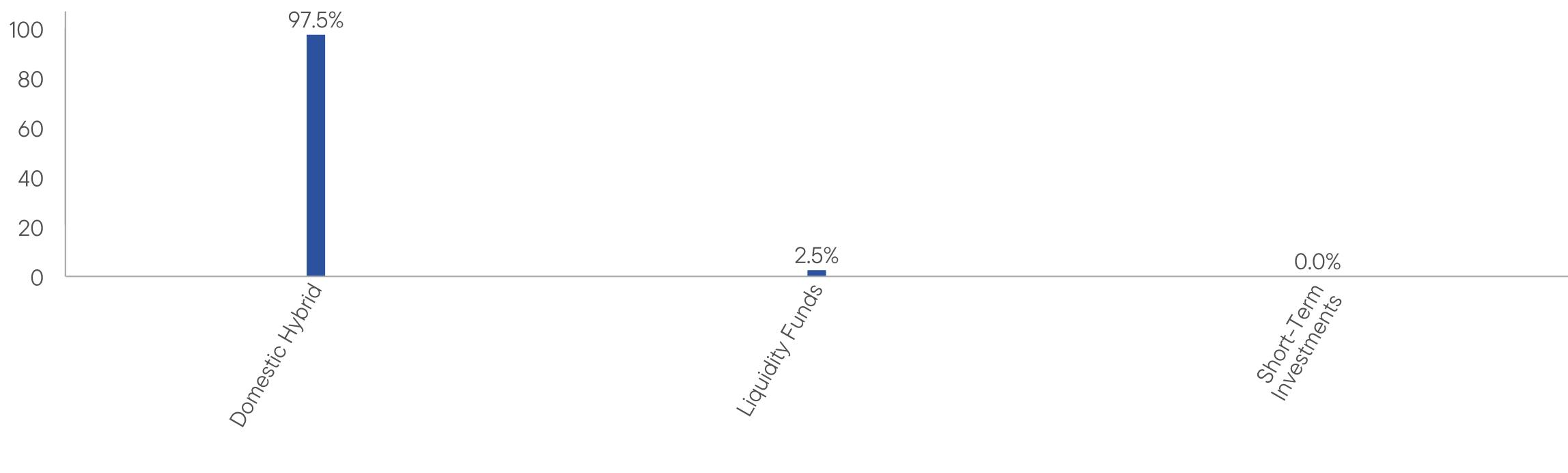

Total Net Assets

|

$26,850,748

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

30%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

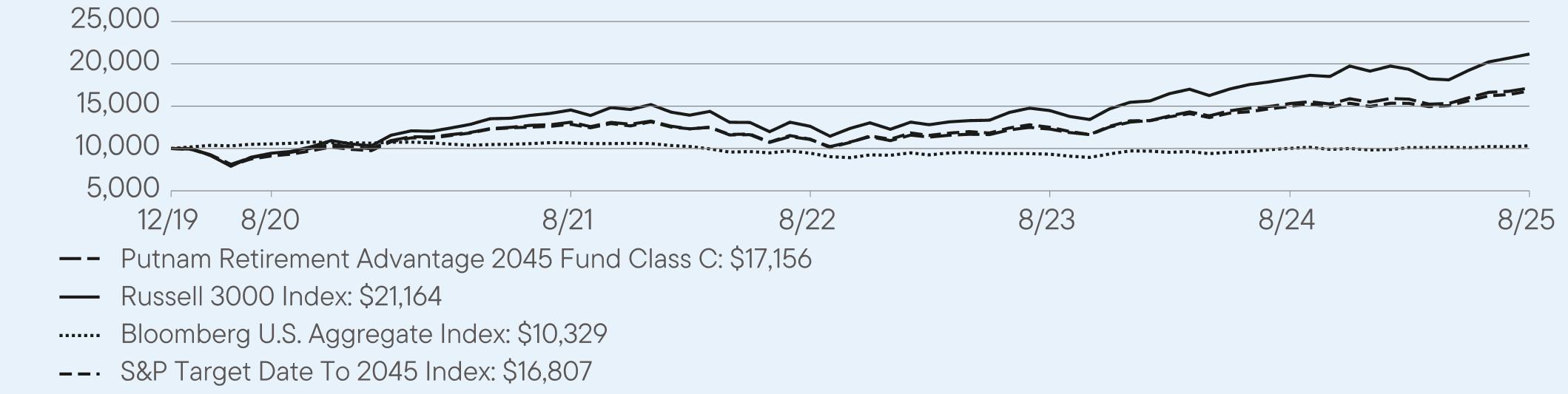

Class C1

|

$100

|

0.94%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class C

|

12.06

|

10.37

|

9.99

|

|

Class C (with sales charge)

|

11.06

|

10.37

|

9.99

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2045 Index

|

12.16

|

10.55

|

9.60

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

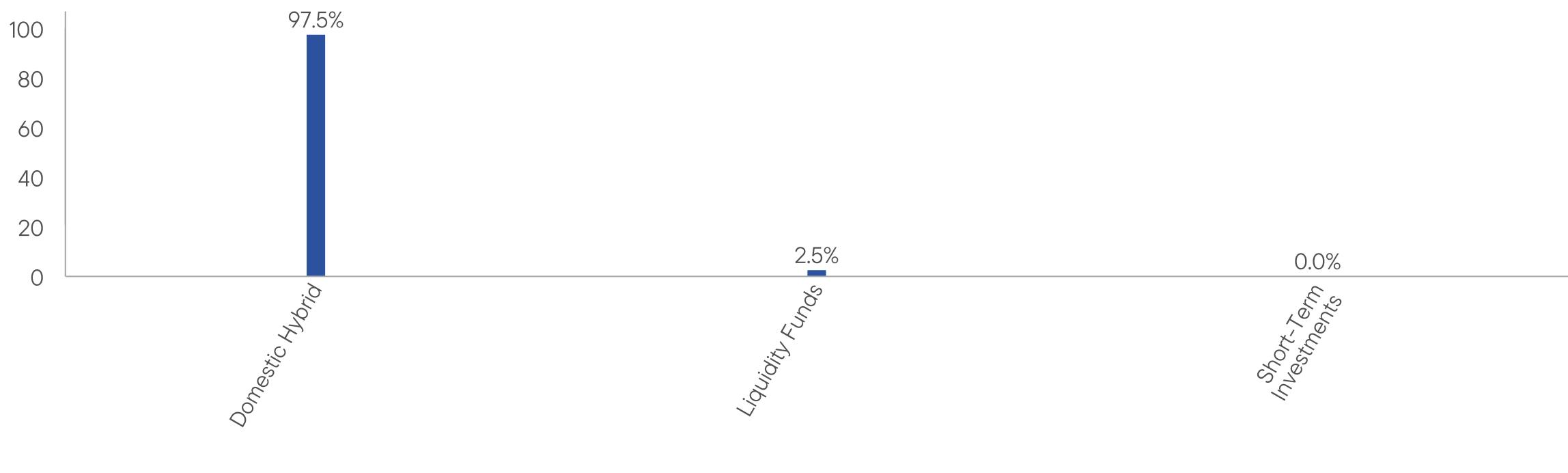

Total Net Assets

|

$26,850,748

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

30%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R1

|

$63

|

0.59%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R

|

12.41

|

10.76

|

10.38

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2045 Index

|

12.16

|

10.55

|

9.60

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$26,850,748

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

30%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R31

|

$36

|

0.34%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R3

|

12.69

|

11.03

|

10.65

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2045 Index

|

12.16

|

10.55

|

9.60

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$26,850,748

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

30%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R41

|

$10

|

0.09%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R4

|

12.99

|

11.30

|

10.91

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2045 Index

|

12.16

|

10.55

|

9.60

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$26,850,748

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

30%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R51

|

$(6)

|

-0.06%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R5

|

13.18

|

11.47

|

11.08

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2045 Index

|

12.16

|

10.55

|

9.60

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$26,850,748

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

30%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R61

|

$(17)

|

-0.16%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R6

|

13.29

|

11.58

|

11.20

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2045 Index

|

12.16

|

10.55

|

9.60

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$26,850,748

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

30%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class Y1

|

$(6)

|

-0.06%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class Y

|

13.13

|

11.46

|

11.08

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2045 Index

|

12.16

|

10.55

|

9.60

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$26,850,748

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

30%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A1

|

$19

|

0.18%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class A

|

13.57

|

11.86

|

11.49

|

|

Class A (with sales charge)

|

7.04

|

10.54

|

10.34

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2050 Index

|

12.60

|

11.04

|

10.06

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$25,807,493

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

28%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C1

|

$99

|

0.93%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class C

|

12.66

|

11.02

|

10.66

|

|

Class C (with sales charge)

|

11.66

|

11.02

|

10.66

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2050 Index

|

12.60

|

11.04

|

10.06

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$25,807,493

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

28%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R1

|

$62

|

0.58%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R

|

13.12

|

11.41

|

11.05

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2050 Index

|

12.60

|

11.04

|

10.06

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$25,807,493

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

28%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R31

|

$35

|

0.33%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R3

|

13.37

|

11.68

|

11.32

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2050 Index

|

12.60

|

11.04

|

10.06

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$25,807,493

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

28%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R41

|

$9

|

0.08%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R4

|

13.68

|

11.96

|

11.59

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2050 Index

|

12.60

|

11.04

|

10.06

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$25,807,493

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

28%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R51

|

$(7)

|

-0.07%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R5

|

13.77

|

12.12

|

11.74

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2050 Index

|

12.60

|

11.04

|

10.06

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$25,807,493

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

28%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class R61

|

$(18)

|

-0.17%

|

|

Top contributors to performance:

|

|

|

↑

|

Quantitative Large Cap strategy

|

|

↑

|

Quantitative International Equity strategy

|

|

↑

|

Fundamental International Equity strategy

|

|

Top detractors from performance:

|

|

|

↓

|

Fundamental U.S. Large Cap Growth strategy

|

|

↓

|

High Yield Fixed Income strategy

|

|

|

1 Year

|

5 Year

|

Since Inception

(12/31/2019) |

|

Class R6

|

13.89

|

12.23

|

11.86

|

|

Russell 3000 Index

|

15.84

|

14.11

|

14.15

|

|

Bloomberg U.S. Aggregate Index

|

3.14

|

-0.68

|

0.57

|

|

S&P Target Date To 2050 Index

|

12.60

|

11.04

|

10.06

|

https://www.franklintempleton.com/investments/options/mutual-funds.

|

Total Net Assets

|

$25,807,493

|

|

Total Number of Portfolio Holdings

|

3

|

|

Total Management Fee Paid

|

$0

|

|

Portfolio Turnover Rate

|

28%

|

funddocuments@putnam.com.

|

Class Name

|

Costs of a $10,000 investment

|