Shareholder Report

|

6 Months Ended |

|

Aug. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

BNY Mellon Research Growth Fund, Inc.

|

|

| Entity Central Index Key |

0000030162

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Aug. 31, 2025

|

|

| C000069523 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BNY Mellon Research Growth Fund, Inc.

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

DWOAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about BNY Mellon Research Growth Fund, Inc. (the “Fund”) for the period of March 1, 2025 to August 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-373-9387

|

|

| Additional Information Email |

info@bny.com

|

|

| Additional Information Website |

bny.com/investments/literaturecenter

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months ? (based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class A* |

$55 |

1.02%** |

| * |

During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

| ** |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 55

|

[1] |

| Expense Ratio, Percent |

1.02%

|

[1],[2] |

| Material Change Date |

Jun. 30, 2025

|

|

| Net Assets |

$ 1,684,000,000

|

|

| Holdings Count | Holding |

60

|

|

| Investment Company Portfolio Turnover |

27.29%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (AS OF 8/31/25 )

Fund Size (Millions) |

Number of Holdings |

Portfolio Turnover |

| $1,684 |

60 |

27.29% |

|

|

| Holdings [Text Block] |

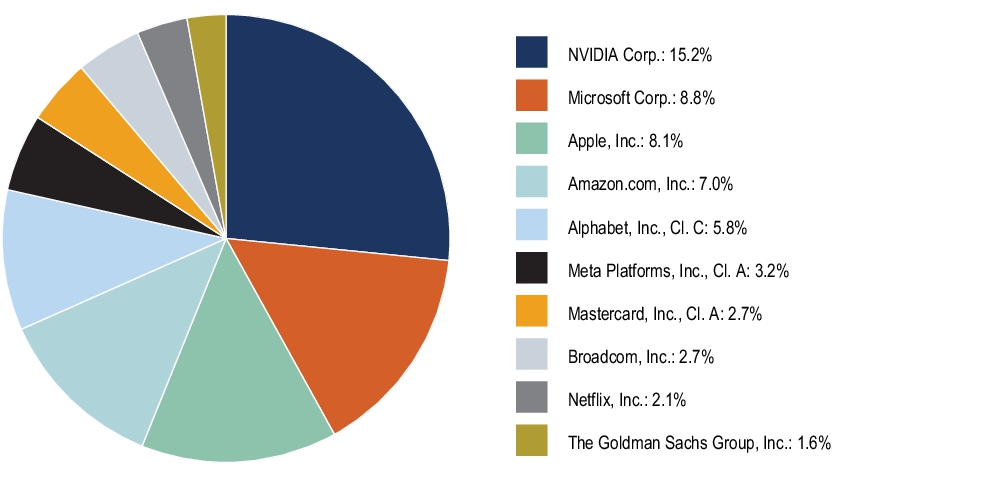

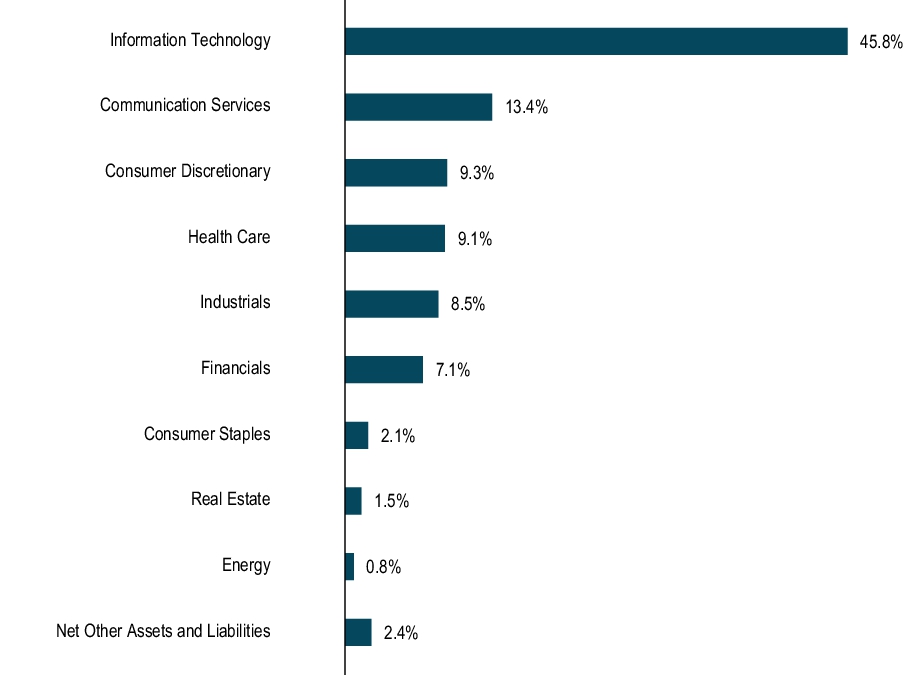

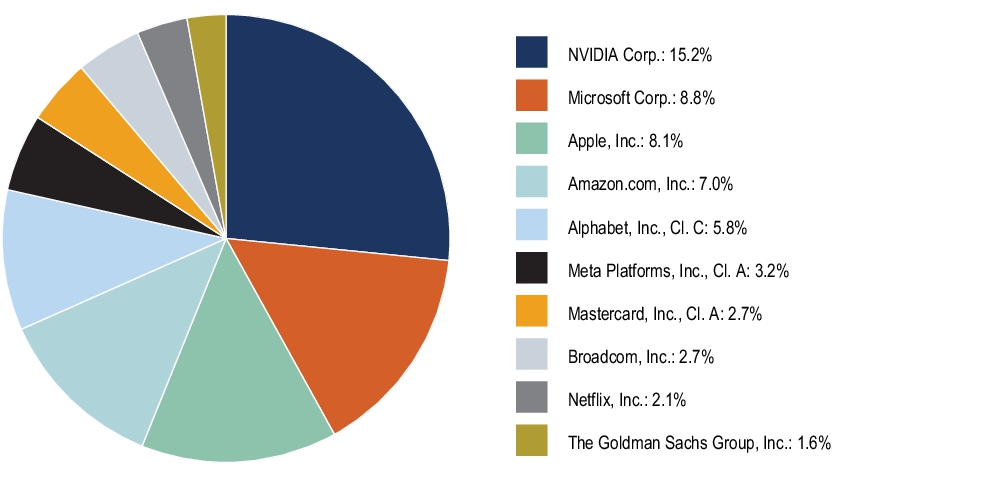

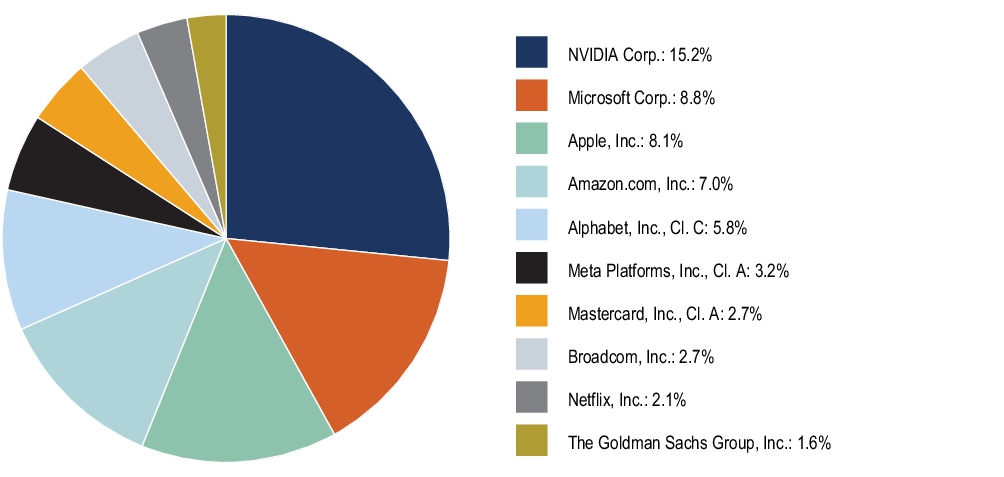

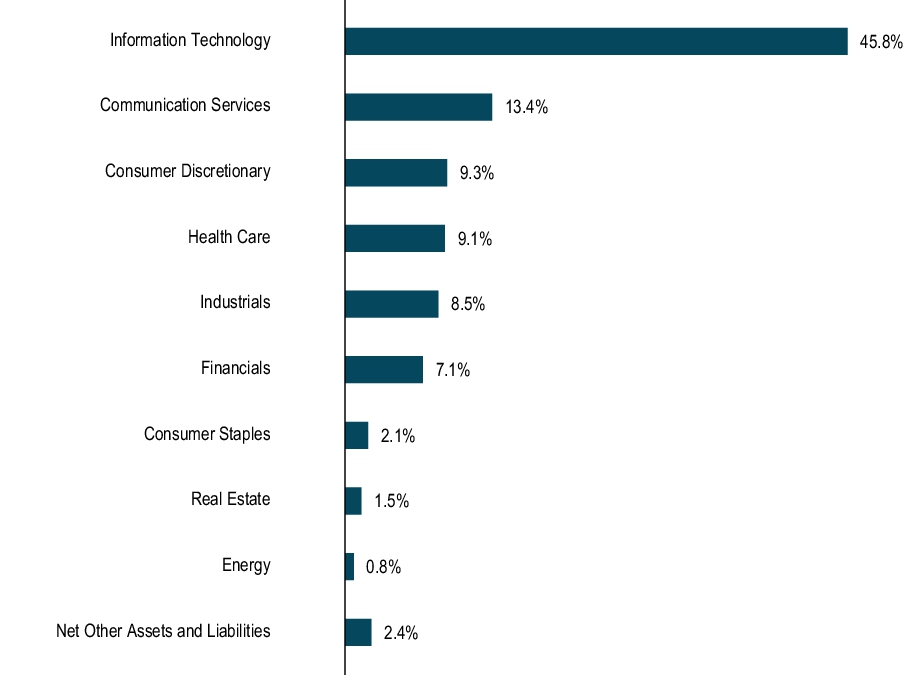

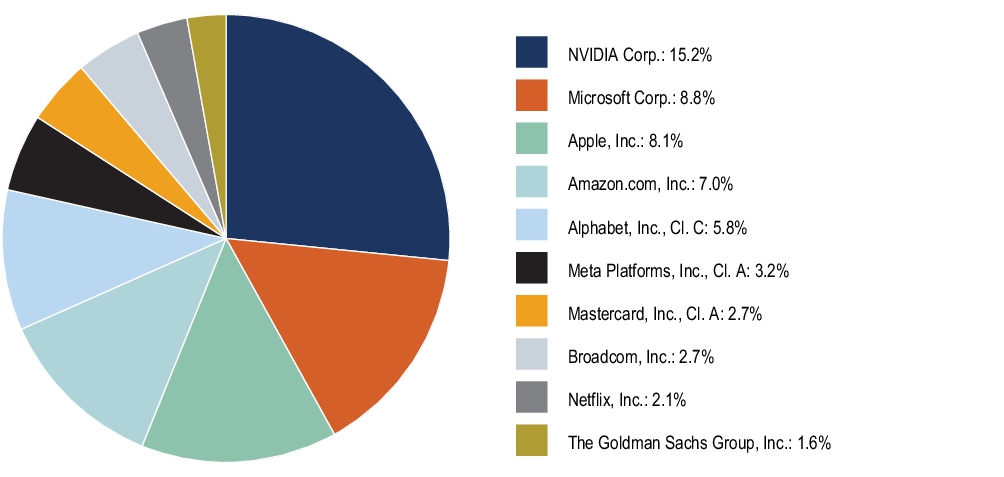

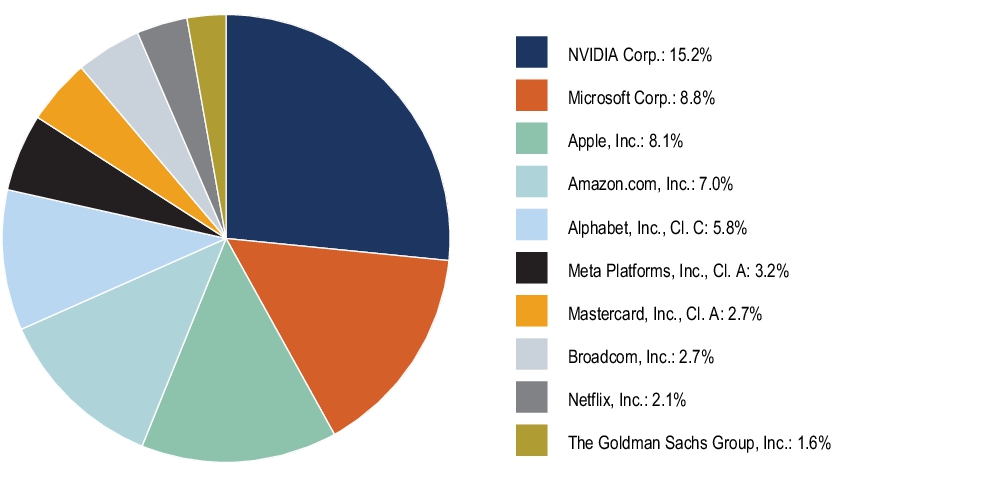

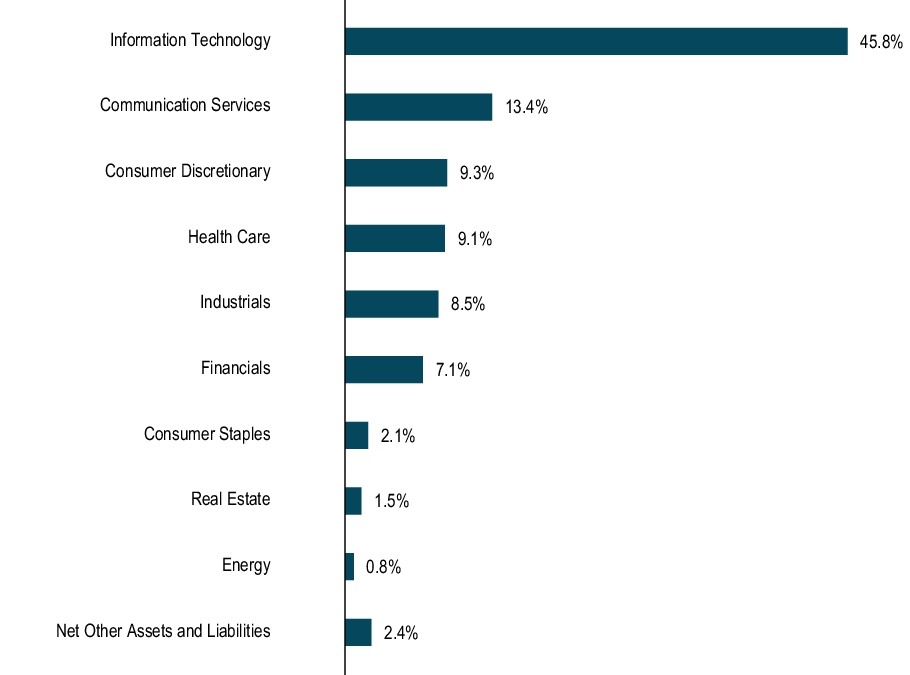

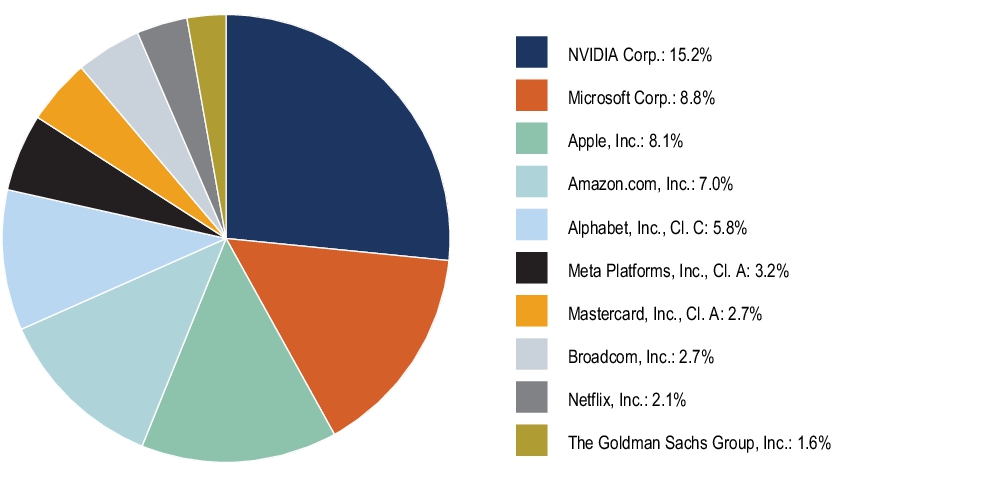

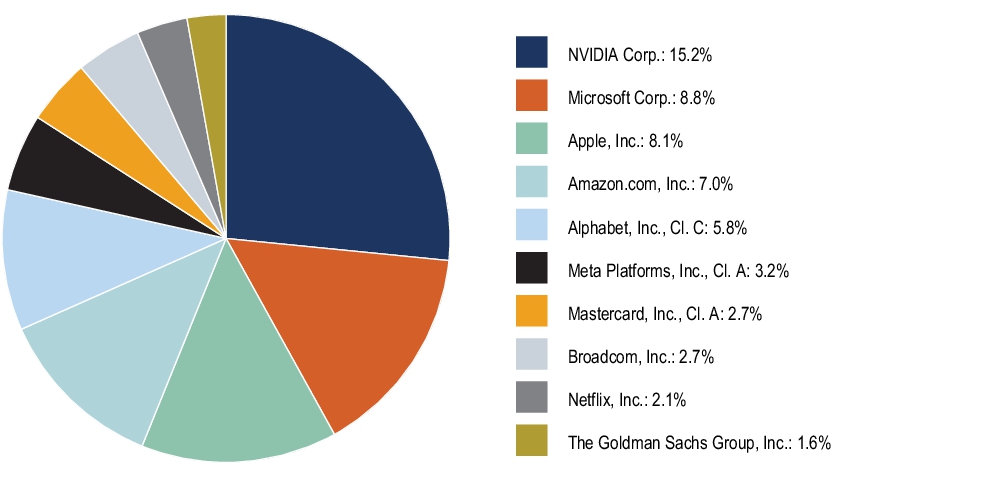

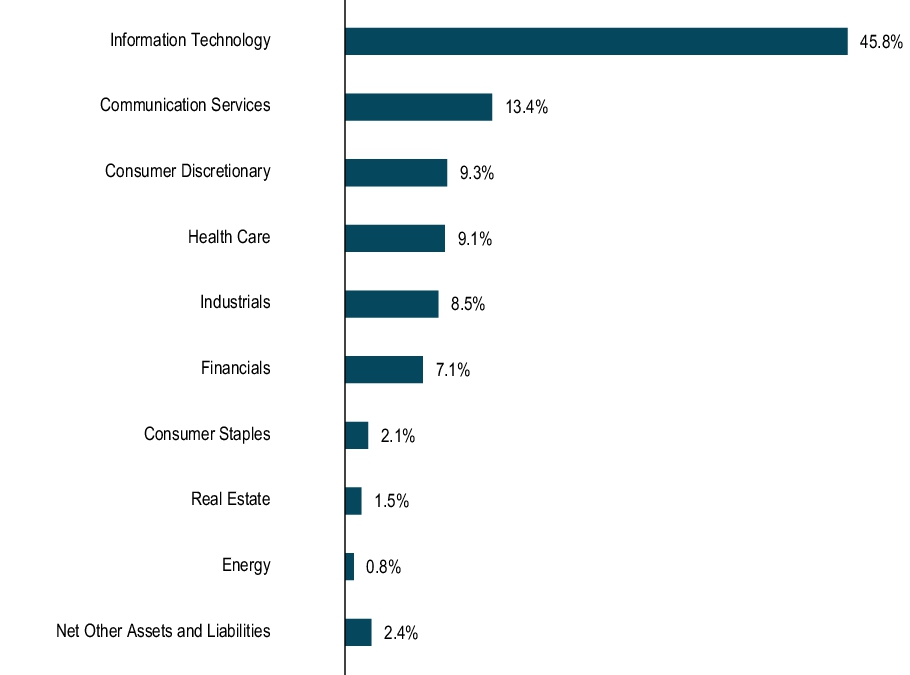

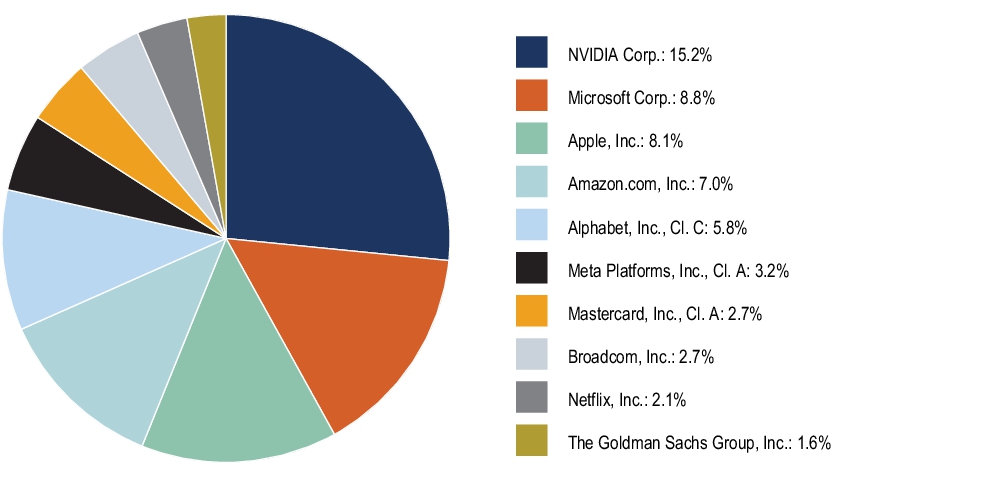

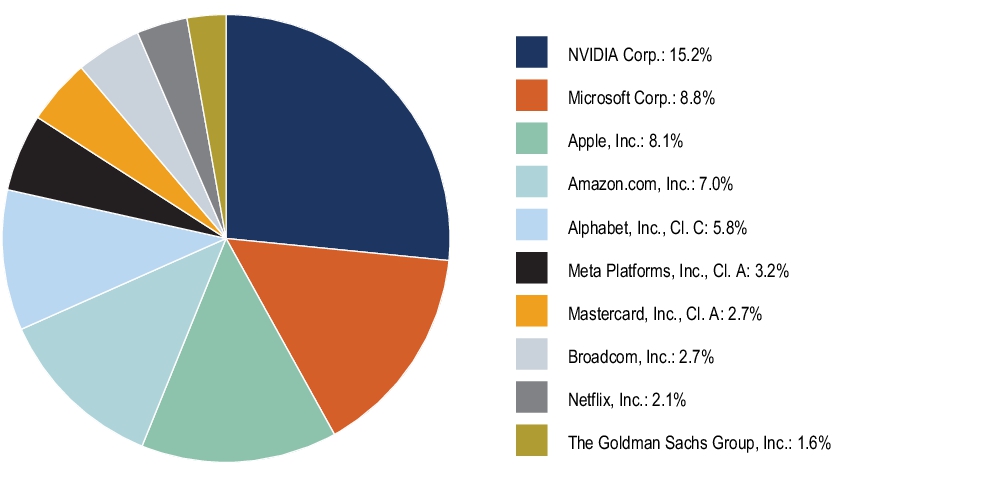

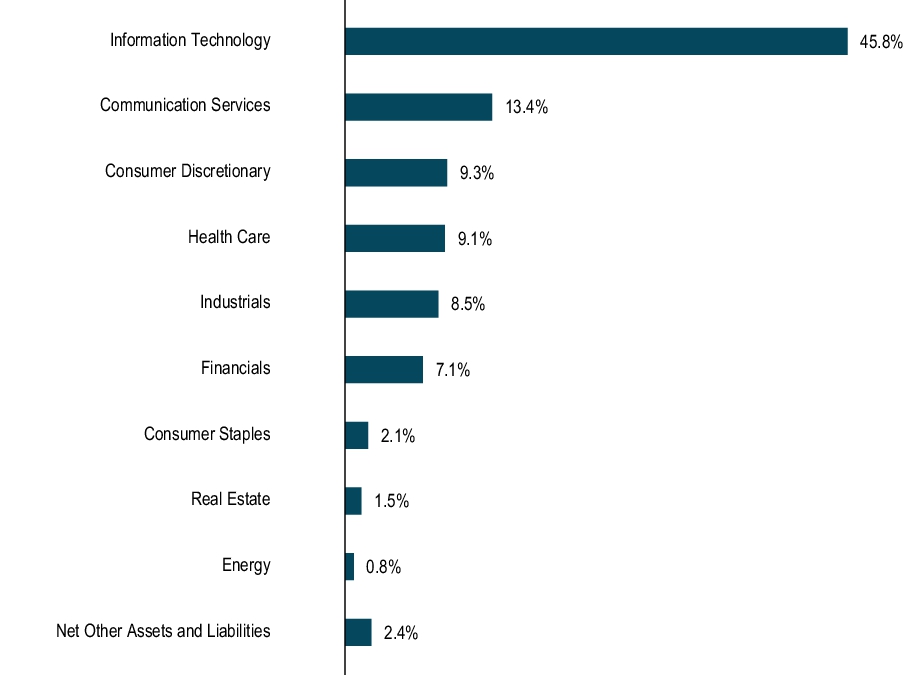

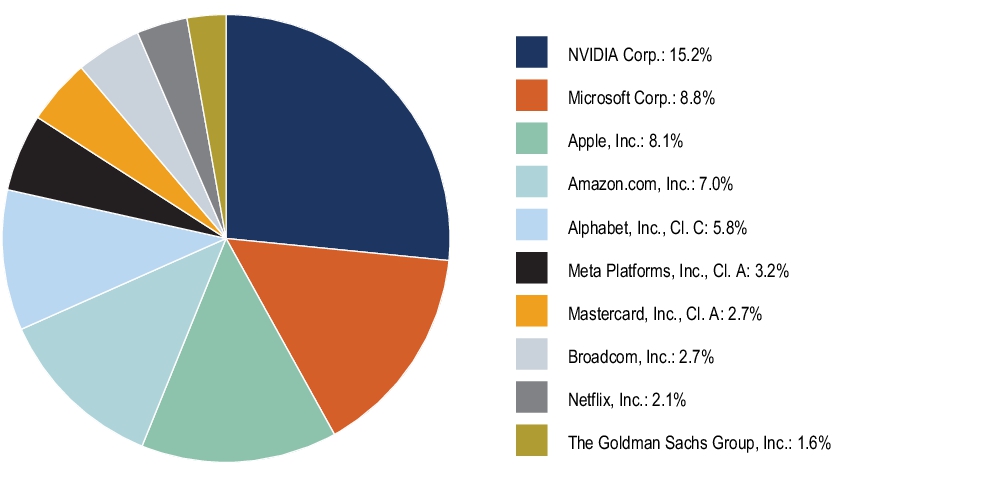

Portfolio Holdings (as of 8/31/25 ) Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any. Sector Allocation (Based on Net Assets)

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed?

-

Effective June 30, 2025, the fund’s investment adviser, BNY Mellon Investment Adviser, Inc., revised the expense limitation agreement and contractually agreed, until June 30, 2026, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .75%. On or after June 30, 2026, BNY Mellon Investment Adviser, Inc. may terminate this expense limitation agreement at any time. This is a summary of certain changes to the Fund since March 1, 2025 . For more complete information, you may review the Fund’s current prospectus dated June 30, 2025 at bny.com/investments/literaturecenter or upon request at 1-800-373-9387.

|

|

| Material Fund Change Expenses [Text Block] |

Effective June 30, 2025, the fund’s investment adviser, BNY Mellon Investment Adviser, Inc., revised the expense limitation agreement and contractually agreed, until June 30, 2026, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .75%. On or after June 30, 2026, BNY Mellon Investment Adviser, Inc. may terminate this expense limitation agreement at any time.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since March 1, 2025 . For more complete information, you may review the Fund’s current prospectus dated June 30, 2025 at bny.com/investments/literaturecenter or upon request at 1-800-373-9387.

|

|

| Updated Prospectus Phone Number |

1-800-373-9387

|

|

| Updated Prospectus Web Address |

bny.com/investments/literaturecenter

|

|

| C000069524 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BNY Mellon Research Growth Fund, Inc.

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

DWOCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about BNY Mellon Research Growth Fund, Inc. (the “Fund”) for the period of March 1, 2025 to August 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-373-9387

|

|

| Additional Information Email |

info@bny.com

|

|

| Additional Information Website |

bny.com/investments/literaturecenter

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months ? (based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class C* |

$95 |

1.77%** |

| * |

During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

| ** |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 95

|

[3] |

| Expense Ratio, Percent |

1.77%

|

[3],[4] |

| Material Change Date |

Jun. 30, 2025

|

|

| Net Assets |

$ 1,684,000,000

|

|

| Holdings Count | Holding |

60

|

|

| Investment Company Portfolio Turnover |

27.29%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (AS OF 8/31/25 )

Fund Size (Millions) |

Number of Holdings |

Portfolio Turnover |

| $1,684 |

60 |

27.29% |

|

|

| Holdings [Text Block] |

Portfolio Holdings (as of 8/31/25 ) Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any. Sector Allocation (Based on Net Assets)

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed?

-

Effective June 30, 2025, the fund’s investment adviser, BNY Mellon Investment Adviser, Inc., revised the expense limitation agreement and contractually agreed, until June 30, 2026, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .75%. On or after June 30, 2026, BNY Mellon Investment Adviser, Inc. may terminate this expense limitation agreement at any time. This is a summary of certain changes to the Fund since March 1, 2025 . For more complete information, you may review the Fund’s current prospectus dated June 30, 2025 at bny.com/investments/literaturecenter or upon request at 1-800-373-9387.

|

|

| Material Fund Change Expenses [Text Block] |

Effective June 30, 2025, the fund’s investment adviser, BNY Mellon Investment Adviser, Inc., revised the expense limitation agreement and contractually agreed, until June 30, 2026, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .75%. On or after June 30, 2026, BNY Mellon Investment Adviser, Inc. may terminate this expense limitation agreement at any time.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since March 1, 2025 . For more complete information, you may review the Fund’s current prospectus dated June 30, 2025 at bny.com/investments/literaturecenter or upon request at 1-800-373-9387.

|

|

| Updated Prospectus Phone Number |

1-800-373-9387

|

|

| Updated Prospectus Web Address |

bny.com/investments/literaturecenter

|

|

| C000069525 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BNY Mellon Research Growth Fund, Inc.

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

DWOIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about BNY Mellon Research Growth Fund, Inc. (the “Fund”) for the period of March 1, 2025 to August 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-373-9387

|

|

| Additional Information Email |

info@bny.com

|

|

| Additional Information Website |

bny.com/investments/literaturecenter

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months ? (based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class I* |

$41 |

0.77%** |

| * |

During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

| ** |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 41

|

[5] |

| Expense Ratio, Percent |

0.77%

|

[5],[6] |

| Material Change Date |

Jun. 30, 2025

|

|

| Net Assets |

$ 1,684,000,000

|

|

| Holdings Count | Holding |

60

|

|

| Investment Company Portfolio Turnover |

27.29%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (AS OF 8/31/25 )

Fund Size (Millions) |

Number of Holdings |

Portfolio Turnover |

| $1,684 |

60 |

27.29% |

|

|

| Holdings [Text Block] |

Portfolio Holdings (as of 8/31/25 ) Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any. Sector Allocation (Based on Net Assets)

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed?

-

Effective June 30, 2025, the fund’s investment adviser, BNY Mellon Investment Adviser, Inc., revised the expense limitation agreement and contractually agreed, until June 30, 2026, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .75%. On or after June 30, 2026, BNY Mellon Investment Adviser, Inc. may terminate this expense limitation agreement at any time. This is a summary of certain changes to the Fund since March 1, 2025 . For more complete information, you may review the Fund’s current prospectus dated June 30, 2025 at bny.com/investments/literaturecenter or upon request at 1-800-373-9387.

|

|

| Material Fund Change Expenses [Text Block] |

Effective June 30, 2025, the fund’s investment adviser, BNY Mellon Investment Adviser, Inc., revised the expense limitation agreement and contractually agreed, until June 30, 2026, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .75%. On or after June 30, 2026, BNY Mellon Investment Adviser, Inc. may terminate this expense limitation agreement at any time.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since March 1, 2025 . For more complete information, you may review the Fund’s current prospectus dated June 30, 2025 at bny.com/investments/literaturecenter or upon request at 1-800-373-9387.

|

|

| Updated Prospectus Phone Number |

1-800-373-9387

|

|

| Updated Prospectus Web Address |

bny.com/investments/literaturecenter

|

|

| C000127666 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BNY Mellon Research Growth Fund, Inc.

|

|

| Class Name |

Class Y

|

|

| Trading Symbol |

DRYQX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about BNY Mellon Research Growth Fund, Inc. (the “Fund”) for the period of March 1, 2025 to August 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-373-9387

|

|

| Additional Information Email |

info@bny.com

|

|

| Additional Information Website |

bny.com/investments/literaturecenter

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months ? (based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class Y* |

$41 |

0.77%** |

| * |

During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

| ** |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 41

|

[7] |

| Expense Ratio, Percent |

0.77%

|

[7],[8] |

| Material Change Date |

Jun. 30, 2025

|

|

| Net Assets |

$ 1,684,000,000

|

|

| Holdings Count | Holding |

60

|

|

| Investment Company Portfolio Turnover |

27.29%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (AS OF 8/31/25 )

Fund Size (Millions) |

Number of Holdings |

Portfolio Turnover |

| $1,684 |

60 |

27.29% |

|

|

| Holdings [Text Block] |

Portfolio Holdings (as of 8/31/25 ) Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any. Sector Allocation (Based on Net Assets)

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed?

-

Effective June 30, 2025, the fund’s investment adviser, BNY Mellon Investment Adviser, Inc., revised the expense limitation agreement and contractually agreed, until June 30, 2026, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .75%. On or after June 30, 2026, BNY Mellon Investment Adviser, Inc. may terminate this expense limitation agreement at any time. This is a summary of certain changes to the Fund since March 1, 2025 . For more complete information, you may review the Fund’s current prospectus dated June 30, 2025 at bny.com/investments/literaturecenter or upon request at 1-800-373-9387.

|

|

| Material Fund Change Expenses [Text Block] |

Effective June 30, 2025, the fund’s investment adviser, BNY Mellon Investment Adviser, Inc., revised the expense limitation agreement and contractually agreed, until June 30, 2026, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .75%. On or after June 30, 2026, BNY Mellon Investment Adviser, Inc. may terminate this expense limitation agreement at any time.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since March 1, 2025 . For more complete information, you may review the Fund’s current prospectus dated June 30, 2025 at bny.com/investments/literaturecenter or upon request at 1-800-373-9387.

|

|

| Updated Prospectus Phone Number |

1-800-373-9387

|

|

| Updated Prospectus Web Address |

bny.com/investments/literaturecenter

|

|

| C000000108 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BNY Mellon Research Growth Fund, Inc.

|

|

| Class Name |

Class Z

|

|

| Trading Symbol |

DREQX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about BNY Mellon Research Growth Fund, Inc. (the “Fund”) for the period of March 1, 2025 to August 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at bny.com/investments/literaturecenter. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

1-800-373-9387

|

|

| Additional Information Email |

info@bny.com

|

|

| Additional Information Website |

bny.com/investments/literaturecenter

|

|

| Expenses [Text Block] |

What were the Fund’s costs for the last six months ? (based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class Z* |

$44 |

0.82%** |

| * |

During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher. |

| ** |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 44

|

[9] |

| Expense Ratio, Percent |

0.82%

|

[9],[10] |

| Material Change Date |

Jun. 30, 2025

|

|

| Net Assets |

$ 1,684,000,000

|

|

| Holdings Count | Holding |

60

|

|

| Investment Company Portfolio Turnover |

27.29%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (AS OF 8/31/25 )

Fund Size (Millions) |

Number of Holdings |

Portfolio Turnover |

| $1,684 |

60 |

27.29% |

|

|

| Holdings [Text Block] |

Portfolio Holdings (as of 8/31/25 ) Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any. Sector Allocation (Based on Net Assets)

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings (Based on Net Assets) * * Excludes money market funds or other short-term securities held for the investment of cash and cash collateral for securities loaned, if any.

|

|

| Material Fund Change [Text Block] |

How has the Fund changed?

-

Effective June 30, 2025, the fund’s investment adviser, BNY Mellon Investment Adviser, Inc., revised the expense limitation agreement and contractually agreed, until June 30, 2026, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .75%. On or after June 30, 2026, BNY Mellon Investment Adviser, Inc. may terminate this expense limitation agreement at any time. This is a summary of certain changes to the Fund since March 1, 2025 . For more complete information, you may review the Fund’s current prospectus dated June 30, 2025 at bny.com/investments/literaturecenter or upon request at 1-800-373-9387.

|

|

| Material Fund Change Expenses [Text Block] |

Effective June 30, 2025, the fund’s investment adviser, BNY Mellon Investment Adviser, Inc., revised the expense limitation agreement and contractually agreed, until June 30, 2026, to waive receipt of its fees and/or assume the direct expenses of the fund so that the direct expenses of none of the fund’s share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed .75%. On or after June 30, 2026, BNY Mellon Investment Adviser, Inc. may terminate this expense limitation agreement at any time.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since March 1, 2025 . For more complete information, you may review the Fund’s current prospectus dated June 30, 2025 at bny.com/investments/literaturecenter or upon request at 1-800-373-9387.

|

|

| Updated Prospectus Phone Number |

1-800-373-9387

|

|

| Updated Prospectus Web Address |

bny.com/investments/literaturecenter

|

|

|

|