The Fund does not have a performance history. Once available, the Fund’s performance information, and information that gives some indication of the risks of an investment in the Fund by comparing the Fund’s performance with a broad measure of market performance, will be available on the Fund’s website at www.madisonfunds.com.

The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

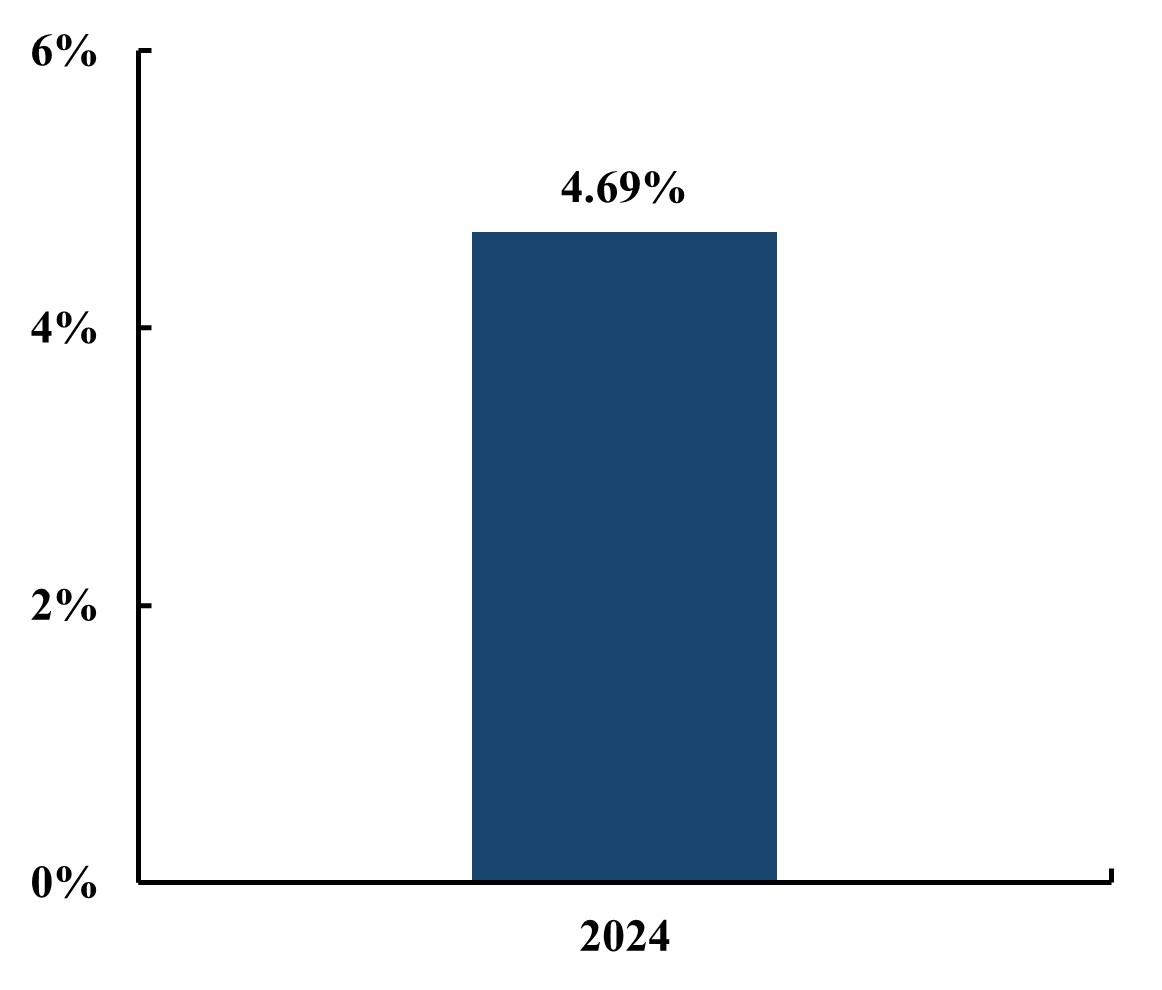

The following performance information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance over time. The following bar chart shows the Fund’s annual returns. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with those of a broad measure of market performance. Performance is also shown for the Bloomberg U.S. 1-5 Year Government/Credit Index, which more closely represents the exposure sought by the Fund than the broad-based securities market index. The Fund’s past performance, before and after taxes, does not necessarily indicate how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.madisonfunds.com.

The Fund’s calendar year-to-date return as of September 30, 2025 was 5.38%.

During the period of time shown in the bar chart, the highest return for a calendar quarter was 3.32% (quarter ended September 30, 2024) and the lowest return for a calendar quarter was -0.36% (quarter ended December 31, 2024).

| 1 Year | Since

Inception (9/5/2023) | |

| Return Before Taxes | 4.69% | 6.62% |

| Return After Taxes on Distributions | 2.39% | 4.33% |

| Return After Taxes on Distributions and Sale of Fund Shares | 2.75% | 4.07% |

| Bloomberg

U.S. 1-5 Year Government/Credit Index (reflects no deduction for fees, expenses, or taxes) |

3.76% | 5.37% |

Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

1.25% | 4.85% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred or other tax-advantaged arrangements such as an individual retirement account (“IRA”). In certain cases, the figures representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.

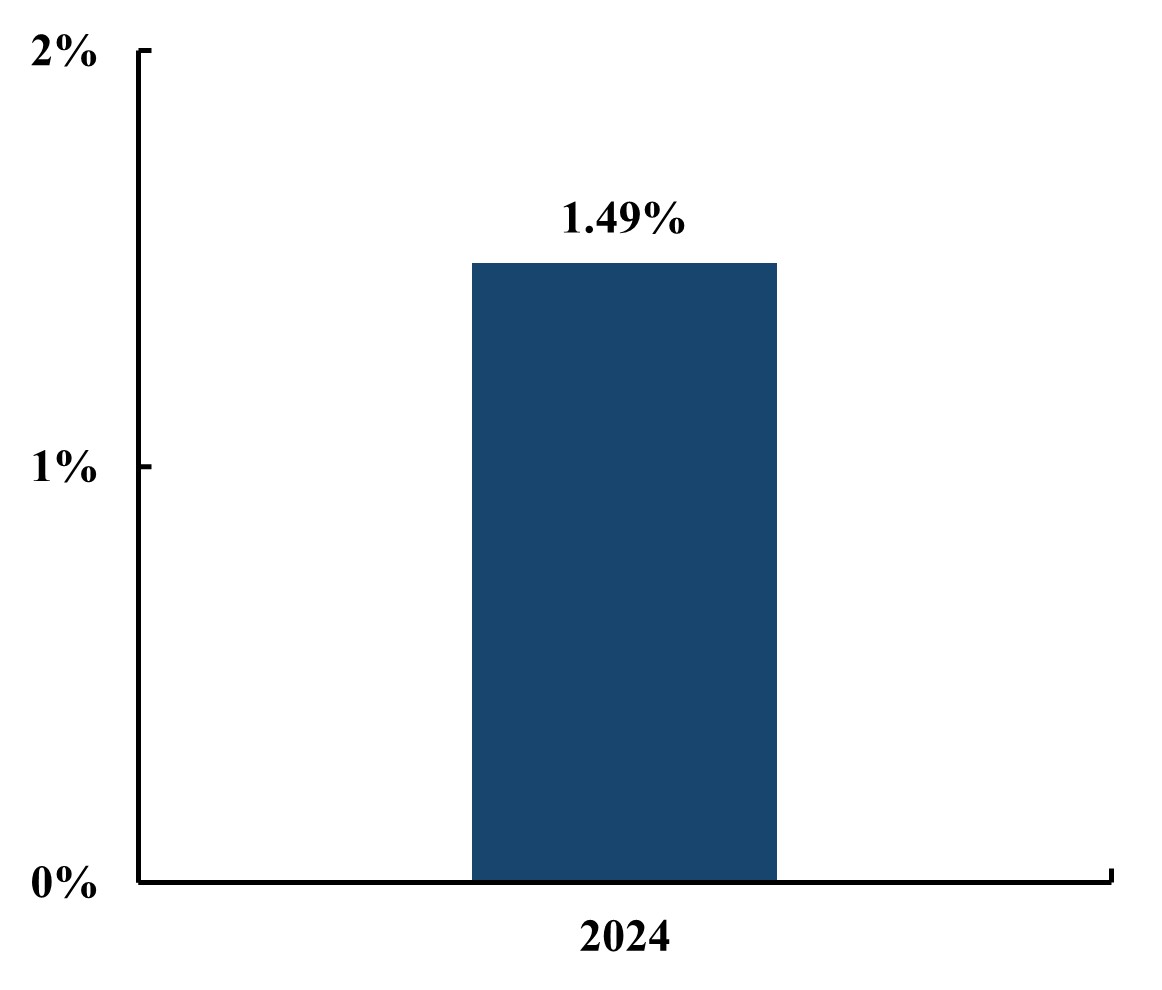

The following performance information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance over time. The following bar chart shows the Fund’s annual returns. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with those of a broad measure of market performance. The Fund’s past performance, before and after taxes, does not necessarily indicate how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.madisonfunds.com.

The Fund’s calendar year-to-date return as of September 30, 2025 was 6.40%.

During the period of time shown in the bar chart, the highest return for a calendar quarter was 4.77% (quarter ended September 30, 2024) and the lowest return for a calendar quarter was -2.90% (quarter ended December 31, 2024).

| 1 Year | Since

Inception (8/28/2023) | |

| Return Before Taxes | 1.49% | 4.90% |

| Return After Taxes on Distributions | -0.58% | 2.82% |

| Return After Taxes on Distributions and Sale of Fund Shares | 0.88% | 2.87% |

| Bloomberg

U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) |

1.25% | 4.55% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred or other tax-advantaged arrangements such as an individual retirement account (“IRA”). In certain cases, the figures representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.

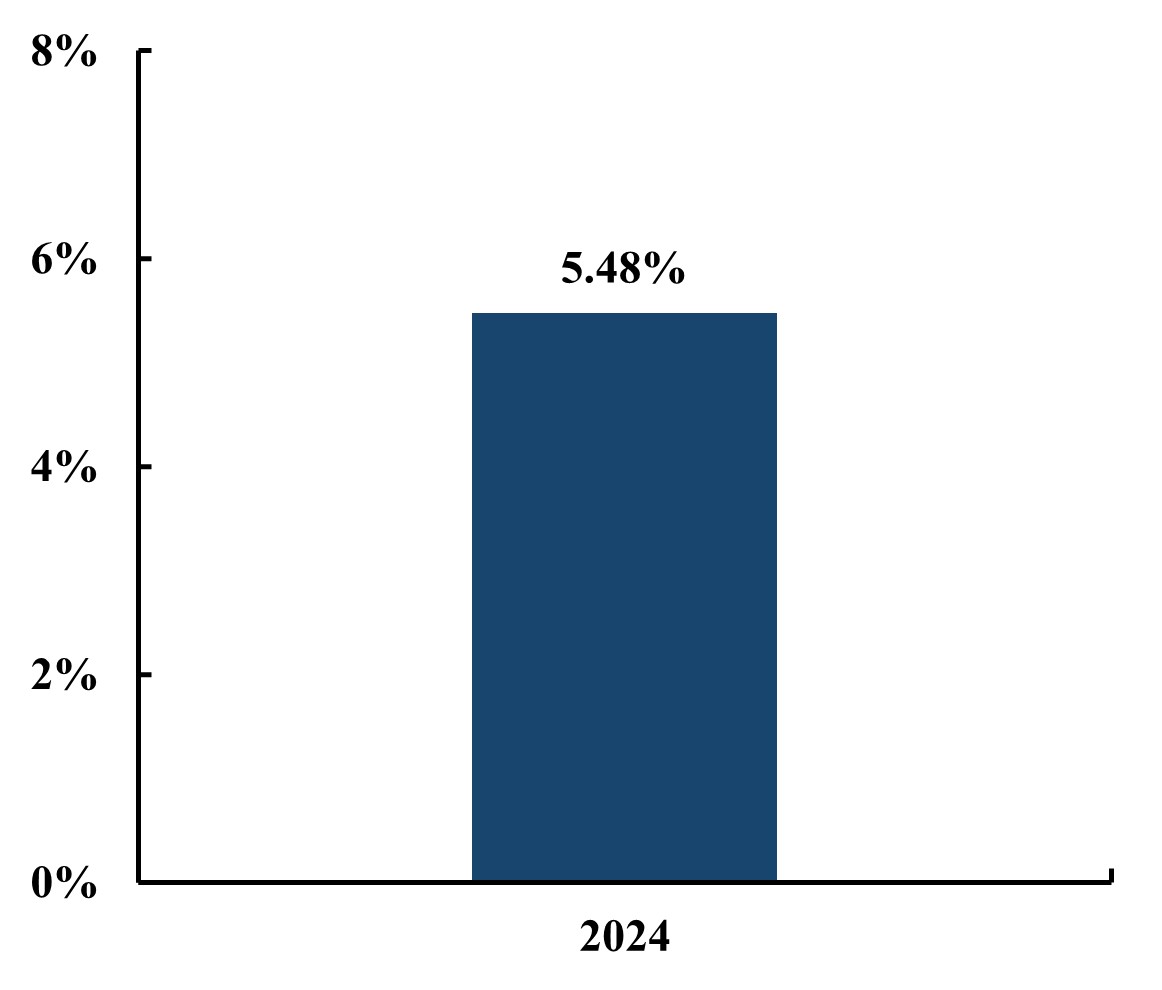

The following performance information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance over time. The following bar chart shows the Fund’s annual returns. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with those of a broad measure of market performance. Performance is also shown for the CBOE S&P 500 BuyWrite Monthly Index, which more closely represents the exposure sought by the Fund than the broad-based securities market index. The Fund’s past performance, before and after taxes, does not necessarily indicate how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.madisonfunds.com.

The Fund’s calendar year-to-date return as of September 30, 2025 was 3.77%.

During the period of time shown in the bar chart, the highest return for a calendar quarter was 4.98% (quarter ended September 30, 2024) and the lowest return for a calendar quarter was -1.32% (quarter ended December 31,2024).

| 1 Year | Since

Inception (8/21/2023) | |

| Return Before Taxes | 5.48% | 7.73% |

| Return After Taxes on Distributions | 0.13% | 3.31% |

| Return After Taxes on Distributions and Sale of Fund Shares | 3.59% | 4.29% |

| S&P

500 TR (reflects no deduction for fees, expenses, or taxes) |

25.02% | 25.55% |

CBOE S&P 500 BuyWrite Monthly Index (reflects no deduction for fees, expenses, or taxes) |

20.12% | 16.52% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred or other tax-advantaged arrangements such as an individual retirement account (“IRA”). In certain cases, the figures representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.

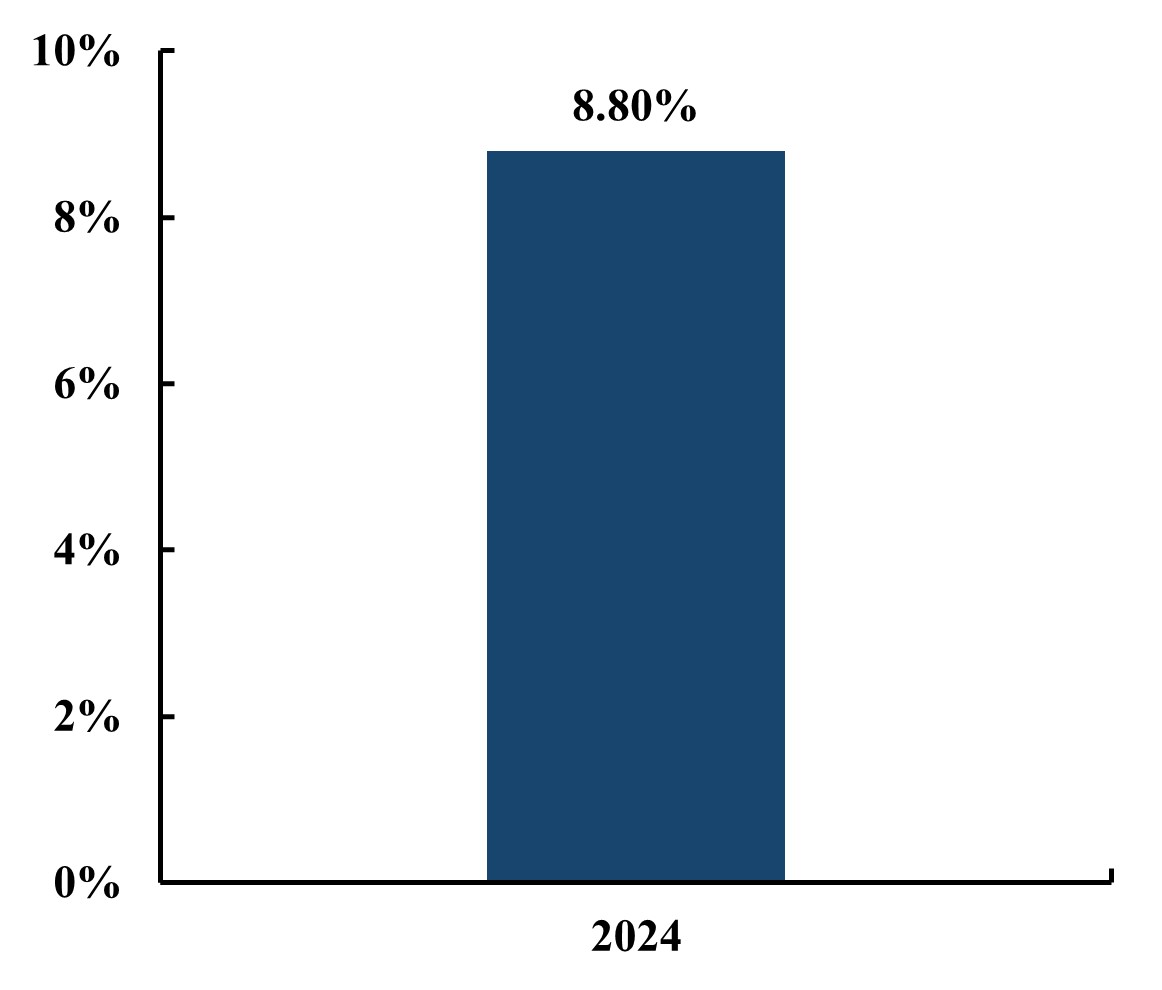

The following performance information provides some indication of the risks of investing in the Fund by showing changes in the Fund’s performance over time. The following bar chart shows the Fund’s annual returns. The table illustrates how the Fund’s average annual returns for the 1-year and since inception periods compare with those of a broad measure of market performance. Performance is also shown for the Lipper Equity Income Funds Index and Russell 1000 Value Total Return Index, which more closely represent the exposure sought by the Fund than the broad-based securities market index. The Fund’s past performance, before and after taxes, does not necessarily indicate how the Fund will perform in the future. Updated performance information is available on the Fund’s website at www.madisonfunds.com.

The Fund’s calendar year-to-date return as of September 30, 2025 was 10.82%.

During the period of time shown in the bar chart, the highest return for a calendar quarter was 9.04% (quarter ended September 30,2024) and the lowest return for a calendar quarter was -4.28% (quarter ended June 30, 2024).

| 1 Year | Since

Inception (8/14/2023) | |

| Return Before Taxes | 8.80% | 7.01% |

| Return After Taxes on Distributions | 8.23% | 6.40 % |

| Return After Taxes on Distributions and Sale of Fund Shares | 5.60% | 5.33% |

| Lipper

Equity Income Funds Index (reflects no deduction for fees, expenses, or taxes) |

14.12% | 13.61% |

Russell 1000 Value Total Return Index (reflects no deduction for fees, expenses, or taxes) |

14.37% | 13.47% |

S&P 500 TR (reflects no deduction for fees, expenses, or taxes) |

25.02% | 23.39% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates during the period covered by the table above and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Shares through tax-deferred or other tax-advantaged arrangements such as an individual retirement account (“IRA”). In certain cases, the figures representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other figures for the same period. A higher after-tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor.