Exhibit 99.2 American Water & Essential Utilities Merger Uniting Two of the Nation’s Premier Water Utilities to Deliver Improved Scale and Long-Term Value OCTOBER 27, 2025

Forward Looking Statements Disclosure Cautionary Statement Regarding Forward-Looking Statements Certain statements included in this communication are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “outlook,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,” “may,” “can,” “will,” “should” and “could,” or the negative of such terms or other variations or similar expressions. Forward-looking statements may relate to, among other things: statements about the benefits of the proposed merger, including future financial and operating results; the parties’ respective plans, objectives, expectations and intentions; the expected timing and likelihood of completion of the merger and related transactions; the results of any strategic review; expected synergies of the proposed merger; the timing and result of various regulatory proceedings related to the proposed merger, and other general rate cases, filings for infrastructure surcharges and other governmental agency authorizations and proceedings, and filings to address regulatory lag; the combined company’s ability to execute its current and long-term business, operational, capital expenditures and growth plans and strategies; the amount, allocation and timing of projected capital expenditures and related funding requirements; the future impacts of increased or increasing transaction and financing costs associated with the proposed merger or otherwise, as well as inflation and interest rates; each party’s ability to finance current and projected operations, capital expenditure needs and growth initiatives by accessing the debt and equity capital markets and sources of short-term liquidity; impacts of the proposed merger on the future settlement or settlements of a party’s forward sale agreements, including potential adjustments to the forward sale price or other economic terms thereunder, and the amount of and the intended use of net proceeds from any such future settlement or settlements; the outcome and impact on other governmental and regulatory investigations; the filing of class action lawsuits and other litigation and legal proceedings related to the proposed merger; the ability to complete, and the timing and efficacy of, the design, development, implementation and improvement of technology and other strategic initiatives; each party’s ability to comply with new and changing environmental regulations; regulatory, legislative, tax policy or legal developments; and impacts that future significant tax legislation may have on each such party and on its business, results of operations, cash flows and liquidity. These forward-looking statements are predictions based on currently available information, the parties’ current respective expectations and assumptions regarding future events that American Water Works Company, Inc. (“American Water”) and Essential Utilities, Inc. (“Essential Utilities”) believe to be reasonable. They are not, however, guarantees or assurances of any outcomes, performance or achievements, and readers are cautioned not to place undue reliance upon them. You should not regard any forward-looking statement as a representation or warranty by American Water, Essential Utilities or any other person that the expectation, plan or objective expressed in such forward-looking statement will be successfully achieved in any specified time frame, or at all. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from those discussed in the forward-looking statements included in this communication as a result of the factors discussed in American Water’s Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the Securities and Exchange Commission (the “SEC”) on February 19, 2025 (available at: ir.amwater.com), Essential Utilities’ Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the SEC on February 27, 2025 (available at: essential.co), and each party’s other filings with the SEC, and additional risks and uncertainties, including with respect to (1) the parties’ ability to consummate the proposed merger pursuant to the terms of the definitive merger agreement or at all; (2) the ability to timely or at all obtain the requisite shareholder approvals with respect to each party; (3) each party’s requirement to obtain required governmental and regulatory approvals required for the proposed merger (and/or that such approvals may result in the imposition of burdensome or commercially undesirable conditions, including required dispositions, that could adversely affect the combined company or the expected benefits of the proposed merger); (4) an event, change or other circumstance that could give rise to the termination of the merger agreement; (5) the failure to satisfy or waive a condition to closing of the proposed merger on a timely basis or at all; (6) a delay in the timing to consummate the proposed merger; (7) the failure to integrate the parties’ businesses successfully; (8) the failure to fully realize cost savings and any other synergies from the proposed merger or that such benefits may take longer to realize than expected; (9) negative or adverse impacts of the announcement of the proposed merger on the market price of American Water’s or Essential Utilities’ common stock; (10) the risk of litigation related to the proposed merger; (11) disruption from the proposed merger making it more difficult to maintain relationships with customers, employees, contractors, suppliers, regulators, vendors, elected officials, governmental agencies, or other stakeholders; (12) the diversion of each party’s management’s time and attention from operations of such party; (13) the challenging macroeconomic environment, including disruptions in the water and wastewater utility industries; (14) the ability of each party to manage its respective existing operations and financing arrangements on favorable terms or at all, including with respect to future capital expenditures and investments, operation and maintenance costs; (15) changes in environmental laws and regulations regarding each party’s respective operations that may adversely impact such party’s businesses or increase the cost of operations; (16) changes in each party’s key management and personnel; (17) changes in tax laws that could adversely affect beneficial tax treatment of the proposed merger; (18) regulatory, legislative, local or municipal actions affecting the water and wastewater industries, which could adversely affect the parties’ respective utility subsidiaries; and (19) other economic, business and other factors, including inflation and interest rate fluctuations. The foregoing factors should not be construed as exhaustive. These forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above and the risk factors included in American Water’s and Essential Utilities’ respective annual and quarterly reports as filed with the SEC, and readers should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. Any forward-looking statements speak only as of the date this communication is first used or given. Neither American Water nor Essential Utilities has any obligation or intention to update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as otherwise required by the federal securities laws. New factors emerge from time to time, and it is not possible for American Water or Essential Utilities to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on American Water’s or Essential Utilities’ businesses, viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Important Additional Information about the Proposed Merger and Where to Find It In connection with the proposed merger, American Water will file a registration statement on Form S-4, which will include a document that serves as a prospectus of American Water with respect to the shares of American Water’s common stock to be issued in the proposed merger and a joint proxy statement of American Water and Essential Utilities for their respective shareholders (the “joint proxy statement/prospectus”), and each party will file other documents regarding the proposed merger with the SEC. This communication is not a substitute for the registration statement, the joint proxy statement/prospectus or any other document that American Water or Essential Utilities may file with the SEC or mail to their respective shareholders in connection with the proposed merger. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF EACH PARTY ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS, ANY AMENDMENTS OR SUPPLEMENTS THERETO AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC OR INCORPORATED BY REFERENCE INTO THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A definitive joint proxy statement/prospectus will be sent to American Water’s and Essential Utilities’ shareholders. Investors and security holders will be able to obtain the registration statement, the joint proxy statement/prospectus and the other documents filed regarding the proposed merger free of charge from the SEC’s website or from American Water or Essential Utilities. The documents filed by American Water with the SEC may be obtained free of charge at American Water’s investor relations website at ir.amwater.com or at the SEC’s website at www.sec.gov. The documents filed by Essential Utilities with the SEC may be obtained free of charge at Essential Utilities website at essential.co or at the SEC’s website at www.sec.gov. The information included on, or accessible through, American Water’s or Essential Utilities’ respective websites is not incorporated by reference into, and does not form a part of, this communication. Participants in the Solicitation American Water, Essential Utilities and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from American Water’s and Essential Utilities’ respective shareholders in connection with the proposed merger. Information about the directors and executive officers of American Water, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in American Water’s definitive proxy statement for its 2025 Annual Meeting of Shareholders, which was filed with the SEC on March 27, 2025, including under the headings “Compensation Discussion and Analysis,” “Director Compensation,” “Equity Compensation Plan Information,” and “Certain Beneficial Ownership Matters.” To the extent holdings of American Water’s common stock by the directors and executive officers of American Water have changed or do change from the amounts of American Water’s common stock held by such persons as reflected therein, such changes have been or will be reflected on Initial Statements of Beneficial Ownership of Securities on Form 3 (“Form 3”), Statements of Changes in Beneficial Ownership on Form 4 (“Form 4”) or Annual Statements of Changes in Beneficial Ownership of Securities on Form 5 (“Form 5”), in each case filed with the SEC. Information about the directors and executive officers of Essential Utilities, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Essential Utilities’ definitive proxy statement for its 2025 Annual Meeting of Shareholders, which was filed with the SEC on March 25, 2025, including under the headings “Director Compensation” and “Compensation Discussion and Analysis.” To the extent holdings of Essential Utilities’ common stock by the directors and executive officers of Essential Utilities have changed or do change from the amounts of Essential Utilities’ common stock held by such persons as reflected therein, such changes have been or will be reflected on Forms 3, Forms 4 or Forms 5, in each case filed with the SEC. Additionally, information regarding the respective directors and executive officers of American Water and Essential Utilities and other participants in each respective proxy solicitation and a description of their direct and indirect interests in the proposed merger, by security holdings or otherwise, will be contained in the registration statement and joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed merger when such materials become available. Investors and security holders should read the registration statement and joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. Investors may obtain free copies of these documents from American Water and Essential Utilities as indicated above. No Offer or Solicitation This communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote for approval, nor shall there be any offer or sale of securities or solicitation of any vote or approval in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. 2

Today’s Participants John Griffith David Bowler Cheryl Norton Christopher Franklin Daniel Schuller President & Chief Executive Vice Executive Vice Chairman & Chief Executive Vice President President & Chief Executive Officer President & Chief Executive Officer & Chief Financial Officer Financial Officer Operating Officer 3

Agenda Transaction Overview Strategic Rationale Combined Business Profile Growth Outlook Credit Profile Regulatory Approvals & Timeline Key Takeaways 4

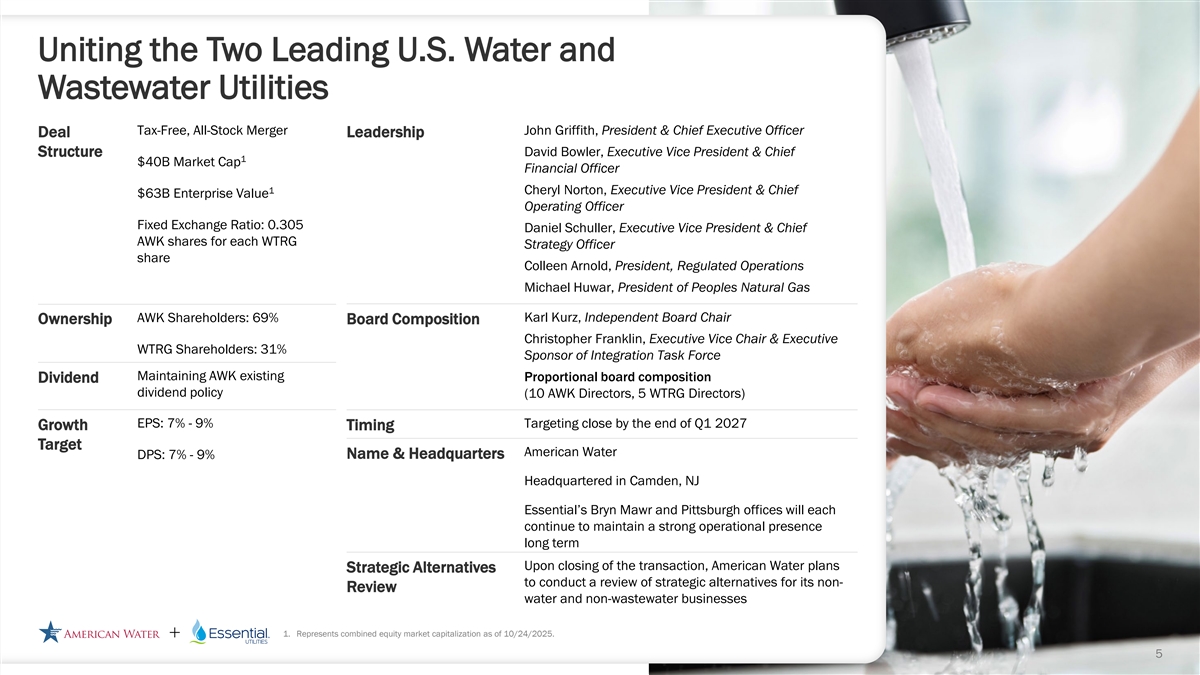

Uniting the Two Leading U.S. Water and Wastewater Utilities Tax-Free, All-Stock Merger John Griffith, President & Chief Executive Officer Deal Leadership Structure David Bowler, Executive Vice President & Chief 1 $40B Market Cap Financial Officer 1 Cheryl Norton, Executive Vice President & Chief $63B Enterprise Value Operating Officer Fixed Exchange Ratio: 0.305 Daniel Schuller, Executive Vice President & Chief AWK shares for each WTRG Strategy Officer share Colleen Arnold, President, Regulated Operations Michael Huwar, President of Peoples Natural Gas AWK Shareholders: 69% Karl Kurz, Independent Board Chair Ownership Board Composition Christopher Franklin, Executive Vice Chair & Executive WTRG Shareholders: 31% Sponsor of Integration Task Force Maintaining AWK existing Proportional board composition Dividend dividend policy (10 AWK Directors, 5 WTRG Directors) EPS: 7% - 9% Targeting close by the end of Q1 2027 Growth Timing Target American Water DPS: 7% - 9% Name & Headquarters Headquartered in Camden, NJ Essential’s Bryn Mawr and Pittsburgh offices will each continue to maintain a strong operational presence long term Upon closing of the transaction, American Water plans Strategic Alternatives to conduct a review of strategic alternatives for its non- Review water and non-wastewater businesses 1. Represents combined equity market capitalization as of 10/24/2025. 5

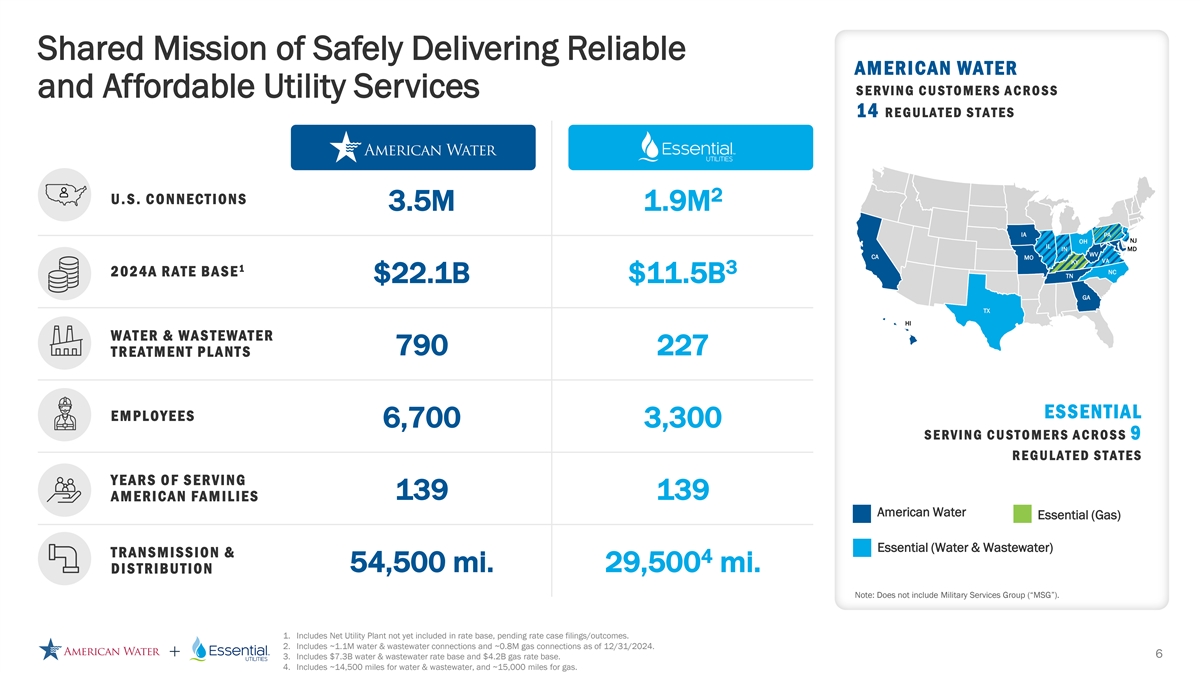

Shared Mission of Safely Delivering Reliable AMERICAN WATER SERVING CUSTOMERS ACROSS and Affordable Utility Services 14 RE GULATED STATES 2 U.S. CONNECTIONS 3.5M 1.9M IA PA NJ OH IL IN MD WV CA MO VA KY 1 3 NC 2024A RATE BASE TN $22.1B $11.5B GA TX HI WATER & WAS TEWATER 790 227 TREATMENT PLANTS ESSENTIAL E M P L O Y EES 6,700 3,300 SERVING CUSTOMERS ACROSS 9 REGULATED STATES YEARS OF SERVING 139 139 AMERICAN FAMILIES American Water Essential (Gas) Essential (Water & Wastewater) TRANSMISSION & 4 54,500 mi. 29,500 mi. D I S TR IBU TION Note: Does not include Military Services Group (“MSG”). 1. Includes Net Utility Plant not yet included in rate base, pending rate case filings/outcomes. 2. Includes ~1.1M water & wastewater connections and ~0.8M gas connections as of 12/31/2024. 6 3. Includes $7.3B water & wastewater rate base and $4.2B gas rate base. 4. Includes ~14,500 miles for water & wastewater, and ~15,000 miles for gas.

Combining Two Complementary Platforms to Expand Market Reach and Unlock Efficiencies, Best Practices Together, the businesses will continue to set the best-in-class standards for water quality, customer experience, and infrastructure replacement and renewal Best-in-Class Water Premier Partner-of-Choice Water Creating a New Top 10 Large- Reinforce Commitment to Quality Provider Utility for Municipal Providers Cap Pure-Play Utility Customers and Communities • Cements nationwide leadership in • Combined equity market cap of • Solidifies position as a compelling • Customer-focused company 1 water quality best practices, $40B ranks among the top option for communities when culture, with eye towards including PFAS and lead 250 in the S&P500 considering a sale technology-driven improvements remediation, for the benefit of • Superior TSR potential driven by • Exciting new geographies with • Merges two companies that customers top-quartile EPS growth, robust clear paths to organic and each have a legacy of • Scale advantage to address large- dividend trajectory, long-term business development growth volunteerism and generous scale surface water quality visible CapEx requirements, support of communities, which challenges and broad regionalization • Improves long-term customer will remain central to the opportunities in a fragmented growth trajectory and long-term • Delivering innovative, targeted combined organization water industry customer affordability proposition solutions to address groundwater • Deep industry depth in resiliency quality challenges • Water and wastewater focused, planning to uphold reliability of fully regulated utility • Leveraging best practices across customer service industry-leading water quality R&D • Unique value proposition in labs and talent to drive terms of customer affordability sustainable service and sustainability credentials enhancements for customers 1. Represents combined equity market capitalization as of 10/24/2025. 7

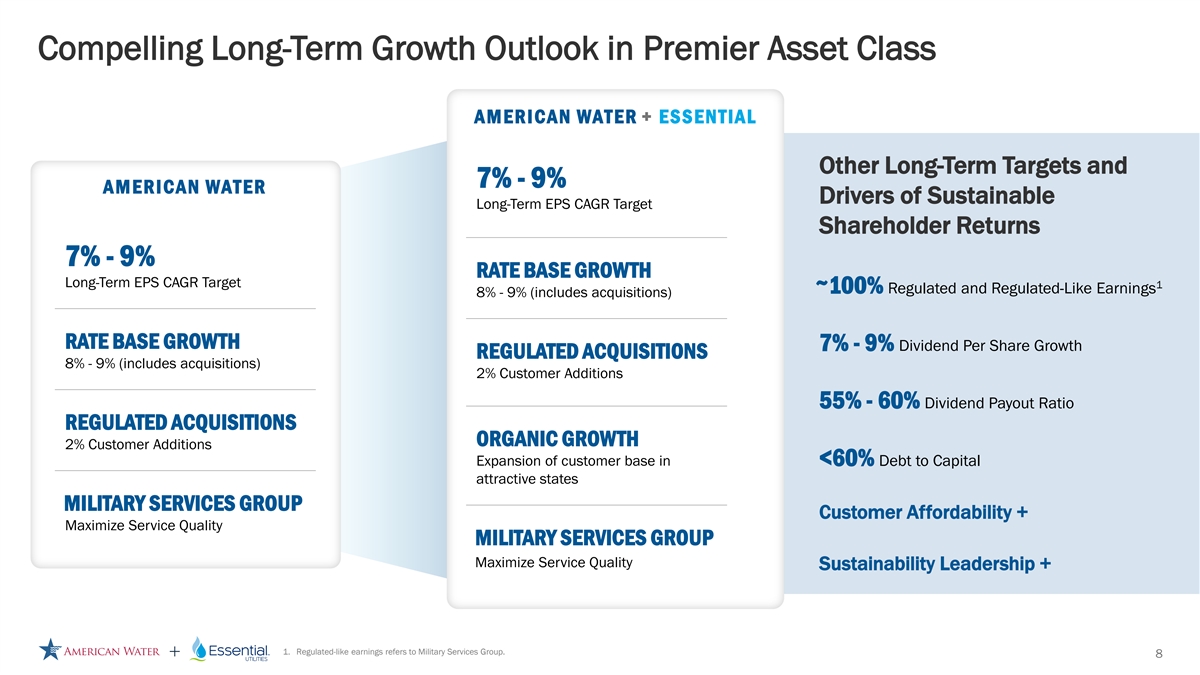

Compelling Long-Term Growth Outlook in Premier Asset Class AMERICAN WATER + ESSENTIAL Other Long-Term Targets and 7% - 9% AMERICAN WATER Drivers of Sustainable Long-Term EPS CAGR Target Shareholder Returns 7% - 9% RATE BASE GROWTH Long-Term EPS CAGR Target 1 100% Regulated and Regulated-Like Earnings 8% - 9% (includes acquisitions) ~ RATE BASE GROWTH 7% - 9% Dividend Per Share Growth REGULATED ACQUISITIONS 8% - 9% (includes acquisitions) 2% Customer Additions 55% - 60% Dividend Payout Ratio REGULATED ACQUISITIONS ORGANIC GROWTH 2% Customer Additions Expansion of customer base in <60% Debt to Capital attractive states MILITARY SERVICES GROUP Customer Affordability + Maximize Service Quality MILITARY SERVICES GROUP Maximize Service Quality Sustainability Leadership + 1. Regulated-like earnings refers to Military Services Group. 8

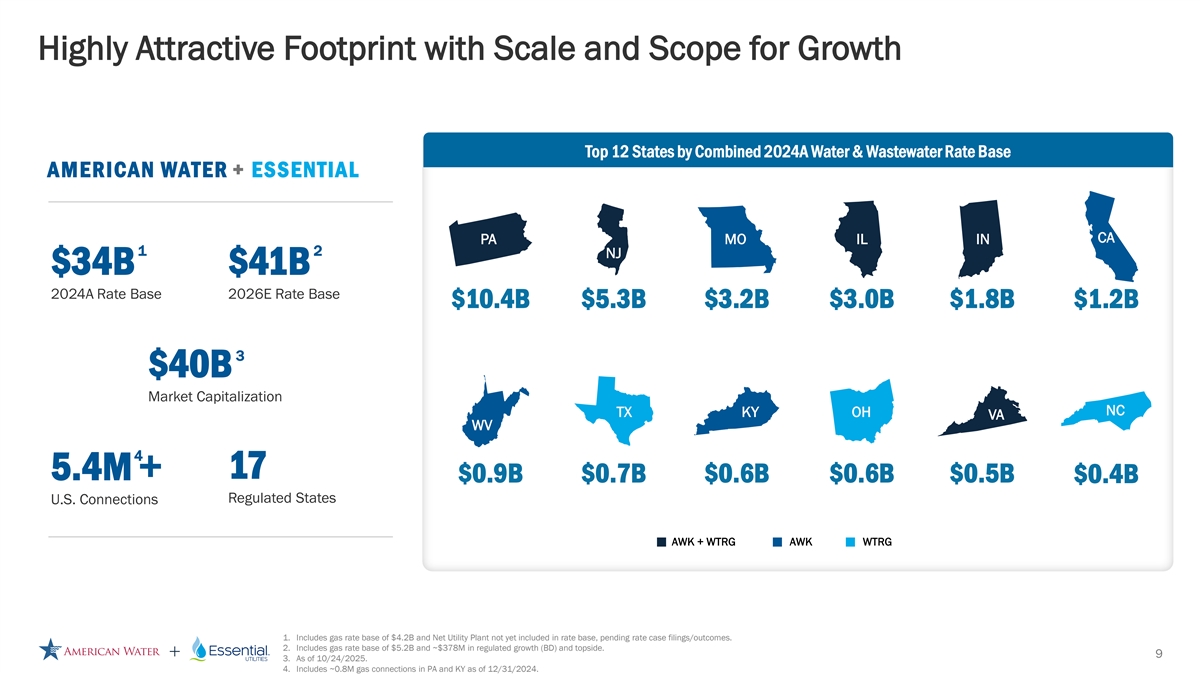

Highly Attractive Footprint with Scale and Scope for Growth Top 12 States by Combined 2024A Water & Wastewater Rate Base AMERICAN WATER + ESSENTIAL CA PA MO IL IN 1 2 NJ $34B $41B 2024A Rate Base 2026E Rate Base $10.4B $5.3B $3.2B $3.0B $1.8B $1.2B 3 $40B Market Capitalization NC TX KY OH VA WV 4 17 5.4M + $0.9B $0.7B $0.6B $0.6B $0.5B $0.4B Regulated States U.S. Connections AWK + WTRG AWK WTRG 1. Includes gas rate base of $4.2B and Net Utility Plant not yet included in rate base, pending rate case filings/outcomes. 2. Includes gas rate base of $5.2B and ~$378M in regulated growth (BD) and topside. 9 3. As of 10/24/2025. 4. Includes ~0.8M gas connections in PA and KY as of 12/31/2024.

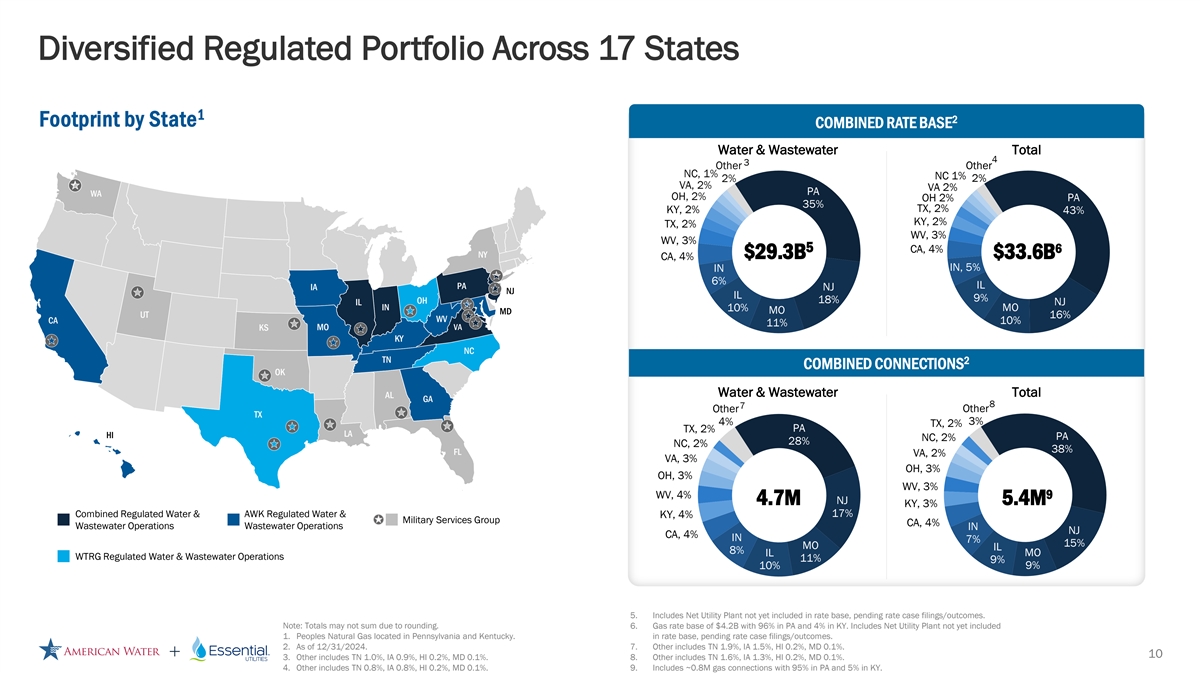

Diversified Regulated Portfolio Across 17 States 1 2 Footprint by State COMBINED RATE BASE Water & Wastewater Total 4 3 Other Other NC, 1% NC 1% 2% 2% VA, 2% VA 2% PA WA OH, 2% OH 2% PA 35% TX, 2% KY, 2% 43% KY, 2% TX, 2% WV, 3% WV, 3% 5 CA, 4% 6 NY $29.3B $33.6B CA, 4% IN, 5% IN 6% IL IA PA NJ NJ IL 9% OH 18% IL NJ IN 10% MO MO MD UT 16% WV CA 10% 11% MO VA KS KY NC TN 2 COMBINED CONNECTIONS OK Water & Wastewater Total AL GA 8 7 Other Other TX 4% 3% TX, 2% TX, 2% PA LA HI PA NC, 2% 28% NC, 2% 38% FL VA, 2% VA, 3% OH, 3% OH, 3% WV, 3% WV, 4% 9 NJ 4.7M 5.4M KY, 3% Combined Regulated Water & AWK Regulated Water & 17% KY, 4% Military Services Group CA, 4% Wastewater Operations Wastewater Operations IN NJ CA, 4% IN 7% 15% MO IL 8% IL MO WTRG Regulated Water & Wastewater Operations 11% 9% 10% 9% 5. Includes Net Utility Plant not yet included in rate base, pending rate case filings/outcomes. Note: Totals may not sum due to rounding. 6. Gas rate base of $4.2B with 96% in PA and 4% in KY. Includes Net Utility Plant not yet included 1. Peoples Natural Gas located in Pennsylvania and Kentucky. in rate base, pending rate case filings/outcomes. 2. As of 12/31/2024. 7. Other includes TN 1.9%, IA 1.5%, HI 0.2%, MD 0.1%. 10 3. Other includes TN 1.0%, IA 0.9%, HI 0.2%, MD 0.1%. 8. Other includes TN 1.6%, IA 1.3%, HI 0.2%, MD 0.1%. 4. Other includes TN 0.8%, IA 0.8%, HI 0.2%, MD 0.1%. 9. Includes ~0.8M gas connections with 95% in PA and 5% in KY.

Delivers Expansive Benefits to Key Stakeholders Continuing superior customer Increased career growth service at affordable rates opportunity for employees • Combined infrastructure and • Strengthens position as a top employer operational efficiencies of choice; Recognized on the Forbes America’s Best Employers for Company • Maintain focus on delivering Culture 2025 list dependable water and wastewater services • Attracting top talent through reputation • Commitment to affordable customer and expanded opportunities rates with strong leverage to manage • Broader career advancement prospects supply chain costs for customers’ across the organization benefit Support communities through Value creation unified services for shareholders • Sustained investment in philanthropic • Enhanced stake in a larger regulated initiatives utility platform • Expanded presence in overlapping and • Access to broader geographic and new service territories regulatory exposure • Coordinated services for local employees • Participation in long-term value to efficiently meet local needs creation 11

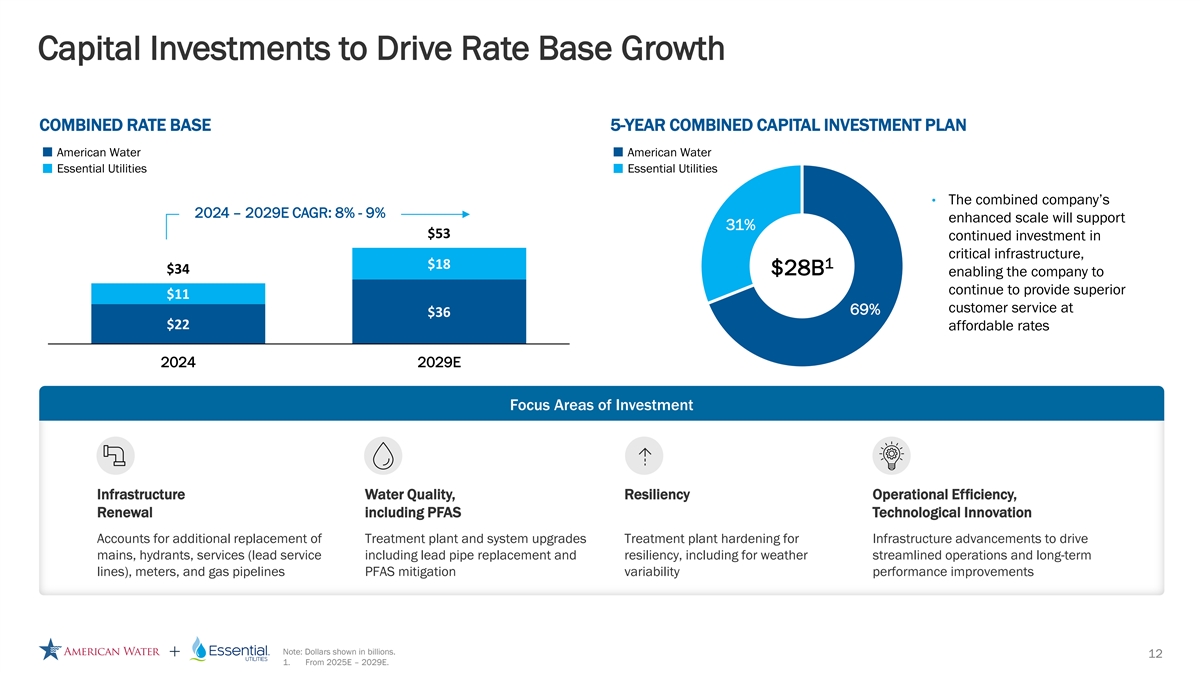

Capital Investments to Drive Rate Base Growth COMBINED RATE BASE 5-YEAR COMBINED CAPITAL INVESTMENT PLAN American Water American Water Essential Utilities Essential Utilities • The combined company’s 2024 – 2029E CAGR: 8% - 9% enhanced scale will support 31% $53 continued investment in critical infrastructure, $18 1 $34 $28B enabling the company to continue to provide superior $11 customer service at 69% $36 $22 affordable rates 2024 2029E Focus Areas of Investment Infrastructure Water Quality, Resiliency Operational Efficiency, Renewal including PFAS Technological Innovation Accounts for additional replacement of Treatment plant and system upgrades Treatment plant hardening for Infrastructure advancements to drive mains, hydrants, services (lead service including lead pipe replacement and resiliency, including for weather streamlined operations and long-term lines), meters, and gas pipelines PFAS mitigation variability performance improvements Note: Dollars shown in billions. 12 1. From 2025E – 2029E.

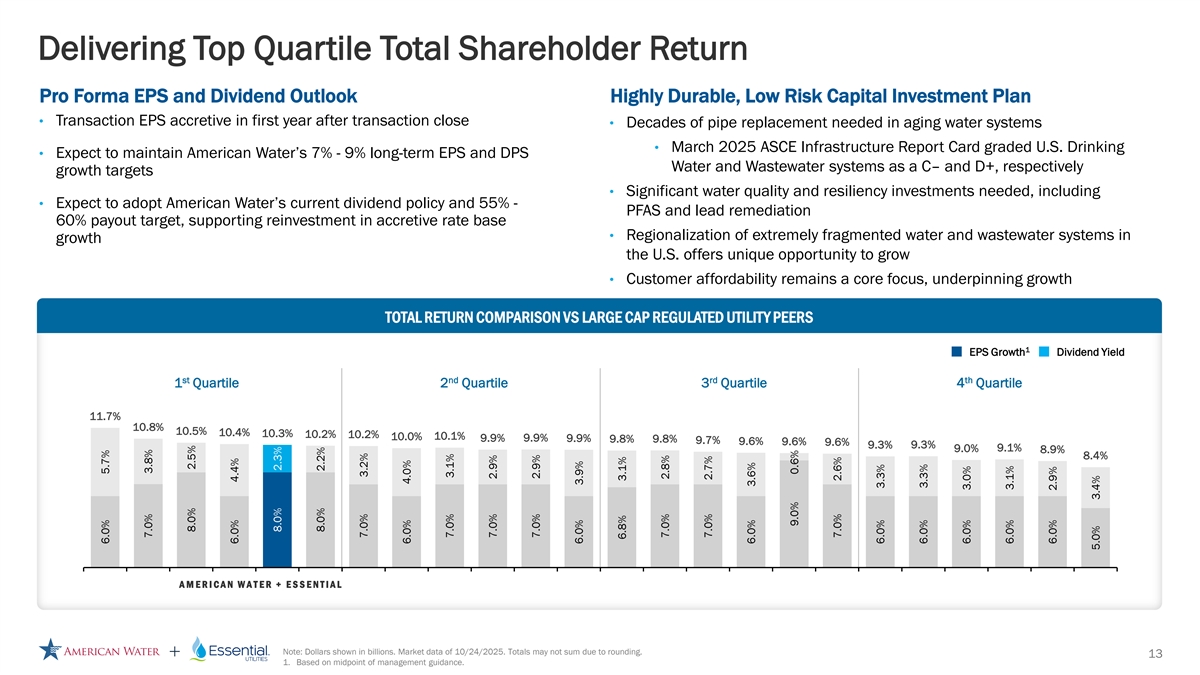

Delivering Top Quartile Total Shareholder Return Pro Forma EPS and Dividend Outlook Highly Durable, Low Risk Capital Investment Plan • Transaction EPS accretive in first year after transaction close • Decades of pipe replacement needed in aging water systems • March 2025 ASCE Infrastructure Report Card graded U.S. Drinking • Expect to maintain American Water’s 7% - 9% long-term EPS and DPS Water and Wastewater systems as a C– and D+, respectively growth targets • Significant water quality and resiliency investments needed, including • Expect to adopt American Water’s current dividend policy and 55% - PFAS and lead remediation 60% payout target, supporting reinvestment in accretive rate base • Regionalization of extremely fragmented water and wastewater systems in growth the U.S. offers unique opportunity to grow • Customer affordability remains a core focus, underpinning growth TOTAL RETURN COMPARISON VS LARGE CAP REGULATED UTILITY PEERS 1 EPS Growth Dividend Yield st nd rd th 1 Quartile 2 Quartile 3 Quartile 4 Quartile 11.7% 10.8% 10.5% 10.4% 10.3% 10.2% 10.2% 10.0% 10.1% 9.9% 9.9% 9.9% 9.8% 9.8% 9.7% 9.6% 9.6% 9.6% 9.3% 9.3% 9.1% 9.0% 8.9% 8.4% A ME R I C A N W ATE R + E S S E N T I A L Note: Dollars shown in billions. Market data of 10/24/2025. Totals may not sum due to rounding. 13 1. Based on midpoint of management guidance. 6.0% 5.7% 7.0% 3.8% 8.0% 2.5% 6.0% 4.4% 8.0% 2.3% 8.0% 2.2% 7.0% 3.2% 6.0% 4.0% 7.0% 3.1% 7.0% 2.9% 7.0% 2.9% 6.0% 3.9% 6.8% 3.1% 7.0% 2.8% 7.0% 2.7% 6.0% 3.6% 9.0% 0.6% 7.0% 2.6% 6.0% 3.3% 6.0% 3.3% 6.0% 3.0% 6.0% 3.1% 6.0% 2.9% 5.0% 3.4%

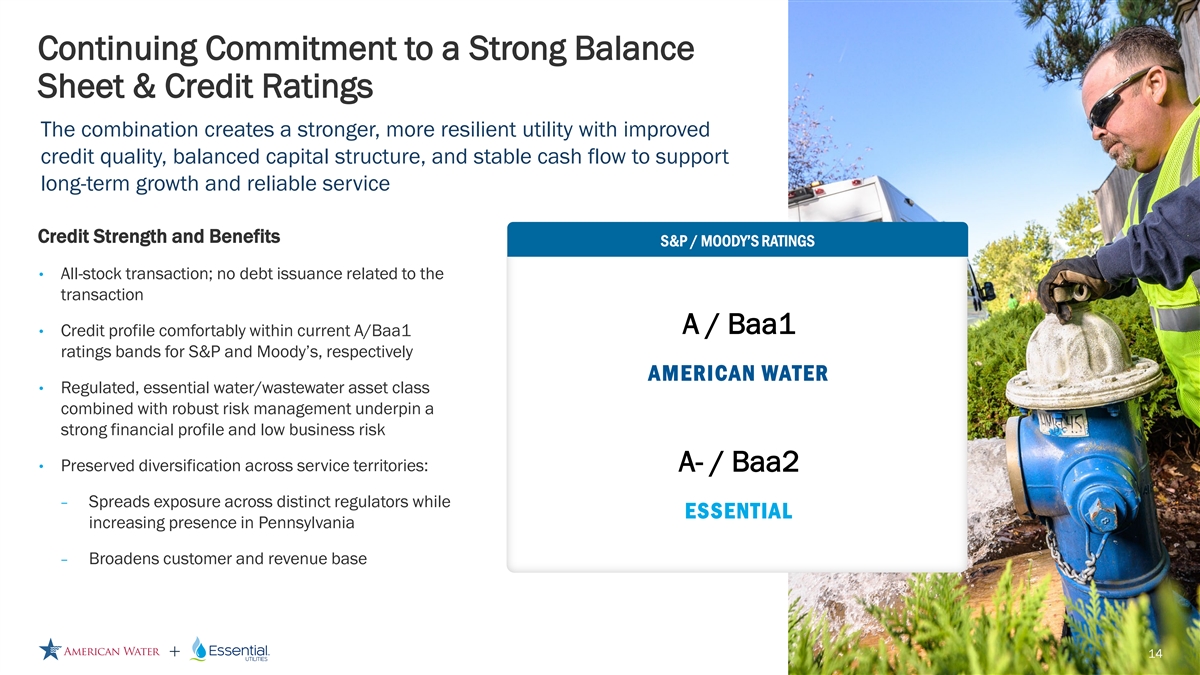

Continuing Commitment to a Strong Balance Sheet & Credit Ratings The combination creates a stronger, more resilient utility with improved credit quality, balanced capital structure, and stable cash flow to support long-term growth and reliable service Credit Strength and Benefits S&P / MOODY’S RATINGS • All-stock transaction; no debt issuance related to the transaction A / Baa1 • Credit profile comfortably within current A/Baa1 ratings bands for S&P and Moody’s, respectively AMERICAN WATER • Regulated, essential water/wastewater asset class combined with robust risk management underpin a strong financial profile and low business risk • Preserved diversification across service territories: A- / Baa2 − Spreads exposure across distinct regulators while ESSENTIAL increasing presence in Pennsylvania − Broadens customer and revenue base 14

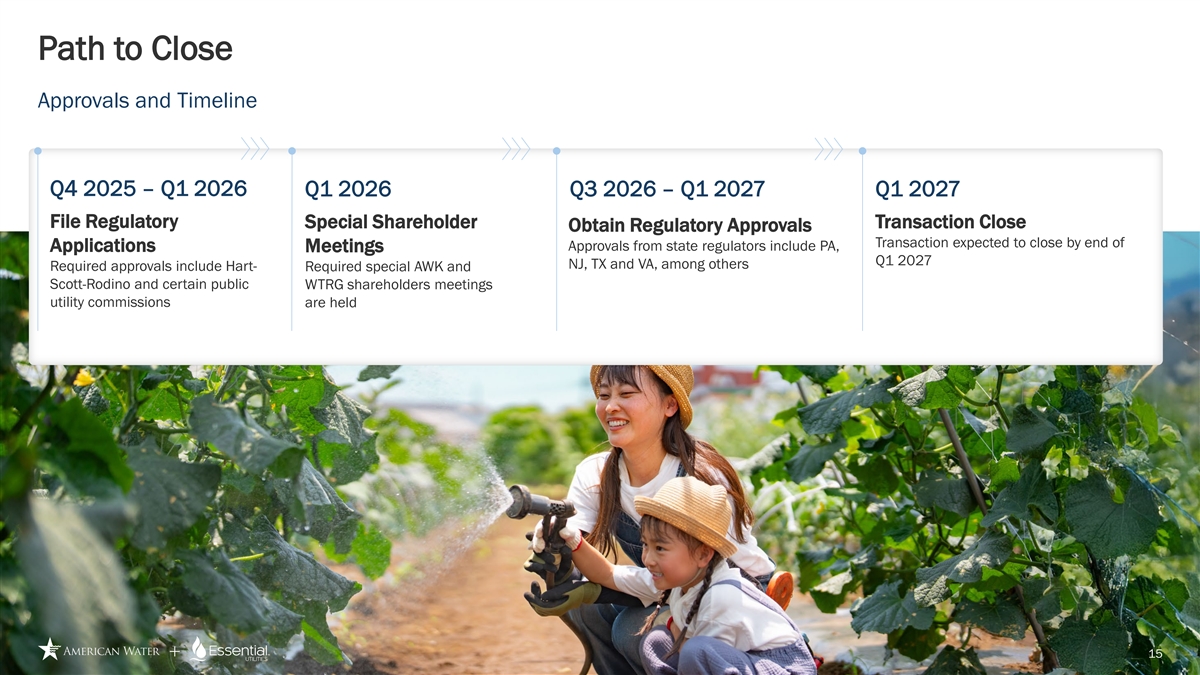

Path to Close Approvals and Timeline Q4 2025 – Q1 2026 Q1 2026 Q3 2026 – Q1 2027 Q1 2027 File Regulatory Special Shareholder Transaction Close Obtain Regulatory Approvals Transaction expected to close by end of Approvals from state regulators include PA, Applications Meetings Q1 2027 NJ, TX and VA, among others Required approvals include Hart- Required special AWK and Scott-Rodino and certain public WTRG shareholders meetings utility commissions are held 15

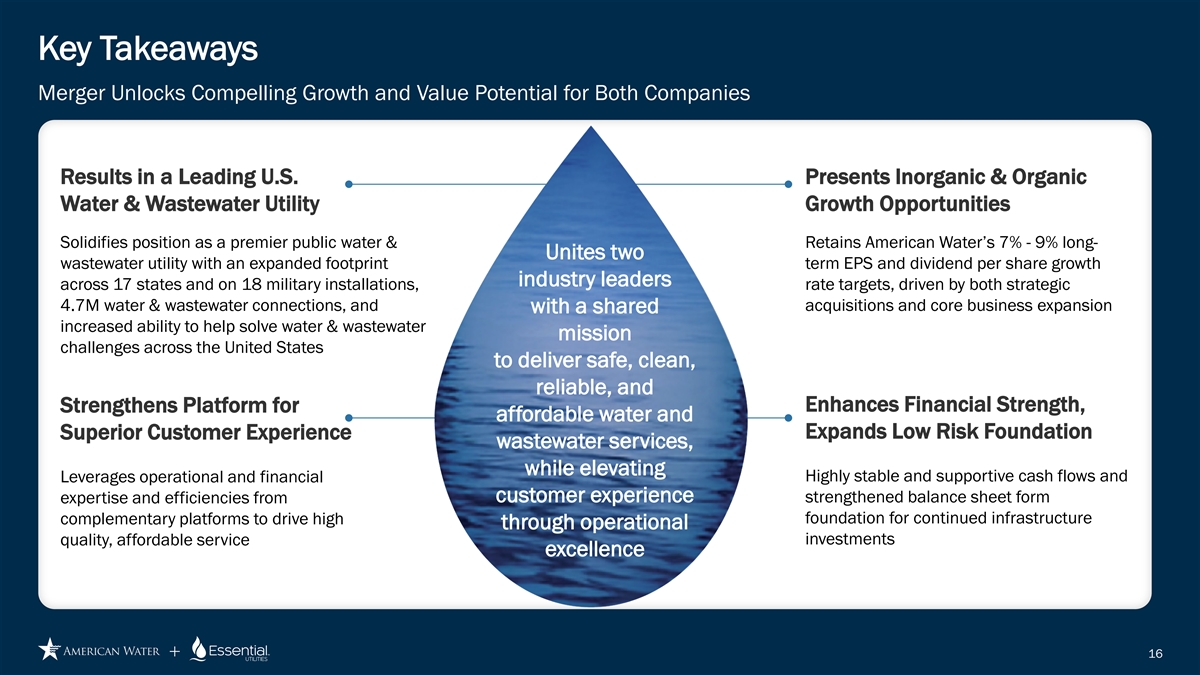

Key Takeaways Merger Unlocks Compelling Growth and Value Potential for Both Companies Results in a Leading U.S. Presents Inorganic & Organic Water & Wastewater Utility Growth Opportunities Solidifies position as a premier public water & Retains American Water’s 7% - 9% long- Unites two wastewater utility with an expanded footprint term EPS and dividend per share growth industry leaders across 17 states and on 18 military installations, rate targets, driven by both strategic 4.7M water & wastewater connections, and acquisitions and core business expansion with a shared increased ability to help solve water & wastewater mission challenges across the United States to deliver safe, clean, reliable, and Enhances Financial Strength, Strengthens Platform for affordable water and Expands Low Risk Foundation Superior Customer Experience wastewater services, while elevating Highly stable and supportive cash flows and Leverages operational and financial customer experience strengthened balance sheet form expertise and efficiencies from foundation for continued infrastructure complementary platforms to drive high through operational quality, affordable service investments excellence 16