Booz Allen Hamilton Announces Second Quarter Fiscal 2026 Results McLean, Virginia - October 24, 2025 - Booz Allen Hamilton Holding Corporation (NYSE: BAH), the parent company of advanced technology company Booz Allen Hamilton Inc., today announced results for the second quarter of fiscal 2026. Top and bottom-line performance below forecast driven by continued funding slowdown Solid growth across national security portfolio; civil business experiencing delayed recovery Record Q2 backlog of $40 billion and quarterly book-to-bill ratio of 1.7x 2.7 percent of outstanding shares repurchased in first half of fiscal year Full year outlook adjusted to reflect current environment "Our second quarter results reflect a bifurcated market. We are winning work and demand is strong for our leading cyber, AI, and warfighting technologies," said Horacio Rozanski, Booz Allen Chairman, CEO and President. "We remain focused on accelerating future growth while building advanced tech that keeps America safe and strong." Q2 Summary • Revenue declined 8.1 percent year-over-year to $2.9 billion ◦ Excluding prior year change to the provision for claimed costs, revenue declined 4.7 percent • Net Income of $175 million, a 55.1 percent decrease • Adjusted Net Income1 of $183 million, a 21.5 percent decrease • Adjusted EBITDA1 of $324 million, an 11.0 percent decrease • Adjusted EBITDA Margin on Revenue1 decreased by 40 basis points to 11.2% • Adjusted Diluted EPS1 of $1.49, a 17.7 percent decrease • Free cash flow1 of $395 million compared to $563 million in the prior year • $279 million in capital deployment • 1.7x quarterly book-to-bill ratio and 1.1x trailing twelve month book-to-bill ratio • Total backlog of $40 billion, a 2.9 percent increase First Half Summary ◦ Revenue declined 4.5 percent year-over-year to $5.8 billion ▪ Excluding prior year change to the provision for claimed costs, revenue declined 2.7 percent ◦ Net Income of $446 million, a 19.6 percent decrease ◦ Adjusted Net Income1 of $367 million, an 11.1 percent decrease ◦ Adjusted EBITDA1 of $635 million, a 4.7 percent decrease ◦ Adjusted EBITDA Margin on Revenue1 remained flat at 10.9% ◦ Adjusted Diluted EPS1 of $2.97, a 6.9 percent decrease ◦ Free cash flow1 of $491 million, compared to $583 million in the prior year A regular quarterly dividend of $0.55 per share will be payable on December 2, 2025, to stockholders of record on November 14, 2025. 1 Due to the fiscal 2025 change in rounding presentation to millions, comparative period presentation within this release has been adjusted accordingly. 1 Revenue, Excluding Billable Expenses, Adjusted Net Income, Adjusted EBITDA, Adjusted Diluted EPS, Adjusted EBITDA Margin on Revenue, and Free Cash Flow are non- GAAP financial measures. See "Non-GAAP Financial Information" below for additional details.

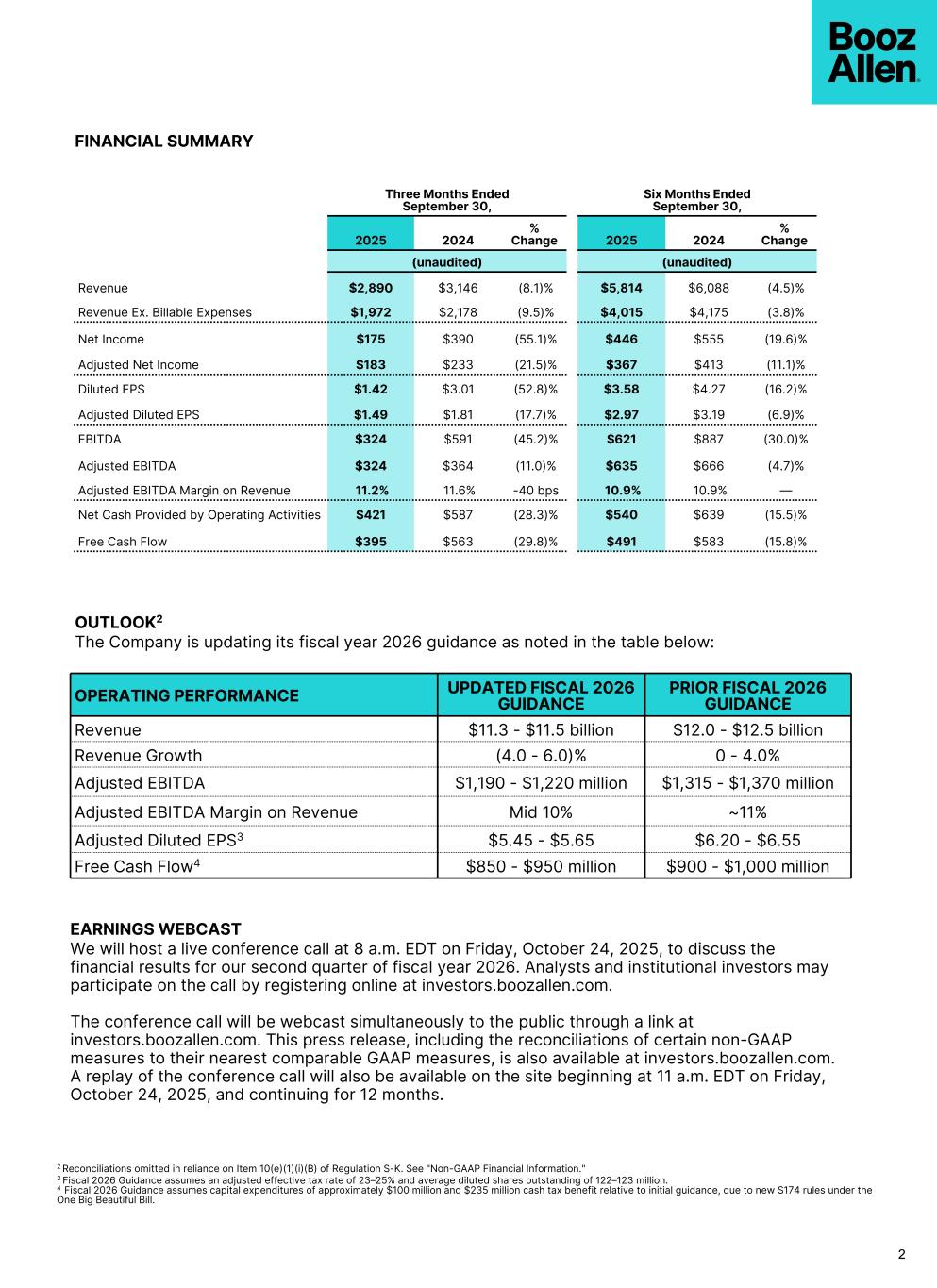

2 Three Months Ended September 30, Six Months Ended September 30, 2025 2024 % Change 2025 2024 % Change (unaudited) (unaudited) Revenue $2,890 $3,146 (8.1)% $5,814 $6,088 (4.5)% Revenue Ex. Billable Expenses $1,972 $2,178 (9.5)% $4,015 $4,175 (3.8)% Net Income $175 $390 (55.1)% $446 $555 (19.6)% Adjusted Net Income $183 $233 (21.5)% $367 $413 (11.1)% Diluted EPS $1.42 $3.01 (52.8)% $3.58 $4.27 (16.2)% Adjusted Diluted EPS $1.49 $1.81 (17.7)% $2.97 $3.19 (6.9)% EBITDA $324 $591 (45.2)% $621 $887 (30.0)% Adjusted EBITDA $324 $364 (11.0)% $635 $666 (4.7)% Adjusted EBITDA Margin on Revenue 11.2% 11.6% -40 bps 10.9% 10.9% — Net Cash Provided by Operating Activities $421 $587 (28.3)% $540 $639 (15.5)% Free Cash Flow $395 $563 (29.8)% $491 $583 (15.8)% FINANCIAL SUMMARY 2 Reconciliations omitted in reliance on Item 10(e)(1)(i)(B) of Regulation S-K. See "Non-GAAP Financial Information." 3 Fiscal 2026 Guidance assumes an adjusted effective tax rate of 23–25% and average diluted shares outstanding of 122–123 million. 4 Fiscal 2026 Guidance assumes capital expenditures of approximately $100 million and $235 million cash tax benefit relative to initial guidance, due to new S174 rules under the One Big Beautiful Bill. OPERATING PERFORMANCE UPDATED FISCAL 2026 GUIDANCE PRIOR FISCAL 2026 GUIDANCE Revenue $11.3 - $11.5 billion $12.0 - $12.5 billion Revenue Growth (4.0 - 6.0)% 0 - 4.0% Adjusted EBITDA $1,190 - $1,220 million $1,315 - $1,370 million Adjusted EBITDA Margin on Revenue Mid 10% ~11% Adjusted Diluted EPS3 $5.45 - $5.65 $6.20 - $6.55 Free Cash Flow4 $850 - $950 million $900 - $1,000 million EARNINGS WEBCAST We will host a live conference call at 8 a.m. EDT on Friday, October 24, 2025, to discuss the financial results for our second quarter of fiscal year 2026. Analysts and institutional investors may participate on the call by registering online at investors.boozallen.com. The conference call will be webcast simultaneously to the public through a link at investors.boozallen.com. This press release, including the reconciliations of certain non-GAAP measures to their nearest comparable GAAP measures, is also available at investors.boozallen.com. A replay of the conference call will also be available on the site beginning at 11 a.m. EDT on Friday, October 24, 2025, and continuing for 12 months. OUTLOOK2 The Company is updating its fiscal year 2026 guidance as noted in the table below:

3 ABOUT BOOZ ALLEN HAMILTON Booz Allen is an advanced technology company delivering outcomes with speed for America’s most critical defense, civil, and national security priorities. We build technology solutions using AI, cyber, and other cutting-edge technologies to advance and protect the nation and its citizens. By focusing on outcomes, we enable our people, clients, and their missions to succeed—accelerating the nation to realize our purpose: Empower People to Change the World®. With global headquarters in McLean, Virginia, our firm employs approximately 32,500 people globally as of September 30, 2025, and had revenue of $12.0 billion for the 12 months ended March 31, 2025. To learn more, visit www.boozallen.com. (NYSE: BAH) CONTACT INFORMATION Investor Relations Dustin Darensbourg Investor_Relations@bah.com Media Relations Jessica Klenk Klenk_Jessica@bah.com

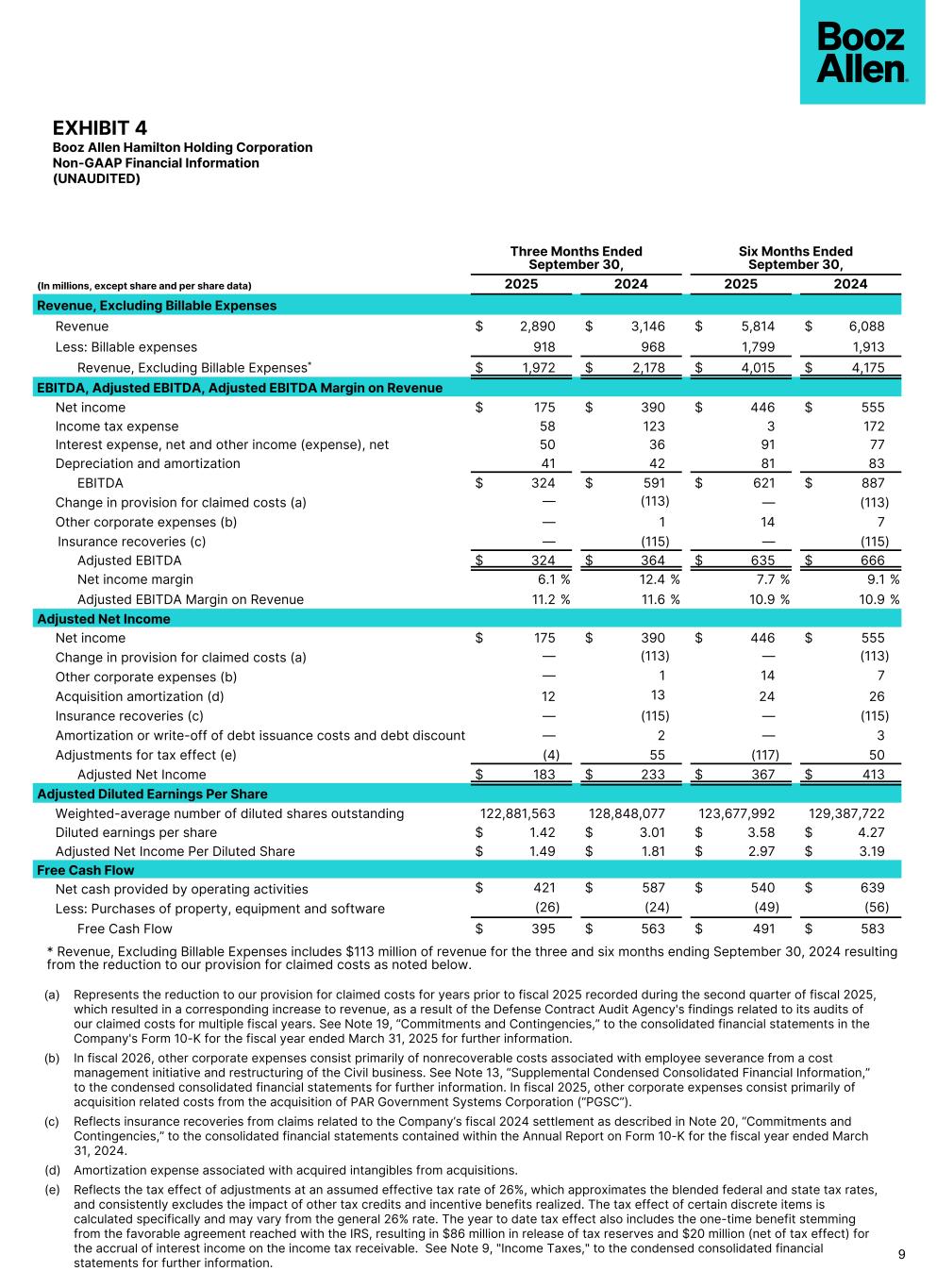

NON-GAAP FINANCIAL INFORMATION Booz Allen utilizes and discusses in this release Revenue, Excluding Billable Expenses, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow. While we believe that these non-GAAP financial measures may be useful in evaluating our financial information, they should be considered as supplemental in nature and not as a substitute for financial information prepared in accordance with GAAP. Reconciliations, definitions, and how we believe these measures are useful to management and investors are provided below. Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, Adjusted Diluted EPS, and Free Cash Flow exclude the impact of the items detailed in the supplemental exhibits, as these items are generally not operational in nature. These non-GAAP measures also provide another basis for comparing period to period results by excluding potential differences caused by non-operational and unusual or non-recurring items. “Revenue, Excluding Billable Expenses” represents revenue less billable expenses. Booz Allen uses Revenue, Excluding Billable Expenses because it provides management useful information about the Company’s operating performance by excluding the impact of costs such as subcontractor expenses, travel expenses, and other non-labor expenses incurred to perform on contracts. Billable expenses generally have lower margin and thus are less indicative of our profit generation capacity. "EBITDA” represents net income before income taxes, interest expense, net and other income (expense), net, and depreciation and amortization. “Adjusted EBITDA” represents net income before income tax expense (benefit), interest expense, net and other income (expense), net and depreciation and amortization and before certain other items, including the change in provision for claimed costs for historical rate years, certain other corporate expenses, DC tax assessment adjustment, and certain insurance recoveries. “Adjusted EBITDA Margin on Revenue” is calculated as Adjusted EBITDA divided by revenue. Booz Allen prepares Adjusted EBITDA and Adjusted EBITDA Margin on Revenue to eliminate the impact of items it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. “Adjusted Net Income” represents net income before: (i) the change in provision for claimed costs for historical rate years (ii) certain other corporate expenses, (iii) acquisition amortization, (iv) certain insurance recoveries, and (v) amortization or write-off of debt issuance costs and debt discount, in each case net of the tax effect where appropriate calculated using an assumed effective tax rate. Booz Allen prepares Adjusted Net Income to eliminate the impact of items, net of tax, it does not consider indicative of ongoing operating performance due to their inherent unusual, extraordinary or non-recurring nature or because they result from an event of a similar nature. “Adjusted Diluted EPS” represents diluted EPS calculated using Adjusted Net Income as opposed to net income. Additionally, Adjusted Diluted EPS does not contemplate any adjustments to net income as required under the two- class method as disclosed in the footnotes to the consolidated financial statements of the Company's Form 10-K for the fiscal year ended March 31, 2025. "Free Cash Flow" represents the net cash generated from operating activities less the impact of purchases of property, equipment and software. Booz Allen presents these supplemental measures because it believes that these measures provide investors and securities analysts with important supplemental information with which to evaluate Booz Allen’s performance, long-term earnings potential, or liquidity, as applicable.These non-GAAP measurements may vary from and may not be comparable to similarly titled measures by other companies in Booz Allen’s industry. "Adjusted Effective Tax Rate" represents income tax expense (benefit) excluding the income tax effects of adjustments to net income, divided by adjusted earnings before income tax expense. "Net Leverage Ratio" is calculated as net debt (total debt less cash) divided by Adjusted EBITDA over the prior twelve months. Revenue, Excluding Billable Expenses, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, Adjusted Diluted EPS, Free Cash Flow, and Net Leverage Ratio are not recognized measurements under accounting principles generally accepted in the United States, or GAAP, and when analyzing Booz Allen’s performance or liquidity, as applicable, investors should (i) evaluate each adjustment in our reconciliation of revenue to Revenue, Excluding Billable Expenses, net income to Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, and Adjusted Diluted Earnings Per Share, net cash provided by operating activities to Free Cash Flow, and net debt to Net Leverage Ratio, (ii) use Revenue, Excluding Billable Expenses, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, and Adjusted Diluted EPS in addition to, and not as an alternative to, revenue, net income or diluted EPS as measures of operating results, each as defined under GAAP, (iii) use Free Cash Flow and Net Leverage Ratio, in addition to, and not as an alternative to, net cash provided by operating activities as a measure of liquidity, each as defined under GAAP, and (iv) use Net Leverage Ratio in addition to, and not as an alternative to, net debt as a measure of Booz Allen's debt leverage. Exhibit 4 includes a reconciliation of Revenue, Excluding Billable Expenses, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue, Adjusted Net Income, Adjusted Diluted EPS, Free Cash Flow and Net Leverage Ratio to the most directly comparable financial measure calculated and presented in accordance with GAAP. With respect to our expectations under “Outlook” above, a reconciliation of Adjusted Diluted EPS guidance to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward- looking basis due to our inability to predict our stock price, equity grants, and dividend declarations during the course of fiscal 2026. Projecting future stock price, equity grants, and the dividends to be declared would be necessary to accurately calculate the difference between Adjusted Diluted EPS and GAAP EPS as a result of the effects of the two-class method and related possible dilution used in the calculation of EPS. Consequently, any attempt to disclose such reconciliation would imply a degree of precision that could be confusing or misleading to investors. We expect the variability of the above charges to have an unpredictable, and potentially significant, impact on our future GAAP financial results. Accordingly, Booz Allen is relying on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K to exclude the reconciliation. In addition, our expectations for Adjusted EBITDA and Adjusted EBITDA Margin on Revenue for fiscal 2026 are presented under "Outlook" above and management may discuss its expectation for Adjusted EBITDA and Adjusted EBITDA Margin on Revenue for fiscal 2026 from time to time. A reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin on Revenue guidance to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to our inability to predict specific quantification of the amounts that would be required to reconcile such measures. Consequently, any attempt to disclose such reconciliation would imply a degree of precision that could be confusing or misleading to investors. Accordingly, Booz Allen is relying on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K to exclude the reconciliation. 4

FORWARD LOOKING STATEMENTS Certain statements contained in this press release and in related comments by our management include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of forward-looking statements include information concerning Booz Allen’s preliminary financial results, financial outlook and guidance, including forecasted revenue, Diluted EPS, and Adjusted Diluted EPS, future quarterly dividends, and future improvements in operating margins, as well as any other statement that does not directly relate to any historical or current fact. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “could,” “should,” “forecasts,” “expects,” “intends,” “plans,” “anticipates,” “projects,” “outlook,” “believes,” “estimates,” “predicts,” “potential,” “continue,” “preliminary,” or the negative of these terms or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give you no assurance these expectations will prove to have been correct. These forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These risks and other factors include: • any issue that compromises our relationships with the U.S. government or damages our professional reputation, including negative publicity concerning government contractors in general or us in particular; • changes in U.S. government spending, including a continuation of efforts by the U.S. government to reduce U.S. government spending, increased insourcing by certain U.S. government agencies, and shifts in expenditures away from agencies or programs that we support, as well as associated uncertainty around the timing, extent, nature and effect of such efforts; • U.S. government shutdowns as well as delayed long-term funding of our contracts; • failure to comply with new and existing U.S. and international laws and regulations; • our ability to compete effectively in the competitive bidding process and delays or losses of contract awards caused by competitors’ protests of major contract awards received by us; • the loss of U.S. government GSA Schedules or our position as prime contractor on government-wide acquisition contract vehicles (“GWACs”); • variable purchasing patterns under certain of our U.S. government contracts and changes in the mix of our contracts including our ability to accurately estimate or otherwise recover expenses, time, and resources for our contracts; • our ability to realize the full value of and replenish our backlog, generate revenue under certain of our contracts, and the timing of our receipt of revenue under contracts included in backlog; • internal system or service failures and security breaches, including, but not limited to, those resulting from external or internal threats, including cyber attacks on our network and internal systems or on our customers’ network or internal systems; • misconduct or other improper activities from our employees, subcontractors or suppliers, including the improper access, use or release of our or our customers’ sensitive or classified information; • failure to maintain strong relationships with other contractors, or the failure of contractors with which we have entered into a sub or prime-contractor relationship to meet their obligations to us or our customers; • inherent uncertainties and potential adverse developments in legal or regulatory proceedings, including litigation, audits, reviews, and investigations, which may result in materially adverse judgments, settlements, withheld payments, penalties, or other unfavorable outcomes including debarment, as well as disputes over the availability of insurance or indemnification; • risks related to a possible recession and volatility or instability of the global financial system, including the failures of financial institutions and the resulting impact on counterparties and business conditions generally; • risks related to a deterioration of economic conditions or weakening in credit or capital markets; • risks related to pending, completed, and future acquisitions and dispositions, including the ability to satisfy specified closing conditions for pending transactions, such as those related to receipt of regulatory approval or lack of regulatory intervention, and to realize the expected benefits from completed acquisitions and dispositions; • risks inherent in the government contracting environment; and • risks related to our indebtedness and credit facilities which contain financial and operating covenants. Additional information concerning these and other factors can be found in our filings with the Securities and Exchange Commission (SEC), including our Annual Report on Form 10-K filed with the SEC on May 23, 2025. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. 5

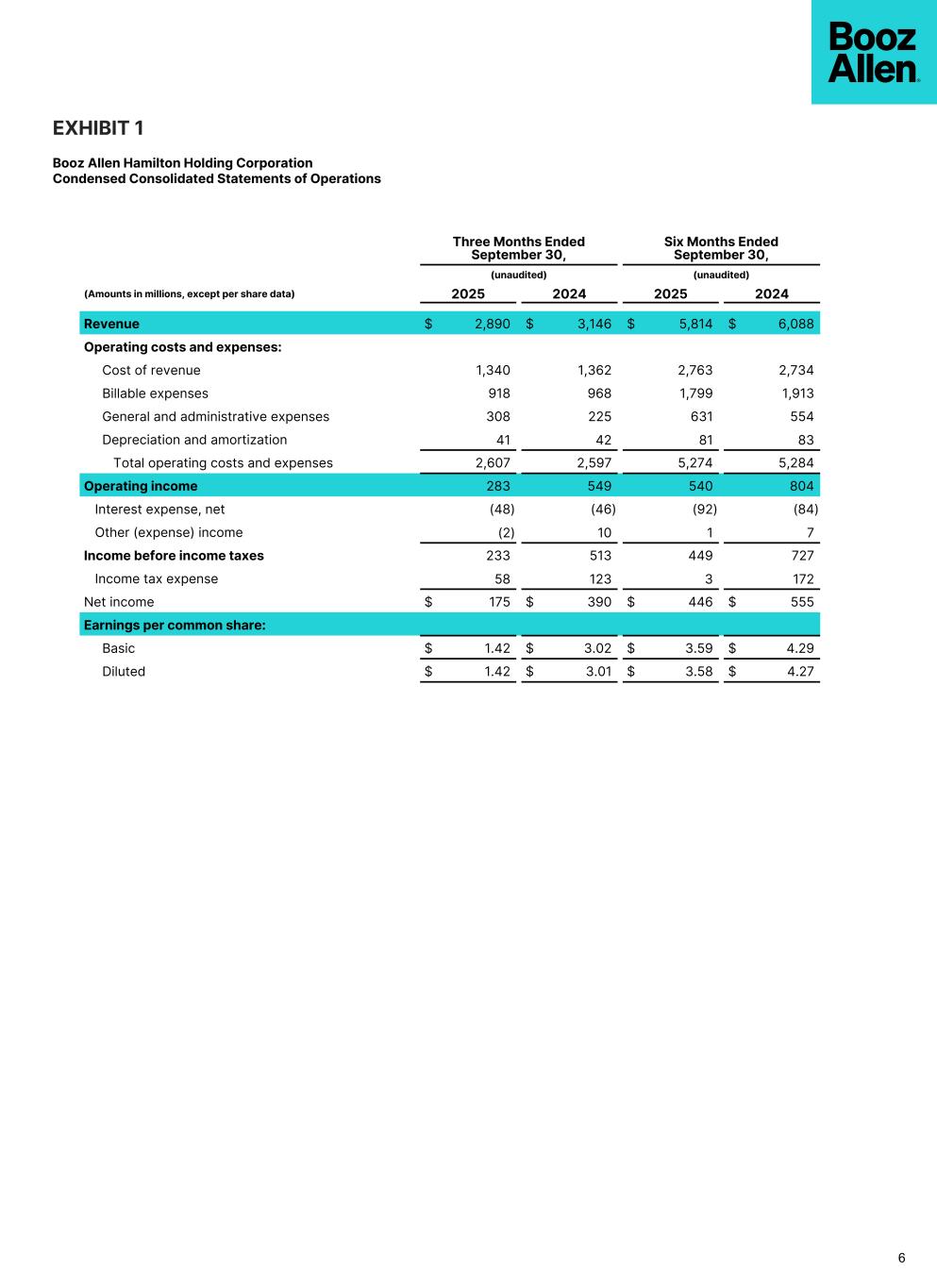

EXHIBIT 1 Booz Allen Hamilton Holding Corporation Condensed Consolidated Statements of Operations 6 Three Months Ended September 30, Six Months Ended September 30, (unaudited) (unaudited) (Amounts in millions, except per share data) 2025 2024 2025 2024 Revenue $ 2,890 $ 3,146 $ 5,814 $ 6,088 Operating costs and expenses: Cost of revenue 1,340 1,362 2,763 2,734 Billable expenses 918 968 1,799 1,913 General and administrative expenses 308 225 631 554 Depreciation and amortization 41 42 81 83 Total operating costs and expenses 2,607 2,597 5,274 5,284 Operating income 283 549 540 804 Interest expense, net (48) (46) (92) (84) Other (expense) income (2) 10 1 7 Income before income taxes 233 513 449 727 Income tax expense 58 123 3 172 Net income $ 175 $ 390 $ 446 $ 555 Earnings per common share: Basic $ 1.42 $ 3.02 $ 3.59 $ 4.29 Diluted $ 1.42 $ 3.01 $ 3.58 $ 4.27

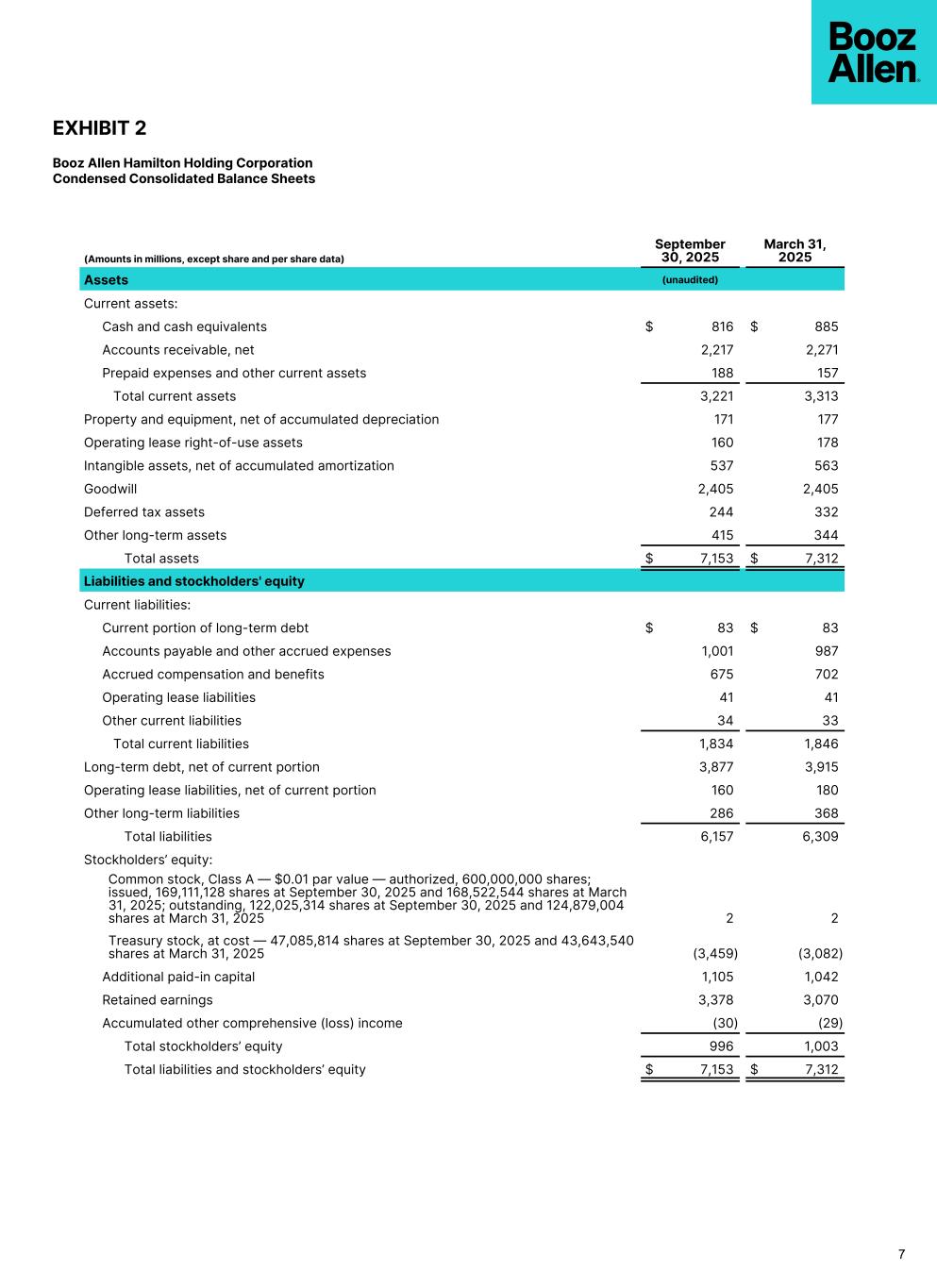

EXHIBIT 2 Booz Allen Hamilton Holding Corporation Condensed Consolidated Balance Sheets (Amounts in millions, except share and per share data) September 30, 2025 March 31, 2025 Assets (unaudited) Current assets: Cash and cash equivalents $ 816 $ 885 Accounts receivable, net 2,217 2,271 Prepaid expenses and other current assets 188 157 Total current assets 3,221 3,313 Property and equipment, net of accumulated depreciation 171 177 Operating lease right-of-use assets 160 178 Intangible assets, net of accumulated amortization 537 563 Goodwill 2,405 2,405 Deferred tax assets 244 332 Other long-term assets 415 344 Total assets $ 7,153 $ 7,312 Liabilities and stockholders' equity Current liabilities: Current portion of long-term debt $ 83 $ 83 Accounts payable and other accrued expenses 1,001 987 Accrued compensation and benefits 675 702 Operating lease liabilities 41 41 Other current liabilities 34 33 Total current liabilities 1,834 1,846 Long-term debt, net of current portion 3,877 3,915 Operating lease liabilities, net of current portion 160 180 Other long-term liabilities 286 368 Total liabilities 6,157 6,309 Stockholders’ equity: Common stock, Class A — $0.01 par value — authorized, 600,000,000 shares; issued, 169,111,128 shares at September 30, 2025 and 168,522,544 shares at March 31, 2025; outstanding, 122,025,314 shares at September 30, 2025 and 124,879,004 shares at March 31, 2025 2 2 Treasury stock, at cost — 47,085,814 shares at September 30, 2025 and 43,643,540 shares at March 31, 2025 (3,459) (3,082) Additional paid-in capital 1,105 1,042 Retained earnings 3,378 3,070 Accumulated other comprehensive (loss) income (30) (29) Total stockholders’ equity 996 1,003 Total liabilities and stockholders’ equity $ 7,153 $ 7,312 7

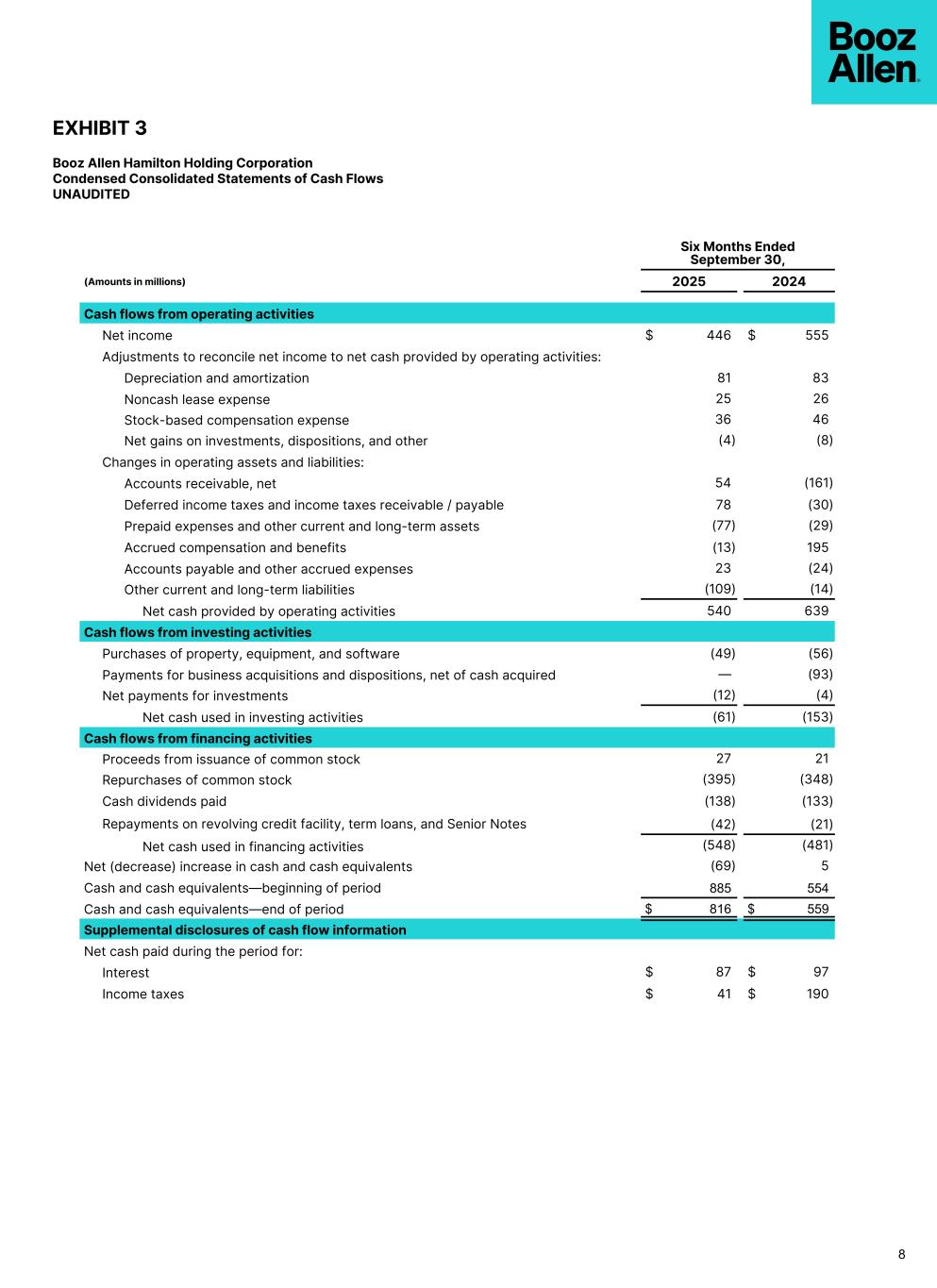

EXHIBIT 3 Booz Allen Hamilton Holding Corporation Condensed Consolidated Statements of Cash Flows UNAUDITED Six Months Ended September 30, (Amounts in millions) 2025 2024 Cash flows from operating activities Net income $ 446 $ 555 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 81 83 Noncash lease expense 25 26 Stock-based compensation expense 36 46 Net gains on investments, dispositions, and other (4) (8) Changes in operating assets and liabilities: Accounts receivable, net 54 (161) Deferred income taxes and income taxes receivable / payable 78 (30) Prepaid expenses and other current and long-term assets (77) (29) Accrued compensation and benefits (13) 195 Accounts payable and other accrued expenses 23 (24) Other current and long-term liabilities (109) (14) Net cash provided by operating activities 540 639 Cash flows from investing activities Purchases of property, equipment, and software (49) (56) Payments for business acquisitions and dispositions, net of cash acquired — (93) Net payments for investments (12) (4) Net cash used in investing activities (61) (153) Cash flows from financing activities Proceeds from issuance of common stock 27 21 Repurchases of common stock (395) (348) Cash dividends paid (138) (133) Repayments on revolving credit facility, term loans, and Senior Notes (42) (21) Net cash used in financing activities (548) (481) Net (decrease) increase in cash and cash equivalents (69) 5 Cash and cash equivalents––beginning of period 885 554 Cash and cash equivalents––end of period $ 816 $ 559 Supplemental disclosures of cash flow information Net cash paid during the period for: Interest $ 87 $ 97 Income taxes $ 41 $ 190 8

EXHIBIT 4 Booz Allen Hamilton Holding Corporation Non-GAAP Financial Information (UNAUDITED) Three Months Ended September 30, Six Months Ended September 30, (In millions, except share and per share data) 2025 2024 2025 2024 Revenue, Excluding Billable Expenses Revenue $ 2,890 $ 3,146 $ 5,814 $ 6,088 Less: Billable expenses 918 968 1,799 1,913 Revenue, Excluding Billable Expenses* $ 1,972 $ 2,178 $ 4,015 $ 4,175 EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin on Revenue Net income $ 175 $ 390 $ 446 $ 555 Income tax expense 58 123 3 172 Interest expense, net and other income (expense), net 50 36 91 77 Depreciation and amortization 41 42 81 83 EBITDA $ 324 $ 591 $ 621 $ 887 Change in provision for claimed costs (a) — (113) — (113) Other corporate expenses (b) — 1 14 7 Insurance recoveries (c) — (115) — (115) Adjusted EBITDA $ 324 $ 364 $ 635 $ 666 Net income margin 6.1 % 12.4 % 7.7 % 9.1 % Adjusted EBITDA Margin on Revenue 11.2 % 11.6 % 10.9 % 10.9 % Adjusted Net Income Net income $ 175 $ 390 $ 446 $ 555 Change in provision for claimed costs (a) — (113) — (113) Other corporate expenses (b) — 1 14 7 Acquisition amortization (d) 12 13 24 26 Insurance recoveries (c) — (115) — (115) Amortization or write-off of debt issuance costs and debt discount — 2 — 3 Adjustments for tax effect (e) (4) 55 (117) 50 Adjusted Net Income $ 183 $ 233 $ 367 $ 413 Adjusted Diluted Earnings Per Share Weighted-average number of diluted shares outstanding 122,881,563 128,848,077 123,677,992 129,387,722 Diluted earnings per share $ 1.42 $ 3.01 $ 3.58 $ 4.27 Adjusted Net Income Per Diluted Share $ 1.49 $ 1.81 $ 2.97 $ 3.19 Free Cash Flow Net cash provided by operating activities $ 421 $ 587 $ 540 $ 639 Less: Purchases of property, equipment and software (26) (24) (49) (56) Free Cash Flow $ 395 $ 563 $ 491 $ 583 * Revenue, Excluding Billable Expenses includes $113 million of revenue for the three and six months ending September 30, 2024 resulting from the reduction to our provision for claimed costs as noted below. 9 (a) Represents the reduction to our provision for claimed costs for years prior to fiscal 2025 recorded during the second quarter of fiscal 2025, which resulted in a corresponding increase to revenue, as a result of the Defense Contract Audit Agency's findings related to its audits of our claimed costs for multiple fiscal years. See Note 19, “Commitments and Contingencies,” to the consolidated financial statements in the Company's Form 10-K for the fiscal year ended March 31, 2025 for further information. (b) In fiscal 2026, other corporate expenses consist primarily of nonrecoverable costs associated with employee severance from a cost management initiative and restructuring of the Civil business. See Note 13, “Supplemental Condensed Consolidated Financial Information,” to the condensed consolidated financial statements for further information. In fiscal 2025, other corporate expenses consist primarily of acquisition related costs from the acquisition of PAR Government Systems Corporation (“PGSC”). (c) Reflects insurance recoveries from claims related to the Company’s fiscal 2024 settlement as described in Note 20, “Commitments and Contingencies,” to the consolidated financial statements contained within the Annual Report on Form 10-K for the fiscal year ended March 31, 2024. (d) Amortization expense associated with acquired intangibles from acquisitions. (e) Reflects the tax effect of adjustments at an assumed effective tax rate of 26%, which approximates the blended federal and state tax rates, and consistently excludes the impact of other tax credits and incentive benefits realized. The tax effect of certain discrete items is calculated specifically and may vary from the general 26% rate. The year to date tax effect also includes the one-time benefit stemming from the favorable agreement reached with the IRS, resulting in $86 million in release of tax reserves and $20 million (net of tax effect) for the accrual of interest income on the income tax receivable. See Note 9, "Income Taxes," to the condensed consolidated financial statements for further information.

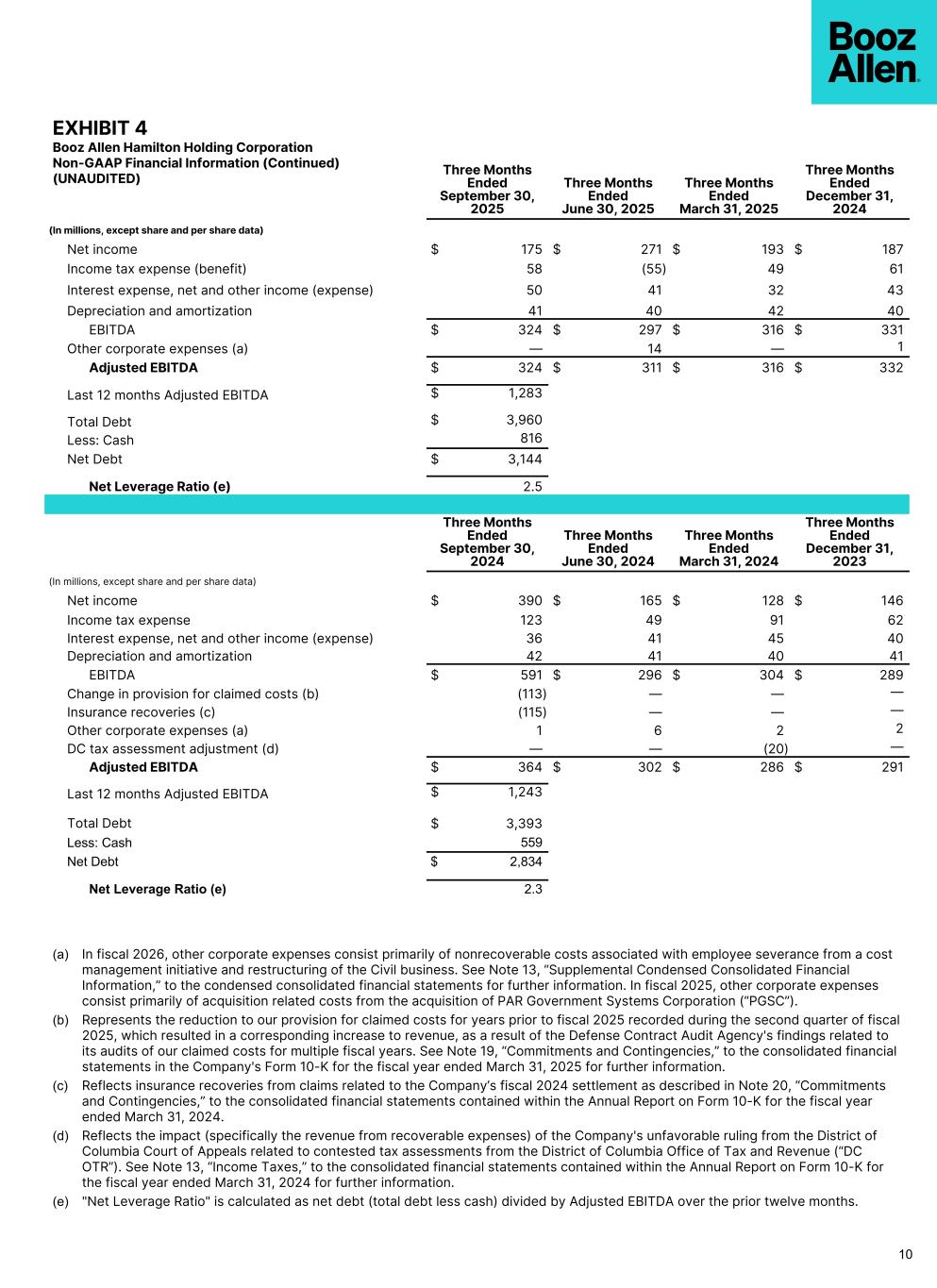

EXHIBIT 4 Booz Allen Hamilton Holding Corporation Non-GAAP Financial Information (Continued) (UNAUDITED) Three Months Ended September 30, 2025 Three Months Ended June 30, 2025 Three Months Ended March 31, 2025 Three Months Ended December 31, 2024 (In millions, except share and per share data) Net income $ 175 $ 271 $ 193 $ 187 Income tax expense (benefit) 58 (55) 49 61 Interest expense, net and other income (expense) 50 41 32 43 Depreciation and amortization 41 40 42 40 EBITDA $ 324 $ 297 $ 316 $ 331 Other corporate expenses (a) — 14 — 1 Adjusted EBITDA $ 324 $ 311 $ 316 $ 332 Last 12 months Adjusted EBITDA $ 1,283 Total Debt $ 3,960 Less: Cash 816 Net Debt $ 3,144 Net Leverage Ratio (e) 2.5 Three Months Ended September 30, 2024 Three Months Ended June 30, 2024 Three Months Ended March 31, 2024 Three Months Ended December 31, 2023 (In millions, except share and per share data) Net income $ 390 $ 165 $ 128 $ 146 Income tax expense 123 49 91 62 Interest expense, net and other income (expense) 36 41 45 40 Depreciation and amortization 42 41 40 41 EBITDA $ 591 $ 296 $ 304 $ 289 Change in provision for claimed costs (b) (113) — — — Insurance recoveries (c) (115) — — — Other corporate expenses (a) 1 6 2 2 DC tax assessment adjustment (d) — — (20) — Adjusted EBITDA $ 364 $ 302 $ 286 $ 291 Last 12 months Adjusted EBITDA $ 1,243 Total Debt $ 3,393 Less: Cash 559 Net Debt $ 2,834 Net Leverage Ratio (e) 2.3 10 (a) In fiscal 2026, other corporate expenses consist primarily of nonrecoverable costs associated with employee severance from a cost management initiative and restructuring of the Civil business. See Note 13, “Supplemental Condensed Consolidated Financial Information,” to the condensed consolidated financial statements for further information. In fiscal 2025, other corporate expenses consist primarily of acquisition related costs from the acquisition of PAR Government Systems Corporation (“PGSC”). (b) Represents the reduction to our provision for claimed costs for years prior to fiscal 2025 recorded during the second quarter of fiscal 2025, which resulted in a corresponding increase to revenue, as a result of the Defense Contract Audit Agency's findings related to its audits of our claimed costs for multiple fiscal years. See Note 19, “Commitments and Contingencies,” to the consolidated financial statements in the Company's Form 10-K for the fiscal year ended March 31, 2025 for further information. (c) Reflects insurance recoveries from claims related to the Company’s fiscal 2024 settlement as described in Note 20, “Commitments and Contingencies,” to the consolidated financial statements contained within the Annual Report on Form 10-K for the fiscal year ended March 31, 2024. (d) Reflects the impact (specifically the revenue from recoverable expenses) of the Company's unfavorable ruling from the District of Columbia Court of Appeals related to contested tax assessments from the District of Columbia Office of Tax and Revenue (“DC OTR”). See Note 13, “Income Taxes,” to the consolidated financial statements contained within the Annual Report on Form 10-K for the fiscal year ended March 31, 2024 for further information. (e) "Net Leverage Ratio" is calculated as net debt (total debt less cash) divided by Adjusted EBITDA over the prior twelve months.

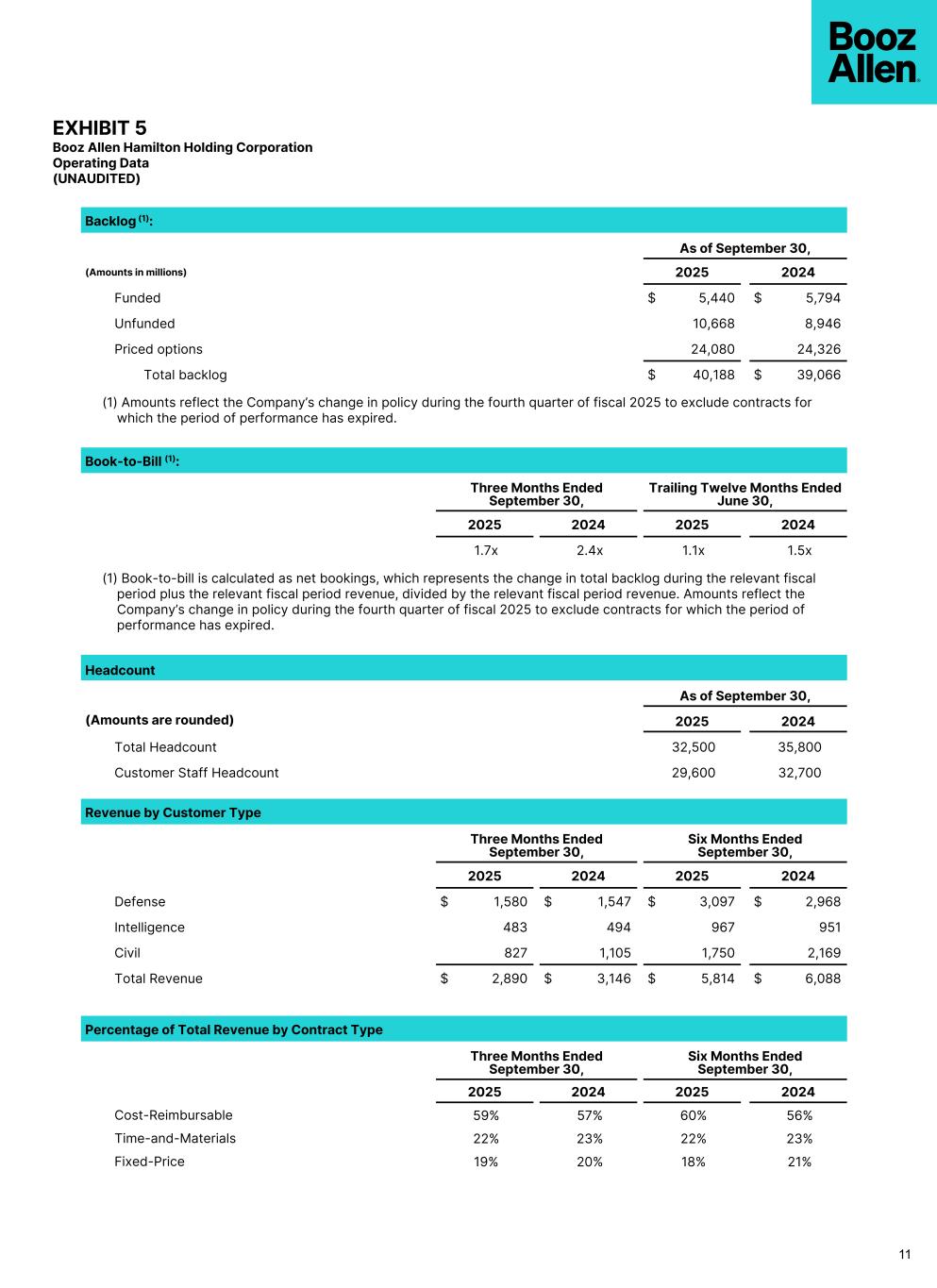

EXHIBIT 5 Booz Allen Hamilton Holding Corporation Operating Data (UNAUDITED) Backlog (1): As of September 30, (Amounts in millions) 2025 2024 Funded $ 5,440 $ 5,794 Unfunded 10,668 8,946 Priced options 24,080 24,326 Total backlog $ 40,188 $ 39,066 (1) Amounts reflect the Company’s change in policy during the fourth quarter of fiscal 2025 to exclude contracts for which the period of performance has expired. Book-to-Bill (1): Three Months Ended September 30, Trailing Twelve Months Ended June 30, 2025 2024 2025 2024 1.7x 2.4x 1.1x 1.5x (1) Book-to-bill is calculated as net bookings, which represents the change in total backlog during the relevant fiscal period plus the relevant fiscal period revenue, divided by the relevant fiscal period revenue. Amounts reflect the Company’s change in policy during the fourth quarter of fiscal 2025 to exclude contracts for which the period of performance has expired. Headcount As of September 30, (Amounts are rounded) 2025 2024 Total Headcount 32,500 35,800 Customer Staff Headcount 29,600 32,700 Revenue by Customer Type Three Months Ended September 30, Six Months Ended September 30, 2025 2024 2025 2024 Defense $ 1,580 $ 1,547 $ 3,097 $ 2,968 Intelligence 483 494 967 951 Civil 827 1,105 1,750 2,169 Total Revenue $ 2,890 $ 3,146 $ 5,814 $ 6,088 Percentage of Total Revenue by Contract Type Three Months Ended September 30, Six Months Ended September 30, 2025 2024 2025 2024 Cost-Reimbursable 59% 57% 60% 56% Time-and-Materials 22% 23% 22% 23% Fixed-Price 19% 20% 18% 21% 11