Third Quarter 2025 Earnings Presentation Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Measures 2 Certain statements in this press release which are not historical in nature are intended to be, and are hereby identified as, “forward-looking statements” for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements about future financial performance of Stellar Bancorp, Inc. (the “Company”), operating results, plans, business and growth strategies, objectives, expectations and intentions, and other statements that are not historical facts, including projections of macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “could,” “scheduled,” “plans,” “intends,” “projects,” “anticipates,” “expects,” “believes,” “estimates,” “potential,” “would,” or “continue” or negatives of such terms or other comparable terminology. All forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company. Such factors include, among others: changes in the interest rate environment, the value of the Company’s assets and obligations and the availability of capital and liquidity; general competitive, economic, political and market conditions; and other factors that may affect future results of the Company including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; disruptions to the economy and the U.S. banking system; risks associated with uninsured deposits and responsive measures by federal or state governments or banking regulators; legislative changes, executive orders, regulatory actions and reforms of the Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation and Texas Department of Banking. Additional factors which could affect the Company’s future results can be found in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at www.sec.gov. We disclaim any obligation and do not intend to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. GAAP Reconciliation of Non-GAAP Financial Measures The Company’s management uses certain non-GAAP (generally accepted accounting principles) financial measures to evaluate its performance. The Company believes that these non- GAAP financial measures provide meaningful supplemental information regarding its performance and that management and investors benefit from referring to these non-GAAP financial measures in assessing the Company’s performance and when planning, forecasting, analyzing and comparing past, present and future periods. Specifically, the Company reviews pre-tax, pre-provision income, pre-tax pre-provision ROAA, tangible book value per share, return on average tangible equity, tangible equity to tangible assets and net interest margin (tax equivalent) excluding PAA for internal planning and forecasting purposes. The Company has included in this earnings release information relating to these non-GAAP financial measures for the applicable periods presented. These non-GAAP measures should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which the Company calculates the non-GAAP financial measures may differ from that of other companies reporting measures with similar names.

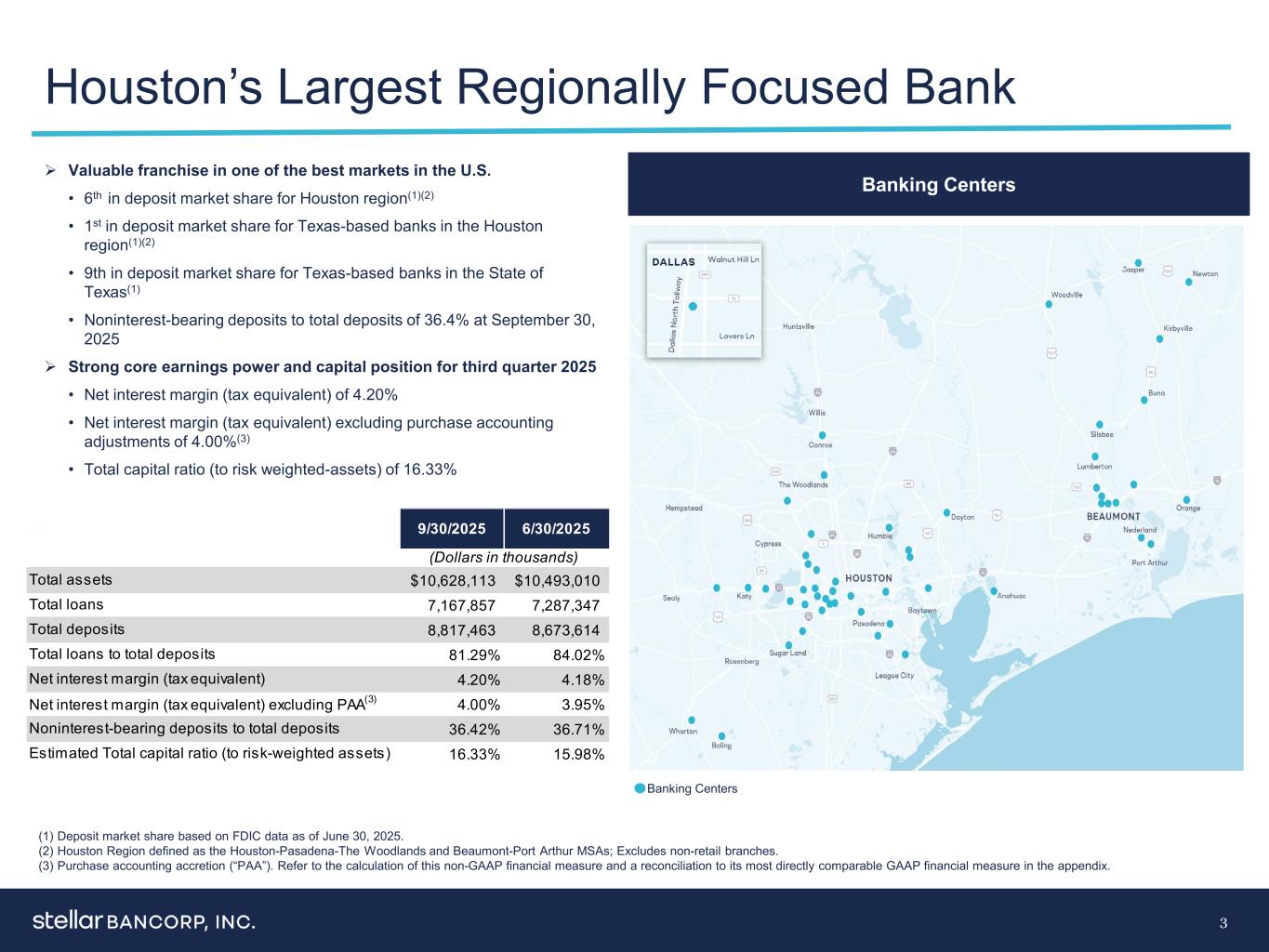

3 (1) Deposit market share based on FDIC data as of June 30, 2025. (2) Houston Region defined as the Houston-Pasadena-The Woodlands and Beaumont-Port Arthur MSAs; Excludes non-retail branches. (3) Purchase accounting accretion (“PAA”). Refer to the calculation of this non-GAAP financial measure and a reconciliation to its most directly comparable GAAP financial measure in the appendix. Houston’s Largest Regionally Focused Bank Valuable franchise in one of the best markets in the U.S. • 6th in deposit market share for Houston region(1)(2) • 1st in deposit market share for Texas-based banks in the Houston region(1)(2) • 9th in deposit market share for Texas-based banks in the State of Texas(1) • Noninterest-bearing deposits to total deposits of 36.4% at September 30, 2025 Strong core earnings power and capital position for third quarter 2025 • Net interest margin (tax equivalent) of 4.20% • Net interest margin (tax equivalent) excluding purchase accounting adjustments of 4.00%(3) • Total capital ratio (to risk weighted-assets) of 16.33% Banking Centers Banking Centers 9/30/2025 6/30/2025 10,628,113$ 10,493,010$ 7,167,857 7,287,347 8,817,463 8,673,614 81.29% 84.02% 4.20% 4.18% 4.00% 3.95% 36.42% 36.71% 16.33% 15.98%Estimated Total capital ratio (to risk-weighted assets) Net interest margin (tax equivalent) Net interest margin (tax equivalent) excluding PAA(3) Noninterest-bearing deposits to total deposits (Dollars in thousands) Total assets Total loans Total deposits Total loans to total deposits

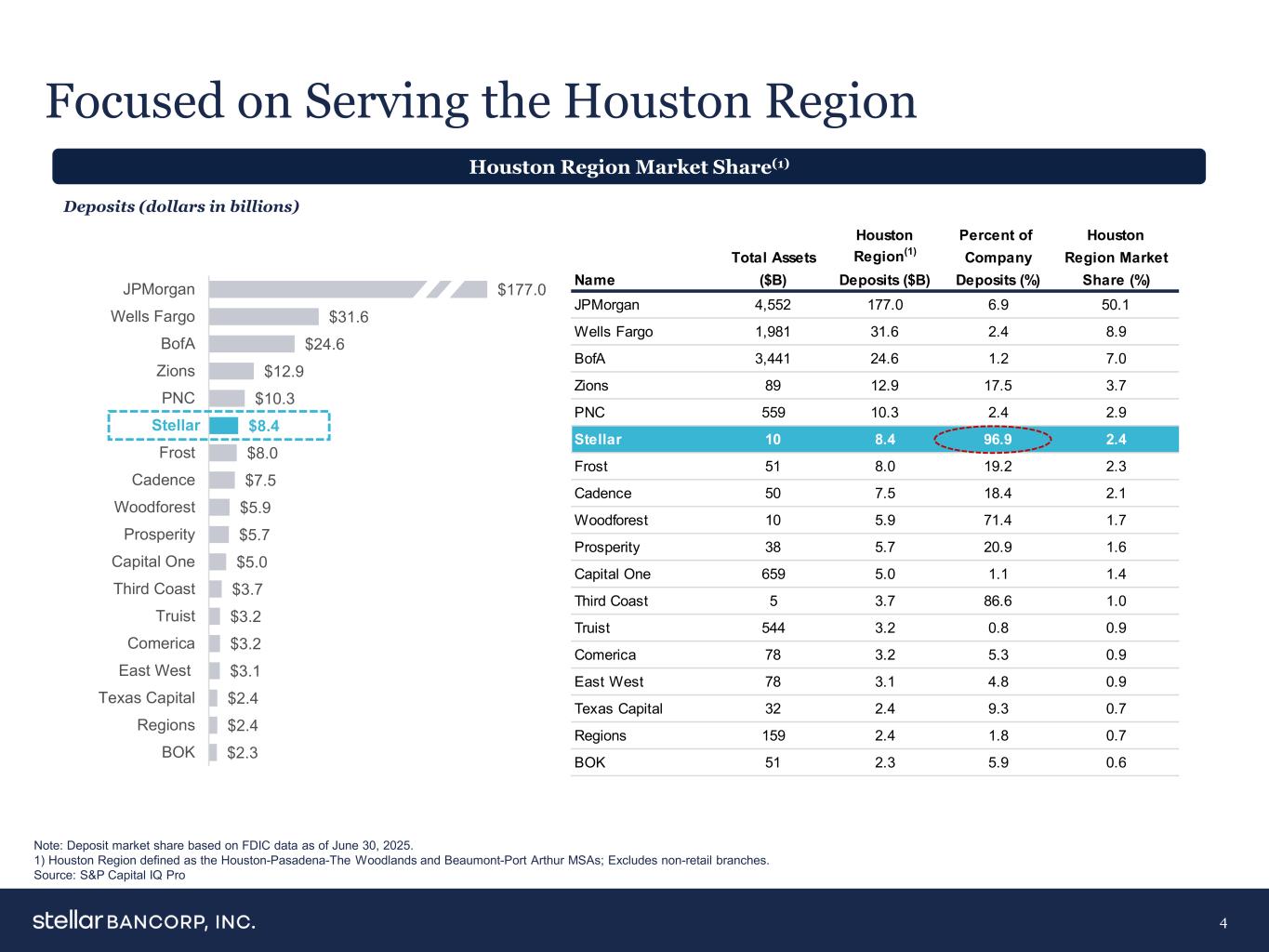

$177.0 $31.6 $24.6 $12.9 $10.3 $8.4 $8.0 $7.5 $5.9 $5.7 $5.0 $3.7 $3.2 $3.2 $3.1 $2.4 $2.4 $2.3 JPMorgan Wells Fargo BofA Zions PNC Frost Cadence Woodforest Prosperity Capital One Third Coast Truist Comerica East West Texas Capital Regions BOK Focused on Serving the Houston Region 4 Stellar Houston Percent of Houston Total Assets Region(1) Company Region Market Name ($B) Deposits ($B) Deposits (%) Share (%) JPMorgan 4,552 177.0 6.9 50.1 Wells Fargo 1,981 31.6 2.4 8.9 BofA 3,441 24.6 1.2 7.0 Zions 89 12.9 17.5 3.7 PNC 559 10.3 2.4 2.9 Stellar 10 8.4 96.9 2.4 Frost 51 8.0 19.2 2.3 Cadence 50 7.5 18.4 2.1 Woodforest 10 5.9 71.4 1.7 Prosperity 38 5.7 20.9 1.6 Capital One 659 5.0 1.1 1.4 Third Coast 5 3.7 86.6 1.0 Truist 544 3.2 0.8 0.9 Comerica 78 3.2 5.3 0.9 East West 78 3.1 4.8 0.9 Texas Capital 32 2.4 9.3 0.7 Regions 159 2.4 1.8 0.7 BOK 51 2.3 5.9 0.6 Houston Region Market Share(1) Note: Deposit market share based on FDIC data as of June 30, 2025. 1) Houston Region defined as the Houston-Pasadena-The Woodlands and Beaumont-Port Arthur MSAs; Excludes non-retail branches. Source: S&P Capital IQ Pro Deposits (dollars in billions)

5 Third Quarter 2025 Highlights (1) Refer to the calculation of these non-GAAP financial measures and a reconciliation to their most directly comparable GAAP financial measures in the appendix. The calculation of return on average tangible equity has been adjusted from prior period disclosures. Strong Net Interest Margin: Tax equivalent net interest margin for the third quarter of 2025 was 4.20% compared to 4.18% for the second quarter of 2025. The tax equivalent net interest margin, excluding PAA, was 4.00%(1) for the third quarter of 2025 compared to 3.95%(1) for the second quarter of 2025. Solid Profitability: Net income for the third quarter of 2025 was $25.7 million, or diluted earnings per share of $0.50, which translated into an annualized return on average assets of 0.97%, an annualized return on average equity of 6.30% and an annualized return on average tangible equity of 11.45%(1). Strong Capital Position and Book Value Build: Total risk-based capital ratio increased to 16.33% at September 30, 2025 from 15.98% at June 30, 2025, while book value per share increased to $32.27 at September 30, 2025 from $31.20 at June 30, 2025 and tangible book value per share increased to $21.08(1) at September 30, 2025 from $19.94(1) at June 30, 2025. Paydown of Subordinated Debt: On October 1, 2025, the Company completed the previously announced redemption of $30 million of its $60 million of subordinated debt outstanding as of September 30, 2025. Tangible Book Value Per Share(1) Total Capital Ratio $14.02 $17.02 $19.05 $21.08 12/31/2022 12/31/2023 12/31/2024 9/30/2025 12.39% 14.02% 16.00% 16.33% 12/31/2022 12/31/2023 12/31/2024 9/30/2025

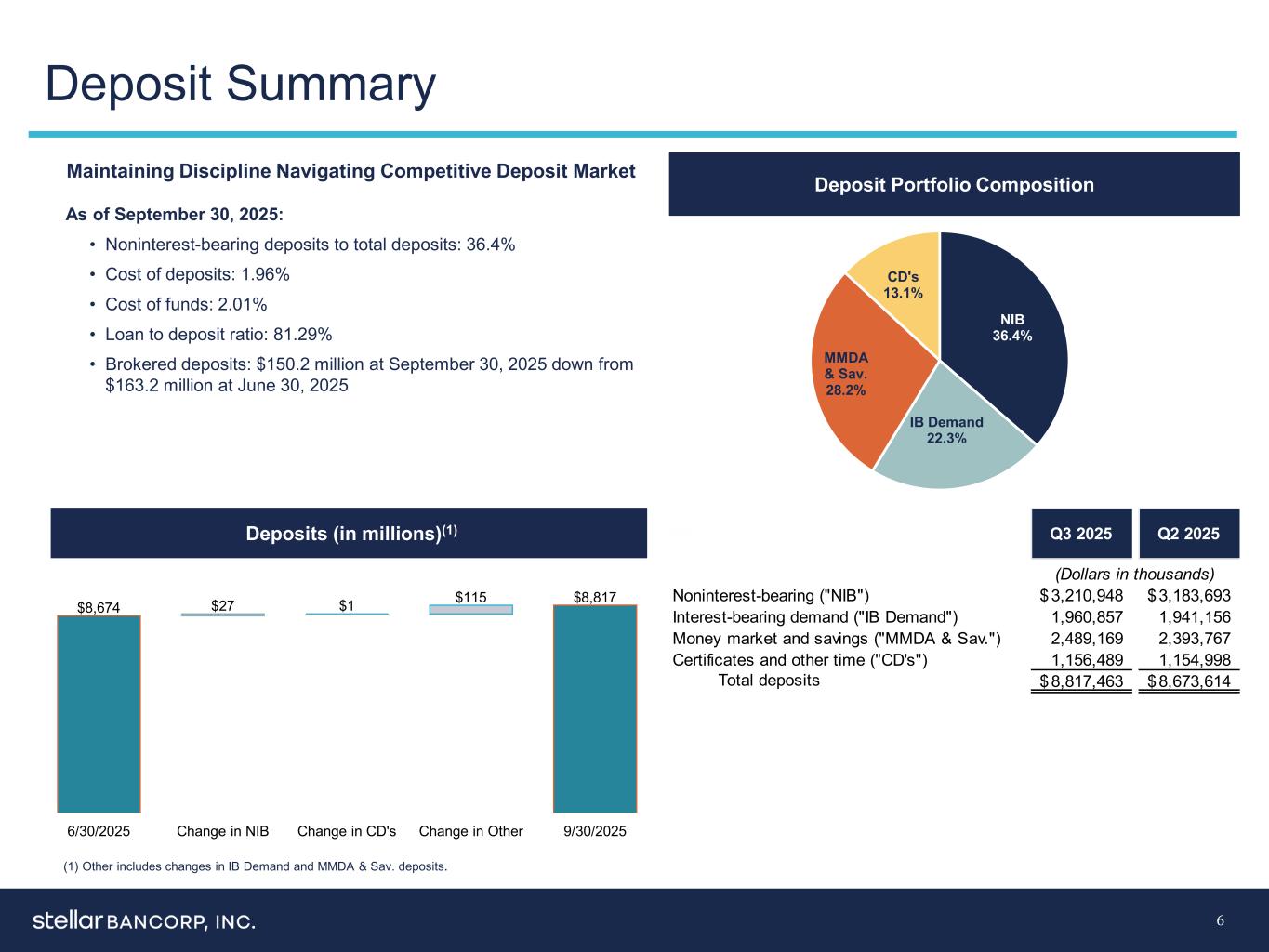

Deposit Summary 6 Deposit Portfolio Composition Deposits (in millions)(1) Maintaining Discipline Navigating Competitive Deposit Market As of September 30, 2025: • Noninterest-bearing deposits to total deposits: 36.4% • Cost of deposits: 1.96% • Cost of funds: 2.01% • Loan to deposit ratio: 81.29% • Brokered deposits: $150.2 million at September 30, 2025 down from $163.2 million at June 30, 2025 . (1) (1) Other includes changes in IB Demand and MMDA & Sav. deposits. Q3 2025 Q2 2025 Noninterest-bearing ("NIB") 3,210,948$ 3,183,693$ Interest-bearing demand ("IB Demand") 1,960,857 1,941,156 Money market and savings ("MMDA & Sav.") 2,489,169 2,393,767 Certificates and other time ("CD's") 1,156,489 1,154,998 Total deposits 8,817,463$ 8,673,614$ (Dollars in thousands) NIB 36.4% IB Demand 22.3% MMDA & Sav. 28.2% CD's 13.1% $8,674 $27 $1 $115 $8,817 6/30/2025 Change in NIB Change in CD's Change in Other 9/30/2025

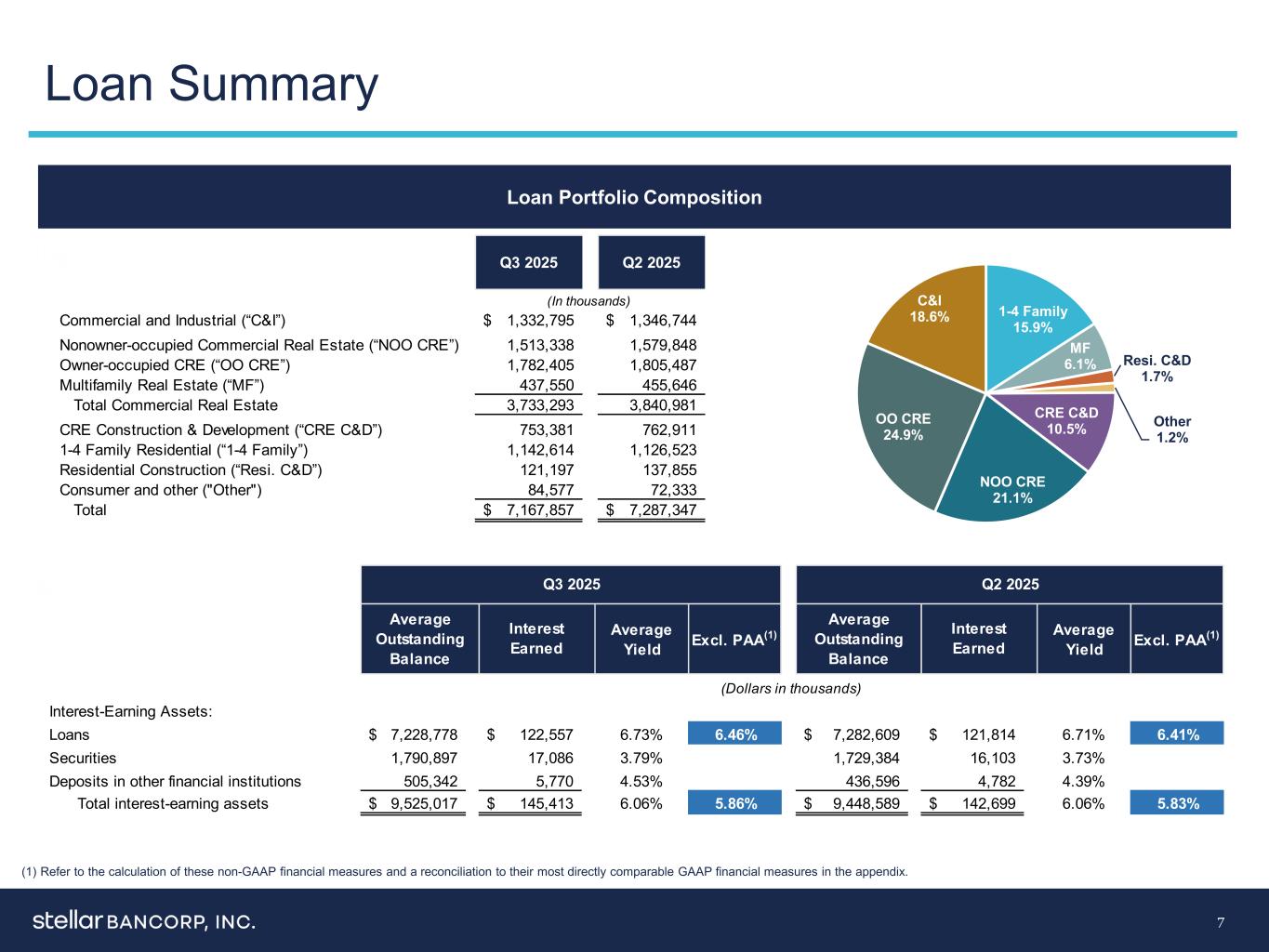

Loan Summary 7 (1) Refer to the calculation of these non-GAAP financial measures and a reconciliation to their most directly comparable GAAP financial measures in the appendix. . Loan Portfolio Composition (1) (1) Q3 2025 Q2 2025 Commercial and Industrial (“C&I”) 1,332,795$ 1,346,744$ Nonowner-occupied Commercial Real Estate (“NOO CRE”) 1,513,338 1,579,848 Owner-occupied CRE (“OO CRE”) 1,782,405 1,805,487 Multifamily Real Estate (“MF”) 437,550 455,646 Total Commercial Real Estate 3,733,293 3,840,981 CRE Construction & Development (“CRE C&D”) 753,381 762,911 1-4 Family Residential (“1-4 Family”) 1,142,614 1,126,523 Residential Construction (“Resi. C&D”) 121,197 137,855 Consumer and other ("Other") 84,577 72,333 Total 7,167,857$ 7,287,347$ (In thousands) 1-4 Family 15.9% MF 6.1% Resi. C&D 1.7% Other 1.2% CRE C&D 10.5% NOO CRE 21.1% OO CRE 24.9% C&I 18.6% Average Yield Excl. PAA(1) Average Yield Excl. PAA(1) Interest-Earning Assets: Loans 7,228,778$ 122,557$ 6.73% 6.46% 7,282,609$ 121,814$ 6.71% 6.41% Securities 1,790,897 17,086 3.79% 1,729,384 16,103 3.73% Deposits in other financial institutions 505,342 5,770 4.53% 436,596 4,782 4.39% Total interest-earning assets 9,525,017$ 145,413$ 6.06% 5.86% 9,448,589$ 142,699$ 6.06% 5.83% Q3 2025 Q2 2025 (Dollars in thousands) Average Outstanding Balance Interest Earned Average Outstanding Balance Interest Earned

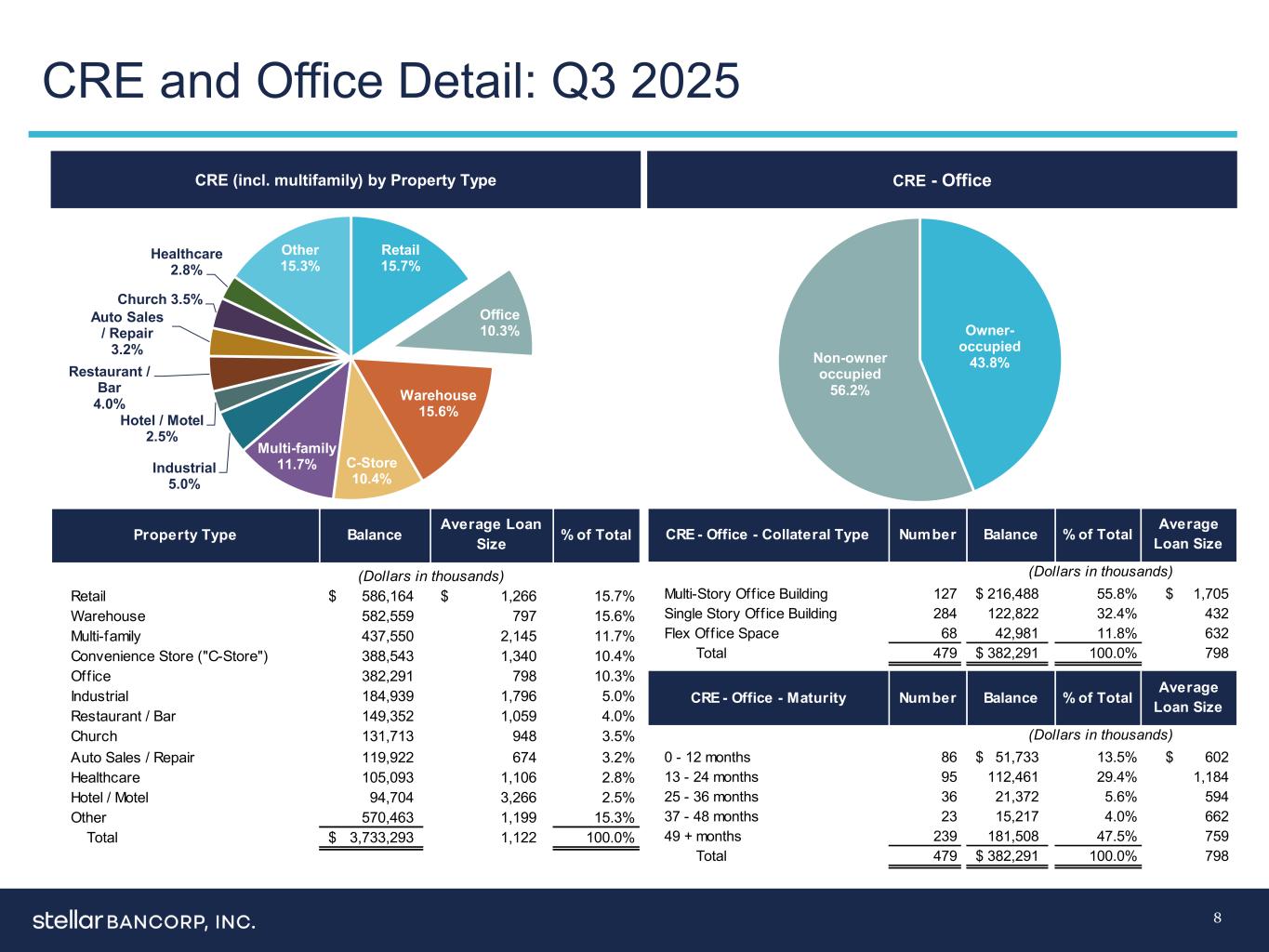

CRE and Office Detail: Q3 2025 8 (1) (1) CRE (incl. multifamily) by Property Type CRE - Office Retail 586,164$ 1,266$ 15.7% Warehouse 582,559 797 15.6% Multi-family 437,550 2,145 11.7% Convenience Store ("C-Store") 388,543 1,340 10.4% Office 382,291 798 10.3% Industrial 184,939 1,796 5.0% Restaurant / Bar 149,352 1,059 4.0% Church 131,713 948 3.5% Auto Sales / Repair 119,922 674 3.2% Healthcare 105,093 1,106 2.8% Hotel / Motel 94,704 3,266 2.5% Other 570,463 1,199 15.3% Total 3,733,293$ 1,122 100.0% (Dollars in thousands) Property Type Balance Average Loan Size % of Total Owner- occupied 43.8%Non-owner occupied 56.2% Retail 15.7% Office 10.3% Warehouse 15.6% C-Store 10.4% Multi-family 11.7%Industrial 5.0% Hotel / Motel 2.5% Restaurant / Bar 4.0% Auto Sales / Repair 3.2% Church 3.5% Healthcare 2.8% Other 15.3% Multi-Story Office Building 127 216,488$ 55.8% 1,705$ Single Story Office Building 284 122,822 32.4% 432 Flex Office Space 68 42,981 11.8% 632 Total 479 382,291$ 100.0% 798 0 - 12 months 86 51,733$ 13.5% 602$ 13 - 24 months 95 112,461 29.4% 1,184 25 - 36 months 36 21,372 5.6% 594 37 - 48 months 23 15,217 4.0% 662 49 + months 239 181,508 47.5% 759 Total 479 382,291$ 100.0% 798 Average Loan Size (Dollars in thousands) (Dollars in thousands) CRE - Office - Maturity Number BalanceCRE - Office - Collateral Type Number Balance % of Total % of Total Average Loan Size

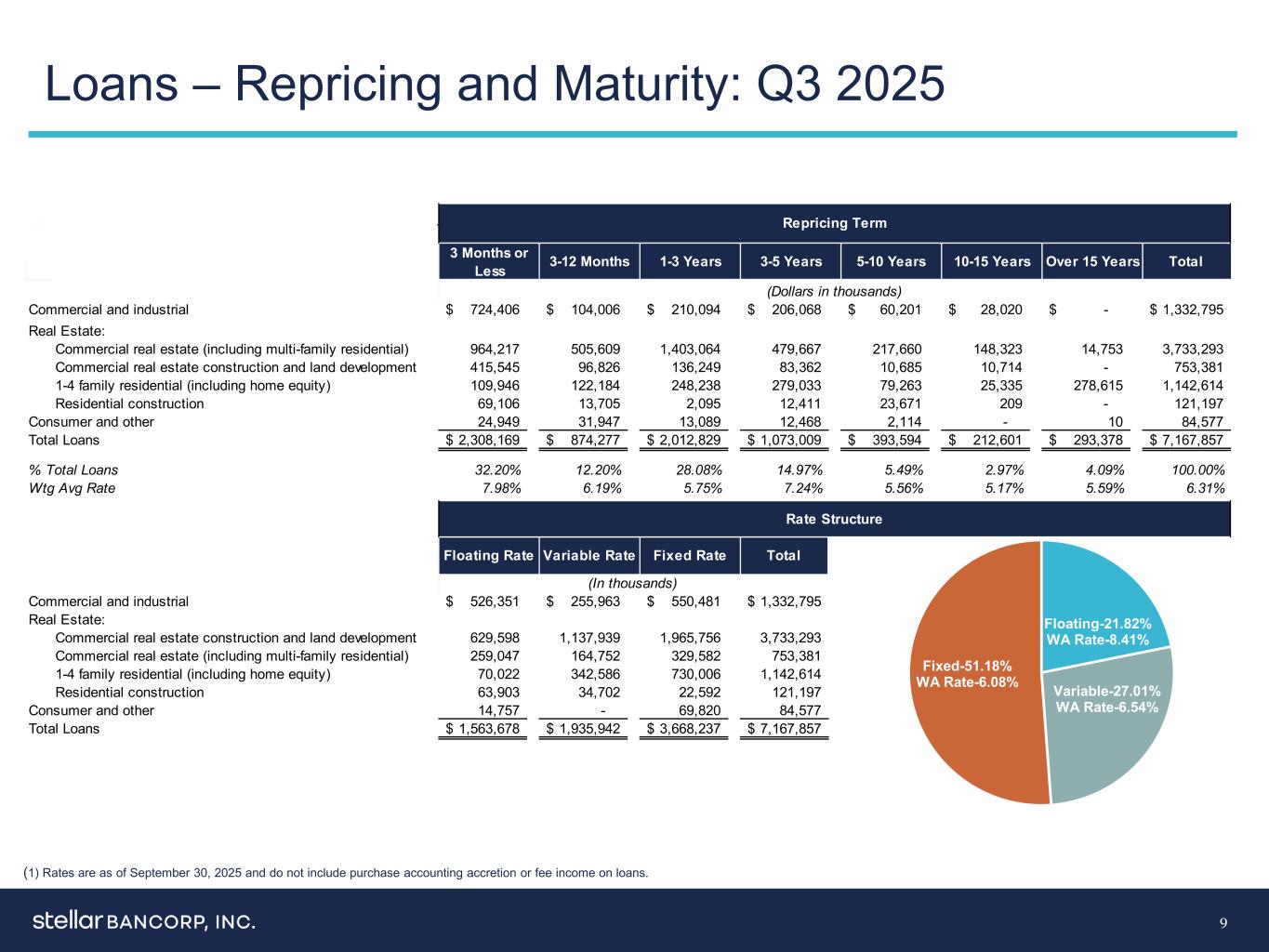

9 Loans – Repricing and Maturity: Q3 2025 (1) Rates are as of September 30, 2025 and do not include purchase accounting accretion or fee income on loans. Floating-21.82% WA Rate-8.41% Variable-27.01% WA Rate-6.54% Fixed-51.18% WA Rate-6.08% Commercial and industrial 724,406$ 104,006$ 210,094$ 206,068$ 60,201$ 28,020$ -$ 1,332,795$ Real Estate: Commercial real estate (including multi-family residential) 964,217 505,609 1,403,064 479,667 217,660 148,323 14,753 3,733,293 Commercial real estate construction and land development 415,545 96,826 136,249 83,362 10,685 10,714 - 753,381 1-4 family residential (including home equity) 109,946 122,184 248,238 279,033 79,263 25,335 278,615 1,142,614 Residential construction 69,106 13,705 2,095 12,411 23,671 209 - 121,197 Consumer and other 24,949 31,947 13,089 12,468 2,114 - 10 84,577 Total Loans 2,308,169$ 874,277$ 2,012,829$ 1,073,009$ 393,594$ 212,601$ 293,378$ 7,167,857$ % Total Loans 32.20% 12.20% 28.08% 14.97% 5.49% 2.97% 4.09% 100.00% Wtg Avg Rate 7.98% 6.19% 5.75% 7.24% 5.56% 5.17% 5.59% 6.31% Commercial and industrial 526,351$ 255,963$ 550,481$ 1,332,795$ Real Estate: Commercial real estate construction and land development 629,598 1,137,939 1,965,756 3,733,293 Commercial real estate (including multi-family residential) 259,047 164,752 329,582 753,381 1-4 family residential (including home equity) 70,022 342,586 730,006 1,142,614 Residential construction 63,903 34,702 22,592 121,197 Consumer and other 14,757 - 69,820 84,577 Total Loans 1,563,678$ 1,935,942$ 3,668,237$ 7,167,857$ Over 15 Years Total (Dollars in thousands) (In thousands) Repricing Term 3 Months or Less 3-12 Months 1-3 Years 3-5 Years 5-10 Years 10-15 Years Total Rate Structure Floating Rate Variable Rate Fixed Rate

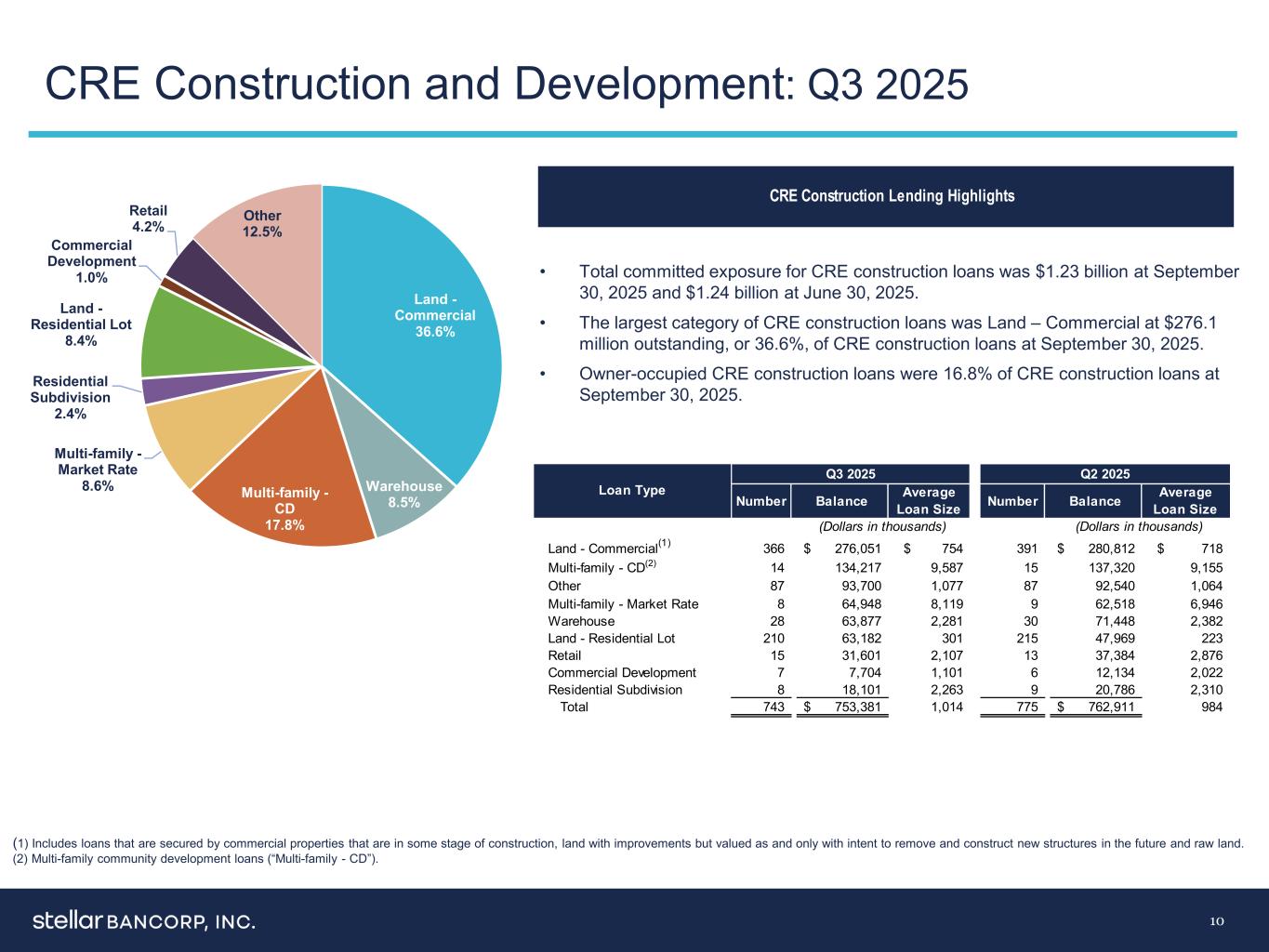

CRE Construction and Development: Q3 2025 10 (1) (1) • Total committed exposure for CRE construction loans was $1.23 billion at September 30, 2025 and $1.24 billion at June 30, 2025. • The largest category of CRE construction loans was Land – Commercial at $276.1 million outstanding, or 36.6%, of CRE construction loans at September 30, 2025. • Owner-occupied CRE construction loans were 16.8% of CRE construction loans at September 30, 2025. (1) Includes loans that are secured by commercial properties that are in some stage of construction, land with improvements but valued as and only with intent to remove and construct new structures in the future and raw land. (2) Multi-family community development loans (“Multi-family - CD”). CRE Construction Lending Highlights Number Balance Number Balance Land - Commercial(1) 366 276,051$ 754$ 391 280,812$ 718$ Multi-family - CD(2) 14 134,217 9,587 15 137,320 9,155 Other 87 93,700 1,077 87 92,540 1,064 Multi-family - Market Rate 8 64,948 8,119 9 62,518 6,946 Warehouse 28 63,877 2,281 30 71,448 2,382 Land - Residential Lot 210 63,182 301 215 47,969 223 Retail 15 31,601 2,107 13 37,384 2,876 Commercial Development 7 7,704 1,101 6 12,134 2,022 Residential Subdivision 8 18,101 2,263 9 20,786 2,310 Total 743 753,381$ 1,014 775 762,911$ 984 (Dollars in thousands) (Dollars in thousands) Loan Type Q3 2025 Q2 2025 Average Loan Size Average Loan Size Land - Commercial 36.6% Warehouse 8.5%Multi-family - CD 17.8% Multi-family - Market Rate 8.6% Residential Subdivision 2.4% Land - Residential Lot 8.4% Commercial Development 1.0% Retail 4.2% Other 12.5%

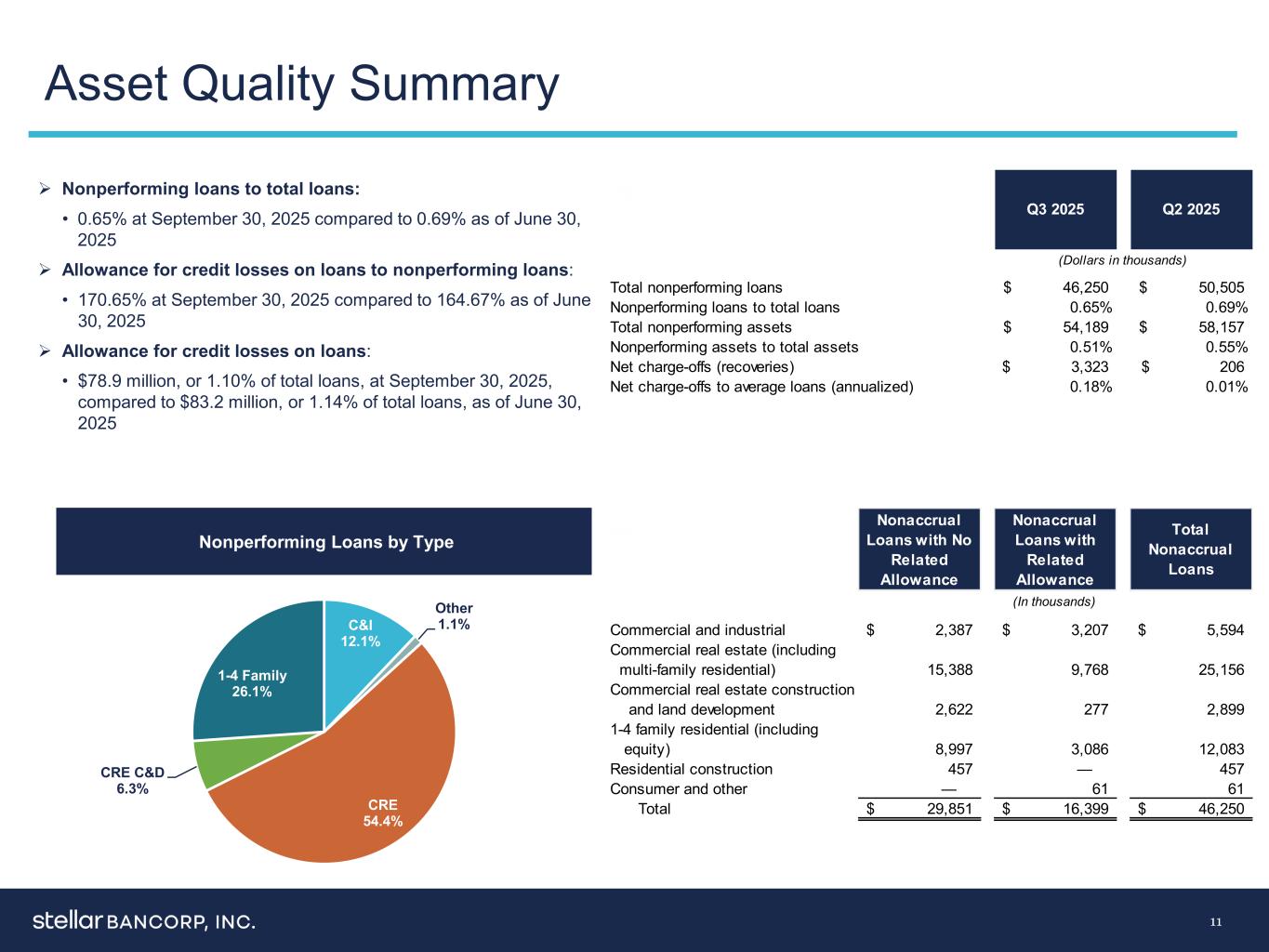

Asset Quality Summary 11 Nonperforming Loans by Type (1) Combined represents the simple addition of legacy balances for 2022; estimated. Nonperforming loans to total loans: • 0.65% at September 30, 2025 compared to 0.69% as of June 30, 2025 Allowance for credit losses on loans to nonperforming loans: • 170.65% at September 30, 2025 compared to 164.67% as of June 30, 2025 Allowance for credit losses on loans: • $78.9 million, or 1.10% of total loans, at September 30, 2025, compared to $83.2 million, or 1.14% of total loans, as of June 30, 2025 Q3 2025 Q2 2025 Total nonperforming loans 46,250$ 50,505$ Nonperforming loans to total loans 0.65% 0.69% Total nonperforming assets 54,189$ 58,157$ 0.51% 0.55% Net charge-offs (recoveries) 3,323$ 206$ 0.18% 0.01% (Dollars in thousands) Nonperforming assets to total assets Net charge-offs to average loans (annualized) Nonaccrual Loans with No Related Allowance Nonaccrual Loans with Related Allowance Total Nonaccrual Loans Commercial and industrial 2,387$ 3,207$ 5,594$ Commercial real estate (including multi-family residential) 15,388 9,768 25,156 Commercial real estate construction and land development 2,622 277 2,899 1-4 family residential (including equity) 8,997 3,086 12,083 Residential construction 457 — 457 Consumer and other — 61 61 Total 29,851$ 16,399$ 46,250$ (In thousands) C&I 12.1% Other 1.1% CRE 54.4% CRE C&D 6.3% 1-4 Family 26.1%

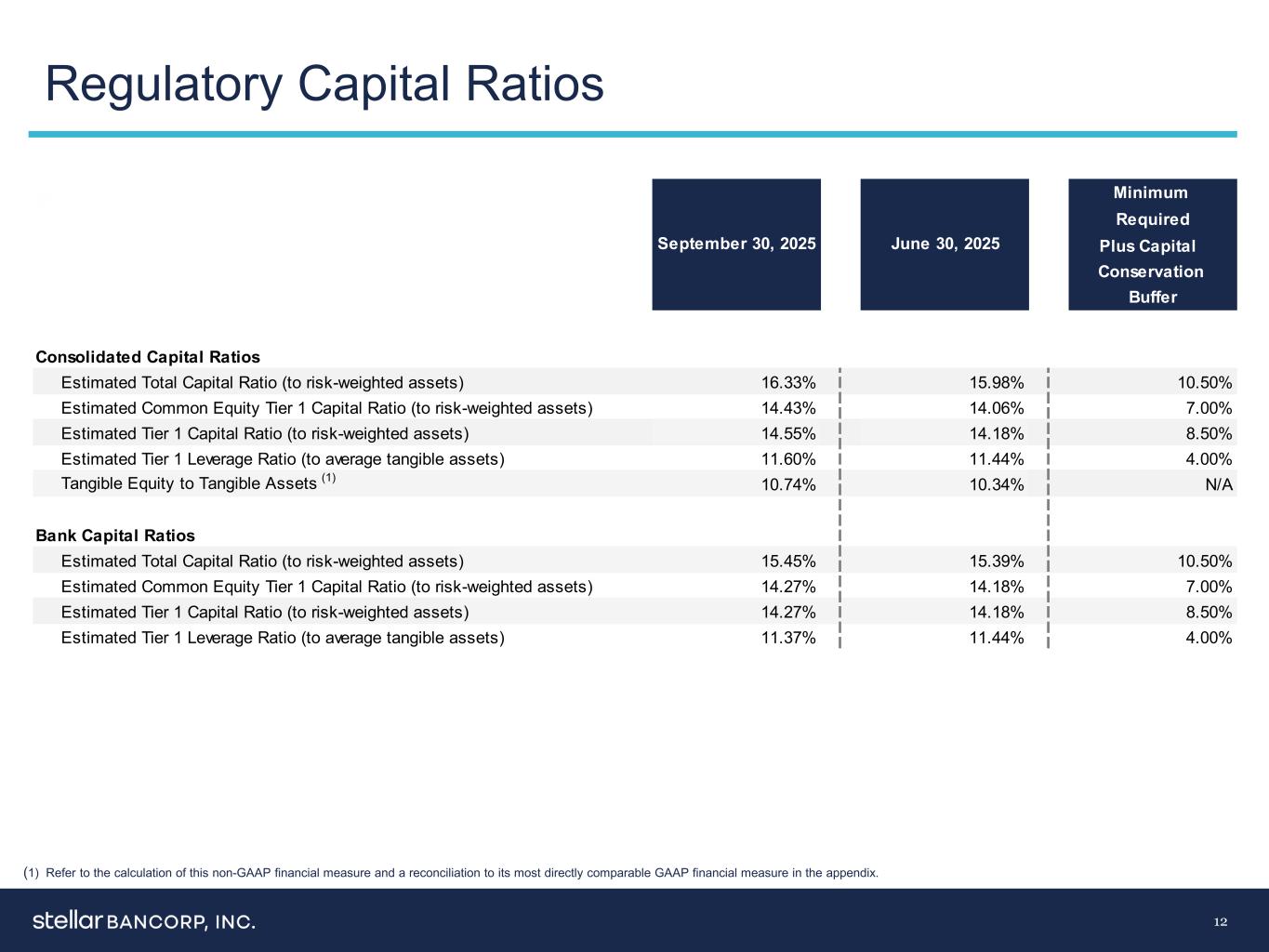

Regulatory Capital Ratios 12 (1) Refer to the calculation of this non-GAAP financial measure and a reconciliation to its most directly comparable GAAP financial measure in the appendix. Minimum Required Plus Capital Conservation Buffer Consolidated Capital Ratios Estimated Total Capital Ratio (to risk-weighted assets) 16.33% 15.98% 10.50% Estimated Common Equity Tier 1 Capital Ratio (to risk-weighted assets) 14.43% 14.06% 7.00% Estimated Tier 1 Capital Ratio (to risk-weighted assets) 14.55% 14.18% 8.50% Estimated Tier 1 Leverage Ratio (to average tangible assets) 11.60% 11.44% 4.00% Tangible Equity to Tangible Assets (1) 10.74% 10.34% N/A Bank Capital Ratios Estimated Total Capital Ratio (to risk-weighted assets) 15.45% 15.39% 10.50% Estimated Common Equity Tier 1 Capital Ratio (to risk-weighted assets) 14.27% 14.18% 7.00% Estimated Tier 1 Capital Ratio (to risk-weighted assets) 14.27% 14.18% 8.50% Estimated Tier 1 Leverage Ratio (to average tangible assets) 11.37% 11.44% 4.00% September 30, 2025 June 30, 2025

13 Key Takeaways Excellent core funding profile Strong earnings power and franchise value in one of the best markets in the U.S. Key success factors: Credit performance and risk management Significant financial flexibility Positioned for continued strong internal capital generation

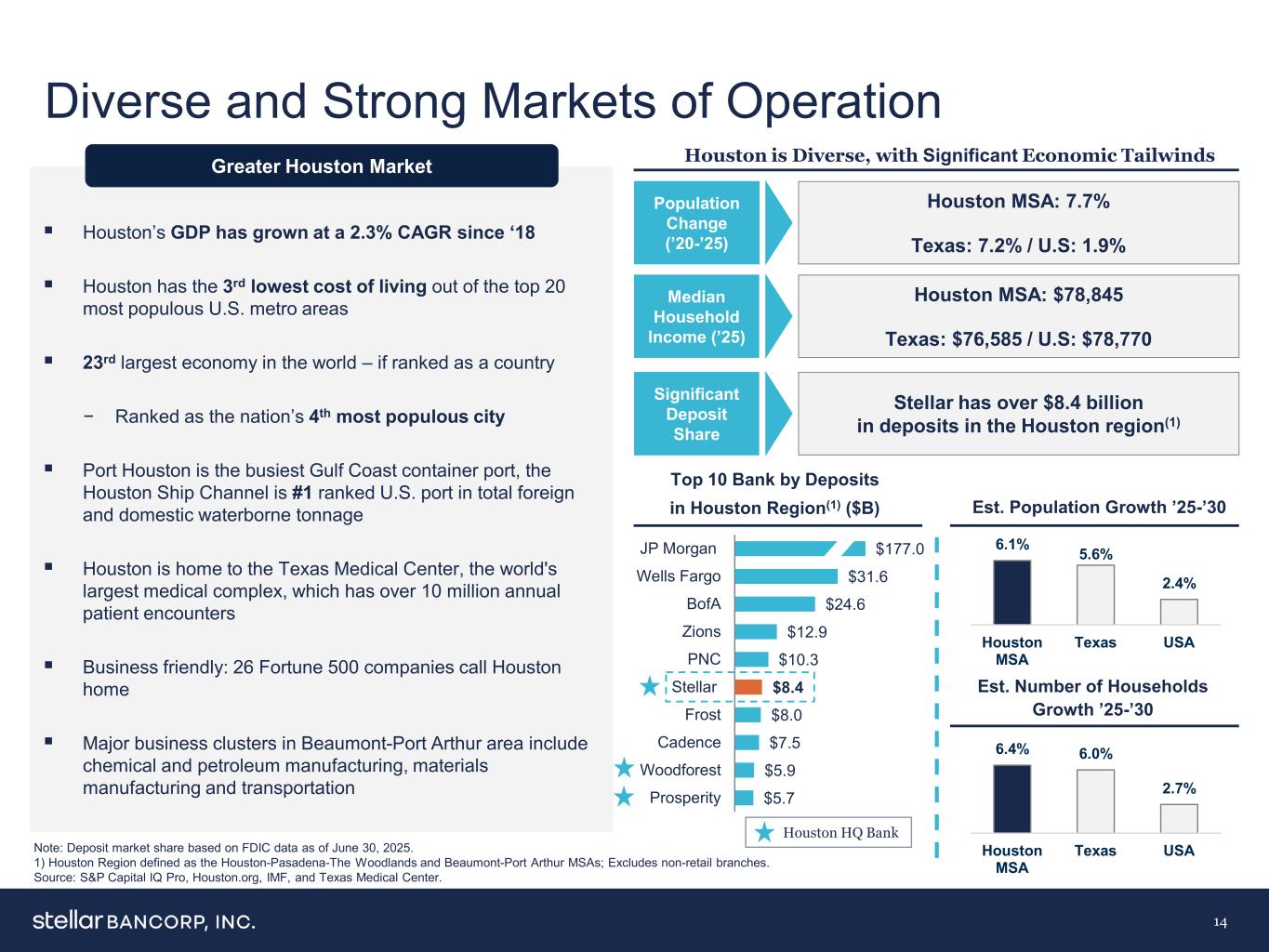

$5.7 $5.9 $7.5 $8.0 $8.4 $10.3 $12.9 $24.6 $31.6 $177.0 Prosperity Woodforest Cadence Frost Stellar PNC Zions BofA Wells Fargo JP Morgan 6.1% 5.6% 2.4% Houston MSA Texas USA 6.4% 6.0% 2.7% Houston MSA Texas USA Diverse and Strong Markets of Operation 14 Houston is Diverse, with Significant Economic TailwindsGreater Houston Market Houston’s GDP has grown at a 2.3% CAGR since ‘18 Houston has the 3rd lowest cost of living out of the top 20 most populous U.S. metro areas 23rd largest economy in the world – if ranked as a country − Ranked as the nation’s 4th most populous city Port Houston is the busiest Gulf Coast container port, the Houston Ship Channel is #1 ranked U.S. port in total foreign and domestic waterborne tonnage Houston is home to the Texas Medical Center, the world's largest medical complex, which has over 10 million annual patient encounters Business friendly: 26 Fortune 500 companies call Houston home Major business clusters in Beaumont-Port Arthur area include chemical and petroleum manufacturing, materials manufacturing and transportation Top 10 Bank by Deposits in Houston Region(1) ($B) Note: Deposit market share based on FDIC data as of June 30, 2025. 1) Houston Region defined as the Houston-Pasadena-The Woodlands and Beaumont-Port Arthur MSAs; Excludes non-retail branches. Source: S&P Capital IQ Pro, Houston.org, IMF, and Texas Medical Center. Est. Population Growth ’25-’30 Est. Number of Households Growth ’25-’30 Population Change (’20-’25) Median Household Income (’25) Significant Deposit Share Houston MSA: 7.7% Texas: 7.2% / U.S: 1.9% Houston MSA: $78,845 Texas: $76,585 / U.S: $78,770 Stellar has over $8.4 billion in deposits in the Houston region(1) Houston HQ Bank

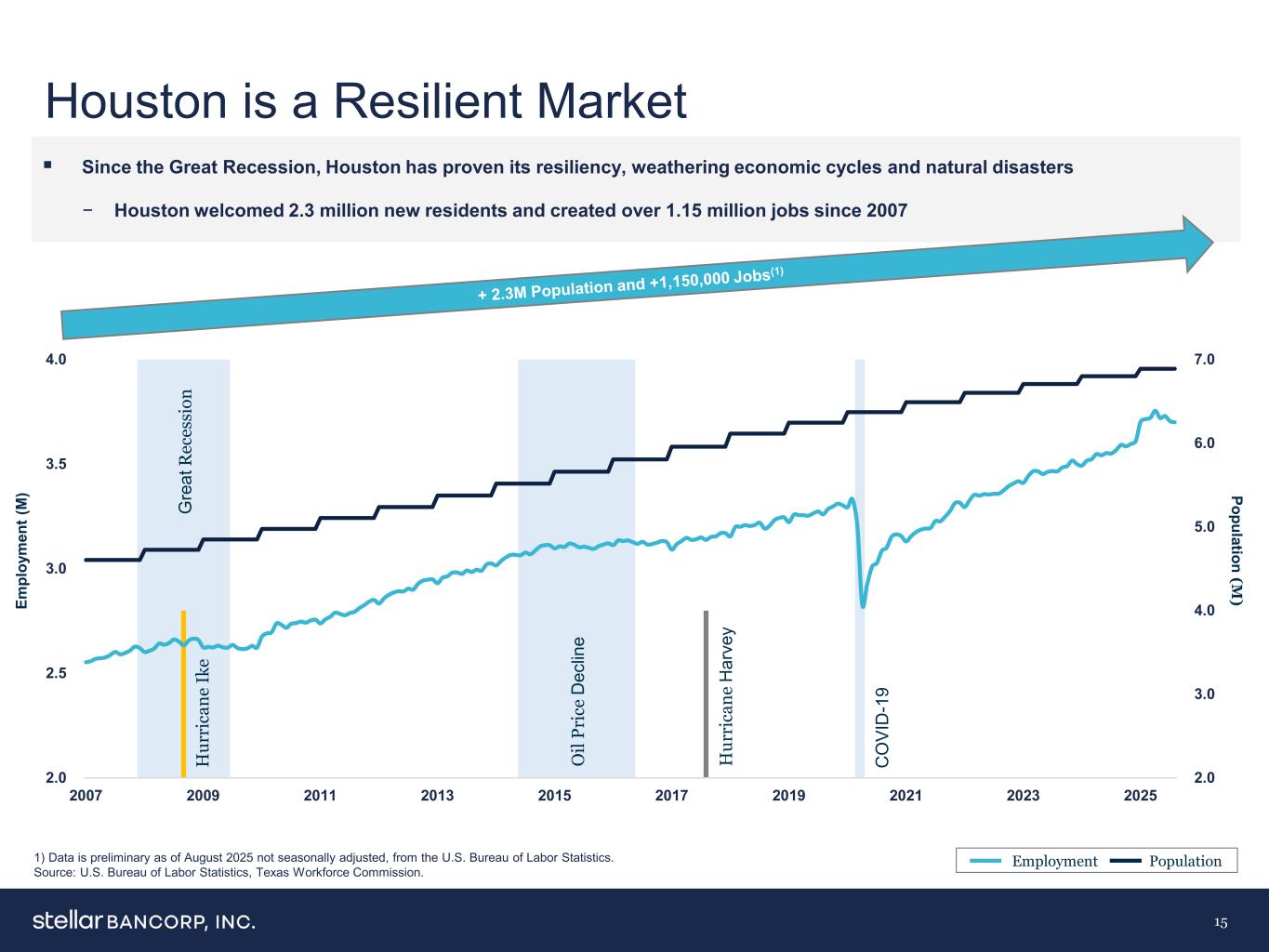

2.0 3.0 4.0 5.0 6.0 7.0 2.0 2.5 3.0 3.5 4.0 2007 2009 2011 2013 2015 2017 2019 2021 2023 2025 Houston is a Resilient Market 15 Since the Great Recession, Houston has proven its resiliency, weathering economic cycles and natural disasters − Houston welcomed 2.3 million new residents and created over 1.15 million jobs since 2007 Population (M ) O il Pr ic e D ec lin e G re at R ec es si on H ur ri ca ne I ke H ur ri ca ne H ar ve y C O VI D -1 9 Em pl oy m en t ( M ) Employment Population1) Data is preliminary as of August 2025 not seasonally adjusted, from the U.S. Bureau of Labor Statistics. Source: U.S. Bureau of Labor Statistics, Texas Workforce Commission.

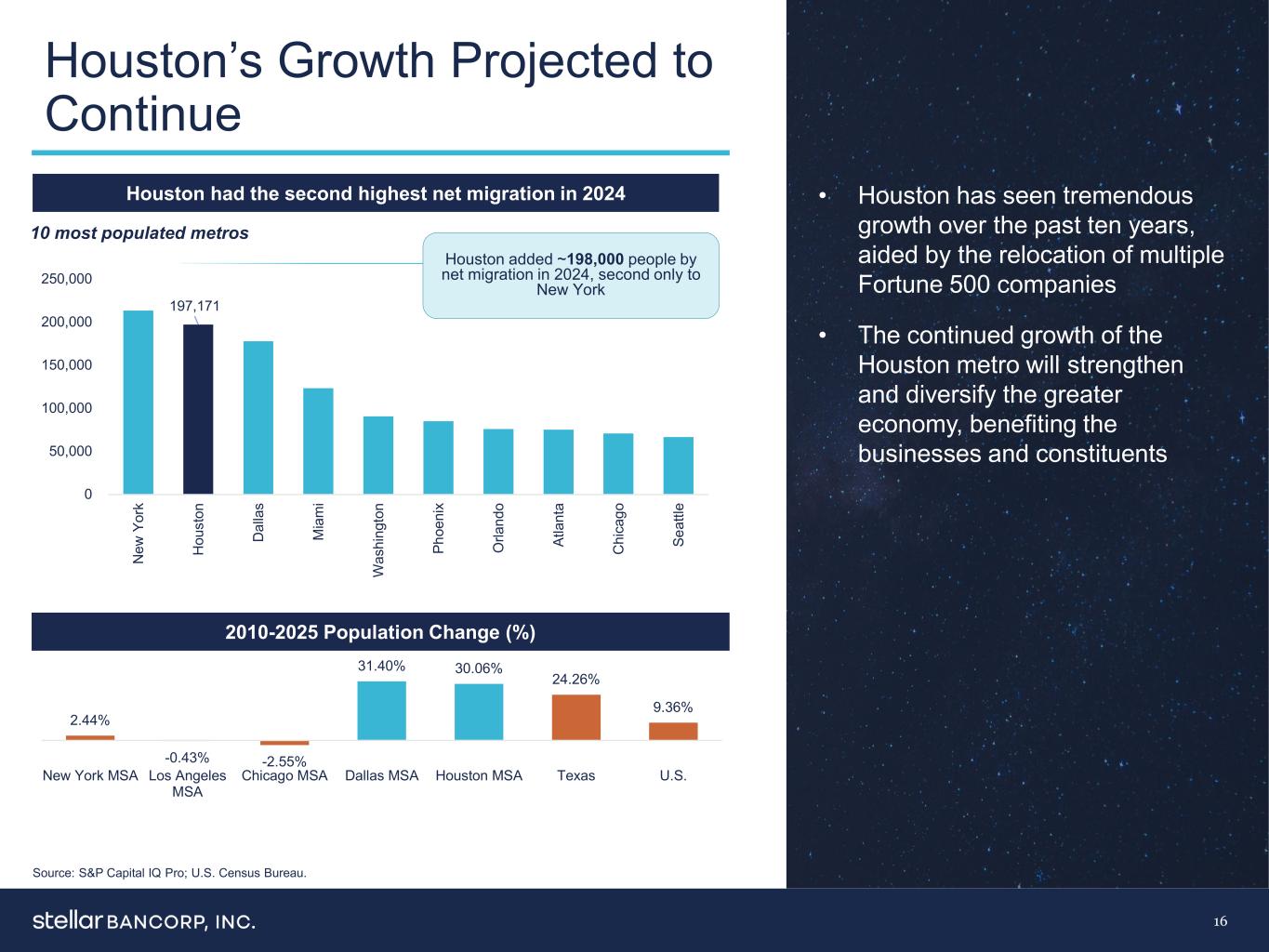

197,171 0 50,000 100,000 150,000 200,000 250,000 N ew Y or k H ou st on D al la s M ia m i W as hi ng to n Ph oe ni x O rla nd o At la nt a C hi ca go Se at tle Houston’s Growth Projected to Continue 16 Source: S&P Capital IQ Pro; U.S. Census Bureau. 2010-2025 Population Change (%) Houston had the second highest net migration in 2024 10 most populated metros 2.44% -0.43% -2.55% 31.40% 30.06% 24.26% 9.36% New York MSA Los Angeles MSA Chicago MSA Dallas MSA Houston MSA Texas U.S. • Houston has seen tremendous growth over the past ten years, aided by the relocation of multiple Fortune 500 companies • The continued growth of the Houston metro will strengthen and diversify the greater economy, benefiting the businesses and constituents Houston added ~198,000 people by net migration in 2024, second only to New York

$94,960 $91,380 $86,627 $88,783 $78,845 $76,585 $78,770 New York MSA Los Angeles MSA Chicago MSA Dallas MSA Houston MSA Texas U.S. $850,000 $1,072,000 $350,000 $395,000 $314,900 $334,900 $418,284 New York Los Angeles Chicago Dallas Houston Texas U.S. 9.0x 11.7x 4.0x 4.4x 4.0x 4.4x 5.3x New York MSA Los Angeles MSA Chicago MSA Dallas MSA Houston MSA Texas U.S. Housing Market and Cost of Living 17 • Cost of living in Houston is 5.3% less than that of the U.S. market average while the median household income is in line with U.S. median • Houston is #1 in U.S. annual new home construction 20 25 M ed ia n H ou se ho ld In co m e 20 25 M ed ia n H om e Pr ic e (1 ) M ed ia n H om e P ri ce to H H I R at io (1) Home price shown for each respective city. Source: S&P Capital IQ Pro; Redfin (March 2025); Houston.org.

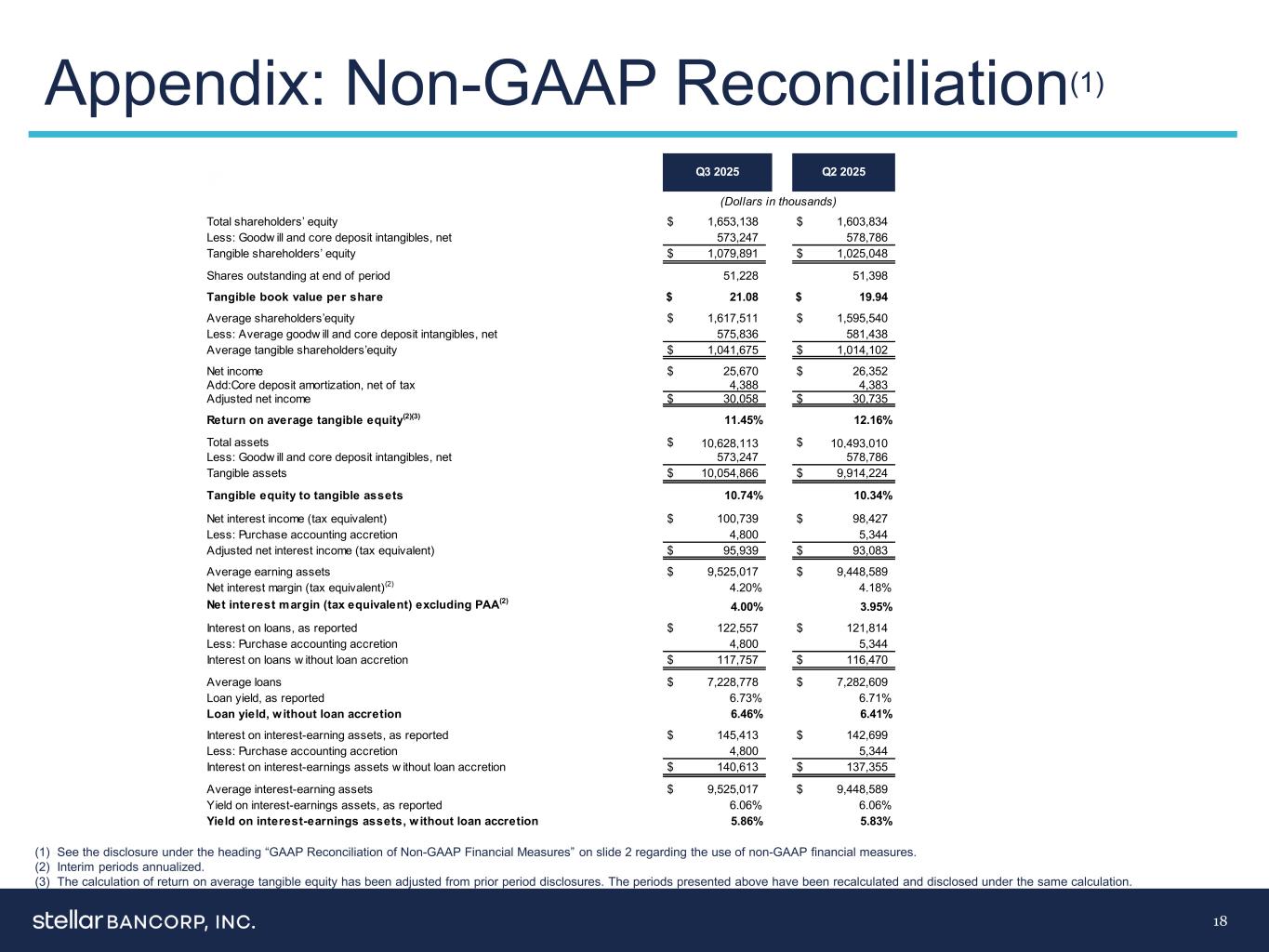

Appendix: Non-GAAP Reconciliation(1) 18 (1) See the disclosure under the heading “GAAP Reconciliation of Non-GAAP Financial Measures” on slide 2 regarding the use of non-GAAP financial measures. (2) Interim periods annualized. (3) The calculation of return on average tangible equity has been adjusted from prior period disclosures. The periods presented above have been recalculated and disclosed under the same calculation. Total shareholders’ equity $ 1,653,138 $ 1,603,834 Less: Goodw ill and core deposit intangibles, net 573,247 578,786 Tangible shareholders’ equity $ 1,079,891 $ 1,025,048 Shares outstanding at end of period 51,228 51,398 Tangible book value per share $ 21.08 $ 19.94 Average shareholders’equity $ 1,617,511 $ 1,595,540 Less: Average goodw ill and core deposit intangibles, net 575,836 581,438 Average tangible shareholders’equity $ 1,041,675 $ 1,014,102 Net income $ 25,670 $ 26,352 Add:Core deposit amortization, net of tax 4,388 4,383 Adjusted net income $ 30,058 $ 30,735 Return on average tangible equity(2)(3) 11.45% 12.16% Total assets $ 10,628,113 $ 10,493,010 Less: Goodw ill and core deposit intangibles, net 573,247 578,786 Tangible assets $ 10,054,866 $ 9,914,224 Tangible equity to tangible assets 10.74% 10.34% Net interest income (tax equivalent) $ 100,739 $ 98,427 Less: Purchase accounting accretion 4,800 5,344 Adjusted net interest income (tax equivalent) $ 95,939 $ 93,083 Average earning assets $ 9,525,017 $ 9,448,589 Net interest margin (tax equivalent)(2) 4.20% 4.18% Net interest margin (tax equivalent) excluding PAA(2) 4.00% 3.95% Interest on loans, as reported $ 122,557 $ 121,814 Less: Purchase accounting accretion 4,800 5,344 Interest on loans w ithout loan accretion $ 117,757 $ 116,470 Average loans $ 7,228,778 $ 7,282,609 Loan yield, as reported 6.73% 6.71% Loan yield, w ithout loan accretion 6.46% 6.41% Interest on interest-earning assets, as reported $ 145,413 $ 142,699 Less: Purchase accounting accretion 4,800 5,344 Interest on interest-earnings assets w ithout loan accretion $ 140,613 $ 137,355 Average interest-earning assets $ 9,525,017 $ 9,448,589 Yield on interest-earnings assets, as reported 6.06% 6.06% Yield on interest-earnings assets, w ithout loan accretion 5.86% 5.83% Q3 2025 Q2 2025 (Dollars in thousands)

19 NYSE: STEL