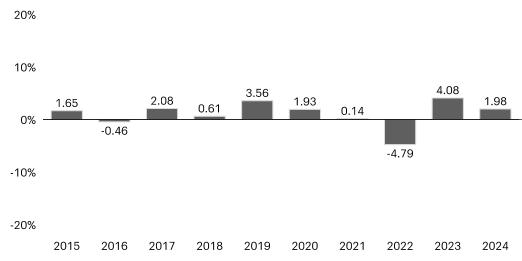

December 31, 2023

March 31, 2022

|

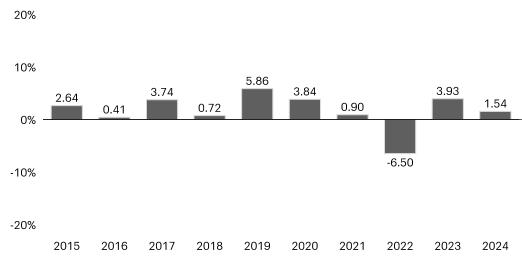

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)

|

||||

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

|

Class A (before taxes)

|

11/18/1992

|

-0.08%

|

0.21%

|

0.85%

|

|

Class A (after taxes on distributions)

|

11/18/1992

|

-1.04%

|

-0.31%

|

0.58%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

11/18/1992

|

-0.06%

|

0.07%

|

0.79%

|

|

Class C (before taxes)

|

8/30/2002

|

0.11%

|

-0.15%

|

0.44%

|

|

Institutional Class (before taxes)

|

10/31/2014

|

2.28%

|

0.92%

|

1.35%

|

|

Bloomberg California Municipal 1-5 Year Blend Index (reflects no deduction for fees, expenses, or taxes)

|

1.73%

|

0.96%

|

1.30%

|

|

|

Bloomberg Municipal Bond 1-5 Year Blend Index (reflects no deduction for fees, expenses, or taxes)

|

1.86%

|

1.08%

|

1.45%

|

|

|

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.05%

|

0.99%

|

2.25%

|

|

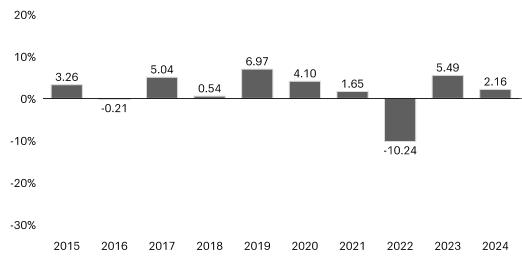

December 31, 2023

March 31, 2022

|

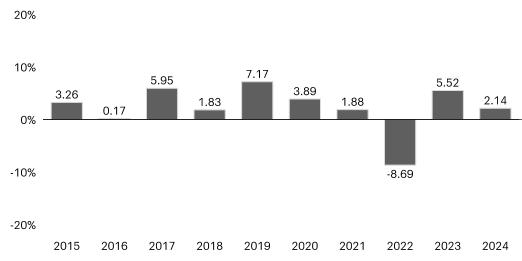

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)

|

||||

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

|

Class A (before taxes)

|

10/6/1988

|

-2.40%

|

-0.45%

|

1.30%

|

|

Class A (after taxes on distributions)

|

10/6/1988

|

-3.69%

|

-1.24%

|

0.89%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

10/6/1988

|

-1.43%

|

-0.44%

|

1.28%

|

|

Class C (before taxes)

|

7/1/1993

|

0.42%

|

-0.29%

|

1.16%

|

|

Institutional Class (before taxes)

|

10/31/2014

|

2.44%

|

0.72%

|

2.04%

|

|

Bloomberg California Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.02%

|

0.96%

|

2.23%

|

|

|

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.05%

|

0.99%

|

2.25%

|

|

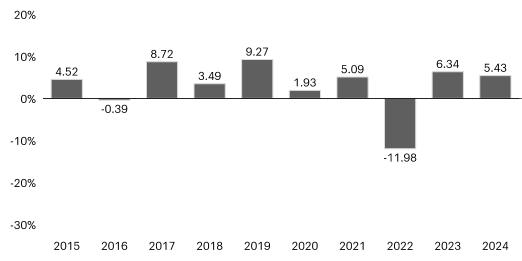

December 31, 2023

March 31, 2022

|

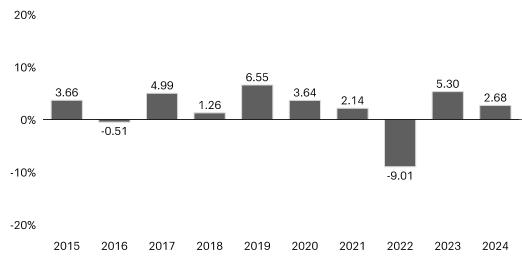

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)

|

||||

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

|

Class A (before taxes)

|

1/31/2013

|

0.64%

|

0.19%

|

2.60%

|

|

Class A (after taxes on distributions)

|

1/31/2013

|

-1.17%

|

-0.92%

|

1.98%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

1/31/2013

|

0.36%

|

-0.01%

|

2.30%

|

|

Class C (before taxes)

|

1/31/2013

|

3.64%

|

0.36%

|

2.45%

|

|

Class R6 (before taxes)1

|

7/31/2018

|

5.74%

|

1.42%

|

3.36%

|

|

Institutional Class (before taxes)

|

1/31/2013

|

5.58%

|

1.34%

|

3.31%

|

|

High Yield Municipal Bond Blended Index (reflects no deduction for fees, expenses, or taxes)2

|

4.19%

|

2.02%

|

3.48%

|

|

|

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.05%

|

0.99%

|

2.25%

|

|

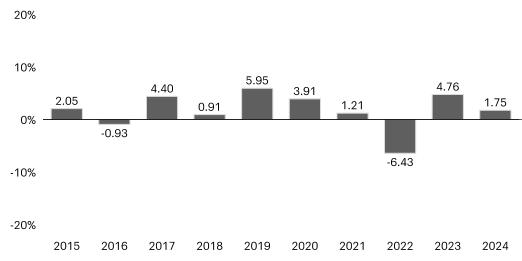

December 31, 2023

March 31, 2022

|

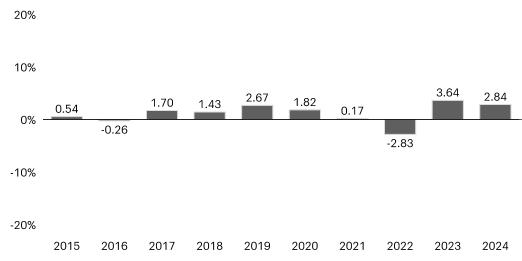

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)

|

||||

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

|

Class A (before taxes)

|

7/31/2007

|

-1.30%

|

0.35%

|

1.39%

|

|

Class A (after taxes on distributions)

|

7/31/2007

|

-2.44%

|

-0.50%

|

0.85%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

7/31/2007

|

-0.78%

|

0.00%

|

1.09%

|

|

Class C (before taxes)

|

7/31/2007

|

-0.10%

|

0.20%

|

1.09%

|

|

Class R6 (before taxes)1

|

7/31/2018

|

2.03%

|

1.27%

|

2.00%

|

|

Institutional Class (before taxes)

|

3/31/2008

|

1.98%

|

1.22%

|

1.97%

|

|

Bloomberg Municipal Bond 1-15 Year Blend Index (reflects no deduction for fees, expenses, or taxes)

|

0.88%

|

1.08%

|

2.04%

|

|

|

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.05%

|

0.99%

|

2.25%

|

|

December 31, 2023

March 31, 2022

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)

|

||||

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

|

Class A (before taxes)

|

1/12/1988

|

-3.03%

|

-0.26%

|

1.19%

|

|

Class A (after taxes on distributions)

|

1/12/1988

|

-4.21%

|

-0.88%

|

0.85%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

1/12/1988

|

-1.80%

|

-0.30%

|

1.15%

|

|

Class C (before taxes)

|

4/8/2005

|

-0.20%

|

-0.05%

|

1.06%

|

|

Institutional Class (before taxes)1

|

10/31/2016

|

1.86%

|

1.00%

|

1.98%

|

|

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.05%

|

0.99%

|

2.25%

|

|

|

Bloomberg Minnesota Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

0.72%

|

0.77%

|

1.90%

|

|

December 31, 2023

March 31, 2022

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)

|

||||

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

|

Class A (before taxes)

|

4/8/2005

|

-2.43%

|

-0.10%

|

1.75%

|

|

Class A (after taxes on distributions)

|

4/8/2005

|

-3.63%

|

-0.81%

|

1.35%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

4/8/2005

|

-1.45%

|

-0.19%

|

1.61%

|

|

Class C (before taxes)

|

4/8/2005

|

0.27%

|

0.04%

|

1.61%

|

|

Class R6 (before taxes)1

|

7/31/2018

|

2.51%

|

1.18%

|

2.56%

|

|

Administrator Class (before taxes)

|

4/8/2005

|

2.18%

|

0.97%

|

2.36%

|

|

Institutional Class (before taxes)

|

3/31/2008

|

2.46%

|

1.13%

|

2.53%

|

|

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.05%

|

0.99%

|

2.25%

|

|

December 31, 2023

March 31, 2022

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)

|

||||

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

|

Class A (before taxes)

|

12/27/1990

|

-1.96%

|

-0.11%

|

1.51%

|

|

Class A (after taxes on distributions)

|

12/27/1990

|

-3.16%

|

-0.86%

|

1.13%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

12/27/1990

|

-1.17%

|

-0.18%

|

1.46%

|

|

Class C (before taxes)

|

2/1/1993

|

0.91%

|

0.05%

|

1.37%

|

|

Institutional Class (before taxes)

|

11/24/1997

|

2.94%

|

1.07%

|

2.23%

|

|

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.05%

|

0.99%

|

2.25%

|

|

|

Bloomberg Pennsylvania Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.31%

|

1.08%

|

2.46%

|

|

December 31, 2023

March 31, 2022

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)

|

||||

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

|

Class A (before taxes)

|

7/18/2008

|

0.78%

|

0.69%

|

0.95%

|

|

Class A (after taxes on distributions)

|

7/18/2008

|

-0.19%

|

0.20%

|

0.63%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

7/18/2008

|

0.46%

|

0.42%

|

0.75%

|

|

Class C (before taxes)

|

1/31/2003

|

1.07%

|

0.34%

|

0.55%

|

|

Class R6 (before taxes)1

|

7/31/2018

|

3.13%

|

1.38%

|

1.42%

|

|

Institutional Class (before taxes)

|

3/31/2008

|

3.18%

|

1.33%

|

1.39%

|

|

Bloomberg 1-3 Year Composite Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

2.38%

|

1.23%

|

1.33%

|

|

|

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.05%

|

0.99%

|

2.25%

|

|

December 31, 2023

March 31, 2022

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)

|

||||

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

|

Class A (before taxes)

|

12/1/1994

|

-1.31%

|

0.27%

|

1.28%

|

|

Class A (after taxes on distributions)

|

12/1/1994

|

-2.30%

|

-0.28%

|

0.96%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

12/1/1994

|

-0.78%

|

0.10%

|

1.09%

|

|

Class C (before taxes)

|

8/18/1997

|

1.07%

|

0.34%

|

1.09%

|

|

Class R6 (before taxes)1

|

7/31/2018

|

3.22%

|

1.47%

|

1.98%

|

|

Institutional Class (before taxes)

|

11/30/2012

|

3.05%

|

1.40%

|

2.02%

|

|

Bloomberg Short-Intermediate Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.14%

|

1.02%

|

1.70%

|

|

|

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.05%

|

0.99%

|

2.25%

|

|

December 31, 2023

March 31, 2022

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)

|

||||

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

|

Class A (before taxes)

|

10/2/2000

|

1.21%

|

0.95%

|

0.82%

|

|

Class A (after taxes on distributions)

|

10/2/2000

|

0.14%

|

0.50%

|

0.54%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

10/2/2000

|

0.71%

|

0.58%

|

0.59%

|

|

Class A2 (before taxes)1

|

5/29/2020

|

3.38%

|

1.41%

|

1.05%

|

|

Class C (before taxes)

|

3/31/2008

|

1.51%

|

0.96%

|

0.61%

|

|

Class R6 (before taxes)2

|

7/31/2018

|

3.58%

|

1.66%

|

1.34%

|

|

Institutional Class (before taxes)

|

7/31/2000

|

3.53%

|

1.59%

|

1.31%

|

|

Ultra Short-Term Municipal Income Blended Index (reflects no deduction for fees, expenses, or taxes)3

|

2.91%

|

1.62%

|

1.30%

|

|

|

Bloomberg 1 Year Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

2.71%

|

1.39%

|

1.30%

|

|

|

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.05%

|

0.99%

|

2.25%

|

|

December 31, 2023

March 31, 2022

|

Average Annual Total Returns for the periods ended 12/31/2024 (returns reflect applicable sales charges)

|

||||

|

Inception Date of Share Class

|

1 Year

|

5 Year

|

10 Year

|

|

|

Class A (before taxes)

|

3/31/2008

|

-2.61%

|

-0.04%

|

1.37%

|

|

Class A (after taxes on distributions)

|

3/31/2008

|

-3.68%

|

-0.67%

|

1.05%

|

|

Class A (after taxes on distributions and the sale of Fund Shares)

|

3/31/2008

|

-1.55%

|

-0.13%

|

1.27%

|

|

Class C (before taxes)

|

12/26/2002

|

0.19%

|

0.12%

|

1.23%

|

|

Institutional Class (before taxes)1

|

10/31/2016

|

2.14%

|

1.06%

|

1.99%

|

|

Bloomberg Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.05%

|

0.99%

|

2.25%

|

|

|

Bloomberg Wisconsin Municipal Bond Index (reflects no deduction for fees, expenses, or taxes)

|

1.38%

|

0.91%

|

2.03%

|

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|

||

| [11] |

|