Third Quarter 2025 Earnings Supplement

Forward Looking Statements and Risk Factors This information contains or incorporates statements that we believe are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to our financial condition, results of operations, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position and other matters regarding or affecting S&T and its future business and operations. Forward-looking statements are typically identified by words or phrases such as “will likely result,” “expect,” “anticipate,” “estimate,” “forecast,” “project,” “intend,” “believe,” “assume,” “strategy,” “trend,” “plan,” “outlook,” “outcome,” “continue,” “remain,” “potential,” “opportunity,” “comfortable,” “current,” “position,” “maintain,” “sustain,” “seek,” “achieve” and variations of such words and similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors including, but not limited to: credit losses and the credit risk of our commercial and consumer loan products; changes in the level of charge- offs and changes in estimates of the adequacy of the allowance for credit losses, or ACL; cybersecurity concerns; rapid technological developments and changes; operational risks or risk management failures by us or critical third parties, including fraud risk; our ability to manage our reputational risks; sensitivity to the interest rate environment, a rapid increase in interest rates or a change in the shape of the yield curve; a change in spreads on interest-earning assets and interest-bearing liabilities; regulatory supervision and oversight, including changes in regulatory capital requirements and our ability to address those requirements; unanticipated changes in our liquidity position; unanticipated changes in regulatory and governmental policies impacting interest rates and financial markets; changes in accounting policies, practices or guidance; legislation affecting the financial services industry as a whole, and S&T, in particular; developments affecting the industry and the soundness of financial institutions and further disruption to the economy and U.S. banking system; the outcome of pending and future litigation and governmental proceedings; increasing price and product/service competition; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; managing our internal growth and acquisitions; the possibility that the anticipated benefits from acquisitions cannot be fully realized in a timely manner or at all, or that integrating the acquired operations will be more difficult, disruptive or costly than anticipated; containing costs and expenses; reliance on significant customer relationships; an interruption or cessation of an important service by a third-party provider; our ability to attract and retain talented executives and other employees; general economic or business conditions, including the strength of regional economic conditions in our market area; ESG practices and disclosures, including climate change, hiring practices, the diversity of the work force and racial and social justice issues; deterioration of the housing market and reduced demand for mortgages; deterioration in the overall macroeconomic conditions or the state of the banking industry that could warrant further analysis of the carrying value of goodwill and could result in an adjustment to its carrying value resulting in a non-cash charge to net income; the stability of our core deposit base and access to contingency funding; re- emergence of turbulence in significant portions of the global financial and real estate markets that could impact our performance, both directly, by affecting our revenues and the value of our assets and liabilities, and indirectly, by affecting the economy generally and access to capital in the amounts, at the times and on the terms required to support our future businesses and geopolitical tensions and conflicts between nations. Many of these factors, as well as other factors, are described in our Annual Report on Form 10-K for the year ended December 31, 2024, including Part I, Item 1A-"Risk Factors" and any of our subsequent filings with the SEC. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are made. We caution you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made. Non-GAAP Financial Measures In addition to the traditional measures presented in accordance with Generally Accepted Accounting Principles (GAAP), S&T management uses and this presentation contains or references certain non-GAAP financial measures, such as net interest margin on a fully taxable equivalent basis, pre-provision net revenue, return on tangible equity, efficiency ratio on a fully taxable equivalent basis, and tangible common equity to tangible assets. S&T believes these non-GAAP financial measures provide information useful to investors in understanding our underlying business, operational performance and performance trends which facilitate comparisons with the performance of others in the financial services industry. Although S&T believes that these non-GAAP financial measures enhance investors’ understanding of S&T’s business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP or considered to be more important than financial results determined in accordance with GAAP, nor are they necessarily comparable with non-GAAP measures which may be presented by other companies. The non-GAAP financial measures contained within this presentation should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in the respective Quarterly Reports on Form 10-Q and in Exhibit 99.1 of Form 8-K for S&T Bancorp, Inc. and subsidiaries. 2

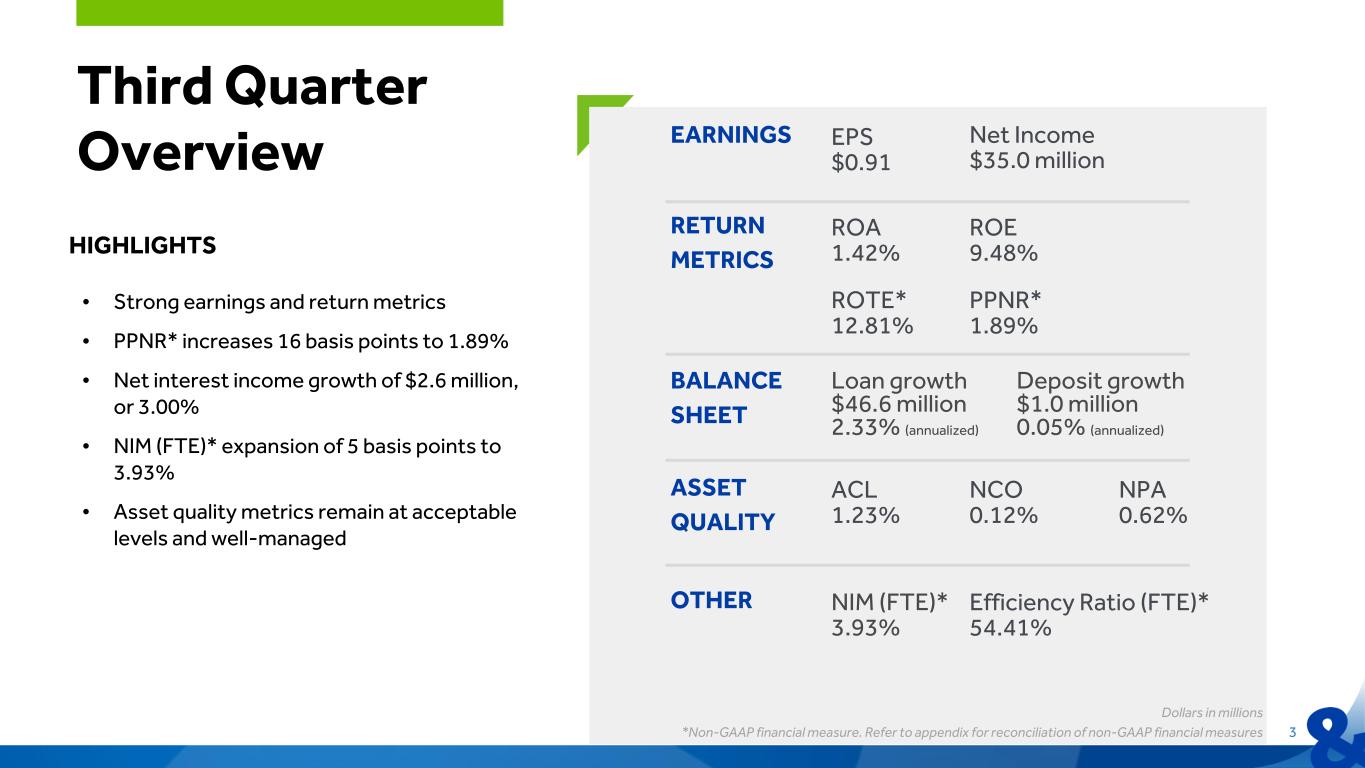

3 Third Quarter Overview RETURN METRICS EARNINGS Net Income $35.0 million EPS $0.91 ROA 1.42% ROE 9.48% ROTE* 12.81% PPNR* 1.89% HIGHLIGHTS • Strong earnings and return metrics • PPNR* increases 16 basis points to 1.89% • Net interest income growth of $2.6 million, or 3.00% • NIM (FTE)* expansion of 5 basis points to 3.93% • Asset quality metrics remain at acceptable levels and well-managed ACL 1.23% NCO 0.12% ASSET QUALITY NPA 0.62% NIM (FTE)* 3.93% Efficiency Ratio (FTE)* 54.41% BALANCE SHEET Loan growth $46.6 million 2.33% (annualized) Deposit growth $1.0 million 0.05% (annualized) OTHER Dollars in millions *Non-GAAP financial measure. Refer to appendix for reconciliation of non-GAAP financial measures

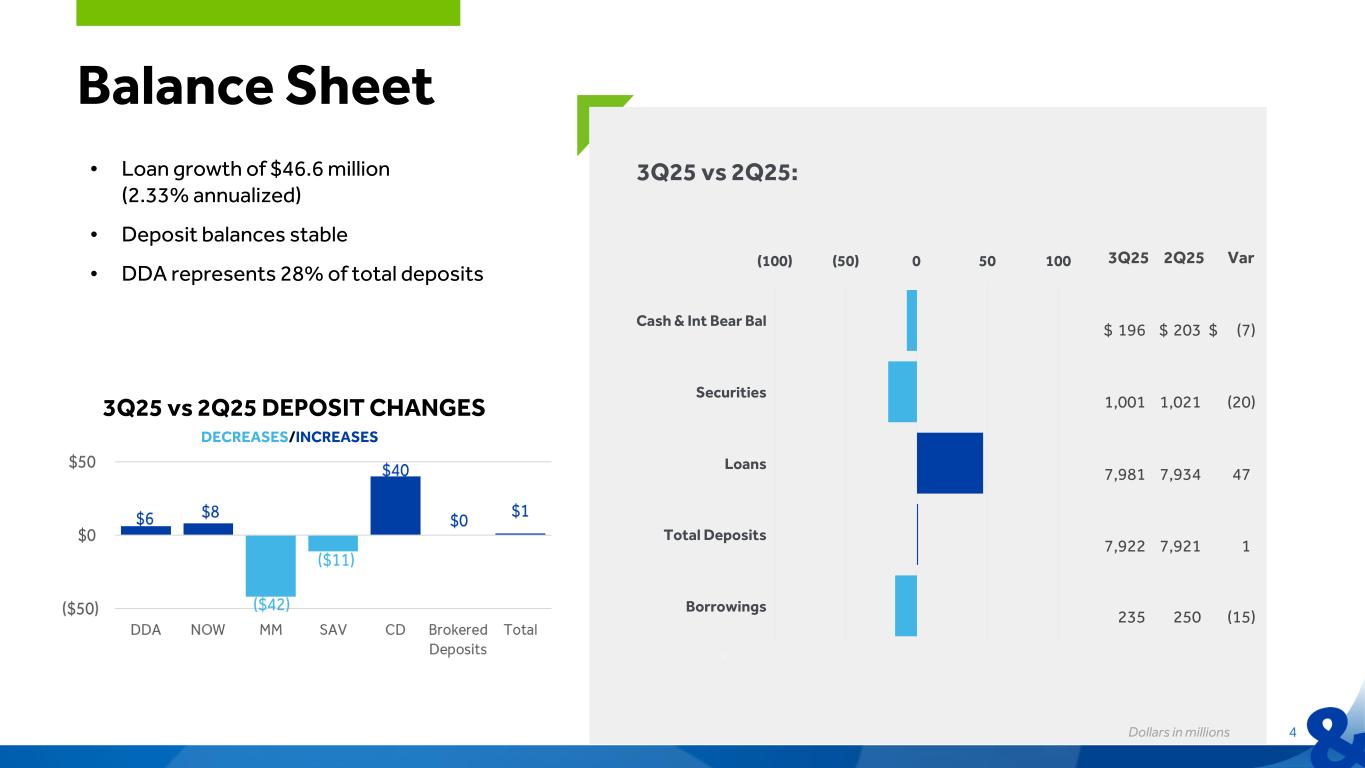

4 Balance Sheet • Loan growth of $46.6 million (2.33% annualized) • Deposit balances stable • DDA represents 28% of total deposits Dollars in millions 3Q25 2Q25 Var $ 196 $ 203 $ (7) 1,001 1,021 (20) 7,981 7,934 47 7,922 7,921 1 235 250 (15) (100) (50) 0 50 100 Cash & Int Bear Bal Securities Loans Total Deposits Borrowings 3Q25 vs 2Q25: 3Q25 vs 2Q25 DEPOSIT CHANGES DECREASES/INCREASES

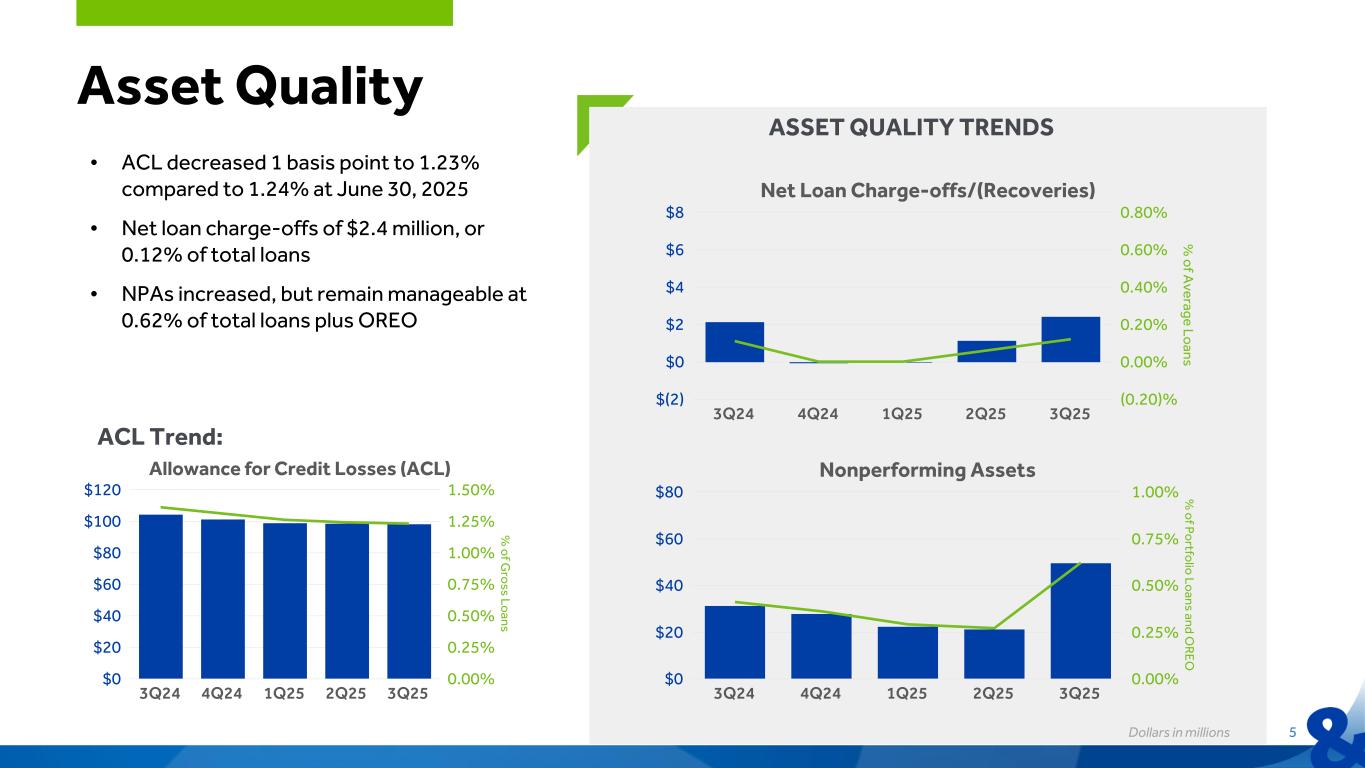

5 Asset Quality ACL Trend: Dollars in millions ASSET QUALITY TRENDS • ACL decreased 1 basis point to 1.23% compared to 1.24% at June 30, 2025 • Net loan charge-offs of $2.4 million, or 0.12% of total loans • NPAs increased, but remain manageable at 0.62% of total loans plus OREO % o f A verage Lo ans Net Loan Charge-offs/(Recoveries) 3Q24 4Q24 1Q25 2Q25 3Q25 $(2) $0 $2 $4 $6 $8 (0.20)% 0.00% 0.20% 0.40% 0.60% 0.80% % o f Po rtfo lio Lo ans and O R EO Nonperforming Assets 3Q24 4Q24 1Q25 2Q25 3Q25 $0 $20 $40 $60 $80 0.00% 0.25% 0.50% 0.75% 1.00% % o f G ro ss Lo ans Allowance for Credit Losses (ACL) 3Q24 4Q24 1Q25 2Q25 3Q25 $0 $20 $40 $60 $80 $100 $120 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 1.50%

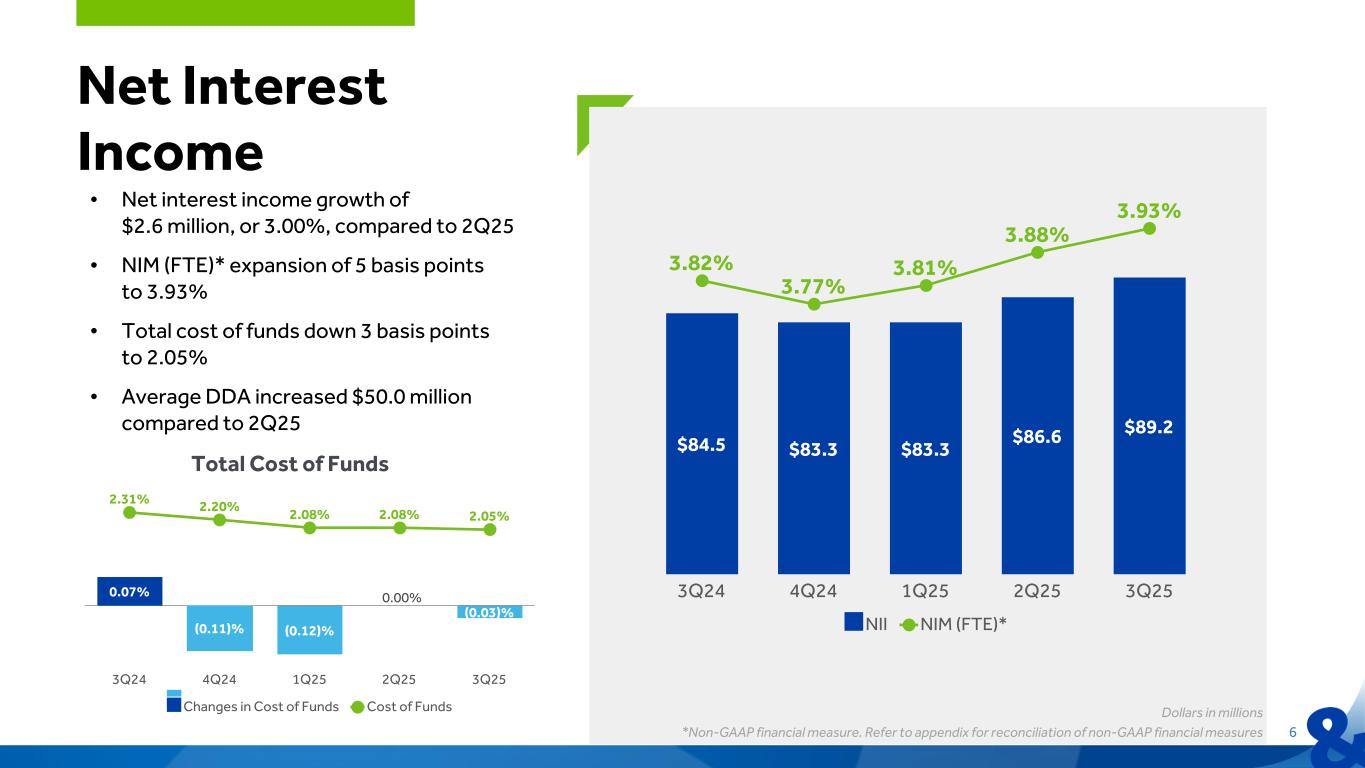

6 Net Interest Income $84.5 $83.3 $83.3 $86.6 $89.2 3.82% 3.77% 3.81% 3.88% 3.93% NII NIM (FTE)* 3Q24 4Q24 1Q25 2Q25 3Q25 Total Cost of Funds 0.07% (0.11)% (0.12)% (0.03)% 2.31% 2.20% 2.08% 2.08% 2.05% Changes in Cost of Funds Cost of Funds 3Q24 4Q24 1Q25 2Q25 3Q25 • Net interest income growth of $2.6 million, or 3.00%, compared to 2Q25 • NIM (FTE)* expansion of 5 basis points to 3.93% • Total cost of funds down 3 basis points to 2.05% • Average DDA increased $50.0 million compared to 2Q25 0.00% Dollars in millions *Non-GAAP financial measure. Refer to appendix for reconciliation of non-GAAP financial measures

7 Noninterest Income Dollars in millions 3Q25 3Q25 vs 2Q25 3Q25 vs 3Q24 Debit and Credit Card $4.7 $0.1 $— Service Charges 4.2 0.1 — Wealth Management 3.1 0.1 — Loss on Sale of Securities — — 2.2 Other 1.8 — (0.3) Noninterest Income $13.8 $0.3 $1.9 • Noninterest income consistent with 2Q $14.1 $13.7 $12.7

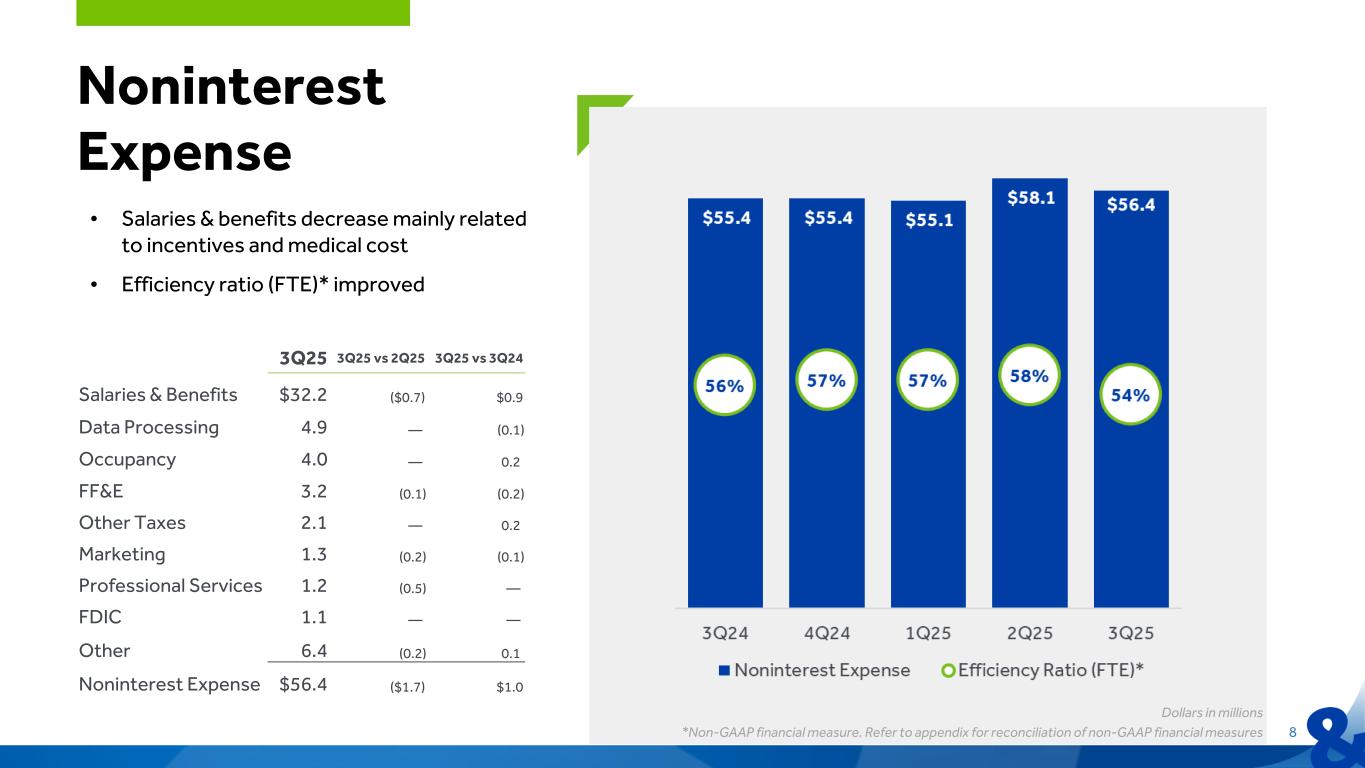

8 3Q25 3Q25 vs 2Q25 3Q25 vs 3Q24 Salaries & Benefits $32.2 ($0.7) $0.9 Data Processing 4.9 — (0.1) Occupancy 4.0 — 0.2 FF&E 3.2 (0.1) (0.2) Other Taxes 2.1 — 0.2 Marketing 1.3 (0.2) (0.1) Professional Services 1.2 (0.5) — FDIC 1.1 — — Other 6.4 (0.2) 0.1 Noninterest Expense $56.4 ($1.7) $1.0 Noninterest Expense • Salaries & benefits decrease mainly related to incentives and medical cost • Efficiency ratio (FTE)* improved Dollars in millions *Non-GAAP financial measure. Refer to appendix for reconciliation of non-GAAP financial measures

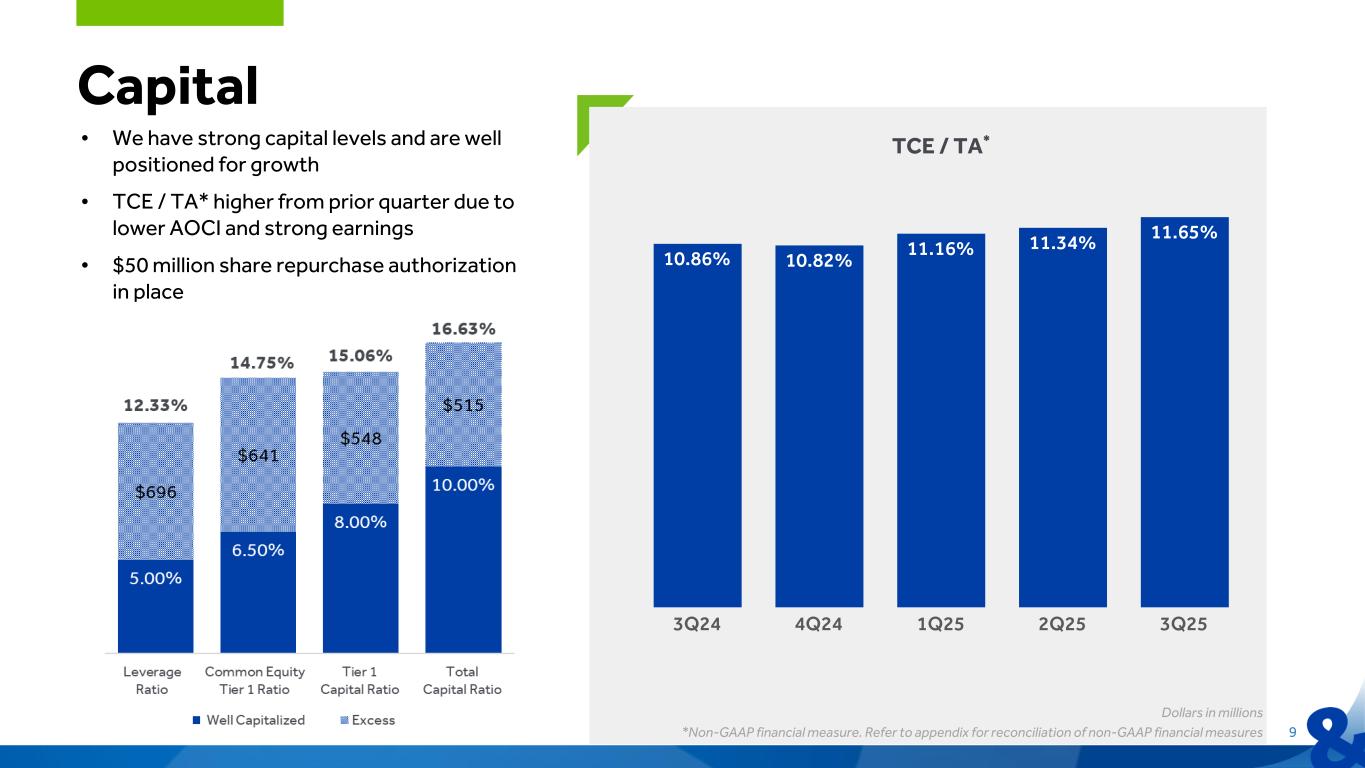

9 Capital Dollars in millions *Non-GAAP financial measure. Refer to appendix for reconciliation of non-GAAP financial measures TCE / TA*• We have strong capital levels and are well positioned for growth • TCE / TA* higher from prior quarter due to lower AOCI and strong earnings • $50 million share repurchase authorization in place 10.86% 10.82% 11.16% 11.34% 11.65% 3Q24 4Q24 1Q25 2Q25 3Q25

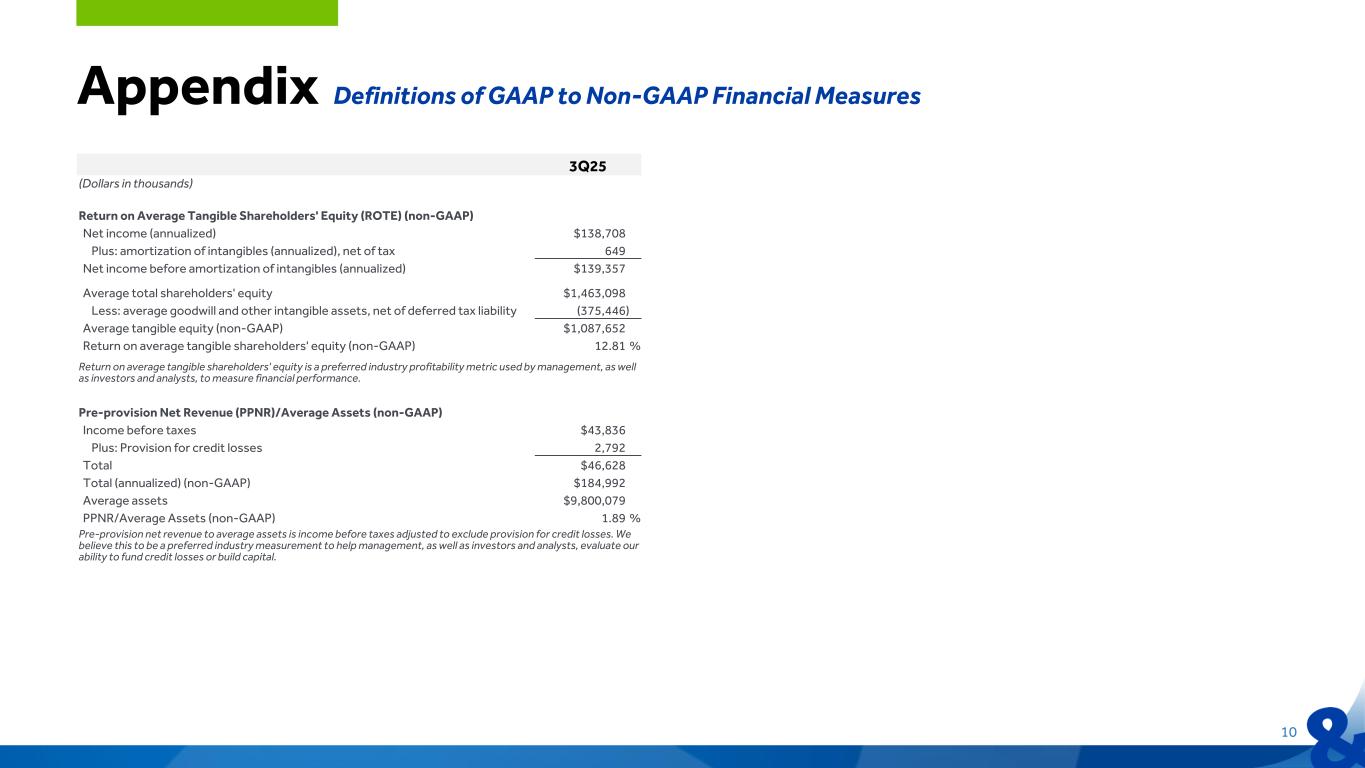

3Q25 (Dollars in thousands) Return on Average Tangible Shareholders' Equity (ROTE) (non-GAAP) Net income (annualized) $138,708 Plus: amortization of intangibles (annualized), net of tax 649 Net income before amortization of intangibles (annualized) $139,357 Average total shareholders' equity $1,463,098 Less: average goodwill and other intangible assets, net of deferred tax liability (375,446) Average tangible equity (non-GAAP) $1,087,652 Return on average tangible shareholders' equity (non-GAAP) 12.81 % Return on average tangible shareholders' equity is a preferred industry profitability metric used by management, as well as investors and analysts, to measure financial performance. Pre-provision Net Revenue (PPNR)/Average Assets (non-GAAP) Income before taxes $43,836 Plus: Provision for credit losses 2,792 Total $46,628 Total (annualized) (non-GAAP) $184,992 Average assets $9,800,079 PPNR/Average Assets (non-GAAP) 1.89 % Pre-provision net revenue to average assets is income before taxes adjusted to exclude provision for credit losses. We believe this to be a preferred industry measurement to help management, as well as investors and analysts, evaluate our ability to fund credit losses or build capital. Appendix Definitions of GAAP to Non-GAAP Financial Measures 10

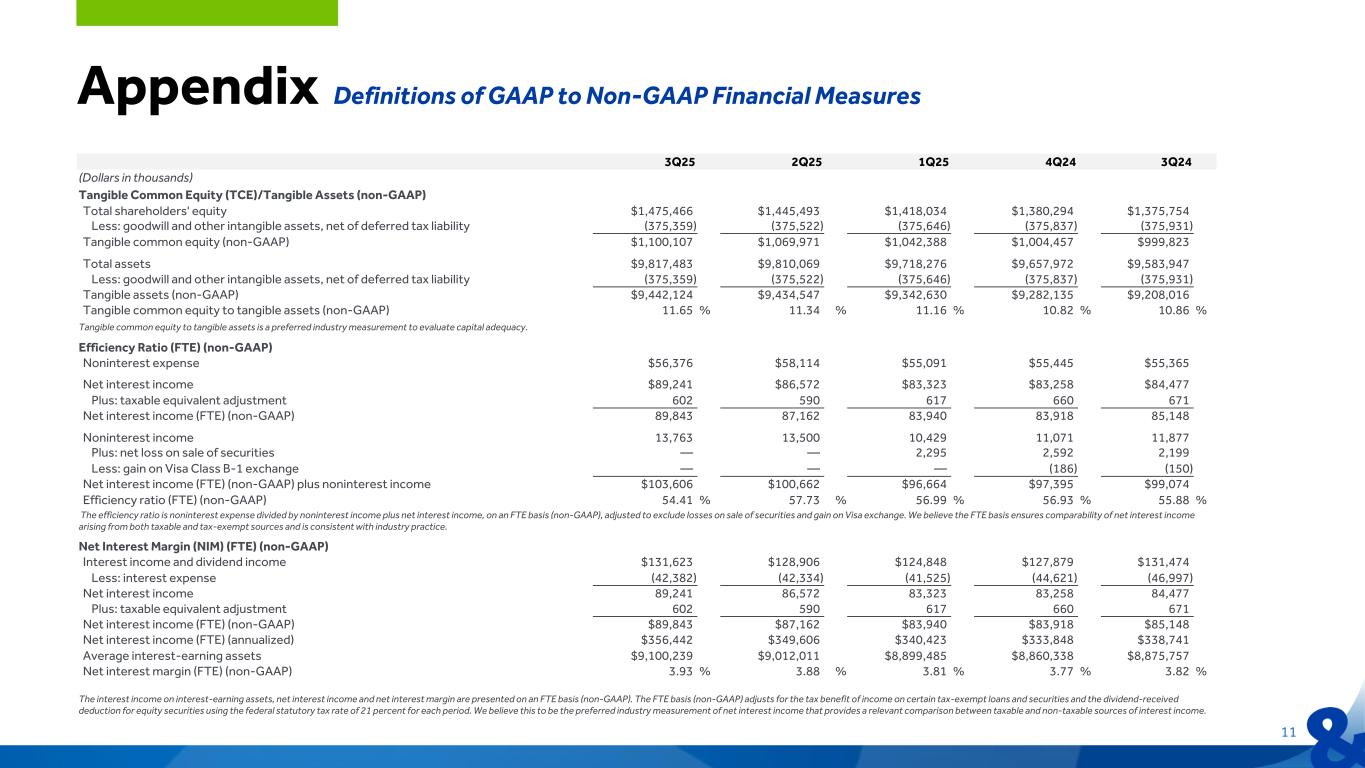

3Q25 2Q25 1Q25 4Q24 3Q24 (Dollars in thousands) Tangible Common Equity (TCE)/Tangible Assets (non-GAAP) Total shareholders' equity $1,475,466 $1,445,493 $1,418,034 $1,380,294 $1,375,754 Less: goodwill and other intangible assets, net of deferred tax liability (375,359) (375,522) (375,646) (375,837) (375,931) Tangible common equity (non-GAAP) $1,100,107 $1,069,971 $1,042,388 $1,004,457 $999,823 Total assets $9,817,483 $9,810,069 $9,718,276 $9,657,972 $9,583,947 Less: goodwill and other intangible assets, net of deferred tax liability (375,359) (375,522) (375,646) (375,837) (375,931) Tangible assets (non-GAAP) $9,442,124 $9,434,547 $9,342,630 $9,282,135 $9,208,016 Tangible common equity to tangible assets (non-GAAP) 11.65 % 11.34 % 11.16 % 10.82 % 10.86 % Tangible common equity to tangible assets is a preferred industry measurement to evaluate capital adequacy. Efficiency Ratio (FTE) (non-GAAP) Noninterest expense $56,376 $58,114 $55,091 $55,445 $55,365 Net interest income $89,241 $86,572 $83,323 $83,258 $84,477 Plus: taxable equivalent adjustment 602 590 617 660 671 Net interest income (FTE) (non-GAAP) 89,843 87,162 83,940 83,918 85,148 Noninterest income 13,763 13,500 10,429 11,071 11,877 Plus: net loss on sale of securities — — 2,295 2,592 2,199 Less: gain on Visa Class B-1 exchange — — — (186) (150) Net interest income (FTE) (non-GAAP) plus noninterest income $103,606 $100,662 $96,664 $97,395 $99,074 Efficiency ratio (FTE) (non-GAAP) 54.41 % 57.73 % 56.99 % 56.93 % 55.88 % The efficiency ratio is noninterest expense divided by noninterest income plus net interest income, on an FTE basis (non-GAAP), adjusted to exclude losses on sale of securities and gain on Visa exchange. We believe the FTE basis ensures comparability of net interest income arising from both taxable and tax-exempt sources and is consistent with industry practice. Net Interest Margin (NIM) (FTE) (non-GAAP) Interest income and dividend income $131,623 $128,906 $124,848 $127,879 $131,474 Less: interest expense (42,382) (42,334) (41,525) (44,621) (46,997) Net interest income 89,241 86,572 83,323 83,258 84,477 Plus: taxable equivalent adjustment 602 590 617 660 671 Net interest income (FTE) (non-GAAP) $89,843 $87,162 $83,940 $83,918 $85,148 Net interest income (FTE) (annualized) $356,442 $349,606 $340,423 $333,848 $338,741 Average interest-earning assets $9,100,239 $9,012,011 $8,899,485 $8,860,338 $8,875,757 Net interest margin (FTE) (non-GAAP) 3.93 % 3.88 % 3.81 % 3.77 % 3.82 % The interest income on interest-earning assets, net interest income and net interest margin are presented on an FTE basis (non-GAAP). The FTE basis (non-GAAP) adjusts for the tax benefit of income on certain tax-exempt loans and securities and the dividend-received deduction for equity securities using the federal statutory tax rate of 21 percent for each period. We believe this to be the preferred industry measurement of net interest income that provides a relevant comparison between taxable and non-taxable sources of interest income. Appendix Definitions of GAAP to Non-GAAP Financial Measures 11

Third Quarter 2025 Earnings Supplement