fcx.com FCX 3rd Quarter 2025 Supplemental Financial Data October 23, 2025

Cautionary Statement This presentation contains forward-looking statements in which FCX discusses its potential future performance, operations and projects. Forward-looking statements are all statements other than statements of historical facts, such as plans, projections or expectations relating to business outlook, strategy, goals or targets; the underlying assumptions and estimated impacts on FCX’s business and stakeholders related to the mud rush incident at PT Freeport Indonesia’s (PTFI) Grasberg Block Cave underground mine; global market conditions, including trade policies; ore grades and milling rates; production and sales volumes; unit net cash costs (credits) and operating costs; capital expenditures; operating plans, including mine sequencing; cash flows; liquidity; investigations, repair efforts, and phased restart and ramp-up of production and downstream processing following the mud rush incident at PTFI’s Grasberg Block Cave underground mine and the anticipated impact on future production, results of operations and operating plans, and recoveries under insurance policies; potential extension of PTFI’s special mining business license (IUPK) beyond 2041; timing of shipments of inventoried production; FCX’s sustainability-related commitments and targets; FCX’s overarching commitment to deliver responsibly produced copper and molybdenum, including plans to implement, validate and maintain validation of its operating sites under specific frameworks; achievement of FCX’s 2030 climate targets and its 2050 net zero aspiration; improvements in operating procedures and technology innovations and applications; exploration efforts and results; development and production activities, rates and costs; future organic growth opportunities; tax rates; the impact of copper, gold and molybdenum price changes; the impact of deferred intercompany profits on earnings; mineral reserve and mineral resource estimates; final resolution of settlements associated with ongoing legal and environmental proceedings; debt repurchases; and the ongoing implementation of FCX’s financial policy and future returns to shareholders, including dividend payments (base or variable) and share repurchases. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,” “expects,” “projects,” “targets,” “intends,” “likely,” “will,” “should,” “could,” “to be,” “potential,” “assumptions,” “guidance,” “aspirations,” “future,” “commitments,” “pursues,” “initiatives,” “objectives,” “opportunities,” “strategy” and any similar expressions are intended to identify those assertions as forward-looking statements. The declaration and payment of dividends (base or variable), and timing and amount of any share repurchases are at the discretion of the Board of Directors (Board) and management, respectively, and are subject to a number of factors, including not exceeding FCX’s net debt target, capital availability, FCX’s financial results, cash requirements, global economic conditions, changes in laws, contractual restrictions and other factors deemed relevant by the Board or management, as applicable. The share repurchase program may be modified, increased, suspended or terminated at any time at the Board’s discretion. FCX cautions readers that forward-looking statements are not guarantees of future performance and actual results may differ materially from those anticipated, expected, projected or assumed in the forward-looking statements. Important factors that can cause FCX’s actual results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, supply of and demand for, and prices of the commodities FCX produces, primarily copper and gold; changes in export duties and tariff rates; production rates; timing of shipments; price and availability of consumables and components FCX purchases as well as constraints on supply and logistics, and transportation services; changes in cash requirements, financial position, financing or investment plans; changes in general market, economic, geopolitical, regulatory or industry conditions, including market volatility regarding trade policies and tariff uncertainty; reductions in liquidity and access to capital; PTFI’s ability to repair mud rush incident-related damage, complete the investigation to the satisfaction of the Indonesian government authorities and implement any recommendations therefrom, safely restart, phase-in ramp-up and achieve full operating rates of production and downstream processing on the expected timeline and optimize production plans; recover amounts under insurance policies; resolve force majeure declarations and maintain relationships with commercial counterparties; changes in tax laws and regulations; political and social risks, including the potential effects of violence in Indonesia, civil unrest in Peru, and relations with local communities and Indigenous Peoples; operational risks inherent in mining, with higher inherent risks in underground mining; mine sequencing; changes in mine plans or operational modifications, delays, deferrals or cancellations, including the ability to smelt and refine or inventory; results of technical, economic or feasibility studies; potential inventory adjustments; potential impairment of long-lived mining assets; satisfaction of requirements in accordance with PTFI’s IUPK to extend mining rights from 2031 through 2041; process relating to the extension of PTFI’s IUPK beyond 2041; cybersecurity risks; any major public health crisis; labor relations, including labor-related work stoppages and increased costs; compliance with applicable environmental, health and safety laws and regulations; weather- and climate-related risks; environmental risks, including availability of secure water supplies; impacts, expenses or results from litigation or investigations; tailings management; FCX’s ability to comply with its responsible production commitments under specific frameworks and any changes to such frameworks and other factors described in more detail under the heading “Risk Factors” in FCX’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the U.S. Securities and Exchange Commission. Investors are cautioned that many of the assumptions upon which FCX’s forward-looking statements are based are likely to change after the date the forward-looking statements are made, including for example commodity prices, which FCX cannot control, and production volumes and costs or technological solutions and innovations, some aspects of which FCX may not be able to control. Further, FCX may make changes to its business plans that could affect its results. FCX undertakes no obligation to update any forward-looking statements, which are as of the date made, notwithstanding any changes in its assumptions, changes in business plans, actual experience or other changes. This presentation also contains measures such as unit net cash costs (credits) per pound of copper and molybdenum, net debt and Adjusted EBITDA (earnings before interest, taxes, depreciation, amortization and accretion), which are not recognized under U.S. generally accepted accounting principles (GAAP). FCX’s calculation and reconciliation of unit net cash costs (credits) per pound of copper and molybdenum and net debt to amounts reported in FCX’s consolidated financial statements are in the supplemental schedules of FCX’s 3Q25 press release, which is available on FCX’s website, fcx.com. A reconciliation of amounts reported in FCX’s consolidated financial statements to Adjusted EBITDA is included on slide [9]. For forward-looking unit net cash costs (credits) per pound of copper and molybdenum measures, FCX is unable to provide a reconciliation to the most comparable GAAP measure without unreasonable effort because estimating such GAAP measures and providing a meaningful reconciliation is extremely difficult and requires a level of precision that is unavailable for these future periods, and the information needed to reconcile these measures is dependent upon future events, many of which are outside of FCX’s control as described above. Forward-looking non-GAAP measures are estimated consistent with the relevant definitions and assumptions. 2

Financial Highlights 3 Copper Consolidated Volumes, excluding purchases (mm lbs) 977 1,035 Average Realization (per lb) $ 4.68 $ 4.30 Site Production & Delivery Costs (per lb) $ 2.71 $ 2.61 Unit Net Cash Costs (per lb) $ 1.40 $ 1.39 Gold Consolidated Volumes (000’s ozs) 336 558 Average Realization (per oz) $3,539 $2,568 Molybdenum Consolidated Volumes (mm lbs) 19 19 Average Realization (per lb) $24.07 $22.88 3Q25 (1) Excludes idle facility costs and recovery expenses associated with the mud rush incident at PTFI. (2) Net of working capital and other uses of $0.2 bn for 3Q25. (3) Includes $3.2 bn of debt associated with PTFI’s downstream processing facilities. NOTE: Refer to non-GAAP disclosure on slide 2. Revenues $ 7.0 $ 6.8 Net Income Attributable to Common Stock $ 0.7 $ 0.5 Diluted Net Income Per Share $ 0.46 $ 0.36 Operating Cash Flows $ 1.7 $ 1.9 Capital Expenditures $ 1.1 $ 1.2 Total Debt $ 9.3 $ 9.7 Cash and Cash Equivalents $ 4.3 $ 5.0 (in billions, except per share amounts) | Sales Data | Financial Results 3Q24 (3) (1) (2) (1)

3Q25 Mining Operating Summary 4 (1) Includes 6 mm lbs in 3Q25 and 3Q24 from South America. (2) Silver sales totaled 0.9 mm ozs in 3Q25 and 3Q24. (3) Silver sales totaled 1.8 mm ozs in 3Q25 and 2.1 mm ozs in 3Q24. (4) Excludes idle facility costs and recovery expenses associated with the mud rush incident at PTFI. (5) Indonesia includes 38¢/lb and consolidated includes 14¢/lb for PTFI’s export duties. NOTE: Refer to non-GAAP disclosure on slide 2. Site Production & Delivery, excl. adjs. $3.59 $2.75 $1.84 $2.71 By-product Credits (0.61) (0.52) (3.52) (1.66) Treatment Charges 0.13 0.06 0.09 0.10 Royalties & Export Duties - 0.01 0.67 0.25 Unit Net Cash Costs (Credits) $3.11 $2.30 $(0.92) $1.40 United South States America Indonesia Consolidated (per lb of Cu)3Q25 Unit Net Cash Costs (Credits) United States 1919 (1) 316339 3Q25 3Q24 Indonesia (3) 426 360 554 332 South America 278 293 Sales From Mines for 3Q25 by Region 3Q25 3Q24 3Q25 3Q24 3Q25 3Q243Q25 3Q24 (2) (5) (1) (5) Au 000’s ozs Mo mm lbs Cu mm lbs (4) (4)

Strong Balance Sheet and Liquidity Attractive Debt Maturity Profile 5 $0 $2 $4 $6 $8 2025 2026 2027 2028 2029 2030 Thereafter (US$ bns) $4.9 5.40% & 5.45% Sr. Notes and FMC Sr. Notes PTFI Revolver $ 0.3 FCX/FMC Senior Notes/Other 6.0 PTFI Senior Notes 3.0 Total Debt $ 9.3 Cons. Cash and Cash Equivalents $ 4.3 Net Debt (1) $ 5.0 Net Debt/Adjusted EBITDA(2) 0.5x $ - at 9/30/25Total Debt & Cash $ - $1.7 (3) 5.00% Sr. Notes & FMC Sr. Notes 4.763% PTFI Sr. Notes 5.315% & 6.2% PTFI Sr. Notes Significant liquidity ▪ $4.3 bn in consolidated cash and cash equiv. ▪ $3.0 bn in availability under FCX credit facility ▪ $1.5 bn in availability under PTFI credit facility ▪ $350 mm in availability under Cerro Verde credit facility 4.125% & 4.375% Sr. Notes $1.2 $0.5 5.25% Sr. Notes 4.25% & 4.625% Sr. Notes $1.0 PTFI Revolver (1) Includes $3.2 bn of debt associated with PTFI’s downstream processing facilities. (2) Trailing 12-months. (3) For purposes of this schedule, maturities of uncommitted lines of credit and other short-term lines are included in FCX’s revolver balance, which matures in 2027. NOTE: Refer to non-GAAP disclosure on slide 2. Atlantic Copper

2025e Outlook 6 (1) Excludes idle facility costs and recovery expenses associated with the mud rush incident at PTFI. (2) Assumes average prices of $4,000/oz gold and $25/lb molybdenum for 4Q25e. (3) 2025e consolidated unit net cash costs include 10¢/lb for PTFI export duties and exclude idle facility costs. (4) For 4Q25e each $100/oz change in gold is estimated to have an approximate $15 mm impact and each $2/lb change in molybdenum is estimated to have an approximate $30 mm impact. (5) Major projects CAPEX includes $0.95 bn for planned projects and $1.35 bn of discretionary projects. NOTE: Projected copper and gold sales and unit net cash costs are dependent on operational performance; the timing of restarting mining and smelting operations at PTFI following the September 2025 mud rush incident; weather-related conditions; timing of shipments and other factors. e = estimate. Refer to non-GAAP disclosure on slide 2. • Copper: 3.5 billion lbs • Gold: 1.05 million ozs • Molybdenum: 82 million lbs | Sales Outlook • Site prod. & delivery(1) o 2025e: $2.77/lb o 4Q25e: $3.21/lb • After by-product credits(2) o 2025e: $1.68/lb(3) o 4Q25e: $2.47/lb | Unit Net Cash Cost of Copper • $3.9 billion (excluding PTFI’s downstream projects) o $2.3 billion for major projects(5) o $1.6 billion for other projects | Capital Expenditures • ~$5.5 billion @ $4.75/lb copper for 4Q25e • Each 10¢/lb change in copper for 4Q25e = $80 million impact | Operating Cash Flows (2,4)

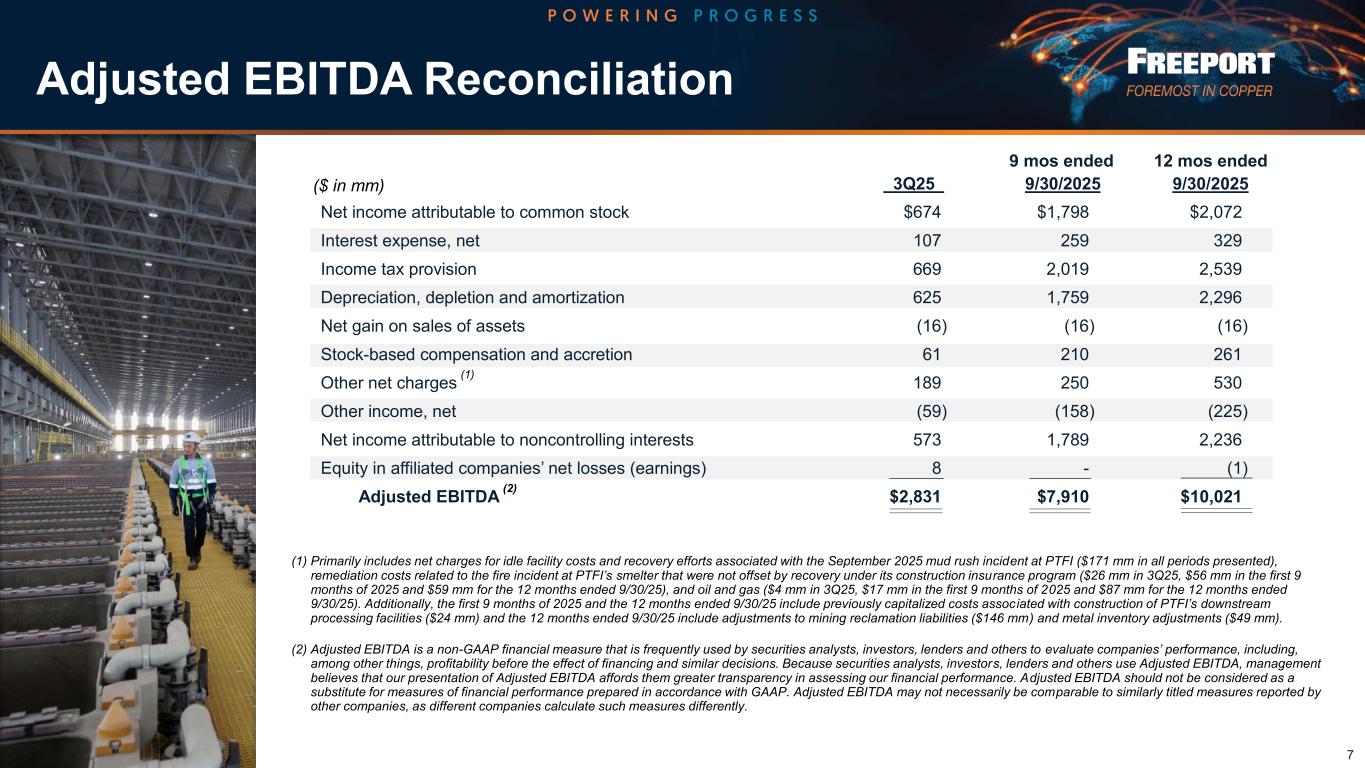

Adjusted EBITDA Reconciliation 7 ($ in mm) 9 mos ended 12 mos ended 3Q25 9/30/2025 9/30/2025 Net income attributable to common stock $674 $1,798 $2,072 Interest expense, net 107 259 329 Income tax provision 669 2,019 2,539 Depreciation, depletion and amortization 625 1,759 2,296 Net gain on sales of assets (16) (16) (16) Stock-based compensation and accretion 61 210 261 Other net charges (1) 189 250 530 Other income, net (59) (158) (225) Net income attributable to noncontrolling interests 573 1,789 2,236 Equity in affiliated companies’ net losses (earnings) 8 - (1) Adjusted EBITDA (2) $2,831 $7,910 $10,021 (1) Primarily includes net charges for idle facility costs and recovery efforts associated with the September 2025 mud rush incident at PTFI ($171 mm in all periods presented), remediation costs related to the fire incident at PTFI’s smelter that were not offset by recovery under its construction insurance program ($26 mm in 3Q25, $56 mm in the first 9 months of 2025 and $59 mm for the 12 months ended 9/30/25), and oil and gas ($4 mm in 3Q25, $17 mm in the first 9 months of 2025 and $87 mm for the 12 months ended 9/30/25). Additionally, the first 9 months of 2025 and the 12 months ended 9/30/25 include previously capitalized costs associated with construction of PTFI’s downstream processing facilities ($24 mm) and the 12 months ended 9/30/25 include adjustments to mining reclamation liabilities ($146 mm) and metal inventory adjustments ($49 mm). (2) Adjusted EBITDA is a non-GAAP financial measure that is frequently used by securities analysts, investors, lenders and others to evaluate companies’ performance, including, among other things, profitability before the effect of financing and similar decisions. Because securities analysts, investors, lenders and others use Adjusted EBITDA, management believes that our presentation of Adjusted EBITDA affords them greater transparency in assessing our financial performance. Adjusted EBITDA should not be considered as a substitute for measures of financial performance prepared in accordance with GAAP. Adjusted EBITDA may not necessarily be comparable to similarly titled measures reported by other companies, as different companies calculate such measures differently.

8