| Ensuring our Clients and Our Institution Succeed Boldly Listed as ESQ Esquire Financial Holdings, Inc. (Financial Holding Company for Esquire Bank, N.A.) 3Q 2025 Investor Presentation Exhibit 99.2 |

| Forward Looking Disclosure This presentation contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements are not historical fact and express management’s current expectations, forecasts of future events or long-term goals and, by their nature, are subject to assumptions, risks and uncertainties, many of which are beyond the control of the Company. These statements are may be identified through the use of words or phrases such as “may,” “might,” “should,” “could,” “predict,” “potential,” “believe,” “expect,” “attribute,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “goal,” “target,” “aim,” “would,” “annualized” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. Forward-looking statements speak only as of the date they are made and are inherently subject to uncertainties and changes in circumstances, including those described under the heading “Risk Factors” in the Company’s 10-K and 10-Q, filed with the Securities and Exchange Commission (“SEC”). Forward-looking statements are not guarantees of future performance and should not be relied upon as representing management’s views as of any subsequent date. Actual results could differ materially from those indicated. The Company undertakes no obligation to update forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. The forward-looking statements speak as of the date of this presentation. The delivery of this presentation shall not, under any circumstances, create any implication there has been no change in the affairs of the Company after the date hereof. This presentation includes industry and market data that we obtained from periodic industry publications, third-party studies and surveys. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable. Although we believe the industry and market data to be reliable as of the date of this presentation, this information could prove to be inaccurate. Industry and market data could be wrong because of the method by which sources obtained their data and because information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. In addition, we do not know all of the assumptions regarding general economic conditions or growth that were used in preparing the forecasts from the sources relied upon or cited herein. This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America (“GAAP”). We believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our financial position, results and ratios. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for this measure, this presentation may not be comparable to other similarly titled measures by other companies. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. A reconciliation of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation. 2 |

| Decades of expertise in the national litigation market which is complex, fragmented, underserved and poised for disruption Asset sensitive model anchored by law firm loans yielding approx. 9.40% “Branchless” and tech enabled core deposit platform funded at 1.03% Driving loan and deposit growth with a 5 Year CAGR of approximately 20% since 2020 Decades of expertise in sales, risk, and compliance management Independent Sales Organization (“ISO”) model with 93,000 merchants nationally Total fee income represents 17% of total revenue Strong growth and stable fee income with a 5 Year CAGR of 14% since 2020 ROA and ROTCE of 2.61%(1) and 20.83%(1), respectively Industry leading NIM of 6.04% Diversified revenue stream with strong NIM and stable fee income Strong efficiency ratio of 48.9% while investing in resources (employees, technology, and digital marketing) for future growth A digital-first disruptor bank with best-in-class technology fueling future growth and industry leading client retention rates Account-based digital marketing (“ABM”) from our CRM to power prospective client engagements nationally Leveraged artificial intelligence (“AI”), advanced data analytics, and personalization features to deliver real-time thought leadership content Nationwide “Branchless” Tech Enabled Litigation & Payment Processing Verticals Generating Industry Leading Growth, Returns, & Performance Metrics Litigation Vertical Commercial Banking Nationally Industry Leading Returns Fueled by “Branchless” and Tech Enabled National Verticals Payment Processing Vertical (Merchant Services) Small Business Banking Nationally Technology – the Future A Catalyst for Strong Growth 3 How Our Clients Succeed Boldly (1) Adjusted ROA and ROTCE were 2.37% and 18.89%, respectively. See Non-GAAP reconciliation provided in appendix. |

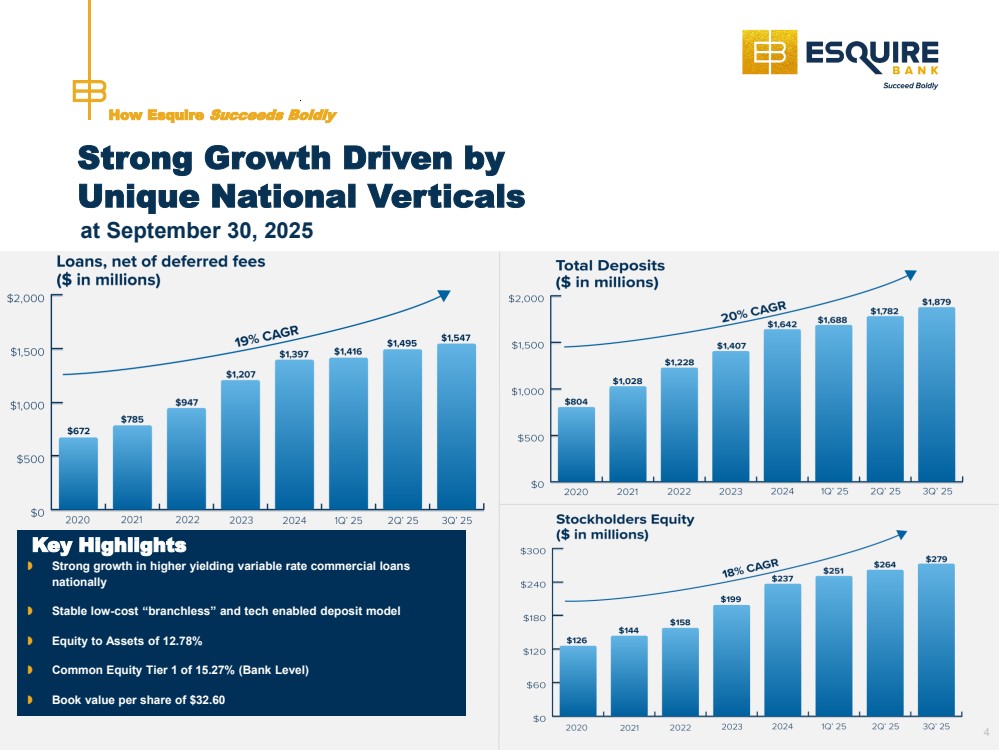

| Strong Growth Driven by Unique National Verticals How Esquire Succeeds Boldly Key Highlights Strong growth in higher yielding variable rate commercial loans nationally Stable low-cost “branchless” and tech enabled deposit model Equity to Assets of 12.78% Common Equity Tier 1 of 15.27% (Bank Level) Book value per share of $32.60 4 at September 30, 2025 |

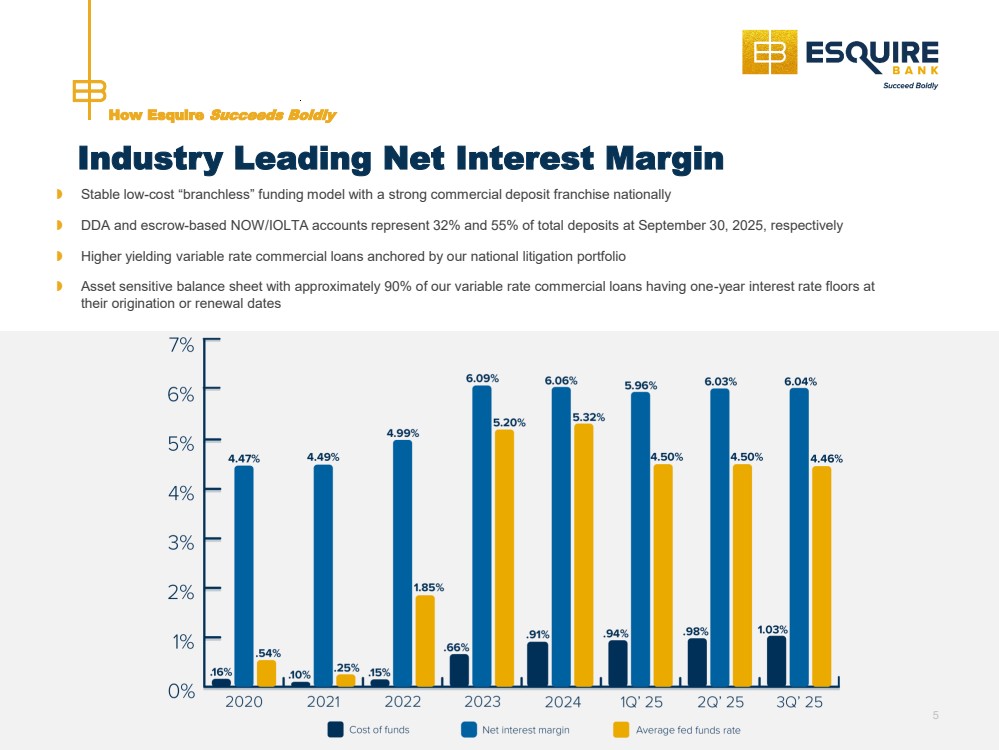

| Stable low-cost “branchless” funding model with a strong commercial deposit franchise nationally DDA and escrow-based NOW/IOLTA accounts represent 32% and 55% of total deposits at September 30, 2025, respectively Higher yielding variable rate commercial loans anchored by our national litigation portfolio Asset sensitive balance sheet with approximately 90% of our variable rate commercial loans having one-year interest rate floors at their origination or renewal dates How Esquire Succeeds Boldly 5 Industry Leading Net Interest Margin |

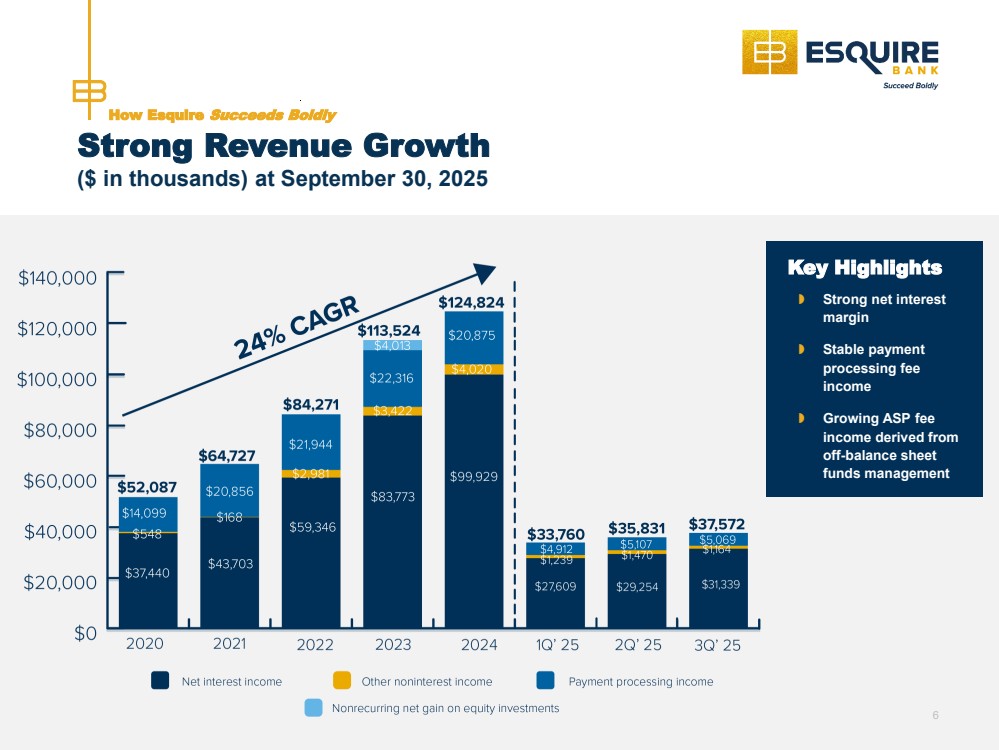

| Strong Revenue Growth ($ in thousands) at September 30, 2025 How Esquire Succeeds Boldly 6 Key Highlights Strong net interest margin Stable payment processing fee income Growing ASP fee income derived from off-balance sheet funds management |

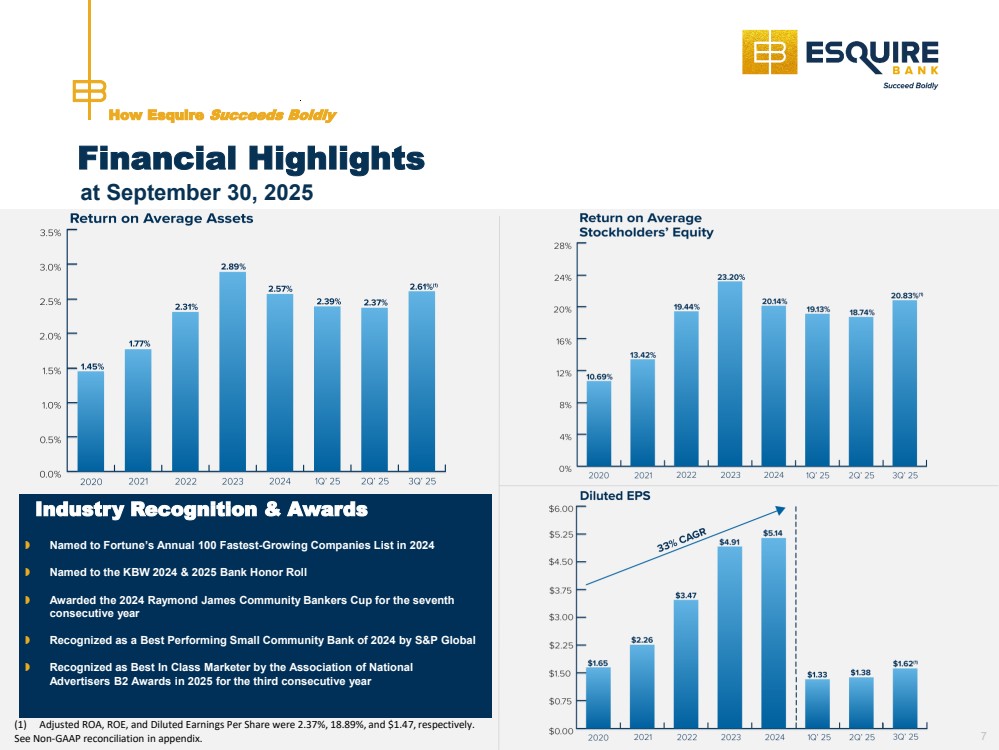

| Financial Highlights How Esquire Succeeds Boldly Industry Recognition & Awards Named to Fortune’s Annual 100 Fastest-Growing Companies List in 2024 Named to the KBW 2024 & 2025 Bank Honor Roll Awarded the 2024 Raymond James Community Bankers Cup for the seventh consecutive year Recognized as a Best Performing Small Community Bank of 2024 by S&P Global Recognized as Best In Class Marketer by the Association of National Advertisers B2 Awards in 2025 for the third consecutive year 7 at September 30, 2025 (1) Adjusted ROA, ROE, and Diluted Earnings Per Share were 2.37%, 18.89%, and $1.47, respectively. See Non-GAAP reconciliation in appendix. |

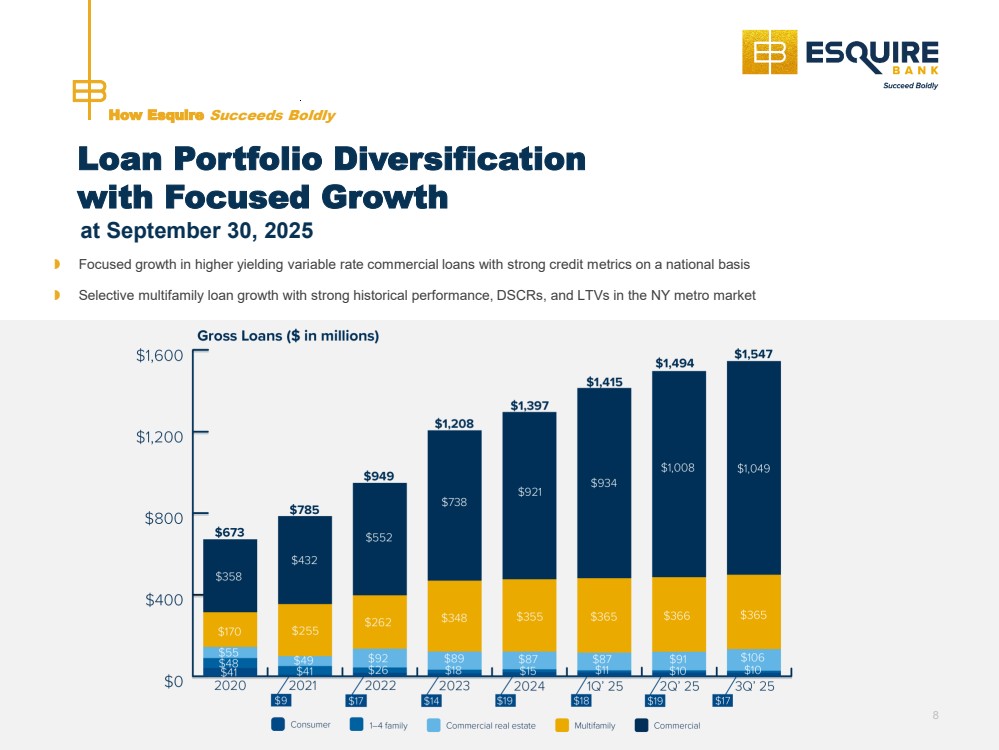

| Loan Portfolio Diversification with Focused Growth Focused growth in higher yielding variable rate commercial loans with strong credit metrics on a national basis Selective multifamily loan growth with strong historical performance, DSCRs, and LTVs in the NY metro market How Esquire Succeeds Boldly 8 at September 30, 2025 |

| Substantially all of our $1.05 billion in commercial loans are variable rate and tied to prime comprising approximately 68% of our loan portfolio Approximately 90% of our variable rate commercial loan portfolio was originated (or renewed annually) with interest rate floors in place Asset sensitive – estimated sensitivity of projected annualized net interest income (“NII”) down 100 and 200 basis point rate scenarios decreases projected NII by 5.2% and 10.9%, respectively at June 30, 2025 Loan Portfolio Diversification with Focused Growth How Esquire Succeeds Boldly 9 |

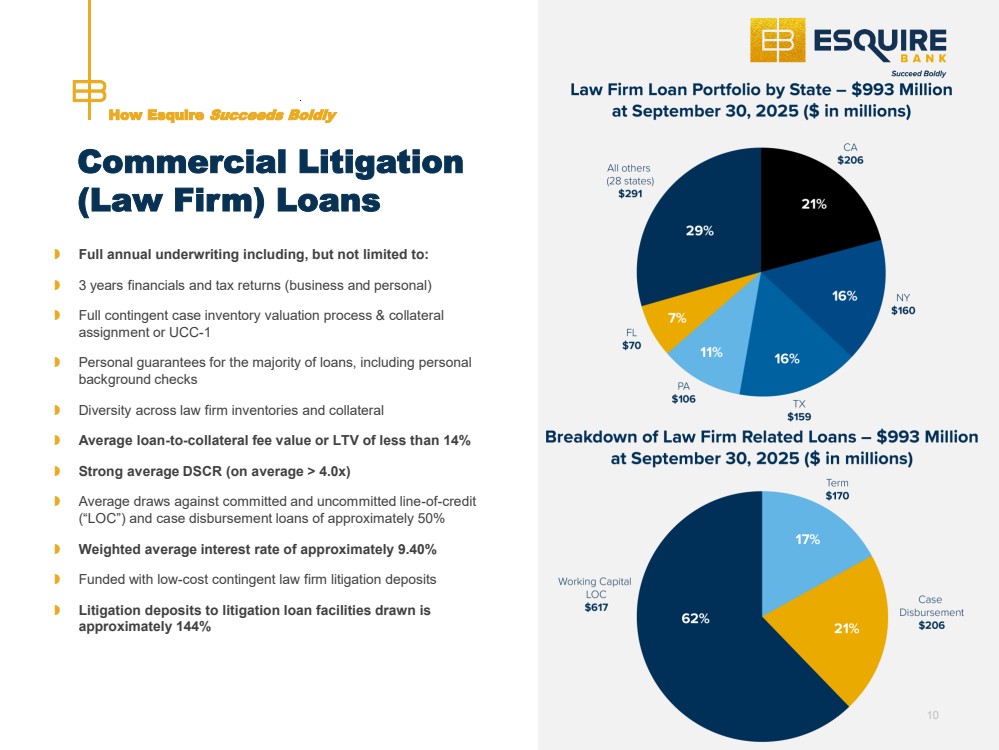

| Commercial Litigation (Law Firm) Loans Full annual underwriting including, but not limited to: 3 years financials and tax returns (business and personal) Full contingent case inventory valuation process & collateral assignment or UCC-1 Personal guarantees for the majority of loans, including personal background checks Diversity across law firm inventories and collateral Average loan-to-collateral fee value or LTV of less than 14% Strong average DSCR (on average > 4.0x) Average draws against committed and uncommitted line-of-credit (“LOC”) and case disbursement loans of approximately 50% Weighted average interest rate of approximately 9.40% Funded with low-cost contingent law firm litigation deposits Litigation deposits to litigation loan facilities drawn is approximately 144% How Esquire Succeeds Boldly 10 |

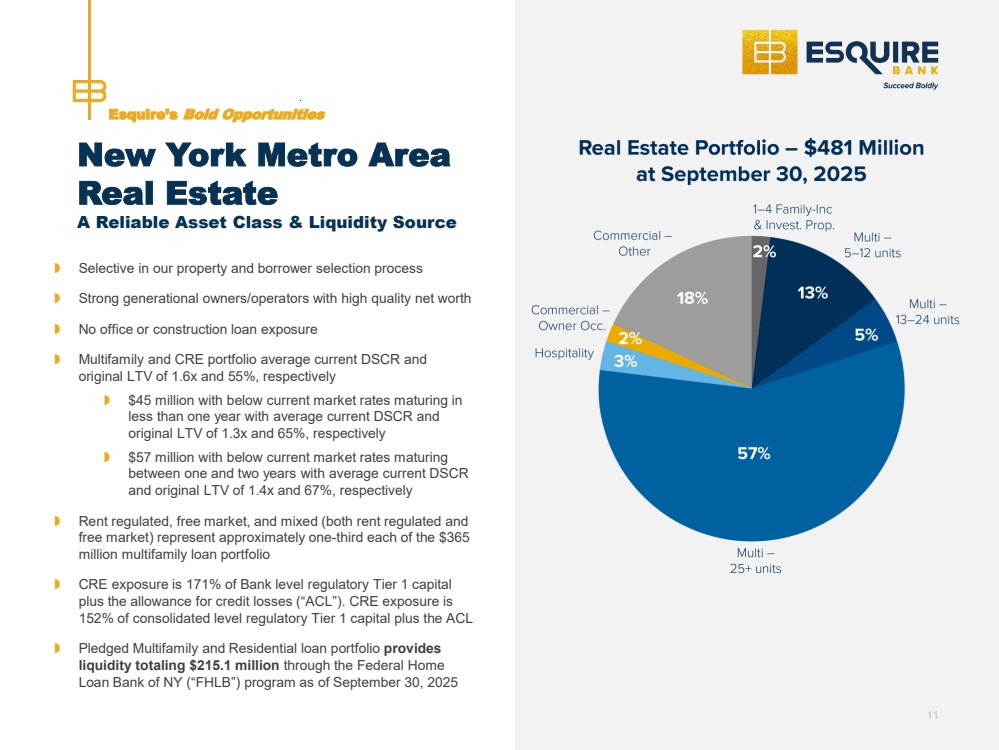

| Esquire’s Bold Opportunities New York Metro Area Real Estate A Reliable Asset Class & Liquidity Source Selective in our property and borrower selection process Strong generational owners/operators with high quality net worth No office or construction loan exposure Multifamily and CRE portfolio average current DSCR and original LTV of 1.6x and 55%, respectively $45 million with below current market rates maturing in less than one year with average current DSCR and original LTV of 1.3x and 65%, respectively $57 million with below current market rates maturing between one and two years with average current DSCR and original LTV of 1.4x and 67%, respectively Rent regulated, free market, and mixed (both rent regulated and free market) represent approximately one -third each of the $365 million multifamily loan portfolio CRE exposure is 171% of Bank level regulatory Tier 1 capital plus the allowance for credit losses (“ACL”). CRE exposure is 152% of consolidated level regulatory Tier 1 capital plus the ACL Pledged Multifamily and Residential loan portfolio provides liquidity totaling $215.1 million through the Federal Home Loan Bank of NY (“FHLB”) program as of September 30, 2025 11 |

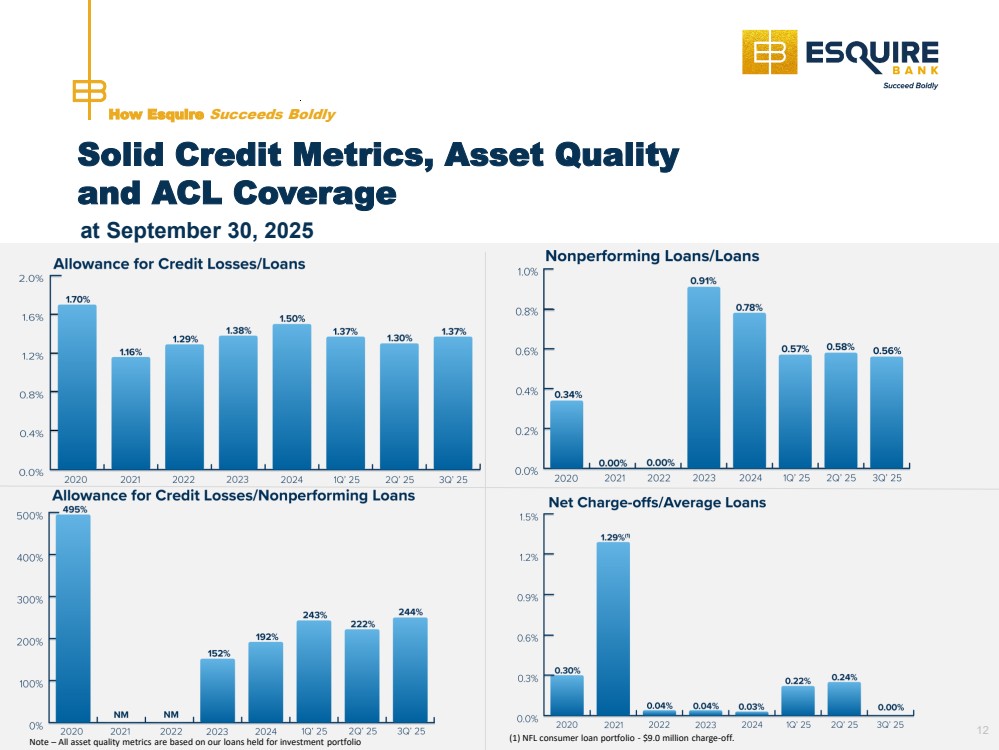

| Solid Credit Metrics, Asset Quality and ACL Coverage How Esquire Succeeds Boldly at September 30, 2025 Note – All asset quality metrics are based on our loans held for investment portfolio (1) NFL consumer loan portfolio - $9.0 million charge-off. 12 |

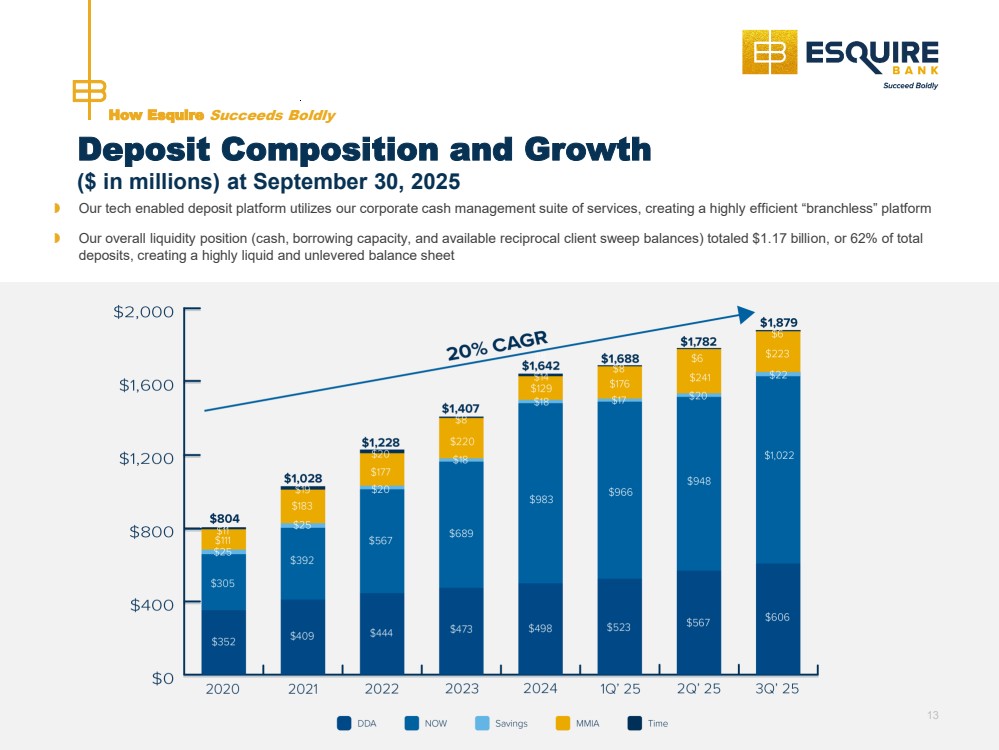

| Deposit Composition and Growth Our tech enabled deposit platform utilizes our corporate cash management suite of services, creating a highly efficient “branchless” platform Our overall liquidity position (cash, borrowing capacity, and available reciprocal client sweep balances) totaled $1.17 billion, or 62% of total deposits, creating a highly liquid and unlevered balance sheet How Esquire Succeeds Boldly 13 ($ in millions) at September 30, 2025 |

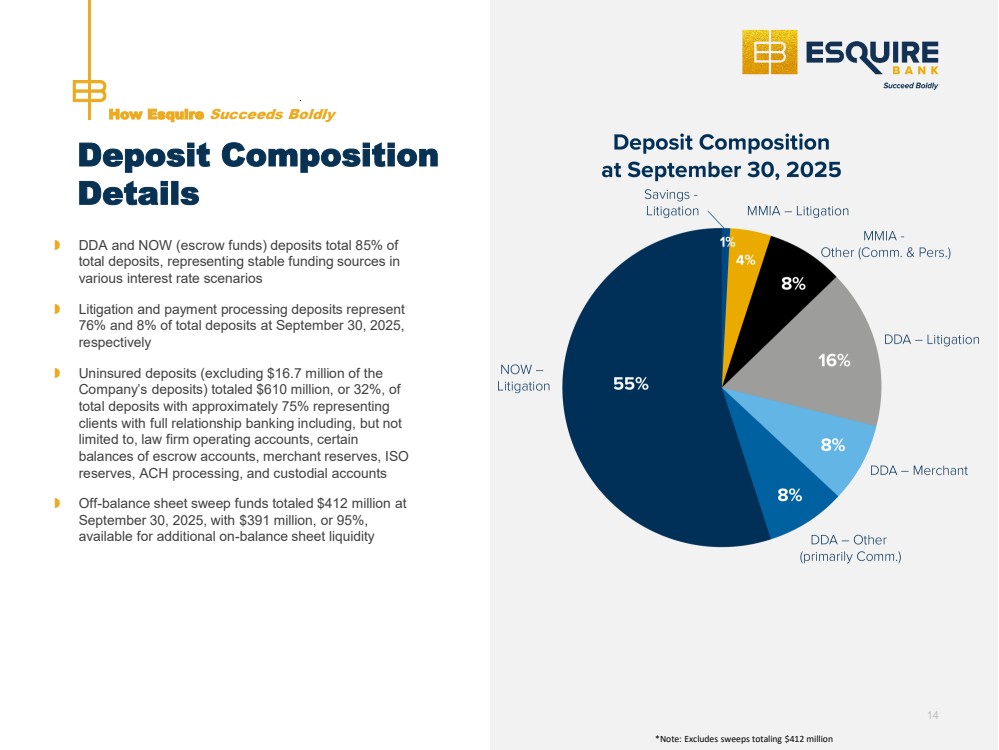

| *Note: Excludes sweeps totaling $412 million Deposit Composition Details DDA and NOW (escrow funds) deposits total 85% of total deposits, representing stable funding sources in various interest rate scenarios Litigation and payment processing deposits represent 76% and 8% of total deposits at September 30, 2025, respectively Uninsured deposits (excluding $16.7 million of the Company’s deposits) totaled $610 million, or 32%, of total deposits with approximately 75% representing clients with full relationship banking including, but not limited to, law firm operating accounts, certain balances of escrow accounts, merchant reserves, ISO reserves, ACH processing, and custodial accounts Off-balance sheet sweep funds totaled $412 million at September 30, 2025, with $391 million, or 95%, available for additional on-balance sheet liquidity How Esquire Succeeds Boldly 14 |

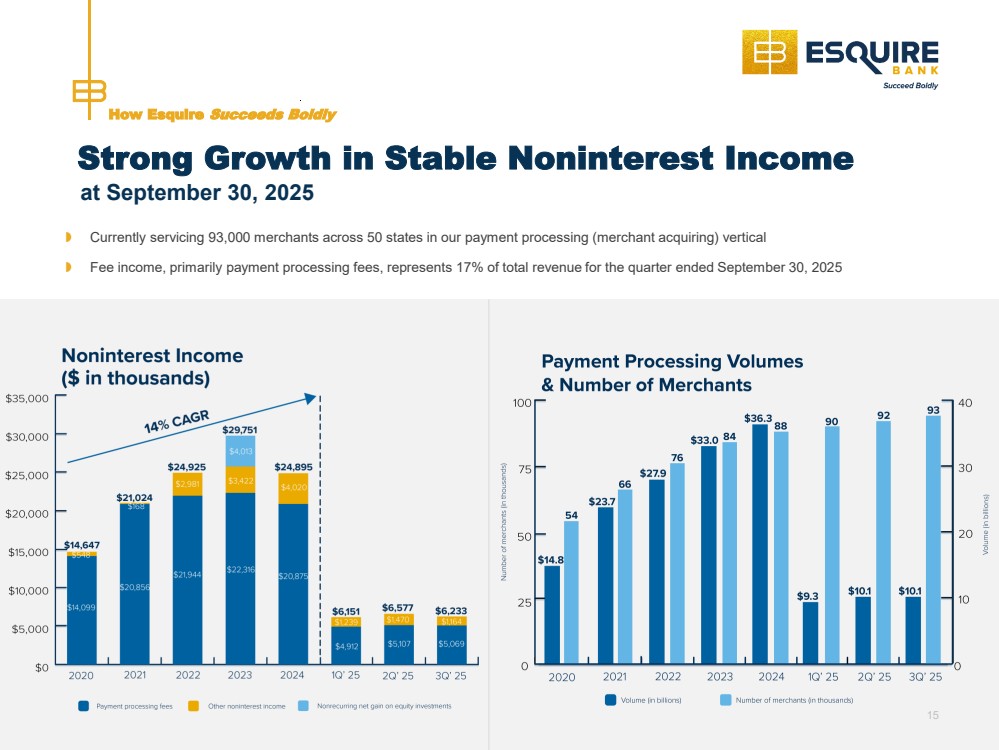

| Currently servicing 93,000 merchants across 50 states in our payment processing (merchant acquiring) vertical Fee income, primarily payment processing fees, represents 17% of total revenue for the quarter ended September 30, 2025 How Esquire Succeeds Boldly Strong Growth in Stable Noninterest Income at September 30, 2025 15 |

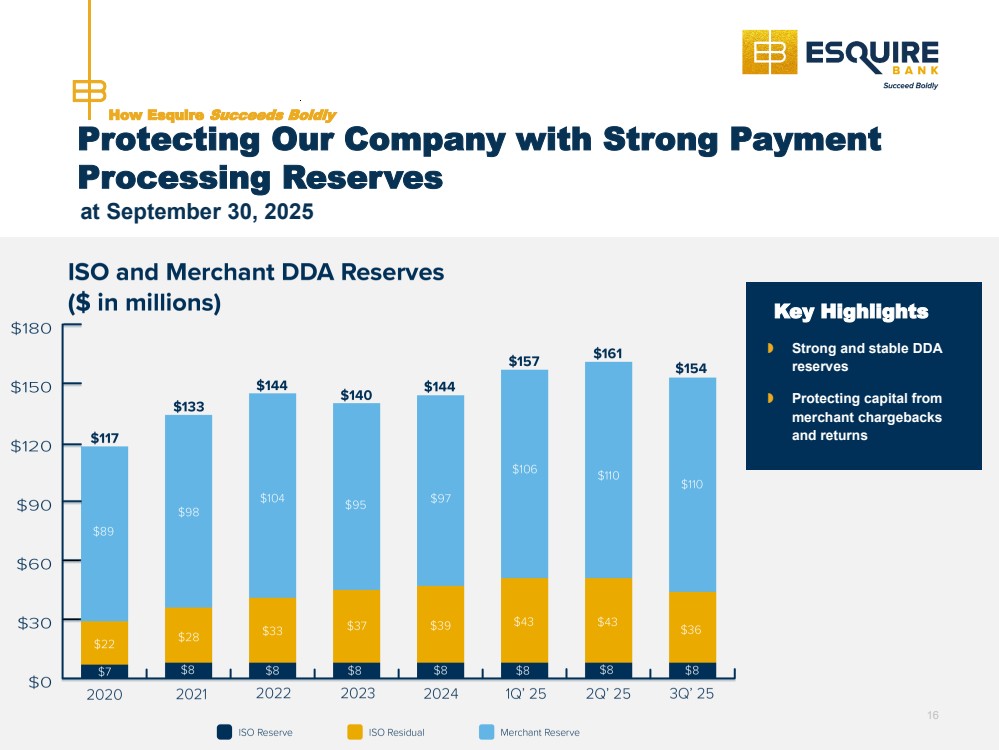

| How Esquire Succeeds Boldly Key Highlights Strong and stable DDA reserves Protecting capital from merchant chargebacks and returns 16 Protecting Our Company with Strong Payment Processing Reserves at September 30, 2025 |

| Significant national markets primed for disruption: $529 billion & 100,000+ firms in the litigation vertical and $11.7 trillion and 10+ million merchants in the payment processing vertical Key Takeaways Why Esquire is Set to Succeed Boldly Tremendous untapped potential: Esquire’s current market share is a fraction of both national verticals that are complex, fragmented, underserved and poised for disruption by our client-centric & tech-focused institution We are thought leaders in the litigation vertical and provide C-suite access for ISO flexibility in the payment processing vertical Differentiated and positioned for growth: With industry leading tailored products and state-of-the-art technology geared towards effective client acquisition 17 |

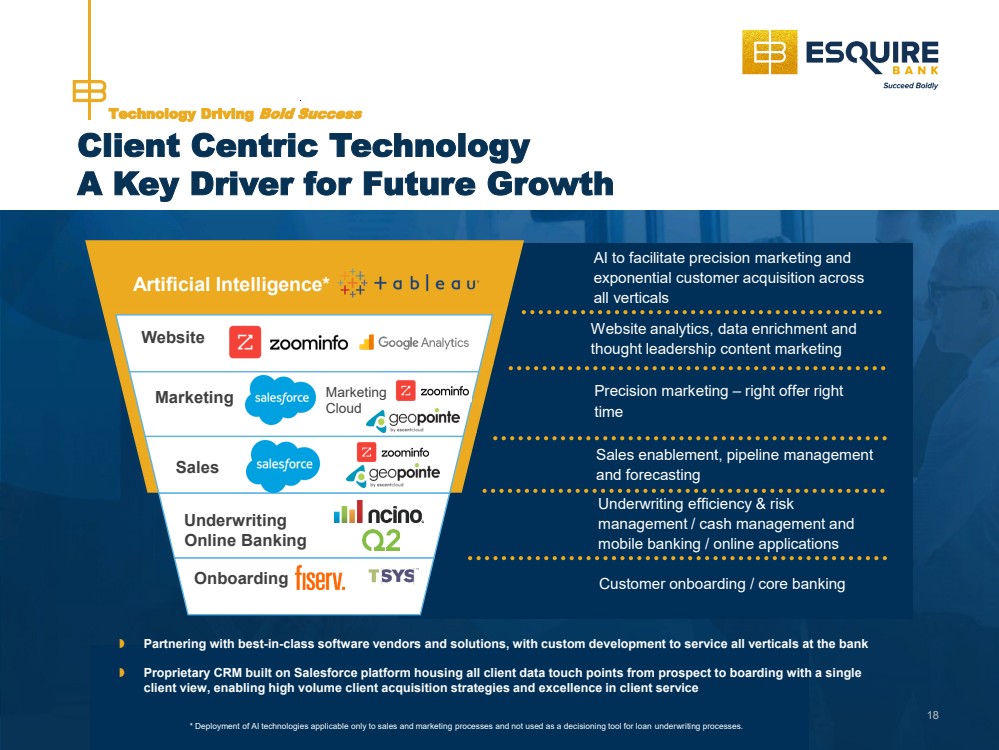

| Technology Driving Bold Success Client Centric Technology A Key Driver for Future Growth Website Artificial Intelligence* Marketing Sales Underwriting Onboarding Marketing Cloud AI to facilitate precision marketing and exponential customer acquisition across all verticals Website analytics, data enrichment and thought leadership content marketing Precision marketing – right offer right time Sales enablement, pipeline management and forecasting Underwriting efficiency & risk management / cash management and mobile banking / online applications Customer onboarding / core banking Partnering with best-in-class software vendors and solutions, with custom development to service all verticals at the bank Proprietary CRM built on Salesforce platform housing all client data touch points from prospect to boarding with a single client view, enabling high volume client acquisition strategies and excellence in client service * Deployment of AI technologies applicable only to sales and marketing processes and not used as a decisioning tool for loan underwriting processes. 18 Online Banking |

| Succeeding Boldly Listed as ESQ Contact Information: Eric S. Bader Executive Vice President & Chief Operating Officer 516-535-2002 eric.bader@esqbank.com |

| Appendix & Supplemental Disclosure National Markets – Litigation & Payment Processing Verticals & Non-GAAP Reconciliation |

| The Esquire Competitive Advantage Esquire’s Bold Opportunities U.S. Litigation Market A Significant Growth Opportunity U.S. Tort actions are estimated to consume 2.1% of U.S. GDP* annually or $529 billion* Esquire does not compete with non-bank finance companies Significant barriers to entry – management expertise, brand awareness, regulatory/compliance, and decades of experience Decades of Industry Track Record Extensive Litigation Experience In-House Deep Relationships with Respected Firms Nationally Daily Resources and Research Cash Flow Lending Coupled with Borrowing Base or Asset Based Approach Tailoring unique products other banks do not offer Typically advancing more than traditional banks, on traditional banking terms 21 Key Highlights $529 billion* Total Addressable Market (“TAM”) in litigation vertical Esquire is a tailored, differentiated brand and thought leader in the litigation market *US Chamber of Commerce Institute for Legal Reform – “Tort Costs in America – An Empirical Analysis of Costs and Compensation of U.S. Tort System”. Published in November 2024. |

| 22 Digitally Transforming The Business of Law Aligning Law Firm Case Inventory Lifecycle to Customer Retention Client Incident Receive Intake Case Management Settlement/ Verdict Disbursement $ 1-3 Years (+) Products Case Cost Loans Working Capital Loans Firm and Partner Acquisition Loans Term Loans to Finance Case Acquisition & Growth Escrow Banking and QSF Settlement Services Plaintiff Banking including Exclusive Prepaid Card Offering Technology Esquire Insight – Case Management Technology Commercial Cash Management Case Cost Management Online Applications Thought Leadership - Digital Platform and Content 22 |

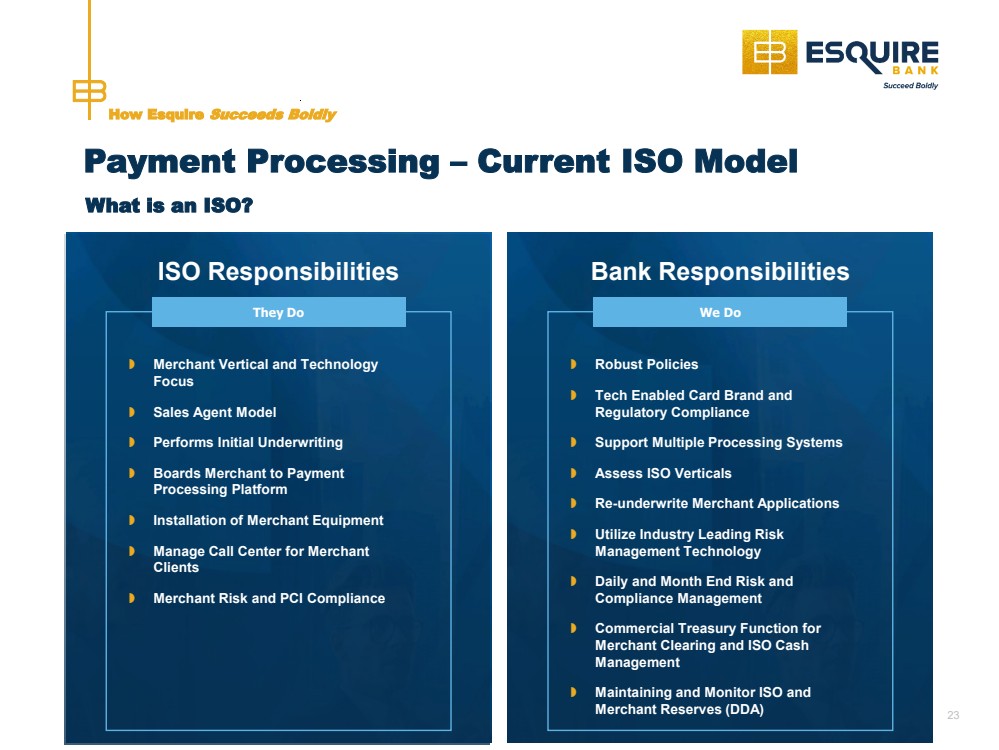

| Payment Processing – Current ISO Model How Esquire Succeeds Boldly What is an ISO? ISO Responsibilities They Do Merchant Vertical and Technology Focus Sales Agent Model Performs Initial Underwriting Boards Merchant to Payment Processing Platform Installation of Merchant Equipment Manage Call Center for Merchant Clients Merchant Risk and PCI Compliance Bank Responsibilities We Do Robust Policies Tech Enabled Card Brand and Regulatory Compliance Support Multiple Processing Systems Assess ISO Verticals Re-underwrite Merchant Applications Utilize Industry Leading Risk Management Technology Daily and Month End Risk and Compliance Management Commercial Treasury Function for Merchant Clearing and ISO Cash Management Maintaining and Monitor ISO and Merchant Reserves (DDA) 23 |

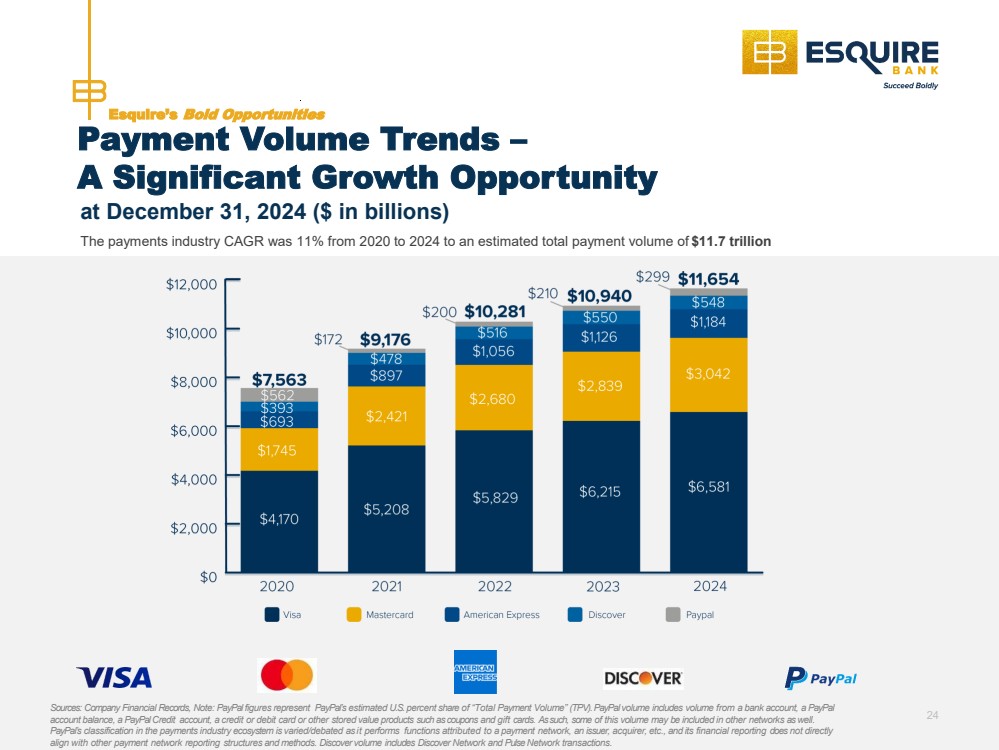

| The payments industry CAGR was 11% from 2020 to 2024 to an estimated total payment volume of $11.7 trillion Esquire’s Bold Opportunities Payment Volume Trends – A Significant Growth Opportunity Sources: Company Financial Records, Note: PayPal figures represent PayPal’s estimated U.S.percent share of “Total Payment Volume” (TPV).PayPal volume includes volume from a bank account, a PayPal account balance, a PayPalCredit account, a credit or debit card or other stored value products such as coupons and gift cards. Assuch, some of this volume may be included in other networks aswell. PayPal’s classification in the payments industry ecosystem is varied/debated as it performs functions attributed to a payment network, an issuer, acquirer, etc., and its financial reporting does not directly align with other payment network reporting structures and methods. Discover volume includes Discover Network and PulseNetwork transactions. 24 at December 31, 2024 ($ in billions) |

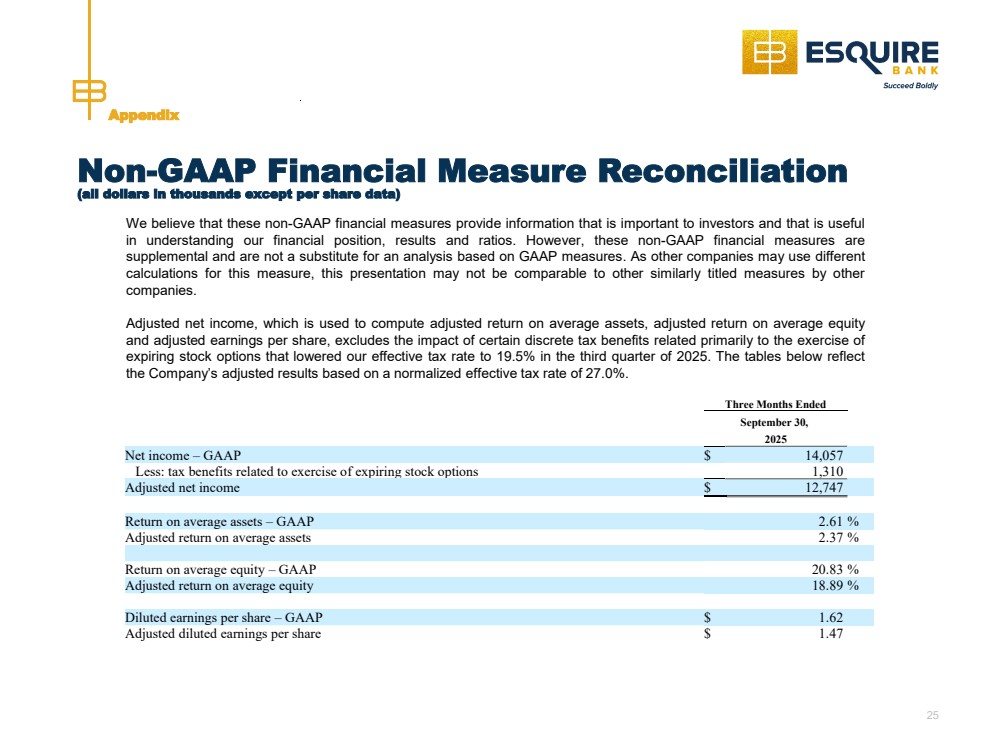

| Appendix (all dollars in thousands except per share data) 25 Non-GAAP Financial Measure Reconciliation We believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our financial position, results and ratios. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for this measure, this presentation may not be comparable to other similarly titled measures by other companies. Adjusted net income, which is used to compute adjusted return on average assets, adjusted return on average equity and adjusted earnings per share, excludes the impact of certain discrete tax benefits related primarily to the exercise of expiring stock options that lowered our effective tax rate to 19.5% in the third quarter of 2025. The tables below reflect the Company’s adjusted results based on a normalized effective tax rate of 27.0%. Three Months Ended September 30, 2025 Net income – GAAP $ 14,057 Less: tax benefits related to exercise of expiring stock options 1,310 Adjusted net income $ 12,747 Return on average assets – GAAP 2.61 % Adjusted return on average assets 2.37 % Return on average equity – GAAP 20.83 % Adjusted return on average equity 18.89 % Diluted earnings per share – GAAP $ 1.62 Adjusted diluted earnings per share $ 1.47 |