Exhibit 99.3 Third Quarter 2025 Financial Results Presentation October 22, 2025 Quarterly Earnings Report

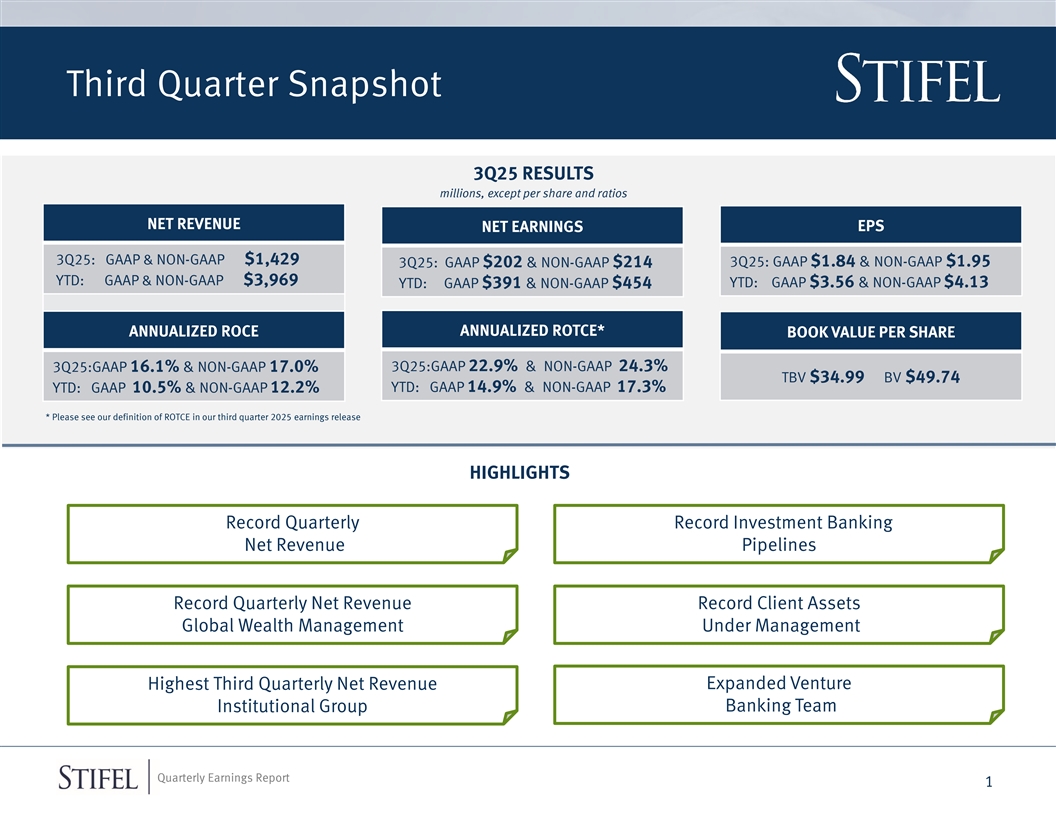

Third Quarter Snapshot 3Q25 RESULTS millions, except per share and ratios NET REVENUE NET EARNINGS EPS 3Q25: GAAP & NON-GAAP $1,429 3Q25: GAAP $1.84 & NON-GAAP $1.95 3Q25: GAAP $202 & NON-GAAP $214 YTD: GAAP & NON-GAAP $3,969 YTD: GAAP $391 & NON-GAAP $454 YTD: GAAP $3.56 & NON-GAAP $4.13 ANNUALIZED ROTCE* ANNUALIZED ROCE BOOK VALUE PER SHARE 3Q25:GAAP 16.1% & NON-GAAP 17.0% 3Q25:GAAP 22.9% & NON-GAAP 24.3% TBV $34.99 BV $49.74 YTD: GAAP 14.9% & NON-GAAP 17.3% YTD: GAAP 10.5% & NON-GAAP 12.2% * Please see our definition of ROTCE in our third quarter 2025 earnings release HIGHLIGHTS Record Quarterly Record Investment Banking Net Revenue Pipelines Record Quarterly Net Revenue Record Client Assets Global Wealth Management Under Management Expanded Venture Highest Third Quarterly Net Revenue Institutional Group Banking Team Quarterly Earnings Report 1

A Long-Term Growth Story (1)(4) (1) Fiscal Year Fiscal Quarter Third Quarter 2025 Results Exceed Fiscal (millions) 2011 3Q25 (2) Net Revenue $1,417 $1,429 Year 2011 Results Global Wealth Management $908 $907 Transactional $581 $203 ■ Total Net Revenue in 3Q25 More Than Full (3) Fee-Based $285 $689 Year 2011 But Mix Has Shifted Institutional Group $507 $500 Investment Banking $179 $317 ■ GWM Revenue Now Primarily Fee & Advisory $75 $179 Balance Sheet Driven Capital Raising $104 $138 Transactional $323 $181 ■ IG Revenue Now Primarily Investment Ratios Banking Driven Comp. Ratio 63.4% 58.0% Non-Comp. Ratio 23.5% 20.8% ■ Expense Ratio Decline as Scale of Business Pre-tax Margin 13.1% 21.2% Increased EPS $1.20 $1.95 Annual Dividend Per Share $0.00 $1.84■ Pre-tax Margin Increased by 810 bps ■ Total Client Assets Increased 360% Client Metrics (millions) ■ Fee-Based Assets Increased 1170% Total Client Assets $119,362 $544,010 Fee-Based Assets $17,282 $219,178 (1) Non-GAAP (2) Includes Other segment (3) Fee-Based includes Asset Management revenue & Net Interest Income from Global Wealth Management (4) Adjusts EPS for 3:2 stock split on 12/17/2020 Quarterly Earnings Report 2

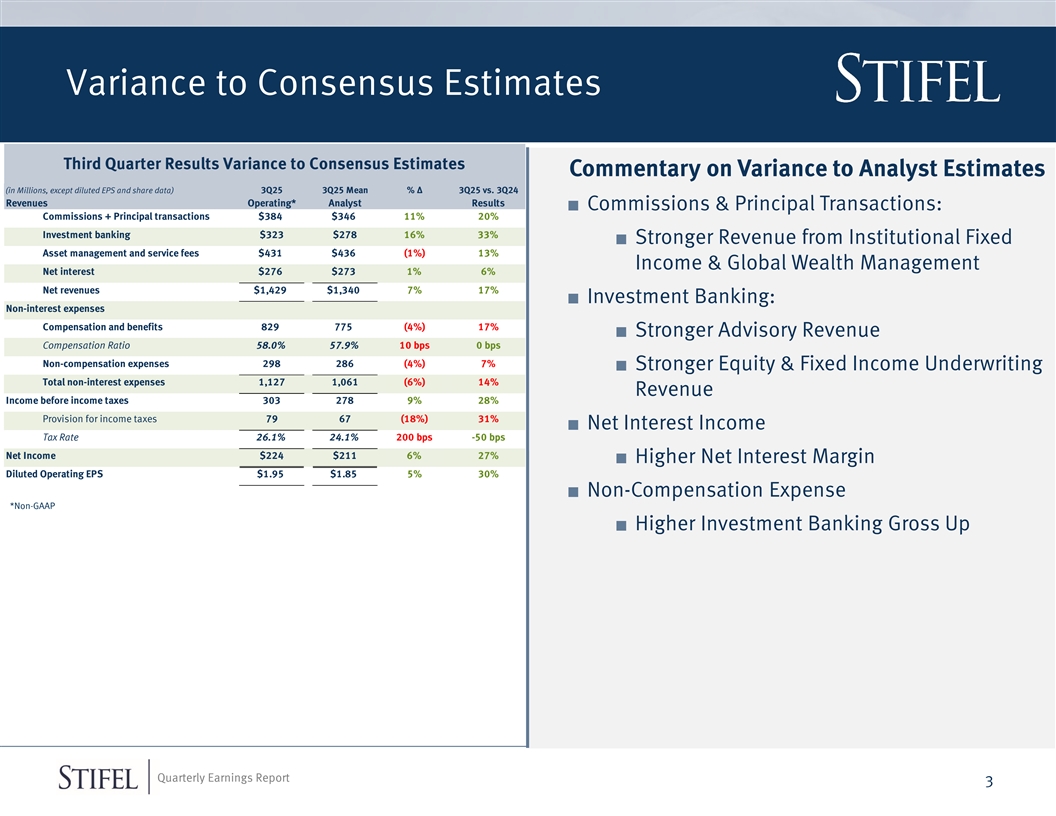

Variance to Consensus Estimates Third Quarter Results Variance to Consensus Estimates Commentary on Variance to Analyst Estimates (in Millions, except diluted EPS and share data) 3Q25 3Q25 Mean % ∆ 3Q25 vs. 3Q24 Revenues Operating* Analyst Results ■ Commissions & Principal Transactions: Commissions + Principal transactions $384 $346 11% 20% Investment banking $323 $278 16% 33% ■ Stronger Revenue from Institutional Fixed Asset management and service fees $431 $436 (1%) 13% Income & Global Wealth Management Net interest $276 $273 1% 6% Net revenues $1,429 $1,340 7% 17% ■ Investment Banking: Non-interest expenses Compensation and benefits 829 775 (4%) 17% ■ Stronger Advisory Revenue Compensation Ratio 58.0% 57.9% 10 bps 0 bps Non-compensation expenses 298 286 (4%) 7% ■ Stronger Equity & Fixed Income Underwriting Total non-interest expenses 1,127 1,061 (6%) 14% Revenue Income before income taxes 303 278 9% 28% Provision for income taxes 79 67 (18%) 31% ■ Net Interest Income Tax Rate 26.1% 24.1% 200 bps -50 bps Net Income $224 $211 6% 27% ■ Higher Net Interest Margin Diluted Operating EPS $1.95 $1.85 5% 30% ■ Non-Compensation Expense *Non-GAAP ■ Higher Investment Banking Gross Up Quarterly Earnings Report 3

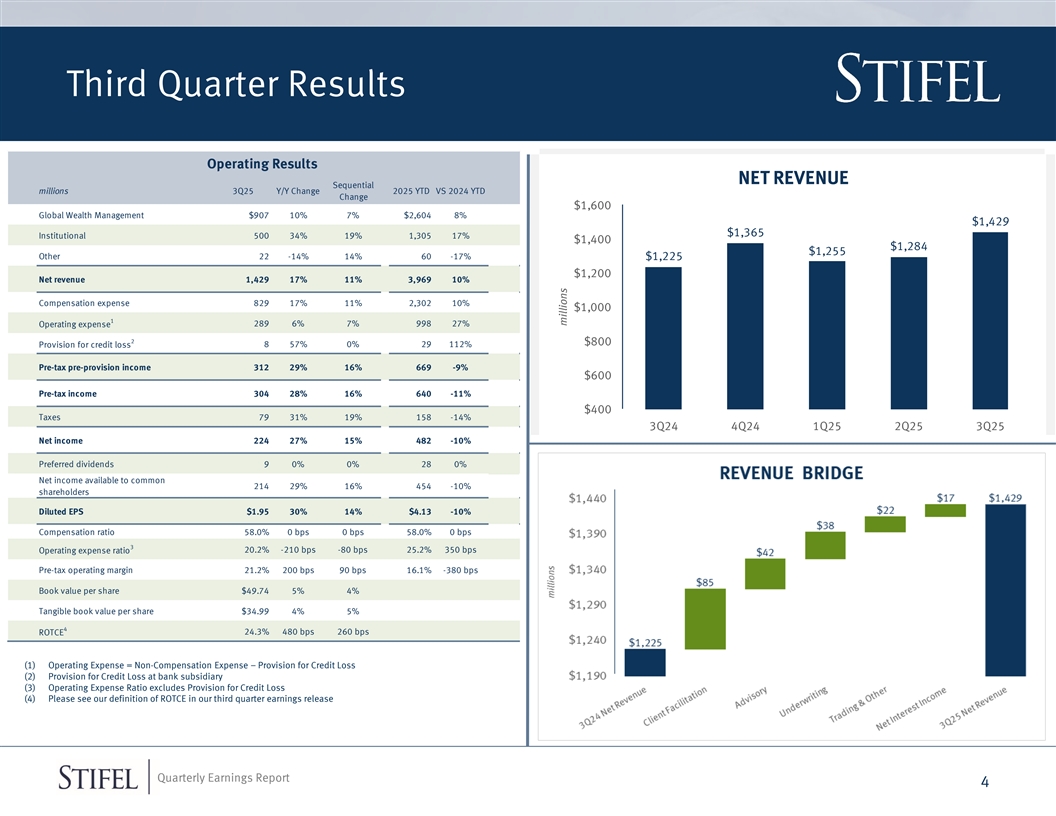

Third Quarter Results Operating Results NET REVENUE Sequential millions 3Q25 Y/Y Change 2025 YTD VS 2024 YTD Change $1,600 Global Wealth Management $907 10% 7% $2,604 8% $1,429 $1,365 Institutional 500 34% 19% 1,305 17% $1,400 $1,284 $1,255 Other 22 -14% 14% 60 -17% $1,225 $1,200 Net revenue 1,429 17% 11% 3,969 10% Compensation expense 829 17% 11% 2,302 10% $1,000 1 289 6% 7% 998 27% Operating expense 2 $800 8 57% 0% 29 112% Provision for credit loss Pre-tax pre-provision income 312 29% 16% 669 -9% $600 Pre-tax income 304 28% 16% 640 -11% $400 Taxes 79 31% 19% 158 -14% 3Q24 4Q24 1Q25 2Q25 3Q25 Net income 224 27% 15% 482 -10% Preferred dividends 9 0% 0% 28 0% Net income available to common 214 29% 16% 454 -10% shareholders Diluted EPS $1.95 30% 14% $4.13 -10% Compensation ratio 58.0% 0 bps 0 bps 58.0% 0 bps 3 Operating expense ratio 20.2% -210 bps -80 bps 25.2% 350 bps Pre-tax operating margin 21.2% 200 bps 90 bps 16.1% -380 bps Book value per share $49.74 5% 4% Tangible book value per share $34.99 4% 5% 4 24.3% 480 bps 260 bps ROTCE (1) Operating Expense = Non-Compensation Expense – Provision for Credit Loss (2) Provision for Credit Loss at bank subsidiary (3) Operating Expense Ratio excludes Provision for Credit Loss (4) Please see our definition of ROTCE in our third quarter earnings release Quarterly Earnings Report 4 millions

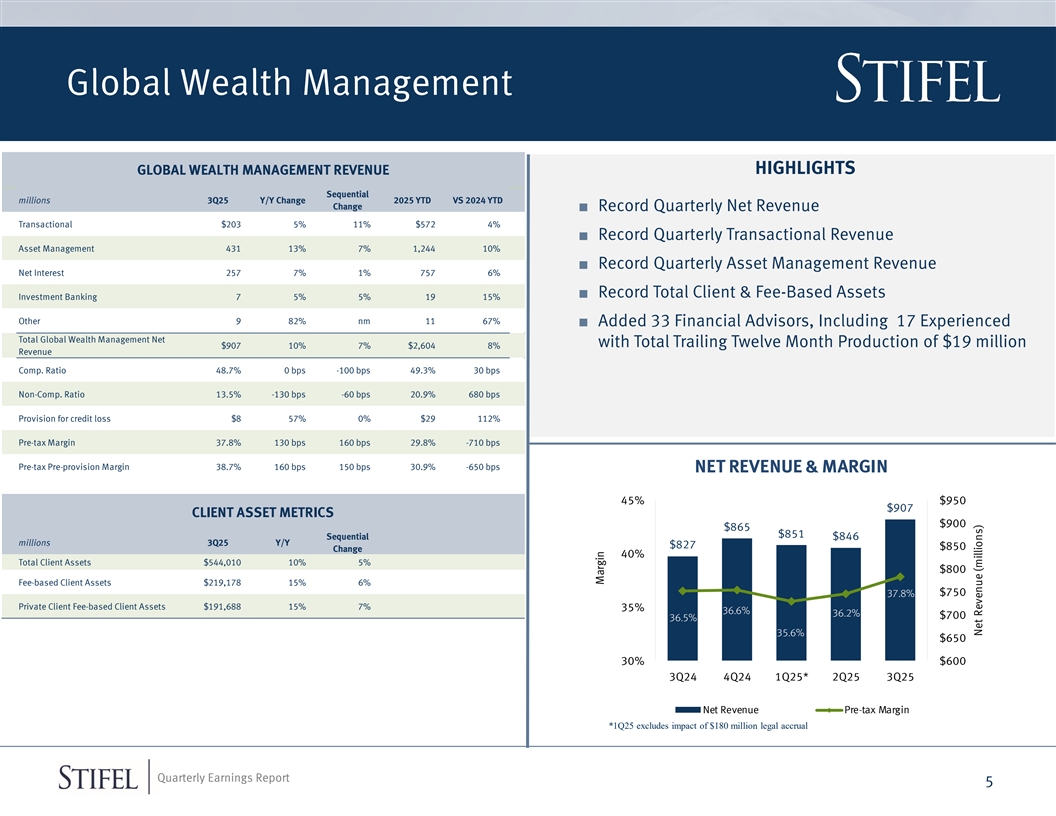

Global Wealth Management GLOBAL WEALTH MANAGEMENT REVENUE HIGHLIGHTS Sequential millions 3Q25 Y/Y Change 2025 YTD VS 2024 YTD Change ■ Record Quarterly Net Revenue Transactional $203 5% 11% $572 4% ■ Record Quarterly Transactional Revenue Asset Management 431 13% 7% 1,244 10% ■ Record Quarterly Asset Management Revenue Net Interest 257 7% 1% 757 6% ■ Record Total Client & Fee-Based Assets Investment Banking 7 5% 5% 19 15% Other 9 82% nm 11 67% ■ Added 33 Financial Advisors, Including 17 Experienced Total Global Wealth Management Net with Total Trailing Twelve Month Production of $19 million $907 10% 7% $2,604 8% Revenue Comp. Ratio 48.7% 0 bps -100 bps 49.3% 30 bps Non-Comp. Ratio 13.5% -130 bps -60 bps 20.9% 680 bps Provision for credit loss $8 57% 0% $29 112% Pre-tax Margin 37.8% 130 bps 160 bps 29.8% -710 bps Pre-tax Pre-provision Margin 38.7% 160 bps 150 bps 30.9% -650 bps NET REVENUE & MARGIN 45% $950 $907 CLIENT ASSET METRICS $900 $865 $851 Sequential $846 millions 3Q25 Y/Y $827 $850 Change 40% Total Client Assets $544,010 10% 5% $800 Fee-based Client Assets $219,178 15% 6% $750 37.8% Private Client Fee-based Client Assets $191,688 15% 7% 35% 36.6% 36.2% $700 36.5% 35.6% $650 30% $600 3Q24 4Q24 1Q25* 2Q25 3Q25 Net Revenue Pre-tax Margin *1Q25 excludes impact of $180 million legal accrual Quarterly Earnings Report 5 Margin Net Revenue (millions)

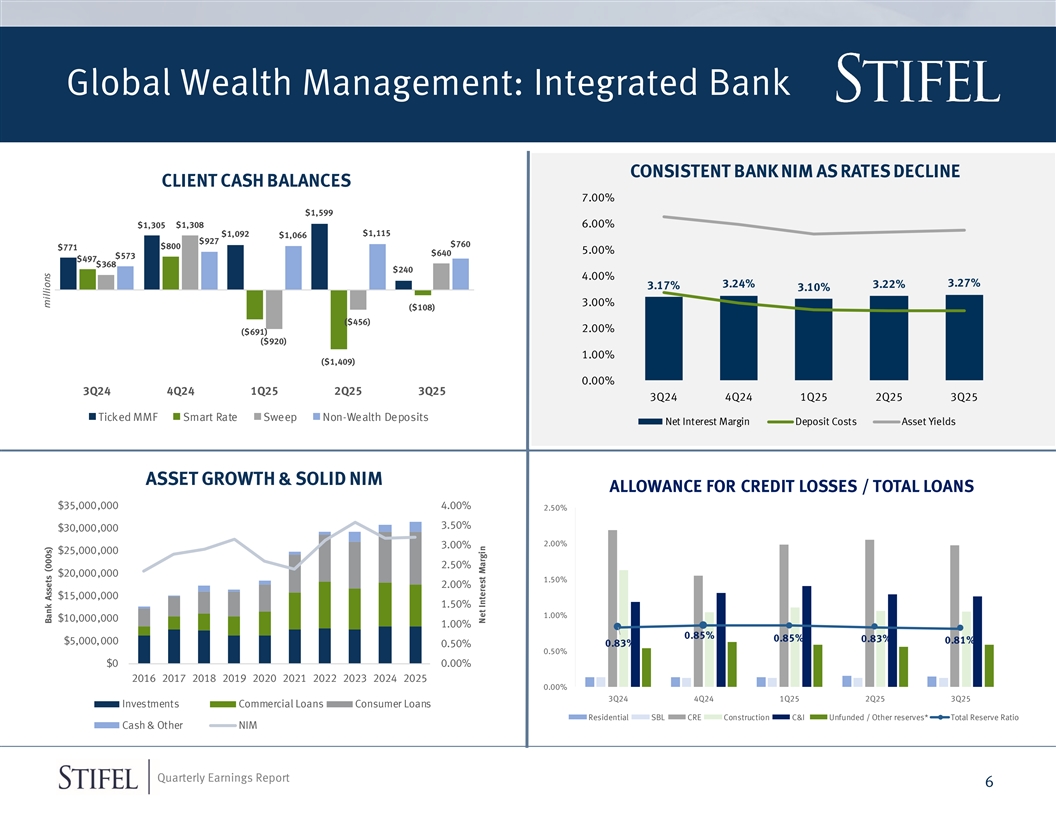

Global Wealth Management: Integrated Bank CONSISTENT BANK NIM AS RATES DECLINE CLIENT CASH BALANCES 7.00% $1,599 $1,305 $1,308 6.00% $1,115 $1,092 $1,066 $927 $760 $800 $771 5.00% $640 $573 $497 $368 $240 4.00% 3.27% 3.24% 3.22% 3.17% 3.10% 3.00% ($108) ($456) 2.00% ($691) ($920) 1.00% ($1,409) 0.00% 3Q24 4Q24 1Q25 2Q25 3Q25 3Q24 4Q24 1Q25 2Q25 3Q25 Ticked MMF Smart Rate Sweep Non-Wealth Deposits Net Interest Margin Deposit Costs Asset Yields ASSET GROWTH & SOLID NIM ALLOWANCE FOR CREDIT LOSSES / TOTAL LOANS $35,000,000 4.00% 2.50% 3.50% $30,000,000 2.00% 3.00% $25,000,000 2.50% $20,000,000 1.50% 2.00% $15,000,000 1.50% 1.00% $10,000,000 1.00% 0.85% 0.85% 0.83% $5,000,000 0.81% 0.83% 0.50% 0.50% $0 0.00% 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 0.00% 3Q24 4Q24 1Q25 2Q25 3Q25 Investments Commercial Loans Consumer Loans Residential SBL CRE Construction C&I Unfunded / Other reserves* Total Reserve Ratio Cash & Other NIM Quarterly Earnings Report 6 millions Bank Assets (000s) Net Interest Margin

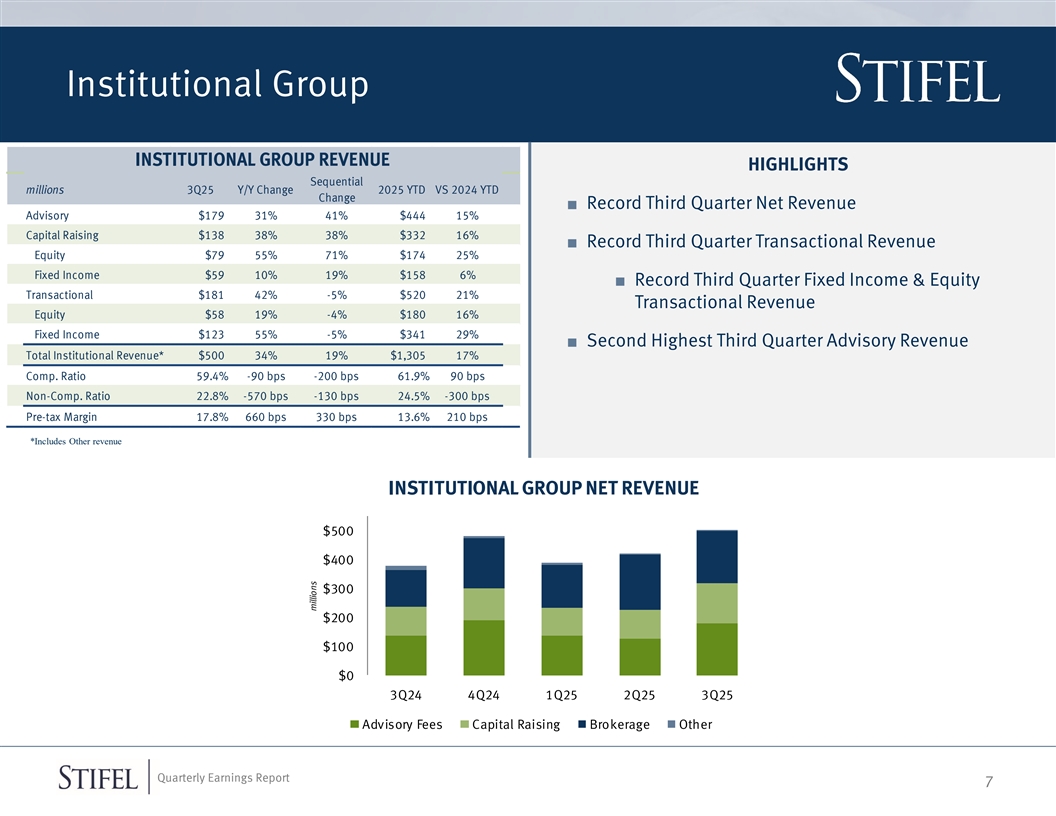

Institutional Group INSTITUTIONAL GROUP REVENUE HIGHLIGHTS Sequential millions 3Q25 Y/Y Change 2025 YTD VS 2024 YTD Change ■ Record Third Quarter Net Revenue Advisory $179 31% 41% $444 15% Capital Raising $138 38% 38% $332 16% ■ Record Third Quarter Transactional Revenue Equity $79 55% 71% $174 25% Fixed Income $59 10% 19% $158 6% ■ Record Third Quarter Fixed Income & Equity Transactional $181 42% -5% $520 21% Transactional Revenue Equity $58 19% -4% $180 16% Fixed Income $123 55% -5% $341 29% ■ Second Highest Third Quarter Advisory Revenue Total Institutional Revenue* $500 34% 19% $1,305 17% Comp. Ratio 59.4% -90 bps -200 bps 61.9% 90 bps Non-Comp. Ratio 22.8% -570 bps -130 bps 24.5% -300 bps Pre-tax Margin 17.8% 660 bps 330 bps 13.6% 210 bps *Includes Other revenue INSTITUTIONAL GROUP NET REVENUE $500 $400 $300 $200 $100 $0 3Q24 4Q24 1Q25 2Q25 3Q25 Advisory Fees Capital Raising Brokerage Other Quarterly Earnings Report 7 millions

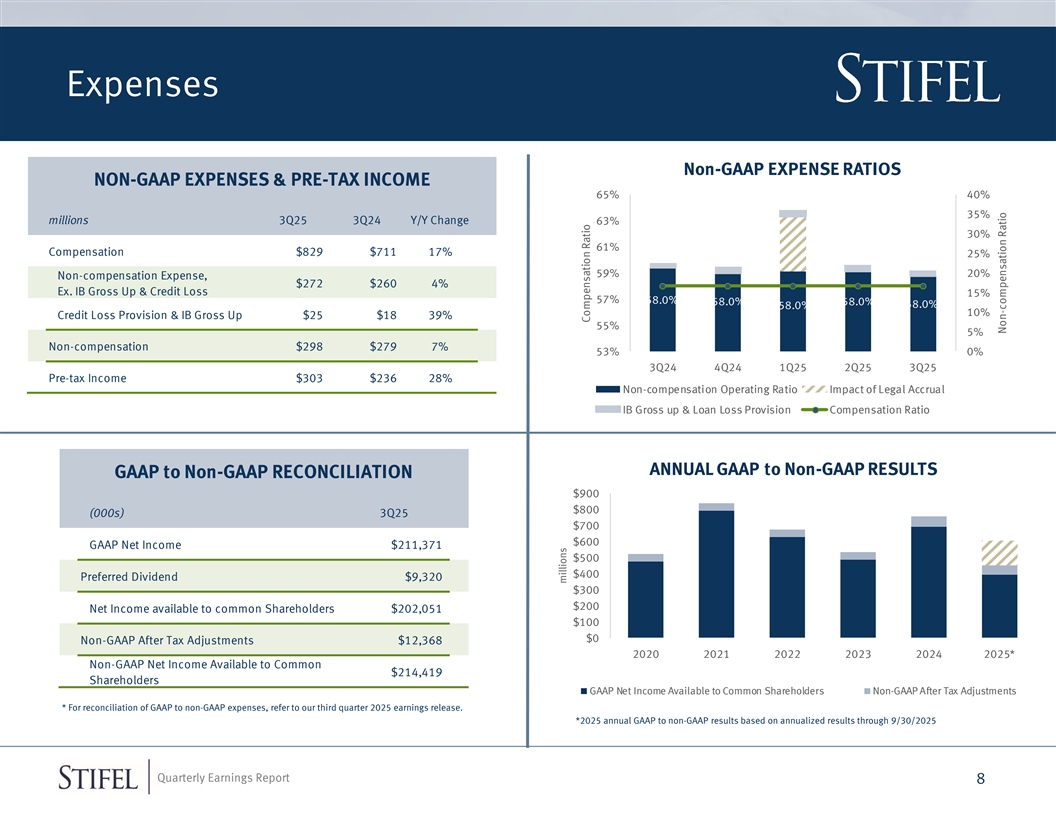

Expenses Non-GAAP EXPENSE RATIOS NON-GAAP EXPENSES & PRE-TAX INCOME 65% 40% 35% millions 3Q25 3Q24 Y/Y Change 63% 30% 61% Compensation $829 $711 17% 25% 59% 20% Non-compensation Expense, $272 $260 4% Ex. IB Gross Up & Credit Loss 15% 57% 58.0% 58.0% 58.0% 58.0% 58.0% 10% Credit Loss Provision & IB Gross Up $25 $18 39% 55% 5% Non-compensation $298 $279 7% 53% 0% 3Q24 4Q24 1Q25 2Q25 3Q25 Pre-tax Income $303 $236 28% Non-compensation Operating Ratio Impact of Legal Accrual IB Gross up & Loan Loss Provision Compensation Ratio ANNUAL GAAP to Non-GAAP RESULTS GAAP to Non-GAAP RECONCILIATION $900 $800 (000s) 3Q25 $700 $600 GAAP Net Income $211,371 $500 $400 Preferred Dividend $9,320 $300 $200 Net Income available to common Shareholders $202,051 $100 $0 Non-GAAP After Tax Adjustments $12,368 2020 2021 2022 2023 2024 2025* Non-GAAP Net Income Available to Common $214,419 Shareholders GAAP Net Income Available to Common Shareholders Non-GAAP After Tax Adjustments * For reconciliation of GAAP to non-GAAP expenses, refer to our third quarter 2025 earnings release. *2025 annual GAAP to non-GAAP results based on annualized results through 9/30/2025 Quarterly Earnings Report 8 millions Compensation Ratio Non-compensation Ratio

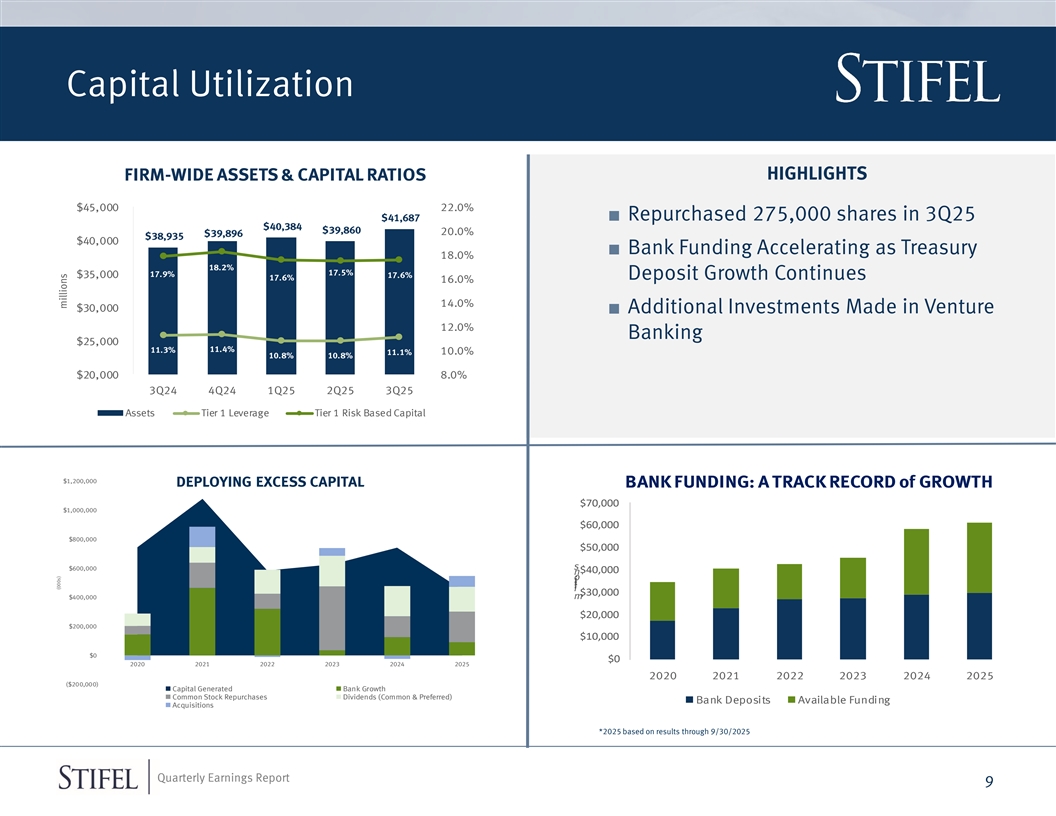

Capital Utilization HIGHLIGHTS FIRM-WIDE ASSETS & CAPITAL RATIOS $45,000 22.0% $41,687 ■ Repurchased 275,000 shares in 3Q25 $40,384 $39,860 20.0% $39,896 $38,935 $40,000 ■ Bank Funding Accelerating as Treasury 18.0% 18.2% 17.5% 17.9% $35,000 17.6% Deposit Growth Continues 17.6% 16.0% 14.0% $30,000 ■ Additional Investments Made in Venture 12.0% Banking $25,000 11.4% 11.3% 10.0% 11.1% 10.8% 10.8% $20,000 8.0% 3Q24 4Q24 1Q25 2Q25 3Q25 Assets Tier 1 Leverage Tier 1 Risk Based Capital $1,200,000 DEPLOYING EXCESS CAPITAL BANK FUNDING: A TRACK RECORD of GROWTH $70,000 $1,000,000 $60,000 $800,000 $50,000 s $600,000 $40,000 n o i l l i $30,000 $400,000 m $20,000 $200,000 $10,000 $0 $0 2020 2021 2022 2023 2024 2025 2020 2021 2022 2023 2024 2025 ($200,000) Capital Generated Bank Growth Common Stock Repurchases Dividends (Common & Preferred) Bank Deposits Available Funding Acquisitions *2025 based on results through 9/30/2025 Quarterly Earnings Report 9 (000s) millions

Concluding Remarks Quarterly Earnings Report

Third Quarter 2025 Financial Results Presentation October 22, 2025 Quarterly Earnings Report

Disclaimer Forward-Looking Statements This presentation may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve significant risks, assumptions, and uncertainties, including statements relating to the market opportunity and future business prospects of Stifel Financial Corp., as well as Stifel, Nicolaus & Company, Incorporated and its subsidiaries (collectively, “SF” or the “Company”). These statements can be identified by the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” and similar expressions. All statements not dealing with historical results are forward-looking and are based on various assumptions. The forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or implied by the statements. For information about the risks and important factors that could affect the Company’s future results, financial condition and liquidity, see “Risk Factors” in Part I of the Company’s Annual Report on Form 10-K for the year ended December 31, 2024. Forward-looking statements speak only as to the date they are made. The Company disclaims any intent or obligation to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made. Use of Non-GAAP Financial Measures The Company prepares its Consolidated Financial Statements using accounting principles generally accepted in the United States (U.S. GAAP). The Company may disclose certain “non-GAAP financial measures” in the course of its earnings releases, earnings conference calls, financial presentations and otherwise. The Securities and Exchange Commission defines a “non-GAAP financial measure” as a numerical measure of historical or future financial performance, financial position, or cash flows that is subject to adjustments that effectively exclude, or include, amounts from the most directly comparable measure calculated and presented in accordance with U.S. GAAP. Non-GAAP financial measures disclosed by the Company are provided as additional information to analysts, investors and other stakeholders in order to provide them with greater transparency about, or an alternative method for assessing the Company’s financial condition or operating results. These measures are not in accordance with, or a substitute for U.S. GAAP, and may be different from or inconsistent with non-GAAP financial measures used by other companies. Whenever the Company refers to a non-GAAP financial measure, it will also define it or present the most directly comparable financial measure calculated and presented in accordance with U.S. GAAP, along with a reconciliation of the differences between the non-GAAP financial measure it references and such comparable U.S. GAAP financial measure. Quarterly Earnings Report 12