Exhibit 99.1

HITEK GLOBAL INC. INC. AND SUBSIDIARIES

INDEX TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

F-1

HITEK GLOBAL INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Expressed in U.S. Dollars, except for the number of shares)

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | $ | ||||||

| Short-term investments | ||||||||

| Accounts receivable, net | ||||||||

| Advances to suppliers, net | ||||||||

| Inventories, net | ||||||||

| Loans receivable | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total current assets | ||||||||

| Non-current assets | ||||||||

| Non-current accounts receivable | ||||||||

| Non-current loan receivable | ||||||||

| Property, equipment and software, net | ||||||||

| Total non-current assets | ||||||||

| Total Assets | $ | $ | ||||||

| Liabilities and Shareholders’ Equity | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | $ | ||||||

| Advances from customers | ||||||||

| Loan payable – related party | - | |||||||

| Deferred revenue | ||||||||

| Taxes payable | ||||||||

| Due to related party | - | |||||||

| Accrued expenses and other current liabilities | ||||||||

| Total current liabilities | ||||||||

| Non-current Liabilities | ||||||||

| Loan payable – related party | ||||||||

| Deferred income tax liabilities, net | ||||||||

| Total non-current liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and Contingencies | ||||||||

| Shareholders’ Equity | ||||||||

| Class A Ordinary Shares, US$ | ||||||||

| Class B Ordinary Shares, US$ | ||||||||

| Additional paid-in capital | ||||||||

| Statutory reserve | ||||||||

| Retained earnings | ||||||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Total Shareholders’ Equity | ||||||||

| Total Liabilities and Shareholders’ Equity | $ | $ | ||||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

F-2

HITEK GLOBAL INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Expressed in U.S. Dollars, except for the number of shares)

| Six Months Ended June 30, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Revenues | $ | $ | ||||||

| Cost of revenues | ( | ) | ( | ) | ||||

| Gross profit | ||||||||

| Operating expenses: | ||||||||

| General and administrative | ||||||||

| Selling | ||||||||

| Total operating expenses | ||||||||

| Operating loss | ( | ) | ( | ) | ||||

| Other income (expense) | ||||||||

| Government subsidies | - | |||||||

| Net investment gain | ||||||||

| Interest income | ||||||||

| Interest expense | ( | ) | ( | ) | ||||

| Other expense, net | ( | ) | ( | ) | ||||

| Total other income, net | ||||||||

| (Loss) income before provision for income taxes | ( | ) | ||||||

| Income tax (benefit) expense | ( | ) | ||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Comprehensive loss/income | ||||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Foreign currency translation gain (loss) | ( | ) | ||||||

| Comprehensive loss | $ | ( | ) | $ | ( | ) | ||

| (Loss) earnings per ordinary share | ||||||||

| Basic and diluted | $ | ( | ) | $ | ||||

| Weighted average number of ordinary shares outstanding | ||||||||

| Basic and diluted | ||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

F-3

HITEK GLOBAL INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

Six Months Ended June 30, 2025 and 2024

(Expressed in U.S. Dollars, except for the number of shares)

| Ordinary shares | Additional paid-in | Statutory | Retained | Accumulated other comprehensive | Total shareholders’ | |||||||||||||||||||||||

| Shares | Amount | capital | reserves | earnings | loss | equity | ||||||||||||||||||||||

| Balance as of December 31, 2023 | $ | $ | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||

| Foreign currency translation adjustment | - | ( | ) | ( | ) | |||||||||||||||||||||||

| Net income | - | |||||||||||||||||||||||||||

| Balance as of June 30, 2024 (unaudited) | $ | $ | $ | $ | $ | ( | ) | $ | ||||||||||||||||||||

| Class A Ordinary Shares | Class B Ordinary Shares | Additional | Accumulated other | Total | ||||||||||||||||||||||||||||||||

| Number of shares | Amount | Number of shares | Amount | paid-in capital | Statutory reserve | Retained earnings | comprehensive loss | Shareholders’ Equity | ||||||||||||||||||||||||||||

| Balance as of December 31, 2024 | $ | $ | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | ||||||||||||||||||||||||||||||||||

| Net loss | - | - | ( | ) | ( | ) | ||||||||||||||||||||||||||||||

| Balance as of June 30, 2025 (unaudited) | $ | $ | $ | $ | $ | $ | ( | ) | $ | |||||||||||||||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

F-4

HITEK GLOBAL INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in U.S. Dollars)

| Six Months Ended June 30, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash flows from operating activities: | ||||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | ||||||||

| Accrued interest income from loans, net | ( | ) | ( | ) | ||||

| Net investment gain | ( | ) | ( | ) | ||||

| Provision for expected credit losses of receivables and advances to suppliers | ||||||||

| Provision for obsolete inventories | ||||||||

| Deferred income tax | ( | ) | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Short-term investments - trading securities | ||||||||

| Accounts receivable | ||||||||

| Advance to suppliers | ( | ) | ( | ) | ||||

| Inventories | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Accounts payable | ( | ) | ||||||

| Advance from customers | ( | ) | ||||||

| Deferred revenue | ( | ) | ( | ) | ||||

| Tax payable | ||||||||

| Due to related parties | ||||||||

| Accrued expenses and other current liabilities | ( | ) | ( | ) | ||||

| Net cash provided by operating activities | ||||||||

| Cash flows from investing activities: | ||||||||

| Payment for software development | ( | ) | ||||||

| Loans to third parties | ( | ) | ( | ) | ||||

| Loans repayment by third-parties | ||||||||

| Purchases of property and equipment | ( | ) | ||||||

| Purchases of held-to-maturity investments | ( | ) | ( | ) | ||||

| Redemption of held-to-maturity investments | ||||||||

| Deposit for acquisition | ( | ) | ||||||

| Refund of deposit for acquisition | ||||||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| Cash flows from financing activities: | ||||||||

| Proceeds from private placement | ||||||||

| Net cash provided by financing activities | ||||||||

| Effect of exchange rate changes on cash | ( | ) | ||||||

| Net increase (decrease) in cash | ( | ) | ||||||

| Cash at the beginning of period | ||||||||

| Cash at the end of period | $ | $ | ||||||

| Supplemental disclosures of cash flow information: | ||||||||

| Cash paid for income taxes | $ | $ | ||||||

| Cash paid for interest | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

F-5

HITEK GLOBAL INC. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

June 30, 2025 and 2024

NOTE 1 – NATURE OF OPERATIONS

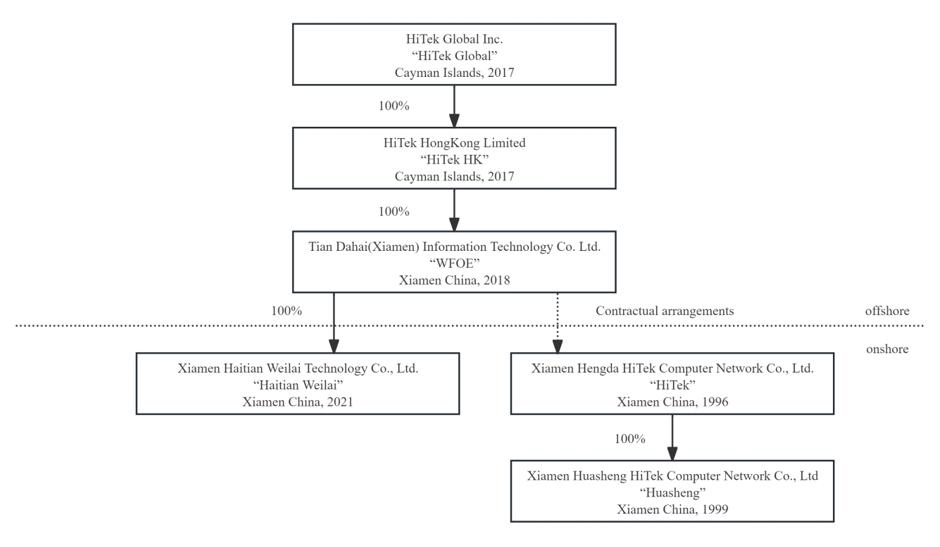

HiTek Global Inc. (“HiTek Global”) was incorporated under the laws of the Cayman Islands on November 3, 2017 in anticipation of an initial public offering. HiTek Global, through its variable interest entity (“VIE”) and VIE’s subsidiaries (collectively, the “Company”) provides hardware sales, software sales, information technology (“IT”) maintenance services and tax devices and services in the People’s Republic of China (the “PRC”).

The Company’s corporate structure as of June 30, 2025 is as follows:

NOTE 2 – BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Financial Information

The condensed consolidated financial statements (“CFS”) as of June 30, 2025 and for the six months ended June 30, 2025 and 2024 are unaudited. The accompanying unaudited condensed CFS were prepared by the Company in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial reporting. Operating results as presented are not necessarily indicative of the results expected for a full year. Certain prior year financial information was reclassified to be conform to current year presentation.

Principles of Consolidation

The accompanying unaudited condensed CFS include financial information for the Company and its wholly-owned subsidiaries and those VIEs where the Company is the primary beneficiary. In preparing the unaudited condensed CFS, all significant inter-company accounts and transactions were eliminated.

F-6

VIE Agreements with HiTek

Due to PRC legal restrictions of foreign ownership in certain sectors, neither we nor our subsidiaries own any equity interest in HiTek. Instead, WFOE, HiTek and HiTek’s shareholders entered into a series of contractual arrangements (“VIE Agreements”) on March 31, 2018, which have not been tested in a court of law. The VIE Agreements by and among WFOE, HiTek, and HiTek’s shareholders include (i) power of attorney agreements and equity interest pledge agreement, which provide WFOE effective control over HiTek; (ii) an exclusive technical consulting and service agreement which allows WFOE to receive substantially all of the economic benefits from HiTek; and (iii) certain exclusive equity interest purchase agreements which provide WFOE an exclusive option to purchase all or part of the equity interests in and/or assets of HiTek when and to the extent permitted by PRC laws. Accordingly, the Company is considered the primary beneficiary of VIE for accounting purpose and has consolidated the VIE and the VIE’s subsidiaries’ assets, liabilities, results of operations, and cash flows in the accompanying CFS.

Each of the VIE Agreements is described below:

Exclusive Technical Consulting and Service Agreement

Pursuant to the Exclusive Technical Consulting

and Service Agreement between HiTek and WFOE, WFOE provides HiTek technical support, consulting services and other management services

for its day-to-day business operations and management, on an exclusive basis. The Exclusive Technical Consulting and Service Agreement

came into effect as of March 31, 2018. For services rendered to HiTek by WFOE under this agreement, WFOE is entitled to collect a fee

that shall be paid per quarter of

Equity Interest Pledge Agreement

WFOE, HiTek and HiTek shareholders entered into an Equity Interest Pledge Agreement, pursuant to which HiTek shareholders pledged all of their equity interests in HiTek to WFOE to guarantee the performance of HiTek’s obligations under the Exclusive Technical Consulting and Service Agreement as described above. The Equity Interest Pledge Agreement came into effect as of March 31, 2018. During the term of the pledge, WFOE is entitled to receive any dividends declared on the pledged equity interests of HiTek. The Equity Interest Pledge Agreement ends when all contractual obligations under the Exclusive Technical Consulting and Service Agreement have been fully performed.

Exclusive Equity Interests Purchase Agreement

Under the Exclusive Equity Interests Purchase Agreement, the HiTek Shareholders granted WFOE (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, part or all of their equity interests in HiTek. The option price is equal to the capital paid in by the HiTek Shareholders subject to any appraisal or restrictions required by applicable PRC laws and regulations. The Exclusive Equity Interests Purchase Agreement remains effective for a term of ten years and may be renewed at WFOE’s election.

Power of Attorney

Each shareholder of the HiTek executed an irrevocable power of attorney in favor of WFOE. Pursuant to this power of attorney, WFOE has full power and authority to exercise all of such shareholders’ rights with respect to their equity interest in the VIE Companies, including HiTek, Huasheng and Huoerguosi. The power of attorney will remain in force for so long as the shareholder remains a shareholder of HiTek.

During the six months ended June 30, 2025 and

2024, there were no transactions in HiTek Global Inc. and HiTek HK besides minimal capital transactions, professional fee payments and

interest income. As of June 30, 2025, the VIEs accounted for

F-7

Risks in relation to the VIE structure

It is possible the Company’s operations and businesses through its VIE could be found by PRC authorities to violate PRC law and regulations prohibiting or restricting foreign ownership of companies that engage in such operations and businesses. While the Company’s management considers the possibility of such a finding by PRC regulatory authorities under current law and regulations remote, on January 19, 2015, the Ministry of Commerce of the PRC, or (the “MOFCOM”) released on its Website for public comment a proposed PRC law (the “Draft FIE Law”) that appears to include VIEs within the scope of entities that could be considered foreign invested enterprises (or “FIEs”) that would be subject to restrictions under existing PRC law on foreign investment in certain categories of industry. Specifically, the Draft FIE Law introduces the concept of “actual control” for determining whether an entity is considered to be an FIE. In addition to control through direct or indirect ownership or equity, the Draft FIE Law includes control through contractual arrangements within the definition of “actual control.” If the Draft FIE Law is passed by the People’s Congress of the PRC and goes into effect in its current form, these provisions regarding control through contractual arrangements could be construed to reach the Company’s VIE arrangements, and as a result the Company’s VIE could become subject to the current restrictions on foreign investment in certain categories of industry. If a finding were made by PRC authorities, under existing law and regulations or under the Draft FIE Law if it becomes effective, about the Company’s operation of certain of its operations and businesses through its VIEs, regulatory authorities with jurisdiction over the licensing and operation of such operations and businesses would have broad discretion in dealing with such a violation, including levying fines, confiscating the Company’s income, revoking the business or operating licenses of the affected businesses, requiring the Company to restructure its ownership structure or operations, or requiring the Company to discontinue all or any portion of its operations. Any of these actions could cause significant disruption to the Company’s business operations, and have a severe adverse impact on the Company’s cash flows, financial position and operating performance.

In addition, it is possible the contracts among WFOE, HiTek and HiTek’s shareholders would not be enforceable in China if PRC government authorities or courts found that such contracts contravene PRC laws and regulations or are otherwise not enforceable for public policy reasons. If the Company was unable to enforce these contractual arrangements, the Company would not be able to exert effective control over the VIEs. Consequently, the VIEs’ results of operations, assets and liabilities would not be included in the Company’s CFS. If such were the case, the Company’s cash flows, financial position, and operating performance would be materially adversely affected. The Company’s contractual arrangements WFOE, HiTek and HiTek’s shareholders are approved and in place. Management believes such contracts are enforceable, and considers the possibility remote that PRC regulatory authorities with jurisdiction over the Company’s operations and contractual relationships would find the contracts to be unenforceable.

The Company’s operations and businesses rely on the operations and businesses of its VIEs, which hold certain recognized revenue-producing assets. The VIEs also have an assembled workforce, focused primarily on R&D, whose costs are expensed as incurred. The Company’s operations and businesses may be adversely impacted if the Company loses the ability to use and enjoy assets held by its VIE.

VIEs are generally entities that lack sufficient equity to finance their activities without additional financial support from other parties or whose equity holders lack adequate decision-making ability. All VIEs and their subsidiaries of the Company must be evaluated to determine the primary beneficiary of the risks and rewards of the VIE. The primary beneficiary is required to consolidate the VIE for financial reporting purposes.

Summary information regarding consolidated VIEs and their subsidiaries is as follows.

| As of June 30, 2025 | As of December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| Total current assets | $ | $ | ||||||

| Total non-current assets | ||||||||

| Total Assets | $ | $ | ||||||

| Total Liabilities | $ | $ | ||||||

| Six Months Ended June 30, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Revenues | $ | $ | ||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Six Months Ended June 30, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Net cash provided by operating activities | $ | $ | ||||||

| Net cash used in investing activities | $ | ( | ) | $ | ( | ) | ||

F-8

Use of Estimates and Assumptions

The preparation of the unaudited condensed CFS in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the unaudited condensed CFS and the reported amounts of revenues and expenses during the reporting period.

Significant accounting estimates reflected in the Company’s unaudited condensed CFS include allowance for doubtful accounts, inventory obsolescence, deferred taxes, and the useful lives of property and equipment. Since the use of estimates is an integral component of the financial reporting process, actual results could differ from those estimates.

Fair Values of Financial Instruments

The U.S. GAAP regarding fair value (“FV”) of financial instruments and related FV measurements define FV, establish a three-level valuation hierarchy that requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring FV.

The three levels of inputs are defined as follows:

| ● | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets |

| ● | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liabilities, either directly or indirectly, for substantially the full term of the financial instrument. |

| ● | Level 3 inputs to the valuation methodology are unobservable. |

ASC 825-10 “Financial Instruments”, allows entities to measure certain financial assets and liabilities at FV (FV option). The FV option may be elected on an instrument-by-instrument basis and is irrevocable, unless a new election date occurs. If the FV option is elected for an instrument, unrealized gains and losses for that instrument are reported in earnings at each subsequent reporting date. The Company did not elect to apply the FV option to any outstanding instruments.

The carrying amounts in the consolidated balance sheets for cash, accounts receivable, accounts receivable – related party, advances to suppliers, deferred offering costs, prepaid expenses and other, accounts payable and accrued liabilities, income taxes payable, VAT and other taxes payable, and due to related parties approximate their FV based on the short-term maturity of these instruments.

The Company’s investments measured at FV on a recurring basis consist of trading securities and held-to-maturity debt securities. The valuation for the Level 1 position is based on quoted prices in active markets. For detailed information, please see “NOTE 3 – INVESTMENTS.”

F-9

(Loss) Earnings Per Share (“EPS”)

Basic EPS is computed by dividing net income by the weighted-average number of ordinary shares outstanding during the period. Diluted EPS is computed by dividing net (loss) income by the weighted-average number of ordinary shares and dilutive potential ordinary shares outstanding during the period.

For the six months ended June 30, 2025 and 2024, there were no other contracts to issue options, warrants or conversion rights, which would have a dilutive effect on EPS.

Cash

Cash consists of cash on hand and in banks. The Company considers all highly liquid investments with an original maturity of three months or less when purchased to be cash equivalents. The Company maintains cash with financial institutions in the PRC. As of June 30, 2025 and December 31, 2024 (audited), cash balances held in PRC banks are uninsured. The Company has not experienced any losses in bank accounts during the six months ended June 30, 2025 and 2024.

Concentrations of Credit Risk

Currently, all of the Company’s operations are in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political, economic, and legal environment in the PRC, and by the state of the PRC’s economy. The Company’s operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in the United States of America. The Company’s results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Financial instruments which potentially subject the Company to concentrations of credit risk consist principally of cash, short-term investments, trade accounts receivable, and accounts receivable from related parties and advances to suppliers. A portion of the Company’s sales are credit sales which are to the customers whose ability to pay is dependent upon the industry economics in these areas; however, concentrations of credit risk with respect to trade accounts receivable is limited due to generally short payment terms. The Company also performs ongoing credit evaluations of its customers to help further reduce credit risk.

Investments

Short-term investments consist of trading stock and debt securities, which include trading securities and held-to-maturity debt securities issued by commercial banks with maturity within one year. Considering the Company’s short-term investments are liquid in nature, changes in the FV and related transactions of short-term investments are presented as operating activities in the Company’s consolidated statements of cash flows. Long-term investments include mutual funds and wealth management products with maturity over one year. The Company accounts for investments in accordance with FASB ASC Topic 320 “Investments — Debt and Equity Securities.” Dividend and interest income, including amortization of the premium and discount arising at acquisition, for all categories of investments in securities is included in unaudited condensed Consolidated Statements of Operations. Net realized and unrealized holding gains and losses for investments are included in unaudited condensed Consolidated Statements of Operations.

If a security is acquired with the intent of selling it within days, it is classified as a trading security. The Company classifies investments in trading stock and mutual funds as trading securities. Unrealized holding gains and losses for trading securities are included in the statements of operations and comprehensive loss.

If the Company has intent and ability to hold to maturity, the security is classified as a held-to-maturity security. The Company classifies investments in wealth management products as held-to-maturity securities as it intends to hold these investments until maturity. The investments in wealth management products are valued at carrying value, which approximates the amortized cost. For individual securities classified as held-to-maturity securities, the Company evaluates whether a decline in FV below the amortized cost basis is other-than-temporary, in accordance with ASC 320. Other-than-temporary impairment loss is recognized in earnings equal to the excess of the debt security’s amortized cost basis over its FV at the balance sheet date of the reporting period for which the assessment is made.

F-10

Expected Credit Losses

The Company maintains an allowance for credit losses in accordance with ASC 326 and records the allowance for credit losses as an offset to assets such as accounts receivable, etc., and the estimated credit losses charged to the allowance are classified as general and administrative expenses in the consolidated statements of operations and comprehensive income loss. The Company assesses collectability by reviewing receivables on a collective basis where similar characteristics exist, primarily based on the size and nature of specific customers’ receivables. In determining the amount of the allowance for credit losses, the Company considers historical collectability based on past due status, the age of the receivable balances, credit quality of the Company’s customers based on ongoing credit evaluations, current economic conditions, reasonable and supportable forecasts of future economic conditions, and other factors that may affect the Company’s ability to collect from customers. Bad debts are written off as incurred.

Advances to Suppliers

Advances to suppliers are amounts prepaid to suppliers for purchases of inventories and outsourced software services. In evaluating the recoverability of such advances, the Company mainly considers the age of the balance and the ability of the suppliers to perform the related obligations.

Inventories

Inventories are stated at the lower of cost (weighted average basis) or net realizable value. The methods of determining inventory costs are used consistently from year to year. Allowance for inventory obsolescence is provided when the market value of certain inventory items is lower than the cost.

Property, Equipment and Software

Property, equipment and software are carried at cost and depreciated on a straight-line basis over their estimated useful lives of the assets. The cost of repairs and maintenance is expensed as incurred; major replacements and improvements are capitalized. When assets are retired or disposed of, the cost and accumulated depreciation and amortization are removed from the accounts, and any resulting gains or losses are included in the statement of operations in the year of disposition. The Company examines the possibility of decreases in the value of property, equipment and software, when events or changes in circumstances reflect the fact that their recorded value may not be recoverable.

Estimated useful lives are as follows, taking into account the assets’ estimated residual value:

| Classification | Estimated useful lives | |

| Furniture and office equipment | ||

| Computer equipment | ||

| Transportation equipment | ||

| Buildings and improvements | ||

| Software |

Impairment of Long-lived Assets

In accordance with ASC Topic 360, the Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of the assets may not be fully recoverable. The Company recognizes an impairment loss when the sum of expected undiscounted future cash flows is less than the carrying amount of the asset. The amount of impairment is measured as the difference between the asset’s estimated FV and its book value. Based on management’s impairment analyses, the Company did not record any impairment charge during the six months ended June 30, 2025 and 2024.

F-11

Revenue Recognition

The Company follows ASU 2014-09, Topic 606, “Revenue from Contracts with Customers” and its related amendments (collectively referred to as “ASC 606”) for its revenue recognition accounting policy that depicts the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Company expects to be entitled in exchange for those goods or services. In accordance with ASC 606, revenue is recognized when all of the following five steps are met: (i) identify the contract(s) with the customer; (ii) identify the performance obligations in the contract; (iii) determine the transaction price; (iv) allocate the transaction price to the performance obligations; (v) recognize revenue when (or as) each performance obligation is satisfied.

The Company generates revenues primarily from three sources: (1) hardware sales, (2) software sales, and (3) tax devices and services. The Company recognizes revenue when performance obligations under the terms of a contract with its customers are satisfied. This occurs when the control of the goods and services have been transferred to the customer.

Hardware sales

Hardware revenues are primarily from the sale of computer and network hardware to end users. The products include computers, printers, internet cables, certain internet servers, cameras and monitors. Sales of hardware have a single performance obligation. The Company recognizes revenue when ownership is transferred to end customers. The Company’s revenue from sales of hardware is reported on a gross basis since the Company is primarily obligated in the transaction, bears inventory and credit risk and has discretion to establish prices.

Software sales

HiTek also makes software sales and focuses on perpetual license sales for a self-developed software Communication Interface System (“CIS”). CIS is based on LINUX, which is a general embedded interface system used by petrochemical and coal companies. The system is used to communicate the RCTX-X module, collect the work diagram, the electricity diagram, the pressure temperature and other measures, and can extract the data and import it to the software of the windows platform to display analysis.

Performance Obligations - Software contracts with customers include multiple performance obligations such as sale of software license, installation of software, operation training service and warranty. The installation and operation training are essential to the functionality of the software which are provided to the clients prior to the acceptance of the software. The Company provides a-year warranty which mainly is for telephone supports. The Company estimates that costs associated with warranty are de minimis to the overall contract. Therefore, the Company does not allocate transaction price. The Company recognizes revenue from software sales when the software is accepted by the customer.

Tax Devices and Services

Before January 21, 2021, all VAT general taxpayer businesses in China were required to purchase the Anti-Counterfeiting Tax Control System (“ACTCS” or Golden Tax Disk or GTD) tax devices to issue the VAT Invoice and for quarterly VAT filing. HiTek is authorized to carry out the implementation of ACTCS specialty hardware retailing. The price of GTD and related supporting services is determined by the National Development and Reform Commission. From January 21, 2021, new taxpayers can receive electronic tax control Ukey for free from the tax authority. HiTek could provide supporting services to the new taxpayers. From 2023, Xiamen Taxation Bureau implemented the use of electronic invoices to replace the traditional tax control system. Enterprises can use a free electronic invoice platform provided by the tax bureau, which has had a significant impact on the Company’s business. Since June, 2024, the Company cooperated with a third party to popularize an electronic tax control platform to replace electronic invoice platform provided by the tax bureau.

Performance Obligations - Tax devices and services contracts with customers include multiple performance obligations such as delivery of products, installation and after-sales supporting services, tax control system risk investigation service, and tax invoicing management service, such as training service on issuing electronic invoice, complete tax declaration automatically and back up data online.

Revenue from the sales of GTD devices is recognized when ownership is transferred to end customers. The Company provides after-sales supporting services for tax device and tax invoicing management service, charging the service fee on an annual basis because the service period is usually one year. Revenue from its service is recognized as the services are performed and amounts are earned, using the straight-line method over the term of the related services agreement. The Company also charges a one-time service charge for each investigation request. Revenue from tax control system risk investigation service is recognized when the services are performed. Revenue is recognized based on each performance obligation’s standalone selling price that is sold separately and charged to customers at contract inception.

F-12

The Company’s revenue is reported on a gross basis since the Company is primarily obligated in the transaction, is subject to inventory and credit risk. The revenue is as follows:

| Six Months Ended June 30, | ||||||||

| 2025 | 2024 | |||||||

| Hardware | $ | $ | ||||||

| CIS Software | ||||||||

| Tax devices and service | ||||||||

| Total Revenues | $ | $ | ||||||

Contract balances

Prepayments from customers prior to the services being performed are recorded as deferred revenue. Deferred revenue consists of annual service fees for GTD and tax invoicing management service. The Company recognizes the service fees as revenue on a straight-line basis in accordance with the service periods.

Deferred Revenue

Deferred revenue consists of the annual service

fees for GTD received from customers for which the services have not yet been performed. The Company recognizes the service amount as

revenue on a straight-line basis in accordance with the service periods. For the six months ended June 30, 2025 and 2024, the Company

recognized revenue of $

Cost of Revenues

Cost of revenues is comprised of (i) the direct cost of our hardware products purchased from third parties; (ii) logistics-related costs, which include product packaging and freight-in charges; (iii) third-party royalties for the GTD; and (iv) compensation for employees who handle the products and other costs necessary to provide the services to our customers.

Selling Expenses

Selling expenses consists of shipping and handling costs for products sold and advertising and marketing expenses for promotion of our products. The Company generally expenses sales commissions as incurred because the amortization period would have been one year or less.

General and Administrative Expenses

General and administrative (“G&A”) expenses consist of salary and welfare for our general administrative and management staff, facilities costs, depreciation and amortization, professional fees, accounting fees, meals and entertainment, utilities, expenses for public offering, and other miscellaneous expenses incurred in connection with general operations. All depreciation and amortization was recorded in G&A expenses because fixed assets are mainly for sales and administrative purposes.

F-13

Government Subsidies

Subsidies are given by the government to mainly support the Company for the increase in production and social insurance compensation for rural laborers. Subsidies are recognized as government subsidies income in the consolidated statements of operations when received.

Income Taxes

The Company is governed by the Income Tax Law of the PRC. The Company accounts for income taxes using the asset/liability method prescribed by ASC 740, “Accounting for Income Taxes.” Under this method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and tax bases of assets and liabilities using enacted tax rates that will be in effect in the period in which the differences are expected to reverse. The Company records a valuation allowance to offset deferred tax assets if, based on the weight of available evidence, it is more-likely-than-not that some portion, or all, of the deferred tax assets will not be realized. The effect on deferred taxes of a change in tax rates is recognized as income or loss in the period that includes the enactment date.

The Company applies ASC 740-10-50, “Accounting for Uncertainty in Income Taxes,” which provides clarification related to the process associated with accounting for uncertain tax positions recognized in the Company’s CFS. Audit periods remain open for review until the statute of limitations has passed. The completion of review or the expiration of the statute of limitations for a given audit period could result in an adjustment to the Company’s liability for income taxes. Any such adjustment could be material to the Company’s results of operations for any given quarterly or annual period based, in part, upon the results of operations for the given period.

Value Added Taxes (“VAT”)

VAT is reported as a deduction of revenue when incurred. Entities that are VAT general taxpayers are allowed to offset qualified input VAT paid to suppliers against their output VAT liabilities. Net VAT balance between input VAT and output VAT is recorded in taxes payable.

Foreign Currency Translation

The functional currency of the Company’s operations in the PRC is the Chinese Yuan or Renminbi (“RMB”). The CFS are translated to U.S. dollars using the period end rates of exchange for assets and liabilities, equity is translated at historical exchange rates, and average rates of exchange (for the period) are used for revenues and expenses and cash flows. As a result, amounts relating to assets and liabilities reported on the statements of cash flows may not necessarily agree with the changes in the corresponding balances on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income / loss. Transactions denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing on the transaction dates. Assets and liabilities denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

All of the Company’s revenue transactions are transacted in its functional currency. The Company does not enter into any material transaction in foreign currencies. Transaction gains or losses have not had, and are not expected to have, a material effect on the results of operations of the Company.

The exchange rates as of June 30, 2025 (unaudited) and December 31, 2024 and for the six months ended June 30, 2025 and 2024 (unaudited) are as follows:

| June 30, | December 31, | Six months Ended June 30, | ||||||||||||||

| 2025 | 2024 | 2025 | 2024 | |||||||||||||

| Foreign currency | Balance Sheet | Balance Sheet | Profits/Loss | Profits/Loss | ||||||||||||

| RMB:1USD | ||||||||||||||||

F-14

Comprehensive Loss

Comprehensive loss is comprised of net (loss) income and all changes to the statements of shareholders’ equity. For the Company, comprehensive loss for the six months ended June 30, 2025 and 2024 consisted of net (loss) income and unrealized gain/loss from foreign currency translation adjustment.

Related Parties

A party is considered related to the Company if it directly or indirectly or through one or more intermediaries, controls, is controlled by, or is under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. A party which can significantly influence the management or operating policies of the transacting parties or if it has an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests is also a related party.

Segment reporting

ASC Topic 280, “Segment Reporting,” requires use of the management approach model for segment reporting. The Company identifies operating segments as components of the consolidated operations for which discrete financial information is available and is regularly reviewed by the chief operating decision maker(“CODM”), in making decisions regarding resource allocation and evaluating financial performance. The Company defines the term CODM to be its chief executive officer. The Company determined it operates in one operating and reportable segment. The CODM reviews financial information presented only on a consolidated basis and uses this information for purposes of allocating resources and evaluating financial performance.

The significant segment expenses and other segment items that are provided to the CODM align with expense information that is included in the Company’s consolidated income statement and notes thereto.

The measure of segment assets is reported in the balance sheet as total consolidated assets. The Company’s long-lived assets are located in China.

Warrants classification

When the Company issues freestanding instruments, it first analyzes the provisions of ASC Topic 480, Distinguishing Liabilities from Equity (“ASC 480”) in order to determine if the instrument should be classified as a liability, with subsequent changes in FV recognized in the statements of comprehensive loss in each period. If the instrument is not within the scope of ASC 480, the Company further analyzes the provisions of ASC Topic 815, Derivatives and Hedging (“ASC 815-40”) in order to determine if the instrument is considered indexed to the entity’s own stock, and qualifies for classification within equity. If the provisions of ASC 815-40 for equity classification are not met, the instrument will be classified as a liability, with subsequent changes in FV recognized in the statements of comprehensive loss in each period.

F-15

Recent Accounting Pronouncements

In December 2023, the FASB issued ASU 2023-09, Improvements to Income Tax Disclosures, which requires disaggregated information about an entity’s effective tax rate reconciliation and additional discloses on income taxes paid. The new requirements are effective for annual periods beginning after December 15, 2024. The guidance is to be applied prospectively, with an option for retrospective application. The Company is currently evaluating the impact of this new guidance on disclosures within its CFS.

In November 2024, the FASB issued ASU 2024-03 on Disaggregation of Income Statement Expenses that enhances disclosure of certain costs and expenses to provide enhanced transparency into the expenses presented in the income statement. The updates are effective for annual periods beginning after December 15, 2026. The Company is still assessing the impact of the disclosure of this standard on its CFS.

The Company does not believe other recently issued but not yet effective accounting standards, if currently adopted, would have a material effect on its CFS.

NOTE 3 – INVESTMENTS

consist of trading stock

and debt securities, which include trading securities and held-to-maturity debt securities issued by commercial banks with maturity within

| June 30, 2025 | Quoted prices in active markets (level 1) | Significant other observable inputs (level 2) | Significant other unobservable inputs (level 3) | |||||||||||||

| (Unaudited) | ||||||||||||||||

| Short-term investments | ||||||||||||||||

| Trading securities | $ | $ | $ | $ | ||||||||||||

| Held-to-maturity debt securities | ||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

| December 31, 2024 | Quoted prices in active markets (level 1) | Significant other observable inputs (level 2) | Significant other unobservable inputs (level 3) | |||||||||||||

| Short-term investments | ||||||||||||||||

| Trading securities | $ | $ | $ | $ | ||||||||||||

| Held-to-maturity debt securities | ||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||

Net investment gain for the six months ended June 30, 2025 and 2024 consists of the following:

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Gain (loss) from sales of short-term investments: | ||||||||

| Trading securities | $ | $ | ( | ) | ||||

| Held-to-maturity debt securities | ||||||||

| Unrealized gain of short-term investments: | ||||||||

| Trading securities | ||||||||

| Held-to-maturity debt securities | ||||||||

| Unrealized gain of long-term investments: | ||||||||

| Held-to-maturity debt securities | ||||||||

| Net investment gain | $ | $ | ||||||

F-16

NOTE 4 – ACCOUNTS RECEIVABLE, NET

At June 30, 2025 and December 31, 2024, accounts receivable, net consisted of the following.

June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| Accounts receivable | $ | $ | ||||||

| Less: allowance for expected credit losses | ( | ) | ( | ) | ||||

| Accounts receivable, net | $ | $ | ||||||

| Non-current accounts receivable | $ | $ | ||||||

The following table describes the movements in the allowance for expected credit losses during the six months ended June 30, 2025 and 2024.

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Balance at December 31, | $ | $ | ||||||

| Provision for expected credit losses | ||||||||

| Foreign exchange difference | ( | ) | ||||||

| Balance at June 30 (Unaudited) | $ | $ | ||||||

NOTE 5 – INVENTORIES, NET

At June 30, 2025 and December 31, 2024, inventories consisted of the following.

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| Purchased goods | $ | $ | ||||||

| Less: reserve for obsolete inventories | ( | ) | ( | ) | ||||

| Total | $ | $ | ||||||

The following table describes the movements in the reserve for obsolete inventories during the six months ended June 30, 2025 and 2024.

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Balance at December 31, | $ | $ | ||||||

| Reserve for obsolete inventories | ||||||||

| Foreign exchange difference | ( | ) | ||||||

| Balance at June 30 (Unaudited) | $ | $ | ||||||

Inventories include computer, network hardware,

and GTDs. The Company reviews its inventories periodically to determine if any reserves are necessary for potential obsolescence or if

a write-down is necessary if the carrying value exceeds net realizable value. The Company established a

F-17

NOTE 6 – PREPAID EXPENSES AND OTHER CURRENT ASSETS

At June 30, 2025 and December 31, 2024, prepaid expenses and current assets consisted of the following.

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| Interest receivable (1) | $ | $ | ||||||

| Deposits (2) | ||||||||

| Other receivables, net (3) | ||||||||

| Total | $ | $ | ||||||

| (1) |

| (2) |

| (3) |

NOTE 7 – LOANS RECEIVABLE

At June 30, 2025 and December 31, 2024, loans receivable consisted of the following.

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| Guangxi Beihengda Mining Co., Ltd. (1) | $ | $ | ||||||

| Beijing Liansheng Innovation Technology Co., Ltd (2) | ||||||||

| Guangzhou Ruilide Information System Co., Ltd (3) | ||||||||

| Total loans receivable | ||||||||

| Less: current portion | ||||||||

| Loan receivable - non current | $ | $ | ||||||

| (1) |

| (2) |

| (3) |

Interest income for the six months ended June 30, 2025 and 2024 was

$

F-18

NOTE 8 – PROPERTY, EQUIPMENT AND SOFTWARE, NET

At June 30, 2025 and December 31, 2024, property, equipment and software consisted of the following.

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| Office furniture | $ | $ | ||||||

| Transportation equipment | ||||||||

| Building and improvements | ||||||||

| Software | ||||||||

| Less: accumulated depreciation and amortization | ( | ) | ( | ) | ||||

| $ | $ | |||||||

NOTE 9 –TAXES PAYABLE

At June 30, 2025 and December 31, 2024, taxes payable consisted of the following.

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| Value-added tax | $ | $ | ||||||

| Corporate tax | ||||||||

| Other taxes | ||||||||

| Total | $ | $ | ||||||

NOTE 10 – RELATED PARTY TRANSACTIONS

The table below sets forth the major related parties and their relationships with the Company as of June 30, 2025.

| Name of related parties | Relationship with the Group | |

| Yin Shenping (Mr. Yin) | ||

| Beijing Baihengda Petroleum Technology Co., Ltd (Beijing Baihengda) |

The following related party balances are non-interest bearing:

As of | As of 2024 | |||||||

| (Unaudited) | ||||||||

| Amounts due to related parties: | ||||||||

| Yin Shenping (1) | $ | $ | ||||||

| $ | $ | |||||||

| Loan payable – related party: | ||||||||

| Beijing Baihengda (2) | $ | $ | ||||||

| $ | $ | |||||||

| (1) |

| (2) |

F-19

NOTE 11 – ACCRUED EXPENSES AND OTHER CURRENT LIABILITIES

At June 30, 2025 and December 31, 2024, accrued expenses and other current liabilities consisted of the following.

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| Payroll | $ | $ | ||||||

| Other | ||||||||

| Total | $ | $ | ||||||

NOTE 12 – LOAN PAYABLE – RELATED PARTY

At June 30, 2025 and December 31, 2024, loan payable – related party, consisted of the following.

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| Loan payable, current | $ | $ | ||||||

| Non-current loan payable | ||||||||

| Total | $ | $ | ||||||

On January 21, March 28 and June 14, 2022, the

Company entered into three loans of RMB

On March 18, 2025, Mr. Yin became a

The interest expense for the six months ended

June 30, 2025 and 2024 was $

NOTE 13 –ORDINARY SHARES

In April 2023, the Company issued

On February 5, 2024, the 2024 annual general meeting

of shareholders adopted resolutions that the issued

F-20

NOTE 14 –WARRANTS

On July 29, 2024, the Company closed a private

placement of (a)

The summary of warrant activities for the six months ended June 30, 2025 was as follows:

| Ordinary Shares Number Outstanding | Weighted Average Exercise Price | Contractual Life in Years | ||||||||||

| Outstanding as of December 31, 2024 | $ | |||||||||||

| Granted | - | |||||||||||

| Exercises | - | |||||||||||

| Expired | - | |||||||||||

| Warrants Outstanding as of June 30, 2025 | ||||||||||||

| Warrants Exercisable as of June 30, 2025 | $ | |||||||||||

NOTE 15 – INCOME TAXES

The entities within the Company file separate tax returns in the respective tax jurisdictions in which they operate.

Cayman Islands

The Company is a tax-exempt entity incorporated in Cayman Islands.

Hong Kong

HiTek Hong Kong Limited was incorporated in Hong Kong and does not conduct any substantial operations. No provision for Hong Kong profits tax has been made in the CFS as HiTek Hong Kong Limited has no assessable profits for the six months ended June 30, 2025 and 2024.

PRC

The Company’s PRC operating subsidiary and

VIEs, being incorporated in the PRC, are governed by the income tax law of the PRC and are subject to PRC enterprise income tax (“EIT”).

The EIT rate of PRC is

F-21

The Company’s (loss) income before income taxes includes the following for the six months ended June 30.

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Non-PRC operations | $ | ( | ) | $ | ( | ) | ||

| PRC operations | ( | ) | ||||||

| Total (loss) income before income taxes | $ | ( | ) | $ | ||||

Income tax expense was comprised of the following for the six months ended June 30.

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Current tax expense | $ | $ | ||||||

| Deferred tax (benefit) expense | ( | ) | ||||||

| Total income tax (benefit) expense | $ | ( | ) | $ | ||||

Deferred income taxes reflect the net tax effects

of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used

for income tax purposes.

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| Deferred tax assets | ||||||||

| Net operating loss | $ | $ | ||||||

| Deferred revenue | ||||||||

| Unbilled cost | ||||||||

| Unbilled interest expenses | ||||||||

| Depreciation | ||||||||

| Software amortization | ||||||||

| Allowance for doubtful accounts | ||||||||

| Inventories obsolescence | ( | ) | ( | ) | ||||

| Unrealized losses on trading securities | ||||||||

| Accrued Bonus | ||||||||

| Other | ||||||||

| Total deferred tax assets | ||||||||

| Valuation allowance | ( | ) | ( | ) | ||||

| Total deferred tax assets, net | ||||||||

| Deferred tax liabilities | ||||||||

| Unbilled revenue | ( | ) | ( | ) | ||||

| Unbilled interest income | ( | ) | ( | ) | ||||

| Deferred government subsidiary income | ( | ) | ( | ) | ||||

| Unrealized gain on short-term investment | ( | ) | ( | ) | ||||

| Other | ( | ) | ( | ) | ||||

| Total deferred tax liabilities | ( | ) | ( | ) | ||||

| Net deferred tax liabilities, net | $ | ( | ) | ( | ) | |||

F-22

Following is a reconciliation of income tax expense at the effective rate to income tax at the calculated statutory rates for the six months ended June 30.

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| PRC statutory tax rate | % | % | ||||||

| Effect of different tax rates in different jurisdictions | ( | )% | % | |||||

| Permanent difference | ( | )% | % | |||||

| Exemption rendered by local authorities | ( | )% | % | |||||

| Effective tax rate | % | % | ||||||

Uncertain Tax Positions

The Company had no significant unrecognized uncertain tax positions or unrecognized liabilities, interest or penalties associated with unrecognized tax benefit as of and for the six months ended June 30, 2025 and 2024.

NOTE 16 – CONCENTRATIONS

Major Customers

Details of customers which accounted for 10% or more of the Company’s total revenues are as follows.

| Six Months Ended June 30, | ||||||||||||||||

| 2025 | 2024 | |||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Customer A | $ | % | $ | % | ||||||||||||

| Customer B | - | % | % | |||||||||||||

| Total | $ | % | $ | % | ||||||||||||

Details of customers which accounted for 10% or more of the Company’s accounts receivable are as follows.

| June 30, 2025 | December 31, 2024 | |||||||||||||||

| (Unaudited) | ||||||||||||||||

| Customer A | $ | % | $ | % | ||||||||||||

| Customer B | % | % | ||||||||||||||

| Total | $ | % | $ | % | ||||||||||||

Major Suppliers

Details of suppliers which accounted for 10% or more of the Company’s purchases are as follows.

| Six Months Ended June 30, | ||||||||||||||||

| 2025 | 2024 | |||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||

| Supplier A | $ | % | $ | % | ||||||||||||

| Supplier B | % | % | ||||||||||||||

| Supplier C | % | % | ||||||||||||||

| Supplier D | % | % | ||||||||||||||

| Total | $ | % | $ | % | ||||||||||||

Details of suppliers which accounted for 10% or more of the Company’s accounts payable are as follows.

| June 30, 2025 | December 31, 2024 | |||||||||||||||

| (unaudited) | ||||||||||||||||

| Supplier B | $ | % | $ | % | ||||||||||||

| Total | $ | % | $ | % | ||||||||||||

F-23

NOTE 17 – COMMITMENTS AND CONTINGENCY

Contingencies

The Company may be involved in various legal proceedings, claims and other disputes arising from the commercial operations, projects, employees and other matters which, in general, are subject to uncertainties and in which the outcomes are not predictable. The Company determines whether an estimated loss from a contingency should be accrued by assessing whether a loss is deemed probable and can be reasonably estimated. As of June 30, 2025, the Company was not aware of any litigation or proceedings against it.

NOTE 18 – SUBSEQUENT EVENTS

The Company performed an evaluation of events and transactions for potential recognition or disclosure through the date on which the CFS are released. The Company is not aware of any material subsequent event other than this disclosed below.

On October 8, 2025, the Company entered into an

at-the-market sales agreement, or the Sales Agreement, with AC Sunshine Securities LLC, or the Sales Agent, acting as a sales agent for

the offer and sale of shares of Class A Ordinary Shares, par value $

NOTE 19 – CONDENSED FINANCIAL INFORMATION OF THE PARENT COMPANY

Pursuant to Rules 12-04(a), 5-04(c), and 4-08(e)(3)

of Regulation S-X, the condensed financial information of the parent company shall be filed when the restricted net assets of consolidated

subsidiaries exceed

F-24

PARENT COMPANY BALANCE SHEETS

(Expressed in U.S. Dollars, except for the number of shares)

| June 30, 2025 | December 31, 2024 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | $ | ||||||

| Short-term investments | ||||||||

| Advances to suppliers, net | ||||||||

| Intercompany receivables | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total current assets | ||||||||

| Non-current assets | ||||||||

| Investments in non-VIE subsidiaries | ||||||||

| Total non-current assets | ||||||||

| Total Assets | $ | $ | ||||||

| Liabilities and Shareholders’ Equity | ||||||||

| Current liabilities | ||||||||

| Intercompany payable | $ | $ | ||||||

| Advances from customers | ||||||||

| Total current liabilities | ||||||||

| Total Liabilities | ||||||||

| Commitments and Contingencies | ||||||||

| Shareholders’ Equity | ||||||||

| Class A Ordinary Shares, US$ | ||||||||

| Class B Ordinary Shares, US$ | ||||||||

| Additional paid-in capital | ||||||||

| Statutory reserve | ||||||||

| Retained earnings | ||||||||

| Accumulated other comprehensive loss | ( | ) | ( | ) | ||||

| Total Shareholders’ Equity | ||||||||

| Total Liabilities and Shareholders’ Equity | $ | $ | ||||||

F-25

PARENT COMPANY STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(Expressed in U.S. Dollars)

| Six Months Ended June 30, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Operating expenses: | ||||||||

| General and administrative | $ | $ | ||||||

| Total operating expenses | ||||||||

| Operating loss | ( | ) | ( | ) | ||||

| Other income (expense) | ||||||||

| Net investment gain | ||||||||

| Interest income | ||||||||

| Other expense, net | ( | ) | ( | ) | ||||

| Total other income, net | ||||||||

| Share of (loss) income from subsidiaries | ( | ) | ||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Comprehensive income | ||||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Comprehensive (loss) income | $ | ( | ) | $ | ||||

| (Loss) earnings per ordinary share | ||||||||

| Basic and diluted | $ | ( | ) | $ | ||||

| Weighted average number of ordinary shares outstanding | ||||||||

| Basic and diluted | ||||||||

F-26

PARENT COMPANY STATEMENTS OF CASH FLOWS

(Expressed in U.S. Dollars)

| Six Months Ended June 30, | ||||||||

| 2025 | 2024 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Operating activities: | ||||||||

| Net (loss) income | $ | ( | ) | $ | ||||

| Adjustments to reconcile net (loss) income to net cash used in operating activities: | ||||||||

| Accrued interest income from loans | ( | ) | ||||||

| Net investment gain | ( | ) | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Advances to suppliers | ( | ) | ||||||

| Prepaid expenses and other current assets | ||||||||

| Advances from customers | ||||||||

| Due to intercompany | ||||||||

| Net cash used in operating activities | ( | ) | ( | ) | ||||

| Investing activities | ||||||||

| Loans to third parties | ( | ) | ||||||

| Prepayment from third-party loans | ||||||||

| Purchases of held-to maturity investments | ( | ) | ( | ) | ||||

| Redemption of Held-to-maturity investments | ||||||||

| Deposit for acquisition | ( | ) | ||||||

| Refund of deposit for acquisition | ||||||||

| Net cash provided by (used in) investing activities | ( | ) | ||||||

| Financing activities | ||||||||

| Proceeds from private placement | ||||||||

| Net cash provided by financing activities | ||||||||

| Net decrease in cash | ( | ) | ( | ) | ||||

| Cash and equivalents at beginning of period | ||||||||

| Cash and equivalents at end of period | $ | $ | ||||||

F-27