N-4

|

Oct. 21, 2025

USD ($)

Contracts

|

| Prospectus: |

|

| Document Type |

N-4

|

| Entity Registrant Name |

ALLIANZ

LIFE VARIABLE ACCOUNT B

|

| Entity Central Index Key |

0000836346

|

| Entity Investment Company Type |

N-4

|

| Document Period End Date |

Oct. 21, 2025

|

| Amendment Flag |

false

|

| Item 2. Overview of the Contract [Line Items] |

|

| Index-Linked Option Overview, Credits are Based in Part on Index Performance [Text Block] |

Index

Options. You may allocate your Purchase Payments to any

or all of the Index Options available under your Contract. The

Contract currently offers Index Options with different types of Crediting Methods, including the Index Protection Strategy with Trigger,

Index Precision Strategy, Index Dual Precision Strategy, Index Guard Strategy, and Index Performance Strategy. We credit positive, zero, or negative

Performance Credits (i.e.,

positive, zero, or negative interest) at the end of a Term for amounts allocated to an Index Option based, in part, on the performance

of the applicable Index (the Index Return).

|

| Index-Linked Option Overview, Investor Could Lose Money if Index Declines [Text Block] |

Other

Index Options include a feature, either a Buffer or Floor, that provides limited protection from negative Index Returns. Under these other

Index Options, you may lose a significant amount of money if an Index declines in value.

|

| Index-Linked Option Overview, Limits the Negative Return [Text Block] |

Each

Index Option offers a certain level of protection from negative Index Returns.

|

| Index-Linked Option Overview, Example of Limiting the Negative Return [Text Block] |

Each

Index Option offers a certain level of protection from negative Index Returns.

− The

Index Protection Strategy with Trigger offers complete (or 100%) protection from negative Index Returns. For example, if at the end of

a Term, the Index Return is -25%, we will apply a 0% Performance Credit to your investment (i.e.,

no loss due to the negative Index Return). − Other

Index Options include a feature, either a Buffer or Floor, that provides limited protection from negative Index Returns. Under these other

Index Options, you may lose a significant amount of money if an Index declines in value. ○ Buffer

– A Buffer is the maximum amount of negative Index Return that we

absorb before applying a negative Performance Credit. For example, if at the end of a Term, the Index Return is -25% and the Buffer is

10%, we apply a Performance Credit of -15%, meaning your Contract Value allocated to that Index Option will decrease by 15% since the

Term Start Date. This reflects the negative Index Return that exceeds the protection of the 10% Buffer. The Index Precision Strategy,

Index Dual Precision Strategy, and Index Performance Strategy offer Index Options with Buffers. ○ Floor

– A Floor, on the other hand, is the maximum amount of negative Index Return you absorb as a negative Performance Credit. We absorb

any negative Index Return beyond the Floor. For example, if the Index Return is -25% and the Floor is -10%, we apply a Performance Credit

of -10%, meaning your Contract Value allocated to that Index Option will decrease by 10% since the Term Start Date. This reflects the

negative Index Return down to the -10% Floor and no further reduction in Index Option Value occurring as a result. The Index Guard Strategy

offers Index Options with a Floor. − The

current limit on Index loss for an Index Option will not change for the life of that Index Option. However, we reserve the right to add

new Index Options, as well as close Index Options to new Purchase Payments and transfers. As such, the limits on Index loss offered under

the Contract may change from one Term to the next if we add an Index Option or discontinue accepting new allocations into an Index Option. − If

we offer a new Index Option with a Buffer or Floor in the future, the Buffer or Floor will be no lower than 5% or -25%, respectively. − At

least one Index Option with a Buffer no lower than 5% or Floor no lower than -25%,

or an Index Option that provides complete protection from Index losses, will always be available for renewal under the Contract.

|

| Index-Linked Option Overview, Guaranteed Minimum Limit on Index Losses [Text Block] |

At

least one Index Option with a Buffer no lower than 5% or Floor no lower than -25%,

or an Index Option that provides complete protection from Index losses, will always be available for renewal under the Contract.

|

| Index-Linked Option Overview, Limiting Index Losses is not Guaranteed to be Offered [Text Block] |

The

current limit on Index loss for an Index Option will not change for the life of that Index Option. However, we reserve the right to add

new Index Options, as well as close Index Options to new Purchase Payments and transfers. As such, the limits on Index loss offered under

the Contract may change from one Term to the next if we add an Index Option or discontinue accepting new allocations into an Index Option.

|

| Index-Linked Option Overview, Limits Positive Return [Text Block] |

Each

Index Option also has an upside feature, either a Trigger Rate, Cap, and/or Participation Rate, used in the calculation of positive Performance

Credits, if any, that may be credited to your investment at the end of a Term.

|

| Index-Linked Option Overview, Example of Limiting the Positive Return [Text Block] |

Each

Index Option also has an upside feature, either a Trigger Rate, Cap, and/or Participation Rate, used in the calculation of positive Performance

Credits, if any, that may be credited to your investment at the end of a Term. We may limit the amount you can earn on

an Index Option based on the Trigger Rate, Cap or Participation Rate, as applicable. − Trigger

Rate – A Trigger Rate represents the positive Performance

Credit, if any, that may apply on the Term End Date. The Index Precision Strategy, Index Dual Precision Strategy, and Index Protection

Strategy with Trigger offer Index Options with a Trigger Rate. ○ For

the Index Precision Strategy and Index Protection Strategy with Trigger, the Trigger Rate will apply if the Index Return is positive or

zero. For example, if at the end of a Term, the Index Return is 6% and the Trigger Rate is 3%, we apply a Performance Credit of 3%, meaning

your Contract Value allocated to that Index Option will increase by 3% since the Term Start Date. ○ For

the Index Dual Precision Strategy, the Trigger Rate will apply if the Index Return is positive, zero, or to a limited extent, negative.

For example, assume a Trigger Rate of 3% and a Buffer of 10%. If at the end of a Term, the Index Return is positive, zero, or negative

but no lower than -10% (i.e., not in excess of the Buffer), we apply a positive Performance Credit of 3%, meaning your Contract Value

allocated to that Index Option will increase by 3% since the Term Start Date. However, if the negative Index Return were lower than -10%

(i.e., in excess of the Buffer), we apply a negative Performance Credit equal to the negative Index Return plus the Buffer, as previously

summarized above. Cap

– A Cap represents the maximum positive Performance Credit, if any, applied on a Term End Date. For example, if at the end of a

Term, the Index Return is 12% and the Cap is 10%, we apply a Performance Credit of 10%, meaning your Contract Value allocated to that

Index Option will increase by 10% since the Term Start Date. The Index Guard Strategy and Index Performance Strategy offer Index Options

with a Cap. Index Performance Strategy multi-year Term Index Options have both a Cap and a Participation Rate (as described below).

− Participation

Rate – A Participation Rate is the percentage that

is multiplied by a positive Index Return in calculating a positive Performance Credit, if any, subject to any applicable Cap. For example,

if at the end of a Term, the Participation Rate is 100%, the Cap is 15%, and the Index Return is 12% (which is lower than the Cap), we

apply a Performance Credit of 12% (i.e.,

100% x 12%). However, if the Index Return were instead 20% (which is higher than the Cap), we would apply the Cap and a Performance Credit

of 15% would be applied. Index Performance Strategy multi-year Term Index Options have both a Participation Rate and a Cap. − The

Trigger Rate, Cap, and/or Participation Rate for an Index Option will change from Term to Term, subject to a specified guaranteed minimum

that will not change for the life of that Index Option. Guaranteed minimum Trigger Rates, Caps, and/or Participation Rates vary by Index

Option. − If

we add a new Index Option to the Contract in the future, the lowest Trigger Rate, Cap, and Participation Rate that we may establish are

0.05%, 0.10%, and 5.00%, respectively. For example, if the Trigger Rate for a new Index Option is 0.05% and the Index Return is 10%, a

0.05% Performance Credit would be applied. Similarly, if the Cap for a new Index Option is 0.10% and the Index Return is 10%, a 0.10%

Performance Credit would be applied. If the Participation Rate for a new Index Option is 5.00%, the Index Option is uncapped, and the

Index Return is 10%, a 0.50% Performance Credit would be applied.

|

| Overview, Investor Could Lose Money Due to Contract Adjustments if Amounts are Removed [Text Block] |

It

is the estimated present value of the future Performance Credit that we will apply on the Term End Date. The Daily Adjustment for the

Index Protection Strategy with Trigger can only be positive or zero – it cannot be negative. However, the Daily Adjustment can

be positive, zero, or negative with the Index Dual Precision Strategy, Index Precision Strategy, Index Guard Strategy, or Index Performance

Strategy. The

Daily Adjustment fluctuates daily and, if it is negative, you could lose a significant amount of money.

|

| Overview, Transactions Subject to Contract Adjustments [Text Block] |

Before

the end of an Index Option’s Term, if you take any type of withdrawal, execute a Performance Lock, begin Annuity Payments, or if

we pay a death benefit or deduct a fee or expense, we base the transaction on the interim Index Option Value, which includes the Daily

Adjustment. The Daily Adjustment approximates the Index Option Value that will be available on the Term End Date.

|

| Item 3. Key Information [Line Items] |

|

| Fees and Expenses [Text Block] |

|

|

|

|

Are

There

Charges

or

Adjustments

for

Early

Withdrawals?

|

Yes,

your Contract is subject to charges for early withdrawals that differ depending on when

you

purchased the Contract.

●If

you purchase the Contract on or after May 1, 2024, and you withdraw money from

the

Contract within six

years of your last Purchase Payment, you will be assessed a

withdrawal

charge of up to 8%

of the Purchase Payment withdrawn, declining to 0%

over

that time period.

●If

you purchased the Contract on or before April 30, 2024, and you withdraw money

from

the Contract within six years of your last Purchase Payment, you will be

assessed

a withdrawal charge of up to 8.5% of the Purchase Payment withdrawn,

declining

to 0% over that time period. |

Fee

Tables

7.

Expenses and

Adjustments

Appendix

C –

Daily

Adjustment

|

|

|

For

example, for Contracts issued on or after May

1, 2024, if you invest $100,000 in the

Contract

and make an early withdrawal, you could pay a withdrawal charge of up to $8,000

(or

$8,500

for Contracts issued on or before April

30, 2024). This loss will be greater if there

is

a negative Daily Adjustment, income taxes, or tax penalties.

In

addition, if you take a full or partial withdrawal from an Index Option on a date other than

the

Term End Date, a Daily Adjustment will apply to the Index Option Value available for

withdrawal.

The Daily Adjustment also applies if before the Term End Date you execute a

Performance

Lock, you annuitize the Contract, we pay a death benefit, or we deduct

Contract

fees and expenses. The Daily Adjustment may be negative depending on the

applicable

Crediting Method. You will lose money if the Daily Adjustment is negative.

●Index

Dual Precision Strategy, Index Precision Strategy, Index Guard Strategy,

and

Index Performance Strategy. Daily Adjustments

under these Crediting Methods

may

be positive, negative, or equal to zero. A negative Daily Adjustment will result in a

loss,

and could result in a loss beyond the protection of the 10%, 20%, or 30% Buffer;

or

-10% Floor, as applicable. The maximum potential loss from a negative Daily

Adjustment

is: -99% for the Index Dual Precision Strategy, Index Precision Strategy,

and

Index Performance Strategy; and -35% for the Index Guard Strategy. For

example,

if you allocate $100,000 to a 1-year Term Index Option with 10% Buffer and

later

withdraw the entire amount before the Term has ended, you could lose up to

$99,000

of your investment. This loss will be greater if you also have to pay a

withdrawal

charge, income taxes, and tax penalties.

●Index

Protection Strategy with Trigger. Daily

Adjustments under this Crediting

Method

may be positive or equal to zero, but cannot be negative. |

|

Are

There

Transaction

Charges?

|

No.

Other than withdrawal charges and Daily Adjustments that may apply to withdrawals

and

other transactions under the Contract, there are no other transaction charges. |

|

|

|

|

|

Are

There

Ongoing

Fees

and

Expenses?

|

Yes,

there are ongoing fees and expenses. The table below describes the fees and

expenses

that you may pay each

year, depending on the options you choose.

Please refer

to

your Contract specifications page for information about the specific fees you will pay

each

year based on the options you have elected.

There

is an implicit ongoing fee on Index Options to the extent that your participation

in

Index gains is limited by us through a Cap or Trigger Rate.

This means that your

returns

may be lower than the Index’s returns. In return for accepting this limit on Index

gains,

you will receive some protection from Index losses. This implicit ongoing fee is not

reflected

in the tables below. Additionally,

if we add Index Options with a guaranteed

minimum

Participation Rate less than 100%, the Participation Rate would be an

implicit

ongoing fee and limit Index gains.

|

Fee

Tables

7.

Expenses and

Adjustments

Appendix

A –

Investment

Options

Available

Under

the

Contract

|

|

|

|

|

|

|

|

|

|

|

|

|

Optional

Benefits Available for an Additional

(for

a single optional benefit, if elected) |

|

|

|

|

An

amount attributable to the contract maintenance charge. |

|

|

|

As

a percentage of the AZL Government Money Market Fund's average daily net assets. |

|

|

|

As

a percentage of the Charge Base. This is the current charge for the Maximum Anniversary Value Death

Benefit.

|

|

|

|

Because

your Contract is customizable, the choices you make affect how much you will

pay.

To help you understand the cost of owning your Contract, the following table shows the

lowest

and highest cost you could pay each

year, based on current charges. This estimate

assumes

that you do not take withdrawals from the Contract, which

could add a

withdrawal

charge and a negative Daily Adjustment that substantially increase costs.

|

|

|

|

|

Highest

Annual Cost:

$825

|

|

|

|

Assumes:

●Investment

of $100,000 in the Variable

Option

(even though you cannot select

the

Variable Option for investment)

●5%

annual appreciation

●Traditional

Death Benefit

●No

additional Purchase Payments,

transfers,

or withdrawals

●No

Daily Adjustment |

Assumes:

●Investment

of $100,000 in the Variable

Option

(even though you cannot select

the

Variable Option for investment)

●5%

annual appreciation

●Maximum

Anniversary Value Death

Benefit

with a 0.20% rider fee

●No

additional Purchase Payments,

transfers,

or withdrawals

●No

Daily Adjustment |

|

|

| Charges for Early Withdrawals [Text Block] |

Are

There

Charges

or

Adjustments

for

Early

Withdrawals?

Yes,

your Contract is subject to charges for early withdrawals that differ depending on when

you

purchased the Contract.

●If

you purchase the Contract on or after May 1, 2024, and you withdraw money from

the

Contract within six

years of your last Purchase Payment, you will be assessed a

withdrawal

charge of up to 8%

of the Purchase Payment withdrawn, declining to 0%

over

that time period.

●If

you purchased the Contract on or before April 30, 2024, and you withdraw money

from

the Contract within six years of your last Purchase Payment, you will be

assessed

a withdrawal charge of up to 8.5% of the Purchase Payment withdrawn,

declining

to 0% over that time period.

Fee

Tables

7.

Expenses and

Adjustments

Appendix

C –

Daily

Adjustment

For

example, for Contracts issued on or after May

1, 2024, if you invest $100,000 in the

Contract

and make an early withdrawal, you could pay a withdrawal charge of up to $8,000

(or

$8,500

for Contracts issued on or before April

30, 2024). This loss will be greater if there

is

a negative Daily Adjustment, income taxes, or tax penalties.

In

addition, if you take a full or partial withdrawal from an Index Option on a date other than

the

Term End Date, a Daily Adjustment will apply to the Index Option Value available for

withdrawal.

The Daily Adjustment also applies if before the Term End Date you execute a

Performance

Lock, you annuitize the Contract, we pay a death benefit, or we deduct

Contract

fees and expenses. The Daily Adjustment may be negative depending on the

applicable

Crediting Method. You will lose money if the Daily Adjustment is negative.

●Index

Dual Precision Strategy, Index Precision Strategy, Index Guard Strategy,

and

Index Performance Strategy. Daily Adjustments

under these Crediting Methods

may

be positive, negative, or equal to zero. A negative Daily Adjustment will result in a

loss,

and could result in a loss beyond the protection of the 10%, 20%, or 30% Buffer;

or

-10% Floor, as applicable. The maximum potential loss from a negative Daily

Adjustment

is: -99% for the Index Dual Precision Strategy, Index Precision Strategy,

and

Index Performance Strategy; and -35% for the Index Guard Strategy. For

example,

if you allocate $100,000 to a 1-year Term Index Option with 10% Buffer and

later

withdraw the entire amount before the Term has ended, you could lose up to

$99,000

of your investment. This loss will be greater if you also have to pay a

withdrawal

charge, income taxes, and tax penalties.

●Index

Protection Strategy with Trigger. Daily

Adjustments under this Crediting

Method

may be positive or equal to zero, but cannot be negative.

|

| Surrender Charge Phaseout Period, Years |

6

|

| Surrender Charge (of Purchase Payments) Maximum [Percent] |

8.00%

|

| Surrender Charge Example Maximum [Dollars] |

$ 8,000

|

| Transaction Charges [Text Block] |

Are

There

Transaction

Charges?

No.

Other than withdrawal charges and Daily Adjustments that may apply to withdrawals

and

other transactions under the Contract, there are no other transaction charges.

Not

Applicable

|

| Ongoing Fees and Expenses [Table Text Block] |

Are

There

Ongoing

Fees

and

Expenses?

Yes,

there are ongoing fees and expenses. The table below describes the fees and

expenses

that you may pay each

year, depending on the options you choose.

Please refer

to

your Contract specifications page for information about the specific fees you will pay

each

year based on the options you have elected.

There

is an implicit ongoing fee on Index Options to the extent that your participation

in

Index gains is limited by us through a Cap or Trigger Rate.

This means that your

returns

may be lower than the Index’s returns. In return for accepting this limit on Index

gains,

you will receive some protection from Index losses. This implicit ongoing fee is not

reflected

in the tables below. Additionally,

if we add Index Options with a guaranteed

minimum

Participation Rate less than 100%, the Participation Rate would be an

implicit

ongoing fee and limit Index gains.

Fee

Tables

7.

Expenses and

Adjustments

Appendix

A –

Investment

Options

Available

Under

the

Contract

Optional

Benefits Available for an Additional

(for

a single optional benefit, if elected)

An

amount attributable to the contract maintenance charge.

As

a percentage of the AZL Government Money Market Fund's average daily net assets.

As

a percentage of the Charge Base. This is the current charge for the Maximum Anniversary Value Death

Benefit.

Because

your Contract is customizable, the choices you make affect how much you will

pay.

To help you understand the cost of owning your Contract, the following table shows the

lowest

and highest cost you could pay each

year, based on current charges. This estimate

assumes

that you do not take withdrawals from the Contract, which

could add a

withdrawal

charge and a negative Daily Adjustment that substantially increase costs.

Highest

Annual Cost:

$825

Assumes:

●Investment

of $100,000 in the Variable

Option

(even though you cannot select

the

Variable Option for investment)

●5%

annual appreciation

●Traditional

Death Benefit

●No

additional Purchase Payments,

transfers,

or withdrawals

●No

Daily Adjustment

Assumes:

●Investment

of $100,000 in the Variable

Option

(even though you cannot select

the

Variable Option for investment)

●5%

annual appreciation

●Maximum

Anniversary Value Death

Benefit

with a 0.20% rider fee

●No

additional Purchase Payments,

transfers,

or withdrawals

●No

Daily Adjustment

|

| Base Contract (of Other Amount) (N-4) Minimum [Percent] |

0.01%

|

| Base Contract (of Other Amount) (N-4) Maximum [Percent] |

0.01%

|

| Investment Options (of Average Annual Net Assets) Minimum [Percent] |

0.65%

|

| Investment Options (of Average Annual Net Assets) Maximum [Percent] |

0.65%

|

| Optional Benefits Minimum [Percent] |

0.20%

|

| Optional Benefits Maximum [Percent] |

0.20%

|

| Base Contract (N-4) Footnotes [Text Block] |

An

amount attributable to the contract maintenance charge.

|

| Optional Benefits Footnotes [Text Block] |

As

a percentage of the Charge Base. This is the current charge for the Maximum Anniversary Value Death

Benefit.

|

| Investment Options Footnotes [Text Block] |

As

a percentage of the AZL Government Money Market Fund's average daily net assets.

|

| Lowest Annual Cost [Dollars] |

$ 637

|

| Highest Annual Cost [Dollars] |

$ 825

|

| Risks [Table Text Block] |

|

|

|

|

Is

There a Risk

of

Loss from

Poor

Performance?

|

Yes,

you can lose money by investing in the Contract, including loss of principal and

previous

earnings.

The

maximum amount of loss that you could experience from negative Index Return,

after

taking into account the current limits on Index loss provided under the

Contract,

is: -90% with a 10% Buffer; -80% with a 20% Buffer; -70% with a 30% Buffer;

-10%

with the Floor; and 0% with the Index Protection Strategy with Trigger.

The

limits on Index loss offered under the Contract may change from one Term to the

next

if we add an Index Option or discontinue accepting new allocations into an

Index

Option. However, at least one Index Option with a Buffer no lower than 5% or

Floor

no lower than -25%, or an Index Option that provides complete protection from

Index

losses, will always be available for renewal under the Contract.

|

Principal

Risks of

Investing

In the

Contract

4.

Index Options

6.

Valuing Your

Contract

–

Calculating

Performance

Credits

|

Is

This a

Short-Term

Investment?

|

No,

this Contract is not a short-term investment and is not appropriate if you need ready

access

to cash.

• Considering

the benefits of tax deferral and long-term income, the Contract is generally

more

beneficial to investors with a long investment time horizon.

• Withdrawals

are subject to income taxes, and may also be subject to a 10% additional

federal

tax for amounts withdrawn before age 59 1∕2.

• If,

within six years after we receive a Purchase Payment, you take a full or partial

withdrawal,

withdrawal charges will apply. A withdrawal charge will reduce your Contract

Value

or the amount of money that you actually receive. Withdrawals may reduce or end

Contract

guarantees.

• Amounts

invested in an Index Option must be held in the Index Option for the full Term

before

they can receive a Performance Credit. We apply a Daily Adjustment if, before the

Term

End Date, you take a full or partial withdrawal, you execute a Performance Lock,

you

annuitize the Contract, we pay a death benefit, or we deduct Contract fees and

expenses.

• The

Daily Adjustment may be negative with the Index Dual Precision Strategy, Index

Precision

Strategy, Index Guard Strategy, and Index Performance Strategy. You will lose

money

if the Daily Adjustment is negative.

• Withdrawals

and other deductions from an Index Option prior to a Term End Date will

result

in a proportionate reduction to your Index Option Base. The proportionate reduction

could

be greater than the amount withdrawn or deducted. Reductions to your Index

Option

Base will result in lower Index Option Values for the remainder of the Term and

lower

gains (if any) on the Term End Date.

• On

the Term End Date, you can transfer assets invested in an Index Option by changing

your

allocation instructions. If you do not change your allocation instructions, you will

continue

to be invested in the same Index Option with a new Term Start Date. The new

Term

will be subject to the applicable renewal Trigger Rate, Cap, and/or Participation

Rate.

|

Principal

Risks of

Investing

In the

Contract

4.

Index Options

6.

Valuing Your

Contract

7.

Expenses and

Adjustments

Appendix

C –

Daily

Adjustment |

|

|

|

|

What

are the

Risks

Associated

with

the

Investment

Options?

|

• An

investment in the Contract is subject to the risk of poor investment performance and

can

vary depending on the performance of the Variable Option and the Index Options

available

under the Contract.

• The

Variable Option and each Index Option have their own unique risks.

• You

should review the Fund’s prospectus and disclosures, including risk factors, before

making

an investment decision.

• Caps

and Trigger Rates will limit positive Performance Credits (e.g., limited upside). This

may

result in earning less than the Index Return.

– For

example, if at the end of a 1-year Term, the Index Return is 25% and the Cap is

15%,

we apply a Performance Credit of 15%, meaning your Contract Value allocated

to

that Index Option will increase by 15% since the Term Start Date. If at the end of the

Term,

the Index Return is 6% and the Trigger Rate is 3%, we apply a Performance

Credit

of 3%, meaning your Contract Value allocated to that Index Option will increase

by

3% since the Term Start Date.

• The

Buffer or Floor will limit negative Performance Credits (e.g., limited protection in the

case

of Index decline). However,

you bear the risk for all Index losses that exceed

the

Buffer. You also bear the risk for Index losses down to the Floor.

– For

example, if at the end of a Term, the Index Return is -25% and the Buffer is 10%,

we

apply a Performance Credit of -15%, meaning your Contract Value allocated to that

Index

Option will decrease by 15% since the Term Start Date. If the Index Return is

-25%

and the Floor is -10%, we apply a Performance Credit of -10%, meaning your

Contract

Value allocated to that Index Option will decrease by 10% since the Term

Start

Date.

• The

Indexes are price return indexes, not total return indexes. This means that the Index

Options

do not receive any dividends payable on these securities. The Index Options also

do

not directly participate in the returns of the Indexes or the Indexes’ component

securities.

This will reduce the Index Return and may cause the Index to underperform a

direct

investment in the securities composing the Index. |

Principal

Risks of

Investing

In the

Contract

|

What

are the

Risks

Related

to

the

Insurance

Company?

|

An

investment in the Contract is subject to the risks related to us. All obligations,

guarantees

or benefits of the Contract, including those relating to the Index Options, are the

obligations

of Allianz Life and are subject to our claims-paying ability and financial strength.

More

information about Allianz Life, including our financial strength ratings, is available

upon

request by visiting https://www.allianzlife.com/about/financial-ratings, or contacting us

at

(800) 624-0197. |

Principal

Risks of

Investing

In the

Contract

|

|

| Investment Restrictions [Text Block] |

• Yes,

there are limits on the Investment Options.

• Certain

Index Options may not be available under your Contract.

• We

can add new Index Options to your Contract in the future.

• You

cannot allocate Purchase Payments to the Variable Option. The sole purpose of the

Variable

Option is to hold Purchase Payments until they are transferred to your selected

Index

Options.

• We

restrict additional Purchase Payments during the Accumulation Phase. Each Index

Year,

you cannot add more than your initial amount (i.e., the total of all Purchase

Payments

received before the first Quarterly Contract Anniversary of the first Contract

Year)

without our prior approval.

• We

do not accept additional Purchase Payments during the Annuity Phase.

• We

typically only allow assets to move into the Index Options on the Index Effective Date

and

on subsequent Index Anniversaries as discussed in section 3, Purchasing the

Contract

– Allocation of Purchase Payments and Contract Value Transfers. However, if

you

execute an Early Reallocation, we will move assets into an Index Option on the

Business

Day we receive your Early Reallocation request in Good Order.

• You

can typically transfer Index Option Value only on Term End Dates. However, you can

transfer

assets out of an Index Option before the Term End Date by first executing a

Performance

Lock and then either requesting an Early Reallocation with new allocation

instructions

or changing your allocation instructions before the next Index Anniversary.

For

more information, see section 6, Valuing Your Contract – Performance Locks and

Early

Reallocations.

• We

do not allow assets to move into an established Index Option until the Term End Date.

If

you request to allocate a Purchase Payment into an established Index Option on an

Index

Anniversary that is not a Term End Date, we will allocate those assets to the same

Index

Option with a new Term Start Date.

• We

reserve the right to substitute the Fund in which the Variable Option invests. We also

reserve

the right to close Index Options to new Purchase Payments and transfers, and to

substitute

Indexes either on a Term Start Date or during a Term.

• We

also reserve the right to decline any or all Purchase Payments at any time on a

nondiscriminatory

basis.

• Caps,

Trigger Rates, and Participation Rates will change from one Term to the next

subject

to their contractual minimum guarantees.

• The

10%, 20%, and 30% Buffers, and -10% Floors for the currently available Index

Options

do not change. However, if we add a new Index Option to your Contract after the

Issue

Date, we establish the Buffer or Floor for it on the date we add the Index Option to

your

Contract. For a new Index Option, the minimum Buffer is 5% and the minimum Floor

is

-25%.

|

| Key Information, Benefit Restrictions [Text Block] |

Yes,

there are restrictions on Contract benefits.

• We

do not allow Performance Locks to occur on Term End Dates. We will not execute

your

request for a Performance Lock on Index Protection Strategy with Trigger Index

Options

if the Daily Adjustment is zero. This may limit your ability to take advantage of the

benefits

of the Early Reallocation feature. We do not accept Early Reallocation requests

within

14 calendar days before an Index Anniversary. You are limited to twelve Early

Reallocation

requests each Index Year.

• We

reserve the right to discontinue or modify the Minimum Distribution Program.

• The

death benefits are only available during the Accumulation Phase. Upon annuitization,

these

benefits will end.

• The

Traditional Death Benefit may not be modified, but it will terminate if you take

withdrawals

that reduce both the Contract Value and Guaranteed Death Benefit Value to

zero.

Withdrawals may reduce the Traditional Death Benefit’s Guaranteed Death Benefit

Value

by more than the value withdrawn and could end the Traditional Death Benefit.

• The

optional Maximum Anniversary Value Death Benefit may not be modified.

Withdrawals

may reduce the Maximum Anniversary Value Death Benefit’s Guaranteed

Death

Benefit Value by more than the value withdrawn and will end the Maximum

Anniversary

Value Death Benefit if the withdrawals reduce both the Contract Value and

Guaranteed

Death Benefit Value to zero.

|

| Tax Implications [Text Block] |

• Consult

with a tax professional to determine the tax implications of an investment in and

withdrawals

from or payments received under the Contract.

• If

you purchased the Contract as an individual retirement annuity or through a custodial

individual

retirement account, you do not get any additional tax benefit under the

Contract.

• Generally,

earnings under a Non-Qualified Contract are taxed at ordinary income rates

when

withdrawn, and may also be subject to a 10% additional federal tax for amounts

withdrawn

before age 59 1∕2.

• Generally,

distributions from Qualified Contracts are taxed at ordinary income tax rates

when

withdrawn, and may also be subject to a 10% additional federal tax for amounts

withdrawn

before age 59 1∕2.

|

| Investment Professional Compensation [Text Block] |

Your

Financial Professional may receive compensation for selling this Contract to you, in

the

form of commissions, additional cash benefits (e.g., cash bonuses), and non-cash

compensation.

We and/or our wholly owned subsidiary distributor may also make marketing

support

payments to certain selling firms for marketing services and costs associated with

Contract

sales. This conflict of interest may influence your Financial Professional to

recommend

this Contract over another investment for which the Financial Professional is

not

compensated or compensated less.

|

| Exchanges [Text Block] |

Whether

to exchange your existing Contract for a new contract is a decision that each

investor

should make based on their personal circumstances and financial objectives.

However,

in making this decision you should be aware that some Financial Professionals

may

have a financial incentive to offer you a new contract in place of one you already own.

You

should only exchange your Contract if you determine, after comparing the features,

risks,

and fees of both contracts, including any fees or penalties to terminate your existing

Contract,

that it is better for you to purchase the new contract rather than continue to own your

existing Contract.

|

| Item 4. Fee Table [Line Items] |

|

| Item 4. Fee Table [Text Block] |

Fee

Tables

The following tables

describe the fees, expenses, and adjustments that you will pay when buying, owning, and surrendering or making withdrawals from an Investment

Option or from the Contract. Please refer to your Contract specifications page for information about the specific fees you will pay each

year based on the options you have elected.

The first table

describes the fees and expenses that you will pay at the time that you buy the Contract, surrender or make withdrawals from an Investment

Option or from the Contract, or transfer Contract Value between Investment Options. State premium taxes may also be deducted.

Transaction

Expenses

Withdrawal Charge During

Your Contract’s First Phase, the Accumulation Phase(1)

(as a percentage of each Purchase Payment withdrawn)(2)

Number

of Complete

Years

Since

Purchase

Payment |

|

Contracts

issued

on

or before

April

30, 2024 |

Contracts

issued

on

or after

May

1, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

The

Contract provides a free withdrawal privilege that allows you to withdraw 10% of your total Purchase Payments annually without incurring

a withdrawal charge, as discussed in section 8, Access to Your Money – Free Withdrawal Privilege.

(2)

The Withdrawal Charge Basis is the total amount under

your Contract that is subject to a withdrawal charge, as discussed in section 7, Expenses and Adjustments – Withdrawal Charge.

The next table describes

the Daily Adjustment, in addition to any transaction expenses, that applies if all or a portion of the Contract Value is removed from

an Index Option before the end of a Term.

|

|

Index

Protection Strategy

with

Trigger |

Index

Dual Precision Strategy,

Index

Precision Strategy,

and

Index

Performance Strategy |

|

Daily

Adjustment Maximum Potential Loss |

|

|

|

(as

a percentage of Index Option Value, applies for

distributions

from an Index Option before any Term

|

|

|

|

(1)

This table shows the maximum potential loss due to

the application of the Daily Adjustment (e.g., maximum loss could occur if there is a total distribution within a Term at a time when

the Index price has declined to zero). The Daily Adjustment could result in a loss beyond the protection of the 10%, 20%, or 30% Buffer;

or -10% Floor. The Daily Adjustment applies if, before the Term End Date, you take a full or partial withdrawal, you execute a Performance

Lock, you annuitize the Contract, we pay a death benefit, or we deduct Contract fees or expenses. The actual Daily Adjustment calculation

is determined by a formula described in Appendix C.

The next table describes

the fees and expenses that you will pay each year during the time that you own the Contract (not including Fund fees and expenses). If

you purchased the optional Maximum Anniversary Value Death Benefit, you pay additional charges, as shown below.

Administrative

Expenses (or contract maintenance charge)(1)

(per

year) |

|

Optional

Benefit Expenses – Maximum Anniversary Value Death Benefit

(as

a percentage of the Charge Base) |

|

(1)

Referred

to as the “contract maintenance charge” in the Contract and elsewhere in this prospectus. Waived if the Contract Value is

at least $100,000. During the Annuity Phase, we deduct the contract maintenance charge proportionately from each Annuity Payment. See

section 7, Expenses and Adjustments – Contract Maintenance Charge (Administrative Expenses).

In addition to the

fees described above, we may limit the amount you can earn on the Index Options. This means your returns may be lower than the Index’s

returns. In return for accepting a limit on Index gains, you will receive some protection from Index losses.

The

next item shows the total operating expenses charged by the Fund that you may pay periodically during the time that you own the Contract.

Expenses shown may change over time and may be higher or lower in the future. More information about the Fund, including its annual expenses,

may be found in Appendix A – Investment Options Available Under the Contract.

(expenses

that are deducted from Fund assets, including management fees,

distribution

and/or service (12b-1) fees, and other expenses) |

|

This Example is

intended to help you compare the cost of investing in the Variable Option with the cost of investing in other annuity contracts that offer

variable options. These costs include transaction expenses, annual Contract expenses, and annual Fund expenses.

The Example assumes

all Contract Value is allocated to the Variable Option, even though you cannot instruct us to allocate Purchase Payments to the Variable

Option. The Example does not reflect the Daily Adjustment. Your costs could differ from those shown below when you invest in the

Index Options.

The Example assumes

that you invest $100,000 in the Variable Option for the time periods indicated. The Example also assumes that your investment has a 5%

return each year and that you elected the Maximum Anniversary Value Death Benefit for an additional charge. Although your actual

costs may be higher or lower, based on these assumptions, your costs would be:

(1)

If

you surrender your Contract (take a full withdrawal) at the end of the applicable time period:

|

|

|

|

|

|

Contracts

issued on or before April 30, 2024 |

|

|

|

|

Contracts

issued on or after May 1, 2024 |

|

|

|

|

(2)

If

you fully annuitize your Contract at the end of the applicable time period.

|

|

|

|

|

|

Contracts

issued on or before April 30, 2024 |

|

|

|

|

Contracts

issued on or after May 1, 2024 |

|

|

|

|

*

The

earliest available Annuity Date is the second Index Anniversary.

(3)

If

you do not surrender your Contract.

|

|

|

|

|

|

Contracts

issued on or before April 30, 2024 |

|

|

|

|

Contracts

issued on or after May 1, 2024 |

|

|

|

|

|

| Transaction Expenses [Table Text Block] |

Transaction

Expenses

Withdrawal Charge During

Your Contract’s First Phase, the Accumulation Phase(1)

(as a percentage of each Purchase Payment withdrawn)(2)

Number

of Complete

Years

Since

Purchase

Payment |

|

Contracts

issued

on

or before

April

30, 2024 |

Contracts

issued

on

or after

May

1, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

The

Contract provides a free withdrawal privilege that allows you to withdraw 10% of your total Purchase Payments annually without incurring

a withdrawal charge, as discussed in section 8, Access to Your Money – Free Withdrawal Privilege.

(2)

The Withdrawal Charge Basis is the total amount under

your Contract that is subject to a withdrawal charge, as discussed in section 7, Expenses and Adjustments – Withdrawal Charge.

The next table describes

the Daily Adjustment, in addition to any transaction expenses, that applies if all or a portion of the Contract Value is removed from

an Index Option before the end of a Term.

Adjustments

|

|

Index

Protection Strategy

with

Trigger |

Index

Dual Precision Strategy,

Index

Precision Strategy,

and

Index

Performance Strategy |

|

Daily

Adjustment Maximum Potential Loss |

|

|

|

(as

a percentage of Index Option Value, applies for

distributions

from an Index Option before any Term

|

|

|

|

(1)

This table shows the maximum potential loss due to

the application of the Daily Adjustment (e.g., maximum loss could occur if there is a total distribution within a Term at a time when

the Index price has declined to zero). The Daily Adjustment could result in a loss beyond the protection of the 10%, 20%, or 30% Buffer;

or -10% Floor. The Daily Adjustment applies if, before the Term End Date, you take a full or partial withdrawal, you execute a Performance

Lock, you annuitize the Contract, we pay a death benefit, or we deduct Contract fees or expenses. The actual Daily Adjustment calculation

is determined by a formula described in Appendix C.

|

| Deferred Sales Load (of Amount Surrendered), Maximum [Percent] |

8.00%

|

| Deferred Sales Load, Footnotes [Text Block] |

The

Contract provides a free withdrawal privilege that allows you to withdraw 10% of your total Purchase Payments annually without incurring

a withdrawal charge, as discussed in section 8, Access to Your Money – Free Withdrawal Privilege.

(2)

The Withdrawal Charge Basis is the total amount under

your Contract that is subject to a withdrawal charge, as discussed in section 7, Expenses and Adjustments – Withdrawal Charge.

|

| Annual Contract Expenses [Table Text Block] |

The next table describes

the fees and expenses that you will pay each year during the time that you own the Contract (not including Fund fees and expenses). If

you purchased the optional Maximum Anniversary Value Death Benefit, you pay additional charges, as shown below.

Annual

Contract Expenses

Administrative

Expenses (or contract maintenance charge)(1)

(per

year) |

|

Optional

Benefit Expenses – Maximum Anniversary Value Death Benefit

(as

a percentage of the Charge Base) |

|

(1)

Referred

to as the “contract maintenance charge” in the Contract and elsewhere in this prospectus. Waived if the Contract Value is

at least $100,000. During the Annuity Phase, we deduct the contract maintenance charge proportionately from each Annuity Payment. See

section 7, Expenses and Adjustments – Contract Maintenance Charge (Administrative Expenses).

|

| Administrative Expense, Current [Dollars] |

$ 50

|

| Administrative Expense, Footnotes [Text Block] |

Referred

to as the “contract maintenance charge” in the Contract and elsewhere in this prospectus. Waived if the Contract Value is

at least $100,000. During the Annuity Phase, we deduct the contract maintenance charge proportionately from each Annuity Payment. See

section 7, Expenses and Adjustments – Contract Maintenance Charge (Administrative Expenses).

|

| Offered Starting [Date] |

May 01, 2024

|

| Offered Ending [Date] |

May 01, 2024

|

| Annual Portfolio Company Expenses [Table Text Block] |

The

next item shows the total operating expenses charged by the Fund that you may pay periodically during the time that you own the Contract.

Expenses shown may change over time and may be higher or lower in the future. More information about the Fund, including its annual expenses,

may be found in Appendix A – Investment Options Available Under the Contract.

Annual

Fund Expenses

(expenses

that are deducted from Fund assets, including management fees,

distribution

and/or service (12b-1) fees, and other expenses) |

|

|

| Portfolio Company Expenses Maximum [Percent] |

0.65%

|

| Surrender Example [Table Text Block] |

|

|

|

|

|

|

Contracts

issued on or before April 30, 2024 |

|

|

|

|

Contracts

issued on or after May 1, 2024 |

|

|

|

|

|

| Surrender Expense, 1 Year, Minimum [Dollars] |

$ 8,865

|

| Surrender Expense, 3 Years, Minimum [Dollars] |

9,704

|

| Surrender Expense, 5 Years, Minimum [Dollars] |

9,699

|

| Surrender Expense, 10 Years, Minimum [Dollars] |

$ 10,455

|

| Annuitize Example [Table Text Block] |

|

|

|

|

|

|

Contracts

issued on or before April 30, 2024 |

|

|

|

|

Contracts

issued on or after May 1, 2024 |

|

|

|

|

|

| Annuitized Expense, 3 Years, Minimum [Dollars] |

$ 2,704

|

| Annuitized Expense, 5 Years, Minimum [Dollars] |

4,699

|

| Annuitized Expense, 10 Years, Minimum [Dollars] |

$ 10,455

|

| No Surrender Example [Table Text Block] |

|

|

|

|

|

|

Contracts

issued on or before April 30, 2024 |

|

|

|

|

Contracts

issued on or after May 1, 2024 |

|

|

|

|

|

| No Surrender Expense, 1 Year, Minimum [Dollars] |

$ 865

|

| No Surrender Expense, 3 Years, Minimum [Dollars] |

2,704

|

| No Surrender Expense, 5 Years, Minimum [Dollars] |

4,699

|

| No Surrender Expense, 10 Years, Minimum [Dollars] |

$ 10,455

|

| Item 5. Principal Risks [Line Items] |

|

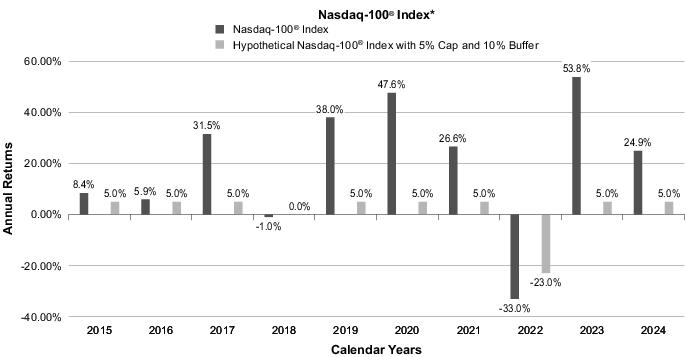

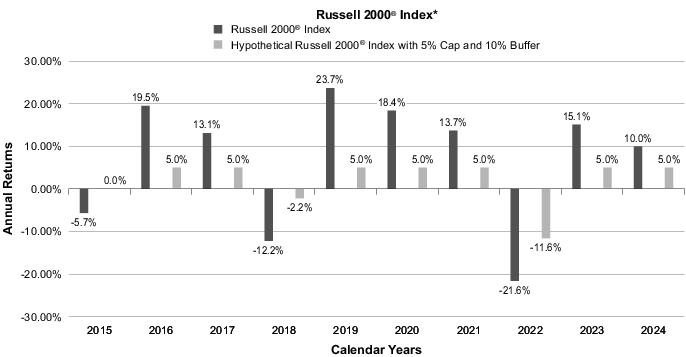

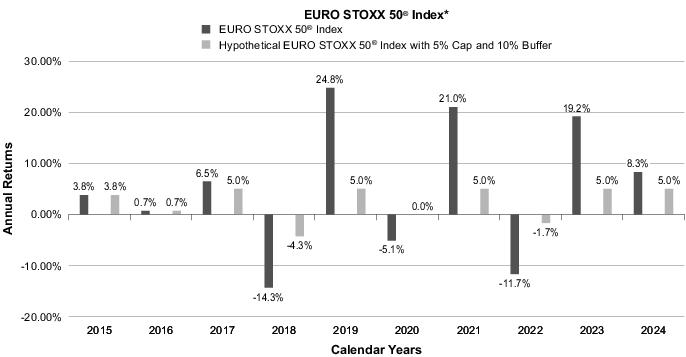

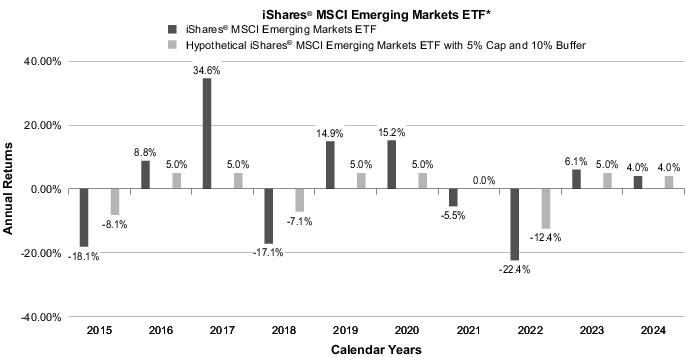

| Item 5. Principal Risks [Table Text Block] |

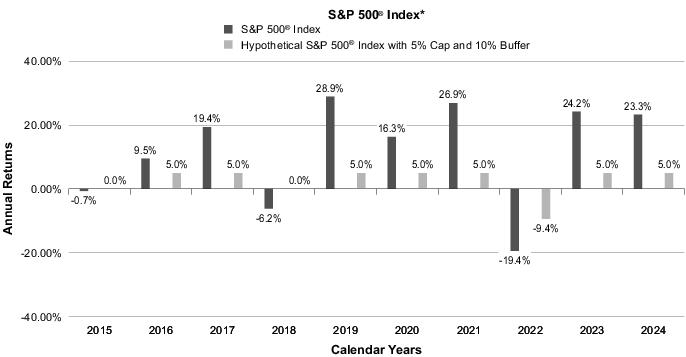

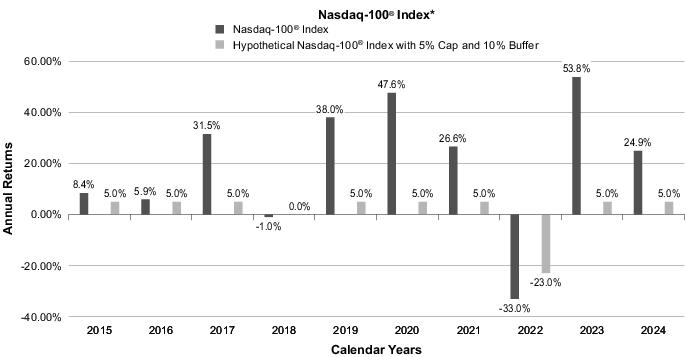

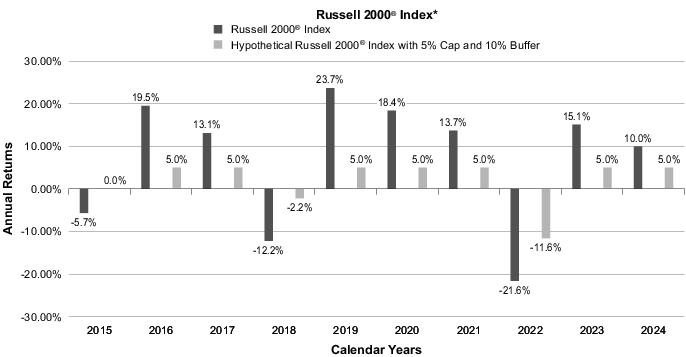

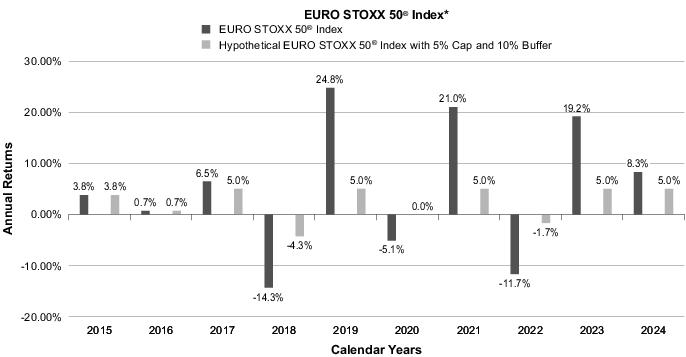

Principal

Risks of Investing In the Contract

The Contract involves certain risks

that you should understand before investing. You should carefully consider your income needs and risk tolerance to determine whether the

Contract is appropriate for you. The level of risk you bear and your potential investment performance will differ depending on the Index

Options you choose.

Returns on securities and securities

Indexes can vary substantially, which may result in investment losses. The historical performance of the Investment Options does not guarantee

future results. It is impossible to predict whether underlying investment values will fall or rise. Trading prices of the securities underlying

the Investment Options are influenced by economic, financial, regulatory, geographic, judicial, political and other complex and interrelated

factors. These factors can affect capital markets generally and markets on which the underlying securities are traded and these factors

can influence the performance of the underlying securities. Depending on your individual circumstances (e.g.,

your selected Index Options and the timing of any Purchase Payments, transfers, or withdrawals), you may experience (perhaps significant)

negative returns under the Contract. You should consult with a Financial Professional.

The Variable

Option does not provide any protection against loss of principal. You

can lose principal and previous earnings for Purchase Payments held in the Variable Option and such losses could be significant.

If you allocate Purchase Payments

or transfer Contract Value to an Index Option with the Index Dual Precision Strategy, Index Precision Strategy, Index Guard

Strategy, or Index Performance Strategy, negative Index Returns may cause Performance Credits to be either negative after application

of the 10%, 20%, or 30% Buffer, or negative down to the -10% Floor. For the Index Dual Precision Strategy and Index Performance Strategy,

we apply the Buffer for the entire Term length; we do not apply the Buffer annually on a 3-year or 6-year Term Index Option. Ongoing

deductions we make for Contract fees and expenses could also cause amounts available for withdrawal to be less than what you invested

even if Index performance has been positive. You

can lose principal and previous earnings if you allocate Purchase Payments or transfer Contract Value to the Index Options with the Index

Dual Precision Strategy, Index Precision Strategy, Index Guard Strategy, or Index Performance Strategy, and such losses could

be significant. If you allocate Purchase Payments or transfer Contract Value to the Index Options with the Index Protection Strategy with

Trigger you can also lose principal and previous earnings if you do not receive a Performance Credit, or if the Contract fees and

expenses are greater than the Performance Credit.

The maximum potential

negative Performance Credit for the Index Dual Precision Strategy, Index Precision Strategy, and Index Performance Strategy is based

on the Buffer. If the Buffer is 10%, the maximum negative Performance Credit is -90%; if the Buffer is 20%, the maximum negative Performance

Credit is -80%; and if the Buffer is 30%, the maximum negative Performance Credit is -70%. The maximum potential negative Performance

Credit for the Index Guard Strategy is the -10% Floor. Such

losses will be greater if you take a withdrawal that is subject to a withdrawal charge, or is a deduction of Contract fees and expenses.

At least one Index Option with a Buffer no lower than 5% or Floor no lower than -25%, or an Index Option that provides complete protection

from Index losses, will always be available for renewal under the Contract.

We designed the Contract to be a

long-term investment that you can use to help build and provide income for retirement. The Contract is not suitable for short-term investment.

If you need to take a full or partial

withdrawal during the withdrawal charge period we deduct a withdrawal charge unless the withdrawal is a Penalty-Free Withdrawal. While

Penalty-Free Withdrawals provide some liquidity, they are permitted in only limited amounts or in special circumstances. If you need to

withdraw most or all of your Contract Value in a short period, you will exceed the Penalty-Free Withdrawal amounts available to you and

incur withdrawal charges. For more information on the withdrawal charge, see the Fee Tables and section 7, Expenses and Adjustments –

Withdrawal Charge.

We calculate the withdrawal charge

as a percentage of your Purchase Payments, not Contract Value. Consequently, if the Contract Value has declined since you made a Purchase

Payment, it is possible the percentage of Contract Value withdrawn to cover the withdrawal charge would be greater than the withdrawal

charge percentage. For example, assume you buy the Contract with a single Purchase Payment of $10,000. If your Contract Value in the fifth

year is $8,000 and you take a full withdrawal a 5% withdrawal charge applies. The total withdrawal charge would be $500 (5% of $10,000).

As your Contract Value is less than $100,000, we will also deduct the $50 contract maintenance charge. This results in you receiving $7,450. For

purposes of this example, we have not factored in any final rider fees that may apply and be deducted in connection with a full withdrawal.

In addition, upon a full withdrawal,

the free withdrawal privilege is not available to you, and we apply a withdrawal charge against Purchase Payments that are still within

their withdrawal charge period, including amounts previously withdrawn under the free withdrawal privilege. On

a full withdrawal, your Withdrawal Charge Basis may be greater than your Contract Value because the following reduce your Contract Value,

but do not reduce your Withdrawal Charge Basis: deductions we make for prior Penalty-Free Withdrawals and Contract fees or expenses; and/or

poor performance.

Amounts withdrawn from this Contract

are subject to income taxes and may also be subject to a 10% additional federal tax for amounts withdrawn before age 59 1∕2.

We only apply Performance Credits

to the Index Options once each Term on the Term End Date, rather than daily. In the interim, we calculate Index Option Values based on

the Daily Adjustment. For more information, see “Risks Associated with the Daily Adjustment” later in this section. The

Variable Option is not subject to the Daily Adjustment. Any assets removed from an Index Option during the Term for withdrawals you take

(including Penalty-Free Withdrawals), Annuity Payments, or deductions we make for Contract fees and expenses, or if we pay a death benefit,

will not be eligible to

receive a Performance

Credit on the Term End Date. These removed assets will not receive the full benefit of the Index Value, Index Return, and the 10%, 20%,

or 30% Buffer; or -10% Floor that would have been available on the Term End Date, and losses could exceed the protection offered by the

10%, 20%, or 30% Buffer; or -10% Floor. You will receive a Performance Credit only on any unlocked Index Option Value remaining in an

Index Option on the Term End Date.

You can typically transfer Index

Option Value among the Index Options only on Term End Dates. At other times, you can only move assets out of an Index Option by taking

a full or partial withdrawal, or entering the Annuity Phase. However, you can transfer assets out of an Index Option before the Term End

Date by executing a Performance Lock. Once an Index Option is locked, you can transfer assets out of it on the Index Anniversary that

occurs on or immediately after the Lock Date. For a 3-year or 6-year Term Index Option this means you can transfer out of the locked Index

Option before the Term End Date by executing a Performance Lock on or before the second Index Anniversary of a 3-year Term, or on or before

the fifth Index Anniversary of a 6-year Term. You can also transfer assets out of any locked Index Option, including 1-year Term

Index Options, before the Term End Date by requesting an Early Reallocation. You may execute twelve Early Reallocations each Index Year,

but each request can involve multiple locked Index Options. These restrictions may limit your ability to react to changes in market conditions.

You should consider whether investing in an Index Option is consistent with your financial needs.

Index Option returns depend on the

performance of an Index although you are not directly invested in the Index or in the securities tracked by the Index. You will have no

voting rights, no rights to receive cash dividends or other distributions, and no other rights with respect to the companies that make

up the Indexes. Because the S&P 500®

Index, Russell 2000®

Index, Nasdaq-100®

Index, EURO STOXX 50®

and iShares®

MSCI Emerging Markets ETF are each comprised of a collection of equity securities, in each case the value of the component securities

is subject to market risk, or the risk that market fluctuations may cause the value of the component securities to go up or down, sometimes

rapidly and unpredictably. In addition, the value of equity securities may decline for reasons directly related to the issuers of the

securities.

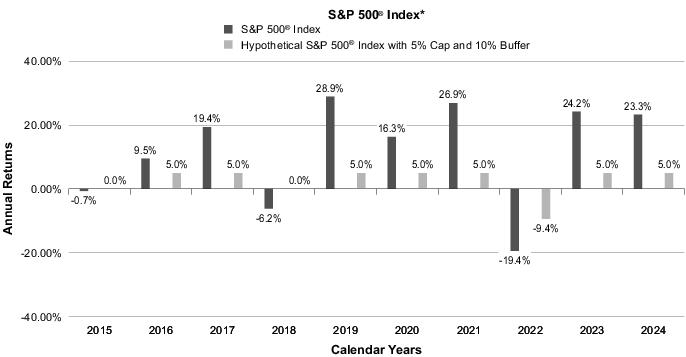

The S&P 500®

Index, Russell 2000®

Index, Nasdaq-100®

Index, and EURO STOXX 50®

are all “price return indexes,” not “total return indexes,” and therefore do not reflect dividends paid on

the securities composing the Index. This will reduce the Index Return and may cause the Index to underperform a direct investment in the

securities composing the Index. For the EURO STOXX 50®,

this Index is a euro “price return index” and Index Returns are determined without any exchange rate adjustment. Because

Index performance for the iShares®

MSCI Emerging Markets ETF is based on the ETF’s closing share price, Index performance is calculated on a “price return”

basis, not a “total return” basis, and therefore does not reflect dividends paid on the securities in which the ETF invests.

In addition, an ETF deducts fees and costs, which reduce Index performance. These factors will reduce the Index Return and may cause the

ETF to underperform a direct investment in the ETF or the securities in which the ETF invests.

In addition to the foregoing, each

Index has its own unique risks, as follows:

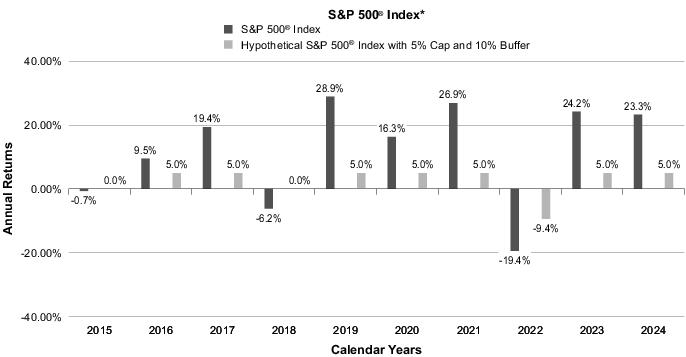

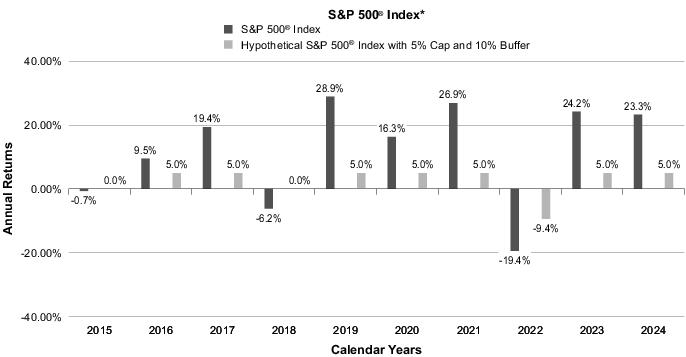

S&P

500®

Index: This Index is comprised of equity securities issued

by large-capitalization (“large cap”) U.S. companies. In general, large capitalization companies may be unable to respond

quickly to new competitive challenges or changes in their industries, and may not be able to attain the high growth rate of successful

smaller companies.

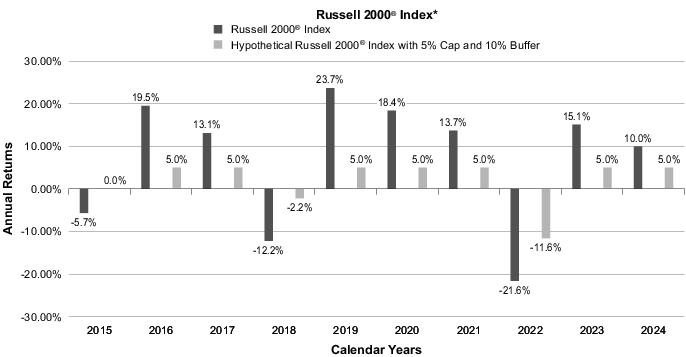

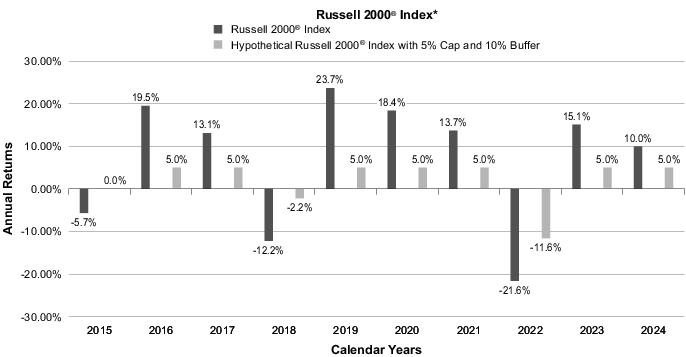

Russell

2000®

Index: This Index is comprised of equity securities of

small-capitalization (“small-cap”) U.S. companies. Generally, the securities of small-cap companies are more volatile and

riskier than the securities of large-cap companies.

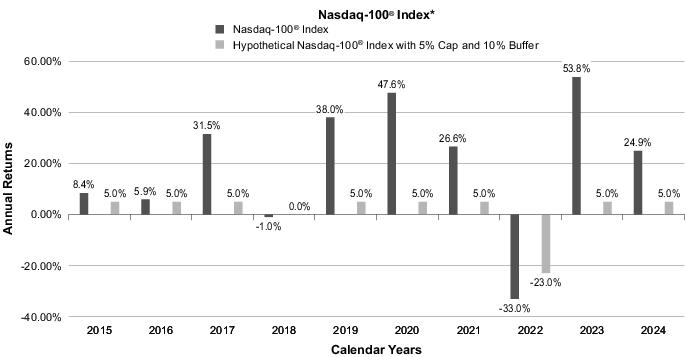

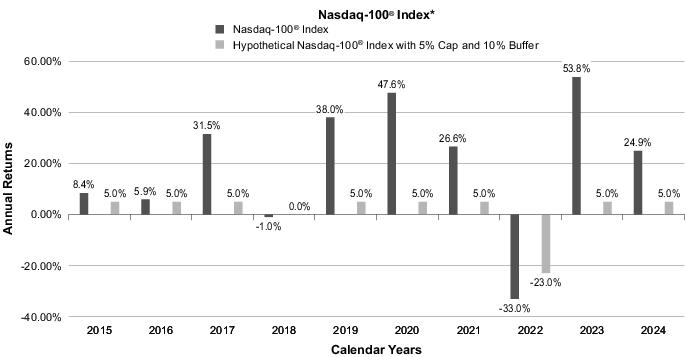

Nasdaq-100®

Index: This Index is comprised of equity securities of

the largest U.S. and non-U.S. companies listed on the Nasdaq Stock Market, including companies across all major industry groups except

financial companies. In general, large-capitalization companies may be unable to respond quickly to new competitive challenges or changes

in their industries, and may not be able to attain the high growth rate of successful smaller companies. To the extent that the Index

is comprised of securities issued by companies in a particular sector, those securities may not perform as well as the securities of companies

in other sectors or the market as a whole. Also, any securities issued by non-U.S. companies are subject to the risks related to investments

in foreign markets (e.g.,

increased volatility; changing currency exchange rates; and greater political, regulatory, and economic uncertainty).

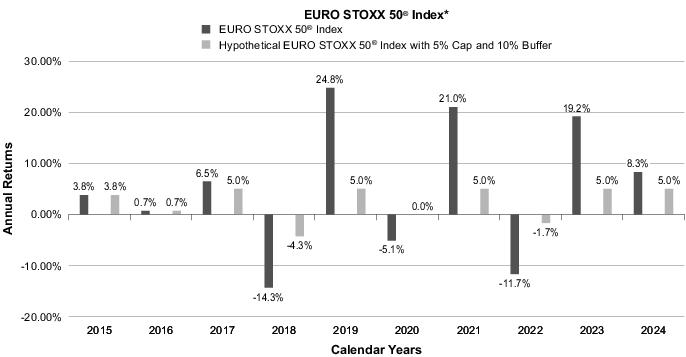

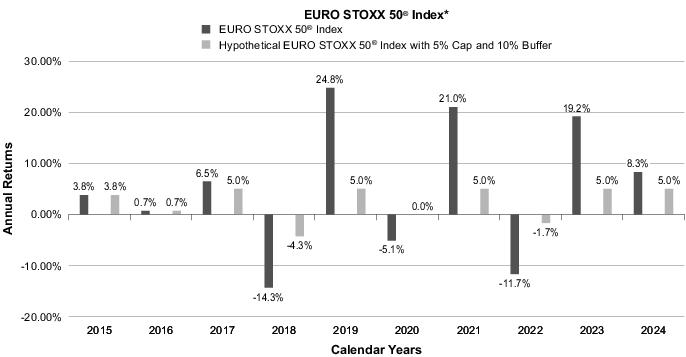

EURO

STOXX 50®:

This Index is comprised of the equity securities of large-capitalization companies in the Eurozone. In general, large-capitalization companies

may be unable to respond quickly to new competitive challenges or changes in their industries, and may not be able to attain the high

growth rate of successful smaller companies. Securities issued by non-U.S. companies are subject to the risks related to investments in

foreign markets (e.g.,

increased volatility; changing currency exchange rates; and greater political, regulatory, and economic uncertainty).

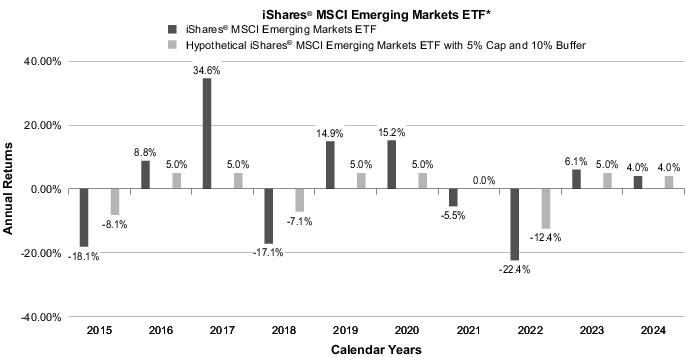

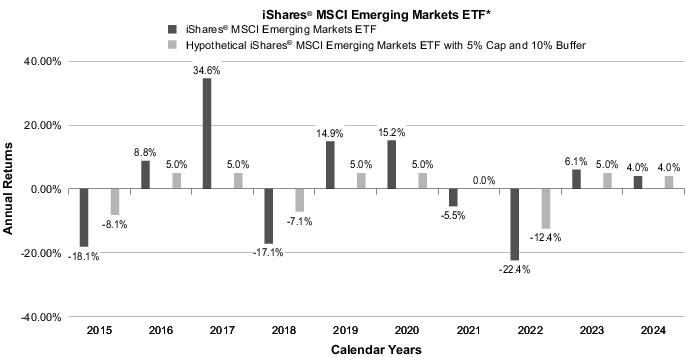

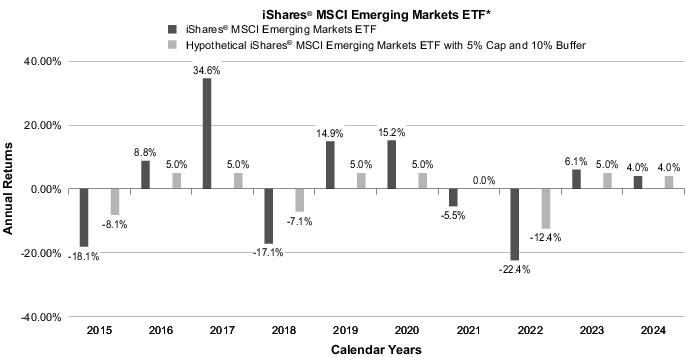

iShares®

MSCI Emerging Markets ETF: The iShares MSCI Emerging Markets

ETF seeks to track the investment results of an index composed of large- and mid-capitalization emerging market equities. Investments

in emerging market issuers may be subject to a greater risk of loss than investments in issuers located or operating in more developed

markets. Emerging markets may be more likely to experience inflation, social instability, political turmoil or rapid changes in economic

conditions than more developed markets. Companies in many emerging markets are not subject to the same degree of regulatory requirements,

accounting standards or auditor oversight as companies in more developed countries, and as a result, information about the securities

in which the ETF invests may be less reliable or complete. Emerging markets often have less reliable securities valuations and greater

risk associated with custody of securities than developed markets. There may be significant obstacles to obtaining information necessary

for investigations into or litigation against companies and shareholders may have limited legal remedies.

Risks

Associated with the Daily Adjustment

The Daily Adjustment is how we calculate

Index Option Values on Business Days other than the Term Start Date or Term End Date. The

Variable Option is not subject to the Daily Adjustment.

The Daily Adjustment can affect the amounts available for withdrawal, Performance Locks, annuitization, payment of the death benefit,

and the Contract Value used to determine the contract maintenance charge and Charge Base for the rider fee. The Daily Adjustment

can be less than the Trigger Rate or Cap even if the current Index return during the Term is greater than the Trigger Rate or Cap. In

addition, even though the current Index return during the Term may be positive, the Daily Adjustment may be negative due to changes in

Proxy Value inputs, such as volatility, dividend yield, and interest rate. However, the Daily Adjustment for the Index Protection Strategy

with Trigger cannot be negative. The Daily Adjustment is generally negatively affected by:

poor

market performance, and

the

expected volatility of Index prices. Generally, increases in the expected volatility of Index prices negatively affect the Index Dual

Precision Strategy, Index Precision Strategy, and Index Performance Strategy 1-year Term Index Options, while decreases in the expected

volatility of Index prices negatively affect the Index Guard Strategy. For the Index Performance Strategy 3-year and 6-year Term Index

Options, the impact of changes in the expected volatility of Index prices is dependent on the market environment and the applicable Caps

and Participation Rates. For the Index Protection Strategy with Trigger, the impact of changes in the expected volatility of Index prices

is dependent on the market environment.

The Daily Adjustment for Index Options

with a Term length of more than 1 year (3-year and 6-year Term Index Options and Early Reallocation to a 1-year Term Index Option) may

be more negatively impacted by changes in the expected volatility of Index prices than 1-year Term Index Options due to the difference

in Term length. Also, the risk of a negative Daily Adjustment is generally greater for Index Options with a Term length of more than 1

year than for 1-year Term Index Options due to the Term length. The Index Performance Strategy 3-year and 6-year Term Index Options with

a Participation Rate above 100% may also have larger fluctuations in the Daily Adjustment than Index Options either without a Participation

Rate, or with a Participation Rate equal to 100%. For shorter Term lengths, there is more certainty in both the final Index Values and

how Trigger Rates, Caps, Buffers, and Floors determine Performance Credits. This means there may be less fluctuation in the Daily Adjustment

due to changes in Index return for Index Options with shorter Term lengths.

If you take a withdrawal from an

Index Option with the Index Dual Precision Strategy, Index Precision Strategy, Index Guard Strategy, or Index Performance Strategy

before the Term End Date, you could lose

principal and previous earnings because of the Daily Adjustment even

if Index performance is positive on that day or has been positive since the Term Start Date.

If the current Index return during the Term is negative, the Daily Adjustment for these Index Options could result in losses greater than

the protection provided by the 10%, 20%, or 30% Buffer; or -10% Floor.

The maximum potential loss from a negative

Daily Adjustment is: -99% for the Index Dual Precision Strategy, Index Precision Strategy, and Index Performance Strategy; and -35%

for the Index Guard Strategy. Such

losses will be greater if you take a withdrawal that is subject to a withdrawal charge, or is a deduction of Contract fees and expenses.

Risks

Associated with Calculation of Performance Credits

We calculate Performance Credits

each Term on the Term End Date. Because we calculate Index Returns only on a single date in time, you may experience negative or flat

performance even though the Index you selected for a given Crediting Method experienced gains through some, or most, of the Term. If you

allocate Purchase Payments or transfer Contract

Value to the

Index Options with Index Protection Strategy with Trigger, positive returns are limited by the Trigger Rates. You are not subject, however,

to potential negative Performance Credits. The Trigger Rates on the Index Dual Precision Strategy and Index Precision Strategy Index

Options, and the Caps on the Index Guard Strategy and Index Performance Strategy Index Options also limit positive returns and could cause

performance to be lower than it would otherwise have been if you invested in a mutual fund or exchange-traded fund designed to track the

performance of the applicable Index. For the Index Performance Strategy, we apply the Cap and any Participation Rate for the entire Term

length; we do not

apply the Cap and any Participation Rate annually on a

3-year or 6-year Term Index Option. For the Index Dual Precision Strategy, we apply the Trigger Rate for the entire Term length; we do

not

apply the Trigger Rate annually on a 3-year or 6-year Term Index Option.

The Index Options do not receive

any dividends payable on these securities. The Index Options also do not directly participate in the returns of the Indexes or the Indexes’

component securities. Index Returns would be higher if they included the dividends from the component securities.

Trigger Rates, Caps, and Participation

Rates may be adjusted on the next Term Start Date and may vary significantly from Term to Term. Changes to Trigger Rates, Caps, and Participation

Rates may significantly affect the Performance Credit you receive. For more information, see the “Risks Associated with Changes

to Trigger Rates, Caps, and Participation Rates” discussion later in this section.

The Crediting Methods only capture

Index Values on the Term Start Date and Term End Date, so you will bear the risk that the Index Value might be abnormally low on these

days.

Risks

Associated with Performance Locks and Early Reallocations

If a Performance Lock is executed:

You

will no longer participate in Index performance, positive or negative, for the remainder of the Term for the locked Index Option. This

means that under no circumstances will your Index Option Value increase during the remainder of the Term for a locked Index Option, and

you will begin a new Index Option with a new Term Start Date on the next Index Anniversary that occurs on or immediately after the

Lock Date unless you execute an Early Reallocation (if available to you). If you decide to execute an Early Reallocation,

you can execute a Performance Lock and then, at the earliest, execute an Early Reallocation on the same Business Day. When executing both

the Performance Lock and Early Reallocation on the same Business Day, your Lock Date is also the Term Start Date for the new Index Option.

You

will not receive a Performance Credit on any locked Index Option on the Term End Date.

We

use the Daily Adjustment calculated at the end of the current

Business Day on the Lock Date to determine your locked Index Option Value. This means that, if you request a Performance Lock, your Index

Option Value will lock at an unknown future value which may be higher or lower than it was at the point in time you requested a Performance

Lock. In addition, if you set a lower target, your Index Option Value may lock at a lower value than the target you set.

If

a Performance Lock is executed when your Daily Adjustment has declined, you will lock in any loss. It is possible that you would have

realized less of a loss or no loss if the Performance Lock occurred at a later time, or if the Index Option was not locked.

We

will not execute a Performance Lock on the Index Protection Strategy with Trigger Index Options if the Daily Adjustment is zero. This

may limit your ability to take advantage of the benefits of the Early Reallocation feature.

There

are limits on Early Reallocations. We do not accept Early Reallocation requests within 14 calendar days before an Index Anniversary; and

you are limited to twelve Early Reallocation requests each Index Year, but each request can involve multiple locked Index Options. After

you reach the Early Reallocation request limit in an Index Year, any locked Index Options will remain locked until the next Index Anniversary.

These limitations mean you may not be able to take advantage of any increases to Early Reallocation rates, or any advantageous changes

to Index values that may become available at the optimal time. This may limit your return potential. Early Reallocation is available for

amounts allocated to any locked Index Option, subject to the restrictions described in this prospectus.

Early

Reallocation Trigger Rates, Caps, and Participation Rates you receive may be less than the Early Reallocation rates that become available