PROG Internal PROG Holdings, Inc. Q3 2025 Earnings Supplement October 22, 2025 Exhibit 99.2

Statements, estimates and projections in this earnings supplement regarding our business that are not historical facts are "forward-looking statements" that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “continue”, “maintaining”, “target”, “outlook”, “assumes”, and similar forward-looking terminology. These risks and uncertainties include (i) continued volatility and challenges in the macro-economic environment and their impact on: (a) consumer confidence and customer demand for the merchandise that our retail partners sell, in particular consumer durables, such as home appliances, electronics and furniture; (b) our customers’ disposable income and their ability to make the lease and loan payments they owe the Company; (c) the availability of consumer credit; and (d) our overall financial performance and outlook; (ii) the impact of the uncertain macro-economic environment on our proprietary algorithms and decisioning tools that we use to approve customers such that they are no longer indicative of our customers’ ability to perform, which in turn may limit the ability of our businesses to manage risk, avoid lease and loan charge-offs and may result in insufficient reserves to cover actual losses; (iii) a large percentage of Progressive Leasing's revenue being concentrated with several key retail partners, and the loss of any of these retail partner relationships materially and adversely affecting several aspects of our performance; (iv) Progressive Leasing being unable to attract additional retail partners and retain and grow its relationships with its existing retail partners, resulting in several aspects of our performance being materially and adversely affected; (v) Progressive Leasing being unable to attract new consumers and retain and grow its relationships with its existing customers materially and adversely affecting several aspects of our performance; (vi) Vive and Four’s business models differing significantly from Progressive Leasing’s lease-to-own business, which means each of these businesses have different risk profiles; (vii) our efforts to modernize and enhance certain enterprise-wide information management systems and technologies adversely impacting our businesses and operations; (viii) the inability of our businesses to successfully operate in highly and increasingly competitive industries materially and adversely affecting several aspects of our performance; (ix) our business, results of operations, financial condition, and prospects being materially and adversely affected due to Progressive Leasing failing to maintain a consistently high level of consumer satisfaction and trust in its brand; (x) our businesses being subject to extensive federal, state and local laws and regulations, including certain laws and regulations unique to the industries in which our businesses operate, that may subject them to government investigations and significant monetary penalties, remediation expenses and compliance-related burdens that may result in them changing the manner in which they operate, which may be materially adverse to several aspects of our performance; (xi) our performance being materially and adversely affected due to the transactions offered to consumers by our businesses being negatively characterized by federal, state and local government officials, consumer advocacy groups and the media; (xii) our inability to protect confidential, proprietary, or sensitive information, including the confidential information of our customers, being adversely affected by cyber-attacks or similar disruptions, which may result in significant costs, litigation and reputational damage or otherwise have a material adverse impact on several aspects of our performance; (xiii) any significant disruption in our vendors' information technology systems, or disruptions in the information our businesses rely on in their lease and loan decisioning, materially and adversely affecting several aspects of our performance; (xiv) our capital allocation strategy and financial policies, including our current stock repurchase and dividend programs, as well as any potential debt repurchase program not being effective at enhancing shareholder value, or providing other benefits we expect; and (xv) the other risks and uncertainties discussed under "Risk Factors" in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on February 19, 2025. Statements, estimates and projections in this earnings supplement that are "forward-looking" include without limitation statements, estimates and projections about: (i) the benefits we expect from our sale of the Vive Financial portfolio, including improving our capital efficiency and increasing our financial flexibility to support future growth initiatives and maximize long-term value; (ii) the performance of our lease portfolio, including our annual write-offs; (iii) the progress of our Four Technologies business and the benefits we expect from that business; (iv) our ability to continue investing in our businesses and products and the benefits we expect from those investments; (v) our capital allocation strategy and plans; and (vi) our revised full year 2025 outlook and the guidance we provide for the fourth quarter. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this earnings supplement. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this earnings supplement. Use of Forward-Looking Statements

3 PROG Holdings Q3 2025 Headlines • Consolidated revenues of $595.1 million; Net earnings of $33.1 million • Adjusted EBITDA of $67.0 million • Diluted EPS of $0.82; Non-GAAP Diluted EPS of $0.90 • Progressive Leasing GMV of $410.9 million • Four Technologies grows GMV 162.8%; third consecutive quarter of positive Adjusted EBITDA

PROG Internal "Our third quarter results once again highlight the strength and consistency of our execution, even as consumers face ongoing economic pressures" said Steve Michaels, President and CEO of PROG Holdings. "We delivered strong earnings and expanded margins in our Progressive Leasing segment, despite modest revenue headwinds, while Four Technologies achieved its eighth consecutive quarter of triple-digit GMV and revenue growth, further validating the scalability and relevance of our BNPL platform.“ "The sale of Vive is evidence of our active management of our portfolio of assets and marks a meaningful step in improving our capital efficiency. With strong free cash flow, a well-capitalized balance sheet, and the proceeds from the portfolio sale, we are well positioned to continue executing on our capital allocation strategy that balances strategic investments while returning excess capital to shareholders.“ "Our focus is clear; we’re doubling down on our three-pillar strategy to Grow, Enhance and Expand. We are investing in high-impact businesses and products, including Progressive Leasing, our direct-to-consumer channel, PROG Marketplace, and our fast- growing BNPL platform Four Technologies, while maintaining the financial flexibility to support future growth and maximize long-term value creation." "I'm incredibly proud of the team's disciplined execution and the momentum we've built as we approach the end of 2025. With a strong product portfolio, solid financial foundation, and continued investment in customer experience, we are well positioned to deliver sustainable growth in 2026 and beyond," Michaels concluded. Steve Michaels President and CEO, PROG Holdings, Inc. PROG Holdings Executive Commentary

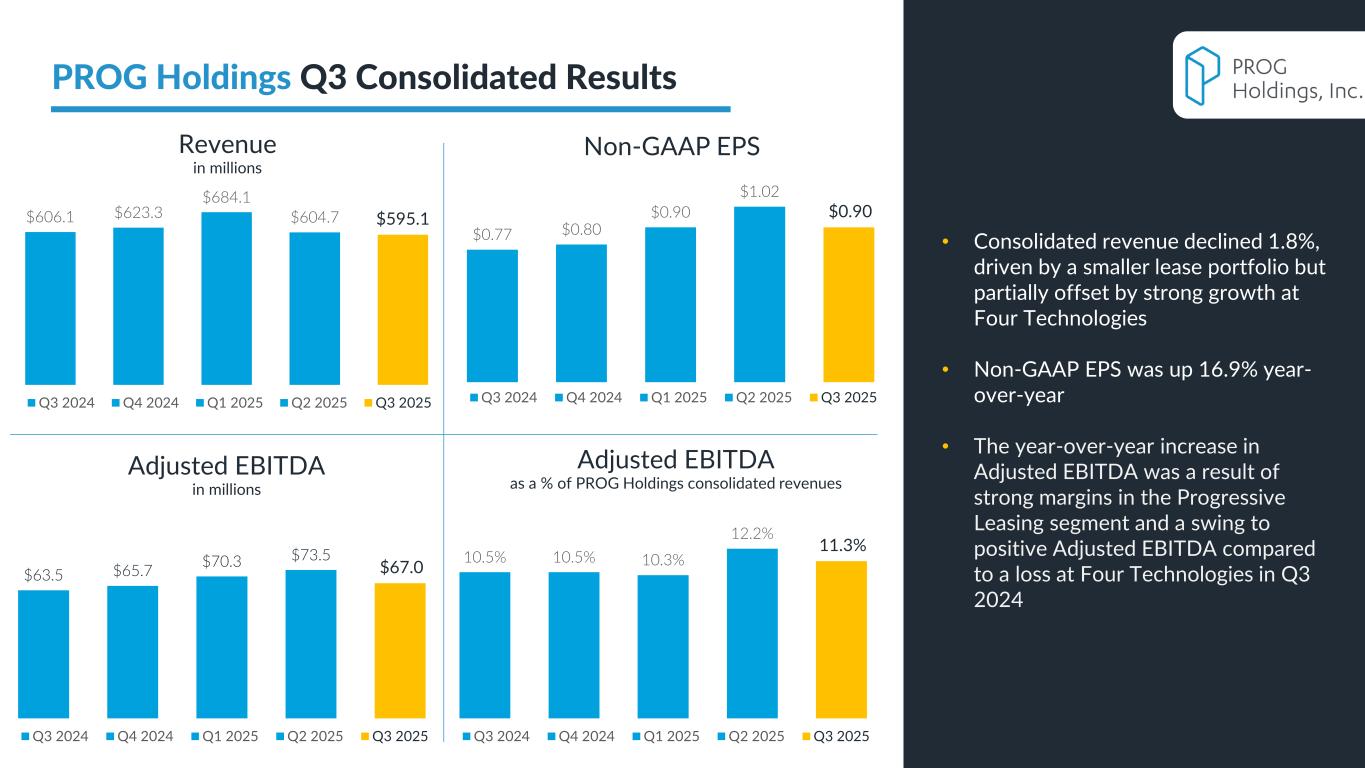

PROG Internal Adjusted EBITDA in millions 5 $606.1 $623.3 $684.1 $604.7 $595.1 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Non-GAAP EPSRevenue in millions 10.5% 10.5% 10.3% 12.2% 11.3% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Adjusted EBITDA as a % of PROG Holdings consolidated revenues PROG Holdings Q3 Consolidated Results $63.5 $65.7 $70.3 $73.5 $67.0 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 $0.77 $0.80 $0.90 $1.02 $0.90 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 • Consolidated revenue declined 1.8%, driven by a smaller lease portfolio but partially offset by strong growth at Four Technologies • Non-GAAP EPS was up 16.9% year- over-year • The year-over-year increase in Adjusted EBITDA was a result of strong margins in the Progressive Leasing segment and a swing to positive Adjusted EBITDA compared to a loss at Four Technologies in Q3 2024

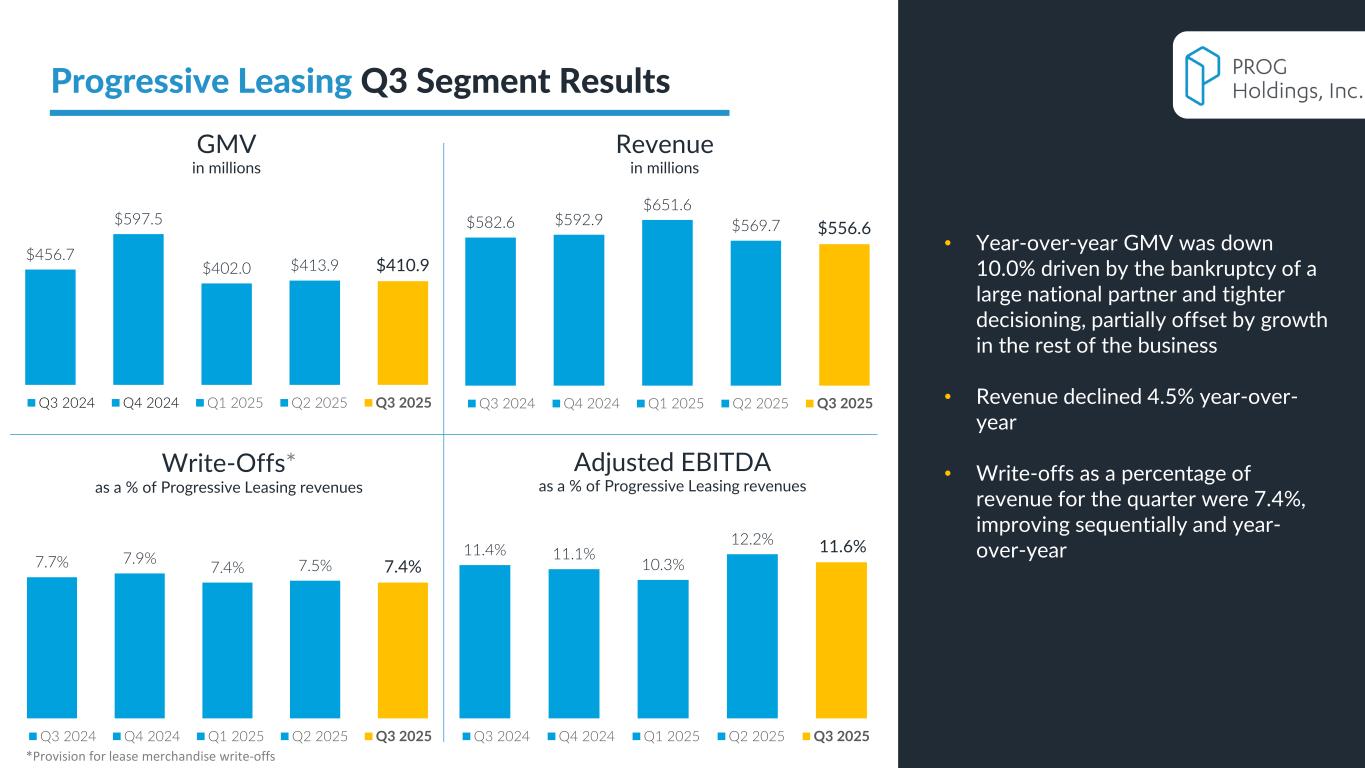

PROG Internal $582.6 $592.9 $651.6 $569.7 $556.6 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Write-Offs* as a % of Progressive Leasing revenues 6 $456.7 $597.5 $402.0 $413.9 $410.9 Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 GMV in millions 7.7% 7.9% 7.4% 7.5% 7.4% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Adjusted EBITDA as a % of Progressive Leasing revenues Progressive Leasing Q3 Segment Results Revenue in millions *Provision for lease merchandise write-offs 11.4% 11.1% 10.3% 12.2% 11.6% Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 • Year-over-year GMV was down 10.0% driven by the bankruptcy of a large national partner and tighter decisioning, partially offset by growth in the rest of the business • Revenue declined 4.5% year-over- year • Write-offs as a percentage of revenue for the quarter were 7.4%, improving sequentially and year- over-year

PROG Internal Results

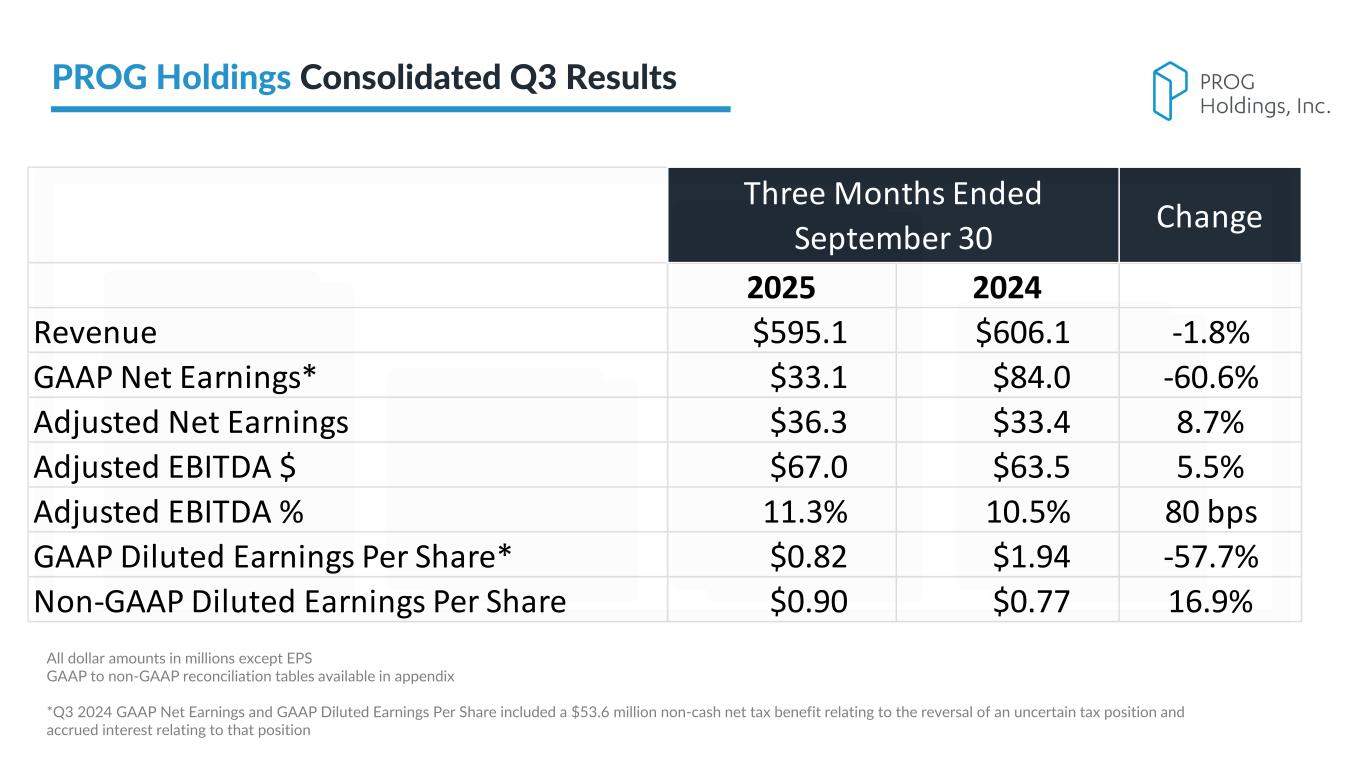

PROG Internal 2025 2024 Revenue $595.1 $606.1 -1.8% GAAP Net Earnings* $33.1 $84.0 -60.6% Adjusted Net Earnings $36.3 $33.4 8.7% Adjusted EBITDA $ $67.0 $63.5 5.5% Adjusted EBITDA % 11.3% 10.5% 80 bps GAAP Diluted Earnings Per Share* $0.82 $1.94 -57.7% Non-GAAP Diluted Earnings Per Share $0.90 $0.77 16.9% Three Months Ended September 30 Change All dollar amounts in millions except EPS GAAP to non-GAAP reconciliation tables available in appendix *Q3 2024 GAAP Net Earnings and GAAP Diluted Earnings Per Share included a $53.6 million non-cash net tax benefit relating to the reversal of an uncertain tax position and accrued interest relating to that position PROG Holdings Consolidated Q3 Results

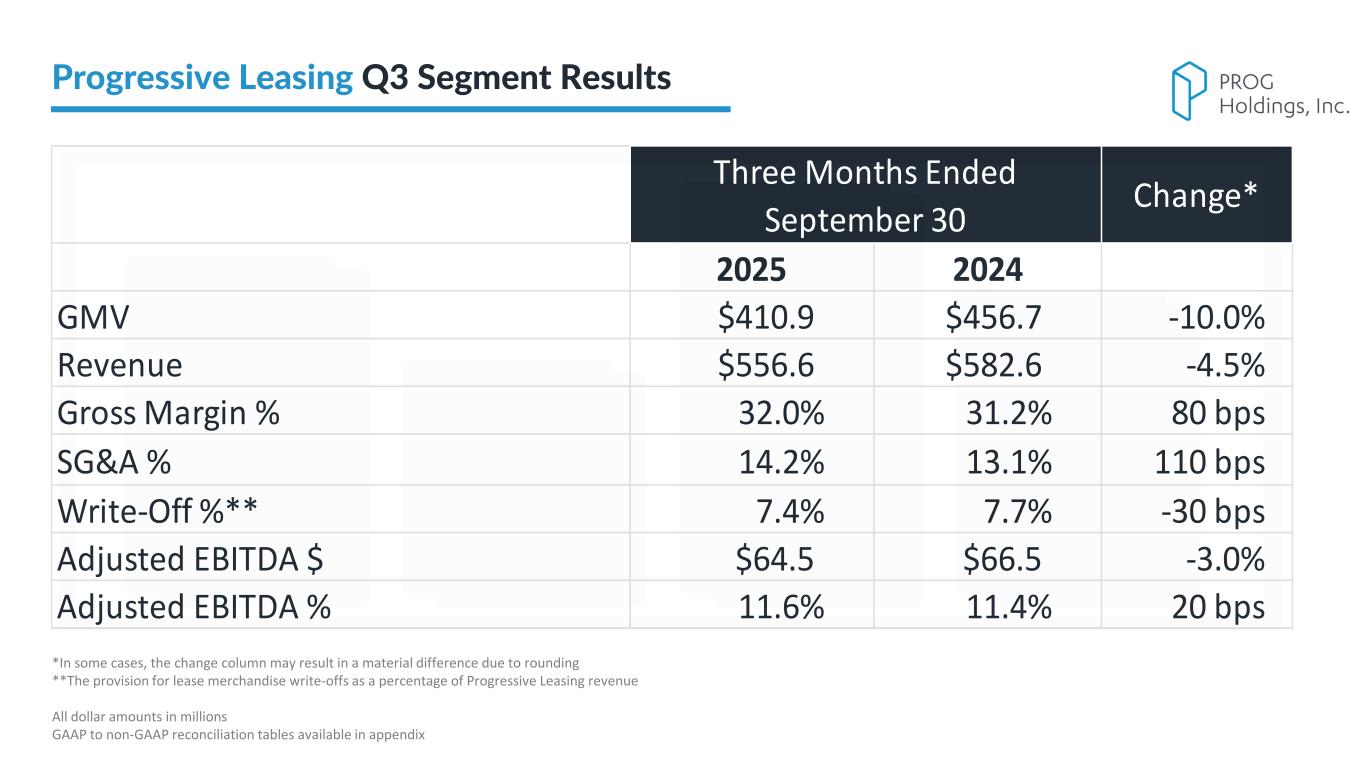

PROG Internal 2025 2024 GMV $410.9 $456.7 -10.0% Revenue $556.6 $582.6 -4.5% Gross Margin % 32.0% 31.2% 80 bps SG&A % 14.2% 13.1% 110 bps Write-Off %** 7.4% 7.7% -30 bps Adjusted EBITDA $ $64.5 $66.5 -3.0% Adjusted EBITDA % 11.6% 11.4% 20 bps Three Months Ended September 30 Change* *In some cases, the change column may result in a material difference due to rounding **The provision for lease merchandise write-offs as a percentage of Progressive Leasing revenue All dollar amounts in millions GAAP to non-GAAP reconciliation tables available in appendix Progressive Leasing Q3 Segment Results

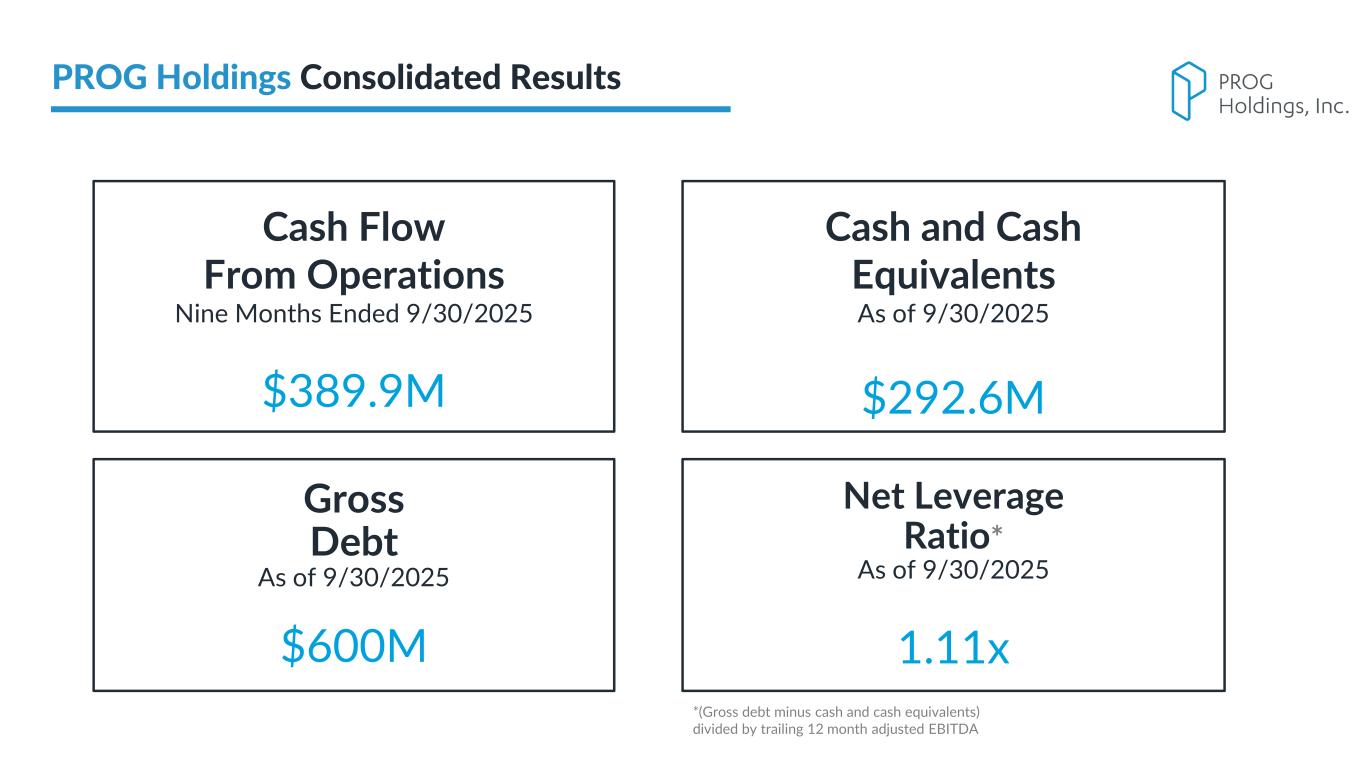

PROG Internal *(Gross debt minus cash and cash equivalents) divided by trailing 12 month adjusted EBITDA PROG Holdings Consolidated Results Cash and Cash Equivalents As of 9/30/2025 $292.6M Gross Debt As of 9/30/2025 $600M Net Leverage Ratio* As of 9/30/2025 1.11x Cash Flow From Operations Nine Months Ended 9/30/2025 $389.9M

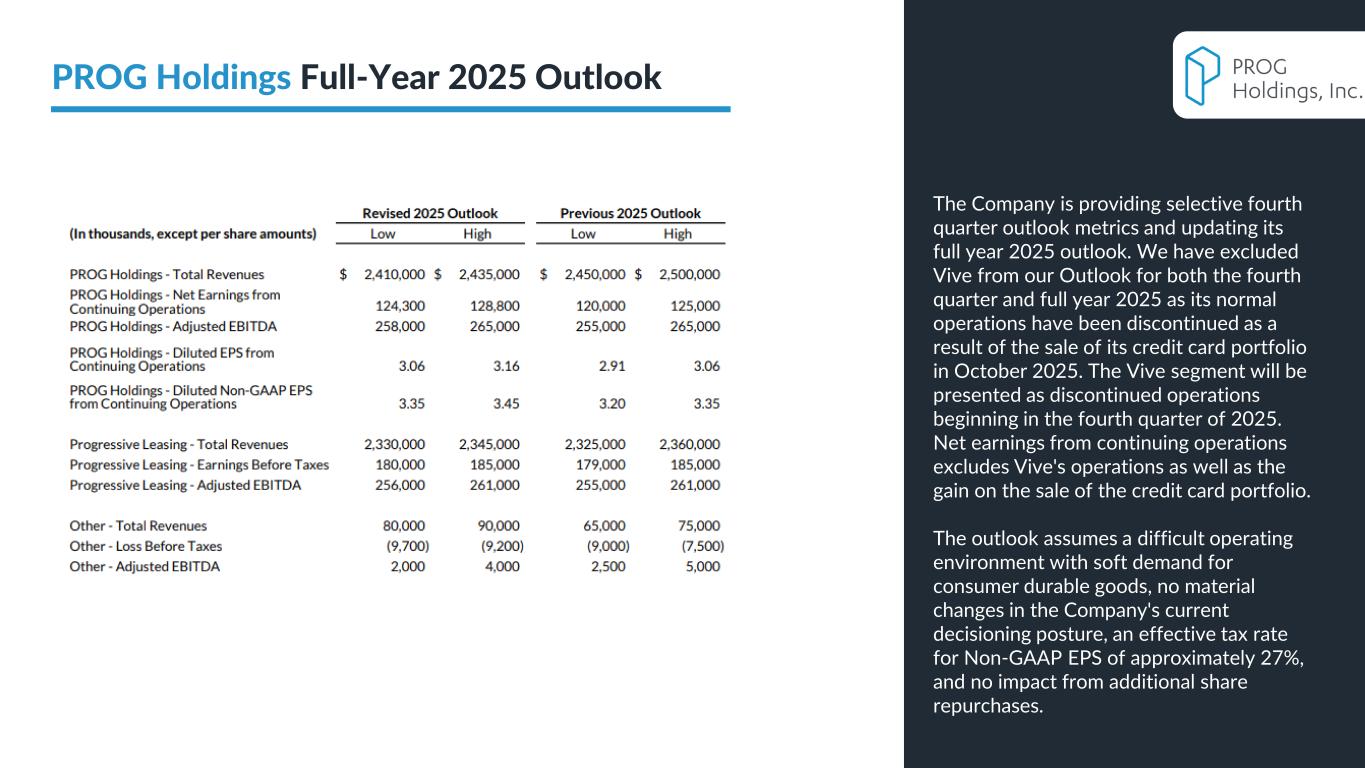

PROG Internal 11 PROG Holdings Full-Year 2025 Outlook The Company is providing selective fourth quarter outlook metrics and updating its full year 2025 outlook. We have excluded Vive from our Outlook for both the fourth quarter and full year 2025 as its normal operations have been discontinued as a result of the sale of its credit card portfolio in October 2025. The Vive segment will be presented as discontinued operations beginning in the fourth quarter of 2025. Net earnings from continuing operations excludes Vive's operations as well as the gain on the sale of the credit card portfolio. The outlook assumes a difficult operating environment with soft demand for consumer durable goods, no material changes in the Company's current decisioning posture, an effective tax rate for Non-GAAP EPS of approximately 27%, and no impact from additional share repurchases.

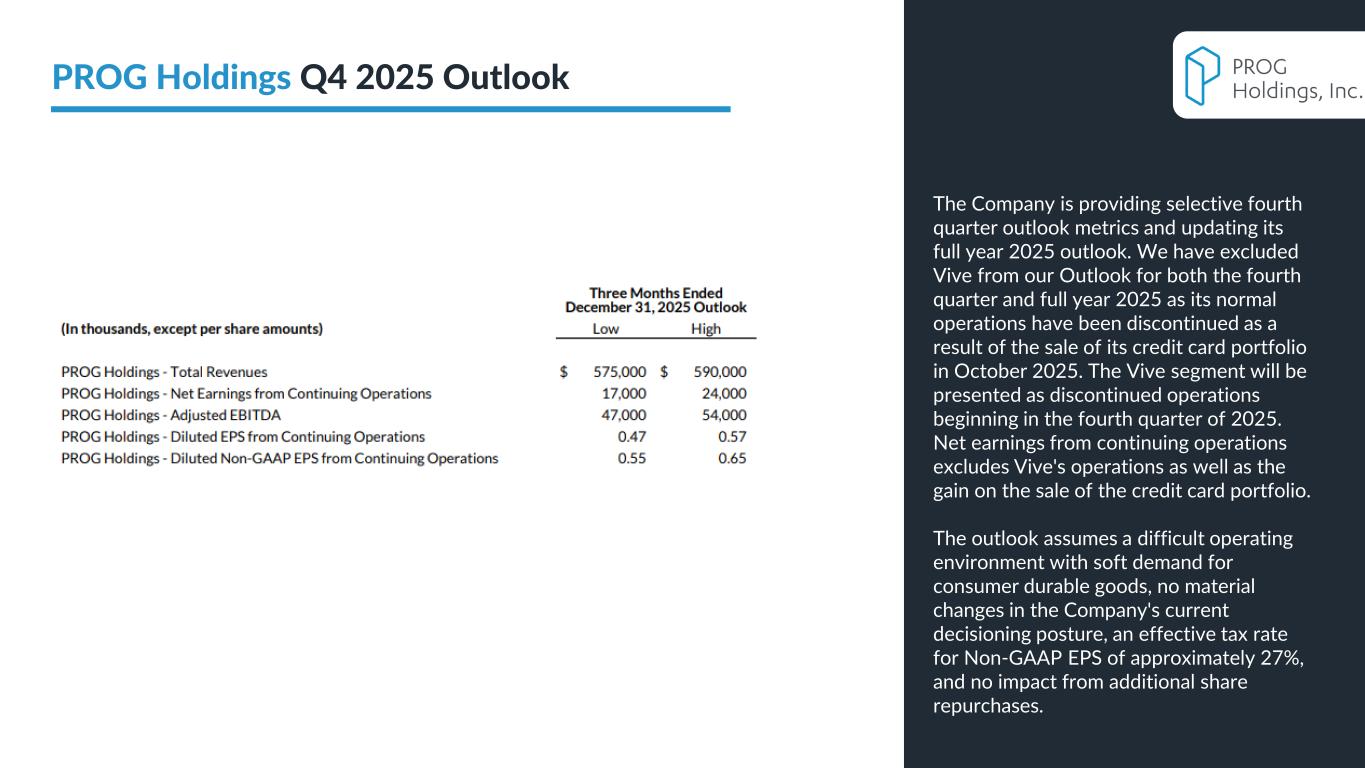

PROG Internal 12 PROG Holdings Q4 2025 Outlook The Company is providing selective fourth quarter outlook metrics and updating its full year 2025 outlook. We have excluded Vive from our Outlook for both the fourth quarter and full year 2025 as its normal operations have been discontinued as a result of the sale of its credit card portfolio in October 2025. The Vive segment will be presented as discontinued operations beginning in the fourth quarter of 2025. Net earnings from continuing operations excludes Vive's operations as well as the gain on the sale of the credit card portfolio. The outlook assumes a difficult operating environment with soft demand for consumer durable goods, no material changes in the Company's current decisioning posture, an effective tax rate for Non-GAAP EPS of approximately 27%, and no impact from additional share repurchases.

PROG Internal

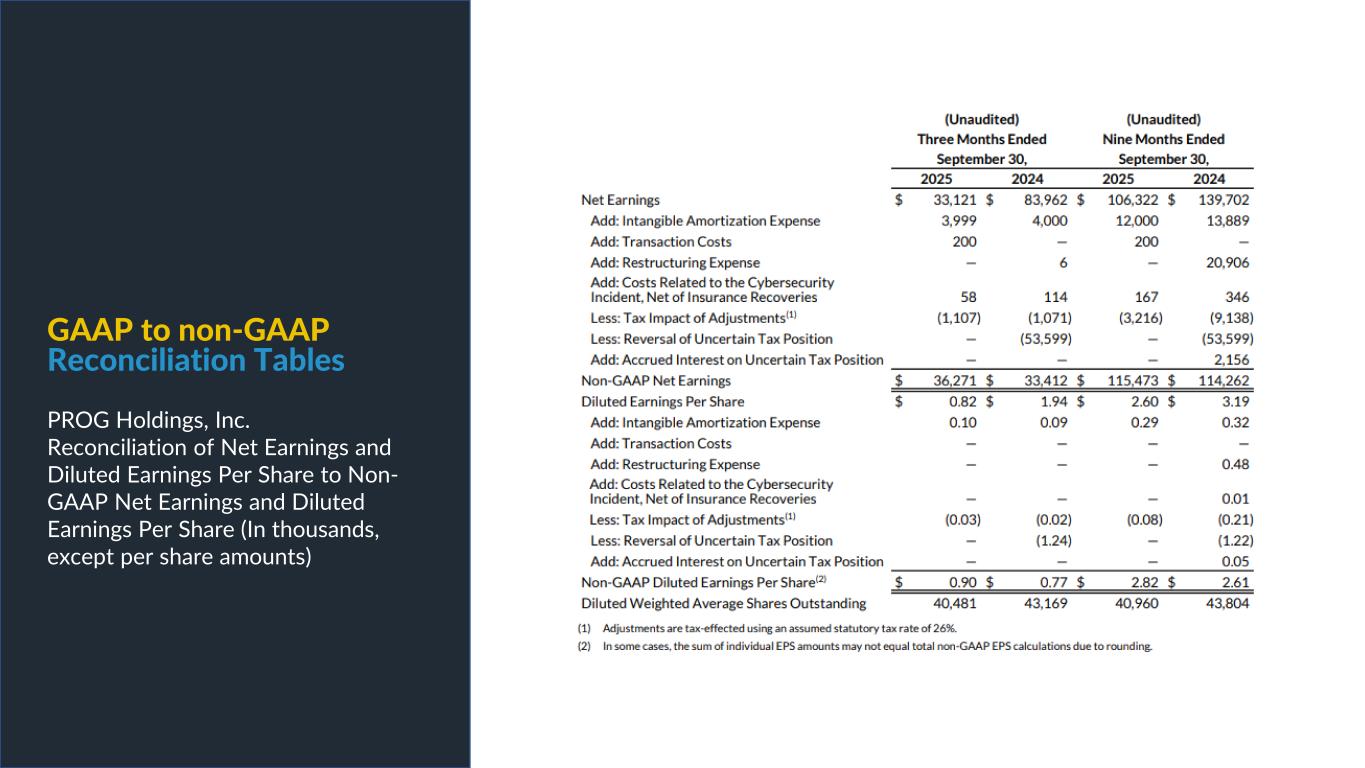

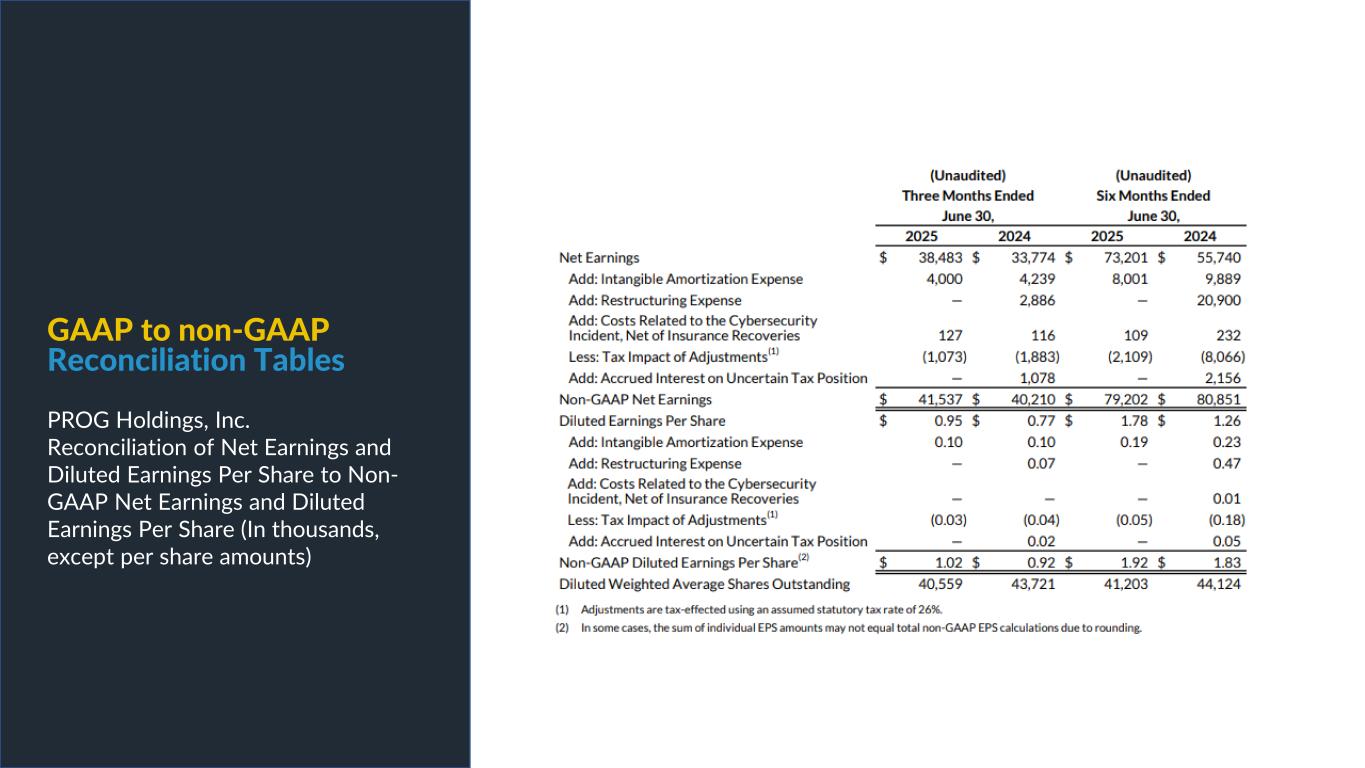

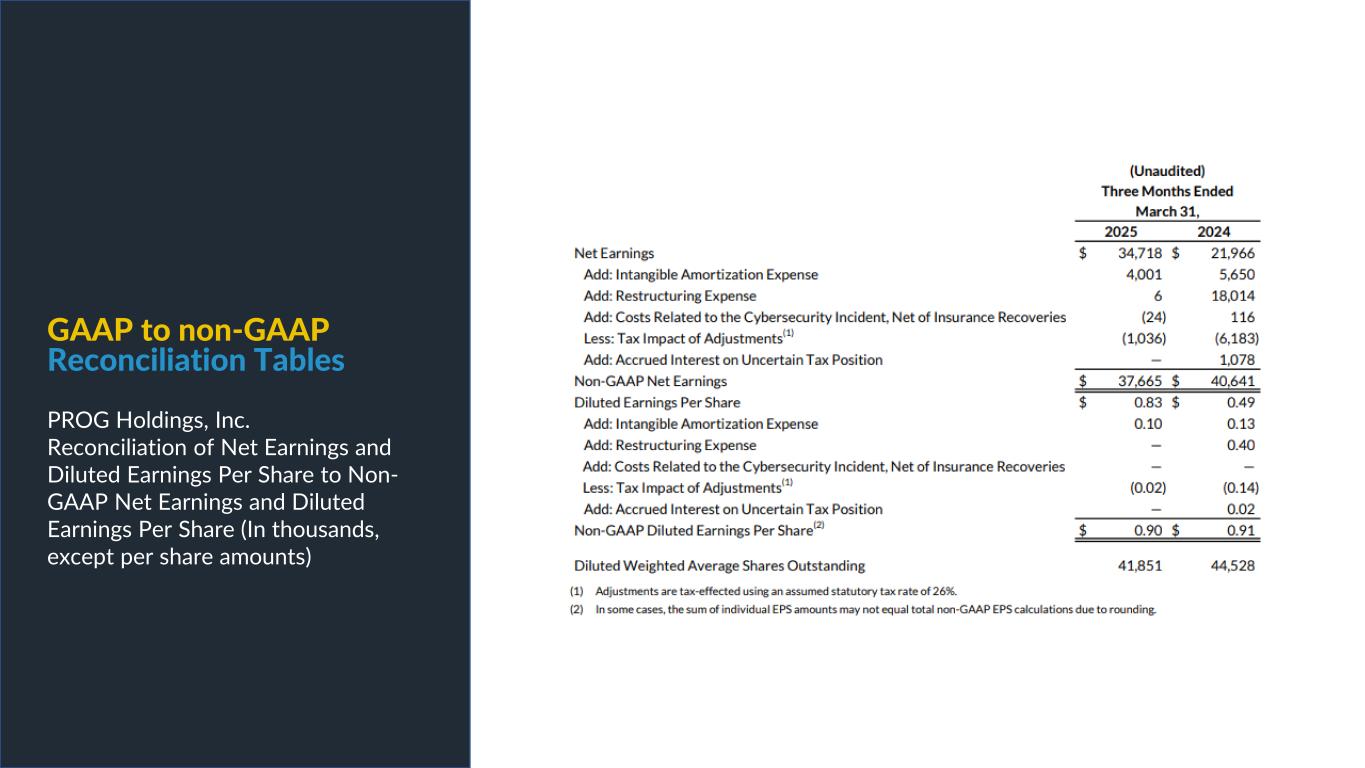

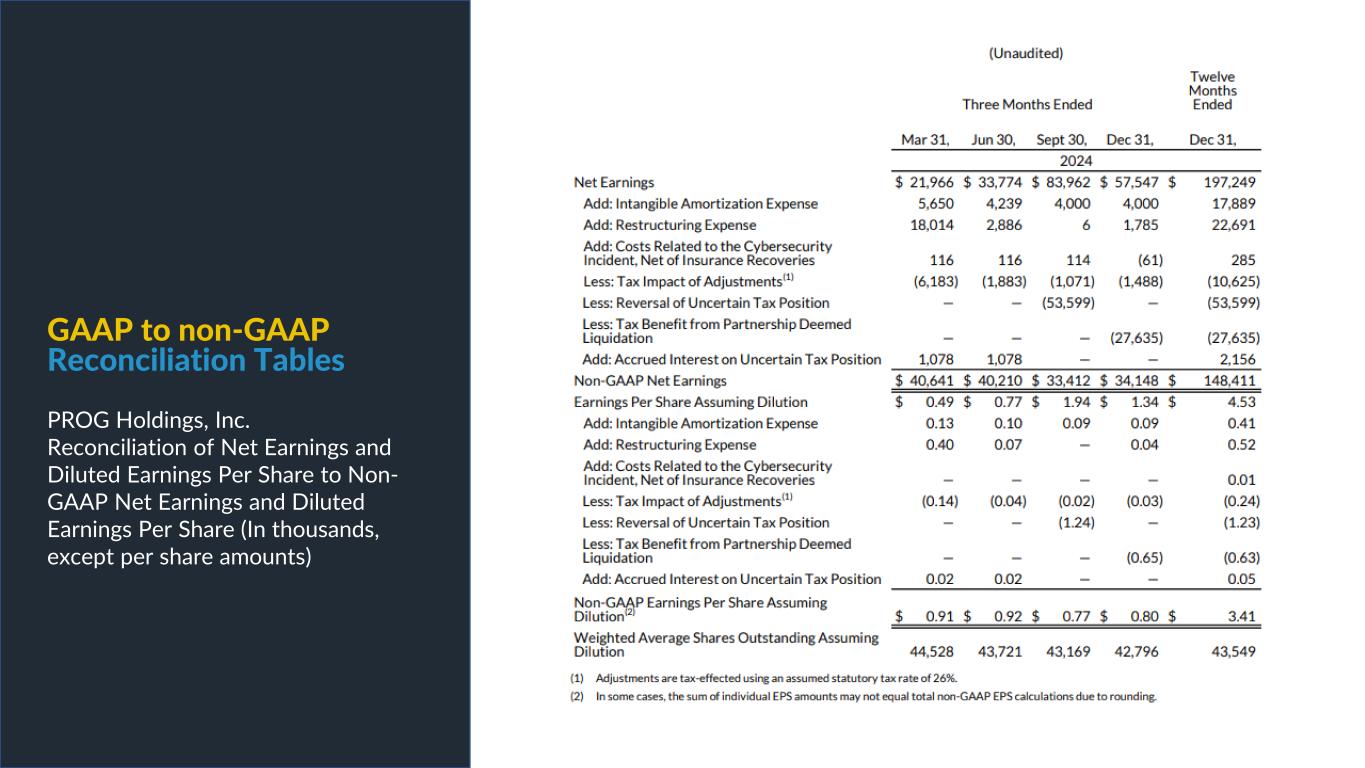

PROG Internal Non-GAAP net earnings, non-GAAP diluted earnings per share, and adjusted EBITDA are supplemental measures of our performance that are not calculated in accordance with generally accepted accounting principles in the United States ("GAAP"). Non-GAAP diluted earnings per share from continuing operations for the full year 2025 and fourth quarter 2025 outlook excludes intangible amortization expense and also excludes Vive as its normal operations have been discontinued as a result of the sale of its credit card portfolio in October 2025. The Vive segment will be presented as discontinued operations beginning in the fourth quarter of 2025. Adjusted EBITDA excludes Vive's operations as well as the gain on the sale of the credit card portfolio. Non-GAAP net earnings and non-GAAP diluted earnings per share for the three and nine months ended September 30, 2025, exclude intangible amortization expense, transaction costs and costs related to the cybersecurity incident, net of insurance recoveries. Non-GAAP net earnings and non-GAAP diluted earnings per share for the three and nine months ended September 30, 2024 exclude intangible amortization expense, restructuring expenses, costs related to the cybersecurity incident, and reversal of the uncertain tax position related to Progressive Leasing’s $175 million settlement with the FTC in 2020. The amount for the after-tax non-GAAP adjustment, which is tax effected using our statutory tax rate, can be found in the reconciliation of net earnings and diluted earnings per share to non-GAAP net earnings and diluted earnings per share table in this presentation. The Adjusted EBITDA figures presented in this presentation are calculated as the Company’s earnings before interest expense, net, depreciation on property and equipment, amortization of intangible assets and income taxes. Adjusted EBITDA for the full year 2025 and fourth quarter 2025 outlook excludes stock-based compensation expense. Adjusted EBITDA for the three and nine months ended September 30, 2025 excludes stock-based compensation expense, costs related to the cybersecurity incident, net of insurance recoveries and transaction costs. Adjusted EBITDA for the three and nine months ended September 30, 2024 excludes stock-based compensation expense, restructuring expenses, and costs related to the cybersecurity incident, net of insurance recoveries. The amounts for these pre-tax non-GAAP adjustments can be found in the segment EBITDA tables in this presentation. Management believes that non-GAAP net earnings, non-GAAP diluted earnings per share, and adjusted EBITDA provide relevant and useful information, and are widely used by analysts, investors and competitors in our industry as well as by our management in assessing both consolidated and business unit performance. Non-GAAP net earnings, non-GAAP diluted earnings, and adjusted EBITDA provide management and investors with an understanding of the results from the primary operations of our business by excluding the effects of certain items that generally arose from larger, one-time transactions that are not reflective of the ordinary earnings activity of our operations or transactions that have variability and volatility of the amount. We believe the exclusion of stock-based compensation expense provides for a better comparison of our operating results with our peer companies as the calculations of stock-based compensation vary from period to period and company to company due to different valuation methodologies, subjective assumptions and the variety of award types. This measure may be useful to an investor in evaluating the underlying operating performance of our business. Adjusted EBITDA also provides management and investors with an understanding of one aspect of earnings before the impact of investing and financing charges and income taxes. These measures may be useful to an investor in evaluating our operating performance because the measures: • Are widely used by investors to measure a company’s operating performance without regard to items excluded from the calculation of such measure, which can vary substantially from company to company depending upon accounting methods, book value of assets, capital structure and the method by which assets were acquired, among other factors. • Are used by rating agencies, lenders and other parties to evaluate our creditworthiness. • Are used by our management for various purposes, including as a measure of performance of our operating entities and as a basis for strategic planning and forecasting. Non-GAAP financial measures, however, should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP, such as the Company’s GAAP basis net earnings and diluted earnings per share and the GAAP revenues and earnings before income taxes of the Company’s segments, which are also included in the presentation. Further, we caution investors that amounts presented in accordance with our definitions of non-GAAP net earnings, non-GAAP diluted earnings per share, and adjusted EBITDA may not be comparable to similar measures disclosed by other companies, because not all companies and analysts calculate these measures in the same manner. Use of Non-GAAP Financial Measures

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Reconciliation of Net Earnings and Diluted Earnings Per Share to Non- GAAP Net Earnings and Diluted Earnings Per Share (In thousands, except per share amounts)

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Reconciliation of Net Earnings and Diluted Earnings Per Share to Non- GAAP Net Earnings and Diluted Earnings Per Share (In thousands, except per share amounts)

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Reconciliation of Net Earnings and Diluted Earnings Per Share to Non- GAAP Net Earnings and Diluted Earnings Per Share (In thousands, except per share amounts)

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Reconciliation of Net Earnings and Diluted Earnings Per Share to Non- GAAP Net Earnings and Diluted Earnings Per Share (In thousands, except per share amounts)

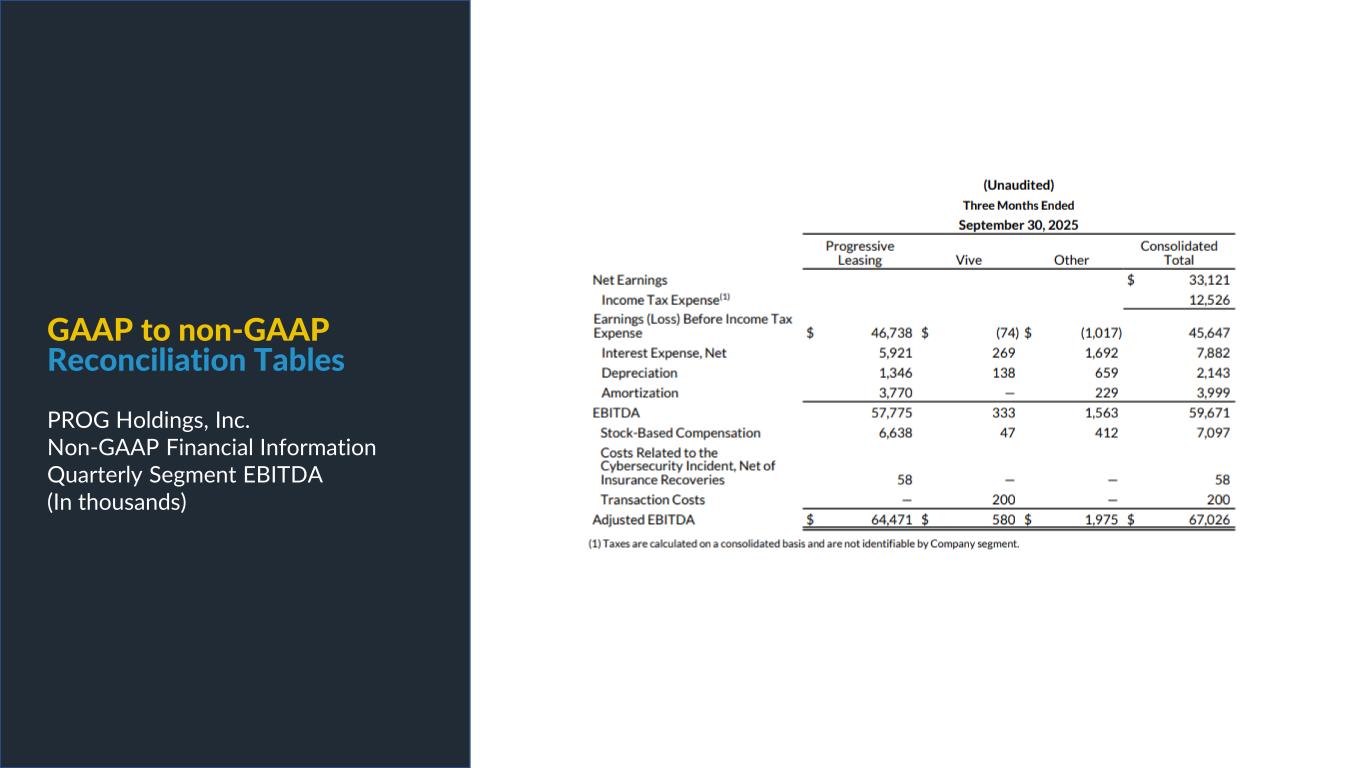

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Quarterly Segment EBITDA (In thousands)

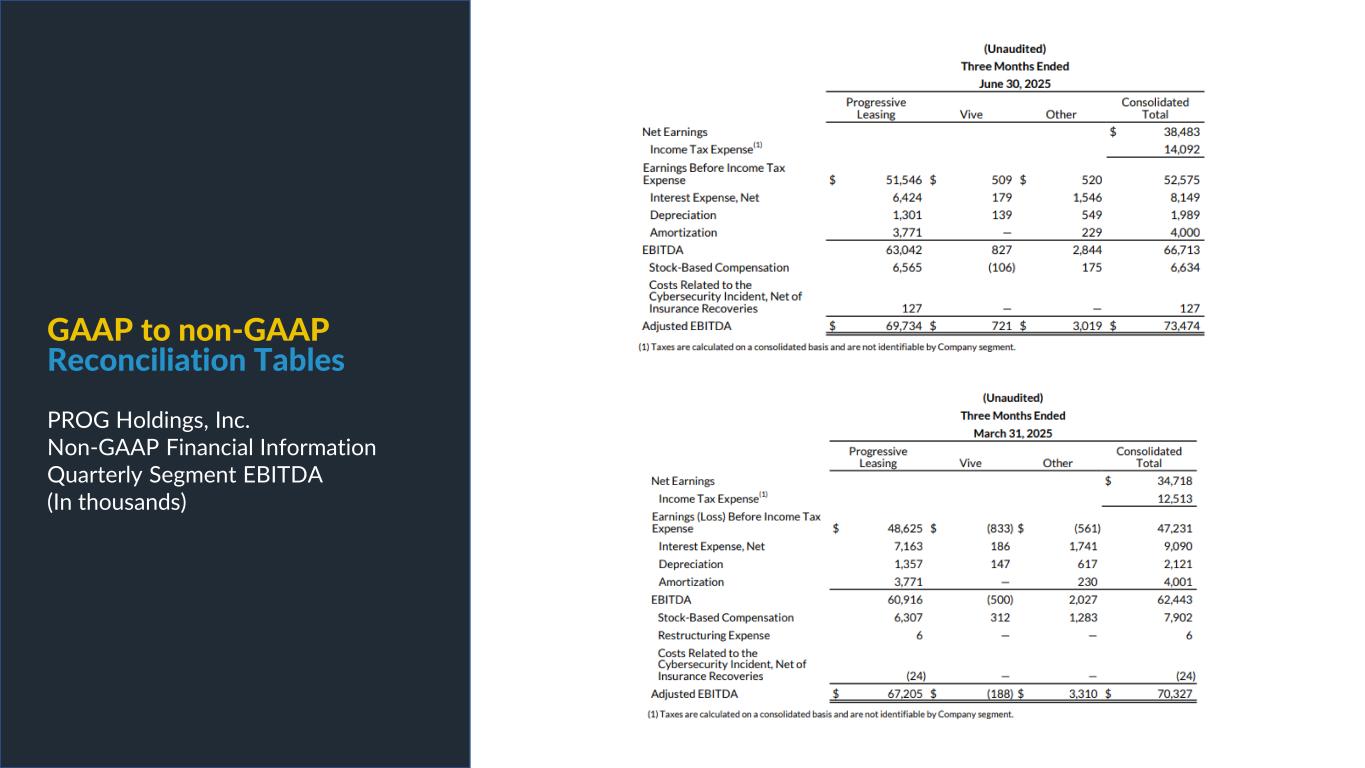

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Quarterly Segment EBITDA (In thousands)

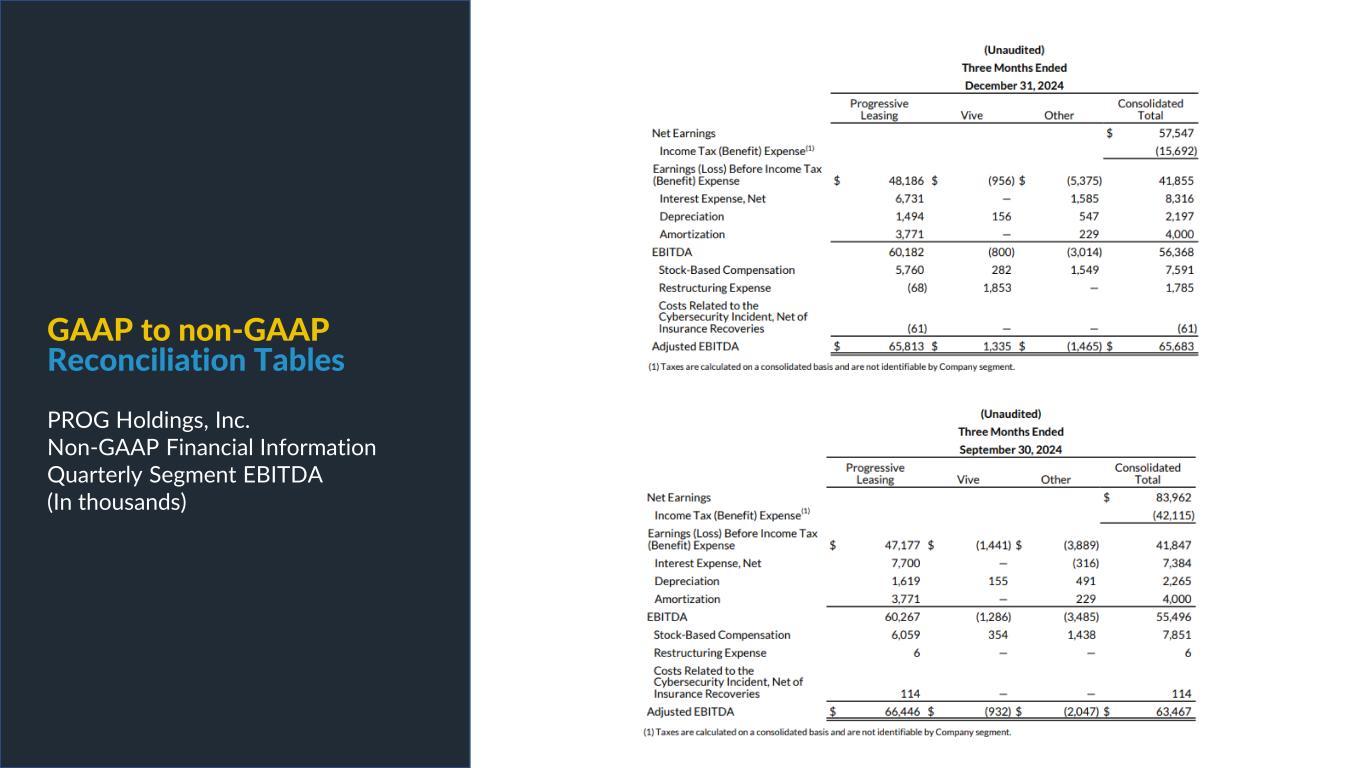

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Quarterly Segment EBITDA (In thousands)

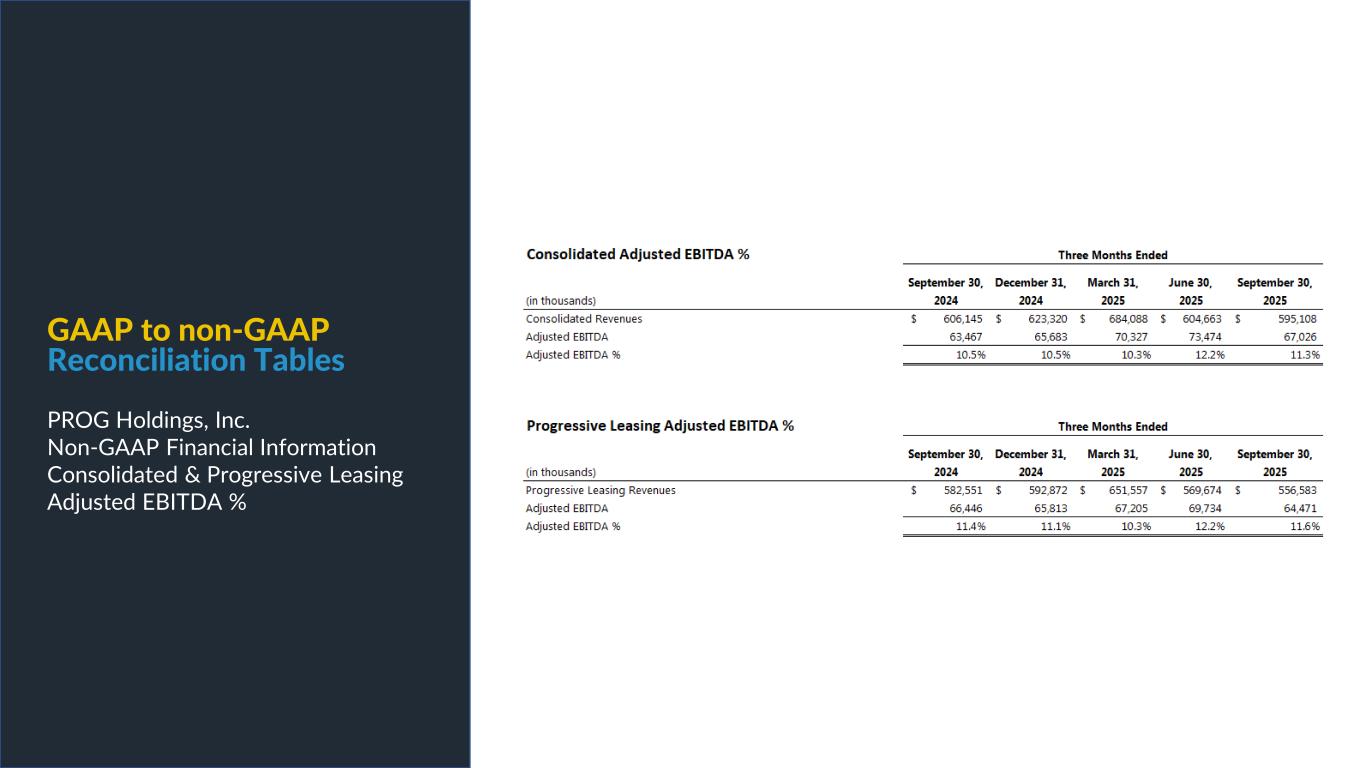

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Consolidated & Progressive Leasing Adjusted EBITDA %

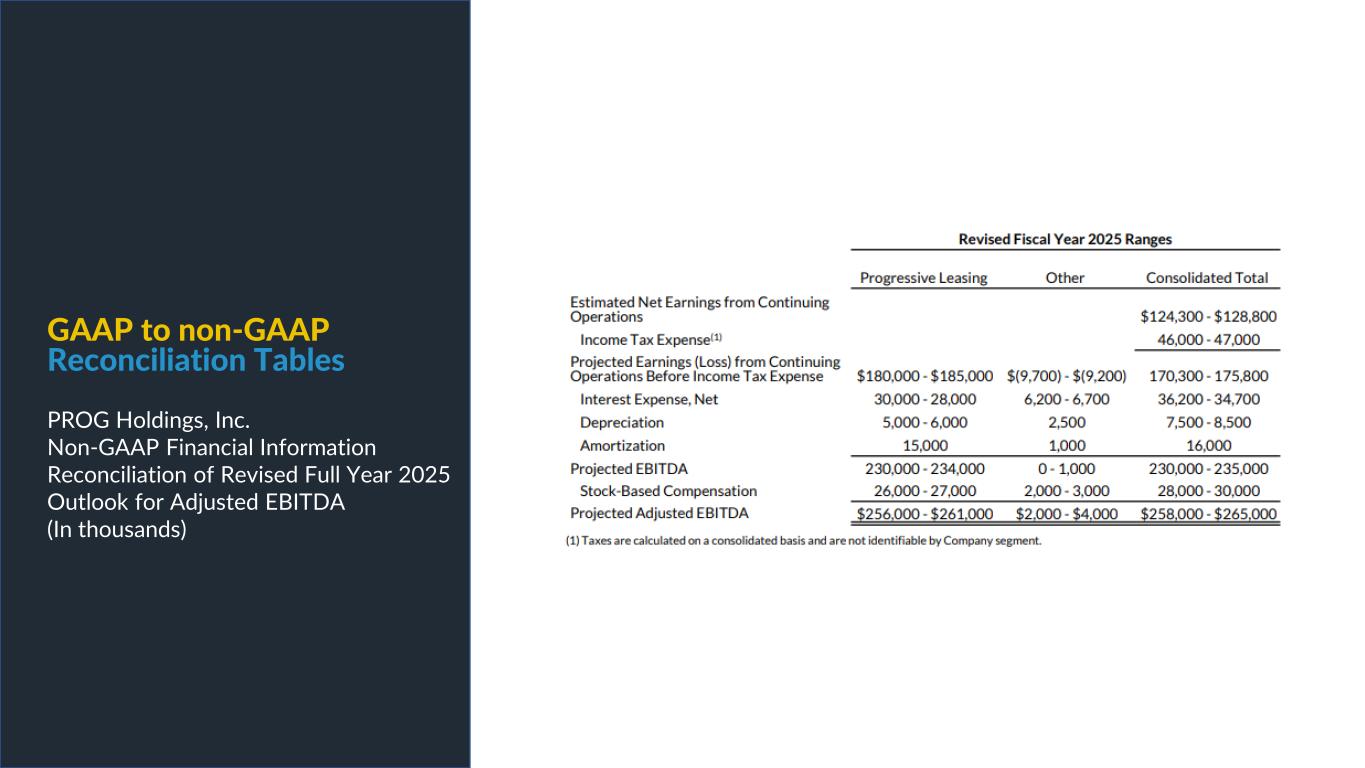

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Reconciliation of Revised Full Year 2025 Outlook for Adjusted EBITDA (In thousands)

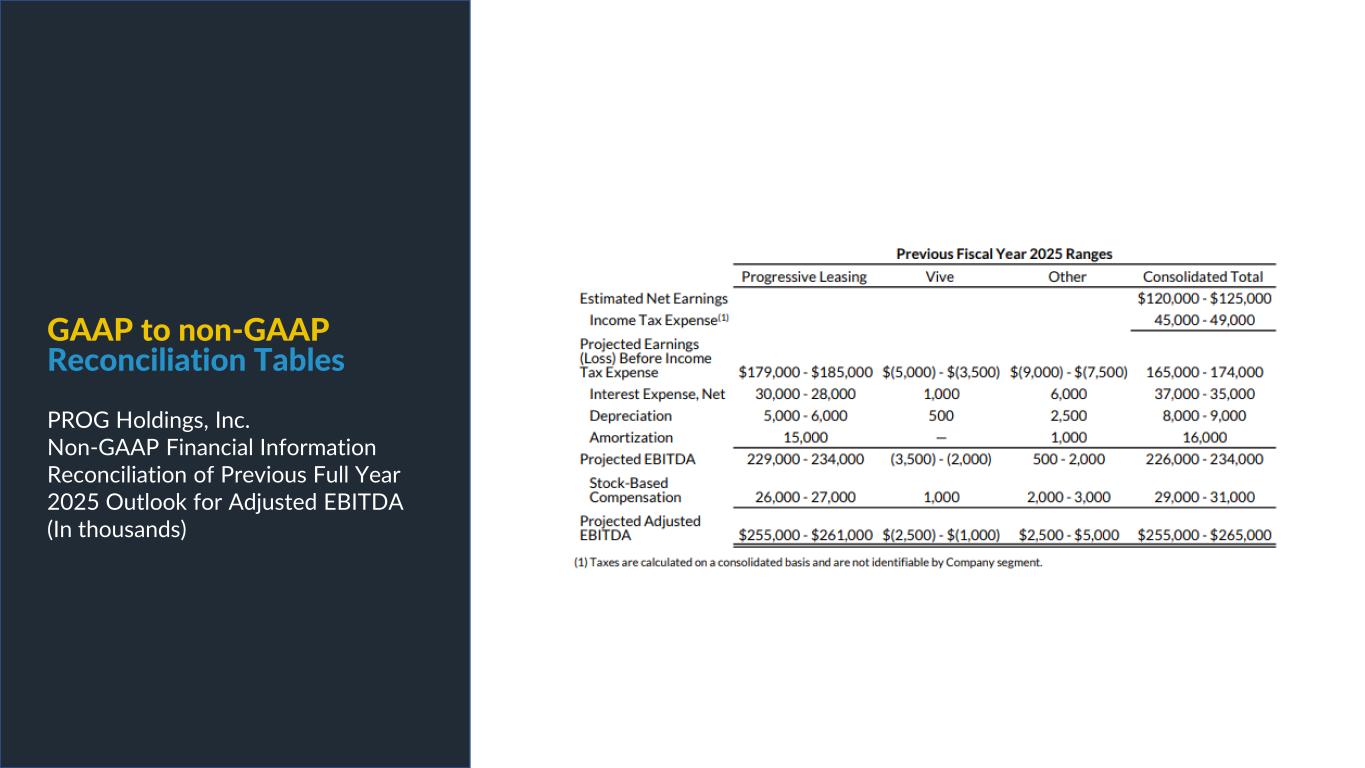

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Reconciliation of Previous Full Year 2025 Outlook for Adjusted EBITDA (In thousands)

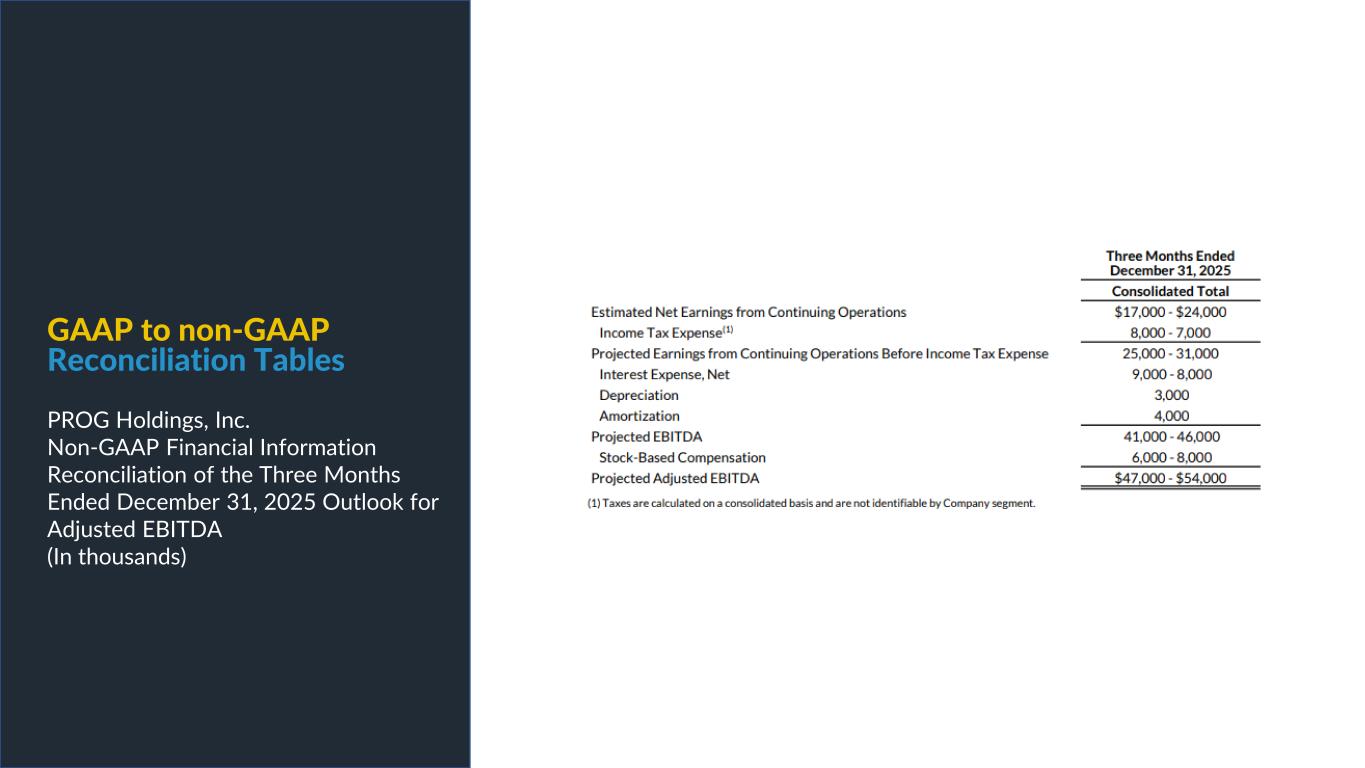

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Reconciliation of the Three Months Ended December 31, 2025 Outlook for Adjusted EBITDA (In thousands)

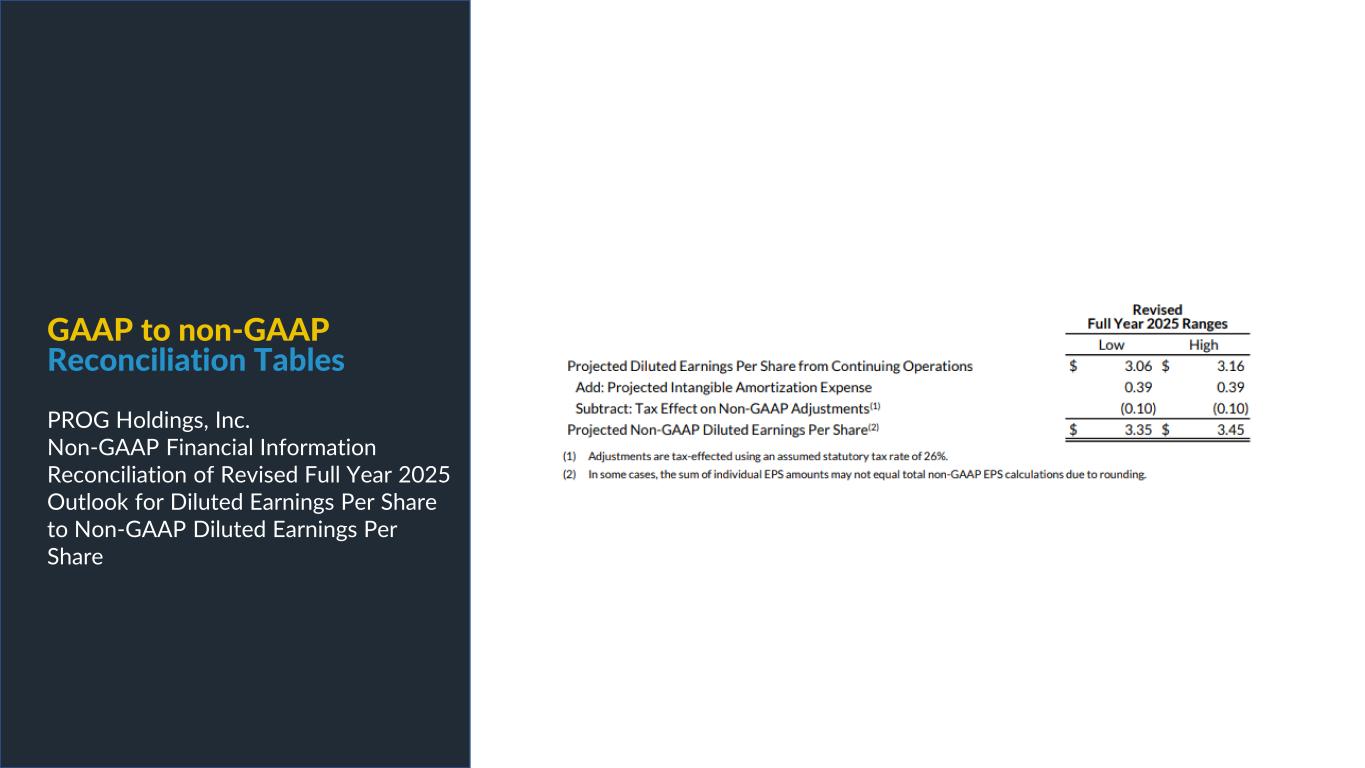

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Reconciliation of Revised Full Year 2025 Outlook for Diluted Earnings Per Share to Non-GAAP Diluted Earnings Per Share

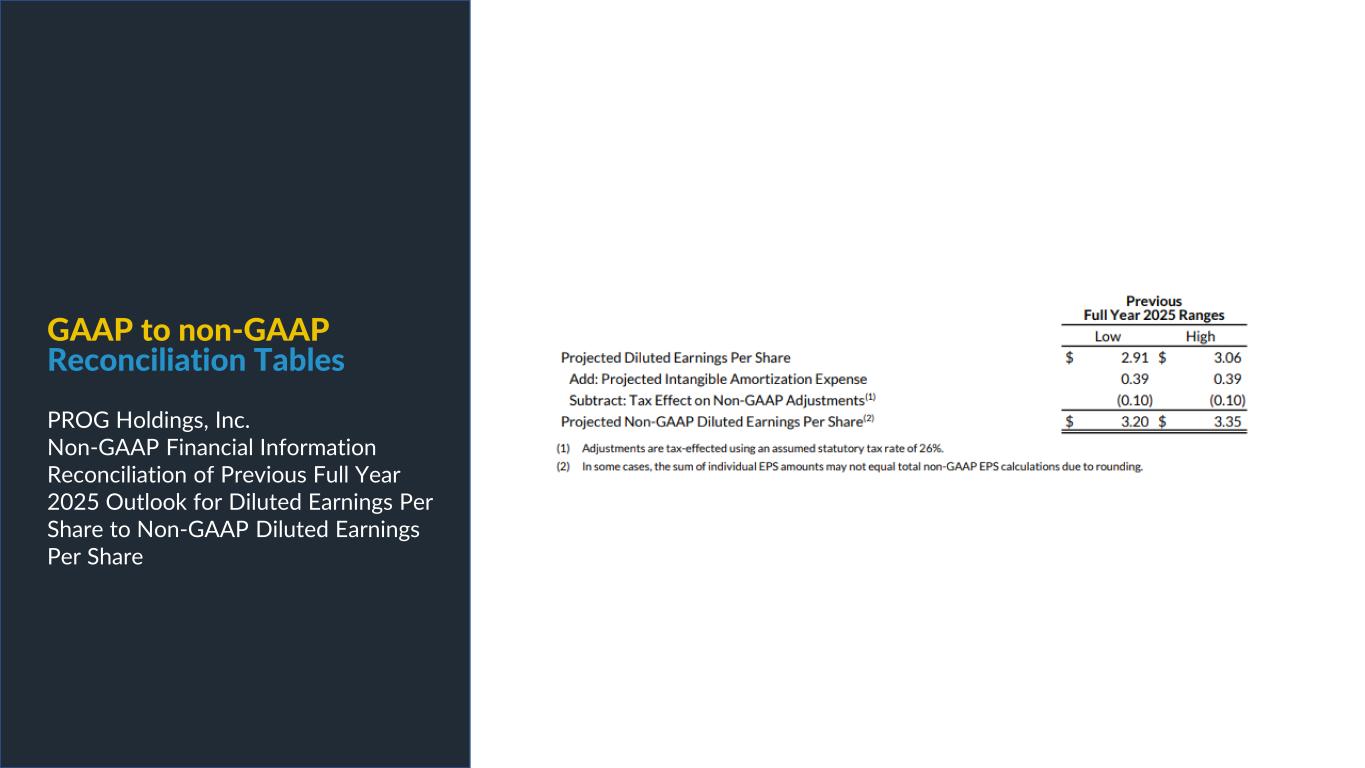

GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Reconciliation of Previous Full Year 2025 Outlook for Diluted Earnings Per Share to Non-GAAP Diluted Earnings Per Share

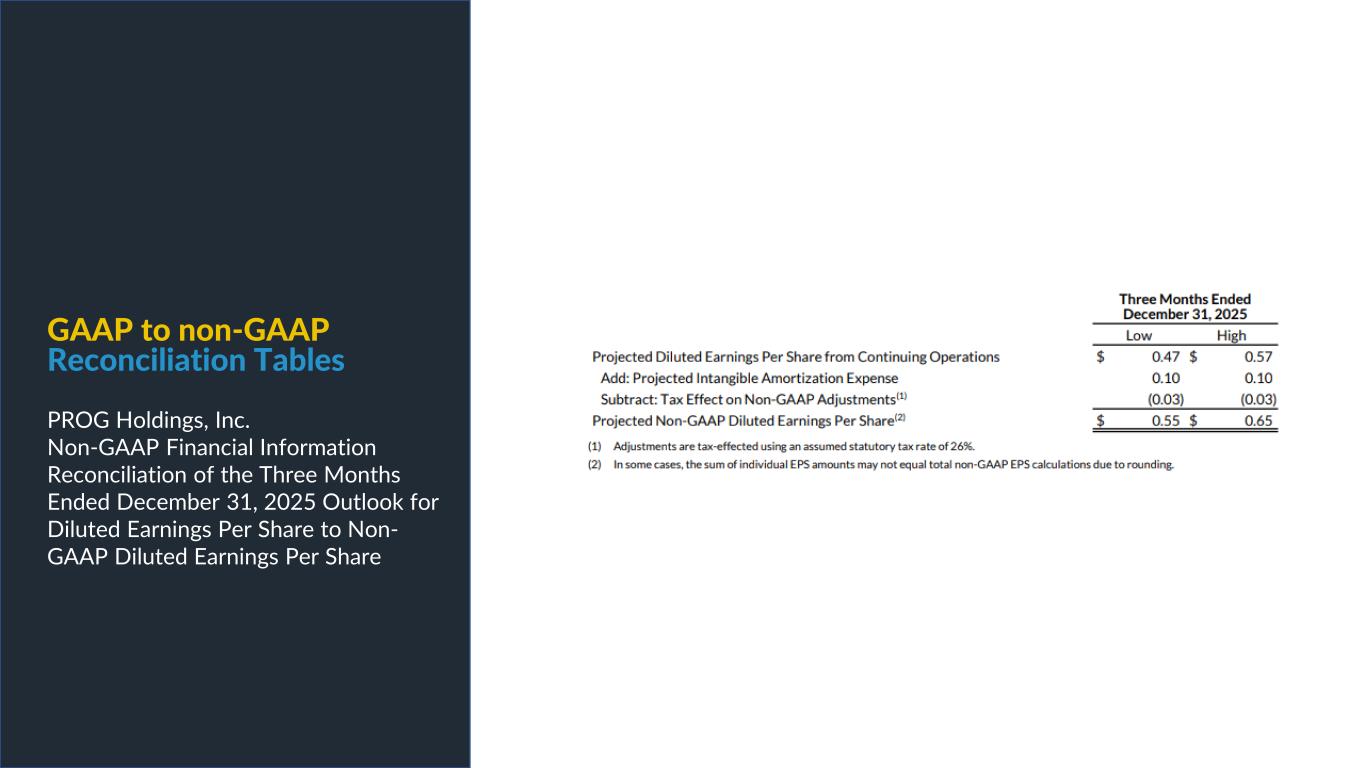

GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Reconciliation of the Three Months Ended December 31, 2025 Outlook for Diluted Earnings Per Share to Non- GAAP Diluted Earnings Per Share

PROG Internal