Third Coast Investor Presentation OCTOBER 22, 2025 Partnering with Keystone and Expanding Austin Market Share Exhibit 99.2

DISCLAIMER Forward-Looking Statements This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are subject to risks and uncertainties and are made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Third Coast Bancshares, Inc. (the “Company,” “Third Coast,” “TCBX,” “we,” “us,” or “our”) with respect to, among other things, future events and Third Coast’s financial performance and include, but are not limited to, the expected completion date, financial benefits and other effects of the proposed transaction. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “looking ahead,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Third Coast’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Third Coast’s control. Accordingly, Third Coast cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Third Coast believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are or will be important factors that could cause Third Coast’s actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: (1) the occurrence of any event, change or other circumstance that could give rise to the right of one or both of the parties to terminate the definitive merger agreement providing for the acquisition of Keystone Bancshares, Inc. (“Keystone”) by Third Coast; (2) the outcome of any legal proceedings that may be instituted against Third Coast or Keystone; (3) the possibility that the transaction does not close when expected or at all because required regulatory, shareholder or other approvals and other conditions to closing are not received or satisfied on a timely basis or at all (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction); (4) the risk that the benefits from the transaction may not be fully realized or may take longer to realize than expected, including as a result of changes in, or problems arising from, general economic and market conditions, interest and exchange rates, monetary policy, laws and regulations and their enforcement, and the degree of competition in the geographic and business areas in which Third Coast and Keystone operate; (5) disruption to the parties’ businesses as a result of the announcement and pendency of the transaction; (6) the risk that the integration of each party’s operations will be materially delayed or will be more costly or difficult than expected or that the parties are otherwise unable to successfully integrate each party’s businesses into the other’s businesses; (7) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; (8) reputational risk and potential adverse reactions of Third Coast’s or Keystone’s customers, suppliers, employees or other business partners, including those resulting from the announcement or completion of the transaction; (9) the dilution caused by Third Coast’s issuance of additional shares of its common stock in connection with the transaction; (10) a material adverse change in the financial condition of Third Coast or Keystone; (11) general competitive, economic, political and market conditions; (12) major catastrophes such as earthquakes, floods or other natural or human disasters, including infectious disease outbreaks; (13) the diversion of management’s attention and time from ongoing business operations and opportunities on merger-related matters; and (14) other factors that may affect future results of Third Coast and Keystone including changes in asset quality and credit risk, the inability to sustain revenue and earnings growth, changes in interest rates and capital markets, inflation, customer borrowing, repayment, investment and deposit practices, the impact, extent and timing of technological changes, capital management activities and other actions of the Board of Governors of the Federal Reserve System and legislative and regulatory actions and reforms. For a discussion of additional factors that could cause Third Coast’s actual results to differ materially from those described in the forward-looking statements, please see the risk factors discussed in Third Coast’s Annual Report on Form 10-K for the year ended December 31, 2024 filed with the U.S. Securities and Exchange Commission (the “SEC”), and Third Coast’s other filings with the SEC. The foregoing factors should not be construed as exhaustive and should be read together with the other cautionary statements included in this communication. If one or more events related to these or other risks or uncertainties materialize, or if Third Coast’s underlying assumptions prove to be incorrect, actual results may differ materially from what Third Coast anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Third Coast does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New factors emerge from time to time, and it is not possible for Third Coast to predict which will arise. In addition, Third Coast cannot assess the impact of each factor on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. NON-GAAP FINANCIAL MEASURES This presentation contains non-GAAP financial measures, including Tangible Common Equity, Tangible Book Value Per Share, Tangible Common Equity to Tangible Assets and Return on Average Tangible Common Equity. The non-GAAP financial measures that we discuss in this presentation should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. A reconciliation of the non-GAAP financial measures used in this presentation to the most directly comparable GAAP measures is provided in the Appendix to this presentation.

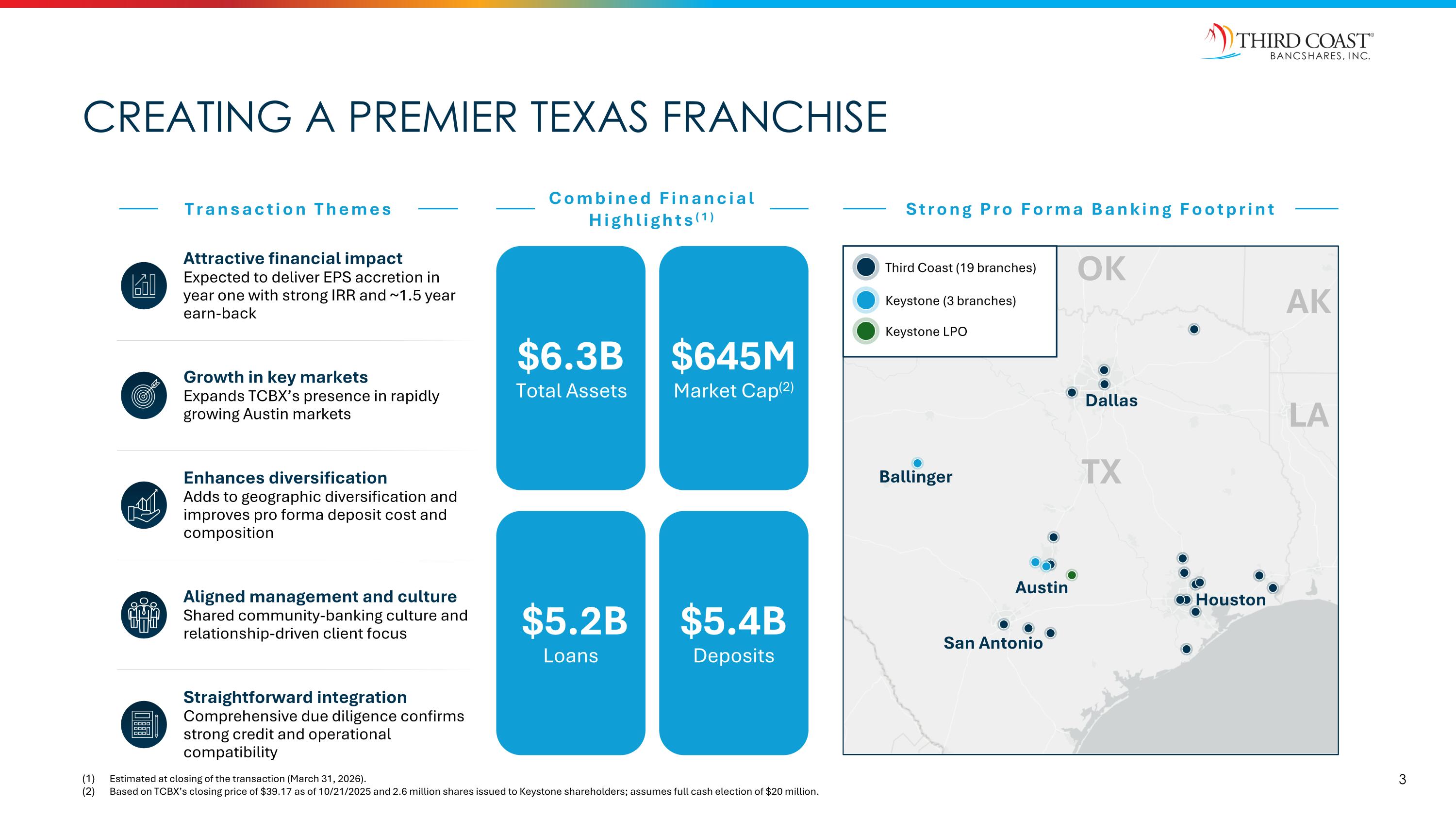

Creating a premier Texas franchise Attractive financial impact Expected to deliver EPS accretion in year one with strong IRR and ~1.5 year earn-back Growth in key markets Expands TCBX’s presence in rapidly growing Austin markets Enhances diversification Adds to geographic diversification and improves pro forma deposit cost and composition Aligned management and culture Shared community-banking culture and relationship-driven client focus Straightforward integration Comprehensive due diligence confirms strong credit and operational compatibility $645M Market Cap(2) $6.3B Total Assets $5.4B Deposits $5.2B Loans Transaction Themes Combined Financial Highlights(1) Strong Pro Forma Banking Footprint Dallas Austin Houston Ballinger San Antonio TX OK LA AK Estimated at closing of the transaction (March 31, 2026). Based on TCBX’s closing price of $39.17 as of 10/21/2025 and 2.6 million shares issued to Keystone shareholders; assumes full cash election of $20 million. Keystone (3 branches) Third Coast (19 branches) Keystone LPO

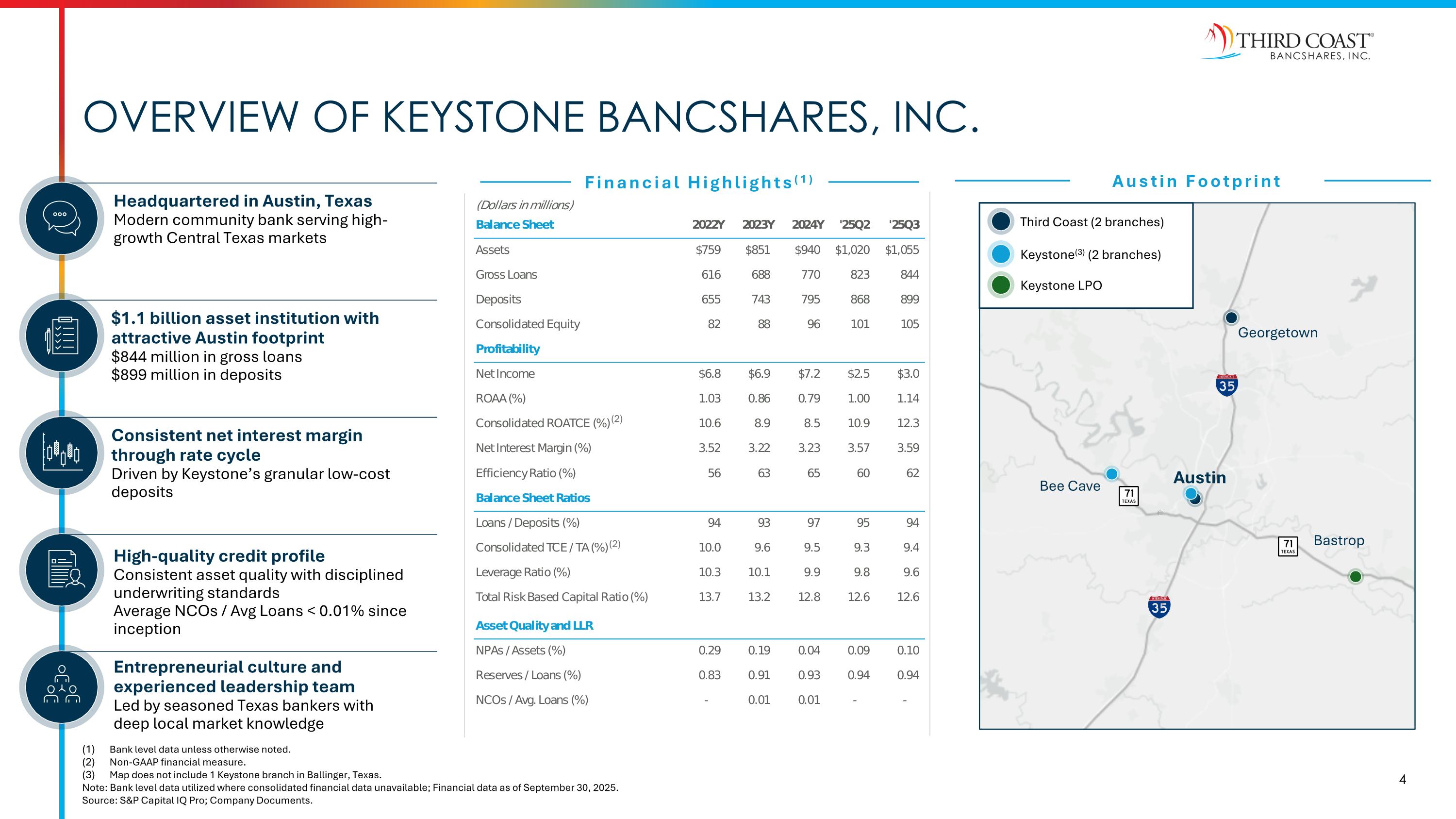

Austin Footprint Overview of Keystone Bancshares, Inc. Bank level data unless otherwise noted. Non-GAAP financial measure. Map does not include 1 Keystone branch in Ballinger, Texas. Note: Bank level data utilized where consolidated financial data unavailable; Financial data as of September 30, 2025. Source: S&P Capital IQ Pro; Company Documents. Headquartered in Austin, Texas Modern community bank serving high-growth Central Texas markets $1.1 billion asset institution with attractive Austin footprint $844 million in gross loans $899 million in deposits High-quality credit profile Consistent asset quality with disciplined underwriting standards Average NCOs / Avg Loans < 0.01% since inception Financial Highlights(1) Entrepreneurial culture and experienced leadership team Led by seasoned Texas bankers with deep local market knowledge Austin Bee Cave Bastrop Georgetown Keystone(3) (2 branches) Third Coast (2 branches) (2) (2) Keystone LPO Consistent net interest margin through rate cycle Driven by Keystone’s granular low-cost deposits

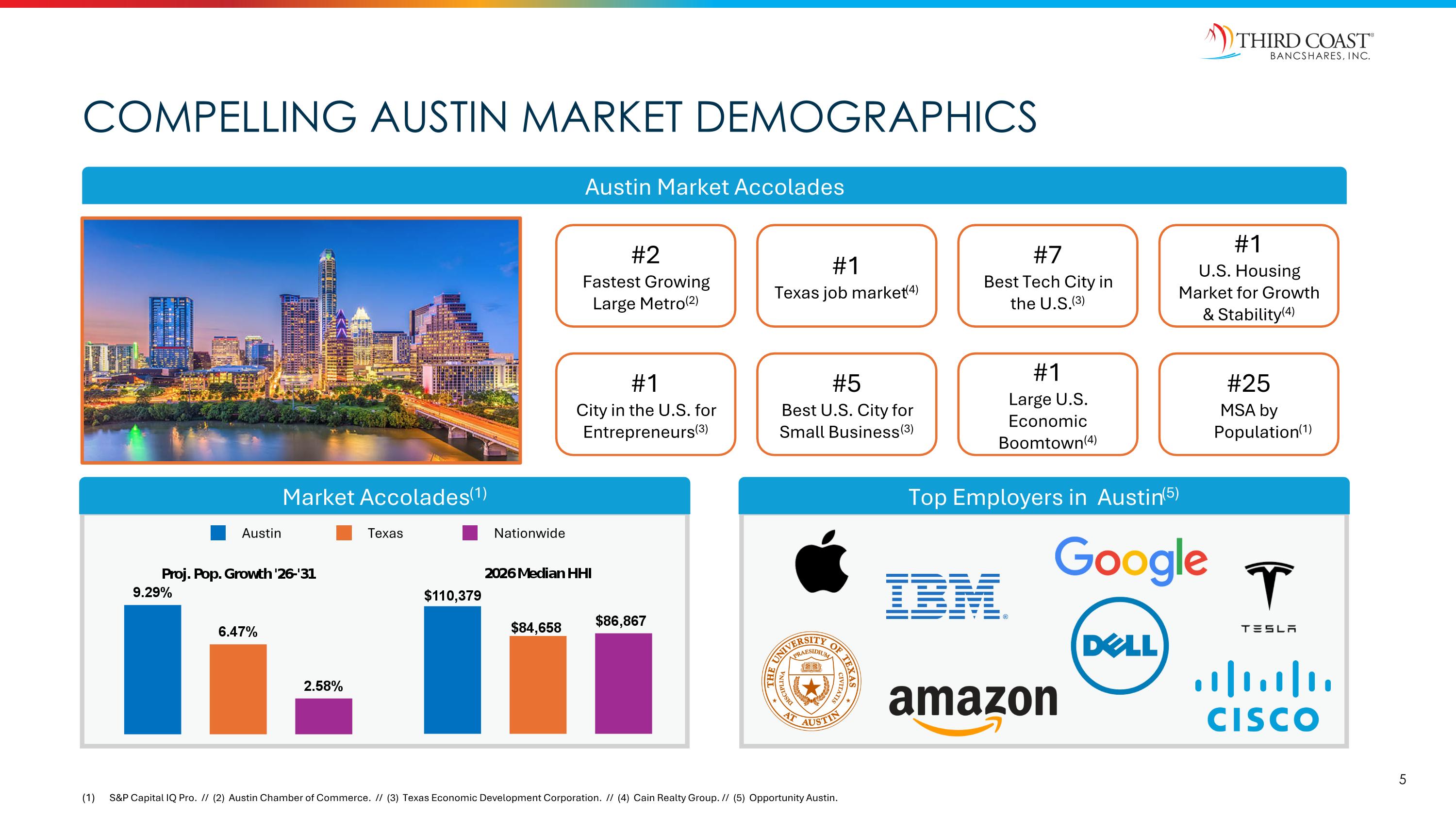

Compelling AusTin Market Demographics S&P Capital IQ Pro. // (2) Austin Chamber of Commerce. // (3) Texas Economic Development Corporation. // (4) Cain Realty Group. // (5) Opportunity Austin. Austin Texas Nationwide Market Accolades(1) Top Employers in Austin(5) Austin Market Accolades #25 MSA by Population(1) #2 Fastest Growing Large Metro(2) #1 City in the U.S. for Entrepreneurs(3) #7 Best Tech City in the U.S.(3) #5 Best U.S. City for Small Business(3) #1 U.S. Housing Market for Growth & Stability(4) #1 Texas job market(4) #1 Large U.S. Economic Boomtown(4)

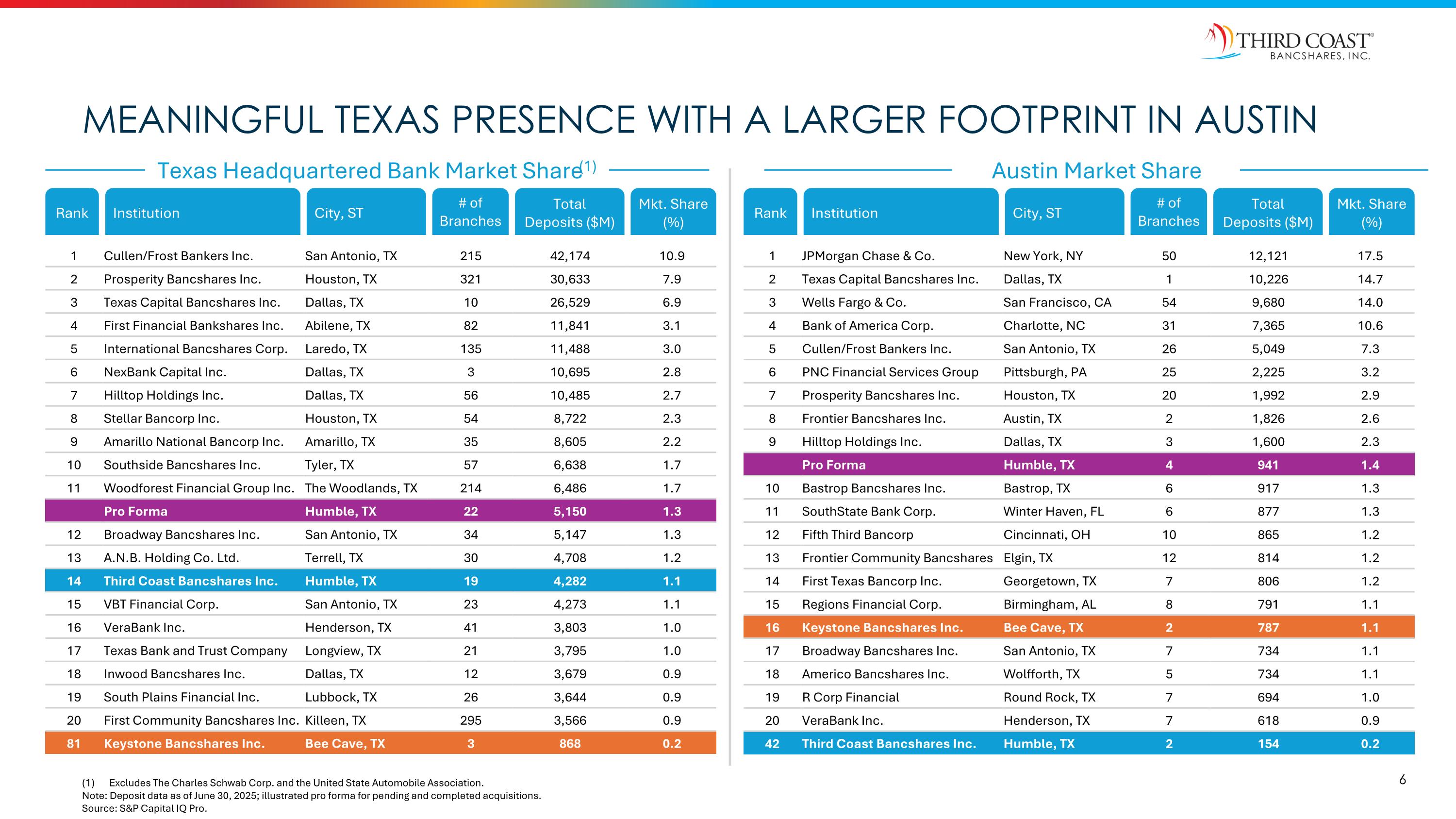

Meaningful Texas presence with a larger footprint in Austin Excludes The Charles Schwab Corp. and the United State Automobile Association. Note: Deposit data as of June 30, 2025; illustrated pro forma for pending and completed acquisitions. Source: S&P Capital IQ Pro. Texas Headquartered Bank Market Share(1) Austin Market Share Rank Institution City, ST Total Deposits ($M) Mkt. Share (%) 1 Cullen/Frost Bankers Inc. San Antonio, TX 215 42,174 10.9 2 Prosperity Bancshares Inc. Houston, TX 321 30,633 7.9 3 Texas Capital Bancshares Inc. Dallas, TX 10 26,529 6.9 4 First Financial Bankshares Inc. Abilene, TX 82 11,841 3.1 5 International Bancshares Corp. Laredo, TX 135 11,488 3.0 6 NexBank Capital Inc. Dallas, TX 3 10,695 2.8 7 Hilltop Holdings Inc. Dallas, TX 56 10,485 2.7 8 Stellar Bancorp Inc. Houston, TX 54 8,722 2.3 9 Amarillo National Bancorp Inc. Amarillo, TX 35 8,605 2.2 10 Southside Bancshares Inc. Tyler, TX 57 6,638 1.7 11 Woodforest Financial Group Inc. The Woodlands, TX 214 6,486 1.7 Pro Forma Humble, TX 22 5,150 1.3 12 Broadway Bancshares Inc. San Antonio, TX 34 5,147 1.3 13 A.N.B. Holding Co. Ltd. Terrell, TX 30 4,708 1.2 14 Third Coast Bancshares Inc. Humble, TX 19 4,282 1.1 15 VBT Financial Corp. San Antonio, TX 23 4,273 1.1 16 VeraBank Inc. Henderson, TX 41 3,803 1.0 17 Texas Bank and Trust Company Longview, TX 21 3,795 1.0 18 Inwood Bancshares Inc. Dallas, TX 12 3,679 0.9 19 South Plains Financial Inc. Lubbock, TX 26 3,644 0.9 20 First Community Bancshares Inc. Killeen, TX 295 3,566 0.9 81 Keystone Bancshares Inc. Bee Cave, TX 3 868 0.2 # of Branches Rank Institution City, ST Total Deposits ($M) Mkt. Share (%) 1 JPMorgan Chase & Co. New York, NY 50 12,121 17.5 2 Texas Capital Bancshares Inc. Dallas, TX 1 10,226 14.7 3 Wells Fargo & Co. San Francisco, CA 54 9,680 14.0 4 Bank of America Corp. Charlotte, NC 31 7,365 10.6 5 Cullen/Frost Bankers Inc. San Antonio, TX 26 5,049 7.3 6 PNC Financial Services Group Pittsburgh, PA 25 2,225 3.2 7 Prosperity Bancshares Inc. Houston, TX 20 1,992 2.9 8 Frontier Bancshares Inc. Austin, TX 2 1,826 2.6 9 Hilltop Holdings Inc. Dallas, TX 3 1,600 2.3 Pro Forma Humble, TX 4 941 1.4 10 Bastrop Bancshares Inc. Bastrop, TX 6 917 1.3 11 SouthState Bank Corp. Winter Haven, FL 6 877 1.3 12 Fifth Third Bancorp Cincinnati, OH 10 865 1.2 13 Frontier Community Bancshares Elgin, TX 12 814 1.2 14 First Texas Bancorp Inc. Georgetown, TX 7 806 1.2 15 Regions Financial Corp. Birmingham, AL 8 791 1.1 16 Keystone Bancshares Inc. Bee Cave, TX 2 787 1.1 17 Broadway Bancshares Inc. San Antonio, TX 7 734 1.1 18 Americo Bancshares Inc. Wolfforth, TX 5 734 1.1 19 R Corp Financial Round Rock, TX 7 694 1.0 20 VeraBank Inc. Henderson, TX 7 618 0.9 42 Third Coast Bancshares Inc. Humble, TX 2 154 0.2 # of Branches

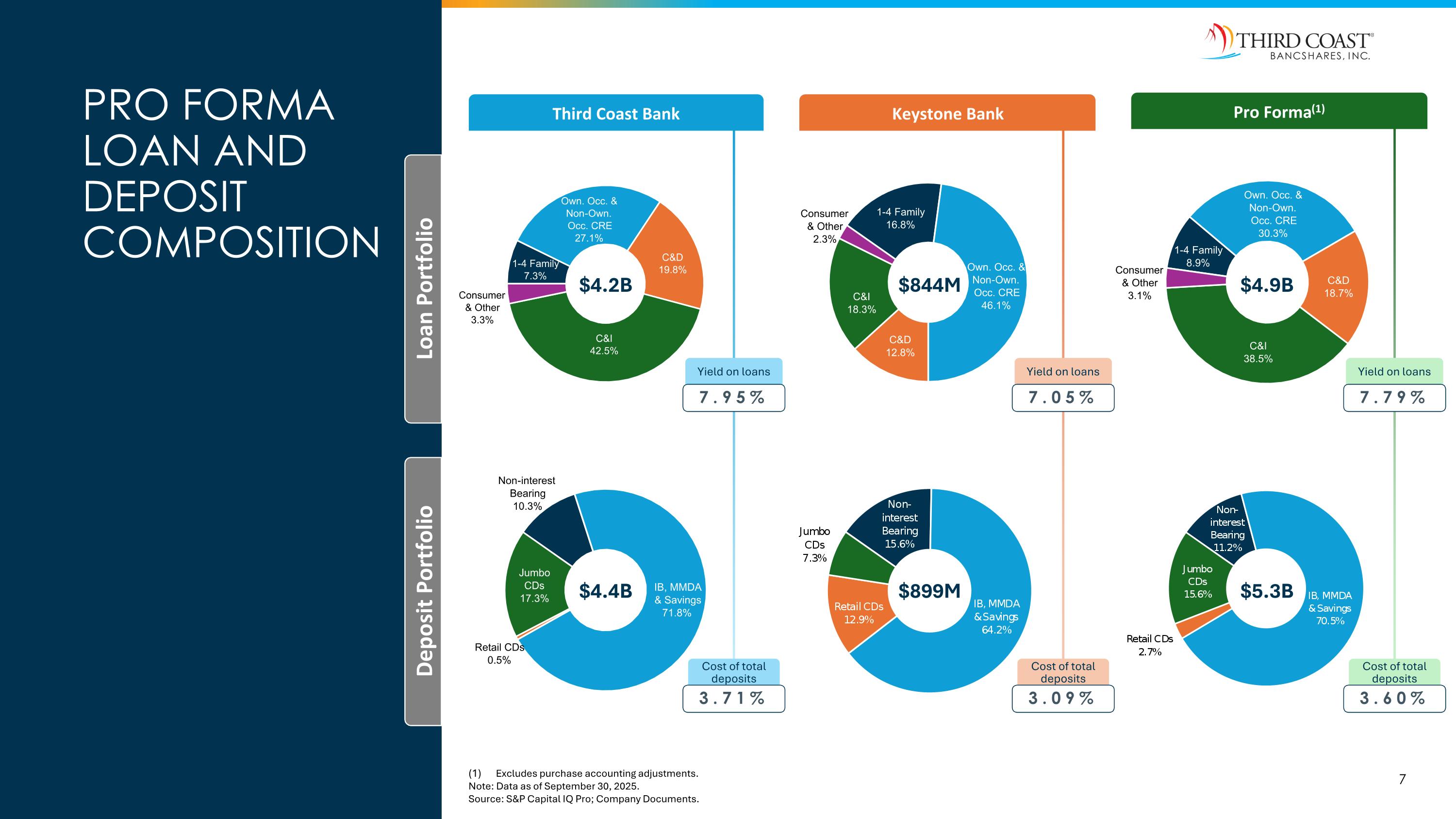

Pro Forma Loan and Deposit Composition Excludes purchase accounting adjustments. Note: Data as of September 30, 2025. Source: S&P Capital IQ Pro; Company Documents. Yield on loans 7.95% Yield on loans 7.05% Yield on loans 7.79% Cost of total deposits 3.60% Cost of total deposits 3.09% Cost of total deposits 3.71% Loan Portfolio Deposit Portfolio $4.2B $844M $4.4B $899M $5.3B $4.9B Third Coast Bank Keystone Bank Pro Forma(1)

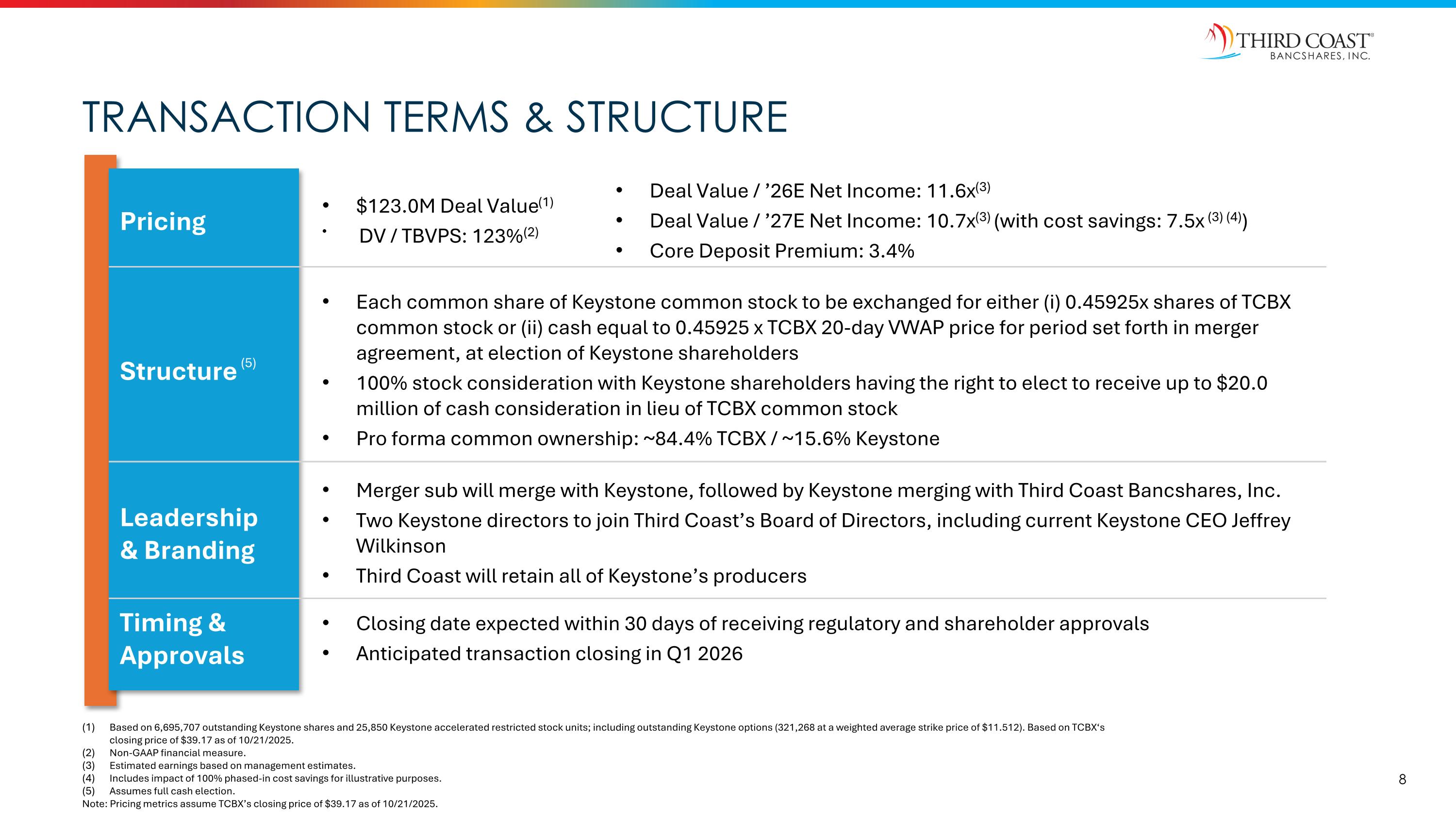

TRANSACTION TERMS & STRUCTURE Pricing Structure (5) Leadership & Branding Timing & Approvals $123.0M Deal Value(1) DV / TBVPS: 123%(2) Deal Value / ’26E Net Income: 11.6x(3) Deal Value / ’27E Net Income: 10.7x(3) (with cost savings: 7.5x (3) (4)) Core Deposit Premium: 3.4% Each common share of Keystone common stock to be exchanged for either (i) 0.45925x shares of TCBX common stock or (ii) cash equal to 0.45925 x TCBX 20-day VWAP price for period set forth in merger agreement, at election of Keystone shareholders 100% stock consideration with Keystone shareholders having the right to elect to receive up to $20.0 million of cash consideration in lieu of TCBX common stock Pro forma common ownership: ~84.4% TCBX / ~15.6% Keystone Merger sub will merge with Keystone, followed by Keystone merging with Third Coast Bancshares, Inc. Two Keystone directors to join Third Coast’s Board of Directors, including current Keystone CEO Jeffrey Wilkinson Third Coast will retain all of Keystone’s producers Closing date expected within 30 days of receiving regulatory and shareholder approvals Anticipated transaction closing in Q1 2026 Based on 6,695,707 outstanding Keystone shares and 25,850 Keystone accelerated restricted stock units; including outstanding Keystone options (321,268 at a weighted average strike price of $11.512). Based on TCBX‘s closing price of $39.17 as of 10/21/2025. Non-GAAP financial measure. Estimated earnings based on management estimates. Includes impact of 100% phased-in cost savings for illustrative purposes. Assumes full cash election. Note: Pricing metrics assume TCBX’s closing price of $39.17 as of 10/21/2025.

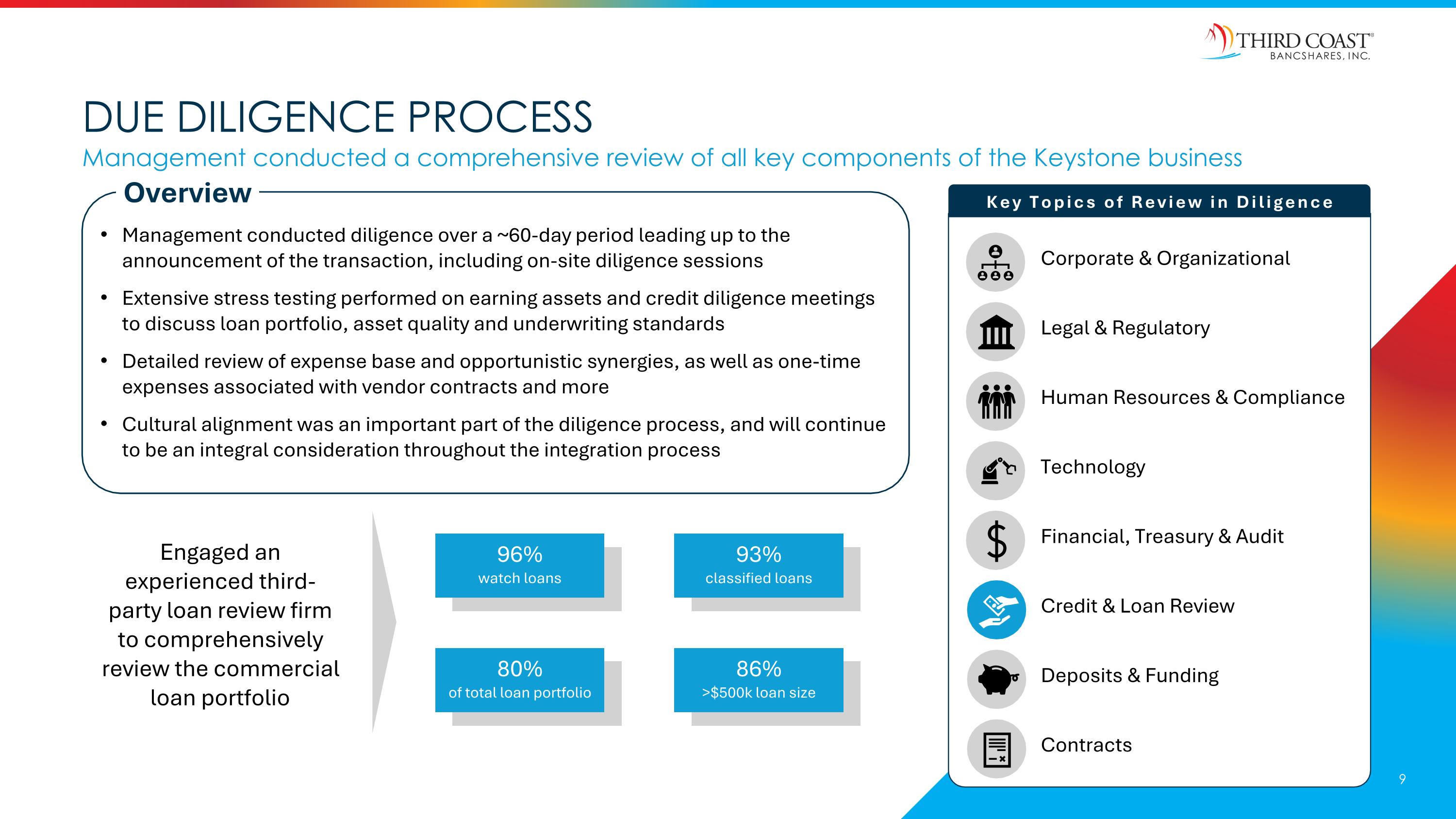

DUE DILIGENCE PROCESS Corporate & Organizational Legal & Regulatory Human Resources & Compliance Technology Financial, Treasury & Audit Credit & Loan Review Deposits & Funding Contracts Overview Management conducted diligence over a ~60-day period leading up to the announcement of the transaction, including on-site diligence sessions Extensive stress testing performed on earning assets and credit diligence meetings to discuss loan portfolio, asset quality and underwriting standards Detailed review of expense base and opportunistic synergies, as well as one-time expenses associated with vendor contracts and more Cultural alignment was an important part of the diligence process, and will continue to be an integral consideration throughout the integration process 80% of total loan portfolio Key Topics of Review in Diligence 96% watch loans 93% classified loans 86% >$500k loan size Engaged an experienced third-party loan review firm to comprehensively review the commercial loan portfolio Management conducted a comprehensive review of all key components of the Keystone business 9

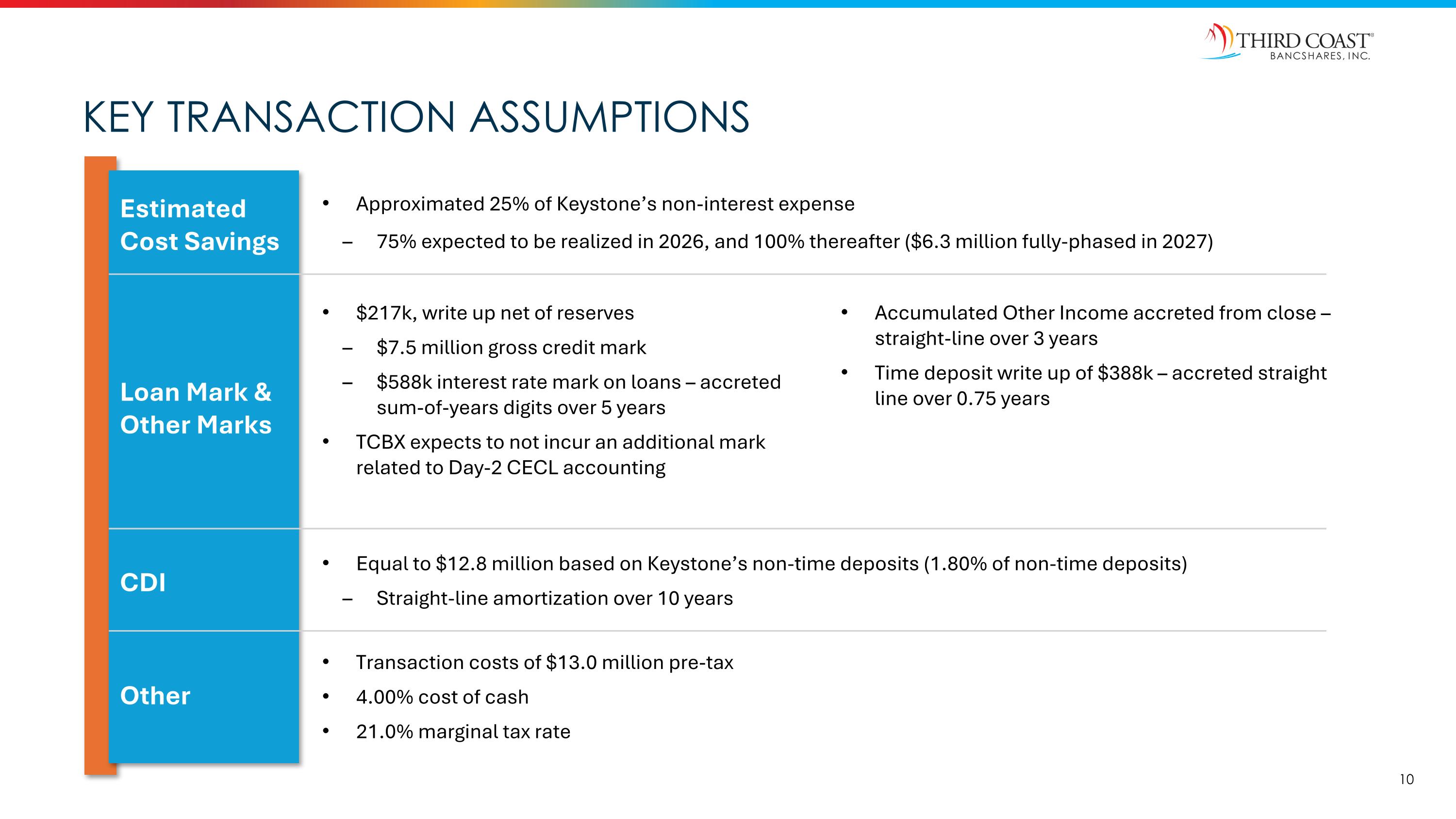

KEY TRANSACTION ASSUMPTIONS Estimated Cost Savings Loan Mark & Other Marks CDI Other Approximated 25% of Keystone’s non-interest expense 75% expected to be realized in 2026, and 100% thereafter ($6.3 million fully-phased in 2027) $217k, write up net of reserves $7.5 million gross credit mark $588k interest rate mark on loans – accreted sum-of-years digits over 5 years TCBX expects to not incur an additional mark related to Day-2 CECL accounting Equal to $12.8 million based on Keystone’s non-time deposits (1.80% of non-time deposits) Straight-line amortization over 10 years Transaction costs of $13.0 million pre-tax 4.00% cost of cash 21.0% marginal tax rate Accumulated Other Income accreted from close – straight-line over 3 years Time deposit write up of $388k – accreted straight line over 0.75 years

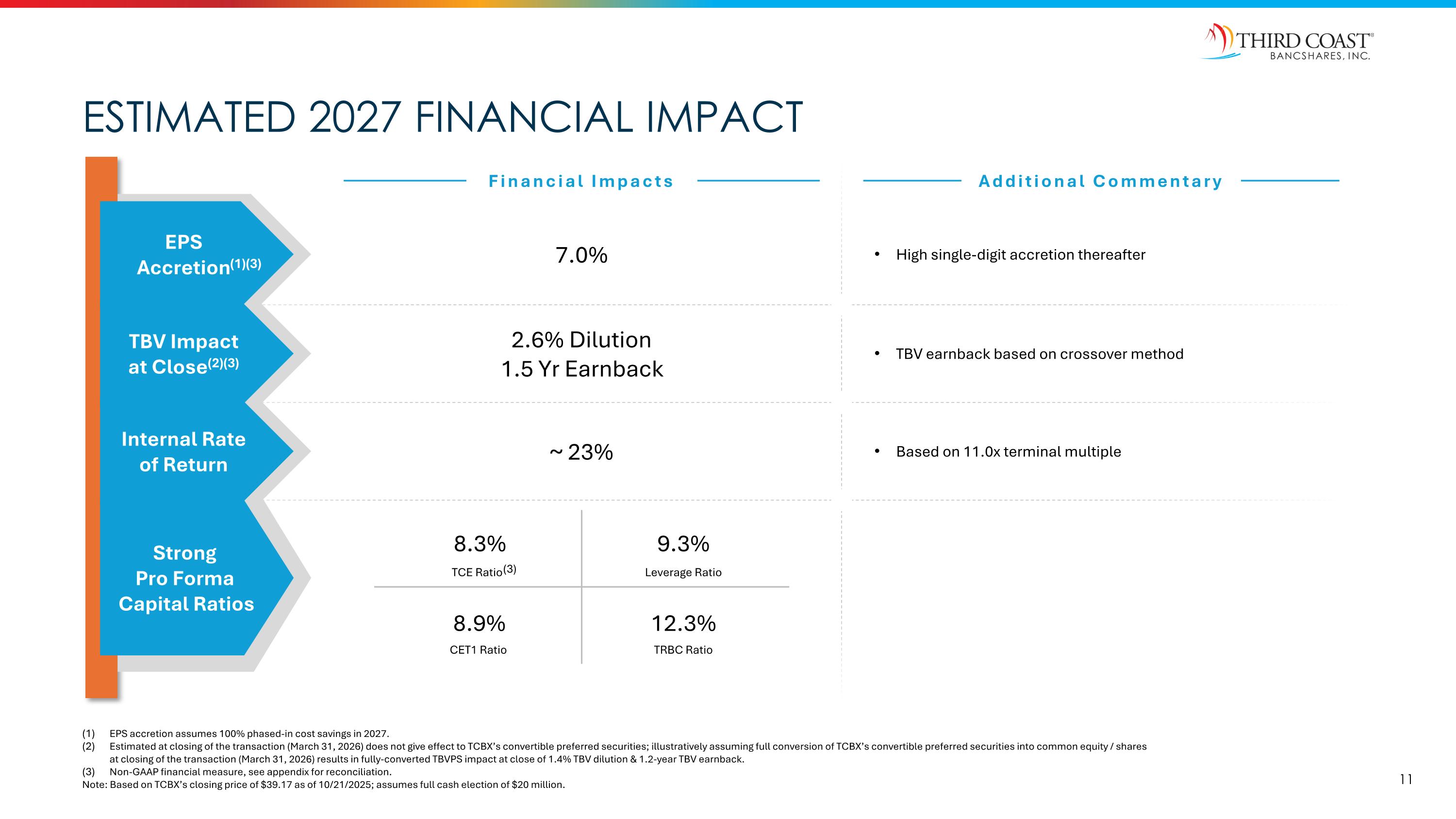

ESTIMATED 2027 FINANCIAL IMPACT EPS Accretion(1)(3) TBV Impact at Close(2)(3) Internal Rate of Return Strong Pro Forma Capital Ratios 7.0% 2.6% Dilution 1.5 Yr Earnback ~ 23% TCE Ratio Leverage Ratio CET1 Ratio TRBC Ratio 8.3% 8.9% 9.3% 12.3% Based on 11.0x terminal multiple TBV earnback based on crossover method High single-digit accretion thereafter EPS accretion assumes 100% phased-in cost savings in 2027. Estimated at closing of the transaction (March 31, 2026) does not give effect to TCBX’s convertible preferred securities; illustratively assuming full conversion of TCBX’s convertible preferred securities into common equity / shares at closing of the transaction (March 31, 2026) results in fully-converted TBVPS impact at close of 1.4% TBV dilution & 1.2-year TBV earnback. Non-GAAP financial measure, see appendix for reconciliation. Note: Based on TCBX’s closing price of $39.17 as of 10/21/2025; assumes full cash election of $20 million. Additional Commentary Financial Impacts (3)

Strategically compelling transaction Solidifies presence in Austin–Round Rock–San Marcos, TX MSA Achievable cost savings & efficiencies Adds geographic diversity and increases granular deposits Strategic & cultural fit Favorable transaction metrics

Non–GAAP Financial Measures APPENDIX

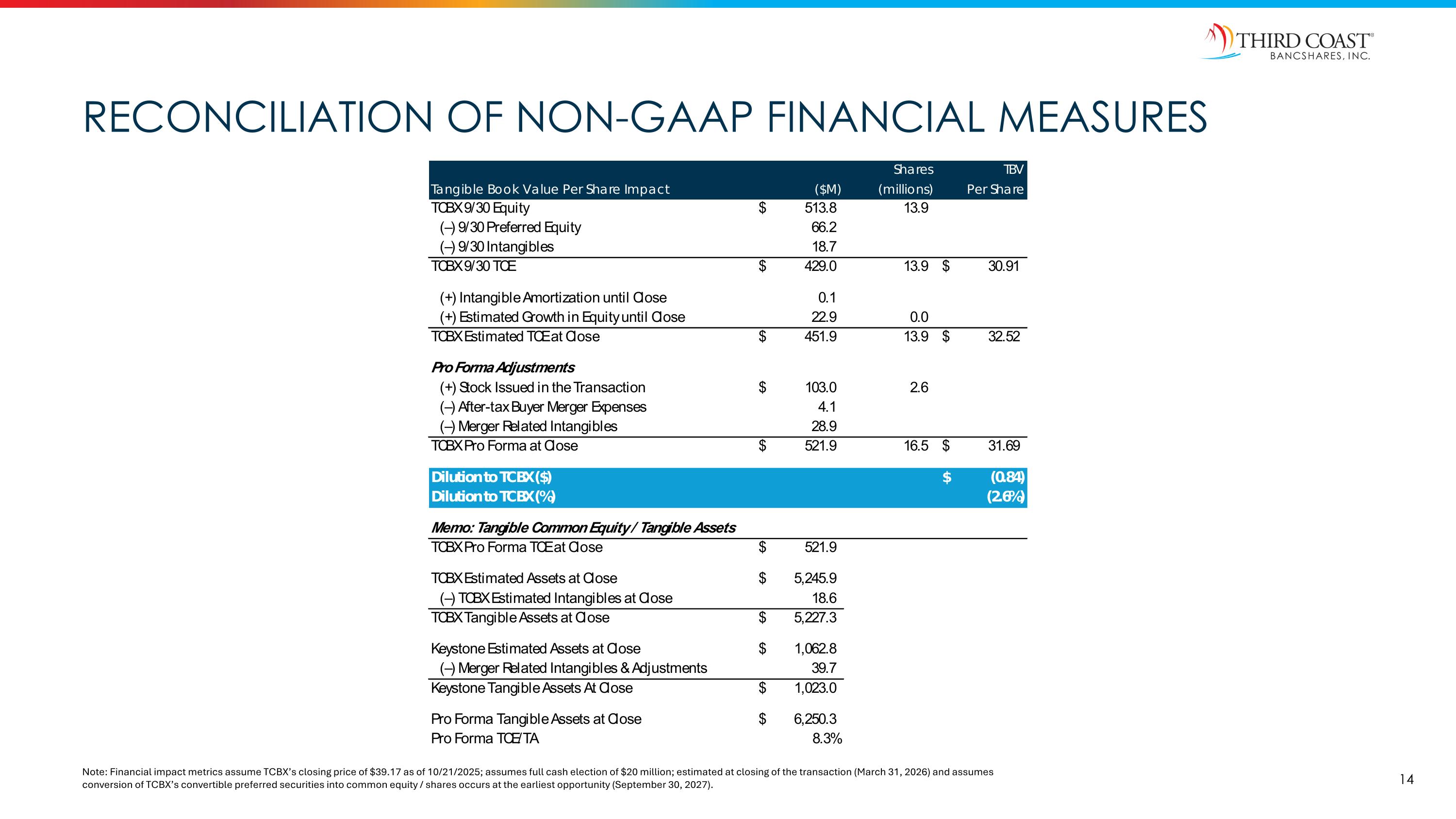

Reconciliation of Non-GAAP Financial Measures Note: Financial impact metrics assume TCBX’s closing price of $39.17 as of 10/21/2025; assumes full cash election of $20 million; estimated at closing of the transaction (March 31, 2026) and assumes conversion of TCBX’s convertible preferred securities into common equity / shares occurs at the earliest opportunity (September 30, 2027).

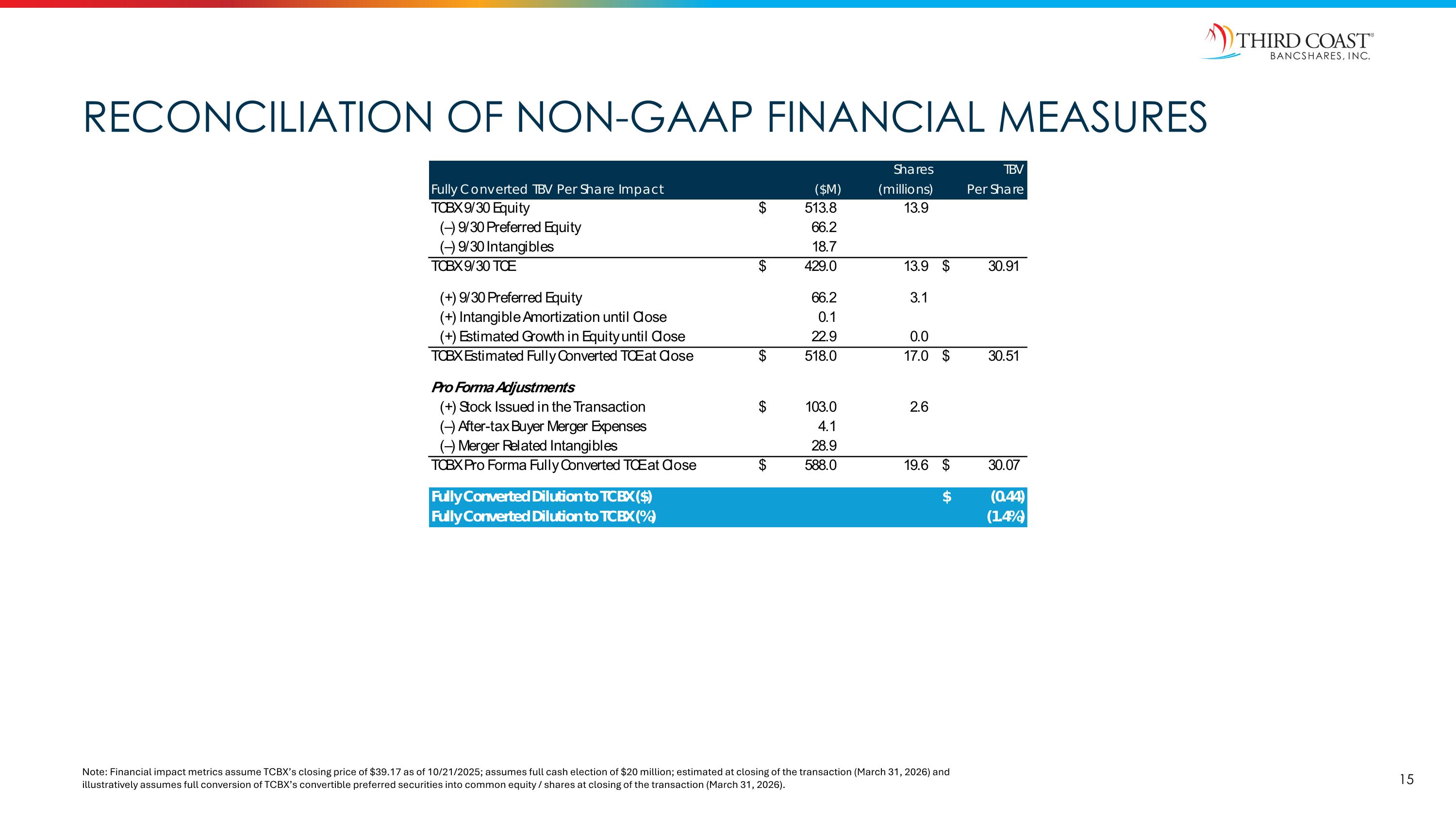

Reconciliation of Non-GAAP Financial Measures Note: Financial impact metrics assume TCBX’s closing price of $39.17 as of 10/21/2025; assumes full cash election of $20 million; estimated at closing of the transaction (March 31, 2026) and illustratively assumes full conversion of TCBX’s convertible preferred securities into common equity / shares at closing of the transaction (March 31, 2026).

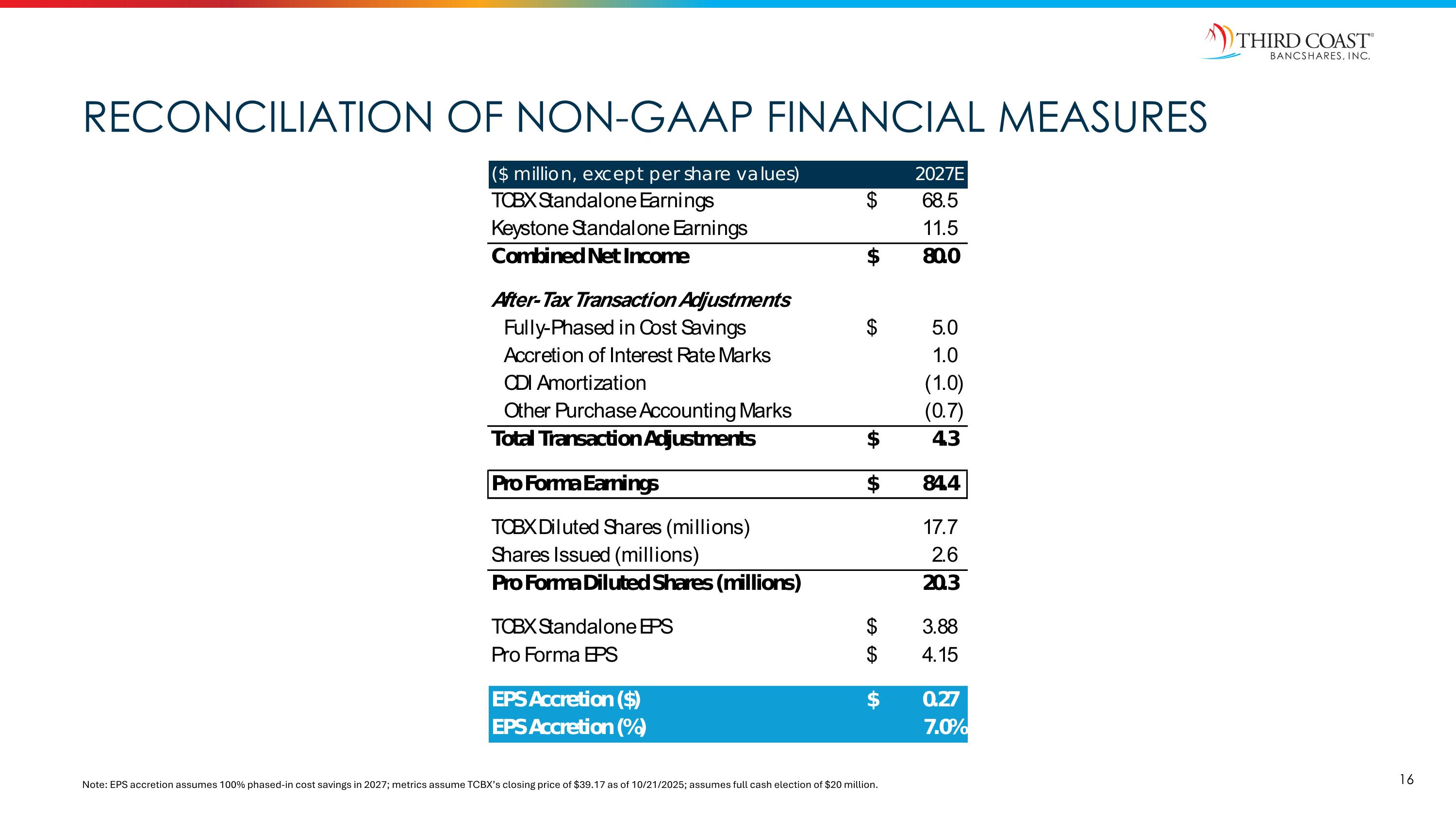

Reconciliation of Non-GAAP Financial Measures Note: EPS accretion assumes 100% phased-in cost savings in 2027; metrics assume TCBX’s closing price of $39.17 as of 10/21/2025; assumes full cash election of $20 million.

Additional information No Offer or Solicitation This communication is being made in respect of the proposed merger transaction involving Third Coast and Keystone. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or the solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act and otherwise in accordance with applicable law. Important Additional Information and Where to Find It Third Coast intends to file a registration statement on Form S-4 with the SEC, which will include a joint proxy statement of Keystone and Third Coast that also constitutes a prospectus of Third Coast, and Third Coast will file other documents regarding the proposed transaction with the SEC. A definitive joint proxy statement/prospectus will also be sent to Keystone’s and Third Coast’s shareholders seeking the required shareholder approvals of the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 WHEN THEY BECOME AVAILABLE, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION REGARDING THIRD COAST, KEYSTONE, THE TRANSACTION AND RELATED MATTERS. The documents filed by Third Coast with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, the documents filed by Third Coast may be obtained free of charge at its website at https://ir.thirdcoast.bank/financials/sec-filings/. Alternatively, these documents, when available, can be obtained free of charge from Third Coast upon written request to Third Coast Bancshares, Inc., Attn: Investor Relations, 1800 West Loop South, Suite 800, Houston, TX 77027, or by calling (713) 960-1300. Participants in this Transaction Third Coast, Keystone, their respective directors and executive officers and certain of their other members of management and employees may be deemed to be participants in the solicitation of proxies from Keystone’s shareholders and Third Coast’s shareholders in connection with the proposed transaction. Information about the directors and executive officers of Third Coast may be found in Third Coast’s Annual Report on Form 10-K for the year ended December 31, 2024, as filed with the SEC on March 5, 2025 and in Third Coast’s proxy statement for its 2025 Annual Meeting of Shareholders, as filed with the SEC on April 17, 2025, copies of which can be obtained free of charge from Third Coast or from the SEC’s website as indicated above. To the extent the holdings of Third Coast’s securities by its directors and executive officers have changed since the amounts set forth in Third Coast’s proxy statement for its 2025 Annual Meeting of Shareholders, such changes have been or will be reflected on Statements of Changes in Beneficial Ownership of Securities on Form 4 filed with the SEC. Additional information regarding the interests of these participants and other persons who may be deemed participants in the transaction will be included in the joint proxy statement/prospectus and other relevant materials when filed with the SEC.

THIRD COAST BANCSHARES, INC. NYSE & NYSE Texas: TCBX Thank you. © 2025 Third Coast Bancshares, Inc.