| Value of Initial Fixed $100 Investment | ||||||||||||||||||||||||

| Year | Summary Compensation Table Total for the Principal Executive Officer (“PEO”) (1) | Compensation Actually Paid to the PEO (1)(3) | Average Summary Compensation Table Total for Non-PEO Named Executive Officers (“NEOs”) (2) | Average Compensation Actually Paid to the NEOs (2)(3) | Total Shareholder Return (“TSR”) | Net Income (Loss) | ||||||||||||||||||

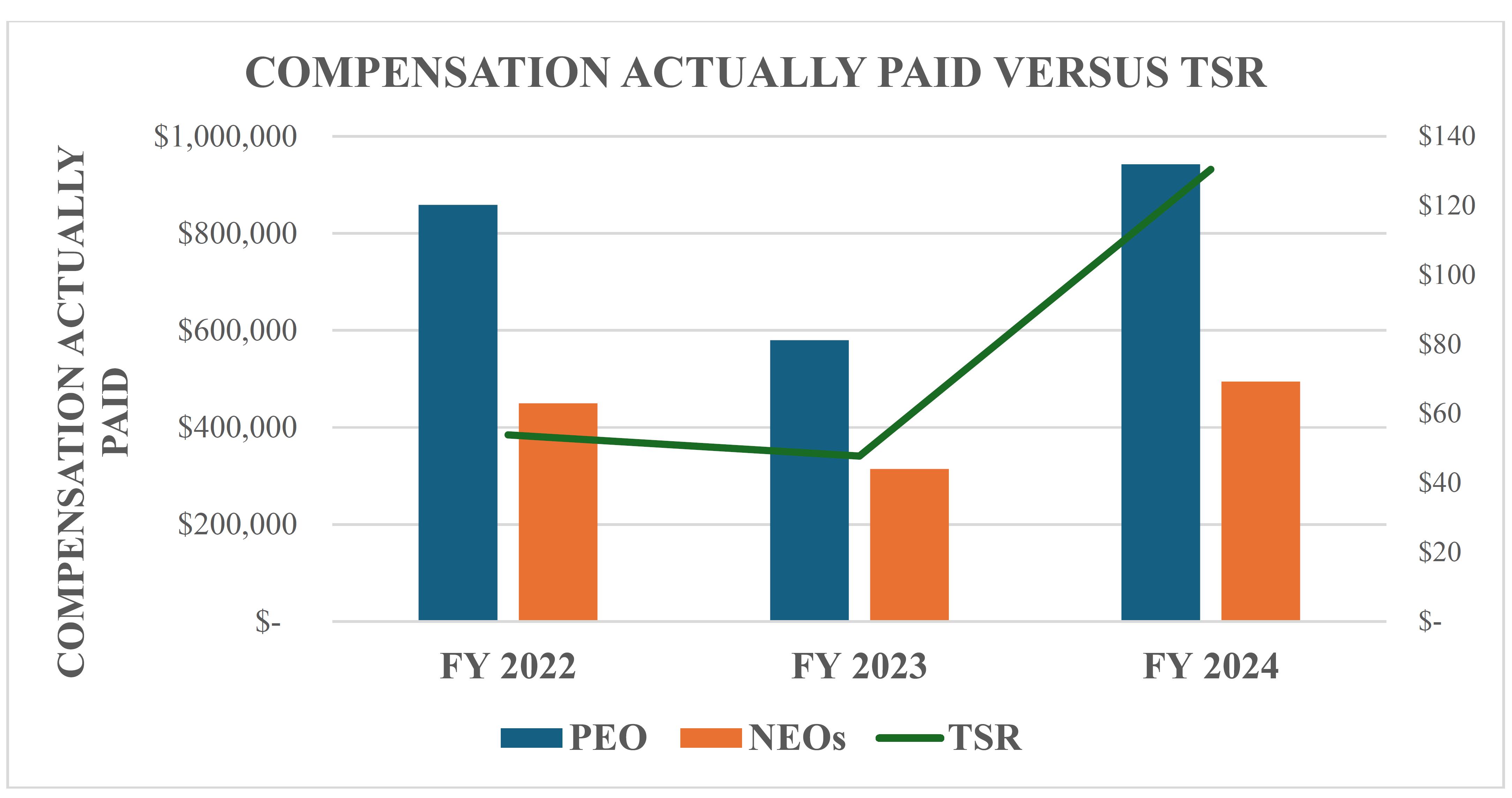

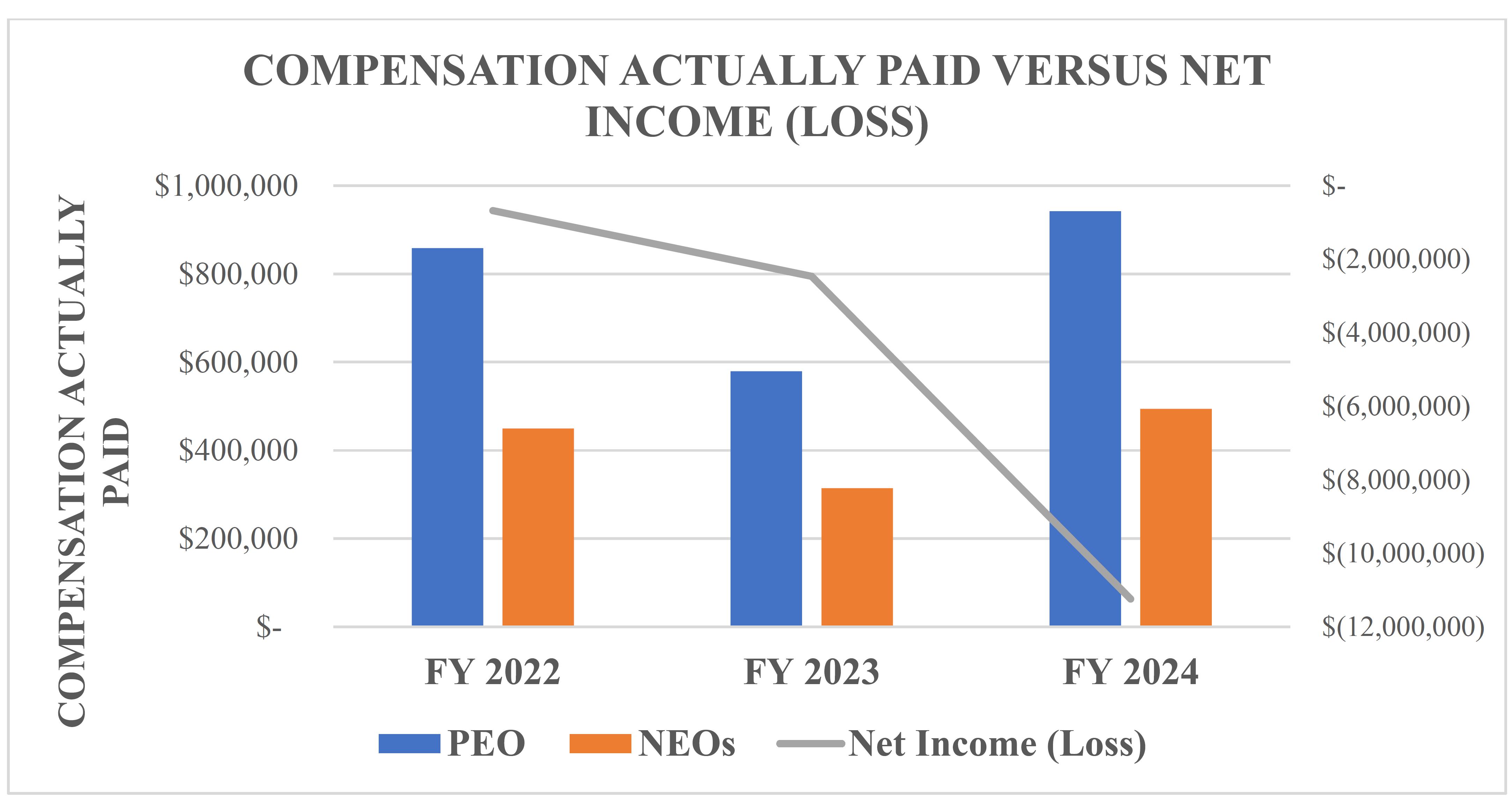

| 2024 | $ | 446,154 | $ | 942,394 | $ | 245,385 | $ | 494,480 | $ | 130 | $ | (11,242,404 | ) | |||||||||||

| 2023 | $ | 657,797 | $ | 579,640 | $ | 353,898 | $ | 314,120 | $ | 54 | $ | (2,465,439 | ) | |||||||||||

| 2022 | $ | 827,122 | $ | 858,739 | $ | 438,376 | $ | 449,687 | $ | 61 | $ | (677,107 | ) | |||||||||||

| (1) | Our Chief Executive Officer, Fawad Maqbool, served as our PEO for all years in the table. | |

| (2) | Our Chief Financial Officer, Louisa Sanfratello, and our Chief Operating Officer, Jorge Flores, served as our NEOs for all years in the table. |

| Year | Executives | Summary Compensation Table Total | Subtract Equity Awards Granted in Covered Year (a) | Add Year-End Fair Value of Equity Awards (b) | Change in Fair Value of Prior Equity Awards (c) | Add Change in Fair Value of Vested Equity Awards (d) | Subtract the Fair Value of Equity Awards that Failed to Meet Vesting Conditions (e) | Total Compensation Actually Paid | ||||||||||||||||||||||

| 2024 | PEO | $ | 446,154 | $ | $ | $ | 528,380 | $ | (32,140 | ) | $ | $ | 942,394 | |||||||||||||||||

| 2024 | NEOs | $ | 245,385 | $ | $ | $ | 265,570 | $ | (16,475 | ) | $ | $ | 494,480 | |||||||||||||||||

| 2023 | PEO | $ | 657,797 | $ | (157,797 | ) | $ | 172,000 | $ | (65,280 | ) | $ | (27,080 | ) | $ | $ | 579,640 | |||||||||||||

| 2023 | NEOs | $ | 353,898 | $ | (78,898 | ) | $ | 86,000 | $ | (33,305 | ) | $ | (13,575 | ) | $ | $ | 314,120 | |||||||||||||

| 2022 | PEO | $ | 827,122 | $ | (330,787 | ) | $ | 340,550 | $ | $ | 21,854 | $ | $ | 858,739 | ||||||||||||||||

| 2022 | NEOs | $ | 438,376 | $ | (165,393 | ) | $ | 170,275 | $ | (4,144 | ) | $ | 10,573 | $ | $ | 449,687 | ||||||||||||||

| a) | Subtract amounts reported in “Stock Awards” and “Option Awards” columns of the Summary Compensation Table. | |

| b) | Add the year-end fair value of equity awards granted during the covered year that are outstanding and unvested as of the end of the covered fiscal year. | |

| c) | Add the year-end change in fair value of equity awards granted during prior years that are outstanding and unvested as of the end of the covered fiscal year compared to the fair value at the end of the prior fiscal year. | |

| d) | Add the vesting date fair value of equity awards granted and vested during the covered fiscal year, as well as equity awards granted during prior years compared to the fair value at the end of the prior fiscal year. | |

| e) | Subtract the prior fiscal year fair value of equity awards granted during prior years that fail to meet the applicable vesting conditions during the covered fiscal year. |

The chart below highlights the alignment between “compensation actually paid” to our Named Executive Officers and our total shareholder return performance for the past three fiscal years.

The chart below highlights the alignment between “compensation actually paid” to our Named Executive Officers and our net income performance for the past three fiscal years.

| [1] | Our Chief Executive Officer, , served as our PEO for all years in the table. |

| [2] | To calculate “compensation actually paid” for our PEO and other NEOs the following adjustments were made to Summary Compensation Table total pay: |

| [3] | Our Chief Financial Officer, Louisa Sanfratello, and our Chief Operating Officer, Jorge Flores, served as our NEOs for all years in the table. |

| [4] | Subtract amounts reported in “Stock Awards” and “Option Awards” columns of the Summary Compensation Table. |

| [5] | Add the year-end fair value of equity awards granted during the covered year that are outstanding and unvested as of the end of the covered fiscal year. |

| [6] | Add the year-end change in fair value of equity awards granted during prior years that are outstanding and unvested as of the end of the covered fiscal year compared to the fair value at the end of the prior fiscal year. |

| [7] | Add the vesting date fair value of equity awards granted and vested during the covered fiscal year, as well as equity awards granted during prior years compared to the fair value at the end of the prior fiscal year. |

| [8] | Subtract the prior fiscal year fair value of equity awards granted during prior years that fail to meet the applicable vesting conditions during the covered fiscal year. |