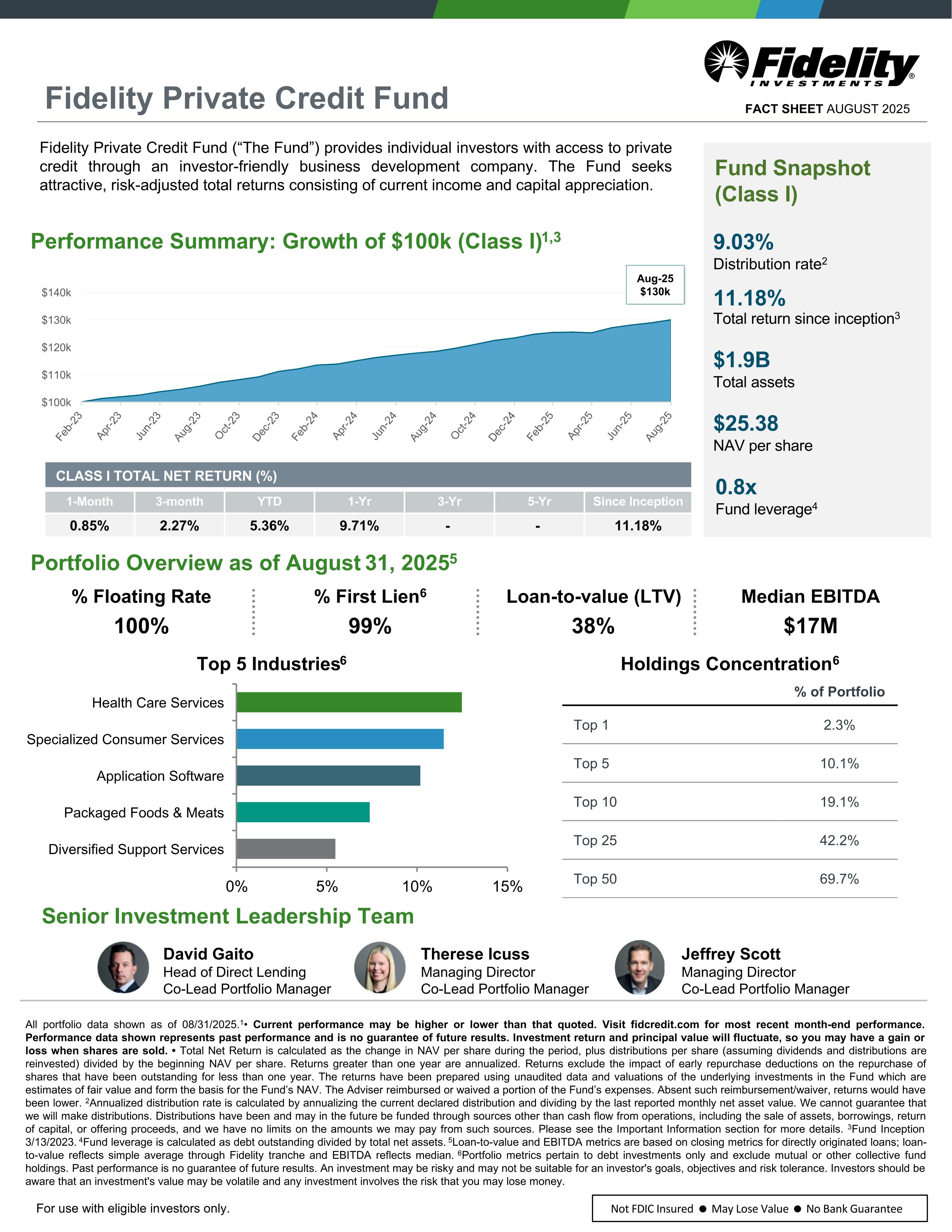

Top 5 Industries6 Fidelity Private Credit Fund FACT SHEET AUGUST 2025 Performance Summary: Growth of $100k (Class I)1,3 Fidelity Private Credit Fund (“The Fund”) provides individual investors with access to private credit through an investor-friendly business development company. The Fund seeks attractive, risk-adjusted total returns consisting of current income and capital appreciation. CLASS I TOTAL NET RETURN (%) 1-Month 3-month YTD 1-Yr 3-Yr 5-Yr Since Inception 0.85% 2.27% 5.36% 9.71% - - 11.18% Not FDIC Insured May Lose Value No Bank Guarantee For use with eligible investors only. % Floating Rate % First Lien6 Loan-to-value (LTV) Median EBITDA 100% 99% 38% $17M Portfolio Overview as of August 31, 20255 9.03% Distribution rate2 11.18% Total return since inception3 $25.38 NAV per share 0.8x Fund leverage4 $1.9B Total assets Fund Snapshot (Class I) Holdings Concentration6 % of Portfolio Top 1 2.3% Top 5 10.1% Top 10 19.1% Top 25 42.2% Top 50 69.7% All portfolio data shown as of 08/31/2025.1• Current performance may be higher or lower than that quoted. Visit fidcredit.com for most recent month-end performance. Performance data shown represents past performance and is no guarantee of future results. Investment return and principal value will fluctuate, so you may have a gain or loss when shares are sold. • Total Net Return is calculated as the change in NAV per share during the period, plus distributions per share (assuming dividends and distributions are reinvested) divided by the beginning NAV per share. Returns greater than one year are annualized. Returns exclude the impact of early repurchase deductions on the repurchase of shares that have been outstanding for less than one year. The returns have been prepared using unaudited data and valuations of the underlying investments in the Fund which are estimates of fair value and form the basis for the Fund’s NAV. The Adviser reimbursed or waived a portion of the Fund’s expenses. Absent such reimbursement/waiver, returns would have been lower. 2Annualized distribution rate is calculated by annualizing the current declared distribution and dividing by the last reported monthly net asset value. We cannot guarantee that we will make distributions. Distributions have been and may in the future be funded through sources other than cash flow from operations, including the sale of assets, borrowings, return of capital, or offering proceeds, and we have no limits on the amounts we may pay from such sources. Please see the Important Information section for more details. 3Fund Inception 3/13/2023. 4Fund leverage is calculated as debt outstanding divided by total net assets. 5Loan-to-value and EBITDA metrics are based on closing metrics for directly originated loans; loan-to-value reflects simple average through Fidelity tranche and EBITDA reflects median. 6Portfolio metrics pertain to debt investments only and exclude mutual or other collective fund holdings. Past performance is no guarantee of future results. An investment may be risky and may not be suitable for an investor's goals, objectives and risk tolerance. Investors should be aware that an investment's value may be volatile and any investment involves the risk that you may lose money. Senior Investment Leadership Team David Gaito Head of Direct Lending Co-Lead Portfolio Manager Jeffrey Scott Managing Director Co-Lead Portfolio Manager Therese Icuss Managing Director Co-Lead Portfolio Manager

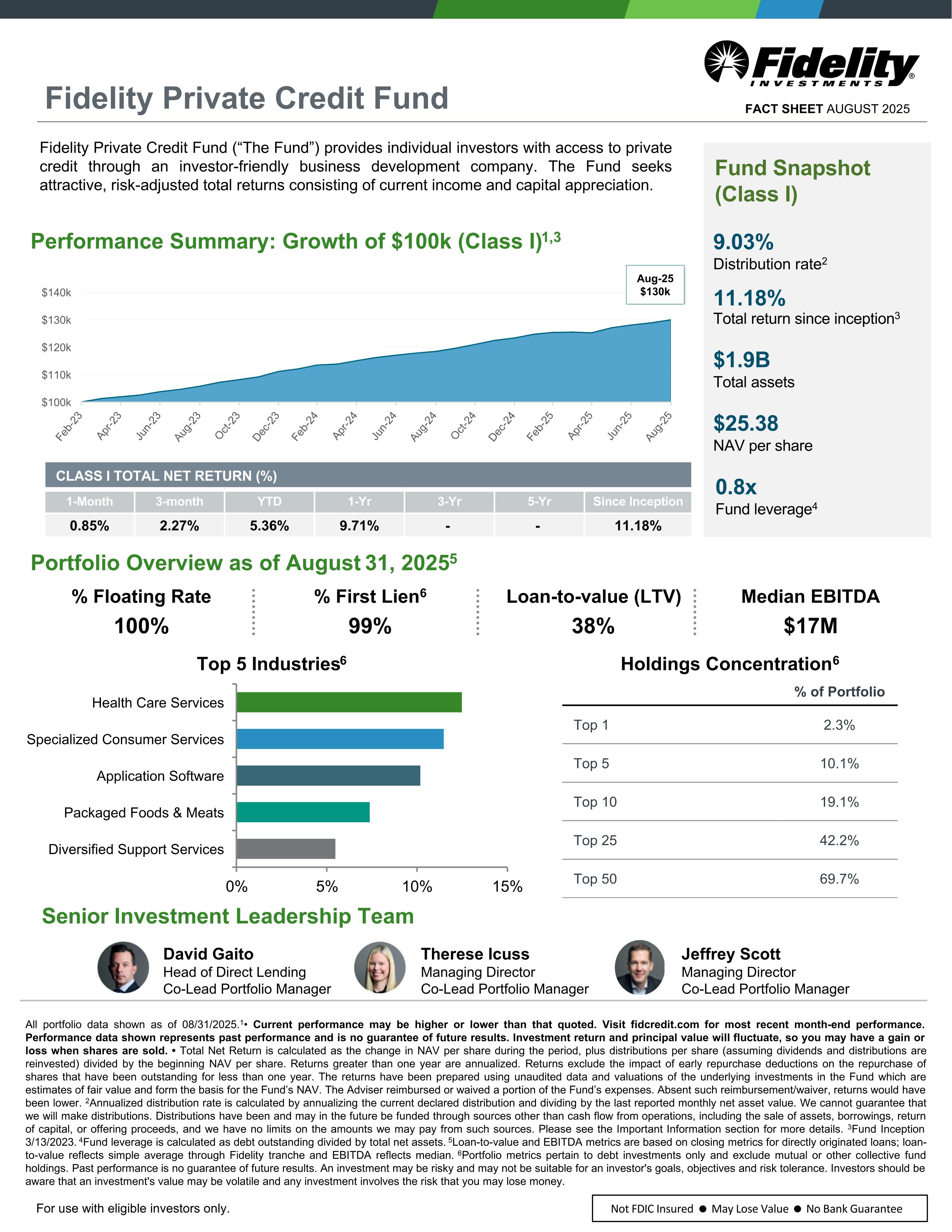

Fidelity Private Credit Fund For use with eligible investors only. All portfolio data shown as of 08/31/2025. Fees and Expenses shown are intended to assist you in understanding the costs and expenses that an investor in Common Shares will bear, directly or indirectly. Other expenses are estimated and may vary. Actual expenses may be greater or less than shown. 1Assumes the maximum amount of upfront placement fees that selling agents may charge (1.5% Class D and 3.5% for Class S). 2Fund Inception 3/13/2023. 3Class Inception 11/1/2023. 4The Managing Dealer has waived or reduced from $1,000,000 for certain categories of investors. 5Under our share repurchase program, to the extent we offer to repurchase shares in any particular quarter, we expect to repurchase shares pursuant to tender offers using a purchase price equal to the NAV per share as of the last calendar day of the applicable quarter, except that shares that have not been outstanding for at least one year may be subject to a fee of 2.0% of such NAV. The one-year holding period is measured as of the subscription closing date immediately following the prospective repurchase date. The Early Repurchase Deduction may be waived in the case of repurchase requests arising from the death, divorce or qualified disability of the holder. The Early Repurchase Deduction will be retained by the Fund for the benefit of remaining shareholders. 6We have entered into the Expense Limitation Agreement with the Adviser pursuant to which the Adviser is obligated to advance all of our “Other Operating Expense” (each, a “Required Expense Payment”) effective as of May 1, 2025, to the effect that such expenses do not exceed 0.70% (on an annualized basis) of the Fund’s NAV. In consideration of the Adviser’s agreement to make Expense Payments at any time during a fiscal year and to the extent that expenses fall below the Expense Limitation, the Adviser reserves the right to recoup through the end of the fiscal year any expenses that were reimbursed during the fiscal year up to, but not in excess of, the Expense Limitation. Performance Summary MONTHLY TOTAL NET RETURN (%) JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Class I 2025 1.11% 0.52% 0.08% -0.20% 1.49% 0.77% 0.62% 0.85% 2024 0.86% 1.24% 0.30% 1.07% 1.05% 0.69% 0.66% 0.53% 0.95% 1.19% 1.19% 0.74% 2023 - - 1.26% 0.63% 0.66% 1.14% 0.83% 1.11% 1.32% 0.92% 0.93% 1.81% Class S (No Upfront Placement Fee) 2025 1.03% 0.45% -0.07% -0.27% 1.42% 0.70% 0.55% 0.78% 2024 0.79% 1.17% 0.22% 1.00% 0.98% 0.62% 0.58% 0.46% 0.88% 1.12% 1.12% 0.67% 2023 - - - - - - - - - - 0.85% 1.74% Class D (No Upfront Placement Fee) 2025 1.08% 0.50% 0.06% -0.22% 1.47% 0.75% 0.60% 0.83% 2024 0.84% 1.22% 0.27% 1.05% 1.03% 0.67% 0.64% 0.51% 0.93% 1.17% 1.17% 0.72% 2023 - - - - - - - - - - 0.90% 1.79% TOTAL NET RETURN (%) Share Class 1-Month 3-month YTD 1-Yr 3-Yr 5-Yr Since Inception Class I 0.85% 2.27% 5.36% 9.71% - - 11.18%2 Class S No Upfront Placement Fee 0.78% 2.05% 4.68% 8.70% - - 9.55%3 With Upfront Placement Fee1 -2.74% -1.52% 1.02% 4.90% - - 7.44%3 Class D No Upfront Placement Fee 0.83% 2.20% 5.18% 9.44% - - 10.25%3 With Upfront Placement Fee1 -0.68% 0.67% 3.60% 7.80% - - 9.35%3 FEES Management Fee 1.25% on net (vs. gross) assets Incentive Fee 12.5% of net investment income subject to a 5.0% annualized hurdle with a catch-up, and paid quarterly in arrears 12.5% of cumulative realized gains net of realized and unrealized losses paid Additional Fees Class S & D ONLY Certain financial intermediaries may directly charge you transaction or other fees up to a 3.50% cap on NAV for Class S shares and a 1.50% cap on NAV for Class D shares, as it states in the Prospectus, and a shareholder servicing and/or distribution fee equal to 0.85% per annum of the aggregate NAV as of the beginning of the first calendar day of the month for the Class S shares, and for Class D shares, a shareholder servicing fee equal to 0.25% per annum of the aggregate NAV. The total underwriting compensation and total organization and offering expenses will not exceed 10% and 15%, respectively, of the gross proceeds from this offering Share Class Specific FEES Class I Class S Class D Minimum Investment $25,0004 Only available through certain non-Fidelity financial intermediaries Minimum Investment $25,0001 $2,500 $2,500 Upfront Placement Fee None Up to 3.5% Up to 1.5% Maximum Early Repurchase Deduction5 2.00% 2.00% 2.00% Total Annual Expenses 6.85% 7.70% 7.10% Total Annual Expenses (after expense support) 6 6.67% 7.52% 6.92% FACT SHEET AUGUST 2025

Fidelity Private Credit Fund Risk Factors Investors should review the offering documents, including the description of risk factors contained in the Fund's Prospectus (the "Prospectus"), prior to making a decision to invest in the securities described herein. The Prospectus will include more complete descriptions of the risks described below as well as additional risks relating to, among other things, conflicts of interest and regulatory and tax matters. Any decision to invest in the securities described herein should be made after reviewing such Prospectus, conducting such investigations as the investor deems necessary and consulting the investor’s own legal, accounting and tax advisors in order to make an independent determination of the suitability and consequences of an investment in the Fund. There is no assurance that we will achieve our investment objective. An investment in our Common Shares may not be appropriate for all investors and is not designed to be a complete investment program. This is a “blind pool” offering and thus you will not have the opportunity to evaluate our investments before we make them. You should not expect to be able to sell your shares regardless of how we perform. You should consider that you may not have access to the money you invest for an extended period of time. We do not intend to list our shares on any securities exchange, and we do not expect a secondary market in our shares to develop. Because you may be unable to sell your shares, you will be unable to reduce your exposure in any market downturn. We intend to implement a share repurchase program, but only a limited number of shares will be eligible for repurchase and repurchases will be subject to available liquidity and other significant restrictions. An investment in our Common Shares is not suitable for you if you need access to the money you invest. We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, or return of capital, and we have no limits on the amounts we may pay from such sources. Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Adviser or its affiliates, that may be subject to reimbursement to the Adviser or its affiliates. The repayment of any amounts owed to the Adviser or its affiliates will reduce future distributions to which you would otherwise be entitled. We use leverage, which will magnify the potential for loss on amounts invested in us. We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our Common Shares less attractive to investors. We intend to invest primarily in securities that are rated below investment grade by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value. Important Information This sales and advertising literature is neither an offer to sell nor a solicitation of an offer to buy securities. An offering is made only by the prospectus. This literature must be read in conjunction with the prospectus in order to fully understand all of the implications and risks of the offering of securities to which the prospectus relates. A copy of the prospectus must be made available to you in connection with any offering. No offering is made except by a prospectus filed with the Department of Law of the State of New York. Neither the Securities and Exchange Commission, the Attorney-General of the State of New York nor any other state securities regulator has approved or disapproved of our securities or determined if the prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Please read this information carefully. Speak with your relationship manager if you have any questions. Unless otherwise expressly disclosed to you in writing, the information provided in this material is for educational purposes only. Any viewpoints expressed by Fidelity are not intended to be used as a primary basis for your investment decisions and are based on facts and circumstances at the point in time they are made and are not particular to you. Accordingly, nothing in this material constitutes impartial investment advice or advice in a fiduciary capacity, as defined or under the Employee Retirement Income Security Act of 1974 or the Internal Revenue Code of 1986, both as amended. Fidelity and its representatives may have a conflict of interest in the products or services mentioned in this material because they have a financial interest in the products or services and may receive compensation, directly or indirectly, in connection with the management, distribution, and/or servicing of these products or services, including Fidelity funds, certain third-party funds and products, and certain investment services. Before making any investment decisions, you should take into account all of the particular facts and circumstances of your or your client’s individual situation and reach out to an investment professional, if applicable. Performance Performance shown is net of Fidelity Private Credit Fund (the Fund) expenses, including general and administrative expenses, transaction related expenses, management fees, incentive fees, and share class specific fees, but exclude the impact of early repurchase deductions on the repurchase of shares that have been outstanding for less than one year. The Adviser waived a portion of the Fund’s expenses. Absent such waiver, returns would have been lower. Class I does not have upfront placement fees. Please see the Fund’s Prospectus for additional fee and expense details. The returns have been prepared using unaudited data and valuations of the underlying investments in the Fund which are estimates of fair value and form the basis for the Fund’s NAV. Valuations based on unaudited reports from the underlying investments may be subject to later adjustments, may not correspond to realized value and may not accurately reflect the price at which assets could be liquidated. Distributions We cannot guarantee that we will make distributions, and if we do, we may fund such distributions from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital, or offering proceeds, and we have no limits on the amounts we may pay from such sources. See the Fund's prospectus. Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Adviser or its affiliates, that may be subject to reimbursement to the Adviser or its affiliates. The repayment of any amounts owed to our affiliates will reduce future distributions to which you would otherwise be entitled. The Fund will post notices regarding distributions subject to Section 19(a) of the investment Company Act of 1940, if applicable. FACT SHEET AUGUST 2025 For use with eligible investors only.

Fidelity Private Credit Fund Not FDIC Insured • May Lose Value • No Bank Guarantee Information provided herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any security or for any investment advisory service. This sales and advertising literature is neither an offer to sell nor a solicitation of an offer to buy securities. An offering is made only by the prospectus. This literature must be read in conjunction with the prospectus in order to fully understand all of the implications and risks of the offering of securities to which the prospectus relates. A copy of the prospectus must be made available to you in connection with any offering. No offering is made except by a prospectus filed with the Department of Law of the State of New York. Neither the Securities and Exchange Commission, the Attorney-General of the State of New York nor any other state securities regulator has approved or disapproved of our securities or determined if the prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Fidelity Private Credit Fund is managed by Fidelity Diversified Solutions LLC, a registered investment adviser, and is offered by Fidelity Distributors Company LLC (FDC LLC), a registered broker-dealer. 1198016.6.0 FIDELITY DISTRIBUTORS COMPANY LLC, 900 SALEM STREET, SMITHFIELD, RI 02917 FIDELITY BROKERAGE SERVICES LLC, MEMBER NYSE, SIPC, 900 SALEM STREET, SMITHFIELD, RI 02917 © 2024 FMR LLC. ALL RIGHTS RESERVED FACT SHEET AUGUST 2025