Exhibit 99.2

Investor Presentation The First NASDAQ - Listed Company to Compound Fully Allocated Gold October 2025

Disclaimer Unless the context otherwise provides, “we,” “us,” “our,” the “Company,” and like terms refer to [Company] and its subsidiaries . DISCLAIMERS AND OTHER IMPORTANT INFORMATION This presentation (this “Presentation”) is being furnished solely to recipients that are “qualified institutional buyers” (“QIBS”) as defined in Rule 144 A of the Securities Act of 1933 , as amended (the “Securities Act”), or institutional “accredited investors” (within the meaning of Rule 501 (a)( 1 ), ( 2 ), ( 3 ), ( 7 ), ( 8 ), ( 9 ), ( 12 ) or ( 13 ) of Regulation D under the Securities Act) (“Accredited Investors”) (any such recipient, together with its subsidiaries and affiliates, the “Recipient”) solely for informational purposes of considering the opportunity to participate in the proposed private placement of Class A ordinary shares and/or Class B ordinary shares (the “Equity PIPE Offering”, or, the “Offering”) . The securities described herein may be offered only in transactions that are exempt from registration under the Securities Act and other applicable securities laws and regulations . By purchasing securities, you will be deemed to have made the acknowledgements, representations, warranties and agreements described in the applicable subscription agreement and related documentation . By reading this Presentation, you will be deemed to acknowledge that you are a QIB or an Accredited Investor and to have agreed to the obligations and restrictions set out below . Neither we nor the placement agent have authorized any other person to provide you with any information other than that contained in this Presentation or in any other information prepared by or on behalf of us or to which we may have referred you . Neither we nor the placement agent take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you . You should assume that, unless otherwise noted, the information appearing in this Presentation is accurate only as of the date of this Presentation . Our business, financial condition, results of operations and future prospects may have changed since those dates . Neither the U . S . Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this Presentation is truthful or complete . Any representation to the contrary is a criminal offense . This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any proxy, vote, consent or approval in any jurisdiction, in connection with the Offering, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction . This Presentation does not constitute either advice or a recommendation regarding any securities . Any offer to sell securities pursuant to the Offering will be made only pursuant to a definitive subscription agreement and related documentation and will be made in reliance on an exemption from registration under the Securities Act for offers and sales of securities that do not involve a public offering . This Presentation, and the information contained herein, will not form the basis of any contract or commitment . The Company reserves the right to withdraw or amend for any reason any offering and to reject any subscription agreement for any reason, or for no reason . The communication of this Presentation is restricted by law ; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation . The Recipient acknowledges that it is (a) aware that the United States securities laws prohibit any person who has material, non - public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securities Exchange Act of 1934 , as amended, and the rules and regulations promulgated thereunder (collectively, the “Exchange Act”), and that the Recipient will neither use, nor cause any third party to use, this Presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10 b - 5 thereunder . Neither the Company nor any of its subsidiaries, equity holders, affiliates, representatives, partners, members, directors, officers, employees, advisers, or agents (collectively, “Representatives”) or the placement agent make any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein or any other written, oral or other communications transmitted or otherwise made available to the Recipient in the course of its evaluation of the Offering, and nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance . To the fullest extent permitted by law, neither the Company nor any of its Representatives or the placement agent shall be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its accuracy or sufficiency, its omissions, its errors, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith . In addition, the information contained herein does not purport to contain all of the information that may be required to evaluate the Offering . Unless otherwise noted, the information contained in this presentation is provided as of the date hereof and may change, and none of the parties nor any of their Representatives undertakes any obligation to update such information, including in the event that such information becomes inaccurate or incomplete . The general explanations included in this Presentation cannot address, nor are they intended to address, your specific investment objectives, financial situations or financial needs .

Disclaimer Cont. Unless the context otherwise provides, “we,” “us,” “our,” the “Company,” and like terms refer to [Company] and its subsidiaries . DISCLAIMERS AND OTHER IMPORTANT INFORMATION The information contained in this presentation has been prepared to assist interested parties in making their own evaluation with respect to the Offering, and for no other purpose . Each reader and each prospective investor is encouraged to obtain separate and independent verification of the information, opinions and financial projections . Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with any party or their respective Representatives, as investment, legal or tax advice . In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of the Company and the Offering . Recipients of this Presentation should read the definitive documents for the Offering and make their own evaluation of the Company and the Offering and of the relevance and adequacy of the information and should make such other investigations as they deem necessary . The Company obtained the industry, market and competitive position data used throughout this presentation from internal estimates and research as well as from industry publications and research, surveys and studies conducted by third parties . The Company believes its estimates to be accurate as of the date of this presentation . However, this information may prove to be inaccurate because of the method by which the Company obtained some of the data for its estimates or because this information cannot always be verified due to the limits on the availability and reliability of raw data . This presentation also contains estimates made by independent parties relating to industry market size and other data . These estimates involve a number of assumptions and limitations and you are cautioned not to give undue weight on such estimates . All rights to the trademarks, copyrights, logos and other intellectual property listed herein belong to their respective owners and the Company’s use hereof does not imply an affiliation with, or endorsement by the owners of such trademarks, copyrights, logos and other intellectual property . This document contains forward - looking statements . Forward - looking statements can be identified by words such as : “anticipate,” “aspire,” “intend,” “plan,” “offer,” “goal,” “objective,” “potential,” “seek,” “believe,” “project,” “estimate,” “expect,” “forecast,” “assume,” “strategy,” “target,” “trend,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods . Forward - looking statements are neither historical facts nor assurances of future performance . Instead, they are based only on current beliefs, expectations and assumptions regarding the future of the relevant business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions, including the anticipated performance of Gold , XAUt , and any other Gold - related product, and the Company’s intention to purchase additional XAUt . Because forward - looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict, and many of which are outside of our control . Actual results and financial conditions may differ materially from those indicated in the forward - looking statements . Forecasts are based on complex calculations and formulas that contain substantial subjectivity, and no express or implied prediction made should be interpreted as investment advice . There can be no assurance that market conditions will perform according to any forecast, the firm will achieve its objectives or that investors will receive a return on their capital . The projections or other forward - looking information regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future investment results . There can be no assurance that unrealized investments will be realized at the valuations shown or in accordance with any return projections . Actual realized returns depend on, among other factors, future operating results, the value of the assets and market conditions at the time of disposition, related transaction costs, and the timing and manner of sale, all of which may differ from the assumptions on which the valuations and projections contained herein are based . Past performance is not indicative of future results, and nothing herein should be deemed a prediction or projection of future outcomes . Some forward - looking statements and assumptions are based on analysis of data prepared by third - party reports, which should be analyzed on their own merits . Third - party sources referenced are believed to be reliable, but we cannot guarantee the accuracy or completeness of such information . No representation or warranty, express or implied, is made as to the accuracy, completeness or fairness of the information and opinions contained in this document . We undertake no obligation to update any statement herein, whether as a result of new information, future developments or otherwise . Investments in any opportunity referred to herein can be made only pursuant to the definitive investment documents relating to such opportunity, which may only be provided upon request to eligible investors (as defined in such documentation) . Investments in opportunities such as those described herein entail significant risks and are suitable only to certain investors as part of an overall diversified investment strategy and only for investors who are able to withstand a total loss of investment . You are urged to request any additional information you may consider necessary or desirable in making an informed investment decision . You (and your Representatives, if any) are invited, prior to the entry into any definitive documentation with respect to the Offering, to ask questions of, and receive answers from, the Company concerning the Offering and to obtain additional information regarding the Offering, to the extent the same can be acquired without unreasonable effort or expense, in order to verify the accuracy of the information contained herein . CONFIDENTIALITY This information is being distributed to you on a confidential basis . By receiving this information, you and your affiliates and Representatives agree to maintain the confidentiality of the information contained herein . Without the express prior written consent of the Company, this Presentation and any information contained within it may not be ( i ) reproduced (in whole or in part), (ii) copied at any time, (iii) used for any purpose other than your evaluation of the Company and the Offering or (iv) provided to any person except your employees and advisors with a need to know who are advised of the confidentiality of the information . This Presentation supersedes and replaces all previous oral or written communications relating to the subject matter hereof .

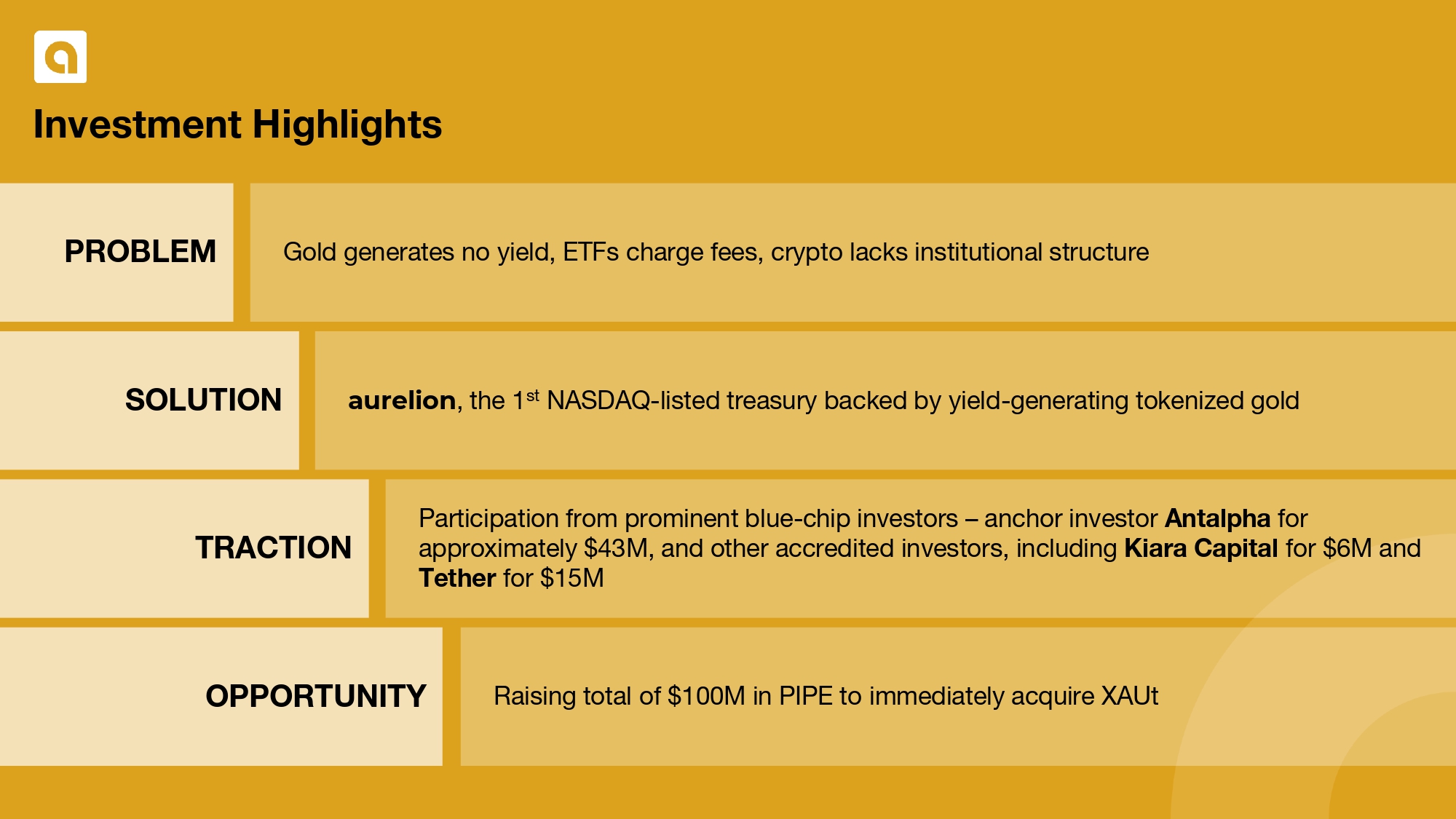

Investment Highlights PROBLEM SOLUTION TRACTION OPPORTUNITY Gold generates no yield, ETFs charge fees, crypto lacks institutional structure aurelion , the 1 st NASDAQ - listed treasury backed by yield - generating tokenized gold Participation from prominent blue - chip investors – anchor investor Antalpha for approximately $43M, and other accredited investors, including Kiara Capital for $6M and Tether for $15M Raising total of $100M in PIPE to immediately acquire XAUt

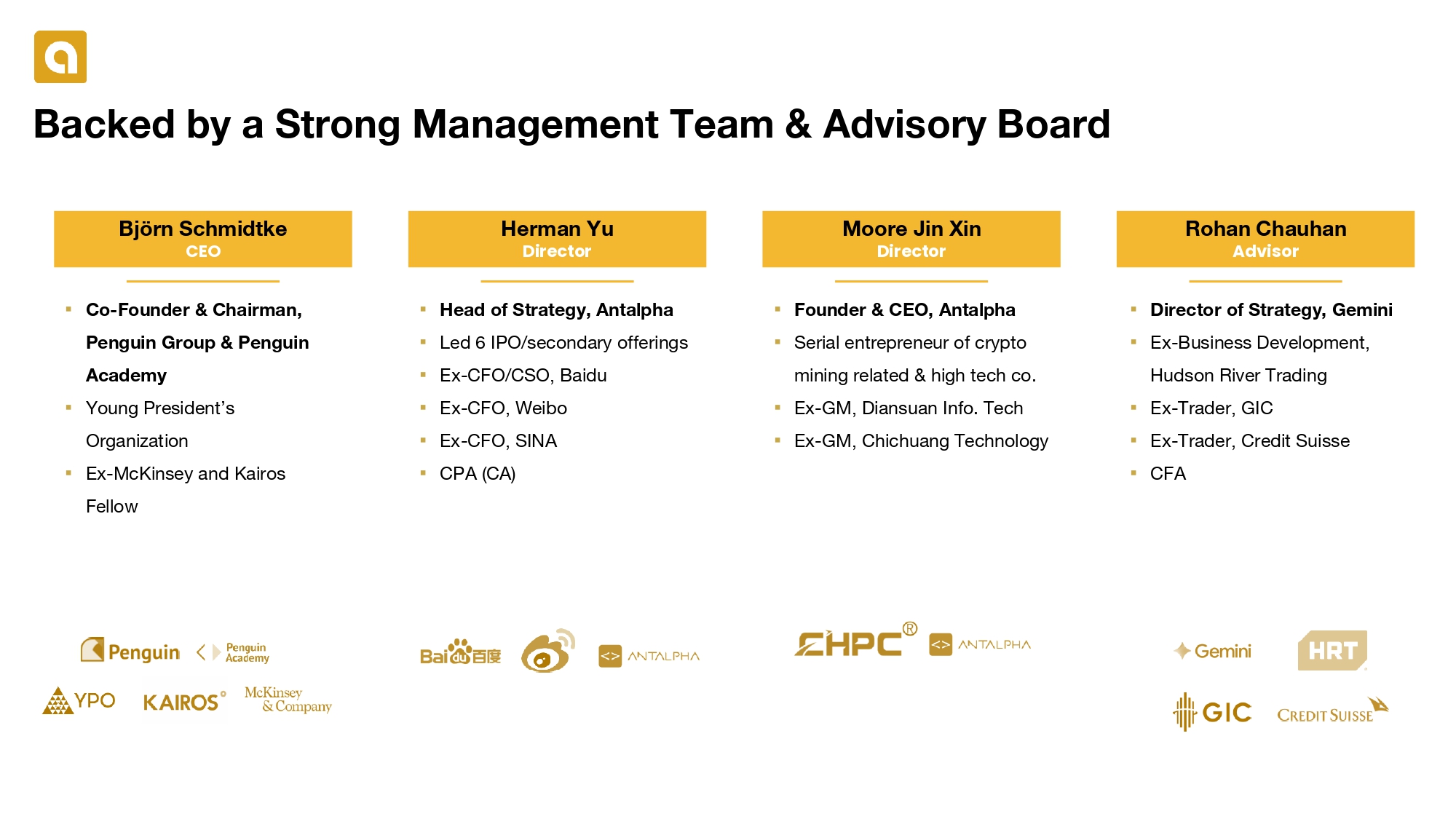

Backed by a Strong Management Team & Advisory Board Björn Schmidtke CEO ▪ Co - Founder & Chairman, Penguin Group & Penguin Academy ▪ Young President’s Organization ▪ Ex - McKinsey and Kairos Fellow ▪ Head of Strategy, Antalpha ▪ Led 6 IPO/secondary offerings ▪ Ex - CFO/CSO, Baidu ▪ Ex - CFO, Weibo ▪ Ex - CFO, SINA ▪ CPA (CA) Herman Yu Director Moore Jin Xin Director ▪ Founder & CEO, Antalpha ▪ Serial entrepreneur of crypto mining related & high tech co. ▪ Ex - GM, Diansuan Info. Tech ▪ Ex - GM, Chichuang Technology Rohan Chauhan Advisor ▪ Director of Strategy, Gemini ▪ Ex - Business Development, Hudson River Trading ▪ Ex - Trader, GIC ▪ Ex - Trader, Credit Suisse ▪ CFA

aurelion will be the world’s first NASDAQ - listed treasury company backed 100% by XAUt — fully redeemable, physically stored gold, digitized on the blockchain by TETHER

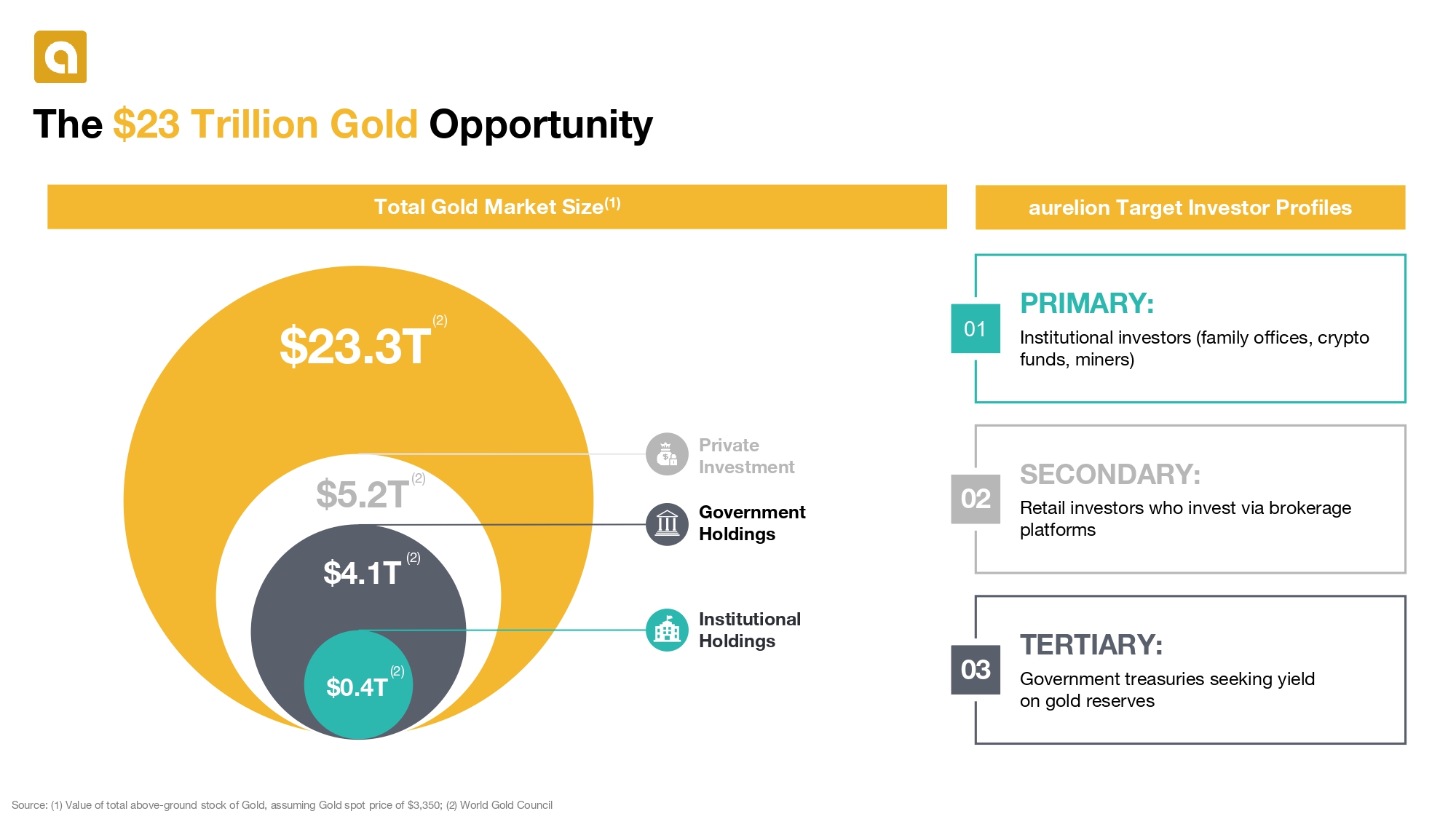

aurelion Target Investor Profiles The $23 Trillion Gold Opportunity Total Gold Market Size (1) Source: (1) Value of total above - ground stock of Gold, assuming Gold spot price of $3,350; (2) World Gold Council $5.2T $4.1T $0.4T $23.3T Private Investment Government Holdings Institutional Holdings PRIMARY: Institutional investors (family offices, crypto funds, miners) SECONDARY: Retail investors who invest via brokerage platforms TERTIARY: Government treasuries seeking yield on gold reserves 01 02 03 (2) (2) (2) (2)

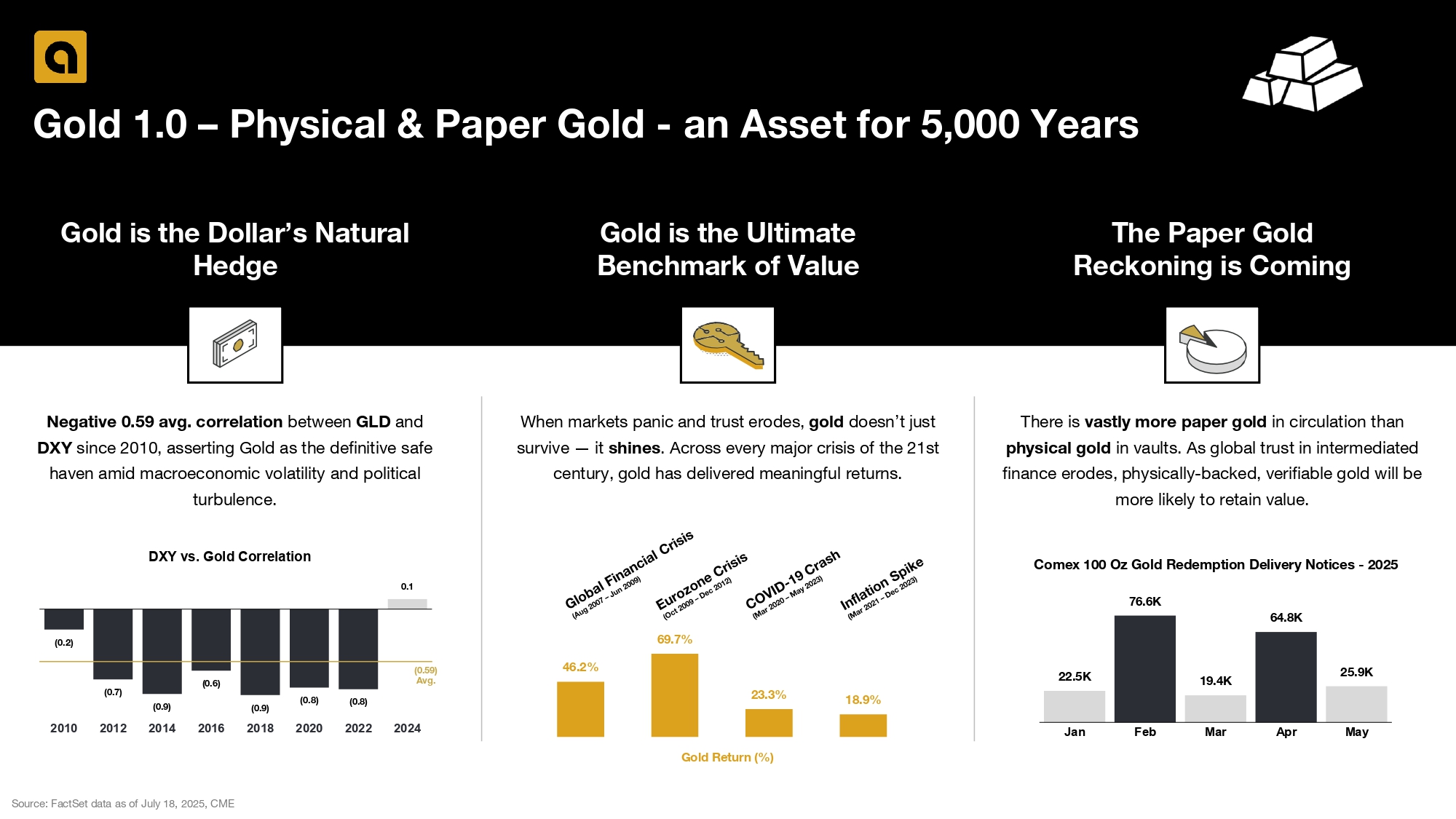

Gold 1.0 – Physical & Paper Gold - an Asset for 5,000 Years Gold is the Dollar’s Natural Hedge Gold is the Ultimate Benchmark of Value When markets panic and trust erodes, gold doesn’t just survive — it shines . Across every major crisis of the 21st century, gold has delivered meaningful returns. Negative 0.59 avg. correlation between GLD and DXY since 2010, asserting Gold as the definitive safe haven amid macroeconomic volatility and political turbulence. Gold Return (%) The Paper Gold Reckoning is Coming There is vastly more paper gold in circulation than physical gold in vaults. As global trust in intermediated finance erodes, physically - backed, verifiable gold will be more likely to retain value. Comex 100 Oz Gold Redemption Delivery Notices - 2025 (0.2) (0.7) (0.9) (0.6) (0.9) (0.8) (0.8) 0.1 2010 2012 2014 2016 2018 2020 2022 2024 DXY vs. Gold Correlation (0.59) Avg. Source: FactSet data as of July 18, 2025, CME 22.5K 76.6K 19.4K 64.8K 25.9K Jan Feb Mar Apr May 46.2% 69.7% 23.3% 18.9%

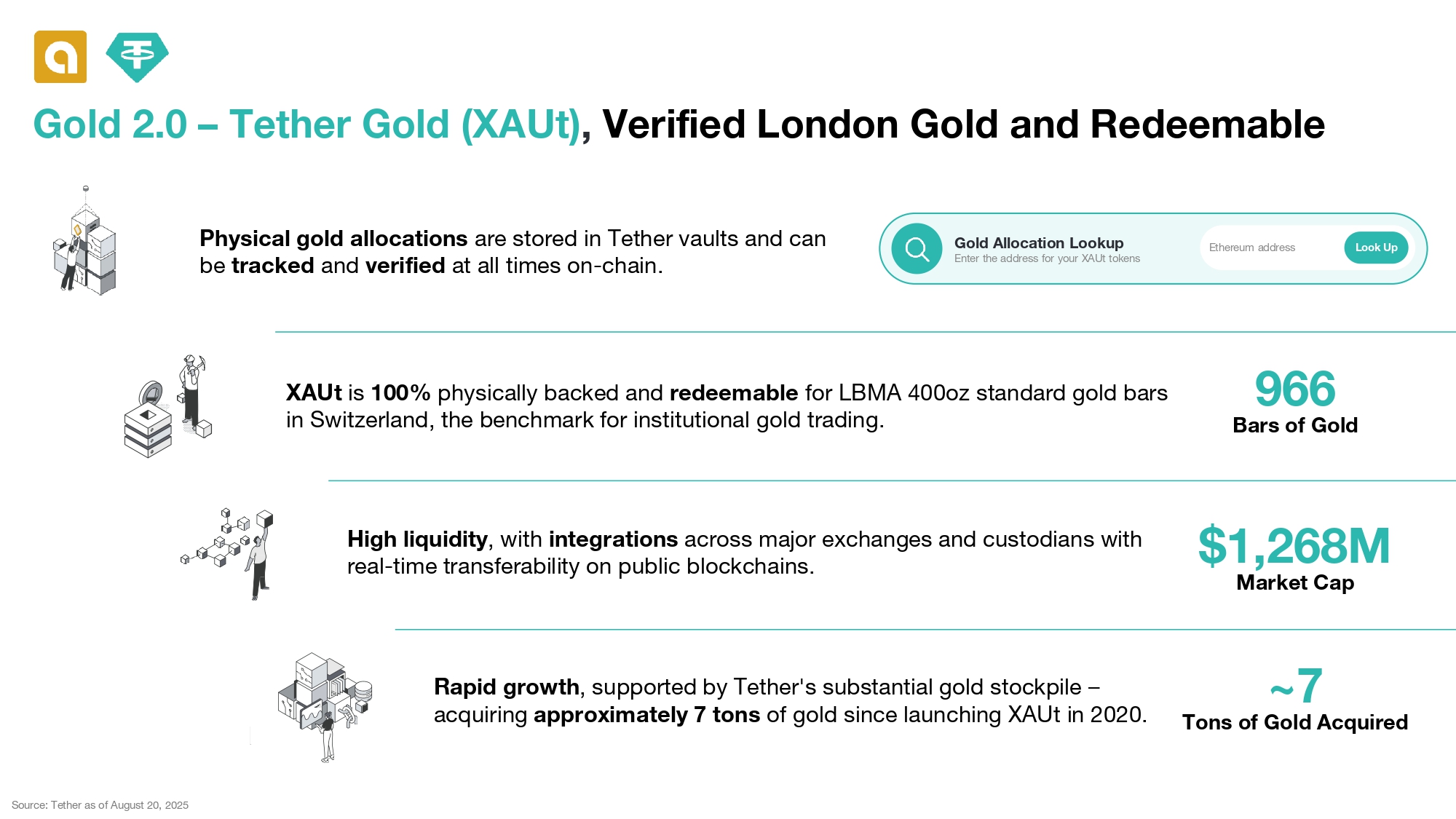

$1,268M Market Cap XAUt is 100% physically backed and redeemable for LBMA 400oz standard gold bars in Switzerland, the benchmark for institutional gold trading. 966 Bars of Gold Rapid growth , supported by Tether's substantial gold stockpile – acquiring approximately 7 tons of gold since launching XAUt in 2020. ~7 Tons of Gold Acquired Gold Allocation Lookup Enter the address for your XAUt tokens Ethereum address Look Up Physical gold allocations are stored in Tether vaults and can be tracked and verified at all times on - chain. Source: Tether as of August 20, 2025 Gold 2.0 – Tether Gold ( XAUt ) , Verified London Gold and Redeemable High liquidity , with integrations across major exchanges and custodians with real - time transferability on public blockchains.

Gold 3.0 – aurelion , the Best Way to Buy Gold THE MARKET IS READY aurelion is here to bridge the gap between physical and digital gold REGULATED AND TRANSPARENT Unlike traditional gold investment vehicles, aurelion is expected to have secure, on - chain vaults, SEC - regulated governance, and independently - audited financials ELEVATED GOLD RETURNS aurelion unlocks yield from gold via lending, transforming it into a productive treasury and capital asset LONG - TERM TREASURY STRATEGY Leveraging gold’s stability and low cost of capital will enable the aurelion to generate yield and accumulate more XAUt over time

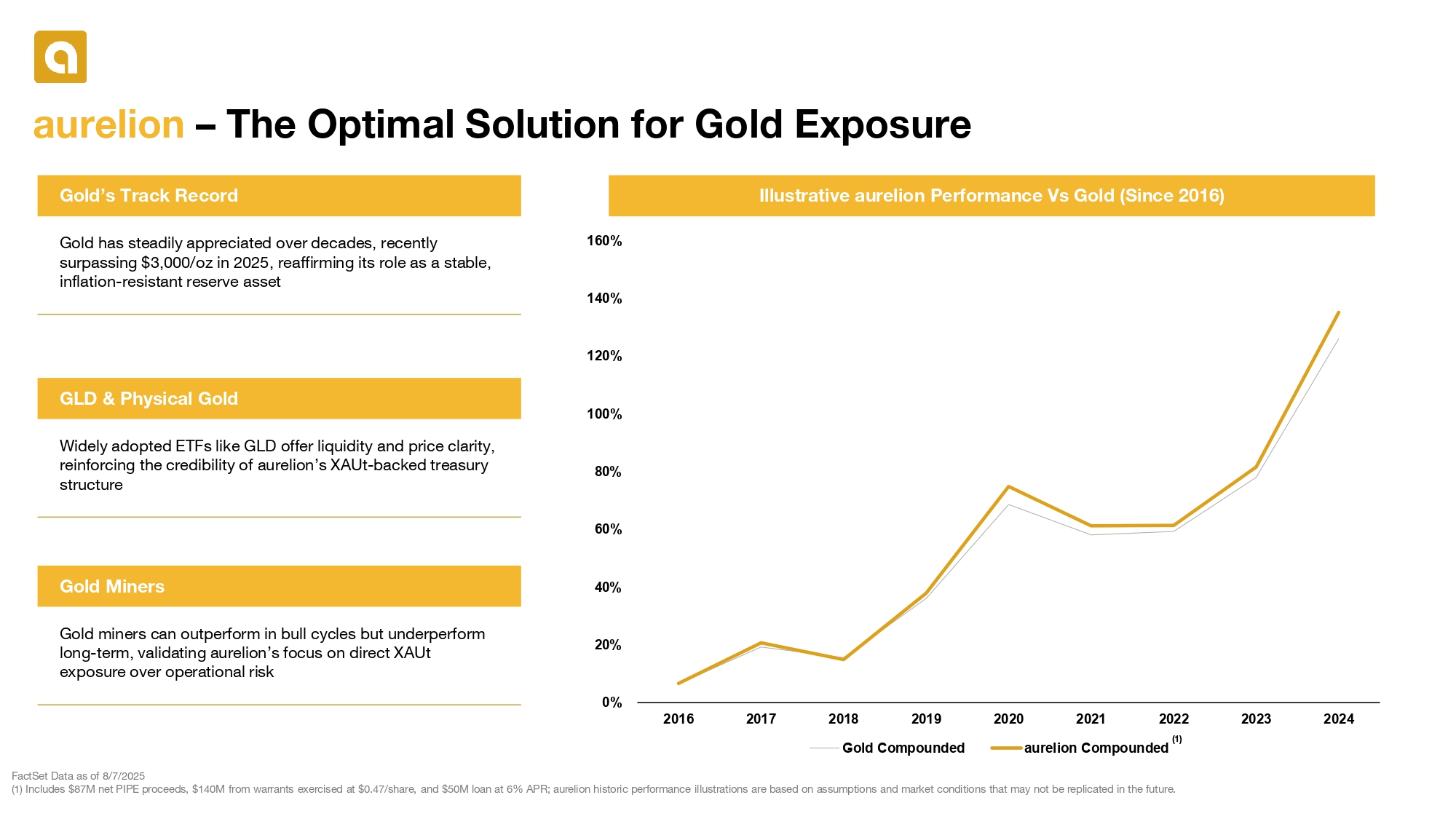

Illustrative aurelion Performance Vs Gold (Since 2016) Gold has steadily appreciated over decades, recently surpassing $3,000/oz in 2025, reaffirming its role as a stable, inflation - resistant reserve asset Gold’s Track Record Widely adopted ETFs like GLD offer liquidity and price clarity, reinforcing the credibility of aurelion’s XAUt - backed treasury structure GLD & Physical Gold Gold miners can outperform in bull cycles but underperform long - term, validating aurelion’s focus on direct XAUt exposure over operational risk Gold Miners (1) FactSet Data as of 8/7/2025 (1) Includes $87M net PIPE proceeds, $140M from warrants exercised at $0.47/share, and $50M loan at 6% APR; aurelion historic performance illustrations are based on assumptions and market conditions that may not be replicated in the future. aurelion – The Optimal Solution for Gold Exposure 0% 20% 40% 60% 80% 100% 120% 140% 160% 2016 2017 2018 2019 2020 2021 2022 2023 2024 Gold Compounded aurelion Compounded

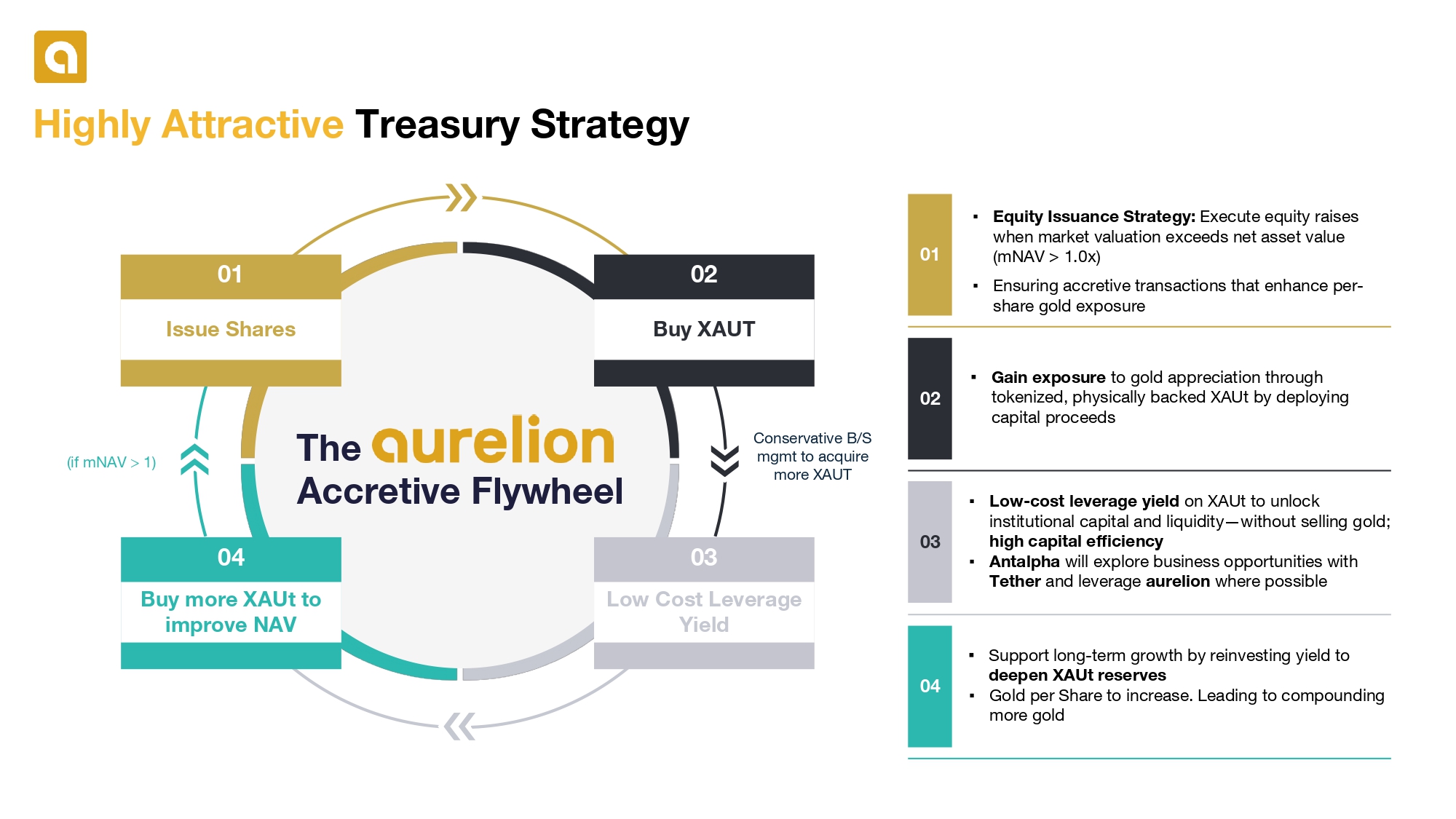

Highly Attractive Treasury Strategy 03 Low Cost Leverage Yield 02 Buy XAUT 04 Buy more XAUt to improve NAV The AURELION Accretive Flywheel 01 Issue Shares 01 ▪ Gain exposure to gold appreciation through tokenized, physically backed XAUt by deploying capital proceeds 02 03 04 ▪ Low - cost leverage yield on XAUt to unlock institutional capital and liquidity — without selling gold; high capital efficiency ▪ Antalpha will explore business opportunities with Tether and leverage aurelion where possible ▪ Support long - term growth by reinvesting yield to deepen XAUt reserves ▪ Gold per Share to increase. Leading to compounding more gold (if mNAV > 1) Conservative B/S mgmt to acquire more XAUT ▪ Equity Issuance Strategy: Execute equity raises when market valuation exceeds net asset value ( mNAV > 1.0x) ▪ Ensuring accretive transactions that enhance per - share gold exposure

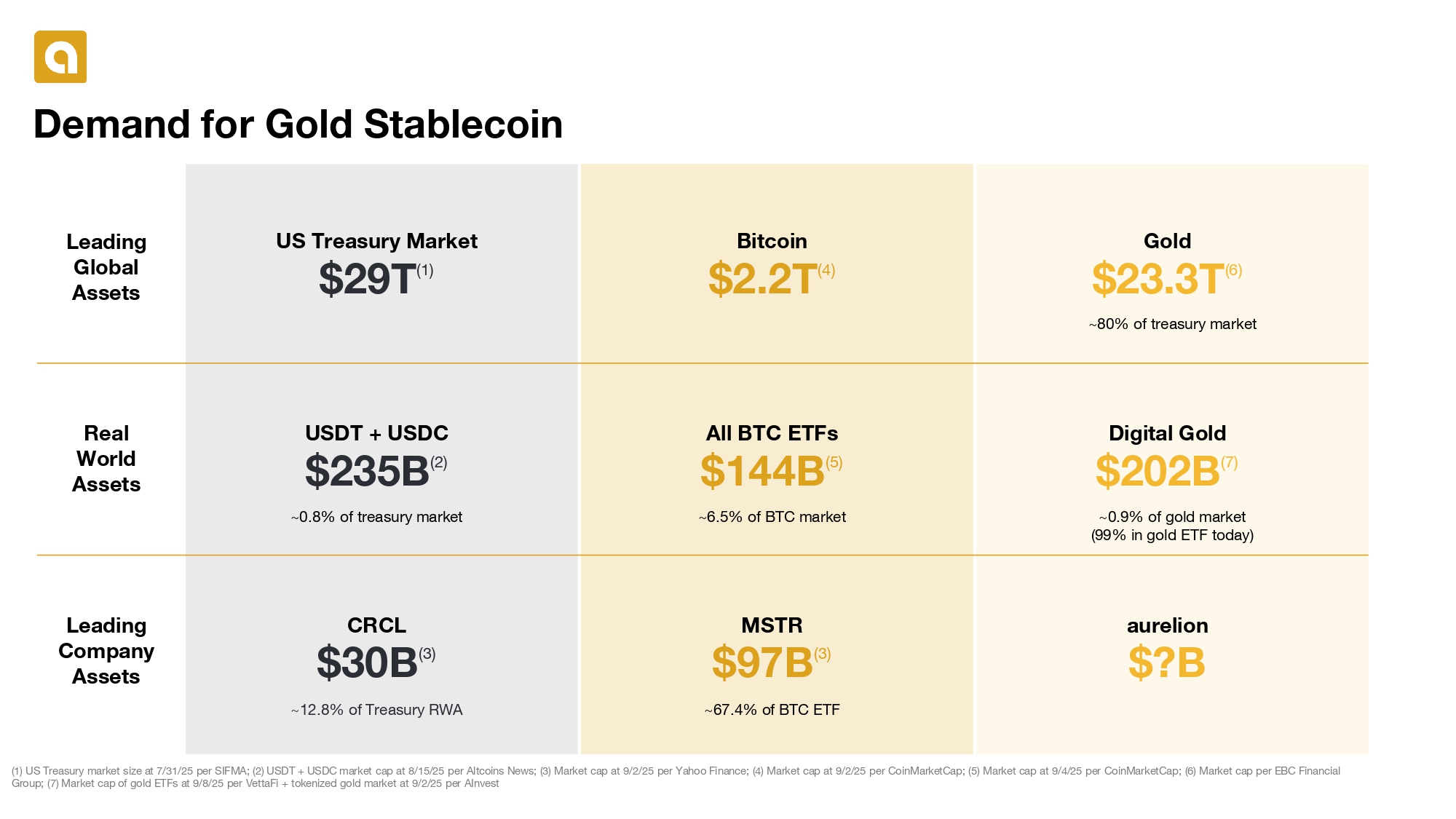

Demand for Gold Stablecoin ~12.8% of Treasury RWA ~67.4% of BTC ETF (1) US Treasury market size at 7/31/25 per SIFMA; (2) USDT + USDC market cap at 8/15/25 per Altcoins News; (3) Market cap at 9/2 /25 per Yahoo Finance; (4) Market cap at 9/2/25 per CoinMarketCap ; (5) Market cap at 9/4/25 per CoinMarketCap ; (6) Market cap per EBC Financial Group; (7) Market cap of gold ETFs at 9/8/25 per VettaFi + tokenized gold market at 9/2/25 per AInvest USDT + USDC $235B (2) All BTC ETFs $144B (5) Digital Gold $202B (7) Real World Assets CRCL $30B (3) MSTR $97B (3) aurelion $?B Leading Company Assets US Treasury Market $29T (1) Bitcoin $2.2T (4) Gold $23.3T (6) Leading Global Assets ~6.5% of BTC market ~0.8% of treasury market ~80% of treasury market ~0.9% of gold market (99% in gold ETF today)

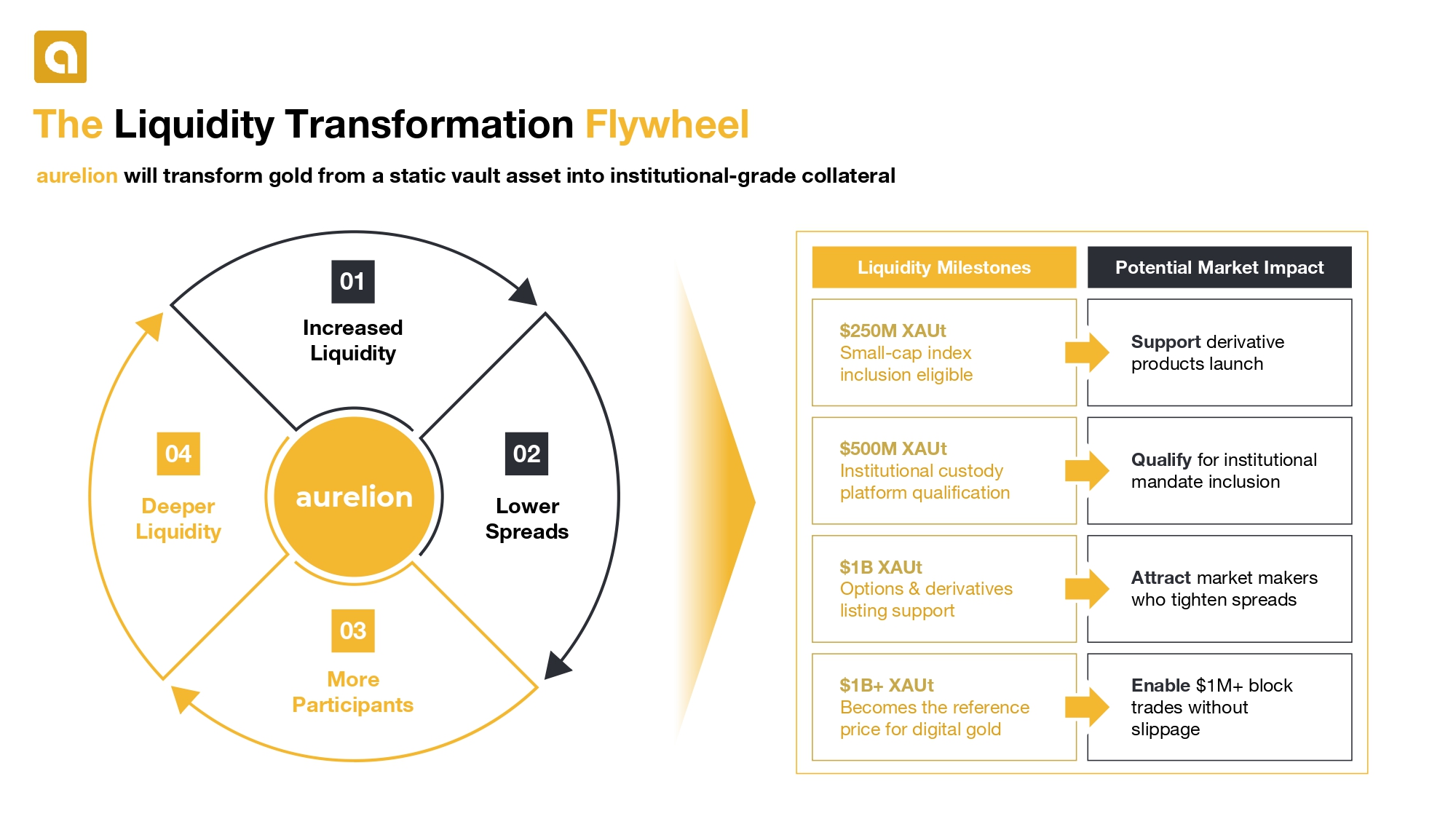

Potential Market Impact Enable $1M+ block trades without slippage Attract market makers who tighten spreads Qualify for institutional mandate inclusion Support derivative products launch Liquidity Milestones $250M XAUt Small - cap index inclusion eligible $500M XAUt Institutional custody platform qualification $1B XAUt Options & derivatives listing support $1B+ XAUt Becomes the reference price for digital gold aurelion 01 02 03 04 Deeper Liquidity Lower Spreads More Participants Increased Liquidity aurelion will transform gold from a static vault asset into institutional - grade collateral The Liquidity Transformation Flywheel

OPERATIONAL SECURITY ▪ Custodian: LMBA certified gold bars in Swiss vaults ▪ Regulatory: FATF - aligned AML/KYC protocols ▪ Security: Audited smart contracts with multi - signature controls ▪ Transparency: On - chain proof of reserves and attestations SEC COMPLIANCE ▪ NASDAQ - listed public company ▪ Quarterly financial reporting ▪ SOX compliance, as applicable ▪ Annual filings INVESTOR PROTECTIONS ▪ Daily NAV reporting ▪ On - chain verification of gold holdings ▪ 1:1 backing at all times Institutional - Grade Compliance & Security Risk Management ▪ Custodian for crypto ▪ Board oversight

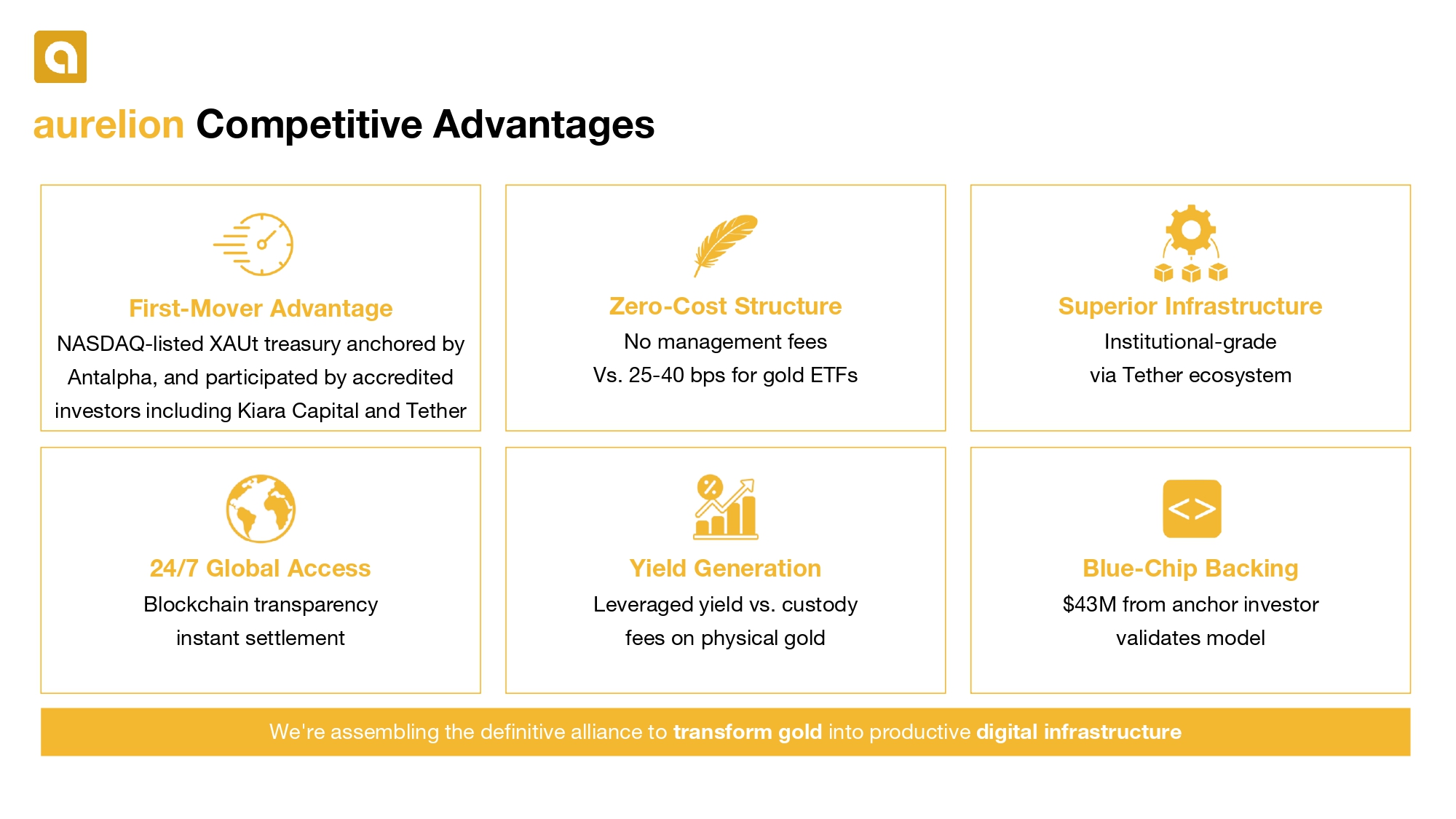

aurelion Competitive Advantages We're assembling the definitive alliance to transform gold into productive digital infrastructure Zero - Cost Structure No management fees Vs. 25 - 40 bps for gold ETFs First - Mover Advantage NASDAQ - listed XAUt treasury anchored by Antalpha , and participated by accredited investors including Kiara Capital and Tether Superior Infrastructure Institutional - grade via Tether ecosystem Yield Generation Leveraged yield vs. custody fees on physical gold 24/7 Global Access Blockchain transparency instant settlement Blue - Chip Backing $43M from anchor investor validates model

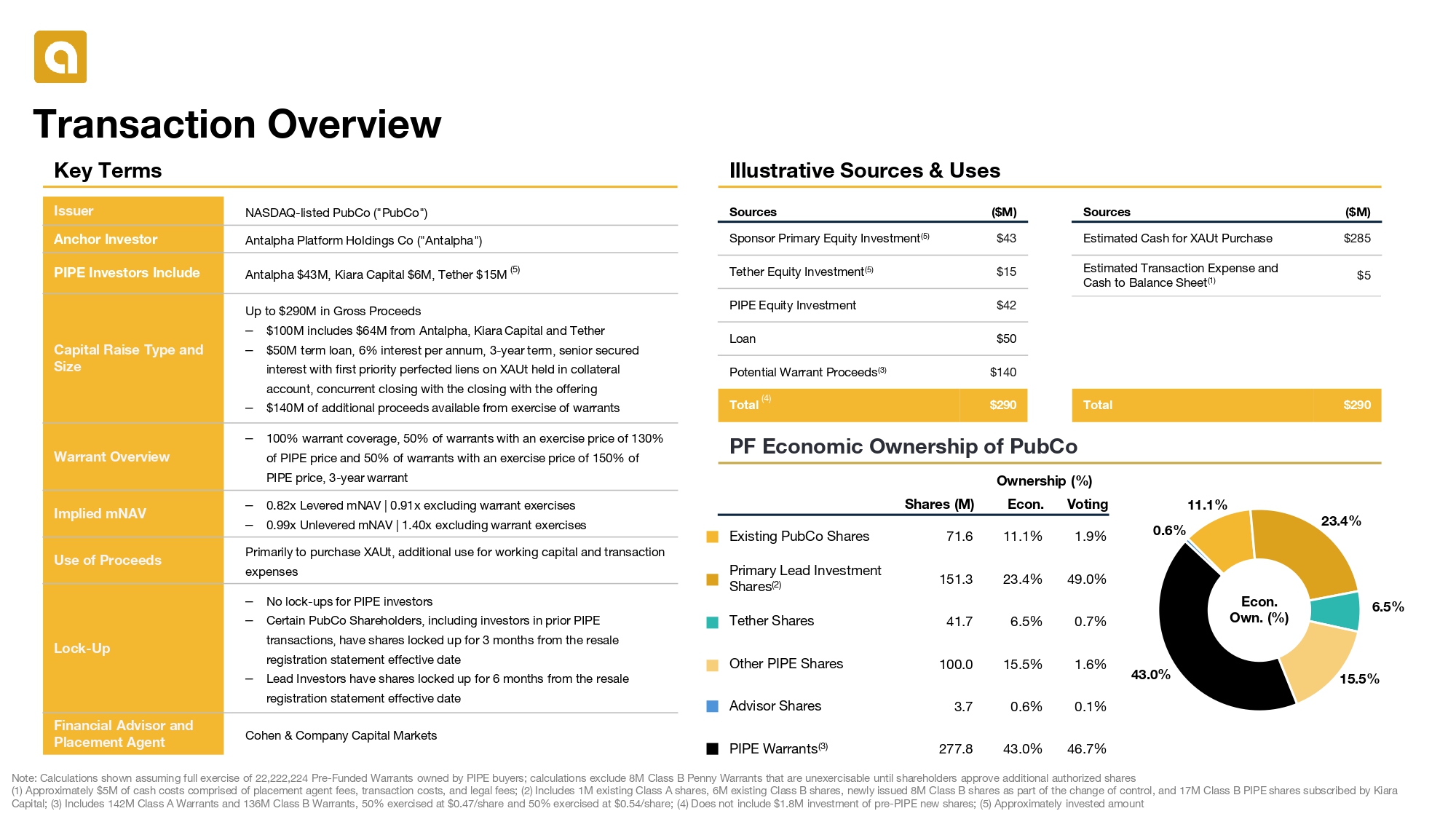

Ownership (%) Voting Econ. Shares (M) 1.9% 11.1% 71.6 Existing PubCo Shares 49.0% 23.4% 151.3 Primary Lead Investment Shares (2) 0.7% 6.5% 41.7 Tether Shares 1.6% 15.5% 100.0 Other PIPE Shares 0.1% 0.6% 3.7 Advisor Shares 46.7% 43.0% 277.8 PIPE Warrants (3) Transaction Overview ($M) Sources $43 Sponsor Primary Equity Investment (5) $15 Tether Equity Investment (5) $42 PIPE Equity Investment $50 Loan $140 Potential Warrant Proceeds (3) $290 Total PF Economic Ownership of PubCo Key Terms NASDAQ - listed PubCo (" PubCo ") Issuer Antalpha Platform Holdings Co (" Antalpha ") Anchor Investor Antalpha $43M, Kiara Capital $6M, Tether $15M PIPE Investors Include Up to $290M in Gross Proceeds – $100M includes $64M from Antalpha , Kiara Capital and Tether – $50M term loan, 6% interest per annum, 3 - year term, senior secured interest with first priority perfected liens on XAUt held in collateral account, concurrent closing with the closing with the offering – $140M of additional proceeds available from exercise of warrants Capital Raise Type and Size – 100% warrant coverage, 50% of warrants with an exercise price of 130% of PIPE price and 50% of warrants with an exercise price of 150% of PIPE price, 3 - year warrant Warrant Overview – 0.82x Levered mNAV | 0.91x excluding warrant exercises – 0.99x Unlevered mNAV | 1.40x excluding warrant exercises Implied mNAV Primarily to purchase XAUt , additional use for working capital and transaction expenses Use of Proceeds – No lock - ups for PIPE investors – Certain PubCo Shareholders, including investors in prior PIPE transactions, have shares locked up for 3 months from the resale registration statement effective date – Lead Investors have shares locked up for 6 months from the resale registration statement effective date Lock - Up Cohen & Company Capital Markets Financial Advisor and Placement Agent Note: Calculations shown assuming full exercise of 22,222,224 Pre - Funded Warrants owned by PIPE buyers; calculations exclude 8M Class B Penny Warrants that are unexercisable until shareholders approve additional authorized shares (1) Approximately $5M of cash costs comprised of placement agent fees, transaction costs, and legal fees; (2) Includes 1M exi sti ng Class A shares, 6M existing Class B shares, newly issued 8M Class B shares as part of the change of control, and 17M Class B PIPE shares subscribed by Kiara Capital; (3) Includes 142M Class A Warrants and 136M Class B Warrants, 50% exercised at $0.47/share and 50% exercised at $0.5 4/s hare; (4) Does not include $1.8M investment of pre - PIPE new shares; (5) Approximately invested amount Illustrative Sources & Uses Econ. Own. (%) (5) ($M) Sources $285 Estimated Cash for XAUt Purchase $5 Estimated Transaction Expense and Cash to Balance Sheet (1) $290 Total 11.1% 23.4% 6.5% 15.5% 43.0% 0.6% (4)

Risk Factors RISKS RELATED TO THE COMPANY’S BUSINESS AND XAUT STRATEGY AND HOLDINGS • The Company’s financial results and the market price of the ordinary shares may be affected by the prices of Gold and XAUt . • Our XAUt treasury strategy may expose us to complex liquidity risks across both traditional and digital asset markets, which could adv er sely affect its financial results. • The redemption risk, pricing risk, and regulatory risk associated with XAUt as a stablecoin may adversely affect the price of XAUt , and thus our business, financial condition, and results of operations. • We operate in a highly competitive market, and established market participants with greater resources, regulatory positioning , o r brand recognition may outperform us. • Investing in XAUt will expose the Company to certain risks associated with XAUt , such as price volatility, limited liquidity and trading volumes, relative anonymity, potential susceptibility to market abu se and manipulation, theft, compliance and internal control failures at exchanges and other risks inherent in its electronic, virtual form and decentralized network. • The Company’s quarterly operating results, revenues, and expenses may fluctuate significantly, including because the Company may be required to account for its digital assets at fair value, which could have an adverse effect on the market price of its se cu rities. • The Company will have broad discretion in how it executes its XAUt strategy, including the timing of purchases and sale of XAUt and XAUt - related products. The Company may not execute its strategy effectively, which could affect its results of operations and caus e its share price to decline. • The price of XAUt has been volatile, and our ability to time the price of its purchase of XAUt pursuant to its strategy, including with the net proceeds of Contemplated Transactions, will be limited. • A significant decrease in the market value of the Company’s XAUt holdings could adversely affect its ability to satisfy its financial obligations under debt financings. • The Company may be, or may become following the Offering, a “passive foreign investment company” within the meaning of Sectio n 1 297(a) of the Internal Revenue Code of 1986, as amended, which may have adverse tax consequences for U.S. investors. • Future developments regarding the treatment of crypto assets for U.S. and foreign tax purposes could adversely impact the Com pan y’s business. • XAUt and other digital assets are novel assets, and are subject to significant legal, commercial, regulatory and technical uncerta in ty. • Competition by other digital asset treasury, Gold - related treasury, or XAUt treasury companies and the availability of spot exchange - traded products (“ETPs”) for other digital assets may adversely affect the market price of its listed securities. • The Company’s XAUt strategy will subject it to enhanced regulatory oversight. • XAUt trading venues may experience greater fraud, security failures, or regulatory or operational problems than trading venues for m ore established asset classes. • The concentration of XAUt holdings may enhance the risks inherent in the Company’s XAUt strategy. • The Company’s XAUt holdings will be less liquid than existing cash and cash equivalents and may not be able to serve as a source of liquidity fo r it to the same extent as cash and cash equivalents. • If the Company or its third - party service providers experience a security breach or cyber - attack and unauthorized parties obtain access to its XAUt assets, the Company may lose some or all of its XAUt assets and its financial condition and results of operations could be materially adversely affected. • Rehypothecation of XAUt may subject the Company to significant risks and uncertainties. • The Company will face risks relating to the custody of its XAUt , including the loss or destruction of private keys required to access its XAUt and cyberattacks or other data loss relating to its XAUt . • Regulatory changes reclassifying XAUt as a security or as a “cash item” could lead to the Company’s classification as an “investment company” under the Investment Co mpany Act of 1940 and could adversely affect the market price of XAUt and the market price of the Company’s listed securities. • The Company’s XAUt strategy exposes it to risk of non - performance, breach of contract, or other violations by counterparties. • This treasury strategy represents an entirely new business strategy in addition to what the Company has employed to date. • We may need additional capital in the future to acquire additional XAUt , but there is no assurance that we will be able to raise additional capital or that funds will be available on acceptable te rms . • Our use of leveraged strategies and the potential illiquidity of digital assets subject us to significant risks, including th e p otential for substantial losses and forced liquidations. • We may engage in leveraged digital asset financing strategies, in which we will leverage our digital asset holdings to acquir e a dditional amounts of the same leveraged digital assets, and may do so on a compounded basis, which will increase our exposure to smart - contract, operational, and counter - party risks. RISKS RELATED TO THE EQUITY PIPE OFFERING • The Company intends to use the net proceeds from this Offering to purchase XAUt , the price of which has been, and will likely continue to be, volatile. • Shares of our ordinary shares will be sold in a private placement, which will limit your ability to resell the shares. • The Company will have broad discretion in the use of the net proceeds from this offering and investors will not have the oppo rtu nity as of this process to assess whether the net proceeds are being used in a manner of which you approve. • Certain shareholders will experience dilution in the future due to any exercise of existing warrants and any future securitie s i ssued by the Company. • The performance of the ordinary shares of the Company following the consummation of the Transactions and the implementation o f t he XAUt treasury strategy may be affected by factors different from those that historically have affected or currently affect the Com pa ny’s ordinary shares. • The Company may not pay cash dividends in the foreseeable future.

Risk Factors Cont. RISKS FACTORS RELATED TO XAUT LENDING ARRANGEMENTS • Borrowers may default on their obligations, potentially resulting in financial losses or loss of lent digital assets. • Transferring possession of digital assets such as XAUt to borrowers exposes us to risks of misappropriation, theft, or loss beyond its direct control. • Evolving and uncertain legal and regulatory frameworks may adversely affect the enforceability of lending agreements and our rig hts to digital assets such as XAUt . • Operational errors or failures in the lending process could result in loss, misallocation, or delayed return of digital asset s. • Volatility in XAUt values and potential illiquidity may increase losses if XAUt are not promptly recovered after a default. • Borrower insolvency or bankruptcy may significantly impair our ability to recover lent digital assets or accrued yield. • Our ability to enforce title and recover assets may be uncertain, especially in cases of insolvency, fraud, or disputes. • Lending a large portion of assets to a few borrowers increases the risk of significant losses if a single borrower defaults. • Losses, delays, or disputes in XAUt lending could harm our reputation and business prospects. • We may face higher borrower defaults and reduced demand for lending during digital asset market downturns. • We may experience delays or losses if third - party custodians holding loaned assets become insolvent or involved in disputes.

Thank You.