Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

FIRST TRUST EXCHANGE-TRADED ALPHADEX FUND

|

|

| Entity Central Index Key |

0001383496

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jul. 31, 2025

|

|

| C000047995 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Large Cap CoreAlphaDEX® Fund

|

|

| Class Name |

First Trust Large Cap CoreAlphaDEX® Fund

|

|

| Trading Symbol |

FEX

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Large Cap Core AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FEX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FEX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Large Cap Core AlphaDEX® Fund |

$61 |

0.57% |

|

|

| Expenses Paid, Amount |

$ 61

|

|

| Expense Ratio, Percent |

0.57%

|

|

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 13.12% during the 12 months ended July 31, 2025. The Fund underperformed its benchmark, the S&P 500® Index, which returned 16.33% for the same Period.

During the Period, investments in the Financials sector received the greatest allocation of any sector with an average weight of 19.4%, and contributed 5.0% to the Fund’s overall return, which was the greatest contribution of any sector. With an average weight of 8.1%, investments in the Health Care sector contributed -1.0% to the Fund’s overall return, which was the most negative contribution of any sector.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Line Graph [Table Text Block] |

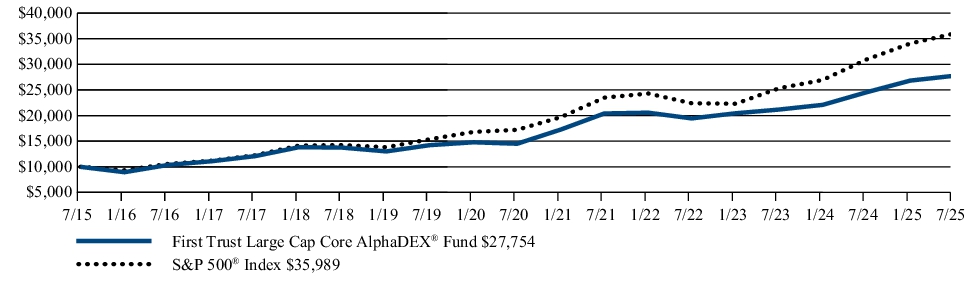

FUND PERFORMANCE (July 31, 2015 to July 31, 2025)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Large Cap Core AlphaDEX® Fund |

13.12% |

13.86% |

10.75% |

| Nasdaq AlphaDEX Large Cap CoreTMIndex(1) |

13.79% |

14.56% |

N/A |

| Nasdaq US 500 Large CapTMIndex(1) |

17.67% |

15.72% |

N/A |

| S&P 500® Index |

16.33% |

15.88% |

13.66% |

|

(1)

|

Performance data is not available for all the periods shown in the table for the index because performance data does not exist for some of the entire periods.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FEX for more recent performance information.

|

|

| Net Assets |

$ 1,320,055,548

|

|

| Holdings Count | Holding |

376

|

|

| Advisory Fees Paid, Amount |

$ 6,403,294

|

|

| Investment Company Portfolio Turnover |

83.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$1,320,055,548 |

| Total number of portfolio holdings |

376 |

| Total advisory fee paid |

$6,403,294 |

| Portfolio turnover rate |

83% |

|

|

| Holdings [Text Block] |

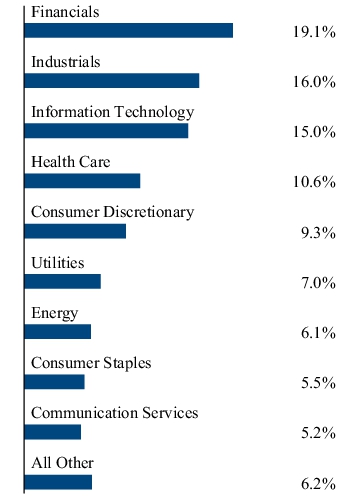

WHAT DID THE FUND INVEST IN? (As of July 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| Comfort Systems USA, Inc. |

0.6% |

| ROBLOX Corp., Class A |

0.6% |

| GE Vernova, Inc. |

0.5% |

| SoFi Technologies, Inc. |

0.5% |

| Western Digital Corp. |

0.5% |

| Super Micro Computer, Inc. |

0.5% |

| Interactive Brokers Group, Inc., Class A |

0.5% |

| EMCOR Group, Inc. |

0.5% |

| Palantir Technologies, Inc., Class A |

0.5% |

| Carvana Co. |

0.5% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Comfort Systems USA, Inc. |

0.6% |

| ROBLOX Corp., Class A |

0.6% |

| GE Vernova, Inc. |

0.5% |

| SoFi Technologies, Inc. |

0.5% |

| Western Digital Corp. |

0.5% |

| Super Micro Computer, Inc. |

0.5% |

| Interactive Brokers Group, Inc., Class A |

0.5% |

| EMCOR Group, Inc. |

0.5% |

| Palantir Technologies, Inc., Class A |

0.5% |

| Carvana Co. |

0.5% |

|

|

| C000047996 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Mid Cap Core AlphaDEX® Fund

|

|

| Class Name |

First Trust Mid Cap Core AlphaDEX® Fund

|

|

| Trading Symbol |

FNX

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Mid Cap Core AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FNX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FNX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Mid Cap Core AlphaDEX® Fund |

$59 |

0.58% |

|

|

| Expenses Paid, Amount |

$ 59

|

|

| Expense Ratio, Percent |

0.58%

|

|

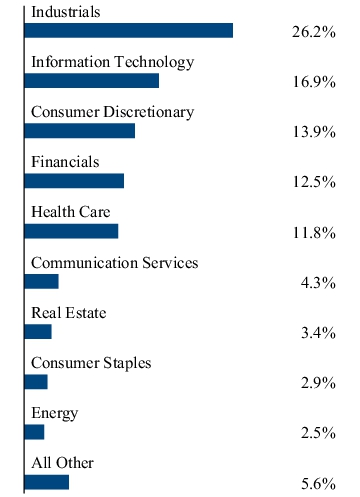

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 2.23% during the 12 months ended July 31, 2025. The Fund underperformed its benchmark, the S&P MidCap 400® Index, which returned 3.28% for the same Period.

During the Period, investments in the Financials sector received the greatest allocation of any sector, with an average weight of 19.4%, which contributed 2.6% to the Fund’s overall return, which was the greatest of any sector. With an average weight of 7.0%, investments in the Energy sector contributed -2.6% to the Fund’s overall return, which was the most negative return for any sector.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

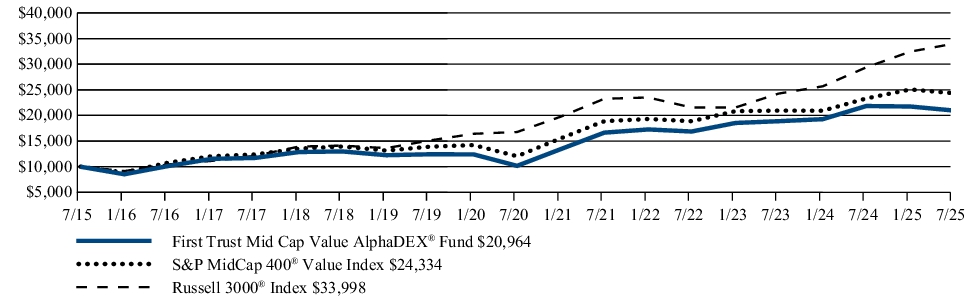

| Line Graph [Table Text Block] |

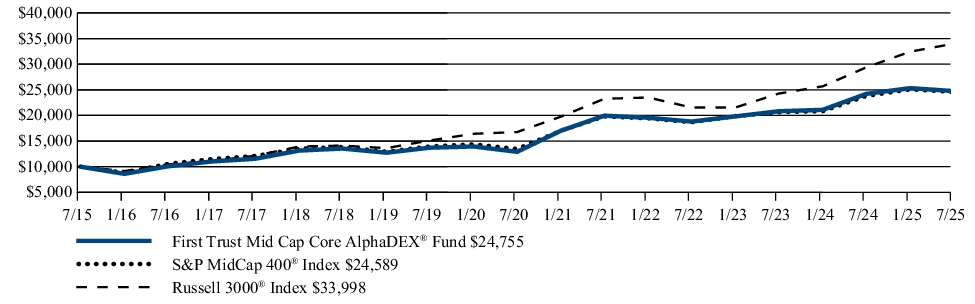

FUND PERFORMANCE (July 31, 2015 to July 31, 2025)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Mid Cap Core AlphaDEX® Fund |

2.23% |

13.91% |

9.49% |

| Nasdaq AlphaDEX Mid Cap CoreTMIndex(1) |

2.83% |

14.62% |

N/A |

| Nasdaq US 600 Mid CapTMIndex(1) |

4.95% |

11.11% |

N/A |

| S&P MidCap 400® Index |

3.28% |

12.79% |

9.41% |

| Russell 3000® Index |

15.68% |

15.19% |

13.02% |

|

(1)

|

Performance data is not available for all the periods shown in the table for the index because performance data does not exist for some of the entire periods.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FNX for more recent performance information.

|

|

| Net Assets |

$ 1,130,978,761

|

|

| Holdings Count | Holding |

455

|

|

| Advisory Fees Paid, Amount |

$ 5,958,217

|

|

| Investment Company Portfolio Turnover |

96.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$1,130,978,761 |

| Total number of portfolio holdings |

455 |

| Total advisory fee paid |

$5,958,217 |

| Portfolio turnover rate |

96% |

|

|

| Holdings [Text Block] |

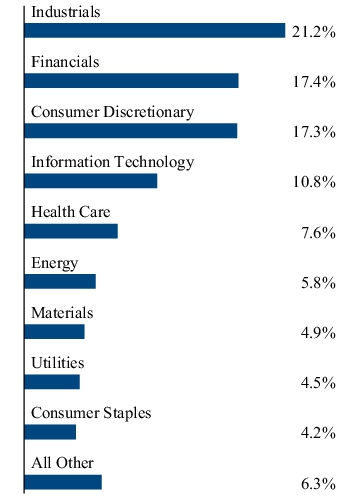

WHAT DID THE FUND INVEST IN? (As of July 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| Bloom Energy Corp., Class A |

0.6% |

| Invesco Ltd. |

0.5% |

| Hims & Hers Health, Inc. |

0.5% |

| Talen Energy Corp. |

0.5% |

| Rocket Lab Corp. |

0.5% |

| Upstart Holdings, Inc. |

0.5% |

| Primoris Services Corp. |

0.4% |

| Credo Technology Group Holding Ltd. |

0.4% |

| Gentex Corp. |

0.4% |

| IES Holdings, Inc. |

0.4% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Bloom Energy Corp., Class A |

0.6% |

| Invesco Ltd. |

0.5% |

| Hims & Hers Health, Inc. |

0.5% |

| Talen Energy Corp. |

0.5% |

| Rocket Lab Corp. |

0.5% |

| Upstart Holdings, Inc. |

0.5% |

| Primoris Services Corp. |

0.4% |

| Credo Technology Group Holding Ltd. |

0.4% |

| Gentex Corp. |

0.4% |

| IES Holdings, Inc. |

0.4% |

|

|

| C000047997 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Small Cap CoreAlphaDEX® Fund

|

|

| Class Name |

First Trust Small Cap CoreAlphaDEX® Fund

|

|

| Trading Symbol |

FYX

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Small Cap Core AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FYX. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FYX

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Small Cap Core AlphaDEX® Fund |

$58 |

0.58% |

|

|

| Expenses Paid, Amount |

$ 58

|

|

| Expense Ratio, Percent |

0.58%

|

|

| Factors Affecting Performance [Text Block] |

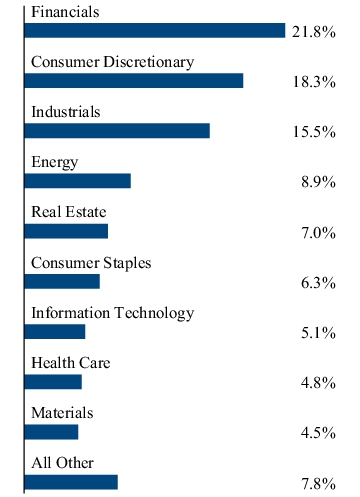

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE? The Fund returned -0.44% during the 12 months ended July 31, 2025. The Fund outperformed its benchmark, the S&P SmallCap 600® Index, which returned -4.72% for the same Period. During the Period, investments in the Financials sector received the greatest allocation of any sector, with an average weight of 22.3%, which contributed 2.0% to the Fund’s overall return. With an average weight of 17.5%, investments in the Industrials sector contributed 2.7% to the Fund’s overall return, which was the greatest of any sector. Investments in the Communication Services sector, with an average weight of 4.1%, contributed

-1.1% to the Fund’s overall return, which was the most negative contribution of any sector.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

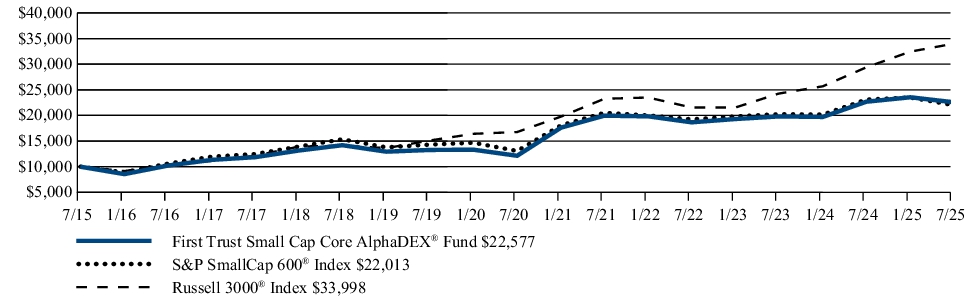

| Line Graph [Table Text Block] |

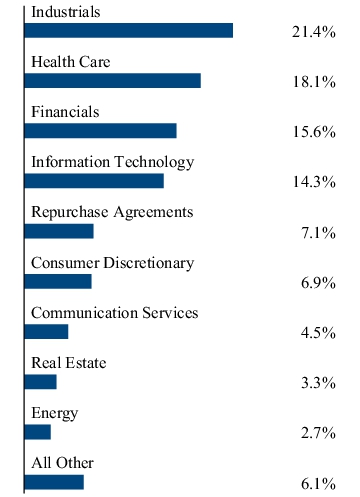

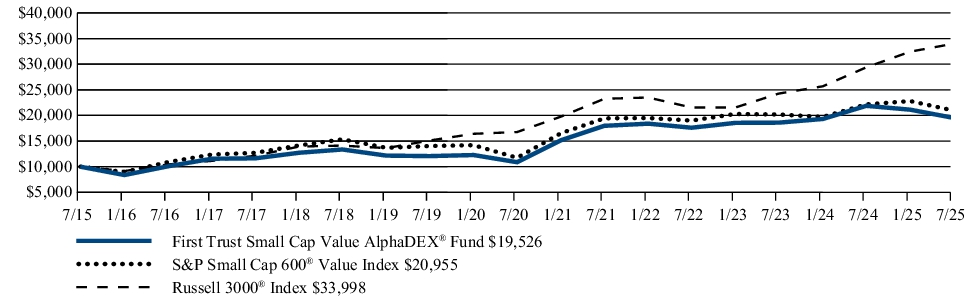

FUND PERFORMANCE (July 31, 2015 to July 31, 2025) The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods. Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Small Cap Core AlphaDEX® Fund |

-0.44% |

13.22% |

8.48% |

| Nasdaq AlphaDEX Small Cap CoreTMIndex(1) |

0.22% |

13.99% |

N/A |

| Nasdaq US 700 Small CapTMIndex(1) |

2.38% |

11.51% |

N/A |

| S&P SmallCap 600® Index |

-4.72% |

10.99% |

8.21% |

| Russell 3000® Index |

15.68% |

15.19% |

13.02% |

|

(1)

|

Performance data is not available for all the periods shown in the table for the index because performance data does not exist for some of the entire periods.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FYX for more recent performance information.

|

|

| Net Assets |

$ 817,642,920

|

|

| Holdings Count | Holding |

530

|

|

| Advisory Fees Paid, Amount |

$ 4,437,456

|

|

| Investment Company Portfolio Turnover |

102.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$817,642,920 |

| Total number of portfolio holdings |

530 |

| Total advisory fee paid |

$4,437,456 |

| Portfolio turnover rate |

102% |

|

|

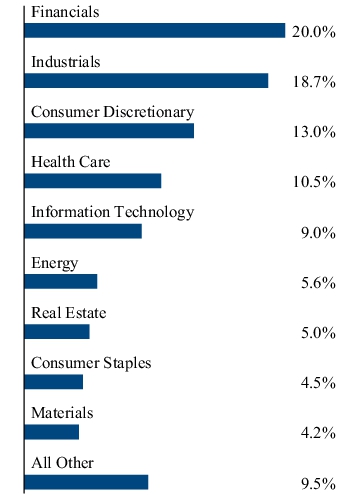

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of July 31, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| JPMorgan Chase & Co. |

1.5% |

| Bank of America Corp. |

1.1% |

| Mizuho Financial Group, Inc. |

1.0% |

| Symbotic, Inc. |

0.4% |

| DXP Enterprises, Inc. |

0.4% |

| Kohl’s Corp. |

0.4% |

| NuScale Power Corp. |

0.4% |

| Expro Group Holdings N.V. |

0.4% |

| Forestar Group, Inc. |

0.4% |

| Peabody Energy Corp. |

0.4% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| JPMorgan Chase & Co. |

1.5% |

| Bank of America Corp. |

1.1% |

| Mizuho Financial Group, Inc. |

1.0% |

| Symbotic, Inc. |

0.4% |

| DXP Enterprises, Inc. |

0.4% |

| Kohl’s Corp. |

0.4% |

| NuScale Power Corp. |

0.4% |

| Expro Group Holdings N.V. |

0.4% |

| Forestar Group, Inc. |

0.4% |

| Peabody Energy Corp. |

0.4% |

|

|

| C000047998 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Large Cap ValueAlphaDEX® Fund

|

|

| Class Name |

First Trust Large Cap ValueAlphaDEX® Fund

|

|

| Trading Symbol |

FTA

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Large Cap Value AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FTA. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FTA

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Large Cap Value AlphaDEX® Fund |

$59 |

0.58% |

|

|

| Expenses Paid, Amount |

$ 59

|

|

| Expense Ratio, Percent |

0.58%

|

|

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE? The Fund returned 3.88% during the 12 months ended July 31, 2025. The Fund underperformed its benchmark, the S&P 500® Value Index, which returned 5.59% for the same Period. During the Period, investments in the Financials sector received the greatest allocation of any sector, with an average weight of 20.5% and contributed 4.5% to the Fund’s overall return, which was the greatest of any sector. With an average weight of 8.2%, investments in the Health Care sector contributed -1.7% to the Funds overall return, which was the most negative return of any sector.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

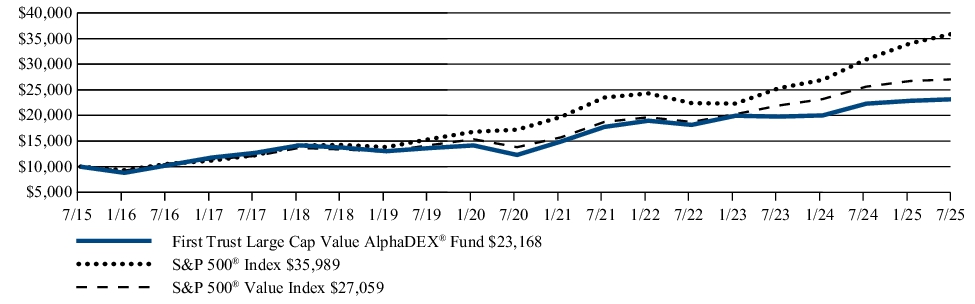

| Line Graph [Table Text Block] |

FUND PERFORMANCE (July 31, 2015 to July 31, 2025) The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods. Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Large Cap Value AlphaDEX® Fund |

3.88% |

13.51% |

8.76% |

| Nasdaq AlphaDEX Large Cap ValueTMIndex(1) |

4.47% |

14.22% |

N/A |

| Nasdaq US 500 Large Cap ValueTMIndex(1) |

2.60% |

13.43% |

N/A |

| S&P 500® Index |

16.33% |

15.88% |

13.66% |

| S&P 500® Value Index |

5.59% |

14.40% |

10.47% |

|

(1)

|

Performance data is not available for all the periods shown in the table for the index because performance data does not exist for some of the entire periods.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FTA for more recent performance information.

|

|

| Net Assets |

$ 1,098,298,289

|

|

| Holdings Count | Holding |

192

|

|

| Advisory Fees Paid, Amount |

$ 5,825,128

|

|

| Investment Company Portfolio Turnover |

75.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$1,098,298,289 |

| Total number of portfolio holdings |

192 |

| Total advisory fee paid |

$5,825,128 |

| Portfolio turnover rate |

75% |

|

|

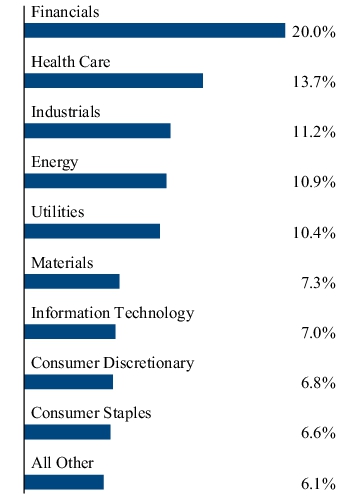

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of July 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| D.R. Horton, Inc. |

1.0% |

| Halliburton Co. |

1.0% |

| Builders FirstSource, Inc. |

1.0% |

| General Motors Co. |

1.0% |

| Diamondback Energy, Inc. |

1.0% |

| PulteGroup, Inc. |

1.0% |

| Newmont Corp. |

1.0% |

| Kraft Heinz (The) Co. |

1.0% |

| ConocoPhillips |

1.0% |

| Chevron Corp. |

1.0% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| D.R. Horton, Inc. |

1.0% |

| Halliburton Co. |

1.0% |

| Builders FirstSource, Inc. |

1.0% |

| General Motors Co. |

1.0% |

| Diamondback Energy, Inc. |

1.0% |

| PulteGroup, Inc. |

1.0% |

| Newmont Corp. |

1.0% |

| Kraft Heinz (The) Co. |

1.0% |

| ConocoPhillips |

1.0% |

| Chevron Corp. |

1.0% |

|

|

| C000047999 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Large Cap GrowthAlphaDEX® Fund

|

|

| Class Name |

First Trust Large Cap GrowthAlphaDEX® Fund

|

|

| Trading Symbol |

FTC

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Large Cap Growth AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FTC. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FTC

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Large Cap Growth AlphaDEX® Fund |

$66 |

0.58% |

|

|

| Expenses Paid, Amount |

$ 66

|

|

| Expense Ratio, Percent |

0.58%

|

|

| Factors Affecting Performance [Text Block] |

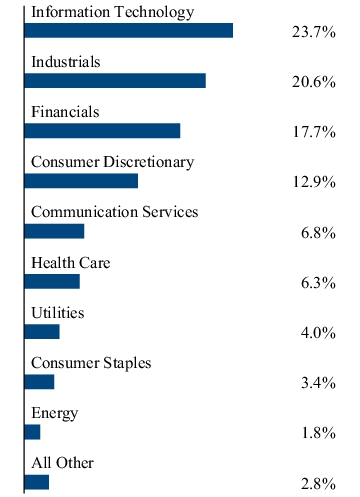

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 26.96% during the 12 months ended July 31, 2025. The Fund outperformed its benchmark, the S&P 500® Growth Index, which returned 25.63% for the same Period.

During the Period, investments in the Information Technology sector received the greatest allocation of any sector, with an average weight of 19.5%, and contributed 6.1% to the Fund’s overall return. With an average weight of 18.9%, investments in the Financials sector contributed 6.4% to the Funds overall return, which was the greatest of any sector. Investments in the Real Estate sector, with an average weight of 3.6%, contributed

-0.1% to the Fund’s overall return, which was the most negative contribution of any sector.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

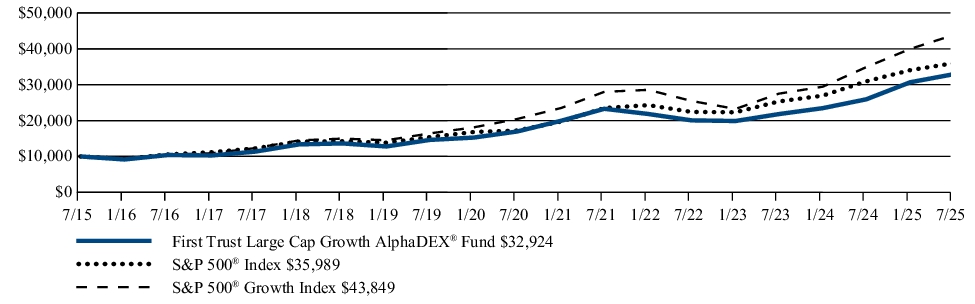

| Line Graph [Table Text Block] |

FUND PERFORMANCE (July 31, 2015 to July 31, 2025)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Large Cap Growth AlphaDEX® Fund |

26.96% |

14.19% |

12.66% |

| Nasdaq AlphaDEX Large Cap GrowthTMIndex(1) |

27.73% |

14.87% |

N/A |

| Nasdaq US 500 Large Cap GrowthTMIndex(1) |

24.68% |

16.42% |

N/A |

| S&P 500® Index |

16.33% |

15.88% |

13.66% |

| S&P 500® Growth Index |

25.63% |

16.50% |

15.93% |

|

(1)

|

Performance data is not available for all the periods shown in the table for the index because performance data does not exist for some of the entire periods.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FTC for more recent performance information.

|

|

| Net Assets |

$ 1,224,662,575

|

|

| Holdings Count | Holding |

188

|

|

| Advisory Fees Paid, Amount |

$ 5,575,337

|

|

| Investment Company Portfolio Turnover |

114.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$1,224,662,575 |

| Total number of portfolio holdings |

188 |

| Total advisory fee paid |

$5,575,337 |

| Portfolio turnover rate |

114% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of July 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| Comfort Systems USA, Inc. |

1.1% |

| ROBLOX Corp., Class A |

1.1% |

| GE Vernova, Inc. |

1.1% |

| SoFi Technologies, Inc. |

1.1% |

| Super Micro Computer, Inc. |

1.0% |

| Interactive Brokers Group, Inc., Class A |

1.0% |

| EMCOR Group, Inc. |

1.0% |

| Palantir Technologies, Inc., Class A |

1.0% |

| Carvana Co. |

1.0% |

| Vertiv Holdings Co., Class A |

1.0% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Comfort Systems USA, Inc. |

1.1% |

| ROBLOX Corp., Class A |

1.1% |

| GE Vernova, Inc. |

1.1% |

| SoFi Technologies, Inc. |

1.1% |

| Super Micro Computer, Inc. |

1.0% |

| Interactive Brokers Group, Inc., Class A |

1.0% |

| EMCOR Group, Inc. |

1.0% |

| Palantir Technologies, Inc., Class A |

1.0% |

| Carvana Co. |

1.0% |

| Vertiv Holdings Co., Class A |

1.0% |

|

|

| C000048000 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Multi Cap ValueAlphaDEX® Fund

|

|

| Class Name |

First Trust Multi Cap ValueAlphaDEX® Fund

|

|

| Trading Symbol |

FAB

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Multi Cap Value AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FAB. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FAB

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Multi Cap Value AlphaDEX® Fund |

$65 |

0.65% |

|

|

| Expenses Paid, Amount |

$ 65

|

|

| Expense Ratio, Percent |

0.65%

|

|

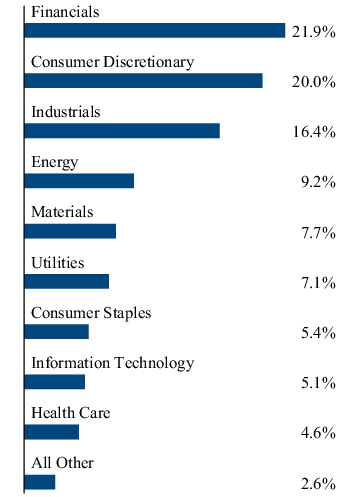

| Factors Affecting Performance [Text Block] |

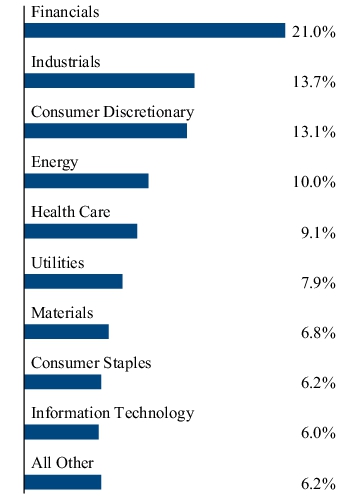

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned -1.53% during the 12 months ended July 31, 2025. The Fund underperformed its benchmark, the S&P Composite 1500® Value Index, which returned 5.25% for the same Period.

During the Period, the average allocation to the Financials sector was 21.7%, the greatest of any sector, and also had the greatest contribution to the Fund’s overall return, accounting for 3.0% of Fund performance. The negative return in the Fund came from multiple sector allocations, but most notably from the average allocation to the Energy sector. Investments in this sector received an average allocation of 11.2% and had a -2.0% contribution to the Fund’s overall return.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

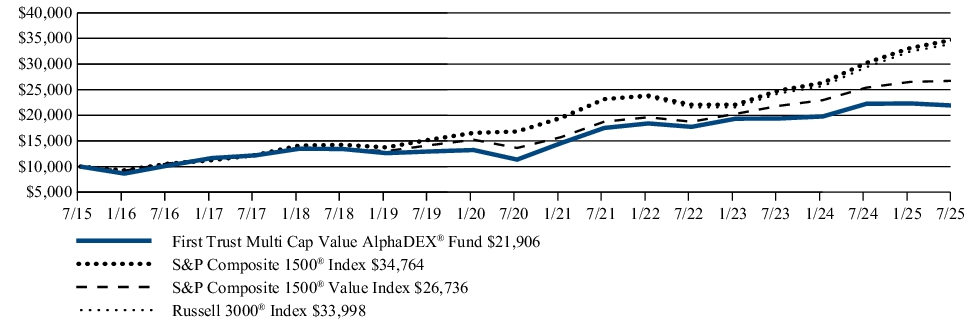

| Line Graph [Table Text Block] |

FUND PERFORMANCE (July 31, 2015 to July 31, 2025)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Multi Cap Value AlphaDEX® Fund |

-1.53% |

14.02% |

8.16% |

| Nasdaq AlphaDEX Multi Cap ValueTMIndex(1) |

-0.87% |

14.81% |

N/A |

| Nasdaq US Multi Cap ValueTMIndex(1) |

1.97% |

13.54% |

N/A |

| S&P Composite 1500® Index |

15.03% |

15.60% |

13.27% |

| S&P Composite 1500® Value Index |

5.25% |

14.43% |

10.33% |

| Russell 3000® Index |

15.68% |

15.19% |

13.02% |

|

(1)

|

Performance data is not available for all the periods shown in the table for the index because performance data does not exist for some of the entire periods.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FAB for more recent performance information.

|

|

| Net Assets |

$ 119,335,671

|

|

| Holdings Count | Holding |

679

|

|

| Advisory Fees Paid, Amount |

$ 646,063

|

|

| Investment Company Portfolio Turnover |

86.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$119,335,671 |

| Total number of portfolio holdings |

679 |

| Total advisory fee paid |

$646,063 |

| Portfolio turnover rate |

86% |

|

|

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of July 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| D.R. Horton, Inc. |

0.5% |

| Halliburton Co. |

0.5% |

| Builders FirstSource, Inc. |

0.5% |

| General Motors Co. |

0.5% |

| Diamondback Energy, Inc. |

0.5% |

| PulteGroup, Inc. |

0.5% |

| Newmont Corp. |

0.5% |

| Kraft Heinz (The) Co. |

0.5% |

| ConocoPhillips |

0.5% |

| Chevron Corp. |

0.5% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| D.R. Horton, Inc. |

0.5% |

| Halliburton Co. |

0.5% |

| Builders FirstSource, Inc. |

0.5% |

| General Motors Co. |

0.5% |

| Diamondback Energy, Inc. |

0.5% |

| PulteGroup, Inc. |

0.5% |

| Newmont Corp. |

0.5% |

| Kraft Heinz (The) Co. |

0.5% |

| ConocoPhillips |

0.5% |

| Chevron Corp. |

0.5% |

|

|

| C000048001 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Multi Cap GrowthAlphaDEX® Fund

|

|

| Class Name |

First Trust Multi Cap GrowthAlphaDEX® Fund

|

|

| Trading Symbol |

FAD

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Multi Cap Growth AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FAD. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FAD

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR?

(Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Multi Cap Growth AlphaDEX® Fund |

$68 |

0.62% |

|

|

| Expenses Paid, Amount |

$ 68

|

|

| Expense Ratio, Percent |

0.62%

|

|

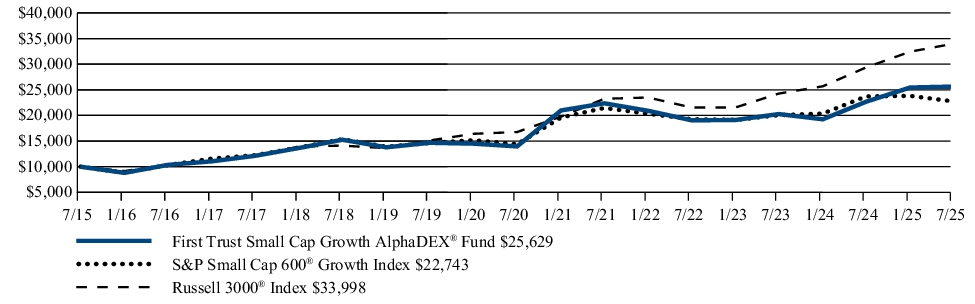

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE?

The Fund returned 19.06% during the 12 months ended July 31, 2025. The Fund underperformed its benchmark, the S&P Composite 1500® Growth Index, which returned 23.48% for the same Period.

During the Period, the Fund’s greatest allocations were to the Industrials sector and the Financials sector. These two sectors were also the greatest drivers of overall Fund performance. The Industrials sector received an average allocation of 19.7% and contributed 5.4% to the Fund’s overall return while the 17.7% average allocation to the Financials sector contributed 5.0% to the Fund’s return. No sector had a meaningfully negative impact on the Fund’s return, although the Materials sector, with an average allocation of 2.3%, caused a -0.1% drag on the Fund’s performance due in particular to holdings Aspen Aerogels, Inc. and The Scotts Miracle-Gro Co., which were each down significantly during the Period.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Line Graph [Table Text Block] |

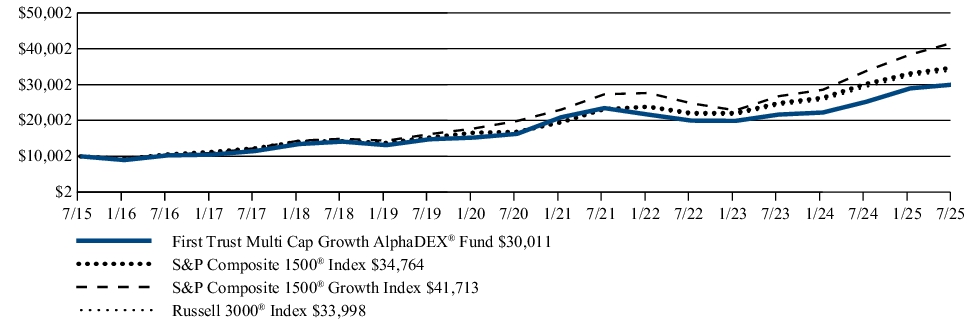

FUND PERFORMANCE (July 31, 2015 to July 31, 2025)

The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods.

Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Multi Cap Growth AlphaDEX® Fund |

19.06% |

13.03% |

11.62% |

| Nasdaq AlphaDEX Multi Cap GrowthTMIndex(1) |

19.85% |

13.78% |

N/A |

| Nasdaq US Multi Cap GrowthTMIndex(1) |

23.70% |

15.74% |

N/A |

| S&P Composite 1500® Index |

15.03% |

15.60% |

13.27% |

| S&P Composite 1500® Growth Index |

23.48% |

16.02% |

15.35% |

| Russell 3000® Index |

15.68% |

15.19% |

13.02% |

|

(1)

|

Performance data is not available for all the periods shown in the table for the index because performance data does not exist for some of the entire periods.

|

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FAD for more recent performance information.

|

|

| Net Assets |

$ 300,577,982

|

|

| Holdings Count | Holding |

681

|

|

| Advisory Fees Paid, Amount |

$ 1,176,511

|

|

| Investment Company Portfolio Turnover |

110.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$300,577,982 |

| Total number of portfolio holdings |

681 |

| Total advisory fee paid |

$1,176,511 |

| Portfolio turnover rate |

110% |

|

|

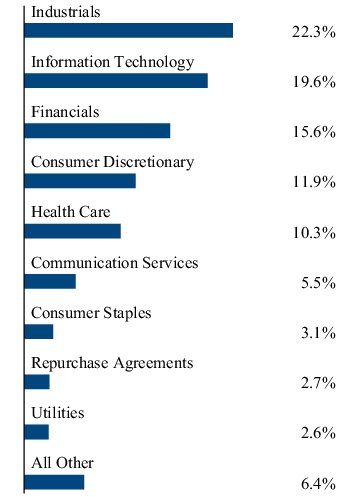

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of July 31, 2025)

The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund.

Top Ten Holdings

| JPMorgan Chase & Co. |

1.1% |

| Bank of America Corp. |

0.8% |

| Mizuho Financial Group, Inc. |

0.7% |

| Comfort Systems USA, Inc. |

0.6% |

| ROBLOX Corp., Class A |

0.6% |

| GE Vernova, Inc. |

0.5% |

| SoFi Technologies, Inc. |

0.5% |

| Super Micro Computer, Inc. |

0.5% |

| Interactive Brokers Group, Inc., Class A |

0.5% |

| EMCOR Group, Inc. |

0.5% |

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| JPMorgan Chase & Co. |

1.1% |

| Bank of America Corp. |

0.8% |

| Mizuho Financial Group, Inc. |

0.7% |

| Comfort Systems USA, Inc. |

0.6% |

| ROBLOX Corp., Class A |

0.6% |

| GE Vernova, Inc. |

0.5% |

| SoFi Technologies, Inc. |

0.5% |

| Super Micro Computer, Inc. |

0.5% |

| Interactive Brokers Group, Inc., Class A |

0.5% |

| EMCOR Group, Inc. |

0.5% |

|

|

| C000048896 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Consumer Discretionary AlphaDEX® Fund

|

|

| Class Name |

First Trust Consumer Discretionary AlphaDEX® Fund

|

|

| Trading Symbol |

FXD

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Consumer Discretionary AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FXD. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FXD

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Consumer Discretionary AlphaDEX® Fund |

$62 |

0.60% |

|

|

| Expenses Paid, Amount |

$ 62

|

|

| Expense Ratio, Percent |

0.60%

|

|

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE? The Fund returned 7.69% during the 12 months ended July 31, 2025. The Fund underperformed its benchmark, the S&P 500® Consumer Discretionary Index, which returned 19.54% for the same Period. During the Period, investments in the Hotels, Restaurants & Leisure industry received the greatest allocation of any industry with an average weight of 17.8% and a contribution of 3.3% to the Fund’s overall return. With an average weight of 8.1%, investments in the Entertainment industry contributed 4.6% to the Fund’s overall return, which was the greatest return contribution of any industry. With an average weight of 8.0%, investments in the Textiles, Apparel & Luxury Goods industry contributed -0.9% to the Fund’s overall return, which was the most negative return contribution of any industry.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

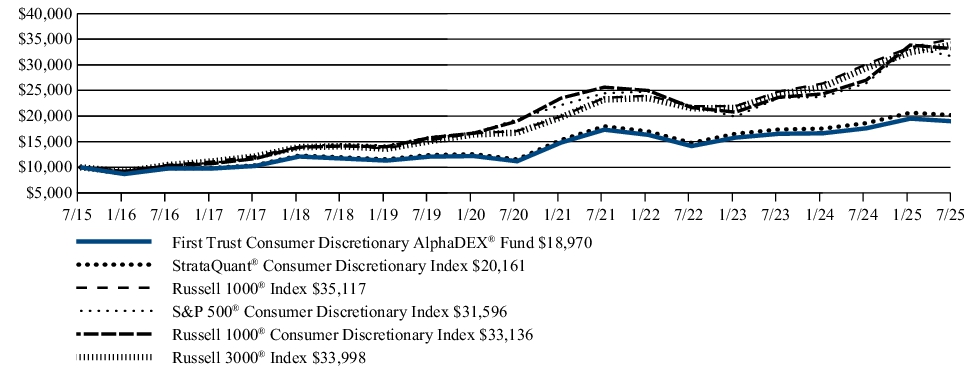

| Line Graph [Table Text Block] |

FUND PERFORMANCE (July 31, 2015 to July 31, 2025) The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods. Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Consumer Discretionary AlphaDEX® Fund |

7.69% |

11.13% |

6.61% |

| StrataQuant® Consumer Discretionary Index |

8.26% |

11.80% |

7.26% |

| Russell 1000® Index |

16.54% |

15.49% |

13.38% |

| S&P 500® Consumer Discretionary Index |

19.54% |

10.32% |

12.19% |

| Russell 1000® Consumer Discretionary Index |

22.68% |

11.78% |

12.73% |

| Russell 3000® Index |

15.68% |

15.19% |

13.02% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FXD for more recent performance information.

|

|

| Net Assets |

$ 319,912,691

|

|

| Holdings Count | Holding |

123

|

|

| Advisory Fees Paid, Amount |

$ 5,636,999

|

|

| Investment Company Portfolio Turnover |

68.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$319,912,691 |

| Total number of portfolio holdings |

123 |

| Total advisory fee paid |

$5,636,999 |

| Portfolio turnover rate |

68% |

|

|

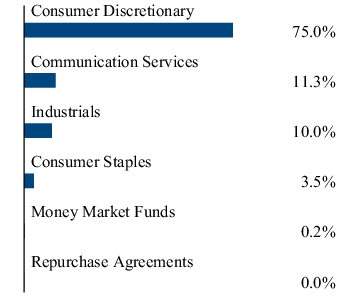

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of July 31, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| ROBLOX Corp., Class A |

1.9% |

| Gentex Corp. |

1.7% |

| Carvana Co. |

1.6% |

| Dillard’s, Inc., Class A |

1.6% |

| D.R. Horton, Inc. |

1.6% |

| Viking Holdings Ltd. |

1.6% |

| General Motors Co. |

1.5% |

| Macy’s, Inc. |

1.5% |

| PulteGroup, Inc. |

1.5% |

| PVH Corp. |

1.5% | Sector Allocation Any amount shown as 0.0% represents less than 0.1%.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| ROBLOX Corp., Class A |

1.9% |

| Gentex Corp. |

1.7% |

| Carvana Co. |

1.6% |

| Dillard’s, Inc., Class A |

1.6% |

| D.R. Horton, Inc. |

1.6% |

| Viking Holdings Ltd. |

1.6% |

| General Motors Co. |

1.5% |

| Macy’s, Inc. |

1.5% |

| PulteGroup, Inc. |

1.5% |

| PVH Corp. |

1.5% |

|

|

| C000048897 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Consumer Staples AlphaDEX® Fund

|

|

| Class Name |

First Trust Consumer Staples AlphaDEX® Fund

|

|

| Trading Symbol |

FXG

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Consumer Staples AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FXG. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FXG

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Consumer Staples AlphaDEX® Fund |

$62 |

0.63% |

|

|

| Expenses Paid, Amount |

$ 62

|

|

| Expense Ratio, Percent |

0.63%

|

|

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE? The Fund returned -2.69% during the 12 months ended July 31, 2025. The Fund underperformed its benchmark, the S&P 500® Consumer Staples Index, which returned 7.43% for the same Period. During the Period, investments in the Food Products industry received the greatest allocation of any industry with an average weight of 48.4% and contributed -4.0% to the Fund’s overall return, which was the most negative contribution of any industry. With an average weight of 16.9%, investments in the Consumer Staples Distribution & Retail industry contributed 2.9% to the Fund’s overall return, which was the greatest return contribution of any industry.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

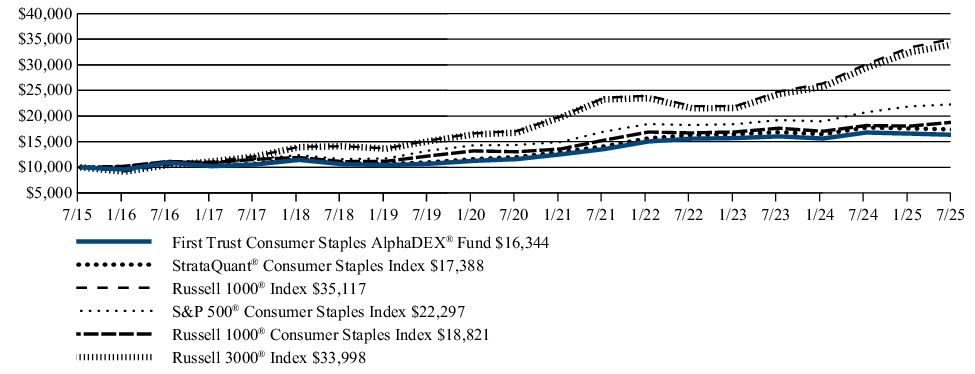

| Line Graph [Table Text Block] |

FUND PERFORMANCE (July 31, 2015 to July 31, 2025) The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods. Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Consumer Staples AlphaDEX® Fund |

-2.69% |

7.08% |

5.04% |

| StrataQuant® Consumer Staples Index |

-2.08% |

7.69% |

5.69% |

| Russell 1000® Index |

16.54% |

15.49% |

13.38% |

| S&P 500® Consumer Staples Index |

7.43% |

9.19% |

8.35% |

| Russell 1000® Consumer Staples Index |

3.68% |

7.62% |

6.53% |

| Russell 3000® Index |

15.68% |

15.19% |

13.02% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FXG for more recent performance information.

|

|

| Net Assets |

$ 284,384,336

|

|

| Holdings Count | Holding |

45

|

|

| Advisory Fees Paid, Amount |

$ 1,717,342

|

|

| Investment Company Portfolio Turnover |

81.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$284,384,336 |

| Total number of portfolio holdings |

45 |

| Total advisory fee paid |

$1,717,342 |

| Portfolio turnover rate |

81% |

|

|

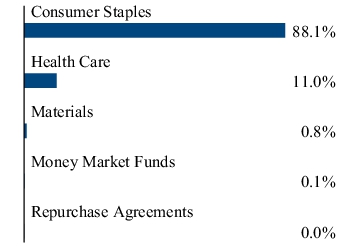

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of July 31, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Kraft Heinz (The) Co. |

4.5% |

| Pilgrim’s Pride Corp. |

4.4% |

| Casey’s General Stores, Inc. |

4.3% |

| Molson Coors Beverage Co., Class B |

4.2% |

| Bunge Global S.A. |

4.2% |

| Cencora, Inc. |

4.0% |

| McKesson Corp. |

4.0% |

| Sprouts Farmers Market, Inc. |

3.9% |

| Performance Food Group Co. |

3.8% |

| Reynolds Consumer Products, Inc. |

3.5% | Sector Allocation Any amount shown as 0.0% represents less than 0.1%.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Kraft Heinz (The) Co. |

4.5% |

| Pilgrim’s Pride Corp. |

4.4% |

| Casey’s General Stores, Inc. |

4.3% |

| Molson Coors Beverage Co., Class B |

4.2% |

| Bunge Global S.A. |

4.2% |

| Cencora, Inc. |

4.0% |

| McKesson Corp. |

4.0% |

| Sprouts Farmers Market, Inc. |

3.9% |

| Performance Food Group Co. |

3.8% |

| Reynolds Consumer Products, Inc. |

3.5% |

|

|

| C000048898 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Energy AlphaDEX® Fund

|

|

| Class Name |

First Trust Energy AlphaDEX® Fund

|

|

| Trading Symbol |

FXN

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Energy AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FXN. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FXN

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Energy AlphaDEX® Fund |

$59 |

0.63% |

|

|

| Expenses Paid, Amount |

$ 59

|

|

| Expense Ratio, Percent |

0.63%

|

|

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE? The Fund returned -11.32% during the 12 months ended July 31, 2025. The Fund underperformed its benchmark, the S&P 500® Energy Index, which returned -3.19% for the same Period. During the Period, investments in the Oil, Gas & Consumable Fuels industry received the greatest allocation of any industry with an average weight of 83.8% and contributed -7.3% to the Fund’s overall return, which was the most negative return contribution of any industry. With an average weight of 2.8%, investments in the Semiconductors & Semiconductor Equipment industry contributed 0.2% to the Fund’s overall return, which was the greatest return contribution of any industry.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

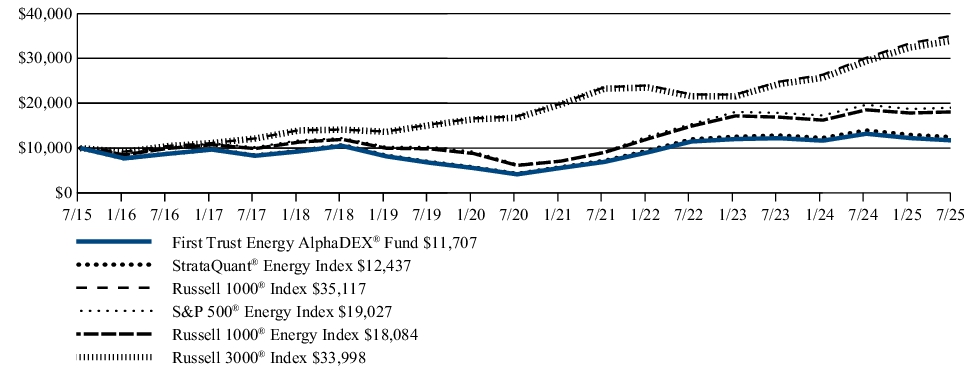

| Line Graph [Table Text Block] |

FUND PERFORMANCE (July 31, 2015 to July 31, 2025) The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods. Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Energy AlphaDEX® Fund |

-11.32% |

23.01% |

1.59% |

| StrataQuant® Energy Index |

-10.79% |

23.91% |

2.21% |

| Russell 1000® Index |

16.54% |

15.49% |

13.38% |

| S&P 500® Energy Index |

-3.19% |

24.55% |

6.64% |

| Russell 1000® Energy Index |

-2.40% |

24.10% |

6.10% |

| Russell 3000® Index |

15.68% |

15.19% |

13.02% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FXN for more recent performance information.

|

|

| Net Assets |

$ 271,958,045

|

|

| Holdings Count | Holding |

44

|

|

| Advisory Fees Paid, Amount |

$ 1,849,310

|

|

| Investment Company Portfolio Turnover |

50.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$271,958,045 |

| Total number of portfolio holdings |

44 |

| Total advisory fee paid |

$1,849,310 |

| Portfolio turnover rate |

50% |

|

|

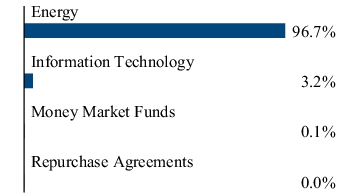

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of July 31, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Chord Energy Corp. |

5.2% |

| Civitas Resources, Inc. |

5.1% |

| Diamondback Energy, Inc. |

5.0% |

| Matador Resources Co. |

4.8% |

| Devon Energy Corp. |

4.8% |

| Permian Resources Corp. |

4.8% |

| NOV, Inc. |

4.6% |

| Weatherford International PLC |

3.6% |

| Halliburton Co. |

3.5% |

| ConocoPhillips |

3.4% | Sector Allocation Any amount shown as 0.0% represents less than 0.1%.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Chord Energy Corp. |

5.2% |

| Civitas Resources, Inc. |

5.1% |

| Diamondback Energy, Inc. |

5.0% |

| Matador Resources Co. |

4.8% |

| Devon Energy Corp. |

4.8% |

| Permian Resources Corp. |

4.8% |

| NOV, Inc. |

4.6% |

| Weatherford International PLC |

3.6% |

| Halliburton Co. |

3.5% |

| ConocoPhillips |

3.4% |

|

|

| C000048899 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Financials AlphaDEX® Fund

|

|

| Class Name |

First Trust Financials AlphaDEX® Fund

|

|

| Trading Symbol |

FXO

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Financials AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FXO. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FXO

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Financials AlphaDEX® Fund |

$65 |

0.60% |

|

|

| Expenses Paid, Amount |

$ 65

|

|

| Expense Ratio, Percent |

0.60%

|

|

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE? The Fund returned 15.31% during the 12 months ended July 31, 2025. The Fund underperformed its benchmark, the S&P 500® Financials Index, which returned 21.54% for the same Period. During the Period, investments in the Insurance industry received the greatest allocation of any industry with an average weight of 32.9% and contributed 3.1% to the Fund’s overall return. With an average weight of 28.5%, investments in the Capital Markets industry contributed 6.5% to the Fund’s overall return, which was the greatest return contribution of any industry. No industry had a negative contribution to overall Fund return.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

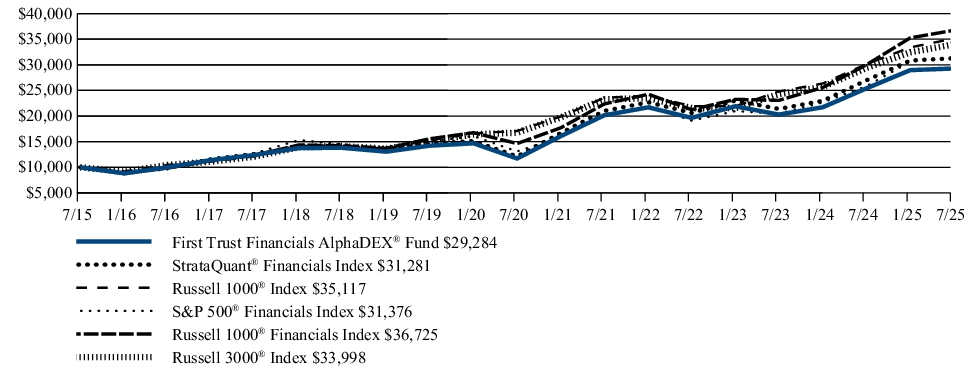

| Line Graph [Table Text Block] |

FUND PERFORMANCE (July 31, 2015 to July 31, 2025) The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods. Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Financials AlphaDEX® Fund |

15.31% |

20.09% |

11.34% |

| StrataQuant® Financials Index |

16.02% |

20.86% |

12.08% |

| Russell 1000® Index |

16.54% |

15.49% |

13.38% |

| S&P 500® Financials Index |

21.54% |

19.09% |

12.11% |

| Russell 1000® Financials Index |

22.47% |

20.20% |

13.89% |

| Russell 3000® Index |

15.68% |

15.19% |

13.02% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FXO for more recent performance information.

|

|

| Net Assets |

$ 2,184,967,852

|

|

| Holdings Count | Holding |

110

|

|

| Advisory Fees Paid, Amount |

$ 8,359,923

|

|

| Investment Company Portfolio Turnover |

90.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$2,184,967,852 |

| Total number of portfolio holdings |

110 |

| Total advisory fee paid |

$8,359,923 |

| Portfolio turnover rate |

90% |

|

|

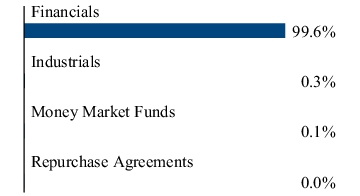

| Holdings [Text Block] |

WHAT DID THE FUND INVEST IN? (As of July 31, 2025) The tables below show the investment makeup of the Fund, representing the percentage of total investments of the Fund. Top Ten Holdings

| Invesco Ltd. |

2.1% |

| SoFi Technologies, Inc. |

1.9% |

| Interactive Brokers Group, Inc., Class A |

1.8% |

| Bank of New York Mellon (The) Corp. |

1.7% |

| Lincoln National Corp. |

1.7% |

| Citigroup, Inc. |

1.7% |

| Robinhood Markets, Inc., Class A |

1.7% |

| Coinbase Global, Inc., Class A |

1.7% |

| LPL Financial Holdings, Inc. |

1.6% |

| T. Rowe Price Group, Inc. |

1.6% | Sector Allocation Any amount shown as 0.0% represents less than 0.1%.

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Invesco Ltd. |

2.1% |

| SoFi Technologies, Inc. |

1.9% |

| Interactive Brokers Group, Inc., Class A |

1.8% |

| Bank of New York Mellon (The) Corp. |

1.7% |

| Lincoln National Corp. |

1.7% |

| Citigroup, Inc. |

1.7% |

| Robinhood Markets, Inc., Class A |

1.7% |

| Coinbase Global, Inc., Class A |

1.7% |

| LPL Financial Holdings, Inc. |

1.6% |

| T. Rowe Price Group, Inc. |

1.6% |

|

|

| C000048900 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

First Trust Health Care AlphaDEX® Fund

|

|

| Class Name |

First Trust Health Care AlphaDEX® Fund

|

|

| Trading Symbol |

FXH

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the First Trust Health Care AlphaDEX® Fund (the “Fund”) for the year of August 1, 2024 to July 31, 2025 (the “Period”).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.ftportfolios.com/fund-documents/etf/FXH. You can also request this information by contacting us at 1-800-621-1675 or info@ftportfolios.com.

|

|

| Additional Information Phone Number |

1-800-621-1675

|

|

| Additional Information Email |

info@ftportfolios.com

|

|

| Additional Information Website |

www.ftportfolios.com/fund-documents/etf/FXH

|

|

| Expenses [Text Block] |

WHAT WERE THE FUND COSTS FOR THE LAST YEAR? (Based on a hypothetical $10,000 investment)

| Fund |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| First Trust Health Care AlphaDEX® Fund |

$58 |

0.61% |

|

|

| Expenses Paid, Amount |

$ 58

|

|

| Expense Ratio, Percent |

0.61%

|

|

| Factors Affecting Performance [Text Block] |

HOW DID THE FUND PERFORM LAST YEAR? WHAT AFFECTED THE FUND’S PERFORMANCE? The Fund returned -9.12% during the 12 months ended July 31, 2025. The Fund outperformed its benchmark, the S&P 500® Health Care Index, which returned -11.32% for the same Period. During the Period, investments in the Health Care Providers & Services industry received the greatest allocation of any industry with an average weight of 29.9% and contributed -5.0% to the Fund’s overall return, which was the most negative return of any industry. With an average weight of 3.2%, investments in the Health Care Technology industry contributed 1.7% to the Fund’s overall return, which was the greatest return contribution of any industry.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

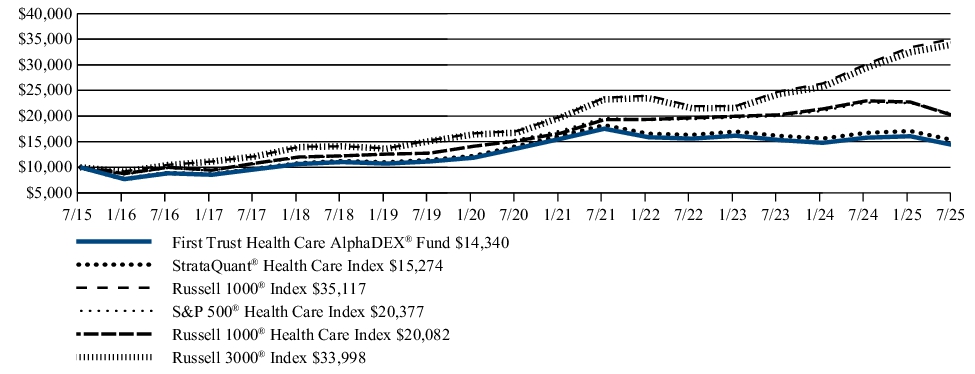

| Line Graph [Table Text Block] |

FUND PERFORMANCE (July 31, 2015 to July 31, 2025) The performance line graph below shows the performance of a hypothetical $10,000 initial investment in the Fund over a ten-year period (or for the life of the Fund, if shorter). The subsequent account value as of the end of the Period is listed next to the name of the Fund or index, as applicable. The performance table below shows the average annual total returns of the Fund for the past one-, five-, and ten-year periods, as applicable (or for the life of the Fund, if shorter), as of the end of the Period. Both the line graph and performance table compare the Fund’s performance to an appropriate broad-based index and may compare to additional indices reflecting the market segment(s) in which the Fund invests over the same periods. Investment Performance of $10,000

|

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (as of July 31, 2025) |

1 Year |

5 Year |

10 Year |

| First Trust Health Care AlphaDEX® Fund |

-9.12% |

0.94% |

3.67% |

| StrataQuant® Health Care Index |

-8.68% |

1.55% |

4.33% |

| Russell 1000® Index |

16.54% |

15.49% |

13.38% |

| S&P 500® Health Care Index |

-11.32% |

6.09% |

7.38% |

| Russell 1000® Health Care Index |

-11.23% |

5.40% |

7.22% |

| Russell 3000® Index |

15.68% |

15.19% |

13.02% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit www.ftportfolios.com/etf/FXH for more recent performance information.

|

|

| Net Assets |

$ 845,450,303

|

|

| Holdings Count | Holding |

81

|

|

| Advisory Fees Paid, Amount |

$ 5,316,835

|

|

| Investment Company Portfolio Turnover |

85.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS (As of July 31, 2025)

| Fund net assets |

$845,450,303 |

| Total number of portfolio holdings |

81 |

| Total advisory fee paid |

$5,316,835 |

| Portfolio turnover rate |

85% |

|

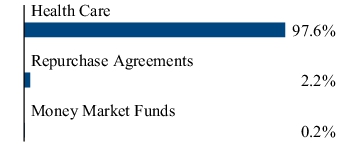

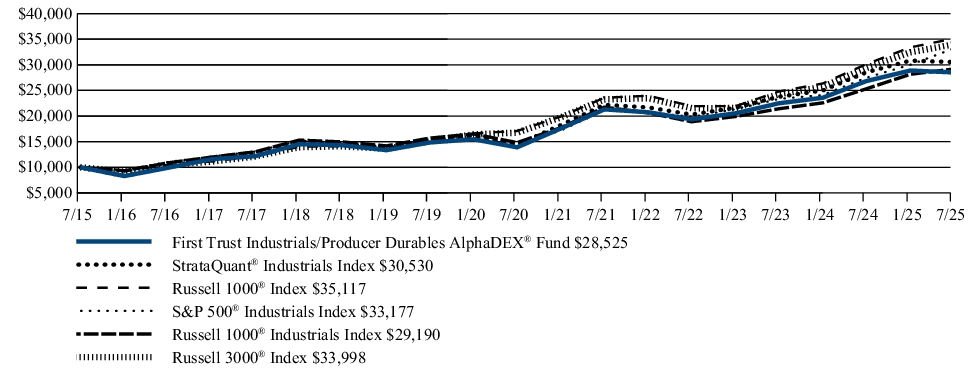

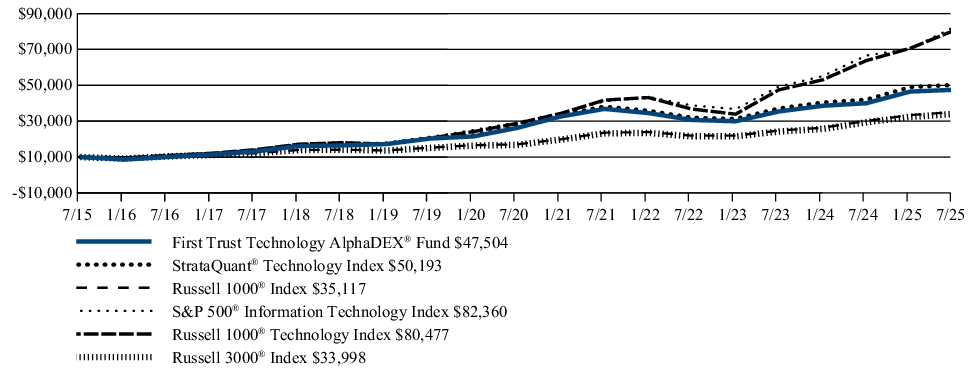

|