Shareholder Report

|

6 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

SUNAMERICA SERIES TRUST

|

|

| Entity Central Index Key |

0000892538

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jul. 31, 2025

|

|

| C000022023 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA JPMorgan Emerging Markets

|

|

| Class Name |

Class 3

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA JPMorgan Emerging Markets Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA JPMorgan Emerging Markets Portfolio (Class 3)* |

$78 |

1.45%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 78

|

[1] |

| Expense Ratio, Percent |

1.45%

|

[1],[2] |

| Net Assets |

$ 198,000,000

|

|

| Holdings Count | Holding |

150

|

|

| Advisory Fees Paid, Amount |

$ 900,000

|

|

| Investment Company Portfolio Turnover |

41.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$198M |

| Total number of portfolio holdings |

150 |

| Total net advisory fee paid |

$0.9M |

| Portfolio turnover rate during the reporting period |

41% |

|

|

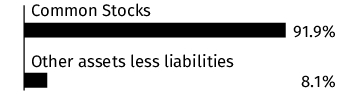

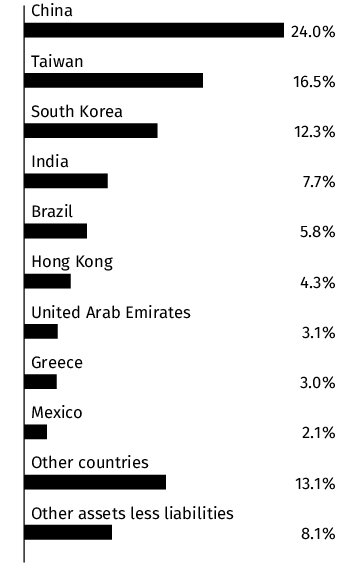

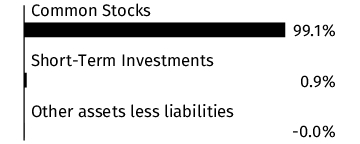

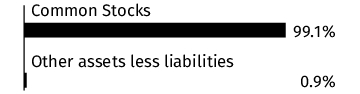

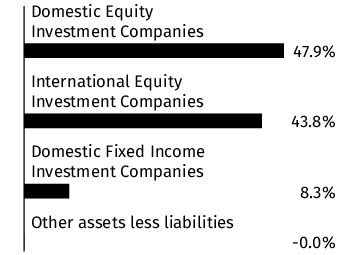

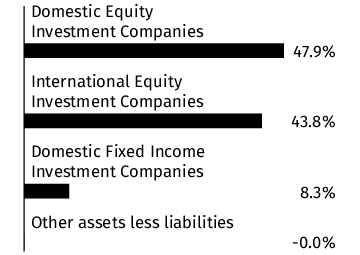

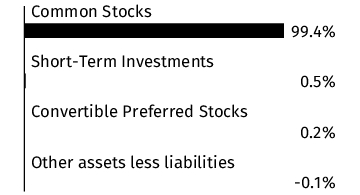

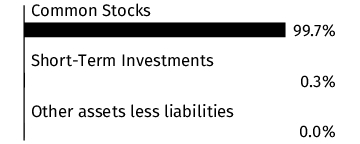

| Holdings [Text Block] |

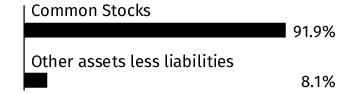

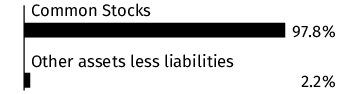

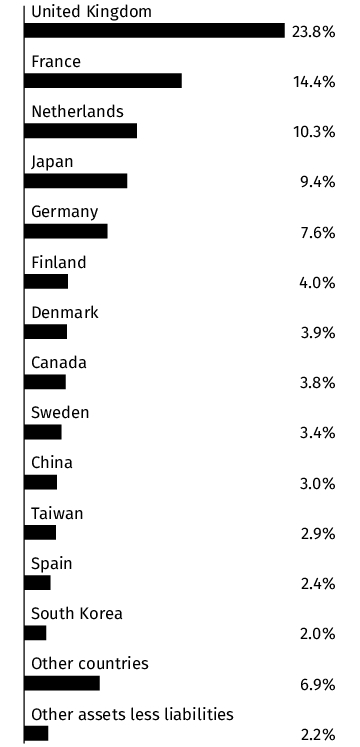

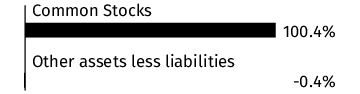

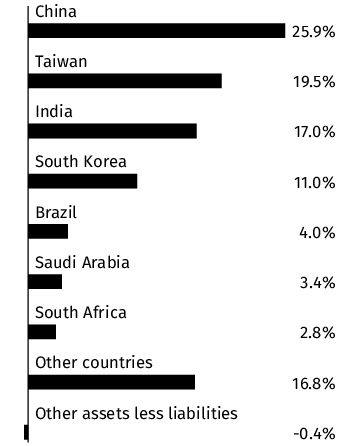

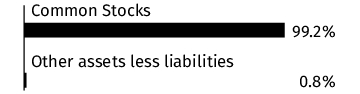

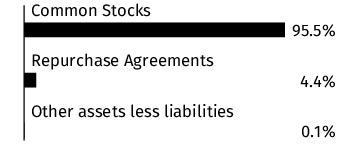

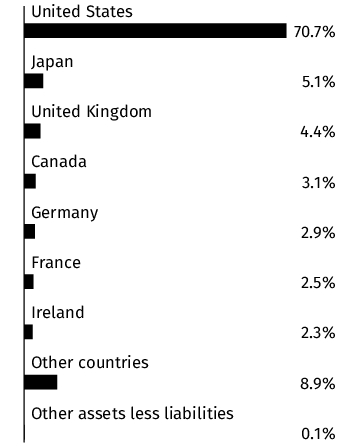

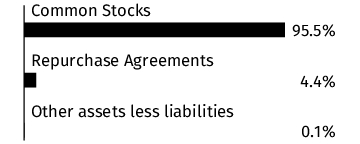

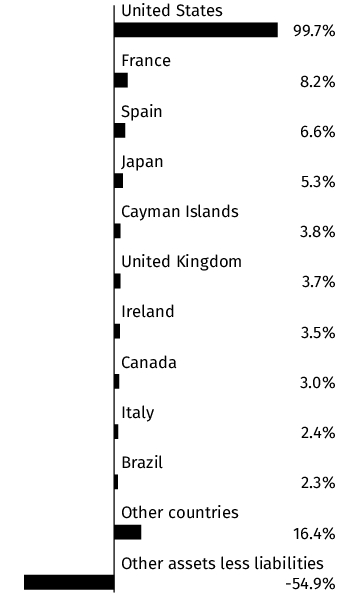

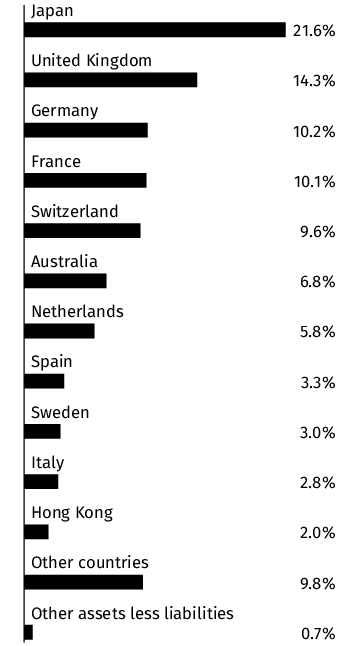

Graphical Representation of Holdings

The information below represents the composition of the Portfolio's net assets as of the end of the period.

Top Industries*

| Banks |

20.2% |

| Semiconductors |

19.0% |

| Internet |

11.8% |

| Insurance |

5.2% |

| Computers |

3.0% |

| Telecommunications |

2.9% |

| Software |

2.8% |

| Diversified Financial Services |

2.6% |

| Auto Manufacturers |

2.5% |

| Airlines |

1.9% |

| Food |

1.8% |

| Retail |

1.8% |

| Oil & Gas |

1.7% |

| Electric |

1.7% |

| Auto Parts & Equipment |

1.6% |

Portfolio Composition

Country

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000022021 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA JPMorgan Emerging Markets

|

|

| Class Name |

Class 1

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA JPMorgan Emerging Markets Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA JPMorgan Emerging Markets Portfolio (Class 1)* |

$64 |

1.20%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 64

|

[3] |

| Expense Ratio, Percent |

1.20%

|

[3],[4] |

| Net Assets |

$ 198,000,000

|

|

| Holdings Count | Holding |

150

|

|

| Advisory Fees Paid, Amount |

$ 900,000

|

|

| Investment Company Portfolio Turnover |

41.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$198M |

| Total number of portfolio holdings |

150 |

| Total net advisory fee paid |

$0.9M |

| Portfolio turnover rate during the reporting period |

41% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The information below represents the composition of the Portfolio's net assets as of the end of the period.

Top Industries*

| Banks |

20.2% |

| Semiconductors |

19.0% |

| Internet |

11.8% |

| Insurance |

5.2% |

| Computers |

3.0% |

| Telecommunications |

2.9% |

| Software |

2.8% |

| Diversified Financial Services |

2.6% |

| Auto Manufacturers |

2.5% |

| Airlines |

1.9% |

| Food |

1.8% |

| Retail |

1.8% |

| Oil & Gas |

1.7% |

| Electric |

1.7% |

| Auto Parts & Equipment |

1.6% |

Portfolio Composition

Country

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000022022 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA JPMorgan Emerging Markets

|

|

| Class Name |

Class 2

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA JPMorgan Emerging Markets Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA JPMorgan Emerging Markets Portfolio (Class 2)* |

$72 |

1.35%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 72

|

[5] |

| Expense Ratio, Percent |

1.35%

|

[5],[6] |

| Net Assets |

$ 198,000,000

|

|

| Holdings Count | Holding |

150

|

|

| Advisory Fees Paid, Amount |

$ 900,000

|

|

| Investment Company Portfolio Turnover |

41.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$198M |

| Total number of portfolio holdings |

150 |

| Total net advisory fee paid |

$0.9M |

| Portfolio turnover rate during the reporting period |

41% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The information below represents the composition of the Portfolio's net assets as of the end of the period.

Top Industries*

| Banks |

20.2% |

| Semiconductors |

19.0% |

| Internet |

11.8% |

| Insurance |

5.2% |

| Computers |

3.0% |

| Telecommunications |

2.9% |

| Software |

2.8% |

| Diversified Financial Services |

2.6% |

| Auto Manufacturers |

2.5% |

| Airlines |

1.9% |

| Food |

1.8% |

| Retail |

1.8% |

| Oil & Gas |

1.7% |

| Electric |

1.7% |

| Auto Parts & Equipment |

1.6% |

Portfolio Composition

Country

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000022018 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Morgan Stanley International Equities

|

|

| Class Name |

Class 1

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Morgan Stanley International Equities Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Morgan Stanley International Equities Portfolio (Class 1)* |

$45 |

0.87%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 45

|

[7] |

| Expense Ratio, Percent |

0.87%

|

[7],[8] |

| Net Assets |

$ 344,000,000

|

|

| Holdings Count | Holding |

58

|

|

| Advisory Fees Paid, Amount |

$ 1,300,000

|

|

| Investment Company Portfolio Turnover |

30.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$344M |

| Total number of portfolio holdings |

58 |

| Total net advisory fee paid |

$1.3M |

| Portfolio turnover rate during the reporting period |

30% |

|

|

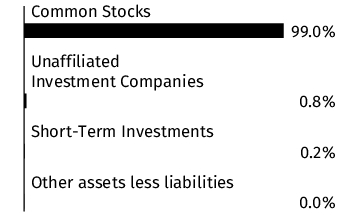

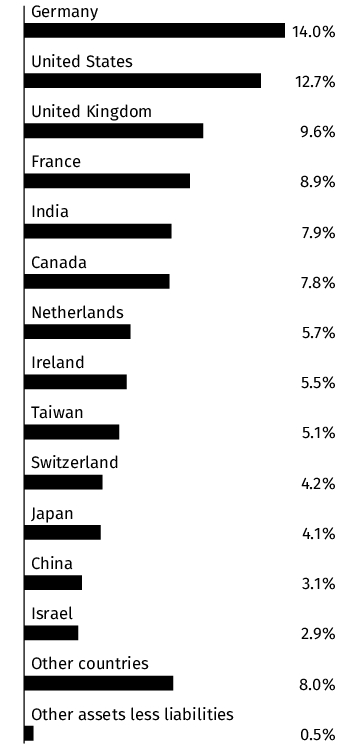

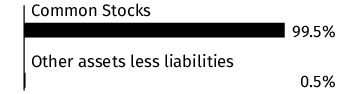

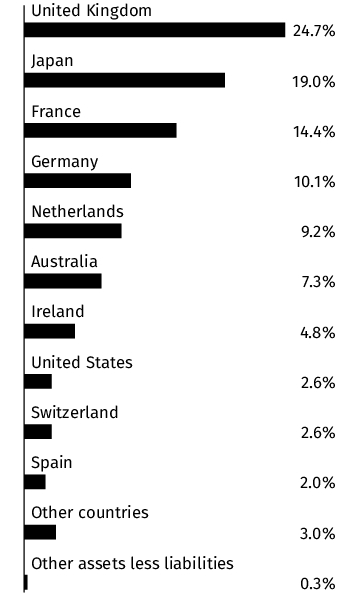

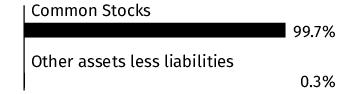

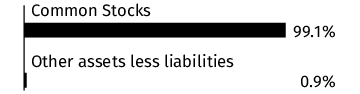

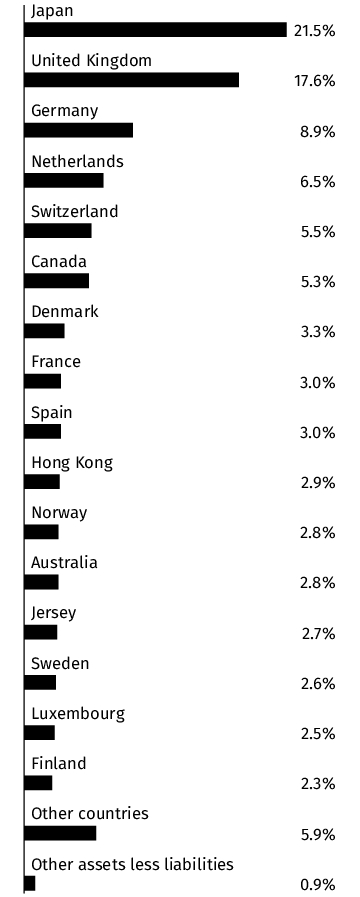

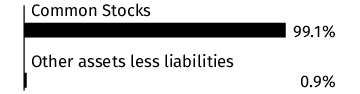

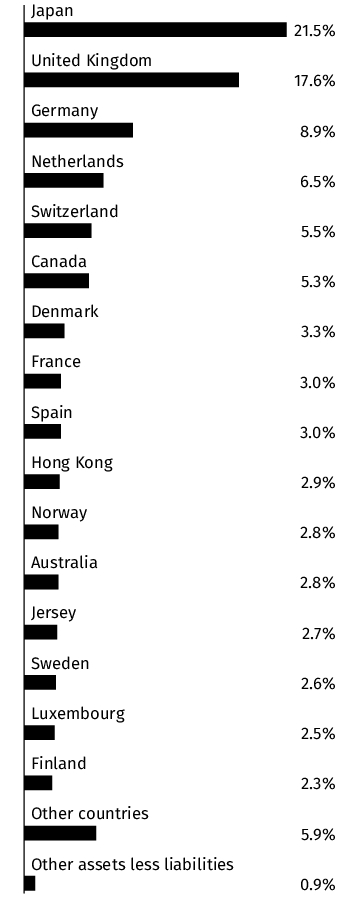

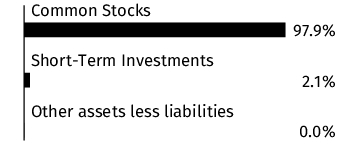

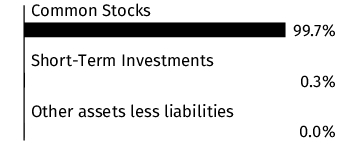

| Holdings [Text Block] |

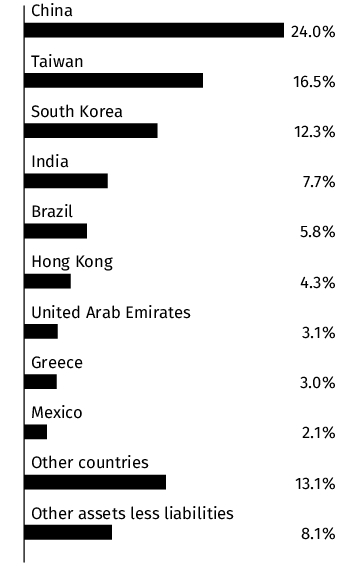

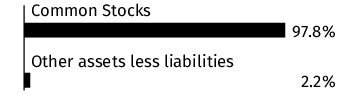

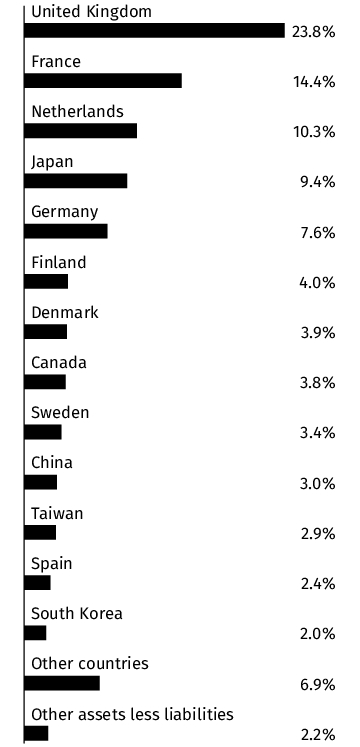

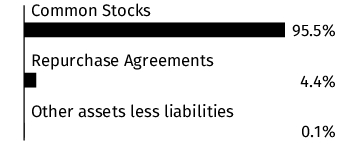

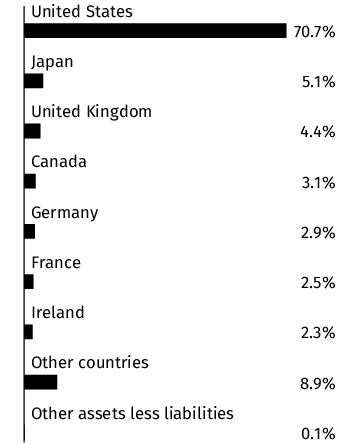

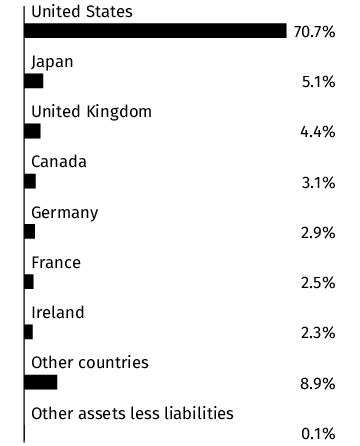

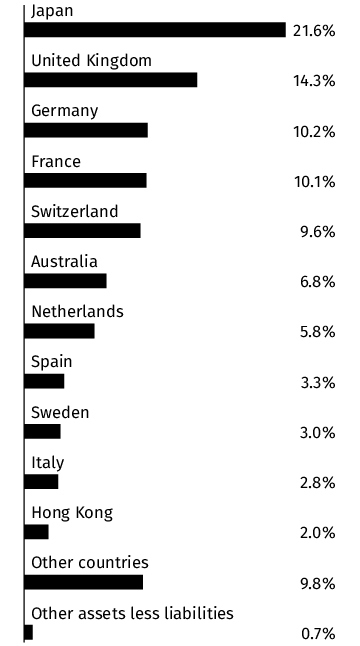

Graphical Representation of Holdings

The information below represents the composition of the Portfolio's net assets as of the end of the period.

Top Industries*

| Machinery-Diversified |

10.0% |

| Semiconductors |

9.4% |

| Software |

7.2% |

| Cosmetics/Personal Care |

6.5% |

| Banks |

5.9% |

| Pharmaceuticals |

5.0% |

| Insurance |

4.7% |

| Electronics |

4.2% |

| Computers |

3.7% |

| Retail |

3.2% |

| Diversified Financial Services |

3.1% |

| Commercial Services |

3.0% |

| Aerospace/Defense |

2.8% |

| Internet |

2.8% |

| Beverages |

2.7% |

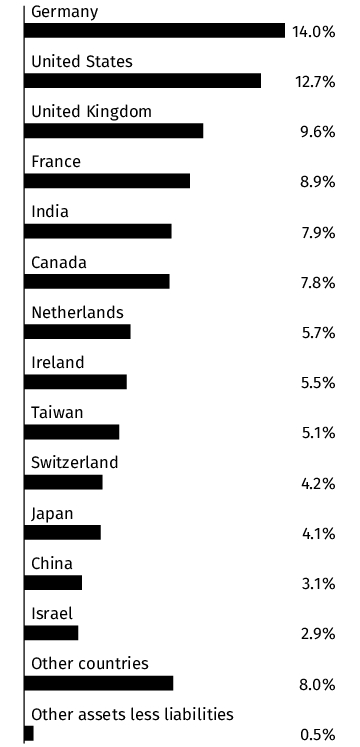

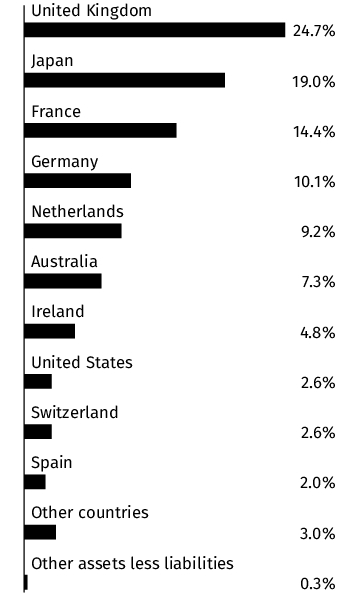

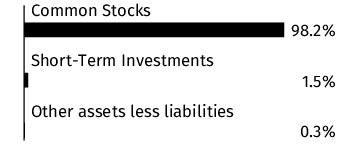

Portfolio Composition

Country

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000022019 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Morgan Stanley International Equities

|

|

| Class Name |

Class 2

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Morgan Stanley International Equities Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Morgan Stanley International Equities Portfolio (Class 2)* |

$53 |

1.02%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 53

|

[9] |

| Expense Ratio, Percent |

1.02%

|

[9],[10] |

| Net Assets |

$ 344,000,000

|

|

| Holdings Count | Holding |

58

|

|

| Advisory Fees Paid, Amount |

$ 1,300,000

|

|

| Investment Company Portfolio Turnover |

30.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$344M |

| Total number of portfolio holdings |

58 |

| Total net advisory fee paid |

$1.3M |

| Portfolio turnover rate during the reporting period |

30% |

|

|

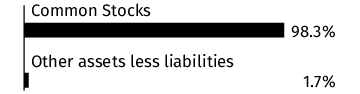

| Holdings [Text Block] |

Graphical Representation of Holdings

The information below represents the composition of the Portfolio's net assets as of the end of the period.

Top Industries*

| Machinery-Diversified |

10.0% |

| Semiconductors |

9.4% |

| Software |

7.2% |

| Cosmetics/Personal Care |

6.5% |

| Banks |

5.9% |

| Pharmaceuticals |

5.0% |

| Insurance |

4.7% |

| Electronics |

4.2% |

| Computers |

3.7% |

| Retail |

3.2% |

| Diversified Financial Services |

3.1% |

| Commercial Services |

3.0% |

| Aerospace/Defense |

2.8% |

| Internet |

2.8% |

| Beverages |

2.7% |

Portfolio Composition

Country

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000022020 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Morgan Stanley International Equities

|

|

| Class Name |

Class 3

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Morgan Stanley International Equities Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Morgan Stanley International Equities Portfolio (Class 3)* |

$58 |

1.12%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 58

|

[11] |

| Expense Ratio, Percent |

1.12%

|

[11],[12] |

| Net Assets |

$ 344,000,000

|

|

| Holdings Count | Holding |

58

|

|

| Advisory Fees Paid, Amount |

$ 1,300,000

|

|

| Investment Company Portfolio Turnover |

30.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$344M |

| Total number of portfolio holdings |

58 |

| Total net advisory fee paid |

$1.3M |

| Portfolio turnover rate during the reporting period |

30% |

|

|

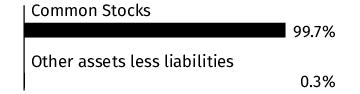

| Holdings [Text Block] |

Graphical Representation of Holdings

The information below represents the composition of the Portfolio's net assets as of the end of the period.

Top Industries*

| Machinery-Diversified |

10.0% |

| Semiconductors |

9.4% |

| Software |

7.2% |

| Cosmetics/Personal Care |

6.5% |

| Banks |

5.9% |

| Pharmaceuticals |

5.0% |

| Insurance |

4.7% |

| Electronics |

4.2% |

| Computers |

3.7% |

| Retail |

3.2% |

| Diversified Financial Services |

3.1% |

| Commercial Services |

3.0% |

| Aerospace/Defense |

2.8% |

| Internet |

2.8% |

| Beverages |

2.7% |

Portfolio Composition

Country

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000022028 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA PineBridge High-Yield Bond

|

|

| Class Name |

Class 3

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA PineBridge High-Yield Bond Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA PineBridge High-Yield Bond Portfolio (Class 3)* |

$49 |

0.98%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 49

|

[13] |

| Expense Ratio, Percent |

0.98%

|

[13],[14] |

| Net Assets |

$ 263,000,000

|

|

| Holdings Count | Holding |

269

|

|

| Advisory Fees Paid, Amount |

$ 800,000

|

|

| Investment Company Portfolio Turnover |

23.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$263M |

| Total number of portfolio holdings |

269 |

| Total net advisory fee paid |

$0.8M |

| Portfolio turnover rate during the reporting period |

23% |

|

|

| Holdings [Text Block] |

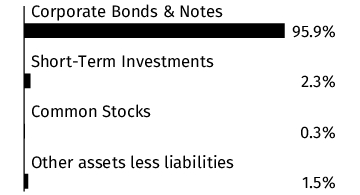

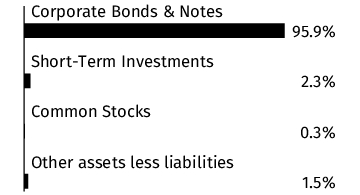

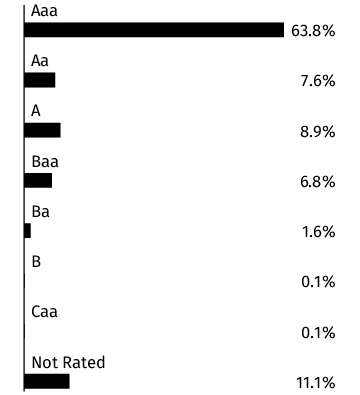

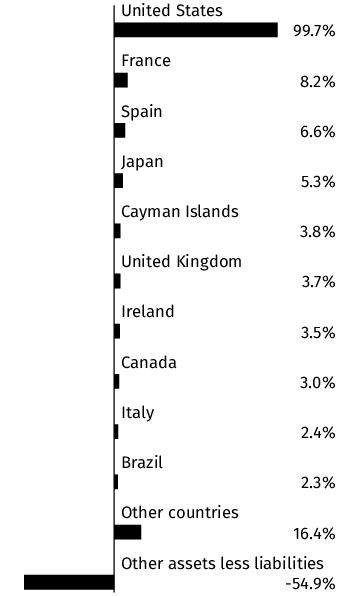

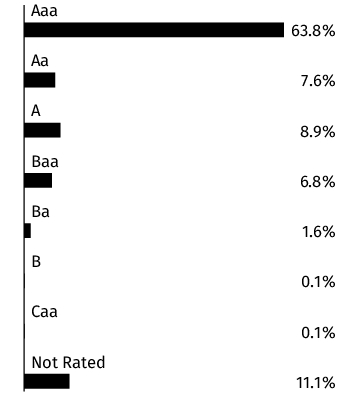

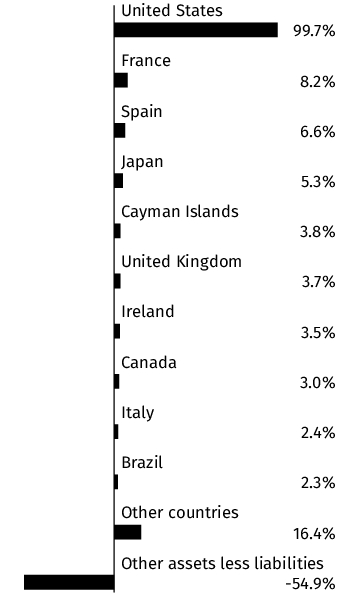

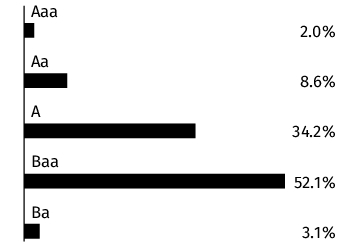

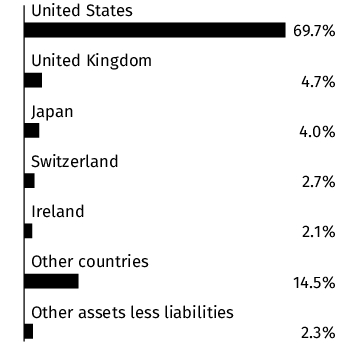

Graphical Representation of Holdings

The information below represents the composition of the Portfolio as of the end of the period.

Top Industries*

(% of net assets)

| Diversified Financial Services |

7.1% |

| Commercial Services |

6.8% |

| Telecommunications |

6.4% |

| Pipelines |

6.4% |

| Oil & Gas |

6.2% |

| Media |

6.0% |

| Retail |

4.5% |

| Electric |

4.3% |

| REITS |

3.4% |

| Leisure Time |

2.9% |

| Insurance |

2.8% |

| Entertainment |

2.8% |

| Iron/Steel |

2.8% |

| Pharmaceuticals |

2.7% |

| Packaging & Containers |

2.6% |

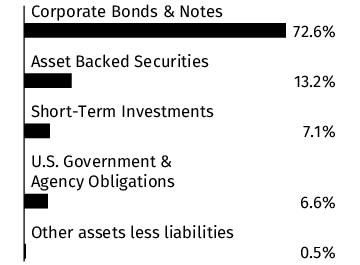

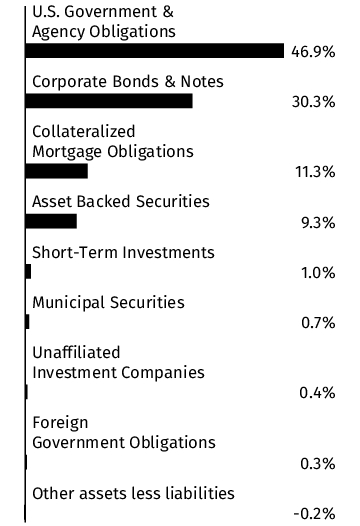

Portfolio Composition

(% of net assets)

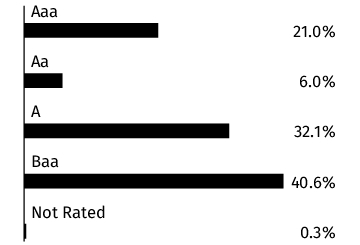

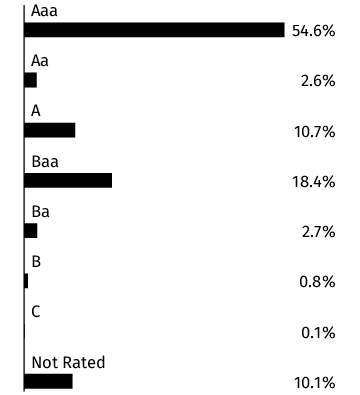

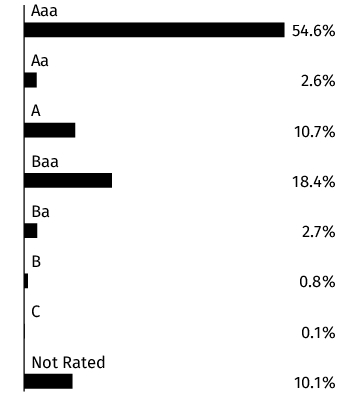

Credit Quality **

(% of total debt issues)

* Percentages exclude derivatives (other than purchased options), if any.

** Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Quality Explanation [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000022027 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA PineBridge High-Yield Bond

|

|

| Class Name |

Class 2

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA PineBridge High-Yield Bond Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA PineBridge High-Yield Bond Portfolio (Class 2)* |

$44 |

0.88%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 44

|

[15] |

| Expense Ratio, Percent |

0.88%

|

[15],[16] |

| Net Assets |

$ 263,000,000

|

|

| Holdings Count | Holding |

269

|

|

| Advisory Fees Paid, Amount |

$ 800,000

|

|

| Investment Company Portfolio Turnover |

23.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$263M |

| Total number of portfolio holdings |

269 |

| Total net advisory fee paid |

$0.8M |

| Portfolio turnover rate during the reporting period |

23% |

|

|

| Holdings [Text Block] |

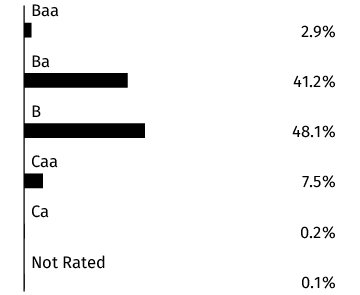

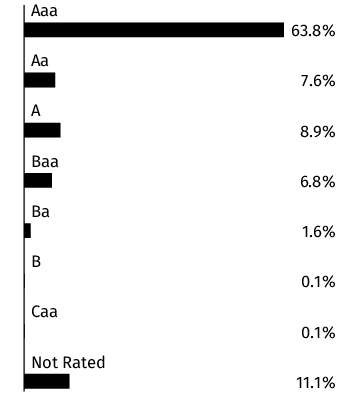

Graphical Representation of Holdings

The information below represents the composition of the Portfolio as of the end of the period.

Top Industries*

(% of net assets)

| Diversified Financial Services |

7.1% |

| Commercial Services |

6.8% |

| Telecommunications |

6.4% |

| Pipelines |

6.4% |

| Oil & Gas |

6.2% |

| Media |

6.0% |

| Retail |

4.5% |

| Electric |

4.3% |

| REITS |

3.4% |

| Leisure Time |

2.9% |

| Insurance |

2.8% |

| Entertainment |

2.8% |

| Iron/Steel |

2.8% |

| Pharmaceuticals |

2.7% |

| Packaging & Containers |

2.6% |

Portfolio Composition

(% of net assets)

Credit Quality **

(% of total debt issues)

* Percentages exclude derivatives (other than purchased options), if any.

** Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Quality Explanation [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000022026 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA PineBridge High-Yield Bond

|

|

| Class Name |

Class 1

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA PineBridge High-Yield Bond Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA PineBridge High-Yield Bond Portfolio (Class 1)* |

$37 |

0.73%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 37

|

[17] |

| Expense Ratio, Percent |

0.73%

|

[17],[18] |

| Net Assets |

$ 263,000,000

|

|

| Holdings Count | Holding |

269

|

|

| Advisory Fees Paid, Amount |

$ 800,000

|

|

| Investment Company Portfolio Turnover |

23.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$263M |

| Total number of portfolio holdings |

269 |

| Total net advisory fee paid |

$0.8M |

| Portfolio turnover rate during the reporting period |

23% |

|

|

| Holdings [Text Block] |

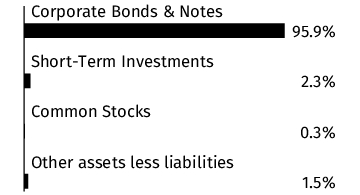

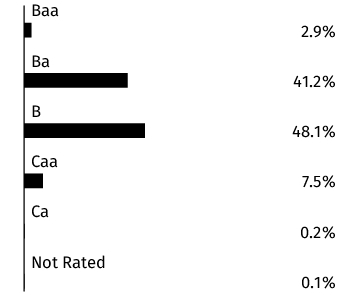

Graphical Representation of Holdings

The information below represents the composition of the Portfolio as of the end of the period.

Top Industries*

(% of net assets)

| Diversified Financial Services |

7.1% |

| Commercial Services |

6.8% |

| Telecommunications |

6.4% |

| Pipelines |

6.4% |

| Oil & Gas |

6.2% |

| Media |

6.0% |

| Retail |

4.5% |

| Electric |

4.3% |

| REITS |

3.4% |

| Leisure Time |

2.9% |

| Insurance |

2.8% |

| Entertainment |

2.8% |

| Iron/Steel |

2.8% |

| Pharmaceuticals |

2.7% |

| Packaging & Containers |

2.6% |

Portfolio Composition

(% of net assets)

Credit Quality **

(% of total debt issues)

* Percentages exclude derivatives (other than purchased options), if any.

** Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Quality Explanation [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000199994 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Emerging Markets Equity Index

|

|

| Class Name |

Class 3

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Emerging Markets Equity Index Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Emerging Markets Equity Index Portfolio (Class 3)* |

$44 |

0.83%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 44

|

[19] |

| Expense Ratio, Percent |

0.83%

|

[19],[20] |

| Net Assets |

$ 104,000,000

|

|

| Holdings Count | Holding |

1,005

|

|

| Advisory Fees Paid, Amount |

$ 200,000

|

|

| Investment Company Portfolio Turnover |

12.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$104M |

| Total number of portfolio holdings |

1,005 |

| Total net advisory fee paid |

$0.2M |

| Portfolio turnover rate during the reporting period |

12% |

|

|

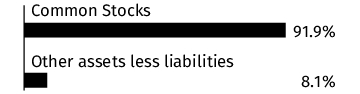

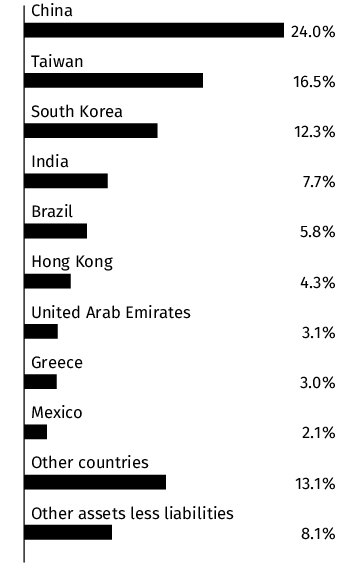

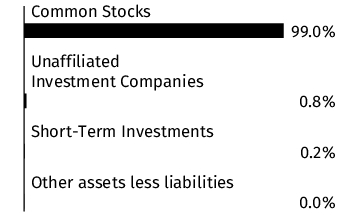

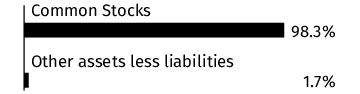

| Holdings [Text Block] |

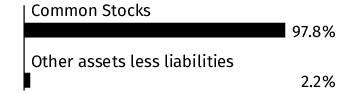

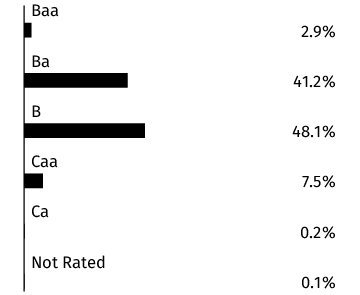

Graphical Representation of Holdings

The information below represents the composition of the Portfolio's net assets as of the end of the period.

Top Industries*

| Semiconductors |

16.9% |

| Banks |

16.7% |

| Internet |

13.5% |

| Diversified Financial Services |

4.6% |

| Telecommunications |

4.3% |

| Oil & Gas |

4.0% |

| Auto Manufacturers |

3.0% |

| Insurance |

2.7% |

| Computers |

2.6% |

| Mining |

2.2% |

| Electronics |

2.2% |

| Retail |

1.9% |

| Pharmaceuticals |

1.9% |

| Electric |

1.7% |

| Real Estate |

1.6% |

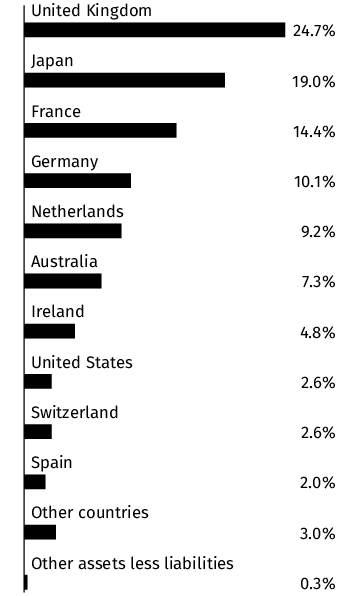

Portfolio Composition

Country

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000199993 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Emerging Markets Equity Index

|

|

| Class Name |

Class 1

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Emerging Markets Equity Index Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Emerging Markets Equity Index Portfolio (Class 1)* |

$31 |

0.58%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 31

|

[21] |

| Expense Ratio, Percent |

0.58%

|

[21],[22] |

| Net Assets |

$ 104,000,000

|

|

| Holdings Count | Holding |

1,005

|

|

| Advisory Fees Paid, Amount |

$ 200,000

|

|

| Investment Company Portfolio Turnover |

12.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$104M |

| Total number of portfolio holdings |

1,005 |

| Total net advisory fee paid |

$0.2M |

| Portfolio turnover rate during the reporting period |

12% |

|

|

| Holdings [Text Block] |

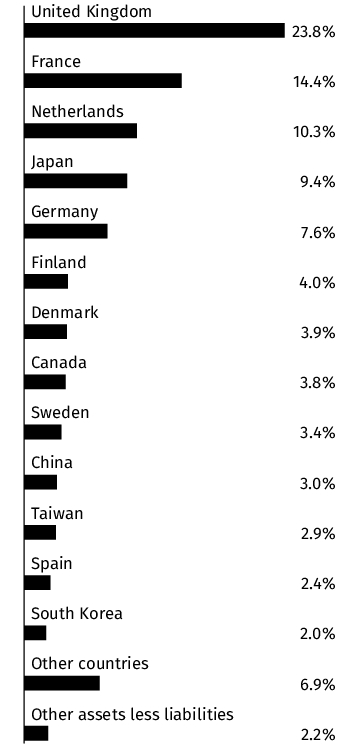

Graphical Representation of Holdings

The information below represents the composition of the Portfolio's net assets as of the end of the period.

Top Industries*

| Semiconductors |

16.9% |

| Banks |

16.7% |

| Internet |

13.5% |

| Diversified Financial Services |

4.6% |

| Telecommunications |

4.3% |

| Oil & Gas |

4.0% |

| Auto Manufacturers |

3.0% |

| Insurance |

2.7% |

| Computers |

2.6% |

| Mining |

2.2% |

| Electronics |

2.2% |

| Retail |

1.9% |

| Pharmaceuticals |

1.9% |

| Electric |

1.7% |

| Real Estate |

1.6% |

Portfolio Composition

Country

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000193967 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Goldman Sachs Multi-Asset Insights

|

|

| Class Name |

Class 1

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Goldman Sachs Multi-Asset Insights Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Goldman Sachs Multi-Asset Insights Portfolio (Class 1)* |

$42 |

0.83%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 42

|

[23] |

| Expense Ratio, Percent |

0.83%

|

[23],[24] |

| Net Assets |

$ 50,000,000

|

|

| Holdings Count | Holding |

291

|

|

| Advisory Fees Paid, Amount |

$ 200,000

|

|

| Investment Company Portfolio Turnover |

79.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$50M |

| Total number of portfolio holdings |

291 |

| Total net advisory fee paid |

$0.2M |

| Portfolio turnover rate during the reporting period |

79% |

|

|

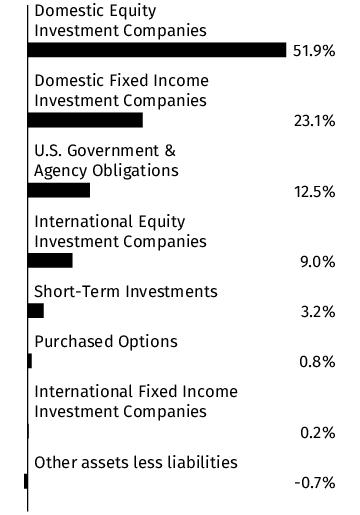

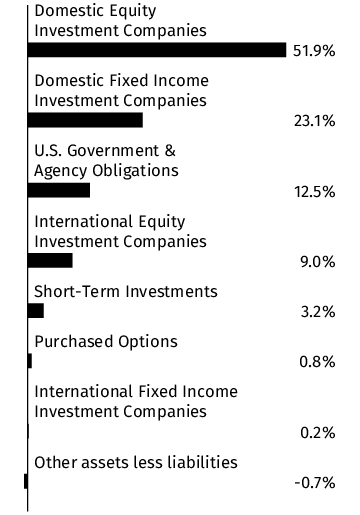

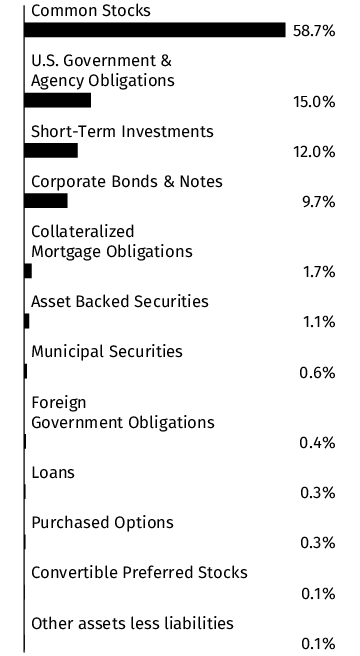

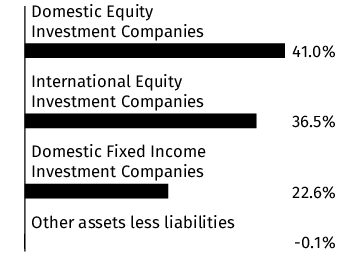

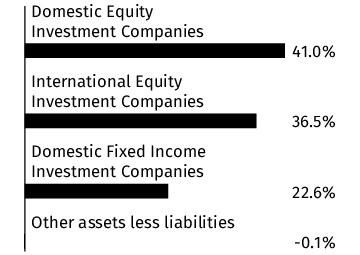

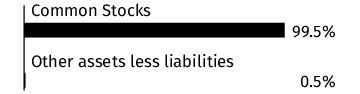

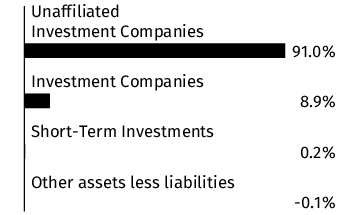

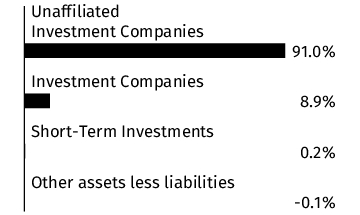

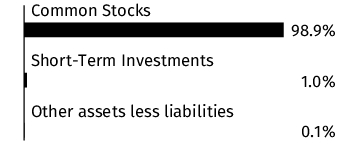

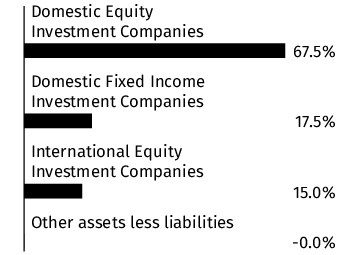

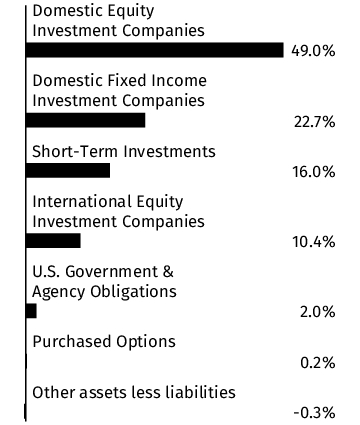

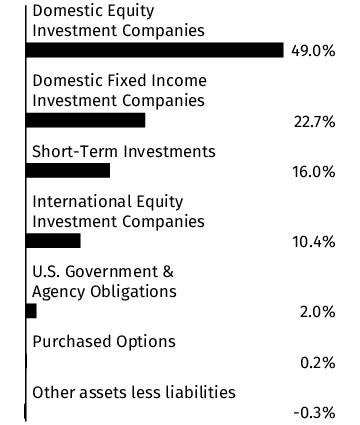

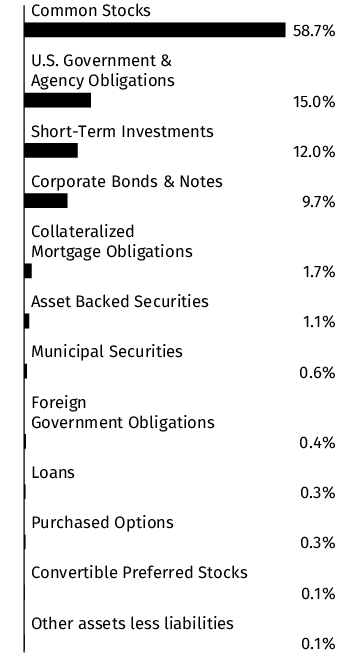

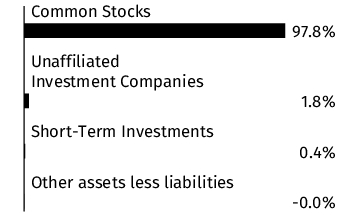

| Holdings [Text Block] |

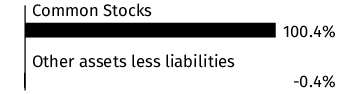

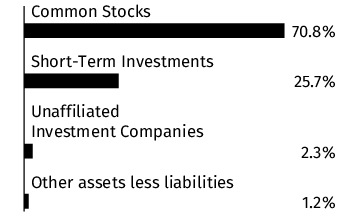

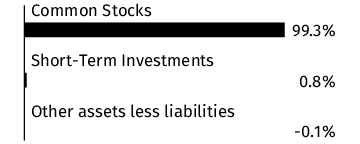

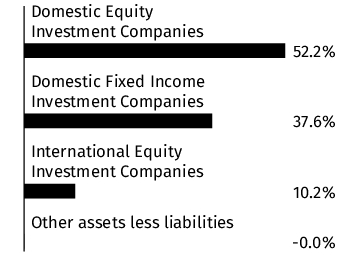

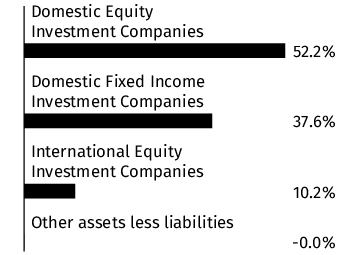

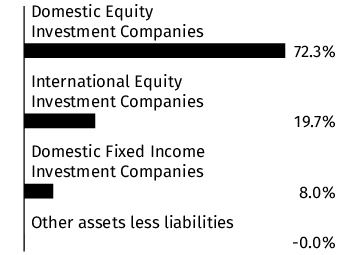

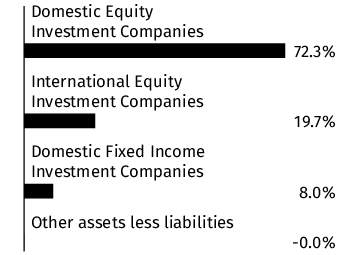

Graphical Representation of Holdings The information below represents the composition of the Portfolio's net assets as of the end of the period. Top Industries*

| Short-Term Investments |

25.7% |

| Internet |

7.4% |

| Semiconductors |

6.1% |

| Banks |

6.0% |

| Software |

4.7% |

| Diversified Financial Services |

4.0% |

| Insurance |

3.3% |

| Aerospace/Defense |

3.1% |

| Computers |

3.0% |

| Pharmaceuticals |

2.7% |

| Unaffiliated Investment Companies |

2.3% |

| REITS |

2.2% |

| Telecommunications |

2.0% |

| Commercial Services |

1.6% |

| Electronics |

1.6% |

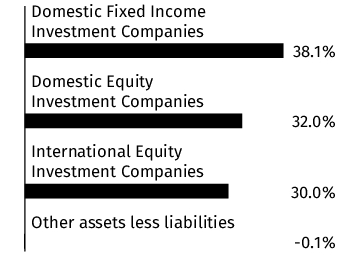

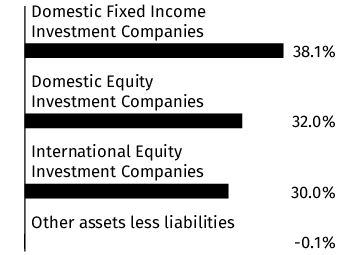

Portfolio Composition * Percentages exclude derivatives (other than purchased options), if any.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000193968 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Goldman Sachs Multi-Asset Insights

|

|

| Class Name |

Class 3

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Goldman Sachs Multi-Asset Insights Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Goldman Sachs Multi-Asset Insights Portfolio (Class 3)* |

$55 |

1.08%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 55

|

[25] |

| Expense Ratio, Percent |

1.08%

|

[25],[26] |

| Net Assets |

$ 50,000,000

|

|

| Holdings Count | Holding |

291

|

|

| Advisory Fees Paid, Amount |

$ 200,000

|

|

| Investment Company Portfolio Turnover |

79.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$50M |

| Total number of portfolio holdings |

291 |

| Total net advisory fee paid |

$0.2M |

| Portfolio turnover rate during the reporting period |

79% |

|

|

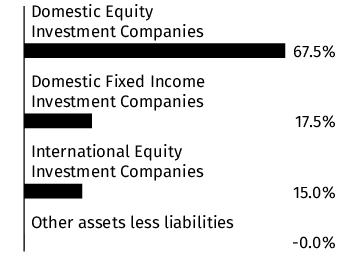

| Holdings [Text Block] |

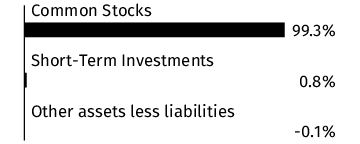

Graphical Representation of Holdings

The information below represents the composition of the Portfolio's net assets as of the end of the period.

Top Industries*

| Short-Term Investments |

25.7% |

| Internet |

7.4% |

| Semiconductors |

6.1% |

| Banks |

6.0% |

| Software |

4.7% |

| Diversified Financial Services |

4.0% |

| Insurance |

3.3% |

| Aerospace/Defense |

3.1% |

| Computers |

3.0% |

| Pharmaceuticals |

2.7% |

| Unaffiliated Investment Companies |

2.3% |

| REITS |

2.2% |

| Telecommunications |

2.0% |

| Commercial Services |

1.6% |

| Electronics |

1.6% |

Portfolio Composition

* Percentages exclude derivatives (other than purchased options), if any.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000193973 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Fixed Income Intermediate Index

|

|

| Class Name |

Class 1

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Fixed Income Intermediate Index Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Fixed Income Intermediate Index Portfolio (Class 1)* |

$17 |

0.33%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 17

|

[27] |

| Expense Ratio, Percent |

0.33%

|

[27],[28] |

| Net Assets |

$ 494,000,000

|

|

| Holdings Count | Holding |

1,009

|

|

| Advisory Fees Paid, Amount |

$ 700,000

|

|

| Investment Company Portfolio Turnover |

70.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$494M |

| Total number of portfolio holdings |

1,009 |

| Total net advisory fee paid |

$0.7M |

| Portfolio turnover rate during the reporting period |

70% |

|

|

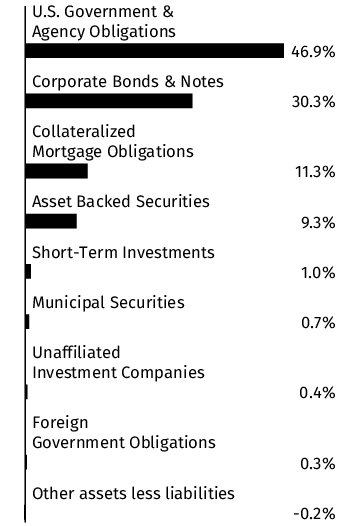

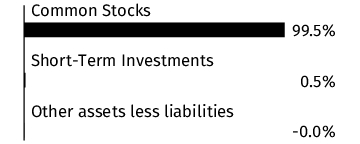

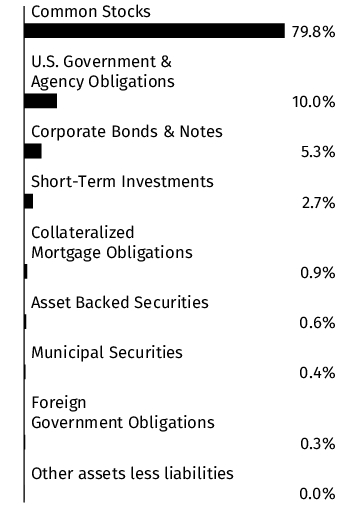

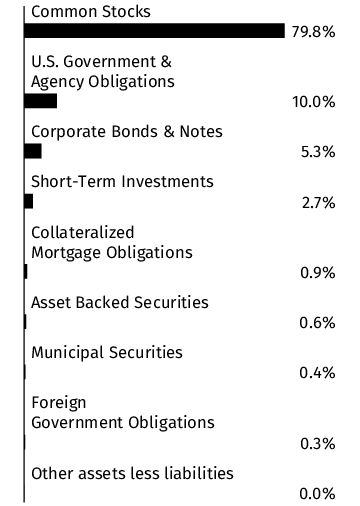

| Holdings [Text Block] |

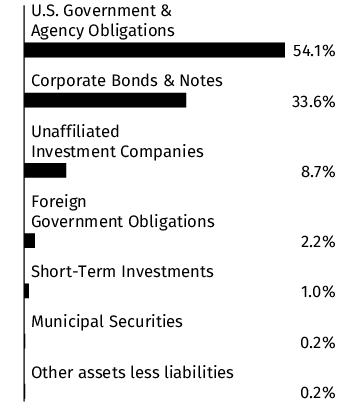

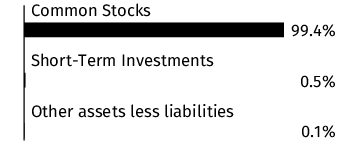

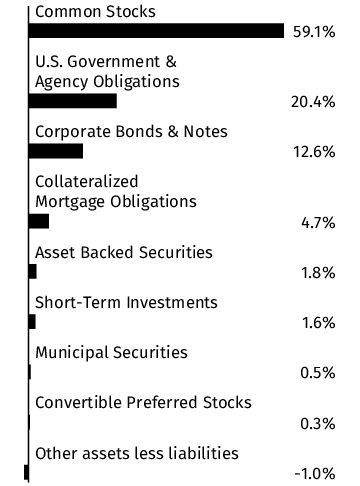

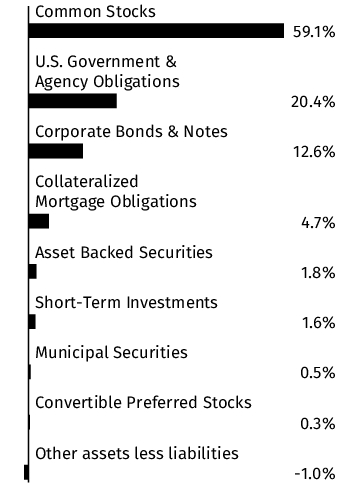

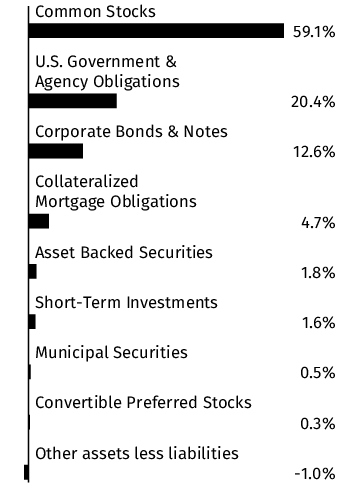

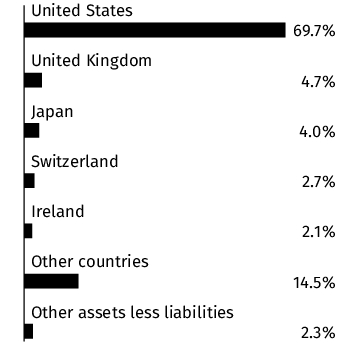

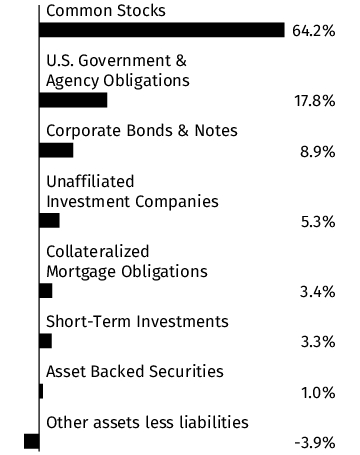

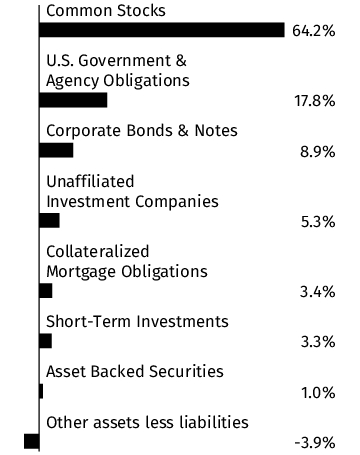

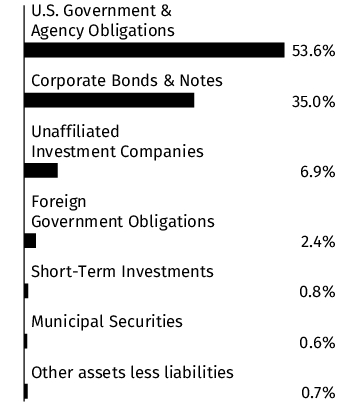

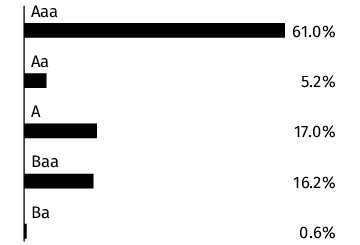

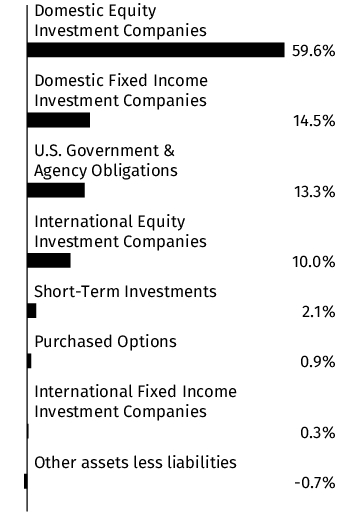

Graphical Representation of Holdings

The information below represents the composition of the Portfolio as of the end of the period.

Top Industries*

(% of net assets)

| U.S. Government & Agency Obligations |

54.1% |

| Banks |

9.4% |

| Unaffiliated Investment Companies |

8.7% |

| Multi-National |

2.7% |

| Electric |

2.3% |

| Foreign Government Obligations |

2.2% |

| Pharmaceuticals |

1.4% |

| REITS |

1.3% |

| Diversified Financial Services |

1.2% |

| Telecommunications |

1.0% |

| Short-Term Investments |

1.0% |

| Oil & Gas |

0.9% |

| Auto Manufacturers |

0.9% |

| Pipelines |

0.9% |

| Semiconductors |

0.8% |

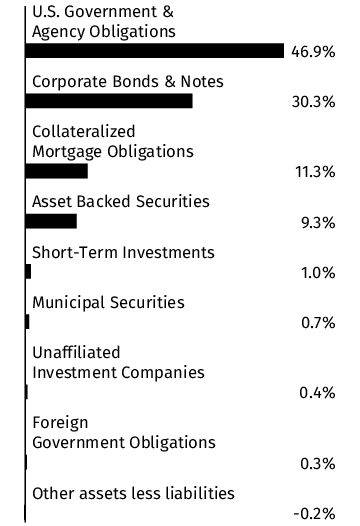

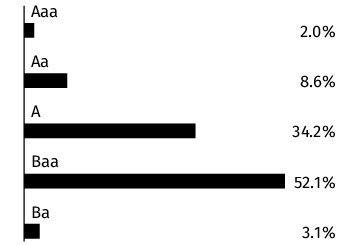

Portfolio Composition

(% of net assets)

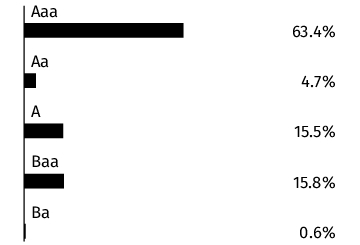

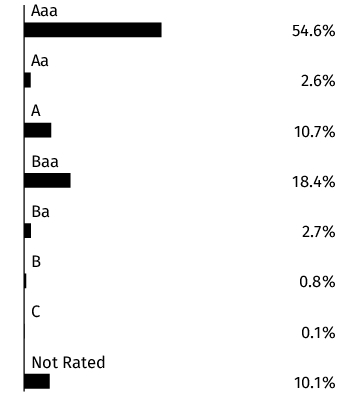

Credit Quality **

(% of total debt issues)

* Percentages exclude derivatives (other than purchased options), if any.

** Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Quality Explanation [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000193974 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Fixed Income Intermediate Index

|

|

| Class Name |

Class 3

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Fixed Income Intermediate Index Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Fixed Income Intermediate Index Portfolio (Class 3)* |

$29 |

0.58%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 29

|

[29] |

| Expense Ratio, Percent |

0.58%

|

[29],[30] |

| Net Assets |

$ 494,000,000

|

|

| Holdings Count | Holding |

1,009

|

|

| Advisory Fees Paid, Amount |

$ 700,000

|

|

| Investment Company Portfolio Turnover |

70.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$494M |

| Total number of portfolio holdings |

1,009 |

| Total net advisory fee paid |

$0.7M |

| Portfolio turnover rate during the reporting period |

70% |

|

|

| Holdings [Text Block] |

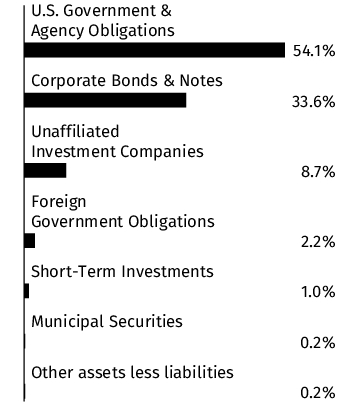

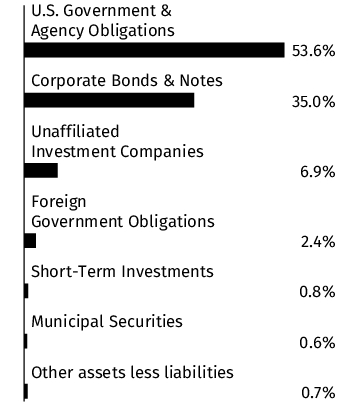

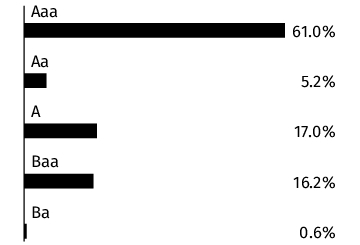

Graphical Representation of Holdings

The information below represents the composition of the Portfolio as of the end of the period.

Top Industries*

(% of net assets)

| U.S. Government & Agency Obligations |

54.1% |

| Banks |

9.4% |

| Unaffiliated Investment Companies |

8.7% |

| Multi-National |

2.7% |

| Electric |

2.3% |

| Foreign Government Obligations |

2.2% |

| Pharmaceuticals |

1.4% |

| REITS |

1.3% |

| Diversified Financial Services |

1.2% |

| Telecommunications |

1.0% |

| Short-Term Investments |

1.0% |

| Oil & Gas |

0.9% |

| Auto Manufacturers |

0.9% |

| Pipelines |

0.9% |

| Semiconductors |

0.8% |

Portfolio Composition

(% of net assets)

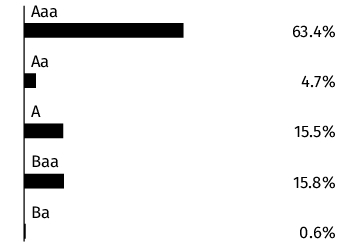

Credit Quality **

(% of total debt issues)

* Percentages exclude derivatives (other than purchased options), if any.

** Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Quality Explanation [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021986 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Federated Hermes Corporate Bond

|

|

| Class Name |

Class 3

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Federated Hermes Corporate Bond Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Federated Hermes Corporate Bond Portfolio (Class 3)* |

$40 |

0.80%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 40

|

[31] |

| Expense Ratio, Percent |

0.80%

|

[31],[32] |

| Net Assets |

$ 1,533,000,000

|

|

| Holdings Count | Holding |

812

|

|

| Advisory Fees Paid, Amount |

$ 3,800,000

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$1,533M |

| Total number of portfolio holdings |

812 |

| Total net advisory fee paid |

$3.8M |

| Portfolio turnover rate during the reporting period |

11% |

|

|

| Holdings [Text Block] |

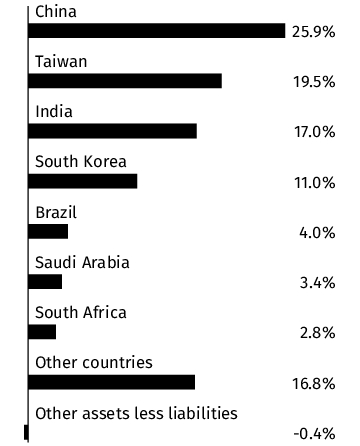

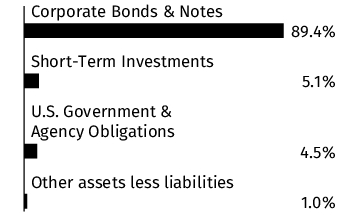

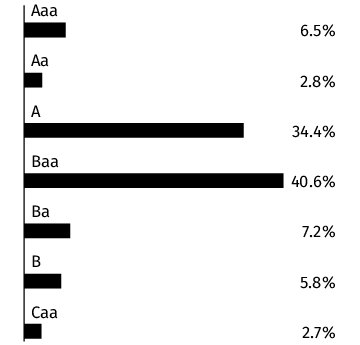

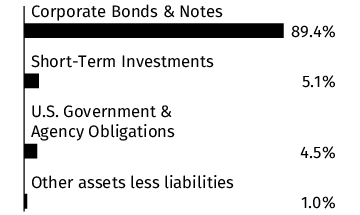

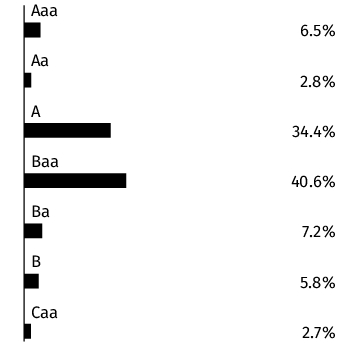

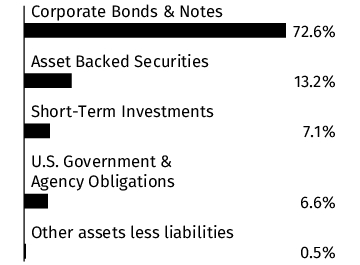

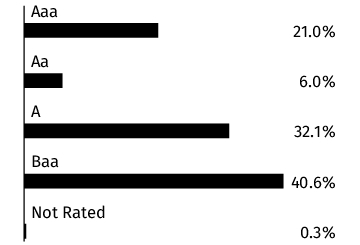

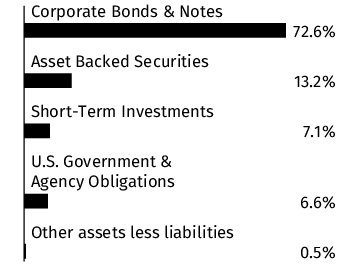

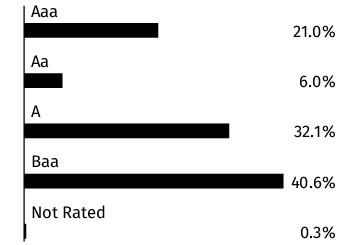

Graphical Representation of Holdings

The information below represents the composition of the Portfolio as of the end of the period.

Top Industries*

(% of net assets)

| Banks |

17.1% |

| Short-Term Investments |

5.1% |

| Telecommunications |

5.1% |

| Electric |

4.9% |

| U.S. Government & Agency Obligations |

4.5% |

| Pharmaceuticals |

4.3% |

| Software |

3.5% |

| Oil & Gas |

3.3% |

| Pipelines |

3.3% |

| Media |

3.1% |

| Commercial Services |

2.8% |

| Computers |

2.6% |

| Beverages |

2.6% |

| Retail |

2.5% |

| Insurance |

2.4% |

Portfolio Composition

(% of net assets)

Credit Quality **

(% of total debt issues)

* Percentages exclude derivatives (other than purchased options), if any.

** Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Quality Explanation [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021984 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Federated Hermes Corporate Bond

|

|

| Class Name |

Class 1

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Federated Hermes Corporate Bond Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Federated Hermes Corporate Bond Portfolio (Class 1)* |

$28 |

0.55%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 28

|

[33] |

| Expense Ratio, Percent |

0.55%

|

[33],[34] |

| Net Assets |

$ 1,533,000,000

|

|

| Holdings Count | Holding |

812

|

|

| Advisory Fees Paid, Amount |

$ 3,800,000

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$1,533M |

| Total number of portfolio holdings |

812 |

| Total net advisory fee paid |

$3.8M |

| Portfolio turnover rate during the reporting period |

11% |

|

|

| Holdings [Text Block] |

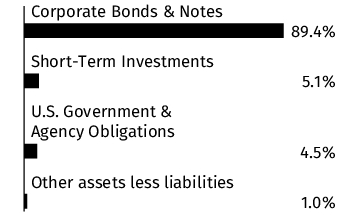

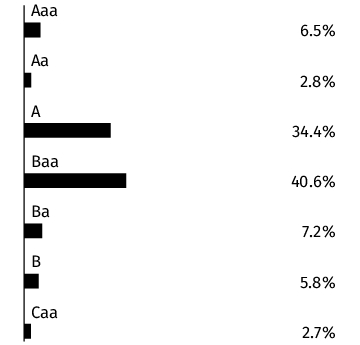

Graphical Representation of Holdings

The information below represents the composition of the Portfolio as of the end of the period.

Top Industries*

(% of net assets)

| Banks |

17.1% |

| Short-Term Investments |

5.1% |

| Telecommunications |

5.1% |

| Electric |

4.9% |

| U.S. Government & Agency Obligations |

4.5% |

| Pharmaceuticals |

4.3% |

| Software |

3.5% |

| Oil & Gas |

3.3% |

| Pipelines |

3.3% |

| Media |

3.1% |

| Commercial Services |

2.8% |

| Computers |

2.6% |

| Beverages |

2.6% |

| Retail |

2.5% |

| Insurance |

2.4% |

Portfolio Composition

(% of net assets)

Credit Quality **

(% of total debt issues)

* Percentages exclude derivatives (other than purchased options), if any.

** Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Quality Explanation [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021985 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA Federated Hermes Corporate Bond

|

|

| Class Name |

Class 2

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA Federated Hermes Corporate Bond Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA Federated Hermes Corporate Bond Portfolio (Class 2)* |

$35 |

0.70%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 35

|

[35] |

| Expense Ratio, Percent |

0.70%

|

[35],[36] |

| Net Assets |

$ 1,533,000,000

|

|

| Holdings Count | Holding |

812

|

|

| Advisory Fees Paid, Amount |

$ 3,800,000

|

|

| Investment Company Portfolio Turnover |

11.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$1,533M |

| Total number of portfolio holdings |

812 |

| Total net advisory fee paid |

$3.8M |

| Portfolio turnover rate during the reporting period |

11% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The information below represents the composition of the Portfolio as of the end of the period.

Top Industries*

(% of net assets)

| Banks |

17.1% |

| Short-Term Investments |

5.1% |

| Telecommunications |

5.1% |

| Electric |

4.9% |

| U.S. Government & Agency Obligations |

4.5% |

| Pharmaceuticals |

4.3% |

| Software |

3.5% |

| Oil & Gas |

3.3% |

| Pipelines |

3.3% |

| Media |

3.1% |

| Commercial Services |

2.8% |

| Computers |

2.6% |

| Beverages |

2.6% |

| Retail |

2.5% |

| Insurance |

2.4% |

Portfolio Composition

(% of net assets)

Credit Quality **

(% of total debt issues)

* Percentages exclude derivatives (other than purchased options), if any.

** Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Quality Explanation [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. Percentages exclude short-term securities.

|

|

| Credit Ratings Selection [Text Block] |

Credit quality ratings shown above reflect the rating assigned by Moody's Investors Service, Inc. Where Moody's ratings are not available, we have used Standard & Poor's ratings.

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no disagreements with the accountants during the period.

|

|

| C000021971 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

SA AB Growth

|

|

| Class Name |

Class 3

|

|

| No Trading Symbol Flag |

true

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the SunAmerica Series Trust SA AB Growth Portfolio (the “Portfolio”) for the period of February 1, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Portfolio at corebridgefinancial.com/getprospectus. You can also request this information by contacting us at 1-800-448-2542.

|

|

| Additional Information Phone Number |

1-800-448-2542

|

|

| Additional Information Website |

corebridgefinancial.com/getprospectus

|

|

| Expenses [Text Block] |

Fund Expenses

What were the Portfolio costs for the last six months ?

(Based on a hypothetical $10,000 investment)

| Portfolio (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| SA AB Growth Portfolio (Class 3)* |

$45 |

0.88%** |

| * |

The expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any fees and expenses that may be charged by the variable annuity contracts and variable life insurance policies that invest in the Portfolio.

|

| ** |

Annualized

|

|

|

| Expenses Paid, Amount |

$ 45

|

[37] |

| Expense Ratio, Percent |

0.88%

|

[37],[38] |

| Net Assets |

$ 1,858,000,000

|

|

| Holdings Count | Holding |

56

|

|

| Advisory Fees Paid, Amount |

$ 5,200,000

|

|

| Investment Company Portfolio Turnover |

14.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics.

| Net assets |

$1,858M |

| Total number of portfolio holdings |

56 |

| Total net advisory fee paid |

$5.2M |

| Portfolio turnover rate during the reporting period |

14% |

|

|

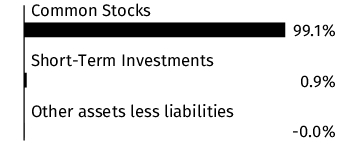

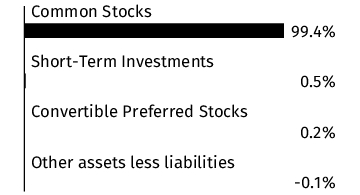

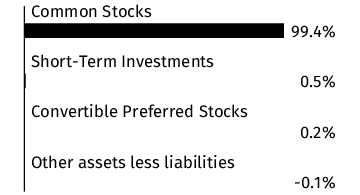

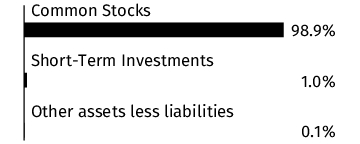

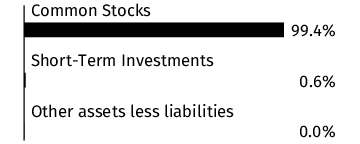

| Holdings [Text Block] |

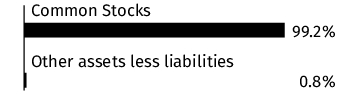

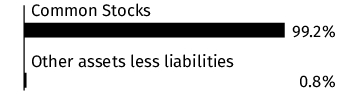

Graphical Representation of Holdings

The information below represents the composition of the Portfolio's net assets as of the end of the period.