|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$78

|

1.54%

|

|

Top Contributors

|

|

|

↑

|

Non-agency RMBS; ABS

|

|

Top Detractors

|

|

|

↓

|

Interest rate duration positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

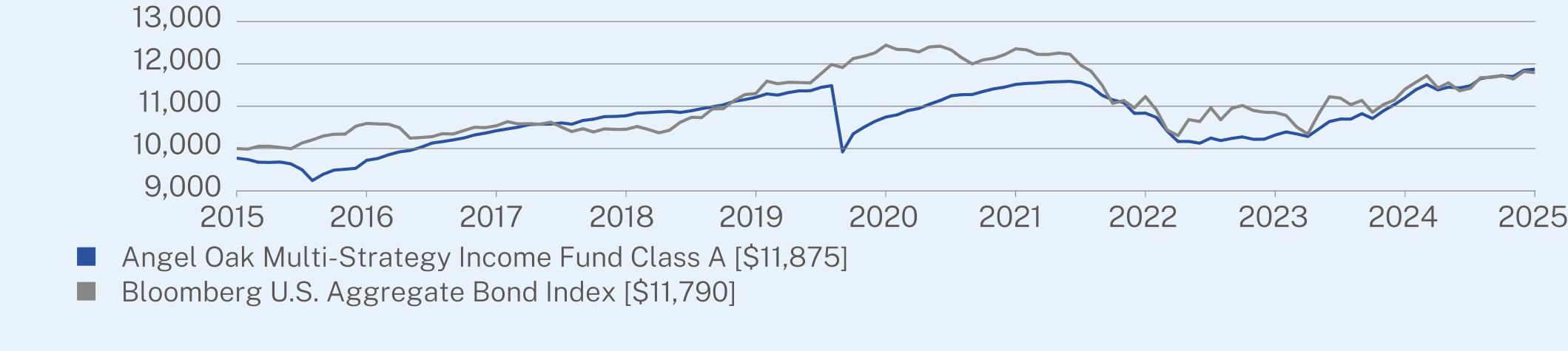

Class A (without sales charge)

|

5.97

|

2.02

|

1.97

|

|

Class A (with maximum 2.25% sales charge)

|

3.57

|

1.56

|

1.73

|

|

Bloomberg U.S. Aggregate Bond Index

|

3.38

|

-1.07

|

1.66

|

|

Net Assets

|

$2,701,609,209

|

Effective Duration

|

4.25 years

|

|

|

Number of Holdings

|

1,098

|

30-Day SEC Yield (Class A)

|

6.14%

|

|

|

Net Advisory Fee

|

$12,222,617

|

30-Day SEC Yield Unsubsidized (Class A)

|

6.14%

|

|

|

Portfolio Turnover

|

41%

|

Weighted Average Life

|

6.34 years

|

|

|

Average Credit Quality

|

BBB

|

Distribution Yield (Class A)

|

5.34%

|

|

Residential Mortgage-Backed Securities

|

47.3%

|

|

Asset-Backed Securities

|

18.4%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency

|

10.8%

|

|

Collateralized Loan Obligations

|

7.8%

|

|

Corporate Obligations

|

6.6%

|

|

Commercial Mortgage-Backed Securities

|

4.6%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency Credit Risk Transfer

|

4.1%

|

|

Commercial Mortgage-Backed Securities - U.S. Government Agency

|

3.2%

|

|

Money Market Funds

|

2.9%

|

|

Cash & Other

|

-5.7%

|

|

Federal National Mortgage Association

|

9.7%

|

|

Federal Home Loan Mortgage Corp.

|

7.8%

|

|

Saluda Grade Mortgage Funding LLC

|

4.0%

|

|

JP Morgan Mortgage Trust

|

4.0%

|

|

GS Mortgage-Backed Securities Trust

|

4.0%

|

|

First American Government Obligations Fund

|

2.9%

|

|

Exeter Automobile Receivables Trust

|

2.5%

|

|

Credit Suisse Mortgage Capital Certificates

|

2.4%

|

|

Helios Loan Funding Trust

|

2.3%

|

|

Verus Securitization Trust

|

2.1%

|

|

AAA

|

8.9%

|

|

AA

|

19.5%

|

|

A

|

5.8%

|

|

BBB

|

11.7%

|

|

BB

|

23.9%

|

|

B

|

5.4%

|

|

CCC

|

3.2%

|

|

CC

|

0.3%

|

|

C

|

0.1%

|

|

NR

|

21.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class C

|

$115

|

2.29%

|

|

Top Contributors

|

|

|

↑

|

Non-agency RMBS; ABS

|

|

Top Detractors

|

|

|

↓

|

Interest rate duration positioning

|

|

|

1 Year

|

5 Year

|

Since Inception

(08/04/2015) |

|

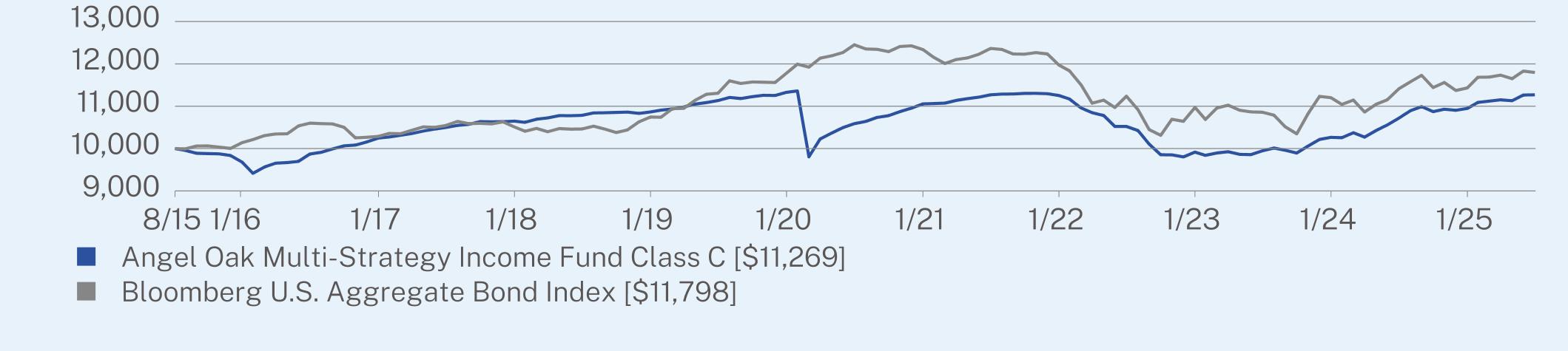

Class C (without sales charge)

|

5.14

|

1.25

|

1.20

|

|

Class C (with maximum 1.00% deferred sales charge)

|

4.14

|

1.25

|

1.20

|

|

Bloomberg U.S. Aggregate Bond Index

|

3.38

|

-1.07

|

1.67

|

|

Net Assets

|

$2,701,609,209

|

Effective Duration

|

4.25 years

|

|

|

Number of Holdings

|

1,098

|

30-Day SEC Yield (Class C)

|

5.53%

|

|

|

Net Advisory Fee

|

$12,222,617

|

30-Day SEC Yield Unsubsidized (Class C)

|

5.53%

|

|

|

Portfolio Turnover

|

41%

|

Weighted Average Life

|

6.34 years

|

|

|

Average Credit Quality

|

BBB

|

Distribution Yield (Class C)

|

4.64%

|

|

Residential Mortgage-Backed Securities

|

47.3%

|

|

Asset-Backed Securities

|

18.4%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency

|

10.8%

|

|

Collateralized Loan Obligations

|

7.8%

|

|

Corporate Obligations

|

6.6%

|

|

Commercial Mortgage-Backed Securities

|

4.6%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency Credit Risk Transfer

|

4.1%

|

|

Commercial Mortgage-Backed Securities - U.S. Government Agency

|

3.2%

|

|

Money Market Funds

|

2.9%

|

|

Cash & Other

|

-5.7%

|

|

Federal National Mortgage Association

|

9.7%

|

|

Federal Home Loan Mortgage Corp.

|

7.8%

|

|

Saluda Grade Mortgage Funding LLC

|

4.0%

|

|

JP Morgan Mortgage Trust

|

4.0%

|

|

GS Mortgage-Backed Securities Trust

|

4.0%

|

|

First American Government Obligations Fund

|

2.9%

|

|

Exeter Automobile Receivables Trust

|

2.5%

|

|

Credit Suisse Mortgage Capital Certificates

|

2.4%

|

|

Helios Loan Funding Trust

|

2.3%

|

|

Verus Securitization Trust

|

2.1%

|

|

AAA

|

8.9%

|

|

AA

|

19.5%

|

|

A

|

5.8%

|

|

BBB

|

11.7%

|

|

BB

|

23.9%

|

|

B

|

5.4%

|

|

CCC

|

3.2%

|

|

CC

|

0.3%

|

|

C

|

0.1%

|

|

NR

|

21.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Institutional Class

|

$65

|

1.29%

|

|

Top Contributors

|

|

|

↑

|

Non-agency RMBS; ABS

|

|

Top Detractors

|

|

|

↓

|

Interest rate duration positioning

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

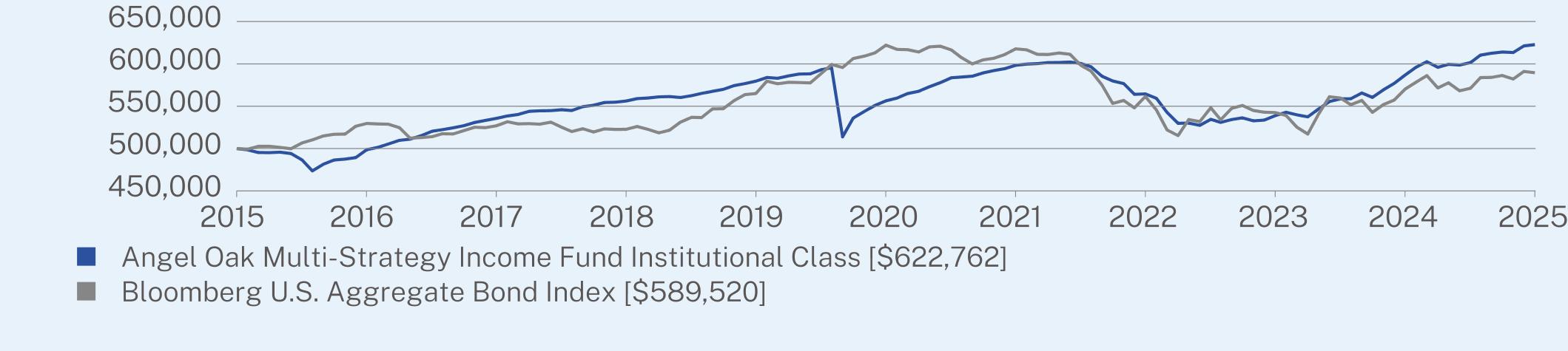

Institutional Class

|

6.13

|

2.28

|

2.22

|

|

Bloomberg U.S. Aggregate Bond Index

|

3.38

|

-1.07

|

1.66

|

|

Net Assets

|

$2,701,609,209

|

Effective Duration

|

4.25 years

|

|

|

Number of Holdings

|

1,098

|

30-Day SEC Yield (Institutional Class)

|

6.54%

|

|

|

Net Advisory Fee

|

$12,222,617

|

30-Day SEC Yield Unsubsidized (Institutional Class)

|

6.54%

|

|

|

Portfolio Turnover

|

41%

|

Weighted Average Life

|

6.34 years

|

|

|

Average Credit Quality

|

BBB

|

Distribution Yield (Institutional Class)

|

5.62%

|

|

Residential Mortgage-Backed Securities

|

47.3%

|

|

Asset-Backed Securities

|

18.4%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency

|

10.8%

|

|

Collateralized Loan Obligations

|

7.8%

|

|

Corporate Obligations

|

6.6%

|

|

Commercial Mortgage-Backed Securities

|

4.6%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency Credit Risk Transfer

|

4.1%

|

|

Commercial Mortgage-Backed Securities - U.S. Government Agency

|

3.2%

|

|

Money Market Funds

|

2.9%

|

|

Cash & Other

|

-5.7%

|

|

Federal National Mortgage Association

|

9.7%

|

|

Federal Home Loan Mortgage Corp.

|

7.8%

|

|

Saluda Grade Mortgage Funding LLC

|

4.0%

|

|

JP Morgan Mortgage Trust

|

4.0%

|

|

GS Mortgage-Backed Securities Trust

|

4.0%

|

|

First American Government Obligations Fund

|

2.9%

|

|

Exeter Automobile Receivables Trust

|

2.5%

|

|

Credit Suisse Mortgage Capital Certificates

|

2.4%

|

|

Helios Loan Funding Trust

|

2.3%

|

|

Verus Securitization Trust

|

2.1%

|

|

AAA

|

8.9%

|

|

AA

|

19.5%

|

|

A

|

5.8%

|

|

BBB

|

11.7%

|

|

BB

|

23.9%

|

|

B

|

5.4%

|

|

CCC

|

3.2%

|

|

CC

|

0.3%

|

|

C

|

0.1%

|

|

NR

|

21.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Class A

|

$30

|

0.60%

|

|

Top Contributors

|

|

|

↑

|

High income relative to performance benchmarks; investment-grade securitized credit

|

|

Top Detractors

|

|

|

↓

|

Cash and government allocations with lower yield versus credit sectors

|

|

|

1 Year

|

5 Year

|

Since Inception

(04/30/2018) |

|

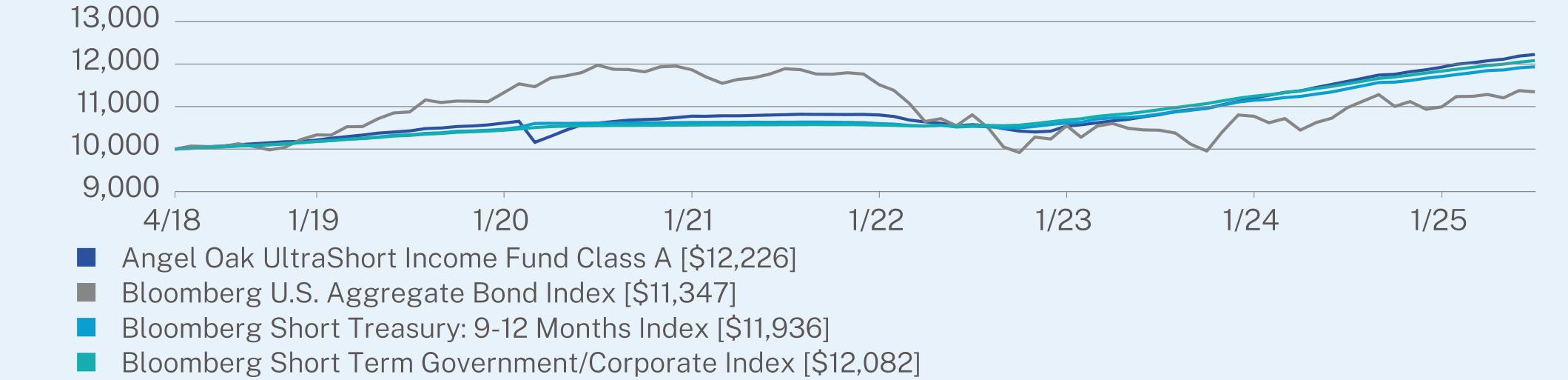

Class A

|

5.46

|

2.88

|

2.81

|

|

Bloomberg U.S. Aggregate Bond Index

|

3.38

|

-1.07

|

1.76

|

|

Bloomberg Short Treasury: 9-12 Months Index

|

4.52

|

2.38

|

2.47

|

|

Bloomberg Short Term Government/Corporate Index

|

4.72

|

2.75

|

2.64

|

|

Net Assets

|

$660,246,034

|

Effective Duration

|

0.79 years

|

|

|

Number of Holdings

|

437

|

30-Day SEC Yield (Class A)

|

4.70%

|

|

|

Net Advisory Fee

|

$705,667

|

30-Day SEC Yield Unsubsidized (Class A)

|

4.50%

|

|

|

Portfolio Turnover

|

38%

|

Weighted Average Life

|

1.58 years

|

|

|

Average Credit Quality

|

A

|

Distribution Yield (Class A)

|

4.82%

|

|

Asset-Backed Securities

|

31.3%

|

|

Commercial Mortgage-Backed Securities - U.S. Government Agency

|

18.3%

|

|

Corporate Obligations

|

16.1%

|

|

Collateralized Loan Obligations

|

14.7%

|

|

Residential Mortgage-Backed Securities

|

13.8%

|

|

Money Market Funds

|

3.0%

|

|

Commercial Mortgage-Backed Securities

|

2.9%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency Credit Risk Transfer

|

0.8%

|

|

Futures Contracts

|

0.2%

|

|

Cash & Other

|

-1.1%

|

|

Federal Home Loan Mortgage Corp.

|

18.0%

|

|

Pagaya AI Debt Selection Trust

|

9.4%

|

|

First American Government Obligations Fund

|

3.0%

|

|

Avis Budget Car Rental LLC

|

1.6%

|

|

Vista Point Securitization Trust

|

1.6%

|

|

GS Mortgage-Backed Securities Trust

|

1.5%

|

|

ACHV ABS Trust

|

1.4%

|

|

American Credit Acceptance Receivables Trust

|

1.4%

|

|

Onslow Bay Mortgage Loan Trust

|

1.3%

|

|

Federal National Mortgage Association

|

1.3%

|

|

AAA

|

31.5%

|

|

AA

|

25.3%

|

|

A

|

20.1%

|

|

BBB

|

18.2%

|

|

BB

|

2.4%

|

|

B

|

0.7%

|

|

CCC

|

0.0%

|

|

CC

|

0.0%

|

|

C

|

0.1%

|

|

NR

|

1.7%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

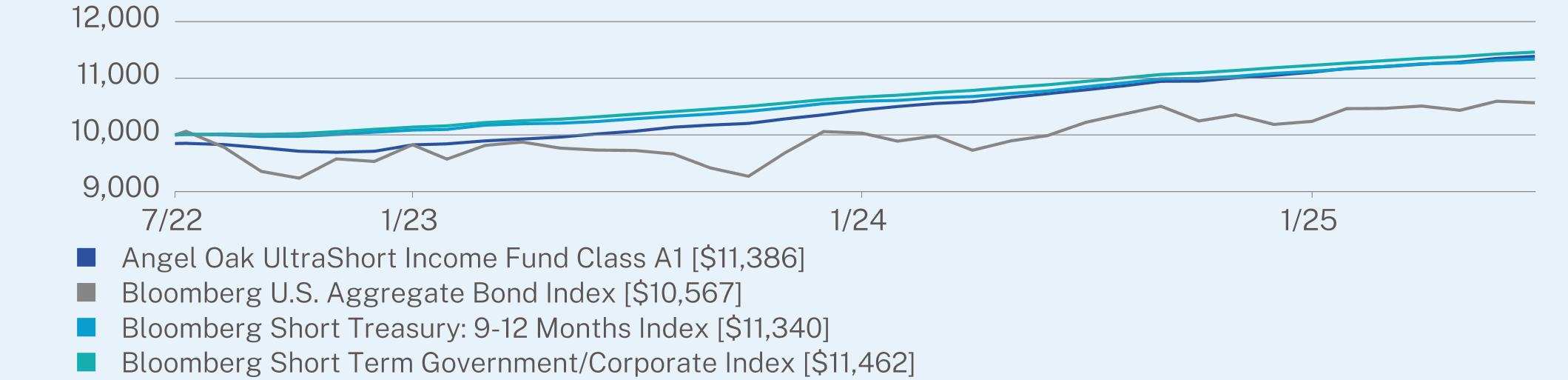

Class A1

|

$30

|

0.60%

|

|

Top Contributors

|

|

|

↑

|

High income relative to performance benchmarks; investment-grade securitized credit

|

|

Top Detractors

|

|

|

↓

|

Cash and government allocations with lower yield versus credit sectors

|

|

|

1 Year

|

Since Inception

(07/22/2022) |

|

Class A1 (without sales charge)

|

5.47

|

4.92

|

|

Class A1 (with maximum 1.50% sales charge)

|

3.39

|

4.39

|

|

Bloomberg U.S. Aggregate Bond Index

|

3.38

|

1.84

|

|

Bloomberg Short Treasury: 9-12 Months Index

|

4.52

|

4.24

|

|

Bloomberg Short Term Government/Corporate Index

|

4.72

|

4.62

|

|

Net Assets

|

$660,246,034

|

Effective Duration

|

0.79 years

|

|

|

Number of Holdings

|

437

|

30-Day SEC Yield (Class A1)

|

4.74%

|

|

|

Net Advisory Fee

|

$705,667

|

30-Day SEC Yield Unsubsidized (Class A1)

|

4.53%

|

|

|

Portfolio Turnover

|

38%

|

Weighted Average Life

|

1.58 years

|

|

|

Average Credit Quality

|

A

|

Distribution Yield (Class A1)

|

4.83%

|

|

Asset-Backed Securities

|

31.3%

|

|

Commercial Mortgage-Backed Securities - U.S. Government Agency

|

18.3%

|

|

Corporate Obligations

|

16.1%

|

|

Collateralized Loan Obligations

|

14.7%

|

|

Residential Mortgage-Backed Securities

|

13.8%

|

|

Money Market Funds

|

3.0%

|

|

Commercial Mortgage-Backed Securities

|

2.9%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency Credit Risk Transfer

|

0.8%

|

|

Futures Contracts

|

0.2%

|

|

Cash & Other

|

-1.1%

|

|

Federal Home Loan Mortgage Corp.

|

18.0%

|

|

Pagaya AI Debt Selection Trust

|

9.4%

|

|

First American Government Obligations Fund

|

3.0%

|

|

Avis Budget Car Rental LLC

|

1.6%

|

|

Vista Point Securitization Trust

|

1.6%

|

|

GS Mortgage-Backed Securities Trust

|

1.5%

|

|

ACHV ABS Trust

|

1.4%

|

|

American Credit Acceptance Receivables Trust

|

1.4%

|

|

Onslow Bay Mortgage Loan Trust

|

1.3%

|

|

Federal National Mortgage Association

|

1.3%

|

|

AAA

|

31.5%

|

|

AA

|

25.3%

|

|

A

|

20.1%

|

|

BBB

|

18.2%

|

|

BB

|

2.4%

|

|

B

|

0.7%

|

|

CCC

|

0.0%

|

|

CC

|

0.0%

|

|

C

|

0.1%

|

|

NR

|

1.7%

|

|

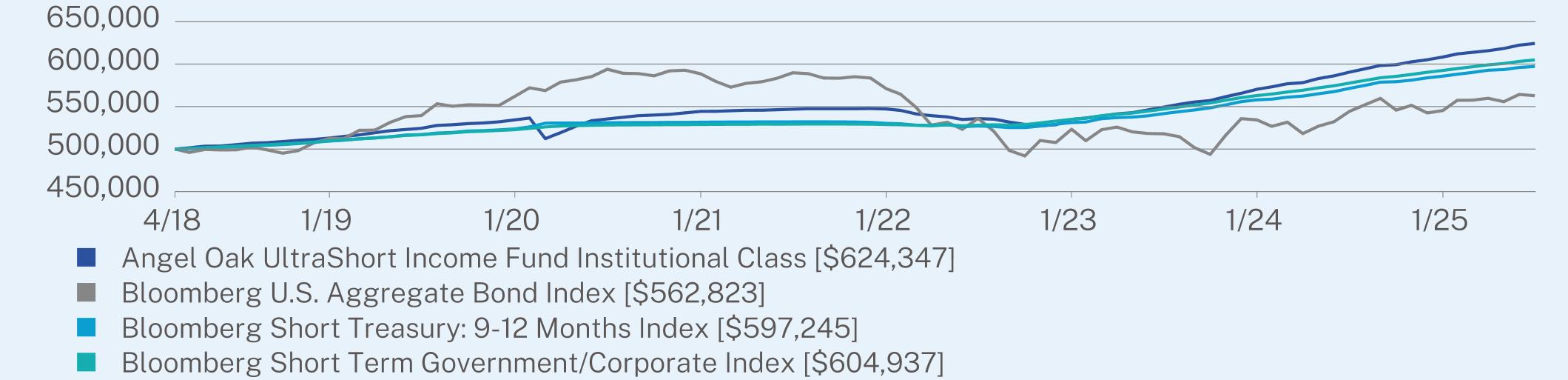

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Institutional Class

|

$18

|

0.35%

|

|

Top Contributors

|

|

|

↑

|

High income relative to performance benchmarks; investment-grade securitized credit

|

|

Top Detractors

|

|

|

↓

|

Cash and government allocations with lower yield versus credit sectors

|

|

|

1 Year

|

5 Year

|

Since Inception

(04/02/2018) |

|

Institutional Class

|

5.72

|

3.12

|

3.08

|

|

Bloomberg U.S. Aggregate Bond Index

|

3.38

|

-1.07

|

1.63

|

|

Bloomberg Short Treasury: 9-12 Months Index

|

4.52

|

2.38

|

2.45

|

|

Bloomberg Short Term Government/Corporate Index

|

4.72

|

2.75

|

2.63

|

|

Net Assets

|

$660,246,034

|

Effective Duration

|

0.79 years

|

|

|

Number of Holdings

|

437

|

30-Day SEC Yield (Institutional Class)

|

5.06%

|

|

|

Net Advisory Fee

|

$705,667

|

30-Day SEC Yield Unsubsidized (Institutional Class)

|

4.86%

|

|

|

Portfolio Turnover

|

38%

|

Weighted Average Life

|

1.58 years

|

|

|

Average Credit Quality

|

A

|

Distribution Yield (Institutional Class)

|

5.08%

|

|

Asset-Backed Securities

|

31.3%

|

|

Commercial Mortgage-Backed Securities - U.S. Government Agency

|

18.3%

|

|

Corporate Obligations

|

16.1%

|

|

Collateralized Loan Obligations

|

14.7%

|

|

Residential Mortgage-Backed Securities

|

13.8%

|

|

Money Market Funds

|

3.0%

|

|

Commercial Mortgage-Backed Securities

|

2.9%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency Credit Risk Transfer

|

0.8%

|

|

Futures Contracts

|

0.2%

|

|

Cash & Other

|

-1.1%

|

|

Federal Home Loan Mortgage Corp.

|

18.0%

|

|

Pagaya AI Debt Selection Trust

|

9.4%

|

|

First American Government Obligations Fund

|

3.0%

|

|

Avis Budget Car Rental LLC

|

1.6%

|

|

Vista Point Securitization Trust

|

1.6%

|

|

GS Mortgage-Backed Securities Trust

|

1.5%

|

|

ACHV ABS Trust

|

1.4%

|

|

American Credit Acceptance Receivables Trust

|

1.4%

|

|

Onslow Bay Mortgage Loan Trust

|

1.3%

|

|

Federal National Mortgage Association

|

1.3%

|

|

AAA

|

31.5%

|

|

AA

|

25.3%

|

|

A

|

20.1%

|

|

BBB

|

18.2%

|

|

BB

|

2.4%

|

|

B

|

0.7%

|

|

CCC

|

0.0%

|

|

CC

|

0.0%

|

|

C

|

0.1%

|

|

NR

|

1.7%

|

|

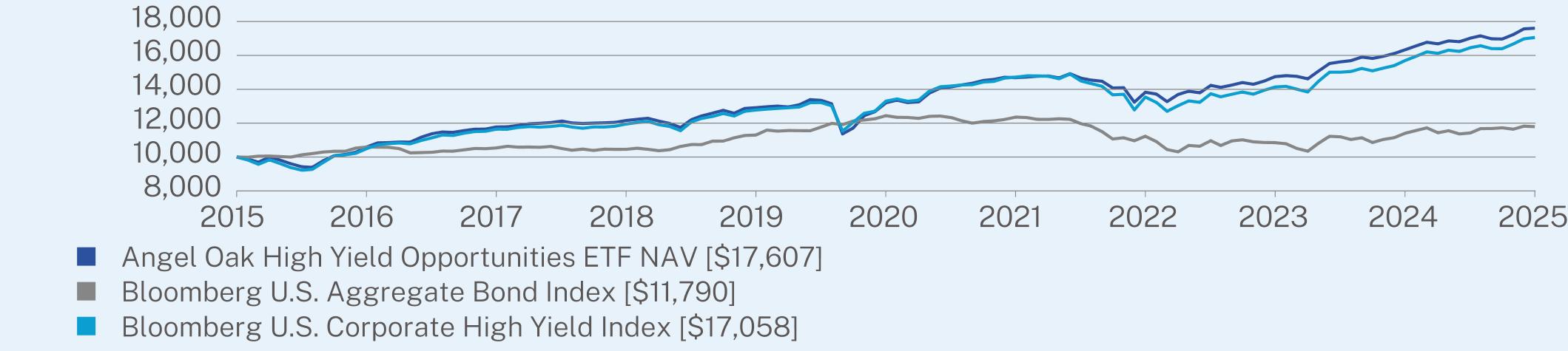

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Angel Oak High Yield Opportunities ETF

|

$28

|

0.55%

|

|

Top Contributors

|

|

|

↑

|

Overweight to HY securitized credit

|

|

Top Detractors

|

|

|

↓

|

Underweight to longer-duration BB-rated issuers during a period when the 5-year Treasury rallied 35 bps and returned 3.68%

|

|

↓

|

Underweight to higher-risk, higher-potential-return CCC-and-below-rated issuers during a period of outperformance

|

|

↓

|

Negative attribution from consumer cyclical holdings, driven primarily by security selection

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Angel Oak High Yield Opportunities ETF NAV

|

7.79

|

5.92

|

5.82

|

|

Bloomberg U.S. Aggregate Bond Index

|

3.38

|

-1.07

|

1.66

|

|

Bloomberg U.S. Corporate High Yield Index

|

8.67

|

5.09

|

5.49

|

|

Net Assets

|

$120,622,766

|

Effective Duration

|

2.87 years

|

|

|

Number of Holdings

|

246

|

30-Day SEC Yield

|

6.89%

|

|

|

Net Advisory Fee

|

$320,299

|

30-Day SEC Yield Unsubsidized

|

6.89%

|

|

|

Portfolio Turnover

|

16%

|

Weighted Average Life

|

3.60 years

|

|

|

Average Credit Quality

|

BB

|

Distribution Yield

|

7.00%

|

|

Financial

|

19.6%

|

|

Energy

|

15.8%

|

|

Consumer, Non-cyclical

|

12.8%

|

|

Industrial

|

12.0%

|

|

Consumer, Cyclical

|

10.1%

|

|

Basic Materials

|

7.6%

|

|

Communications

|

5.4%

|

|

Mortgage Securities

|

4.6%

|

|

Asset-Backed Securities

|

4.0%

|

|

Cash & Other

|

8.1%

|

|

First American Government Obligations Fund

|

3.8%

|

|

Venture Global LNG, Inc.

|

1.8%

|

|

Freedom Mortgage Holdings LLC

|

1.8%

|

|

goeasy Ltd.

|

1.4%

|

|

Directv Financing LLC / Directv Financing Co.-Obligor, Inc.

|

1.3%

|

|

Nationstar Mortgage Holdings, Inc.

|

1.2%

|

|

USA Compression Partners LP / USA Compression Finance Corp.

|

1.2%

|

|

Antero Midstream Partners LP / Antero Midstream Finance Corp.

|

1.1%

|

|

Consolidated Energy Finance SA

|

1.1%

|

|

Goodyear Tire & Rubber Co.

|

1.1%

|

|

AAA

|

3.6%

|

|

AA

|

0.5%

|

|

BBB

|

5.4%

|

|

BB

|

53.3%

|

|

B

|

30.4%

|

|

CCC

|

5.1%

|

|

CC

|

0.1%

|

|

NR

|

1.6%

|

|

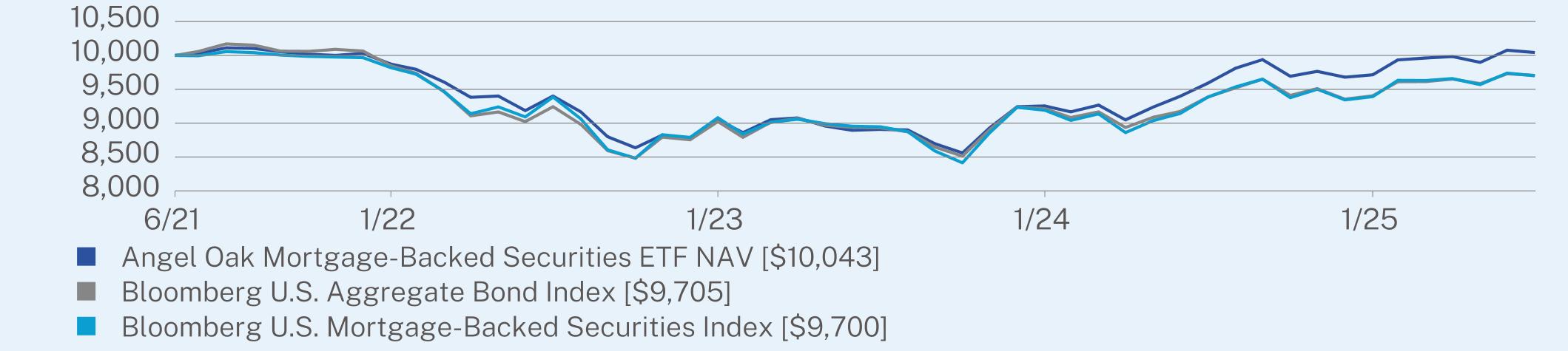

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

Angel Oak Mortgage-Backed Securities ETF

|

$25

|

0.49%

|

|

Top Contributors

|

|

|

↑

|

Investment-grade non-agency RMBS; non-QM subsector; underweight to agency RMBS

|

|

Top Detractors

|

|

|

↓

|

Overweight to higher-coupon agency RMBS

|

|

|

1 Year

|

Since Inception

(06/04/2021) |

|

Angel Oak Mortgage-Backed Securities ETF NAV

|

4.71

|

0.10

|

|

Bloomberg U.S. Aggregate Bond Index

|

3.38

|

-0.72

|

|

Bloomberg U.S. Mortgage-Backed Securities Index

|

3.36

|

-0.73

|

|

Net Assets

|

$128,726,825

|

Effective Duration

|

6.29 years

|

|

|

Number of Holdings

|

125

|

30-Day SEC Yield

|

4.69%

|

|

|

Net Advisory Fee

|

$425,487

|

30-Day SEC Yield Unsubsidized

|

4.39%

|

|

|

Portfolio Turnover

|

45%

|

Weighted Average Life

|

8.76 years

|

|

|

Average Credit Quality

|

AA

|

Distribution Yield

|

7.29%

|

|

Residential Mortgage-Backed Securities

|

60.5%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency

|

44.1%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency Credit Risk Transfer

|

15.5%

|

|

Money Market Funds

|

2.7%

|

|

Commercial Mortgage-Backed Securities - U.S. Government Agency

|

0.2%

|

|

Asset-Backed Securities

|

0.0%

|

|

Futures Contracts

|

-0.1%

|

|

Cash & Other

|

-22.9%

|

|

Federal National Mortgage Association

|

34.7%

|

|

Federal Home Loan Mortgage Corp.

|

25.0%

|

|

JP Morgan Mortgage Trust

|

7.6%

|

|

COLT Funding LLC

|

7.6%

|

|

Verus Securitization Trust

|

6.8%

|

|

Pretium Mortgage Credit Partners LLC

|

4.4%

|

|

PRPM LLC

|

3.6%

|

|

SGR Residential Mortgage Trust

|

3.0%

|

|

Credit Suisse Mortgage Capital Certificates

|

2.9%

|

|

First American Government Obligations Fund

|

2.7%

|

|

AAA

|

25.2%

|

|

AA

|

56.9%

|

|

A

|

4.4%

|

|

BBB

|

5.9%

|

|

BB

|

5.4%

|

|

B

|

0.9%

|

|

NR

|

1.3%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

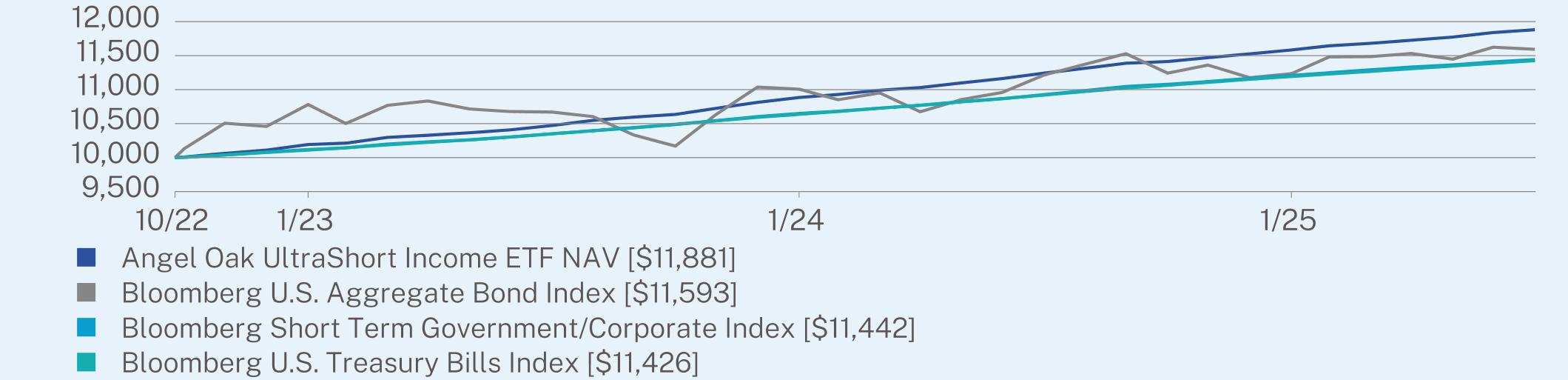

Angel Oak UltraShort Income ETF

|

$17

|

0.34%

|

|

Top Contributors

|

|

|

↑

|

High income relative to performance benchmarks; investment-grade securitized credit

|

|

Top Detractors

|

|

|

↓

|

Cash and government allocations with lower yield versus credit sectors

|

|

|

1 Year

|

Since Inception

(10/24/2022) |

|

Angel Oak UltraShort Income ETF NAV

|

5.69

|

6.43

|

|

Bloomberg U.S. Aggregate Bond Index

|

3.38

|

5.49

|

|

Bloomberg Short Term Government/Corporate Index

|

4.72

|

4.99

|

|

Bloomberg U.S. Treasury Bills Index

|

4.65

|

4.94

|

|

Net Assets

|

$1,050,024,683

|

Effective Duration

|

0.80 years

|

|

|

Number of Holdings

|

474

|

30-Day SEC Yield

|

5.04%

|

|

|

Net Advisory Fee

|

$1,454,778

|

30-Day SEC Yield Unsubsidized

|

4.83%

|

|

|

Portfolio Turnover

|

43%

|

Weighted Average Life

|

1.29 years

|

|

|

Average Credit Quality

|

A

|

Distribution Yield

|

5.37%

|

|

Asset-Backed Securities

|

28.8%

|

|

Corporate Obligations

|

17.5%

|

|

Collateralized Loan Obligations

|

16.1%

|

|

Commercial Mortgage-Backed Securities - U.S. Government Agency

|

14.8%

|

|

Residential Mortgage-Backed Securities

|

10.5%

|

|

Money Market Funds

|

10.4%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency Credit Risk Transfer

|

1.8%

|

|

Commercial Mortgage-Backed Securities

|

1.3%

|

|

Common Stocks

|

0.3%

|

|

Cash & Other

|

-1.5%

|

|

Federal Home Loan Mortgage Corp.

|

14.3%

|

|

First American Government Obligations Fund

|

10.4%

|

|

Pagaya AI Debt Selection Trust

|

8.4%

|

|

Federal National Mortgage Association

|

1.9%

|

|

ACHV ABS TRUST

|

1.9%

|

|

Avis Budget Car Rental LLC

|

1.8%

|

|

Vista Point Securitization Trust

|

1.6%

|

|

Apidos CLO Ltd.

|

1.6%

|

|

American Credit Acceptance Receivables Trust

|

1.5%

|

|

Marlette Funding Trust

|

1.4%

|

|

AAA

|

35.0%

|

|

AA

|

22.9%

|

|

A

|

18.7%

|

|

BBB

|

20.6%

|

|

BB

|

1.5%

|

|

B

|

0.6%

|

|

NR

|

0.7%

|

|

Fund Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment*

|

|

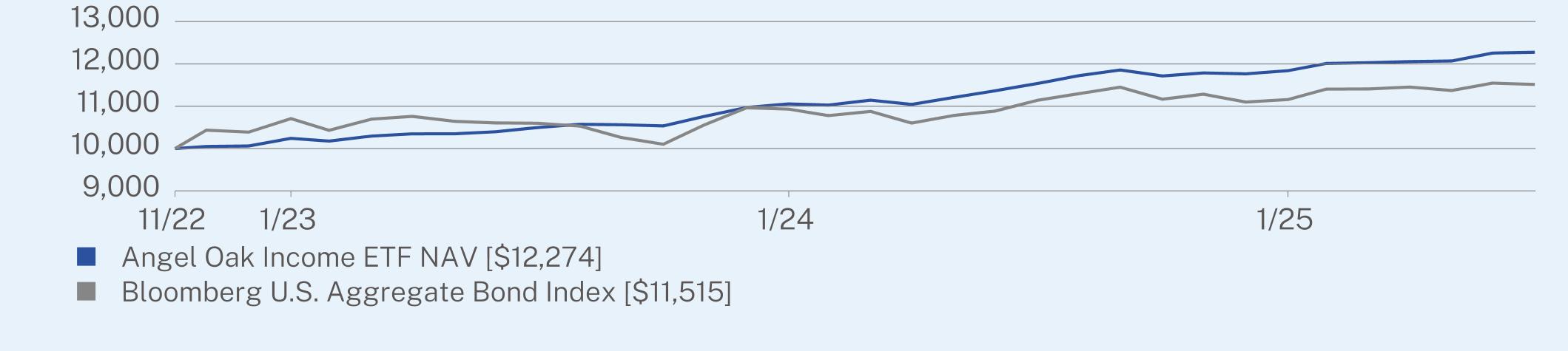

Angel Oak Income ETF

|

$40

|

0.79%

|

|

Top Contributors

|

|

|

↑

|

Non-agency RMBS; ABS

|

|

Top Detractors

|

|

|

↓

|

Interest rate duration positioning

|

|

|

1 Year

|

Since Inception

(11/07/2022) |

|

Angel Oak Income ETF NAV

|

6.41

|

7.80

|

|

Bloomberg U.S. Aggregate Bond Index

|

3.38

|

5.31

|

|

Net Assets

|

$551,639,271

|

Effective Duration

|

4.21 years

|

|

|

Number of Holdings

|

635

|

30-Day SEC Yield

|

5.82%

|

|

|

Net Advisory Fee

|

$1,772,845

|

30-Day SEC Yield Unsubsidized

|

5.62%

|

|

|

Portfolio Turnover

|

37%

|

Weighted Average Life

|

6.51 years

|

|

|

Average Credit Quality

|

BBB

|

Distribution Yield

|

6.25%

|

|

Residential Mortgage-Backed Securities

|

31.4%

|

|

Asset-Backed Securities

|

21.8%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency

|

20.1%

|

|

Collateralized Loan Obligations

|

10.9%

|

|

Corporate Obligations

|

6.6%

|

|

Commercial Mortgage-Backed Securities

|

3.8%

|

|

Exchange Traded Funds

|

3.7%

|

|

Money Market Funds

|

3.4%

|

|

Residential Mortgage-Backed Securities - U.S. Government Agency Credit Risk Transfer

|

0.3%

|

|

Cash & Other

|

-2.0%

|

|

Federal Home Loan Mortgage Corp.

|

10.0%

|

|

Federal National Mortgage Association

|

8.9%

|

|

Verus Securitization Trust

|

4.6%

|

|

First American Government Obligations Fund

|

3.4%

|

|

PRPM LLC

|

3.1%

|

|

JP Morgan Mortgage Trust

|

3.1%

|

|

Exeter Automobile Receivables Trust

|

3.1%

|

|

COLT Funding LLC

|

2.3%

|

|

CPS Auto Trust

|

2.3%

|

|

Ellington Financial Mortgage Trust

|

2.3%

|

|

AAA

|

6.8%

|

|

AA

|

22.7%

|

|

A

|

8.4%

|

|

BBB

|

16.3%

|

|

BB

|

30.2%

|

|

B

|

5.8%

|

|

CCC

|

0.1%

|

|

NR

|

9.7%

|

| [1] |

|

||

| [2] |

|

||

| [3] |

|

||

| [4] |

|

||

| [5] |

|

||

| [6] |

|

||

| [7] |

|

||

| [8] |

|

||

| [9] |

|

||

| [10] |

|

||

| [11] |

|

||

| [12] |

|

||

| [13] |

|

||

| [14] |

|

||

| [15] |

|

||

| [16] |

|

||

| [17] |

|

||

| [18] |

|

||

| [19] |

|

||

| [20] |

|