What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Institutional Shares | $142 | 1.37% |

How did the Fund perform last year?

For the reporting period ended July 31, 2025, the Fund's Institutional Shares returned 8.06%.

For the same period, the Fund’s benchmark, the Bloomberg Global Aggregate Bond Index, returned 4.40% and the ICE BofA 3 Month Treasury Bill Index, returned 4.57%.

What contributed to performance?

The Fund’s U.S. absolute return strategies led performance for the reporting period. Specifically, event-related trades, idiosyncratic long positions, and thematic trades all meaningfully contributed to results. European absolute return strategies, particularly event-related trades, also contributed.

Directional positions in European high yield, financials, and mezzanine collateralized loan obligations (“CLOs”) further contributed. In the United States, directional positions in high yield and short-term investment grade corporates were additive.

In European carry (income) strategies, allocations to bank loans and senior CLOs helped performance. U.S. carry strategies, particularly enhanced equipment trust certificates and bank loans, also performed well. The Fund’s cash position made a small contribution to absolute performance.

What detracted from performance?

At a time of positive returns for the fixed-income markets, detractors were limited to risk-management strategies in both the United States and Europe. The implementation of these strategies included the use of derivatives, which contributed to an elevated cash position.

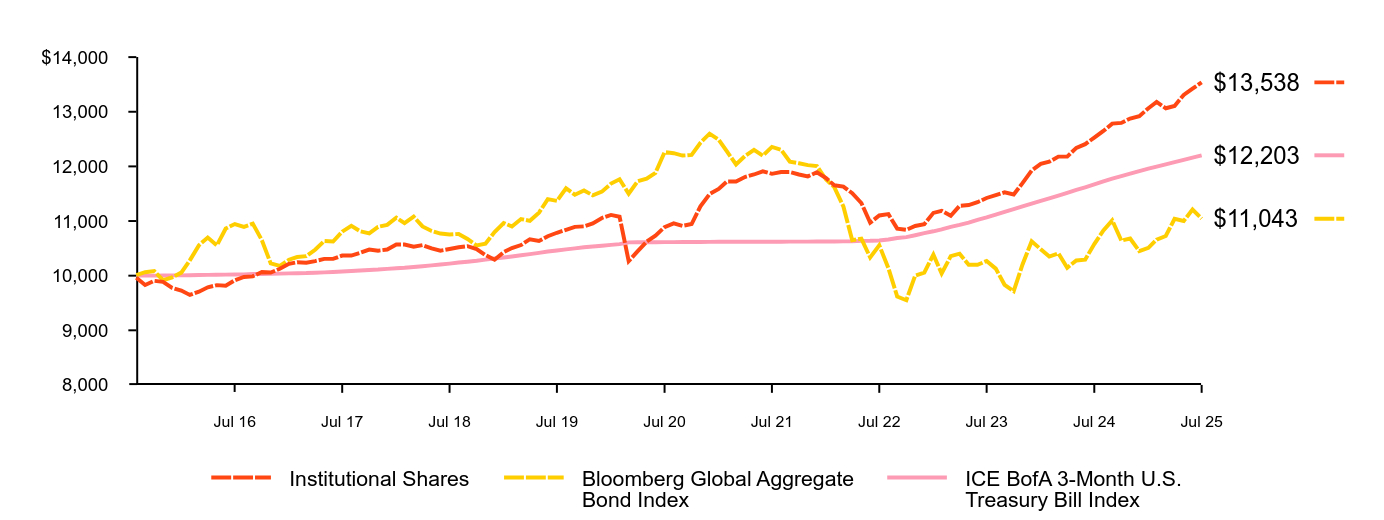

Fund performance

Cumulative performance: August 1, 2015 through July 31, 2025

Initial Investment of $10,000

Institutional Shares | Bloomberg Global Aggregate Bond Index | ICE BofA 3-Month U.S. Treasury Bill Index | |

|---|---|---|---|

Aug 15 | $9,962 | $10,012 | $10,001 |

Sep 15 | $9,829 | $10,063 | $10,002 |

Oct 15 | $9,905 | $10,084 | $10,001 |

Nov 15 | $9,886 | $9,917 | $10,002 |

Dec 15 | $9,777 | $9,970 | $10,005 |

Jan 16 | $9,727 | $10,056 | $10,005 |

Feb 16 | $9,647 | $10,280 | $10,008 |

Mar 16 | $9,707 | $10,558 | $10,012 |

Apr 16 | $9,787 | $10,698 | $10,015 |

May 16 | $9,827 | $10,555 | $10,016 |

Jun 16 | $9,817 | $10,863 | $10,019 |

Jul 16 | $9,917 | $10,945 | $10,022 |

Aug 16 | $9,977 | $10,892 | $10,024 |

Sep 16 | $9,987 | $10,952 | $10,029 |

Oct 16 | $10,067 | $10,648 | $10,032 |

Nov 16 | $10,057 | $10,225 | $10,033 |

Dec 16 | $10,127 | $10,178 | $10,038 |

Jan 17 | $10,217 | $10,292 | $10,042 |

Feb 17 | $10,247 | $10,341 | $10,046 |

Mar 17 | $10,237 | $10,357 | $10,048 |

Apr 17 | $10,267 | $10,474 | $10,055 |

May 17 | $10,307 | $10,636 | $10,060 |

Jun 17 | $10,307 | $10,626 | $10,068 |

Jul 17 | $10,368 | $10,805 | $10,077 |

Aug 17 | $10,368 | $10,912 | $10,086 |

Sep 17 | $10,418 | $10,814 | $10,095 |

Oct 17 | $10,478 | $10,773 | $10,104 |

Nov 17 | $10,458 | $10,893 | $10,112 |

Dec 17 | $10,478 | $10,930 | $10,124 |

Jan 18 | $10,569 | $11,061 | $10,136 |

Feb 18 | $10,569 | $10,962 | $10,145 |

Mar 18 | $10,529 | $11,079 | $10,159 |

Apr 18 | $10,559 | $10,902 | $10,173 |

May 18 | $10,498 | $10,819 | $10,188 |

Jun 18 | $10,458 | $10,771 | $10,205 |

Jul 18 | $10,488 | $10,753 | $10,221 |

Aug 18 | $10,519 | $10,764 | $10,240 |

Sep 18 | $10,539 | $10,671 | $10,256 |

Oct 18 | $10,488 | $10,552 | $10,273 |

Nov 18 | $10,377 | $10,585 | $10,294 |

Dec 18 | $10,292 | $10,799 | $10,313 |

Jan 19 | $10,431 | $10,964 | $10,334 |

Feb 19 | $10,506 | $10,900 | $10,352 |

Mar 19 | $10,560 | $11,037 | $10,375 |

Apr 19 | $10,667 | $11,004 | $10,395 |

May 19 | $10,635 | $11,153 | $10,418 |

Jun 19 | $10,721 | $11,401 | $10,441 |

Jul 19 | $10,785 | $11,369 | $10,460 |

Aug 19 | $10,839 | $11,600 | $10,482 |

Sep 19 | $10,893 | $11,482 | $10,500 |

Oct 19 | $10,903 | $11,558 | $10,520 |

Nov 19 | $10,957 | $11,471 | $10,533 |

Dec 19 | $11,056 | $11,538 | $10,549 |

Jan 20 | $11,112 | $11,685 | $10,563 |

Feb 20 | $11,079 | $11,764 | $10,578 |

Mar 20 | $10,266 | $11,500 | $10,609 |

Apr 20 | $10,444 | $11,726 | $10,610 |

May 20 | $10,622 | $11,777 | $10,610 |

Jun 20 | $10,733 | $11,882 | $10,611 |

Jul 20 | $10,889 | $12,261 | $10,614 |

Aug 20 | $10,956 | $12,242 | $10,614 |

Sep 20 | $10,912 | $12,198 | $10,616 |

Oct 20 | $10,945 | $12,210 | $10,617 |

Nov 20 | $11,268 | $12,432 | $10,618 |

Dec 20 | $11,493 | $12,599 | $10,619 |

Jan 21 | $11,586 | $12,488 | $10,620 |

Feb 21 | $11,725 | $12,273 | $10,621 |

Mar 21 | $11,725 | $12,037 | $10,622 |

Apr 21 | $11,806 | $12,189 | $10,622 |

May 21 | $11,852 | $12,303 | $10,622 |

Jun 21 | $11,910 | $12,195 | $10,622 |

Jul 21 | $11,864 | $12,357 | $10,622 |

Aug 21 | $11,898 | $12,306 | $10,622 |

Sep 21 | $11,898 | $12,087 | $10,623 |

Oct 21 | $11,852 | $12,058 | $10,623 |

Nov 21 | $11,817 | $12,023 | $10,623 |

Dec 21 | $11,893 | $12,006 | $10,624 |

Jan 22 | $11,785 | $11,760 | $10,624 |

Feb 22 | $11,654 | $11,620 | $10,625 |

Mar 22 | $11,630 | $11,266 | $10,628 |

Apr 22 | $11,510 | $10,649 | $10,630 |

May 22 | $11,330 | $10,678 | $10,637 |

Jun 22 | $10,970 | $10,335 | $10,639 |

Jul 22 | $11,102 | $10,555 | $10,645 |

Aug 22 | $11,126 | $10,138 | $10,662 |

Sep 22 | $10,862 | $9,618 | $10,689 |

Oct 22 | $10,838 | $9,551 | $10,705 |

Nov 22 | $10,910 | $10,001 | $10,740 |

Dec 22 | $10,941 | $10,055 | $10,779 |

Jan 23 | $11,149 | $10,385 | $10,812 |

Feb 23 | $11,188 | $10,040 | $10,848 |

Mar 23 | $11,097 | $10,357 | $10,894 |

Apr 23 | $11,279 | $10,403 | $10,929 |

May 23 | $11,292 | $10,200 | $10,972 |

Jun 23 | $11,344 | $10,199 | $11,022 |

Jul 23 | $11,422 | $10,269 | $11,066 |

Aug 23 | $11,473 | $10,129 | $11,116 |

Sep 23 | $11,525 | $9,833 | $11,167 |

Oct 23 | $11,486 | $9,716 | $11,216 |

Nov 23 | $11,694 | $10,205 | $11,267 |

Dec 23 | $11,925 | $10,630 | $11,319 |

Jan 24 | $12,045 | $10,483 | $11,368 |

Feb 24 | $12,085 | $10,351 | $11,414 |

Mar 24 | $12,179 | $10,408 | $11,465 |

Apr 24 | $12,179 | $10,146 | $11,515 |

May 24 | $12,340 | $10,279 | $11,570 |

Jun 24 | $12,407 | $10,293 | $11,617 |

Jul 24 | $12,528 | $10,578 | $11,669 |

Aug 24 | $12,649 | $10,828 | $11,725 |

Sep 24 | $12,783 | $11,012 | $11,776 |

Oct 24 | $12,796 | $10,643 | $11,821 |

Nov 24 | $12,877 | $10,679 | $11,866 |

Dec 24 | $12,920 | $10,450 | $11,914 |

Jan 25 | $13,064 | $10,510 | $11,958 |

Feb 25 | $13,179 | $10,660 | $11,996 |

Mar 25 | $13,064 | $10,726 | $12,036 |

Apr 25 | $13,107 | $11,041 | $12,077 |

May 25 | $13,308 | $11,002 | $12,121 |

Jun 25 | $13,423 | $11,210 | $12,161 |

Jul 25 | $13,538 | $11,043 | $12,203 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Institutional Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.06% | 4.45% | 3.08% |

Bloomberg Global Aggregate Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.40 | (2.07) | 1.00 |

ICE BofA 3-Month U.S. Treasury Bill Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.57 | 2.83 | 2.01 |

The Fund's returns shown prior to May 5, 2025 are the returns of the Fund when it followed different investment strategies under the name BlackRock Global Long/Short Credit Fund.

On September 17, 2018, the Fund acquired all of the assets, subject to the liabilities, of BlackRock Credit Relative Value Fund (the “Predecessor Fund”), a series of BlackRock FundsSM, through a tax-free reorganization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization.

On December 1, 2023, the Fund began to compare its performance to the standard pricing time of the ICE BofA 3-Month U.S. Treasury Bill Index (the “Index”). Index data prior to March 1, 2021 is for the Index’s standard pricing time of 3pm. Index data from March 1, 2021 through November 30, 2023 is for a custom 4pm pricing variant of the Index. Index returns beginning on December 1, 2023 reflect the Index’s new standard pricing time of 4pm. The change of the Index’s standard pricing time from 3pm to 4pm resulted in the discontinuation of the custom 4pm pricing variant used from March 1, 2021 through November 30, 2023.

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $818,857,957 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 835 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $7,695,241 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 113% |

Geographic allocation

Credit quality allocation

Percent of Total

InvestmentsFootnote Reference(a) | |||

|---|---|---|---|

Country/Geographic Region | Long | Short | Total |

United States........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 53.6% | 1.3% | 54.9% |

United Kingdom........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.8 | 0.1 | 7.9 |

Ireland........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.0 | - | 7.0 |

Germany........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.8 | - | 4.8 |

France........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.2 | - | 4.2 |

Luxembourg........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.5 | - | 3.5 |

Italy........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.8 | 0.5 | 3.3 |

Portugal........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.7 | - | 1.7 |

Netherlands........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.5 | - | 1.5 |

Canada........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.2 | - | 1.2 |

OtherFootnote Reference(b) | 9.5 | 0.5 | 10.0 |

Total........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 97.6% | 2.4% | 100.0% |

Credit RatingFootnote Reference(c) | Percent of Total InvestmentsFootnote Reference(d) |

|---|---|

AAA/AaaFootnote Reference(e)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.4% |

A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.8 |

BBB/Baa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.5 |

BB/Ba........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 26.9 |

B........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 33.9 |

CCC/Caa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.3 |

CC/Ca........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.1 |

N/R........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 17.1 |

| Footnote | Description |

Footnote(a) | Includes the gross market value of long and short securities and excludes short-term securities and options, if any. |

Footnote(b) | Ten largest countries/geographic regions are presented. Additional countries/geographic regions are found in Other. |

Footnote(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Footnote(d) | Excludes short-term securities, short investments and options, if any. |

Footnote(e) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Investor A Shares | $163 | 1.57% |

How did the Fund perform last year?

For the reporting period ended July 31, 2025, the Fund's Investor A Shares returned 7.90%.

For the same period, the Fund’s benchmark, the Bloomberg Global Aggregate Bond Index, returned 4.40% and the ICE BofA 3 Month Treasury Bill Index, returned 4.57%.

What contributed to performance?

The Fund’s U.S. absolute return strategies led performance for the reporting period. Specifically, event-related trades, idiosyncratic long positions, and thematic trades all meaningfully contributed to results. European absolute return strategies, particularly event-related trades, also contributed.

Directional positions in European high yield, financials, and mezzanine collateralized loan obligations (“CLOs”) further contributed. In the United States, directional positions in high yield and short-term investment grade corporates were additive.

In European carry (income) strategies, allocations to bank loans and senior CLOs helped performance. U.S. carry strategies, particularly enhanced equipment trust certificates and bank loans, also performed well. The Fund’s cash position made a small contribution to absolute performance.

What detracted from performance?

At a time of positive returns for the fixed-income markets, detractors were limited to risk-management strategies in both the United States and Europe. The implementation of these strategies included the use of derivatives, which contributed to an elevated cash position.

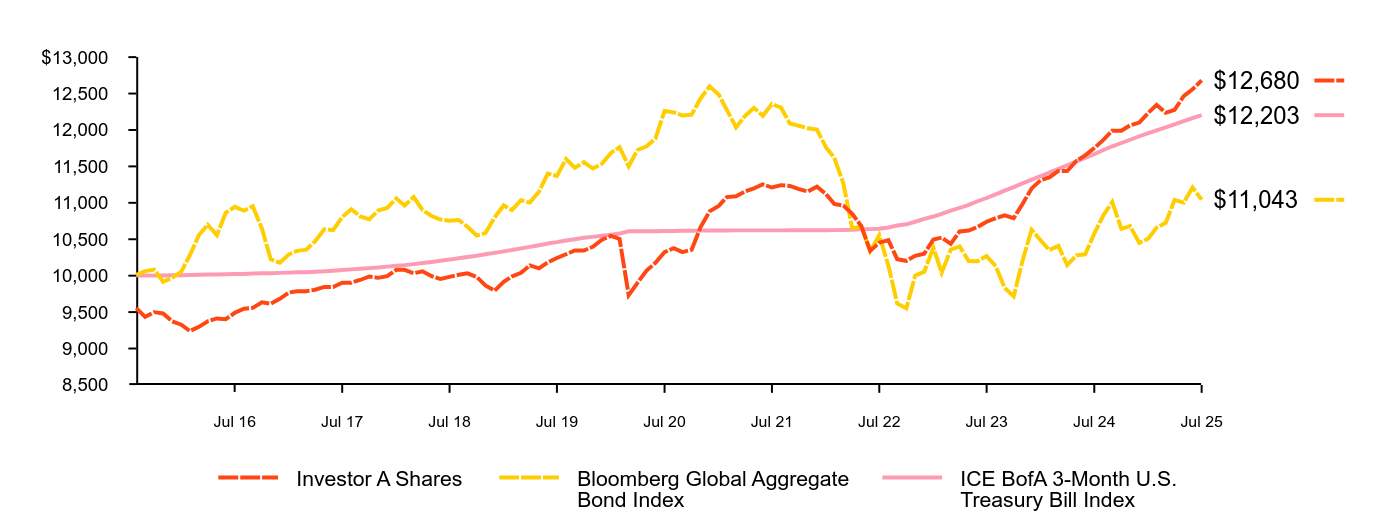

Fund performance

Cumulative performance: August 1, 2015 through July 31, 2025

Initial Investment of $10,000

Investor A Shares | Bloomberg Global Aggregate Bond Index | ICE BofA 3-Month U.S. Treasury Bill Index | |

|---|---|---|---|

Aug 15 | $9,554 | $10,012 | $10,001 |

Sep 15 | $9,435 | $10,063 | $10,002 |

Oct 15 | $9,499 | $10,084 | $10,001 |

Nov 15 | $9,481 | $9,917 | $10,002 |

Dec 15 | $9,374 | $9,970 | $10,005 |

Jan 16 | $9,326 | $10,056 | $10,005 |

Feb 16 | $9,240 | $10,280 | $10,008 |

Mar 16 | $9,298 | $10,558 | $10,012 |

Apr 16 | $9,374 | $10,698 | $10,015 |

May 16 | $9,413 | $10,555 | $10,016 |

Jun 16 | $9,403 | $10,863 | $10,019 |

Jul 16 | $9,490 | $10,945 | $10,022 |

Aug 16 | $9,547 | $10,892 | $10,024 |

Sep 16 | $9,557 | $10,952 | $10,029 |

Oct 16 | $9,634 | $10,648 | $10,032 |

Nov 16 | $9,615 | $10,225 | $10,033 |

Dec 16 | $9,682 | $10,178 | $10,038 |

Jan 17 | $9,768 | $10,292 | $10,042 |

Feb 17 | $9,787 | $10,341 | $10,046 |

Mar 17 | $9,787 | $10,357 | $10,048 |

Apr 17 | $9,807 | $10,474 | $10,055 |

May 17 | $9,845 | $10,636 | $10,060 |

Jun 17 | $9,845 | $10,626 | $10,068 |

Jul 17 | $9,903 | $10,805 | $10,077 |

Aug 17 | $9,903 | $10,912 | $10,086 |

Sep 17 | $9,941 | $10,814 | $10,095 |

Oct 17 | $9,989 | $10,773 | $10,104 |

Nov 17 | $9,970 | $10,893 | $10,112 |

Dec 17 | $9,993 | $10,930 | $10,124 |

Jan 18 | $10,080 | $11,061 | $10,136 |

Feb 18 | $10,080 | $10,962 | $10,145 |

Mar 18 | $10,032 | $11,079 | $10,159 |

Apr 18 | $10,061 | $10,902 | $10,173 |

May 18 | $9,993 | $10,819 | $10,188 |

Jun 18 | $9,954 | $10,771 | $10,205 |

Jul 18 | $9,983 | $10,753 | $10,221 |

Aug 18 | $10,012 | $10,764 | $10,240 |

Sep 18 | $10,032 | $10,671 | $10,256 |

Oct 18 | $9,983 | $10,552 | $10,273 |

Nov 18 | $9,867 | $10,585 | $10,294 |

Dec 18 | $9,794 | $10,799 | $10,313 |

Jan 19 | $9,916 | $10,964 | $10,334 |

Feb 19 | $9,988 | $10,900 | $10,352 |

Mar 19 | $10,039 | $11,037 | $10,375 |

Apr 19 | $10,141 | $11,004 | $10,395 |

May 19 | $10,100 | $11,153 | $10,418 |

Jun 19 | $10,182 | $11,401 | $10,441 |

Jul 19 | $10,243 | $11,369 | $10,460 |

Aug 19 | $10,294 | $11,600 | $10,482 |

Sep 19 | $10,345 | $11,482 | $10,500 |

Oct 19 | $10,345 | $11,558 | $10,520 |

Nov 19 | $10,396 | $11,471 | $10,533 |

Dec 19 | $10,493 | $11,538 | $10,549 |

Jan 20 | $10,546 | $11,685 | $10,563 |

Feb 20 | $10,504 | $11,764 | $10,578 |

Mar 20 | $9,733 | $11,500 | $10,609 |

Apr 20 | $9,902 | $11,726 | $10,610 |

May 20 | $10,071 | $11,777 | $10,610 |

Jun 20 | $10,176 | $11,882 | $10,611 |

Jul 20 | $10,324 | $12,261 | $10,614 |

Aug 20 | $10,377 | $12,242 | $10,614 |

Sep 20 | $10,324 | $12,198 | $10,616 |

Oct 20 | $10,356 | $12,210 | $10,617 |

Nov 20 | $10,663 | $12,432 | $10,618 |

Dec 20 | $10,882 | $12,599 | $10,619 |

Jan 21 | $10,958 | $12,488 | $10,620 |

Feb 21 | $11,079 | $12,273 | $10,621 |

Mar 21 | $11,090 | $12,037 | $10,622 |

Apr 21 | $11,155 | $12,189 | $10,622 |

May 21 | $11,199 | $12,303 | $10,622 |

Jun 21 | $11,254 | $12,195 | $10,622 |

Jul 21 | $11,210 | $12,357 | $10,622 |

Aug 21 | $11,243 | $12,306 | $10,622 |

Sep 21 | $11,232 | $12,087 | $10,623 |

Oct 21 | $11,188 | $12,058 | $10,623 |

Nov 21 | $11,155 | $12,023 | $10,623 |

Dec 21 | $11,222 | $12,006 | $10,624 |

Jan 22 | $11,121 | $11,760 | $10,624 |

Feb 22 | $10,985 | $11,620 | $10,625 |

Mar 22 | $10,962 | $11,266 | $10,628 |

Apr 22 | $10,849 | $10,649 | $10,630 |

May 22 | $10,679 | $10,678 | $10,637 |

Jun 22 | $10,340 | $10,335 | $10,639 |

Jul 22 | $10,453 | $10,555 | $10,645 |

Aug 22 | $10,487 | $10,138 | $10,662 |

Sep 22 | $10,227 | $9,618 | $10,689 |

Oct 22 | $10,204 | $9,551 | $10,705 |

Nov 22 | $10,272 | $10,001 | $10,740 |

Dec 22 | $10,302 | $10,055 | $10,779 |

Jan 23 | $10,497 | $10,385 | $10,812 |

Feb 23 | $10,522 | $10,040 | $10,848 |

Mar 23 | $10,437 | $10,357 | $10,894 |

Apr 23 | $10,607 | $10,403 | $10,929 |

May 23 | $10,619 | $10,200 | $10,972 |

Jun 23 | $10,668 | $10,199 | $11,022 |

Jul 23 | $10,741 | $10,269 | $11,066 |

Aug 23 | $10,790 | $10,129 | $11,116 |

Sep 23 | $10,827 | $9,833 | $11,167 |

Oct 23 | $10,790 | $9,716 | $11,216 |

Nov 23 | $10,985 | $10,205 | $11,267 |

Dec 23 | $11,198 | $10,630 | $11,319 |

Jan 24 | $11,311 | $10,483 | $11,368 |

Feb 24 | $11,349 | $10,351 | $11,414 |

Mar 24 | $11,437 | $10,408 | $11,465 |

Apr 24 | $11,437 | $10,146 | $11,515 |

May 24 | $11,575 | $10,279 | $11,570 |

Jun 24 | $11,651 | $10,293 | $11,617 |

Jul 24 | $11,751 | $10,578 | $11,669 |

Aug 24 | $11,864 | $10,828 | $11,725 |

Sep 24 | $11,990 | $11,012 | $11,776 |

Oct 24 | $11,990 | $10,643 | $11,821 |

Nov 24 | $12,065 | $10,679 | $11,866 |

Dec 24 | $12,102 | $10,450 | $11,914 |

Jan 25 | $12,236 | $10,510 | $11,958 |

Feb 25 | $12,344 | $10,660 | $11,996 |

Mar 25 | $12,236 | $10,726 | $12,036 |

Apr 25 | $12,277 | $11,041 | $12,077 |

May 25 | $12,465 | $11,002 | $12,121 |

Jun 25 | $12,559 | $11,210 | $12,161 |

Jul 25 | $12,680 | $11,043 | $12,203 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Investor A Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.90% | 4.20% | 2.82% |

Investor A Shares (with sales charge)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.58 | 3.35 | 2.40 |

Bloomberg Global Aggregate Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.40 | (2.07) | 1.00 |

ICE BofA 3-Month U.S. Treasury Bill Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.57 | 2.83 | 2.01 |

Assuming maximum sales charges. Average annual total returns with and without sales charges reflect reductions for service fees.

The Fund's returns shown prior to May 5, 2025 are the returns of the Fund when it followed different investment strategies under the name BlackRock Global Long/Short Credit Fund.

On September 17, 2018, the Fund acquired all of the assets, subject to the liabilities, of BlackRock Credit Relative Value Fund (the “Predecessor Fund”), a series of BlackRock FundsSM, through a tax-free reorganization (the “Reorganization”). The Predecessor Fund is the performance and accounting survivor of the Reorganization.

On December 1, 2023, the Fund began to compare its performance to the standard pricing time of the ICE BofA 3-Month U.S. Treasury Bill Index (the “Index”). Index data prior to March 1, 2021 is for the Index’s standard pricing time of 3pm. Index data from March 1, 2021 through November 30, 2023 is for a custom 4pm pricing variant of the Index. Index returns beginning on December 1, 2023 reflect the Index’s new standard pricing time of 4pm. The change of the Index’s standard pricing time from 3pm to 4pm resulted in the discontinuation of the custom 4pm pricing variant used from March 1, 2021 through November 30, 2023.

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $818,857,957 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 835 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $7,695,241 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 113% |

Geographic allocation

Credit quality allocation

Percent of Total

InvestmentsFootnote Reference(a) | |||

|---|---|---|---|

Country/Geographic Region | Long | Short | Total |

United States........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 53.6% | 1.3% | 54.9% |

United Kingdom........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.8 | 0.1 | 7.9 |

Ireland........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.0 | - | 7.0 |

Germany........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.8 | - | 4.8 |

France........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.2 | - | 4.2 |

Luxembourg........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.5 | - | 3.5 |

Italy........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.8 | 0.5 | 3.3 |

Portugal........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.7 | - | 1.7 |

Netherlands........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.5 | - | 1.5 |

Canada........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.2 | - | 1.2 |

OtherFootnote Reference(b) | 9.5 | 0.5 | 10.0 |

Total........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 97.6% | 2.4% | 100.0% |

Credit RatingFootnote Reference(c) | Percent of Total InvestmentsFootnote Reference(d) |

|---|---|

AAA/AaaFootnote Reference(e)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.4% |

A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.8 |

BBB/Baa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 9.5 |

BB/Ba........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 26.9 |

B........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 33.9 |

CCC/Caa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.3 |

CC/Ca........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.1 |

N/R........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 17.1 |

| Footnote | Description |

Footnote(a) | Includes the gross market value of long and short securities and excludes short-term securities and options, if any. |

Footnote(b) | Ten largest countries/geographic regions are presented. Additional countries/geographic regions are found in Other. |

Footnote(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

Footnote(d) | Excludes short-term securities, short investments and options, if any. |

Footnote(e) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Investor C Shares | $240 | 2.32% |

How did the Fund perform last year?

For the reporting period ended July 31, 2025, the Fund's Investor C Shares returned 7.03%.

For the same period, the Fund’s benchmark, the Bloomberg Global Aggregate Bond Index, returned 4.40% and the ICE BofA 3 Month Treasury Bill Index, returned 4.57%.

What contributed to performance?

The Fund’s U.S. absolute return strategies led performance for the reporting period. Specifically, event-related trades, idiosyncratic long positions, and thematic trades all meaningfully contributed to results. European absolute return strategies, particularly event-related trades, also contributed.

Directional positions in European high yield, financials, and mezzanine collateralized loan obligations (“CLOs”) further contributed. In the United States, directional positions in high yield and short-term investment grade corporates were additive.

In European carry (income) strategies, allocations to bank loans and senior CLOs helped performance. U.S. carry strategies, particularly enhanced equipment trust certificates and bank loans, also performed well. The Fund’s cash position made a small contribution to absolute performance.

What detracted from performance?

At a time of positive returns for the fixed-income markets, detractors were limited to risk-management strategies in both the United States and Europe. The implementation of these strategies included the use of derivatives, which contributed to an elevated cash position.

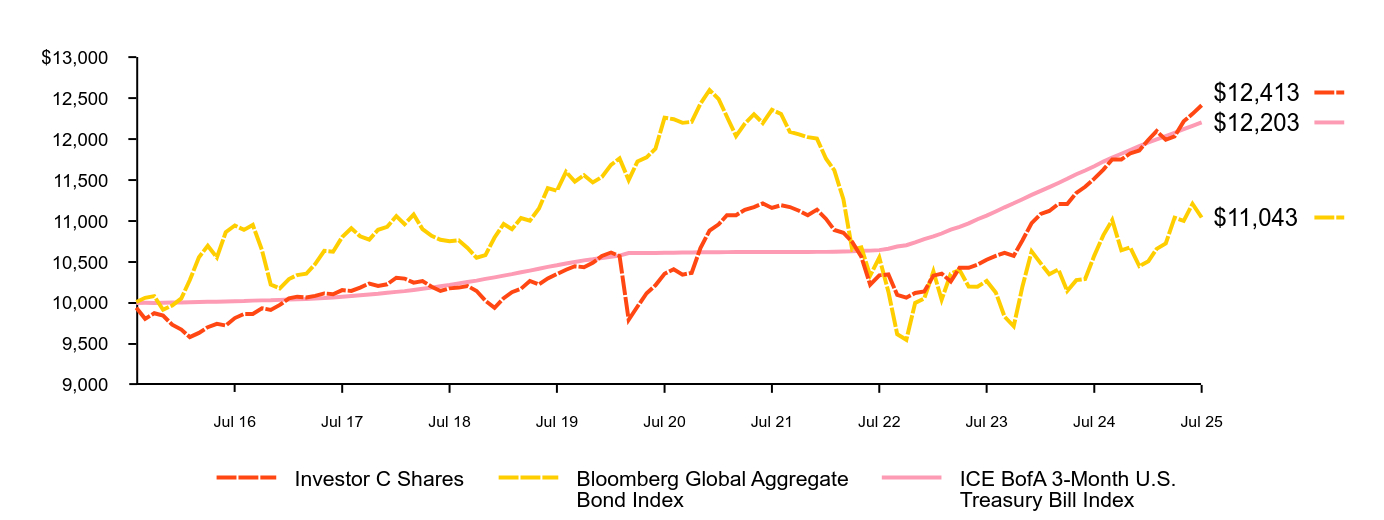

Fund performance

Cumulative performance: August 1, 2015 through July 31, 2025

Initial Investment of $10,000

Investor C Shares | Bloomberg Global Aggregate Bond Index | ICE BofA 3-Month U.S. Treasury Bill Index | |

|---|---|---|---|

Aug 15 | $9,942 | $10,012 | $10,001 |

Sep 15 | $9,807 | $10,063 | $10,002 |

Oct 15 | $9,875 | $10,084 | $10,001 |

Nov 15 | $9,846 | $9,917 | $10,002 |

Dec 15 | $9,735 | $9,970 | $10,005 |

Jan 16 | $9,675 | $10,056 | $10,005 |

Feb 16 | $9,584 | $10,280 | $10,008 |

Mar 16 | $9,635 | $10,558 | $10,012 |

Apr 16 | $9,705 | $10,698 | $10,015 |

May 16 | $9,745 | $10,555 | $10,016 |

Jun 16 | $9,725 | $10,863 | $10,019 |

Jul 16 | $9,816 | $10,945 | $10,022 |

Aug 16 | $9,866 | $10,892 | $10,024 |

Sep 16 | $9,866 | $10,952 | $10,029 |

Oct 16 | $9,936 | $10,648 | $10,032 |

Nov 16 | $9,916 | $10,225 | $10,033 |

Dec 16 | $9,976 | $10,178 | $10,038 |

Jan 17 | $10,057 | $10,292 | $10,042 |

Feb 17 | $10,077 | $10,341 | $10,046 |

Mar 17 | $10,067 | $10,357 | $10,048 |

Apr 17 | $10,087 | $10,474 | $10,055 |

May 17 | $10,117 | $10,636 | $10,060 |

Jun 17 | $10,107 | $10,626 | $10,068 |

Jul 17 | $10,157 | $10,805 | $10,077 |

Aug 17 | $10,147 | $10,912 | $10,086 |

Sep 17 | $10,188 | $10,814 | $10,095 |

Oct 17 | $10,238 | $10,773 | $10,104 |

Nov 17 | $10,208 | $10,893 | $10,112 |

Dec 17 | $10,228 | $10,930 | $10,124 |

Jan 18 | $10,308 | $11,061 | $10,136 |

Feb 18 | $10,298 | $10,962 | $10,145 |

Mar 18 | $10,248 | $11,079 | $10,159 |

Apr 18 | $10,268 | $10,902 | $10,173 |

May 18 | $10,198 | $10,819 | $10,188 |

Jun 18 | $10,147 | $10,771 | $10,205 |