What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Institutional Shares | $71 | 0.68% |

How did the Fund perform last year?

For the reporting period ended July 31, 2025, the Fund's Institutional Shares returned 6.87%.

For the same period, the Fund’s benchmark, the Bloomberg U.S. Universal Index returned 4.00%, and the Morningstar LSTA Leveraged Loan Index returned 7.50%.

What contributed to performance?

With respect to credit tiers, B and BB rated securities were the leading contributors to absolute performance. At the sector level, the largest contributions came from information technology, property and casualty, and healthcare issues. The Fund used derivatives to manage its portfolio positioning, and this aspect of its strategy was an additional contributor. Holdings in cash also added to absolute returns.

What detracted from performance?

At a time of strong returns for the broader market, no aspect of the Fund’s positioning significantly detracted from absolute performance. With this said, an allocation to D rated securities was a small detractor, as was a position in the construction machinery sector.

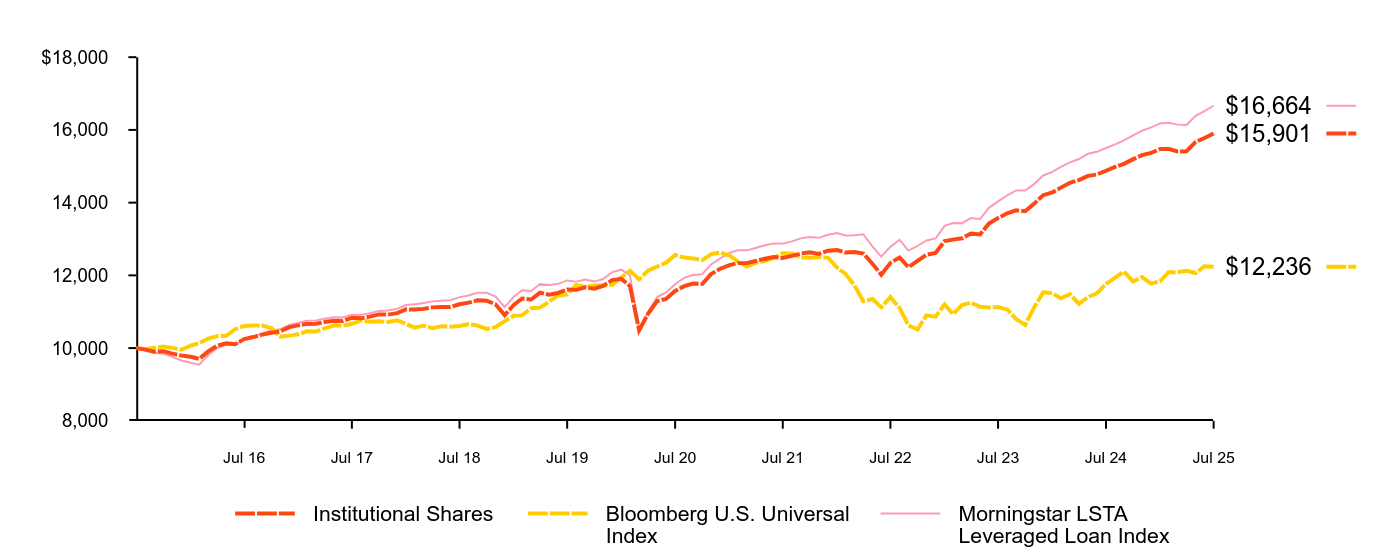

Fund performance

Cumulative performance: August 1, 2015 through July 31, 2025

Initial Investment of $10,000

Institutional Shares | Bloomberg U.S. Universal Index | Morningstar LSTA Leveraged Loan Index | |

|---|---|---|---|

Jul 15 | $10,000 | $10,000 | $10,000 |

Aug 15 | $9,957 | $9,971 | $9,930 |

Sep 15 | $9,902 | $10,010 | $9,866 |

Oct 15 | $9,915 | $10,042 | $9,848 |

Nov 15 | $9,849 | $10,005 | $9,761 |

Dec 15 | $9,795 | $9,955 | $9,659 |

Jan 16 | $9,761 | $10,065 | $9,596 |

Feb 16 | $9,704 | $10,136 | $9,545 |

Mar 16 | $9,908 | $10,261 | $9,808 |

Apr 16 | $10,063 | $10,330 | $10,003 |

May 16 | $10,132 | $10,339 | $10,092 |

Jun 16 | $10,108 | $10,521 | $10,094 |

Jul 16 | $10,246 | $10,607 | $10,239 |

Aug 16 | $10,304 | $10,619 | $10,316 |

Sep 16 | $10,372 | $10,621 | $10,405 |

Oct 16 | $10,421 | $10,551 | $10,491 |

Nov 16 | $10,457 | $10,314 | $10,518 |

Dec 16 | $10,575 | $10,344 | $10,640 |

Jan 17 | $10,623 | $10,381 | $10,699 |

Feb 17 | $10,665 | $10,461 | $10,753 |

Mar 17 | $10,671 | $10,457 | $10,762 |

Apr 17 | $10,717 | $10,544 | $10,809 |

May 17 | $10,753 | $10,625 | $10,848 |

Jun 17 | $10,746 | $10,616 | $10,844 |

Jul 17 | $10,836 | $10,669 | $10,918 |

Aug 17 | $10,820 | $10,761 | $10,913 |

Sep 17 | $10,866 | $10,723 | $10,956 |

Oct 17 | $10,926 | $10,736 | $11,022 |

Nov 17 | $10,920 | $10,720 | $11,034 |

Dec 17 | $10,960 | $10,767 | $11,078 |

Jan 18 | $11,066 | $10,664 | $11,185 |

Feb 18 | $11,059 | $10,563 | $11,207 |

Mar 18 | $11,078 | $10,616 | $11,239 |

Apr 18 | $11,119 | $10,545 | $11,285 |

May 18 | $11,131 | $10,603 | $11,304 |

Jun 18 | $11,128 | $10,587 | $11,317 |

Jul 18 | $11,205 | $10,609 | $11,401 |

Aug 18 | $11,249 | $10,662 | $11,446 |

Sep 18 | $11,314 | $10,616 | $11,525 |

Oct 18 | $11,303 | $10,527 | $11,522 |

Nov 18 | $11,203 | $10,574 | $11,418 |

Dec 18 | $10,906 | $10,740 | $11,127 |

Jan 19 | $11,184 | $10,888 | $11,410 |

Feb 19 | $11,365 | $10,900 | $11,592 |

Mar 19 | $11,336 | $11,097 | $11,572 |

Apr 19 | $11,522 | $11,112 | $11,763 |

May 19 | $11,468 | $11,282 | $11,737 |

Jun 19 | $11,516 | $11,442 | $11,766 |

Jul 19 | $11,612 | $11,476 | $11,860 |

Aug 19 | $11,601 | $11,736 | $11,828 |

Sep 19 | $11,670 | $11,685 | $11,883 |

Oct 19 | $11,633 | $11,723 | $11,829 |

Nov 19 | $11,710 | $11,720 | $11,899 |

Dec 19 | $11,871 | $11,738 | $12,089 |

Jan 20 | $11,903 | $11,948 | $12,156 |

Feb 20 | $11,707 | $12,127 | $11,995 |

Mar 20 | $10,490 | $11,891 | $10,512 |

Apr 20 | $10,940 | $12,129 | $10,985 |

May 20 | $11,292 | $12,242 | $11,402 |

Jun 20 | $11,352 | $12,344 | $11,532 |

Jul 20 | $11,571 | $12,561 | $11,757 |

Aug 20 | $11,702 | $12,489 | $11,933 |

Sep 20 | $11,774 | $12,466 | $12,008 |

Oct 20 | $11,764 | $12,421 | $12,033 |

Nov 20 | $12,035 | $12,584 | $12,301 |

Dec 20 | $12,182 | $12,627 | $12,466 |

Jan 21 | $12,280 | $12,548 | $12,615 |

Feb 21 | $12,336 | $12,386 | $12,689 |

Mar 21 | $12,336 | $12,242 | $12,688 |

Apr 21 | $12,395 | $12,345 | $12,754 |

May 21 | $12,457 | $12,392 | $12,828 |

Jun 21 | $12,505 | $12,482 | $12,875 |

Jul 21 | $12,478 | $12,607 | $12,873 |

Aug 21 | $12,538 | $12,599 | $12,935 |

Sep 21 | $12,600 | $12,491 | $13,018 |

Oct 21 | $12,635 | $12,481 | $13,052 |

Nov 21 | $12,590 | $12,496 | $13,032 |

Dec 21 | $12,676 | $12,488 | $13,115 |

Jan 22 | $12,696 | $12,214 | $13,163 |

Feb 22 | $12,627 | $12,047 | $13,095 |

Mar 22 | $12,640 | $11,724 | $13,101 |

Apr 22 | $12,602 | $11,287 | $13,130 |

May 22 | $12,322 | $11,349 | $12,794 |

Jun 22 | $12,016 | $11,122 | $12,517 |

Jul 22 | $12,343 | $11,402 | $12,784 |

Aug 22 | $12,492 | $11,105 | $12,977 |

Sep 22 | $12,224 | $10,627 | $12,681 |

Oct 22 | $12,399 | $10,510 | $12,807 |

Nov 22 | $12,566 | $10,902 | $12,960 |

Dec 22 | $12,618 | $10,865 | $13,014 |

Jan 23 | $12,941 | $11,202 | $13,361 |

Feb 23 | $12,982 | $10,927 | $13,438 |

Mar 23 | $13,020 | $11,183 | $13,434 |

Apr 23 | $13,150 | $11,252 | $13,575 |

May 23 | $13,127 | $11,135 | $13,550 |

Jun 23 | $13,423 | $11,118 | $13,857 |

Jul 23 | $13,576 | $11,129 | $14,035 |

Aug 23 | $13,705 | $11,062 | $14,199 |

Sep 23 | $13,790 | $10,798 | $14,336 |

Oct 23 | $13,764 | $10,636 | $14,333 |

Nov 23 | $13,967 | $11,114 | $14,508 |

Dec 23 | $14,205 | $11,536 | $14,747 |

Jan 24 | $14,281 | $11,508 | $14,847 |

Feb 24 | $14,412 | $11,370 | $14,982 |

Mar 24 | $14,548 | $11,482 | $15,109 |

Apr 24 | $14,620 | $11,214 | $15,200 |

May 24 | $14,736 | $11,400 | $15,343 |

Jun 24 | $14,775 | $11,504 | $15,397 |

Jul 24 | $14,878 | $11,765 | $15,502 |

Aug 24 | $14,982 | $11,938 | $15,600 |

Sep 24 | $15,067 | $12,102 | $15,711 |

Oct 24 | $15,196 | $11,827 | $15,847 |

Nov 24 | $15,306 | $11,952 | $15,978 |

Dec 24 | $15,370 | $11,771 | $16,068 |

Jan 25 | $15,474 | $11,842 | $16,179 |

Feb 25 | $15,476 | $12,087 | $16,196 |

Mar 25 | $15,406 | $12,084 | $16,145 |

Apr 25 | $15,414 | $12,127 | $16,137 |

May 25 | $15,669 | $12,065 | $16,387 |

Jun 25 | $15,775 | $12,253 | $16,519 |

Jul 25 | $15,901 | $12,236 | $16,664 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Institutional Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.87% | 6.56% | 4.75% |

Bloomberg U.S. Universal Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.00 | (0.52) | 2.04 |

Morningstar LSTA Leveraged Loan Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.50 | 7.22 | 5.24 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $3,572,144,216 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 464 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $19,779,918 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 47% |

Portfolio composition

Credit quality allocation

Investment Type | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

Floating Rate Loan Interests........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 95.0% |

Investment Companies........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.5 |

Fixed Rate Loan Interests........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.6 |

Corporate Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.5 |

Common Stocks........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.4 |

Preferred Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.0Footnote Reference(b) |

Warrants........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | - |

Other Interests........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | - |

Credit RatingFootnote Reference(c) | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.1% |

BBB/Baa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.3 |

BB/Ba........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 27.4 |

B........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 55.6 |

CCC/Caa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 |

CC/Ca........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.1 |

N/R........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.6 |

| Footnote | Description |

Footnote(a) | Excludes short-term securities. |

Footnote(b) | Rounds to less than 0.1%. |

Footnote(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Investor A Shares | $97 | 0.94% |

How did the Fund perform last year?

For the reporting period ended July 31, 2025, the Fund's Investor A Shares returned 6.60%.

For the same period, the Fund’s benchmark, the Bloomberg U.S. Universal Index returned 4.00%, and the Morningstar LSTA Leveraged Loan Index returned 7.50%.

What contributed to performance?

With respect to credit tiers, B and BB rated securities were the leading contributors to absolute performance. At the sector level, the largest contributions came from information technology, property and casualty, and healthcare issues. The Fund used derivatives to manage its portfolio positioning, and this aspect of its strategy was an additional contributor. Holdings in cash also added to absolute returns.

What detracted from performance?

At a time of strong returns for the broader market, no aspect of the Fund’s positioning significantly detracted from absolute performance. With this said, an allocation to D rated securities was a small detractor, as was a position in the construction machinery sector.

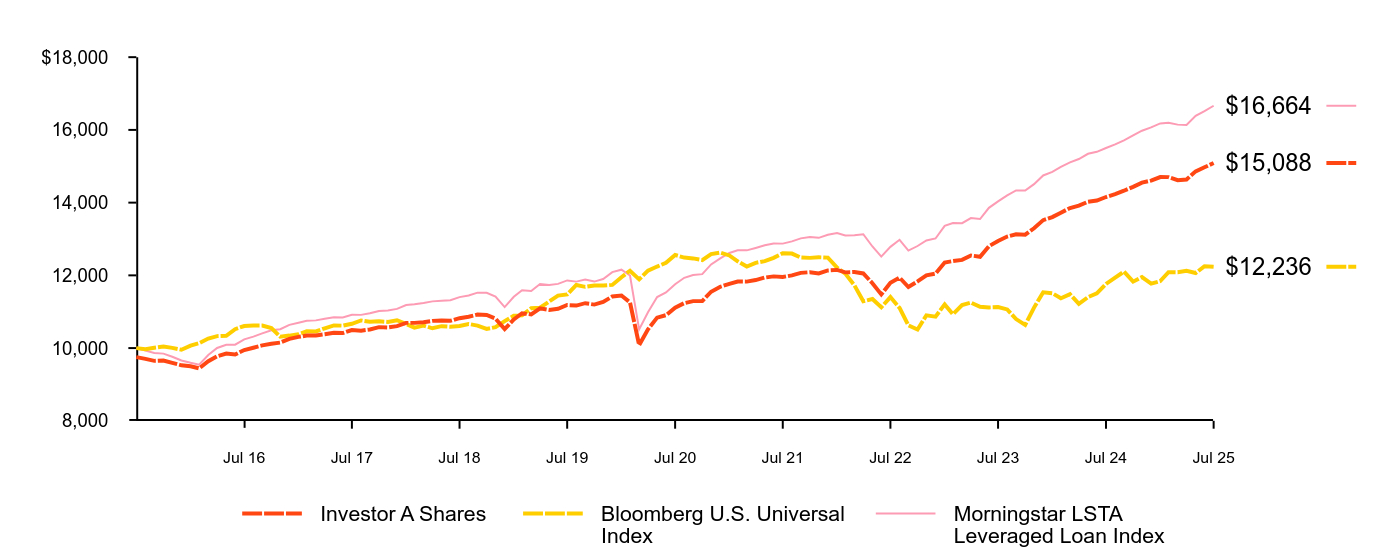

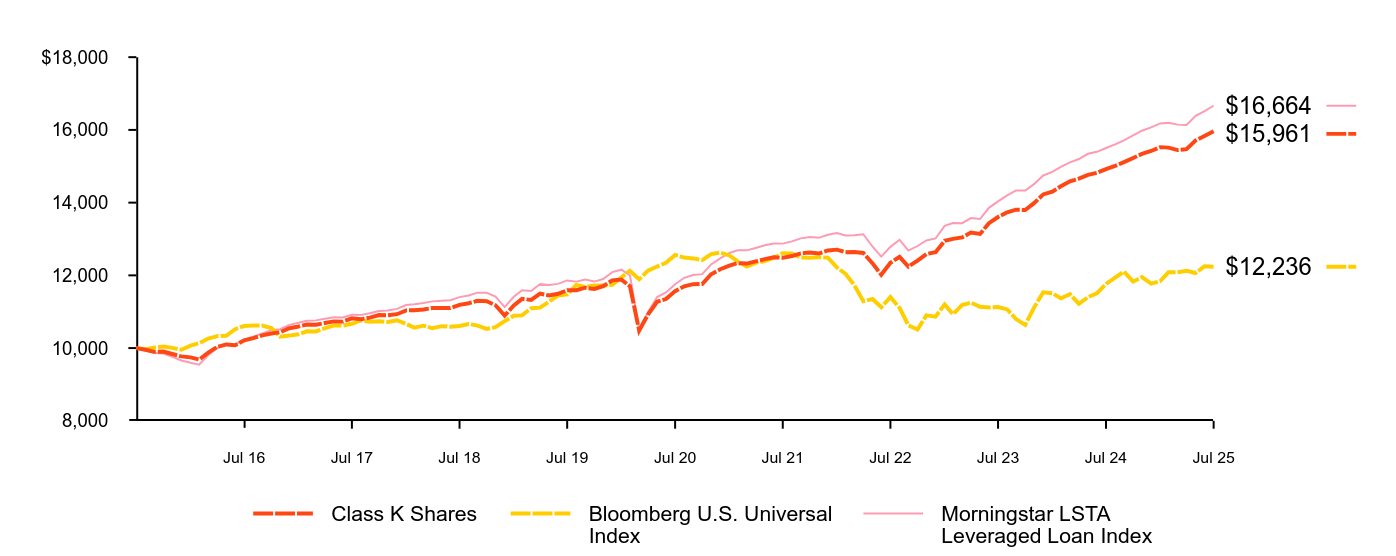

Fund performance

Cumulative performance: August 1, 2015 through July 31, 2025

Initial Investment of $10,000

Investor A Shares | Bloomberg U.S. Universal Index | Morningstar LSTA Leveraged Loan Index | |

|---|---|---|---|

Jul 15 | $9,750 | $10,000 | $10,000 |

Aug 15 | $9,705 | $9,971 | $9,930 |

Sep 15 | $9,649 | $10,010 | $9,866 |

Oct 15 | $9,659 | $10,042 | $9,848 |

Nov 15 | $9,592 | $10,005 | $9,761 |

Dec 15 | $9,527 | $9,955 | $9,659 |

Jan 16 | $9,500 | $10,065 | $9,596 |

Feb 16 | $9,443 | $10,136 | $9,545 |

Mar 16 | $9,638 | $10,261 | $9,808 |

Apr 16 | $9,776 | $10,330 | $10,003 |

May 16 | $9,850 | $10,339 | $10,092 |

Jun 16 | $9,824 | $10,521 | $10,094 |

Jul 16 | $9,946 | $10,607 | $10,239 |

Aug 16 | $10,010 | $10,619 | $10,316 |

Sep 16 | $10,074 | $10,621 | $10,405 |

Oct 16 | $10,118 | $10,551 | $10,491 |

Nov 16 | $10,151 | $10,314 | $10,518 |

Dec 16 | $10,253 | $10,344 | $10,640 |

Jan 17 | $10,307 | $10,381 | $10,699 |

Feb 17 | $10,345 | $10,461 | $10,753 |

Mar 17 | $10,348 | $10,457 | $10,762 |

Apr 17 | $10,380 | $10,544 | $10,809 |

May 17 | $10,422 | $10,625 | $10,848 |

Jun 17 | $10,413 | $10,616 | $10,844 |

Jul 17 | $10,497 | $10,669 | $10,918 |

Aug 17 | $10,479 | $10,761 | $10,913 |

Sep 17 | $10,511 | $10,723 | $10,956 |

Oct 17 | $10,576 | $10,736 | $11,022 |

Nov 17 | $10,568 | $10,720 | $11,034 |

Dec 17 | $10,604 | $10,767 | $11,078 |

Jan 18 | $10,693 | $10,664 | $11,185 |

Feb 18 | $10,694 | $10,563 | $11,207 |

Mar 18 | $10,710 | $10,616 | $11,239 |

Apr 18 | $10,748 | $10,545 | $11,285 |

May 18 | $10,756 | $10,603 | $11,304 |

Jun 18 | $10,750 | $10,587 | $11,317 |

Jul 18 | $10,822 | $10,609 | $11,401 |

Aug 18 | $10,862 | $10,662 | $11,446 |

Sep 18 | $10,922 | $10,616 | $11,525 |

Oct 18 | $10,909 | $10,527 | $11,522 |

Nov 18 | $10,810 | $10,574 | $11,418 |

Dec 18 | $10,521 | $10,740 | $11,127 |

Jan 19 | $10,786 | $10,888 | $11,410 |

Feb 19 | $10,958 | $10,900 | $11,592 |

Mar 19 | $10,927 | $11,097 | $11,572 |

Apr 19 | $11,093 | $11,112 | $11,763 |

May 19 | $11,050 | $11,282 | $11,737 |

Jun 19 | $11,082 | $11,442 | $11,766 |

Jul 19 | $11,184 | $11,476 | $11,860 |

Aug 19 | $11,170 | $11,736 | $11,828 |

Sep 19 | $11,234 | $11,685 | $11,883 |

Oct 19 | $11,196 | $11,723 | $11,829 |

Nov 19 | $11,267 | $11,720 | $11,899 |

Dec 19 | $11,419 | $11,738 | $12,089 |

Jan 20 | $11,447 | $11,948 | $12,156 |

Feb 20 | $11,256 | $12,127 | $11,995 |

Mar 20 | $10,084 | $11,891 | $10,512 |

Apr 20 | $10,514 | $12,129 | $10,985 |

May 20 | $10,838 | $12,242 | $11,402 |

Jun 20 | $10,905 | $12,344 | $11,532 |

Jul 20 | $11,113 | $12,561 | $11,757 |

Aug 20 | $11,237 | $12,489 | $11,933 |

Sep 20 | $11,292 | $12,466 | $12,008 |

Oct 20 | $11,292 | $12,421 | $12,033 |

Nov 20 | $11,549 | $12,584 | $12,301 |

Dec 20 | $11,687 | $12,627 | $12,466 |

Jan 21 | $11,767 | $12,548 | $12,615 |

Feb 21 | $11,831 | $12,386 | $12,689 |

Mar 21 | $11,828 | $12,242 | $12,688 |

Apr 21 | $11,871 | $12,345 | $12,754 |

May 21 | $11,940 | $12,392 | $12,828 |

Jun 21 | $11,972 | $12,482 | $12,875 |

Jul 21 | $11,956 | $12,607 | $12,873 |

Aug 21 | $11,999 | $12,599 | $12,935 |

Sep 21 | $12,068 | $12,491 | $13,018 |

Oct 21 | $12,087 | $12,481 | $13,052 |

Nov 21 | $12,054 | $12,496 | $13,032 |

Dec 21 | $12,134 | $12,488 | $13,115 |

Jan 22 | $12,151 | $12,214 | $13,163 |

Feb 22 | $12,082 | $12,047 | $13,095 |

Mar 22 | $12,093 | $11,724 | $13,101 |

Apr 22 | $12,053 | $11,287 | $13,130 |

May 22 | $11,783 | $11,349 | $12,794 |

Jun 22 | $11,476 | $11,122 | $12,517 |

Jul 22 | $11,798 | $11,402 | $12,784 |

Aug 22 | $11,938 | $11,105 | $12,977 |

Sep 22 | $11,680 | $10,627 | $12,681 |

Oct 22 | $11,833 | $10,510 | $12,807 |

Nov 22 | $12,002 | $10,902 | $12,960 |

Dec 22 | $12,050 | $10,865 | $13,014 |

Jan 23 | $12,355 | $11,202 | $13,361 |

Feb 23 | $12,392 | $10,927 | $13,438 |

Mar 23 | $12,426 | $11,183 | $13,434 |

Apr 23 | $12,548 | $11,252 | $13,575 |

May 23 | $12,510 | $11,135 | $13,550 |

Jun 23 | $12,803 | $11,118 | $13,857 |

Jul 23 | $12,947 | $11,129 | $14,035 |

Aug 23 | $13,067 | $11,062 | $14,199 |

Sep 23 | $13,131 | $10,798 | $14,336 |

Oct 23 | $13,118 | $10,636 | $14,333 |

Nov 23 | $13,295 | $11,114 | $14,508 |

Dec 23 | $13,519 | $11,536 | $14,747 |

Jan 24 | $13,602 | $11,508 | $14,847 |

Feb 24 | $13,725 | $11,370 | $14,982 |

Mar 24 | $13,851 | $11,482 | $15,109 |

Apr 24 | $13,917 | $11,214 | $15,200 |

May 24 | $14,025 | $11,400 | $15,343 |

Jun 24 | $14,059 | $11,504 | $15,397 |

Jul 24 | $14,154 | $11,765 | $15,502 |

Aug 24 | $14,235 | $11,938 | $15,600 |

Sep 24 | $14,328 | $12,102 | $15,711 |

Oct 24 | $14,433 | $11,827 | $15,847 |

Nov 24 | $14,549 | $11,952 | $15,978 |

Dec 24 | $14,607 | $11,771 | $16,068 |

Jan 25 | $14,703 | $11,842 | $16,179 |

Feb 25 | $14,702 | $12,087 | $16,196 |

Mar 25 | $14,617 | $12,084 | $16,145 |

Apr 25 | $14,636 | $12,127 | $16,137 |

May 25 | $14,860 | $12,065 | $16,387 |

Jun 25 | $14,972 | $12,253 | $16,519 |

Jul 25 | $15,088 | $12,236 | $16,664 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Investor A Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.60% | 6.31% | 4.46% |

Investor A Shares (with sales charge)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.94 | 5.77 | 4.20 |

Bloomberg U.S. Universal Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.00 | (0.52) | 2.04 |

Morningstar LSTA Leveraged Loan Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.50 | 7.22 | 5.24 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $3,572,144,216 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 464 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $19,779,918 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 47% |

Portfolio composition

Credit quality allocation

Investment Type | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

Floating Rate Loan Interests........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 95.0% |

Investment Companies........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.5 |

Fixed Rate Loan Interests........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.6 |

Corporate Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.5 |

Common Stocks........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.4 |

Preferred Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.0Footnote Reference(b) |

Warrants........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | - |

Other Interests........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | - |

Credit RatingFootnote Reference(c) | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

A........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.1% |

BBB/Baa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 8.3 |

BB/Ba........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 27.4 |

B........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 55.6 |

CCC/Caa........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.9 |

CC/Ca........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.1 |

N/R........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.6 |

| Footnote | Description |

Footnote(a) | Excludes short-term securities. |

Footnote(b) | Rounds to less than 0.1%. |

Footnote(c) | For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Investor C Shares | $173 | 1.68% |

How did the Fund perform last year?

For the reporting period ended July 31, 2025, the Fund's Investor C Shares returned 5.82%.

For the same period, the Fund’s benchmark, the Bloomberg U.S. Universal Index returned 4.00%, and the Morningstar LSTA Leveraged Loan Index returned 7.50%.

What contributed to performance?

With respect to credit tiers, B and BB rated securities were the leading contributors to absolute performance. At the sector level, the largest contributions came from information technology, property and casualty, and healthcare issues. The Fund used derivatives to manage its portfolio positioning, and this aspect of its strategy was an additional contributor. Holdings in cash also added to absolute returns.

What detracted from performance?

At a time of strong returns for the broader market, no aspect of the Fund’s positioning significantly detracted from absolute performance. With this said, an allocation to D rated securities was a small detractor, as was a position in the construction machinery sector.

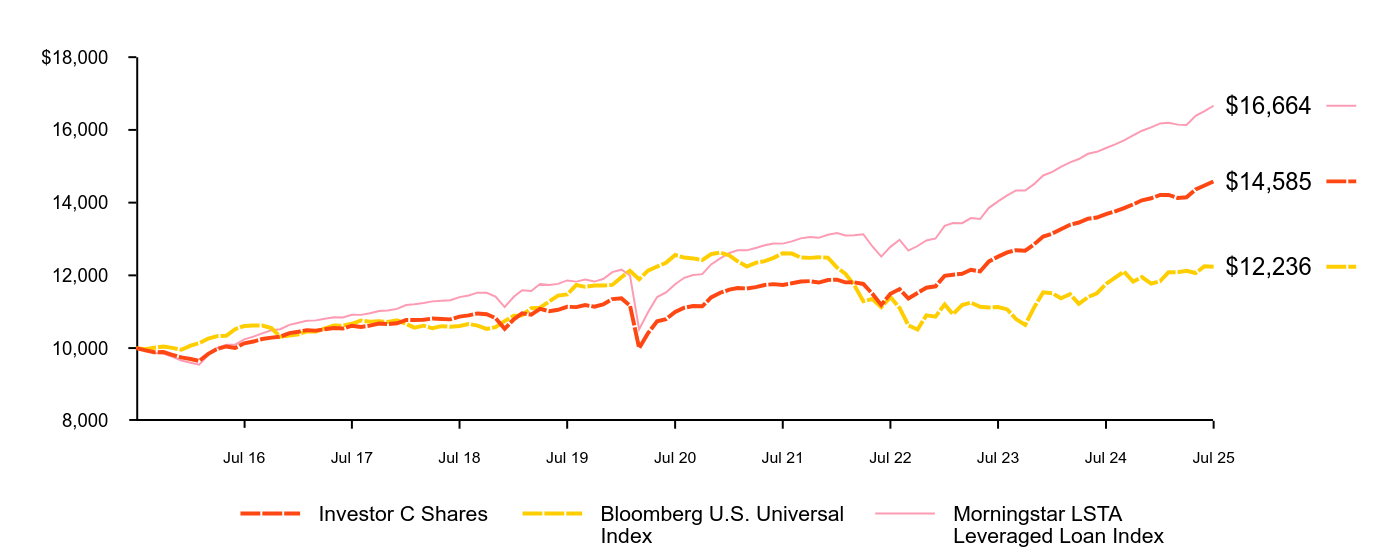

Fund performance

Cumulative performance: August 1, 2015 through July 31, 2025

Initial Investment of $10,000

Investor C Shares | Bloomberg U.S. Universal Index | Morningstar LSTA Leveraged Loan Index | |

|---|---|---|---|

Jul 15 | $10,000 | $10,000 | $10,000 |

Aug 15 | $9,939 | $9,971 | $9,930 |

Sep 15 | $9,885 | $10,010 | $9,866 |

Oct 15 | $9,890 | $10,042 | $9,848 |

Nov 15 | $9,816 | $10,005 | $9,761 |

Dec 15 | $9,743 | $9,955 | $9,659 |

Jan 16 | $9,700 | $10,065 | $9,596 |

Feb 16 | $9,646 | $10,136 | $9,545 |

Mar 16 | $9,840 | $10,261 | $9,808 |

Apr 16 | $9,976 | $10,330 | $10,003 |

May 16 | $10,045 | $10,339 | $10,092 |

Jun 16 | $10,003 | $10,521 | $10,094 |

Jul 16 | $10,131 | $10,607 | $10,239 |

Aug 16 | $10,180 | $10,619 | $10,316 |

Sep 16 | $10,249 | $10,621 | $10,405 |

Oct 16 | $10,288 | $10,551 | $10,491 |

Nov 16 | $10,315 | $10,314 | $10,518 |

Dec 16 | $10,413 | $10,344 | $10,640 |

Jan 17 | $10,450 | $10,381 | $10,699 |

Feb 17 | $10,494 | $10,461 | $10,753 |

Mar 17 | $10,480 | $10,457 | $10,762 |

Apr 17 | $10,517 | $10,544 | $10,809 |

May 17 | $10,553 | $10,625 | $10,848 |

Jun 17 | $10,537 | $10,616 | $10,844 |

Jul 17 | $10,616 | $10,669 | $10,918 |

Aug 17 | $10,581 | $10,761 | $10,913 |

Sep 17 | $10,617 | $10,723 | $10,956 |

Oct 17 | $10,676 | $10,736 | $11,022 |

Nov 17 | $10,662 | $10,720 | $11,034 |

Dec 17 | $10,681 | $10,767 | $11,078 |

Jan 18 | $10,775 | $10,664 | $11,185 |

Feb 18 | $10,770 | $10,563 | $11,207 |

Mar 18 | $10,780 | $10,616 | $11,239 |

Apr 18 | $10,811 | $10,545 | $11,285 |

May 18 | $10,802 | $10,603 | $11,304 |

Jun 18 | $10,790 | $10,587 | $11,317 |

Jul 18 | $10,866 | $10,609 | $11,401 |

Aug 18 | $10,899 | $10,662 | $11,446 |

Sep 18 | $10,953 | $10,616 | $11,525 |

Oct 18 | $10,933 | $10,527 | $11,522 |

Nov 18 | $10,827 | $10,574 | $11,418 |

Dec 18 | $10,531 | $10,740 | $11,127 |

Jan 19 | $10,790 | $10,888 | $11,410 |

Feb 19 | $10,956 | $10,900 | $11,592 |

Mar 19 | $10,918 | $11,097 | $11,572 |

Apr 19 | $11,077 | $11,112 | $11,763 |

May 19 | $11,016 | $11,282 | $11,737 |

Jun 19 | $11,053 | $11,442 | $11,766 |

Jul 19 | $11,136 | $11,476 | $11,860 |

Aug 19 | $11,127 | $11,736 | $11,828 |

Sep 19 | $11,183 | $11,685 | $11,883 |

Oct 19 | $11,138 | $11,723 | $11,829 |

Nov 19 | $11,202 | $11,720 | $11,899 |

Dec 19 | $11,346 | $11,738 | $12,089 |

Jan 20 | $11,367 | $11,948 | $12,156 |

Feb 20 | $11,170 | $12,127 | $11,995 |

Mar 20 | $10,000 | $11,891 | $10,512 |

Apr 20 | $10,409 | $12,129 | $10,985 |

May 20 | $10,735 | $12,242 | $11,402 |

Jun 20 | $10,795 | $12,344 | $11,532 |

Jul 20 | $10,994 | $12,561 | $11,757 |

Aug 20 | $11,109 | $12,489 | $11,933 |

Sep 20 | $11,155 | $12,466 | $12,008 |

Oct 20 | $11,148 | $12,421 | $12,033 |

Nov 20 | $11,394 | $12,584 | $12,301 |

Dec 20 | $11,523 | $12,627 | $12,466 |

Jan 21 | $11,606 | $12,548 | $12,615 |

Feb 21 | $11,651 | $12,386 | $12,689 |

Mar 21 | $11,640 | $12,242 | $12,688 |

Apr 21 | $11,675 | $12,345 | $12,754 |

May 21 | $11,735 | $12,392 | $12,828 |

Jun 21 | $11,759 | $12,482 | $12,875 |

Jul 21 | $11,735 | $12,607 | $12,873 |

Aug 21 | $11,782 | $12,599 | $12,935 |

Sep 21 | $11,830 | $12,491 | $13,018 |

Oct 21 | $11,841 | $12,481 | $13,052 |

Nov 21 | $11,802 | $12,496 | $13,032 |

Dec 21 | $11,872 | $12,488 | $13,115 |

Jan 22 | $11,881 | $12,214 | $13,163 |

Feb 22 | $11,807 | $12,047 | $13,095 |

Mar 22 | $11,809 | $11,724 | $13,101 |

Apr 22 | $11,764 | $11,287 | $13,130 |

May 22 | $11,492 | $11,349 | $12,794 |

Jun 22 | $11,186 | $11,122 | $12,517 |

Jul 22 | $11,493 | $11,402 | $12,784 |

Aug 22 | $11,622 | $11,105 | $12,977 |

Sep 22 | $11,363 | $10,627 | $12,681 |

Oct 22 | $11,516 | $10,510 | $12,807 |

Nov 22 | $11,661 | $10,902 | $12,960 |

Dec 22 | $11,699 | $10,865 | $13,014 |

Jan 23 | $11,989 | $11,202 | $13,361 |

Feb 23 | $12,017 | $10,927 | $13,438 |

Mar 23 | $12,042 | $11,183 | $13,434 |

Apr 23 | $12,153 | $11,252 | $13,575 |

May 23 | $12,108 | $11,135 | $13,550 |

Jun 23 | $12,384 | $11,118 | $13,857 |

Jul 23 | $12,515 | $11,129 | $14,035 |

Aug 23 | $12,631 | $11,062 | $14,199 |

Sep 23 | $12,693 | $10,798 | $14,336 |

Oct 23 | $12,680 | $10,636 | $14,333 |

Nov 23 | $12,852 | $11,114 | $14,508 |

Dec 23 | $13,068 | $11,536 | $14,747 |

Jan 24 | $13,148 | $11,508 | $14,847 |

Feb 24 | $13,267 | $11,370 | $14,982 |

Mar 24 | $13,389 | $11,482 | $15,109 |

Apr 24 | $13,453 | $11,214 | $15,200 |

May 24 | $13,557 | $11,400 | $15,343 |

Jun 24 | $13,590 | $11,504 | $15,397 |

Jul 24 | $13,682 | $11,765 | $15,502 |

Aug 24 | $13,760 | $11,938 | $15,600 |

Sep 24 | $13,850 | $12,102 | $15,711 |

Oct 24 | $13,952 | $11,827 | $15,847 |

Nov 24 | $14,064 | $11,952 | $15,978 |

Dec 24 | $14,120 | $11,771 | $16,068 |

Jan 25 | $14,213 | $11,842 | $16,179 |

Feb 25 | $14,211 | $12,087 | $16,196 |

Mar 25 | $14,129 | $12,084 | $16,145 |

Apr 25 | $14,148 | $12,127 | $16,137 |

May 25 | $14,364 | $12,065 | $16,387 |

Jun 25 | $14,473 | $12,253 | $16,519 |

Jul 25 | $14,585 | $12,236 | $16,664 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Investor C Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.82% | 5.50% | 3.85% |

Investor C Shares (with sales charge)........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.83 | 5.50 | 3.85 |

Bloomberg U.S. Universal Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.00 | (0.52) | 2.04 |

Morningstar LSTA Leveraged Loan Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 7.50 | 7.22 | 5.24 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $3,572,144,216 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 464 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $19,779,918 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 47% |

Portfolio composition

Credit quality allocation

Investment Type | Percent of Total InvestmentsFootnote Reference(a) |

|---|---|

Floating Rate Loan Interests........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 95.0% |