Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

DAVIS NEW YORK VENTURE FUND INC

|

| Entity Central Index Key |

0000071701

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jul. 31, 2025

|

| C000009521 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Davis Research Fund

|

| Class Name |

Class A

|

| Trading Symbol |

DRFAX

|

| Annual or Semi-Annual Statement [Text Block] |

This Annual shareholder report contains important information about the Davis Research Fund (the “Fund”) for the period of August 1, 2024 to July 31, 2025 (the “period”).

|

| Shareholder Report Annual or Semi-Annual |

Annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at http://dsainternal.davis.local/html/fundinfo/fundinfo.html or by contacting Investor Services at 1-800-279-0279.

|

| Additional Information Phone Number |

1-800-279-0279

|

| Additional Information Website |

http://dsainternal.davis.local/html/fundinfo/fundinfo.html

|

| Expenses [Text Block] |

What were the Fund expenses for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Davis Research Fund

(Class A) |

$74 |

0.68% |

|

| Expenses Paid, Amount |

$ 74

|

| Expense Ratio, Percent |

0.68%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

Summary of Results

The Fund outperformed the Standard & Poor’s 500 Index (“S&P 500” or the “Index”) for the period. The Fund’s Class A shares delivered a total return on net asset value of 19.06%, versus a 16.33% return for the S&P 500. The Fund invests principally in common stocks (including American Depositary Receipts) issued by medium- and large-capitalization companies. The Fund considers companies with market capitalizations between $3 billion and $10 billion to be medium-capitalization companies and companies with market capitalizations of at least $10 billion to be large-capitalization companies. The Fund has the flexibility to invest in foreign securities.

Market Overview

-

S&P 500

-

Strongest performing sectors - Communication Services (+31%), Information Technology (+24%),

and Financials (+22%)

-

Weakest performing sectors - Health Care (-11%), Energy (-3%), and Materials (-3%)

Contributors to Performance

-

Financials - outperformed the Index sector (+25% vs +22%) and significantly overweight (average weighting 34% vs 14%)

-

Capital One Financial (+44%), Bank of New York Mellon (+60%), Danske Bank (+43%), and Wells Fargo (+39%)

-

Underweight in Health Care (average weighting 5% vs 11%), the weakest performing sector of the Index

-

Communication Services - outperformed the Index sector (+53% vs +31%)

-

Consumer Discretionary - outperformed the Index sector (+23% vs +20%) and overweight (average weighting 18% vs 10%)

-

Underweight in Consumer Staples (average weighting 1% vs 6%)

-

Individual Information Technology holdings

-

Oracle (+84%), SAP (+36%), and Microsoft (+28%)

-

Oracle - largest individual contributor

Detractors from Performance

-

Information Technology - underperformed the Index sector (+20% vs +24%) and underweight (average weighting 23% vs 32%)

-

Intel (-30%), Applied Materials (-14%), and Texas Instruments (-8%)

-

Intel - largest individual detractor (no longer a Fund holding)

-

Industrials - significantly underperformed the Index sector (+3% vs +21%) and underweight (average weighting 5% vs 8%)

-

Underweight in Communication Services (average weighting 6% vs 9%), the strongest performing sector of the Index

-

Individual holdings

-

RH (-29%), MGM Resorts (-15%), Teck Resources (-33%), Humana (-30%), UnitedHealth Group (-56%), and

Viatris (-24%)

|

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of how the Fund will perform in the future.

|

| Line Graph [Table Text Block] |

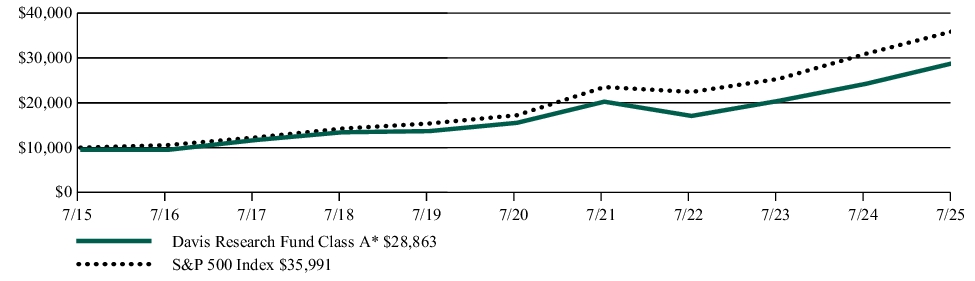

Fund Performance

The following graph compares the initial and subsequent account values of a $10,000 investment in the Fund and the S&P 500 Index over 10 fiscal years for an investment made on July 31, 2015.

GROWTH OF $10,000

|

*

|

Reflects 4.75% front-end sales charge.

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN FOR PERIODS ENDED 07/31/25 |

1 Year |

5 Years |

10 Years |

| Davis Research Fund (Class A) — Without sales charge |

19.06% |

13.18% |

11.71% |

| Davis Research Fund (Class A) — With sales charge* |

13.40% |

12.09% |

11.17% |

| S&P 500 Index |

16.33% |

15.87% |

13.65% |

|

*

|

Reflects 4.75% front-end sales charge.

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

|

| Updated Performance Information Location [Text Block] |

For most recent month-end performance information, please call Investor Services at 1-800-279-0279 .

|

| Net Assets |

$ 78,000,000.0

|

| Holdings Count | Holding |

65

|

| Advisory Fees Paid, Amount |

$ 394,500

|

| Investment Company Portfolio Turnover |

15.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

| Fund net assets as of 07/31/25 (in millions) |

$78.0 |

| Total number of portfolio holdings as of 07/31/25 |

65 |

| Portfolio turnover rate for the period |

15% |

| Total advisory fees paid for the period (in thousands) |

$394.5 |

|

| Holdings [Text Block] |

Top Sectors as of 07/31/25 Net Assets

| Financials |

34.16% |

| Information Technology |

25.69% |

| Consumer Discretionary |

17.40% |

| Communication Services |

6.51% |

| Industrials |

4.64% |

|