Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

BlackRock ETF Trust II

|

|

| Entity Central Index Key |

0001804196

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jul. 31, 2025

|

|

| C000219258 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

iShares Short Duration High Yield Muni Active ETF

|

|

| Class Name |

iShares Short Duration High Yield Muni Active ETF

|

|

| Trading Symbol |

SHYM

|

|

| Security Exchange Name |

CboeBZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about iShares Short Duration High Yield Muni Active ETF (the “Fund”) (formerly known as BlackRock High Yield Muni Income ETF) for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 474‑2737.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 474‑2737

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| iShares Short Duration High Yield Muni Active ETF |

$33 |

0.33% |

|

|

| Expenses Paid, Amount |

$ 33

|

|

| Expense Ratio, Percent |

0.33%

|

|

| Factors Affecting Performance [Text Block] |

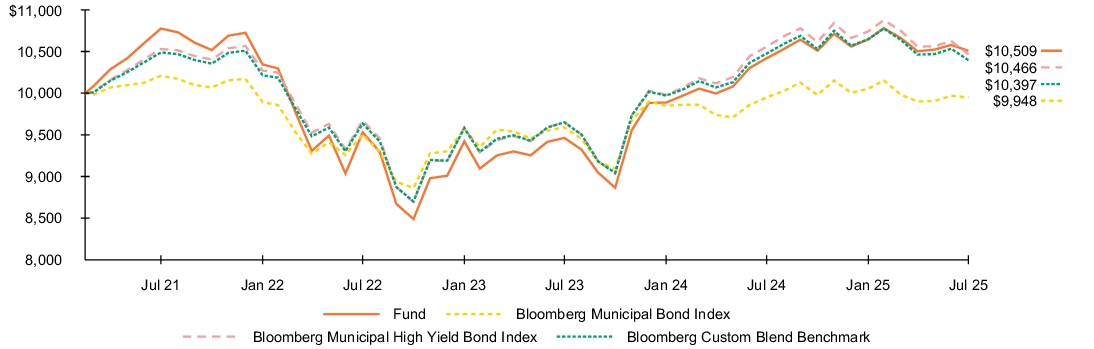

How did the Fund perform last year? -

For the reporting period ended July 31, 2025, the Fund returned 0.86%. -

For the same period, the Bloomberg Municipal Bond Index returned 0.00%, the Bloomberg Municipal High Yield Bond Index returned (0.86)%, and the Bloomberg Custom Blend Benchmark returned (0.75)%. What contributed to performance? Income, which offset the impact of falling prices and widening yield spreads, was the key contributor to performance. At the sector level, holdings in short-term development district issues and prepaid gas bonds contributed. What detracted from performance? Holdings in longer-duration securities and those with maturities of 20 years and longer, which posted negative total returns, detracted from performance. (Duration is a measure of interest rate sensitivity.) In terms of sectors, transportation was the largest detractor. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: March 16, 2021 through July 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

1 Year |

|

Since Fund

Inception |

|

| Fund NAV |

0.86 |

% |

1.14 |

% |

| Bloomberg Municipal Bond Index |

0.00 |

|

(0.12 |

) |

| Bloomberg Custom Blend Muni Index |

N/A |

|

N/A |

|

| Bloomberg Municipal High Yield Bond Index |

(0.86 |

) |

1.05 |

|

| Bloomberg Custom Blend Benchmark |

(0.75 |

) |

0.89 |

|

|

|

| Performance Inception Date |

Mar. 16, 2021

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Performance Table Market Index Changed [Text Block] |

Effective July 1, 2025, the Fund has changed the benchmark against which it measures its performance from Bloomberg Municipal High Yield Bond Index and Bloomberg Custom Blend Benchmark to Bloomberg Custom Blend Muni Index. The Bloomberg Custom Blend Muni Index is relevant to the Fund because it has characteristics similar to the Fund's investment strategies. The Fund's returns shown prior to July 1, 2025 are the returns of the Fund when it followed different investment strategies under the name iShares High Yield Muni Income Active ETF.

|

|

| Material Change Date |

Jul. 01, 2025

|

|

| Updated Performance Information Location [Text Block] |

Visit iShares.com for more recent performance information.

|

|

| Net Assets |

$ 366,732,564

|

|

| Holdings Count | Holding |

321

|

|

| Advisory Fees Paid, Amount |

$ 895,878

|

|

| Investment Company Portfolio Turnover |

50.00%

|

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$366,732,564 |

| Number of Portfolio Holdings |

321 |

| Net Investment Advisory Fees |

$895,878 |

| Portfolio Turnover Rate |

50% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of July 31, 2025) Credit quality allocation

| Credit Rating* |

Percent of Total

Investments(a) |

|

| AAA/Aaa |

0.1 |

% |

| AA/Aa |

8.9 |

% |

| A |

10.2 |

% |

| BBB/Baa |

8.9 |

% |

| BB/Ba |

14.9 |

% |

| B |

7.5 |

% |

| CCC/Caa |

0.2 |

% |

| N/R |

49.3 |

% | Ten largest holdings

| Security |

Percent of Total

Investments(a) |

|

| University of Vermont and State Agricultural College RB, 5.00%, 10/01/40 |

3.8 |

% |

| New York Transportation Development Corp RB AMT, 5.25%, 08/01/31 |

3.4 |

% |

| California Infrastructure & Economic Development Bank RB AMT, 9.50%, 01/01/65 |

2.9 |

% |

| California Municipal Finance Authority RB AMT, 4.00%, 07/15/29 |

2.2 |

% |

| City & County of Denver CO RB AMT, 5.00%, 10/01/32 |

2.2 |

% |

| New York Transportation Development Corp. RB AMT, 5.00%, 07/01/46 |

2.1 |

% |

| City of Philadelphia PA Water & Wastewater Revenue RB, Series A, 5.00%, 10/01/42 |

2.1 |

% |

| Southeast Energy Authority A Cooperative District RB, 5.00%, 01/01/56 |

1.9 |

% |

| Vermont Economic Development Authority RB AMT, 5.00%, 06/01/52 |

1.6 |

% |

| Massachusetts School Building Authority RB, Series C, 5.00%, 08/15/37 |

1.6 |

% |

| (a) |

Excludes money market funds. |

| * |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security |

Percent of Total

Investments(a) |

|

| University of Vermont and State Agricultural College RB, 5.00%, 10/01/40 |

3.8 |

% |

| New York Transportation Development Corp RB AMT, 5.25%, 08/01/31 |

3.4 |

% |

| California Infrastructure & Economic Development Bank RB AMT, 9.50%, 01/01/65 |

2.9 |

% |

| California Municipal Finance Authority RB AMT, 4.00%, 07/15/29 |

2.2 |

% |

| City & County of Denver CO RB AMT, 5.00%, 10/01/32 |

2.2 |

% |

| New York Transportation Development Corp. RB AMT, 5.00%, 07/01/46 |

2.1 |

% |

| City of Philadelphia PA Water & Wastewater Revenue RB, Series A, 5.00%, 10/01/42 |

2.1 |

% |

| Southeast Energy Authority A Cooperative District RB, 5.00%, 01/01/56 |

1.9 |

% |

| Vermont Economic Development Authority RB AMT, 5.00%, 06/01/52 |

1.6 |

% |

| Massachusetts School Building Authority RB, Series C, 5.00%, 08/15/37 |

1.6 |

% | (a)Excludes money market funds.

|

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737. On July 30, 2024, the Fund’s Board approved to change the name of the Fund from BlackRock High Yield Muni Income ETF to iShares High Yield Muni Income Active ETF. This change became effective on October 10, 2024. Additionally, on February 10, 2025, the Fund changed its ticker from HYMU to SHYM. On September 13, 2024, the Fund’s Board approved to change the name of the Fund from iShares High Yield Muni Income Active ETF to iShares Short Duration High Yield Muni Active ETF. In connection with the Fund’s name change, the Fund made certain changes to its investment strategies, including (i) seeking a weighted average effective duration of less than 5 years and (ii) adding the ability to invest in derivatives, other investment companies, and tender option bonds. These changes became effective on July 1, 2025. Effective July 1, 2025, BlackRock Fund Advisors LLC has contractually agreed to reduce the Fund’s investment advisory fee from 0.45% to 0.40% based on the Fund’s average daily net assets and to reduce the advisory fee waiver from 0.10% to 0.05%.

|

|

| Material Fund Change Name [Text Block] |

On July 30, 2024, the Fund’s Board approved to change the name of the Fund from BlackRock High Yield Muni Income ETF to iShares High Yield Muni Income Active ETF. This change became effective on October 10, 2024. Additionally, on February 10, 2025, the Fund changed its ticker from HYMU to SHYM. On September 13, 2024, the Fund’s Board approved to change the name of the Fund from iShares High Yield Muni Income Active ETF to iShares Short Duration High Yield Muni Active ETF.

|

|

| Material Fund Change Expenses [Text Block] |

Effective July 1, 2025, BlackRock Fund Advisors LLC has contractually agreed to reduce the Fund’s investment advisory fee from 0.45% to 0.40% based on the Fund’s average daily net assets and to reduce the advisory fee waiver from 0.10% to 0.05%.

|

|

| Material Fund Change Strategies [Text Block] |

In connection with the Fund’s name change, the Fund made certain changes to its investment strategies, including (i) seeking a weighted average effective duration of less than 5 years and (ii) adding the ability to invest in derivatives, other investment companies, and tender option bonds. These changes became effective on July 1, 2025.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737.

|

|

| Updated Prospectus Phone Number |

(800) 474-2737

|

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

|

| C000225367 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

iShares Intermediate Muni Income Active ETF

|

|

| Class Name |

iShares Intermediate Muni Income Active ETF

|

|

| Trading Symbol |

INMU

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about iShares Intermediate Muni Income Active ETF (the “Fund”) (formerly known as BlackRock Intermediate Muni Income Bond ETF) for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 474‑2737.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 474‑2737

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| iShares Intermediate Muni Income Active ETF |

$29 |

0.29% |

|

|

| Expenses Paid, Amount |

$ 29

|

|

| Expense Ratio, Percent |

0.29%

|

|

| Factors Affecting Performance [Text Block] |

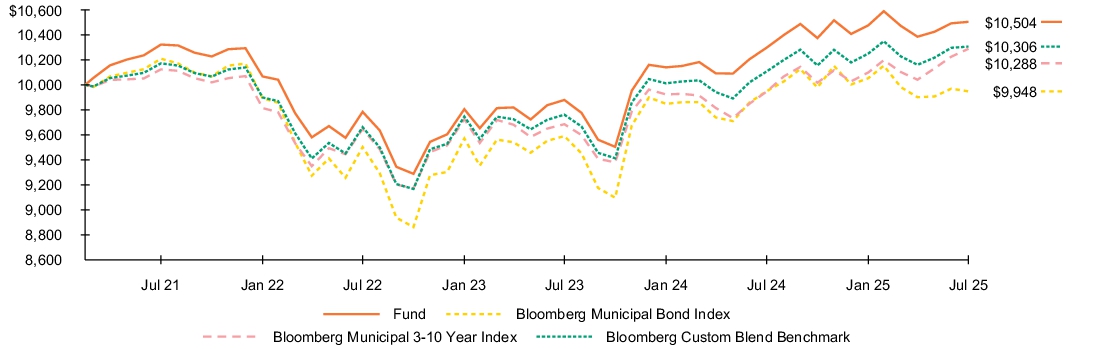

How did the Fund perform last year? -

For the reporting period ended July 31, 2025, the Fund returned 2.01%. -

For the same period, the Bloomberg Municipal Bond Index returned 0.00%, the Bloomberg Municipal Bond 3-10 Year Index returned 3.44%, and the Bloomberg Custom Blend Benchmark returned 1.98%. What contributed to performance? Income, which offset the impact of falling prices and widening yield spreads, was the key contributor to performance. At the sector level, transportation and corporate-backed issues made the largest contributions. What detracted from performance? Positions in longer-duration securities, which posted negative total returns, detracted from performance. (Duration is a measure of interest rate sensitivity.) The decision to add to the Fund’s weighting in the intermediate-term portion of the yield curve during the course of the period detracted from results. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: March 16, 2021 through July 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

1 Year |

|

Since Fund

Inception |

|

| Fund NAV |

2.01 |

% |

1.13 |

% |

| Bloomberg Municipal Bond Index |

0.00 |

|

(0.12 |

) |

| Bloomberg Municipal 3-10 Year Index |

3.44 |

|

0.65 |

|

| Bloomberg Custom Blend Benchmark |

1.98 |

|

0.69 |

|

|

|

| Performance Inception Date |

Mar. 16, 2021

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Material Change Date |

Oct. 10, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit iShares.com for more recent performance information.

|

|

| Net Assets |

$ 116,731,073

|

|

| Holdings Count | Holding |

216

|

|

| Advisory Fees Paid, Amount |

$ 151,879

|

|

| Investment Company Portfolio Turnover |

66.00%

|

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$116,731,073 |

| Number of Portfolio Holdings |

216 |

| Net Investment Advisory Fees |

$151,879 |

| Portfolio Turnover Rate |

66% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of July 31, 2025) Credit quality allocation

| Credit Rating* |

Percent of Total

Investments(a) |

|

| AAA/Aaa |

13.9 |

% |

| AA/Aa |

37.2 |

% |

| A |

34.9 |

% |

| BBB/Baa |

9.2 |

% |

| BB/Ba |

1.0 |

% |

| B |

0.4 |

% |

| N/R |

3.4 |

% | Ten largest holdings

| Security |

Percent of Total

Investments(a) |

|

| Oklahoma Water Resources Board RB, 5.00%, 04/01/41 |

1.7 |

% |

| Indiana Finance Authority RB, 5.00%, 10/01/57 |

1.6 |

% |

| Commonwealth Financing Authority RB, 5.00%, 06/01/34 |

1.4 |

% |

| State of Washington GO, 5.00%, 02/01/41 |

1.4 |

% |

| Chicago O'Hare International Airport RB, 5.00%, 01/01/35 |

1.4 |

% |

| Commonwealth Financing Authority RB, 5.00%, 06/01/35 |

1.4 |

% |

| New Jersey Educational Facilities Authority RB, 5.00%, 07/01/35 |

1.4 |

% |

| Black Belt Energy Gas District RB, 5.25%, 02/01/53 |

1.1 |

% |

| Central Plains Energy Project RB, 5.00%, 05/01/53 |

1.1 |

% |

| New Jersey Transportation Trust Fund Authority RB, 5.00%, 06/15/35 |

1.1 |

% |

| (a) |

Excludes money market funds. |

| * |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security |

Percent of Total

Investments(a) |

|

| Oklahoma Water Resources Board RB, 5.00%, 04/01/41 |

1.7 |

% |

| Indiana Finance Authority RB, 5.00%, 10/01/57 |

1.6 |

% |

| Commonwealth Financing Authority RB, 5.00%, 06/01/34 |

1.4 |

% |

| State of Washington GO, 5.00%, 02/01/41 |

1.4 |

% |

| Chicago O'Hare International Airport RB, 5.00%, 01/01/35 |

1.4 |

% |

| Commonwealth Financing Authority RB, 5.00%, 06/01/35 |

1.4 |

% |

| New Jersey Educational Facilities Authority RB, 5.00%, 07/01/35 |

1.4 |

% |

| Black Belt Energy Gas District RB, 5.25%, 02/01/53 |

1.1 |

% |

| Central Plains Energy Project RB, 5.00%, 05/01/53 |

1.1 |

% |

| New Jersey Transportation Trust Fund Authority RB, 5.00%, 06/15/35 |

1.1 |

% | (a)Excludes money market funds.

|

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737. On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Intermediate Muni Income Bond ETF to iShares Intermediate Muni Income Active ETF. This change became effective on October 10, 2024.

|

|

| Material Fund Change Name [Text Block] |

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Intermediate Muni Income Bond ETF to iShares Intermediate Muni Income Active ETF. This change became effective on October 10, 2024.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737.

|

|

| Updated Prospectus Phone Number |

(800) 474-2737

|

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

|

| C000238207 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

iShares Floating Rate Loan Active ETF

|

|

| Class Name |

iShares Floating Rate Loan Active ETF

|

|

| Trading Symbol |

BRLN

|

|

| Security Exchange Name |

CboeBZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about iShares Floating Rate Loan Active ETF (the “Fund”) (formerly known as BlackRock Floating Rate Loan ETF) for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 474‑2737.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 474‑2737

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| iShares Floating Rate Loan Active ETF |

$55 |

0.53% |

|

|

| Expenses Paid, Amount |

$ 55

|

|

| Expense Ratio, Percent |

0.53%

|

|

| Factors Affecting Performance [Text Block] |

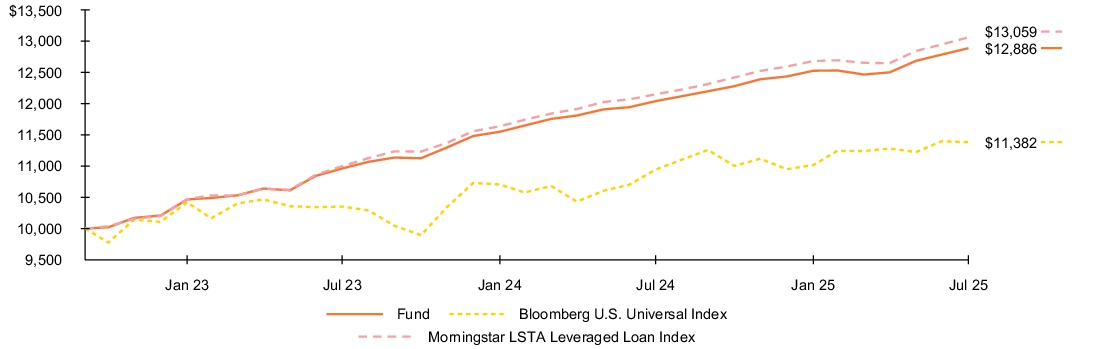

How did the Fund perform last year? -

For the reporting period ended July 31, 2025, the Fund returned 7.04%. -

For the same period, the Bloomberg U.S. Universal Index returned 4.00%, and the Morningstar LSTA Leveraged Loan Index returned 7.50%. What contributed to performance? The core allocation to bank loans was the primary contributor to the Fund’s absolute return. The overall bank loan market experienced strong performance over the period, returning 7.50%. Allocations to both high yield corporate bonds and bank loans via indexed products also contributed positively to performance, as both asset classes posted strong returns over the period. In terms of credit categories, issues rated BB and higher led positive contributions, followed by those rated B2 and B3. In sector terms, holdings within technology, diversified manufacturing, and property & casualty insurance proved most additive. What detracted from performance? While there were no material detractors from performance, holdings within the lodging and construction machinery sectors detracted very slightly. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: October 4, 2022 through July 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

1 Year |

|

Since Fund

Inception |

|

| Fund NAV |

7.04 |

% |

9.39 |

% |

| Bloomberg U.S. Universal Index |

4.00 |

|

4.69 |

|

| Morningstar LSTA Leveraged Loan Index |

7.50 |

|

9.92 |

|

|

|

| Performance Inception Date |

Oct. 04, 2022

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Material Change Date |

Oct. 10, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit iShares.com for more recent performance information.

|

|

| Net Assets |

$ 60,015,526

|

|

| Holdings Count | Holding |

448

|

|

| Advisory Fees Paid, Amount |

$ 307,665

|

|

| Investment Company Portfolio Turnover |

38.00%

|

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$60,015,526 |

| Number of Portfolio Holdings |

448 |

| Net Investment Advisory Fees |

$307,665 |

| Portfolio Turnover Rate |

38% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of July 31, 2025) Credit quality allocation

| Credit Rating* |

Percent of Total

Investments(a) |

|

| A |

0.0 |

%(b) |

| BBB/Baa |

8.2 |

% |

| BB/Ba |

29.1 |

% |

| B |

55.3 |

% |

| CCC/Caa |

2.8 |

% |

| N/R |

4.6 |

% | Maturity allocation

| Maturity |

Percent of Total

Investments(a) |

|

| 0-1 Year |

0.1 |

% |

| 1-5 Years |

44.4 |

% |

| 5-10 Years |

55.5 |

% |

| (a) |

Excludes money market funds. |

| (b) |

Rounds to less than 0.1%. |

| * |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737. On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Floating Rate Loan ETF to iShares Floating Rate Loan Active ETF. This change became effective on October 10, 2024.

|

|

| Material Fund Change Name [Text Block] |

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Floating Rate Loan ETF to iShares Floating Rate Loan Active ETF. This change became effective on October 10, 2024.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737.

|

|

| Updated Prospectus Phone Number |

(800) 474-2737

|

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

|

| C000239899 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

iShares AAA CLO Active ETF

|

|

| Class Name |

iShares AAA CLO Active ETF

|

|

| Trading Symbol |

CLOA

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about iShares AAA CLO Active ETF (the “Fund”) (formerly known as BlackRock AAA CLO ETF) for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 474‑2737.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 474‑2737

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| iShares AAA CLO Active ETF |

$21 |

0.20% |

|

|

| Expenses Paid, Amount |

$ 21

|

|

| Expense Ratio, Percent |

0.20%

|

|

| Factors Affecting Performance [Text Block] |

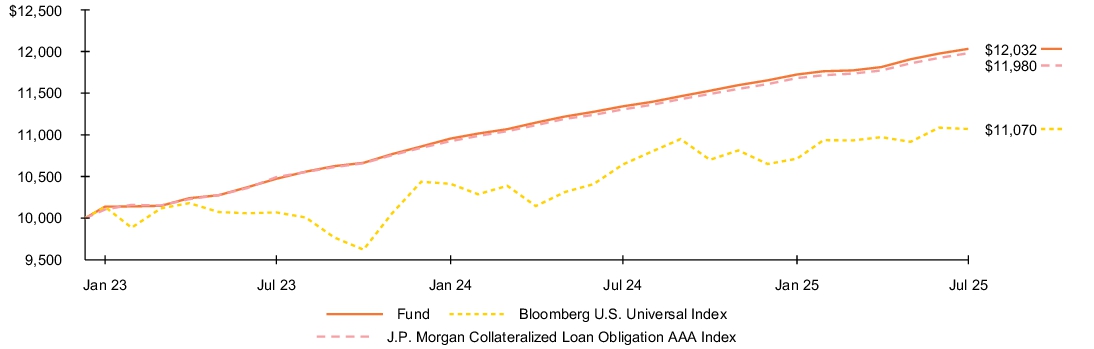

How did the Fund perform last year? -

For the reporting period ended July 31, 2025, the Fund returned 6.09%. -

For the same period, the Bloomberg U.S. Universal Index returned 4.00%, and the J.P. Morgan Collateralized Loan Obligation AAA Index returned 5.97%. What contributed to performance? The largest contributor to the Fund’s absolute return was portfolio yield as the Secured Overnight Financing Rate which serves as the base rate for CLOs benefited from the U.S. Federal Reserve holding short term policy rates steady over the time frame. In addition, discount margins on the floating rate securities held generally tightened over the period, despite some volatility in April of 2025, resulting in a modest contribution from price appreciation. Modest allocations to CLOs rated AA and A also proved additive. What detracted from performance? There were no material detractors from performance. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: January 10, 2023 through July 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

1 Year |

|

Since Fund

Inception |

|

| Fund NAV |

6.09 |

% |

7.50 |

% |

| Bloomberg U.S. Universal Index |

4.00 |

|

4.06 |

|

| J.P. Morgan Collateralized Loan Obligation AAA Index |

5.97 |

|

7.32 |

|

|

|

| Performance Inception Date |

Jan. 10, 2023

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Material Change Date |

Oct. 10, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit iShares.com for more recent performance information.

|

|

| Net Assets |

$ 1,023,592,905

|

|

| Holdings Count | Holding |

316

|

|

| Advisory Fees Paid, Amount |

$ 1,356,604

|

|

| Investment Company Portfolio Turnover |

89.00%

|

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$1,023,592,905 |

| Number of Portfolio Holdings |

316 |

| Net Investment Advisory Fees |

$1,356,604 |

| Portfolio Turnover Rate |

89% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of July 31, 2025) Maturity allocation

| Maturity |

Percent of Total

Investments(a) |

|

| 1-5 Years |

0.3 |

% |

| 5-10 Years |

19.3 |

% |

| 10-15 Years |

80.4 |

% | Ten largest holdings

| Security |

Percent of Total

Investments(a) |

|

| OHA Credit Funding 3 Ltd., 5.65%, 01/20/38 |

1.4 |

% |

| AGL CLO 37 Ltd., 5.57%, 04/22/38 |

1.0 |

% |

| Elmwood CLO 40 Ltd., 5.52%, 03/22/38 |

1.0 |

% |

| ARES Loan Funding VIII Ltd., 5.57%, 01/24/38 |

1.0 |

% |

| Sculptor CLO XXXV Ltd., 5.56%, 04/27/38 |

1.0 |

% |

| OHA Credit Funding 2 Ltd., 5.57%, 01/21/38 |

0.8 |

% |

| OHA Credit Funding 4 Ltd., 5.62%, 01/22/38 |

0.8 |

% |

| Generate CLO 15 Ltd., 5.90%, 07/20/37 |

0.8 |

% |

| ARES XXXIX CLO Ltd., 5.75%, 07/18/37 |

0.8 |

% |

| OCP CLO Ltd., 5.70%, 07/20/37 |

0.8 |

% |

| (a) |

Excludes money market funds. |

|

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security |

Percent of Total

Investments(a) |

|

| OHA Credit Funding 3 Ltd., 5.65%, 01/20/38 |

1.4 |

% |

| AGL CLO 37 Ltd., 5.57%, 04/22/38 |

1.0 |

% |

| Elmwood CLO 40 Ltd., 5.52%, 03/22/38 |

1.0 |

% |

| ARES Loan Funding VIII Ltd., 5.57%, 01/24/38 |

1.0 |

% |

| Sculptor CLO XXXV Ltd., 5.56%, 04/27/38 |

1.0 |

% |

| OHA Credit Funding 2 Ltd., 5.57%, 01/21/38 |

0.8 |

% |

| OHA Credit Funding 4 Ltd., 5.62%, 01/22/38 |

0.8 |

% |

| Generate CLO 15 Ltd., 5.90%, 07/20/37 |

0.8 |

% |

| ARES XXXIX CLO Ltd., 5.75%, 07/18/37 |

0.8 |

% |

| OCP CLO Ltd., 5.70%, 07/20/37 |

0.8 |

% |

| (a) |

Excludes money market funds. |

|

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737. On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock AAA CLO ETF to iShares AAA CLO Active ETF. This change became effective on October 10, 2024.

|

|

| Material Fund Change Name [Text Block] |

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock AAA CLO ETF to iShares AAA CLO Active ETF. This change became effective on October 10, 2024.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737.

|

|

| Updated Prospectus Phone Number |

(800) 474-2737

|

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

|

| C000242803 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

iShares Flexible Income Active ETF

|

|

| Class Name |

iShares Flexible Income Active ETF

|

|

| Trading Symbol |

BINC

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about iShares Flexible Income Active ETF (the “Fund”) (formerly known as BlackRock Flexible Income ETF) for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 474‑2737.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 474‑2737

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| iShares Flexible Income Active ETF |

$39 |

0.38% |

|

|

| Expenses Paid, Amount |

$ 39

|

|

| Expense Ratio, Percent |

0.38%

|

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended July 31, 2025, the Fund returned 6.50%. -

For the same period, the Bloomberg U.S. Universal Index returned 4.00%. What contributed to performance? For the 12-month period, positive contributions to the Fund’s performance were led by exposures to U.S. high yield and European high yield corporate bonds. The allocation to securitized assets including commercial mortgage-backed securities, collateralized loan obligations, asset-backed securities and non-agency residential mortgage-backed securities also proved additive. Positioning with respect to duration and corresponding interest rate sensitivity in emerging markets as well as in European and other developed international markets also contributed to return. Other contributors included exposures to emerging market hard currencies, agency mortgage-backed securities and European investment grade corporate bonds. The Fund utilized derivatives to help manage interest rate and credit exposures, as well as to hedge foreign currency exposures. The use of derivatives contributed modestly to the Fund’s performance during the period. What detracted from performance? The Fund’s positioning with respect to duration and corresponding interest rate sensitivity in the U.S. market weighed most heavily on return over the 12-month period. Exposure to U.S. investment grade corporate bonds also detracted from performance. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

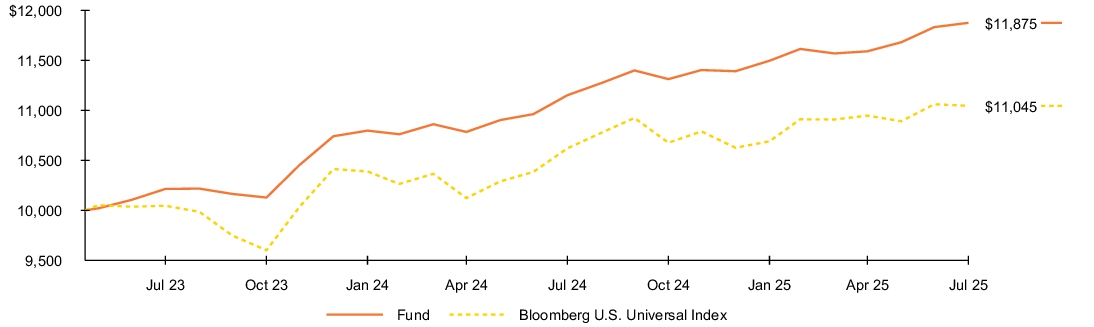

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: May 19, 2023 through July 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

1 Year |

|

Since Fund

Inception |

|

| Fund NAV |

6.50 |

% |

8.11 |

% |

| Bloomberg U.S. Universal Index |

4.00 |

|

4.63 |

|

|

|

| Performance Inception Date |

May 19, 2023

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Material Change Date |

Oct. 10, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit iShares.com for more recent performance information.

|

|

| Net Assets |

$ 10,728,405,834

|

|

| Holdings Count | Holding |

3,774

|

|

| Advisory Fees Paid, Amount |

$ 28,226,931

|

|

| Investment Company Portfolio Turnover |

291.00%

|

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$10,728,405,834 |

| Number of Portfolio Holdings |

3,774 |

| Net Investment Advisory Fees |

$28,226,931 |

| Portfolio Turnover Rate |

291% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of July 31, 2025) Portfolio composition

| Investment Type |

Percent of Total

Investments(a) |

|

| Corporate Bonds & Notes |

39.8 |

% |

| Collateralized Mortgage Obligations |

21.2 |

% |

| U.S. Government & Agency Obligations |

15.5 |

% |

| Asset-Backed Securities |

15.0 |

% |

| Foreign Government Obligations |

8.0 |

% |

| Floating Rate Loan Interests |

2.8 |

% |

| Investment Companies |

1.6 |

% |

| Convertible Bonds |

0.2 |

% |

| Municipal Debt Obligations |

0.0 |

%(b) |

| Preferred Stocks |

0.0 |

%(b) |

| Other^ |

(4.1 |

)% | Credit quality allocation

| Credit Rating* |

Percent of Total

Investments(a) |

|

| AAA/Aaa |

30.6 |

% |

| AA/Aa |

5.1 |

% |

| A |

3.7 |

% |

| BBB/Baa |

7.2 |

% |

| BB/Ba |

19.7 |

% |

| B |

14.4 |

% |

| CCC/Caa |

1.4 |

% |

| CC/Ca |

0.1 |

% |

| C |

0.0 |

%(b) |

| D |

0.0 |

%(b) |

| N/R |

17.8 |

% |

| (a) |

Excludes money market funds. |

| (b) |

Rounds to less than 0.1%. |

| ^ |

Ten largest investment types are presented. Additional asset types are found in Other. |

| * |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737. On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Flexible Income ETF to iShares Flexible Income Active ETF. This change became effective on October 10, 2024.

|

|

| Material Fund Change Name [Text Block] |

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Flexible Income ETF to iShares Flexible Income Active ETF. This change became effective on October 10, 2024.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737.

|

|

| Updated Prospectus Phone Number |

(800) 474-2737

|

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

|

| C000242862 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

iShares Short-Term California Muni Active ETF

|

|

| Class Name |

iShares Short-Term California Muni Active ETF

|

|

| Trading Symbol |

CALI

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about iShares Short-Term California Muni Active ETF (the “Fund”) (formerly known as BlackRock Short-Term California Muni Bond ETF) for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 474‑2737.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 474‑2737

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| iShares Short-Term California Muni Active ETF |

$20 |

0.20% |

|

|

| Expenses Paid, Amount |

$ 20

|

|

| Expense Ratio, Percent |

0.20%

|

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended July 31, 2025, the Fund returned 3.26%. -

For the same period, the Bloomberg Municipal Bond Index returned 0.00%, and the Bloomberg California Municipal 0-2 Year Index returned 3.24%. What contributed to performance? Holdings in longer-dated securities—those with maturities of up to five years—in the corporate, prepaid gas, and transportation sectors contributed to performance, as did select holdings in the school district, tax-backed state, and tax-backed local categories. A focus on variable rate demand notes (VRDNs) and tender option bond floaters (TOBs) as core holdings, which in the adviser’s view featured both attractive yields and price stability, also contributed. Select commercial paper purchases, which offered additional yield and short maturity profiles, further helped results in a volatile interest rate environment. In terms of credit tiers, holdings in AA and A rated bonds had the strongest influence on the Fund’s performance. What detracted from performance? At a time of positive return for the California municipal market, there were no meaningful detractors from absolute returns. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

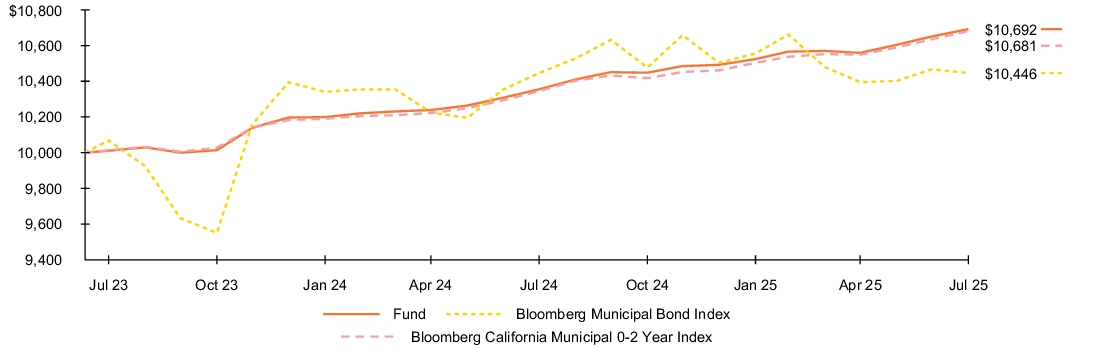

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: July 11, 2023 through July 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

1 Year |

|

Since Fund

Inception |

|

| Fund NAV |

3.26 |

% |

3.30 |

% |

| Bloomberg Municipal Bond Index |

0.00 |

|

2.15 |

|

| Bloomberg California Municipal 0-2 Year Index |

3.24 |

|

3.26 |

|

|

|

| Performance Inception Date |

Jul. 11, 2023

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Material Change Date |

Oct. 10, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit iShares.com for more recent performance information.

|

|

| Net Assets |

$ 131,136,615

|

|

| Holdings Count | Holding |

138

|

|

| Advisory Fees Paid, Amount |

$ 125,081

|

|

| Investment Company Portfolio Turnover |

113.00%

|

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$131,136,615 |

| Number of Portfolio Holdings |

138 |

| Net Investment Advisory Fees |

$125,081 |

| Portfolio Turnover Rate |

113% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of July 31, 2025) Credit quality allocation

| Credit Rating* |

Percent of Total

Investments(a) |

|

| AAA/Aaa |

4.2 |

% |

| AA/Aa |

64.0 |

% |

| A |

30.3 |

% |

| BBB/Baa |

1.3 |

% |

| N/R |

0.2 |

% | Ten largest holdings

| Security |

Percent of Total

Investments(a) |

|

| City of Modesto California Water Revenue COP, 1.80%, 08/07/25 |

4.6 |

% |

| Metropolitan Water District of Southern California RB, 1.54%, 08/07/25 |

4.2 |

% |

| San Diego Public Facilities Financing Authority RB, 2.37%, 08/07/25 |

3.5 |

% |

| Anaheim Housing & Public Improvements Authority RB, 2.60%, 08/01/25 |

3.4 |

% |

| Orange County Water District COP, VRDN, 2.35%, 08/07/25 |

3.0 |

% |

| California Community Choice Financing Authority RB, 5.25%, 01/01/30 |

2.9 |

% |

| San Francisco City & County Airport Comm-San Francisco International Airport RB, 1.00%, 08/07/25 |

2.3 |

% |

| Tender Option Bond Trust Receipts/Certificates RB, 2.32%, 08/07/25 |

2.3 |

% |

| University of California RB, 2.25%, 08/01/25 |

2.2 |

% |

| California Housing Finance Agency RB, 1.00%, 08/07/25 |

1.8 |

% |

| (a) |

Excludes money market funds. |

| * |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security |

Percent of Total

Investments(a) |

|

| City of Modesto California Water Revenue COP, 1.80%, 08/07/25 |

4.6 |

% |

| Metropolitan Water District of Southern California RB, 1.54%, 08/07/25 |

4.2 |

% |

| San Diego Public Facilities Financing Authority RB, 2.37%, 08/07/25 |

3.5 |

% |

| Anaheim Housing & Public Improvements Authority RB, 2.60%, 08/01/25 |

3.4 |

% |

| Orange County Water District COP, VRDN, 2.35%, 08/07/25 |

3.0 |

% |

| California Community Choice Financing Authority RB, 5.25%, 01/01/30 |

2.9 |

% |

| San Francisco City & County Airport Comm-San Francisco International Airport RB, 1.00%, 08/07/25 |

2.3 |

% |

| Tender Option Bond Trust Receipts/Certificates RB, 2.32%, 08/07/25 |

2.3 |

% |

| University of California RB, 2.25%, 08/01/25 |

2.2 |

% |

| California Housing Finance Agency RB, 1.00%, 08/07/25 |

1.8 |

% | (a)Excludes money market funds.

|

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737. On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Short-Term California Muni Bond ETF to iShares Short-Term California Muni Active ETF. The Fund's ticker was changed from CALY to CALI. These changes became effective on October 10, 2024.

|

|

| Material Fund Change Name [Text Block] |

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Short-Term California Muni Bond ETF to iShares Short-Term California Muni Active ETF. The Fund's ticker was changed from CALY to CALI. These changes became effective on October 10, 2024.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737.

|

|

| Updated Prospectus Phone Number |

(800) 474-2737

|

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

|

| C000246586 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

iShares Total Return Active ETF

|

|

| Class Name |

iShares Total Return Active ETF

|

|

| Trading Symbol |

BRTR

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about iShares Total Return Active ETF (the “Fund”) (formerly known as BlackRock Total Return ETF) for the period of August 1, 2024 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 474‑2737.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

(800) 474‑2737

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| iShares Total Return Active ETF |

$38 |

0.37% |

|

|

| Expenses Paid, Amount |

$ 38

|

|

| Expense Ratio, Percent |

0.37%

|

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended July 31, 2025, the Fund returned 3.59%. -

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 3.38%. What contributed to performance? Over the 12-month period, economic growth generally surprised to the upside and credit sensitive sectors across fixed income performed well despite elevated interest rate volatility. Positive contributions to the Fund’s performance were led by the allocation to securitized assets including commercial mortgage-backed securities, non-agency mortgage-backed securities, collateralized loan obligations and asset-backed securities. The Fund’s allocation to and positioning within both investment grade corporate bonds and agency mortgage-backed securities also proved additive, along with an allocation to high yield corporate bonds. What detracted from performance? The Fund’s positioning with respect to duration and corresponding interest rate sensitivity was a modest detractor from performance over the period. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

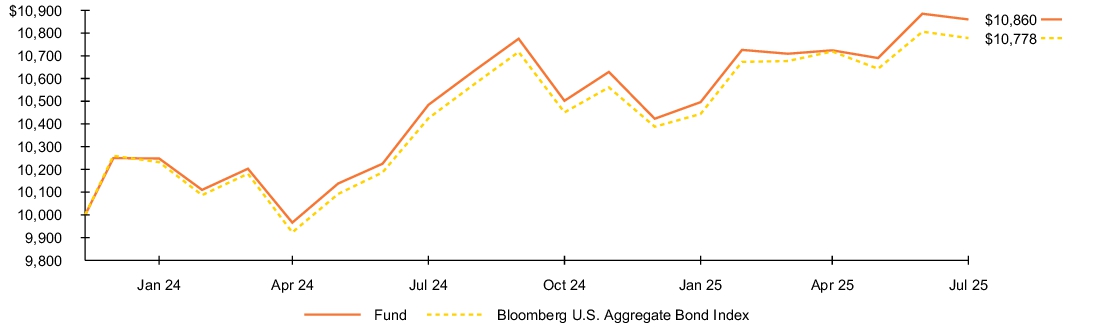

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: December 12, 2023 through July 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

| Average annual total returns |

|

|

|

|

|

1 Year |

|

Since Fund

Inception |

|

| Fund NAV |

3.59 |

% |

5.17 |

% |

| Bloomberg U.S. Aggregate Bond Index |

3.38 |

|

4.69 |

|

|

|

| Performance Inception Date |

Dec. 12, 2023

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Material Change Date |

Oct. 10, 2024

|

|

| Updated Performance Information Location [Text Block] |

Visit iShares.com for more recent performance information.

|

|

| Net Assets |

$ 257,870,012

|

|

| Holdings Count | Holding |

1,681

|

|

| Advisory Fees Paid, Amount |

$ 594,314

|

|

| Investment Company Portfolio Turnover |

647.00%

|

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$257,870,012 |

| Number of Portfolio Holdings |

1,681 |

| Net Investment Advisory Fees |

$594,314 |

| Portfolio Turnover Rate |

647% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of July 31, 2025) Credit quality allocation

| Credit Rating* |

Percent of Total

Investments(a) |

|

| AAA/Aaa |

63.2 |

% |

| AA/Aa |

3.1 |

% |

| A |

5.6 |

% |

| BBB/Baa |

13.8 |

% |

| BB/Ba |

3.8 |

% |

| B |

0.9 |

% |

| CCC/Caa |

0.8 |

% |

| CC/Ca |

0.1 |

% |

| C |

0.5 |

% |

| N/R |

8.2 |

% | Maturity allocation

| Maturity |

Percent of Total

Investments(a) |

|

| 0-1 Year |

2.0 |

% |

| 1-5 Years |

19.9 |

% |

| 5-10 Years |

21.2 |

% |

| 10-15 Years |

10.1 |

% |

| 15-20 Years |

4.9 |

% |

| More than 20 Years |

41.9 |

% |

| (a) |

Excludes money market funds. |

| * |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

|

| Credit Quality Explanation [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc.

|

|

| Material Fund Change [Text Block] |

Material Fund changes This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737. On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Total Return ETF to iShares Total Return Active ETF. This change became effective on October 10, 2024.

|

|

| Material Fund Change Name [Text Block] |

On July 30, 2024, the Fund’s Board approved a proposal to change the name of the Fund from BlackRock Total Return ETF to iShares Total Return Active ETF. This change became effective on October 10, 2024.

|

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since July 31, 2024. For more complete information, you may review the Fund’s next prospectus, which we expect to be available approximately 120 days after July 31, 2025 at blackrock.com/fundreports or upon request by contacting us at (800) 474-2737.

|

|

| Updated Prospectus Phone Number |

(800) 474-2737

|

|

| Updated Prospectus Web Address |

blackrock.com/fundreports

|

|

| C000255648 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

iShares BBB-B CLO Active ETF

|

|

| Class Name |

iShares BBB-B CLO Active ETF

|

|

| Trading Symbol |

BCLO

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about iShares BBB-B CLO Active ETF (the “Fund”) for the period of January 29, 2025 to July 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 474‑2737.

|

|

| Additional Information Phone Number |

(800) 474‑2737

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| iShares BBB-B CLO Active ETF |

$23(a) |

0.45%(b) |

| (a) |

The Fund commenced operations during the reporting period. Expenses for a full reporting period would be higher than the amount shown. |

| (b) |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 23

|

[1] |

| Expense Ratio, Percent |

0.45%

|

[2] |

| Factors Affecting Performance [Text Block] |

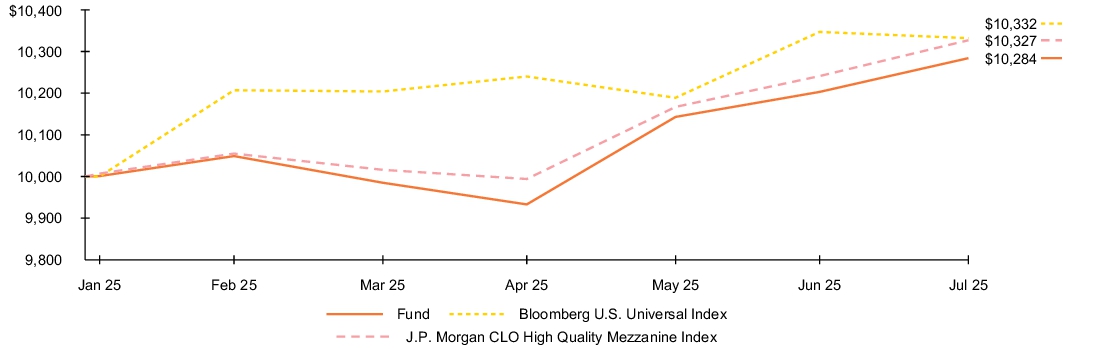

How did the Fund perform during the period? -

For the period beginning with the Fund’s January 29, 2025 inception and ended July 31, 2025, the Fund returned 2.84%. -

For the same period, the Bloomberg U.S. Universal Index returned 3.32%, and the J.P. Morgan CLO High Quality Mezzanine Index returned 3.27%. What contributed to performance? The largest contributor to the Fund’s absolute return was portfolio yield as the Secured Overnight Financing Rate which serves as the base rate for CLOs benefited from the U.S. Federal Reserve holding short term policy rates steady over the time frame. In addition, the average discount margin on the floating rate securities held contributed positively to the contribution to return from portfolio yield. What detracted from performance? The widening of spreads and accompanying downward pressure on prices for CLOs rated BBB and BB during the elevated market volatility in April of 2025 weighed on returns for the period. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: January 29, 2025 through July 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

Average annual total returns As of the date of this report, the Fund does not have a full fiscal year of performance information to report.

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit iShares.com for more recent performance information.

|

|

| Net Assets |

$ 64,849,853

|

|

| Holdings Count | Holding |

41

|

|

| Advisory Fees Paid, Amount |

$ 134,857

|

|

| Investment Company Portfolio Turnover |

30.00%

|

|

| Additional Fund Statistics [Text Block] |

| Key Fund statistics |

|

| Net Assets |

$64,849,853 |

| Number of Portfolio Holdings |

41 |

| Net Investment Advisory Fees |

$134,857 |

| Portfolio Turnover Rate |

30% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of July 31, 2025) Maturity allocation

| Maturity |

Percent of Total

Investments(a) |

|

| 5-10 Years |

4.7 |

% |

| 10-15 Years |

95.3 |

% | Ten largest holdings

| Security |

Percent of Total

Investments(a) |

|

| OHA Credit Partners XIV Ltd., 7.18%, 07/21/37 |

6.3 |

% |

| GoldenTree Loan Management U.S. CLO 10 Ltd., 7.43%, 10/20/37 |

4.8 |

% |

| Apidos CLO L, 7.13%, 01/20/38 |

4.6 |

% |

| Birch Grove CLO 11 Ltd., 7.43%, 01/22/38 |

4.0 |

% |

| Barings CLO Ltd., 8.82%, 10/15/36 |

3.6 |

% |

| Madison Park Funding XXXVII Ltd., 8.07%, 04/15/37 |

3.2 |

% |

| Elmwood CLO V Ltd., 8.58%, 10/20/37 |

3.2 |

% |

| Whitebox CLO I Ltd., 8.57%, 07/24/36 |

3.2 |

% |

| Palmer Square CLO Ltd., 6.97%, 01/15/38 |

3.2 |

% |

| Ballyrock CLO 28 Ltd., 7.13%, 01/20/38 |

3.2 |

% |

| (a) |

Excludes money market funds. |

|

|

| Largest Holdings [Text Block] |

Ten largest holdings

| Security |

Percent of Total

Investments(a) |

|

| OHA Credit Partners XIV Ltd., 7.18%, 07/21/37 |

6.3 |

% |

| GoldenTree Loan Management U.S. CLO 10 Ltd., 7.43%, 10/20/37 |

4.8 |

% |

| Apidos CLO L, 7.13%, 01/20/38 |

4.6 |

% |

| Birch Grove CLO 11 Ltd., 7.43%, 01/22/38 |

4.0 |

% |

| Barings CLO Ltd., 8.82%, 10/15/36 |

3.6 |

% |

| Madison Park Funding XXXVII Ltd., 8.07%, 04/15/37 |

3.2 |

% |

| Elmwood CLO V Ltd., 8.58%, 10/20/37 |

3.2 |

% |

| Whitebox CLO I Ltd., 8.57%, 07/24/36 |

3.2 |

% |

| Palmer Square CLO Ltd., 6.97%, 01/15/38 |

3.2 |

% |

| Ballyrock CLO 28 Ltd., 7.13%, 01/20/38 |

3.2 |

% |

| (a) |

Excludes money market funds. |

|

|

|

|