What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

|

Fund Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

|---|---|---|

|

Cultivar ETF |

$88 |

0.87% |

How did the Fund perform?

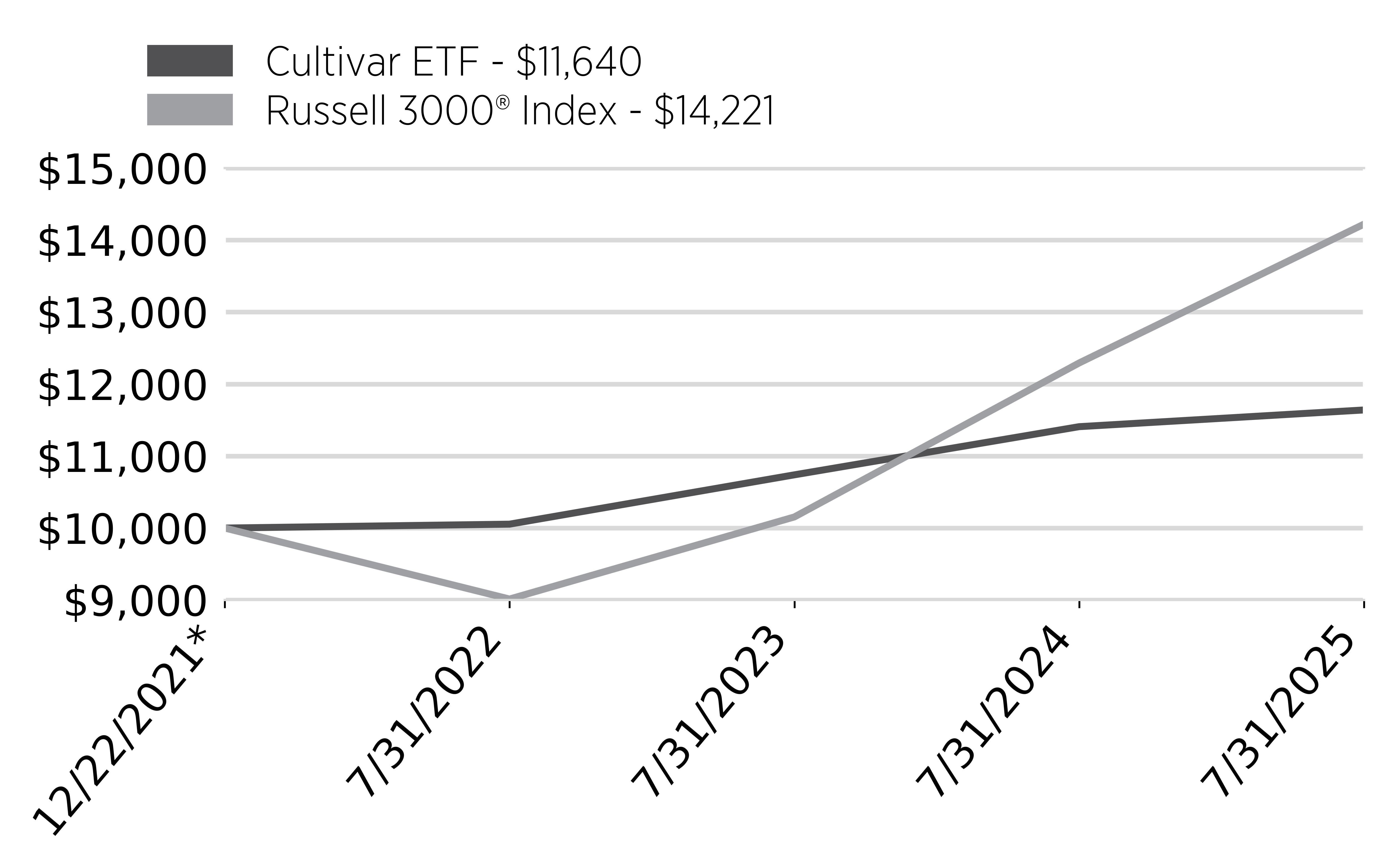

For the period of August 1, 2024 to July 31, 2025 the Cultivar ETF (the "Fund") returned 2.04%, underperforming its benchmark, the Russell 3000® Index, which returned 15.68% during the same period. The Fund does not follow a capitalization-weighted indexed approach, as it focuses on active stock selection based on the portfolio managers’ assessment of individual stock valuations, as well as broad macro risks.

What key factors affected the Fund’s performance?

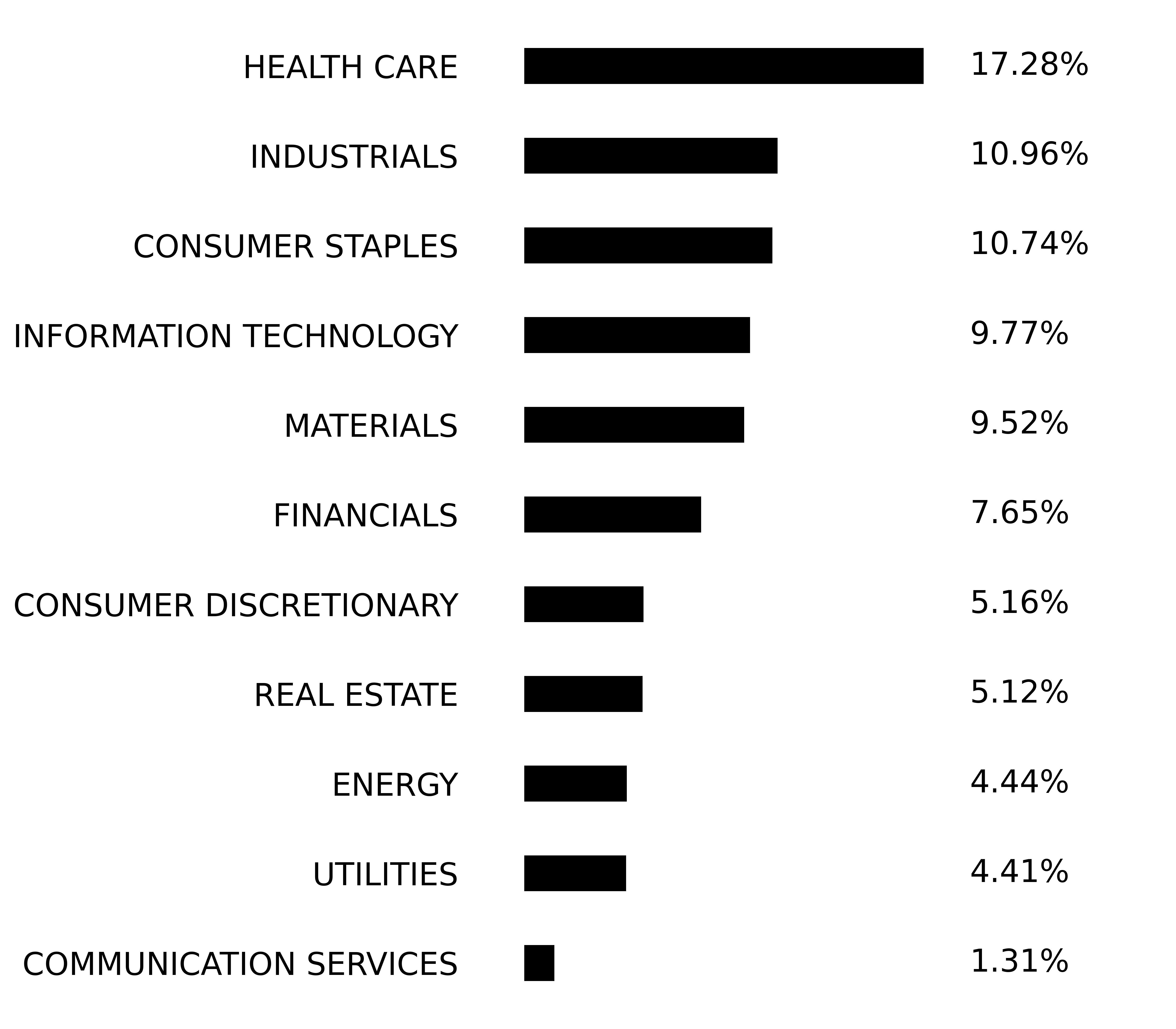

The Fund’s active assessment of individual security valuations and concerns about macro risks, caused underweights to the technology sector, which was a significant driver of the benchmark index performance. This assessment also led to an overweight in traditionally less volatile areas, such as cash and U.S. Treasuries, basic materials, consumer staples and healthcare.

Positioning

The Fund held an overweight in the basic materials sector with a focus on gold and silver miners, with opportunistic entry points and trimming upon recovery. The Fund has also built additional weight in the healthcare sector, as softness in this sector brought several companies into the desired valuation range. With mega-cap technology stocks appearing overvalued and with the index being driven higher by such valuations, the Fund exercised a measure of risk control by continuing to maintain its underweight in the technology sector relative to the benchmark.

Performance

The Fund posted a positive absolute return for the year, while maintaining broad diversification with a focus toward risk control measures. The focus on diversification was beneficial to performance relative to the benchmark during the volatile period in early 2025 when there was an initial shift in U.S. foreign trade policy rhetoric. Industrials helped performance with positive results from some of our largest weights in this sector. Additionally, positive impacts came from holdings in the materials sector, primarily through precious metals mining companies. Healthcare was a positive contributor to Fund performance while the broad sector was down for the year.

Top Contributors – Industrials, Materials, Healthcare

Top Detractors – Underweight Technology, Energy, Financials

Cumulative Performance

(based on a hypothetical $10,000 investment)

| * | Inception |

Annual Performance

|

|

One

Year |

Average

Annual

Total

Return

Since

Inception |

|---|---|---|

|

Cultivar

ETF |

2.04% |

4.30% |

|

Russell

3000® Index |

15.68% |

10.24% |

Key Fund Statistics

(as of July 31, 2025)

|

Fund

Net Assets |

$33,216,990 |

|

Number

of Holdings |

86 |

|

Total

Advisory Fee |

$277,500 |

|

Portfolio

Turnover Rate |

57.33% |

Sector Breakdown

|

Top

Ten Holdings |

|

|---|---|

|

US

Treasury 5/15/2052 2.875% |

|

|

US

Treasury 8/5/2025 0.034% |

|

|

MarketAxess

Holdings, Inc. |

|

|

Newmont

Goldcorp Corp. |

|

|

Proto

Labs, Inc. |

|

|

Southwest

Airlines Co. |

|

|

Alexandria

Real Estate Equities, Inc. |

|

|

US

Treasury 5/15/2054 4.625% |

|

|

Healthcare

Services Group, Inc. |

|

|

Northwest

Natural Holding Co. |