Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Columbia Funds Series Trust II

|

| Entity Central Index Key |

0001352280

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jul. 31, 2025

|

| Columbia Minnesota Tax-Exempt Fund - Class A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Minnesota Tax-Exempt Fund

|

| Class Name |

Class A

|

| Trading Symbol |

IMNTX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Minnesota Tax-Exempt Fund (the Fund) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?

(Based on a hypothetical $10,000 investment)

| Class |

Cost of a $10,000 investment |

Cost paid as a percentage of a $10,000 investment |

| Class A |

$ 80 |

0.81 % |

|

| Expenses Paid, Amount |

$ 80

|

| Expense Ratio, Percent |

0.81%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance

The performance of Class A shares for the period presented is shown in the Average Annual Total Returns table.

Top Performance Contributors

Credit quality security selection | Positive contribution to benchmark-relative performance was driven by security selection in AAA, AA and BBB rated bonds. Sector security selection | Strong sector security selection in local general obligation (GO) and hospital bonds contributed to the Fund’s performance relative to its benchmark. Credit quality allocation | Underweight to AAA bonds added to relative performance. Sector allocation | An underweight to the state GO bonds added to the Fund’s relative performance. Top Performance Detractors

Yield curve positioning I Heavy supply and market uncertainty resulted in a reshaping of the yield curve, driving the curve steeper as short rates declined and intermediate and long rates moved higher. The Fund’s yield curve positioning was the main detractor from performance, relative to its benchmark. Specifically, the Fund’s overweight to longer maturity bonds (20 years and longer) and underweight to the shorter end of the curve detracted, as municipal market interest rates saw a material increase on the long end of the curve. Credit quality allocation | Overweights to not-rated and BB bonds detracted from relative performance. Sector allocation | Overweights to charter schools and continuing care retirement communities (CCRCs) detracted. Sector security selection | Security selection in housing bonds detracted from relative performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

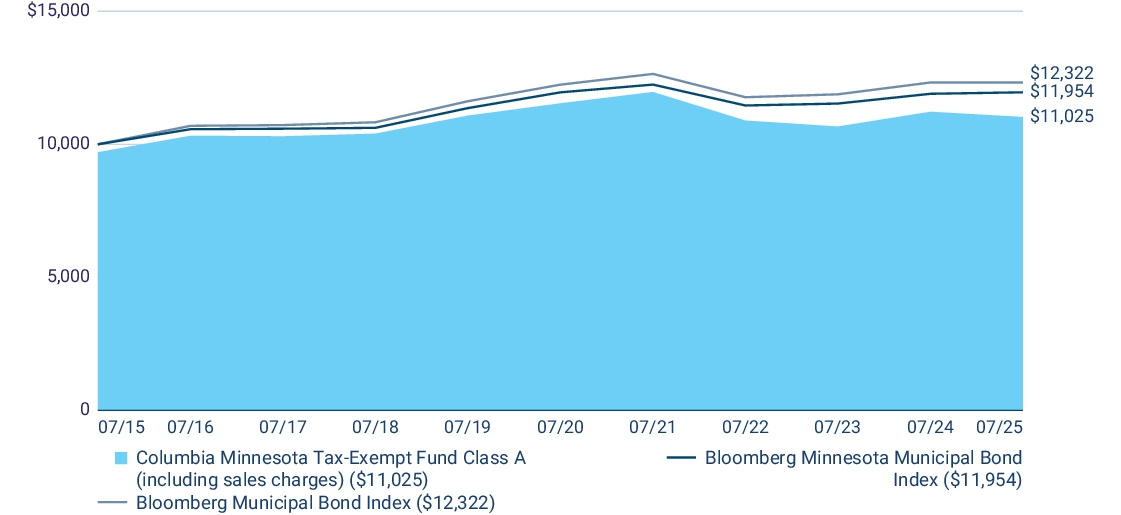

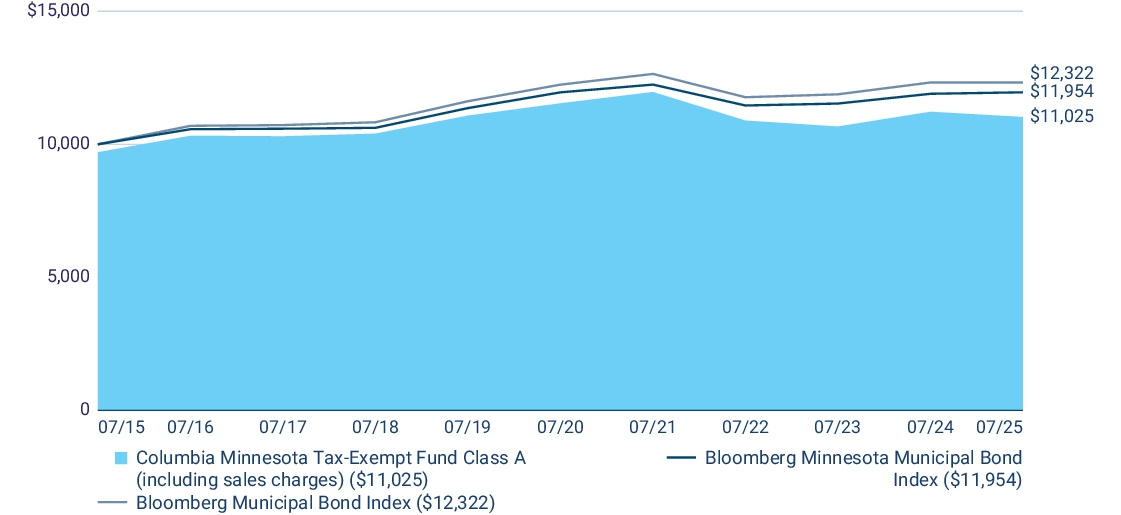

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) |

1 year |

5 years |

10 years |

| Class A (excluding sales charges) |

(1.75 ) |

(0.91 ) |

1.29 |

| Class A (including sales charges) |

(4.70 ) |

(1.49 ) |

0.98 |

| Bloomberg Minnesota Municipal Bond Index |

0.47 |

0.00 |

1.80 |

| Bloomberg Municipal Bond Index |

0.00 |

0.13 |

2.11 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 461,142,016

|

| Holdings Count | Holding |

242

|

| Advisory Fees Paid, Amount |

$ 2,362,545

|

| Investment Company, Portfolio Turnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

Fund net assets |

$ 461,142,016 |

Total number of portfolio holdings |

242 |

Management services fees

(represents 0.47% of Fund average net assets) |

$ 2,362,545 |

Portfolio turnover for the reporting period |

13% |

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio is subject to change.

City of Rochester

11/15/2057 5.000% |

2.8 % |

Roseville Independent School District No. 623

02/01/2038 4.000% |

2.2 % |

Southern Minnesota Municipal Power Agency

01/01/2026 0.000% |

2.1 % |

Brainerd Independent School District No. 181

02/01/2037 4.000% |

2.1 % |

City of Maple Grove

05/01/2037 4.000% |

2.1 % |

Minnesota Higher Education Facilities Authority

10/01/2052 5.000% |

1.7 % |

County of Chippewa

03/01/2037 4.000% |

1.5 % |

City of Minneapolis

11/15/2037 4.000% |

1.4 % |

Stillwater Independent School District No. 834

02/01/2042 4.000% |

1.4 % |

State of Minnesota

08/01/2043 4.000% |

1.4 % |

|

| Largest Holdings [Text Block] |

City of Rochester

11/15/2057 5.000% |

2.8 % |

Roseville Independent School District No. 623

02/01/2038 4.000% |

2.2 % |

Southern Minnesota Municipal Power Agency

01/01/2026 0.000% |

2.1 % |

Brainerd Independent School District No. 181

02/01/2037 4.000% |

2.1 % |

City of Maple Grove

05/01/2037 4.000% |

2.1 % |

Minnesota Higher Education Facilities Authority

10/01/2052 5.000% |

1.7 % |

County of Chippewa

03/01/2037 4.000% |

1.5 % |

City of Minneapolis

11/15/2037 4.000% |

1.4 % |

Stillwater Independent School District No. 834

02/01/2042 4.000% |

1.4 % |

State of Minnesota

08/01/2043 4.000% |

1.4 % |

|

| Columbia Minnesota Tax-Exempt Fund - Class C |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Minnesota Tax-Exempt Fund

|

| Class Name |

Class C

|

| Trading Symbol |

RMTCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Minnesota Tax-Exempt Fund (the Fund) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class C | $ 153 | 1.55 % |

|

| Expenses Paid, Amount |

$ 153

|

| Expense Ratio, Percent |

1.55%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Class C shares for the period presented is shown in the Average Annual Total Returns table. Sector security selection | Strong sector security selection in local general obligation (GO) and hospital bonds contributed to the Fund’s performance relative to its benchmark. Credit quality allocation | Underweight to AAA bonds added to relative performance. Sector allocation | An underweight to the state GO bonds added to the Fund’s relative performance. Top Performance Detractors Yield curve positioning I Heavy supply and market uncertainty resulted in a reshaping of the yield curve, driving the curve steeper as short rates declined and intermediate and long rates moved higher. The Fund’s yield curve positioning was the main detractor from performance, relative to its benchmark. Specifically, the Fund’s overweight to longer maturity bonds (20 years and longer) and underweight to the shorter end of the curve detracted, as municipal market interest rates saw a material increase on the long end of the curve. Credit quality allocation | Overweights to not-rated and BB bonds detracted from relative performance. Sector allocation | Overweights to charter schools and continuing care retirement communities (CCRCs) detracted. Sector security selection | Security selection in housing bonds detracted from relative performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

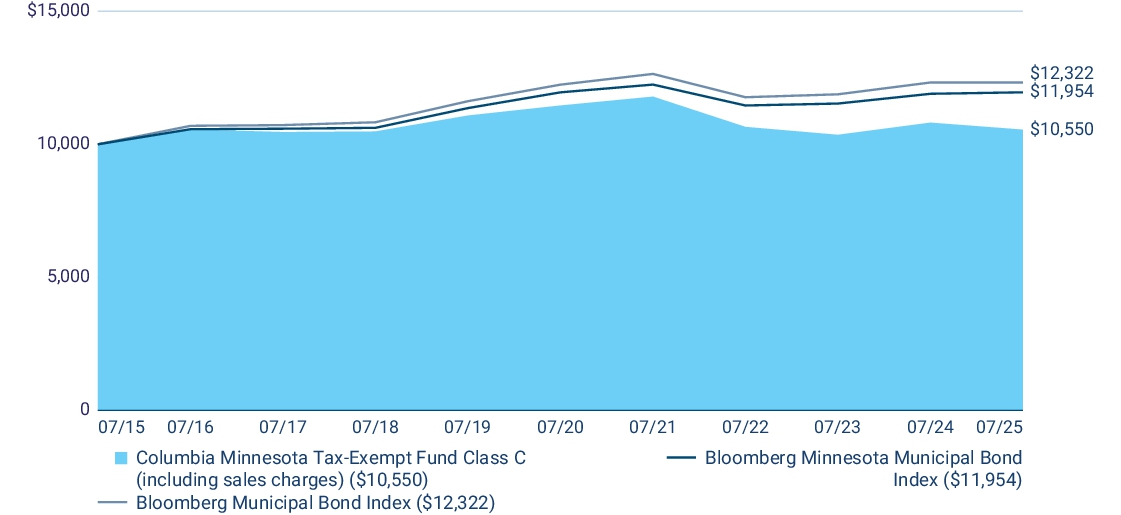

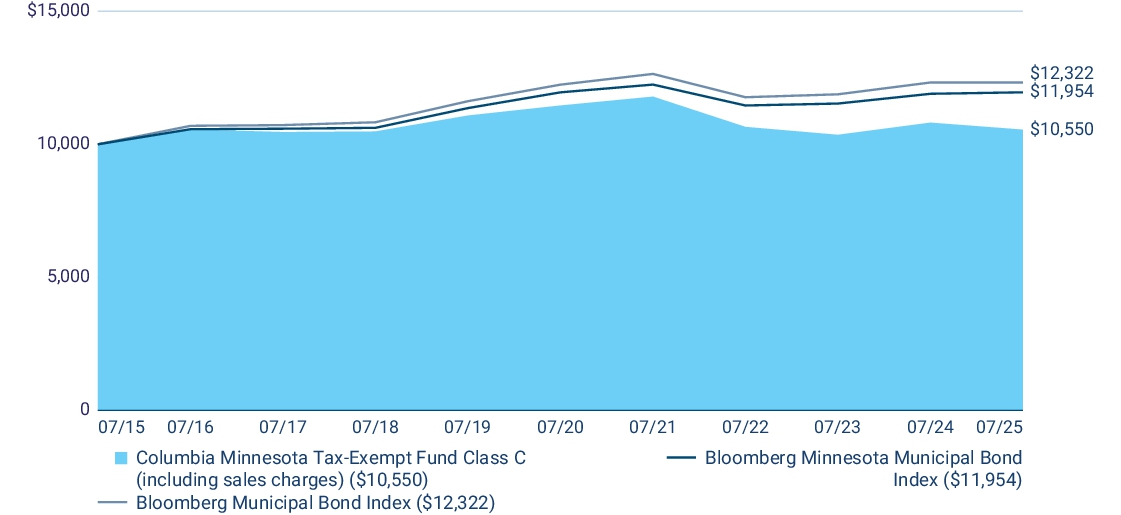

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class C (excluding sales charges) | (2.43 ) | (1.64 ) | 0.54 | | Class C (including sales charges) | (3.39 ) | (1.64 ) | 0.54 | | Bloomberg Minnesota Municipal Bond Index | 0.47 | 0.00 | 1.80 | | Bloomberg Municipal Bond Index | 0.00 | 0.13 | 2.11 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 461,142,016

|

| Holdings Count | Holding |

242

|

| Advisory Fees Paid, Amount |

$ 2,362,545

|

| Investment Company, Portfolio Turnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 461,142,016 | Total number of portfolio holdings | 242 | Management services fees

(represents 0.47% of Fund average net assets) | $ 2,362,545 | Portfolio turnover for the reporting period | 13% |

|

| Holdings [Text Block] |

Graphical Repr es entation of Fund Holdings City of Rochester

11/15/2057 5.000% | 2.8 % | Roseville Independent School District No. 623

02/01/2038 4.000% | 2.2 % | Southern Minnesota Municipal Power Agency

01/01/2026 0.000% | 2.1 % | Brainerd Independent School District No. 181

02/01/2037 4.000% | 2.1 % | City of Maple Grove

05/01/2037 4.000% | 2.1 % | Minnesota Higher Education Facilities Authority

10/01/2052 5.000% | 1.7 % | County of Chippewa

03/01/2037 4.000% | 1.5 % | City of Minneapolis

11/15/2037 4.000% | 1.4 % | Stillwater Independent School District No. 834

02/01/2042 4.000% | 1.4 % | State of Minnesota

08/01/2043 4.000% | 1.4 % |

|

| Largest Holdings [Text Block] |

City of Rochester

11/15/2057 5.000% | 2.8 % | Roseville Independent School District No. 623

02/01/2038 4.000% | 2.2 % | Southern Minnesota Municipal Power Agency

01/01/2026 0.000% | 2.1 % | Brainerd Independent School District No. 181

02/01/2037 4.000% | 2.1 % | City of Maple Grove

05/01/2037 4.000% | 2.1 % | Minnesota Higher Education Facilities Authority

10/01/2052 5.000% | 1.7 % | County of Chippewa

03/01/2037 4.000% | 1.5 % | City of Minneapolis

11/15/2037 4.000% | 1.4 % | Stillwater Independent School District No. 834

02/01/2042 4.000% | 1.4 % | State of Minnesota

08/01/2043 4.000% | 1.4 % |

|

| Columbia Minnesota Tax-Exempt Fund - Institutional Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Minnesota Tax-Exempt Fund

|

| Class Name |

Institutional Class

|

| Trading Symbol |

CMNZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Minnesota Tax-Exempt Fund (the Fund) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 56 | 0.56 % |

|

| Expenses Paid, Amount |

$ 56

|

| Expense Ratio, Percent |

0.56%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Institutional Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Credit quality security selection | Positive contribution to benchmark-relative performance was driven by security selection in AAA, AA and BBB rated bonds. Sector security selection | Strong sector security selection in local general obligation (GO) and hospital bonds contributed to the Fund’s performance relative to its benchmark. Credit quality allocation | Underweight to AAA bonds added to relative performance. Sector allocation | An underweight to the state GO bonds added to the Fund’s relative performance. Top Performance Detractors Yield curve positioning I Heavy supply and market uncertainty resulted in a reshaping of the yield curve, driving the curve steeper as short rates declined and intermediate and long rates moved higher. The Fund’s yield curve positioning was the main detractor from performance, relative to its benchmark. Specifically, the Fund’s overweight to longer maturity bonds (20 years and longer) and underweight to the shorter end of the curve detracted, as municipal market interest rates saw a material increase on the long end of the curve. Credit quality allocation | Overweights to not-rated and BB bonds detracted from relative performance. Sector allocation | Overweights to charter schools and continuing care retirement communities (CCRCs) detracted. Sector security selection | Security selection in housing bonds detracted from relative performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

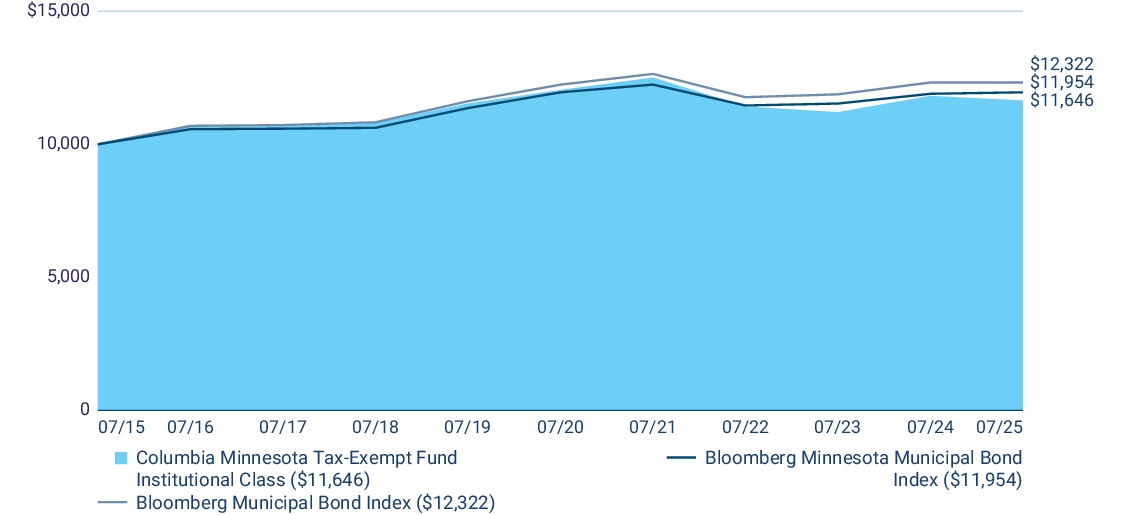

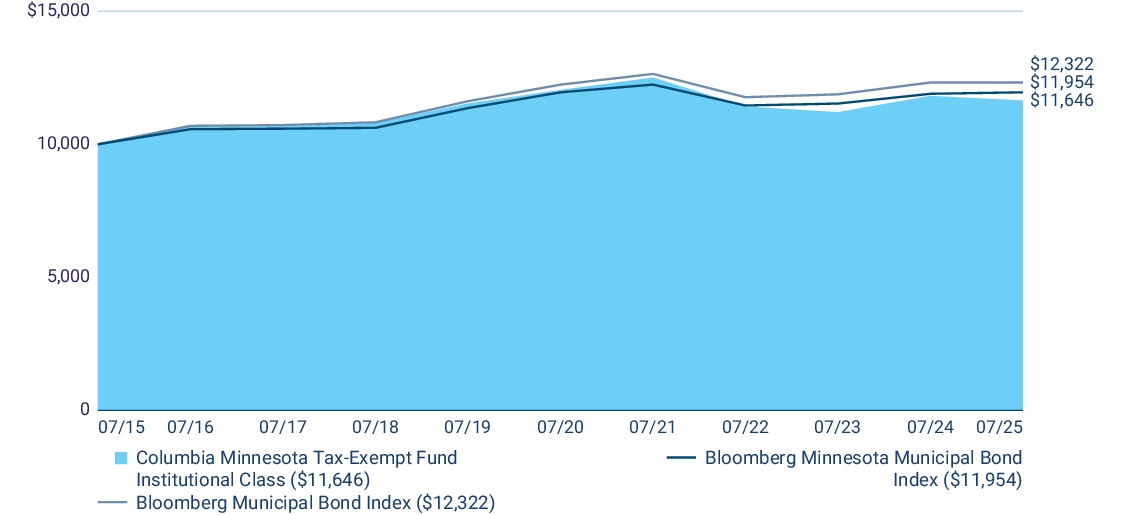

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional Class | (1.46 ) | (0.67 ) | 1.54 | | Bloomberg Minnesota Municipal Bond Index | 0.47 | 0.00 | 1.80 | | Bloomberg Municipal Bond Index | 0.00 | 0.13 | 2.11 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 461,142,016

|

| Holdings Count | Holding |

242

|

| Advisory Fees Paid, Amount |

$ 2,362,545

|

| Investment Company, Portfolio Turnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 461,142,016 | Total number of portfolio holdings | 242 | Management services fees

(represents 0.47% of Fund average net assets) | $ 2,362,545 | Portfolio turnover for the reporting period | 13% |

|

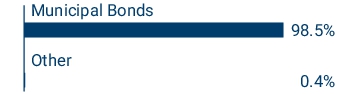

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. City of Rochester

11/15/2057 5.000% | 2.8 % | Roseville Independent School District No. 623

02/01/2038 4.000% | 2.2 % | Southern Minnesota Municipal Power Agency

01/01/2026 0.000% | 2.1 % | Brainerd Independent School District No. 181

02/01/2037 4.000% | 2.1 % | City of Maple Grove

05/01/2037 4.000% | 2.1 % | Minnesota Higher Education Facilities Authority

10/01/2052 5.000% | 1.7 % | County of Chippewa

03/01/2037 4.000% | 1.5 % | City of Minneapolis

11/15/2037 4.000% | 1.4 % | Stillwater Independent School District No. 834

02/01/2042 4.000% | 1.4 % | State of Minnesota

08/01/2043 4.000% | 1.4 % |

|

| Largest Holdings [Text Block] |

City of Rochester

11/15/2057 5.000% | 2.8 % | Roseville Independent School District No. 623

02/01/2038 4.000% | 2.2 % | Southern Minnesota Municipal Power Agency

01/01/2026 0.000% | 2.1 % | Brainerd Independent School District No. 181

02/01/2037 4.000% | 2.1 % | City of Maple Grove

05/01/2037 4.000% | 2.1 % | Minnesota Higher Education Facilities Authority

10/01/2052 5.000% | 1.7 % | County of Chippewa

03/01/2037 4.000% | 1.5 % | City of Minneapolis

11/15/2037 4.000% | 1.4 % | Stillwater Independent School District No. 834

02/01/2042 4.000% | 1.4 % | State of Minnesota

08/01/2043 4.000% | 1.4 % |

|

| Columbia Minnesota Tax-Exempt Fund - Institutional 2 Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Minnesota Tax-Exempt Fund

|

| Class Name |

Institutional 2 Class

|

| Trading Symbol |

CADOX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Minnesota Tax-Exempt Fund (the Fund) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?

(Based on a hypothetical $10,000 investment)

| Class |

Cost of a $10,000 investment |

Cost paid as a percentage of a $10,000 investment |

| Institutional 2 Class |

$ 56 |

0.56 % |

|

| Expenses Paid, Amount |

$ 56

|

| Expense Ratio, Percent |

0.56%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance

The performance of Institutional 2 Class shares for the period presented is shown in the Average Annual Total Returns table.

Top Performance Contributors

Credit quality security selection | Positive contribution to benchmark-relative performance was driven by security selection in AAA, AA and BBB rated bonds. Sector security selection | Strong sector security selection in local general obligation (GO) and hospital bonds contributed to the Fund’s performance relative to its benchmark. Credit quality allocation | Underweight to AAA bonds added to relative performance. Sector allocation | An underweight to the state GO bonds added to the Fund’s relative performance. Top Performance Detractors

Yield curve positioning I Heavy supply and market uncertainty resulted in a reshaping of the yield curve, driving the curve steeper as short rates declined and intermediate and long rates moved higher. The Fund’s yield curve positioning was the main detractor from performance, relative to its benchmark. Specifically, the Fund’s overweight to longer maturity bonds (20 years and longer) and underweight to the shorter end of the curve detracted, as municipal market interest rates saw a material increase on the long end of the curve. Credit quality allocation | Overweights to not-rated and BB bonds detracted from relative performance. Sector allocation | Overweights to charter schools and continuing care retirement communities (CCRCs) detracted. Sector security selection | Security selection in housing bonds detracted from relative performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

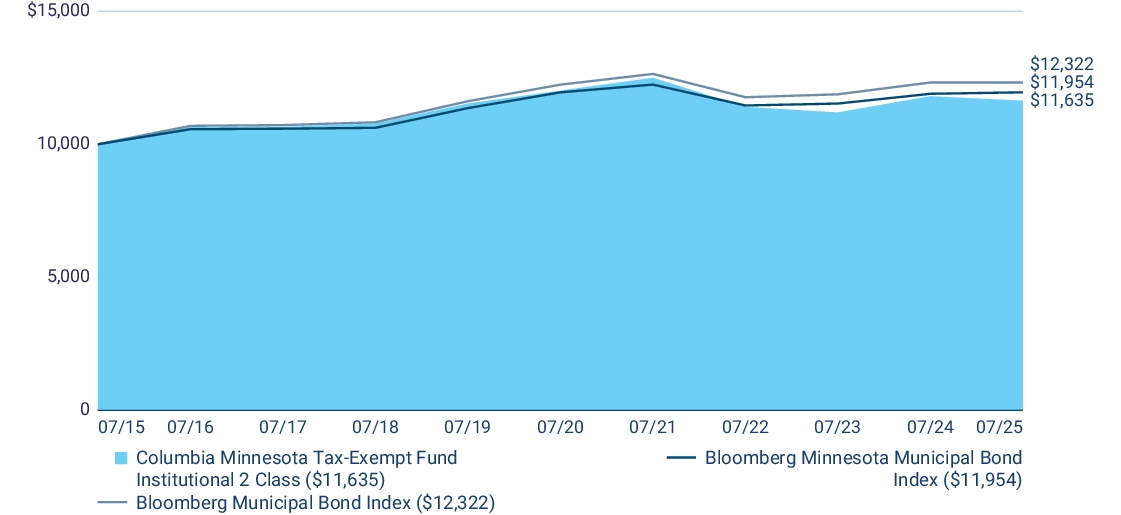

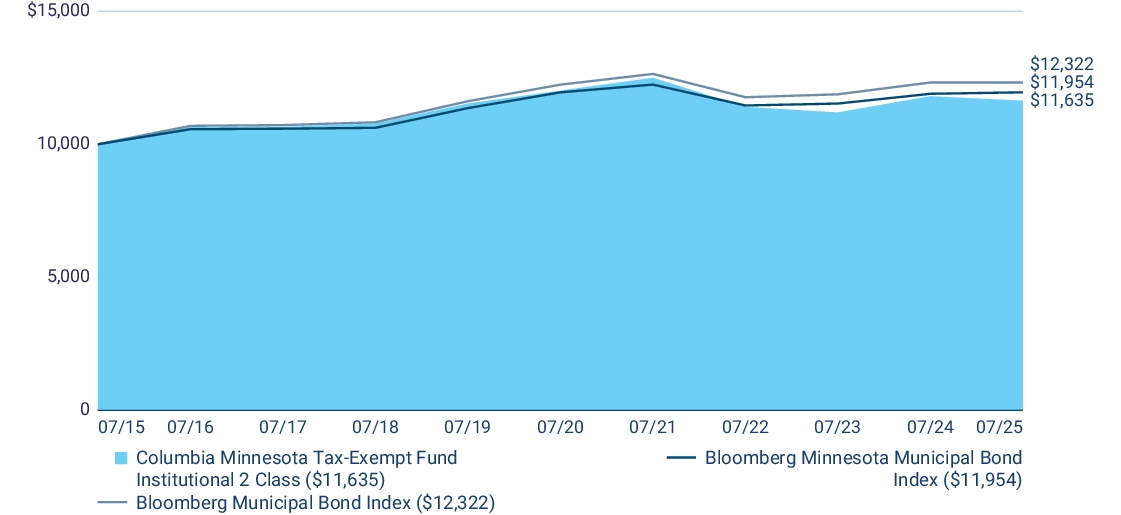

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) |

1 year |

5 years |

10 years |

| Institutional 2 Class |

(1.46 ) |

(0.65 ) |

1.53 |

| Bloomberg Minnesota Municipal Bond Index |

0.47 |

0.00 |

1.80 |

| Bloomberg Municipal Bond Index |

0.00 |

0.13 |

2.11 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 461,142,016

|

| Holdings Count | Holding |

242

|

| Advisory Fees Paid, Amount |

$ 2,362,545

|

| Investment Company, Portfolio Turnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

Fund net assets |

$ 461,142,016 |

Total number of portfolio holdings |

242 |

Management services fees

(represents 0.47% of Fund average net assets) |

$ 2,362,545 |

Portfolio turnover for the reporting period |

13% |

|

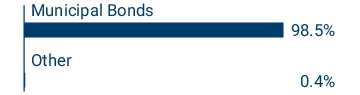

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change.

City of Rochester

11/15/2057 5.000% |

2.8 % |

Roseville Independent School District No. 623

02/01/2038 4.000% |

2.2 % |

Southern Minnesota Municipal Power Agency

01/01/2026 0.000% |

2.1 % |

Brainerd Independent School District No. 181

02/01/2037 4.000% |

2.1 % |

City of Maple Grove

05/01/2037 4.000% |

2.1 % |

Minnesota Higher Education Facilities Authority

10/01/2052 5.000% |

1.7 % |

County of Chippewa

03/01/2037 4.000% |

1.5 % |

City of Minneapolis

11/15/2037 4.000% |

1.4 % |

Stillwater Independent School District No. 834

02/01/2042 4.000% |

1.4 % |

State of Minnesota

08/01/2043 4.000% |

1.4 % |

|

| Largest Holdings [Text Block] |

City of Rochester

11/15/2057 5.000% |

2.8 % |

Roseville Independent School District No. 623

02/01/2038 4.000% |

2.2 % |

Southern Minnesota Municipal Power Agency

01/01/2026 0.000% |

2.1 % |

Brainerd Independent School District No. 181

02/01/2037 4.000% |

2.1 % |

City of Maple Grove

05/01/2037 4.000% |

2.1 % |

Minnesota Higher Education Facilities Authority

10/01/2052 5.000% |

1.7 % |

County of Chippewa

03/01/2037 4.000% |

1.5 % |

City of Minneapolis

11/15/2037 4.000% |

1.4 % |

Stillwater Independent School District No. 834

02/01/2042 4.000% |

1.4 % |

State of Minnesota

08/01/2043 4.000% |

1.4 % |

|

| Columbia Minnesota Tax-Exempt Fund - Institutional 3 Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Minnesota Tax-Exempt Fund

|

| Class Name |

Institutional 3 Class

|

| Trading Symbol |

CMNYX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Minnesota Tax-Exempt Fund (the Fund) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 3 Class | $ 51 | 0.51 % |

|

| Expenses Paid, Amount |

$ 51

|

| Expense Ratio, Percent |

0.51%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Institutional 3 Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Credit quality security selection | Positive contribution to benchmark-relative performance was driven by security selection in AAA, AA and BBB rated bonds. Sector security selection | Strong sector security selection in local general obligation (GO) and hospital bonds contributed to the Fund’s performance relative to its benchmark. Credit quality allocation | Underweight to AAA bonds added to relative performance. Sector allocation | An underweight to the state GO bonds added to the Fund’s relative performance. Top Performance Detractors Yield curve positioning I Heavy supply and market uncertainty resulted in a reshaping of the yield curve, driving the curve steeper as short rates declined and intermediate and long rates moved higher. The Fund’s yield curve positioning was the main detractor from performance, relative to its benchmark. Specifically, the Fund’s overweight to longer maturity bonds (20 years and longer) and underweight to the shorter end of the curve detracted, as municipal market interest rates saw a material increase on the long end of the curve. Credit quality allocation | Overweights to not-rated and BB bonds detracted from relative performance. Sector allocation | Overweights to charter schools and continuing care retirement communities (CCRCs) detracted. Sector security selection | Security selection in housing bonds detracted from relative performance. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

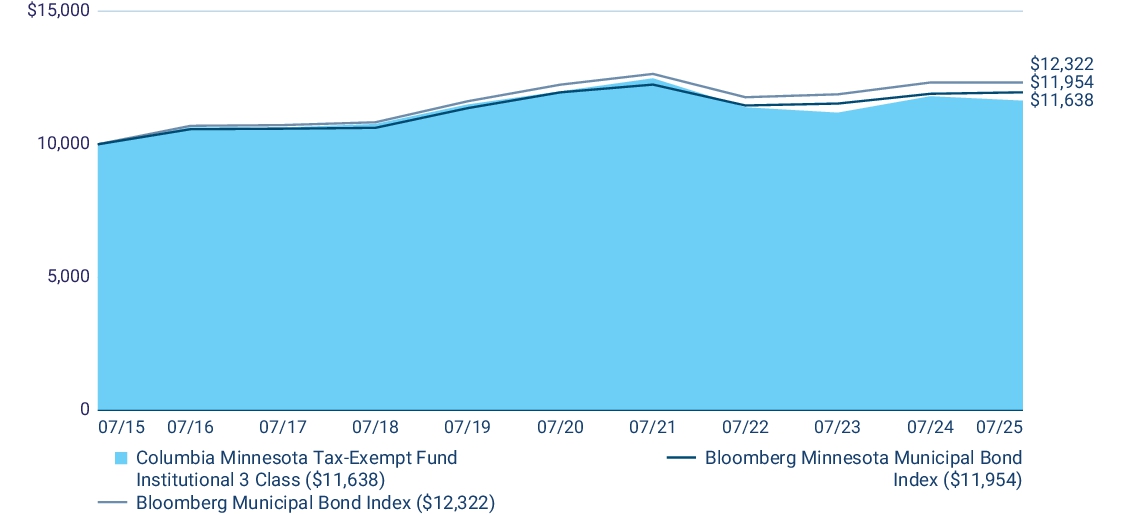

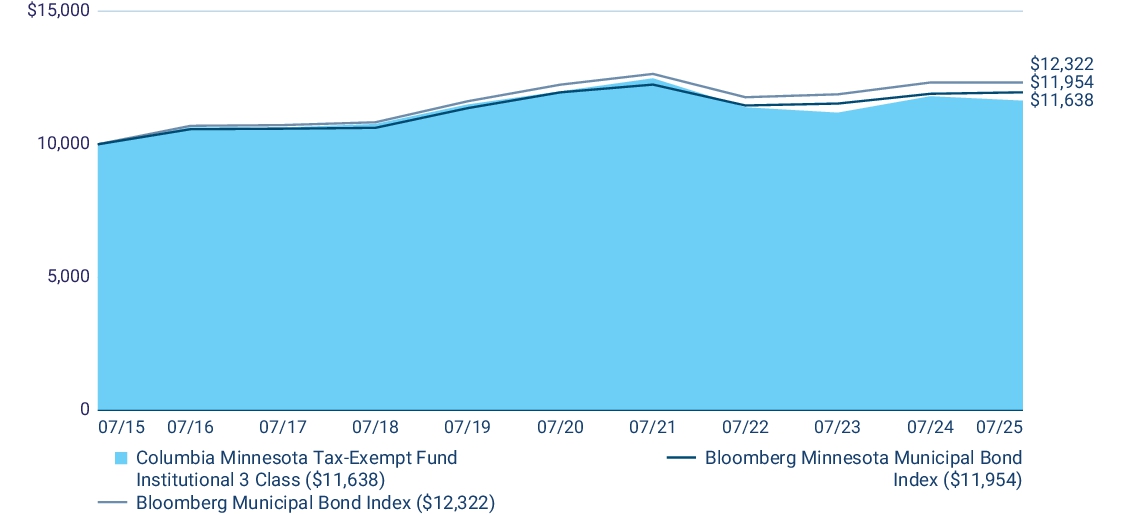

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional 3 Class | (1.41 ) | (0.59 ) | 1.53 | | Bloomberg Minnesota Municipal Bond Index | 0.47 | 0.00 | 1.80 | | Bloomberg Municipal Bond Index | 0.00 | 0.13 | 2.11 |

(a) | The returns shown for periods prior to March 1, 2017 (including Since Fund Inception returns, if shown) include the returns of Class A. These returns are adjusted to reflect any higher class-related operating expenses of the newer share classes, as applicable. Please visit columbiathreadneedleus.com/investment-products/mutual-funds/appended-performance for more information. |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 461,142,016

|

| Holdings Count | Holding |

242

|

| Advisory Fees Paid, Amount |

$ 2,362,545

|

| Investment Company, Portfolio Turnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics Fund net assets | $ 461,142,016 | Total number of portfolio holdings | 242 | Management services fees

(represents 0.47% of Fund average net assets) | $ 2,362,545 | Portfolio turnover for the reporting period | 13% |

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. City of Rochester

11/15/2057 5.000% | 2.8 % | Roseville Independent School District No. 623

02/01/2038 4.000% | 2.2 % | Southern Minnesota Municipal Power Agency

01/01/2026 0.000% | 2.1 % | Brainerd Independent School District No. 181

02/01/2037 4.000% | 2.1 % | City of Maple Grove

05/01/2037 4.000% | 2.1 % | Minnesota Higher Education Facilities Authority

10/01/2052 5.000% | 1.7 % | County of Chippewa

03/01/2037 4.000% | 1.5 % | City of Minneapolis

11/15/2037 4.000% | 1.4 % | Stillwater Independent School District No. 834

02/01/2042 4.000% | 1.4 % | State of Minnesota

08/01/2043 4.000% | 1.4 % |

|

| Largest Holdings [Text Block] |

City of Rochester

11/15/2057 5.000% | 2.8 % | Roseville Independent School District No. 623

02/01/2038 4.000% | 2.2 % | Southern Minnesota Municipal Power Agency

01/01/2026 0.000% | 2.1 % | Brainerd Independent School District No. 181

02/01/2037 4.000% | 2.1 % | City of Maple Grove

05/01/2037 4.000% | 2.1 % | Minnesota Higher Education Facilities Authority

10/01/2052 5.000% | 1.7 % | County of Chippewa

03/01/2037 4.000% | 1.5 % | City of Minneapolis

11/15/2037 4.000% | 1.4 % | Stillwater Independent School District No. 834

02/01/2042 4.000% | 1.4 % | State of Minnesota

08/01/2043 4.000% | 1.4 % |

|