Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Columbia Funds Series Trust II

|

| Entity Central Index Key |

0001352280

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jul. 31, 2025

|

| Columbia Disciplined Growth Fund - Class A |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Disciplined Growth Fund

|

| Class Name |

Class A

|

| Trading Symbol |

RDLAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Disciplined Growth Fund (the Fund) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class A | $ 115 | 1.06 % |

|

| Expenses Paid, Amount |

$ 115

|

| Expense Ratio, Percent |

1.06%

|

| Factors Affecting Performance [Text Block] |

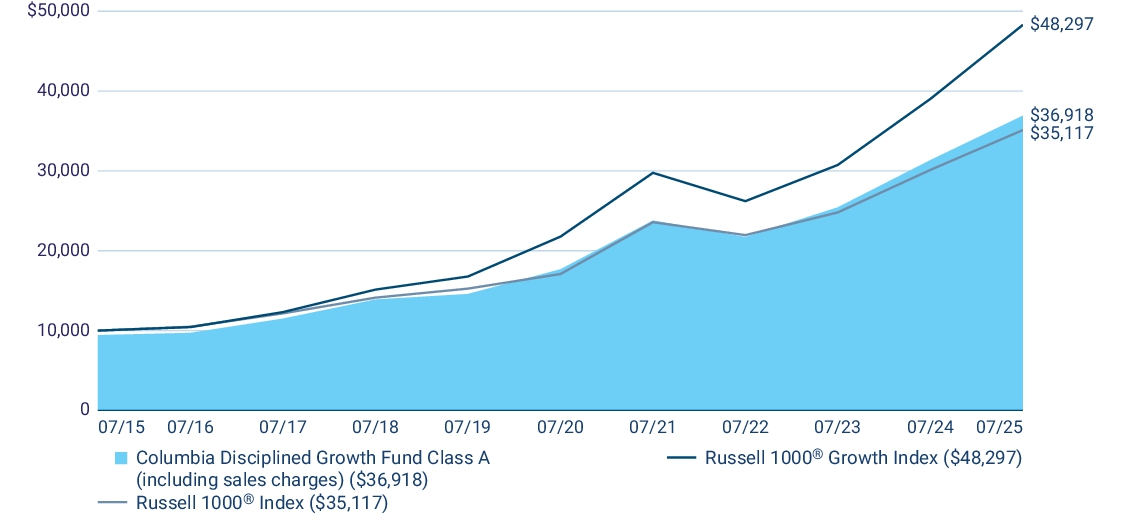

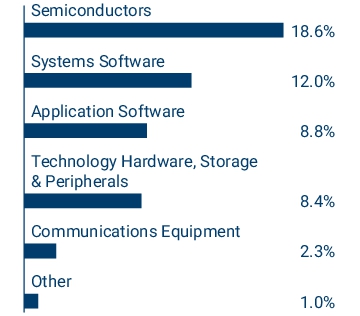

Management's Discussion of Fund Performance The performance of Class A shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the real estate sector contributed to performance relative to the benchmark. Allocations | Sector allocation within the consumer discretionary, consumer staples and health care sectors contributed to relative performance. Individual holdings | Top individual contributors to relative performance included Carvana Co., Fortinet, Inc. and Apple, Inc. Top Performance Detractors Stock selection I Selections in the health care, financials and energy sector were the largest detractors from performance relative to the benchmark. Allocations | Sector allocation within the utilities, materials and communication services sectors were the top three detracting sectors from relative performance. Individual holdings | Bottom individual detractors to relative performance included Fortrea Holdings, Inc., TopBuild Corp. and Netflix, Inc. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class A (excluding sales charges) | 17.73 | 15.87 | 14.63 | | Class A (including sales charges) | 10.99 | 14.50 | 13.95 | | Russell 1000 ® Growth Index | 23.75 | 17.27 | 17.06 | | Russell 1000 ® Index | 16.54 | 15.49 | 13.38 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 295,052,060

|

| Holdings Count | Holding |

68

|

| Advisory Fees Paid, Amount |

$ 2,202,678

|

| Investment Company, Portfolio Turnover |

58.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 295,052,060 | Total number of portfolio holdings | 68 | Management services fees

(represents 0.75% of Fund average net assets) | $ 2,202,678 | Portfolio turnover for the reporting period | 58% |

|

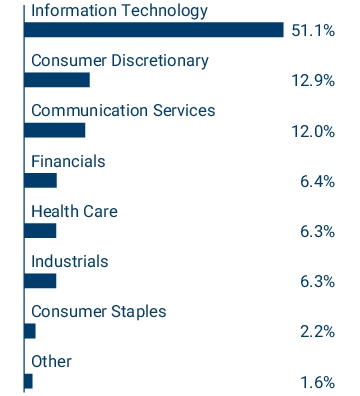

| Holdings [Text Block] |

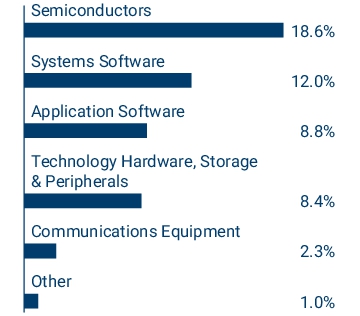

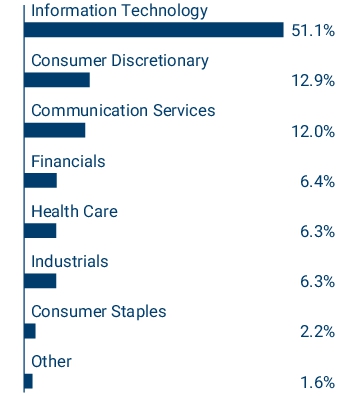

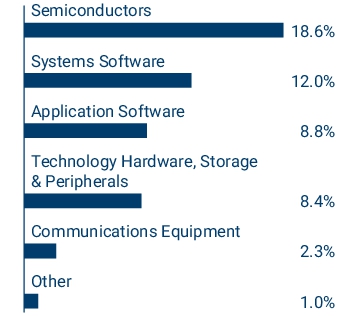

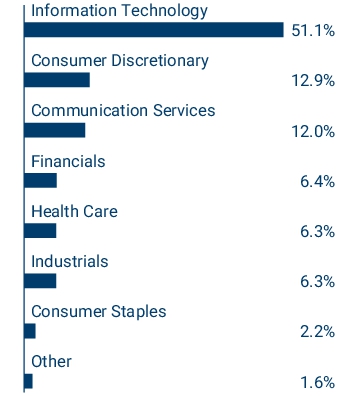

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | NVIDIA Corp. | 10.4 % | | Microsoft Corp. | 10.3 % | | Apple, Inc. | 7.7 % | | Meta Platforms, Inc., Class A | 6.4 % | | Amazon.com, Inc. | 4.8 % | | Alphabet, Inc., Class A | 4.8 % | | Broadcom, Inc. | 4.4 % | | Tesla, Inc. | 2.4 % | | Arista Networks, Inc. | 2.3 % | | Advanced Micro Devices, Inc. | 2.2 % |

Information Technology Sub-industry Allocation |

| Largest Holdings [Text Block] |

| NVIDIA Corp. | 10.4 % | | Microsoft Corp. | 10.3 % | | Apple, Inc. | 7.7 % | | Meta Platforms, Inc., Class A | 6.4 % | | Amazon.com, Inc. | 4.8 % | | Alphabet, Inc., Class A | 4.8 % | | Broadcom, Inc. | 4.4 % | | Tesla, Inc. | 2.4 % | | Arista Networks, Inc. | 2.3 % | | Advanced Micro Devices, Inc. | 2.2 % |

|

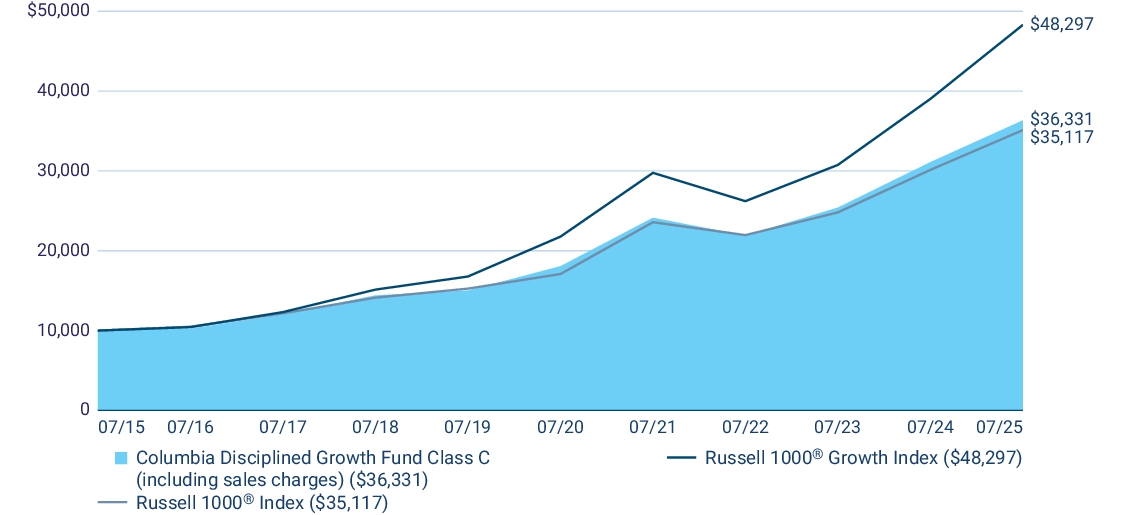

| Columbia Disciplined Growth Fund - Class C |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Disciplined Growth Fund

|

| Class Name |

Class C

|

| Trading Symbol |

RDLCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Disciplined Growth Fund (the Fund) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Class C | $ 196 | 1.81 % |

|

| Expenses Paid, Amount |

$ 196

|

| Expense Ratio, Percent |

1.81%

|

| Factors Affecting Performance [Text Block] |

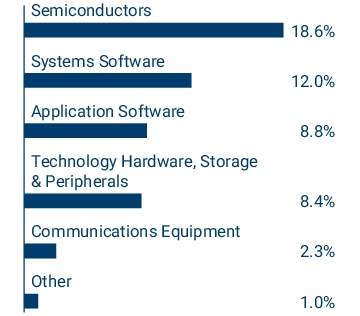

Management's Discussion of Fund Performance The performance of Class C shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the real estate sector contributed to performance relative to the benchmark. Allocations | Sector allocation within the consumer discretionary, consumer staples and health care sectors contributed to relative performance. Individual holdings | Top individual contributors to relative performance included Carvana Co., Fortinet, Inc. and Apple, Inc. Top Performance Detractors Stock selection I Selections in the health care, financials and energy sector were the largest detractors from performance relative to the benchmark. Allocations | Sector allocation within the utilities, materials and communication services sectors were the top three detracting sectors from relative performance. Individual holdings | Bottom individual detractors to relative performance included Fortrea Holdings, Inc., TopBuild Corp. and Netflix, Inc. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Class C (excluding sales charges) | 16.82 | 15.01 | 13.77 | | Class C (including sales charges) | 15.82 | 15.01 | 13.77 | | Russell 1000 ® Growth Index | 23.75 | 17.27 | 17.06 | | Russell 1000 ® Index | 16.54 | 15.49 | 13.38 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 295,052,060

|

| Holdings Count | Holding |

68

|

| Advisory Fees Paid, Amount |

$ 2,202,678

|

| Investment Company, Portfolio Turnover |

58.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 295,052,060 | Total number of portfolio holdings | 68 | Management services fees

(represents 0.75% of Fund average net assets) | $ 2,202,678 | Portfolio turnover for the reporting period | 58% |

|

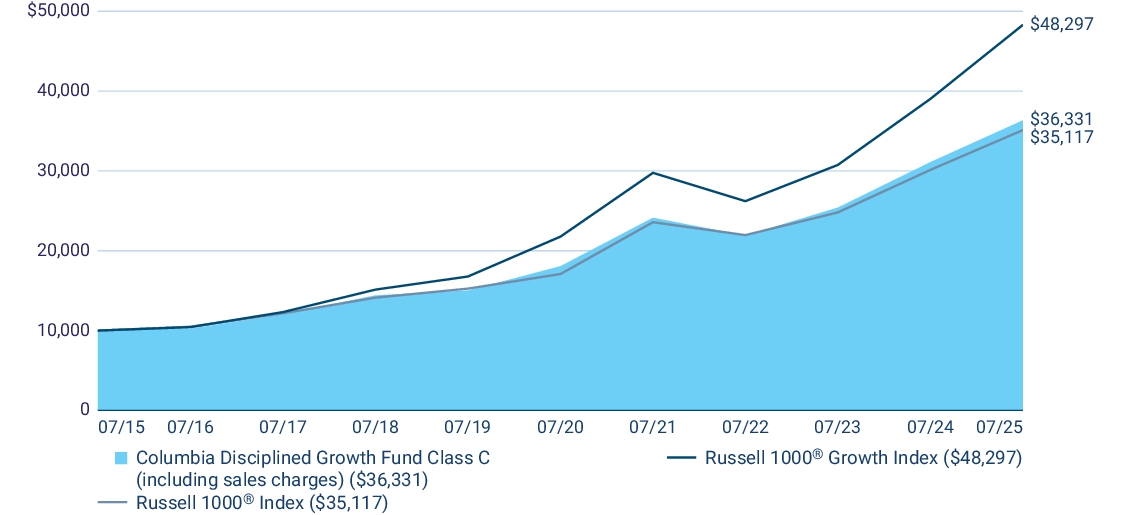

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | NVIDIA Corp. | 10.4 % | | Microsoft Corp. | 10.3 % | | Apple, Inc. | 7.7 % | | Meta Platforms, Inc., Class A | 6.4 % | | Amazon.com, Inc. | 4.8 % | | Alphabet, Inc., Class A | 4.8 % | | Broadcom, Inc. | 4.4 % | | Tesla, Inc. | 2.4 % | | Arista Networks, Inc. | 2.3 % | | Advanced Micro Devices, Inc. | 2.2 % |

Information Technology Sub-industry Allocation |

| Largest Holdings [Text Block] |

| NVIDIA Corp. | 10.4 % | | Microsoft Corp. | 10.3 % | | Apple, Inc. | 7.7 % | | Meta Platforms, Inc., Class A | 6.4 % | | Amazon.com, Inc. | 4.8 % | | Alphabet, Inc., Class A | 4.8 % | | Broadcom, Inc. | 4.4 % | | Tesla, Inc. | 2.4 % | | Arista Networks, Inc. | 2.3 % | | Advanced Micro Devices, Inc. | 2.2 % |

|

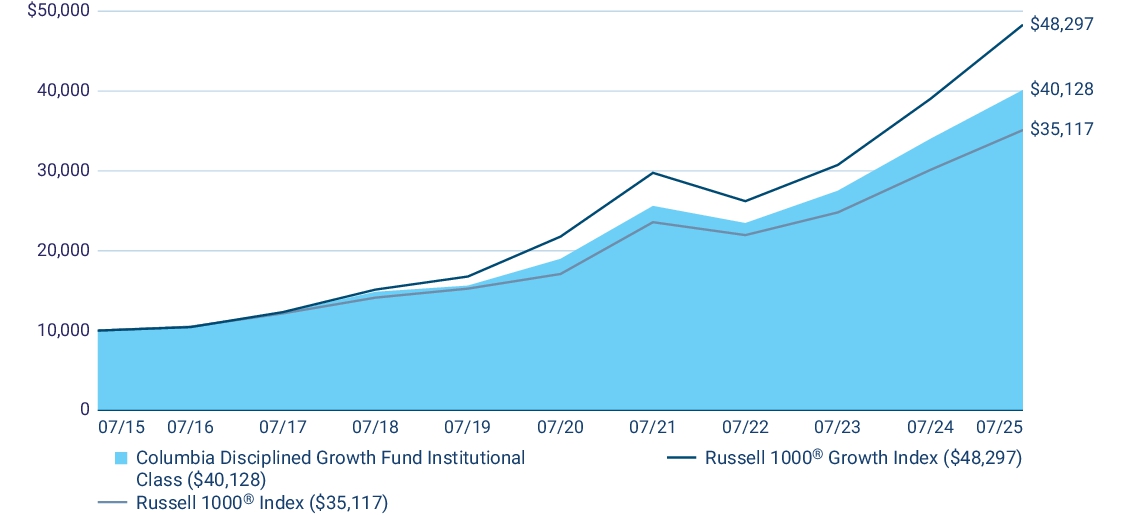

| Columbia Disciplined Growth Fund - Institutional Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Disciplined Growth Fund

|

| Class Name |

Institutional Class

|

| Trading Symbol |

CLQZX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Disciplined Growth Fund (the Fund) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional Class | $ 88 | 0.81 % |

|

| Expenses Paid, Amount |

$ 88

|

| Expense Ratio, Percent |

0.81%

|

| Factors Affecting Performance [Text Block] |

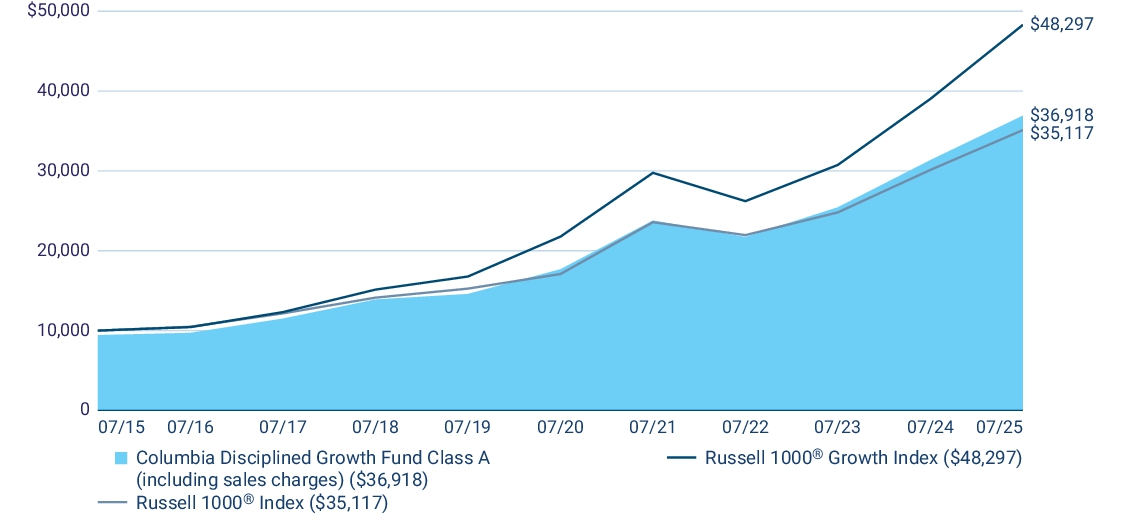

Management's Discussion of Fund Performance The performance of Institutional Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the real estate sector contributed to performance relative to the benchmark. Allocations | Sector allocation within the consumer discretionary, consumer staples and health care sectors contributed to relative performance. Individual holdings | Top individual contributors to relative performance included Carvana Co., Fortinet, Inc. and Apple, Inc. Top Performance Detractors Stock selection I Selections in the health care, financials and energy sector were the largest detractors from performance relative to the benchmark. Allocations | Sector allocation within the utilities, materials and communication services sectors were the top three detracting sectors from relative performance. Individual holdings | Bottom individual detractors to relative performance included Fortrea Holdings, Inc., TopBuild Corp. and Netflix, Inc. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

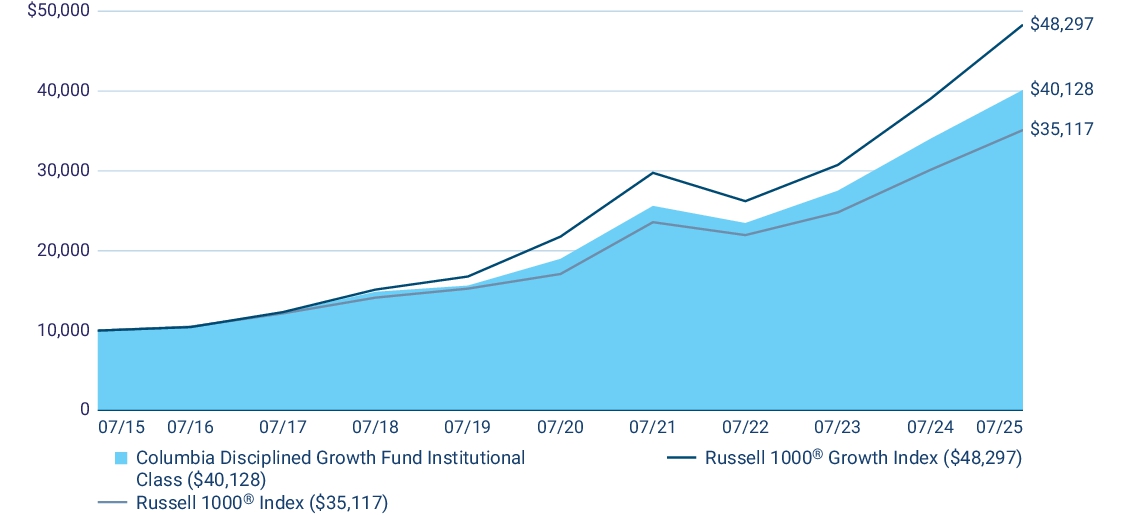

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional Class | 17.98 | 16.16 | 14.91 | | Russell 1000 ® Growth Index | 23.75 | 17.27 | 17.06 | | Russell 1000 ® Index | 16.54 | 15.49 | 13.38 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 295,052,060

|

| Holdings Count | Holding |

68

|

| Advisory Fees Paid, Amount |

$ 2,202,678

|

| Investment Company, Portfolio Turnover |

58.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 295,052,060 | Total number of portfolio holdings | 68 | Management services fees

(represents 0.75% of Fund average net assets) | $ 2,202,678 | Portfolio turnover for the reporting period | 58% |

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | NVIDIA Corp. | 10.4 % | | Microsoft Corp. | 10.3 % | | Apple, Inc. | 7.7 % | | Meta Platforms, Inc., Class A | 6.4 % | | Amazon.com, Inc. | 4.8 % | | Alphabet, Inc., Class A | 4.8 % | | Broadcom, Inc. | 4.4 % | | Tesla, Inc. | 2.4 % | | Arista Networks, Inc. | 2.3 % | | Advanced Micro Devices, Inc. | 2.2 % |

Information Technology Sub-industry Allocation |

| Largest Holdings [Text Block] |

| NVIDIA Corp. | 10.4 % | | Microsoft Corp. | 10.3 % | | Apple, Inc. | 7.7 % | | Meta Platforms, Inc., Class A | 6.4 % | | Amazon.com, Inc. | 4.8 % | | Alphabet, Inc., Class A | 4.8 % | | Broadcom, Inc. | 4.4 % | | Tesla, Inc. | 2.4 % | | Arista Networks, Inc. | 2.3 % | | Advanced Micro Devices, Inc. | 2.2 % |

|

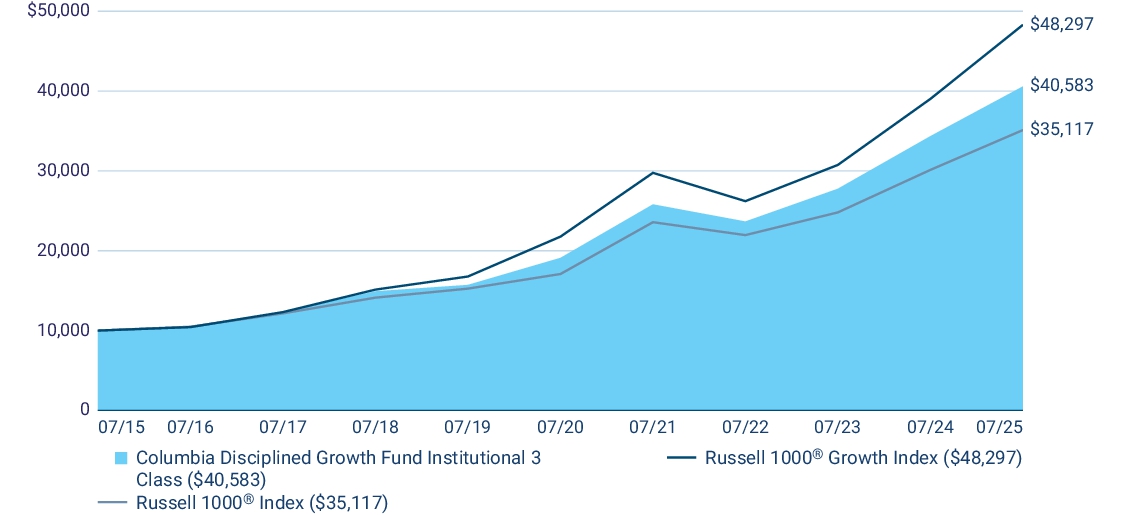

| Columbia Disciplined Growth Fund - Institutional 3 Class |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Columbia Disciplined Growth Fund

|

| Class Name |

Institutional 3 Class

|

| Trading Symbol |

CGQYX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Columbia Disciplined Growth Fund (the Fund) for the period of August 1, 2024 to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at columbiathreadneedleus.com/resources/literature . You can also request more information by contacting us at 1-800-345-6611.

|

| Additional Information Phone Number |

1-800-345-6611

|

| Additional Information Website |

columbiathreadneedleus.com/resources/literature

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period? (Based on a hypothetical $10,000 investment) | Class | Cost of a $10,000 investment | Cost paid as a percentage of a $10,000 investment | | Institutional 3 Class | $ 80 | 0.73 % |

|

| Expenses Paid, Amount |

$ 80

|

| Expense Ratio, Percent |

0.73%

|

| Factors Affecting Performance [Text Block] |

Management's Discussion of Fund Performance The performance of Institutional 3 Class shares for the period presented is shown in the Average Annual Total Returns table. Top Performance Contributors Stock selection | Selections in the real estate sector contributed to performance relative to the benchmark. Allocations | Sector allocation within the consumer discretionary, consumer staples and health care sectors contributed to relative performance. Individual holdings | Top individual contributors to relative performance included Carvana Co., Fortinet, Inc. and Apple, Inc. Top Performance Detractors Stock selection I Selections in the health care, financials and energy sector were the largest detractors from performance relative to the benchmark. Allocations | Sector allocation within the utilities, materials and communication services sectors were the top three detracting sectors from relative performance. Individual holdings | Bottom individual detractors to relative performance included Fortrea Holdings, Inc., TopBuild Corp. and Netflix, Inc. |

| Performance Past Does Not Indicate Future [Text] |

The Fund's past performance is not a good predictor of the Fund's future performance.

|

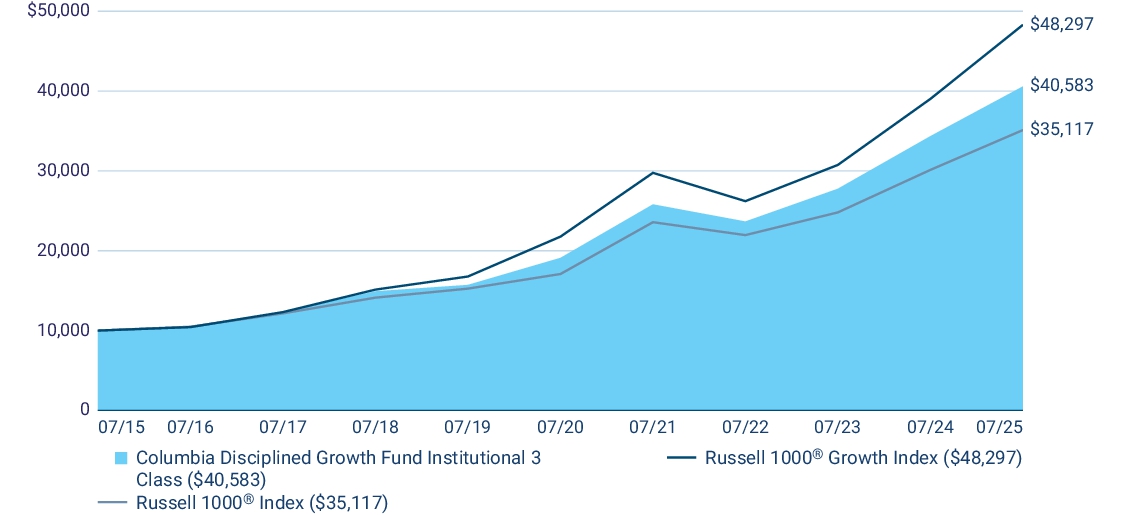

| Line Graph [Table Text Block] |

|

| Average Annual Return [Table Text Block] |

| Average Annual Total Returns (%) | 1 year | 5 years | 10 years | | Institutional 3 Class | 18.12 | 16.26 | 15.04 | | Russell 1000 ® Growth Index | 23.75 | 17.27 | 17.06 | | Russell 1000 ® Index | 16.54 | 15.49 | 13.38 |

|

| No Deduction of Taxes [Text Block] |

Performance does not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemptions of fund shares.

|

| Updated Performance Information Location [Text Block] |

Visit columbiathreadneedleus.com/investment-products/mutual-funds for more recent performance information.

|

| Net Assets |

$ 295,052,060

|

| Holdings Count | Holding |

68

|

| Advisory Fees Paid, Amount |

$ 2,202,678

|

| Investment Company, Portfolio Turnover |

58.00%

|

| Additional Fund Statistics [Text Block] |

Fund net assets | $ 295,052,060 | Total number of portfolio holdings | 68 | Management services fees

(represents 0.75% of Fund average net assets) | $ 2,202,678 | Portfolio turnover for the reporting period | 58% |

|

| Holdings [Text Block] |

Graphical Representation of Fund Holdings The tables below show the investment makeup of the Fund represented as a percentage of Fund net assets. Derivatives are excluded from the tables unless otherwise noted. The Fund's portfolio composition is subject to change. | NVIDIA Corp. | 10.4 % | | Microsoft Corp. | 10.3 % | | Apple, Inc. | 7.7 % | | Meta Platforms, Inc., Class A | 6.4 % | | Amazon.com, Inc. | 4.8 % | | Alphabet, Inc., Class A | 4.8 % | | Broadcom, Inc. | 4.4 % | | Tesla, Inc. | 2.4 % | | Arista Networks, Inc. | 2.3 % | | Advanced Micro Devices, Inc. | 2.2 % |

Information Technology Sub-industry Allocation |

| Largest Holdings [Text Block] |

| NVIDIA Corp. | 10.4 % | | Microsoft Corp. | 10.3 % | | Apple, Inc. | 7.7 % | | Meta Platforms, Inc., Class A | 6.4 % | | Amazon.com, Inc. | 4.8 % | | Alphabet, Inc., Class A | 4.8 % | | Broadcom, Inc. | 4.4 % | | Tesla, Inc. | 2.4 % | | Arista Networks, Inc. | 2.3 % | | Advanced Micro Devices, Inc. | 2.2 % |

|