Shareholder Report

|

12 Months Ended |

|

Jul. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Lattice Strategies Trust

|

|

| Entity Central Index Key |

0001605803

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Jul. 31, 2025

|

|

| C000149406 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Hartford Multifactor Developed Markets (ex-US) ETF

|

|

| Class Name |

Hartford Multifactor Developed Markets (ex-US) ETF

|

|

| Trading Symbol |

RODM

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Multifactor Developed Markets (ex-US) ETF (the "Fund") for the period of October 1, 2024 to July 31, 2025. This annual report covers less than a full 12 month period (effective May 1, 2025, the Fund changed it's fiscal year end from September 30 to July 31).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment* |

Costs paid as a percentage

of a $10,000 investment^ |

| Hartford Multifactor Developed Markets (ex-US) ETF |

$26 |

0.29% |

| * |

Costs of a $10,000 investment for a full 12 month period would be higher. |

| ^ |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 26

|

[1] |

| Expense Ratio, Percent |

0.29%

|

[2] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance International developed market equities generated strong returns over the trailing one-year period ending July 31, 2025 as measured by the MSCI World ex USA Index. Equities were positive across most countries within the index led by performance from the Financials and Industrials sectors. Top Contributors to Performance -

The Fund’s positive active exposures to the Value, Small Size, and Momentum risk factors contributed positively to performance as these factors generated positive excess return for the trailing twelve-month period. -

Positive stock selection in Healthcare, Financials, and Materials were top contributors to performance. -

Performance also benefited from positive security selection in Israel, Denmark, and Canada. Top Detractors to Performance -

The Fund was negatively affected from its positive active exposures to Low Volatility and Dividend Yield as these risk factors underperformed. -

Negative stock selection in Utilities detracted from performance. -

Underweights to Germany and Spain also detracted from performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Line Graph [Table Text Block] |

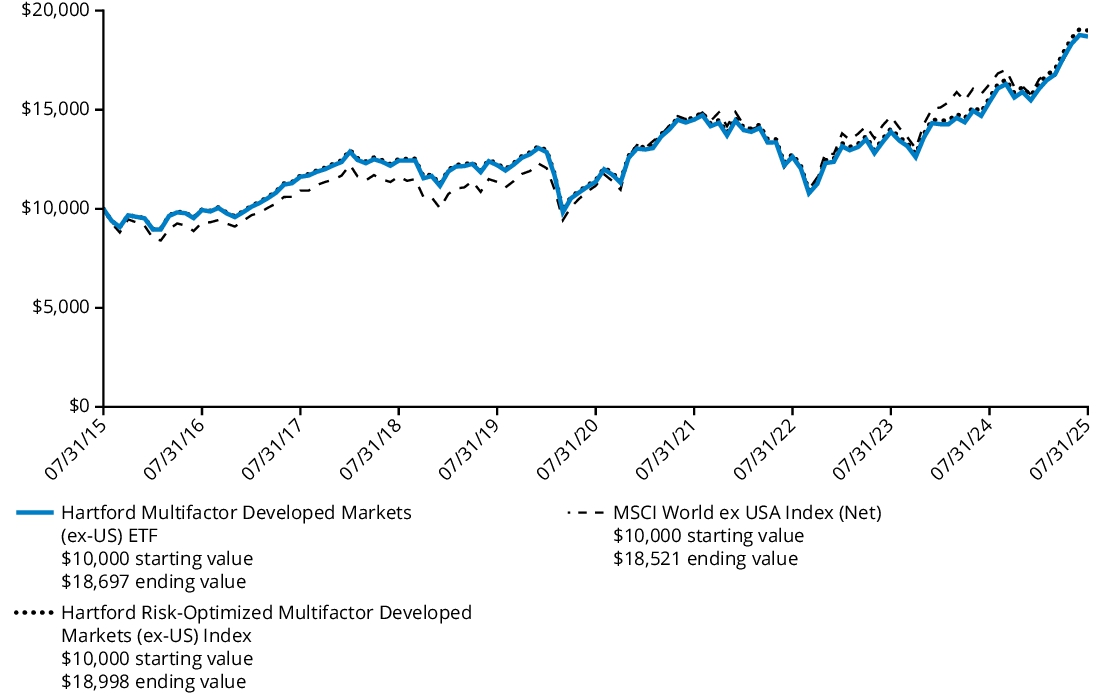

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

5 Years |

10 Years |

| Fund |

21.40%† |

10.47% |

6.46% |

| Hartford Risk-Optimized Multifactor Developed Markets (ex-US) Index |

21.73% |

10.67% |

6.63% |

| MSCI World ex USA Index (Net) |

13.70% |

10.65% |

6.36% |

| † |

Cumulative performance for the period was 14.78%. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

|

| Net Assets |

$ 1,158,932,071

|

|

| Holdings Count | Holding |

320

|

|

| Advisory Fees Paid, Amount |

$ 2,678,108

|

[3] |

| Investment Company Portfolio Turnover |

25.00%

|

[3] |

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$1,158,932,071 |

| Total number of portfolio holdings (excluding derivatives, if any) |

320 |

| Total investment advisory fees paid* |

$2,678,108 |

| Portfolio turnover rate (excludes in-kind creation or redemption transactions)* |

25% |

| * |

Reflects for the period October 1, 2024 through July 31, 2025. |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Country *

| Japan |

19.9 |

% |

| Canada |

14.6 |

% |

| United Kingdom |

10.8 |

% |

| Australia |

10.2 |

% |

| United States |

5.7 |

% |

| France |

5.3 |

% |

| Germany |

4.9 |

% |

| Israel |

3.8 |

% |

| Netherlands |

2.9 |

% |

| Sweden |

2.9 |

% |

| Other |

18.2 |

%** |

| Short-Term Investments |

1.2 |

% |

| Other Assets & Liabilities |

(0.4 |

)% |

| Total |

100.0 |

% |

| * |

For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

| ** |

Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

|

|

| C000149407 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Hartford Multifactor Emerging Markets ETF

|

|

| Class Name |

Hartford Multifactor Emerging Markets ETF

|

|

| Trading Symbol |

ROAM

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Multifactor Emerging Markets ETF (the "Fund") for the period of October 1, 2024 to July 31, 2025. This annual report covers less than a full 12 month period (effective May 1, 2025, the Fund changed it's fiscal year end from September 30 to July 31).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment* |

Costs paid as a percentage

of a $10,000 investment^ |

| Hartford Multifactor Emerging Markets ETF |

$38 |

0.44% |

| * |

Costs of a $10,000 investment for a full 12 month period would be higher. |

| ^ |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 38

|

[4] |

| Expense Ratio, Percent |

0.44%

|

[5] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance Emerging Market equities generated strong returns over the trailing one-year period ending July 31, 2025 as measured by the MSCI Emerging Markets Index. Equities were positive across most countries within the index led by contribution to return from the Financials, Information Technology, and Communication Services sectors. Top Contributors to Performance -

The Fund’s positive active exposures to the Value and Small Size risk factors contributed positively to performance as these factors generated positive excess return for the trailing twelve-month period. -

Positive stock selection in Financials, Industrials, and Materials contributed to results. -

Performance also benefited from positive security selection in South Korea and Thailand. Top Detractors to Performance -

The Fund was negatively affected by its positive active exposures to the Dividend Yield and Low Volatility risk factors as these factors generated negative excess return for the trailing twelve-month period. -

Negative stock selection in Communication Services, Consumer Discretionary, and Information Technology detracted from results. -

Negative stock selection in Taiwan and Hong Kong and an overweight in Turkey also detracted from performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Line Graph [Table Text Block] |

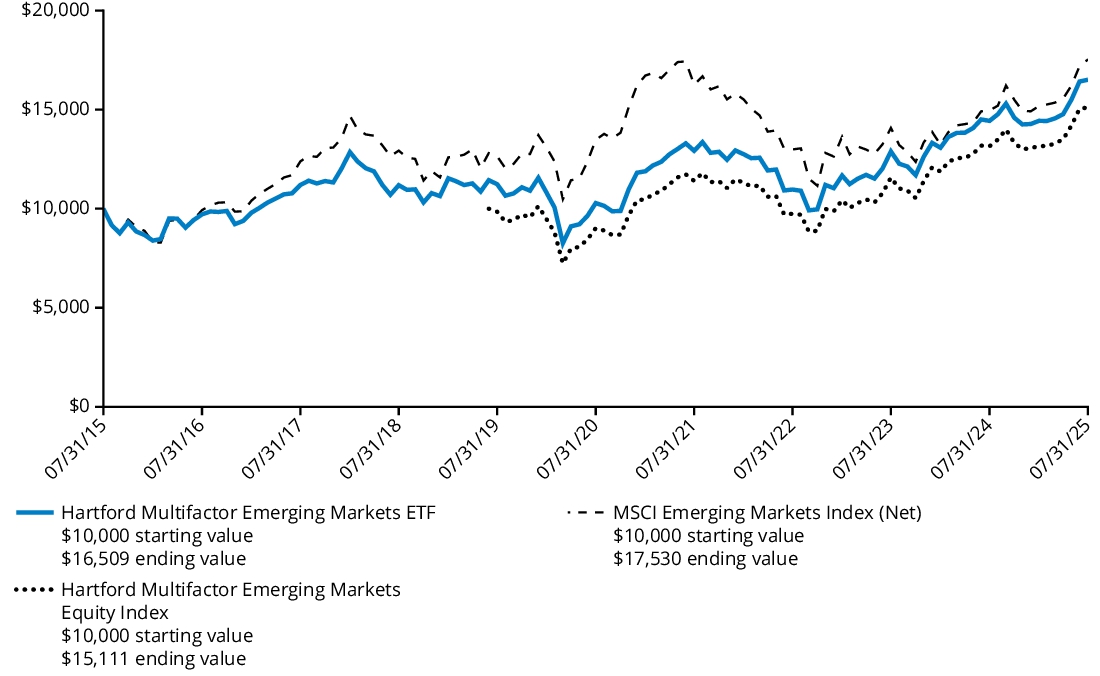

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

5 Years |

10 Years |

| Fund |

14.38%† |

9.93% |

5.14% |

| Hartford Multifactor Emerging Markets Equity Index |

14.89% |

10.87% |

0.00%* |

| MSCI Emerging Markets Index (Net) |

17.18% |

5.40% |

5.77% |

| † |

Cumulative performance for the period was 7.88%. |

| * |

The Hartford Multifactor Emerging Markets Equity Index commenced operations on June 28, 2019. Reflects annualized returns starting on June 28, 2019. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

|

| Net Assets |

$ 39,371,428

|

|

| Holdings Count | Holding |

315

|

|

| Advisory Fees Paid, Amount |

$ 114,469

|

[6] |

| Investment Company Portfolio Turnover |

32.00%

|

[6] |

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$39,371,428 |

| Total number of portfolio holdings (excluding derivatives, if any) |

315 |

| Total investment advisory fees paid* |

$114,469 |

| Portfolio turnover rate (excludes in-kind creation or redemption transactions)* |

32% |

| * |

Reflects for the period October 1, 2024 through July 31, 2025. |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Country *

| China |

21.1 |

% |

| Taiwan |

15.9 |

% |

| India |

14.9 |

% |

| South Korea |

14.0 |

% |

| Saudi Arabia |

5.5 |

% |

| Thailand |

3.7 |

% |

| Indonesia |

3.5 |

% |

| Malaysia |

3.2 |

% |

| Poland |

3.2 |

% |

| Brazil |

4.3 |

% |

| Other |

10.2 |

%** |

| Short-Term Investments |

0.4 |

% |

| Other Assets & Liabilities |

0.1 |

% |

| Total |

100.0 |

% |

| * |

For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

| ** |

Ten largest country/geographic regions are presented. Additional country/geographic regions are found in Other. |

|

|

| C000149409 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Hartford Multifactor US Equity ETF

|

|

| Class Name |

Hartford Multifactor US Equity ETF

|

|

| Trading Symbol |

ROUS

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Multifactor US Equity ETF (the "Fund") for the period of October 1, 2024 to July 31, 2025. This annual report covers less than a full 12 month period (effective May 1, 2025, the Fund changed it's fiscal year end from September 30 to July 31).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment* |

Costs paid as a percentage

of a $10,000 investment^ |

| Hartford Multifactor US Equity ETF |

$16 |

0.19% |

| * |

Costs of a $10,000 investment for a full 12 month period would be higher. |

| ^ |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 16

|

[7] |

| Expense Ratio, Percent |

0.19%

|

[8] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance Large-Cap U.S. equities generated positive returns over the trailing one-year period ending July 31, 2025, as measured by the Russell 1000 Index. Performance across sectors was mixed over the period led by positive return in the Communication Services sector while the Healthcare sector had the largest negative return over the trailing one-year period. Top Contributors to Performance -

The Fund’s positive active exposures to the Dividend yield and Momentum risk factors were contributors to performance as these factors generated positive excess return for the trailing twelve-month period. -

Positive stock selection in the Consumer Staples and Utilities sectors contributed to performance. Top Detractors to Performance. -

Positive active exposure to Value, Small Size, and Low Volatility contributed negatively to performance, as higher volatility, growth stocks and larger-cap equities outperformed for the period. -

Negative stock selection occurred in Information Technology led by underweights in NVIDIA and Microsoft. -

Negative stock selection in Industrials and Consumer Discretionary were also top detractors over the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Line Graph [Table Text Block] |

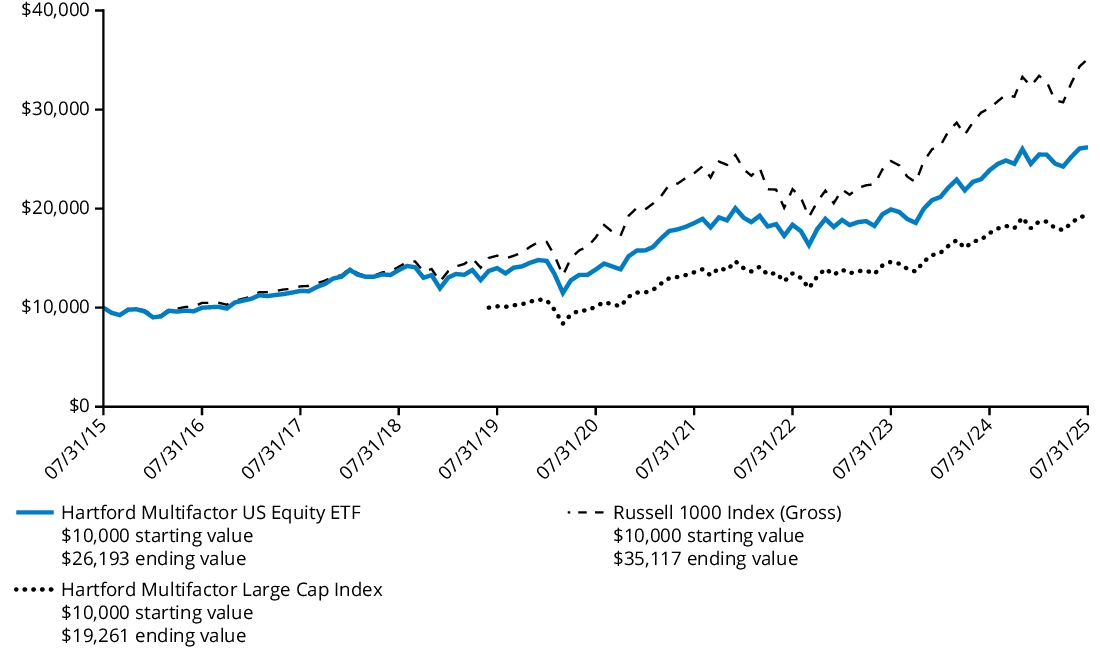

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

5 Years |

10 Years |

| Fund |

9.72%† |

13.59% |

10.11% |

| Hartford Multifactor Large Cap Index |

9.91% |

13.75% |

0.00%* |

| Russell 1000 Index (Gross) |

16.54% |

15.49% |

13.38% |

| † |

Cumulative performance for the period was 5.36%. |

| * |

The Hartford Multifactor Large Cap Index commenced operations on June 28, 2019. Reflects annualized returns starting on June 28, 2019. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

|

| Net Assets |

$ 473,099,675

|

|

| Holdings Count | Holding |

334

|

|

| Advisory Fees Paid, Amount |

$ 717,045

|

[9] |

| Investment Company Portfolio Turnover |

26.00%

|

[9] |

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$473,099,675 |

| Total number of portfolio holdings (excluding derivatives, if any) |

334 |

| Total investment advisory fees paid* |

$717,045 |

| Portfolio turnover rate (excludes in-kind creation or redemption transactions)* |

26% |

| * |

Reflects for the period October 1, 2024 through July 31, 2025. |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Sector *

| Information Technology |

29.1 |

% |

| Financials |

12.2 |

% |

| Health Care |

10.9 |

% |

| Industrials |

10.9 |

% |

| Consumer Discretionary |

9.7 |

% |

| Communication Services |

7.8 |

% |

| Consumer Staples |

7.2 |

% |

| Utilities |

4.6 |

% |

| Materials |

3.2 |

% |

| Energy |

2.7 |

% |

| Real Estate |

1.4 |

% |

| Short-Term Investments |

0.1 |

% |

| Other Assets & Liabilities |

0.2 |

% |

| Total |

100.0 |

% |

| * |

For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

|

|

| C000149410 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Hartford Multifactor Small Cap ETF

|

|

| Class Name |

Hartford Multifactor Small Cap ETF

|

|

| Trading Symbol |

ROSC

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Multifactor Small Cap ETF (the "Fund") for the period of October 1, 2024 to July 31, 2025. This annual report covers less than a full 12 month period (effective May 1, 2025, the Fund changed it's fiscal year end from September 30 to July 31).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment* |

Costs paid as a percentage

of a $10,000 investment^ |

| Hartford Multifactor Small Cap ETF |

$28 |

0.34% |

| * |

Costs of a $10,000 investment for a full 12 month period would be higher. |

| ^ |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 28

|

[10] |

| Expense Ratio, Percent |

0.34%

|

[11] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance Small-Cap U.S. equities generated negative returns over the trailing one-year period ending July 31, 2025 as measured by the Russell 2000 Index. Performance across sectors was mixed over the period led by positive return in the Consumer Staples and Industrials sectors while Energy and Healthcare had the largest negative returns over the trailing one-year period. Top Contributors to Performance -

The Fund’s positive active exposure to the Dividend Yield risk factor contributed to performance as this factor generated positive excess return for the trailing twelve-month period. -

Positive stock selection in Healthcare contributed to performance for the period. Top Detractors to Performance -

Positive active exposure to Value, Small Size, and Low Volatility contributed negatively to performance, as higher volatility, growth stocks and larger-cap equities outperformed for the period. -

Negative stock selection in Industrials detracted from performance for the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Line Graph [Table Text Block] |

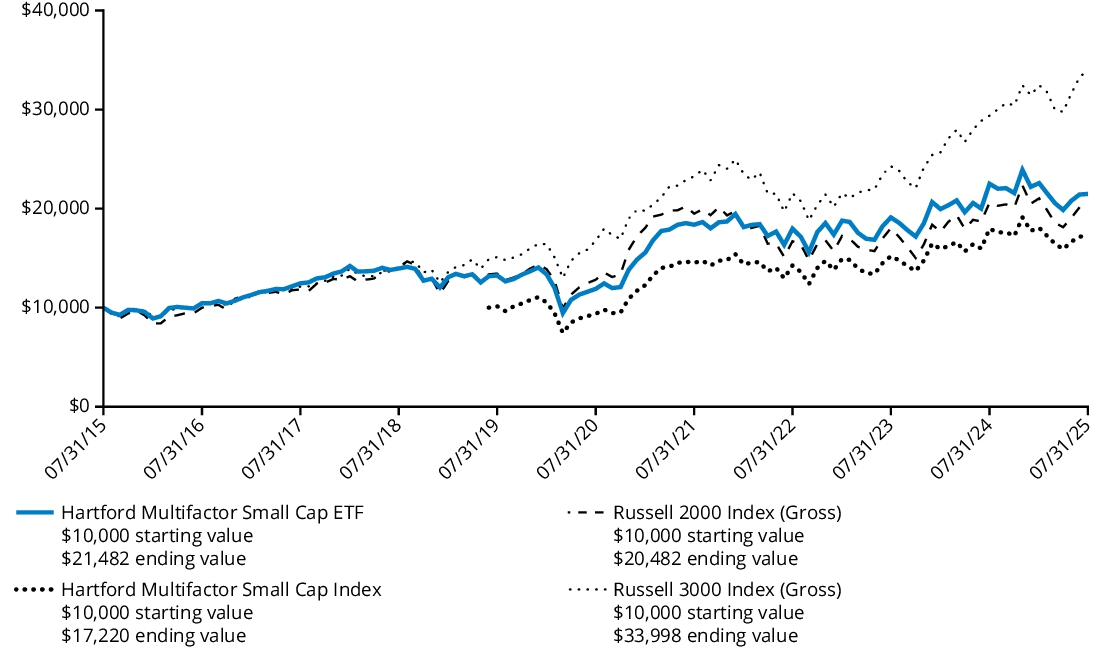

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Period Ended July 31, 2025 |

1 Year |

5 Years |

10 Years |

| Fund |

(4.54)%† |

12.53% |

7.95% |

| Hartford Multifactor Small Cap Index |

(4.19)% |

12.92% |

0.00%* |

| Russell 2000 Index (Gross) |

(0.55)% |

9.81% |

7.43% |

| Russell 3000 Index (Gross) |

15.68% |

15.19% |

13.02% |

| † |

Cumulative performance for the period was (2.63)%. |

| * |

The Hartford Multifactor Small Cap Index commenced operations on June 28, 2019. Reflects annualized returns starting on June 28, 2019. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

|

| Net Assets |

$ 35,571,241

|

|

| Holdings Count | Holding |

311

|

|

| Advisory Fees Paid, Amount |

$ 93,549

|

[12] |

| Investment Company Portfolio Turnover |

25.00%

|

[12] |

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$35,571,241 |

| Total number of portfolio holdings (excluding derivatives, if any) |

311 |

| Total investment advisory fees paid* |

$93,549 |

| Portfolio turnover rate (excludes in-kind creation or redemption transactions)* |

25% |

| * |

Reflects for the period October 1, 2024 through July 31, 2025. |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Sector *

| Financials |

17.9 |

% |

| Industrials |

17.6 |

% |

| Health Care |

16.8 |

% |

| Consumer Discretionary |

12.0 |

% |

| Information Technology |

10.6 |

% |

| Real Estate |

6.7 |

% |

| Consumer Staples |

5.5 |

% |

| Energy |

3.3 |

% |

| Materials |

3.2 |

% |

| Communication Services |

3.1 |

% |

| Utilities |

3.0 |

% |

| Short-Term Investments |

2.6 |

% |

| Other Assets & Liabilities |

(2.3 |

)% |

| Total |

100.0 |

% |

| * |

For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

|

|

| C000238811 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Hartford Disciplined US Equity ETF

|

|

| Class Name |

Hartford Disciplined US Equity ETF

|

|

| Trading Symbol |

HDUS

|

|

| Security Exchange Name |

NYSEArca

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford Disciplined US Equity ETF (the "Fund") for the period of October 1, 2024 to July 31, 2025. This annual report covers less than a full 12 month period (effective May 1, 2025, the Fund changed it's fiscal year end from September 30 to July 31).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment* |

Costs paid as a percentage

of a $10,000 investment^ |

| Hartford Disciplined US Equity ETF |

$17 |

0.19% |

| * |

Costs of a $10,000 investment for a full 12 month period would be higher. |

| ^ |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 17

|

[13] |

| Expense Ratio, Percent |

0.19%

|

[14] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance Large-Cap U.S. equities generated positive returns over the trailing one-year period ending July 31, 2025, as measured by the Russell 1000 Index. Performance across sectors was mixed over the period led by positive return in the Communication Services sector while the Healthcare sector had the largest negative return over the trailing one-year period. Top Contributors to Performance -

The Fund’s positive active exposures to the Momentum and Dividend Yield risk factors were contributors to performance as these factors generated positive excess return for the trailing twelve-month period. -

Positive stock selection in Healthcare contributed to performance for the period. Top Detractors to Performance -

Positive active exposure to Value, Small Size, and Low Volatility contributed negatively to performance, as higher volatility, growth stocks and larger-cap equities outperformed for the period. -

Negative stock selection in Industrials detracted from performance for the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

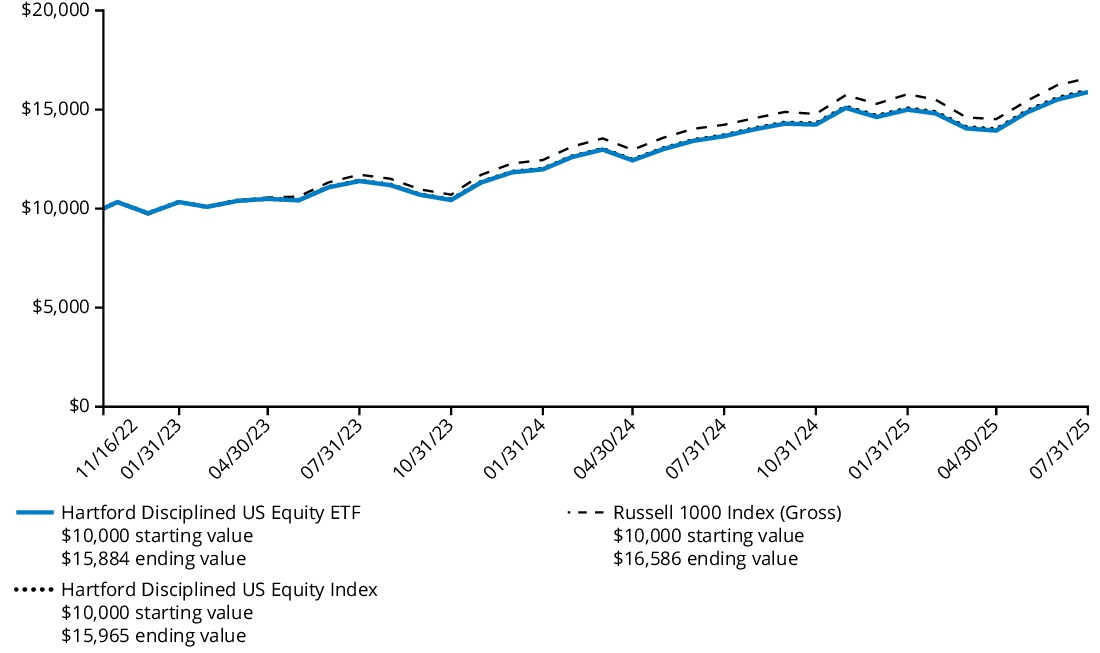

| Line Graph [Table Text Block] |

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

Since Inception

(November 16, 2022) |

| Fund |

16.31%† |

18.66% |

| Hartford Disciplined US Equity Index |

16.52% |

18.89% |

| Russell 1000 Index (Gross) |

16.54% |

20.14% |

| † |

Cumulative performance for the period was 11.16%. |

|

|

| Performance Inception Date |

Nov. 16, 2022

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

|

| Net Assets |

$ 138,717,113

|

|

| Holdings Count | Holding |

260

|

|

| Advisory Fees Paid, Amount |

$ 209,456

|

[15] |

| Investment Company Portfolio Turnover |

33.00%

|

[15] |

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$138,717,113 |

| Total number of portfolio holdings (excluding derivatives, if any) |

260 |

| Total investment advisory fees paid* |

$209,456 |

| Portfolio turnover rate (excludes in-kind creation or redemption transactions)* |

33% |

| * |

Reflects for the period October 1, 2024 through July 31, 2025. |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Sector *

| Information Technology |

30.5 |

% |

| Financials |

11.7 |

% |

| Industrials |

10.4 |

% |

| Communication Services |

10.3 |

% |

| Consumer Discretionary |

9.9 |

% |

| Health Care |

8.6 |

% |

| Consumer Staples |

6.7 |

% |

| Real Estate |

3.9 |

% |

| Energy |

3.1 |

% |

| Materials |

2.7 |

% |

| Utilities |

1.9 |

% |

| Short-Term Investments |

0.2 |

% |

| Other Assets & Liabilities |

0.1 |

% |

| Total |

100.0 |

% |

| * |

For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

|

|

| C000246653 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Hartford US Quality Growth ETF

|

|

| Class Name |

Hartford US Quality Growth ETF

|

|

| Trading Symbol |

HQGO

|

|

| Security Exchange Name |

NASDAQ

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford US Quality Growth ETF (the "Fund") for the period of October 1, 2024 to July 31, 2025. This annual report covers less than a full 12 month period (effective May 1, 2025, the Fund changed it's fiscal year end from September 30 to July 31).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment* |

Costs paid as a percentage

of a $10,000 investment^ |

| Hartford US Quality Growth ETF |

$30 |

0.34% |

| * |

Costs of a $10,000 investment for a full 12 month period would be higher. |

| ^ |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 30

|

[16] |

| Expense Ratio, Percent |

0.34%

|

[17] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance U.S. equities were positive over the trailing one-year period ending July 31, 2025, as measured by the Russell 1000 Index and led by large-cap growth stocks as the Russell 1000 Growth Index outperformed the broad index. Within the Russell 1000 Growth Index, performance was positive across most sectors with strong performance from Information Technology being the largest contributor to return. Top Contributors to Performance -

The Fund’s positive active exposure to Dividend Yield was a contributor to performance as this risk factor generated positive excess return for the period. -

Positive stock selection in Consumer Staples also contributed to performance. Top Detractors to Performance -

Positive active exposure to Value, Small Size, and Low Volatility contributed negatively to performance, as higher volatility, growth stocks and larger-cap equities outperformed for the period. -

An underweight and negative stock selection in Information Technology detracted from performance during the period. -

An overweight and negative stock selection in Healthcare also detracted from performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

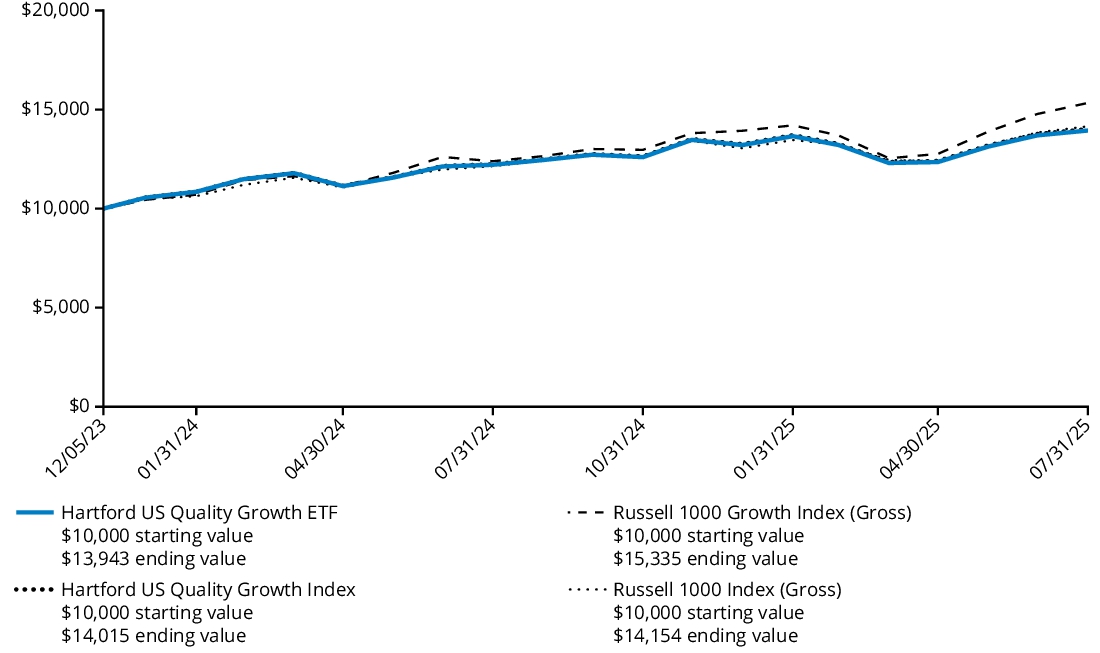

| Line Graph [Table Text Block] |

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

Since Inception

(December 05, 2023) |

| Fund |

14.16%† |

22.24% |

| Hartford US Quality Growth Index |

14.49% |

22.59% |

| Russell 1000 Growth Index (Gross) |

23.75% |

29.77% |

| Russell 1000 Index (Gross) |

16.54% |

23.21% |

| † |

Cumulative performance for the period was 9.62%. |

|

|

| Performance Inception Date |

Dec. 05, 2023

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

|

| Net Assets |

$ 45,590,662

|

|

| Holdings Count | Holding |

222

|

|

| Advisory Fees Paid, Amount |

$ 114,999

|

[18] |

| Investment Company Portfolio Turnover |

34.00%

|

[18] |

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$45,590,662 |

| Total number of portfolio holdings (excluding derivatives, if any) |

222 |

| Total investment advisory fees paid* |

$114,999 |

| Portfolio turnover rate (excludes in-kind creation or redemption transactions)* |

34% |

| * |

Reflects for the period October 1, 2024 through July 31, 2025. |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Sector *

| Information Technology |

42.1 |

% |

| Consumer Discretionary |

14.0 |

% |

| Communication Services |

12.8 |

% |

| Health Care |

8.6 |

% |

| Industrials |

5.9 |

% |

| Consumer Staples |

5.5 |

% |

| Financials |

5.1 |

% |

| Energy |

3.1 |

% |

| Materials |

1.7 |

% |

| Real Estate |

1.1 |

% |

| Utilities |

0.1 |

% |

| Other Assets & Liabilities |

0.0 |

%† |

| Total |

100.0 |

% |

| * |

For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

| † |

Percentage rounds to zero. |

|

|

| C000246654 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Hartford US Value ETF

|

|

| Class Name |

Hartford US Value ETF

|

|

| Trading Symbol |

VMAX

|

|

| Security Exchange Name |

CboeBZX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the Hartford US Value ETF (the "Fund") for the period of October 1, 2024 to July 31, 2025. This annual report covers less than a full 12 month period (effective May 1, 2025, the Fund changed it's fiscal year end from September 30 to July 31).

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at hartfordfunds.com/reports-etf. You can also request this information by contacting us by calling 1‑800‑456‑7526.

|

|

| Additional Information Phone Number |

1‑800‑456‑7526

|

|

| Additional Information Website |

hartfordfunds.com/reports-etf

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Fund Name |

Costs of a $10,000 investment* |

Costs paid as a percentage

of a $10,000 investment^ |

| Hartford US Value ETF |

$25 |

0.29% |

| * |

Costs of a $10,000 investment for a full 12 month period would be higher. |

| ^ |

Annualized. |

|

|

| Expenses Paid, Amount |

$ 25

|

[19] |

| Expense Ratio, Percent |

0.29%

|

[20] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what impacted its performance? Management's Discussion of Fund Performance U.S. equities were positive over the trailing one-year period ending July 31, 2025, as measured by the Russell 1000 Index. Large-cap value stocks as measured by the Russell 1000 Value Index underperformed the broad index but still generated positive returns. Within the Russell 1000 Value Index, performance was positive across most sectors led by the Communication Services and Financials sectors. Top Contributors to Performance -

The Fund’s negative active exposure to the Low Volatility risk factor contributed to performance as this factor generated negative excess return for the period. -

The Fund’s overweight and positive stock selection in the Utilities sector contributed to results. -

The Fund’s underweight in Healthcare and overweight to Financials also contributed. Top Detractors to Performance -

The Fund was negatively affected by its positive active exposures to Value, Quality, and Small Size as these risk factors generated negative excess return for the period. -

Negative stock selection in Industrials, Energy, and Consumer Discretionary also detracted.

|

|

| Performance Past Does Not Indicate Future [Text] |

The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

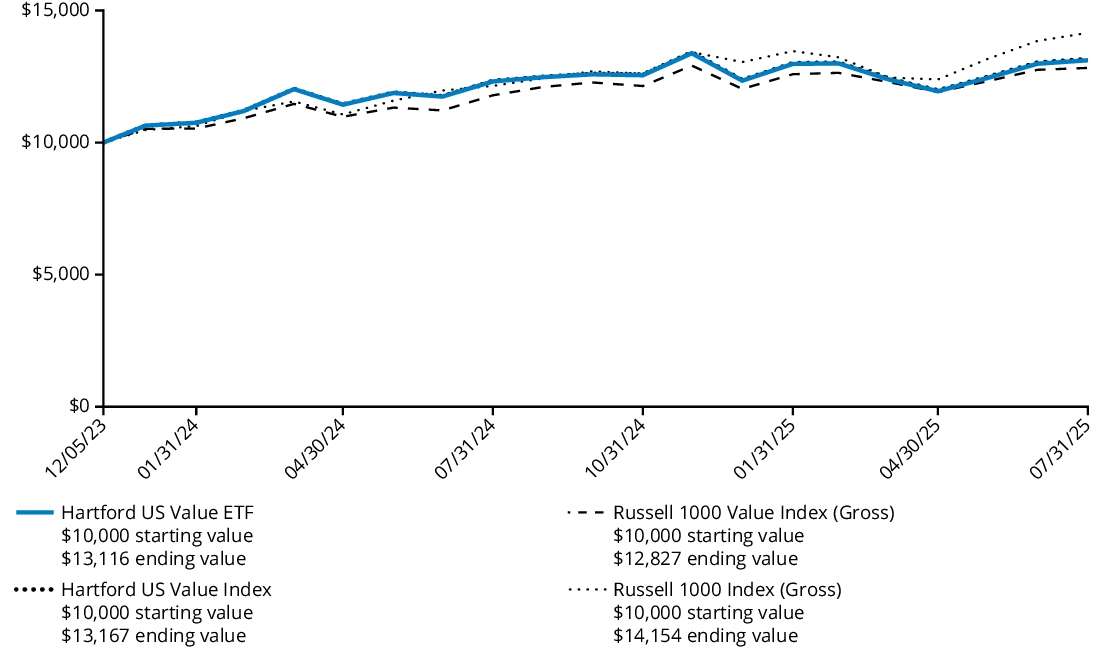

| Line Graph [Table Text Block] |

Comparison of Change in Value of $ 10,000 Investment The graph below represents the hypothetical growth of a $10,000 investment in the Fund and the comparative indices. The Fund’s past performance is not a good predictor of the Fund’s future performance.

|

|

| Average Annual Return [Table Text Block] |

Average Annual Total Returns

For the Periods Ended July 31, 2025 |

1 Year |

Since Inception

(December 05, 2023) |

| Fund |

6.51%† |

17.81% |

| Hartford US Value Index |

6.70% |

17.58% |

| Russell 1000 Value Index (Gross) |

8.79% |

15.63% |

| Russell 1000 Index (Gross) |

16.54% |

23.21% |

| † |

Cumulative performance for the period was 4.24%. |

|

|

| Performance Inception Date |

Dec. 05, 2023

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or

sale of Fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit hartfordfunds.com for the most recent performance information.

|

|

| Net Assets |

$ 44,166,784

|

|

| Holdings Count | Holding |

148

|

|

| Advisory Fees Paid, Amount |

$ 100,443

|

[21] |

| Investment Company Portfolio Turnover |

42.00%

|

[21] |

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of

July 31, 2025

| Fund's net assets |

$44,166,784 |

| Total number of portfolio holdings (excluding derivatives, if any) |

148 |

| Total investment advisory fees paid* |

$100,443 |

| Portfolio turnover rate (excludes in-kind creation or redemption transactions)* |

42% |

| * |

Reflects for the period October 1, 2024 through July 31, 2025. |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings as of July 31, 2025 The table below shows the investment makeup of the Fund, representing the percentage of net assets of the Fund. Composition by Sector *

| Financials |

34.0 |

% |

| Energy |

9.7 |

% |

| Information Technology |

8.5 |

% |

| Health Care |

8.3 |

% |

| Industrials |

8.0 |

% |

| Utilities |

7.8 |

% |

| Communication Services |

7.0 |

% |

| Real Estate |

4.8 |

% |

| Consumer Staples |

4.5 |

% |

| Consumer Discretionary |

3.7 |

% |

| Materials |

3.6 |

% |

| Other Assets & Liabilities |

0.1 |

% |

| Total |

100.0 |

% |

| * |

For Fund compliance purposes, the Fund may not use the same classification system. These classifications are used for financial reporting purposes. |

|

|

|

|