Shareholder Report

|

6 Months Ended |

|

Jul. 31, 2025

USD ($)

Holdings

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

Tidal

Trust III

|

| Entity Central Index Key |

0001722388

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Jul. 31, 2025

|

| Intech S&P Large Cap Diversified Alpha ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Intech S&P Large Cap Diversified Alpha ETF

|

| Class Name |

Intech S&P Large Cap Diversified Alpha ETF

|

| Trading Symbol |

LGDX

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Intech S&P Large Cap Diversified Alpha ETF (the "Fund") for the period February 27, 2025 (the Fund's “Inception”) to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.IntechETFs.com. You can also request this information by contacting us at (833) 933-2083 or by writing to the Intech S&P Large Cap Diversified Alpha ETF, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

|

| Additional Information Phone Number |

(833) 933-2083

|

| Additional Information Website |

https://www.IntechETFs.com

|

| Expenses [Text Block] |

What were the Fund costs since inception?

(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Intech S&P Large Cap Diversified Alpha ETF | $11 | 0.25% |

|

| Expenses Paid, Amount |

$ 11

|

| Expense Ratio, Percent |

0.25%

|

| Material Change Date |

Feb. 27, 2025

|

| Net Assets |

$ 98,916,000

|

| Holdings Count | Holdings |

240

|

| Advisory Fees Paid, Amount |

$ 79,476

|

| Investment Company, Portfolio Turnover |

43.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of July 31, 2025)

| |

|---|

Fund Size (Thousands) | $98,916 | Number of Holdings | 240 | Total Advisory Fee | $79,476 | Portfolio Turnover Rate | 43% |

|

| Holdings [Text Block] |

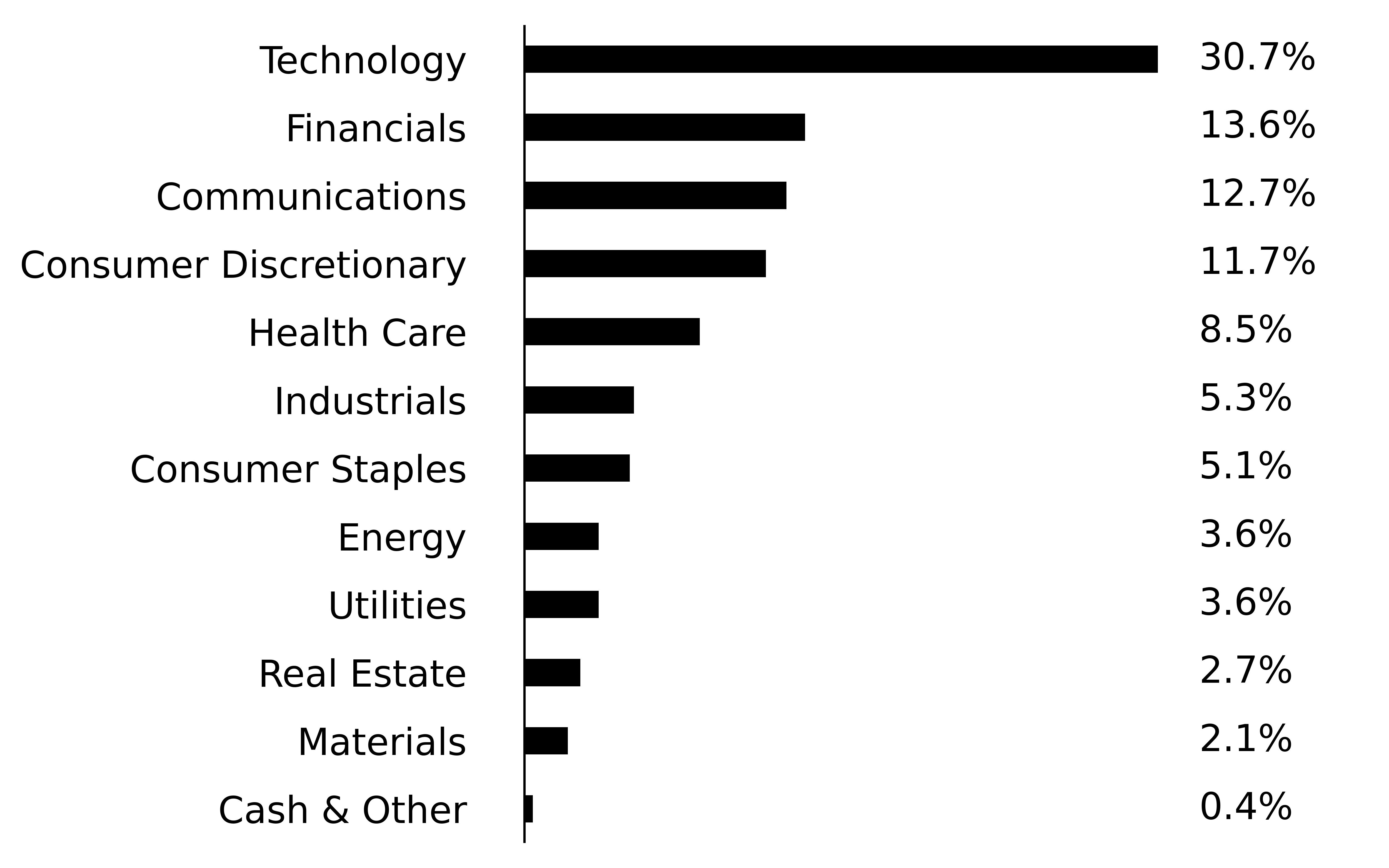

Sector Type - Investments

(% of Total Net Assets)

|

| Largest Holdings [Text Block] |

What did the Fund invest in? (as of July 31, 2025)

Top Ten Holdings | (% of Total Net Assets) |

|---|

NVIDIA Corp. | 7.9 | Microsoft Corp. | 5.3 | Meta Platforms, Inc. | 4.8 | Amazon.com, Inc. | 4.8 | Apple, Inc. | 4.4 | Broadcom, Inc. | 3.2 | Netflix, Inc. | 2.4 | Tesla, Inc. | 2.1 | Adobe, Inc. | 1.9 | Progressive Corp. | 1.7 |

|

| Material Fund Change [Text Block] |

How Has the Fund Changed? Effective February 27, 2025, the Intech U.S. Enhanced Plus Fund LLC reorganized into the Intech S&P Large Cap Diversified Alpha ETF.For financial reporting purposes, assets received, and shares issued by the LGDX ETF were recorded at fair value; however, the cost basis of the investments received from the Predecessor Fund were carried forward to align ongoing reporting of the Acquiring Fund realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes. |

| Material Fund Change Name [Text Block] |

Effective February 27, 2025, the Intech U.S. Enhanced Plus Fund LLC reorganized into the Intech S&P Large Cap Diversified Alpha ETF.For financial reporting purposes, assets received, and shares issued by the LGDX ETF were recorded at fair value; however, the cost basis of the investments received from the Predecessor Fund were carried forward to align ongoing reporting of the Acquiring Fund realized and unrealized gains and losses with amounts distributable to shareholders for tax purposes.

|

| Accountant Change Statement [Text Block] |

Changes in and Disagreements with Accountants In connection with the reorganization on February 27, 2025, the Tidal Trust III Audit Committee approved the decision to appoint Tait, Weller & Baker as the Fund's independent registered public accounting firm. |

| Intech S&P Small-Mid Cap Diversified Alpha ETF |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Intech S&P Small-Mid Cap Diversified Alpha ETF

|

| Class Name |

Intech S&P Small-Mid Cap Diversified Alpha ETF

|

| Trading Symbol |

SMDX

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Intech S&P Small-Mid Cap Diversified Alpha ETF (the "Fund") for the period February 27, 2025 (the Fund's "Inception") to July 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.IntechETFs.com. You can also request this information by contacting us at (833) 933-2083 or by writing to the Intech S&P Small-Mid Cap Diversified Alpha ETF, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701.

|

| Additional Information Phone Number |

(833) 933-2083

|

| Additional Information Website |

https://www.IntechETFs.com

|

| Expenses [Text Block] |

What were the Fund costs since inception?

(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Intech S&P Small-Mid Cap Diversified Alpha ETF | $15 | 0.35% |

|

| Expenses Paid, Amount |

$ 15

|

| Expense Ratio, Percent |

0.35%

|

| Net Assets |

$ 81,235,000

|

| Holdings Count | Holdings |

549

|

| Advisory Fees Paid, Amount |

$ 89,331

|

| Investment Company, Portfolio Turnover |

61.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of July 31, 2025)

| |

|---|

Fund Size (Thousands) | $81,235 | Number of Holdings | 549 | Total Advisory Fee | $89,331 | Portfolio Turnover Rate | 61% |

|

| Holdings [Text Block] |

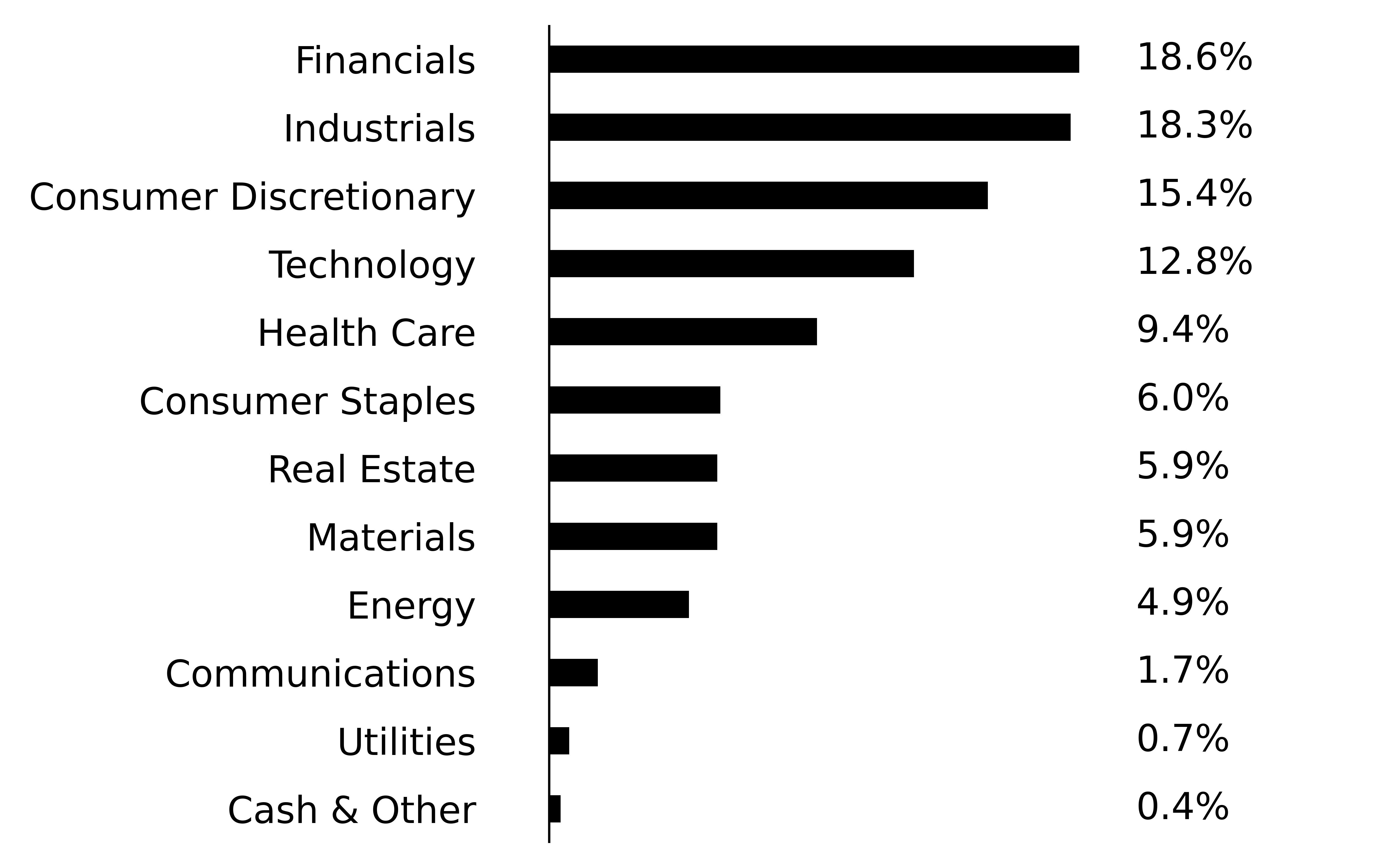

Sector Type - Investments

(% of Total Net Assets)

|

| Largest Holdings [Text Block] |

What did the Fund invest in? (as of July 31, 2025)

Top Ten Holdings | (% of Total Net Assets) |

|---|

EMCOR Group, Inc. | 2.5 | Interactive Brokers

Group, Inc. | 1.9 | Tenet Healthcare, Corp. | 1.3 | Jones Lang LaSalle, Inc. | 1.3 | Sprouts Farmers Market, Inc. | 1.2 | Jefferies Financial Group, Inc. | 1.1 | DT Midstream, Inc. | 1.1 | Universal Display Corp. | 1.0 | Exelixis, Inc. | 1.0 | Antero Resources Corp. | 0.9 |

|