What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Institutional Shares | $29 | 0.29% |

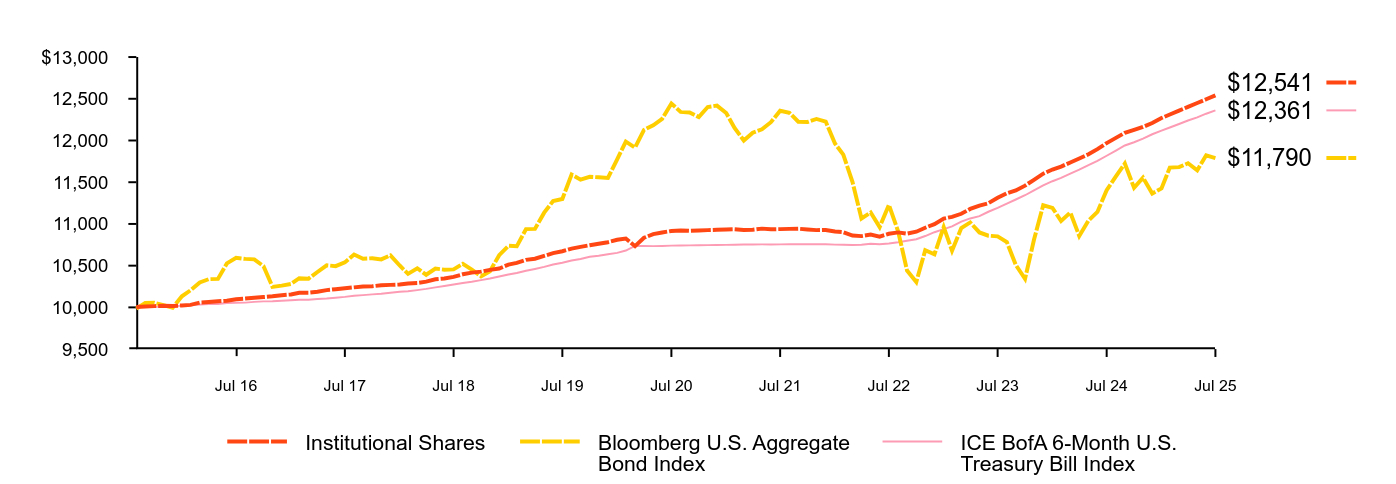

How did the Fund perform last year?

For the reporting period ended July 31, 2025, the Fund's Institutional Shares returned 4.77%.

For the same period, the Fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index, returned 3.38% and the ICE BofA 6-Month U.S. Treasury Bill Index, returned 4.60%.

What contributed to performance?

The Fund’s duration positioning contributed to absolute performance (duration is a measure of interest rate sensitivity). Asset allocation—namely, positions in U.S. Treasuries, commercial paper, and investment-grade corporate bonds—also helped results. The Fund’s cash position had no material impact on performance.

What detracted from performance?

At a time of positive returns for the broader fixed-income markets, no aspect of the Fund’s positioning was a significant detractor.

Fund performance

Cumulative performance: August 1, 2015 through July 31, 2025

Initial Investment of $10,000

Institutional Shares | Bloomberg U.S. Aggregate Bond Index | ICE BofA 6-Month U.S. Treasury Bill Index | |

|---|---|---|---|

Aug 15 | $10,005 | $9,986 | $10,001 |

Sep 15 | $10,010 | $10,053 | $10,011 |

Oct 15 | $10,015 | $10,055 | $10,008 |

Nov 15 | $10,020 | $10,028 | $10,007 |

Dec 15 | $10,016 | $9,996 | $10,012 |

Jan 16 | $10,023 | $10,133 | $10,020 |

Feb 16 | $10,030 | $10,205 | $10,024 |

Mar 16 | $10,058 | $10,299 | $10,033 |

Apr 16 | $10,065 | $10,338 | $10,040 |

May 16 | $10,073 | $10,341 | $10,041 |

Jun 16 | $10,080 | $10,527 | $10,053 |

Jul 16 | $10,098 | $10,594 | $10,056 |

Aug 16 | $10,106 | $10,581 | $10,057 |

Sep 16 | $10,115 | $10,575 | $10,066 |

Oct 16 | $10,124 | $10,494 | $10,072 |

Nov 16 | $10,133 | $10,246 | $10,074 |

Dec 16 | $10,146 | $10,261 | $10,079 |

Jan 17 | $10,155 | $10,281 | $10,086 |

Feb 17 | $10,175 | $10,350 | $10,092 |

Mar 17 | $10,176 | $10,344 | $10,092 |

Apr 17 | $10,187 | $10,424 | $10,100 |

May 17 | $10,207 | $10,504 | $10,106 |

Jun 17 | $10,218 | $10,494 | $10,115 |

Jul 17 | $10,229 | $10,539 | $10,126 |

Aug 17 | $10,240 | $10,634 | $10,140 |

Sep 17 | $10,251 | $10,583 | $10,147 |

Oct 17 | $10,253 | $10,589 | $10,156 |

Nov 17 | $10,265 | $10,575 | $10,164 |

Dec 17 | $10,270 | $10,624 | $10,175 |

Jan 18 | $10,274 | $10,502 | $10,187 |

Feb 18 | $10,287 | $10,402 | $10,193 |

Mar 18 | $10,292 | $10,469 | $10,207 |

Apr 18 | $10,308 | $10,391 | $10,222 |

May 18 | $10,337 | $10,465 | $10,240 |

Jun 18 | $10,346 | $10,452 | $10,256 |

Jul 18 | $10,366 | $10,455 | $10,274 |

Aug 18 | $10,397 | $10,522 | $10,293 |

Sep 18 | $10,417 | $10,454 | $10,307 |

Oct 18 | $10,428 | $10,372 | $10,327 |

Nov 18 | $10,450 | $10,433 | $10,347 |

Dec 18 | $10,466 | $10,625 | $10,371 |

Jan 19 | $10,512 | $10,738 | $10,394 |

Feb 19 | $10,534 | $10,732 | $10,413 |

Mar 19 | $10,570 | $10,938 | $10,438 |

Apr 19 | $10,583 | $10,941 | $10,460 |

May 19 | $10,617 | $11,135 | $10,485 |

Jun 19 | $10,650 | $11,275 | $10,514 |

Jul 19 | $10,673 | $11,299 | $10,534 |

Aug 19 | $10,705 | $11,592 | $10,562 |

Sep 19 | $10,725 | $11,531 | $10,580 |

Oct 19 | $10,745 | $11,565 | $10,607 |

Nov 19 | $10,763 | $11,559 | $10,619 |

Dec 19 | $10,781 | $11,551 | $10,637 |

Jan 20 | $10,810 | $11,774 | $10,653 |

Feb 20 | $10,826 | $11,986 | $10,681 |

Mar 20 | $10,734 | $11,915 | $10,736 |

Apr 20 | $10,834 | $12,127 | $10,736 |

May 20 | $10,878 | $12,183 | $10,734 |

Jun 20 | $10,897 | $12,260 | $10,736 |

Jul 20 | $10,916 | $12,443 | $10,740 |

Aug 20 | $10,922 | $12,343 | $10,741 |

Sep 20 | $10,917 | $12,336 | $10,743 |

Oct 20 | $10,922 | $12,281 | $10,744 |

Nov 20 | $10,926 | $12,401 | $10,746 |

Dec 20 | $10,930 | $12,418 | $10,748 |

Jan 21 | $10,933 | $12,329 | $10,749 |

Feb 21 | $10,936 | $12,151 | $10,751 |

Mar 21 | $10,928 | $12,000 | $10,753 |

Apr 21 | $10,931 | $12,094 | $10,754 |

May 21 | $10,944 | $12,134 | $10,755 |

Jun 21 | $10,936 | $12,219 | $10,754 |

Jul 21 | $10,938 | $12,356 | $10,755 |

Aug 21 | $10,941 | $12,332 | $10,756 |

Sep 21 | $10,943 | $12,225 | $10,756 |

Oct 21 | $10,934 | $12,222 | $10,756 |

Nov 21 | $10,926 | $12,258 | $10,756 |

Dec 21 | $10,928 | $12,227 | $10,757 |

Jan 22 | $10,909 | $11,964 | $10,752 |

Feb 22 | $10,901 | $11,830 | $10,751 |

Mar 22 | $10,861 | $11,501 | $10,747 |

Apr 22 | $10,854 | $11,065 | $10,751 |

May 22 | $10,872 | $11,136 | $10,763 |

Jun 22 | $10,848 | $10,962 | $10,756 |

Jul 22 | $10,882 | $11,229 | $10,766 |

Aug 22 | $10,899 | $10,912 | $10,781 |

Sep 22 | $10,884 | $10,441 | $10,798 |

Oct 22 | $10,907 | $10,305 | $10,816 |

Nov 22 | $10,955 | $10,684 | $10,855 |

Dec 22 | $10,997 | $10,636 | $10,901 |

Jan 23 | $11,064 | $10,963 | $10,938 |

Feb 23 | $11,085 | $10,680 | $10,970 |

Mar 23 | $11,122 | $10,951 | $11,028 |

Apr 23 | $11,180 | $11,018 | $11,066 |

May 23 | $11,220 | $10,898 | $11,093 |

Jun 23 | $11,248 | $10,859 | $11,146 |

Jul 23 | $11,313 | $10,851 | $11,192 |

Aug 23 | $11,368 | $10,782 | $11,243 |

Sep 23 | $11,401 | $10,508 | $11,293 |

Oct 23 | $11,459 | $10,342 | $11,344 |

Nov 23 | $11,529 | $10,810 | $11,403 |

Dec 23 | $11,602 | $11,224 | $11,462 |

Jan 24 | $11,652 | $11,193 | $11,512 |

Feb 24 | $11,687 | $11,035 | $11,552 |

Mar 24 | $11,737 | $11,137 | $11,604 |

Apr 24 | $11,785 | $10,856 | $11,650 |

May 24 | $11,835 | $11,040 | $11,705 |

Jun 24 | $11,896 | $11,144 | $11,755 |

Jul 24 | $11,969 | $11,405 | $11,817 |

Aug 24 | $12,031 | $11,569 | $11,879 |

Sep 24 | $12,092 | $11,724 | $11,940 |

Oct 24 | $12,128 | $11,433 | $11,979 |

Nov 24 | $12,162 | $11,554 | $12,023 |

Dec 24 | $12,210 | $11,365 | $12,075 |

Jan 25 | $12,269 | $11,425 | $12,118 |

Feb 25 | $12,311 | $11,676 | $12,156 |

Mar 25 | $12,358 | $11,681 | $12,198 |

Apr 25 | $12,403 | $11,727 | $12,240 |

May 25 | $12,449 | $11,643 | $12,277 |

Jun 25 | $12,494 | $11,822 | $12,321 |

Jul 25 | $12,541 | $11,790 | $12,361 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Institutional Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.77% | 2.81% | 2.29% |

Bloomberg U.S. Aggregate Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.38 | (1.07) | 1.66 |

ICE BofA 6-Month U.S. Treasury Bill Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.60 | 2.85 | 2.14 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $1,113,134,413 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 247 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $1,523,024 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 59% |

Portfolio composition

Maturity allocation

Asset Type | Percent of

Net Assets |

|---|---|

Corporate Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 42.0% |

U.S. Treasury Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.0 |

Asset-Backed Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.7 |

Foreign Agency Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.7 |

Municipal Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.4 |

Short-Term Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 52.5 |

Liabilities in Excess of Other Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | (0.3) |

Percent of

Net Assets | |

|---|---|

1-7 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.0% |

8-14 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.6 |

15-30 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.4 |

31-60 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.2 |

61-90 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.4 |

91-120 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 12.0 |

121-150 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.4 |

>150 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 59.0 |

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Investor A Shares | $51 | 0.50% |

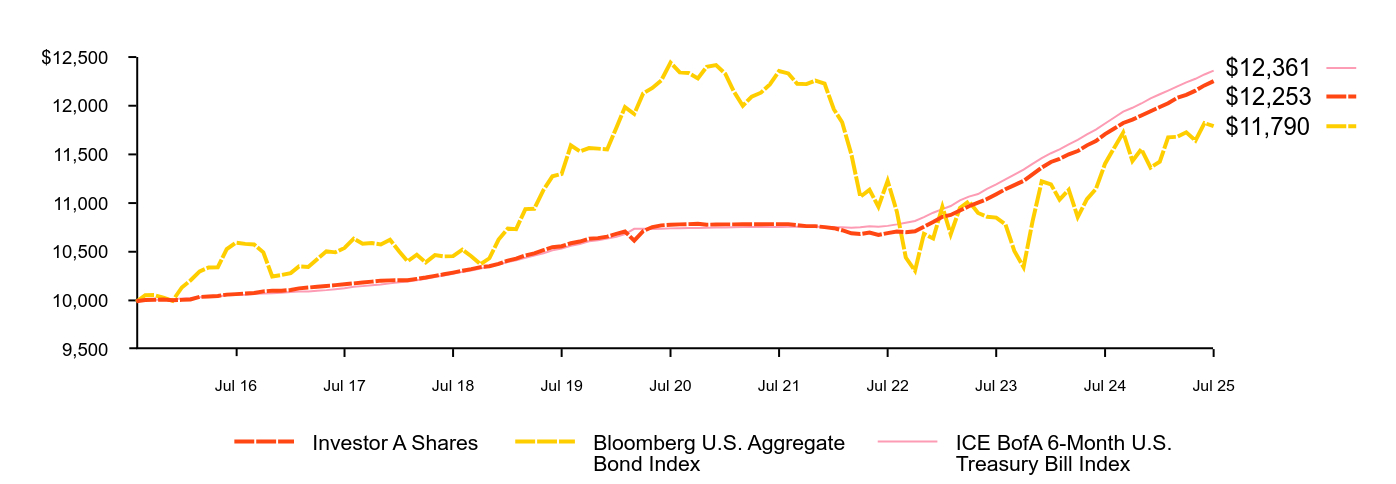

How did the Fund perform last year?

For the reporting period ended July 31, 2025, the Fund's Investor A Shares returned 4.65%.

For the same period, the Fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index, returned 3.38% and the ICE BofA 6-Month U.S. Treasury Bill Index, returned 4.60%.

What contributed to performance?

The Fund’s duration positioning contributed to absolute performance (duration is a measure of interest rate sensitivity). Asset allocation—namely, positions in U.S. Treasuries, commercial paper, and investment-grade corporate bonds—also helped results. The Fund’s cash position had no material impact on performance.

What detracted from performance?

At a time of positive returns for the broader fixed-income markets, no aspect of the Fund’s positioning was a significant detractor.

Fund performance

Cumulative performance: August 1, 2015 through July 31, 2025

Initial Investment of $10,000

Investor A Shares | Bloomberg U.S. Aggregate Bond Index | ICE BofA 6-Month U.S. Treasury Bill Index | |

|---|---|---|---|

Aug 15 | $9,992 | $9,986 | $10,001 |

Sep 15 | $10,004 | $10,053 | $10,011 |

Oct 15 | $10,006 | $10,055 | $10,008 |

Nov 15 | $10,009 | $10,028 | $10,007 |

Dec 15 | $10,002 | $9,996 | $10,012 |

Jan 16 | $10,006 | $10,133 | $10,020 |

Feb 16 | $10,010 | $10,205 | $10,024 |

Mar 16 | $10,036 | $10,299 | $10,033 |

Apr 16 | $10,040 | $10,338 | $10,040 |

May 16 | $10,046 | $10,341 | $10,041 |

Jun 16 | $10,060 | $10,527 | $10,053 |

Jul 16 | $10,065 | $10,594 | $10,056 |

Aug 16 | $10,071 | $10,581 | $10,057 |

Sep 16 | $10,077 | $10,575 | $10,066 |

Oct 16 | $10,093 | $10,494 | $10,072 |

Nov 16 | $10,100 | $10,246 | $10,074 |

Dec 16 | $10,100 | $10,261 | $10,079 |

Jan 17 | $10,107 | $10,281 | $10,086 |

Feb 17 | $10,124 | $10,350 | $10,092 |

Mar 17 | $10,132 | $10,344 | $10,092 |

Apr 17 | $10,140 | $10,424 | $10,100 |

May 17 | $10,149 | $10,504 | $10,106 |

Jun 17 | $10,157 | $10,494 | $10,115 |

Jul 17 | $10,166 | $10,539 | $10,126 |

Aug 17 | $10,175 | $10,634 | $10,140 |

Sep 17 | $10,184 | $10,583 | $10,147 |

Oct 17 | $10,193 | $10,589 | $10,156 |

Nov 17 | $10,203 | $10,575 | $10,164 |

Dec 17 | $10,206 | $10,624 | $10,175 |

Jan 18 | $10,207 | $10,502 | $10,187 |

Feb 18 | $10,208 | $10,402 | $10,193 |

Mar 18 | $10,221 | $10,469 | $10,207 |

Apr 18 | $10,235 | $10,391 | $10,222 |

May 18 | $10,252 | $10,465 | $10,240 |

Jun 18 | $10,269 | $10,452 | $10,256 |

Jul 18 | $10,286 | $10,455 | $10,274 |

Aug 18 | $10,305 | $10,522 | $10,293 |

Sep 18 | $10,322 | $10,454 | $10,307 |

Oct 18 | $10,342 | $10,372 | $10,327 |

Nov 18 | $10,351 | $10,433 | $10,347 |

Dec 18 | $10,376 | $10,625 | $10,371 |

Jan 19 | $10,409 | $10,738 | $10,394 |

Feb 19 | $10,429 | $10,732 | $10,413 |

Mar 19 | $10,462 | $10,938 | $10,438 |

Apr 19 | $10,484 | $10,941 | $10,460 |

May 19 | $10,516 | $11,135 | $10,485 |

Jun 19 | $10,547 | $11,275 | $10,514 |

Jul 19 | $10,557 | $11,299 | $10,534 |

Aug 19 | $10,587 | $11,592 | $10,562 |

Sep 19 | $10,605 | $11,531 | $10,580 |

Oct 19 | $10,634 | $11,565 | $10,607 |

Nov 19 | $10,640 | $11,559 | $10,619 |

Dec 19 | $10,656 | $11,551 | $10,637 |

Jan 20 | $10,683 | $11,774 | $10,653 |

Feb 20 | $10,708 | $11,986 | $10,681 |

Mar 20 | $10,615 | $11,915 | $10,736 |

Apr 20 | $10,712 | $12,127 | $10,736 |

May 20 | $10,754 | $12,183 | $10,734 |

Jun 20 | $10,771 | $12,260 | $10,736 |

Jul 20 | $10,777 | $12,443 | $10,740 |

Aug 20 | $10,781 | $12,343 | $10,741 |

Sep 20 | $10,784 | $12,336 | $10,743 |

Oct 20 | $10,787 | $12,281 | $10,744 |

Nov 20 | $10,778 | $12,401 | $10,746 |

Dec 20 | $10,780 | $12,418 | $10,748 |

Jan 21 | $10,781 | $12,329 | $10,749 |

Feb 21 | $10,781 | $12,151 | $10,751 |

Mar 21 | $10,782 | $12,000 | $10,753 |

Apr 21 | $10,783 | $12,094 | $10,754 |

May 21 | $10,783 | $12,134 | $10,755 |

Jun 21 | $10,784 | $12,219 | $10,754 |

Jul 21 | $10,784 | $12,356 | $10,755 |

Aug 21 | $10,784 | $12,332 | $10,756 |

Sep 21 | $10,773 | $12,225 | $10,756 |

Oct 21 | $10,763 | $12,222 | $10,756 |

Nov 21 | $10,763 | $12,258 | $10,756 |

Dec 21 | $10,753 | $12,227 | $10,757 |

Jan 22 | $10,742 | $11,964 | $10,752 |

Feb 22 | $10,721 | $11,830 | $10,751 |

Mar 22 | $10,690 | $11,501 | $10,747 |

Apr 22 | $10,682 | $11,065 | $10,751 |

May 22 | $10,697 | $11,136 | $10,763 |

Jun 22 | $10,672 | $10,962 | $10,756 |

Jul 22 | $10,692 | $11,229 | $10,766 |

Aug 22 | $10,707 | $10,912 | $10,781 |

Sep 22 | $10,701 | $10,441 | $10,798 |

Oct 22 | $10,711 | $10,305 | $10,816 |

Nov 22 | $10,756 | $10,684 | $10,855 |

Dec 22 | $10,806 | $10,636 | $10,901 |

Jan 23 | $10,859 | $10,963 | $10,938 |

Feb 23 | $10,878 | $10,680 | $10,970 |

Mar 23 | $10,923 | $10,951 | $11,028 |

Apr 23 | $10,967 | $11,018 | $11,066 |

May 23 | $11,004 | $10,898 | $11,093 |

Jun 23 | $11,041 | $10,859 | $11,146 |

Jul 23 | $11,091 | $10,851 | $11,192 |

Aug 23 | $11,143 | $10,782 | $11,243 |

Sep 23 | $11,184 | $10,508 | $11,293 |

Oct 23 | $11,228 | $10,342 | $11,344 |

Nov 23 | $11,294 | $10,810 | $11,403 |

Dec 23 | $11,364 | $11,224 | $11,462 |

Jan 24 | $11,422 | $11,193 | $11,512 |

Feb 24 | $11,454 | $11,035 | $11,552 |

Mar 24 | $11,501 | $11,137 | $11,604 |

Apr 24 | $11,534 | $10,856 | $11,650 |

May 24 | $11,593 | $11,040 | $11,705 |

Jun 24 | $11,638 | $11,144 | $11,755 |

Jul 24 | $11,708 | $11,405 | $11,817 |

Aug 24 | $11,766 | $11,569 | $11,879 |

Sep 24 | $11,823 | $11,724 | $11,940 |

Oct 24 | $11,857 | $11,433 | $11,979 |

Nov 24 | $11,900 | $11,554 | $12,023 |

Dec 24 | $11,944 | $11,365 | $12,075 |

Jan 25 | $11,987 | $11,425 | $12,118 |

Feb 25 | $12,026 | $11,676 | $12,156 |

Mar 25 | $12,082 | $11,681 | $12,198 |

Apr 25 | $12,112 | $11,727 | $12,240 |

May 25 | $12,155 | $11,643 | $12,277 |

Jun 25 | $12,209 | $11,822 | $12,321 |

Jul 25 | $12,253 | $11,790 | $12,361 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Investor A Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.65% | 2.60% | 2.05% |

Bloomberg U.S. Aggregate Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.38 | (1.07) | 1.66 |

ICE BofA 6-Month U.S. Treasury Bill Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.60 | 2.85 | 2.14 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $1,113,134,413 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 247 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $1,523,024 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 59% |

Portfolio composition

Maturity allocation

Asset Type | Percent of

Net Assets |

|---|---|

Corporate Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 42.0% |

U.S. Treasury Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.0 |

Asset-Backed Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.7 |

Foreign Agency Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.7 |

Municipal Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.4 |

Short-Term Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 52.5 |

Liabilities in Excess of Other Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | (0.3) |

Percent of

Net Assets | |

|---|---|

1-7 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 6.0% |

8-14 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.6 |

15-30 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.4 |

31-60 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 10.2 |

61-90 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 5.4 |

91-120 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 12.0 |

121-150 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 2.4 |

>150 days........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 59.0 |

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

Class name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Class K Shares | $21 | 0.20% |

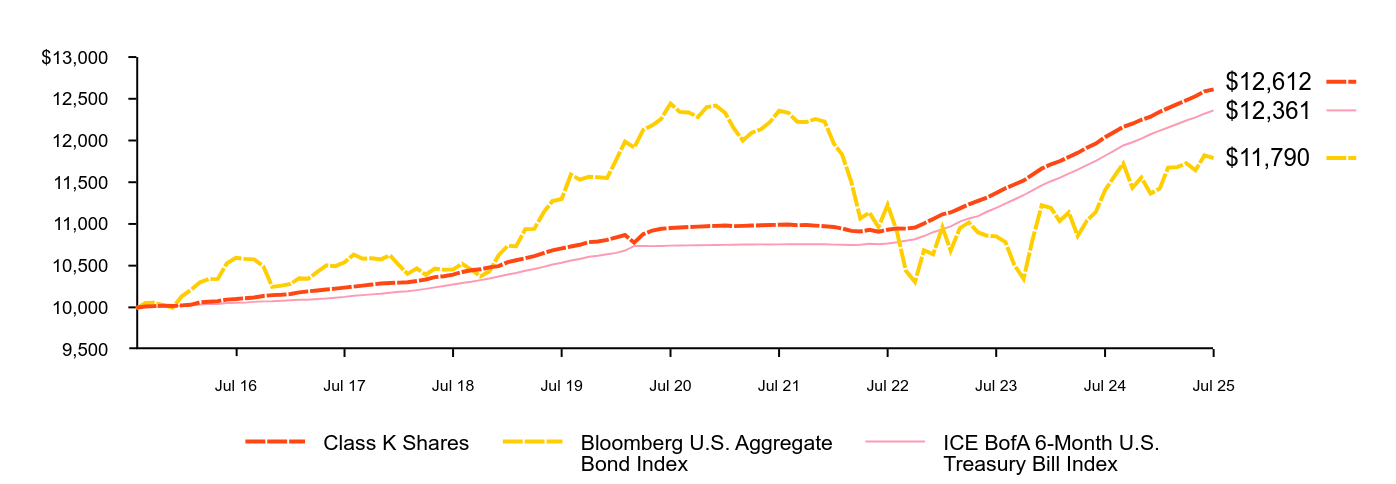

How did the Fund perform last year?

For the reporting period ended July 31, 2025, the Fund's Class K Shares returned 4.76%.

For the same period, the Fund’s benchmark, the Bloomberg U.S. Aggregate Bond Index, returned 3.38% and the ICE BofA 6-Month U.S. Treasury Bill Index, returned 4.60%.

What contributed to performance?

The Fund’s duration positioning contributed to absolute performance (duration is a measure of interest rate sensitivity). Asset allocation—namely, positions in U.S. Treasuries, commercial paper, and investment-grade corporate bonds—also helped results. The Fund’s cash position had no material impact on performance.

What detracted from performance?

At a time of positive returns for the broader fixed-income markets, no aspect of the Fund’s positioning was a significant detractor.

Fund performance

Cumulative performance: August 1, 2015 through July 31, 2025

Initial Investment of $10,000

Class K Shares | Bloomberg U.S. Aggregate Bond Index | ICE BofA 6-Month U.S. Treasury Bill Index | |

|---|---|---|---|

Aug 15 | $9,995 | $9,986 | $10,001 |

Sep 15 | $10,010 | $10,053 | $10,011 |

Oct 15 | $10,015 | $10,055 | $10,008 |

Nov 15 | $10,021 | $10,028 | $10,007 |

Dec 15 | $10,017 | $9,996 | $10,012 |

Jan 16 | $10,024 | $10,133 | $10,020 |

Feb 16 | $10,031 | $10,205 | $10,024 |

Mar 16 | $10,059 | $10,299 | $10,033 |

Apr 16 | $10,067 | $10,338 | $10,040 |

May 16 | $10,075 | $10,341 | $10,041 |

Jun 16 | $10,093 | $10,527 | $10,053 |

Jul 16 | $10,100 | $10,594 | $10,056 |

Aug 16 | $10,110 | $10,581 | $10,057 |

Sep 16 | $10,118 | $10,575 | $10,066 |

Oct 16 | $10,137 | $10,494 | $10,072 |

Nov 16 | $10,147 | $10,246 | $10,074 |

Dec 16 | $10,151 | $10,261 | $10,079 |

Jan 17 | $10,160 | $10,281 | $10,086 |

Feb 17 | $10,180 | $10,350 | $10,092 |

Mar 17 | $10,192 | $10,344 | $10,092 |

Apr 17 | $10,203 | $10,424 | $10,100 |

May 17 | $10,214 | $10,504 | $10,106 |

Jun 17 | $10,225 | $10,494 | $10,115 |

Jul 17 | $10,237 | $10,539 | $10,126 |

Aug 17 | $10,249 | $10,634 | $10,140 |

Sep 17 | $10,261 | $10,583 | $10,147 |

Oct 17 | $10,274 | $10,589 | $10,156 |

Nov 17 | $10,287 | $10,575 | $10,164 |

Dec 17 | $10,293 | $10,624 | $10,175 |

Jan 18 | $10,297 | $10,502 | $10,187 |

Feb 18 | $10,301 | $10,402 | $10,193 |

Mar 18 | $10,317 | $10,469 | $10,207 |

Apr 18 | $10,334 | $10,391 | $10,222 |

May 18 | $10,363 | $10,465 | $10,240 |

Jun 18 | $10,373 | $10,452 | $10,256 |

Jul 18 | $10,393 | $10,455 | $10,274 |

Aug 18 | $10,424 | $10,522 | $10,293 |

Sep 18 | $10,445 | $10,454 | $10,307 |

Oct 18 | $10,456 | $10,372 | $10,327 |

Nov 18 | $10,479 | $10,433 | $10,347 |

Dec 18 | $10,495 | $10,625 | $10,371 |

Jan 19 | $10,542 | $10,738 | $10,394 |

Feb 19 | $10,565 | $10,732 | $10,413 |

Mar 19 | $10,590 | $10,938 | $10,438 |

Apr 19 | $10,615 | $10,941 | $10,460 |

May 19 | $10,650 | $11,135 | $10,485 |

Jun 19 | $10,684 | $11,275 | $10,514 |

Jul 19 | $10,707 | $11,299 | $10,534 |

Aug 19 | $10,729 | $11,592 | $10,562 |

Sep 19 | $10,750 | $11,531 | $10,580 |

Oct 19 | $10,782 | $11,565 | $10,607 |

Nov 19 | $10,790 | $11,559 | $10,619 |

Dec 19 | $10,809 | $11,551 | $10,637 |

Jan 20 | $10,839 | $11,774 | $10,653 |

Feb 20 | $10,867 | $11,986 | $10,681 |

Mar 20 | $10,775 | $11,915 | $10,736 |

Apr 20 | $10,877 | $12,127 | $10,736 |

May 20 | $10,921 | $12,183 | $10,734 |

Jun 20 | $10,942 | $12,260 | $10,736 |

Jul 20 | $10,951 | $12,443 | $10,740 |

Aug 20 | $10,957 | $12,343 | $10,741 |

Sep 20 | $10,963 | $12,336 | $10,743 |

Oct 20 | $10,968 | $12,281 | $10,744 |

Nov 20 | $10,973 | $12,401 | $10,746 |

Dec 20 | $10,977 | $12,418 | $10,748 |

Jan 21 | $10,981 | $12,329 | $10,749 |

Feb 21 | $10,974 | $12,151 | $10,751 |

Mar 21 | $10,977 | $12,000 | $10,753 |

Apr 21 | $10,981 | $12,094 | $10,754 |

May 21 | $10,984 | $12,134 | $10,755 |

Jun 21 | $10,987 | $12,219 | $10,754 |

Jul 21 | $10,990 | $12,356 | $10,755 |

Aug 21 | $10,993 | $12,332 | $10,756 |

Sep 21 | $10,985 | $12,225 | $10,756 |

Oct 21 | $10,988 | $12,222 | $10,756 |

Nov 21 | $10,980 | $12,258 | $10,756 |

Dec 21 | $10,972 | $12,227 | $10,757 |

Jan 22 | $10,964 | $11,964 | $10,752 |

Feb 22 | $10,945 | $11,830 | $10,751 |

Mar 22 | $10,917 | $11,501 | $10,747 |

Apr 22 | $10,910 | $11,065 | $10,751 |

May 22 | $10,929 | $11,136 | $10,763 |

Jun 22 | $10,906 | $10,962 | $10,756 |

Jul 22 | $10,930 | $11,229 | $10,766 |

Aug 22 | $10,947 | $10,912 | $10,781 |

Sep 22 | $10,944 | $10,441 | $10,798 |

Oct 22 | $10,957 | $10,305 | $10,816 |

Nov 22 | $11,006 | $10,684 | $10,855 |

Dec 22 | $11,060 | $10,636 | $10,901 |

Jan 23 | $11,116 | $10,963 | $10,938 |

Feb 23 | $11,138 | $10,680 | $10,970 |

Mar 23 | $11,187 | $10,951 | $11,028 |

Apr 23 | $11,235 | $11,018 | $11,066 |

May 23 | $11,276 | $10,898 | $11,093 |

Jun 23 | $11,316 | $10,859 | $11,146 |

Jul 23 | $11,371 | $10,851 | $11,192 |

Aug 23 | $11,427 | $10,782 | $11,243 |

Sep 23 | $11,472 | $10,508 | $11,293 |

Oct 23 | $11,520 | $10,342 | $11,344 |

Nov 23 | $11,591 | $10,810 | $11,403 |

Dec 23 | $11,664 | $11,224 | $11,462 |

Jan 24 | $11,715 | $11,193 | $11,512 |

Feb 24 | $11,751 | $11,035 | $11,552 |

Mar 24 | $11,802 | $11,137 | $11,604 |

Apr 24 | $11,852 | $10,856 | $11,650 |

May 24 | $11,914 | $11,040 | $11,705 |

Jun 24 | $11,964 | $11,144 | $11,755 |

Jul 24 | $12,039 | $11,405 | $11,817 |

Aug 24 | $12,102 | $11,569 | $11,879 |

Sep 24 | $12,164 | $11,724 | $11,940 |

Oct 24 | $12,201 | $11,433 | $11,979 |

Nov 24 | $12,248 | $11,554 | $12,023 |

Dec 24 | $12,285 | $11,365 | $12,075 |

Jan 25 | $12,345 | $11,425 | $12,118 |

Feb 25 | $12,388 | $11,676 | $12,156 |

Mar 25 | $12,436 | $11,681 | $12,198 |

Apr 25 | $12,482 | $11,727 | $12,240 |

May 25 | $12,530 | $11,643 | $12,277 |

Jun 25 | $12,589 | $11,822 | $12,321 |

Jul 25 | $12,612 | $11,790 | $12,361 |

See “Average annual total returns” for additional information on fund performance.

Average annual total returns

Average Annual Total Returns | 1 Year | 5 Years | 10 Years |

|---|---|---|---|

Class K Shares ........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.76% | 2.86% | 2.35% |

Bloomberg U.S. Aggregate Bond Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.38 | (1.07) | 1.66 |

ICE BofA 6-Month U.S. Treasury Bill Index........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 4.60 | 2.85 | 2.14 |

Key Fund statistics

Net Assets........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $1,113,134,413 |

|---|---|

Number of Portfolio Holdings........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 247 |

Net Investment Advisory Fees........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | $1,523,024 |

Portfolio Turnover Rate........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 59% |

Portfolio composition

Maturity allocation

Asset Type | Percent of

Net Assets |

|---|---|

Corporate Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 42.0% |

U.S. Treasury Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 3.0 |

Asset-Backed Securities........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 1.7 |

Foreign Agency Obligations........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.7 |

Municipal Bonds........................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................ | 0.4 |